国际财务管理6章习题第四组剖析

- 格式:ppt

- 大小:265.50 KB

- 文档页数:9

CHAPTER 6 INTERNATIONAL PARITY RELATIONSHIPSSUGGESTED ANSWERS AND SOLUTIONS TO END-OF-CHAPTERQUESTIONS AND PROBLEMSQUESTIONS1. Give a full definition of arbitrage.Answer:Arbitrage can be defined as the act of simultaneously buying and selling the same or equivalent assets or commodities for the purpose of making certain, guaranteed profits.2. Discuss the implications of the interest rate parity for the exchange rate determination.Answer: Assuming that the forward exchange rate is roughly an unbiased predictor of the future spot rate, IRP can be written as:S = [(1 + I£)/(1 + I$)]E[S t+1 I t].The exchange rate is thus determined by the relative interest rates, and the expected future spot rate, conditional on all the available information, I t, as of the present time. One thus can say that expectation is self-fulfilling. Since the information set will be continuously updated as news hit the market, the exchange rate will exhibit a highly dynamic, random behavior.3. Explain the conditions under which the forward exchange rate will be an unbiased predictor of the future spot exchange rate.Answer: The forward exchange rate will be an unbiased predictor of the future spot rate if (I) the risk premium is insignificant and (ii) foreign exchange markets are informationally efficient.4. Explain the purchasing power parity, both the absolute and relative versions. What causes the deviations from the purchasing power parity?Answer: The absolute version of purchasing power parity (PPP):S = P$/P£.The relative version is:e = π$ - π£.PPP can be violated if there are barriers to international trade or if people in different countries have different consumption taste. PPP is the law of one price applied to a standard consumption basket.8. Explain the random walk model for exchange rate forecasting. Can it be consistent with the technical analysis?Answer: The random walk model predicts that the current exchange rate will be the best predictor of the future exchange rate. An implication of the model is that past history of the exchange rate is of no value in predicting future exchange rate. The model thus is inconsistent with the technical analysis which tries to utilize past history in predicting the future exchange rate.*9. Derive and explain the monetary approach to exchange rate determination.Answer: The monetary approach is associated with the Chicago School of Economics. It is based on two tenets: purchasing power parity and the quantity theory of money. Combing these two theories allows for stating, say, the $/£ spot exchange rate as:S($/£) = (M$/M£)(V$/V£)(y£/y$),where M denotes the money supply, V the velocity of money, and y the national aggregate output. The theory holds that what matters in exchange rate determination are:1. The relative money supply,2. The relative velocities of monies, and3. The relative national outputs.10. CFA question: 1997, Level 3.A.Explain the following three concepts of purchasing power parity (PPP):a. The law of one price.b. Absolute PPP.c. Relative PPP.B.Evaluate the usefulness of relative PPP in predicting movements in foreign exchange rates on:a.Short-term basis (for example, three months)b.Long-term basis (for example, six years)Answer:A. a. The law of one price (LOP) refers to the international arbitrage condition for the standardconsumption basket. LOP requires that the consumption basket should be selling for the same price ina given currency across countries.A. b. Absolute PPP holds that the price level in a country is equal to the price level in another countrytimes the exchange rate between the two countries.A. c. Relative PPP holds that the rate of exchange rate change between a pair of countries is aboutequalto the difference in inflation rates of the two countries.B. a. PPP is not useful for predicting exchange rates on the short-term basis mainly becauseinternational commodity arbitrage is a time-consuming process.B. b. PPP is useful for predicting exchange rates on the long-term basis.PROBLEMS1. Suppose that the treasurer of IBM has an extra cash reserve of $100,000,000 to invest for six months. The six-month interest rate is 8 percent per annum in the United States and 6 percent per annum in Germany. Currently, the spot exchange rate is €1.01 per dollar and the six-month forward exchange rate is €0.99 per dollar. The treasurer of IBM does not wish to bear any exchange risk. Where should he/she invest to maximize the return?The market conditions are summarized as follows:I$ = 4%; i€= 3.5%; S = €1.01/$; F = €0.99/$.If $100,000,000 is invested in the U.S., the maturity value in six months will be$104,000,000 = $100,000,000 (1 + .04).Alternatively, $100,000,000 can be converted into euros and invested at the German interest rate, with the euro maturity value sold forward. In this case the dollar maturity value will be$105,590,909 = ($100,000,000 x 1.01)(1 + .035)(1/0.99)Clearly, it is better to invest $100,000,000 in Germany with exchange risk hedging.2. While you were visiting London, you purchased a Jaguar for £35,000, payable in three months. You have enough cash at your bank in New York City, which pays 0.35% interest per month, compounding monthly, to pay for the car. Currently, the spot exchange rate is $1.45/£and the three-month forward exchange rate is $1.40/£. In London, the money market interest rate is 2.0% for a three-month investment. There are two alternative ways of paying for your Jaguar.(a) Keep the funds at your bank in the U.S. and buy £35,000 forward.(b) Buy a certain pound amount spot today and invest the amount in the U.K. for three months so that the maturity value becomes equal to £35,000.Evaluate each payment method. Which method would you prefer? Why?Solution: The problem situation is summarized as follows:A/P = £35,000 payable in three monthsi NY = 0.35%/month, compounding monthlyi LD = 2.0% for three monthsS = $1.45/£; F = $1.40/£.Option a:When you buy £35,000 forward, you will need $49,000 in three months to fulfill the forward contract. The present value of $49,000 is computed as follows:$49,000/(1.0035)3 = $48,489.Thus, the cost of Jaguar as of today is $48,489.Option b:The present value of £35,000 is £34,314 = £35,000/(1.02). To buy £34,314 today, it will cost $49,755 = 34,314x1.45. Thus the cost of Jaguar as of today is $49,755.You should definitely choose to use “option a”, and save $1,266, which is the diff erence between $49,755 and $48489.3. Currently, the spot exchange rate is $1.50/£ and the three-month forward exchange rate is $1.52/£. The three-month interest rate is 8.0% per annum in the U.S. and 5.8% per annum in the U.K. Assume that you can borrow as much as $1,500,000 or £1,000,000.a. Determine whether the interest rate parity is currently holding.b. If the IRP is not holding, how would you carry out covered interest arbitrage? Show all the steps and determine the arbitrage profit.c. Explain how the IRP will be restored as a result of covered arbitrage activities.Solution: Let’s summarize the given data first:S = $1.5/£; F = $1.52/£; I$ = 2.0%; I£ = 1.45%Credit = $1,500,000 or £1,000,000.a. (1+I$) = 1.02(1+I£)(F/S) = (1.0145)(1.52/1.50) = 1.0280Thus, IRP is not holding exactly.b. (1) Borrow $1,500,000; repayment will be $1,530,000.(2) Buy £1,000,000 spot using $1,500,000.(3) Invest £1,000,000 at the pound interest rate of 1.45%;maturity value will be £1,014,500.(4) Sell £1,014,500 forward for $1,542,040Arbitrage profit will be $12,040c. Following the arbitrage transactions described above,The dollar interest rate will rise;The pound interest rate will fall;The spot exchange rate will rise;The forward exchange rate will fall.These adjustments will continue until IRP holds.4. Suppose that the current spot exchange rate is €0.80/$ and the three-month forward exchange rate is €0.7813/$. The three-month interest rate is5.6 percent per annum in the United States and 5.40 percent per annum in France. Assume that you can borrow up to $1,000,000 or €800,000.a. Show how to realize a certain profit via covered interest arbitrage, assuming that you want to realize profit in terms of U.S. dollars. Also determine the size of your arbitrage profit.b. Assume that you want to realize profit in terms of euros. Show the covered arbitrage process and determine the arbitrage profit in euros.Solution:a.(1+ i $) = 1.014 < (F/S) (1+ i € ) = 1.053. Thus, one has to borrow dollars and invest in euros tomake arbitrage profit.1.Borrow $1,000,000 and repay $1,014,000 in three months.2.Sell $1,000,000 spot for €1,060,000.3.Invest €1,060,000 at the euro interest rate of 1.35 % for three months and receive €1,074,310 atmaturity.4.Sell €1,074,310 forward for $1,053,245.Arbitrage profit = $1,053,245 - $1,014,000 = $39,245.b.Follow the first three steps above. But the last step, involving exchange risk hedging, will bedifferent.5.Buy $1,014,000 forward for €1,034,280.Arbitrage profit = €1,074,310 - €1,034,280 = €40,0305. In the issue of October 23, 1999, the Economist reports that the interest rate per annum is 5.93% in the United States and 70.0% in Turkey. Why do you think the interest rate is so high in Turkey? Based on the reported interest rates, how would you predict the change of the exchange rate between the U.S. dollarand the Turkish lira?Solution: A high Turkish interest rate must reflect a high expected inflation in Turkey. According to international Fisher effect (IFE), we haveE(e) = i$ - i Lira= 5.93% - 70.0% = -64.07%The Turkish lira thus is expected to depreciate against the U.S. dollar by about 64%.6. As of November 1, 1999, the exchange rate between the Brazilian real and U.S. dollar is R$1.95/$. The consensus forecast for the U.S. and Brazil inflation rates for the next 1-year period is 2.6% and 20.0%, respectively. How would you forecast the exchange rate to be at around November 1, 2000?Solution: Since the inflation rate is quite high in Brazil, we may use the purchasing power parity to forecast the exchange rate.E(e) = E(π$) - E(πR$)= 2.6% - 20.0%= -17.4%E(S T) = S o(1 + E(e))= (R$1.95/$) (1 + 0.174)= R$2.29/$7. (CFA question) Omni Advisors, an international pension fund manager, uses the concepts of purchasing power parity (PPP) and the International Fisher Effect (IFE) to forecast spot exchange rates. Omni gathers the financial information as follows:Base price level 100Current U.S. price level 105Current South African price level 111Base rand spot exchange rate $0.175Current rand spot exchange rate $0.158Expected annual U.S. inflation 7%Expected annual South African inflation 5%Expected U.S. one-year interest rate 10%Expected South African one-year interest rate 8%Calculate the following exchange rates (ZAR and USD refer to the South African and U.S. dollar, respectively).a. The current ZAR spot rate in USD that would have been forecast by PPP.b. Using the IFE, the expected ZAR spot rate in USD one year from now.c. Using PPP, the expected ZAR spot rate in USD four years from now.Solution:a. ZAR spot rate under PPP = [1.05/1.11](0.175) = $0.1655/rand.b. Expected ZAR spot rate = [1.10/1.08] (0.158) = $0.1609/rand.c. Expected ZAR under PPP = [(1.07)4/(1.05)4] (0.158) = $0.1704/rand.8. Suppose that the current spot exchange rate is €1.50/₤ and the one-year forward exchange rate is €1.60/₤. The one-year interest rate is 5.4% in euros and 5.2% in pounds. You can borrow at most €1,000,000 or the equivalent pound amount, i.e., ₤666,667, at the current spot exchange rate.a.Show how you can realize a guaranteed profit from covered interest arbitrage. Assume that you are aeuro-based investor. Also determine the size of the arbitrage profit.b.Discuss how the interest rate parity may be restored as a result of the abovetransactions.c.Suppose you are a pound-based investor. Show the covered arbitrage process anddetermine the pound profit amount.Solution:a. First, note that (1+i €) = 1.054 is less than (F/S)(1+i €) = (1.60/1.50)(1.052) = 1.1221.You should thus borrow in euros and lend in pounds.1)Borrow €1,000,000 and promise to repay €1,054,000 in one year.2)Buy ₤666,667 spot for €1,000,000.3)Invest ₤666,667 at the pound interest rate of 5.2%; the maturity value will be ₤701,334.4)To hedge exchange risk, sell the maturity value ₤701,334 forward in exchange for €1,122,134.The arbitrage profit will be the difference between €1,122,134 and €1,054,000, i.e., €68,134.b. As a result of the above arbitrage transactions, the euro interest rate will rise, the poundinterest rate will fall. In addition, the spot exchange rate (euros per pound) will rise and the forward rate will fall. These adjustments will continue until the interest rate parity is restored.c. The pound-based investor will carry out the same transactions 1), 2), and 3) in a. But to hedge, he/she will bu y €1,054,000 forward in exchange for ₤658,750. The arbitrage profit will then be ₤42,584 = ₤701,334 - ₤658,750.9. Due to the integrated nature of their capital markets, investors in both the U.S. and U.K. require the same real interest rate, 2.5%, on their lending. There is a consensus in capital markets that the annual inflation rate is likely to be 3.5% in the U.S. and 1.5% in the U.K. for the next three years. The spot exchange rate is currently $1.50/£.pute the nominal interest rate per annum in both the U.S. and U.K., assuming that the Fishereffect holds.b.What is your expected future spot dollar-pound exchange rate in three years from now?c.Can you infer the forward dollar-pound exchange rate for one-year maturity?Solution.a. Nominal ra te in US = (1+ρ) (1+E(π$)) – 1 = (1.025)(1.035) – 1 = 0.0609 or 6.09%.Nominal rate in UK= (1+ρ) (1+E(π₤)) – 1 = (1.025)(1.015) – 1 = 0.0404 or 4.04%.b. E(S T) = [(1.0609)3/(1.0404)3] (1.50) = $1.5904/₤.c. F = [1.0609/1.0404](1.50) = $1.5296/₤.Mini Case: Turkish Lira and the Purchasing Power ParityVeritas Emerging Market Fund specializes in investing in emerging stock markets of the world. Mr. Henry Mobaus, an experienced hand in international investment and your boss, is currently interested in Turkish stock markets. He thinks that Turkey will eventually be invited to negotiate its membership in the European Union. If this happens, it will boost the stock prices in Turkey. But, at the same time, he is quite concerned with the volatile exchange rates of the Turkish currency. He would like to understand what drives the Turkish exchange rates. Since the inflation rate is much higher in Turkey than in the U.S., he thinks that the purchasing power parity may be holding at least to some extent. As a research assistant for him, you were assigned to check this out. In other words, you have to study and prepare a report on the following question: Does the purchasing power parity hold for the Turkish lira-U.S. dollar exchange rate? Among other things, Mr. Mobaus would like you to do the following:Plot the past exchange rate changes against the differential inflation rates betweenTurkey and the U.S. for the last four years.Regress the rate of exchange rate changes on the inflation rate differential to estimatethe intercept and the slope coefficient, and interpret the regression results.Data source: You may download the consumer price index data for the U.S. and Turkey from the following website: , “hot file” (Excel format) . You may download the exchange rate data from the website: merce.ubc.ca/xr/data.html.Solution:a. In the current solution, we use the monthly data from January 1999 – December 2002.b. We regress exchange rate changes (e) on the inflation rate differential and estimate theintercept (α ) and slope coefficient (β):3.095) (t 1.472βˆ0.649)- (t 0.011αˆε Inf_US) -Inf_Turkey (βˆαˆ e tt ===-=++=The estimated intercept is insignificantly different from zero, whereas the slope coefficient is positive and significantly different from zero. In fact, the slope coefficient is insignificantly different from unity. [Note that t-statistics for β = 1 is 0.992 = (1.472 – 1)/0.476 where s.e. is 0.476] In other words, we cannot reject the hypothesis that the intercept is zero and the slope coefficient is one. The results are thus supportive of purchasing power parity.5. Discuss the implications of the deviations from the purchasing power parity for countries’ competitive positions in the world market.Answer: If exchange rate changes satisfy PPP, competitive positions of countries will remain unaffected following exchange rate changes. Otherwise, exchange rate changes will affect relative competitiveness of countries. If a country’s currency appreciates (depre ciates) by more than is warranted by PPP, that will hurt (strengthen) the country’s competitive position in the world market.6. Explain and derive the international Fisher effect.Answer: The international Fisher effect can be obtained by combining the Fisher effect and the relative version of PPP in its expectational form. Specifically, the Fisher effect holds thatE(π$) = I$ - ρ$,E(π£) = I£ - ρ£.Assuming that the real interest rate is the same between the two countries, i.e., ρ$ = ρ£, and substituting the above results into the PPP, i.e., E(e) = E(π$)- E(π£), we obtain the international Fisher effect: E(e) = I$ - I£.7. Researchers found that it is very difficult to forecast the future exchange rates more accurately than the forward exchange rate or the current spot exchange rate. How would you interpret this finding?Answer: This implies that exchange markets are informationally efficient. Thus, unless one has private information that is not yet reflected in the current market rates, it would be difficult to beat the market.。

