信开信用证样本

- 格式:doc

- 大小:33.00 KB

- 文档页数:7

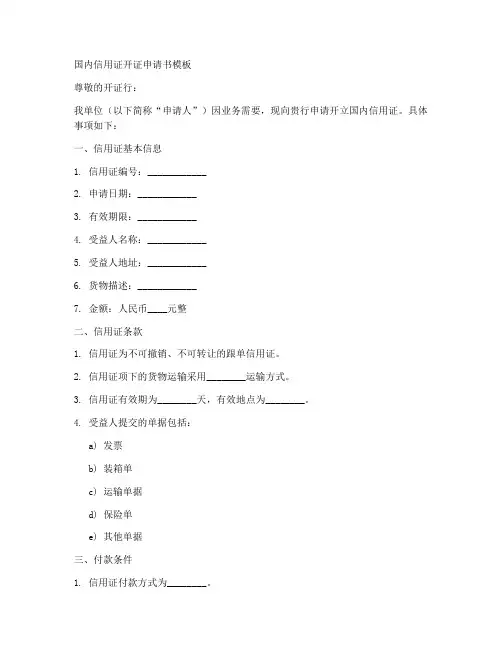

国内信用证开证申请书模板尊敬的开证行:我单位(以下简称“申请人”)因业务需要,现向贵行申请开立国内信用证。

具体事项如下:一、信用证基本信息1. 信用证编号:____________2. 申请日期:____________3. 有效期限:____________4. 受益人名称:____________5. 受益人地址:____________6. 货物描述:____________7. 金额:人民币____元整二、信用证条款1. 信用证为不可撤销、不可转让的跟单信用证。

2. 信用证项下的货物运输采用________运输方式。

3. 信用证有效期为________天,有效地点为________。

4. 受益人提交的单据包括:a) 发票b) 装箱单c) 运输单据d) 保险单e) 其他单据三、付款条件1. 信用证付款方式为________。

2. 付款期限为________天,自运输单据签发之日起计算。

四、其他要求1. 货物数量及金额允许有________%的浮动范围。

2. 受益人应在信用证有效期内提交单据,否则视为无效。

3. 信用证项下的货物须符合我国相关法律法规及标准。

五、申请人的承诺1. 申请人保证按照信用证的条款和条件履行付款义务。

2. 申请人同意承担信用证项下的各项费用,包括但不限于开证费、手续费、利息等。

3. 申请人承诺在信用证有效期内按时提交符合要求的单据。

六、申请人的信息1. 申请人名称:____________2. 申请人地址:____________3. 联系人:____________4. 联系电话:____________七、开证行确认1. 贵行应在收到申请人的开证申请书后,进行审核并决定是否开立信用证。

2. 贵行同意按照申请人的要求开立信用证,并承担相应的法律责任。

特此申请,敬请审阅。

申请人:(签字)日期:____________注:本模板仅供参考,具体内容需根据实际情况进行调整。

信用证样本中英文对照信用证是国际贸易中常见的一种支付方式,它是由银行作为中间人,对客户的支付请求进行担保的一种文件。

以下是一份信用证样本,包括中文和英文对照。

样本:Date:2024年6月1日受益人:ABC有限公司123号路城市,国家开证行:XYZ银行456号大街城市,国家亲爱的先生/女士我们开证行为您的受益人ABC有限公司开立信用证,确保在上述日期之前在以下指定条件下付款给您。

定义:1.受益人:指定的ABC有限公司。

2.申请人:我行客户,指定在信用证编号中。

1.信用证金额:信用证金额为:USD10,000.00(美元一万)。

金额以美元为单位,对应其他货币将按照当天的汇率进行折算。

2.有效期:本信用证将在接到受益人提供的所有必需单据之日起生效,并于开证之日的180天后到期。

必备单据的最后接收日期为到期日前15天。

3.运输要求:货物必须在开证生效后60天内装运,并在到期日之前抵达目的地。

装运文件必须包括保险单的正本副本,以确保货物的安全。

4.付款条件:付款将通过电汇方式进行,在所有必需单据获得接纳后的五个工作日内完成。

付款将以美元进行,按照当日汇率折算为其他货币。

5.必备单据:以下是必备单据的清单,所有单据都必须按时提交,并在接收日后十天内由我行接受。

-标准商业发票(正副本)-包装单据-装运货物的提单(正副本)-保险单(正副本)-由欧洲银行证明的发货证明书6.文件发送地址:所有必须的单据,请发送到以下地址:XYZ银行Attn: 信用证部门456号大街城市,国家谢谢您的合作。

此致XYZ银行Dear Sir/Madam,We, the issuing bank, hereby open this letter of credit in favor of your beneficiary, ABC Co. Ltd., ensuring payment to be made to you under the following terms and conditions on or before the above-mentioned date.Definitions:1. Beneficiary: The designated ABC Co. Ltd.2. Applicant: Our customer, as specified in the letter of credit number.1. Amount:The amount of this letter of credit is USD 10,000.00 (Ten Thousand US Dollars). The amount is in USD and equivalent in other currencies will be calculated at the prevailing rate of exchange on the day of negotiation/payment.2. Validity:3. Shipment Requirement:The goods must be shipped within 60 days after the effective date of the letter of credit and arrive at the destination before the expiry date. Shipping documents must include the original and duplicate copies of the insurance policy to ensure the safety of the goods.4. Payment Terms:Payment will be made via telegraphic transfer within five working days after the acceptance of all required documents. The payment will be made in USD and equivalent in other currencies will be calculated at the prevailing exchange rate on the day of payment.5. Required Documents:- Packing List- Bill of Lading (original and duplicate copies)- Insurance Policy (original and duplicate copies)- Certificate of Shipment, attested by a European bank6. Document Submission Address:Please send all required documents to the following address: XYZ BankAttn: Letter of Credit Department456 Main StreetCity, CountryThank you for your cooperation.Yours sincerely,。

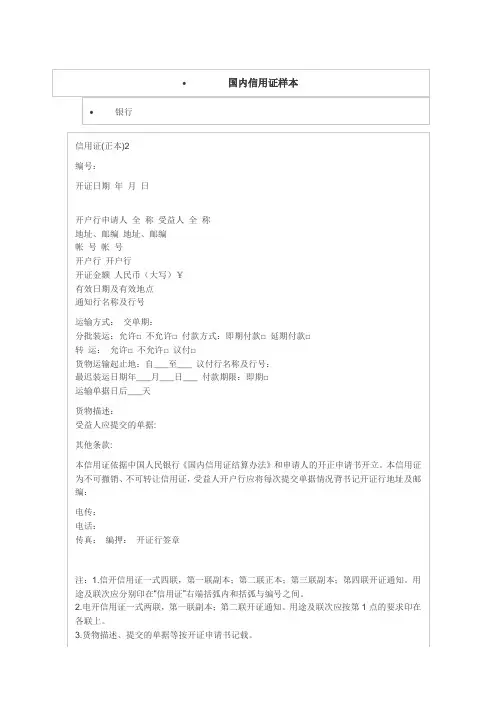

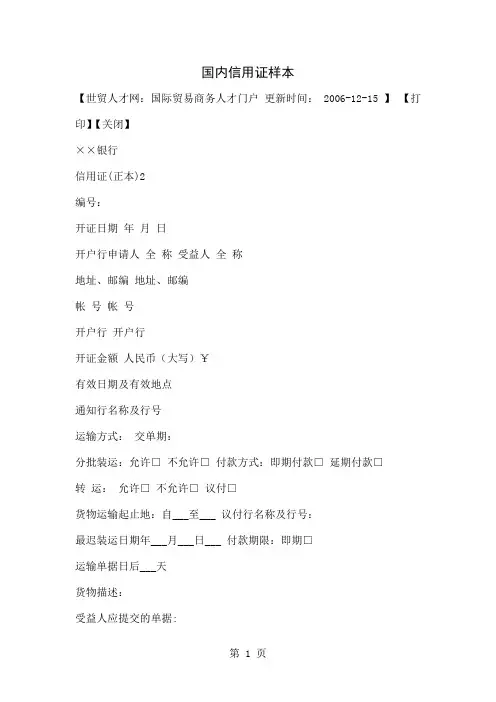

国内信用证样本【世贸人才网:国际贸易商务人才门户更新时间: 2006-12-15 】【打印】【关闭】××银行信用证(正本)2编号:开证日期年月日开户行申请人全称受益人全称地址、邮编地址、邮编帐号帐号开户行开户行开证金额人民币(大写)¥有效日期及有效地点通知行名称及行号运输方式:交单期:分批装运:允许□不允许□付款方式:即期付款□延期付款□转运:允许□不允许□议付□货物运输起止地:自___至___ 议付行名称及行号:最迟装运日期年___月___日___ 付款期限:即期□运输单据日后___天货物描述:受益人应提交的单据:其他条款:本信用证依据中国人民银行《国内信用证结算办法》和申请人的开正申请书开立。

本信用证为不可撤销、不可转让信用证,受益人开户行应将每次提交单据情况背书记开证行地址及邮编:电传:电话:传真:编押:开证行签章注:1.信开信用证一式四联,第一联副本;第二联正本;第三联副本;第四联开证通知。

