公司金融考前模拟题讲解学习

- 格式:doc

- 大小:60.38 KB

- 文档页数:13

金融硕士MF金融学综合(资本结构与公司价值)模拟试卷1(题后含答案及解析)题型有:1. 单项选择题 4. 简答题单项选择题1.最佳资本结构是指( )。

A.每股利润最大时的资本结构B.企业风险最小时的资本结构C.企业目标资本结构D.综合资金成本最低,企业价值最大时的资本结构正确答案:D解析:最佳资本结构的定义即综合资金成本最低,企业价值最大的资本结构。

知识模块:资本结构与公司价值2.调整企业资金结构并不能( )。

A.降低财务风险B.降低经营风险C.降低资金成本D.增强融资弹性正确答案:B解析:经营风险与资金结构无关,资金结构与财务风险相关。

知识模块:资本结构与公司价值3.要使资本结构达到最佳,应使( )达到最低A.边际资本成本B.债务资本成本C.个别资本成本D.综合资本成本正确答案:D解析:这是最佳资本结构的定义。

知识模块:资本结构与公司价值4.通过企业资本结构的调整,可以( )。

A.提高经营风险B.降低经营风险C.影响财务风险D.不影响财务风险正确答案:C解析:资本结构影响财务风险。

知识模块:资本结构与公司价值5.某企业的借入资本和权益资本的比例为1:3,则该企业( )。

A.只有经营风险B.只有财务风险C.没有风险D.既有经营风险又有财务风险正确答案:D解析:经营风险存在于任何企业,而财务风险只存在于有负债的企业中,所以,存在借入资本时,就会具有财务风险,同时也有经营风险。

知识模块:资本结构与公司价值6.(上海财大2012)企业资本总市值与企业占用的投入总资本之差即( )。

A.市场增加值B.经济增加值C.资本增加值D.经济利润正确答案:A解析:经济增加值:税后收益一投入资本。

市场增加值=总市值一投入资本知识模块:资本结构与公司价值7.(上海财大2013)甲乙丙三人讨论债务结构,其中甲认为:(1)一个公司资本结构和财务杠杆没有太大关系,财务杠杆不改变公司向股东分配的权益。

(2)完美市场假设是资本结构不影响公司价值的必要条件之一。

金融学模拟考试题目及答案在下列选项中,哪一项不属于金融市场的范畴?答案:D.房地产市场。

解释:房地产市场属于实物资产市场,不属于金融市场。

答案:A.稳定物价。

解释:货币政策的最终目标包括稳定物价、经济增长、充分就业和国际收支平衡,其中稳定物价是最重要的目标。

答案:D.金融管制放松。

解释:金融创新的推动因素包括技术进步、规避管制、市场竞争和金融管制放松,但金融管制放松不是金融创新的推动因素。

答案:A.对冲风险。

解释:风险管理策略包括对冲风险、承担风险、转移风险和保留风险,其中对冲风险是正确的风险管理策略。

答案:D.增加就业机会。

解释:金融市场的作用包括促进资金融通、促进企业改革和发展、促进产业结构优化,但不包括增加就业机会。

增加就业机会是经济发展的结果,不是金融市场的作用。

答案:货币政策的三大工具包括法定准备金率、再贴现率和公开市场业务。

法定准备金率可以调节货币供应量,再贴现率可以调节贷款成本,公开市场业务可以调节货币供应量。

这些工具的作用是通过调节货币供应量来影响经济活动,从而实现货币政策的最终目标。

请简述资本资产定价模型(CAPM)的主要内容及其应用。

答案:资本资产定价模型(CAPM)是一种用来决定资产合理预期收益的模型,它认为资产的合理预期收益应该等于无风险收益率加上该资产的系统性风险乘以市场风险溢价之和。

CAPM可以用来评估投资组合的风险和收益,以及决定投资组合的有效前沿。

它还可以用来评估股票的内在价值和风险,以及决定股票的合理价格。

CAPM还可以用来评估投资项目的风险和收益,以及决定投资项目的可行性。

第一节听句子,从所给图中选出所听句子的正确答语。

( ) A. It's a book. B. It's on the table. C. It's in the pencil box.( ) A. Yes,there is. B. Yes,there are. C. No,there is no book. ( ) A. Yes,it is. B. No,it isn't. C. Yes,they are.( ) A. It's on the chair. B. They are on the chair. C. They are under the chair.( ) A. Yes,I can. B. No,I can't. C. Yes,I have.听下面一段对话,然后根据所听内容判断下列句子的正误。

