技术经济学英文版演示文稿C41

- 格式:ppt

- 大小:563.52 KB

- 文档页数:141

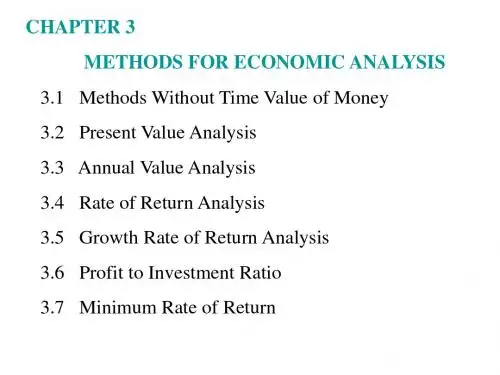

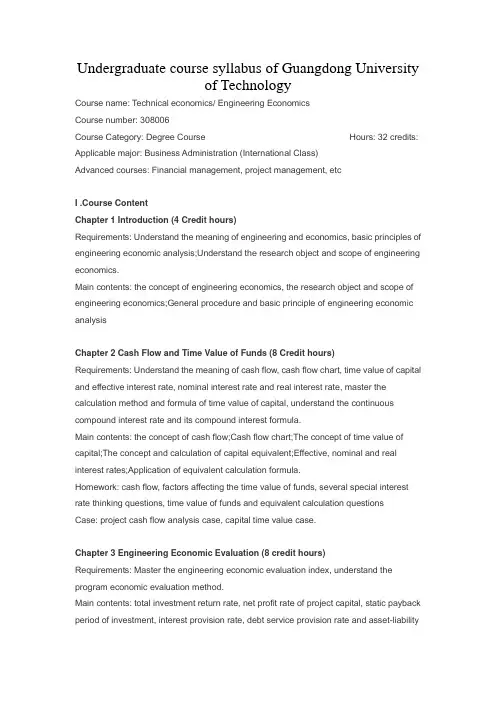

Undergraduate course syllabus of Guangdong Universityof TechnologyCourse name: Technical economics/ Engineering EconomicsCourse number: 308006Course Category: Degree Course Hours: 32 credits: Applicable major: Business Administration (International Class)Advanced courses: Financial management, project management, etcI .Course ContentChapter 1 Introduction (4 Credit hours)Requirements: Understand the meaning of engineering and economics, basic principles of engineering economic analysis;Understand the research object and scope of engineering economics.Main contents: the concept of engineering economics, the research object and scope of engineering economics;General procedure and basic principle of engineering economic analysisChapter 2 Cash Flow and Time Value of Funds (8 Credit hours)Requirements: Understand the meaning of cash flow, cash flow chart, time value of capital and effective interest rate, nominal interest rate and real interest rate, master the calculation method and formula of time value of capital, understand the continuous compound interest rate and its compound interest formula.Main contents: the concept of cash flow;Cash flow chart;The concept of time value of capital;The concept and calculation of capital equivalent;Effective, nominal and real interest rates;Application of equivalent calculation formula.Homework: cash flow, factors affecting the time value of funds, several special interest rate thinking questions, time value of funds and equivalent calculation questionsCase: project cash flow analysis case, capital time value case.Chapter 3 Engineering Economic Evaluation (8 credit hours)Requirements: Master the engineering economic evaluation index, understand the program economic evaluation method.Main contents: total investment return rate, net profit rate of project capital, static payback period of investment, interest provision rate, debt service provision rate and asset-liabilityratio of static evaluation index, dynamic payback period of investment, net present value, net present value rate, net annual value, internal rate of return, present value of expenses and annual value of expenses of dynamic evaluation index;The types of alternatives and their comparison methods.Assignment: calculation of static and dynamic evaluation indexes.Case: Project evaluation caseChapter 4 Uncertainty Analysis and Risk Analysis (6 credit hours) Requirements: Understand the concept and relationship between uncertainty andrisk;Master the basic principles and methods of linear break-even analysis and its application in program evaluation;Master single factor sensitivity analysis;Master risk analysis;Understand nonlinear break-even analysis method and multi-factor sensitivity analysis method.Main contents: break-even analysis: assumed conditions and break-even model of linear break-even analysis, application of linear break-even analysis in investment project evaluation, nonlinear break-even analysis;Sensitivity analysis: the steps and contents of sensitivity analysis, single factor sensitivity analysis, double factor sensitivity analysis and three factor sensitivity analysis of investment projects;Basic principles and main methods of risk analysis.Homework: application of linear break-even analysis in investment project evaluation, single factor sensitivity analysis and cumulative probability analysis.Chapter 5 Financial Evaluation of Construction Projects (4 credit hours) Requirements: Understand the concept, content and steps of financial evaluation of construction projects, understand the calculation of basic financial data, master the financial evaluation of new legal person projects, and understand the financial evaluation of existing legal person projects and non-profit projects.Main Contents:Construction project concept, content and procedure of the project financial evaluation, the concept of financial benefits and costs, the principle of estimate and the estimate content, the selection of financial evaluation parameters, a new report of the project entity project financial evaluation and profit ability, debt paying ability analysis, financial viability analysis, the characteristics of both the project entity project financial evaluation content and evaluation,Types and methods of financial evaluation for non-profit projects.Homework: the concept, content and steps of the financial evaluation of construction projects, the differences and connections between the evaluation methods and contents of the project financial evaluation of the newly established project legal person, the existing project legal person and the non-profit project.Chapter 6Feasibility Study of Construction Project (2 Credit hours) Requirements: Understand the definition, function and procedure of the feasibility study, master the basic framework and main content of the feasibility study, and understand the preparation requirements of the feasibility study report.Main contents: definition, function and procedure of feasibility study, basic framework and main content of feasibility study, requirement of preparation of feasibility study report. Homework: the definition, function, procedure, basic frame and main content of feasibility study.Case: Feasibility study caseIi. Teaching MethodsEngineering economics is a degree course with strong theory and application, and quantitative analysis accounts for a large proportion. Therefore, classroom teaching, homework and case analysis can be used in teaching methods.After each chapter, you will be assigned related thinking questions, exercises, cases and reading reference books.Iv. BibliographWilliam G. Sullivan. Engineering Economics (17th edition), Tsinghua University Press, 2020Xiaojun Liu: Economics of Technology (3rd edition), Science Press, 2014Yuming Liu.Engineering Economics, Tsinghua University Press, 2014V. Assessment methods and requirements:The examination mainly adopts the closed-book method. The specific requirements are that the examination scope should cover all the chapters, and the examination content should objectively reflect the students' memory and mastery of the main concepts of the course, as well as their ability to master and apply the principles and methods of technical and economic analysis.Test questions should be as varied as possible.Total score: 30% for normal homework, 70% for closed-book examinationWriter: Hongyan Lee September 15, 2021。

