sample invoice快递发票模板

- 格式:xls

- 大小:27.00 KB

- 文档页数:1

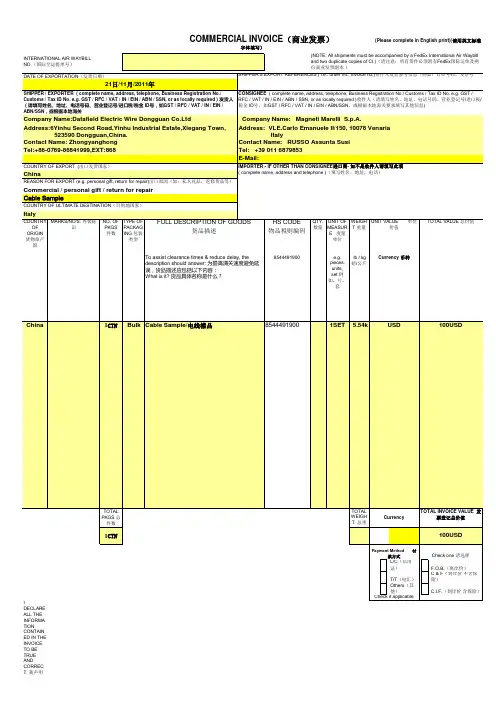

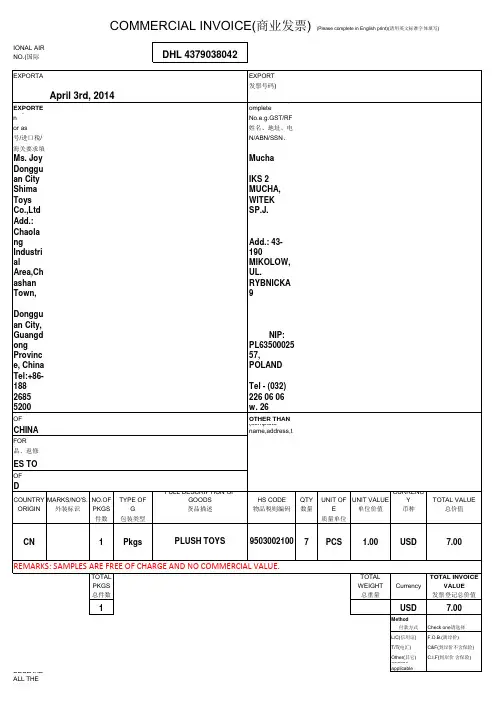

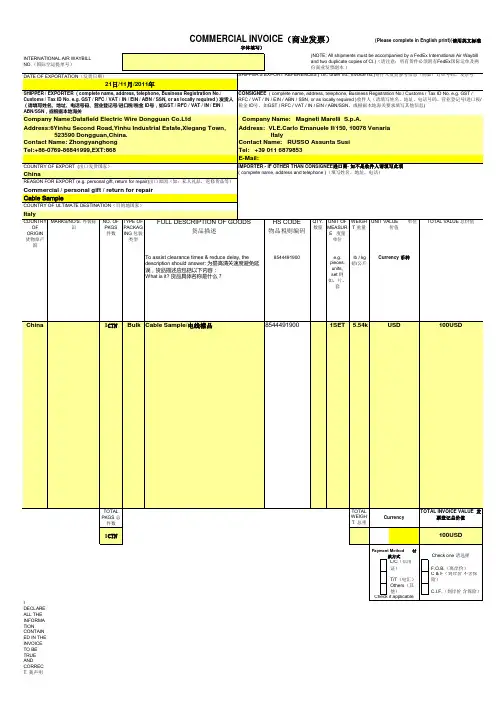

竭诚为您提供优质文档/双击可除customs,invoice模板篇一:sampleinVoiceinVoiceno.to.xxxxxxco.,ltddate:xxx,xxx,xxxRoad,samaedam, xxxxxx,bangkok,thailand篇二:国际快递形式发票样本形式发票用于非商业物品递送的清关过程.非商业物品指不用于销售且运费加物品价值低于1000美元的物品.发票抬头要注明pRoFoRmainVoice字样,海关只接受发票原件,不接受复印件,请使用发件人公司的详细信息为发票抬头pRoFoRmainVoicedate(输入发票填写日期)篇三:商业发票的种类和模板商业发票的种类和模板1、商业发票(commercialinvoice),是记帐单据简称发票(invoice),是出口商向进口商开立的发货价目清单,也是卖方凭以向买方索取所提供的货物或服务的价款的依据。

