CH01-案例及习题

- 格式:doc

- 大小:93.00 KB

- 文档页数:3

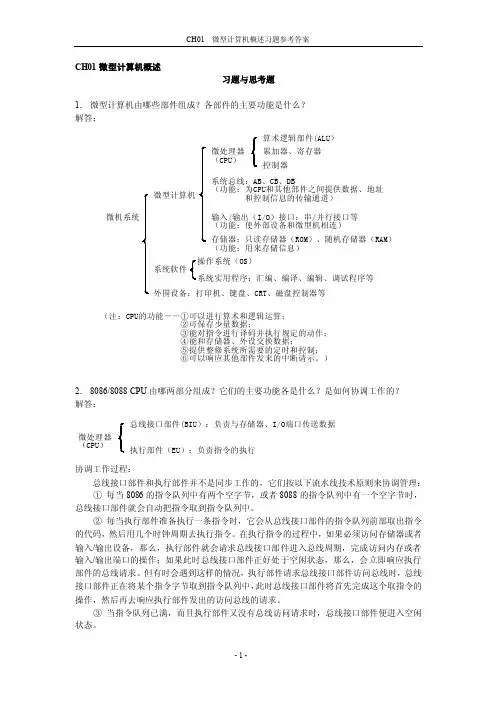

CH01微型计算机概述习题与思考题1. 微型计算机由哪些部件组成?各部件的主要功能是什么? 解答:微机系统微型计算机系统软件外围设备:打印机、键盘、CRT 、磁盘控制器等微处理器(CPU )系统总线:AB 、CB 、DB(功能:为CPU 和其他部件之间提供数据、地址 和控制信息的传输通道)存储器:只读存储器(ROM )、随机存储器(RAM )(功能:用来存储信息)输入/输出(I/O )接口:串/并行接口等(功能:使外部设备和微型机相连)算术逻辑部件(ALU )累加器、寄存器控制器操作系统(OS )系统实用程序:汇编、编译、编辑、调试程序等(注:CPU 的功能--①可以进行算术和逻辑运算; ②可保存少量数据; ③能对指令进行译码并执行规定的动作; ④能和存储器、外设交换数据;⑤提供整修系统所需要的定时和控制; ⑥可以响应其他部件发来的中断请示。

)2. 8086/8088 CPU 由哪两部分组成?它们的主要功能各是什么?是如何协调工作的? 解答:微处理器(CPU )总线接口部件(BIU ):负责与存储器、I/O 端口传送数据执行部件(EU ):负责指令的执行协调工作过程:总线接口部件和执行部件并不是同步工作的,它们按以下流水线技术原则来协调管理: ① 每当8086的指令队列中有两个空字节,或者8088的指令队列中有一个空字节时,总线接口部件就会自动把指令取到指令队列中。

② 每当执行部件准备执行一条指令时,它会从总线接口部件的指令队列前部取出指令的代码,然后用几个时钟周期去执行指令。

在执行指令的过程中,如果必须访问存储器或者输入/输出设备,那么,执行部件就会请求总线接口部件进入总线周期,完成访问内存或者输入/输出端口的操作;如果此时总线接口部件正好处于空闲状态,那么,会立即响应执行部件的总线请求。

但有时会遇到这样的情况,执行部件请求总线接口部件访问总线时,总线接口部件正在将某个指令字节取到指令队列中,此时总线接口部件将首先完成这个取指令的操作,然后再去响应执行部件发出的访问总线的请求。

【Lua程序设计第四版练习题答案】ch01Lua语⾔⼊门

联系1.1: 运⾏阶乘的⽰例并观察,如果输⼊负数,程序会出现什么问题?试着修改代码来解决问题。

-- 定义⼀个计算阶乘的函数

function fact (n)

if n == 0 then

return 1

else

return n * fact(n-1)

end

end

print("enter a number:")

a = io.read("*n") -- 读取⼀个数字

print(fact(a))

这是本章最开始提到的阶乘⽰例程序,通过实际的运⾏,我们了解到由于程序没有对负数形式进⾏校验的逻辑,因此程序会⼀直迭代递归下去,没有终⽌条件lua编译器报出堆栈溢出的错误才结束。

在进⾏修改之后的代码如下:

opefunction fact(n)

n = n or 0

if n < 0 then

error("Cannot calculate the factorial of a negative number")

elseif n == 0 then

return 1

else

return n * fact(n-1)

end

end

print("Enter a number: ")

a = io.read("*n")

print("Answer is: ", fact(a))

