金融学题库

- 格式:doc

- 大小:890.50 KB

- 文档页数:56

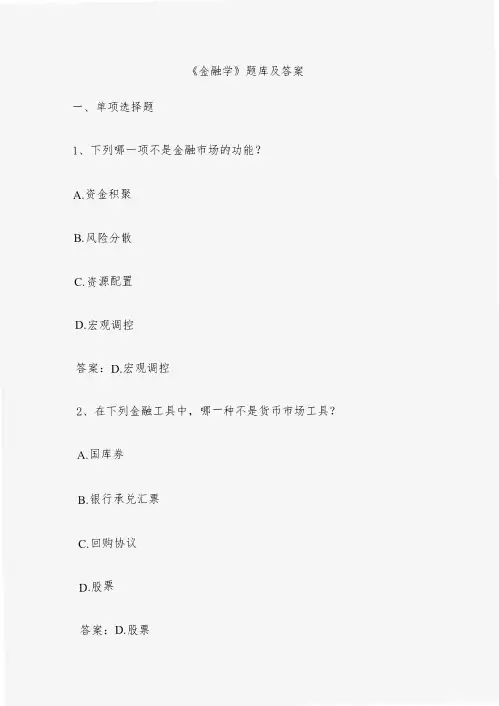

《金融学》题库及答案一、单项选择题l、下列哪一项不是金融市场的功能?A.资金积聚B.风险分散C.资源配置D.宏观调控答案:D. 宏观调控2、在下列金融工具中,哪一种不是货币市场工具?A.国库券B.银行承兑汇票C.回购协议D. 股票答案:D.股票3、下列哪一项不是金融体系的构成要素?A.金融市场B.金融机构C.金融工具D.金融政策答案:D.金融政策二、多项选择题l、下列哪些是金融市场的特点?A.交易分散化B.交易标准化C.交易集中化D. 交易国际化E.交易电子化答案:AC DE2、下列哪些是货币市场的主要功能?A提供短期融资渠道B.提供投资机会C参与国际金融市场D. 调节经济生活中的货币供应量E.促进经济发展答案:ABD3、下列哪些是资本市场的主要特点?A.期限较长B.资本密集型C.长期投资性D. 高风险高回报E.管理严格性答案:ABCD《金融学》试题及答案一、选择题l、下列哪一项不是金融市场的功能?A.资金积累B.资源配置C.风险管理D通货膨胀答案:D通货膨胀解释:金融市场的功能主要包括资金积累、资源配置、风险管理等,而通货膨胀是宏观经济政策的结果,不是金融市场的功能。

2、下列哪一项不是货币市场的主要特点?A.交易期限短B.流动性强C.利率敏感性D. 长期投资答案:D.长期投资解释:货币市场的主要特点是交易期限短、流动性强和利率敏感性。

长期投资与此无关。

3、下列哪一项不是资本市场的主要特点?A.交易期限短B.交易数量大C.价格波动大D.资本成本高答案:A.交易期限短解释:资本市场的主要特点是交易期限长、交易数量大、价格波动小、资本成本低等,而交易期限短与此无关。

二、简答题l、请简述金融市场的定义及其重要性。

答案:金融市场是指资金供求双方通过金融二具进行交易的场所。

它的重要性在于可以实现资金的有效配置,促进经济发展,同时也可以帮助企业和个人进行风险管理,实现资产保值增值。

此外,金融市场还是中央银行进行货币政策操作的重要场所,可以调节宏观经济运行。

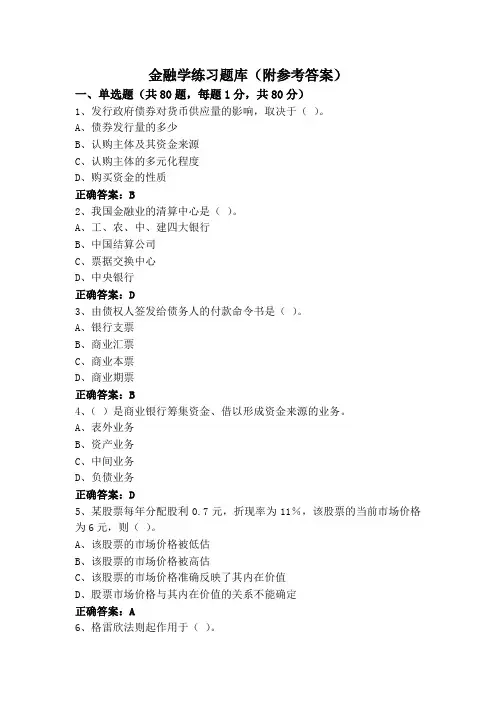

金融学练习题库(附参考答案)一、单选题(共80题,每题1分,共80分)1、发行政府债券对货币供应量的影响,取决于()。

A、债券发行量的多少B、认购主体及其资金来源C、认购主体的多元化程度D、购买资金的性质正确答案:B2、我国金融业的清算中心是()。

A、工、农、中、建四大银行B、中国结算公司C、票据交换中心D、中央银行正确答案:D3、由债权人签发给债务人的付款命令书是()。

A、银行支票B、商业汇票C、商业本票D、商业期票正确答案:B4、()是商业银行筹集资金、借以形成资金来源的业务。

A、表外业务B、资产业务C、中间业务D、负债业务正确答案:D5、某股票每年分配股利0.7元,折现率为11%,该股票的当前市场价格为6元,则()。

A、该股票的市场价格被低估B、该股票的市场价格被高估C、该股票的市场价格准确反映了其内在价值D、股票市场价格与其内在价值的关系不能确定正确答案:A6、格雷欣法则起作用于()。

A、跛行本位制B、平行本位制C、单本位制D、双本位制正确答案:D7、根据我国《商业银行法》规定,在改革开放后逐步建立起来的我国现行的商业银行体系,目前采用的是()模式。

A、职能分工B、混业经营C、单元型D、全能型正确答案:A8、人民币从中国人民银行现金发行库直接进入商业银行和其他金融机构现金业务库的过程,称为()。

A、现金发行B、现金投放C、现金归还D、现金回笼正确答案:A9、直接金融市场和间接金融市场的区别在于()。

A、是否存款中介机构B、中介机构在交易中的地位和性质C、是否存款固定的交易场所D、是否存款完善的交易程序正确答案:B答案解析:直接金融市场和间接金融市场的差别在于中介机构在交易中的地位和性质。

在直接金融市场上也有中介机构,但这些机构并不作为资金的中介,而仅仅是充当信息中介和服务中介。

10、下列属于政策性银行的有()。

A、中国农业发展银行B、中国农业银行C、中国银行D、中国工商银行正确答案:A11、()是金融衍生产品中相对简单的一种,交易双方约定在未来特定日期按既定的价(格购买或出售某项资产。

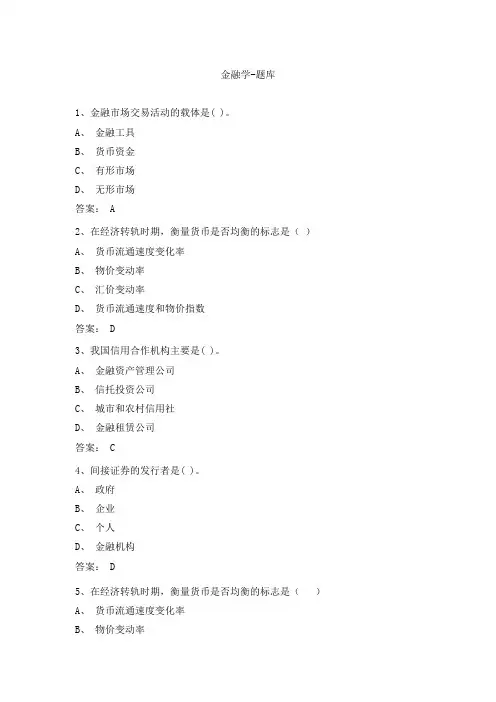

金融学-题库1、金融市场交易活动的载体是( )。

A、金融工具B、货币资金C、有形市场D、无形市场答案: A2、在经济转轨时期,衡量货币是否均衡的标志是()A、货币流通速度变化率B、物价变动率C、汇价变动率D、货币流通速度和物价指数答案: D3、我国信用合作机构主要是( )。

A、金融资产管理公司B、信托投资公司C、城市和农村信用社D、金融租赁公司答案: C4、间接证券的发行者是( )。

A、政府B、企业C、个人D、金融机构答案: D5、在经济转轨时期,衡量货币是否均衡的标志是()A、货币流通速度变化率B、物价变动率C、汇价变动率D、货币流通速度和物价指数答案: D6、金银复本位制的形式有()A、金块本位制B、跛行本位制C、双本位制D、平行本位制E、金汇兑本位制答案: BCD7、消费信用的形式主要有()A、买方信贷B、分期付款C、赊销商品D、卖方信贷E、货币贷款答案: CE8、1994年我国建立的政策性金融机构有()A、国家开发银行B、中国投资银行C、中国国际信托投资公司D、中国农业发展银行E、中国进出口银行答案: ADE9、属于货币市场的金融工具有()A、股票B、债券C、商业票据D、回购协议E、国库券答案: CDE10、所谓资金的有效融通指的是( )。

