国际财务管理-第十六章

- 格式:ppt

- 大小:1.80 MB

- 文档页数:18

第一章第一节:国际财务管理的定义⑴视国际财务管理为世界财务管理⑵视国际财务管理为比较财务管理⑶是国际财务管理为跨国公司管理。

国际财务管理的定义:国际财务管理是财务管理的一个新领域,它是按照国际惯例和国际经济法的有关条款,根据国际企业财务收支的特点,组织国际企业的财务活动,处理财务关系的一项经济管理活动。

国际财务管理的特点⑴国际企业的理财环境具有复杂性⑵国际企业的资金筹集具有更多的额可选择性⑶国际企业的资金投放具有较高的风险性。

国际财务管理的容:⑴国际财务管理环境,所谓环境,就是指被研究系统之外的、对被影响系统有影响作用的一切系统的总和。

⑵外汇管理风险。

是指由于汇率的变动而给企业带来的不确定性。

外汇风险分为三类:交易风险,换算风险,经济风险。

⑶国际筹资管理。

国际企业的资金来源主要有:公司部的资金;母公司地主国工资;子公司东道国资金;国际金融机构的资金。

国际企业的筹资方式有:国际股份筹资;国际债券;国际租赁;国际银行信贷;国际金融机构贷款。

⑷国际投资管理。

国际投资是把筹到的资金用于国际生产经营活动,以获取收益的行为。

(5)国际营运资金管理。

国际营运资金管理主要包括存量管理和流量管理。

(6)国际税收管理。

(7)其他容。

包括:国际性财务分析,国际性的企业购并,国际转移价格等。

第一章第二节:国际财务管理目标的特点:(一)国际财务管理的目标在一定时期具有相对稳定性,(二)国际财务管理的目标具有多元化,(三)国际财务管理的目标具有层次性,(四)国际财务管理的目标具有复杂性。

财务管理目标主要观点的评价:1、产值最大化。

它的缺点有:(A)只讲产值,不讲效益。

(B)只讲数量,不求质量。

(C)只抓生产,不抓销售。

(D)只重投入,不讲挖潜。

2、利润最大化。

缺点有:(A)利润最大化没有考虑利润发生的时间,没能考虑资金的时间价值。

(B)利润最大化没能有效地考虑风险问题,这可能会使财务人员不顾风险的大小去追求最多的利润。

(C)利润最大化往往会使企业财务决策带有短期生为的倾向,即只顾实现目前的最大利润,而不顾企业的长远发展。

第一章第一节:国际财务管理的定义⑴视国际财务管理为世界财务管理⑵视国际财务管理为比较财务管理⑶是国际财务管理为跨国公司管理。

国际财务管理的定义:国际财务管理是财务管理的一个新领域,它是按照国际惯例和国际经济法的有关条款,根据国际企业财务收支的特点,组织国际企业的财务活动,处理财务关系的一项经济管理活动。

国际财务管理的特点⑴国际企业的理财环境具有复杂性⑵国际企业的资金筹集具有更多的额可选择性⑶国际企业的资金投放具有较高的风险性。

国际财务管理的内容:⑴国际财务管理环境,所谓环境,就是指被研究系统之外的、对被影响系统有影响作用的一切系统的总和。

⑵外汇管理风险。

是指由于汇率的变动而给企业带来的不确定性。

外汇风险分为三类:交易风险,换算风险,经济风险。

⑶国际筹资管理。

国际企业的资金来源主要有:公司内部的资金;母公司地主国工资;子公司东道国资金;国际金融机构的资金。

国际企业的筹资方式有:国际股份筹资;国际债券;国际租赁;国际银行信贷;国际金融机构贷款。

⑷国际投资管理。

国际投资是把筹到的资金用于国际生产经营活动,以获取收益的行为。

(5)国际营运资金管理。

国际营运资金管理主要包括存量管理和流量管理。

(6)国际税收管理。

(7)其他内容。

包括:国际性财务分析,国际性的企业购并,国际转移价格等。

第一章第二节:国际财务管理目标的特点:(一)国际财务管理的目标在一定时期内具有相对稳定性,(二)国际财务管理的目标具有多元化,(三)国际财务管理的目标具有层次性,(四)国际财务管理的目标具有复杂性。

