(完整word版)备用信用证

- 格式:doc

- 大小:13.55 KB

- 文档页数:6

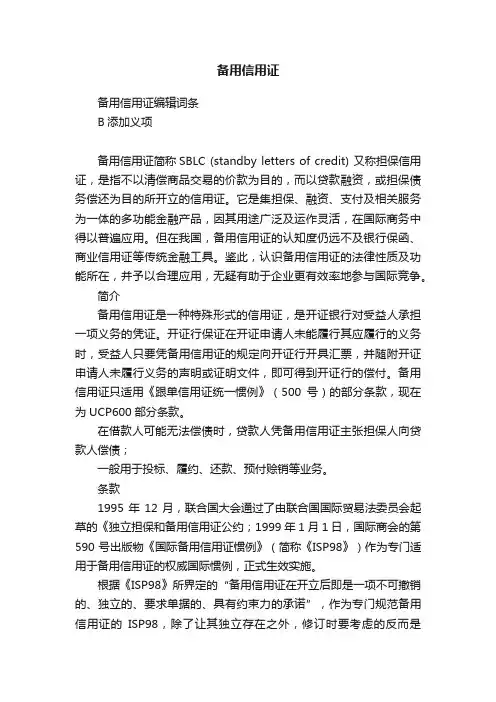

备用信用证备用信用证编辑词条B添加义项备用信用证简称SBLC (standby letters of credit) 又称担保信用证,是指不以清偿商品交易的价款为目的,而以贷款融资,或担保债务偿还为目的所开立的信用证。

它是集担保、融资、支付及相关服务为一体的多功能金融产品,因其用途广泛及运作灵活,在国际商务中得以普遍应用。

但在我国,备用信用证的认知度仍远不及银行保函、商业信用证等传统金融工具。

鉴此,认识备用信用证的法律性质及功能所在,并予以合理应用,无疑有助于企业更有效率地参与国际竞争。

简介备用信用证是一种特殊形式的信用证,是开证银行对受益人承担一项义务的凭证。

开证行保证在开证申请人未能履行其应履行的义务时,受益人只要凭备用信用证的规定向开证行开具汇票,并随附开证申请人未履行义务的声明或证明文件,即可得到开证行的偿付。

备用信用证只适用《跟单信用证统一惯例》(500号)的部分条款,现在为UCP600部分条款。

在借款人可能无法偿债时,贷款人凭备用信用证主张担保人向贷款人偿债;一般用于投标、履约、还款、预付赊销等业务。

条款1995年12月,联合国大会通过了由联合国国际贸易法委员会起草的《独立担保和备用信用证公约;1999年1月1日,国际商会的第590号出版物《国际备用信用证惯例》(简称《ISP98》)作为专门适用于备用信用证的权威国际惯例,正式生效实施。

根据《ISP98》所界定的“备用信用证在开立后即是一项不可撤销的、独立的、要求单据的、具有约束力的承诺”,作为专门规范备用信用证的ISP98,除了让其独立存在之外,修订时要考虑的反而是UCP600是否仍有必要涉及备用信用证。

最终多数意见是备用信用证仍然可依继续适用UCP600。

性质1.不可撤销性。

除非在备用证中另有规定,或经对方当事人同意,开证人不得修改或撤销其在该备用证下之义务。

2.独立性。

备用证下开证人义务的履行并不取决于:①开证人从申请人那里获得偿付的权利和能力。

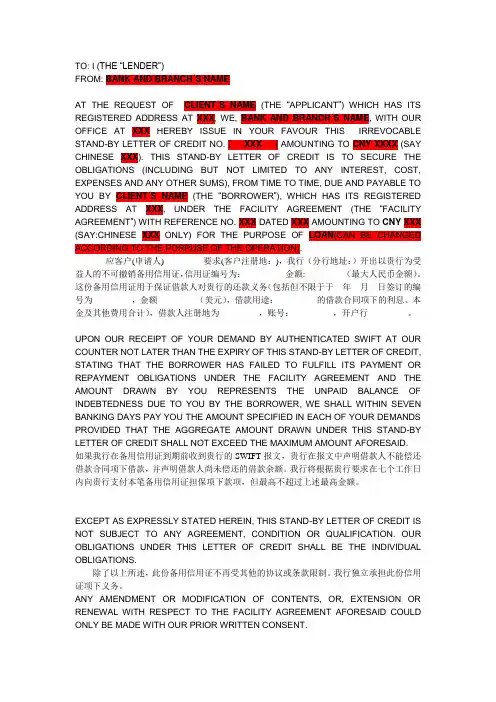

TO: I (THE “LENDER”)FROM: BANK AND BRANCH´S NAMEAT THE REQUEST OF CLIENT´S NAME (THE “APPLICANT”) WHICH HAS ITS REGISTERED ADDRESS AT XXX, WE, BANK AND BRANCH´S NAME, WITH OUR OFFICE AT XXX HEREBY ISSUE IN YOUR FAVOUR THIS IRREVOCABLE STAND-BY LETTER OF CREDIT NO. ( XXX) AMOUNTING TO CNY XXXX (SAY CHINESE XXX). THIS STAND-BY LETTER OF CREDIT IS TO SECURE THE OBLIGATIONS (INCLUDING BUT NOT LIMITED TO ANY INTEREST, COST, EXPENSES AND ANY OTHER SUMS), FROM TIME TO TIME, DUE AND PAYABLE TO YOU BY CLIENT´S NAME (THE “BORROWER”), WHICH HAS ITS REGISTERED ADDRESS AT XXX, UNDER THE FACILITY AGREEMENT (THE “FACILITY AGREEMENT”) WITH REFERENCE NO. XXX DATED XXX AMOUNTING TO CNY XXX (SAY:CHINESE XXX ONLY) FOR THE PURPOSE OF LOAN(CAN BE CHANGED ACCORDING TO THE PORPUSE OF THE OPERATION).应客户(申请人)_________要求(客户注册地:),我行(分行地址:)开出以贵行为受益人的不可撤销备用信用证,信用证编号为:__________金额: _________(最大人民币金额)。