A、将有限的资金能配置到经济效益最佳的地方B、资金融通能够以尽快的速度得以完成C、扩大融资规模D、改善融资结构E.优化投资结构答案: AB11、纸币之所以可以作为流通手段,是因为它本身具有价值。

()答案:错误12、当市场利率上升时,证券行市也上升。

( )答案:错误13、银行和保险业务收支在国际收支平衡表中属于资本项目。

( )答案:错误14、外汇是指外国货币。

( )答案:错误15、中国人民银行在1983年之前是复合式中央银行。

( )答案:正确16、弗里德曼的货币需求函数与凯恩斯的货币需求函数的区别。

答案:(1)二者强调的侧重点不同(2)二者在货币政策的传导变量的选择上不同(3)凯恩斯认为货币需求受未来利率不确定性的影响,因而不稳定,货币政策应相机行事。

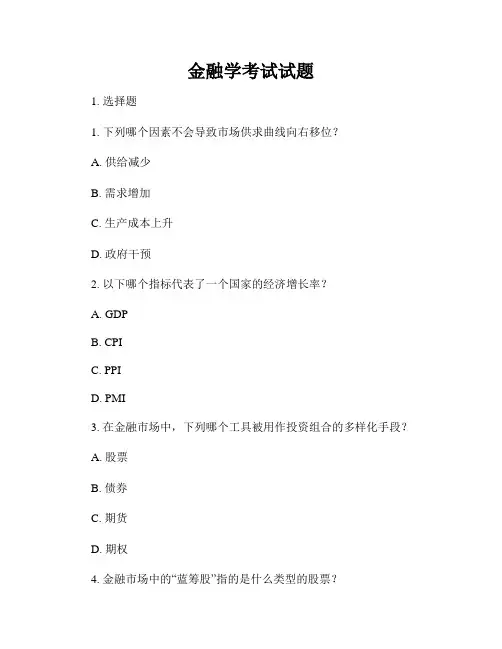

金融学考试试题1. 选择题1. 下列哪个因素不会导致市场供求曲线向右移位?A. 供给减少B. 需求增加C. 生产成本上升D. 政府干预2. 以下哪个指标代表了一个国家的经济增长率?A. GDPB. CPIC. PPID. PMI3. 在金融市场中,下列哪个工具被用作投资组合的多样化手段?A. 股票B. 债券C. 期货D. 期权4. 金融市场中的“蓝筹股”指的是什么类型的股票?A. 高成长潜力股B. 中等市值股票C. 大型稳健股票D. 纳斯达克股票5. “央行”通常指的是哪个国家的中央银行?A. 美国B. 中国C. 日本D. 欧洲联盟2. 简答题1. 解释什么是货币政策和财政政策,它们分别如何影响经济活动?2. 分别阐述风险投资和私募股权投资的定义和特点。

3. 说明股票和债券之间的区别以及投资者购买这两种资产的动机。

4. 请简要介绍一下利率是如何影响借贷和消费的。

5. 解释杠杆效应是什么,并说明杠杆对企业和投资者的影响。

3. 计算题1. 如果一笔本金10000元的投资在1年后产生了12000元的收益,计算其年收益率是多少?2. 请计算一个初始本金为5000元,投资时间为5年,年复利利率为5%的投资最终价值是多少?3. 一家公司的总资产为5000万元,负债为2000万元,计算其资产负债率是多少?4. 如果一只股票的初始价格为20元,一年后上涨到25元,计算其年收益率是多少?5. 请计算一笔投资的现值,假设未来5年的投资预期收益率为6%,未来每年的现金流分别为1000元,2000元,3000元,4000元和5000元。

4. 分析题1. 阐述金融市场的功能和作用,以及它们对经济发展的重要性。

2. 分析金融风险和金融投资组合的关系,如何通过投资组合管理降低风险。

3. 探讨国际金融市场的特点和影响因素,介绍国际金融合作的重要性。

4. 解释金融衍生品的概念和种类,讨论金融衍生品的风险管理作用。

5. 分析货币政策对宏观经济和金融市场的影响,探讨央行在调控经济中的作用和挑战。

《金融学》题库河北理工大学经济管理学院经济学部金融必须植根于繁荣的实体经济第一篇基础理论篇第一章导言(略)第二章货币与货币制度一、填空1、从货币本质出发,货币是固定充当()的特殊商品;从价值规律的角度看,货币是核算()的工具。

答案:一般等价物2、古今中外很多思想家和经济学家都看到了货币的起源与()的联系。

答案:交换发展3、银行券是随着()的发展而出现的一种用纸印制的货币。

答案:资本主义银行4、铸币的发展有一个从足值到()铸币的过程。

答案:不足值5、用纸印制的货币产生于货币的()职能。

答案:流通手段6、价格是()的货币表现。

答案:价值7、存储于银行电子计算机系统内可利用银行卡随时提取现金或支付的存款货币称为()。

答案:电子货币8、货币在商品交换中起媒介作用时发挥的是()职能。

答案:流通手段9、在金属货币流通条件下货币贮藏具有()的作用。

答案:自发调节货币数量10、一国流通中标准的基本通货是()。

答案:本位币11、没有商品(劳务)在同时、同地与之作相向运动是货币发挥()职能的特征。

答案:支付手段12、至今为止历史上最理想的货币制度通常被认为是()。

答案:金铸币本位制13、我国的人民币是从()开始发行的。

答案:1948年12月1日14、人民币采取的是()银行券的形式。

答案:不兑现15、欧元的出现对()提出了挑战。

答案:国家货币主权二、单项选择题:1、与货币的出现紧密相联的是()A、金银的稀缺性B、交换产生与发展C、国家的强制力D、先哲的智慧答案:B2、商品价值形式最终演变的结果是()A、简单价值形式B、扩大价值形式C、一般价值形式D、货币价值形式答案:D3、中国最早的铸币金属是()A、铜B、银C、铁D、贝答案:A4、在下列货币制度中劣币驱逐良币律出现在()A、金本位制B、银本位制C、金银复本位制D、金汇兑本位制答案:C5、中华人民共和国货币制度建立于()A、1948年B、1949年C、1950年D、1951年答案:A6、欧洲货币同盟开始使用“欧元EURO”于()A、1998年B、1999年C、2001年D、2002年答案:B7、金银复本位制的不稳定性源于()A、金银的稀缺B、生产力的迅猛提高C、货币发行管理混乱D、金银同为本位币答案:D8、中国本位币的最小规格是()A、1分B、1角C、1元D、10元答案:C9、金属货币制度下的蓄水池功能源于()A、金属货币的稀缺性B、金属货币的价值稳定C、金属货币的自由铸造和熔化D、金属货币的易于保存答案:C10、单纯地从物价和货币购买力的关系看,物价指数上升25%,则货币购买力()A、上升20%B、下降20%C、上升25%D、下降25% 答案:B11、在国家财政和银行信用中发挥作用的主要货币职能是()A、价值尺度B、流通手段C、支付手段D、贮藏手段答案:C12、下列货币制度中最稳定的是()A、银本位制B、金银复本位制C、金铸币本位制D、金汇兑本位制答案:C13、马克思的货币本质观的建立基础是()A、劳动价值说B、货币金属说C、货币名目说D、创造发明说答案:A14、对商品价格的理解正确的是()A、同商品价值成反比B、同货币价值成正比C、商品价值的货币表现D、商品价值与货币价值的比答案:C15、货币的本质特征是充当()A、特殊等价物B、一般等价物C、普通商品D、特殊商品答案:B二、多项选择题1、一般而言,要求作为货币的商品具有如下特征()A、价值比较高B、金属的一种C、易于分割D、易于保存E、便于携带答案:ACDE2、中国最古老的铜铸币的三种形制是()A、五铢B、布C、刀D、元宝E、铜贝答案:BCE3、信用货币包括()A、银行券B、支票C、活期存款D、商业票据E、定期存款答案:ABCDE4、货币支付职能发挥作用的场所有()A、赋税B、各种劳动报酬C、国家财政D、银行信用E、地租答案:ABCDE5、对本位币的理解正确的是()A、本位币是一国的基本通货B、本位币具有有限法偿C、本位币具有无限法偿D、本位币的最小规格是一个货币单位E、本位币具有排他性答案:ABCDE6、信用货币制度的特点有()A、黄金作为货币发行的准备B、贵金属非货币化C、国家强制力保证货币的流通D、金银储备保证货币的可兑换性E、货币发行通过信用渠道答案:BCE7、货币的两个基本职能是()A、流通手段B、支付手段C、贮藏手段D、世界货币E、价值尺度答案:AE8、对货币单位的理解正确的有()A、国家法定的货币计量单位B、规定了货币单位的名称C、规定本位币的币材D、确定技术标准E、规定货币单位所含的货币金属量答案:ABE9、我国货币制度规定人民币具有以下的特点()A、人民币是可兑换货币B、人民币与黄金没有直接联系C、人民币是信用货币D、人民币具有无限法偿力E、人民币具有有限法偿力答案:BCD10、货币制度的基本类型有()A、银本位制B、金银复本位制C、金本位制D、信用本位制E、银行券本位制答案:ABCD三、判断题1、最早的货币形式是金属铸币。