用途及联次应分别印在“信用证”右端括弧内和括弧与编号之间。

2.电开信用证一式两联,第一联副本;第二联开证通知。

用途及联次应按第1点的要求印在各联上。

3.货物描述、提交的单据等按开证申请书记载。

正本信用证背面仪付或付款日期业务编号增额仪付或付款金额信用证金额仪付行名称备注仪付行或开征行签章Issue of a Documentary CreditBKCHCNBJA08E SESSION: 000 ISN: 000000BANK OF CHINALIAONINGNO. 5 ZHONGSHAN SQUAREZHONGSHAN DISTRICTDALIANCHINA-------开证行Destination BankKOEXKRSEXXX MESSAGE TYPE: 700KOREA EXCHANGE BANKSEOUL178.2 KA, ULCHI RO, CHUNG-KO--------通知行Type of Documentary Credit40AIRREVOCABLE--------信用证性质为不可撤消Letter of Credit Number20LC84E0081/99------信用证号码,一般做单时都要求注此号Date of Issue31G990916------开证日期Date and Place of Expiry31D991015 KOREA-------失效时间地点Applicant Bank51DBANK OF CHINA LIAONING BRANCH----开证行Applicant50DALIAN WEIDA TRADING CO., LTD.------开证申请人Beneficiary59SANGYONG CORPORATIONCPO BOX 110SEOULKOREA-------受益人Currency Code, Amount32BUSD 1,146,725.04-------信用证总额Available with...by...41DANY BANK BY NEGOTIATION-------呈兑方式任何银行议付有的信用证为 ANY BANK BY PAYMENT, 些两句有区别, 第一个为银行付款后无追索权, 第二个则有追索权就是有权限要回已付给你的钱Drafts at42C45 DAYS AFTER SIGHT-------见证45天内付款Drawee42DBANK OF CHINA LIAONING BRANCH-------付款行Partial Shipments43PNOT ALLOWED---分装不允许Transhipment43TNOT ALLOWED---转船不允许Shipping on Board/Dispatch/Packing in Charge at/ from44A RUSSIAN SEA----- 起运港Transportation to44BDALIAN PORT, P.R.CHINA -----目的港Latest Date of Shipment44C990913--------最迟装运期Description of Goods or Services: 45A--------货物描述FROZEN YELLOWFIN SOLE WHOLE ROUND (WITH WHITE BELLY) USD770/MT CFR DALIAN QUANTITY: 200MTALASKA PLAICE (WITH YELLOW BELLY) USD600/MT CFR DALIAN QUANTITY: 300MTDocuments Required: 46A------------议付单据1. SIGNED COMMERCIAL INVOICE IN 5 COPIES.--------------签字的商业发票五份2. FULL SET OF CLEAN ON BOARD OCEAN BILLS OF LADING MADE OUT TO ORDER AND BLANK ENDORSED, MARKED "FREIGHT PREPAID" NOTIFYING LIAONING OCEAN FISHING CO., LTD. TEL:(86)411-3680288-------------一整套清洁已装船提单, 抬头为TO ORDER 的空白背书,且注明运费已付,通知人为LIAONING OCEAN FISHING CO., LTD. TEL:(86)411-36802883. PACKING LIST/WEIGHT MEMO IN 4 COPIES INDICATING QUANTITY/GROSS AND NET WEIGHTS OF EACH PACKAGE AND PACKING CONDITIONSAS CALLED FOR BY THE L/C.-------------装箱单/重量单四份, 显示每个包装产品的数量/毛净重和信用证要求的包装情况.4. CERTIFICATE OF QUALITY IN 3 COPIES ISSUED BY PUBLIC RECOGNIZED SURVEYOR.--------由PUBLIC RECOGNIZED SURVEYOR签发的质量证明三份..5. BENEFICIARY'S CERTIFIED COPY OF FAX DISPATCHED TO THE ACCOUNTEE WITH 3 DAYS AFTER SHIPMENT ADVISING NAME OF VESSEL, DATE, QUANTITY, WEIGHT, VALUE OF SHIPMENT, L/C NUMBER AND CONTRACT NUMBER. --------受益人证明的传真件, 在船开后三天内已将船名航次,日期,货物的数量, 重量价值,信用证号和合同号通知付款人.6. CERTIFICATE OF ORIGIN IN 3 COPIES ISSUED BY AUTHORIZEDINSTITUTION.----------当局签发的原产地证明三份.7. CERTIFICATE OF HEALTH IN 3 COPIES ISSUED BY AUTHORIZED INSTITUTION.----------当局签发的健康/检疫证明三份.ADDITIONAL INSTRUCTIONS: 47A-----------附加指示1. CHARTER PARTY B/L AND THIRD PARTY DOCUMENTS ARE ACCEPTABLE.----------租船提单和第三方单据可以接受2. SHIPMENT PRIOR TO L/C ISSUING DATE IS ACCEPTABLE.----------装船期在信用证有效期内可接受3. BOTH QUANTITY AND AMOUNT 10 PERCENT MORE OR LESS ARE ALLOWED. ---------允许数量和金额公差在10%左右Charges71BALL BANKING CHARGES OUTSIDE THE OPENNING BANK ARE FOR BENEFICIARY'S ACCOUNT.Period for Presentation48DOCUMENTSMUST BE PRESENTED WITHIN 15 DAYS AFTER THE DATE OF ISSUANCE OF THE TRANSPORT DOCUMENTS BUT WITHIN THE VALIDITY OF THE CREDIT.Confimation Instructions49WITHOUTInstructions to the Paying/Accepting/Negotiating Bank: 781. ALL DOCUMENTS TO BE FORWARDED IN ONE COVER, UNLESS OTHERWISE STATED ABOVE.2. DISCREPANT DOCUMENT FEE OF USD 50.00 OR EQUAL CURRENCY WILL BE DEDUCTED FROM DRAWING IF DOCUMENTS WITH DISCREPANCIES ARE ACCEPTED."Advising Through" Bank57AKOEXKRSEXXX MESSAGE TYPE: 700KOREA EXCHANGE BANKSEOUL178.2 KA, ULCHI RO, CHUNG-KO标签:信用证样本信用证国内信用证备用信用证范本http://cncshipping 2006-09-29 10:18:34 编辑:中国国际航贸网IRREVOCABLE STANDBY LETTER OF CREDIT FORMATDATE OF ISSUANCE: _______________[Address]RE: Credit No. __________________We hereby establish our Irrevocable Standby Letter of Creditin your favor for the account of ___________________________ (the “Account Party”), for the aggregate amount not exceeding _________________ United States Dollars ($____________), available to you for payment at sight upon demand at our counters at (Location) on or before the expiration hereof against presentation to us of the following document, dated and signed by a representative of the beneficiary:“The Account Party has not performed in accordance with an agreement with us. Wherefore, the undersigned does hereby demand payment of USD [Beneficiary fills in the amount not to exceed the full value of the letter of credit]”Partial and multiple drawings are permitted hereunder.We hereby agree with you that documents drawn under and in compliance with the terms of this Letter of Credit shall be duly honored upon presentation as specified.This Letter of Credit shall be governed by the Uniform Customs and Practice for Documentary Credits, 1993 Revision, International Chamber of Commerce Publication No. 500 (the “UCP”), except to the extent that the terms hereof are inconsistent with the provisions of the UCP, including but not limited to Articles 13(b) and 17 of the UCP, in which case the terms of this Letter of Credit shall govern.In the event of an Act of God, riot, civil commotion, insurrection, war or any other cause beyond our control that interrupts our business (collectively, an “Interruption Event”) and causes the place for presentation of this Letter of Credit to be closed for business on the last day for presentation, the expiry date of this Letter of Credit will be automatically extended without amendment to a date thirty (30) calendar days after the place for presentation reopens for business.All commissions, expenses and charges incurred with this Letter of Credit are for the account of the Account Party.{Note: Must note the Expiry Date in the format}[BANK SIGNATURE]备用信用证详解及样本什么是备用信用证,备用信用证的融资性质:备用信用证又称担保信用证,是指不以清偿商品交易的价款为目的,而以贷款融资,或担保债务偿还为目的所开立的信用证。

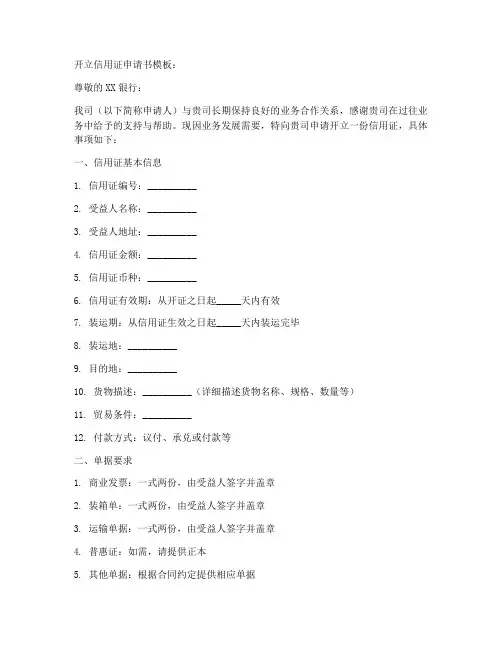

开立信用证申请书模板:尊敬的XX银行:我司(以下简称申请人)与贵司长期保持良好的业务合作关系,感谢贵司在过往业务中给予的支持与帮助。

现因业务发展需要,特向贵司申请开立一份信用证,具体事项如下:一、信用证基本信息1. 信用证编号:__________2. 受益人名称:__________3. 受益人地址:__________4. 信用证金额:__________5. 信用证币种:__________6. 信用证有效期:从开证之日起_____天内有效7. 装运期:从信用证生效之日起_____天内装运完毕8. 装运地:__________9. 目的地:__________10. 货物描述:__________(详细描述货物名称、规格、数量等)11. 贸易条件:__________12. 付款方式:议付、承兑或付款等二、单据要求1. 商业发票:一式两份,由受益人签字并盖章2. 装箱单:一式两份,由受益人签字并盖章3. 运输单据:一式两份,由受益人签字并盖章4. 普惠证:如需,请提供正本5. 其他单据:根据合同约定提供相应单据三、开证申请人的声明1. 申请人保证上述信用证申请内容的真实性、准确性和完整性。

