审计学练习题(26)

- 格式:pdf

- 大小:43.28 KB

- 文档页数:10

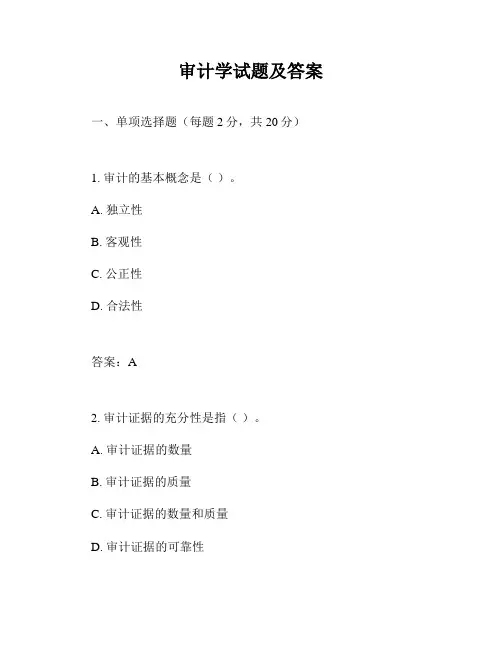

审计学考试题及答案一、单项选择题(每题1分,共10分)1. 审计的独立性是指审计人员在进行审计工作时,必须保持()。

A. 客观性B. 独立性C. 公正性D. 专业性答案:B2. 内部控制制度的健全性评价属于审计的()阶段。

A. 准备阶段B. 实施阶段C. 报告阶段D. 后续阶段答案:A3. 下列哪项不是审计证据的类型?()A. 书面证据B. 口头证据C. 电子证据D. 推测证据答案:D4. 审计人员在对被审计单位的财务报表进行审计时,主要关注的是()。

A. 合规性B. 合法性C. 真实性D. 效益性答案:C5. 审计报告中,如果审计人员发现被审计单位存在重大错误,通常会出具()。

A. 无保留意见B. 保留意见C. 否定意见D. 无法表示意见答案:B6. 审计抽样中,如果样本量过小,可能会导致()。

A. 审计风险增加B. 审计成本降低C. 审计效率提高D. 审计证据充分答案:A7. 审计人员在进行风险评估时,不需要考虑的因素是()。

A. 被审计单位的内部控制B. 被审计单位的经营环境C. 被审计单位的财务状况D. 被审计单位的员工福利答案:D8. 在审计过程中,如果被审计单位拒绝提供必要的审计证据,审计人员可以采取的措施是()。

A. 出具保留意见B. 出具否定意见C. 出具无法表示意见D. 终止审计答案:C9. 审计人员在对被审计单位的存货进行审计时,主要关注的是存货的()。

A. 完整性B. 所有权C. 存在性D. 计价准确性答案:C10. 审计人员在对被审计单位的固定资产进行审计时,主要关注的是固定资产的()。

A. 存在性B. 所有权C. 折旧的合理性D. 减值准备的充分性答案:A二、多项选择题(每题2分,共20分)1. 审计的职能包括()。

A. 经济监督B. 经济评价C. 经济鉴定D. 经济咨询答案:ABCD2. 审计证据的充分性取决于()。

A. 证据的数量B. 证据的质量C. 证据的类型D. 证据的来源答案:AB3. 审计风险包括()。

审计学练习题一、选择题1. 审计的目的是增强信息的可靠性,其核心是提供对以下哪项的合理保证?A. 财务报表的准确性B. 财务报表的完整性C. 财务报表的合法性D. 财务报表的公允性2. 以下哪项不是审计证据的来源?A. 被审计单位的内部记录B. 被审计单位的管理层声明C. 被审计单位的外部通信D. 审计师的个人假设3. 在审计过程中,审计师对被审计单位的财务报表进行评估,以下哪项不是评估的内容?A. 财务报表是否遵循了适用的财务报告框架B. 财务报表是否在所有重大方面公允地反映了被审计单位的财务状况C. 财务报表是否包含了所有必要的注释D. 财务报表的编制是否符合审计师的个人偏好4. 审计师在审计过程中发现被审计单位存在重大错误,以下哪项是正确的做法?A. 忽略错误并继续审计B. 通知被审计单位管理层并要求其更正C. 直接修改财务报表D. 停止审计并报告给监管机构5. 在审计报告中,审计师对被审计单位的财务报表发表的意见,以下哪项是正确的?A. 无保留意见B. 保留意见C. 否定意见D. 以上都是二、判断题1. 审计可以完全消除财务报表中的错误和舞弊的风险。

(对/错)2. 审计师在审计过程中发现的任何错误都应被立即更正。

(对/错)3. 审计报告中的意见类型只包括无保留意见和保留意见。

(对/错)4. 审计师在审计过程中应保持独立性和客观性。

(对/错)5. 审计师在审计报告中发表否定意见意味着财务报表完全不可信赖。

(对/错)三、简答题1. 简述审计的基本概念及其对企业和社会的重要性。

2. 描述审计师在审计过程中可能使用的审计程序和方法。

3. 解释审计证据的概念,并举例说明其来源。

4. 阐述审计师在发现被审计单位财务报表存在重大错误时的应对措施。

5. 描述审计报告中不同意见类型的含义及其对财务报表使用者的影响。

四、案例分析题假设你是一名审计师,正在对一家上市公司进行年度财务报表审计。

在审计过程中,你发现了以下情况:- 被审计单位的存货账面价值与实际盘点结果存在较大差异。

审计学考试试卷和答案一、选择题(每题2分,共20分)1. 审计的基本概念是指:A. 财务报表的准确性B. 财务报表的完整性C. 对财务报表的独立检查D. 对财务报表的内部控制2. 下列哪项不是审计证据的特点?A. 充分性B. 相关性C. 客观性D. 随意性3. 审计风险通常由以下哪几部分构成?A. 固有风险 + 控制风险 + 检测风险B. 固有风险 + 检测风险C. 控制风险 + 检测风险D. 固有风险 + 重大错报风险...二、判断题(每题1分,共10分)1. 审计的最终目标是发现和报告财务报表中的错误。