金融学试题库(附答案)一、单选题(共40题,每题1分,共40分)1、下列利率决定理论中,( )是着重强调储蓄与投资对利率的决定作用的。

A、可贷资金理论B、流动偏好理论C、马克思的利率理论D、投资-储蓄利率理论正确答案:D2、货币支付手段职能最初是起源于( )。

A、支付工资B、商品赊销C、发放贷款D、吸收存款正确答案:B3、当货币在商品交换中起媒介作用时,执行( )。

A、支付手段职能B、价值尺度职能C、流通手段职能D、贮藏手段职能正确答案:C4、在企业经营活动中产生的外汇风险是( )A、会计风险B、交易风险C、经济风险D、转换风险正确答案:B5、为了推动本国的进出口贸易,特别是大型机电设备的出口,加强国际间金融合作,广泛吸引国际资本和收集国际市场信息面开办的是( )A、储蓄银行B、投资银行C、投资基金D、进出口银行正确答案:D6、从各国汇率管制程度宽严不同的角度划分,汇率可分为官方汇率和( )。

A、固定汇率B、市场汇率C、有效汇率D、浮动汇率正确答案:B7、货币市场基金是以货币市场工具,如银行短期存款、国库券、公司债券、银行承兑票据及( )。

商业票据等为投资对象,投资至少为(A、90%B、100%C、80%D、60%正确答案:B8、如果法定存款准备金为15万元,超额存款准备金为8万元,则实际存款准备金为().A、15 万元B、8万元C、7万元D、23 万元正确答案:D9、( )指在预测外汇汇率将要上升时先买进后卖出外汇,在预测外汇汇率将要下降时则先卖出后买进外汇的行为。

A、投机交易B、掉期交易C、套汇交易D、外汇保值正确答案:A10、作为交易对象的货币资金,在资金融通这种交易过程中,往往需要有一种契据、凭证,作为载体进行交易。

这种载体即为金融市场的交易工具,因此称为( )。

A、金融工具B、融通工具C、金融工程D、金融载体正确答案:A11、()指具有一定实力和信誉保障的非银行机构,借助通信、计算机和信息安全技术,采用与各大银行签约的方式,在用户和银行支付结算系统间建立连接的电子支付模式。

金融学题库一、单选题1、流动性最强的金融资产是() [单选题] *A.银行活期存款B.居民储蓄存款C.银行定期存款D.现金(正确答案)2、在货币层次中,货币具有()的性质 [单选题] *A.流动性越强,现实购买力越强B.流动性越强,现实购买力越弱C.流动性越弱,现实购买力越弱D.答案AC是正确的(正确答案)3、马克思的货币起源理论表明() [单选题] *A.货币是国家创造的产物B.货币是先哲为解决交换困难而创造的C.货币是未来保存财富而创造的D.货币是固定充当一般等价物的商品(正确答案)4、价值形式发展的最终结果是()。

[单选题] *A.货币形式(正确答案)B.纸币C.扩大的价值形式D.一般价值形式5、货币执行支付手段职能的特点是()。

[单选题] *A.货币是商品交换的媒介B.货币运动伴随商品运动C.货币是一-般等价物.D.货币作为价值的独立形式进行单方面转移(正确答案)6、货币在()时执行流通手段的职能。

[单选题] *A.商品买卖(正确答案)B.缴纳税款C.支付工资D.表现商品价值7、美元与黄金内挂钩,其他国家货币与美元挂钩是()的特点。

[单选题] *A.国际金本位制B.牙买加体系C.布雷顿森林体系(正确答案)D.国际金块本位制8、金属货币制度不具有的性质是()。

[单选题] *A.流通中主币为金属铸币B.辅币限制铸造C.主币无限法偿D.辅币无限法偿(正确答案)9、信用货币制度不具有的性质是()。

[单选题] *A.主币集中发行B.辅币集中发行C.信用货币在流通中使用D.流通中主币为金属铸币(正确答案)10、金银铸币按照法定比价流通是()。

[单选题] *A.金汇兑本位制B.金块本位制C.双本位制(正确答案)D.平行本位制11、最早从金银复本位制过渡到金币本位制的国家是() [单选题] *A、英国(正确答案)B、法国C、美国D、中国12、“劣币驱逐良币”现象发生于()制度 [单选题] *A、金本位B、银本位C、金银复本位(正确答案)D、纸币本位13、信用是()。

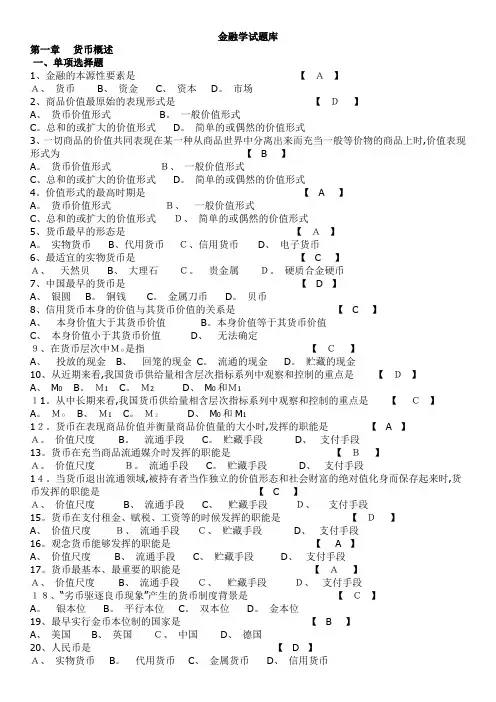

金融学试题库第一章货币概述一、单项选择题1、金融的本源性要素是【A】A、货币B、资金C、资本D。

市场2、商品价值最原始的表现形式是【D】A、货币价值形式 B。

一般价值形式C。

总和的或扩大的价值形式D。

简单的或偶然的价值形式3、一切商品的价值共同表现在某一种从商品世界中分离出来而充当一般等价物的商品上时,价值表现形式为【 B 】A。

货币价值形式B、一般价值形式C、总和的或扩大的价值形式D。

简单的或偶然的价值形式4。

价值形式的最高时期是【 A 】A。

货币价值形式B、一般价值形式C、总和的或扩大的价值形式D、简单的或偶然的价值形式5、货币最早的形态是【A】A。

实物货币B、代用货币C、信用货币D、电子货币6、最适宜的实物货币是【 C 】A、天然贝B、大理石C。

贵金属D。

硬质合金硬币7、中国最早的货币是【 D 】A、银圆B。

铜钱C。

金属刀币D。

贝币8、信用货币本身的价值与其货币价值的关系是【 C 】A、本身价值大于其货币价值B。

本身价值等于其货币价值C、本身价值小于其货币价值D、无法确定是指【C】9、在货币层次中M0A、投放的现金B、回笼的现金C。

流通的现金D。

贮藏的现金10、从近期来看,我国货币供给量相含层次指标系列中观察和控制的重点是【D】A、M0B。

M1C。

M2D、M0和M111。

从中长期来看,我国货币供给量相含层次指标系列中观察和控制的重点是【C】A。

M0B、M1C。

M2D、M0和M112。

货币在表现商品价值并衡量商品价值量的大小时,发挥的职能是【 A 】A。

价值尺度B。

流通手段C。

贮藏手段D、支付手段13。

货币在充当商品流通媒介时发挥的职能是【B】A。

价值尺度B。

流通手段C。

贮藏手段D、支付手段14。

当货币退出流通领域,被持有者当作独立的价值形态和社会财富的绝对值化身而保存起来时,货币发挥的职能是【 C 】A、价值尺度B、流通手段C、贮藏手段D、支付手段15。

货币在支付租金、赋税、工资等的时候发挥的职能是【D】A、价值尺度B、流通手段C、贮藏手段D、支付手段16。

金融学题库及答案详解一、单选题1. 金融学是研究什么的学科?A. 金融市场与金融机构B. 金融工具与金融产品C. 金融风险与金融监管D. 所有上述选项2. 以下哪个不是金融市场的基本功能?A. 资源配置B. 风险管理C. 信息传递D. 商品交易3. 现代金融体系中,银行扮演的角色是什么?A. 资金中介B. 风险承担者C. 信息提供者D. 所有上述选项4. 股票市场和债券市场分别属于以下哪种市场?A. 一级市场和二级市场B. 初级市场和次级市场C. 公开市场和非公开市场D. 资本市场和货币市场5. 以下哪个是金融衍生品?A. 股票B. 债券C. 期权D. 存款二、多选题6. 金融市场的参与者包括:A. 投资者B. 融资者C. 监管机构D. 金融机构7. 以下哪些是金融监管的目的?A. 保护投资者利益B. 维护市场秩序C. 促进金融创新D. 防范金融风险8. 金融产品的主要类型包括:A. 固定收益产品B. 权益类产品C. 衍生品D. 商品三、判断题9. 金融学是一门应用性很强的学科,需要结合实际案例进行学习。