财务管理目标主要观点的评价:1、产值最大化。

它的缺点有:(A)只讲产值,不讲效益。

(B)只讲数量,不求质量。

(C)只抓生产,不抓销售。

(D)只重投入,不讲挖潜。

2、利润最大化。

缺点有:(A)利润最大化没有考虑利润发生的时间,没能考虑资金的时间价值。

(B)利润最大化没能有效地考虑风险问题,这可能会使财务人员不顾风险的大小去追求最多的利润。

第一部分自学指导第1章:国际财务管理总论一.主要内容1.国际财务管理的概念。

2.国际财务管理的目标。

3.国际财务管理的发展。

二.重点1.国际财务管理基本概念。

2.国际财务管理特点。

3.国际财务管理目标。

三.难点1.国际财务管理目标。

2.国际财务管理特点。

第2章:国际财务管理环境一.主要内容1.国际财务管理环境概述2.国际财务管理的经济环境。

3.国际财务管理社会环境。

二.重点1.国际财务管理环境的概念。

2.研究国际财务管理环境的意义。

3.经济环境对国际财务管理的影响。

4.社会环境对国际财务管理的影响。

三.难点1.国际财务管理环境的概念。

2.环境对国际财务管理影响。

第3章:国际企业的财务分析一.主要内容1.财务分析概述。

2.财务比率分析。

3.财务分析的国际比较。

二.重点1.财务分析基本概念与程序。

2.判别财务指标优劣标准。

3.各种财务指标计算与运用。

4.各国财务比率差异比较。

三.难点1.财务分析程序。

2.在财务分析中正确运用有关标准。

3.财务分析指标运用。

第4章:外汇市场一.主要内容1.外汇市场概论。

2.即期外汇市场。

3.远期外汇市场。

4.货币期货市场。

5.货币期权市场。

二.重点1.外汇市场的概念及其分类、功能。

2.即期和远期外汇市场概念。

3.即期外汇交易的报价。

4.远期外汇合约、远期外汇合约。

5.货币期货概念、市场组成、货币期货合约。

6.货币期权概念、交易类型、货币期权合约三.难点1.外汇市场功能。

2.远期升水与贴水。

3.远期外汇交易报价。

4.货币期货交易功能。

5. 货币期权的估价。

第5章:汇率预测一.主要内容1.汇率概述。

2.汇率决定理论。

3.汇率预测的基本方法。

二.重点1.汇率及其标价法基本概念。

2.汇率升值与贬值。

3.购买力平价说、国际费雪效应、利率平价说等理论基本观点。

4.汇率预测基本方法。

三.难点1.利用汇率计算货币的升值与贬值。

2.汇率决定理论基本观点理解。

第6章:外汇风险管理一.主要内容1.外汇风险的种类。

国际财务管理国际财务管理(现代财务管理的一个新领域)由于世界各国经济活动的国际化,国际大垄断企业的出现和发展、各国之间产品与技术的交换、对外投资等活动,必然产生国际之间的资金运动,即国际财务管理。