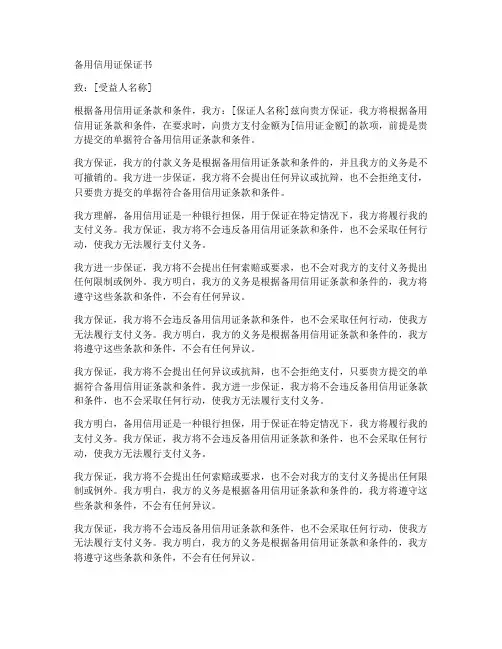

备用信用证保证书致:[受益人名称]根据备用信用证条款和条件,我方:[保证人名称]兹向贵方保证,我方将根据备用信用证条款和条件,在要求时,向贵方支付金额为[信用证金额]的款项,前提是贵方提交的单据符合备用信用证条款和条件。

我方保证,我方的付款义务是根据备用信用证条款和条件的,并且我方的义务是不可撤销的。

我方进一步保证,我方将不会提出任何异议或抗辩,也不会拒绝支付,只要贵方提交的单据符合备用信用证条款和条件。

我方理解,备用信用证是一种银行担保,用于保证在特定情况下,我方将履行我的支付义务。

我方保证,我方将不会违反备用信用证条款和条件,也不会采取任何行动,使我方无法履行支付义务。

我方进一步保证,我方将不会提出任何索赔或要求,也不会对我方的支付义务提出任何限制或例外。

我方明白,我方的义务是根据备用信用证条款和条件的,我方将遵守这些条款和条件,不会有任何异议。

我方保证,我方将不会违反备用信用证条款和条件,也不会采取任何行动,使我方无法履行支付义务。

我方明白,我方的义务是根据备用信用证条款和条件的,我方将遵守这些条款和条件,不会有任何异议。

我方保证,我方将不会提出任何异议或抗辩,也不会拒绝支付,只要贵方提交的单据符合备用信用证条款和条件。

我方进一步保证,我方将不会违反备用信用证条款和条件,也不会采取任何行动,使我方无法履行支付义务。

我方明白,备用信用证是一种银行担保,用于保证在特定情况下,我方将履行我的支付义务。

我方保证,我方将不会违反备用信用证条款和条件,也不会采取任何行动,使我方无法履行支付义务。

我方保证,我方将不会提出任何索赔或要求,也不会对我方的支付义务提出任何限制或例外。

我方明白,我方的义务是根据备用信用证条款和条件的,我方将遵守这些条款和条件,不会有任何异议。

我方保证,我方将不会违反备用信用证条款和条件,也不会采取任何行动,使我方无法履行支付义务。

我方明白,我方的义务是根据备用信用证条款和条件的,我方将遵守这些条款和条件,不会有任何异议。

备用信用证详解及样本什么是备用信用证,备用信用证的融资性质:备用信用证又称担保信用证,是指不以清偿商品交易的价款为目的,而以贷款融资,或担保债务偿还为目的所开立的信用证。

备用信用证是在美国发展起来的一种以融通资金、保证债务为目的的金融工具。

在十九世纪初,美国有关法例限制银行办理保函业务,然而随着各项业务的发展,银行确有为客户提供保证业务的需要,因而产生了备用信用证。

由此可见,备用信用证就是一种银行保函性质的支付承诺。

在备用信用证中,开证行保证在开证申请人未能履行其应履行的义务时,受益人只要凭备用信用证的规定向开证行开具汇票,并随附开证申请人未履行义务的声明或证明文件即可得到开证行偿付。

备用信用证只适用《跟单信用证统一惯例》(500号)的部分条款。

备用信用证有如下性质:1、不可撤销性。

除非在备用证中另有规定,或经对方当事人同意,开证人不得修改或撤销其在该备用证下之义务。

2、独立性。

备用证下开证人义务的履行并不取决于:a.开证人从申请人那里获得偿付的权利和能力;b.受益人从申请人那里获得付款的权利;c.备用证中对任何偿付协议或基础交易的援引;d.开证人对任何偿付协议或基础交易的履约或违约的了解与否。