()10. 金融创新可以完全消除金融风险。

()四、简答题11. 简述金融学的主要研究内容。

五、论述题12. 论述金融市场的功能及其在经济发展中的作用。

六、案例分析题13. 某公司计划通过发行股票来筹集资金,分析其可能面临的风险以及如何进行风险管理。

七、计算题14. 假设你购买了一份面值为1000元,年利率为5%的债券,如果持有两年后卖出,计算你的总收益。

八、答案详解1. 答案:D。

金融学是一门综合性学科,研究金融市场与金融机构、金融工具与金融产品、金融风险与金融监管等多个方面。

2. 答案:D。

金融市场的基本功能包括资源配置、风险管理、信息传递,但不包括商品交易。

3. 答案:D。

银行在现代金融体系中扮演资金中介、风险承担者和信息提供者的角色。

4. 答案:D。

股票市场属于资本市场,债券市场属于货币市场。

金融学题库第2章货币与货币制度一、单项选择题1、在下列货币制度中劣币驱逐良币律出现在()A、金本位制B、银本位制C、金银复本位制D、金汇兑本位制2、中华人民共和国货币制度建立于()A、1948年B、1949年C、1950年D、1951年3、某公司以延期付款方式销售给某商场一批商品,则该商场到期偿还欠款时,货币执行()职能。

A支付手段B流通手段C购买手段D贮藏手段4、中国本位币的最小规格是()A、1分B、1角C、1元D、10元5、单纯地从物价和货币购买力的关系看,物价指数上升25%,则货币购买力()A、上升20%B、下降20%C、上升25%D、下降25%6、中国最早的纸币“交子”产生于()A.南唐B.北宋C.元代D.明朝7、信用货币是以一定的债权债务关系为基础的货币,主要指()A.实物货币B.金属货币C.国家纸币D.银行券8.在金属货币制度下,辅币具有的特点()A.自由铸造B.无限法偿C.有限法偿D.足值货币9.下列说法错误的是()。

A、代用货币是由足值货币向现代信用货币发展的一种中介性、过渡性的货币形态B、代用货币体现了一定的信用关系,具有信用货币的特征C、代用货币作为足值货币的价值符号,其本身的内在价值等于其额定货币价值D、代用货币可以和足值货币等价交换10.以下说法错误的是()。

A、信用货币是债务货币B、信用货币具有强制性的特征C、国家可以通过银行来控制和管理信用货币流通,把货币政策作为实现国家宏观经济目标的重要手段D、现代信用货币都是以国家信用为保证而发行的,所以,不会出现贬值现象11.历史上最早出现的货币形态是()。

A、实物货币B、信用货币C、代用货币D、电子货币12.典型的银行券属于()类型的货币。

A、实物货币B、信用货币C、代用货币D、电子货币13.在金银复本位制下,如果金银的法定比价为1:10,而市场比价为1:12,这时充斥市场的将是()。

A、金币B、银币C、金币和银币D、纸币14.历史上最早的货币制度是()。

金融学一、填空题1.主要资本主义国家的银行券发行有()、()和最高限额发行制三种类型。

答:部分准备制(信用发行制)????? 比例准备制2.流通中的货币必要量取决于三个因素:()、()和()答:待实现的商品总量;单位商品价格;单位货币平均流通速度2.凯恩斯认为,货币需求具有交易动机、()和()三个动机。

答:预防动机????? 投机动机3.商业银行派生存款能力与()成正比,与()成反比。

答:原始存款????? 法定存款准备率4.货币政策有三大构成要素:货币政策()、货币政策()、货币政策()。

答:工具;中介指标;目标5.政策性金融机构除了具有金融机构的一般职能外,还具有()、()、选择性职能和服务性职能四个特有职能。

答:倡导性职能????? 补充性职能6.目前,中国的金融机构体系是以()为核心,以()、()为主体,多种金融机构并存,()、相互协作的格局。

答:中央银行;商业银行;政策性银行;分业经营7.作为我国中央银行的中国人民银行成立于()年,其制度类型属于()。

答:1948 单一型中央银行制8.货币政策一般由三要素构成,即政策工具、()和()。

答:最终目标中介目标9.决定外汇汇率的基础是()。

我国目前的汇率制度是()。

答:铸币平价单一的有管理的浮动汇率制10.在业务经营上,各国商业银行都遵循()、()、()原则。

答:盈利性;流动性;安全性11.直接标价法是以一定单位的()为标准,用折算成若干()来表示汇率的标价法。

答:外国货币本国货币12.美国某企业在日本发行的以日元标价的债券称为(),而在日本发行以美元标价的债券称为()。

答:外国债券欧洲债券13.虽然影响汇率变动的因素很多,但最基本的两个方面还是()和()答:货币本身价值量的变动;外汇供求关系14.出口信贷的方式有()和()两种。

答:买方信贷卖方信贷15.现代信用的形式繁多,按信用主体的不同,可分为()、()()、()和()答:商业信用;银行信用;国家信用;消费信用;国际信用二、名词解释1.利息率答案要点:简称利率,是一定时期内利息额同贷出资本额的比率。

金融学题库(含参考答案)一、单选题(共53题,每题1分,共53分)1.在以下金融资产中,流动性最强的是( )。

A、现金B、银行定期存款C、居民储蓄存款D、银行活期存款正确答案:A2.关于我国现行的货币制度,说法错误的是( )。

A、人民币与港元、澳门元之间按以市场供求为基础决定的汇价进行兑换B、由于我国实行“一国多币”的特殊货币制度,所以港元可以和人民币一样在内地流通C、澳门元与港元直接挂钩D、新台币主要与美元挂钩正确答案:B3.关于金币本位制的性质说法错误的是( )。

A、货币发行准备全部是黄金B、黄金可以自由输出输入C、只有金币可以自由铸造,具有有限法偿能力D、只有金币可以自由铸造,具有无限法偿能力正确答案:C4.以下关于信用与市场运行之间关系的表述,不正确的是( )A、信用状况会影响市场空间的拓展B、危机传递导致的失信行为也会影响市场运行C、信用秩序会影响市场运行成本D、只有蓄意赖账才会影响市场运行正确答案:D5.以下关于货币与信用关系的表述,正确的是( )A、货币和信用一直是必须相互依赖才可能存在B、现代信用货币体系下的货币与信用是相互依赖、不可分割的C、不存在信用不依赖货币独立存在的情形D、不存在货币不依赖信用独立存在的情形正确答案:B6.贝币和谷帛是我国历史上的( )A、金属货币B、信用货币C、实物货币D、纸币正确答案:C7.以下关于货币借贷替代实物借贷的表述,不正确的是( )A、是专业化和分工发展的必然结果B、体现了效率的提升和成本的降低C、任何情况下货币借贷都比实物借贷具有绝对优势D、货币借贷相对于实物借贷具有优势,是有条件的正确答案:C8.在通常对融资方式的划分中,以下信用形式属于间接融资的是( )A、发行股票B、商业信用C、发行公债D、银行信用正确答案:D9.从本质上说,金融市场的交易对象是( )A、货币资金B、使用价值C、所有权D、交换价值正确答案:A10.以下说法与古典利率理论的观点相吻合的是( )A、利率不会高于平均利润率B、边际储蓄倾向提高会引起利率下降C、利息是剩余价值的一部分D、货币需求增加会引起利率上升正确答案:B11.现代经济中信用活动与货币运动联系紧密,信用扩张通常意味着货币供给的( )A、不变B、不确定C、减少D、增加正确答案:D12.在现代信用体系下,以下关于盈余和赤字的表述的是( )A、收不抵支即为盈余,盈余意味着资金的净流出B、收大于支即为盈余,盈余意味着资金的净流入C、收大于支即为赤字,赤字意味着资金的净流出D、收不抵支即为赤字,赤字意味着资金的净流入正确答案:B13.关于货币层次说法的是( )。