国际财务管理是现代财务管理的一个新领域。

概念20世纪80年代,由于美元大幅度贬值,国际游资十分充裕再加上利率水平底,国际过剩资本纷纷寻找出路,更使得国际财务管理成为热门话题。

由于世界各国经济活动的国际化,国际大垄断企业的出现和发展、各国之间产品与技术的交换、对外投资等活动,必然产生国际之间的资金运动,即国际财务管理。

国际经济联系越发展,国际财务管理就越重要。

在西方国家,一般认为财务管理已成为国际企业提高获利能力的关键因素。

国际财务管理是现代财务管理的一个新领域。

作为一门新的科学,国内外学者关于国际财务管理概念的认识还不统一。

一般来讲,财务管理按照其财务活动是否超越国界,可分为国内财务管理和国际财务管理。

纯粹的国内财务管理,其财务活动局限于本国范围之内,资金的筹集、使用和分配等活动通常不跨越国界,这在计划经济环境下是常见的。

而国际财务管理则不同,企业的财务活动跨越了本国国界,与其他国家和地区的有关企业、单位、个人发生财务关系。

企业筹资、投资、分配等活动,均超越国界。

企业参与国际市场的竞争,是市场经济环境下不可避免的。

我们认为,国际财务管理就是对国际企业财务活动的管理。

国际企业是相对于纯粹的国内企业而言,它泛指一切超越国界从事生产经营活动的企业,包括跨国公司、进出口企业、外商投资企业等。

国际财务管理重点1.简述国际财务管理定义的各种观点。

(1)国际财务管理是世界财务管理——研究能在全世界范围内普遍使用的原理方法,使世界各国的财务管理逐渐走向统一。

(2)国际财务管理是比较财务管理——比较不同国家在组织财务收支处理财务关系方面的差异,以便在解决国际间财务问题是不把自己国家的原则强加给对方,求同存异互惠互利。

(3)国际财务管理是跨国公司财务管理——研究跨国公司在组织财务活动处理财务关系时所遇到的特殊问题。

Chapter 16Long-Term FinancingLecture OutlineLong-Term Financing DecisionSources of EquitySources of DebtCost of Debt FinancingMeasuring the Cost of FinancingActual Effects of Exchange Rate Movements on Financing Costs Assessing the Exchange Rate Risk of Debt Financing Use of Exchange Rate ProbabilitiesUse of SimulationReducing Exchange Rate RiskOffsetting Cash InflowsContractsForwardSwapsCurrencyLoansParallelDiversifying Among CurrenciesInterest Rate Risk from Debt FinancingThe Debt Maturity DecisionThe Fixed Versus Floating-rate DecisionHedging With Interest Rate SwapsPlain Vanilla SwapChapter ThemeThis chapter introduces the long-term sources of funds available to MNCs. Should the MNC choose bonds as a medium to attract long-term funds, a currency for denomination must be chosen. This is a critical decision for the MNC. While there is no clear-cut solution, this chapter illustrates how such a problem can be analyzed. A suggested method of presenting this analysis is to run through an example under assumed exchange rates. Then stress that future exchange rates are not known with certainty. Therefore, the firm should consider the possible costs of financing under a variety of exchange rate scenarios.Topics to Stimulate Class Discussion1. Why would U.S. firms consider issuing bonds denominated in a foreign currency?2. What are the desirable characteristics related to a currency’s interest rate (high or low) and value(strong or weak) that would make the currency attractive from a borrower’s perspective?Critical debateAre swaps deceiving the market?Proposition. Yes. Interest rates are charged to firms because the market estimates that the risk is appropriate for the borrower. For MNC’s to then swap the loans is to ignore this judgment and puts lenders at risk and hence the interests of the shareholders.Opposing View. No. The difference in rates is often small and hardly related to non payment. There are other reasons for swaps to do with currencies and changing the nature of the loan, so there is no second guessing the market.With whom do you agree? Provide a reasoned argument as to why you agree or with one of the above views.ANSWER:The swap rates will be in line with forward rates, so that MNCs will not benefit from borrowing low interest rate currencies and simultaneously hedging. As the forward rates are market rates there is little by the way of deceiving the market especially as swaps are usually between highly creditworthy companies.Answers to End of Chapter Questions1. Floating-Rate Bonds.a. What factors should be considered by a UK firm that plans to issue a floating rate bonddenominated in a foreign currency?b. Is the risk of issuing a floating rate bond higher or lower than the risk of issuing a fixed ratebond? Explain.c. How would an investing firm differ from a borrowing firm in the features (i.e., interest rate andcurrency’s future exchange rates) it would prefer a floating rate foreign currency-denominated bond to exhibit?ANSWER:a. A firm should consider the interest rate for each possible currency as well as forecasts of theexchange rate relative to the firm’s home currency. The firm should also determine whether it has future cash inflows in any foreign currencies that could denominate the bond. Finally, the firm should forecast the future path of the coupon rate.b. The risk from issuing a floating rate bond is that the interest rate may rise over time. The riskfrom issuing a fixed rate bond is that the firm is obligated to pay that coupon rate even if interest rates decline. Some firms may feel that a fixed rate bond is less risky since at least they know with certainty the coupon rate they must pay in the future. This question is somewhat open-ended.c. An investing firm prefers a bond denominated in a currency that is expected to appreciate andwith an interest rate that is high and expected to increase. A borrowing firm prefers a bond denominated in a currency that is expected to depreciate and with an interest rate that is low and expected to decrease.2.Risk From Issuing Foreign Currency-Denominated Bonds. What is the advantage of usingsimulation to assess the bond financing position?ANSWER: Unlike point forecasts, simulation provides a distribution of possible outcomes. Thus, the firm can determine the probability that a particular foreign issued bond will be a less expensive source of funds than a locally issued bond.3. Exchange Rate Effects.a. Explain the difference in the cost of financing with foreign currencies during a strong-poundperiod versus a weak-pound period for a UK firm.b. Explain how a UK-based MNC issuing bonds denominated in euros may be able to offset aportion of its exchange rate risk.ANSWER:a. The cost of financing with foreign currencies is low when the pound strengthens, and highwhen the pound weakens.b. It may offset some exchange rate risk if it has cash inflows in euros. These euros could beused to make coupon payments.4.Bond Offering Decision. Columbia plc is a UK company with no foreign currency cash flows. Itplans to issue either a bond denominated in euros with a fixed interest rate or a bond denominated in UK pounds with a floating interest rate. It estimates its periodic pound cash flows for each bond. Which