这⾥加⼊对输⼊负数的终⽌条件的判断,因此不会再出现堆栈溢出的错误。

Chapter 1The Demand for Audit and Other Assurance Services Review Questions1-1The relationship among audit services, attestation services, and assurance services is reflected in Figure 1-3 on page 13 of the text. An assurance service is an independent professional service to improve the quality of information for decision makers. An attestation service is a form of assurance service in which the CPA firm issues a report about the reliability of an assertion that is the responsibility of another party. Audit services are a form of attestation service in which the auditor expresses a written conclusion about the degree of correspondence between information and established criteria.The most common form of audit service is an audit of historical financial statements, in which the auditor expresses a conclusion as to whether the financial statements are presented in conformity with generally accepted accounting principles. An example of an attestation service is a report on the effe ctiveness of an entity’s internal control over financial reporting. There are many possible forms of assurance services, including services related to business performance measurement, health care performance, and information system reliability. 1-2 An independent audit is a means of satisfying the need for reliable information on the part of decision makers. Factors of a complex society which contribute to this need are:1.Remoteness of informationa.Owners (stockholders) divorced from managementb.Directors not involved in day-to-day operations ordecisionsc.Dispersion of the business among numerous geographiclocations and complex corporate structures2.Biases and motives of providerrmation will be biased in favor of the providerwhen his or her goals are inconsistent with thedecision maker's goals.3.Voluminous dataa.Possibly millions of transactions processed daily viasophisticated computerized systemsb.Multiple product linesc.Multiple transaction locationsplex exchange transactionsa.New and changing business relationships lead toinnovative accounting and reporting problemsb.Potential impact of transactions not quantifiable,leading to increased disclosures1-3 1. Risk-free interest rate This is approximately the rate the bank could earn by investing in U.S. treasury notes for thesame length of time as the business loan.2.Business risk for the customer This risk reflects thepossibility that the business will not be able to repay itsloan because of economic or business conditions such as arecession, poor management decisions, or unexpectedcompetition in the industry.rmation risk This risk reflects the possibility thatthe information upon which the business risk decision wasmade was inaccurate. A likely cause of the information riskis the possibility of inaccurate financial statements.Auditing has no effect on either the risk-free interest rate or business risk. However, auditing can significantly reduce information risk.1-4The four primary causes of information risk are remoteness of information, biases and motives of the provider, voluminous data, and the existence of complex exchange transactions.The three main ways to reduce information risk are:er verifies the information.er shares the information risk with management.3.Audited financial statements are provided.The advantages and disadvantages of each are as follows:1-5 To do an audit, there must be information in a verifiable form and some standards (criteria) by which the auditor can evaluate the information. Examples of established criteria include generally accepted accounting principles and the Internal Revenue Code. Determining the degree of correspondence between information and established criteria is determining whether a given set of information is in accordance with the established criteria. The information for Jones Company's tax return is the federal tax returns filed by the company. The established criteria are found in the Internal Revenue Code and all interpretations. For the audit of Jones Company's financial statements the information is the financial statements being audited and the established criteria are generally accepted accounting principles.1-6The primary evidence the internal revenue agent will use in the audit of the Jones Company's tax return include all available documentation and other information available in Jones' office or from other sources. For example, when the internal revenue agent audits taxable income, a major source of information will be bank statements, the cash receipts journal and deposit slips. The internal revenue agent is likely to emphasize unrecorded receipts and revenues. For expenses, major sources of evidence are likely to be cancelled checks, vendors' invoices and other supporting documentation.1-7This apparent paradox arises from the distinction between the function of auditing and the function of accounting. The accounting function is the recording, classifying and summarizing of economic events to provide relevant information to decision makers. The rules of accounting are the criteria used by the auditor for evaluating the presentation of economic events for financial statements and he or shemust therefore have an understanding of generally accepted accounting principles (GAAP), as well as auditing standards. The accountant need not, and frequently does not, understand what auditors do, unless he or she is involved in doing audits, or has been trained as an auditor.1-81-9Five examples of specific operational audits that could be conducted by an internal auditor in a manufacturing company are:1.Examine employee time cards and personnel records todetermine if sufficient information is available to maximizethe effective use of personnel.2.Review the processing of sales invoices to determine if itcould be done more efficiently.3.Review the acquisitions of goods, including costs, todetermine if they are being purchased at the lowest possiblecost considering the quality needed.4.Review and evaluate the efficiency of the manufacturingprocess.5.Review the processing of cash receipts to determine if theyare deposited as quickly as possible.1-10 When using a strategic systems auditing approach in an audit of historical financial statements, an auditor must have a thorough understanding of the client and its environment. This knowledge should include the client’s regulatory and operating environment, business strategies and processes, and measurement indicators. The strategicsystems approach is also useful in other assurance or consulting engagements. For example, an auditor who is performing an assurance service on information technology would need to understand the client’s business strategies and processes related to information technology, including such things as purchases and sales via the Internet. Similarly, a practitioner performing a consulting engagement to evaluate the efficiency and effectiveness of a cli ent’s manufacturing process would likely start with an analysis of various measurement indicators, including ratio analysis and benchmarking against key competitors.1-11 The major differences in the scope of audit responsibilities are:1.CPAs perform audits in accordance with auditing standards ofpublished financial statements prepared in accordance withgenerally accepted accounting principles.2.GAO auditors perform compliance or operational audits inorder to assure the Congress of the expenditure of publicfunds in accordance with its directives and the law.3.IRS agents perform compliance audits to enforce the federaltax laws as defined by Congress, interpreted by the courts,and regulated by the IRS.4.Internal auditors perform compliance or operational auditsin order to assure management or the board of directors thatcontrols and policies are properly and consistentlydeveloped, applied and evaluated.1-12 The four parts of the Uniform CPA Examination are: Auditing and Attestation, Financial Accounting and Reporting, Regulation, and Business Environment and Concepts.1-13 It is important for CPAs to be knowledgeable about e-commerce technologies because more of their clients are rapidly expanding their use of e-commerce. Examples of commonly used e-commerce technologies include purchases and sales of goods through the Internet, automatic inventory reordering via direct connection to inventory suppliers, and online banking. CPAs who perform audits or provide other assurance services about information generated with these technologies need a basic knowledge and understanding of information technology and e-commerce in order to identify and respond to risks in the financial and other information generated by these technologies.Multiple Choice Questions From CPA Examinations1-14 a. (3) b. (2) c. (2) d. (3)1-15 a. (2) b. (3) c. (4) d. (3)Discussion Questions And Problems1-16 a. The relationship among audit services, attestation services and assurance services is reflected in Figure 1-3 on page 13of the text. Audit services are a form of attestationservice, and attestation services are a form of assuranceservice. In a diagram, audit services are located within theattestation service area, and attestation services arelocated within the assurance service area.b. 1. (1) Audit of historical financial statements2.(2) An attestation service other than an auditservice; or(3) An assurance service that is not an attestationservice (WebTrust developed from the AICPASpecial Committee on Assurance Services, but theservice meets the criteria for an attestationservice.)3.(2) An attestation service other than an auditservice4.(2) An attestation service other than an auditservice5.(2) An attestation service other than an auditservice6.(2) An attestation service that is not an auditservice (Review services are a form ofattestation, but are performed according toStatements on Standards for Accounting andReview Services.)7.(2) An attestation service other than an auditservice8.(2) An attestation service other than an auditservice9.