第一章货币与货币制度一、不定项选择题1、与货币的出现紧密相联的是( B )A、金银的稀缺性B、交换产生与发展C、国家的强制力D、先哲的智慧2、商品价值形式最终演变的结果是( D )A、简单价值形式B、扩大价值形式C、一般价值形式D、货币价值形式3、中国最早的铸币金属是( A )A、铜B、银C、铁D、贝4、在下列货币制度中劣币驱逐良币律出现在( C )A、金本位制B、银本位制C、金银复本位制D、金汇兑本位制5、中华人民共和国货币制度建立于( A )A、1948年B、1949年C、1950年D、1951年6、欧洲货币同盟开始使用“欧元EURO”于( B )A、1998年B、1999年C、2001年D、2002年7、金银复本位制的不稳定性源于( D )A、金银的稀缺B、生产力的迅猛提高C、货币发行管理混乱D、金银同为本位币8、中国本位币的最小规格是( C )A、1分B、1角C、1元D、10元9、金属货币制度下的蓄水池功能源于( C )A、金属货币的稀缺性B、金属货币的价值稳定C、金属货币的自由铸造和熔化D、金属货币的易于保存10、单纯地从物价和货币购买力的关系看,物价指数上升25%,则货币购买力( B )A、上升20%B、下降20%C、上升25%D、下降25%11、在国家财政和银行信用中发挥作用的主要货币职能是( C )A、价值尺度B、流通手段C、支付手段D、贮藏手段12、下列货币制度中最稳定的是( C )A、银本位制B、金银复本位制C、金铸币本位制D、金汇兑本位制13、马克思的货币本质观的建立基础是( A )A、劳动价值说B、货币金属说C、货币名目说D、创造发明说14、对商品价格的理解正确的是( C )A、同商品价值成反比B、同货币价值成正比C、商品价值的货币表现D、商品价值与货币价值的比15、货币的本质特征是充当( B )A、特殊等价物B、一般等价物C、普通商品D、特殊商品16、马克思关于货币起源的论述,是以如下哪种理论为依据的 ? (D )A 、货币价值论B 、货币数量论C 、国家政权决定论D 、劳动价值论17、马克思主要是通过分析如下哪一要素的发展,来揭示货币产生的客观必然性的 ? ( C)A 、经济体制B 、使用价值形式C 、价值形式D 、社会形态18、与货币的起源密不可分的是:( D)A 、私有制B 、社会分工C 、贫富分化D 、商品交换19、不同商品在量上可以比较、在质上同一的共同基础是:( C)A 、价格标准B 、使用价值C 、价值D 、价格20、属于物物的直接交换的价值形式包括:(CD )A 、一般的价值形式B 、特殊的价值形式C 、简单的价值形式D 、扩大的价值形式21、最初的货币所采取的形态是:( B)A 、金币、银币B 、牲畜、皮革、烟草C 、纸币D 、银行券22、货币的各种职能都是从现实的货币出发来描述的,但可用货币符号来代替的是:(B )A 、流通手段B 、价值尺度C 、储藏手段D 、支付手段23、货币支付手段职能最初是导源于:( B)A 、支付工资B 、商品赊销C 、吸收存款D 、发放贷款24、在价值形式的演进中,商品交换有质的变化的是:(A )A 、扩大价值形式到一般价值形式B 、一般价值形式到货币形式C 、简单价值形式到货币形式D 、货币价值形式25、金本位制度下,汇价的基本决定因素是:( A)A 、铸币平价B 、商品的价格C 、货币购买力D 、物价指数26、第一次世界大战前,主要的国际储备货币是:(C )A 、美元B 、黄金C 、英镑D 、德国马克27、作为流通手段职能的货币是:(AD )A 、价值符号B 、现实的货币C 、信用货币D 、观念上的货币28、在发达的商品经济中,支付手段发挥作用的主要场所是:(D )A 、信贷收支B 、支付工资C 、财政收支D 、大额交易29、以下属于货币发挥支付手段职能的有:( AC)A 、银行吸收存款B 、汽车购买C 、工资支付D 、商品购买30、经济对货币的需求包括对:(CD )A 、世界货币的需求B 、储藏手段的需求C 、流通手段的需求D 、支付手段的需求31、货币所具有的特征是:(ACD )A 、表现商品价值B 、在世界范围内流通C 、衡量商品价值D 、和一切商品相交换32、在我国境内严禁作为计算单位和价值尺度流通的有:(BCD )A 、人民币B 、金银C 、港币、澳元D 、外国货币二、判断题1、最早的货币形式是金属铸币。

金融学题库第二章货币与货币制度一、单项选择题1、流动性最强的金融资产是( D )。

A.银行活期存款B.居民储蓄存款C.银行定期存款D.现金2、在货币层次中,货币具有( D )的性质。

A.流动性越强,现实购买力越强B.流动性越强,现实购买力越弱C.流动性越弱,现实购买力越弱D.答案AC是正确的3、马克思的货币起源理论表明( D )。

A.货币是国家创造的产物B.货币是先哲为解决交换困难而创造的C.货币是为了保存财富而创造的D.货币是固定充当一般等价物的商品4、价值形式发展的最终结果是( A )。

A.货币形式B.纸币C.扩大的价值形式D.一般价值形式5、货币执行支付手段职能的特点是( D )。

A.货币是商品交换的媒介B.货币运动伴随商品运动C.货币是一般等价物D.货币作为价值的独立形式进行单方面转移6、货币在( A )时执行流通手段的职能。

A.商品买卖B.缴纳税款C.支付工资D.表现商品价值7、美元与黄金内挂钩,其他国家货币与美元挂钩是( C )的特点。

A.国际金本位制B.牙买加体系C.布雷顿森林体系D.国际金块本位制8、金属货币制度不具有的性质是( D )。

A.流通中主币为金属铸币B.辅币限制铸造C.主币无限法偿D.辅币无限法偿9、信用货币制度不具有的性质是( D )。

A.主币集中发行B.辅币集中发行C.信用货币在流通中使用D.流通中主币为金属铸币10、金银铸币按照法定比价流通是( C )。

A.金汇兑本位制B.金块本位制C.双本位制D.平行本位制11、最早从金银复本位制过渡到金币本位制的国家是(A )A、英国B、法国C、美国D、中国12、“劣币驱逐良币”现象发生于(C )制度A、金本位B、银本位C、金银复本位D、纸币本位二、多项选择题1、在我国货币层次中,狭义货币量包括(AD )。

A.银行活期存款B.企业单位定期存款C.居民储蓄存款D. 现金2、在我国货币层次中准货币是指(ABCD )。

A.银行活期存款B.企业单位定期存款C.居民储蓄存款D.证券公司的客户保证金存款3、信用货币包括(AD )。

第二章货币与货币制度二、单项选择题:1、与货币的出现紧密相联的是(交换产生与发展)2、商品价值形式最终演变的结果是(货币价值形式)3、中国最早的铸币金属是(铜)4、在下列货币制度中劣币驱逐良币律出现在(金银复本位制)5、中华人民共和国货币制度建立于(1948年)6、欧洲货币同盟开始使用“欧元EURO”于(1999年)7、金银复本位制的不稳定性源于(金银同为本位币)8、中国本位币的最小规格是(1元)9、金属货币制度下的蓄水池功能源于(金属货币的自由铸造和熔化)10、单纯地从物价和货币购买力的关系看,物价指数上升25%,则货币购买力(下降20%)11、在国家财政和银行信用中发挥作用的主要货币职能是(支付手段)12、下列货币制度中最稳定的是(金铸币本位制)13、马克思的货币本质观的建立基础是(劳动价值说)14、对商品价格的理解正确的是(商品价值的货币表现)15、货币的本质特征是充当(一般等价物)第三章信用二、单项选择题1、商业信用是企业之间由于(商品交易)而相互提供的信用。

2、信用的基本特征是(以偿还为条件的价值单方面转移)。

3、本票与汇票的区别之一是(是否需要承兑)。

4、以金融机构为媒介的信用是(银行信用)。

5、下列经济行为中属于间接融资的是(银行发放贷款)。

6、下列经济行为中属于直接融资的是(开出商业本票)。

7、工商企业之间以赊销方式提供的信用是(商业信用)。

8、货币运动与信用活动相互渗透相互连接所形成的新范畴是(金融)。

9、《中华人民共和国票据法》颁布的时间是(1995年5月10日)。

10、现代经济中,信用活动与货币运动紧密相联,信用的扩张意味着货币供给的(增加)。

11、高利贷信用产生的经济条件是(自己自足的自然经济)。

12、典型的商业信用(是商品买卖行为与货币借贷行为的统一)。

13、商业票据必须经过(背书)才能转让流通。

14、个人获得住房贷款属于(消费信用)。

15、国家信用的主要工具是(政府债券)。

第一章货币与货币制度二、单项选择题(每题1分,共15题)1.货币的产生是_C_。

A由金银的天然属性决定的 B 国家发明创造的C商品交换过程中商品内在矛盾发展的产物 D人们相互协商的结果2.货币在_D_时执行价值尺度职能。

A 商品买卖B 缴纳租金C 支付工资D 给商品标价时3.货币在_D_时执行价值贮藏职能。

A 支付水电费B 购买商品C 表现和衡量商品价值D 准备用于明年的购买4.货币执行支付手段职能的特点是_D_。

A 货币是商品交换的媒介B 货币运动伴随商品运动C 货币是一般等价物D 货币作为价值的独立形式进行单方面转移5.在金属货币流通条件下,货币在执行贮藏手段职能时,能自发的调节_B_。