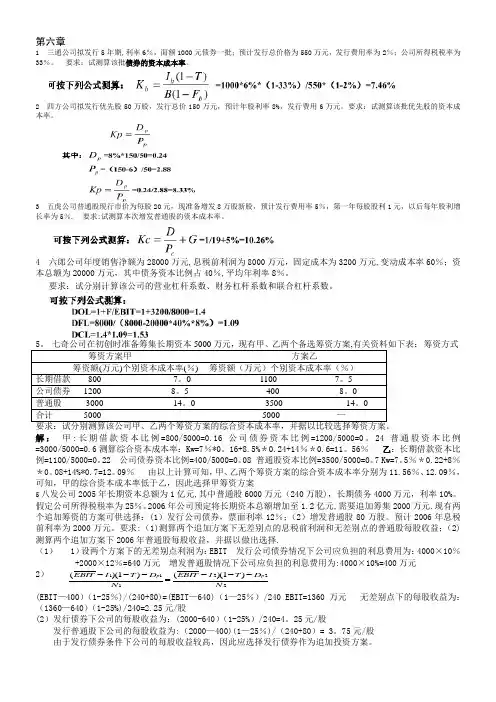

第六章1 三通公司拟发行5年期,利率6%,面额1000元债券一批;预计发行总价格为550万元,发行费用率为2%;公司所得税税率为33%。

要求:试测算该批债券的资本成本率。

2 四方公司拟发行优先股50万股,发行总价150万元,预计年股利率8%,发行费用6万元。

要求:试测算该批优先股的资本成本率。

3 五虎公司普通股现行市价为每股20元,现准备增发8万股新股,预计发行费用率5%,第一年每股股利1元,以后每年股利增长率为5%. 要求:试测算本次增发普通股的资本成本率。

4 六郎公司年度销售净额为28000万元,息税前利润为8000万元,固定成本为3200万元,变动成本率60%;资本总额为20000万元,其中债务资本比例占40%,平均年利率8%。

要求:试分别计算该公司的营业杠杆系数、财务杠杆系数和联合杠杆系数。

筹资方式筹资方案甲 方案乙筹资额(万元)个别资本成本率(%) 筹资额(万元)个别资本成本率(%)长期借款 800 7。

0 1100 7。

5公司债券 1200 8。

5 400 8。

0普通股 3000 14。

0 3500 14。

0合计 5000 - 5000 —解: 甲:长期借款资本比例=800/5000=0.16公司债券资本比例=1200/5000=0。

24 普通股资本比例=3000/5000=0.6测算综合资本成本率:Kw=7%*0。

16+8.5%*0.24+14%*0.6=11。

56% 乙:长期借款资本比例=1100/5000=0。

22 公司债券资本比例=400/5000=0。

08 普通股资本比例=3500/5000=0。

7 Kw=7。

5%*0.22+8%*0。

08+14%*0.7=12。

09% 由以上计算可知,甲、乙两个筹资方案的综合资本成本率分别为11.56%、12.09%, 可知,甲的综合资本成本率低于乙,因此选择甲筹资方案5八发公司2005年长期资本总额为1亿元,其中普通股6000万元(240万股),长期债务4000万元,利率10%。