2. 申请人同意在信用证有效期内,按照合同约定履行付款义务。

3. 申请人承认在没有付清货款前,开证行对单据及其所代表的货物有所有权。

4. 申请人授权贵司根据本申请书内容开立信用证,并同意贵司根据本申请书和信用证条款处理与受益人的结算事宜。

四、其他事项1. 申请人在信用证有效期内如需修改或撤销信用证,需提前_____天通知贵司,并经贵司同意。

2. 申请人同意按照贵司的要求交纳相应的信用证押金或其他担保。

3. 申请人承诺按照我国法律法规和信用证条款,合法开展贸易活动,不得利用信用证进行欺诈等违法行为。

请贵司审慎审核本申请书内容,并在符合贵司相关规定的前提下,尽快开立信用证。

如有任何疑问,请随时与申请人联系。

申请人将积极配合贵司完成开证手续,并感谢贵司的支持与帮助。

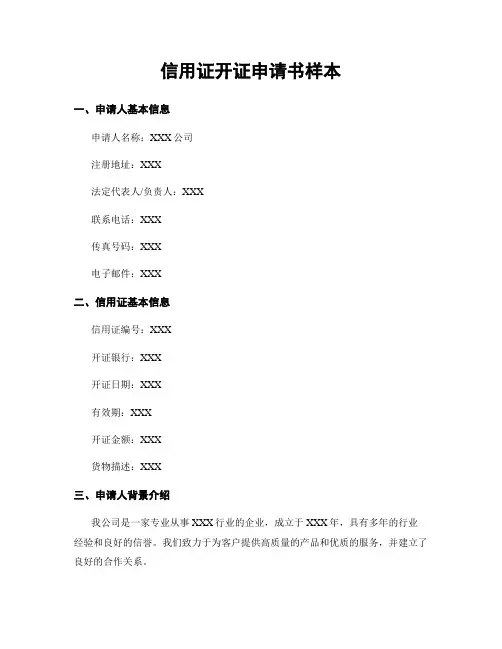

信用证开证申请书样本一、申请人基本信息申请人名称:XXX公司注册地址:XXX法定代表人/负责人:XXX联系电话:XXX传真号码:XXX电子邮件:XXX二、信用证基本信息信用证编号:XXX开证银行:XXX开证日期:XXX有效期:XXX开证金额:XXX货物描述:XXX三、申请人背景介绍我公司是一家专业从事XXX行业的企业,成立于XXX年,具有多年的行业经验和良好的信誉。

我们致力于为客户提供高质量的产品和优质的服务,并建立了良好的合作关系。

四、申请理由1. 市场需求根据市场调研和需求分析,我们注意到XXX产品在市场上的需求量呈现增长趋势。

为了满足市场需求,我们计划扩大生产规模,并寻找新的供应商。

2. 供应商选择经过广泛的供应商调研和评估,我们已经选择了一家具有良好信誉和专业能力的供应商。

该供应商具有丰富的行业经验和先进的生产设备,能够按时交付高质量的产品。

3. 信用证开证的必要性为了确保供应商按时交付货物并保证质量,我们希望通过信用证开证的方式进行交易。

信用证开证可以有效地降低交易风险,保障双方的权益。

五、交货方式和时间我们计划采用XXX方式进行交货,具体交货时间为XXX。

我们将与供应商协商具体的交货细节,并确保按时交付货物。

六、付款方式根据双方协商,付款方式为XXX。

我们将按照合同规定的付款条件进行支付,并确保及时支付货款。

七、其他附加条件1. 质量检验我们将对供应商提供的货物进行质量检验,确保符合合同规定的质量标准。

如发现质量问题,我们有权要求供应商进行退换货。

2. 违约责任双方在合同中明确了违约责任和赔偿方式。

如任何一方违约,应承担相应的法律责任,并赔偿对方因此造成的损失。

八、附件清单1. 供应商合作协议2. 货物清单及规格说明3. 付款条件协议4. 质量检验标准5. 其他相关文件以上是我公司信用证开证申请书的样本,希望能够得到贵行的支持和配合。

我们相信通过双方的合作,将能够实现互利共赢的局面。

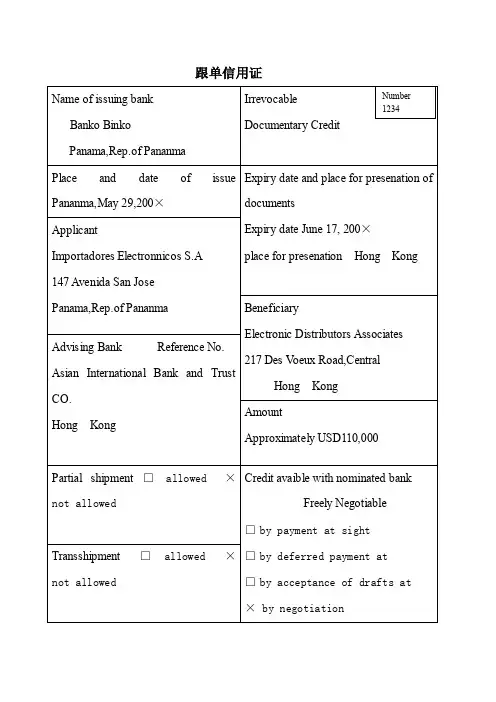

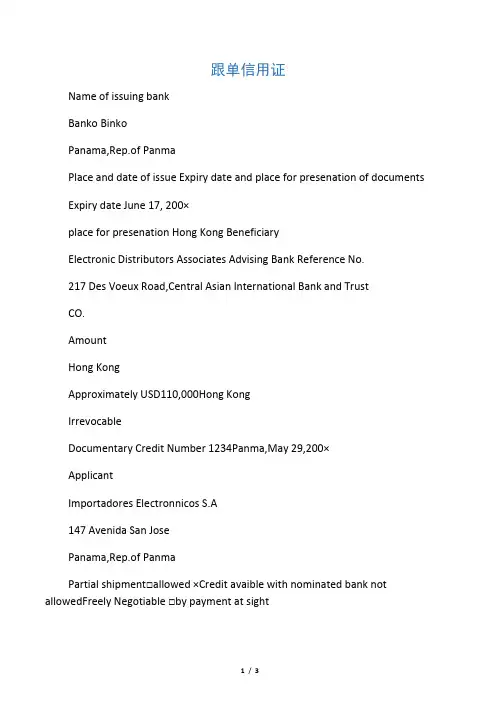

跟单信用证Name of issuing bankBanko BinkoPanama,Rep.of PanmaPlace and date of issue Expiry date and place for presenation of documents Expiry date June 17, 200×place for presenation Hong Kong BeneficiaryElectronic Distributors Associates Advising Bank Reference No.217 Des Voeux Road,Central Asian International Bank and TrustCO.AmountHong KongApproximately USD110,000Hong KongIrrevocableDocumentary Credit Number 1234Panma,May 29,200×ApplicantImportadores Electronnicos S.A147 Avenida San JosePanama,Rep.of PanmaPartial shipment□allowed ×Credit avaible with nominated bank not allowedFreely Negotiable □by payment at sightTransshipment □allowed ×□by deferred payment atnot allowed□by acceptance of drafts at× by negotiation× Insurance covered by buyersShipment as defined in UCP600From port of Hong KongFor transport to Puerto Against the documents details herein:× and B eneficiary′s draft drawn on:Banko BinkoPanama,Rep.of Panma Armuelles, PanmaNot later than June 9, 200×Signed Commercial InvoiceCertificate of OriginFull set of clean “on board”ocean bills of lading consigned to Transitarios Panma,Covering:issuedTelevisions,VCRs,Video Recorders and spare parts of Japanese origin and10,000VHS cassettes of Chinaese Origin as purchase order 1714—×,CIFPuerto Armuelles,Panma,INCITERMS 200×Draft to be marked “drawn under Banko Binko, Panma Documentary Credit 1234 issued May 29,200×Documents to be presented with □ days after the date of shipment but within the validity of the credit.We have issued the Irrevocable Ducumentary Crdit as detailed aboved.It is subject to the Uniform Customs and Practice for Documentary Credits(2001Revision,Internation Chamber of Commerce,Paris,France,PublicationNo.600).and engages us in accordance with the terms thereof.The number and the date of the credit and the name of our bank must be quoted on all drafts required.If the credit is avaible by negotiation,each presention mus be noted on the reverse side of this advise by the bank where the Crdit is avaible.Name and signature of the Issuing bankBanko Binko Panama,Rep.of Panma This document consists of □signed page。