()2. 审计师在审计过程中必须保持独立性和客观性。

()3. 审计证据的获取只能通过询问和观察。

()...三、简答题(每题10分,共20分)1. 简述审计的基本原则。

2. 描述内部控制的重要性及其在审计过程中的作用。

四、案例分析题(每题15分,共30分)1. 假设你是一家公司的审计师,你发现公司管理层在财务报表中故意低估了存货的价值。

请分析这种情况可能对审计结果产生的影响,并提出你的审计建议。

2. 某公司最近实施了一项新的内部控制系统,但审计师在审计过程中发现该系统存在缺陷。

请讨论内部控制系统的缺陷可能带来的风险,并给出改进建议。

五、论述题(每题20分,共20分)1. 论述信息技术对现代审计工作的影响。

审计学考试答案一、选择题1. C2. D3. A...二、判断题1. ×(审计的最终目标是提供合理的保证,而非仅仅发现错误。

)2. √3. ×(审计证据的获取还包括检查、函证等方法。

)...三、简答题1. 审计的基本原则包括独立性原则、客观性原则、职业怀疑原则、充分性和适当性原则等。

2. 内部控制的重要性在于它能够保证企业资产的安全、财务报告的准确性和经营活动的效率。

在审计过程中,内部控制的有效性可以减少审计风险,提高审计效率。

四、案例分析题1. 管理层故意低估存货价值可能会导致财务报表的不真实,增加审计风险。

审计学练习一、单选题:1、我国审计的确立阶段是(A)A、秦汉时期B、隋唐及宋C、元明时期D、辛亥革命时期2、下列不是审计职能的是(D)A、经济监督B、经济评价C、经济鉴证D、证明作用3.对于当期减少的固定资产,CPA通常不执行的审计程序是(C)A.审查有关的批准文件B.审查有关的会计记录C.函证固定资产的购买单位D.审查出售和报废处理固定资产的净损益4.在了解被审计单位的性质时,最有助于注册会计师发现其在经营策略和经营方向上的重大变化的是(C) A.所有权结构B.组织结构C.投资活动D.资本结构5.会计师事务所应当周期性地选取已完成的业务进行检查,周期最长不得超过(C)A.1年B.2年C.3年D.4年6.下列中国注册会计师执业准则,不包括(D)A.中国注册会计师相关服务准则B.中国注册会计师审计准则C.会计师事务所质量控制准则D.中国注册会计师职业道德准则7、下列不是注册会计师法律责任的是(D)A、违约B、过失C、欺诈D、经营失败8、在确定收费时,会计师事务所不应当考虑的因素是(D)A、专业服务所需的知识和前提B、所需的专业人员的水平和经验C、每一专业人员提供服务所需的时间D、鉴证的结果9、客户更换会计师事务所的时候,后任注册会计师必须与前任注册会计师进行沟通的是(A)A、接受委托前的沟通B、接受委托时的沟通C、接受委托后的沟通D、出具报告时的沟通10、下列关于财务报表层次重大错报风险的说法,不正确的是(B)A、与财务报表整体广泛相关B、与特定的各类交易、账户余额、列报的认定相关C、可能影响多项认定D、很可能源于薄弱的控制环境11.只有认为控制设计合理、能够防止或发现和纠正认定层次的重大错报,注册会计师才有必要进行(D)A.细节测试B.实质性测试C.了解内部控制D.控制测试12、下列不是鉴证业务特点的是(C)A、审计对象是历史财务信息B、得出的结论是合理保证C、业务报告不向第三方提交D、得出的结论是有限保证13、注册会计师了解审计单位及其环境的目的是(C)A、为了进行风险评估程序B、收集充分适当的审计证据C、为了识别和评估财务报表重大错报风险D、控制检查风险14.下列关于审计工作底稿的表述,正确的是(D)A.审计报告日后将审计底稿归档是一项事务性的工作,涉及实施新审计程序或得出新的结论B.审计工作底稿的归档期限为审计报告日后90天C.在归档期间对审计工作作出的变动即便是属于事务性的,注册会计师也无权变动D.删除或废弃被取代的审计工作底稿,在审计工作归档时可以予以清理15.注册会计师了解被审计单位及其环境的目的是(B)A.控制检查风险B.为了识别和评估财务报表重大错报风险C.收集充分适当的审计证据D.为了进行风险评估程序16.注册会计师与政府审计部门如果对同一事项进行审计,最终形成的审计结论可能存在差异。

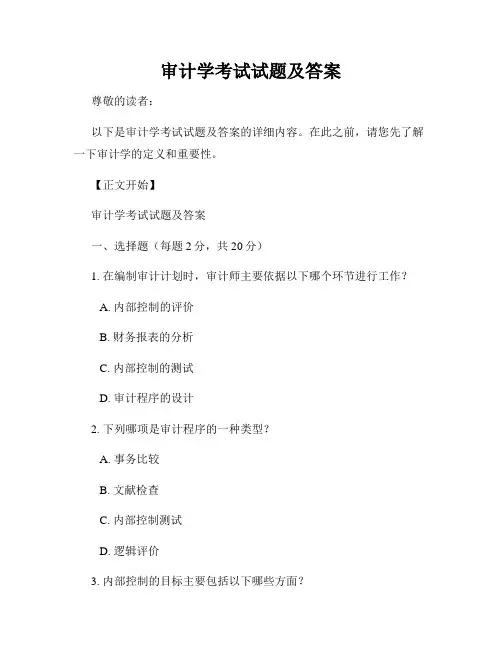

审计学考试试题及答案尊敬的读者:以下是审计学考试试题及答案的详细内容。

在此之前,请您先了解一下审计学的定义和重要性。

【正文开始】审计学考试试题及答案一、选择题(每题2分,共20分)1. 在编制审计计划时,审计师主要依据以下哪个环节进行工作?A. 内部控制的评价B. 财务报表的分析C. 内部控制的测试D. 审计程序的设计2. 下列哪项是审计程序的一种类型?A. 事务比较B. 文献检查C. 内部控制测试D. 逻辑评价3. 内部控制的目标主要包括以下哪些方面?A. 资产保护和成本控制B. 业绩评价和市场竞争C. 公司治理和信息披露D. 盈余预测和财务分析4. 下列哪个是审计程序的主要步骤?A. 建立审计计划B. 评估重大审计风险C. 进行事务测试D. 分析财务报表5. 在审计计划中,审计师主要考虑以下哪个因素?A. 客户的行业背景B. 审计师的工作经验C. 审计师的职业道德D. 审计师的薪酬水平6. 在进行财务报表分析时,审计师主要关注以下哪个方面?A. 公司的市场占有率B. 公司的财务风险C. 公司的股价变动D. 公司的人力资源管理7. 在进行内部控制测试时,审计师主要使用以下哪种方法?A. 随机抽样B. 数据分析C. 逻辑评价D. 会计估计8. 审计风险主要包括以下哪些类型?A. 技术风险和法律风险B. 知识风险和经济风险C. 控制风险和检查风险D. 定量风险和定性风险9. 以下哪个是审计师的职业道德要求之一?A. 独立性B. 多样性C. 创造性D. 竞争性10. 审计师主要通过以下哪个环节来发表审计意见?A. 审计计划B. 审计程序C. 审计报告D. 审计备忘录二、案例分析题(每题10分,共40分)案例一:某公司的财务报表显示,其净利润在过去三年内呈现持续增长的趋势。