(3) An assurance service that is not an attestationservice1-17 a. The interest rate for the loan that requires a review report is lower than the loan that did not require a review becauseof lower information risk. A review report provides moderateassurance to financial statement users, which lowersinformation risk. An audit report provides further assuranceand lower information risk. As a result of reduced information risk, the interest rate is lowest for the loan with the audit report.b.Given these circumstances, Vial-tek should select the loanfrom City First Bank that requires an annual audit. In this situation, the additional cost of the audit is less than the reduction in interest due to lower information risk. The following is the calculation of total costs for each loan:1-17 (continued)c. Vial-tek may desire to have an audit because of the manyother positive benefits that an audit provides. The auditwill provide Vial-tek’s management with assurance aboutannual financial information used for decision-makingpurposes. The audit may detect errors or fraud, and providemanagement with information about the effectiveness ofcontrols. In addition, the audit may result inrecommendations to management that will improve efficiencyor effectiveness.d. Under a strategic systems audit approach, the auditor musthave a thorough understanding of the client and itsenvironment, including the client’s e-commerce technologies,industry, regulatory and operating environment, suppliers,customers, creditors, and business strategies and processes.This thorough analysis helps the auditor identify risksassociated with the client’s strategies that may affectwhether the financial statements are fairly stated. Whenapplying the strategic systems audit approach, the auditoroften discovers ways to help the client improve businessoperations, thereby providing added value to the auditfunction.1-18 a. The services provided by Consumers Union are very similar to assurance services provided by CPA firms. The servicesprovided by Consumers Union and assurance services providedby CPA firms are designed to improve the quality ofinformation for decision makers. CPAs are valued for theirindependence, and the reports provided by Consumers Union are valued because Consumers Union is independent of the products tested.b.The concepts of information risk for the buyer of anautomobile and for the user of financial statements are essentially the same. They are both concerned with the problem of unreliable information being provided. In the case of the auditor, the user is concerned about unreliable information being provided in the financial statements. The buyer of an automobile is likely to be concerned about the manufacturer or dealer providing unreliable information.c.The four causes of information risk are essentially the samefor a buyer of an automobile and a user of financial statements:(1)Remoteness of information It is difficult for a userto obtain much information about either an automobilemanufacturer or the automobile itself withoutincurring considerable cost. The automobile buyer doeshave the advantage of possibly knowing other users whoare satisfied or dissatisfied with a similarautomobile.(2)Biases and motives of provider There is a conflictbetween the automobile buyer and the manufacturer. Thebuyer wants to buy a high quality product at minimumcost whereas the seller wants to maximize the sellingprice and quantity sold.(3)Voluminous data There is a large amount of availableinformation about automobiles that users might like tohave in order to evaluate an automobile. Either that information is not available or too costly to obtain.1-18 (continued)(4)Complex exchange transactions The acquisition of anautomobile is expensive and certainly a complexdecision because of all the components that go intomaking a good automobile and choosing between a largenumber of alternatives.d.The three ways users of financial statements and buyers ofautomobiles reduce information risk are also similar:(1)User verifies information him or herself That can beobtained by driving different automobiles, examiningthe specifications of the automobiles, talking toother users and doing research in various magazines.(2)User shares information risk with management Themanufacturer of a product has a responsibility to meetits warranties and to provide a reasonable product.The buyer of an automobile can return the automobilefor correction of defects. In some cases a refund maybe obtained.(3)Examine the information prepared by Consumer ReportsThis is similar to an audit in the sense thatindependent information is provided by an independentparty. The information provided by Consumer Reports iscomparable to that provided by a CPA firm that auditedfinancial statements.1-19 a. The following parts of the definition of auditing are related to the narrative:(1)Virms is being asked to issue a report aboutqualitative and quantitative information for trucks.The trucks are therefore the information with which the auditor is concerned.(2)There are four established criteria which must beevaluated and reported by Virms: existence of the trucks on the night of June 30, 2005, ownership of each truck by Regional Delivery Service, physical condition of each truck and fair market value of each truck.(3)Susan Virms will accumulate and evaluate four types ofevidence:(a)Count the trucks to determine their existence.(b)Use registrations documents held by Oatley forcomparison to the serial number on each truck todetermine ownership.(c)Examine the trucks to determine each truck'sphysical condition.(d)Examine the blue book to determine the fairmarket value of each truck.(4)Susan Virms, CPA, appears qualified, as a competent,independent person. She is a CPA, and she spends most of her time auditing used automobile and truck dealerships and has extensive specialized knowledge about used trucks that is consistent with the nature of the engagement.1-19(continued)(5)The report results are to include:(a)which of the 35 trucks are parked in Regional'sparking lot the night of June 30.(b)whether all of the trucks are owned by RegionalDelivery Service.(c)the condition of each truck, using establishedguidelines.(d)fair market value of each truck using thecurrent blue book for trucks.b.The only parts of the audit that will be difficult for Virmsare:(1)Evaluating the condition, using the guidelines of poor,good, and excellent. It is highly subjective to do so.If she uses a different criterion than the "bluebook," the fair market value will not be meaningful.Her experience will be essential in using thisguideline.(2)Determining the fair market value, unless it isclearly defined in the blue book for each condition.1-20 a. The major advantages and disadvantages of a career as an IRS agent, CPA, GAO auditor, or an internal auditor are:1-20 (continued)EMPLOYMENT ADVANTAGES DISADVANTAGESINTERNAL AUDITOR 1.Extensive exposure to allsegments of theenterprise with whichemployed.2.Constant exposure to oneindustry presentingopportunity for expertisein that industry.3.Likely to have exposureto compliance, financialand operational auditing.1.Little exposure totaxation and the auditthereof.2.Experience is limited toone enterprise, usuallywithin one or a limitednumber of industries.(b)Other auditing careers that are available are:Auditors within many of the branches of the federalgovernment ., Atomic Energy Commission)Auditors for many state and local government units .,state insurance or bank auditors)1-21 The most likely type of auditor and the type of audit for each of the examples are:1-22 a. The conglomerate should either engage the management advisory services division of a CPA firm or its own internalauditors to conduct the operational audit.b.The auditors will encounter problems in establishingcriteria for evaluating the actual quantitative events andin setting the scope to include all operations in whichsignificant inefficiencies might exist. In writing thereport, the auditors must choose proper wording to state that no financial audit was performed, that the procedures were limited in scope and that the results reported do not necessarily include all the inefficiencies that might exist.1-23 a. The CPA firm for the Internet company described in this problem could address these customer concerns by performinga WebTrust attestation engagement. The WebTrust assuranceservice was created by the profession to respond to thegrowing need for assurance resulting from the growth ofbusiness transacted over the Internet.b.The appropriate WebTrust principle for each of the customerconcerns noted in the problem is as follows:1.Accuracy of product descriptions and adherence tostated return policies: (3) Processing Integrity.2.Credit card and other personal information: (1) OnlinePrivacy and (2) Security.3.Selling information to other companies: (1) OnlinePrivacy and (2) Security.4.System failure: (4) Availability.Internet Problem Solution: Assurance Services1-1 This problem requires students to work with the AICPA assurance services Web site.1.Considering the assurance needs of customers and thecapabilities of CPAs, the Special Committee on AssuranceServices developed business plans for six assurance services.Chapter 1 of the textbook discussed several of theseservices. Go to the service description for the assuranceservice that most interests you (any one of the six). Whatare the major aspects or sections of the associated businessplan ., does the plan address market potential, competition,etc.)Answer: Each business plan provides background information,describes the service, assesses market potential, discussesissues such as competition and why CPAs should offer theservice, identifies practice tools available and steps thatCPAs must take to begin offering the services.2.The Special Committee's report on Assurance Servicesdiscusses competencies needed by assurance providers todayand in the coming decade. Briefly describe the 5 generalcompetencies needed in the next decade (Hint: See the“About Assurance Services” link. Then follow the“Assurance Services and Academia” link.)Answer:The Committee identified the following five majorimperatives regarding future competencies, each of whichimplies increasing emphasis on the competencies noted:1-1 (continued)Customer focus.Assurance service providers need tounderstand user decision processes and how informationshould enter into those processes. Increased emphasis isneeded on: understanding user needs, communication skills,relationship management, responsiveness and timeliness.Migration to higher value-added information activities. To provide more value to client/decision makers and others, assurance service providers need to focus less on activities involved in the conversion of business events into information ., collecting, classifying, and summarizing activities) and more on activities involved in the transformation of information into knowledge ., analyzing, interpreting, and evaluating activities) that effectively drives decision processes. This will require: analytical skills, business advisory skills, business knowledge, model building (including sensitivity analysis), understanding the client’s business processes, measurement theory (development of operational definitions of concepts, design of appropriate measurement techniques, etc.).Information technology (IT).Assurance services deal in information. Hence, the profound changes occurring in information technology will shape virtually all aspects of assurance services. As information specialists, assurance service providers need to embrace information technology in all of its complex dimensions. Embracing IT means understanding how it is transforming all aspects of business. It also means learning how to effectively use new developments in hardware, software, communications, memory, encryption, etc., in everything assurance service providers do as information specialists, not only in dealing with clients, but also in dealing with each other as individuals,teams, firms, state societies, and national professionalorganizations.Pace of change and complexity. Assurance services will takeplace in an environment of rapid change and increasingcomplexity. Assurance service providers need to investheavily in life-long learning in order to maintain up-to-date knowledge and skills. They will require: intellectualcapability, learning and rejuvenation.Competition.Growth in new assurance services will dependless on franchise/regulation and more on market forces.Assurance service providers need to develop their marketingskills —the ability to see clients’ latent informationand assurance needs and rapidly design and deploy cost-effective services to meet those needs —in order toeffectively compete for market-driven assurance services.Required skills include: marketing and selling,understanding customer needs, designing and deployingeffective solutions.1-1 (continued)(Note: Internet problems address current issues using Internet sources. Because Internet sites are subject to change, Internet problems and solutions are subject to change. Current information on Internet problems is available at。