国际财务治理?练习题参考答案第1章国际财务治理导论一、名词解释1.国际企业:超越国界从事商业活动的企业,包括各种类型、各种规模的参与国际商务的企业。

国内生产、国际销售是国际企业最简单的国际业务。

跨国公司是国际企业开展的较高时期和典型代表。

2.许可经营:许可方企业向受许可方企业提供技术,包括版权、专利技术、技术诀窍或商标以换取使用费的一种经营方式。

当许可方企业与受许可方企业分不位于不同国家时,就形成了国家间的许可经营。

这种方式也能够被瞧作技术出口。

3.特许经营:是一种特殊的许可经营方式,许可方通过向被许可方提供全套专业化企业经营手段,包括商标、企业组织、销售或效劳策略和培训、技术支持等定期取得特许权使用费,被许可方那么必须同意遵守严格的规那么和程序以实现经营的标准化。

特许权使用费通常以被许可方的销售收进为根底收取。

4.分部式组织:称事业部制组织结构。

其特点是在高层治理者之下,按地区或产品设置假设干分部,实行“集中政策,分散经营〞的集中领导下的分权治理。

5.混合式组织:事实上非常少有哪家企业是单纯采纳一种结构类型的,采纳两种以上组合方式的称为混合式结构。

6.分权模式:子公司拥有充分的财务治理决策权,母公司关于其财务治理操纵以间接治理为主。

二、简答题1.国际财务治理与国内企业的财务治理内容有哪些的重要区不。

【答案】国际财务治理是指对国际企业的涉外经济活动进行的财务治理。

财务治理要紧涉及的是如何作出各种最正确的公司财务决定,比方通过适宜的投资、资产结构、股息政策以及人力资源治理,从而到达既定的公司目标〔股东财宝最大化〕。

国际财务治理与国内财务治理之间的区不要紧表达在以下几个方面:〔1〕跨国经营和财务活动受外汇风险的妨碍;〔2〕全球范围内融资,寻求最正确全球融资战略;〔3〕跨国经营中商品和资金无法自由流淌;〔4〕对外投资为股东在全球范围内分散风险。

2.试述国际财务治理体系的内容。

【答案】国际财务治理体系的内容要紧包括:〔1〕国际财务治理环境。

国际财务管理课后习题答案chapter4CHAPTER 4 CORPORATE GOVERNANCE AROUND THE WORLDSUGGESTED ANSWERS AND SOLUTIONS TO END-OF-CHAPTERQUESTIONS AND PROBLEMSQuestions1.The majority of major corporations are franchised as public corporations. Discuss the key strengthand weakness of the ‘public corporation’. When do you think the public corporation as an organizational form is unsuitable?Answer: The key strength of the public corporation lies in that it allows for efficient risk sharing among investors. As a result, the public corporation may raise a large sum of capital at a relatively low cost. The main weakness of the public corporation stems from the conflicts of interest between managers and shareholders.2.The public corporation is owned by multitude of shareholders but managed by professional managers.Managers can take self-interested actions at the expense of shareholders. Discuss the conditions under which the so-called agency problem arises.Answer: The agency problem arises when managers have control rights but insignificant cash flow rights. This wedge between control and cash flow rights motivates managers to engage in self-dealings at the expense of shareholders.3.Following corporate scandals and failures in the U.S. and abroad, there is a growingdemand for corporate governance reform. What should be the key objectives ofcorporate governance reform? What kind of obstacles can there be thwarting reformefforts?Answer: The key objectives of corporate governance reform should be to strengthen shareholder rights and protect shareholders from expropriation by corporate insiders, whether managers or large shareholders. Controlling shareholders or managers do not wish to lose their control rights and thus resist reform efforts.4.Studies show that the legal protection of shareholder rights varies a great deal acrosscountries. Discuss the possible reasons why the English common law traditionprovides the strongest and the French civil law tradition the weakest protection ofinvestors.Answer: In civil law countries, the state historically has played an active role in regulating economic activities and has been less protective of property rights. In England, control of the court passed from the crown to the parliament and property owners in seventeenth century. English common law thus became more protective of property owners, and this protection was extended to investors over time.5.Explain ‘the wedge’ between the control and cash flow rights and discuss its implications forcorporate governance.Answer: When there is a separation of ownership and control, managers have control rights with insignificant cash flow rights,whereas shareholders have cash flow rights but no control rights. This wedge gives rise to the conflicts of interest between managers and shareholders. The wedge is the source of the agency problem.6.Discuss different ways that dominant investors use to establish and maintain the control of thecompany with relatively small investments.Answer: Dominant investors may use: (i) shares with superior voting rights, (ii) pyramidal ownership structure, and (iii) inter-firm cross-holdings.7.The Cadbury Code of the Best Practice adopted in the United Kingdom led to a successful reform ofcorporate governance in the country. Explain the key requirements of the Code and discuss how it may have contributed to the success of reform.Answer: The Code requires that chairman of the board and CEO be held by two different individuals, and that there should be at least three outside board members. The recommended board structure helped to strengthen the monitoring function of the board and reduce the agency problem.8.Many companies grant stocks or stock options to the managers. Discuss the benefitsand possible costs of using this kind of incentive compensation scheme.Answer: Stock options can be useful for aligning the interest of managers with that of shareholders and reduce the wedge between managerial control rights and cash flow rights. But at the same time, stock options may induce managers to distort investment decisions and manipulate financial statements so that they can maximize their benefits in the short run.9.It has been shown that foreign companies listed in the U.S. stock exchanges are valued more thanthose from the same countries that are not listed in the U.S. Explain the reasons why U.S.-listed foreign firms are valued more than those which are not. Also explain why not every foreign firm wants to list stocks in the United States.Answer: Foreign companies domiciled in countries with weak investor protection can bond themselves credibly to better investor protection by listing their stocks in U.S. exchanges that are known to provide a strong investor protection. Managers of some companies may not wish to list shares in U.S. exchanges, subjecting themselves to stringent disclosure and monitoring, for fear of losing their control rights and private benefits.。