3、跟单性。

开证人的义务要取决于单据的提示,以及对所要求单据的表面审查。

4、强制性。

备用证在开立后即具有约束力,无论申请人是否授权开立,开证人是否收取了费用,或受益人是否收到或因信赖备用证或修改而采取了行动,它对开证行都是有强制性的。

备用信用证(STANDBY L/C)的种类:根据在基础交易中备用信用证的不同作用主要可分为以下8类:1.履约保证备用信用证(PERFORMANCE STANDBY)——支持一项除支付金钱以外的义务的履行,包括对由于申请人在基础交易中违约所致损失的赔偿。

2.预付款保证备用信用证(ADV ANCE PAYMENT STANDBY)——用于担保申请人对受益人的预付款所应承担的义务和责任。

备用信用证(Standby L/C)国际商会“UCP 500”规定,该惯例也适用于备用信用征。

备用信用证的定义和前述信用证的定义并无不同,都是银行(开证行)应申请人的请求,向受益人开立的,在一定条件下凭规定的单据向受益人支付一定款项的书面凭证。

所不同的是,规定的单据不同。

备用信用证要求受益人提交的单据,不是货运单据,而是受益人出具的关于申请人违约的声明或证明。

传统的银行保函有可能使银行卷入商业纠纷,美、日等国的法律禁止银行开立保函。

于是美国银行采用备用信用证的形式,对国际经济交易行为提供担保。

随着银行保函在应用中性质的变化,特别是1992年国际商会《见索即付保函统一规则》的公布,银行保函和备用信用证的内容和作用已趋一致。

所不同的只是两者遵循的惯例不同。

备用信用证运用于“UCP 600”,而银行保函则适用于上述《规则》。

备用信用证是担保银行向贴现或贷款银行承诺到期为借款方偿还债务,如果借款方到期偿还了贷款,那么,备用信用证就备而不用,如果,借款方到期不归还贷款,那么,备用信用证就起作用,担保银行就要为借款方向贷款银行偿还贷款。

备用信用证有无条件兑付信用证和有条件兑付信用证。

备用信用证样本1:T Bank of communications, SHENYING BranchFrom: XYZ BANKDate: 20 DECEMBER 2004Standby Letter of CreditWith reference to the loan agreement no. 2004HN028 (hereinafter referred to as "the agreement" ) signed between Bank of Communications, SHENYANG Branch (hereinafter referred to as "the lender" ) and LIAONING ABC CO., LTD (hereinafter referred to as "the borrower" )for a principal amount of RMB2,000,000 (in words),we hereby issue our irrevocable standby letter of credit no.810LC040000027D in the lender's favor for amount of the HONGKONG AABBCC CORPORATION which has its registered office at AS 8 FL. 2SEC. CHARACTER RD. HONG KONG for an amount up to UNITED STATES DOLLARS THREE MILLION ONLY.(USD3,000,000) which covers the principal amount of the agreement plus interest accrued from aforesaid principal amount and other charges all of which the borrower has undertaken to pay the lender. The exchange rate will be the buying rate of USD/RMB quoted by Bank of Communications on the date of our payment. In the case that the guaranteed amount is not sufficient to satisfy your claim due to the exchange rate fluctuation between USD and RMB we hereby agree to increase the amount of this standby L/C accordingly.Partial drawing and multiple drawing are allowed under this standby L/C.This standby letter of credit is available by sight payment. We engage with you that upon receipt of your draft(s) and your signed statement or tested telex statement or SWIFT stating that the amount in USD represents the unpaid balance of indebtedness due to you by the borrower, we will pay you within 7 banking days the amount specified in your statement or SWIFT. All drafts drawn hereunder must be marked drawn under XYZ Bank standby letter of credit no. 810LC040000027D dated 20 DECEMBER 2004.This standby letter of is credit will come into effect on 20 DECEMBER 2004 and expire on 09 DECEMBER 2005 at the counter of bank of Communications , SHENYANG branch.This standby letter of credit is subject to Uniform Customs and Practice for Document Credits(1993 revision) International Chamber of Commerce Publication No.500.备用信用证样本2:To: Bank of communications, SHENYANG BranchFrom: XYZ BANKDate: 20 DECEMBER 2004Standby Letter of CreditWith reference to the loan agreement no. 2004HN028 (hereinafter referred to as "the agreement" ) signed between Bank of Communications, SHENYANG Branch (hereinafter referred to as "the lender" ) and LIAONING ABC CO., LTD (hereinafter referred to as "the borrower" )for a principal amount of RMB2,000,000 (in words),we hereby issue our irrevocable standby letter of credit no.810LC040000027D in the lender's favor for amount of the HONGKONG AABBCC CORPORATION which has its registered office at AS 8 FL. 2SEC. CHARACTER RD. HONGKONG for an amount up to UNITED STATES DOLLARS THREE MILLION ONLY.(USD3,000,000) which covers the principal amount of the agreement plus interest accrued from aforesaid principal amount and other charges all of which the borrower has undertaken to pay the lender. The exchange rate will be the buying rate of USD/RMB quoted by Bank of Communications on the date of our payment. In the case that the guaranteed amount is not sufficient to satisfy your claim due to the exchange rate fluctuation between USD and RMB we hereby agree to increase the amount of this standby L/C accordingly.Partial drawing and multiple drawing are allowed under this standby L/C.This standby letter of credit is available by sight payment. We engage with you that uponreceipt of your draft(s) and your signed statement or tested telex statement or SWIFT stating that the amount in USD represents the unpaid balance of indebtedness due to you by the borrower, we will pay you within 7 banking days the amount specified in your statement or SWIFT. All drafts drawn hereunder must be marked drawn under XYZ Bank standby letter of credit no. 810LC040000027D dated 20 DECEMBER 2004.This standby letter of is credit will come into effect on 20 DECEMBER 2004 and expire on 09 DECEMBER 2005 at the counter of bank of Communications , SHENYANG branch.This standby letter of credit is subject to Uniform Customs and Practice for Document Credits(1993 revision) International Chamber of Commerce Publication No.500.。