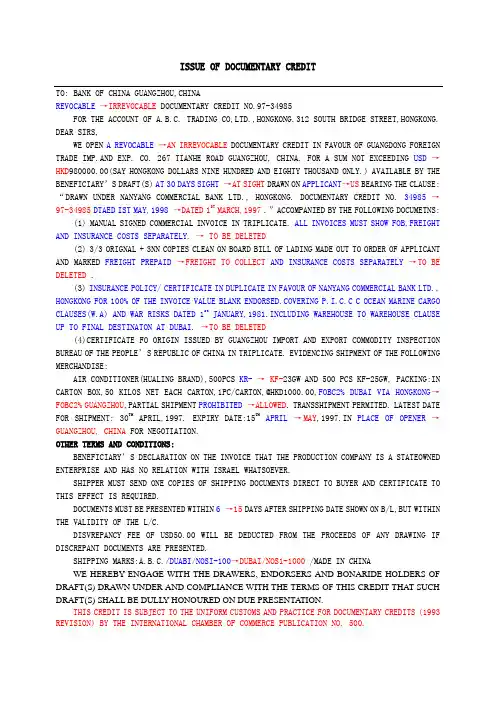

ISSUE OF DOCUMENTARY CREDITTO: BANK OF CHINA GUANGZHOU,CHINAREVOCABLE→IRREVOCABLE DOCUMENTARY CREDIT NO.97-34985FOR THE ACCOUNT OF A.B.C. TRADING CO,LTD.,HONGKONG.312 SOUTH BRIDGE STREET,HONGKONG. DEAR SIRS,WE OPEN A REVOCABLE→AN IRREVOCABLE DOCUMENTARY CREDIT IN FAVOUR OF GUANGDONG FOREIGN TRADE IMP.AND EXP. CO. 267 TIANHE ROAD GUANGZHOU, CHINA. FOR A SUM NOT EXCEEDING USD →HKD980000.00(SAY HONGKONG DOLLARS NINE HUNDRED AND EIGHTY THOUSAND ONLY.) AVAILABLE BY THE BENEFICIARY’S DRAFT(S) AT 30 DAYS SIGHT→AT SIGHT DRAWN ON APPLICANT→US BEARING THE CLAUSE:“DRAWN UNDER NANYANG COMMERCIAL BANK LTD., HONGKONG. DOCUMENTARY CREDIT NO. 34985→97-34985DTAED IST MAY,1998→DATED 1ST MARCH,1997 .”ACCOMPANIED BY THE FOLLOWING DOCUMETNS:(1) MANUAL SIGNED COMMERCIAL INVOICE IN TRIPLICATE. ALL INVOICES MUST SHOW FOB,FREIGHT AND INSURANCE COSTS SEPARATELY.→ TO BE DELETED(2) 3/3 ORIGNAL + 3NN COPIES CLEAN ON BOARD BILL OF LADING MADE OUT TO ORDER OF APPLICANT AND MARKED FREIGHT PREPAID→FREIGHT TO COLLECT AND INSURANCE COSTS SEPARATELY→TO BE DELETED .(3) INSURANCE POLICY/ CERTIFICATE IN DUPLICATE IN FAVOUR OF NANYANG COMMERCIAL BANK LTD., HONGKONG FOR 100% OF THE INVOICE VALUE BLANK ENDORSED.COVERING P.I.C.C C OCEAN MARINE CARGO CLAUSES(W.A) AND WAR RISKS DATED 1st JANUARY,1981.INCLUDING WAREHOUSE TO WAREHOUSE CLAUSE UP TO FINAL DESTINATON AT DUBAI.→TO BE DELETED(4)CERTIFICATE FO ORIGIN ISSUED BY GUANGZHOU IMPORT AND EXPORT COMMODITY INSPECTION BUREAU OF THE PEOPLE’S REPUBLIC OF CHINA IN TRIPLICATE. EVIDENCING SHIPMENT OF THE FOLLOWING MERCHANDISE:AIR CONDITIONER(HUALING BRAND),500PCS KR-→ KF-23GW AND 500 PCS KF-25GW, PACKING:IN CARTON BOX,50 KILOS NET EACH CARTON,1PC/CARTON,@HKD1000.00,FOBC2% DUBAI VIA HONGKONG→FOBC2% GUANGZHOU,PARTIAL SHIPMENT PROHIBITED→ALLOWED. TRANSSHIPMENT PERMITED. LATEST DATE FOR SHIPMENT: 30TH APRIL,1997. EXPIRY DATE:15TH APRIL→MAY,1997.IN PLACE OF OPENER→GUANGZHOU, CHINA FOR NEGOTIATION.OTHER TERMS AND CONDITIONS:BENEFICIARY’S DECLARATION ON THE INVOICE THAT THE PRODUCTION COMPANY IS A STATEOWNED ENTERPRISE AND HAS NO RELATION WITH ISRAEL WHATSOEVER.SHIPPER MUST SEND ONE COPIES OF SHIPPING DOCUMENTS DIRECT TO BUYER AND CERTIFICATE TO THIS EFFECT IS REQUIRED.DOCUMENTS MUST BE PRESENTED WITHIN 6 →15 DAYS AFTER SHIPPING DATE SHOWN ON B/L,BUT WITHIN THE VALIDITY OF THE L/C.DISVREPANCY FEE OF USD50.00 WILL BE DEDUCTED FROM THE PROCEEDS OF ANY DRAWING IF DISCREPANT DOCUMENTS ARE PRESENTED.SHIPPING MARKS:A.B.C./DUABI/NOSI-100→DUBAI/NOS1-1000 /MADE IN CHINAWE HEREBY ENGAGE WITH THE DRAWERS, ENDORSERS AND BONARIDE HOLDERS OF DRAFT(S) DRAWN UNDER AND COMPLIANCE WITH THE TERMS OF THIS CREDIT THAT SUCH DRAFT(S) SHALL BE DULL Y HONOURED ON DUE PRESENTATION.THIS CREDIT IS SUBJECT TO THE UNIFORM CUSTOMS AND PRACTICE FOR DOCUMENTARY CREDITS (1993 REVISION) BY THE INTERNATIONAL CHAMBER OF COMMERCE PUBLICATION NO. 500.YOURS FAITHFULLY NANYNG COMMERCIAL BANK LED.,HONGKONG。

信用证样本信用证样本(中英文对照)1点信用证样本(中英文对照)信用证样本:以下信用证内容源自华利陶瓷厂与一塞浦路斯客户所开立并付的信用证TO:BANK OF CYPRUS LTDLETTERS OF CREDIT DEPARTMENTNTCOSIA COMMERCIAL OPERATIONS CENTER INTERNATIONAL DIVISION************TEL:******FAX:******TELEX:2451 & 4933 KYPRIA CYSWIFT:BCYPCY2NDATE:23 MARCH 2005APPLICATION FOR THE ISSUANCE OF A LETTER OF CREDITSWIFT MT700 SENT TO:MT700转送至STANDARD CHARTERD BANKUNIT 1-8 52/F SHUN NIND SQUAREO1 WANG COMMERCIAL CENTRE,SHEN NANROAD EAST,SHENZHEN 518008 - CHINA渣打银行深圳分行深南东路5002号信兴广场地王商业大厦52楼1-8单元电话:82461688:27: SEQUENCE OF TOTAL序列号1/1 指只有一张电文:40A: FORM OF DOCUMENTARY CREDIT跟单信用证形IRREVOCABLE 不可撤消的信用证:20OCUMENTARY CREDIT NUMBER信用证号码00143-01-0053557:31C: DATE OF ISSUE开证日如果这项没有填,则开证日期为电文的发送日期。