A 货币流通B 货币必要量C 生产规模D 投资规模6.中国工商银行发行的电子货币是__。

A 牡丹卡B VISA卡C 长城卡D 金穗卡7.货币单位规定有含金量,但国内流通银行券,无铸币流通,无金块可供兑换,银行券可兑换外币汇票是(C )。

A 金块本位制B 金铸币本位制C 金汇兑本位制D 银行券制8.目前世界各国实行的是_D_。

A 银本位制B 金本位制C 金、银复本位制D 不兑现信用货币制度9.金银复本位制中,金银两种货币比价均各按其市场价值决定的货币制度是__。

A平行本位制 B双本位制 C跛行本位制 D单本位制10.金币本位制的特点是_B_。

A货币单位规定有含金量,但不铸造、不流通金币 B金币可以自由铸造和熔化C 纸币仍是金单位 D金银铸币同时流通11.劣币驱逐良币规律中所谓的劣币是指_B_。

A名义价值高于实际价值的货币 B名义价值低于实际价值的货币C没有名义价值的货币 D没有实际价值的货币12.与本位币相比,辅币具有如下特点_A_。

A为有限法偿货币 B为不足值货币C国家垄断铸造 D币材多为贱金属13.我国货币制度规定,人民币具有以下特点_B_。

A人民币与黄金有直接联系B人民币是可兑现的银行券C人民币与黄金没有直接联系D人民币不与任何外币确定正式联系14.弗里德曼将货币定义为BA 流动性B M2C 商业银行储蓄D购买力的暂息所15.__指出货币和资本作为每一个新开办的企业的第一推动力和持续的动力。

《金融学》试题库含参考答案一、单选题(共40题,每题1分,共40分)1、货币在()时执行流通手段的职能A、分期付款购房B、企业发放职工工资C、缴纳房租,水电费D、饭馆就餐付账正确答案:D2、在凯恩斯的货币需求函数中,人们持有的金融资产可分为()。

A、货币和债券B、现金和股票C、股票和债券D、现金和存款正确答案:A3、二十世纪七十年代,被用于解释西方国家经历的高事业和高通货膨胀并存的“滞涨”局面的是()。

A、混合型通货膨胀B、结构型通货膨胀C、需求拉上型通货膨胀D、成本推动型通货膨胀正确答案:D4、发行人公开向投资者推销证券的发型方式是()A、代销B、私募C、公募D、包销正确答案:C5、金融公司与商业银行的区别在于()A、金融公司可以发行商业票据,商业银行则不能B、商业银行可以发放贷款,金融公司则不能C、商业银行可以公开吸收存款,金融公司则不能D、金融公司可以发行股票,商业银行则不能正确答案:C6、美国地方政府发行的市政债券的利率低于联邦政府债券,其原因可能是()。

A、违约风险因素B、税收差异因素C、流动性差异因素D、市场需求因素正确答案:B7、下列不属于负债管理理论的是()A、销售理论B、银行券理论C、存款理论D、预期收入理论正确答案:D8、以下不属于金融中介功能的是()A^充当支付中介B、最后贷款人C、融通资金D、充当信用中介正确答案:B9、用表内业务的方式来管理违约风险的信用衍生产品是()A、信用违约期权B、信用违约互换C、信用联系票据D、信用利差期权正确答案:C10、信用工具的流动性与债务人的信用能力成()。

A、无关B、不确定C、反比D^正比正确答案:D11、金融市场上交易的对象是()A、金融资产B、有形资产C、实物商品D、无形资产正确答案:A12、在影响基础货币增减变动的因素中()的影响最主要。

A、固定资产的增减变化B、中央银行对商业银行的债权C、国外净资产D、中央银行对政府债权正确答案:B13、由于信息不对称,交易发生前存在的()将会使直接融资交易成本提高。