bond do you think would have greater uncertainty surrounding these future pound cash flows? Explain.ANSWER: Exchange rates are generally more volatile than interest rates over time. Therefore the pound value of payments made on euro-denominated bonds would likely be more uncertain than the payments made on floating-rate bonds denominated in pounds. Also, the principal payment is subject to exchange rate risk but not to interest rate risk.5. Currency Diversification. Why would a UK firm consider issuing bonds denominated inmultiple currencies?ANSWER: The firm may issue bonds in multiple currencies to reduce exchange rate risk. This is especially possible when the currencies used to denominate bonds are not highly correlated.6.Financing That Reduces Exchange Rate Risk. Kerr, Plc a major UK exporter of products toJapan, denominates its exports in pounds and has no other international business. It can borrow pounds at 9 percent to finance its operations or borrow yen at 3 percent. If it borrows yen, it will be exposed to exchange rate risk. How can Kerr borrow yen and possibly reduce its economic exposure to exchange rate risk?ANSWER: Kerr could invoice its exports in yen and use the proceeds to pay back loans. Its economic exposure would be reduced because Japanese consumers would not be subjected to exchange rate swings.7. Exchange Rate Effects. Katina, Plc is a UK firm that plans to finance with bonds denominated ineuros to obtain a lower interest rate than is available on pound-denominated bonds. What is the most critical point in time when the exchange rate will have the greatest impact?ANSWER: The most critical time is maturity, since the principal will be paid back at that time.8.Financing Decision. Ivax plc (based in Germany) is a drug company that has attempted to capitalize on new opportunities to expand in Eastern Europe. The production costs in most Eastern European countries are very low, often less than one-fourth of the cost in Germany or Switzerland. Furthermore, there is a strong demand for drugs in Eastern Europe. Ivax penetrated Eastern Europe by purchasing a 60 percent stake in Galena AS, a Czech firm that produces drugs.a. Should Ivax finance its investment in the Czech firm by borrowing euros that would then be converted into koruna (the Czech currency) or by borrowing koruna from a local Czech bank? What information do you need to know to answer this question?b. How can borrowing koruna locally from a Czech bank reduce the exposure of Ivax to exchange rate risk?c. How can borrowing koruna locally from a Czech bank reduce the exposure of Ivax to political risk caused by government regulations?ANSWER:a. Ivax would need to consider the interest rate in the Europe versus the interest rate when borrowingkoruna (the Czech currency). It would also need to consider the potential change in the koruna currency against the euro. If it finances the project in dollars, it is more exposed to exchange rate risk, because the funds would be remitted to Germany before paying the interest expenses on the loan. Conversely, if it finances the project in koruna, it could use some of its local funds to pay off its interest expenses before remitting any funds to the parent. Another reason for borrowing from a local Czech bank is that the bank may help Ivax avoid any excessive regulatory restrictions that could be imposed on foreign firms in the drug industry. These potential advantages of borrowing locally must be weighed against the potentially higher interest rate when borrowing locally.b. By borrowing koruna, the Czech subsidiary of Ivax should make its interest payments beforeremitting any funds to the parent. Therefore, there are less funds that have to be remitted (less exposure) than if the funds are remitted to Europe before interest payments are paid to a European bank.c. By borrowing from a local Czech bank, Ivax may be able to avoid excessive regulations thatcould be imposed on foreign firms by the local government. Also, there is less chance of any extreme action to be taken on a foreign firm when that firm’s failure would cause defaults on loans provided by local lenders.Advanced Questions9. Bond Financing Analysis. Sambuka plc can issue bonds in either UK pounds or in Swiss francs.Pound-denominated bonds would have a coupon rate of 15 percent; Swiss franc-denominated bonds would have a coupon rate of 12 percent. Assuming that Sambuka can issue bonds worth £10,000,000 in either currency, that the current exchange rate of the Swiss franc is £0.47, and that the forecasted exchange rate of the franc in each of the next three years is £0.50, what is the annual cost of financing for the franc-denominated bonds? Which type of bond should Sambuka issue?ANSWER:If Sambuka issues Swiss franc-denominated bonds, the bonds would have a face value of £10,000,000/£0.47 = Sf21,276,595.2Year3YearYear1SF Payment SF2,553,191 SF2,553,191 SF23,829,786£0.50£0.50rateExchange£0.50Payments in £ £1,276,596 £1,276,596 £11,914,893A UK bond at 15% on £10m would cost more (annual payments being £1.5m etc) but can wereally assume that the exchange ratte will stay as it is? A change of 1.5/1.276 – 1 = 17 ½% would make the SF more expensive, this is quite a big change but Sambuka would be wise to carry out a risk assessment.10. Bond Financing Analysis. Hatton ltd has just agreed to a long-term deal in which it willexport products to Japan. It needs funds to finance the production of the products that it will export. The products will be denominated in pounds. The prevailing UK long-term interest rate is 9 percent versus 3 percent in Japan. Assume that interest rate parity exists, and that Hatton believes that the international Fisher effect holds.a. Should Hatton finance its production with yen and leave itself open to exchange rate risk?Explain.b. Should Hatton finance its production with yen and simultaneously engage in forward contractsto hedge its exposure to exchange rate risk?c. How could Hatton plc achieve low-cost financing while eliminating its