请你以审计师的角度,分析可能存在的风险并提出相应的审计程序。

案例二:某公司在采购过程中存在一系列的内部控制问题,包括无法与供应商签署正式合同、采购金额超出预算等。

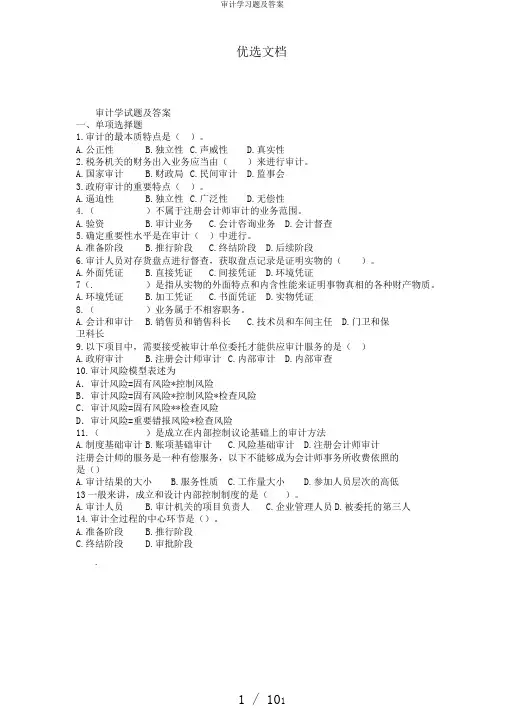

优选文档审计学试题及答案一、单项选择题1.审计的最本质特点是()。

A.公正性B.独立性C.声威性D.真实性2.税务机关的财务出入业务应当由()来进行审计。

A.国家审计B.财政局C.民间审计D.监事会3.政府审计的重要特点()。

A.逼迫性B.独立性C.广泛性D.无偿性4.()不属于注册会计师审计的业务范围。

A.验资B.审计业务C.会计咨询业务D.会计督查5.确定重要性水平是在审计()中进行。

A.准备阶段B.推行阶段C.终结阶段D.后续阶段6.审计人员对存货盘点进行督查,获取盘点记录是证明实物的()。

A.外面凭证B.直接凭证C.间接凭证D.环境凭证7(. )是指从实物的外面特点和内含性能来证明事物真相的各种财产物质。

A.环境凭证B.加工凭证C.书面凭证D.实物凭证8.()业务属于不相容职务。

A.会计和审计B.销售员和销售科长C.技术员和车间主任D.门卫和保卫科长9.以下项目中,需要接受被审计单位委托才能供应审计服务的是()A.政府审计B.注册会计师审计C.内部审计D.内部审查10.审计风险模型表述为A.审计风险=固有风险*控制风险B.审计风险=固有风险*控制风险*检查风险C.审计风险=固有风险**检查风险D.审计风险=重要错报风险*检查风险11.()是成立在内部控制议论基础上的审计方法A.制度基础审计B.账项基础审计C.风险基础审计D.注册会计师审计注册会计师的服务是一种有偿服务,以下不能够成为会计师事务所收费依照的是()A.审计结果的大小B.服务性质C.工作量大小D.参加人员层次的高低13一般来讲,成立和设计内部控制制度的是()。

A.审计人员B.审计机关的项目负责人C.企业管理人员D.被委托的第三人14.审计全过程的中心环节是()。

A.准备阶段B.推行阶段C.终结阶段D.审批阶段.优选文档15、若是应付账款所属明细科目出现借方余额,审计人员应提请在财产负债表的()项目列示。

A.应收账款 B.预收账款C.应付账款D.预付账款16、以下关于内部控制作用的论述正确的选项是()。

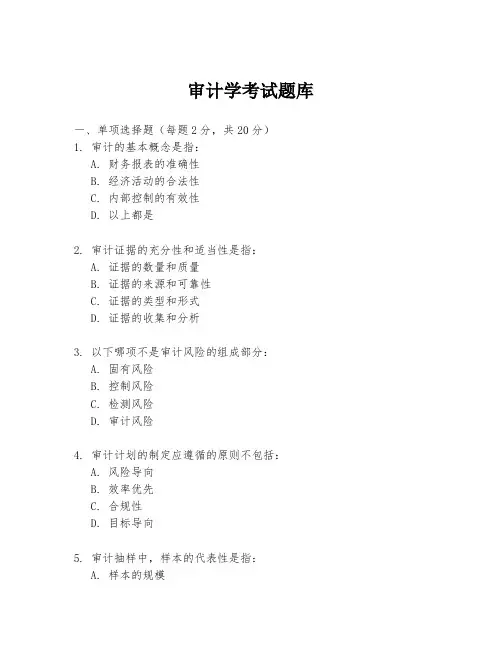

审计学考试题库一、单项选择题(每题2分,共20分)1. 审计的基本概念是指:A. 财务报表的准确性B. 经济活动的合法性C. 内部控制的有效性D. 以上都是2. 审计证据的充分性和适当性是指:A. 证据的数量和质量B. 证据的来源和可靠性C. 证据的类型和形式D. 证据的收集和分析3. 以下哪项不是审计风险的组成部分:A. 固有风险B. 控制风险C. 检测风险D. 审计风险4. 审计计划的制定应遵循的原则不包括:A. 风险导向B. 效率优先C. 合规性D. 目标导向5. 审计抽样中,样本的代表性是指:A. 样本的规模B. 样本的随机性C. 样本的多样性D. 样本的广泛性6. 以下哪项不是审计过程中的审计程序:A. 询问B. 观察C. 检查D. 预测7. 审计报告的类型不包括:A. 标准无保留意见B. 保留意见C. 否定意见D. 预测性意见8. 内部控制的五要素不包括:A. 控制环境B. 风险评估C. 控制活动D. 审计证据9. 以下哪项是审计过程中的非标准审计证据:A. 财务报表B. 合同协议C. 口头陈述D. 内部审计报告10. 审计人员在审计过程中应保持的独立性是指:A. 与被审计单位的独立B. 与审计委托人的独立C. 与审计团队的独立D. 以上都是二、多项选择题(每题3分,共15分)11. 审计目标包括:A. 财务报表的准确性B. 财务报表的完整性C. 财务报表的合规性D. 财务报表的公允性12. 审计证据的获取方式包括:A. 直接观察B. 函证C. 重新计算D. 重新执行13. 审计过程中的分析程序可能包括:A. 比率分析B. 趋势分析C. 垂直分析D. 水平分析14. 审计报告中可能包含的段落有:A. 引言段B. 范围段C. 意见段D. 强调事项段15. 内部控制的局限性包括:A. 人为错误B. 舞弊C. 技术限制D. 成本限制三、判断题(每题1分,共10分)16. 审计人员在审计过程中需要对所有财务报表项目进行详细检查。