:31DATE AND PLACE OF EXPIRY信用证有效期050622 IN CHINA 050622在中国到期:50: APPLICANT 信用证开证审请人******* NICOSIA 较对应同发票上是一致的:59: BENEFICIARY 受益人CHAOZHOU HUALI CERAMICS FACTORYFENGYI INDUSTRIAL DISTRICT, GUXIANG TOWN, CHAOZHOU CITY,GUANGDONG PROVINCE,CHINA.潮陶瓷洁具厂:32B: CURRENCY CODE,AMOUNT 信用证项下的金额USD***7841,89:41D:AVAILABLE WITH....BY.... 议付适用银行STANDARD CHARTERED BANKCHINA AND/OR AS BELOW 渣打银行或以下的BY NEGOTIATION 任何议付行:42CRAFTS AT 开汇票SIGHT 即期:42A RAWEE 付款人BCYPCY2NO10BANK OF CYPRUS LTD 塞浦路斯的银行名:43PARTIAL SHIPMENTS 是否允许分批装运NOT ALLOWED 不可以:43T:TRANSHIPMENT转运ALLOWED允许:44AOADING ON BOARD/DISPATCH/TAKING IN CHA AT/FROM...装船港口SHENZHEN PORT深圳:44B:FOR TRANSPORTATION TO 目的港LIMASSOL PORT发票中无提及:44C: LATEST DATE OF SHIPMENT最后装船期050601:045A ESCRIPTION OF GOODS AND/OR SERVICES务描述SANITARY WARE 陶瓷洁具F O B SHENZHEN PORT,INCOTERMS 2000 fob深圳港,INCOMTERMS 2000:046A OCUMENTS REQUIRED 须提供的单据文件*FULL SET (AT LEAST THREE) ORIGINAL CLEAN SH ON BOARD BILLSOF LADING ISSUED TO THE ORDER OF BANK OF CY PUBLIC COMPANYLTD,CYPRUS,NOTIFY PARTIES APPLICANT AND OURSELVES,SHOWING全套清洁已装船提单原件(至少三份),作成以“塞浦路斯股份司”为抬头,通知开证人和我们自己,注明*FREIGHT PAYABLE AT DESTINATION AND BEARIN NUMBER OF THISCREDIT.运费在目的港付注明该信用证号码*PACKING LIST IN 3 COPIES.装箱单一式三份*CERTIFICATE ISSUED BY THE SHIPPING COMPANY/CARRIER OR THEIRAGENT STATING THE B/L NO(S) AND THE VESSEL(S) CERTIFYINGTHAT THE CARRYING VESSEL(S) IS/ARE: A) HOLDIN VALID SAFETYMANAGEMENT SYSTEM CERTIFICATE AS PER TERM INTERNATIONALSAFETY MANAGEMENT CODE ANDB) CLASSIFIED AS PER INSTITUTE CLASSIFICATION CLAUSE 01/01/2001BY AN APPROPRIATE CLASSIFICATION SOCIETY由船公司或代理出有注明B/L号和船名的证明书证明他们的A)持有根据国际安全管理条款编码的有效安全管理系统证书B)由相关分级协会根据2001年1月1日颁布的ICC条款分*COMMERCIAL INVOICE FOR USD11,202,70 IN 4 COP DULY SIGNED BYTHE BENEFICIARY/IES, STATING THAT THE GOODS SHIPPED:A)ARE OF CHINESE ORIGIN.B)ARE IN ACCORDANCE WITH BENEFICIARIES PROFORMA INVOICE NO.HL050307 DATED 07/03/05.由受益人签署的商业发票总额USD11,202,70一式四份,声明输:A)原产地为中国B)同号码为HL050307 开立日为07/03/05的商业发票内容:047A: ADDITIONAL CONDITIONS附加条件* THE NUMBER AND DATE OF THE CREDIT AND TH OF OUR BANK MUSTBE QUOTED ON ALL DRAFTS (IF REQUIRED).信用证号码及日期和我们的银行名必须体现在所有单据上(要求)*TRANSPORT DOCUMENTS TO BE CLAUSED: ’VESSE NOT SCHEDULED TOCALL ON ITS CURPENT VOYAGE AT FAMAGUSTA,KYRENTA OR KARAVOSTASSI, CYPRUS.运输单据注明" 船在其航行途中不得到塞***的Famagusta Kyrenta or Karavostassi这些地方*INSURANCE WILL BE COVERED BY THE APPLICAN 由申请人支付*ALL DOCUMENTS TO BE ISSUED IN ENGLISH LANG 所有单据由英文缮制*NEGOTIATION/PAYMENT:UNDER RESERVE/GUARA STRICTLY 保结押汇或是银行保函PROHIBITED. 禁止*DISCREPANCY FEES USD80, FOR EACH SET OF DISCREPANT DOCUMENTSPRESENTED UNDER THIS CREDIT,WHETHER ACCEP OR NOT,PLUS OURCHARGES FOR EACH MESSAGE CONCERNING REJE AND/OR ACCEPTANCEMUST BE BORNE BY BENEFICIARIES THEMSELVES DEDUCTED FROM THEAMOUNT PAYABLE TO THEM.修改每个单据不符点费用将扣除80美元(最多40)*IN THE EVENT OF DISCREPANT DOCUMENTS ARE PRESENTED TO US ANDREJECTED,WE MAY RELEASE THE DOCUMENTS AN EFFECT SETTLEMENT UPONAPPLICANT’S WAIVER OF SUCH DISCREPANCIES,NOTWITHSTANDING ANY COMMUNICATION WITH THE PRESENTER THAT WE HOLDING DOCUMENTS ATITS DISPOSAL,UNLESS ANY PRIOR INSTRUCTIONS T CONTRARY ARERECEIVED.如果不符点是由我方提出并被拒绝,我们将视为受益人放弃个不符点的权利。

信用证样本(中英文对照.信用证样本.以下信用证内容源自华利陶瓷厂与一塞浦路斯客户所开立并顺利支付的信用. TO:BAN.O.CYPRU.LT.LETTER.O.CREDI.DEPARTMEN.MERCIA.OPERATION.CENTE.INTERNATIONA.DIVISIO.*****.*****.TEL:*****.FAX:*****.TELEX:245..493.KYPRI.C.SWIFT:BCYPCY2.DATE:2.MARC.200.APPLICATIO.FO.TH.ISSUANC.O..LETTE.O.CREDI.SWIF.MT70.SEN.TO:MT700转送.STANDAR.CHARTER.BAN.UNI.1-.52/.SHU.NIN.SQUAR.MERCIA.CENTRE,SHE.NA.ROA.EAST,SHENZHE.51800..CHIN.渣打银行深圳分.深南东路5002.信兴广场地王商业大厦52楼1-8单.电话.8246168.:27.SEQUENC.O.TOTAL序列.1/.指只有一张电.:40A.FOR.O.DOCUMENTAR.CREDIT跟单信用证形.IRREVOCABL.不可撤消的信用.:20OCUMENTAR.CREDI.NUMBER信用证号.00143-01-005355.:31C.DAT.O.ISSUE开证.如果这项没有填, 则开证日期为电文的发送日期.:31DAT.AN.PLAC.O.EXPIRY信用证有效.05062.I.CHIN.050622在中国到.:50.APPLICAN.信用证开证审请.******.NICOSI.较对应同发票上是一致.:59.BENEFICIAR.受益.CHAOZHO.HUAL.CERAMIC.FACTOR.FENGY.INDUSTRIA.DISTRICT.GUXIAN.TOWN.CHAOZHO.CITY,GUANGDON.PROVINCE,CHINA.潮州华利陶瓷洁具.:32B.CURRENC.CODE,AMOUN.信用证项下的金.USD***7841,8.:41D:AVAILABL.WITH....BY....议付适用银.STANDAR.CHARTERE.BAN.CHIN.AND/O.A.BELO.渣打银行或以下.B.NEGOTIATIO.任何议付.:42CRAFT.A.开汇.SIGH.即.:42A.RAWE.付款.BCYPCY2NO1.BAN.O.CYPRU.LT.塞浦路斯的银行.:43PARTIA.SHIPMENT.是否允许分批装.NO.ALLOWE.不可.:43T:TRANSHIPMENT转.ALLOWED允.:44AOADIN.O.BOARD/DISPATCH/TAKIN.I.CHARG.AT/FROM...装船港.SHENZHE.PORT深.:44B:FO.TRANSPORTATIO.T.目的.LIMASSO.PORT发票中无提.:TES.DAT.O.SHIPMENT最后装船.05060.:045.ESCRIPTIO.O.GOOD.AND/O.SERVICE.货物/服务描.SANITAR.WAR.陶瓷洁....SHENZHE.PORT,INCOTERM.200.fob深圳港, INCOMTERM.200.:046.OCUMENT.REQUIRE.须提供的单据文.*FUL.SE.(A.LEAS.THREE.ORIGINA.CLEA.SHIPPE.O.BOAR.BILL.PAN.LTD,CYPRUS,NOTIF.PARTIE.APPLICAN.AN.OURSELVES,SHOWIN.全套清洁已装船提单原件(至少三份), 作成以“塞浦路斯股份有限公司”为抬头.通知开证人和我们自己, 注.*FREIGH.PAYABL.A.DESTINATIO.AN.BEARIN.TH.NUMBE.O.THI.CREDIT.运费在目的港付注明该信用证号.*PACKIN.LIS.I..COPIES.装箱单一式三.*PANY/CARRIE.O.THEI.AGEN.STATIN.TH.B/.NO(S.AN.TH.VESSEL(S.NAM.CERTIFYIN.THA.TH.CARRYIN.VESSEL(S.IS/ARE.A.HOLDIN..VALI.SAFET.MANAGEMEN.SYSTE.CERTIFICAT.A.PE.TERM.O.INTERNATIONA.SAFET.MANAGEMEN.COD.AN.B.CLASSIFIE.A.PE.INSTITUT.CLASSIFICATIO.CLAUS.01/01/200.B.A.APPROPRIAT.CLASSIFICATIO.SOCIET.由船公司或代理出有注明B/L号和船名的证明书证明他们的船是.A)持有根据国际安全管理条款编码的有效安全管理系统证书..B)由相关分级协会根据2001年1月1日颁布的ICC条款分类的.*D11,202,7.I..COPIE.DUL.SIGNE.B.TH.BENEFICIARY/IES.STATIN.THA.TH.GOOD.SHIPPED.A)AR.O.CHINES.ORIGIN.B)AR.I.ACCORDANC.WIT.BENEFICIARIE.PROFORM.INVOIC.NO.HL05030.DATE.07/03/05.由受益人签署的商业发票总额USD11,202,70一式四份,声明货物运输.A)原产地为中.B)同号码为HL05030.开立日.07/03/05的商业发票内容一.:047A.ADDITIONA.CONDITIONS附加条..TH.NUMBE.AN.DAT.O.TH.CREDI.AN.TH.NAM.O.OU.BAN.MUS.B.QUOTE.O.AL.DRAFT.(I.REQUIRED).信用证号码及日期和我们的银行名必须体现在所有单据上(如果有要求.*TRANSPOR.DOCUMENT.T.B.CLAUSED.’VESSE.I.NO.SCHEDULE.T.CAL.O.IT.CURPEN.VOYAG.A.FAMAGUSTA,KYRENT.O.KARAVOSTASSI.CYPRUS.运输单据注明.船在其航行途中不得到塞***的Famagusta.Kyrent.o.Karavostassi这些地. *INSURANC.WIL.B.COVERE.B.TH.APPLICANTS.保险由申请人支.*NGUAGE.所有单据由英文缮.*NEGOTIATION/PAYMENT:UNDE.RESERVE/GUARANTE.STRICTL.保结押汇或是银行保. PROHIBITED.禁.*D80.FO.EAC.SE.O.DISCREPAN.DOCUMENT.PRESENTE.UNDE.THI.CREDIT,WHETHE.ACCEPTE.O.NOT,PLU.OU.CHARGE.FO.EAC.MESSAG.CONCERNIN.REJECTIO.AND/O.ACCEPTANC.MUS.B.BORN.B.BENEFICIARIE.THEMSELVE.AN.DEDUCTE.FRO.TH.AMOUN.PAYABL.T.THEM.修改每个单据不符点费用将扣除80美元(最多40.*I.TH.EVEN.O.DISCREPAN.DOCUMENT.AR.PRESENTE.T.U.AN.REJECTED,W.MA.RELEAS.TH.DOCUMENT.AN.EFFEC.SETTLEMEN.UPO.APPLICANT’.WAIVE.O.SUC.DISCREPANCIES,NOTWITHSTANDIN.AN.COMMUNICATIO.WIT.TH.PRESENTE.THA.W.AR.HOLDIN.DOCUMENT.A.IT.DISPOSAL,UNLES.AN.PRIO.INSTRUCTION.T.TH.CONTRAR.AR.RECEIVED.如果不符点是由我方提出并被拒绝,我们将视为受益人放弃修改这个不符点的权利.是说你如果提交了有不符点的单据并且被银行拒付的话,如果客人接受这些不符点.银行在没有收到你们的指示之前有权把单据REALSE给客.*TRANSPOR.DOCUMENT.BEARIN..DAT.PRIO.T.TH.L/.DAT.AR.NO.ACCEPTABLE.早于开证前的运输文件不接.*D3363.81(T.E.3.PERCEN.O.INVOIC.VALUE.BETWEE.L/.AMOUN.AN.INVOICE.AMOUN.REPRESENT.AMOUN.PAI.B.APPLICANT.DIREC.T.BENEFICIARIE.OUTSID.TH.L/.TERM.WITHOU.AN.RESPONSIBILIT.O.OURSELVE.AN.T.B.SHOW.O.INVOICE.A.SUCH.L/C跟发票上USD3363.81的差额(30%发票额)由申请人直接用L/C以.的方式直接给予受益.:71B.CHARGE.BAN.CHARGE.OUTSID.CYPRU.INCLUDIN.THOS.O.TH.REIMBURSIN.BAN.AR.FO.BEN.A/C.在塞浦路斯以外银行产生的费用包括支付行的费用由信用证收益人负担.:48.PERIO.FO.PRESENTATIO.单据提交期.DOCUMENT.MUS.B.PRESENTE.WITHI.2.DAY.AFTE.B/LADIN.DATE,BU.WITHI.TH.VALIDIT.O.TH.CREDIT.在信用证有效期内,最迟装运期后21天内,向银行提交单. :49:CONFIRMATIO.INSTRUCTIONS保兑指.WITHOU.不保.:53A.REIMBURSIN.BANK偿付.BCYPGB2.BAN.O.CYPRU.U.INTERNATIONA.DEPARTMENT.87/9.CHAS.SIDE,SOUTHGAT.N1.5B.LONDO..UNITE.KINGDOM.:78.INSTRUCTION.T.TH.PAY/ACCEP/NE.BAN.议付.NEG.O.DOC.THR.BAN.O.CHIN.LIMITE.CHIN.I.ALLOWED.PLEAS.可通过中国银行议付,.D15,0.(是15还是1500,请指明. 于受益人的帐户中扣去USD15,0.REPRESENTIN.RECORDIN.FEES.NEGOTIATIO.BAN.T.OBTAI.作为记录费.REIMBURSEMEN.FRO.OU.ACCOUN.WIT.REIMBURSIN.BAN..BUSINES.DAY.FOLLOWIN.THEI.AUTHENTICATE.TELEX/.STATIN.A.OU.CREDI.NUMBER.B)AMOUN.CLAIMED.C.VALU.O.DOCUMENT.D)SHIPMENT/DISPATC.DAT.AN.E)THA.DOC.AR.I.STRIC.,BAN.O.APN.LTD,MERCIA.OPER.CENTE.INTERN.DIV..1.KYRIACO.MATS.AV.108.AY.OMOLOYITES,NIGOSIA.CYPRUS,AL.DOC.I.ON.LO.B.COURIE.SERVIC.A.BENEFICIARIE.EXPENSE.所有单据应由偿付行于三个工作日内通过快件形式发给我们,费用由受益人承担. :RMATIO.附.CREDI.I.SUBJEC.T.U.C.P.199.本信用证根据跟单信用证统一惯例UCP500(199.年版)开.I.C..PUBL.NO.500.SUBJEC.T.UR.IC.525.COLLEC.YOU.CHARGE.FRO.BENE.PLEAS.ACKN.RECEIPT.CUMSTOMER’.APPROVAL.Welcome To Download欢迎您的下载, 资料仅供参考!。