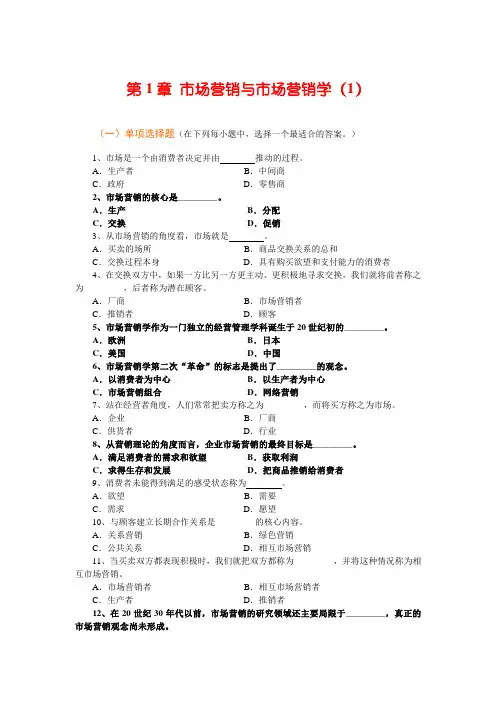

第1章市场营销与市场营销学(1)(一)单项选择题(在下列每小题中,选择一个最适合的答案。

)1、市场是一个由消费者决定并由推动的过程。

A.生产者B.中间商C.政府D.零售商2、市场营销的核心是_________。

A.生产B.分配C.交换D.促销3、从市场营销的角度看,市场就是。

A.买卖的场所B.商品交换关系的总和C.交换过程本身D.具有购买欲望和支付能力的消费者4、在交换双方中,如果一方比另一方更主动、更积极地寻求交换,我们就将前者称之为_________,后者称为潜在顾客。