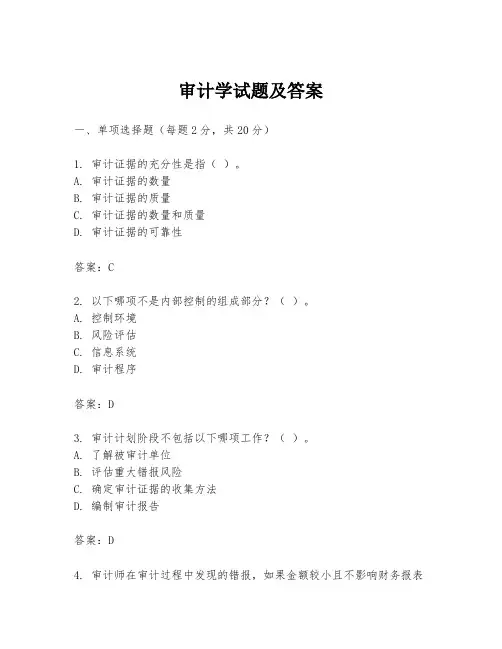

审计学试题及答案一、单项选择题(每题2分,共20分)1. 审计证据的充分性是指()。

A. 审计证据的数量B. 审计证据的质量C. 审计证据的数量和质量D. 审计证据的可靠性答案:C2. 以下哪项不是内部控制的组成部分?()。

A. 控制环境B. 风险评估C. 信息系统D. 审计程序答案:D3. 审计计划阶段不包括以下哪项工作?()。

A. 了解被审计单位B. 评估重大错报风险C. 确定审计证据的收集方法D. 编制审计报告答案:D4. 审计师在审计过程中发现的错报,如果金额较小且不影响财务报表整体的公允性,审计师通常会()。

A. 忽略B. 调整C. 披露D. 报告给管理层答案:A5. 以下哪项不是审计师在审计过程中应保持的独立性?()。

A. 经济独立B. 心理独立C. 职业独立D. 法律独立答案:D6. 在审计过程中,审计师对被审计单位的内部控制进行评估,其目的是为了()。

A. 减少审计证据的收集B. 增加审计证据的收集C. 确定审计证据的可靠性D. 提高审计效率答案:A7. 审计师在进行风险评估时,不需要考虑的因素是()。

A. 被审计单位的行业特点B. 被审计单位的财务状况C. 被审计单位的内部控制D. 审计师的个人偏好答案:D8. 以下哪项不属于审计证据的来源?()。

A. 观察B. 询问C. 函证D. 审计师的直觉答案:D9. 审计报告中不包含以下哪项内容?()。

A. 审计意见B. 财务报表C. 审计师的责任D. 审计结论答案:B10. 审计师在审计过程中发现的错报,如果金额较大且影响财务报表整体的公允性,审计师通常会()。

A. 忽略B. 调整C. 披露D. 报告给管理层答案:C二、多项选择题(每题3分,共15分)1. 审计证据的可靠性可能受到以下哪些因素的影响?()。

A. 证据的来源B. 证据的性质C. 证据的时间D. 审计师的个人偏好答案:ABC2. 审计师在审计过程中可能采取的审计程序包括()。

审计学试题及答案一、单项选择题(每题2分,共20分)1. 审计的基本概念是()。

A. 独立性B. 客观性C. 公正性D. 合法性答案:A2. 审计证据的充分性是指()。

A. 审计证据的数量B. 审计证据的质量C. 审计证据的数量和质量D. 审计证据的可靠性答案:C3. 内部控制审计的目的是()。

A. 评价内部控制系统的完整性B. 评价内部控制系统的有效性C. 评价内部控制系统的合规性D. 评价内部控制系统的风险性答案:B4. 下列哪项不是审计风险的组成部分?()。

A. 固有风险B. 控制风险C. 检测风险D. 经营风险答案:D5. 审计计划阶段的主要工作不包括()。

A. 确定审计目标B. 制定审计计划C. 实施审计程序D. 评估审计风险答案:C6. 审计证据的可靠性受()的影响。

A. 证据来源B. 证据形式C. 证据数量D. 证据时间答案:A7. 审计抽样中,非统计抽样方法不包括()。

A. 随机抽样B. 系统抽样C. 判断抽样D. 整群抽样答案:A8. 审计报告的类型不包括()。

A. 标准无保留意见报告B. 带强调事项段的无保留意见报告C. 保留意见报告D. 否定意见报告答案:B9. 审计中对被审计单位的财务报表进行分析性复核的目的是()。

A. 识别可能存在的舞弊行为B. 评估财务报表的公允性C. 确定审计重点D. 验证财务报表的准确性答案:C10. 审计中对被审计单位的内部控制进行测试的目的是()。

A. 评估内部控制的设计和实施B. 确定审计证据的充分性C. 减少实质性测试的工作量D. 提高审计效率答案:A二、多项选择题(每题3分,共15分)1. 审计证据的类型包括()。

A. 书面证据B. 口头证据C. 电子证据D. 实物证据答案:ABCD2. 审计程序包括()。

A. 询问B. 观察C. 检查D. 函证答案:ABCD3. 审计中对被审计单位的财务报表进行分析性复核时,可能使用的比率分析包括()。

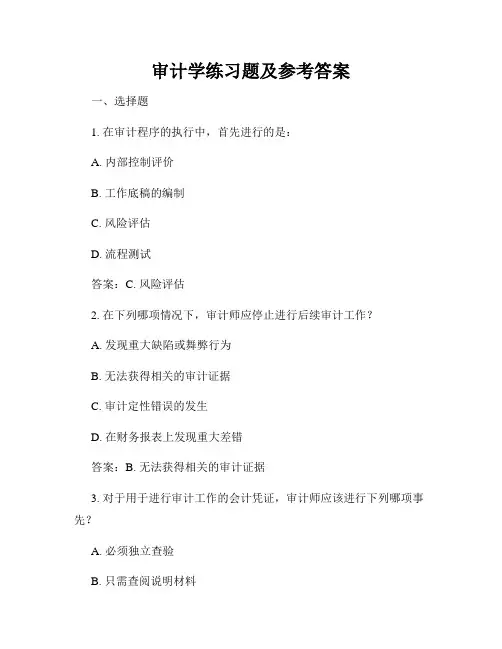

审计学练习题及参考答案一、选择题1. 在审计程序的执行中,首先进行的是:A. 内部控制评价B. 工作底稿的编制C. 风险评估D. 流程测试答案:C. 风险评估2. 在下列哪项情况下,审计师应停止进行后续审计工作?A. 发现重大缺陷或舞弊行为B. 无法获得相关的审计证据C. 审计定性错误的发生D. 在财务报表上发现重大差错答案:B. 无法获得相关的审计证据3. 对于用于进行审计工作的会计凭证,审计师应该进行下列哪项事先?A. 必须独立查验B. 只需查阅说明材料C. 无需进行任何检查D. 可根据自己的判断决定检查与否答案:A. 必须独立查验4. 审计是通过对审计对象所执行的内部控制实施的评估,迫使负有进一步的职责来保证发现任何潜在的舞弊行为。