商业发票是全套单据的中心。

2、商业发票的作用1)、商业发票是全部单据的中心,是出口商装运货物并表明是否履约的总说明。

2)、便于进口商核对已发货物是否符合合同条款的规定。

3)、作为出口商和进口商记帐的依据。

4)、在出口地和进口地作为报关缴税的计算依据。

5)、在不用汇票的情况下,发票替代汇票作为付款的依据。

3、商业发票的种类1)、领事发票(consularinvoice)有些国家法令规定,进口货物必须要领取进口国在出口国或其邻近地区的领事签证的发票,交进口商作为有关货物报关和缴纳关税的前提条件之一。

领事发票和商业发票是平等的单据。

领事发票是一份官方的单证,有些国家规定了领事发票的固定格式,这种格式可以从领事馆获得。

2)、海关发票(customsinvoice)海关发票是非洲、美洲和大洋洲等某些国家海关规定的格式,由出口商填制,供进口商凭以报关用的一种特别的发票。

其主要内容是商品的价值(Valueofgoods)和商品的产地(originofgoods)。

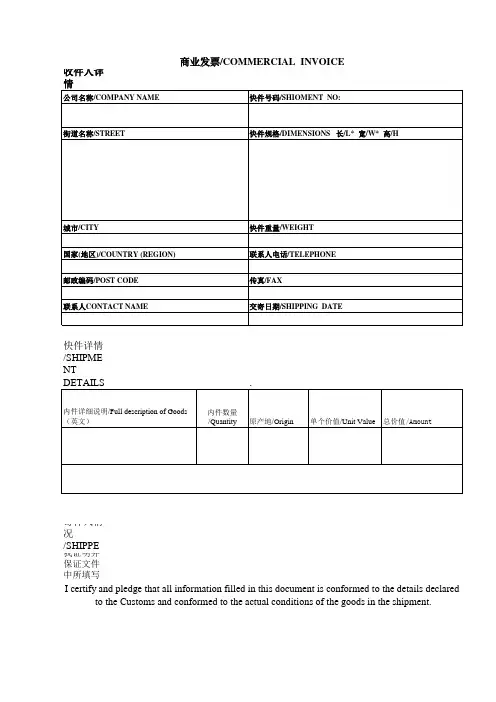

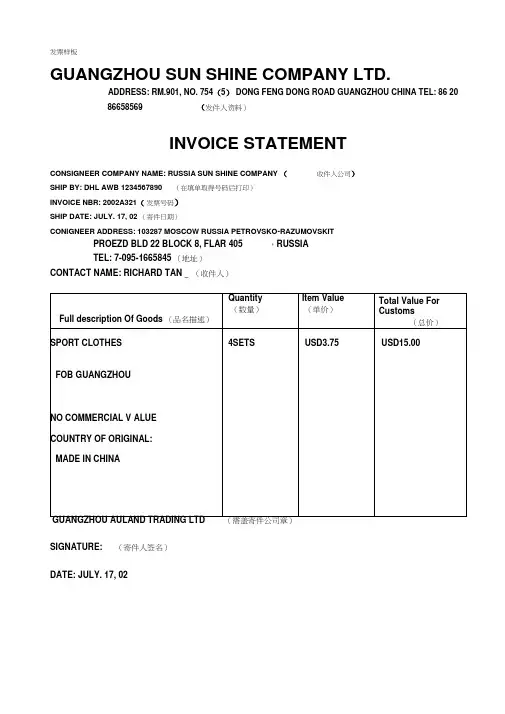

发票样板GUANGZHOU SUN SHINE COMPANY LTD.ADDRESS: RM.901, NO. 754(5) DONG FENG DONG ROAD GUANGZHOU CHINA TEL: 86 2086658569 (发件人资料)INVOICE STATEMENTCONSIGNEER COMPANY NAME: RUSSIA SUN SHINE COMPANY (收件人公司)SHIP BY: DHL AWB 1234567890 (在填单取得号码后打印)INVOICE NBR: 2002A321(发票号码)SHIP DATE: JULY. 17, 02 (寄件日期)CONIGNEER ADDRESS: 103287 MOSCOW RUSSIA PETROVSKO-RAZUMOVSKITPROEZD BLD 22 BLOCK 8, FLAR 405 ,RUSSIATEL: 7-095-1665845 (地址)CONTACT NAME: RICHARD TAN _ (收件人)SIGNATURE: (寄件人签名)DATE: JULY. 17, 02尊敬的客户:由于贵司的快件所要寄往的目的地国家海关要求提供正本发票,为了您的快件能够顺利清关,请按以下要求制作发票:有发票字样及寄件人的公司抬头(英文)有寄件人的公司名称、地址(英文)及电话有收件人的公司名称、地址(英文)及电话有分运单号码和发票号码有贸易术语(如FOB,CFR,CIF), 货物重量及尺寸物品名称的详细描述(中英文)货物数量,单价及申报总价(注明货币单位:美金)原产地有寄件人的公司章此发票必须是打印原件(不可手写),复印件、传真件无效;不得有修改痕迹(修改后须盖章)烦请将制作好发票与快件一同备妥,我们将尽快为您收取。

非常感谢您对DHL的支持与合作!附件:空白发票样板)ADDRESS: TEL:INVOICE STATEMENTINVOICE NUMBER:CONSIGNEE COMPANY (收件公司名称): SHIP BY (DHL AWB ): SHIP DATE(发件日期):ADDRESS (收件人地址):TEL (电话):ATTENTION (收件人姓名):SIGNATURE:(发件人签名) COMPANY STAMP:(公司盖章) DATE:。