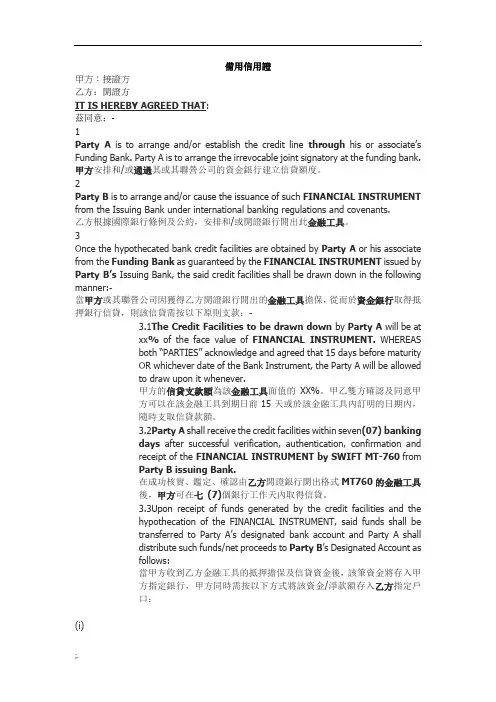

備用信用證甲方:接證方乙方:開證方IT IS HEREBY AGREED THAT:茲同意:-1Party A is to arrange and/or establish the credit line through his or associate’s Funding Bank. Party A is to arrange the irrevocable joint signatory at the funding bank.甲方安排和/或通過其或其聯營公司的資金銀行建立信貸額度。

2Party B is to arrange and/or cause the issuance of such FINANCIAL INSTRUMENT from the Issuing Bank under international banking regulations and covenants.乙方根據國際銀行條例及公約,安排和/或開證銀行開出此金融工具。

3Once the hypothecated bank credit facilities are obtained by Party A or his associate from the Funding Bank as guaranteed by the FINANCIAL INSTRUMENT issued by Party B’s Issuing Bank, the said credit facilities shall be drawn down in the following manner:-當甲方或其聯營公司因獲得乙方開證銀行開出的金融工具擔保,從而於資金銀行取得抵押銀行信貸,則該信貸需按以下原則支款:-3.1The Credit Facilities to be drawn down by Party A will be atxx%of the face value of FINANCIAL INSTRUMENT.WHEREASboth “PARTIES” acknowledge and agreed that 15 days before maturityOR whichever date of the Bank Instrument, the Party A will be allowedto draw upon it whenever.甲方的信貸支款額為該金融工具面值的XX%。

备用信用证详解及样本备用信用证是一种用于保障买卖双方利益的支付方式,特别适用于贸易中存在一定风险或可疑情况的情况下。

它是指在正式信用证未能履行或无法履行时,由发证行按约定条件执行的一种付款代理方式。

下面将详细介绍备用信用证的具体内容,并提供一份备用信用证的样本。

2.信用证号码和日期:备用信用证应有唯一的信用证号码,并标明信用证的日期。

3.被保证金额和货币种类:备用信用证中应明确规定所保证的金额和货币种类。

4.履约条件:备用信用证中应明确规定履约条件,即在何种情况下可以触发备用信用证的履行,如正式信用证未能履行或无法履行。

5.履行期限:备用信用证中应明确规定履行期限,即受益人需要在何时之前提出支付申请并向发证人提供履行文件。

6.履行文件和检查要求:备用信用证中应明确规定受益人需要提供的履行文件,并具体规定发证人对相关文件的检查要求。

7.付款条款和方式:备用信用证中应明确规定付款的条款和方式,包括付款金额、付款期限以及付款方式(如电汇、票据等)。

日期:2024年1月1日发证人:XXXX银行地址:XXXXX街道XX号受益人:XXXX公司地址:XXXXX街道XX号一、被保证金额和货币种类:本备用信用证保证金额为:XXX万美元(大写:XXX万美元),货币种类为美元。

二、履约条件:正式信用证无法履行或未能履行时,本备用信用证将按照第三章第4条的条件履行。

三、履行期限:受益人需在正式信用证无法履行或未能履行之日起的30个工作日内向发证人提出履行申请,并向发证人提供以下履行文件:1.交货清单:受益人应向发证人提供货物的详细交货清单。

2.提单副本:受益人应向发证人提供货物的提单副本。

3.发票:受益人应向发证人提供货物的发票。

四、履行文件和检查要求:发证人将按照国际贸易惯例对受益人提供的履行文件进行检查,确保文件的真实有效。

五、付款条款和方式:受益人向发证人提出履行申请后,发证人将按照条款规定的付款金额、付款期限和付款方式进行支付。

备用信用证条款

备用信用证(Standby Letters of Credit,简称 SBLC)又称担保信用证,是一种特殊形式的信用证,主要用于担保债务偿还或贷款融资等目的,而非直接用于商品交易的价款支付。

备用信用证的条款通常包括以下几个方面:

1. 信用证的基本信息:包括信用证的编号、开证行名称、受益人名称、开证日期、到期日等。

2. 金额和货币种类:信用证中应明确规定担保的最高金额以及所使用的货币种类。

3. 付款条件和单据要求:备用信用证通常需要受益人提供特定的单据作为索赔的依据,如违约声明、汇票等。

同时,条款中会规定开证行在收到符合要求的单据后的付款条件,如即期付款、延期付款等。

4. 有效期和到期地点:备用信用证应明确规定其有效期和到期地点,以便受益人在需要时能够及时索赔。

5. 转让和让渡条款:备用信用证可能包含有关转让和让渡的条款,规定信用证的转让程序和相关当事人的权利义务。

6. 其他特殊条款:根据具体需要,备用信用证还可能包含一些特殊条款,如适用法律、仲裁条款等。

备用信用证详解及样本备用信用证是指在不同情况下,开证行能够根据申请人或受益人的要求,将信用证的付款责任转移到一个备用的信用证上。

备用信用证通常用于贸易业务中,以提供信用支持和确保付款的安全性。

下面将对备用信用证进行详细解析,并提供一个样本。

1.信用支持:备用信用证提供了额外的信用支持,并确保在一些情况下支付能够如期进行,例如出口商无法获得主信用证的付款或主信用证无法满足受益人的需求。

2.灵活性:备用信用证具有更大的灵活性,受益人可以根据实际需要使用备用信用证。

例如,如果主信用证的金额不足以满足受益人的要求,受益人可以要求开证行将付款责任转移到备用信用证上。

3.安全性:备用信用证提供了额外的安全性,使受益人对付款有更高的保障。

无论在何种情况下,备用信用证都能够确保支付的准时进行,避免了付款风险。

4.条件灵活:备用信用证的条件可以根据申请人和受益人的需求进行调整。

开证行和受益人可以协商并制定适当的条款和条件,以满足双方的要求。

以下是一个备用信用证的样本:-----------------------------------------------------------------------------样本备用信用证[信用证编号]贸易条款:1.开证行:[开证行名称和地址]2.申请人:[申请人名称和地址]3.受益人:[受益人名称和地址]4.付款行:[付款行名称和地址]5.有效期:[有效期限]6.金额:[备用信用证金额]7.付款条件:即期信用证,受益人提交符合信用证条款的单据后,开证行将在三个工作日内付款。

单据要求:1.发票:一式三份符合国际贸易规则的发票,包括商品名称、数量、单价和金额等详细信息。

2.装箱单:一式三份的装箱单,详细说明货物包装和运输情况。

3.提单:一式三份正本的清洁提单,表明货物已经发运,并详细说明货物的品名、数量和运输方式。

4.保险单:一式三份的货物保险单,表明货物在运输途中的保险情况,并提供合适的险别和金额。

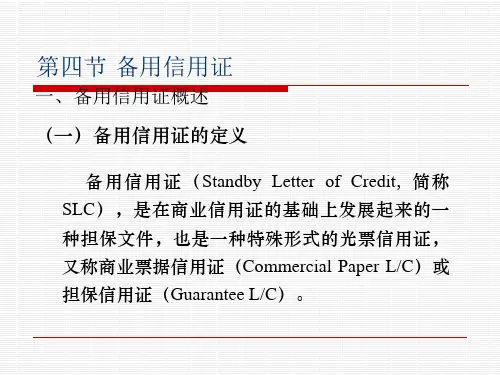

第十二章备用信用证教学内容:备用信用证的定义、种类备用信用证的特点备用信用证的应用范围备用信用证与跟单信用证的区别I S P98主要内容教学重点:备用信用证的特点备用信用证的应用范围第一节备用信用证概述一、备用信用证的定义备用信用证是指依照第三方(申请人)的请求,由担保人或开证行向另一方(受益人)开立的,规定在申请人不履行有关合同时,由担保人或开证行承担第一性付款责任的一种独立保证性的信用证。

二、备用信用证的种类1、履约备用信用证2、预付款备用信用证3、招标/投标备用信用证4、反担保备用信用证5、融资备用信用证6、保险备用信用证7、商业备用信用证8、直接付款备用信用证三、备用信用证的特点1、独立性备用证下开证人义务的履行并不取决于:(1)开证人从申请人那里获得偿付的权利和能力;(2)受益人从申请人那里获得付款的权利;(3)备用证中对任何偿付协议或基础交易的援引;或(4)开证人对任何偿付协议或基础交易的履约或违约的了解与否。

2、不可撤销性除非在备用证中另有规定,或经受益人同意,开证人不得修改或撤销其在备用证下之义务。

3、强制性备用证在开立后即具有约束力,无论申请人是否授权开立,开证人是否收取了费用,或受益人是否收到或因信赖备用证或修改而采取了行动,它对开证行都是有强制性的。

4、单据性开证人的义务要取决于单据的提示,以及对所要求单据的表面审查。

第二节备用信用证的应用范围备用信用证从最初美国银行作为替其客户担保的替代形式发展到现在,其应用范围十分广泛。

只要某人对他人承担一项义务,若他人认为某人的承诺不足以为自己提供足够的安全保障,则可以使用备用信用证。

以下从贸易领域和非贸易领域两个范畴对备用信用证的应用范围做简单介绍。

一、备用信用证在国际贸易中的应用1、预付款情形下可使用备用信用证2、短距离货物运输(近洋贸易)情形下可使用备用信用证3、买卖合同中订有违约金时可使用备用信用证4、商业汇票付款时可使用备用信用证总之,只要为防止对方不履行其贸易合同义务时,均可使用备用信用证来维护自身的权益。