一、单项选择题(只有一个正确答案)【1】公司仅将其投资需求满足之后剩余的资金用来发放股利的政策称为()。

A: 在手之鸟股利政策B: 持续增长股利政策C: 剩余股利政策D: 客户效应答案: C【2】Toni’s Tool公司正准备购买设备,可供选择的设备在价格、营运成本、寿命期等方面各不相同,这种类型的资本预算决策应()。

A: 使用折旧税盾方法B: 同时使用净现值法和内部收益率法C: 使用净现值法D: 使用约当年金成本法答案: D【3】现在有两个投资项目甲和乙,已知甲、乙方案收益率的期望值分别为20%、28%,标准差分别为40%、55%,那么()。

A: 甲项目的风险程度小于乙项目的风险程度B: 甲项目的风险程度大于乙项目的风险程度C: 不能确定D: 甲项目的风险程度等于乙项目的风险程度答案: B【4】由无风险资产和风险性资产组合构成的投资组合的集合是()。

A: 有效投资组合从MV向上的一段曲线B: 投资组合有效集的切线C: 经过最小投资组合与横轴垂直的直线D: 从无风险资产伸向所选定的风险性投资组合的直线答案: D【5】依据投资于股票其收益率将不断增长的理论,进行留存收益资本成本估算的方法是()。

A: 风险溢价法B: 风险收益率调整法C: 股利增长模型法D: 资本资产定价模型法答案: C【6】预期下一年分配的股利除以当期股票价格得到的是()。

A: 到期收益率B: 内部收益率C: 资本利得收益率D: 股利收益率答案: D【7】下列各项中,容易使股利支付与盈余脱节的股利政策是()。

A: 低正常股利加额外股利政策B: 剩余股利政策C: 固定股利支付率政策D: 固定股利或稳定增长股利政策答案: C【8】对于一个股票投资组合而言,其方差()。

A: 等于组合中各个股票方差的算数平均数B: 一定大于等于组合中风险最小的股票的方差C: 有可能小于组合中风险最小的股票的方差D: 等于组合中风险最大的股票的方差答案: C【9】假设企业按12%的年利率取得贷款200000元,要求在5年内每年末等额偿还,每年的偿付额应为()元。

初级经济师之初级金融专业模拟考试试卷附有答案详解单选题(共20题)1. “企业过去的交易或者事项形成的、由企业拥有或者控制的、预期会给企业带来经济利益的资源”,这是指会计核算要素中的()。

A.资产B.所有者权益C.收入D.利润【答案】 A2. 作为(),证券公司代表买方或卖方,按照客户提出的价格进行代理交易。

A.交易商B.做市商C.承销商D.经纪商【答案】 D3. 某商业银行受理居民甲定期储蓄存款1万元,年利率为3%,存期为1年。

A.定期储蓄存款、单位定期存款B.单位活期存款、单位定期存款C.活期储蓄存款、单位活期存款D.活期储蓄存款、定期储蓄存款【答案】 D4. 我国贷款通则规定,商业银行针对借款人短期贷款,贷与不贷的答复时间不能超过()个月A.6B.4C.2D.1【答案】 D5. 商业银行通过吸收存款,动员和集中社会闲置资金,然后贷放给资金需求者,这是指商业银行的()职能。

A.货币投放B.货币转换C.支付中介D.信用中介【答案】 D6. 借款人所在国政局动荡、社会动荡、经济恶化、政策多变可能给金融企业带来损失,这是金融企业所蒙受的风险是()。

A.信用风险B.国家风险C.转移风险D.市场风险【答案】 B7. “过去的交易、事项形成并由企业拥有或控制的资源,该资源预期会给企业带来未来经济利益”,这是指会计要素中的( )。