A.厂商B.市场营销者C.推销者D.顾客5、市场营销学作为一门独立的经营管理学科诞生于20世纪初的_________。

A.欧洲B.日本C.美国D.中国6、市场营销学第二次“革命”的标志是提出了_________的观念。

A.以消费者为中心B.以生产者为中心C.市场营销组合D.网络营销7、站在经营者角度,人们常常把卖方称之为_________,而将买方称之为市场。

A.企业B.厂商C.供货者D.行业8、从营销理论的角度而言,企业市场营销的最终目标是_________。

A.满足消费者的需求和欲望B.获取利润C.求得生存和发展D.把商品推销给消费者9、消费者未能得到满足的感受状态称为。

A.欲望B.需要C.需求D.愿望10、与顾客建立长期合作关系是_________的核心内容。

A.关系营销B.绿色营销C.公共关系D.相互市场营销11、当买卖双方都表现积极时,我们就把双方都称为_________,并将这种情况称为相互市场营销。

A.市场营销者B.相互市场营销者C.生产者D.推销者12、在20世纪30年代以前,市场营销的研究领域还主要局限于_________,真正的市场营销观念尚未形成。

第01章市场营销与市场营销学.2.A.生产领域B.流通领域C.交换领域D.消费领域13、营销理论的基础是_________和价值实现论。

A.价值来源论B.生产目的论C.交换目的论D.消费者主权论14、我国现存最早的市场营销学教材,是由丁馨伯教授编译、复旦大学1933年出版的_________。

SOLUTIONS TO TEXT PROBLEMS:Quick Quizzes1. The four principles of economic decisionmaking are: (1) people face tradeoffs; (2) the cost ofsomething is what you give up to get it; (3) rational people think at the margin; and (4) peoplerespond to incentives. People face tradeoffs because to get one thing that they like, they usually have to give up another thing that they like. The cost of something is what you give up to get it, not just in terms of monetary costs but all opportunity costs. Rational people think at the margin by taking an action if and only if the marginal benefits exceed the marginal costs. Peoplerespond to incentives because as they compare benefits to costs, a change in incentives maycause their behavior to change.2. The three principles concerning economic interactions are: (1) trade can make everyone betteroff; (2) markets are usually a good way to organize economic activity; and (3) governments cansometimes improve market outcomes. Trade can make everyone better off because it allowscountries to specialize in what they do best and to enjoy a wider variety of goods and services.Markets are usually a good way to organize economic activity because the invisible hand leadsmarkets to desirable outcomes. Governments can so metimes improve market outcomes because sometimes markets fail to allocate resources efficiently because of an externality or market power.3. The three principles that describe how the economy as a whole works are: (1) a country’sstandard of living depends on its ability to produce goods and services; (2) prices rise when thegovernment prints too much money; and (3) society faces a short-run tradeoff between inflation and unemployment. A country’s standard of living depends on its ability to produce g oods andservices, which in turn depends on its productivity, which is a function of the education ofworkers and the access workers have to the necessary tools and technology. Prices rise whenthe government prints too much money because more money in circulation reduces the value of money, causing inflation. Society faces a short-run tradeoff between inflation and unemployment that is only temporary and policymakers have some ability to exploit this relationship usingvarious policy instruments.Questions for Review1. Examples of tradeoffs include time tradeoffs (such as studying one subject over another, orstudying at all compared to engaging in social activities) and spending tradeoffs (such as whether to use your last ten dollars on pizza or on a study guide for that tough economics course).2. The opportunity cost of seeing a movie includes the monetary cost of admission plus the timecost of going to the theater and attending the show. The time cost depends on what else youmight do with that time; if it's staying home and watching TV, the time cost may be small, but if it's working an extra three hours at your job, the time cost is the money you could have earned. 3. The marginal benefit of a glass of water depends on your circumstances. If you've just run amarathon, or you've been walking in the desert sun for three hours, the marginal benefit is veryhigh. But if you've been drinking a lot of liquids recently, the marginal benefit is quite low. Thepoint is that even the necessities of life, like water, don't always have large marginal benefits.4. Policymakers need to think about incentives so they can understand how people will respond tothe policies they put in place. The text's example of seat belts shows that policy actions canhave quite unintended consequences. If incentives matter a lot, they may lead to a very2 Chapter 1/Ten Principles of Economicsdifferent type of policy; for example, some economists have suggested putting knives in steeringcolumns so that people will drive much more carefully! While this suggestion is silly, it highlights the importance of incentives.5. Trade among countries isn't a game with some losers and some winners because trade can makeeveryone better off. By allowing specialization, trade between people and trade betweencountries can improve everyone's welfare.6. The "invisible hand" of the marketplace represents the idea that even though individuals andfirms are all acting in their own self-interest, prices and the marketplace guide them to do what is good for society as a whole.7. The two main causes of market failure are externalities and market power. An externality is theimpact of one person’s actions on the well-being of a bystander, such as from pollution or thecreation of knowledge. Market power refers to the ability of a single person (or small group ofpeople) to unduly influence market prices, such as in a town with only one well or only one cable television company. In addition, a market economy also leads to an unequal distribution ofincome.8. Productivity is important because a country's standard of living depends on its ability to producegoods and services. The greater a country's productivity (the amount of goods and servicesproduced from each hour of a worker's time), the greater will be its standard of living.9. Inflation is an increase in the overall level of prices in the economy. Inflation is caused byincreases in the quantity of a nation's money.10. Inflation and unemployment are negatively related in the short run. Reducing inflation entailscosts to society in the form of higher unemployment in the short run.Problems and Applications1. a. A family deciding whether to buy a new car faces a tradeoff between the cost of the carand other things they might want to buy. For example, buyi ng the car might mean theymust give up going on vacation for the next two years. So the real cost of the car is thefamily's opportunity cost in terms of what they must give up.b. For a member of Congress deciding whether to increase spending on national parks, thetradeoff is between parks and other spending items or tax cuts. If more money goesinto the park system, that may mean less spending on national defense or on the policeforce. Or, instead of spending more money on the park system, taxes could be reduced.c. When a company president decides whether to open a new factory, the decision is basedon whether the new factory will increase the firm's profits compared to other alternatives.For example, the company could upgrade existing equipment or expand existing factories.The bottom line is: Which method of expanding production will increase profit the most?d. In deciding how much to prepare for class, a professor faces a tradeoff between thevalue of improving the quality of the lecture compared to other things she could do withher time, such as working on additional research.2. When the benefits of something are psychological, such as going on a vacation, it isn't easy tocompare benefits to costs to determine if it's worth doing. But there are two ways to think aboutChapter 1/Ten Principles of Economics 3 the benefits. One is to compare the vacation with what you would do in its place. If you didn'tgo on vacation, would you buy something like a new set of golf clubs? Then you can decide ifyou'd rather have the new clubs or the vacation. A second way is to think about how much work you had to do to earn the money to pay for the vacation; then you can decide if thepsychological benefits of the vacation were worth the psychological cost of working.3. If you are thinking of going skiing instead of working at your part-time job, the cost of skiingincludes its monetary and time costs, which includes the opportunity cost of the wages you aregiving up by not working. If the choice is between skiing and going to the library to study, then the cost of skiing is its monetary and time costs including