一、越南信用证(信开)Appliant(申请人) : MINEXPORT SAIGON35-37 BEN CHUONG DUONG ST.,DIST.1HOCHIMINH CITY,VIETNAMBeneficiary(受益人): /1207047109045731923TAIZHOU JIADELI DOOR MACHINE CO.,LTD,NO.188,NORTHERN DAXI ROAD,DAXI TOWN,WENLING CITY,ZHEJIANG PROVINCE,CHINACurrency code,amount(信用证总额):USD7380.00Availlable With By:ANY BANK IN CHINA BY NEGOTIATION 任何银行议付Drafts at: SIGHT FOR 100POT OF INVOICE value付发票的全部金额Drawee(付款行):EBVIVNVXVIETNAM EXPORT IMPORT COMMERCIAL JOMO CHIMINH CITY,VIETNAMPartial Shipments:NOT ALLOWED(不允许分装)Transshipment:ALLOWED 允许转船Loading on Boad/Dispatch/Taking in Charge at /Form: ANY CHINESE PORT起运港Latest Date of shipment(最迟装船日):060820Description of Goods and /or services(货物描述): OF GOODS:ELECTRIC ROLLING DOOR MACHINE(FULL SET)2.QUANTITY:100SETS3.UNITPRICE:USD73.80/SETCIFTANCANG,HOCHINHCITY,VIETNAM(INCOTERMS2000)4.AMOUNT:USD7,380.005.ORIGIN:MADE IN CHINA6.QUALITY:BRAND NEW AND IN GOOD WORKING CONDITION7.PACKING:EACH SET IS PACKED INTO ONE CARTON BOX8.MARKING IEN ANH,VIETNAMDocuments Required: THE FOLLOWING DOCUMENTS IN ENGLISH:1.SIGNED COMMERCIAL INVOICE IN 03 ORIGINALSAND 01 PHOTOCOPY已签发的商业发票三正一副2.FULL SET(3/3) ORIGINALS AND 01 PHOTOSHOP OF SIGNED CLEAN SHIPPED ON BOARD OCEAN BILLL OF LADING MADE OUT TO ORDER OF VIETNAM EXIMBANK MARKED FREIGHT PREPAID AND NOTIFY THE APPLICANT,ADDRESS AND TELEPHONE NBR OF SHIPPING AGENT IN HOCHIMINH CITY AND L/C NBR MUST BE INDICATED IN B/L已装船的清洁提单三正一副,做成以VIETNAM EXIMBANK 为抬头,注明运费已付,通知申请人,地址和电话号码在胡志明市的货运代理,信用证号码必须显示在提单上。