A.资产B.所有者权益C.收入D.利润【答案】 A8. 金融风险管理应当渗透到金融企业的各项业务过程和各个操作环节.覆盖所有的部门、岗位和人员,这体现了金融风险管理的()。

A.垂直管理原则B.全面风险管理原则C.集中管理原则D.独立性原则【答案】 B9. (2018年真题)活期储蓄存款按季计息,每季末月的()日为结息日,按结息日挂牌公告的活期储蓄存款利率计息。

A.1B.10C.20D.25【答案】 C10. 全国的金融监管权集中于中央政府,地方没有独立的权利,在中央一级设立两家或两家以上监管机构,分别负责监管国内不同金融机构,这是()金融监管体制。

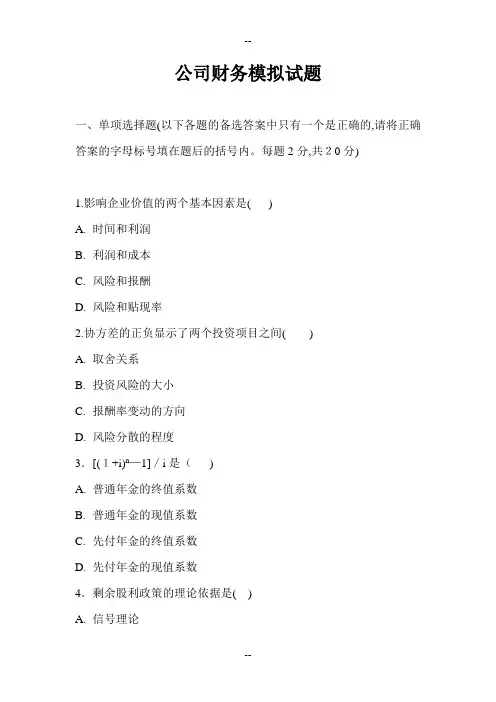

公司财务模拟试题一、单项选择题(以下各题的备选答案中只有一个是正确的,请将正确答案的字母标号填在题后的括号内。

每题2分,共20分)1.影响企业价值的两个基本因素是( )A.时间和利润B.利润和成本C.风险和报酬D.风险和贴现率2.协方差的正负显示了两个投资项目之间()A.取舍关系B.投资风险的大小C.报酬率变动的方向D.风险分散的程度3.[(1+i)n—1]/i是()A.普通年金的终值系数B.普通年金的现值系数C.先付年金的终值系数D.先付年金的现值系数4.剩余股利政策的理论依据是( )A.信号理论B.税差理论C.MM理论D.“一鸟在手”理论5.存货控制的基本方法是( )A.稳健的资产组合策略B.激进的资产组合策略C.中庸的资产组合策略D.经济批量控制法6.资本资产定价模型的核心思想是将( )引入到对风险资产的定价中来。

A. 无风险报酬率B.风险资产报酬率C.投资组合D. 市场组合7.在存货日常管理中达到最佳采购批量时( )A.持有成本加上订购成本最低B.订购成本低于持有成本C.订购成本最低D.持有成本低于定价成本8.在财务管理实务中一般把()作为无风险报酬率。

A.定期存款报酬率B.投资报酬率C.预期报酬率D.短期国库券报酬率9.机会成本不是通常意义上的成本,而是( )A.一种费用B.一种支出C.失去的收益D.实际发生的收益10.一般而言,一个投资项目,只有当其()高于其资本成本率,在经济上才是合理的;否则,该项目将无利可图,甚至会发生亏损。

A.预期资本成本率B.投资收益率C.无风险收益率D.市场组合的期望收益率二、多项选择题(以下各题的备选答案中有两个或两个以上是正确的,请将正确答案的字母标号填在题后的括号内,多选、漏选均不得分。