备用信用证ISP98(中文版)规则1:总则本规则司范围、适用、定义和解释1.01范围和适用a.本规则旨在适用于备用信用证(包括履约、融资和直接付款备用信用证)。

b.备用信用证或其它类似承诺,无论如何命名和描述,用于国内或国际,都可通过明确的援引而使其受本规则约束。

c.适用于本规则的承诺,可以明确地变更或排除其条款的适用。

d.适用于本规则的承诺,在下文中简称"备用证"。

1.02与法律和其它规则的关系a.本规则在不被法律禁止的范围内对适用的法律进行补充。

b.在备用证也受其它实务规则制约而其规定与本规则冲突时,以本规则为准。

1.03解释的原则本规则在以下方面应作为商业用法进行解释:a.作为可信赖和有效的付款承诺的备用证的完善性;b.在日常业务中银行和商界的习惯做法和术语:c.全球银行运作和商业体系内的一致性;及d.在解释和适用上的全球统一性。

1.04本规则的效力除非文本另有要求,或明确地进行了对本规则的修改或排除,本规则作为被订人的条款,适用于备用证、保兑、通知、指定、修改、转让、开立申请或下述当事人同意的其它事项:i.开证人;ii.受益人(在其使用备用证的范围内);iii.通知人;iv.保兑人;V.在备用证中被指定并照其行事或同意照其行事的任何人;及vi .授权开立备用证或同意适用本规则的申请人。

1.05有关开证权力和欺诈或滥用权利提款等事项的排除本规则对下述事项不予界定或规定:a.开立备用证的权力或授权;b.对签发备用证的形式要求(如:署名的书面形式);或c.以欺诈、滥用权利或类似情况为根据对承付提出的抗辩。

这些事项留给适用的法律解决。

一般原则1.06备用证的性质a.备用证在开立后即是一个不可撤销的、独立的、跟单的及具有约束力的承诺,并且无需如此写明。

b.因为备用证是不可撤销的,除非在备用证中另有规定,或经对方当事人同意,开证人不得修改或撤销其在该备用证下之义务。

c.因为备用证是独立的,备用证下开证人义务的履行并不取决于:i.开证人从申请人那里获得偿付的权利和能力;ii.受益人从申请人那里获得付款的权利;iii.在备用证中对任何偿付协议或基础交易的援引;或iV.开证人对任何偿付协议或基础交易的履约或违约的了解与否。

备用信用证(Standby L/C)国际商会“UCP 500”规定,该惯例也适用于备用信用征。

备用信用证的定义和前述信用证的定义并无不同,都是银行(开证行)应申请人的请求,向受益人开立的,在一定条件下凭规定的单据向受益人支付一定款项的书面凭证。

所不同的是,规定的单据不同。

备用信用证要求受益人提交的单据,不是货运单据,而是受益人出具的关于申请人违约的声明或证明。

传统的银行保函有可能使银行卷入商业纠纷,美、日等国的法律禁止银行开立保函。

于是美国银行采用备用信用证的形式,对国际经济交易行为提供担保。

随着银行保函在应用中性质的变化,特别是1992年国际商会《见索即付保函统一规则》的公布,银行保函和备用信用证的内容和作用已趋一致。

所不同的只是两者遵循的惯例不同。

备用信用证运用于“UCP 600”,而银行保函则适用于上述《规则》。

备用信用证是担保银行向贴现或贷款银行承诺到期为借款方偿还债务,如果借款方到期偿还了贷款,那么,备用信用证就备而不用,如果,借款方到期不归还贷款,那么,备用信用证就起作用,担保银行就要为借款方向贷款银行偿还贷款。

