开立不可撤销跟单信用证申请书

- 格式:doc

- 大小:86.50 KB

- 文档页数:3

不可撤销跟单国际信用证随着全球化的脚步加快,国际贸易得到了大幅发展。

对于贸易中的一种重要支付方式——国际信用证,很多人或许不太了解。

要说起国际信用证,它是一种传统的跨国贸易支付方式,通俗点来说就是商品交易时银行作为中间人提供的一种保障机制。

而不可撤销跟单国际信用证,更是业内人士所推崇的一种信用证方式。

什么是不可撤销跟单国际信用证?国际信用证是由银行为双方提供担保,以确保进口商能够按时支付外汇和出口商能够按时收到货款。

而不可撤销跟单国际信用证,更是进一步提高了这种信用证方式的保障水平。

通俗来说,不可撤销跟单国际信用证是银行承诺的一种支付方式,一旦银行发出支付通知,交易货款就会被立即支付,并且付款后无法退回。

不可撤销跟单国际信用证的优势首先,不可撤销跟单国际信用证可以大大减少交易双方之间的风险。

进口商在信用证开立时,可以设定一系列需要满足的交易条件,如交付货物的时间、货物的质量、证书的完整性等等。

只有在满足这些条件的情况下,出口商才能领取货款,这样就加强了刚性条款,避免了不必要的风险。

其次,不可撤销跟单国际信用证可以有效减轻交易双方之间的信任问题。

由于跟单信用证是由银行作为中介机构提供保障的,因此在国际贸易中具有极高的可信度。

这样的话,出口商就可以放心地交付货物,而进口商也可以放心地付款。

最后,不可撤销跟单国际信用证可以增强银行的保障作用。

由于银行负责承诺货款的支付,因此,银行会更加谨慎地审核交易过程中的各种信息和文件。

这样的话,银行就可以保障自己的利益不受到明显的损失,从而更好地维护了银行内部的风险控制。

结语总之,不可撤销跟单国际信用证是当前主流的交易保障方式,它能够极大地减少交易双方之间的风险和信任问题,同时增强银行的保障作用。

相信这种支付方式未来会在国际贸易中发挥越来越重要的作用。

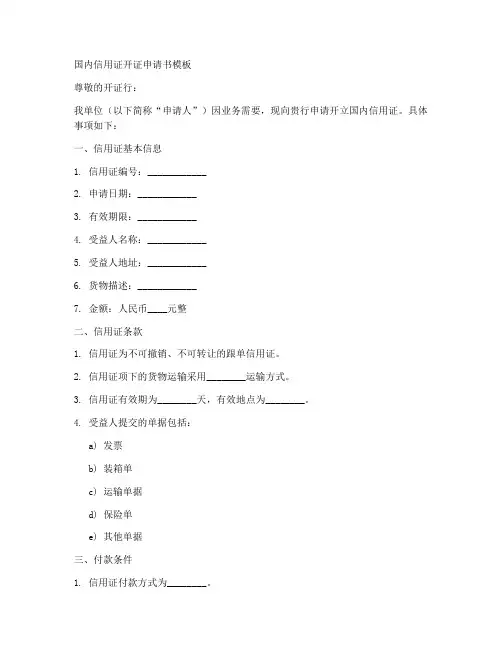

国内信用证开证申请书模板尊敬的开证行:我单位(以下简称“申请人”)因业务需要,现向贵行申请开立国内信用证。

具体事项如下:一、信用证基本信息1. 信用证编号:____________2. 申请日期:____________3. 有效期限:____________4. 受益人名称:____________5. 受益人地址:____________6. 货物描述:____________7. 金额:人民币____元整二、信用证条款1. 信用证为不可撤销、不可转让的跟单信用证。

2. 信用证项下的货物运输采用________运输方式。

3. 信用证有效期为________天,有效地点为________。

4. 受益人提交的单据包括:a) 发票b) 装箱单c) 运输单据d) 保险单e) 其他单据三、付款条件1. 信用证付款方式为________。

2. 付款期限为________天,自运输单据签发之日起计算。

四、其他要求1. 货物数量及金额允许有________%的浮动范围。

2. 受益人应在信用证有效期内提交单据,否则视为无效。

3. 信用证项下的货物须符合我国相关法律法规及标准。

五、申请人的承诺1. 申请人保证按照信用证的条款和条件履行付款义务。

2. 申请人同意承担信用证项下的各项费用,包括但不限于开证费、手续费、利息等。

3. 申请人承诺在信用证有效期内按时提交符合要求的单据。

六、申请人的信息1. 申请人名称:____________2. 申请人地址:____________3. 联系人:____________4. 联系电话:____________七、开证行确认1. 贵行应在收到申请人的开证申请书后,进行审核并决定是否开立信用证。

2. 贵行同意按照申请人的要求开立信用证,并承担相应的法律责任。

特此申请,敬请审阅。

申请人:(签字)日期:____________注:本模板仅供参考,具体内容需根据实际情况进行调整。

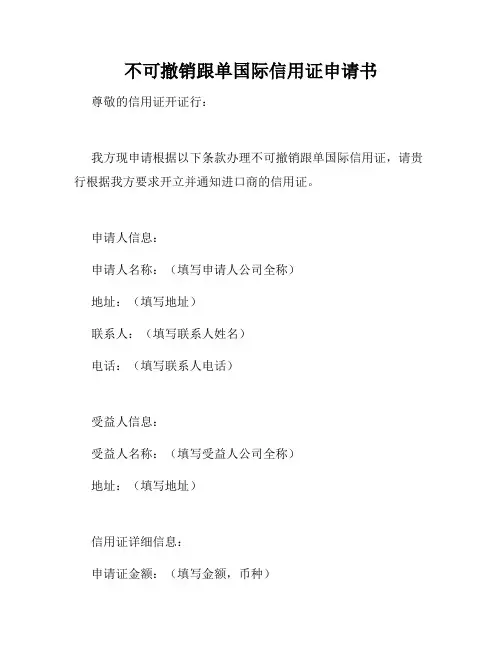

不可撤销跟单国际信用证申请书尊敬的信用证开证行:

我方现申请根据以下条款办理不可撤销跟单国际信用证,请贵行根据我方要求开立并通知进口商的信用证。

申请人信息:

申请人名称:(填写申请人公司全称)

地址:(填写地址)

联系人:(填写联系人姓名)

电话:(填写联系人电话)

受益人信息:

受益人名称:(填写受益人公司全称)

地址:(填写地址)

信用证详细信息:

申请证金额:(填写金额,币种)

货物描述:(填写货物详细描述)

装运方式:(填写装运方式,如海运、空运)

运输目的地:(填写目的地国家/地区)

信用证条款要求:

1. 符合国际商会统一惯例第600条版本的跟单信用证条款;

2. 在受益人装运全部货物之前,信用证生效;

3. 信用证有效期为装运日期后60天,装运期限为信用证生效后30天内;

4. 在信用证有效期内,受益人可进行分批装运;

