- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

博弈论复旦大学中国经济研究中心

1.Static Game of Complete Information

1.3 Further Discussion on Nash Equilibrium (NE) 1.3.1 NE versus Iterated Elimination of Strict

Dominance Strategies

(2) Players 3 and 4 observe the outcome of the first stage

( a 1 , a 2 ) and then simultaneously choose actions and

from feasible sets A 3 and A 4 , respectively. (3) Payoffs are ui(a1,a2,a3,a4), i 1,2,3,4

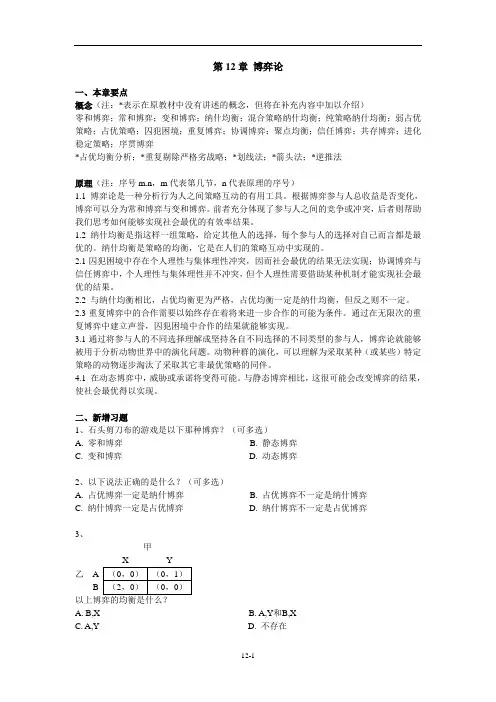

Proposition A In the n -player normal form game

G { S 1,...,S n;u 1,...,u n}

if iterated elimination of strictly dominated strategies

eliminates all but the strategies (s1* , ..., sn* ) , then these

Cont’d

Proposition B In the n -player normal form game

G {S1,...,Sn;u1,...,un}

if the strategies (s1* , ..., sn* ) are a NE, then they survive

iterated elimination of strictly dominated strategies.

a a (1)Players 1 and 2 simultaneously choose actions 1 and 2 from feasible sets A 1 and A 2 respectively.

(2) Payoffs are u i(a 1 ,a 2,a 3 *(a 1 ,a 2),a 4 *(a 1 ,a 2))

;

1

2

i (3) The payoff to firm is given by the profit function

i(qi,qj)qi[P(Q )c]

P(Q)aQis the inverse demand function, Q q1 q2, and

c is the constant marginal cost of production (fixed cost being zero).

FOC:

v (G * * ) G * * v '(G * * ) c 0

(4)

Comparing (3) and (4), we can see that

G*G**

Implications for social and economic systems (Coase Theorem)

2. Dynamic Games of Complete Information

strategies are the unique NE of the game.

A Formal Definition of NE

In the n-player normal form G {S1,...,Sn;u 1,...,un}

the strategies (s1* , ..., sn* )

2.1 Dynamic Games of Complete and Perfect Information

2.1.A Theory: Backward Induction Example: The Trust Game

General features:

a (1) Player 1 chooses an action 1 from the feasible set A 1 . a (2) Player 2 observes 1 and then chooses an action a 2 from

d A dqA

a

2qA

qB

c

0

qA

a

qB 2

c

d 2 A dqA2

2

0

Cont’d

By symmetry, firm B’s problem. Figure Illustration: Response Function, Tatonnement Process Exercise: what will happens if there are n identical Cournot

2.1.B An example: Stackelberg Model of Duopoly

Two firms quantity compete sequentially.

q Timing: (1) Firm 1 chooses a quantity 1

0

;

q q 0 (2) Firm 2 observes and then chooses a quantity

Hardin(1968) : The Tragedy of Commons

Cont’d

There are n farmers in a village. They all graze their goat on the village green. Denote the number of goats the i t h farmer owns

goats to own (to choose g i ).

Cont’d

His payoff is

g iv ( g 1 ... g i 1 g i g i 1 ... g n ) c g i

(1)

In NE (g1*,..., gn*) , for each

i

,

g

* i

must maximize

least one NE, possibly involving mixed strategies.

See Fudenberg and Tirole (1991) for a rigorous proof.

1.4 Applications 1.4.1 Cournot Model

Two firms A and B quantity compete.

Cont’d

A maximum number of goats : Gmax:v(G)0 ,

for G Gmax but v(G) 0 for G Gmax

Also v'(G )0,v''(G )0

The villagers’ problem is simultaneously choosing how manyLeabharlann (1),given

that other farmers choose

(g1*,...,gi*1,gi*1,gn *)

Cont’d

First order condition (FOC):

v (g i g * i) g iv '(g i g * i) c 0 (2)

(where g * i g 1 * ... g i* 1 g i* 1 ... g n * )

are a NE, if for each player i,

s

* i

is (at least tied for) player i’s best response to the strategies

specified for the n-1 other players,

( s 1 * , . . . , s i * 1 , s i * , s i * 1 , . . . , s n * ) u i ( s 1 * , . . . , s i * 1 , s i , s i * 1 , . . . , s n * )

Here the information set is not a singleton.

Consider following games

(1)Players 1 and 2 simultaneously choose actions a 1 and a 2

from feasible sets A 1 and A 2 , respectively.

Cont’d

We solve this game with backward induction

q2argmax2(q1,q2)q2(aq1q2c)

q2 *R2(q1)aq21c

(provided that q1 a c ).

Cont’d

Now, firm 1’s problem

q1argm ax1(q1,R2(q1))q1[aq1R2(q1)c]

by g i , and the total number of goats in the village by Gg1...gn

c Buying and caring each goat cost and value to a farmer of

grazing each goat is v ( G ) .

Summing up all n farmers’ FOC and then dividing by n yields

v(G *)1G *v'(G *)c0 (3) n

Cont’d

In contrast, the social optimum G * * should resolve

m axG v(G )G c

Inverse demand function PaQ,a0

They have the same constant marginal cost, and there is no fixed cost.