CHAPTER 6 INTERNATIONAL PARITY RELATIONSHIPSSUGGESTED ANSWERS AND SOLUTIONS TO END-OF-CHAPTERQUESTIONS AND PROBLEMSQUESTIONS1. Give a full definition of arbitrage.Answer:Arbitrage can be defined as the act of simultaneously buying and selling the same or equivalent assets or commodities for the purpose of making certain, guaranteed profits.2. Discuss the implications of the interest rate parity for the exchange rate determination.Answer: Assuming that the forward exchange rate is roughly an unbiased predictor of the future spot rate, IRP can be written as:S = [(1 + I£)/(1 + I$)]E[S t+1 I t].The exchange rate is thus determined by the relative interest rates, and the expected future spot rate, conditional on all the available information, I t, as of the present time. One thus can say that expectation is self-fulfilling. Since the information set will be continuously updated as news hit the market, the exchange rate will exhibit a highly dynamic, random behavior.3. Explain the conditions under which the forward exchange rate will be an unbiased predictor of the future spot exchange rate.Answer: The forward exchange rate will be an unbiased predictor of the future spot rate if (I) the risk premium is insignificant and (ii) foreign exchange markets are informationally efficient.4. Explain the purchasing power parity, both the absolute and relative versions. What causes the deviations from the purchasing power parityAnswer: The absolute version of purchasing power parity (PPP):S = P$/P£.The relative version is:e = ?$ - ?£.PPP can be violated if there are barriers to international trade or if people in different countries have different consumption taste. PPP is the law of one price applied to a standard consumption basket.8. Explain the random walk model for exchange rate forecasting. Can it be consistent with the technical analysisAnswer: The random walk model predicts that the current exchange rate will be the best predictor of the future exchange rate. An implication of the model is that past history of the exchange rate is of no value in predicting future exchange rate. The model thus is inconsistent with the technical analysis which tries to utilize past history in predicting the future exchange rate.*9. Derive and explain the monetary approach to exchange rate determination.Answer: The monetary approach is associated with the Chicago School of Economics. It is based on two tenets: purchasing power parity and the quantity theory of money. Combing these two theories allows for stating, say, the $/£spot exchange rate as:S($/£) = (M$/M£)(V$/V£)(y£/y$),where M denotes the money supply, V the velocity of money, and y the national aggregate output. The theory holds that what matters in exchange rate determination are:1. The relative money supply,2. The relative velocities of monies, and3. The relative national outputs.10. CFA question: 1997, Level 3.A.Explain the following three concepts of purchasing power parity (PPP):a. The law of one price.b. Absolute PPP.c. Relative PPP.B.Evaluate the usefulness of relative PPP in predicting movements in foreign exchange rates on:a.Short-term basis (for example, three months)b.Long-term basis (for example, six years)Answer:A. a. The law of one price (LOP) refers to the international arbitrage condition for the standardconsumption basket. LOP requires that the consumption basket should be selling for the same price ina given currency across countries.A. b. Absolute PPP holds that the price level in a country is equal to the price level in another countrytimes the exchange rate between the two countries.A. c. Relative PPP holds that the rate of exchange rate change between a pair of countries is aboutequalto the difference in inflation rates of the two countries.B. a. PPP is not useful for predicting exchange rates on the short-term basis mainly becauseinternational commodity arbitrage is a time-consuming process.B. b. PPP is useful for predicting exchange rates on the long-term basis.PROBLEMS1. Suppose that the treasurer of IBM has an extra cash reserve of $100,000,000 to invest for six months. The six-month interest rate is 8 percent per annum in the United States and 6 percent per annum in Germany. Currently, the spot exchange rate is €1.01 per dollar and the six-month forward exchange rate is €0.99 per dollar. The treasurer of IBM does not wish to bear any exchange risk. Where should he/she invest to maximize the returnThe market conditions are summarized as follows:I$ = 4%; i€= 3.5%; S = €1.01/$; F = €0.99/$.If $100,000,000 is invested in the U.S., the maturity value in six months will be$104,000,000 = $100,000,000 (1 + .04).Alternatively, $100,000,000 can be converted into euros and invested at the German interest rate, with the euro maturity value sold forward. In this case the dollar maturity value will be$105,590,909 = ($100,000,000 x 1.01)(1 + .035)(1/0.99)Clearly, it is better to invest $100,000,000 in Germany with exchange risk hedging.2. While you were visiting London, you purchased a Jaguar for £35,000, payable in three months. You have enough cash at your bank in New York City, which pays 0.35% interest per month, compounding monthly, to pay for the car. Currently, the spot exchange rate is $1.45/£and the three-month forward exchange rate is $1.40/£. In London, the money market interest rate is 2.0% for a three-month investment. There are two alternative ways of paying for your Jaguar.(a) Keep the funds at your bank in the U.S. and buy £35,000 forward.(b) Buy a certain pound amount spot today and invest the amount in the U.K. for three months so that the maturity value becomes equal to £35,000.Evaluate each payment method. Which method would you prefer WhySolution: The problem situation is summarized as follows:A/P = £35,000 payable in three monthsi NY = 0.35%/month, compounding monthlyi LD = 2.0% for three monthsS = $1.45/£; F = $1.40/£.Option a:When you buy £35,000 forward, you will need $49,000 in three months to fulfill the forward contract. The present value of $49,000 is computed as follows:$49,000/(1.0035)3 = $48,489.Thus, the cost of Jaguar as of today is $48,489.Option b:The present value of £35,000 is £34,314 = £35,000/(1.02). To buy £34,314 today, it will cost $49,755 = 34,314x1.45. Thus the cost of Jaguar as of today is $49,755.You should definitely choose to use “option a”, and save $1,266, which is the difference between $49,755 and $48489.3. Currently, the spot exchange rate is $1.50/£and the three-month forward exchange rate is $1.52/£. The three-month interest rate is 8.0% per annum in the U.S. and 5.8% per annum in the U.K. Assume that you can borrow as much as $1,500,000 or £1,000,000.a. Determine whether the interest rate parity is currently holding.b. If the IRP is not holding, how would you carry out covered interest arbitrage Show all the steps and determine the arbitrage profit.c. Explain how the IRP will be restored as a result of covered arbitrage activities.Solution: Let’s summarize the given data first:S = $1.5/£; F = $1.52/£; I$ = 2.0%; I£= 1.45%Credit = $1,500,000 or £1,000,000.a. (1+I$) = 1.02(1+I£)(F/S) = (1.0145)(1.52/1.50) = 1.0280Thus, IRP is not holding exactly.b. (1) Borrow $1,500,000; repayment will be $1,530,000.(2) Buy £1,000,000 spot using $1,500,000.(3) Invest £1,000,000 at the pound interest rate of 1.45%;maturity value will be £1,014,500.(4) Sell £1,014,500 forward for $1,542,040Arbitrage profit will be $12,040c. Following the arbitrage transactions described above,The dollar interest rate will rise;The pound interest rate will fall;The spot exchange rate will rise;The forward exchange rate will fall.These adjustments will continue until IRP holds.4. Suppose that the current spot exchange rate is €0.80/$ and the three-month forward exchange rate is €0.7813/$. The three-month interest rate is5.6 percent per annum in the United States and 5.40 percent per annum in France. Assume that you can borrow up to $1,000,000 or €800,000.a. Show how to realize a certain profit via covered interest arbitrage, assuming that you want to realize profit in terms of U.S. dollars. Also determine the size of your arbitrage profit.b. Assume that you want to realize profit in terms of euros. Show the covered arbitrage process and determine the arbitrage profit in euros.Solution:a.(1+ i $) = 1.014 < (F/S) (1+ i € ) = 1.053. Thus, one has to borrow dollars and invest in euros tomake arbitrage profit.1.Borrow $1,000,000 and repay $1,014,000 in three months.2.Sell $1,000,000 spot for €1,060,000.3.Invest €1,060,000 at the euro interest rate of 1.35 % for three months and receive €1,074,310 atmaturity.4.Sell €1,074,310 forward for $1,053,245.Arbitrage profit = $1,053,245 - $1,014,000 = $39,245.b.Follow the first three steps above. But the last step, involving exchange risk hedging, will bedifferent.5.Buy $1,014,000 forward for €1,034,280.Arbitrage profit = €1,074,310 - €1,034,280 = €40,0305. In the issue of October 23, 1999, the Economist reports that the interest rate per annum is 5.93% in the United States and 70.0% in Turkey. Why do you think the interest rate is so high in Turkey Based on the reported interest rates, how would you predict the change of the exchange rate between the U.S. dollarand the Turkish liraSolution: A high Turkish interest rate must reflect a high expected inflation in Turkey. According to international Fisher effect (IFE), we haveE(e) = i$ - i Lira= 5.93% - 70.0% = -64.07%The Turkish lira thus is expected to depreciate against the U.S. dollar by about 64%.6. As of November 1, 1999, the exchange rate between the Brazilian real and U.S. dollar is R$1.95/$. The consensus forecast for the U.S. and Brazil inflation rates for the next 1-year period is 2.6% and 20.0%, respectively. How would you forecast the exchange rate to be at around November 1, 2000Solution: Since the inflation rate is quite high in Brazil, we may use the purchasing power parity to forecast the exchange rate.E(e) = E(?$) - E(?R$)= 2.6% - 20.0%= -17.4%E(S T) = S o(1 + E(e))= (R$1.95/$) (1 + 0.174)= R$2.29/$7. (CFA question) Omni Advisors, an international pension fund manager, uses the concepts of purchasing power parity (PPP) and the International Fisher Effect (IFE) to forecast spot exchange rates. Omni gathers the financial information as follows:Base price level 100Current U.S. price level 105Current South African price level 111Base rand spot exchange rate $0.175Current rand spot exchange rate $0.158Expected annual U.S. inflation 7%Expected annual South African inflation 5%Expected U.S. one-year interest rate 10%Expected South African one-year interest rate 8%Calculate the following exchange rates (ZAR and USD refer to the South African and U.S. dollar, respectively).a. The current ZAR spot rate in USD that would have been forecast by PPP.b. Using the IFE, the expected ZAR spot rate in USD one year from now.c. Using PPP, the expected ZAR spot rate in USD four years from now.Solution:a. ZAR spot rate under PPP = [1.05/1.11](0.175) = $0.1655/rand.b. Expected ZAR spot rate = [1.10/1.08] (0.158) = $0.1609/rand.c. Expected ZAR under PPP = [(1.07)4/(1.05)4] (0.158) = $0.1704/rand.8. Suppose that the current spo t exchange rate is €1.50/? and the one-year forward exchange rate is €1.60/?. The one-year interest rate is 5.4% in euros and 5.2% in pounds. You can borrow at most €1,000,000 or the equivalent pound amount, i.e., ?666,667, at the current spot exchange rat e.a.Show how you can realize a guaranteed profit from covered interest arbitrage. Assume that you are aeuro-based investor. Also determine the size of the arbitrage profit.b.Discuss how the interest rate parity may be restored as a result of the abovetransactions.c.Suppose you are a pound-based investor. Show the covered arbitrage process anddetermine the pound profit amount.Solution:a. First, note that (1+i €) = 1.054 is less than (F/S)(1+i €) = (1.60/1.50)(1.052) = 1.1221.You should thus borrow in euros and lend in pounds.1)Borrow €1,000,000 and promise to repay €1,054,000 in one year.2)Buy ?666,667 spot for €1,000,000.3)Invest ?666,667 at the pound interest rate of 5.2%; the maturity value will be ?701,334.4)To hedge exchange risk, sell the maturity value ?701,334 forward in exchange for €1,122,134.The arbitrage profit will be the difference between €1,122,134 and €1,054,000, i.e., €68,134.b. As a result of the above arbitrage transactions, the euro interest rate will rise, the poundinterest rate will fall. In addition, the spot exchange rate (euros per pound) will rise and the forward rate will fall. These adjustments will continue until the interest rate parity is restored.c. The pound-based investor will carry out the same transactions 1), 2), and 3) in a. But to hedge, he/she will buy €1,054,000 forward in exchange for ?658,750. The arbitrage profit will then be ?42,584 = ?701,334 - ?658,750.9. Due to the integrated nature of their capital markets, investors in both the U.S. and U.K. require the same real interest rate, 2.5%, on their lending. There is a consensus in capital markets that the annual inflation rate is likely to be 3.5% in the U.S. and 1.5% in the U.K. for the next three years. The spot exchange rate is currently $1.50/£.pute the nominal interest rate per annum in both the U.S. and U.K., assuming that the Fishereffect holds.b.What is your expected future spot dollar-pound exchange rate in three years from nowc.Can you infer the forward dollar-pound exchange rate for one-year maturitySolution.a. Nominal rate in US = (1+ρ) (1+E(π$)) – 1 = (1.025)(1.035) – 1 = 0.0609 or 6.09%.Nominal rate in UK= (1+ρ) (1+E(π?)) – 1 = (1.025)(1.015) – 1 = 0.0404 or 4.04%.b. E(S T) = [(1.0609)3/(1.0404)3] (1.50) = $1.5904/?.c. F = [1.0609/1.0404](1.50) = $1.5296/?.Mini Case: Turkish Lira and the Purchasing Power ParityVeritas Emerging Market Fund specializes in investing in emerging stock markets of the world. Mr. Henry Mobaus, an experienced hand in international investment and your boss, is currently interested in Turkish stock markets. He thinks that Turkey will eventually be invited to negotiate its membership in the European Union. If this happens, it will boost the stock prices in Turkey. But, at the same time, he is quite concerned with the volatile exchange rates of the Turkish currency. He would like to understand what drives the Turkish exchange rates. Since the inflation rate is much higher in Turkey than in the U.S., he thinks that the purchasing power parity may be holding at least to some extent. As a research assistant for him, you were assigned to check this out. In other words, you have to study and prepare a report on the following question: Does the purchasing power parity hold for the Turkish lira-U.S. dollar exchange rate Among other things, Mr. Mobaus would like you to do the following:Plot the past exchange rate changes against the differential inflation rates betweenTurkey and the U.S. for the last four years.Regress the rate of exchange rate changes on the inflation rate differential to estimatethe intercept and the slope coefficient, and interpret the regression results.Data source: You may download the consumer price index data for the U.S. and Turkey from the following website:Solution:a. In the current solution, we use the monthly data from January 1999 – December 2002.b. We regress exchange rate changes (e) on the inflation rate differential and estimate theintercept (α ) and slope coefficient (β):The estimated intercept is insignificantly different from zero, whereas the slope coefficient is positive and significantly different from zero. In fact, the slope coefficient is insignificantly different from unity. [Note that t-statistics for β = 1 is 0.992 = (1.472 – 1)/0.476 where s.e. is 0.476] In other words, wecannot reject the hypothesis that the intercept is zero and the slope coefficient is one. The results are thus supportive of purchasing power parity.5. Discuss the implications of the deviations from the purchasing power parity for countries’ competitive positions in the world market.Answer: If exchange rate changes satisfy PPP, competitive positions of countries will remain unaffected following exchange rate changes. Otherwise, exchange rate changes will affect relative competitiveness of countries. If a country’s currency appreciates (depreciates) by more than is warranted by PPP, that will hurt (strengthen) the country’s competitive posi tion in the world market.6. Explain and derive the international Fisher effect.Answer: The international Fisher effect can be obtained by combining the Fisher effect and the relative version of PPP in its expectational form. Specifically, the Fisher effect holds thatE(?$) = I$ - ?$,E(?£) = I£- ?£.Assuming that the real interest rate is the same between the two countries, i.e., ?$ = ?£, and substituting the above results into the PPP, i.e., E(e) = E(?$)- E(?£), we obtain the international Fisher effect: E(e) = I$ - I£.7. Researchers found that it is very difficult to forecast the future exchange rates more accurately than the forward exchange rate or the current spot exchange rate. How would you interpret this finding Answer: This implies that exchange markets are informationally efficient. Thus, unless one has private information that is not yet reflected in the current market rates, it would be difficult to beat the market.。