5. 付款条款:信用证项下货款将在见到符合要求的单据后,由开证行以不可撤销、即期的方式付款给受益人;

6. 信用证项下的单据须包括以下内容:

- 提货单(装船单);

- 商业发票;

- 由受益人签发的保险单,保险金额为发票总值加20%;

- 装箱单或装箱清单;

- 由受益人签发的不可撤销、可转让的海运提单。

信用证通知:

请在开证后立即将信用证及所有有关文件以快递形式邮寄至我方地址,并且在同一时间通过传真或电子邮件通知受益人。

邮件或传真的副本也需要同时发至我方电子邮件(填写电子邮件地址)。

特此申请。

申请人签章:

签署日期:

签署人姓名及职务:。

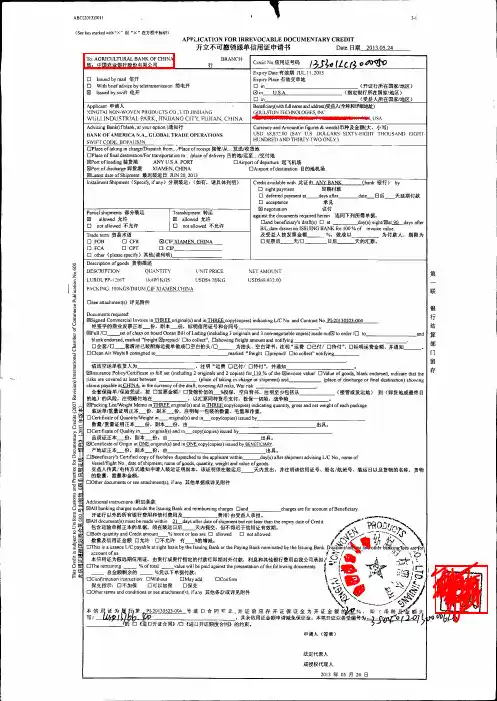

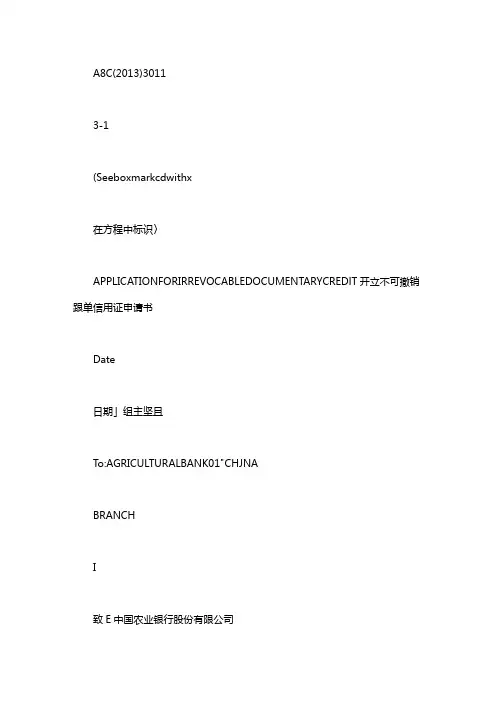

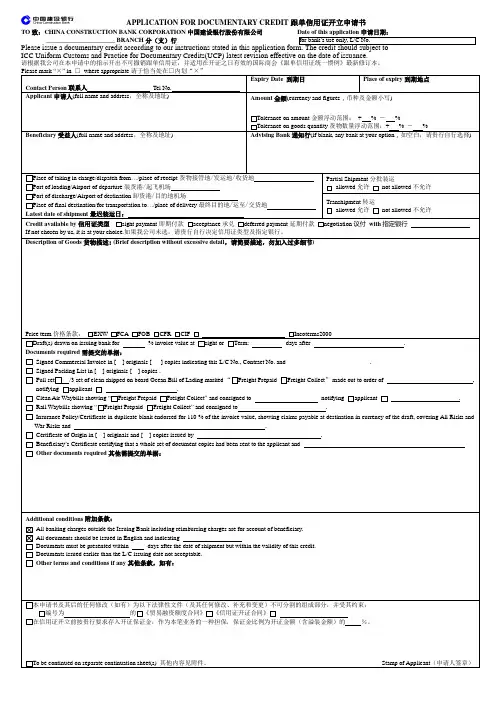

A8C(2013)30113-1(Seeboxmarkcdwithx在方程中标识〉APPLICATIONFORIRREVOCABLEDOCUMENTARYCREDlT开立不可撤销跟单信用证申请书Date日期」组主坚且To:AGRICULTURALBANK01"CHJNABRANCHI致E中国农业银行股份有限公司w.-ICre?ilN队信用证号码IιxpiryiDate有效期且JL1I,2013口Issuedbymail信开ExpiryPlace有效交单地口Withp?efadvicebyteletransm?ss?on简电开|口in ._____________(开证行所在国家/地区〉囚Issuedbyswi由电开10in1S.A〈指定银行所在国家/地区〉1口m一(受益人所在国家/地区)忡忡cant申请人IBenefici町仰由也IInameandadXINGTA.INON-WOVENPRODUCTSω,1:11)JrNJ认NG∞曲回)受益人i全称和详细她。

IGOUJSWNITCllNα[1茧,INCWUUINDUSTRIALPARK,JfNJIANGCITY,FUJIAN,CHINA171直)NOR门J.!OHNSONMONROEJ1-502US,\ AdvisingBank(阳lank,atyouropt?on)通知行ICurrencyandAmount(infigures&wo巾)币种及金额大、小写) BANK01"AMERICAN.A.,GLOIIALTRAI川、OJ>ERATlO附IUSD憾,8300(SAYU.SDOLLARSSIXTY-El(丑ITTHOUSAND EIGHTswwrCOD立BOFAl.iS3NI尸川HlJNDREDANDTHIRTY-TWOONLY)口凹aceoftakinginchargeIDispatchfrom.缸eofreceipt接管/从发送/收货地口Placeoffinald田tifl.atíonIFortrans阴阳ionto.四ofdeliveη目的地运至/交付地因Po忱。