exposure to exchangerate risk?ANSWER:a. No. The exchange rate of the yen is expected to rise according to the IFE, whichwould offset the interest rate differential.b. No. The forward rate premium should reflect the interest rate differential, so the financing ratewould be 9% if Hawaii used this strategy.c. Hawaii could request that the Japanese importers pay for their imports in yen. It could financein yen at 3% and use a portion of the proceeds from its export revenue to cover its finance payments.11. Cost of Financing. Assume that Seminole, plc considers issuing a Singapore pound-denominatedbond at its present coupon rate of 7 percent, even though it has no incoming cash flows to cover the bond payments. It is attracted to the low financing rate, since UK pound-denominated bonds issued in the United Kingdom would have a coupon rate of 12 percent. Assume that either type of bond would have a four-year maturity and could be issued at par value. Seminole needs to borrow £10 million. Therefore, it will issue either UK pound-denominated bonds with a par value of £10 million or bonds denominated in Singapore dollars with a par value of S$20 million. The spot rate of the Singapore dollar is £0.33. Seminole has forecasted the Singapore dollar’s value at the end of each of the next four years, when coupon payments are to be paid:End of Year Pound Exchange Rateof Singapore1 £0.342 0.353 0.384 0.33Determine the expected annual cost of financing with Singapore pounds. Should Seminole, Plc issue bonds denominated in UK pounds or Singapore pounds? Explain.ANSWER:End of Year:1234 S$ payment S$1,400,000S$1,400,000S$1,400,000 S$21,400,000 Exchange rate £0.340.350.38 0.33£ payment £476,000£490,000£532,000 £7,062,000 S$20m is at the spot rate only worth 20 x 0.33 = £6,600,000 so some borrowing will also be needed. The question is whether the foreign borrowing in S$ is cheaper than the UK equivalent.?12% of £6,600,000 is £792,000 so it would seenm that borrowing in Singapore dollars would be much cheaper. But clearly the validity of the exchange rate predictions must be examined.12.Interaction Between Financing and Invoicing Policies. Assume that Hurricane, plc is a UKcompany that exports products to the United States, invoiced in pounds. It also exports products to Denmark, invoiced in pounds. It currently has no cash outflows in foreign currencies, and it plans to issue bonds in the near future. Hurricane could issue bonds at par value in (1) pounds with a coupon rate of 12 percent, (2) Danish kroner with a coupon rate of 9 percent, or (3) dollars with a coupon rate of 15 percent. It expects the kroner and dollar to strengthen over time. How could Hurricane revise its invoicing policy and make its bond denomination decision to achieve low financing costs without excessive exposure to exchange rate fluctuations?ANSWER: Hurricane could invoice goods exported to Denmark in kroner instead of pounds.Thus, it would now have inflows in kroner that could be used to make coupon payments on bonds denominated in kroner that it could issue. This strategy achieves a cost of financing of 9 percent,which is lower than the cost of other financing alternatives. To the extent that the inflows in kroner can cover bond payments, this strategy is not exposed to exchange rate risk.13.Swap Agreement. Grant, plc is a well-known UK firm that needs to borrow 10 million dollars tosupport a new business in the United States. However, it cannot obtain financing from US banks because it is not yet established within the United States. It decides to issue pound-denominated debt (at par value) in the United Kingdom, for which it will pay an annual coupon rate of 10 percent. It then will convert the pound proceeds from the debt issue into dollars at the prevailing spot rate (the prevailing spot rate is one pound = $1.70). Over each of the next three years, it plans to use the revenue in dollars from the new business in the United States to make its annual debt payment. Grant, plc engages in a currency swap in which it will convert dollars to pounds at an exchange rate of $1.70 per pound at the end of each of the next three years. How many pounds must be borrowed initially to support the new business in the United States? How many dollars should Grant plc specify in the swap agreement that it will swap over each of the next three years in exchange for pounds so that it can make its annual coupon payments to the UK creditors?ANSWER: Since Grant Inc. needs $10 million, Grant will need to issue debt amounting to £5.882 million (computed as $10 million / $1.70 per pound). Grant will pay 10% on the principal amount of £5.882 million annually as a coupon rate, which is equal to £0.5882 million. It should specify that 1 million dollars are to be swapped for pounds in each of the next three years.14.Interest Rate Swap. Janutis plc has just issued fixed rate debt at 10 percent. Yet, it prefers toconvert its financing to incur a floating rate on its debt. It engages in an interest rate swap in which it swaps variable rate payments of LIBOR plus 1 percent in exchange for payments of 10 percent.The interest rates are applied to an amount that represents the principal from its recent debt issue in order to determine the interest payments due at the end of each year for the next three years.Janutis plc expects that the LIBOR will be 9 percent at the end of the first year, 8.5 percent at the end of the second year, and 7 percent at the end of the third year. Determine the financing rate that Janutis plc expects to pay on its debt after considering the effect of the interest rate swap.ANSWER: The fixed rate of 10% to be received from the interest rate swap offsets the 10% payments made on the debt. Therefore, the annual cost of financing on the debt over the next three years is simply the variable rate that is paid out on the interest rate swap. This rate is derived below:End of Year LIBOR Variable Rate Paid Due to Swap1 9.0% 9.0% + 1.0% = 10.0%2 8.5% 8.5% + 1.0% = 9.5%3 7.0% 7.0% + 1.0% = 8.0%。