Chapter OneFinancial EconomicsThis chapter contains 48 multiple choice questions, 20 short problems and 5 longer problems.Multiple Choice1.The primary goal of corporate management is to________ shareholder wealth.(a)minimize(b)maximize(c)leverage(d)mitigateAnswer: (b)2. A ________ stock market imposes ________discipline on managers to take actions to maximize the market value of the firm’s shares.(a)competitive, strong(b)dispersed, weak(c)mature, no(d)dispersed, strongAnswer: (a)3. The ________ form is especially well suited to the separation of ownership and management of firms because it allows relatively frequent changes in owners by share transfer without affecting the operations of the firm.(a)corporate(b)sole proprietorship(c)partnership(d)householdAnswer: (a)4. ________ is anything that has economic value.(a) A partnership(b)An asset(c) A balance sheet(d)An income statementAnswer: (b)5. A household’s wealth or net worth is measured by the value of its ________ minus its ________.(a)liabilities; assets(b)assets; liabilities(c)stocks; bonds(d)bonds; liabilitiesAnswer: (b)6. The branch of finance dealing with financial decisions of firms is called ________ or ________.(a)investments; international finance(b)markets; institutions(c)business finance; institutions(d)business finance; corporate financeAnswer: (d)7. Bonds promise ________ cash payments, while stocks pay the ________ value left over after all other claimants have been paid.(a)variable; residual(b)residual; fixed(c)fixed; residual(d)fixed; variableAnswer: (c)8. The day-to-day financial affairs of the firm are usually referred to as ________.(a)working capital management(b)capital structure(c)capital budgeting(d)strategic planningAnswer: (a)9. A disadvantage of the sole proprietorship is the fact that the sole proprietor has ________.(a)limited liability for the debts of the firm(b)unlimited liability for the debts of the firm(c)expensive costs to establish the firm(d)limited authority over the day-to-daybusiness decisions of the firmAnswer: (b)10. In the U.S. corporations with concentrated ownership are called ________ and corporations with broadly dispersed ownership are called ________.(a)private corporations; public corporations(b)public corporations; private corporations(c)public corporations; monopolies(d)private corporations; state ownedcorporationsAnswer: (a)11. Billy owns a house worth $350,000 and has a $55,000 bank account. Billy owes $270,000 to the bank on a home mortgage loan and has a $12,000 credit card debt outstanding. Calculate Billy’s net worth.(a)$135,000(b)$123,000(c)$497,000(d)$37,000Answer: (b)12. Marlowe owns a house worth $150,000, a car worth $25,000 and has an $18,000 bank account. Marlowe owes $135,000 to the bank on a home mortgage loan, $18,000 on the car loan and has an $18,000 credit card debt outstanding. Calculate Marlowe’s net wor th.(a)$58,000(b)$123,000(c)$22,000(d)$37,000Answer: (c)13. An advantage of the corporate form of ownership is ________.(a)no liability(b)unlimited liability(c)limited liability(d)CEO liabilityAnswer: (c)14. In the corporate form, the separated structure creates the potential for ________ between owners and managers.(a) a conflict of interest(b)increased transactional costs(c)stability in relations(d)none of the aboveAnswer: (a)15. All of the following are reasons for having a separation of management and ownership of the firm except:(a)the “going concern” effect favors theseparated structure(b)professional managers may be found whopossess a superior ability to run thebusiness(c)it prevents the possibility of a conflict ofinterest between the owners andmanagement(d)it allows for savings in the cost ofinformation gatheringAnswer: (c)16. ________ involves the evaluation of costs and benefits spread out over time, and it is largely a financial decision-making process.(a)Stock valuation(b)Bond valuation(c)Inventory costing(d)Strategic planningAnswer: (d)17. Shareholder wealth maximization depends on all of the following except:(a)production technology(b)market interest rates(c)risk aversion(d)market risk premiumsAnswer: (c)18. A problem with using the profit maximization criterion is ________.(a)d eciding which period’s profit is to bemaximized(b)the definition of “maximize profits” isambiguous(c)the failure to consider risk(d)all of the aboveAnswer: (d)19. The existence of a well functioning stock market facilitates the efficient separation of the ownership and management of firms, since stock prices can be substituted for external information about ________.(a)the firm’s production technology(b)the wealth, preferences, and otherinvestment opportunities of the owners(c)the historic costs of the firm’sinfrastructure(d)the firm’s ability to meet its projected goalsAnswer: (b)20. One place to look for a statement of the goals of a corporation’s top managers is the ________.(a)balance sheet(b)income statement(c)annual report(d)bankruptcy filingAnswer: (c)21. In the absence of a stock market, managers would require information that is ________ to obtain.(a)costly if not impossible(b)costless(c)readily available(d)time-consuming but inexpensiveAnswer: (a)22. Management’s task is made much easier when it can observe the ________ of its own and other firms’ shares.(a)book prices(b)market prices(c)historical prices(d)security pricesAnswer: (b)23. ________ are entitled to a share of any of the distributions from the corporation such as cash dividends.(a)Sole proprietors(b)General partners(c)Professional managers(d)ShareholdersAnswer: (d)24. ________ is the founder of modern portfolio theory.(a)Harry Markowitz(b)Merton Miller(c)William Sharpe(d)Bill GatesAnswer: (a)25. In Germany, public corporations are identifiable by ________ after the company name, whereas private companies are denoted by ________.(a)PLC, Inc.(b)GmbH, AG(c)AG, GmbH(d)SpA, GmbHAnswer: (c)26. In the United Kingdom, public corporations are identifiable by ________ after the company name, whereas private companies are denoted by ________.(a)Inc, PLC(b)LTD, PLC(c)AG, GmbH(d)PLC, LTDAnswer: (d)27. Shareholders elect ________ who in turn select________ to run the business.(a) a board of directors; a treasurer(b) a board of directors; managers(c)managers; a board of directors(d) a board of directors; accountantsAnswer: (b)28. In a competitive stock market, ________ offer(s) another important mechanism for aligning the incentives of managers with those of shareholders.(a)takeovers(b)increased taxes(c)liquidation(d)increased liabilityAnswer: (a)29. If a raider is interested in making a profit through the takeover of a prospective firm, the only expenses that need be incurred are ________.(a)the cost of identifying a mismanaged firm(b)the cost of acquiring the firm’s shares(c)physical capital(d)both (a) and (b)Answer: (d)30. The cost of identifying a mismanaged firm can be low if the raider is which of the following:(a) a supplier(b) a customer(c) a competitor(d)all of the aboveAnswer: (d)31. Takeover mechanisms can most effectively be reduced by ________.(a)directives from the board of directors(b)media intervention(c)government policies(d)public disapprovalAnswer: (c)32. The chief financial officer (CFO) of a corporation normally reports to the ________ of the company.(a)controller(b)treasurer(c)chief executive officer(d)chairman of the board of directorsAnswer: (c)33. All of the following departments typically report to the chief financial officer (CFO) except:(a)marketing(b)financial planning(c)treasury(d)controlAnswer: (a)34. The treasurer’s job includes managing all of the following except:(a)the firm’s exposure to currency and interestrate risks(b)the tax department(c)relations with the external investmentcommunity(d)the analysis of proposed mergers andacquisitionsAnswer: (d)35. The activities of the vice president for financial planning include all of the following except:(a)analyzing proposed mergers(b)analyzing proposed spin-offs(c)preparing internal reports comparingplanned and actual costs(d)analyzing major capital expendituresAnswer: (c)36.Which of the following statements is most correct?(a)The shareholders of a corporation electmanagers who in turn select a board ofdirectors to run the business.(b)Partnerships do not pay corporate tax.(c) A disadvantage of the corporation isunlimited liability.(d)The government is powerless to discouragecorporate takeovers.Answer: (b)37.For a typical firm, which of the followingstatements is most correct?(a)The CFO has three departments reportingto him: financial planning, treasury andcontrol.(b)The treasurer oversees the accounting andauditing activities of the firm.(c)The controller has responsibility formanaging the financing activities of thefirm and for working capital management.(d)The CEO is a senior vice president withresponsibility for all the financial functionsin the firm.Answer: (a)38.Which of the following are financial decisions afirm has to make?(a)financing decisions(b)capital budgeting decisions(c)working capital decisions(d)all of the aboveAnswer: (d)39.The controller’s job includes responsibility for________.(a)relations with the external investmentcommunity(b)preparation of financial statements for useby shareholders, creditors and regulatoryauthorities(c)analysis of proposed mergers, acquisitionsand spin-offs(d)all of the aboveAnswer: (b)40.The basic unit of analysis in capital budgeting is the________.(a)financing project(b)investment project(c)strategic project(d)variable projectAnswer: (b)41.The steps involved in any capital budgeting processinclude:(a)evaluating projects(b)deciding which projects to undertake(c)identifying ideas for new investmentprojects(d)all of the aboveAnswer: (d)42.Preferred stock, bonds, and convertible securitiesare also known as ________.(a)nonmarketable claims(b)standardized securities(c)variable securities(d)covenantsAnswer: (b)43.The basic unit of analysis in capital structuredecisions is the ________.(a)firm as a whole(b)investment project(c)firm’s personnel(d)financial systemAnswer: (a)44.Which one of the following correctly orders thesteps involved in capital structure decisions?(a)determining a feasible financing plan;identifying new ideas for investmentprojects(b)determining the optimal financing mix;determining a feasible financing plan(c)identifying ideas for investment projects;determining the optimal financing mix(d)determining a feasible financing plan;determining the optimal financing mix Answer: (d)45.Which of the following is not a financial functionof a corporation?(a)investor relations(b)tax administration(c)provision of capital(d)regulatory legislationAnswer: (d)46.Which of the following functions may becategorized as administration of funds?(a)custodial responsibilities(b)tax administration(c)internal auditing(d)all of the aboveAnswer: (a)47.Investor relations includes:(a)government reporting(b)establishment and maintenance ofcommunications with companystockholders(c)relations with taxing agencies(d)consultation with and advice to othercorporate executivesAnswer: (b)48.Oscar owns a boat worth $2 million, a house worth$lion and has $900,000 in a bank account.Oscar owes $1.1 million to the bank on the boatloan, $2 million on the home loan and has $20,000credit card debt. Calculate Oscar’s net worth.(a)$3.12 million(b)$5.28 million(c)$7.28 million(d)$8.4 millionAnswer: (b)Short Problems1.Give a brief definition of the financial system.Answer: A financial system is defined as the set of markets and other institutions used for financial contracting and the exchange of assets and risks.2.List the markets that the financial system likelyincludes.Answer: A financial system includes the markets for stocks, bonds and other financial instruments, financial intermediaries, financial service firms and the regulatory bodies that govern all of these institutions. 