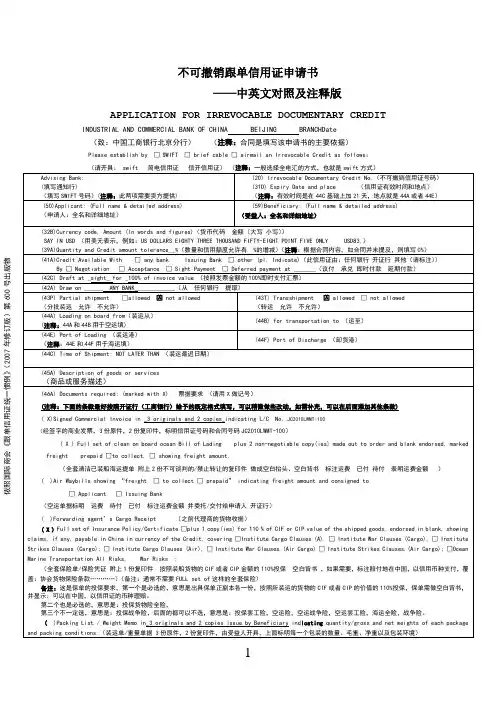

不可撤销跟单信用证申请书——中英文对照及注释版APPLICATION FOR IRREVOCABLE DOCUMENTARY CREDITINDUSTRIAL AND COMMERCIAL BANK OF CHINA BEIJING BRANCHDate(致:中国工商银行北京分行) (注释:合同是填写该申请书的主要依据)Please establish by □ SWIFT □ brief cable □ airmail an Irrevocable Credit as follows : (46A) Documents required: (marked with X) 票据要求 (请用X 做记号) (注释:下面的条款最好按照开证行(工商银行)给予的既定格式填写,可以稍微做些改动,如需补充,可以在后面添加其他条款) ( X)Signed Commercial Invoice in _3 originals and 2 copies_indicating L/C No. JC2010LWMT-100 (经签字的商业发票,3份原件,2份复印件,标明信用证号码和合同号码JC2010LWMT-100) ( X ) Full set of clean on board ocean Bill of Lading plus 2 non-negotiable copy(ies) made out to order and blank endorsed, marked freight prepaid □to collect, □ showing freight amount . (全套清洁已装船海运提单 附上2份不可谈判的/禁止转让的复印件 做成空白抬头、空白背书 标注运费 已付 待付 表明运费金额 ) ( )Air Waybills showing “freight □ to collect □ prepaid” indicating freight amount and consigned to □ Applicant □ Issuing Bank(空运单据标明 运费 待付 已付 标注运费金额 并委托/交付给申请人 开证行)( )Forwarding agent’s Cargo Receipt (之前代理商的货物收据)( X ) Full set of Insurance Policy/Certificate □plus 1 copy(ies) for 110 % of CIF or CIP value of the shipped goods, endorsed in blank, showing claims, if any, payable in China in currency of the Credit, covering □Institute Cargo Clauses (A), □ Institute War Clauses (Cargo), □ Institute Strikes Clauses (Cargo); □ Institute Cargo Clauses (Air), □ Institute War Clauses.(Air Cargo) □ Institute Strikes Clauses.(Air Cargo); □Ocean Marine Transportation All Risks, War Risks ;(全套保险单/保险凭证 附上1份复印件 按照装船货物的CIF 或者CIP 金额的110%投保 空白背书 ,如果需要,标注赔付地在中国,以信用币种支付,覆盖:协会货物保险条款…………)(备注:通常不需要FULL set of 这样的全套保险)备注:这是保单的投保要求,第一个是必选的,意思是出具保单正副本各一份,按照所装运的货物的CIF 或者CIP 的价值的110%投保,保单需做空白背书,并显示:可以在中国,以信用证的币种理赔。