这种说法是()。

A. 正确的B. 错误的答案:A. 正确的二、判断题1. 审计师只需对财务报表数字进行抽样检查,不需要进行全面审计。

A. 正确B. 错误答案:B. 错误2. 内部审计师和外部审计师的角色和职责大致相同。

A. 正确B. 错误答案:B. 错误3. 审计机构应该具备审计师执业资格证书。

A. 正确B. 错误答案:A. 正确三、简答题1. 请简述审计师对内部控制的评价过程。

答:审计师对内部控制的评价过程包括以下步骤:1)了解与评估内部控制环境:审计师需要了解企业的组织结构、领导层的态度和行为、内部控制政策和程序是否健全等。

2)评估与沟通风险:审计师应根据其对企业的了解,评估存在的风险,并与企业管理层进行沟通,了解他们对风险的了解和处理方式。

3)进行内部控制测试:审计师会选择一定数量的样本进行测试,以评估内部控制的有效性。

测试结果将作为评估依据之一。

4)编制内部控制评价报告:审计师会根据内部控制测试结果,编制内部控制评价报告,对企业的内部控制环境进行评价,并提出改进建议。

2. 简述外部审计师的职责。

答:外部审计师的主要职责包括:1)审核企业的财务报表:外部审计师需要对企业的财务报表进行全面检查,以确定其真实性和准确性。

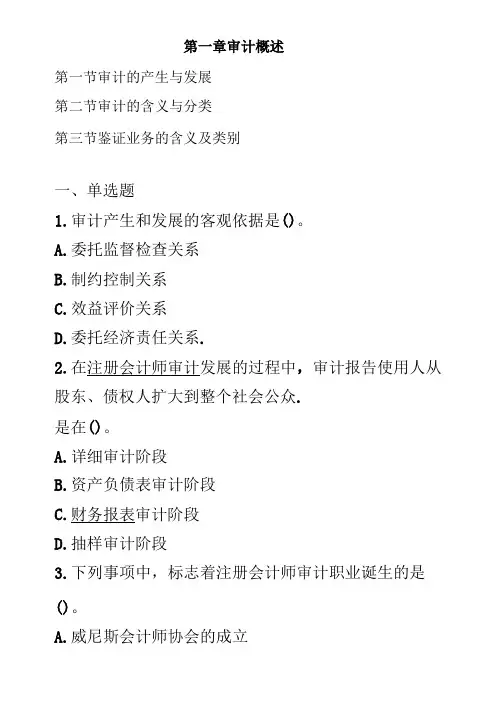

第一章审计概述第一节审计的产生与发展第二节审计的含义与分类第三节鉴证业务的含义及类别一、单选题1.审计产生和发展的客观依据是()。

A.委托监督检查关系B.制约控制关系C.效益评价关系D.委托经济责任关系.2.在注册会计师审计发展的过程中,审计报告使用人从股东、债权人扩大到整个社会公众.是在()。

A.详细审计阶段B.资产负债表审计阶段C.财务报表审计阶段D.抽样审计阶段3.下列事项中,标志着注册会计师审计职业诞生的是()。

A.威尼斯会计师协会的成立B.热那亚会计师协会的成立.C.美国注册会计师协会的成立口.爱丁堡会计师协会的成立4.编制财务报表的责任在于()。

A.公司管理层B.审计委员会C.注册会计师D.内部审计人员5.下列关于注册会计师审计的提法中,不正确的是()。

A.注册会计师审计的产生早于政府审计B.注册会计师审计产生的直接原因是财产所有权与经营权的分离C.注册会计师审计是由会计师事务所和注册会计师实施的审计D.注册会计师审计在经济活动中的特殊作用是提高财务信息的可靠性和可信性6.注册会计师进行的独立审计称为()。

A.内部审计8.国家审计C.定期审计D.民间审计7.以下关于政府审计、内部审计和注册会计师审计的论述中,正确的是()。

A.注册会计师审计和政府审计都是随着商品经济的发展而产生和发展的B.注册会计师审计和内部审计尽管存在很大的差别/但注册会计师审计作为一种外部审计,在工作中要利用内部审计的工作成果,因此,内部审计是注册会计师审计的基础C.从独立性和权威性.上讲,内部审计最强D.相对审计客体而言,政府审计和注册会计师审计均为外部审计,都具有较强的独立性8.经营审计的判断标准是()。

A.会计准则8.审计准则.C.管理层或法令设立的目标D.政府颁布的政策、法规、规定或第三者的要求9.下列各项中,属于合规审计的是()。

A.环境审计B.上市公司年度财务报表审计C.经济效益审计D.财经法纪审计10.从独立性的角度来看,在我国审计监督体系中,政府审计()。

审计学练习题一、选择题1. 审计师在开始对一家公司进行审计前,应当进行以下哪个环节的工作?A. 确定审计目标和范围B. 编制审计程序C. 收集审计证据D. 形成审计报告2. 审计师对被审计单位的重要信息是否真实可靠进行评估的目的是什么?A. 发现并纠正被审计单位的违法行为B. 发现并报告会计记录的错误C. 发现并报告财务报表中的重大错误D. 发现被审计单位的竞争对手3. 对于销售公司来说,以下哪个是一个内部控制不当的表现?A. 销售部门销售人员有权同时操作客户账户和收款账户B. 销售人员没有销售目标C. 销售人员的业绩评估仅基于销售额D. 销售部门收到的现金与销售记录相符4. 下列哪项不属于内部审计的职责?A. 发现并纠正组织内部控制缺陷B. 评估组织运营的风险C. 编制组织的财务报表D. 发现并纠正违法行为5. 在审计过程中,审计师发现了公司财务报表中的一个重大错误。

根据审计准则,审计师应该采取下列哪种行动?A. 不做任何报告B. 纠正错误后再报告C. 立即将错误报告给公司管理层D. 立即将错误报告给公司股东二、简答题1. 请解释什么是审计准则?审计准则是审计师在进行审计工作时应遵循的一组规定和原则。