the cost to you of getting a lower grade in your course.4. If you spend $100 now instead of saving it for a year and earning 5 percent interest, you aregiving up the opportunity to spend $105 a year from now. The idea that money has a time value is the basis for the field of finance, the subfield of economics that has to do with prices offinancial instruments like stocks and bonds.5. The fact that you've already sunk $5 million isn't relevant to your decision anymore, since thatmoney is gone. What matters now is the chance to earn profits at the margin. If you spendanother $1 million and can generate sales of $3 million, you'll earn $2 million in marginal profit,so you should do so. You are right to think that the project has lost a total of $3 million ($6million in costs and only $3 million in revenue) and you shouldn't have started it. That's true, but if you don't spend the additional $1 million, you won't have any sales and your losses will be $5million. So what matters is not the total profit, but the profit you can earn at the margin. In fact, you'd pay up to $3 million to complete development; any more than that, and you won't beincreasing profit at the margin.6. Harry suggests looking at whether productivity would rise or fall. Productivity is certainlyimportant, since the more productive workers are, the lower the cost per gallon of potion. Ronwants to look at average cost. But both Harry and Ron are missing the other side of theequation−revenue. A firm wants to maximize its profits, so it needs to examine both costs andrevenues. Thus, Hermione is right−it’s best to examine whether the extra revenue wouldexceed the extra costs. Hermione is the only one who is thinking at the margin.7. a. The provision of Social Security benefits lowers an individual’s incentive to save forretirement. The benefits provide some level of income to the individual when he or sheretires. This means that the individual is not entirely dependent on savings to supportconsumption through the years in retirement.b. Since a person gets fewer after-tax Social Security benefits the greater is his or herearnings, there is an incentive not to work (or not work as much) a fter age 65. Themore you work, the lower your after-tax Social Security benefits will be. Thus thetaxation of Social Security benefits discourages work effort after age 65.8. a. When welfare recipients who are able to work have their benefits cut off after two years,they have greater incentive to find jobs than if their benefits were to last forever.b. The loss of benefits means that someone who can't find a job will get no income at all,so the distribution of income will become less equal. But the economy will be moreefficient, since welfare recipients have a greater incentive to find jobs. Thus the changein the law is one that increases efficiency but reduces equity.9. By specializing in each task, you and your roommate can finish the chores more quickly. If you4 Chapter 1/Ten Principles of Economicsdivided each task equally, it would take you more time to cook than it would take your roommate, and it would take him more time to clean than it would take you. By specializing, you reduce the total time spent on chores.Similarly, countries can specialize and trade, making both better off. For example, suppose ittakes Spanish workers less time to make clothes than French workers, and French workers canmake wine more efficiently than Spanish workers. Then Spain and France can both benefit ifSpanish workers produce all the clothes and French workers produce all the wine, and theyexchange some wine for some clothes.10. a. Being a central planner is tough! To produce the right number of CDs by the right artistsand deliver them to the right people requires an enormous amount of information. Youneed to know about production techniques and costs in the CD industry. You need toknow each person's musical tastes and which artists they want to hear. If you make thewrong decisions, you'll be producing too many CDs by artists that people don't want tohear, and not enough by others.b. Your decisions about how many CDs to produce carry over to other decisions. You haveto make the right number of CD players for people to use. If you make too many CDsand not enough cassette tapes, people with cassette players will be stuck with CDs theycan't play. The probability of making mistakes is very high. You will also be faced withtough choices about the music industry compared to other parts of the economy. If youproduce more sports equipment, you'll have fewer resources for making CDs. So alldecisions about the economy influence your decisions about CD production.11. a. Efficiency: The market failure comes from the monopol y by the cable TV firm.b. Equityc. Efficiency: An externality arises because secondhand smoke harms nonsmokers.d. Efficiency: The market failure occurs because of Standard Oil's monopoly power.e. Equityf. Efficiency: There is an externality because of accidents caused by drunk drivers.12. a. If everyone were guaranteed the best health care possible, much more of our nation'soutput would be devoted to medical care than is now the case. Would that be efficient?If you think that currently doctors form a monopoly and restrict health care to keep theirincomes high, you might think efficiency would increase by providing more health care.But more likely, if the government mandated increased spending on health care, theeconomy would be less efficient because it would give people more health care than theywould choose to pay for. From the point of view of equity, if poor people are less likelyto have adequate health care, providing more health care would represent animprovement. Each person would have a more even slice of the economic pie, thoughthe pie would consist of more health care and less of other goods.b. When workers are laid off, equity considerations argue for the unemployment benefitssystem to provide them with some income until they can find new jobs. After all, no oneplans to be laid off, so unemployment benefits are a form of insurance. But there’s anefficiency problem why work if you can get income for doing nothing? The economyisn’t operating efficiently if p eople remain unemployed for a long time, andunemployment benefits encourage unemployment. Thus, there’s a tradeoff betweenequity and efficiency. The more generous are unemployment benefits, the less income islost by an unemployed person, but the more that person is encouraged to remainunemployed. So greater equity reduces efficiency.Chapter 1/Ten Principles of Economics 5 13. Since average income in the United States has roughly doubled every 35 years, we are likely tohave a better standard of living than our parents, and a much better s tandard of living than our grandparents. This is mainly the result of increased productivity, so that an hour of workproduces more goods and services than it used to. Thus incomes have continuously risen overtime, as has the standard of living.14. If Americans save more and it leads to more spending on factories, there will be an increase inproduction and productivity, since the same number of workers will have more equipment towork with. The benefits from higher productivity will go to both the workers, who will get paidmore since they're producing more, and the factory owners, who will get a return on theirinvestments. There is no such thing as a free lunch, however, because when people save more, they are giving up spending. They get higher incomes at the cost of buying fewer goods.15. a. If people have more money, they are probably going to spend more on goods andservices.b. If prices are sticky, and people spend more on goods and services, then output mayincrease, as producers increase output to meet the higher demand rather than raisingprices.c. If prices can adjust, then the higher spending of consumers will be matched withincreased prices and output won't rise.16. To make an intelligent decision about whether to reduce inflation, a policymaker would need toknow what causes inflation and unemployment, as well as what determines the tradeoff between them. Any attempt to reduce inflation will likely lead to higher unemployment in the short run. A policymaker thus faces a tradeoff between the benefits of lower inflation compared to the cost of higher unemployment.。