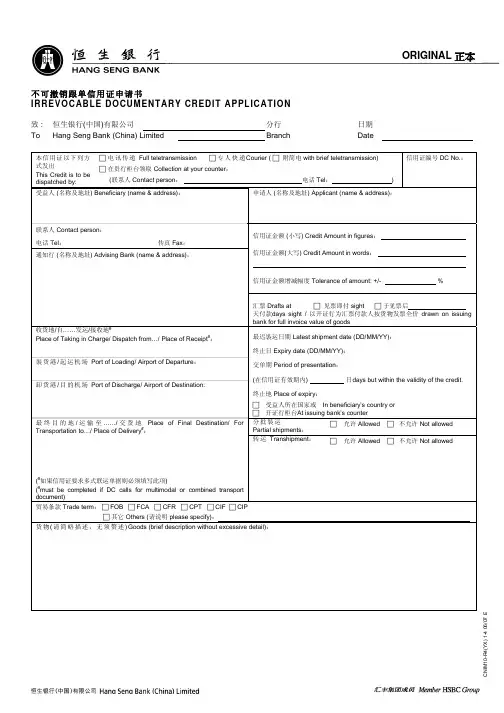

ORIGINAL 正本不可撤销跟单信用证申请书IRREVOCABLE DOCUMENTARY CREDIT APPLICATION致 : 恒生银行(中国)有限公司分行 日期 To Hang Seng Bank (China) LimitedBranchDate本信用证以下列方式发出This Credit is to be dispatched by:电讯传递 Full teletransmission 专人快递Courier ( 附简电 with brief teletransmission) 在贵行柜台领取 Collection at your counter :(联系人 Contact person :电话 Tel :)信用证编号 DC No.: 受益人 (名称及地址) Beneficiary (name & address):申请人 (名称及地址) Applicant (name & address):联系人 Contact person : 电话 Tel :传真 Fax :信用证金额 (小写) Credit Amount in figures :信用证金额(大写) Credit Amount in words :信用证金额增减幅度 Tolerance of amount: +/- % 通知行 (名称及地址) Advising Bank (name & address):汇票 Drafts at 见票即付 sight 于见票后 天付款days sight / 以开证行为汇票付款人按货物发票全价 drawn on issuing bank for full invoice value of goods收货地/自……发运/接收地#Place of Taking in Charge/ Dispatch from…/ Place of Receipt #:裝货港/起运机场 Port of Loading/ Airport of Departure :卸货港/目的机场 Port of Discharge/ Airport of Destination:最迟裝运日期 Latest shipment date (DD/MM/YY): 终止日 Expiry date (DD/MM/YY): 交单期 Period of presentation : (在信用证有效期内) 日days but within the validity of the credit.终止地 Place of expiry :受益人所在国家或 In beneficiary’s country or 开证行柜台At issuing bank’s counter分批裝运 Partial shipments : 允许 Allowed 不允许 Not allowed最终目的地/运输至……/交货地 Place of Final Destination/ For Transportation to…/ Place of Delivery #:(#如果信用证要求多式联运单据则必须填写此项)(#must be completed if DC calls for multimodal or combined transport document)转运 Transhipment : 允许 Allowed 不允许 Not allowed 贸易条款 Trade term : FOB FCA CFR CPT CIF CIP其它 Others (请说明 please specify):货物(请简略描述,无须赘述)Goods (brief description without excessive detail):X ) 1-4 06/07 EY X ) 2-4 06/07 E申请开立不可撤销跟单信用证的条款与条件(“条款与条件”)TERMS AND CONDITIONS UNDER IRREVOCABLE DOCUMENTARY CREDIT APPLICATION (“TERMS AND CONDITIONS”)鉴于恒生银行(中国)有限公司(简称”银行”)根据开立不可撤销跟单信用证申请书(以下简称“申请书”)开立跟单信用证,信用证申请人(“申请人”)同意:In consideration of Hang Seng Bank (China) Limited (“the Bank”) establishing documentary credit under an Irrevocable Documentary Credit Application (“this application”), the applicant of the documentary credit (“the Applicant”) agrees: 承兑及在到期日偿付根据本信用证所载条款开立的所有汇票; (a) to accept and pay at maturity all drafts drawn in accordance with the terms of the documentary credit;(b) 在到期日或之前向银行交付资金,以偿付银行支付的所有款项和/或银行所承兑的金额,并偿付银行的全部佣金及费用(包括运费,如有)以及银行或银行的代理行与本信用证相关而发生的任何性质的义务、责任及费用;to provide the Bank at or before maturity with funds to meet all disbursements and/or the Bank’s acceptances and to pay all the Bank’s commission and charges including freight if any and all obligations, liabilities and expenses of any nature incurred by the Bank or the Bank’s agents in connection with the documentary credit;(c)如保险由申请人负责,自不可撤销跟单信用证申请日起15天内,把银行认可的保额为全额发票价值另加至少10%的保险单、保险凭证或临时保单送交银行保存, 如临时保单已送交银行保存,则于其后获得正式签发的保险单或保险凭证时, 立即将有关保险单或保险凭证交付银行,否则银行可以(但无义务)另行购买保险,费用一律由申请人承担;in the event of insurance being covered on this side, to deposit with the Bank within 15 days from the date of this application an insurance policy or certificate or cover note acceptable to the Bank for full invoice values plus at least 10% and in case an insurance cover note is deposited with the Bank, to produce to the Bank the relevant insurance policy or certificate forthwith when the same is subsequently issued, failing which the Bank may (but is not obliged to) effect insurance at the applicant’s expense;(d)银行可全权指定银行的往来行、代理行、分行、办事处或子银行作为信用证的通知行, 不论申请人是否已对此进行指定,银行也有权从任何往来行、代理行、办事处或子银行请求、收取及保留任何形式的款项和收益,无论采取折扣、佣金或其它任何形式,而无需向申请人支付或得到申请人的同意或通知申请人;that the Bank has sole discretion in the selection of any correspondent or agent or branch, office or subsidiary through whom the documentary credit may be advised to the beneficiary thereof whether or not the applicant has nominated the same and that the Bank is also entitled to solicit, receive and retain any payment and benefit in whatever form, whether by way of rebate, commission or otherwise, from any correspondent agent, branch, office or subsidiary without accounting to and without consent from, or notice to, the applicant; (e) 银行及其管理人员、雇员、往来行、代理行、分行、办事处和子银行不得对由于使用邮递、电传或电报机构传送其指示或因其指示有不清晰之处而导致的错误或延误而承担任何责任;that the Bank and its officers and employees and correspondents, agents, branches, offices and subsidiaries shall not be liable for any mistake or delay which may result in or from the transmission of its instructions by the postal, cable and telegraph authorities, or in or from any ambiguity in such instructions;(f) 授权银行可全权决定接受反映信用证受益人所在地或者通知信用证的往来行或代理行所在地的当地市场惯例的保单或保险凭证,若上述所在地在美国境内,该保单或保险凭证应为包含美国协会条款的保单或保险凭证;that the Bank is authorized to accept at the Bank’s sole discretion insurance policies or certificates which reflect any local market practice in the jurisdiction where the beneficiary of the relevant documentary credit or where the correspondent or agent through which it is advised is located including American Institute clauses insurance policies or certificates where such jurisdiction is in the United States of America; (g) 如果单据本身表面状况良好,并且除发票以外的单据在总体上载明符合本信用证要求的相关货物的一般性描述,便可视为与本信用证的条款相符;that it shall be a sufficient compliance with the documentary credit if the documents purported to be in order and the documents other than invoice contain only a general description of the relevant goods provided that the documents tendered taken as a whole contain the description required by the documentary credit;在需要进口许可证时,向银行提供申请书所述货物的有效进口许可证,而进口货物经申请人证明为非禁止或限制种类的货物;(h) where an import license is required, to exhibit to the Bank a valid import license for the goods described in this application, the importation of which is certified by the applicant to be not prohibited or restricted;(i) 为保证偿付申请人于任何时间欠付的本申请书项下的任何及所有款项,银行对所有相关货物、单据及保险单及其收益均有担保权益(包括质押权及留置权(如法律允许)),可全权决定且有权在货物运抵之前或之后出售相关货物而无需另行通知申请人;that to secure the payment of all or any moneys for which the applicant may at any time be liable under this application, the Bank has a security interest (including pledge and lien (if permitted by law)) on all the relevant goods, documents and policies and proceeds thereof with full discretion and power of sale over the relevant goods before or after arrival without notice to the applicant; (j) 无特定指示时,无需固定汇率;that fixing exchange is not required if no specific instruction is given;(k) 授权银行(但银行无义务)对信用证指明的单据作任何银行认为必要的补充,以确保符合法律法规;C N I M 10-R 4(Y X ) 3-4 06/07 Ethat the Bank is authorized (but not obliged) to make any additions to the documents specified under the documentary credit which the Bank may consider necessary to ensure compliance with the applicable laws and regulations;(l) 在没有与本申请书中所述内容相反的指示的情况下,授权银行全权指示任何其往来行、代理行、分行或子银行以一次或多次邮递或其它传递方法传递任何汇票及/或单据;that in the absence of any instructions to the contrary specified in this application, the Bank is authorized to instruct any correspondent, agent, branch, office or subsidiary to dispatch any draft(s) and/or any documents by one or more mails or other method of conveyance as the Bank may at its sole discretion determine;(m)在银行根据本信用证付款之前或之后,如以申请人名义签/盖在货物收据、信托收据或其它文件上的签名、印章或公章被发现为假冒,只要银行已对该等签名、印章和/或公章与银行记录中所存档的核实相似,银行有权为付款之目的全权决定接受此等签名、印章或公章,且对申请人具有最终的约束力,申请人须向银行偿付银行在本信用证项下的付款;that notwithstanding that the signature(s), chop(s) and/or seal(s) purported to be given put or affixed on the applicant’s behalf on the cargo receipt, trust receipt or any other document(s) required under the documentary credit issued pursuant to this application may subsequently be found to be forgery whether on or before or after the Bank’s payment under the documentary credit, such signature(s), chop(s) and/or seal(s) may be accepted by the Bank at its discretion for the purpose of payment and shall be conclusively binding upon the applicant and the applicant shall be bound to reimburse the Bank for its payment under the documentary credit provided that the Bank has verified it/them to be favourably comparable with that/those appearing in the Bank’s record;(n) 本申请书、信用证及其项下票据受在银行存档的由申请人签署的有关贸易融资的交易文件(包括贸易融资业务通用协议)所载的条款与条件(可不时修订)约束;that this application, the documentary credit and drawings thereunder are also subject to the terms and conditions of the documents relating to trade financing transactions (including the Bank’s Trade Financing General Agreement) executed by the applicant and on file with the Bank (as they may be amended from time to time);(o) 除非在将来的修订中另有约定,本申请书、信用证及将来的修订及其项下票据均受在开立信用证时的国际商会《跟单信用证统一惯例》的通行版本所约束;that this application, the documentary credit and subsequent amendment(s) and drawing(s) are subject to the Uniform Customs and Practice for the Documentary Credits of the International Chamber of Commerce as are in effect at the time of establishing the documentary credit, unless otherwise stipulated in subsequent amendment(s) to the documentary credit;(p) 申请人充分理解国际商会第600号出版物《跟单信用证统一惯例》2007年修订版第34条的含义或《跟单信用证统一惯例》将来的版本中任何类似性质的条款的含义,如果一家银行声称已就本信用证作出议付,在无相反证据的情况下确认其善意及议付的事实;that the applicant fully understands the implications of Article 34 of the Uniform Customs and Practice for Documentary Credits, 2007 Revision, International Chamber of Commerce Publication No. 600 or any article(s) of similar nature in subsequent edition(s) of the Uniform Customs and Practice for Documentary Credits of the International Chamber of Commerce and acknowledges that where a bank claims to have negotiated under the documentary credit, its good faith and the fact of negotiation thereof shall be presumed in the absence of evidence to the contrary;(q) 本信用证将来的所有修订(如有)均受上述条款与条件约束;that all subsequent amendment(s) (if any) to the documentary credit is/are subject to the above terms and conditions; and(r)本申请书及其条款与条件均受中国法律(为此条款与条件之目的,不包括香港特别行政区、澳门特别行政区及台湾的法律)管辖并按其解释。