《国际财务管理》章后练习题及参考答案《国际财务管理》章后练习题及参考答案《国际财务管理》章后练习题及参考答案第一章绪论第一章绪论一、单选题一、单选题1. 关于国际财务管理学与财务管理学的关系表述正确的是(C)。

A. 国际财务管理是学习财务管理的基础B. 国际财务管理与财务管理是两门截然不同的学科C. 国际财务管理是财务管理的一个新的分支D. 国际财务管理研究的范围要比财务管理的窄2. 凡经济活动跨越两个或更多国家国界的企业,都可以称为( A )。

A. 国际企业 B. 跨国企业 C. 跨国公司 D. 多国企业3.企业的( C)管理与财务管理密切结合,是国际财务管理的基本特点 A.资金 B.人事 C.外汇 D成本4.国际财务管理与跨国企业财务管理两个概念( D) 。

A. 完全相同B. 截然不同C. 仅是名称不同D. 内容有所不同 4.国际财务管理的内容不应该包括( C )。

A. 国际技术转让费管理B. 外汇风险管理企业进出口外汇收支管理 C. 合并财务报表管理 D.5.“企业生产经营国际化”和“金融市场国际化”的关系是( C )。

A. 二者毫不相关 B. 二者完全相同 C. 二者相辅相成 D. 二者互相起负面影响二、多选题二、多选题1.国际企业财务管理的组织形态应考虑的因素有( )。

A.公司规模的大小 B.国际经营的投入程度C.管理经验的多少D.整个国际经营所采取的组织形式 2.国际财务管理体系的内容包括( )A.外汇风险的管理B.国际税收管理C.国际投筹资管理D.国际营运资金管 3.国际财务管理目标的特点( )。