它们旨在确保审计师的工作具有可比性、可靠性和一致性,并提供准确的审计意见。

审计准则包括一般准则、工作准则和报告准则。

一般准则指导审计师在进行审计工作时的职业行为。

工作准则规定了审计师应当采取的审计方法和程序。

报告准则则规定了审计师应当如何在完成审计后向相关方发出审计报告。

2. 请解释什么是内部控制?内部控制是组织内部一系列制度、规定和程序的总和,旨在确保组织的运营达到预期目标并合规。

内部控制可以包括财务控制、运营控制和合规控制等。

它可以通过确保财务报表的准确性、预防资产损失、保护组织资源、促进有效和高效的运营等方式来帮助组织实现目标。

3. 请解释什么是审计证据?审计证据是指审计师通过对财务报表、会计记录和其他相关信息的收集和分析,用于形成审计意见的可靠信息。

审计学原理练习题汇总陈雨珂单项选择题1.在秦汉时期,( )制度日趋完善。

A.监察B.御史C.上计D.下计2.宋代审计司的建立,是我国“审计”的正式命名,从此,“审计”一词便成为( )的专用名词。

A.财会审核B.经济司法C.经济执法D.财政监督3.目前世界上最大的民间审计专业团体是( )。

A.英国爱丁堡会计师协会B.英国苏格兰会计师协会C.中国注册会计师协会D.美国注册公共会计师协会4.无论是我国还是外国都承认( )的经济监督活动是审计的属性。

A.权威性B.独立性C.客观性D.合法性5.审计的最基本的职能是( )A.经济评价B.经济监察C.经济监督D.经济司法6.在审计工作中,揭示审计对象的差错和弊端,属于审计的()A.制约性作用B.促进性作用C.建设性作用D.宏观调控作用7.中国第一家会计师事务所是()A.潘序伦会计师事务所B.立信会计师事务所C.正则会计师事务所D.上海会计师事务所8.根据控制测试的目的和特点所采用的审计抽样称为( )。

A.变量抽样B.属性抽样C.统计抽样D.非统计抽样9.有关审计抽样的下列表述中,正确的是( )。

A.注册会计师可采用统计抽样或非统计抽样方法选取样本,只要运用得当,均可获得充分、适当的审计证据B.审计抽样可用于所有审计程序C.统计抽样和判断抽样的选用,往往判断抽样选取的样本不如统计抽样D.信赖过度风险和误受风险影响审计效率10.统计抽样是指具备下列( )特征的抽样方法。

A.随机选取样本B.运用概率论评价样本结果,包括计量抽样风险C.A和BD.A或B11.下列关于审计抽样的说法中,不正确的是( )。

A.审计抽样是对某类交易或账户余额中低于百分之百的项目实施审计程序B.在审计抽样中,所有抽样单元都有被选取的机会C.审计抽样的目的是为了评价该账户余额或交易类型的某一特征D.选取特定项目进行测试属于审计抽样12.有关抽样风险与非抽样风险的下列表述中,注册会计师不能认同的是( )。