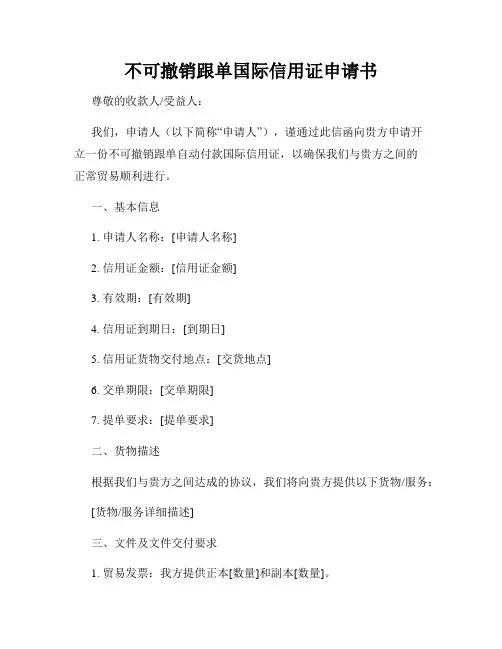

不可撤销跟单国际信用证申请书尊敬的收款人/受益人:我们,申请人(以下简称“申请人”),谨通过此信函向贵方申请开立一份不可撤销跟单自动付款国际信用证,以确保我们与贵方之间的正常贸易顺利进行。

一、基本信息1. 申请人名称:[申请人名称]2. 信用证金额:[信用证金额]3. 有效期:[有效期]4. 信用证到期日:[到期日]5. 信用证货物交付地点:[交货地点]6. 交单期限:[交单期限]7. 提单要求:[提单要求]二、货物描述根据我们与贵方之间达成的协议,我们将向贵方提供以下货物/服务:[货物/服务详细描述]三、文件及文件交付要求1. 贸易发票:我方提供正本[数量]和副本[数量]。

2. 装箱单/清单:我方提供正本[数量]和副本[数量]。

3. 提单/运单:按照贵方要求,运输公司将提供正本[数量]和副本[数量]。

4. 保险单据:我方提供正本[数量]和副本[数量]。

5. 其他:[若有其他文件要求,请列明]所有文件均应于交单期限前寄送至贵方指定地点。

四、付款及付款条款1. 付款方式:信用证规定的付款方式为不可撤销跟单信用证。

2. 付款期限:根据信用证规定,我方将根据单据的完整性和一致性,在收到合规单据后[天/周/月]内付款。

3. 付款货币及金额:根据信用证规定,我方将以[货币]支付[金额]。

五、信用证条款及特殊要求1. (根据实际情况,列出信用证条款及特殊要求,简洁明了地描述具体内容)请贵方确保符合上述信用证条款,并在规定期限内提供准确完整的单据。

六、违约责任与解决争议1. 申请人承诺按照信用证的要求履行支付义务,如有违约,愿意承担因此产生的一切责任和损失。

2. 凡因本信用证引起的或与本信用证相关的任何争议,双方应尽力友好协商解决;若协商不成,应提交由仲裁机构进行调解、仲裁或诉讼解决。

七、其他补充说明1. 本申请书一式[份数],各方均持有有效原件。

2. 本申请书适用于所有与贵方之间的交易,有效期内无需重新申请。

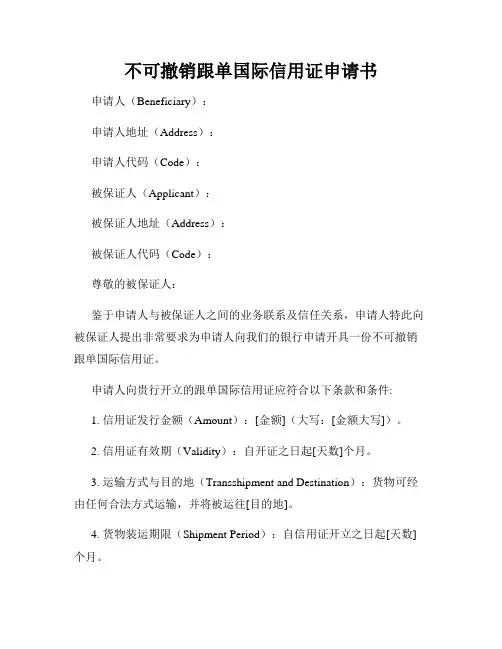

不可撤销跟单国际信用证申请书申请人(Beneficiary):申请人地址(Address):申请人代码(Code):被保证人(Applicant):被保证人地址(Address):被保证人代码(Code):尊敬的被保证人:鉴于申请人与被保证人之间的业务联系及信任关系,申请人特此向被保证人提出非常要求为申请人向我们的银行申请开具一份不可撤销跟单国际信用证。