3.Briefly describe the distinction between physicalcapital and financial capital.Answer: Physical capital includes items such as buildings, machinery and other intermediate products used in the production process. Financial capital, however, includes stocks, bonds and loans used to finance the acquisition of physical capital.4. Give a brief description of the wide range of financial instruments and claims a firm can issue.Answer: These include common stock, preferred stock, bonds and convertible securities (standardized securities that can be traded in organized markets). Financial instruments and claims can also include nonmarketable claims such as bank loans, employee stock options, leases and pension liabilities.5.Siggy owns a house worth $200,000, a car worth$25,000 and has an $18,000 bank account. He also has furniture worth $4,000 and jewelry worth $10,000. However, Siggy owes $145,000 to the bank on a home mortgage loan, $17,000 on the car loan, $40,000 on student loans and has an $16,000 credit card debt outstanding. Calculate Siggy’s net worth.Answer: Net Worth = Total Assets – Total Liabilities= ($200,000 + $25,000 + $18,000 + $4,000 + $10,000) – ($145,000 + $17,000 + $40,000 + $16,000)= $39,0006.Briefly list the problems associated with profitmaximization as the chief goal of corporatemanagers.Answer: The profit-maximization criterion has two problems associated with it. The first is that it is difficult to determine which period’s profit is to be maximized if the production process requires many periods. Secondly, if either future revenues or expenses are uncertain, then what exactly is the meaning of “maximize profits” if profits are described by a probability distribution?7.Kecia owns a house worth $220,000, a car worth$20,000 and has a $13,000 bank account. She also has furniture worth $8,000. However, Kecia owes $165,000 to the bank on a home mortgage loan, $17,000 on the car loan, $50,000 on student loans and has an $18,000 credit card debt outstanding.Calculate Kecia's net worth.Answer: Net Worth = Total Assets – Total Liabilities= ($220,000 + $20,000 + $13,000+ $8,000) – ($165,000 + $17,000 +$50,000 + $18,000)= $261,000 - $250,000= $11,0008.Give an example of a potential conflict of interestthat can arise between owners and managers of afirm.Answer: Managers being concerned with their own personal welfare may lead to concern about job security in the long run. This concern about long run survival may cause managers to limit the risk incurred by the firm and make other decisions not with the objective of shareholder wealth maximization.9.What use does the existence of a stock market serveto the manager of a firm?Answer: Observing its own and other firms’ market price of shares helps it make decisions about maximizing the firm’s value to its shareholders. If there was not a stock market, then managers would be required to obtain information that is costly, if not impossible, to obtain. This includes the wealth, preferences and other investment opportunities of the owners. 10.Outline the role of the takeover in aligning theincentives of managers with those of shareholders. Answer: The threat of a takeover provides a strong incentive for current managers to act in the interests of the firm’s current shareholders by maximizing market value. If managers fail to maximize the market value of the firm’s shares, the firm will be vulnerable to a takeover in which the managers may lose their jobs. 11.Outline the role of the chief financial officer (CFO)in a corporation.Answer: The CFO is a senior vice president with responsibility for all the financial functions in the firm and reports directly to the CEO. Three departments report to the CFO: financial planning, treasury, and control.12.Discuss the role of the treasurer in a corporation. Answer: The treasurer has responsibility for managing the financing activities of the firm and for working capital management. The treasurer is responsible for managing relations with the external investor community, managing the firm’s exposure to currency and interest rate risks, and managing the tax department.13. Discuss the tasks performed by the controller of a corporation.Answer: The controller oversees the accounting and auditing tasks of the firm. The controller is responsible for the preparation of internal reports comparing planned and actual costs, revenues, and profits from the corporation’s various busi ness units. The controller will also be involved with preparation of financial statements for use by shareholders, creditors and regulatory authorities.14.Discuss why voting rights for shareholders are notadequate to compel managers to act in the bestinterests of the shareholders.Answer: Because a major benefit of the separated structure is that the owners can remain relatively uninformed about the operations of the firm, it is not apparent how these owners could know whether their firm is being mismanaged. The value of voting rights is further cast into doubt if ownership of the firm is widely dispersed. If that is the situation, then the holdings of any single owner are likely to be so small that he or she would not incur the expense to become informed and to convey this information to the other owners.15.Is it possible for government to reduce theeffectiveness of the takeover mechanism?Answer: Yes. It is possible for government policy to prevent the formation of monopolies in various product markets – as in the case of the United States Department of Justice, which can take legal action under the antitrust laws to prevent mergers and acquisitions that might reduce competition.16.In terms of the financial functions of a corporation,what responsibilities do administration of fundsentail?Answer: Management of cash; maintenance of banking arrangements; receipt, custody and disbursement of the company’s monies and securities; credit and collection management; management of pension funds; management of investments and custodial responsibilities.17.Discuss the liability a partnership faces.Answer: Unless otherwise specified, all partners have unlimited liability as in the sole proprietorship. However, it is possible to limit the liability for somep artners called “limited partners”. At least one of the partners, called the general partner, has unlimited liability for the debts of the firm.18.Describe the advantages of the corporate form ofbusiness organization.Answer: The corporate form of ownership has the advantage that ownership shares can usually be transferred without disrupting the business. Limited liability is also another advantage of the corporate form. In this case, if the corporation fails to pay its debts, the creditors can seize the assets of the corporation but have no recourse to the personal assets of the shareholders.19.Briefly outline the process of capital budgeting.Answer:The process of capital budgeting includes identifying ideas for new investment projects, evaluating them, deciding which ones to undertake, and then implementing them.20.Briefly discuss the process of working capitalmanagement.Answer: Working capital management refers to the day-to-day financial affairs of the business, such as whether to extend credit to customers or demand cash on delivery or managing cash flow. Longer Problems1.Describe the four basic types of financial decisionsfaced by householders.Answer: Investment decisions– whether to invest in stocks or bondsConsumption/Savings Decisions– how muchto save for one’s retirement or a child’seducationRisk management decisions– whether to buy disability insuranceFinancing decisions– what type of loan to adopt in order to finance the purchase of a home or car.2.Give a brief description of each of the four mainareas of financial decision-making in a business. Answer: Strategic Planning: Evaluating thecosts and benefits associated with thefirm’s business line, which may changeover time.Capital Budgeting: Identifying ideasfor new investment projects, evaluatingthem, deciding which ones toundertake, and then implementingthem.Capital Structure: The initial step isdeciding upon a feasible financing planfor the firm. The next decisioninvolves the optimal debt/equity mix touse.Working Capital Management: Theday-to-day affairs of the business.This includes paying bills as they comedue, collecting from customers,managing the firm’s cash flows toensure that operating cash flowsdeficits are financed and that cash flowsurpluses are efficiently invested toearn a good return.3.Explain the five basic reasons for separating themanagement from the ownership of an enterprise. Answer:•Professional managers may be found who have a superior ability to run the business.•To achieve the efficient scale of a business the resources of many households may have to bepooled.•In an uncertain economic environment, owners will want to diversify their risks across manyfirms.•The separated structure allows for savings in the costs of information gathering.•There is a “learning curve” or “going concern”effect, which favors to separated structure.4.Discuss the types of decisions that firms must make. Answer: Capital budgeting decisions– whether to build a new plant or produce a new product.Financing decisions– how much equity andhow much debt a firm should adopt in itscapitalstructure.Working Capital decisions– whether creditshould be extended to a customer or cashdemanded on delivery.5.Outline the roles of the three departments that reportto the Chief Financial Officer.Answer: Treasury: This department is responsible for managing the financing activitiesof the firm and for working capitalmanagement. This includes managingrelations with the external investmentcommunity, managing the firm’s exposure tocurrency and interest rate risks, andmanaging the tax department.Financial Planning: This department isresponsible for analyzing major capitalexpenditures such as proposals to enter newlines of business or to exit existing businesses.This includes analyzing proposed mergers,acquisitions and spin-offs.Controller: This department oversees theaccounting and auditing activities of the firm.Activities include preparation of financialstatements for use by shareholders, creditorsand regulatory authorities, as well as thepreparation of internal reports comparingplanned and actual costs, revenues, andprofits from the corporation’s variousbusiness units.Chapter TwoFinancial Markets and InstitutionsThis chapter contains 49 multiple-choice questions, 20 short problems and 10 longer problems. Multiple Choice1. A market that has no one specific location is termed a(n) ________ market.(a)over-the-counter(b)geographic location(c)intermediary(d)conceptualAnswer: (a)2. ________ problems arise because parties to contracts often cannot easily monitor or control one another.(a)Payment(b)Counter(c)Incentive(d)ExchangeAnswer: (c)3. Incentive problems take a variety of forms and include:(a)moral hazard(b)adverse selection(c)principal-agent(d)all of the aboveAnswer: (d)4. The ________ problem exists when having insurance against some risk causes the insured party to take greater risk or to take less care in preventing the event that gives rise to the loss.(a)moral hazard(b)adverse selection(c)principal-agent(d)all of the aboveAnswer: (a)5. Life annuities are examples of ________ problems.(a)moral hazard(b)adverse selection(c)principal-agent(d)all of the aboveAnswer: (b)6. ________ means giving the lender the right to seize specific business assets in the event of default.(a)Increasing moral hazard(b)Increasing adverse selection(c)Collateralization of loans(d)All of the aboveAnswer: (c)7. ________ instruments are also called fixed-income instruments.(a)Debt(b)Equity(c)Derivative(d)All of the aboveAnswer: (a)8. The market for short-term debt (less than one year) is called the ________ market, and the market forlong-term debt and equity securities is called the________ market.(a)capital; money(b)money; capital(c)fixed-income; money(d)derivative; equityAnswer: (b)9. ________ securities are financial instruments that derive their value from the prices of one or more other assets.(a)Debt(b)Equity(c)Derivative(d)Fixed-incomeAnswer: (c)10. A call option gives its holder the right to ________ some asset at a specified price on or before some specified expiration date.(a)sell(b)buy(c)loan(d)borrowAnswer: (b)11. A put option gives its holder the right to ________ some asset at a specified price on or before some specified expiration date.(a)sell(b)buy(c)loan(d)borrowAnswer: (a)12. ________ contracts oblige one party to the contract to buy, and the other party to sell, some asset at a specified price on some specified date.(a)Options(b)Uncertainty(c)Money market(d)ForwardAnswer: (d)13.The ________ curve depicts the relation betweeninterest rates on fixed-income instruments issued by the U.S. Treasury and the maturity of theinstrument.(a)long-term(b)short-term(c)yield(d)exchange rateAnswer: (c)14.If the short-term rates are higher than the long-termrates, then the yield curve is ________.(a)upward sloping(b)downward sloping(c)horizontal(d)verticalAnswer: (b) Questions 15 and 16 are intended to be calculated as a pair.15.Suppose you are a French investor, who wants asafe investment in terms of francs. You are investing for one year and the interest rate on a one-year French government bond is 5% and at the same time it is 9% on a U.S. government bond. The exchange rate is currently 6.15 French francs to the dollar. Suppose you invest $1,000 in a U.S. bond.Also suppose that a year from now the French franc/dollar exchange rate is 6.50 French francs to the dollar. What will be the realized French franc rate of return on the U.S. bond?(a) 5.69%(b)9.00%(c)15.2%(d)7.00%Answer: (c)16.In question 15, what would the exchange rate atyear’s end have to be in order for the Fr enchinvestor to earn exactly 4% per year on theinvestment in U.S. bonds?(a) 6.20 FF/$(b) 5.87 FF/$(c) 6.40 FF/$(d) 5.42 FF/$Answer: (b)Use the following yield data to answer questions 17 and 18.2/29/98Treasury 1-10 yr 5.58%10+ yr 5.72Corporate 1-10 yr High Qlty 5.98Med Qlty 6.17Corporate 10+ yr High Qlty 6.26Med Qlty 6.5717. Calculate the yield spread for Treasury bonds with maturity 1-10 year and corporate bonds of high quality of the same maturity.(a)11.56%(b)0.68%(c)0.59%(d)0.40%Answer: (d)18. Calculate the yield spread for Treasury bonds with maturity 10+ years and corporate bonds of medium quality of the same maturity.(a)12.29%(b)0.85%(c)0.54%(d)0.45%Answer: (b)19.You invest in a stock that costs $45.50 per share. Itpays a cash dividend during the year of $1.20 andyou expect its price to be $49 at year’s end. What is。