Chapter 1Introduction to Corporate Finance Multiple Choice Questions1. Conflicts between shareholders and managers are usually resolvedA) by arbitration.B) in favor of shareholders.C) in favor of managers.D) by rules of first priority.E) None of the above.Answer: B Difficulty: Easy Page: 12. Firms issue securities or financial instruments (or claims) to raise capital. These claims areclassified asA) stocks or bonds.B) debt or equity.C) contingent claims on the value of the firm.D) All of the above.E) None of the above.Answer: D Difficulty: Medium Page: 23. The balance sheet is made up of what five key components?A) Fixed assets, current liabilities, long term debt, tangible current assets and shareholders equityB) Intangible fixed assets, current liabilities, long-term debt, net income and current assetsC) Fixed assets, long-term debt, current assets, current liabilities and shareholders equityD) Current assets, fixed assets, long term debt, shareholders equity and retained earningsE) None of the above.Answer: C Difficulty: Medium Page: 34. In terms of the balance sheet model of the firm, the value of the firm in financial markets is equal toA) tangible fixed assets plus intangible fixed assets.B) sales minus costs.C) cash inflow minus cash outflow.D) the value of the debt plus the value of the equity.E) the value of the debt minus the value of the equity.Answer: D Difficulty: Easy Page: 35. Inventory is a(n) ________ account.A) current assetB) current liabilityC) equityD) fixed assetE) long-term liabilityAnswer: A Difficulty: Easy Page: 36. Capital structure is defined as the major financing of the firm. The capital structure is dividedA) between debtholders and creditors.B) creditors and shareholders.C) assets and liabilities.D) All of the above.E) None of the above.Answer: B Difficulty: Medium Page: 47. Using the balance sheet model of the firm, finance may be thought of as analysis of three primarysubject areas. Which of the following groups correctly lists these three areas?A) Capital budgeting, capital structure, net working capitalB) Capital budgeting, capital structure, security marketingC) Capital budgeting, net working capital, tax analysisD) Capital budgeting, tax analysis, security marketingE) Net working capital, tax analysis, security marketingAnswer: A Difficulty: Easy Page: 48. Which of the following is not considered one of the basic questions of corporate finance?A) What long-lived assets should the firm invest?B) How much inventory should the firm hold?C) How can the firm raise cash for required capital expenditures?D) How should the short-term operating cash flows be managed?E) All of the above.Answer: B Difficulty: Medium Page: 49. The need to manage net working capital arises becauseA) financial management is naturally broken into those areas.B) shareholders want to ensure they receive dividend payments.C) there is a mismatch between the timing of cash inflows and cash outflows.D) the sum of current assets and current liabilities usually is zero.E) the capital structure pie is limited in size.Answer: C Difficulty: Easy Page: 410. In the managerial structure of the corporation the two officers and their responsibilities that reportdirectly to the Chief Financial Officer (CFO) areA) the credit manager who handles accounts receivable and the tax manager who minimizes taxpayments.B) the personnel manager who manages salaries and compensation, and the production operationsmanager who manages facility operations.C) the treasurer who is responsible handling cash flow and making financial decisions and the taxmanager who minimizes tax payments.D) the controller who manages the accounting function and the treasurer who is responsiblehandling cash flow and making financial decisions.E) None of the above.Answer: D Difficulty: Easy Page: 5-611. Value is created and recognized over time ifA) cash raised is invested in the investment activities of the firm.B) funds are raised in the capital markets.C) cash paid to investors, shareholders and bondholders, is greater than cash raised in the financialmarkets.D) management pursues activities to reduce taxes to zero.E) All of the above.Answer: C Difficulty: Medium Page: 712. Generally accepted accounting principles may recognize and record a saleA) before a customer pays assuming they will pay soon.B) only after the company receives payment in full.C) when the company receives at least 50% of the total revenue from the customer.D) All of the above.E) None of the above.Answer: A Difficulty: Medium Page: 713. Time preference refers to the fact thatA) corporations match current assets with current liabilities to minimize the chance of bankruptcy.B) corporations match both current and long-term assets with current and long-term liabilities tominimize the change of bankruptcy.C) investors prefer current cash flows to future cash flows.D) investors seek to time cash flows to minimize tax liabilities.E) None of the above.Answer: C Difficulty: Medium Page: 814. Finance determines the value to the firm is based onA) the cash flows of the firm.B) the timing and risk of the cash flows.C) the profits earned under GAAP.D) Both A and C.E) Both A and B.Answer: E Difficulty: Medium Page: 8-915. A corporate security can be viewed as a contingent claim on the firm. This means thatA) debtholders will receive their payoff from the firm based on their fixed claim or the firm cashflows if less than the fixed claim.B) debtholders will receive the maximum of the firm cash flows or the fixed claim.C) no payoff will be made unless the firm makes more than the fixed claim of the debt.D) no debt payoff will be made unless there is an equity payoff.E) None of the above.Answer: A Difficulty: Medium Page: 916. If a firm has debt outstanding the contingent claim of a shareholder isA) equal to the payment to the debtholders.B) equal to the firm cash flows minus the fixed debt payment if the residual cash flows arepositive.C) equal to the firm cash flows minus the fixed debt payment whether positive or negative.D) equal to the debt payment plus the residual cash flow of the firm.E) None of the above.Answer: B Difficulty: Medium Page: 1017. The Simple Corporation has outstanding obligation to the Complex Corporation of $250. It isyear-end and the total cash flow of Simple from all sources is $325. The contingent payoff to the debtholders and the shareholders isA) $250; $325B) $75; $250C) $250; $75D) $325; $250E) None of the above.Answer: C Difficulty: Medium Page: 1018. Sole proprietorships are predominantly started becauseA) they are easily and cheaply setup.B) the proprietorship life is limited to the business owner's life.C) all business taxes are paid as individual tax.D) All of the above.E) None of the above.Answer: D Difficulty: Easy Page: 1119. Which of the following is a true statement concerning partnerships?A) Limited partners are responsible for all debts of the partnership.B) Limited partners generally manage the partnership.C) The income of the general partner is taxed at the corporate income tax rate.D) Partnerships are never terminated and they have infinite life.E) None of the above.Answer: E Difficulty: Easy Page: 1120. The general partner(s) in a general partnership agree to share work, costs, profits, and losses. EachpartnerA) has liability only up to the amount of their investment.B) has liability for the debts of the partnership.C) has liability only if it is formally documented.D) never has any liability but the limited partners do.E) None of the above.Answer: B Difficulty: Medium Page: 1121. In the large corporation, the separation of management and ownership provides the followingadvantage(s)A) it must have a limited life.B) ease of share ownership transfer.C) unlimited shareholder liability.D) Both A and B.E) Both B and C.Answer: B Difficulty: Medium Page: 11-1222. Businesses that are good candidates for incorporation haveA) low taxable income.B) low marginal corporate tax rates.C) low marginal personal tax rates among potential shareholders.D) All of the above.E) None of the above.Answer: D Difficulty: Hard Page: 