![[经济市场]工程经济学第四-1章英文版](https://uimg.taocdn.com/0293c57049d7c1c708a1284ac850ad02df80075c.webp)

![18《技术经济学》课程教学大纲(45)[1]](https://uimg.taocdn.com/4dbeedbb1ed9ad51f11df263.webp)

18《技术经济学》课程教学大纲(45)[1]?技术经济学?课程教学大纲课程英文名称:Technical economics 适用专业:工商管理课程类型:专业必修课学时及学分:45学时,3学分先修课程:经济学一、基本目的通过本课程的学习,使学生全面了解投资项目评价的基本方法,可行性研究的基本步骤及可行性论证报告的内容,能作简单的价值工程活动分析。

二、教学基本要求通过本课程的学习,要求学生:1.了解技术与经济的基本关系,经济效果的评价原则 2.掌握常用的静态评价方法。

3.资金的时间价值及其相关计算 4.熟练掌握常用的动态评价方法。

5.能进行一般的敏感分析6.掌握可行性论证的基本步骤和主要内容。

7.掌握价值工程理论及方法。

三、教学内容(一)技术经济学概论技术与经济的关系:技术与经济的关系。

技术经济学研究的对象和内容:技术经济学研究的对象,主要研究的内容技术经济学与其他科学的关系:技术经济学与其他科学的关系。

经济效果的评价原则:经济效果的评价原则技术经济学研究的方法与步骤:研究方法有调查研究和理论研究二种、技术经济学研究的工作程序(二)静态分析法投资收益率法和投资回收期:投资收益率、投资回收期、标准投资回收期和标准投资收益率追加投资效果评价法:追加投资回收期、追加投资效果系数。

最小费用法:标准偿还年限内年费用法、标准偿还年限内总费用法投资方案的可比性:产量不同的可比性、质量不同的可比性(三)利息公式和等值计算货币的时间价值:货币的时间价值利息与利率:单利、复利。

普通复利公式:现金流量图、普通复利公式。

名义利率与实际利率:名义利率与实际利率的含义和换算。

等值计算:等值的概念、等额多次支付中付款间隔期长于复利期的问题、复利计算期长于支付间隔期的问题。

(四)动态分析法投资方案的现金流量:静现金流量及其表示。

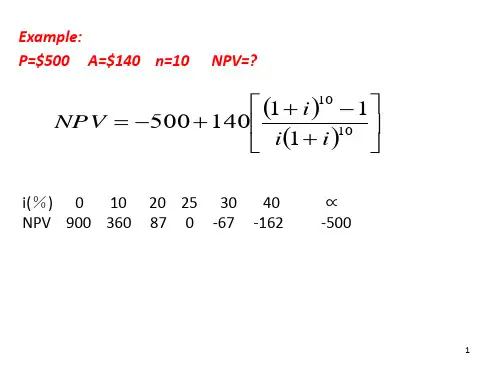

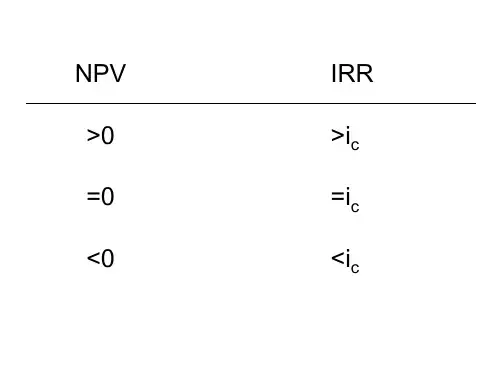

净现值法:净现值计算的步骤、净现值的数学模型。

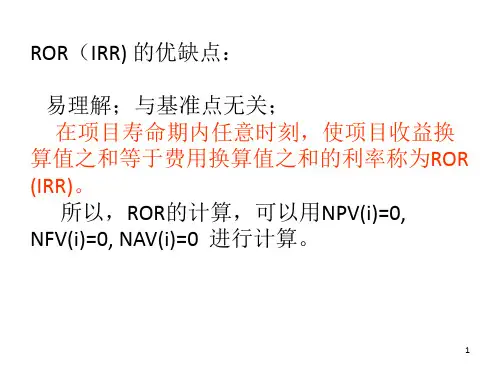

内部收益率:内部收益率的定义、内部收益率的计算方法、内部收益率和净现值的关系、具有多个内部收益率的现金流量。