审计学练习题一、单项选择题1. 审计的主体是()。

A. 被审计单位B. 审计机构C. 审计人员D. 审计对象2. 审计的基本职能不包括()。

A. 经济监督B. 经济评价C. 经济鉴定D. 经济咨询3. 按照审计主体的不同,审计可以分为()。

A. 内部审计和外部审计B. 政府审计和社会审计C. 财务审计和管理审计D. 法定审计和自愿审计4. 审计证据的充分性是指()。

A. 审计证据的数量B. 审计证据的质量C. 审计证据的数量和质量D. 审计证据的可靠性5. 下列哪项不属于审计风险的构成要素?()A. 固有风险C. 审计风险D. 控制风险二、多项选择题1. 审计目标包括()。

A. 财务报表的公允性B. 财务报表的合法性C. 内部控制的有效性D. 经营效率和效果2. 审计证据的特征包括()。

A. 相关性B. 充分性C. 可靠性D. 完整性3. 审计程序通常包括()。

A. 风险评估B. 控制测试C. 实质性测试D. 报告编制4. 审计意见类型包括()。

A. 无保留意见B. 保留意见C. 否定意见D. 无法表示意见5. 内部控制的要素包括()。

A. 控制环境C. 控制活动D. 信息与沟通三、判断题1. 审计只能由独立的第三方进行。

()2. 审计报告是审计工作的最终成果。

()3. 审计证据的获取只能通过询问和观察。

()4. 审计人员在审计过程中必须遵守职业操守。

()5. 审计工作可以完全替代内部控制。

()四、简答题1. 简述审计的作用。

2. 说明审计证据的获取方法。

3. 描述内部控制的重要性。

4. 阐述审计风险的类型及其相互关系。

5. 讨论审计意见对投资者决策的影响。

五、案例分析题某公司财务报表经过审计后,审计师出具了保留意见的审计报告。

请分析可能导致保留意见的原因,并讨论该保留意见对公司财务报表使用者可能产生的影响。

CHAPTER 26 Multiple-Choice Questions1. easy b The IIA Code of Ethics is based on all but which of the following ethical principles?a. Integrity.b. Independence.c. Competency.d. Confidentiality.2. easy c Statements on Internal Auditing Standards are issued by the:a. AICPA.b. SEC.c. Internal Auditing Standards Boards.d. Auditing Standards Boards.3. easy c Internal auditors are responsible to:a. the board of directors.b. management.c. both a and b.d. neither a nor b.4. easy a Which of the following is not a similarity between external and internal auditors?a. Both must be independent of the company.b. Both must be competent.c. Both use similar methodologies in performing their work.d. Both consider risk and materiality in their work.5. easy d External auditors consider internal auditors effective if they are:a. independent of the operating units being evaluated.b. competent and well trained.c. have performed relevant audit tests of the internal controls and financial statements.d. all of the above.6. easy d Auditing standards _______ external auditors to use the internal auditors for direct assistance on the audit.a. discourageb. prohibitc. encouraged. permit7. easy b The primary source of authoritative literature for doing government audits is the:a. Purple Book.b. Yellow Book.c. Green Book.d. Red Book.8. easy d When a state or local government agency receives federal financial assistance, it is subject to the audit requirements of:a. the Yellow Book.b. the Single Audit Act.c. the OMB Circular A-133.d. All three of the above.9. easy c Which of the following is not one of the broad categories of operational audits?a. Functional audits.b. Organizational audits.c. Single Audit Act audits.d. Special assignment audits.10. easy d Which of the following groups would not be involved in an operational audit?a. CPA firms.b. Internal auditors.c. Government auditors.d. None of the above answers is correct; that is, all of the above would be involved.11. easy b The IIA’s professional practice framework (including its code of ethics and International Standards for the Professional Practice of Internal Auditing) is commonly referred to as the:a. Blue Book.b. Red Book.c. Green Book.d. Yellow Book.12. easy b The professional organization which is responsible for providing guidance for internal auditors is the:a. APA.b. IIA.c. ABA.d. AIA.13. easy d The financial auditing standards of the Yellow Book are ______ the 10 GAAS of the AICPA.a. the same asb. quite different fromc. incompatible withd. consistent with14. easy b Which of the following is not one of the three phases in an operational audit?a. Planning.b. Training and supervising employees.c. Evidence accumulation and evaluation.d. Reporting and follow-up.15. medium a The correct title of the Yellow Book is:a. Government Auditing Standards.b. IIA Practice Standards.c. Statement of Responsibilities of Internal Auditing.d. Statement of Standards on Accounting and Review Services.16. medium b The Yellow Book recognizes that, because of the sensitivity of government activities and their public accountability, in government audits the thresholds of acceptable audit risk and tolerable misstatement compared to an audit of a commercial enterprise may be:a. equal.b. lower.c. higher.d. indeterminable.17. medium b The Single Audit Act requires that an audit be conducted for recipients who receive total federal funds in any fiscal year of:a. $1,000,000 or more.b. $500,000 or more.c. $300,000 or more.d. $100,000 or more.18. medium b An audit conducted in accordance with the Yellow Book must include an audit report that states the audit was performed in accordance with:a. GAAS.b. GAGAS.c. GASA.d. SAS.19. medium d An audit designed to evaluate the efficiency and effectiveness of an organization or some part would not be called a(n):a. performance audit.b. management audit.c. operational audit.d. compliance audit.20. medium c Which of the following is not one of the major differences between financial and operational auditing?a. The financial audit is oriented to the past, but an operational audit concerns performancefor the future.b. The financial audit report is distributed to many readers, but the operational audit reportgoes to a few managers.c. Financial audits deal with the information on the financial statements, but operationalaudits are concerned with the information in the ledgers.d. Financial audits are limited to matters that directly affect the financial statements, butoperational audits cover any aspect of efficiency and effectiveness.21. medium d Before an operational audit for effectiveness can be performed, there must be:a. a financial audit by an independent auditor.b. a financial audit by an internal auditor.c. a review performed by either an independent or an internal auditor.d. specific criteria developed to define effectiveness.22. medium d Auditors involved in planning, performing, or reporting on audits under GAGAS must complete ____ hours of continuing professional education in each two-year period.a. 20b. 40c. 60d. 8023. medium b Which of the following statements regarding types of operational audits is false?a. A functional audit has the advantage of permitting specialization by auditors.b. An advantage of functional auditing is its ability to evaluate interrelated functions.c. The emphasis in an organizational audit is on how efficiently and effectively functionsinteract.d. Special operational auditing assignments arise at the request of management.24. medium b The two most important qualities for an operational auditor are:a. personality and appearance.b. independence and competence.c. competence and technical training.d. academic background and sufficient experience.25. medium a Which of the following is not a difference between operational auditing and financial auditing?a. Competent personnel are required more for financial audits.b. Operational audit reports are usually of a restricted distribution while financial auditreports are widely distributed.c. Operational audits often cover non-financial issues while financial audits do not.d. None of the above is a difference.26. medium c A typical objective of an operational audit is to determ ine whether an entity’s:a. internal control is adequately operating as designed.b. financial statements present fairly the results of operations.c. specific operating units are functioning efficiently and effectively.b. operational information is in accordance with generally accepted government auditingstandards.27. medium c Which of the following can affect the independence of operational auditors?a. Their responsibilities.b. To whom they report in the organization.c. Both a and b.d. Neither a nor b.28. challenging d Which is not a purpose of an economy and efficiency audit?a. Whether the entity is acquiring, protecting, and using resources economically andefficiently.b. The causes of inefficiencies and uneconomical practices.c. Whether the entity has complied with laws and regulations concerning matters of economyand efficiency.d. Each of the above is a purpose.29. challenging d A(n) _________ audit emphasizes how efficiently and effectively functions interact.a. operationalb. compliancec. financiald. organizational30. challenging b Which of the following is not a purpose of a program audit as performed by government auditors?a. Determination of the extent to which the desired results established by the legislature arebeing achieved.b. Determination of the causes of inefficiencies in sponsored programs.c. Determination of the effectiveness of organizations, programs and activities.d. Determination as to whether the entity has complied with laws and regulations applicableto the program.31. challenging c What distinguishes internal control evaluation and testing for financial and operational auditing?a. Purpose of the work.b. Scope of the work.c. Both a and b.d. Neither a nor b.32. challenging c Of the many hours of continuing professional education required every two years, how many must be in subjects related to the government environment and government auditing for auditors involved in planning, performing and reporting on audits under GAGAS?a. 8 hoursb. 16 hoursc. 24 hoursd. 