国际财务管理第⼀章多数为选择判断1 国际企业是国际财务管理的主体2 国际财务管理的基础是国际业务3 国际财务管理的⽬标:企业价值最⼤化—⼀般⽬标4 国际财务管理的原则(每个原则的内容要掌握)㈠收益与风险均衡的原则风险:1.经济与经营⽅⾯的风险,包括汇率、利率变化的风险;通胀的风险;经营管理的风险等2.上层建筑与政治风险,包括政府变动的风险;政策变动的风险;战争的因素;法律的风险等㈡分权与集权结合的原则㈢各⽅利益协调的原则相关者:政府、供应商、股东、债权⼈、管理层、员⼯、顾客、社会公众㈣本⼟化原则㈤有效控制原则第⼆章1 外汇是以外币表⽰的⽤于国际结算的⽀付凭证⼴义的外汇指的是⼀国拥有的⼀切以外币表⽰的资产《外汇管理条例》规定:外汇是指下列以外币表⽰的可以⽤作国际清偿的⽀付⼿段和资产:(⼀)国外货币,包括铸币、钞票等;(⼆)外币⽀付凭证,包括票据、银⾏存款凭证、邮政储蓄凭证等;(三)外币有价证券,包括政府公债、国库券、公司债券、股票、息票等;(四)其他外汇资产其他外狭义的外汇指的是以外国货币表⽰的,为各国普遍接受的,可⽤于国际间债权债务结算的各种⽀付⼿段。