A.稳定性B.多元性C.层次性D.复杂性4.广义的国际财务管理观包括( )。

A.世界统一财务管理观B.比较财务管理观C.跨国公司财务管理观D.国际企业财务管理观5. 我国企业的国际财务活动日益频繁,具体表现在( )。

A. 企业从内向型向外向型转化 B. 外贸专业公司有了新的发展 C. 在国内开办三资企业 D. 向国外投资办企业 E. 通过各种形式从国外筹集资金三、判断题三、判断题1.国际财务管理是对企业跨国的财务活动进行的管理。

CHAPTER 6 INTERNATIONAL PARITY RELATIONSHIPSSUGGESTED ANSWERS AND SOLUTIONS TO END-OF-CHAPTERQUESTIONS AND PROBLEMSQUESTIONS1. Give a full definition of arbitrage.Answer:Arbitrage can be defined as the act of simultaneously buying and selling the same or equivalent assets or commodities for the purpose of making certain, guaranteed profits.2. Discuss the implications of the interest rate parity for the exchange rate determination.Answer: Assuming that the forward exchange rate is roughly an unbiased predictor of the future spot rate, IRP can be written as:S = [(1 + I£)/(1 + I$)]E[S t+1 I t].The exchange rate is thus determined by the relative interest rates, and the expected future spot rate, conditional on all the available information, I t, as of the present time. One thus can say that expectation is self-fulfilling. Since the information set will be continuously updated as news hit the market, the exchange rate will exhibit a highly dynamic, random behavior.3. Explain the conditions under which the forward exchange rate will be an unbiased predictor of the future spot exchange rate.Answer: The forward exchange rate will be an unbiased predictor of the future spot rate if (I) the risk premium is insignificant and (ii) foreign exchange markets are informationally efficient.4. Explain the purchasing power parity, both the absolute and relative versions. What causes the deviations from the purchasing power parity?Answer: The absolute version of purchasing power parity (PPP):S = P$/P£.The relative version is:e = π$ - π£.PPP can be violated if there are barriers to international trade or if people in different countries have different consumption taste. PPP is the law of one price applied to a standard consumption basket.5. Discuss the implications of the deviations from the purchasing power parity for countries’ competitive positions in the world market.Answer: If exchange rate changes satisfy PPP, competitive positions of countries will remain unaffected following exchange rate changes. Otherwise, exchange rate changes will affect relative competitiveness of countries. If a country’s currency appreciates (depreciates) by more than is warranted by PPP, that will hurt (strengthen) the country’s competitive position in the world market.6. Explain and derive the international Fisher effect.Answer: The international Fisher effect can be obtained by combining the Fisher effect and the relative version of PPP in its expectational form. Specifically, the Fisher effect holds thatE(π$) = I$ - ρ$,E(π£) = I£ - ρ£.Assuming that the real interest rate is the same between the two countries, i.e., ρ$ = ρ£, and substituting the above results into the PPP, i.e., E(e) = E(π$)- E(π£), we obtain the international Fisher effect: E(e) = I$ - I£.7. Researchers found that it is very difficult to forecast the future exchange rates more accurately than the forward exchange rate or the current spot exchange rate. How would you interpret this finding?Answer: This implies that exchange markets are informationally efficient. Thus, unless one has private information that is not yet reflected in the current market rates, it would be difficult to beat the market.8. Explain the random walk model for exchange rate forecasting. Can it be consistent with the technical analysis?Answer: The random walk model predicts that the current exchange rate will be the best predictor of the future exchange rate. An implication of the model is that past history of the exchange rate is of no value in predicting future exchange rate. The model thus is inconsistent with the technical analysis which tries to utilize past history in predicting the future exchange rate.*9. Derive and explain the monetary approach to exchange rate determination.Answer: The monetary approach is associated with the Chicago School of Economics. It is based on two tenets: purchasing power parity and the quantity theory of money. Combing these two theories allows for stating, say, the $/£ spot exchange rate as:S($/£) = (M$/M£)(V$/V£)(y£/y$),where M denotes the money supply, V the velocity of money, and y the national aggregate output. The theory holds that what matters in exchange rate determination are:1. The relative money supply,2. The relative velocities of monies, and3. The relative national outputs.10. CFA question: 1997, Level 3.A.Explain the following three concepts of purchasing power parity (PPP):a. The law of one price.b. Absolute PPP.c. Relative PPP.B.Evaluate the usefulness of relative PPP in predicting movements in foreign exchange rates on:a.Short-term basis (for example, three months)b.Long-term basis (for example, six years)Answer:A. a. The law of one price (LOP) refers to the international arbitrage condition for the standardconsumption basket. LOP requires that the consumption basket should be selling for the same price ina given currency across countries.A. b. Absolute PPP holds that the price level in a country is equal to the price level in another country times the exchange rate between the two countries.A. c. Relative PPP holds that the rate of exchange rate change between a pair of countries is about equal to the difference in inflation rates of the two countries.B. a. PPP is not useful for predicting exchange rates on the short-term basis mainly becauseinternational commodity arbitrage is a time-consuming process.B. b. PPP is useful for predicting exchange rates on the long-term basis.PROBLEMS1. Suppose that the treasurer of IBM has an extra cash reserve of $100,000,000 to invest for six months. The six-month interest rate is 8 percent per annum in the United States and 6 percent per annum in Germany. Currently, the spot exchange rate is €1.01 per dollar and the six-month forward exchange rate is €0.99 per dollar. The treasurer of IBM does not wish to bear any exchange risk. Where should he/she invest to maximize the return?The market conditions are summarized as follows:I$ = 4%; i€ = 3.5%; S = €1.01/$; F = €0.99/$.If $100,000,000 is invested in the U.S., the maturity value in six months will be$104,000,000 = $100,000,000 (1 + .04).Alternatively, $100,000,000 can be converted into euros and invested at the German interest rate, with the euro maturity value sold forward. In this case the dollar maturity value will be$105,590,909 = ($100,000,000 x 1.01)(1 + .035)(1/0.99)Clearly, it is better to invest $100,000,000 in Germany with exchange risk hedging.2. While you were visiting London, you purchased a Jaguar for £35,000, payable in three months. You have enough cash at your bank in New York City, which pays 0.35% interest per month, compounding monthly, to pay for the car. Currently, the spot exchange rate is $1.45/£ and the three-month forward exchange rate is $1.40/£. In London, the money market interest rate is 2.0% for a three-month investment. There are two alternative ways of paying for your Jaguar.(a) Keep the funds at your bank in the U.S. and buy £35,000 forward.(b) Buy a certain pound amount spot today and invest the amount in the U.K. for three months so that the maturity value becomes equal to £35,000.Evaluate each payment method. Which method would you prefer? Why?Solution: The problem situation is summarized as follows:A/P = £35,000 payable in three monthsi NY = 0.35%/month, compounding monthlyi LD = 2.0% for three monthsS = $1.45/£; F = $1.40/£.Option a:When you buy £35,000 forward, you will need $49,000 in three months to fulfill the forward contract. The present value of $49,000 is computed as follows:$49,000/(1.0035)3 = $48,489.Thus, the cost of Jaguar as of today is $48,489.Option b:The present value of £35,000 is £34,314 = £35,000/(1.02). To buy £34,314 today, it will cost $49,755 = 34,314x1.45. Thus the cost of Jaguar as of today is $49,755.You should definitely choose to use “option a”, and save $1,266, which is the difference between $49,755 and $48489.3. Currently, the spot exchange rate is $1.50/£ and the three-month forward exchange rate is $1.52/£. The three-month interest rate is 8.0% per annum in the U.S. and 5.8% per annum in the U.K. Assume that you can borrow as much as $1,500,000 or £1,000,000.a. Determine whether the interest rate parity is currently holding.b. If the IRP is not holding, how would you carry out covered interest arbitrage? Show all the steps and determine the arbitrage profit.c. Explain how the IRP will be restored as a result of covered arbitrage activities.Solution: Let’s summarize the given data first:S = $1.5/£; F = $1.52/£; I$ = 2.0%; I£ = 1.45%Credit = $1,500,000 or £1,000,000.a. (1+I$) = 1.02(1+I£)(F/S) = (1.0145)(1.52/1.50) = 1.0280Thus, IRP is not holding exactly.b. (1) Borrow $1,500,000; repayment will be $1,530,000.