1423. The Splitz Corporation has borrowed $5 million in debt with a promise to repay $5.5 million in oneyear. The corporation had 10 million shares outstanding worth $2 each at the time of the borrowing.Splitz's net income was earns $6 million during the year. What is the debtholder's contingent claim;how much do the debtholders receive; and, how much do the shareholders receive?A) $5,500,000; $6,000,000; $20,000,000B) $5,000,000; $5,500,000; $0C) $5,000,000; $5,500,000; $20,000,000D) $5,500,000; $5,500,000; $500,000E) $5,000,000; $5,000,000; $1,000,000Answer: D Difficulty: Medium Page: 9-10Rationale:Earnings - Debt Claim = Shareholder Residual or Debt Shortfall = $6,000,000 - $5,500,000 =$500,000; debtholders receive $5,500,000; stockholders receive $500,000.24. The Splitz Corporation has borrowed $5 million in debt with a promise to repay $5.5 million in oneyear. The corporation had 10 million shares outstanding worth $2 each at the time of the borrowing.Splitz earns $5 million during the year. What is the debtholder's contingent claim; how much does the debtholder receive; and, how much do the shareholders receive?A) $5,000,000; $5,500,000; $20,000,000B) $5,500,000; $5,000,000; $0C) $5,000,000; -$500,000; $20,000,000D) -$500,000; $5,000,000; $0.E) $5,000,000; 5,500,000; -$500,000Answer: B Difficulty: Medium Page: 9-10Rationale:Earnings - Debt Claim = Shareholder Residual or Debt Shortfall = $5,000,000 - $5,500,000 =-500,000; debtholders receive $5,000,000; stockholders receive $0.25. Corporate securities are contingent claims becauseA) they don't represent a direct claim on the firm.B) the firm may be bought out.C) the securities value is derived from the value of the firm.D) book value can be negative.E) None of the above.Answer: C Difficulty: Hard Page: 9-1026. Agency costs surrounding the conflict of interest between managers and shareholders areA) the monitoring costs of the shareholders and the residual loss of wealth due to divergentmanagement behavior.B) the costs of implementing control devices and the monitoring costs of the shareholders.C) the costs of implementing control devices and the residual loss of wealth due to divergentmanagement behavior.D) the set-of-contracts needed to structure the firm and residual wealth.E) None of the above.Answer: B Difficulty: Hard Page: 1527. Residual losses surrounding the conflict of interest between shareholders and management arecalledA) reduction in shareholder wealth due to competitors' behaviors.B) a gain to shareholder wealth if the manager does not own stock in the company.C) lost wealth of the shareholders due to divergent behavior of managers.D) Both A and C.E) None of the above.Answer: C Difficulty: Hard Page: 1528. From a finance perspective, what is the primary goal of the corporation?A) Maximize the pay and compensation of employees and managers of the firm.B) Maximize the value of the stockholders because they are the owners of the corporation.C) Maximize the wealth of all stakeholders if the firm wants to continue to exist.D) Maximize the societal value to minimize governmental interference.E) None of the above.Answer: B Difficulty: Easy Page: 1529. Shareholders attempt to control managerial behavior byA) electing the board of directors who select management.B) the threat of a takeover by another firm.C) setting compensation contracts and tying compensation to corporate success.D) Both A and B.E) All of the above.Answer: E Difficulty: Medium Page: 1630. Financial markets are composed ofA) capital markets and equity markets.B) capital markets and debt markets.C) capital markets and money markets.D) equity markets and money markets.Answer: C Difficulty: Easy Page: 1731. The primary market is defined as theA) market for insured securities.B) market for new issues.C) market for securities of the largest firms.D) over-the-counter market.E.) None of the above.Answer: B Difficulty: Easy Page: 1732. Registration of a public issue of new securities with the Securities and Exchange Commission(SEC) requiresA) the use of an underwriter.B) disclosure of all material information in a registration statement.C) the sale of the securities by private negotiation.D) All of the above.E) None of the above.Answer: B Page: 1733. The NYSE and NASDAQ are bothA) primary markets.B) dealer markets.C) secondary markets.D) All of the above.E) None of the above.Answer: C Difficulty: Medium Page: 1834. Which of the following statements concerning registration of publicly available corporatesecurities is false?A) The securities must be registered at the SEC.B) Registration involves the disclosure of relevant information.C) The costs of preparing the registration statement are negligible.D) Private placement of securities avoids registering with the SEC.E) None of the above.Answer: C Difficulty: Easy Page: 1735. The NYSE listing requirements for non-U.S. companies areA) more flexible than those for U.S. companies.B) more stringent than those for U.S. companies.C) the same as those for U.S. companies.D) irrelevant since non U.S. companies cannot list on the NYSE.E) None of the above.Answer: B Difficulty: Medium Page: 1836. In order to list on the NYSE, a firm must haveA) net tangible assets of at least $40 million.B) a market value for publicly held shares of at least $40 million.C) at least 3,000 holders of 100 shares of stock or more.D) Both A and B.E) All of the above.Answer: D Difficulty: Hard Page: 1837. In a limited partnershipA) each partner's liability is limited to his net worth.B) each partner's liability is limited to the amount he put into the partnership.C) each partner's liability is limited to his annual salary.D) there is no limitation on liability; only a limitation on what the partner can earn.E) None of the above.Answer: B Difficulty: Easy Page: 11Essay Questions38. Flea Fall Inc., a maker of dog flea collars, paid $125,000 cash for inventory on January 1, 2004. OnDecember 31, 2004, the company's sales total $147,000 of which $117,000 has been collected. If inventory represents Flea Falls only cost, calculate the firms accounting profit as well as its cash flow as of December 31, 2004.Difficulty: Medium Page: 7-8Answer:Accounting Profit = Sales - Cost [$147,000 - $125,000 = $22,000]Cash Flow = Cash Inflow-Cash Outflow [$117,000 - $125,000 = $-8,000]39. The Harlow Corporation has promised to pay its debtholders an amount of $2,700 over the nextyear. The firm's shareholders hold claim to whatever is left after the debtholders' claims have been satisfied. Calculate Harlow's debt and equity level if its assets total $1,100 at the end of the year.Recalculate for asset levels of $2,200 and $6,000.Difficulty: Medium Page: 9-10Answer:If assets = $1,100: Value of Debt = $1,100; Value of Equity =$0If assets = $2,200: Value of Debt = $2,200; Value of Equity =$0If assets = $6,000: Value of Debt = $2,700; Value of Equity = $3,30040. A financial manager's most important job is to create value from capital budgeting, financing, andliquidity activities. Explain how financial managers create value.Difficulty: Medium Page: 6Answer:∙ Buy assets that generate more than their cost.∙ Sell financial securities that raise more cash than they cost.∙ Minimize cash payouts to non-investors, i.e., taxes to governments.41. The decision to incorporate must consider the fact that earnings will be taxed at both the corporateand personal levels. Since this is disadvantageous, provide three reasons why one may want to incorporate.Difficulty: Hard Page: 12-14Answer:∙ Easier access to capital markets.∙ Retention of funds for reinvestment opportunities.∙ Market pricing and trading of securities.∙ Ownership can be more readily transferred∙ Corporations have unlimited life.∙ Shareholders' liability is limited to the amount invested.42. How can shareholders attempt to control managerial behavior to match shareholder interest?Difficulty: Hard Page: 16Answer:∙ Vote for directors with shareholder's interest to select management.∙ Provide incentive contracts; performance shares or options.∙ Outside threat of takeover.∙ Competition in managerial labor market.。