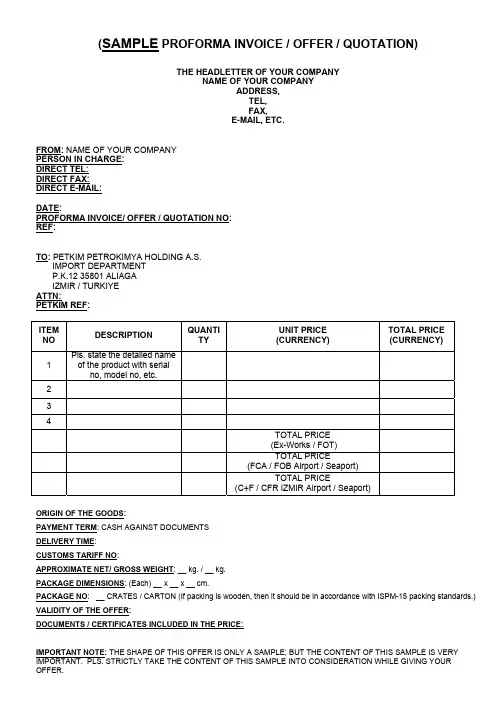

(SAMPLE PROFORMA INVOICE / OFFER / QUOTATION)THE HEADLETTER OF YOUR COMPANYNAME OF YOUR COMPANYADDRESS,TEL,FAX,E-MAIL, ETC.FROM: NAME OF YOUR COMPANYPERSON IN CHARGE:DIRECT TEL:DIRECT FAX:DIRECT E-MAIL:DATE:PROFORMA INVOICE/ OFFER / QUOTATION NO:REF:TO: PETKIM PETROKIMYA HOLDING A.S.IMPORT DEPARTMENTP.K.12 35801 ALIAGAIZMIR / TURKIYEATTN:PETKIM REF:ITEM NO DESCRIPTIONQUANTITYUNIT PRICE(CURRENCY)TOTAL PRICE(CURRENCY)1 Pls. state the detailed name of the product with serial no, model no, etc.234TOTAL PRICE(Ex-Works / FOT)TOTAL PRICE(FCA / FOB Airport / Seaport)TOTAL PRICE(C+F / CFR IZMIR Airport / Seaport)ORIGIN OF THE GOODS:PAYMENT TERM: CASH AGAINST DOCUMENTSDELIVERY TIME:CUSTOMS TARIFF NO:APPROXIMATE NET/ GROSS WEIGHT: __ kg. / __ kg.PACKAGE DIMENSIONS: (Each) __ x __ x __ cm.PACKAGE NO: __ CRATES / CARTON (If packing is wooden, then it should be in accordance with ISPM-15 packing standards.) VALIDITY OF THE OFFER:DOCUMENTS / CERTIFICATES INCLUDED IN THE PRICE:IMPORTANT NOTE:THE SHAPE OF THIS OFFER IS ONLY A SAMPLE; BUT THE CONTENT OF THIS SAMPLE IS VERY IMPORTANT. PLS. STRICTLY TAKE THE CONTENT OF THIS SAMPLE INTO CONSIDERATION WHILE GIVING YOUR OFFER.Box 1 Name and address of UK exporter needs to be inserted. If exporter is not based in UK, list company’s name c/o UK representative.Box 2 OptionalBox 7 OptionalBox 8 – Should only be completed when Duplicate,Retrospective and Replacement ATRs are needed – see sections 4.7 – 4.9 of Notice 812.Box 10 Full commercial description of the goods is required, plus details of packages and transport details. For example: “56 Rolls of Cotton Fabric” is a more accurate description than just “Textiles”. However, if there is a full description on the invoices a more general description on the ATR is satisfactory.Recommended that a horizontal line is drawn under the final entry and the unused space is ruled through with a “Zshaped” line.Box 12 – Signature of authenticating officer required, plus official stamp. Only Preference stamps should be used.Box 13 Original signature is mandatory. Must also be dated. Agents can complete certificate if authorised to do so by exporter. Any agent so authorised should produce the letter of authority on demand.Box 9 Relevant Item NumberBox 6 TurkeyBox 11 Indicateappropriate quantity of productBox 3 – Optional, but recommendedBox 5 –. Relevant Member StateFormulated For Guidance Purposes1. Goods consigned from (Exporter’s business name, address,country)2. Goods consigned to (Consignee’s name, address, country) Reference NoGENERALIZED SYSTEM OF PREFERENCESCERTIFICATE OF ORIGIN(Combined declaration and certificate)FORM AIssued in .................................................................................. (country)See notes overleaf3. Means of transport and route (as far as known)4. For official use5. Item num- ber6. Marks andnumbers ofpackages7. Number and kind of packages, description of goods8. Origincriterion(see Notesoverleaf)9. Grossweightor otherquantity10. Numberand dateof invoices11. CertificationIt is hereby certified, on the basis of control carried out,that the declaration by the exporter is correct.. ............................................................................................................. Place and date, signature and stamp of certifying authority12. Declaration by the exporterThe undersigned hereby declares that the above detailsand