申请人向贵行开立的跟单国际信用证应符合以下条款和条件:1. 信用证发行金额(Amount):[金额](大写:[金额大写])。

2. 信用证有效期(Validity):自开证之日起[天数]个月。

3. 运输方式与目的地(Transshipment and Destination):货物可经由任何合法方式运输,并将被运往[目的地]。

4. 货物装运期限(Shipment Period):自信用证开立之日起[天数]个月。

5. 单据要求(Documentary Requirements):a) 提单:正本[数量],副本[数量]。

标注"收货人为被保证人或指定的受益人"。

b) 商业发票:按照申请人提供的发票金额,发票总金额为[金额](大写:[金额大写])。

要求提供两份以被保证人为收货人的正本商业发票。

c) 装箱单:由申请人或其代理人提供,标明装箱的具体情况以及货物数量。

d) 保险单:按照申请人提供的保险单金额,保单总金额为[金额](大写:[金额大写])。

要求提供两份以被保证人为受益人的保险单。

6. 支付条件(Payment Terms):一旦被保证人按要求提交符合信用证要求的单据,我们将在收到该单据后[天数]个工作日内支付信用证金额。

我们要求被保证人向我行确认并保证如下事项:1. 被保证人已清楚并完全了解信用证的相关条款和条件。

2. 被保证人同意遵守信用证中规定的所有要求并按照信用证的规定提供相关单据。

3. 被保证人已妥善保管信用证副本,并将不会向其他任何人透露或提供信用证的相关信息。

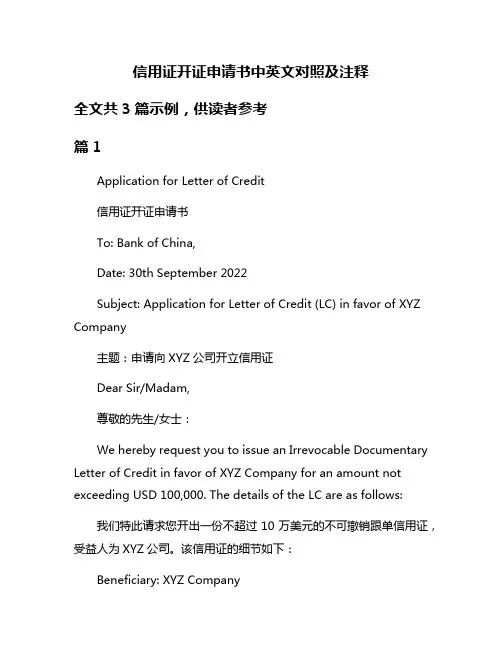

信用证开证申请书中英文对照及注释全文共3篇示例,供读者参考篇1Application for Letter of Credit信用证开证申请书To: Bank of China,Date: 30th September 2022Subject: Application for Letter of Credit (LC) in favor of XYZ Company主题:申请向XYZ公司开立信用证Dear Sir/Madam,尊敬的先生/女士:We hereby request you to issue an Irrevocable Documentary Letter of Credit in favor of XYZ Company for an amount not exceeding USD 100,000. The details of the LC are as follows:我们特此请求您开出一份不超过10万美元的不可撤销跟单信用证,受益人为XYZ公司。

该信用证的细节如下:Beneficiary: XYZ Company受益人:XYZ公司Amount: USD 100,000金额:10万美元Expiry Date: 31st December 2022到期日期:2022年12月31日Goods/Services: Import of machinery equipment for manufacturing purpose货物/服务:用于制造目的的机械设备进口LC Terms: The LC should be issued in accordance with the Uniform Customs and Practice for Documentary Credits (UCP 600) latest version.信用证条款:该信用证应根据最新版本的《跟单信用证统一惯例》(UCP 600)规定。

不可撤销跟单国际信用证申请书尊敬的收款行(Beneficiary's Bank):我们(Applicant)谨依照贵行的要求,通过此信函向贵行申请开立不可撤销跟单国际信用证,以确保我们的交易顺利进行。

我们的详细信息如下:申请人名称:[申请人名称]申请人地址:[申请人地址]申请人账号:[申请人账号]有关受益人(Beneficiary)的详细信息如下:受益人名称:[受益人名称]受益人地址:[受益人地址]受益人账号:[受益人账号]信用证开立金额:[金额]货币:[货币类型]信用证开立有效期:[有效期]货物或服务描述:[描述]我们郑重声明,我们将按照以下条件和要求的方式开立此不可撤销跟单国际信用证:1. 开证行:信用证应由贵行开立,并以不可撤销的方式进行。

我们希望您能认真履行自己作为开证行的责任,并确保信用证的有效性和可执行性。

2. 有效期和地点:信用证应在开始日期后的一段时间内有效,有效期至合同约定完成之日,地点为[指定地点]。

3. 保证金:作为申请人,我们将于信用证生效时支付一笔保证金,作为对可能发生的未按合同约定履行责任的赔偿。

该保证金应在信用证到期后的[指定天数]内无息退还给我们。

4. 单据要求:受益人必须按照信用证的要求提交以下单据:a) 一份符合本信用证规定的装船清单(即发票);b) 一份非转让的提单或运输文件;c) 一份符合运输工具、起运地和目的地的保险单据;d) 一份符合当地法规的出口许可证或其他必要的文件。

5. 支付条款:信用证执行时,受益人将根据信用证和相关单据要求,向我们提供上述单据副本。

一旦单据符合信用证规定,我们将在收到单据后[指定天数]内支付信用证金额给受益人。

6. 经通知信用证:此信用证将通过正规的银行渠道经通知给受益人,除非我们另有要求,否则贵行将默认通过[指定通知银行]作为通知行。

7. 修改和撤回:此信用证在生效后不得修改或撤回,除非有我们的书面同意。

8. 适用法律和争议解决:此信用证的解释和执行将适用[适用法律],任何因此信用证引起的争议,双方应首先通过友好协商解决。

APPLICATION FOR IRREVOCABLE DOCUMENTARY CREDITTo:China Merchants Bank Co., Ltd. Date:___________________CONTRACT NO.CONTRACT AMT:SCHEDULE不可撤销跟单信用证申请书致:中国招商银行股份有限公司日期:在相应的框中标记“X”请发行及寄发的不可撤销跟单信用证(“信贷”)按本申请的条款到期日期和到期地点大概 %的信贷金额和数量的商品津贴信用证发送形式如下:是被允许的完全远程传送原始的航空邮件传送快递申请人(姓名和地址)收益人(姓名和地址)通知行小写金额大写金额收货地点/调度…/收货地点: 议付适用银行装货港/机场出发: 开户行任何银行卸货港/目的地机场: 通过□谈判接受□即期付款□延期付款最终目的地的地方/运输…/交货地点: 即期__天__凭单第1部分中指定的时间表。

不迟于: 汇票上(不适用于即期或延期付款直流)开户银行:分批装运转运转移信用证确认□允许□允许□可转移□要求□不允许□不允许□不可转移□受益人要求则允许文件必须在装船后天之内发出,但必须在信用证有效期内提交货物简要描述:价格条款:□离岸价格□成本加运费□到岸价格□货交承运人□运费付至□运费和保险费付至□本地交付□其他按照ICC国际贸易术语通则解释其他说明:□背对背信用证这个背对背信用证与雇主的支持是相反的,信贷号码:开户于:(主信贷)原来的信贷是□关闭的□在你手上□从前端到后端的信贷这张信用证的发行是从属于以我方收益发行的原始信用状的,我方保证一旦我方收到相同的信用证就马上向你方提供原来的原始信用证。