2 .根据外汇交易的交割时间不同,分为即期外汇和远期外汇即期外汇是指外汇买卖成交后,两个营业⽇内交割的外汇远期外汇是指外汇买卖双⽅成交后,在两个营业⽇以后按合同约定的时间按交割的外汇3 根据外汇交割时间长短:现货市场:两个交易⽇期货市场:未来某⼀特定时间4 汇率--亦称“外汇⾏市或汇价”。

⼀国货币兑换另⼀国货币的⽐率,是以⼀种货币表⽰的另⼀种货币的价格。

由于世界各国货币的名称不同,币值不⼀,所以⼀国货币对其他国家的货币要规定⼀个兑换率,即汇率5 汇率制度⼜称汇率安排(Exchange Rate Arrangement):是指⼀国货币当局对汇率制度本国汇率变动的基本⽅式所作的⼀系列安排或规定。

传统上,按照汇率变动的幅度,汇率制度被分为两⼤类型:固定汇率制和浮动汇率制6 汇率的标价⽅式包括直接标价法、间接标价法1.直接标价法:是以⼀定单位(1、100、1000、10000)的外国货币为标准来计算应付出多少单位本国货币,包括中国在内的世界上绝⼤多数国家⽬前都采⽤直接标价法。

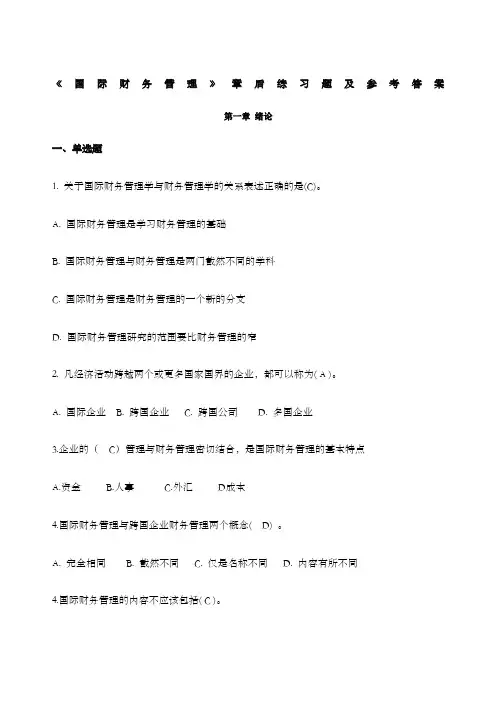

《国际财务管理》章后练习题及参考答案第一章绪论一、单选题1. 关于国际财务管理学与财务管理学的关系表述正确的是(C)。

A. 国际财务管理是学习财务管理的基础B. 国际财务管理与财务管理是两门截然不同的学科C. 国际财务管理是财务管理的一个新的分支D. 国际财务管理研究的范围要比财务管理的窄2. 凡经济活动跨越两个或更多国家国界的企业,都可以称为( A )。

A. 国际企业B. 跨国企业C. 跨国公司D. 多国企业3.企业的(C)管理与财务管理密切结合,是国际财务管理的基本特点A.资金B.人事C.外汇D成本4.国际财务管理与跨国企业财务管理两个概念( D) 。

A. 完全相同B. 截然不同C. 仅是名称不同D. 内容有所不同4.国际财务管理的内容不应该包括( C )。

A. 国际技术转让费管理B. 外汇风险管理C. 合并财务报表管理D. 企业进出口外汇收支管理5.“企业生产经营国际化”和“金融市场国际化”的关系是( C )。

A. 二者毫不相关B. 二者完全相同C. 二者相辅相成D. 二者互相起负面影响二、多选题1.国际企业财务管理的组织形态应考虑的因素有()。

A.公司规模的大小B.国际经营的投入程度C.管理经验的多少D.整个国际经营所采取的组织形式2.国际财务管理体系的内容包括()A.外汇风险的管理B.国际税收管理C.国际投筹资管理D.国际营运资金管3.国际财务管理目标的特点()。

A.稳定性B.多元性C.层次性D.复杂性4.广义的国际财务管理观包括()。

A.世界统一财务管理观B.比较财务管理观C.跨国公司财务管理观D.国际企业财务管理观5. 我国企业的国际财务活动日益频繁,具体表现在( )。

A. 企业从内向型向外向型转化B. 外贸专业公司有了新的发展C. 在国内开办三资企业D. 向国外投资办企业E. 通过各种形式从国外筹集资金三、判断题1.国际财务管理是对企业跨国的财务活动进行的管理。

()2.国际财务管理学是着重研究企业如何进行国际财务决策,使所有者权益最大化的一门科学。