statements are correct; that all the goods were produced in ................................................................................................... (country)and that they comply with the origin requirements specified for those goods in the Generalized System of Preferences forgoods exported to................................................................................................... (importing country)................................................................................................................ Place and date, signature of authorized signatoryNOTES (2007)I. Countries which accept Form A for the purposes of the generalized system of preferences (GSP):Australia* European Union: Belarus Austria Finland Netherlands Canada Belgium France Poland Japan Bulgaria Hungary Portugal New Zealand** Cyprus Ireland Romania Norway Czech Republic Italy Slovakia Russian Federation Denmark Latvia Slovenia Switzerland including Liechtenstein*** Estonia Lithuania Spain Turkey Germany Luxembourg Sweden United States of America**** Greece Malta United KingdomFull details of the conditions covering admission to the GSP in these countries are obtainable from the designated authorities in the exporting preference-receiving countries or from the customs authorities of the preference-giving countries listed above. An information note is also obtainable from the UNCTAD secretariat.II. General conditionsTo qualify for preference, products must: (a) fall within a description of products eligible for preference in the country of destination. The descriptionentered on the form must be sufficiently detailed to enable the products to be identified by the customs officer examining them;(b) comply with the rules of origin of the country of destination. Each article in a consignment must qualifyseparately in its own right; and,(c) comply with the consignment conditions specified by the country of destination. In general, products must beconsigned direct from the country of exportation to the country of destination but most preference-giving countries accept passage through intermediate countries subject to certain conditions. (For Australia, direct consignment is not necessary).III. Entries to be made in Box 8Preference products must either be wholly obtained in accordance with the rules of the country of destination or sufficiently worked or processed to fulfil the requirements of that country's origin rules. (a) Products wholly obtained: for export to all countries listed in Section I, enter the letter "P" in Box 8 (forAustralia and New Zealand Box 8 may be left blank).(b) Products sufficiently worked or processed: for export to the countries specified below, the entry in Box 8should be as follows:(1) United States of America: for single country shipments, enter the letter "Y" in Box 8, for shipments fromrecognized associations of counties, enter the letter "Z", followed by the sum of the cost or value of the domestic materials and the direct cost of processing, expressed as a percentage of the ex-factory price of the exported products; (example "Y" 35% or "Z" 35%).(2) Canada: for products which meet origin criteria from working or processing in more than one eligibleleast developed country, enter letter "G" in Box 8; otherwise "F".(3) The European Union, Japan, Norway, Switzerland including Liechtenstein, and Turkey; enter the letter"W" in Box 8 followed by the Harmonized Commodity Description and coding system (Harmonized System) heading at the 4-digit level of the exported product (example "W" 96.18).