□信托收据(T / R)贷款申请请订一个T / R贷款解决本证项下开具的图纸。

此T / R贷款申请从属于承诺和信托收据附呈。

你不可撤销地授权完成承诺,代表我们的信托收据在任何时候与T / R颁发的贷款的细节。

付款说明:请从我方账户扣除你方佣金、手续费以及远期利率该利率是伦敦银行同业拆进利率+()%,如果有的话。

百度文库 - 让每个人平等地提升自我!1ABC(2013)3011 3-1(See box marked with “×” 用“×”在方框中标识)APPLICATION FOR IRREVOCABLE DOCUMENTARY CREDIT开立不可撤销跟单信用证申请书 Date 日期 2013.4.1T h i s C r e d i t i s s u b j e c t t o U n i f o r m C u s t o m s a n d P r a c t i c e f o r D o c u m e n t a r y C r e d i t s (2007 R e v i s i o n ) I n t e r n a t i o n a l C h a m b e r o f C o m m e r c e P u b l i c a t i o n N o .600. 此信用证遵循国际商会第600号出版物《跟单信用To: AGRICULTURAL BANK OF CHINA BRANCH 致:中国农业银行股份有限公司 行Credit No.信用证号码□ Issued by mail 信开 □ With brief advice by teletransmission 简电开 Issued by swift 电开 Expiry Date 有效期2013.05.21Expiry Place 有效交单地 ITALY □ in (开证行所在国家/地区)□ in (指定银行所在国家/地区)□ in (受益人所在国家/地区)Applicant 申请人XAC GROUP IMPORT AND EXPORT CO., LTD. NO.1 XIFEI ROAD YANLIANG DISTRICT, XI'AN 710089 CHINA TEL:8629-86845587 FAX:8629-86207040 Beneficiary(with full name and address)受益人(全称和详细地址) ITALTHERM SRL via G.Orsi,44 29122 piacenza (PC) - ITALY TEL: +0039 0523 575611 FAX: +39 0523 575600Advising Bank(if blank, at your option )通知行RECEIVING BANK: BANCA POPOLARE DELL ’EMILIA ROMAGNA-VIA SAN CARLO 8/20-MODENA SWIFT CODE :BPMOIT22XXXCurrency and Amount(in figures & words)币种及金额(大、小写)EUR100050.53 Say EUR one hundred thousand fifty cents fifty three only. □Place of taking in charge/Dispatch from …/Place of receipt 接管/从…发送/收货地XPlace of final destination/For transportation to …/place of delivery 目的地/运至…/交付地Beijing China.X Port of loading 装货港 SEA PORT, ITALY . □Airport of departure 起飞机场 XPort of discharge 卸货港 SEA PORT,TIANJING ,XINGANG , CHINA. □Airport of destination 目的地机场 XLatest date of Shipment 最迟装运日 2013.04.30 Instalment Shipment (Specify, if any )分期装运:(如有,请具体列明)Credit available with 此证由 (bank 银行) by □ sight payment 即期付款 X deferred payment at 90 days after B/L date 日后 天延期付款 □ acceptance 承兑□ negotiation 议付against the documents required herein 连同下列所需单据,□and beneficiary ’s draft(s) □ at day(s) sight/□at days after date drawn on for % of invoice value. 及受益人按发票金额 %,做成以 为付款人,期限为 □见票后 天/□ 日后 天的汇票。

不可撤销信用证开证申请书尊敬的贵公司,我代表本公司(或个人)正式向贵公司提交不可撤销信用证开证申请书,请贵公司合作银行(以下简称开证行)开立一份不可撤销信用证,以确保我们的贸易交易顺利进行。

本信用证的开证金额、有效期、规定条款等具体细节如下:1. 交易细节:我方作为出口商,愿意根据贵方提供的采购合同/订单,按合同/订单规定的要求向贵公司出售商品(以下简称货物)。

货物的详细信息包括但不限于名称、规格、型号、数量、单价、交货地点和交货日期等。

2. 信用证开证金额:本信用证的开证金额为(货币种类和具体金额),该金额将在贵方按照合同/订单要求按期交付相应的货物后支付给我方。

3. 有效期:本信用证的有效期为开证日起至指定到期日(不得少于货物最后装运日之后的 (__) 天)。

未能按指定到期日使用或对信用证项下的支付提出请求的信用证将自动失效。

4. 受益人和付款条款:本信用证的受益人为我方,付款条件为:付款由开证行在收到我方提交的下列单据后根据信用证规定的条件进行确认和付款:a. 货物完整的运输单据,包括但不限于商业发票、装箱单、提单、保险单等;b. 发票金额必须与信用证规定的金额一致;c. 所有单据必须符合信用证规定的格式和要求;d. 单据的有效期限在货物装运后 (__) 天内。

5. 延期装运:如因我方原因无法按合同/订单规定的交货日期装运货物,我方须提前书面通知贵方,并在装运日之前获得贵方书面同意。

双方协商后确定的延期交货日期将作为信用证的有效期予以调整。

6. 文档修改和通知:除非经过我方和贵方双方书面同意,否则不得对信用证项下的任何内容进行修改。

任何关于信用证的修改通知必须以书面形式发送给我方,并经我方确认才能生效。

7. 法律适用和争议解决:本信用证开证申请书将受到适用于该信用证的国家法律的管辖。

对于因信用证交易引起的任何争议,双方应通过友好协商解决,如果协商不成,应提交至管辖该信用证的城市的仲裁机构进行仲裁。

不可撤销跟单信用证申请书APPLICATION FOR IRREVOCABLE DOCUMENTARYCREDITTO: INDUSTRIALAND COMMERCIAL BANK OF CHINA BRANCH DatePlease establish by □ SWIFT □ brief cable □ airmail an Irrevocable Credit as follows:Advising Bank: (to be left for bank to fill in) (20) Irrevocable Documentary Credit No.(31D) Expiry Date and place (50)Applicant: (Full name &detailed address)(59)Beneficiary: (Full name &detailed address) (32B)Currency code, Amount (In words and figures)(39A)Quantity and Credit amount tolerance_________%(41A)Credit Available With □ any bank □ Issuing Bank □ other (pl. Indicate) By □ Negotiation □ Acceptance □ Sight Payment □ Deferred payment at _______(42C) Draft at _________________________________for ______%of invoice value (42A) Draw on □issuing bank □ other bank(pls indicated)(43P) Partial shipment □ allowed □ not allowed (43T) Transshipment □ allowed □ not allowed (44A) Loading on board from (44B) for transportation to (44E) Port of Loading (44F) Port of Discharge (44C) Latest shipment date (45A) Description of goods or services Price term:Packing:(46A) Documents required: (marked with X)( )Signed Commercial Invoice in ___________ indicating L/C No. and Contract No.( )________ set of clean on board ocean Bills of Lading made out to order and blank endorsed marked “ freight______________ ” □ notifying □ Applicant ( )Air Waybills showing “freight □ to collect □prepaid” indicating freight amount and consigned to □ Applicant □ Issuing Bank ( )Forwarding agent’s Cargo Receipt ( )Insurance Policy/Certificate in______ for____ % of the invoice value showing claims payable in China in currency of the draft. blank endorsed, covering ( □ Ocean Marine Transportation □ Air Transportation □ Over LandTransportation) AllRisks, War Risks, including______________________ asper____________________________ Clause.( )Packing List / Weight Memo in___________ indicating quantity / gross and net weights of each package and packing conditions as called for by the L/C.( )Certificate of Quantity / Weight in _____________ .( )Certificate of Quality in_____________ issued by □ Beneficiary □ public recognized surveyor □ manufacturer. ( )Beneficiary’s certified copy of fax / telex dispatched to the applicant within____hours after shipment advising □ name of vessel □ B/L No. □ Flight No. □ Wagon No. □ Shipping date □ contract No. □ L/C No., Commodity, quantity, weight and value of shipment.(47A) Additional conditions: (Marked with X)( ) Documents issued earlier than L/C issuing date are not acceptable.( ) All documents to be forwarded in one cover, unless otherwise stated.( )The remaining __________% of invoice value . ( ) Third party as shipper □ is □ is not acceptable. ( )Our bank process transactions in accordance with local and international laws and regulations, and reserve theright to comply with foreign sanctions as well.consequently documents issued by or showing any involvement of parties sanctioned by any competent authority or contained any information thereon might not be processed by our bank at our sole discretion and without any liability on our part. (X )unless otherwise stipulated in the credit,all documents must be issued in english.(71B) All banking charges and interest if any outside issuing bank are for account of □ beneficiary □ other (pl. Indicate)(48)Documents to be presented within_____ days after the date of issuance of the transport document(s) but within the validity of the credit依照国际商会《跟单信用证统一惯例》(2007年修订版)第600号出版物开证申请人(公章或授权印鉴) :法定代表人或被授权人:联系人:电话:。