(2) Buy £1,000,000 spot using $1,500,000.(3) Invest £1,000,000 at the pound interest rate of 1.45%;maturity value will be £1,014,500.(4) Sell £1,014,500 forward for $1,542,040Arbitrage profit will be $12,040c. Following the arbitrage transactions described above,The dollar interest rate will rise;The pound interest rate will fall;The spot exchange rate will rise;The forward exchange rate will fall.These adjustments will continue until IRP holds.4. Suppose that the current spot exchange rate is €0.80/$ and the three-month forward exchange rate is €0.7813/$. The three-month interest rate is5.6 percent per annum in the United States and 5.40 percent per annum in France. Assume that you can borrow up to $1,000,000 or €800,000.a. Show how to realize a certain profit via covered interest arbitrage, assuming that you want to realize profit in terms of U.S. dollars. Also determine the size of your arbitrage profit.b. Assume that you want to realize profit in terms of euros. Show the covered arbitrage process and determine the arbitrage profit in euros.Solution:a.(1+ i $) = 1.014 < (F/S) (1+ i € ) = 1.053. Thus, one has to borrow dollars and invest in euros to makearbitrage profit.1.Borrow $1,000,000 and repay $1,014,000 in three months.2.Sell $1,000,000 spot for €1,060,000.3.Invest €1,060,000 at the euro interest rate of 1.35 % for three months and receive €1,074,310 atmaturity.4.Sell €1,074,310 forward for $1,053,245.Arbitrage profit = $1,053,245 - $1,014,000 = $39,245.b.Follow the first three steps above. But the last step, involving exchange risk hedging, will bedifferent.5. Buy $1,014,000 forward for €1,034,280.Arbitrage profit = €1,074,310 - €1,034,280 = €40,0305. In the issue of October 23, 1999, the Economist reports that the interest rate per annum is 5.93% in the United States and 70.0% in Turkey. Why do you think the interest rate is so high in Turkey? Based on the reported interest rates, how would you predict the change of the exchange rate between the U.S. dollarand the Turkish lira?Solution: A high Turkish interest rate must reflect a high expected inflation in Turkey. According to international Fisher effect (IFE), we haveE(e) = i$ - i Lira= 5.93% - 70.0% = -64.07%The Turkish lira thus is expected to depreciate against the U.S. dollar by about 64%.6. As of November 1, 1999, the exchange rate between the Brazilian real and U.S. dollar is R$1.95/$. The consensus forecast for the U.S. and Brazil inflation rates for the next 1-year period is 2.6% and 20.0%, respectively. How would you forecast the exchange rate to be at around November 1, 2000?Solution: Since the inflation rate is quite high in Brazil, we may use the purchasing power parity to forecast the exchange rate.E(e)= E(π$) - E(πR$)= 2.6% - 20.0%= -17.4%E(S T)= S o(1 + E(e))= (R$1.95/$) (1 + 0.174)= R$2.29/$7. (CFA question) Omni Advisors, an international pension fund manager, uses the concepts of purchasing power parity (PPP) and the International Fisher Effect (IFE) to forecast spot exchange rates. Omni gathers the financial information as follows:Base price level 100Current U.S. price level 105Current South African price level 111Base rand spot exchange rate $0.175Current rand spot exchange rate $0.158Expected annual U.S. inflation 7%Expected annual South African inflation 5%Expected U.S. one-year interest rate 10%Expected South African one-year interest rate 8%Calculate the following exchange rates (ZAR and USD refer to the South African and U.S. dollar, respectively).a. The current ZAR spot rate in USD that would have been forecast by PPP.b. Using the IFE, the expected ZAR spot rate in USD one year from now.c. Using PPP, the expected ZAR spot rate in USD four years from now.Solution:a. ZAR spot rate under PPP = [1.05/1.11](0.175) = $0.1655/rand.b. Expected ZAR spot rate = [1.10/1.08] (0.158) = $0.1609/rand.c. Expected ZAR under PPP = [(1.07)4/(1.05)4] (0.158) = $0.1704/rand.8. Suppose that the current spot exchange rate is €1.50/₤and the one-year forward exchange rate is €1.60/₤.The one-year interest rate is 5.4% in euros and 5.2% in pounds. You can borrow at most €1,000,000 or the equivalent pound amount, i.e., ₤666,667, at the current spot exchange rate.a.Show how you can realize a guaranteed profit from covered interest arbitrage. Assume that you are aeuro-based investor. Also determine the size of the arbitrage profit.b.Discuss how the interest rate parity may be restored as a result of the abovetransactions.c.Suppose you are a pound-based investor. Show the covered arbitrage process anddetermine the pound profit amount.Solution:a. First, note that (1+i €) = 1.054 is less than (F/S)(1+i €) = (1.60/1.50)(1.052) = 1.1221.You should thus borrow in euros and lend in pounds.1)Borrow €1,000,000 and promise to repay €1,054,000 in one year.2)Buy ₤666,667 spot for €1,000,000.3)Invest ₤666,667 at the pound interest rate of 5.2%; the maturity value will be ₤701,334.4)To hedge exchange risk, sell the maturity value ₤701,334forward in exchange for €1,122,134.The arbitrage profit will be the difference between €1,122,134 and €1,054,000, i.e., €68,134.b. As a result of the above arbitrage transactions, the euro interest rate will rise, the poundinterest rate will fall. In addition, the spot exchange rate (euros per pound) will rise and the forward rate will fall. These adjustments will continue until the interest rate parity is restored.c. The pound-based investor will carry out the same transactions 1), 2), and 3) in a. But to hedge, he/she will buy €1,054,000 forward in exchange for ₤658,750.The arbitrage profit will then be ₤42,584= ₤701,334 - ₤658,750.9. Due to the integrated nature of their capital markets, investors in both the U.S. and U.K. require the same real interest rate, 2.5%, on their lending. There is a consensus in capital markets that the annual inflation rate is likely to be 3.5% in the U.S. and 1.5% in the U.K. for the next three years. The spot exchange rate is currently $1.50/£.pute the nominal interest rate per annum in both the U.S. and U.K., assuming that the Fishereffect holds.b.What is your expected future spot dollar-pound exchange rate in three years from now?c.Can you infer the forward dollar-pound exchange rate for one-year maturity?Solution.a. Nominal rate in US = (1+ρ)(1+E(π$)) – 1 = (1.025)(1.035) – 1 = 0.0609 or 6.09%.Nominal rate in UK= (1+ρ)(1+E(π₤)) – 1 = (1.025)(1.015) – 1 = 0.0404 or 4.04%.b. E(S T) = [(1.0609)3/(1.0404)3] (1.50) = $1.5904/₤.c. F = [1.0609/1.0404](1.50) = $1.5296/₤.Mini Case: Turkish Lira and the Purchasing Power ParityVeritas Emerging Market Fund specializes in investing in emerging stock markets of the world. Mr. Henry Mobaus, an experienced hand in international investment and your boss, is currently interested in Turkish stock markets. He thinks that Turkey will eventually be invited to negotiate its membership in the European Union. If this happens, it will boost the stock prices in Turkey. But, at the same time, he is quite concerned with the volatile exchange rates of the Turkish currency. He would like to understand what drives the Turkish exchange rates. Since the inflation rate is much higher in Turkey than in the U.S., he thinks that the purchasing power parity may be holding at least to some extent. As a research assistant for him, you were assigned to check this out. In other words, you have to study and prepare a report on the following question: Does the purchasing power parity hold for the Turkish lira-U.S. dollar exchange rate? Among other things, Mr. Mobaus would like you to do the following:a.Plot the past exchange rate changes against the differential inflation rates betweenTurkey and the U.S. for the last four years.b.Regress the rate of exchange rate changes on the inflation rate differential to estimatethe intercept and the slope coefficient, and interpret the regression results.Data source: You may download the consumer price index data for the U.S. and Turkey from the following website: /home/0,2987,en_2649_201185_1_1_1_1_1,00.html, “hot file” (Excel format) . You may download the exchange rate data from the website: merce.ubc.ca/xr/data.html.Solution:a. In the current solution, we use the monthly data from January 1999 – December 2002.IM-123.095) (t 1.472βˆ0.649)- (t 0.011αˆε Inf_US) -Inf_Turkey (βˆαˆ e t t ===-=++= The estimated intercept is insignificantly different from zero, whereas the slope coefficient is positive and significantly different from zero. In fact, the slope coefficient is insignificantly different from unity. [Note that t-statistics for β = 1 is 0.992 = (1.472 – 1)/0.476 where s.e. is 0.476] In other words, we cannot reject the hypothesis that the intercept is zero and the slope coefficient is one. The results are thussupportive of purchasing power parity.。