(4) Russian Federation: for products which include value added in the exporting preference-receivingcountry, enter the letter "Y" in Box 8 followed by the value of imported materials and components expressed as a percentage of the fob price of the exported products (example "Y" 45%); for products obtained in a preference-receiving country and worked or processed in one or more other such countries, enter "Pk".(5) Australia and New Zealand: completion of Box 8 is not required. It is sufficient that a declaration beproperly made in Box 12._______________________ * For Australia, the main requirement is the exporter's declaration on the normal commercial invoice. Form A, accompaniedby the normal commercial invoice, is an acceptable alternative, but official certification is not required. ** Official certification is not required.*** The Principality of Liechtenstein forms, pursuant to the Treaty of 29 March 1923, a customs union with Switzerland.****The United States does not require GSP Form A. A declaration setting forth all pertinent detailed information concerning the production or manufacture of the merchandise is considered sufficient only if requested by the district collector of Customs.SAMPLE INVOICETHE HEADLETTER OF YOUR COMPANYNAME OF YOUR COMPANYADDRESS,TEL,FAX,E-MAIL, ETC.FROM: NAME OF YOUR COMPANYPERSON IN CHARGE:DIRECT TEL:DIRECT FAX:DIRECT E-MAIL:DATE:PROFORMA INVOICE/ OFFER / QUOTATION NO:REF:TO: PETKIM PETROKIMYA HOLDING A.S.IMPORT DEPARTMENTP.K.12 35801 ALIAGAIZMIR / TURKIYEATTN:PETKIM REF:ITEM NO DESCRIPTIONQUANTITYUNIT PRICE(CURRENCY)TOTAL PRICE(CURRENCY)1 Pls. state the detailed name of the product with serial no, model no, etc.234TOTAL PRICE(Ex-Works / FOT)TOTAL PRICE(FCA / FOB Airport / Seaport)TOTAL PRICE(C+F / CFR IZMIR Airport / Seaport)YOUR BANK INFORMATION :ORIGIN OF THE GOODS:PAYMENT TERM: CASH AGAINST DOCUMENTSDOCUMENTS / CERTIFICATES INCLUDED IN THE PRICE:IMPORTANT NOTE:THE SHAPE OF THIS OFFER IS ONLY A SAMPLE; BUT THE CONTENT OF THIS SAMPLE IS VERY IMPORTANT. PLS. STRICTLY TAKE THE CONTENT OF THIS SAMPLE INTO CONSIDERATIONSAMPLE FREE OF CHARGEINVOICETHE HEADLETTER OF YOUR COMPANYNAME OF YOUR COMPANYADDRESS,TEL,FAX,E-MAIL, ETC.FROM: NAME OF YOUR COMPANYPERSON IN CHARGE:DIRECT TEL:DIRECT FAX:DIRECT E-MAIL:DATE:PROFORMA INVOICE/ OFFER / QUOTATION NO:REF:TO: PETKIM PETROKIMYA HOLDING A.S.IMPORT DEPARTMENTP.K.12 35801 ALIAGAIZMIR / TURKIYEATTN:PETKIM REF:ITEM NO DESCRIPTIONQUANTITYUNIT PRICE(CURRENCY)TOTAL PRICE(CURRENCY)1 Pls. state the detailed nameof the product with serialno, model no, etc.(FREE OF CHARGE)234TOTAL PRICE(Ex-Works / FOT)TOTAL PRICE(FCA / FOB Airport / Seaport)TOTAL PRICE(C+F / CFR IZMIR Airport / Seaport)THE VALUE FOR CUSTOMS PURPOSES ONLY : ……………………………………………… ORIGIN OF THE GOODS:PAYMENT TERM: CASH AGAINST DOCUMENTSCUSTOMS TARIFF NO:APPROXIMATE NET/ GROSS WEIGHT: __ kg. / __ kg.PACKAGE DIMENSIONS: (Each) __ x __ x __ cm.PACKAGE NO: __ CRATES / CARTON (If packing is wooden, then it should be in accordance with ISPM-15 packing standards.) DOCUMENTS / CERTIFICATES INCLUDED IN THE PRICE:IMPORTANT NOTE:THE SHAPE OF THIS INVOICE IS ONLY A SAMPLE; BUT THE EXPRESSION OF “FREE OF CHARGE” AND “THE VALUE FOR CUSTOMS PURPOSES ONLY” ARE VERY IMPORTANT, PLS. STRICTLY TAKE THE CONTENT OF THIS SAMPLE INTO CONSIDERATION.。