备用信用证有无条件兑付信用证和有条件兑付信用证。

备用信用证样本1:T Bank of communications, SHENYING BranchFrom: XYZ BANKDate: 20 DECEMBER 2004Standby Letter of CreditWith reference to the loan agreement no. 2004HN028 (hereinafter referred to as "the agreement" ) signed between Bank of Communications, SHENYANG Branch (hereinafter referred to as "the lender" ) and LIAONING ABC CO., LTD (hereinafter referred to as "the borrower" )for a principal amount of RMB2,000,000 (in words),we hereby issue our irrevocable standby letter of credit no.810LC040000027D in the lender's favor for amount of the HONGKONG AABBCC CORPORATION which has its registered office at AS 8 FL. 2SEC. CHARACTER RD. HONG KONG for an amount up to UNITED STATES DOLLARS THREE MILLION ONLY.(USD3,000,000) which covers the principal amount of the agreement plus interest accrued from aforesaid principal amount and other charges all of which the borrower has undertaken to pay the lender. The exchange rate will be the buying rate of USD/RMB quoted by Bank of Communications on the date of our payment. In the case that the guaranteed amount is not sufficient to satisfy your claim due to the exchange rate fluctuation between USD and RMB we hereby agree to increase the amount of this standby L/C accordingly.Partial drawing and multiple drawing are allowed under this standby L/C.This standby letter of credit is available by sight payment. We engage with you that upon receipt of your draft(s) and your signed statement or tested telex statement or SWIFT stating that the amount in USD represents the unpaid balance of indebtedness due to you by the borrower, we will pay you within 7 banking days the amount specified in your statement or SWIFT. All drafts drawn hereunder must be marked drawn under XYZ Bank standby letter of credit no. 810LC040000027D dated 20 DECEMBER 2004.This standby letter of is credit will come into effect on 20 DECEMBER 2004 and expire on 09 DECEMBER 2005 at the counter of bank of Communications , SHENYANG branch.This standby letter of credit is subject to Uniform Customs and Practice for Document Credits(1993 revision) International Chamber of Commerce Publication No.500.备用信用证样本2:To: Bank of communications, SHENYANG BranchFrom: XYZ BANKDate: 20 DECEMBER 2004Standby Letter of CreditWith reference to the loan agreement no. 2004HN028 (hereinafter referred to as "the agreement" ) signed between Bank of Communications, SHENYANG Branch (hereinafter referred to as "the lender" ) and LIAONING ABC CO., LTD (hereinafter referred to as "the borrower" )for a principal amount of RMB2,000,000 (in words),we hereby issue our irrevocable standby letter of credit no.810LC040000027D in the lender's favor for amount of the HONGKONG AABBCC CORPORATION which has its registered office at AS 8 FL. 2SEC. CHARACTER RD. HONGKONG for an amount up to UNITED STATES DOLLARS THREE MILLION ONLY.(USD3,000,000) which covers the principal amount of the agreement plus interest accrued from aforesaid principal amount and other charges all of which the borrower has undertaken to pay the lender. The exchange rate will be the buying rate of USD/RMB quoted by Bank of Communications on the date of our payment. In the case that the guaranteed amount is not sufficient to satisfy your claim due t o the exchange rate fluctuation between USD and RMB we hereby agree to increase the amount of this standby L/C accordingly.Partial drawing and multiple drawing are allowed under this standby L/C.This standby letter of credit is available by sight payment. We engage with you that upon receipt of your draft(s) and your signed statement or tested telex statement or SWIFT stating that the amount in USD represents the unpaid balance of indebtedness due to you by the borrower, we will pay you within 7 banking days the amount specified in your statement or SWIFT. All drafts drawn hereunder must be marked drawn under XYZ Bank standby letter of credit no. 810LC040000027D dated 20 DECEMBER 2004.This standby letter of is credit will come into effect on 20 DECEMBER 2004 and expire on 09 DECEMBER 2005 at the counter of bank of Communications , SHENYANG branch.This standby letter of credit is subject to Uniform Customs and Practice for Document Credits(1993 revision) International Chamber of Commerce Publication N o.500.0。

备用信用证操作流程2024备用信用证操作流程2024备用信用证是一种供应商与买方之间的贸易工具,它在原信用证付款出现问题或无法履约时提供保障。

备用信用证的操作流程主要包括开立备用信用证、提交开证申请、开证行审查等环节。

下面将详细介绍备用信用证的操作流程。

一、开立备用信用证1.买方与卖方达成一致并决定使用备用信用证进行贸易合作。

2.买方向开证行发出申请开备用信用证的要求,并提交相关的文件和信息。

3.开证行审查申请材料,确保符合国际贸易规范和相关法规。

同时,开证行会对买方的信誉和资信状况进行评估。

4.开证行根据买方的要求开立备用信用证,并发送给买方和卖方。

二、提交开证申请1.卖方根据备用信用证的要求提交开证申请,并提供相关的文件和信息。

这些文件通常包括合同、商业发票、包装单、装运单据等。

2.开证行审查开证申请,确保其符合备用信用证的要求,并核实提交的文件的真实性和合法性。

3.开证行向买方发出开证通知书,通知买方备用信用证已被开立,并告知买方在备用信用证有效期内如何发出付款请求。

三、开证行审查1.买方根据备用信用证的要求,在备用信用证有效期内提交付款请求给开证行。

2.开证行接收买方的付款请求,并进行审查。

审查主要包括核对买方的请求是否符合备用信用证规定的条件和限制。

3.如果买方的请求符合备用信用证的要求,开证行会为买方进行支付,并将付款金额划转至卖方的账户。

四、卖方履约1.卖方收到开证行的付款后,按照贸易合同的规定进行履约,并向开证行提交相应的单据以证明履约。

2.开证行对卖方提交的单据进行核查,确保其符合备用信用证的规定。

3.如果卖方提交的单据符合备用信用证的规定,开证行将向买方递交单据,并告知买方有关付款的事宜。

五、买方支付1.买方在收到开证行递交的单据后,对单据进行核查,确保其符合备用信用证的规定。

2.如果单据符合备用信用证的规定,买方会向开证行支付相应的费用。

3.开证行收到买方的付款后,将资金划转给卖方,并完成交易。

(2-1)LG14-012/142 ( SAMPLE LG transferred)

银行保函14-012/142 (可转让银行信用证)

--------------------------- Message Header -------------------------

标题

Swift Input : SBLC 760

SWIFT(环球同业银行金融电讯协会)转入标准:备用信用证760

Sender :WINTER BANK,AUSTRIA

发送者:奥地利冬季银行

SWIFT:

WISMATWWAXXX

Receiver: XXXXXX BANK, CHINA

接收方:中国XX银行

SWIFT:

XXXXXXXXXXXXX

------------------------- Message Text (DRAFT) --------------------------------

汇票

20: Transaction Reference Number

交易文件编号

XXXXXX

12: Sub-Message Type

子消息编号:

760

77E: Proprietary Message

专有信息

REF: LG NO.XXXXX DD XXXXXX AMOUNT:USD 000,000,000,00 ISSUED BY POITGB21XXX

参考:LG NO.XXXXXDDXXXXXX量:美金000,000,000,00,发布点GB21XXX

.