T h i s C r e d i t i s s u b j e c t t o I C C N o .600 U n i f o r m C u s t o m s a n d P r a c t i c e f o r D o c u m e n t a r y C r e d i t s (2007 R e v i s i o n ) 此信用证遵循国际商会第600号出版物《跟单信用证统一惯例》(2007年修订版)APPLICATION FOR IRREVOCABLE DOCUMENTARY CREDIT开立不可撤销跟单信用证申请书Date 日期 _________________To: BANK OF HANGZHOU 致:杭州银行Advising Bank ( if blank, at your option) 通知行Credit No.信用证号码Expiry Date and Place 到期日和到期地点Applicant (full name & detailed address )申请人(全称和详细地址)Beneficiary ( with full name and address ) 受益人(全称和详细地址)Amount ( in figures & words) 金额(大、小写)Credit available with 此证可由 □any bank 任何银行 □issuing bank 开证行 By □ sight payment 即期付款 □ acceptance 承兑□ negotiation 议付 □ deferred payment 迟期付款 Partial shipments 分批装运 Transhipment 转运 □ allowed 允许□ allowed 允许□ not allowed 不允许 □ not allowed 不允许Draft at_____________________________________ for _______ % of invoice value 汇票付款期限_______,发票金额的_______ %Drawn on 付款人 ________________________________________________________Shipment from 装运从 For transportation to 运至Latest shipment date 最迟装运日Documents required: (marked with “╳”) 所需单据(用“╳”标明):□ Signed Commercial Invoice in _______ copies indicating L/C No. and Contract No. _____________________________________________经签字的商业发票一式_______份,标明信用证号和合同号______________________________________________________________ □ Full set of clean on board Ocean Bill of Lading □ made out to order and blank endorsed, □___________________ , marked “freight □prepaid / □ to collect ” □ showing freight amount and notifying ______________________________________________________________全套清洁已装船海运提单做成□空白抬头、空白背书,□_____________,注明“运费□已付/□待付”, □标明运费金额,并通知_____________________。

□ Air Waybills consigned to applicant marked “freight □ prepaid / □to collect” notifying ____________________________________________________________________________________________________________________________.空运单据收货人为开证申请人,注明“运费□已付/□待付”,并通知_________________________________________________________________________。

□ Full set of Insurance Policy / Certificate for ______ % of the invoice value, blank endorsed, showing claims payable in China in the currency of the draft, covering □ocean marine transportation □air transportation □overland transportation All risks and War risks and __________________________________________________ 全套保险单/保险凭证,按发票金额的 ______ %投保,空白背书,注明赔付地在中国,以汇票币种支付,覆盖□海运 □空运 □陆运,承保一切险,战争险和____________________________________________________________________。

□ Packing List / Weight Memo in _________ copies indicating quantity, gross and net weight of each package.装运单 / 重量证明一式______份,注明每一包装的数量、毛重和净重。

□ Certificate of Quantity / Weight in __________ copies issued by _______________________________________________________________________________ 数量 / 重量证明一式______份,由____________________________________________________出具。

□ Certificate of Quality in ________ copies issued by___________________________________________________________________________________________ 品质证一式 ______ 份,由____________________________________________________出具。

□ Certificate of Origin in ________ copies issued by _________________________________________________________________________产地证一式________份,由 ______________________________________________ 出具。

□ Beneficiary’s Certified copy of fax / telex dispatched to the applicant within _______ day(s) after shipment advising □L/C No., □name of vessel, □flight No. □shipping date, □name of goods, quantity, □weight and value of goods.受益人传真/电传方式通知申请人装船证明副本。

该证明须在装船后__________天内发出,并注明该□信用证号、□船名、□航班号、□装运日以及□货物的名称、□货物的数量、□重量和货物价值。

□ Other documents, if any 其他单据Description of goods or services 货物或服务描述Additional instructions: 附加条款□ All banking charges outside the Issuing Bank are for account of Beneficiary.开证行以外的所有银行费用由受益人承担。

□ Documents must be presented within ________ days after date of issuance of the transport document but within the validity of the credit.所需单据须在运输单据签发日后___________天内提交,但不得超过信用证有效期。

□Third party as shipper is not acceptable. 第三方为托运人不可接受。

□Both quantity and Credit amount _________ % more or less are allowed. 数量及信用证金额允许有_________%的增减。

□Other terms and conditions, if any 其他条款申请人盖章开证申请人承诺书致:杭州银行我公司已依法办妥一切必要的进口手续,兹谨请贵行为我公司依照本申请书所列条款开立不可撤销跟单信用证,并承诺如下:一、同意贵行依照国际商会第600号出版物《跟单信用证统一惯例》办理该信用证项下的一切事宜,并同意承担由此产生的一切责任。

二、及时提供贵行要求我公司提供的真实、有效的文件及资料,接受贵行的审查监督。

三、在贵行规定期限内支付该信用证项下的各种款项,包括货款及贵行和有关银行的各项手续费、杂费、利息以及国外受益人拒绝承担的有关银行费用等。

四、在贵行到单通知书规定的期限内,书面通知贵行办理对外付款/承兑/确认迟期付款/拒付手续。

否则,贵行有权自行确定对外付款/承兑/确认迟期付款/拒付,并由我公司承担全部责任。