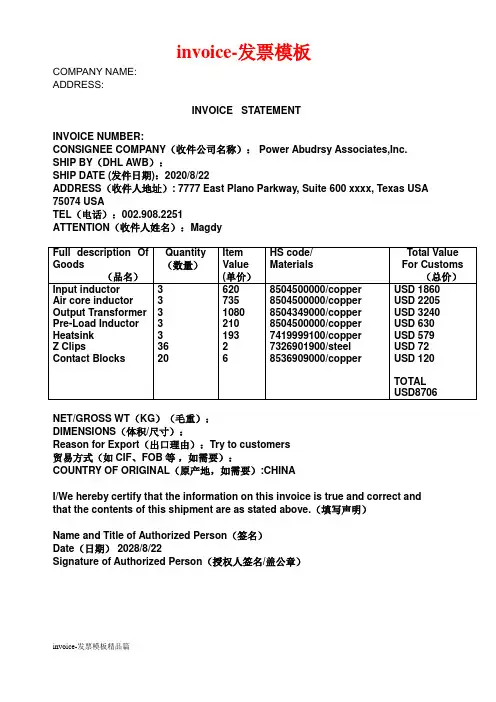

ADDRESS:INVOICE STATEMENTINVOICE NUMBER:CONSIGNEE COMPANY(收件公司名称): Power Abudrsy Associates,Inc. SHIP BY(DHL AWB):SHIP DATE (发件日期):2020/8/22ADDRESS(收件人地址): 7777 East Plano Parkway, Suite 600 xxxx, Texas USA 75074 USATEL(电话):002.908.2251ATTENTION(收件人姓名):MagdyNET/GROSS WT(KG)(毛重):DIMENSIONS(体积/尺寸):Reason for Export(出口理由):Try to customers贸易方式(如CIF、FOB等,如需要):COUNTRY OF ORIGINAL(原产地,如需要):CHINAI/We hereby certify that the information on this invoice is true and correct and that the contents of this shipment are as stated above.(填写声明)Name and Title of Authorized Person(签名)Date(日期) 2028/8/22Signature of Authorized Person(授权人签名/盖公章)ADDRESS:INVOICE STATEMENTINVOICE NUMBER:CONSIGNEE COMPANY(收件公司名称): Power Abudrsy Associates,Inc. SHIP BY(DHL AWB):SHIP DATE (发件日期):2020/8/22ADDRESS(收件人地址): 7777 East Plano Parkway, Suite 600 xxxx, Texas USA 75074 USATEL(电话):002.908.2251ATTENTION(收件人姓名):MagdyNET/GROSS WT(KG)(毛重):DIMENSIONS(体积/尺寸):Reason for Export(出口理由):Try to customers贸易方式(如CIF、FOB等,如需要):COUNTRY OF ORIGINAL(原产地,如需要):CHINAI/We hereby certify that the information on this invoice is true and correct and that the contents of this shipment are as stated above.(填写声明)Name and Title of Authorized Person(签名)Date(日期) 2028/8/22Signature of Authorized Person(授权人签名/盖公章)。