32 hoursEssay Questions33. easy What organization establishes auditing standards for internal auditors and what are those standards commonly called?Answer:Auditing standards for internal auditors are established by the Internal Auditing Standards Board. They are commonly known as the “Red Book.”34.mediumWhat are several similarities between internal and external auditors?Answer:Both must be competent as auditors and remain objective in performing their work andreporting their results.Both follow a similar methodology in performing their audits, including planning andperforming tests of controls and substantive tests.Both consider risk and materiality in deciding the extent of their tests and evaluatingresults. However, their decisions about materiality and risks may differ, becauseexternal users may have different needs than management or the board.35. medium External auditors typically consider internal auditors effective if they meet three criteria. What are these criteria?Answer:External auditors typically consider internal auditors effective if they are:Independent of the operating units being evaluatedCompetent and well-trainedHave performed relevant audit tests of the internal controls and financial statements36. medium How do the risk and materiality thresholds change in a government audit compared to a financial statement audit of a public company?Answer:The Yellow Book recognizes that in government audits the thresholds of acceptable auditrisk and materiality may be lower than in an audit of a commercial enterprise. This is because of the sensitivity of government activities and their public accountability.37.mediumDiscuss each of the three phases of an operational audit.Answer:Planning. In the planning phase, the auditor must determine the scope of theengagement, staff the engagement, obtain background information about theorganizational unit, understand internal control, and decide on the appropriateevidence to accumulate.Evidence accumulation and evaluation. In operational auditing, it is common to usedocumentation, client inquiry, and observation extensively, while confirmation andreperformance are used less extensively for most operational audits than for financialaudits.Reporting and follow-up. The audit report is tailored to address the scope of the audit,findings, and recommendations and is typically sent only to management. Whenrecommendations are made to management, follow-up is done to determine whetherthe recommended changes were made, and if not, why.38. medium The Institute of Internal Auditors has established Ethical Principles for its members. List each of the principles.Answer:The IIA’s ethical principles are:Integrity.Objectivity.Confidentiality.Competency.39.mediumDefine internal auditing.Answer:According to the IIA: “Internal a uditing is an independent, objective assurance andconsulting activity designed to add value and improve an organization’soperations. It helps an organization accomplish its objectives by bringing a systematic, disciplinedapproach to evaluate and improve the effectiveness of risk management, control, andgovernance processes.”40.mediumDiscuss three major differences between operational and financial auditing.Answer:Purpose of the audit. Financial auditing emphasizes whether historical informationwas correctly recorded, whereas operational auditing emphasizes effectiveness andefficiency.Distribution of the reports. For financial auditing, the report typically goes to manyusers of financial statements, such as stockholders and bankers, whereas operationalaudit reports are intended primarily for management.Inclusion of nonfinancial areas in operational auditing. Operational audits cover anyaspect of efficiency and effectiveness in an organization, whereas financial audits arelimited to matters that directly affect the fairness of financial statement presentations.41.mediumDiscuss each of the three broad categories (types) of operational audits.Answer:Functional. A functional audit deals with auditing one or more functions (e.g.,purchasing) in an organization.Organizational. An organizational audit deals with an entire organizational unit, suchas a department, branch, or subsidiary.Special assignments. Special assignments audits arise at the request of managementwhen there is a need to investigate a particular area, such as investigating thepossibility of fraud in a division, or determining the cause of an ineffective EDPsystem.42. medium Operational auditing is the review of an organization for efficiency and effectiveness. Discusswhat is meant by the terms “effectiveness” and “efficiency.”Answer:Effectiveness refers to the degree to which the organizat ion’s objectives and goals areaccomplished.Efficiency refers to the degree to which costs are reduced without reducingeffectiveness.43. challenging Audit tests as required by the Single Audit Act must meet several specific objectives. One objective is to determine “whether the amounts reported as expenditures were for allowable services.” Identify three other specific objectives.Answer:Whether the records show that those who received services or benefits were eligible toreceive them.Whether matching requirements, levels of effort, and earmarking limitations weremet.Whether federal financial reports and claims for advances and reimbursementscontain information that is supported by the books and records from which the basicfinancial statements have been prepared.Whether amounts claimed or used for matching were determined in accordance withOMB Circular A-87 and OMB Circular A-102.44. challenging The auditing standards of the Yellow Book are consistent with the ten generally acceptedauditing standards of the AICPA. There are, however, important additions/modifications in theYellow Book. For example, the Yellow Book recognizes that materiality and risk are lower dueto the nature of the government enterprise. Discuss the other additions/modifications.Answer:Quality control. Auditors of government entities must have an appropriate system ofinternal quality control and participate in an external quality control review program.Compliance auditing. The audit should be designed to provide reasonable assuranceof detecting material misstatements resulting from noncompliance with provisions ofcontracts or grant agreements that have a material and direct effect on the financialstatements.Reporting. The report on financial statements must describe the scope of the auditors’ testing of compliance with laws and regulations and internal controls and present theresults of those tests, or refer to a separate report containing that information.45. challenging In addition to an opinion on whether the financial statements are in accordance with GAAP, identify four other reports required by the OMB Circular A-133.Answer:The following reports are required:An opinion as to whether the schedule of federal awards is presented fairly in allmaterial respects in relation to the financial statements as a whole.A report on internal control related to the financial statements and major programs.A report on compliance with laws, regulations, and the provisions of contracts orgrant agreements, noncompliance with which could have a material effect on thefinancial statements. This report can be combined with the report on internal control.A schedule of findings and questioned costs.Other Objective Answer Format Questions46. Match seven of the terms (a-o) with the descriptions/definitions provided below (1-7):mediuma. Compliance auditb. Economy and efficiency auditc. Effectivenessd. Efficiencye. Functional auditf. Government Auditing Standardsg. Government audith. Institute of Internal Auditorsi. Operational auditingj. Organizational auditk. Program auditl. Single Audit Actm. Special assignmentn. IIA Practice Standardso. Statements on Internal Auditing Standardsf 1. The official title of the Yellow Book.m 2. A management request for an operational audit for a specific purpose, such asinvestigating the possibility of fraud in a division or making recommendationsfor reducing the cost of a manufactured product.b 3. A government audit to determine whether an entity is acquiring, protecting, andusing its resources economically and efficiently and whether the entity hascomplied with laws and regulations concerning such matters.c 4. The degree to which the organization’s objectives are accomplished.i 5. The review of an organization for efficiency and effectiveness.l 6. Federal legislation that provides for a single coordinated audit to satisfy theaudit requirements of all federal funding agencies.o 7. Statements issued by the Internal Auditing Standards Board of the IIA toprovide authoritative interpretation of the IIA Practice Standards.47. easy b Independence is a fundamental ethical principle for internal auditors.a. Trueb. False48. easy b Current professional auditing standards prohibit external auditors from using internal auditors for direct assistance on external audits.a. Trueb. False49. easy b Current professional auditing standards require external auditors to use internal auditors for direct assistance on external audits.a. Trueb. False50. easy a The objectives of internal auditors are considerably broader than the objectives of external auditors.a.Trueb.False51. easy a For financial auditing, the audit report typically goes to many users of financial statements, whereas operational audit reports are intended primarily for management.a. Trueb. False52. easy a Integrity is one of the IIA’s ethical principles.a. Trueb. False53. easy b Operational audits are primarily geared toward compliance.a. Trueb. False54. easy b Effectiveness refers to the degree to which costs are reduced without reducing efficiency.a. Trueb. False55. easy a Efficiency refers to the degree to which costs are reduced without reducing effectiveness.a. Trueb. False56. easy b Internal auditing standards are included in the Yellow Book.a. Trueb. False57. easy a Government auditing standards are included in the Yellow Book.a. Trueb. False58. easy a Effectiveness is concerned with whether defined goals are achieved, whereas efficiency is concerned with whether the goals are achieved with a minimum use of resources.a. Trueb. False59. easy b Operational audits may be performed by internal auditors and government auditors, but not by external auditors.a. Trueb. False60. easy a Benchmarking is one source of evaluation criteria for completing an operational audit.a. Trueb. False61. easy a The two most important qualities for an internal auditor to possess are independence and competence.a. Trueb. False62. easy b Program audits are primarily focused on inefficient uses of federal funds in sponsored programs.a. Trueb. False63. easy a The formal name of the Yellow Book is Government Auditing Standards.a. Trueb. False64. medium a Professional guidelines for performing internal audits for companies are not as well-defined as for external audits.a. Trueb. False65. medium b To help them remain independent of the operations they audit, internal auditors should report directly to the controller.a. Trueb. False66. medium a An operational auditor may use “engineered standards” as evaluation criteria.a. Trueb. False67. medium a The Internal Auditing Standards Board issues Statements on Internal Auditing Standards.a. Trueb. False68. medium a Operational audits are often categorized as functional, organizational, or special assignments.a. Trueb. False69. medium b Internal auditors should have the authority to require implementation of suggestions for improvement.a. Trueb. False70. medium b The “Red Book” specifies all auditing standards issued by the U.S. General Accounting Office.a. Trueb. False71. challenging a One disadvantage of functional auditing is the failure to evaluate interrelated functions.a. Trueb. False。