信用证(L/C)样本2007-05-30 18:41对于很多外贸新手来说,信用证(L/C)是个不小的问题,相信有不少人可能都没见过。

对我来说,信用证也是新的东西,也需要学习。

在此,从其它地方搬来样本,供大家参考、学习。

对于原创者,表示感谢!正题:其实所有的信用证条款都大同小异,具体款项都是那些,下面列出一个样本供大家参考.有一个问题需要新手注意,一般韩国开过来的信用证经常用假远期,这也是韩国人的精明之处,可以用假信用证向开证行押汇,狡猾狡猾地!!信用证样本1SAMPLE LETTER OF CREDIT/1(See Instructions on Page 2)Name and Address of BankDate: __________________Irrevocable letter of Credit No. ______________Beneficiary: Commodity Credit Corporation Account Party: Name of Exporte rAddress of ExporterGentlemen:We hereby open our irrevocable credit in your favor for the sum or sums not to exceed a total of _______________dollars ($__________), to be made available by your req uest for payment at sight upon the presentation of your draft accompanied by the following statement:(Insert applicable statement)/2This Letter of Credit is valid until _____________________/3, provided, however, that th is Letter of Credit will be automatically extended without amendment for _________ ________/4 from the present or any future expiration date thereof, unless at least th irty (30) days prior to any such expiration date the Issuing Bank provides written n otice to the Commodity Credit Corporation at the U.S. Department of Agriculture, 14th and Independence Avenue, S.W., Room 4503, South Building, Stop 1035, Was hington, D.C. 20250-1035, of its election not to renew this Letter of Credit for such additional ______________________/5 period. The notice required hereunder will be d eemed to have been given when received by you.This letter of Credit is issued subject to the Uniform Customs and Practice for Doc umentary Credits, 1993 Revision, International Chamber of Commerce Publication No. 500(Name of Bank)By: _______________________________________________________________-2-INSTRUCTIONS FOR LETTER OF CREDIT ISSUED FOR DEIP BID1. Send to: Treasurer, CCCU.S. Department of Agriculture14th & Independence Avenue, S.W.Room 4503 South BuildingStop 1035Washington, DC 20250-10352. If the letter of credit is to apply to any Dairy Export Incentive Program (DEIP) I nvitation:“The Commodity Credit Corporation (CCC) has a right to the amount drawn in ac cordance with the terms and conditions of one or more Dairy Export Incentive Pro gram (DEIP) Agreements entered into by the exporter pursuant to 7 C.F.R. Part 149 4, and the applicable DEIP Invitation(s) issued by CCC.”If the letter of credit is to apply to a single DEIP Invitation:“The Commodity Credit Corporation (CCC) has a right to the amount drawn in ac cordance with the terms and conditions of one or more Dairy Export incentive Pro gram (DEIP) Agreements entered into by the exporter pursuant to 7 C.F.R. Part 149 4, and DEIP Invitation No. ________________.If the letter of credit is to apply to more than one specific DEIP Invitation:“The Commodity Credit Corporation (CCC) has a right to the amount drawn in ac cordance with the terms and conditions of one or more Dairy Export incentive Pro gram (DEIP) Agreements entered into by the exporter pursuant to 7 C.F.R. Part 149 4, and DEIP Invitation Nos. ________________, ___________________, and _________________ .”3. Insert the last date of the month in which the 90th day after the date of the le tter of credit falls (e.g., if the date of the letter of credit is March 15, 2002, the date to be inserted would be Jun 30, 2002).4. Insert a time period of either “one (1) year” or a specific number of whole month(s) which total less than one year (e.g., “one (1) month,”“two (2) months ,” etc.).5. Insert the same time period as inserted in the previous space (e.g., “one (1) y ear,”“one (1) month,” etc.).信用证样本2Issue of a Documentary Credit (开证行,一般为出口商的往来银行,须示开证行的信用程度决定是否需要其他银行保兑confirmation见49)BKCHCNBJA08E SESSION: 000 ISN: 000000 BANK OF CHINA LIAONING NO. 5 ZHONGSHAN SQUARE ZHONGSHAN DISTRICT DALIAN CHINADestination Bank (通知行advising bank见57A)KOEXKRSEXXX MESSAGE TYPE: 700 KOREA EXCHANGE BANK SEOUL 178.2 KA, ULCHI RO, CHUNG-KO (一般由受益人指定往来银行为通知行,如愿意通知,其须谨慎鉴别信用证表面真实性;应注意信用证文本的生效形式和内容是否完整,如需小心信用证简电或预先通知和由开证人直接寄送的信用证或信用证申请书,因其还未生效,且信用证一般通过指定通知行来通知,可参考《出口实务操作》page237)40A Type of Documentary Credit (跟单信用证类型)IRREVOCABLE (信用证性质为不可撤消。

信用证样本1. 什么是信用证信用证是国际贸易中常用的一种支付方式,也被称为L/C (Letter of Credit)。

它是商业银行以买方为委托人,开具给卖方的一种保证,信用证确保卖方在符合所规定的交货条件下,能够及时收到买方支付的货款。

2. 信用证的主要内容信用证包括以下主要内容:•信用证编号:每个信用证都有一个独特的编号,用于识别该信用证。

•申请人:即买方,通常是国际贸易中的进口商或买方。

•受益人:即卖方,通常是国际贸易中的出口商或卖方。

•开证行:即发出信用证的商业银行,其责任是根据申请人的要求,向受益人开具信用证。

•通知行:即收到信用证后通知受益人的商业银行,其责任是传达信用证的内容给受益人。

除此之外,信用证还包括以下重要信息:•合同总金额:即买卖双方达成的交易金额。

•发货日期:卖方承诺的交货日期。

•装运港口:货物装运的起始港口。

•目的地:货物最终到达的目的地。

3. 信用证样本以下是一个典型的信用证样本:信用证编号: ABC1234567890申请人: Buyer Company受益人: Seller Company开证行: Issuing Bank通知行: Advising Bank合同总金额: 100,000 USD发货日期: 2022-01-01装运港口: Port A目的地: Destination B根据买方的请求,我们开具此信用证,以确保在买方支付货款后,卖方能按合同要求及时发货。

信用证的有效期为开证之日起90天。

在此期限内,卖方应根据合同规定的发货日期将货物装运至指定的装运港口。

受益人须在装船后5天内向开证行提交以下单据:1. 提单:正本3份2. 装箱单:正本3份3. 发票:正本3份4. 保险单:正本3份上述单据须与买方合同内容相符,并在有效期内提交给开证行。

如买方支付货款时发生延误或未按合同约定支付,我们开证行将不承担任何责任。

此信用证效力对买方、受益人及受益人合法受让人具有不可撤销的约束力。

信用证模板1. 信用证的定义和作用信用证是一种国际贸易支付工具,可以简单理解为银行对买卖双方进行担保的凭证。

买方在国内银行开立信用证后,国内银行通知卖方提货,同时向国外开证行支付货款。

在卖方向国外开证行提供符合信用证条款要求的单据后,国外银行按照信用证的约定支付货款给卖方。

信用证的出现有效地解决了国际贸易双方的诚信问题,保障了交易的顺利进行。

2. 信用证的基本要素信用证一般包括以下几个基本要素:•申请人:也称为买方或进口商,需要支付货款的一方。

•受益人:也称为卖方或出口商,提供商品或服务的一方。

•开证行:由申请人委托的国内银行,负责开立信用证。

•通知行:开证行的国内代理银行,负责通知受益人提货。

•开证日期:信用证的开立日期。

•有效期:信用证的有效期限。

•金额:信用证的金额,即货款的支付金额。

•单据要求:信用证规定的提供给开证行的单据要求。

3. 信用证模板的基本结构以下是一个基本的信用证模板的结构示例:信用证编号:[信用证编号]开证日期:[开证日期]有效期:[有效期]买方:[申请人姓名/公司名称]卖方:[受益人姓名/公司名称]开证行:[开证行名称]通知行:[通知行名称]金额:[货款金额]货币:[货币种类]单据要求:- 提单:[提单要求]- 发票:[发票要求]- 装箱单:[装箱单要求]- 保险单:[保险单要求]这是一个简单的示例,实际使用中可以根据具体的交易要求进行相应修改和补充。

4. 编写信用证模板的注意事项编写信用证模板时需要注意以下几点:•详细准确:信用证模板中的各项信息需要准确无误地填写,以保证交易的顺利进行。

•条款一致:信用证模板中的条款需要与实际交易的合同一致,确保双方权益得到保障。

•注意单据要求:信用证模板中单据要求需要根据具体的交易情况进行明确,确保卖方提供符合要求的单据。

•审核确认:在使用信用证模板前,需要经过开证行的审核确认,确保模板的合法性和可行性。

5. 总结信用证作为一种国际贸易支付工具,在国际贸易中扮演着重要的角色。

请开信用证信函请开信用证信函精选2篇(一)尊敬的××银行:我方现在正在进行一笔国际贸易交易,需要您方开立一份信用证作为付款保障。

以下是我们对信用证的要求和详细信息:受益人( Beneficiary):[受益人名称][受益人地址][受益人联系人及联系方式]开证申请人(Applicant):[申请人名称][申请人地址][申请人联系人及联系方式]开证银行(Issuing Bank):[银行名称][银行地址][银行联系人及联系方式]开证金额(Amount):[金额]有效期(Validity):装运期限(Shipment Date):[装运期限]付款条件(Payment Terms):[付款条件]货物信息(Goods Information):[货物描述][货物数量][货物单价]其他特殊要求(Other Special Instructions):[特殊要求]我们希望能够尽快收到您的回复,并且于合适的时间开立该信用证。

请您在确认后以书面形式通知我们,并提供相关的开证文件和要求的提货期限。

如果您有任何疑问或需要额外信息,请随时与我们联系。

再次感谢您对我们贸易交易的支持与合作。

此致敬礼[您的职位][您的联系方式]请开信用证信函精选2篇(二)尊敬的先生/女士,我们公司目前有一个业务合作机会,需要您的帮助开立一份信用证。

根据我们的合作协议,我们需要您的银行以我们公司名义向受益人开立一份信用证。

以下是有关信用证的详细信息:1. 我们的公司名称和地址:公司名称:[公司名称]公司地址:[公司地址]2. 受益人的名称和地址:受益人名称:[受益人名称]受益人地址:[受益人地址]3. 信用证的金额和货币:信用证金额:[金额]货币种类:[货币类型]4. 信用证的有效期:开证日期:[日期]有效期至:[日期]5. 货物/服务的描述:货物/服务描述:[描述]6. 付款条件:付款方式:不可撤销的、即期、可转让的信用证付款条款:[具体条款]为了顺利开立信用证,请您务必尽快与我们联系,以便我们提供进一步的文件和指示。