CHAPTER 6 INTERNATIONAL PARITY RELATIONSHIPSSUGGESTED ANSWERS AND SOLUTIONS TO END-OF-CHAPTERQUESTIONS AND PROBLEMSQUESTIONS1. Give a full definition of arbitrage.Answer:Arbitrage can be defined as the act of simultaneously buying and selling the same or equivalent assets or commodities for the purpose of making certain, guaranteed profits.2. Discuss the implications of the interest rate parity for the exchange rate determination.Answer: Assuming that the forward exchange rate is roughly an unbiased predictor of the future spot rate, IRP can be written as:S = [(1 + I£)/(1 + I$)]E[S t+1 I t].The exchange rate is thus determined by the relative interest rates, and the expected future spot rate, conditional on all the available information, I t, as of the present time. One thus can say that expectation is self-fulfilling. Since the information set will be continuously updated as news hit the market, the exchange rate will exhibit a highly dynamic, random behavior.3. Explain the conditions under which the forward exchange rate will be an unbiased predictor of the future spot exchange rate.Answer: The forward exchange rate will be an unbiased predictor of the future spot rate if (I) the risk premium is insignificant and (ii) foreign exchange markets are informationally efficient.4. Explain the purchasing power parity, both the absolute and relative versions. What causes the deviations from the purchasing power parity?Answer: The absolute version of purchasing power parity (PPP):S = P$/P£.The relative version is:e = π$ - π£.PPP can be violated if there are barriers to international trade or if people in different countries have different consumption taste. PPP is the law of one price applied to a standard consumption basket.5. Discuss the implications of the deviations from the purchasing power parity for countries’ competitive positions in the world market.Answer: If exchange rate changes satisfy PPP, competitive positions of countries will remain unaffected following exchange rate changes. Otherwise, exchange rate changes will affect relative competitiveness of countries. If a country’s currency appreciates (depreciates) by more than is warranted by PPP, that will hurt (strengthen) the country’s competitive position in the world market.6. Explain and derive the international Fisher effect.Answer: The international Fisher effect can be obtained by combining the Fisher effect and the relative version of PPP in its expectational form. Specifically, the Fisher effect holds thatE(π$) = I$ - ρ$,E(π£) = I£ - ρ£.Assuming that the real interest rate is the same between the two countries, i.e., ρ$ = ρ£, and substituting the above results into the PPP, i.e., E(e) = E(π$)- E(π£), we obtain the international Fisher effect: E(e) = I$ - I£.7. Researchers found that it is very difficult to forecast the future exchange rates more accurately than the forward exchange rate or the current spot exchange rate. How would you interpret this finding?Answer: This implies that exchange markets are informationally efficient. Thus, unless one has private information that is not yet reflected in the current market rates, it would be difficult to beat the market.8. Explain the random walk model for exchange rate forecasting. Can it be consistent with the technical analysis?Answer: The random walk model predicts that the current exchange rate will be the best predictor of the future exchange rate. An implication of the model is that past history of the exchange rate is of no value in predicting future exchange rate. The model thus is inconsistent with the technical analysis which tries to utilize past history in predicting the future exchange rate.*9. Derive and explain the monetary approach to exchange rate determination.Answer: The monetary approach is associated with the Chicago School of Economics. It is based on two tenets: purchasing power parity and the quantity theory of money. Combing these two theories allows for stating, say, the $/£ spot exchange rate as:S($/£) = (M$/M£)(V$/V£)(y£/y$),where M denotes the money supply, V the velocity of money, and y the national aggregate output. The theory holds that what matters in exchange rate determination are:1. The relative money supply,2. The relative velocities of monies, and3. The relative national outputs.10. CFA question: 1997, Level 3.A.Explain the following three concepts of purchasing power parity (PPP):a. The law of one price.b. Absolute PPP.c. Relative PPP.B.Evaluate the usefulness of relative PPP in predicting movements in foreign exchange rates on:a.Short-term basis (for example, three months)b.Long-term basis (for example, six years)Answer:A. a. The law of one price (LOP) refers to the international arbitrage condition for the standardconsumption basket. LOP requires that the consumption basket should be selling for the same price ina given currency across countries.A. b. Absolute PPP holds that the price level in a country is equal to the price level in another country times the exchange rate between the two countries.A. c. Relative PPP holds that the rate of exchange rate change between a pair of countries is about equal to the difference in inflation rates of the two countries.B. a. PPP is not useful for predicting exchange rates on the short-term basis mainly becauseinternational commodity arbitrage is a time-consuming process.B. b. PPP is useful for predicting exchange rates on the long-term basis.PROBLEMS1. Suppose that the treasurer of IBM has an extra cash reserve of $100,000,000 to invest for six months. The six-month interest rate is 8 percent per annum in the United States and 6 percent per annum in Germany. Currently, the spot exchange rate is €1.01 per dollar and the six-month forward exchange rate is €0.99 per dollar. The treasurer of IBM does not wish to bear any exchange risk. Where should he/she invest to maximize the return?The market conditions are summarized as follows:I$ = 4%; i€= 3.5%; S = €1.01/$; F = €0.99/$.If $100,000,000 is invested in the U.S., the maturity value in six months will be$104,000,000 = $100,000,000 (1 + .04).Alternatively, $100,000,000 can be converted into euros and invested at the German interest rate, with the euro maturity value sold forward. In this case the dollar maturity value will be$105,590,909 = ($100,000,000 x 1.01)(1 + .035)(1/0.99)Clearly, it is better to invest $100,000,000 in Germany with exchange risk hedging.2. While you were visiting London, you purchased a Jaguar for £35,000, payable in three months. You have enough cash at your bank in New York City, which pays 0.35% interest per month, compounding monthly, to pay for the car. Currently, the spot exchange rate is $1.45/£and the three-month forward exchange rate is $1.40/£. In London, the money market interest rate is 2.0% for a three-month investment. There are two alternative ways of paying for your Jaguar.(a) Keep the funds at your bank in the U.S. and buy £35,000 forward.(b) Buy a certain pound amount spot today and invest the amount in the U.K. for three months so that the maturity value becomes equal to £35,000.Evaluate each payment method. Which method would you prefer? Why?Solution: The problem situation is summarized as follows:A/P = £35,000 payable in three monthsi NY = 0.35%/month, compounding monthlyi LD = 2.0% for three monthsS = $1.45/£; F = $1.40/£.Option a:When you buy £35,000 forward, you will need $49,000 in three months to fulfill the forward contract. The present value of $49,000 is computed as follows:$49,000/(1.0035)3 = $48,489.Thus, the cost of Jaguar as of today is $48,489.Option b:The present value of £35,000 is £34,314 = £35,000/(1.02). To buy £34,314 today, it will cost $49,755 = 34,314x1.45. Thus the cost of Jaguar as of today is $49,755.You should definitely choose to use “option a”, and save $1,266, which is the difference between $49,755 and $48489.3. Currently, the spot exchange rate is $1.50/£ and the three-month forward exchange rate is $1.52/£. The three-month interest rate is 8.0% per annum in the U.S. and 5.8% per annum in the U.K. Assume that you can borrow as much as $1,500,000 or £1,000,000.a. Determine whether the interest rate parity is currently holding.b. If the IRP is not holding, how would you carry out covered interest arbitrage? Show all the steps and determine the arbitrage profit.c. Explain how the IRP will be restored as a result of covered arbitrage activities.Solution: Let’s summarize the given data first:S = $1.5/£; F = $1.52/£; I$ = 2.0%; I£ = 1.45%Credit = $1,500,000 or £1,000,000.a. (1+I$) = 1.02(1+I£)(F/S) = (1.0145)(1.52/1.50) = 1.0280Thus, IRP is not holding exactly.b. (1) Borrow $1,500,000; repayment will be $1,530,000.(2) Buy £1,000,000 spot using $1,500,000.(3) Invest £1,000,000 at the pound interest rate of 1.45%;maturity value will be £1,014,500.(4) Sell £1,014,500 forward for $1,542,040Arbitrage profit will be $12,040c. Following the arbitrage transactions described above,The dollar interest rate will rise;The pound interest rate will fall;The spot exchange rate will rise;The forward exchange rate will fall.These adjustments will continue until IRP holds.4. Suppose that the current spot exchange rate is €0.80/$ and the three-month forward exchange rate is €0.7813/$. The three-month interest rate is5.6 percent per annum in the United States and 5.40 percent per annum in France. Assume that you can borrow up to $1,000,000 or €800,000.a. Show how to realize a certain profit via covered interest arbitrage, assuming that you want to realize profit in terms of U.S. dollars. Also determine the size of your arbitrage profit.b. Assume that you want to realize profit in terms of euros. Show the covered arbitrage process and determine the arbitrage profit in euros.Solution:a.(1+ i $) = 1.014 < (F/S) (1+ i € ) = 1.053. Thus, one has to borrow dollars and invest in euros to makearbitrage profit.1.Borrow $1,000,000 and repay $1,014,000 in three months.2.Sell $1,000,000 spot for €1,060,000.3.Invest €1,060,000 at the euro interest rate of 1.35 % for three months and receive€1,074,310 atmaturity.4.Sell €1,074,310 forward for $1,053,245.Arbitrage profit = $1,053,245 - $1,014,000 = $39,245.b.Follow the first three steps above. But the last step, involving exchange risk hedging, will be different.5.Buy $1,014,000 forward for €1,034,280.Arbitrage profit = €1,074,310 - €1,034,280 = €40,0305. In the issue of October 23, 1999, the Economist reports that the interest rate per annum is 5.93% in the United States and 70.0% in Turkey. Why do you think the interest rate is so high in Turkey? Based on the reported interest rates, how would you predict the change of the exchange rate between the U.S. dollarand the Turkish lira?Solution: A high Turkish interest rate must reflect a high expected inflation in Turkey. According to international Fisher effect (IFE), we haveE(e) = i$ - i Lira= 5.93% - 70.0% = -64.07%The Turkish lira thus is expected to depreciate against the U.S. dollar by about 64%.6. As of November 1, 1999, the exchange rate between the Brazilian real and U.S. dollar is R$1.95/$. The consensus forecast for the U.S. and Brazil inflation rates for the next 1-year period is 2.6% and 20.0%, respectively. How would you forecast the exchange rate to be at around November 1, 2000?Solution: Since the inflation rate is quite high in Brazil, we may use the purchasing power parity to forecast the exchange rate.E(e) = E(π$) - E(πR$)= 2.6% - 20.0%= -17.4%E(S T) = S o(1 + E(e))= (R$1.95/$) (1 + 0.174)= R$2.29/$7. (CFA question) Omni Advisors, an international pension fund manager, uses the concepts of purchasing power parity (PPP) and the International Fisher Effect (IFE) to forecast spot exchange rates. Omni gathers the financial information as follows:Base price level 100Current U.S. price level 105Current South African price level 111Base rand spot exchange rate $0.175Current rand spot exchange rate $0.158Expected annual U.S. inflation 7%Expected annual South African inflation 5%Expected U.S. one-year interest rate 10%Expected South African one-year interest rate 8%Calculate the following exchange rates (ZAR and USD refer to the South African and U.S. dollar, respectively).a. The current ZAR spot rate in USD that would have been forecast by PPP.b. Using the IFE, the expected ZAR spot rate in USD one year from now.c. Using PPP, the expected ZAR spot rate in USD four years from now.Solution:a. ZAR spot rate under PPP = [1.05/1.11](0.175) = $0.1655/rand.b. Expected ZAR spot rate = [1.10/1.08] (0.158) = $0.1609/rand.c. Expected ZAR under PPP = [(1.07)4/(1.05)4] (0.158) = $0.1704/rand.8. Suppose that the current spot exchange rate is €1.50/₤ and the one-year forward exchange rate is €1.60/₤. The one-year interest rate is 5.4% in euros and 5.2% in pounds. You can borrow at most €1,000,000 or the equivalent pound amount, i.e., ₤666,667, at the current spot exchange rate.a.Show how you can realize a guaranteed profit from covered interest arbitrage. Assume that you are aeuro-based investor. Also determine the size of the arbitrage profit.b.Discuss how the interest rate parity may be restored as a result of the abovetransactions.c.Suppose you are a pound-based investor. Show the covered arbitrage process anddetermine the pound profit amount.Solution:a. First, note that (1+i €) = 1.054 is less than (F/S)(1+i €) = (1.60/1.50)(1.052) = 1.1221.You should thus borrow in euros and lend in pounds.1)Borrow €1,000,000 and promise to repay €1,054,000 in one year.2)Buy ₤666,667 spot for €1,000,000.3)Invest ₤666,667 at the pound interest rate of 5.2%; the maturity value will be ₤701,334.4)To hedge exchange risk, sell the maturity value ₤701,334 forward in exchange for €1,122,134.The arbitrage profit will be the difference between €1,122,134 and €1,054,000, i.e., €68,134.b. As a result of the above arbitrage transactions, the euro interest rate will rise, the poundinterest rate will fall. In addition, the spot exchange rate (euros per pound) will rise and the forward rate will fall. These adjustments will continue until the interest rate parity is restored.c. The pound-based investor will carry out the same transactions 1), 2), and 3) in a. But to hedge, he/she will buy €1,054,000 forward in exchange for ₤658,750. The arbitrage profit will then be ₤42,584 = ₤701,334 - ₤658,750.9. Due to the integrated nature of their capital markets, investors in both the U.S. and U.K. require the same real interest rate, 2.5%, on their lending. There is a consensus in capital markets that the annual inflation rate is likely to be 3.5% in the U.S. and 1.5% in the U.K. for the next three years. The spot exchange rate is currently $1.50/£.pute the nominal interest rate per annum in both the U.S. and U.K., assuming that the Fishereffect holds.b.What is your expected future spot dollar-pound exchange rate in three years from now?c.Can you infer the forward dollar-pound exchange rate for one-year maturity?Solution.a. Nominal rate in US = (1+ρ) (1+E(π$)) – 1 = (1.025)(1.035) – 1 = 0.0609 or 6.09%.Nominal rate in UK= (1+ρ) (1+E(π₤)) – 1 = (1.025)(1.015) – 1 = 0.0404 or 4.04%.b. E(S T) = [(1.0609)3/(1.0404)3] (1.50) = $1.5904/₤.c. F = [1.0609/1.0404](1.50) = $1.5296/₤.Mini Case: Turkish Lira and the Purchasing Power ParityVeritas Emerging Market Fund specializes in investing in emerging stock markets of the world. Mr. Henry Mobaus, an experienced hand in international investment and your boss, is currently interested in Turkish stock markets. He thinks that Turkey will eventually be invited to negotiate its membership in the European Union. If this happens, it will boost the stock prices in Turkey. But, at the same time, he is quite concerned with the volatile exchange rates of the Turkish currency. He would like to understand what drives the Turkish exchange rates. Since the inflation rate is much higher in Turkey than in the U.S., he thinks that the purchasing power parity may be holding at least to some extent. As a research assistant for him, you were assigned to check this out. In other words, you have to study and prepare a report on the following question: Does the purchasing power parity hold for the Turkish lira-U.S. dollar exchange rate? Among other things, Mr. Mobaus would like you to do the following:a.Plot the past exchange rate changes against the differential inflation rates betweenTurkey and the U.S. for the last four years.b.Regress the rate of exchange rate changes on the inflation rate differential to estimatethe intercept and the slope coefficient, and interpret the regression results.Data source: You may download the consumer price index data for the U.S. and Turkey from the following website: /home/0,2987,en_2649_201185_1_1_1_1_1,00.html, “hot file” (Excel format) . You may download the exchange rate data from the website: merce.ubc.ca/xr/data.html.Solution:a. In the current solution, we use the monthly data from January 1999 – December 2002.b. We regress exchange rate changes (e) on the inflation rate differential and estimate theintercept (α ) and slope coefficient (β):3.095) (t 1.472βˆ0.649)- (t 0.011αˆε Inf_US) -Inf_Turkey (βˆαˆ e tt ===-=++=The estimated intercept is insignificantly different from zero, whereas the slope coefficient is positive and significantly different from zero. In fact, the slope coefficient is insignificantly different from unity.[Note that t-statistics for β = 1 is 0.992 = (1.472 – 1)/0.476 where s.e. is 0.476] In other words, we cannot reject the hypothesis that the intercept is zero and the slope coefficient is one. The results are thus supportive of purchasing power parity.。