DEAR SIRS, WE

您好先生,

WISMATWWAXXX ACCORDING THE INSTRUCTIONS OF THE FIRST

我们依照某某公司WISMATWWAXXX的要求

BENEFICIARY (TRANSFEROR) XXXXXXXXXXXXXXXXXXXXXXXX, TRANSFER OF THIS LG IN THE AMOUNT OF USD 000,000,000.00 TO THE SECOND BENEFICIARY (TRANSFEREE) AS FOLLOWING:

.受益人(转让方)XXXXXXXXXXXXXXXXXXXXX,以美元结算下的数额USD000,000,000.00到第二受益人(受让人)

QUOTE

引用

27: Sequence of Total

总序列

1/1

20: Transaction Reference Number

交易文件编号

XXXXXX

23: Further Identification

进一步跟进的

Issue

问题

30: Date

日期

XXXXXXXXX某年某月某日

40C: Applicable Rules

适用规则

OTHR

其他

77C: Details of Guarantee

保证的详细细则

LETTER OF GUARANTEE NO: 142/112/XXXXXX

保证书:142/112/XXXXXX

DATE OF ISSUE: 1403XX

签发日期:1403XX

DATE OF MATURITY: 1503XX

到期日期:1503XX

ISSUER: POITGB21, POINT BANK , UK

发送银行:英国点银行GB21

ADDRESS OF THE ISSUER: 11 Church Road, Great Bookham, Surrey, KT23 3PB, UK 发送方地址:11教堂路,大波科海姆,萨里,英国KT23 3PB

APPLICANT: XXXXXXXXXXXXXX

申请人:XXXXXXXXXXXXXXX

SECOND BENEFICIARY'S BANK: XXXXXXXXXX BANK,CHINA

第二受益人银行:XXXXXXXXXXXX银行,中国

SWIFT:(环球同业银行金融电讯协会)

XXXXXXXXXXXXXX

BENEFICIARY: XXXXXXXXX

受益人:XXXXXXXXXXX

ACC NO. XXXXXXXXXXXX

ACC 编号.

AMOUNT (FACE VALUE): USD 000,000,000.00

金额(票面价值):USD000,000,000.00

FOR THE VALUE RECEIVED, WE, THE UNDERSIGNED, POINT BANK LOCATED

AT 11 Church Road, Great Bookham, Surrey, KT23 3PB, UK, HEREBY

IRREVOCABLY AND UNCONDITIONALLY, WITHOUT PROTEST OR

NOTIFICATION, PROMISE TO PAY AGAINST THIS LETTER OF GUARANTEE TO

THE ORDER OF SECOND BENEFICIARY THEREOF, BEFORE OR

AT THE DATE OF MATURITY, UPON RECEIPT OF SECOND BENEFICIARY’S

FIRST WRITTEN DEMAND.

OUR GUARANTEE IS VALID TILL 1503XX AND EXPIRES IN FULL AND

AUTOMATICALLY

为获得彼此共同价值,我们签署英国点银行地址在11 Church Road, Great Bookham, Surrey, KT23 3PB, UK,不可撤销和无条件的,没有抗议或通知,支付承诺没有抗议,支付承诺对本第二受益人的要求,或之前,在到期日,第二受益人要求持有书面收据,我们的担保有效期至1503XX,而且将自动生效

IF WE DO NOT RECEIVE THE REQUEST FOR PAYMENT, EITHER IN WRITING

OR BY SWIFT,

ON OR BEFORE THAT DATE. CLAIMS AND RIGHTS RESULTING THIS L/G CAN

ONLY BE ASSIGNED AND PRESENTED WITH OUR PRIOR WRITTEN CONSENT

(MT 799).

.如果我们没有收到付款要求,以书面形式SWIFT为准则,在该日期或之前,权力利益的产生,本保函只能分配和提交我方事先书面意,(MT799)

SUCH PAYMENT SHALL BE MADE WITHOUT SET-OFF FREE AND CLEAR OF

ANY

DEDUCTION, CHARGES, FEES, OR WITHHOLDING OF ANY ASSESSED BY THE

GOVERNMENT, OR ANY POLITICAL SUBDIVISION OF AUTHORITY THEREOF

OR THEREIN.

此种支付应无抵消和自由,没有任何义务扣除,改变收费或扣缴方式,目前或是以后征收,自动扣交,截留或由及政府的评估或任何政府内权威部门的评估.

THIS GUARANTEE IS AS CASH BACKED, IRREVOCABLE, NEGOTIABLE,

DIVISIBLE, ASSIGNABLE WITHOUT PRESENTATION TO US AND WITHOUT THE PAYMENT OF ANY TRANSFER FEES.

.为了保证现金安全,不可撤销跟单信用证,可转让跟单信用证,可分开跟单信用证,介绍给我们,并不付任何手续费用,

THIS GUARANTEE IS SUBJECT TO THE UNIFORM RULES FOR DEMAND

GUARANTEES, ICC PUBLICATION NO.758.

THIS IS AN OPERATIVE INSTRUMENT AND NO MAIL CONFIRMATION WILL

FOLLOW.

.这种保证是在确定双方利益的前提下订立的,依据国际法条款(ICC)第NO.758。

这是一个有效的相互约定标准,无需邮件确定。

72: SENDER TO RECEIVER INFORMATION

发送到接受通知

KINDLY CONFIRM RECEIPT MT768 AND DATE WHEN ADVISED TO THE

SECOND BENEFICIARY.

请确认收到MT768,并通知第二受益人。

.

REGARDS,

此致敬礼POINT BANK, UK 英国点银行UNQUOTE WINTER BANK 奥地利冬天银行。