信用证开证申请书模板尊敬的XX银行:我司因业务需要,向贵行申请开立一份信用证,具体开证事宜如下:一、开证申请人信息开证申请人(全称):XXX公司地址:XX省XX市XX区XX路XX号联系人:XXX联系电话:XXX的开证申请人与贵行已有多年业务往来,信誉良好,特此申请开立信用证。

二、受益人信息受益人(全称):XXX公司地址:XX省XX市XX区XX路XX号联系人:XXX联系电话:XXX受益人为我司长期合作伙伴,信誉可靠,享有开证权利。

三、信用证基本信息信用证编号:XXX开证金额:人民币XX万元整货币单位:人民币开证有效期:自信用证开出之日起XX天有效地点:受益人所在地四、运输方式及交单期运输方式:XXX交单期:货物装船后XX天内五、货物描述货物名称:XXX规格型号:XXX数量:XXX单价:XXX总价:XXX六、单据要求1. 商业发票:正本一份,注明信用证号码及合同号码。

2. 海运提单:正本一份,收货人为我司,注明运费已付。

3. 航空运单:正本一份,收货人为我司,注明运费已付。

4. 铁路运单:正本一份,收货人为我司,注明运费已付。

5. 邮政收据:正本一份,收货人为我司,注明运费已付。

6. 货物收据:正本一份,收货人为我司。

7. 保险单:正本一份,副本一份,投保金额为货物总价,险别为XXX。

8. 装箱单:正本一份,注明每一包装件内货物数量及每件的毛重、净重。

9. 其他单据:按实际需要提供。

七、付款方式及期限付款方式:XXX付款期限:货物到达后XX天内八、其他条款1. 单据必须自运输单据签发日起XX天内提交(不能晚于信用证有效期)。

2. 货物数量及信用证金额均可有5%的浮动范围。

3. 其他条款:按实际需要约定。

特此申请,敬请贵行审慎办理。

此致敬礼!开证申请人(签章):年月日。

FROM:THE HONGKONG AND SHANGHAI BANKING CORP. , DUBAITO:THE HONGKONG AND SHANGHAI BANKING CORP. , SHANGHAISEQUENCE OF TOTAL 1/2FORM OF DOC. CREDIT IRREVOCABLEDOC. CREDIT NUMBER DBS 268330DATE OF ISSUE 080202EXPIRY DATE 080502 PLACE IN COUNTRYOF BENEFICIARYAPPLICANT ABDULAH SALEM AND CO.,P.O.BOX 3472, DUBAI, U.A.E. BENEFICIARY ZHEJIANG LIGT INDUSTRIALPRODUCTS IMPORTANDEXPPORT CORP.,191 BAOCHU ROAD,HANGZHOU,CHINACURRENCY AMOUNT USD AMOUNT 7,600. 00NEG. A V AILABLE BY ANY BANK BY NEGOTIATION DRAFT AT AT SIGHTPARTIAL SHIPMENT ALLOWEDTRANSSHIPMENT NOT ALLOWEDLAODING IN CHARGE SHANGHAIFOR TRANSPORT TO DUBAILATEST DATE OF SHIP. 080421DESCRIPT. OF GOODS FLOWER BRAND PLAYING CARDART. NO. 778, 500 GROSS, USD15.20PER GROSS CFR DUBAI DOCUMENTS REQUIRED+ SIGNED COMMERCIAL INVOICE IN THREECOPIES SHOWING INDENT NO. GG/NSN/04/07.+ FULL SET OF ORIGINAL CLEAN ON BOARDMARINE BILL OF LADING MADE OUT TOORDER, BLANK ENDORSED, MARKED FREIGHTPREPAID, NOTIFY GARGERN NASAMN CO., P.O.BOX 2926, DUBAI, U.A.E. TEL:2-284321.+ SHIPPING COMPANY’S CERTIFICATECERTIFYING THAT THE CARRYING VESSELDOES NOT CALL AT ANY ISRAELI PORT NORISRAELI NATIONALITY DURING THIS VOYAGETO DUBAI U.A.E.+ PACKING LIST IN THREE COPIES.+ ORIGINAL CERTIFICATE OF ORIGIN ISSUEDBY CHAMBER OF COMMERCE SHOWING B/LNOTIFY PARTY AS CONSIGNEE+ COPY OF FAX SENT BY BENEFICIARY TODUBAI INSURANCE COMPANY ON FAX ON:02-571334 SHOWING GARGERN NASAMN CO.’SOPEN POLICY NO., GG/04/325, EVIDENCINGTHAT THE DESCRIPTION OF GOODS, QUANTITYAND NUMBER OF KINDS PACKAGE, NAME OFVESSEL AND VOYAGE NUMBER, PORT OFLADING AND E.T.D., PORT OF DESTINATIONAND E.T.A. TWO DAYS BEFORE SHIPMENT. THERELEV ANT FAX REPORT WILL BE PRESENTEDFOR NEGOTIATION.+ BENEFICIARY CERTIFICATE CERTIFYINGTHAT COPIES OF INVICE, BILL OF LADING ANDPACKING LIST HA VE BEEN FAXED TOAPPLICANT ON FAX NO. 02-384364 WITHIN 3DAYS OF BILL OF LADING DATE. THERELEV ANT FAX REPORT WILL BE PRESENTEDFOR NEGOTIATION.ADDITIONAL COND.+ A DISCREPANCY HANDLING FEE OF USD60.00SHOULD BE DEDUCTED AND INDICATED ONTHE BILL SCHEDULE FOR EACHPRESENTATION OF DISCREPANT DOCUMENTSUNDER THIS CREDIT。

+ EXCEPT SO FAR AS OTHERWISE EXPRESSLYSTATE, THIS DOCUMENTARY CREDIT ISSUBJECT TO UNIFORM CUSTOMS ANDPRACTICE FOR DOCUMENTARY CREDIT ICCPUBLICATION NO.500+ 2 PCT OF INVOICE V ALUE WILL BE REMITTEDTO M/S. ABDULLAH SALEM AND CO. AS AGENTSCOMMISSION AT THE TIME OF NEGOTIATIONBY US.PRESENTATION PERIOD WHTHIN 12 DAYS AFTER THE DATE OF B/L BUT WITHIN THE V ALIDITY OFTHIS CREDIT.CONFIRMATION ALL BANK CHARGES OUTSIDE DUBAI, U.A.E. ARE FOR THE ACCORNT OF BNEFICIARY. INSTRUCTION ON RECEIPT OF DOCUMENTS CONFIRMING TO THE TERMS OF THIS DOCUMENTARYCREDIT, WE UNDERTATE REIMBURSE TO YOUON DUE DATE IN THE CURRENCY OF THECREDIT IN ACCORDANCE WITH YOURINSTRUCTIONS, WHICH SHOULD INCLUDEYOUR UID NUMBER AND THE ABA CODE OFTHE RECEIVING BANK.SEND. TO .REC. INFO. DOCUMENTS TO BE DESPATCHED BY COURIER SERVICE IN ONE LOT TO THEHONGKONG AND SHANGHAI BANKING CORP.,DUBAI BRANCH, FINANCIAL DEPARTMENT, 15THFLOOR, 92 NASELA STREET, DUBAI, U.A.E.迪拜汇丰银行致上海汇丰银行页号:第1页/共2页信用证类型:不可撤销信用证号码:DBS 268330签发日期:2008-02-02有效期:2008-05-02,受益人所在国家时间申请人:ABDULLAH SALEM AND CO,P.O.BOX 3472, DUBAI, U.A.E.受益人:浙江轻工业品进出口公司金额:7600美元议付行:受益人所在国家任何银行议付有效付款日期:见票即付分批装船:允许转船:不允许装载地:上海目的地:迪拜装船日期:2008-03-21之前货物说明:花牌纸牌,货号778,500罗,每罗CFR迪拜15.20美元单据要求:*已签署商业发票一式三份显示印号GG/NSN/04/07*全套清洁、舱载、已装载、海运、空白抬头提单,空白背书,标示运费预付,被通知人为GARGERN NASAMN CO., P.O. BOX 2926, DUBAI, U.A.E.TEL:2-284321.*装运公司证书。

证明本次前往迪拜的船只本次航程中未到访任何以色列港口,亦非以色列国籍船只。

*商会签发的原产地证,显示以收货人为被通知人的提单。

*受益人发往FAX ON: 02-571334迪拜保险公司的传真副本,显示GARGERN NASAMN CO.’S的开放保单号NO., GG/04/325。

证明名下货物、质量、包装类型与数目、船名、航次,装载港和离港时间,目的港和到港时间,传真在实际装船之前两日内发出。

相关传真报告议付货款时需提交。

*受益人证明。

证明提单签发3日内,发票副本、提单和装箱单已经被传真至NO. 02-384364。

相关传真报告议付货款时需提交。

附加条件:*单据不符费用60美元需从付款单据中扣除,并在本信用证下的各项文件中显示。

*除非另有明确声明,本信用证依据《跟单信用证统一惯例500》解释。

*2%的发票金额将汇付给M/S. ABDULLAH SALEM AND CO.作为代理佣金。

*单据提供有效期:提单签发12日内,信用证有效期截止日前。

*迪拜以外地区的银行费用由受益人账户支出。

*在收到与本信用要求相一致的单据后,我们承担清偿责任,合适的时间由你方指示。

但你方必须提供收款银行的UID号码和ABA号码。

*银行间通知:单据通过快递服务,一并发往汇丰迪拜分行金融部,阿联酋迪拜那塞拉大街92号15楼。