每题2分,共20分)1.风险报酬包括( )A.通货膨胀补偿B.违约风险报酬C.流动性风险报酬D.期限风险报酬2.二十世纪七、八十年代后出现了一些新的资本结构理论,主要有( )A.MM资本结构理论B.代理成本理论C.啄序理论D.信号传递理论3.企业的财务活动包括( )A.企业筹资引起的财务活动B.企业投资引起的财务活动C.企业经营引起的财务活动D.企业分配引起的财务活动4.下列收付形式中,属于年金收付的是( )A.分期偿还贷款B.发放养老金C.支付租金D.提取折旧(直线法)5.公司的基本目标可以概括为( )A.生存B.发展C.获利D.稳定6.按照企业经营业务发生的性质将企业一定时期内产生的现金流量归纳为()A.企业经营活动产生的现金流量B.投资活动中产生的现金流量C.股利分配过程中产生的现金流量D.筹资活动中产生的现金流量7.期间费用主要包括()A.生产费用B.财务费用C.营业费用D.管理费用8.财务分析的方法主要有( )A. 比较分析法B. 比率分析法C.因素分析法D.平衡分析法9.资产整合应遵循的原则主要有( )A.协调性原则B.适应性原则C. 即时出售原则D.成本收益原则10. 按我国《证券法》和《股票发行与交易管理暂行条例》等规定,股票发行有( )等形式。

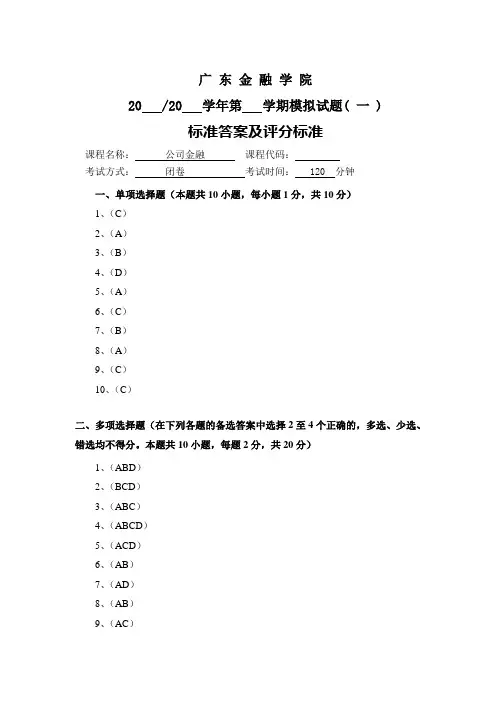

广东金融学院20 /20 学年第学期模拟试题( 一 )标准答案及评分标准课程名称:公司金融课程代码:考试方式:闭卷考试时间: 120 分钟一、单项选择题(本题共10小题,每小题1分,共10分)1、(C)2、(A)3、(B)4、(D)5、(A)6、(C)7、(B)8、(A)9、(C)10、(C)二、多项选择题(在下列各题的备选答案中选择2至4个正确的,多选、少选、错选均不得分。

本题共10小题,每题2分,共20分)1、(ABD)2、(BCD)3、(ABC)4、(ABCD)5、(ACD)6、(AB)7、(AD)8、(AB)9、(AC)10、(BCD )三、判断题(要求:正确打√,错误打×)(本题共10小题,每小题1分,共10分)1、(×)2、(√)3、(×)4、(√)5、(√)6、(√)7、(√)8、(√)9、(√) 10、(×)四、计算题:(本题共3小题,共35分)1、(10分)(1)该公司放弃3/10的现金折扣成本为:()()1030×31360×3--%%×100%=55.67%放弃1/20的现金折扣成本为:()()2030×11360×1--%%×100%=36.4%均大于此时银行短期贷款利率15%,所以对公司最有利的付款日期为10天。

(2)如果短期投资报酬率为40%,大于36.4%的最低放弃现金折扣成本,公司可以放弃现金折扣成本,最有利的付款日期为30日。

2、(15分) (1)由公式DOL =FVC S VC S ---可得,基期的经营杠杆系数为:DOL =()()40000812×20000812×20000---=2 基期息税前利润=S -VC -F=20000×(12-8)-40000 =40000 当销售量下降25%时, 息税前利润=S -VC -F=20000×(1-25%)×(12-8)-40000 =20000 下降的幅度为400002000040000-×100%=50%(2)基期的息税前利润EBIT =20000×(12-8)-40000 =40000 债务筹资的利息额I =300000×40%×10% =12000 得:基期财务杠杆系数DFL =120004000040000-=1.43 (3)总杠杆系数DTL =DOL·DFL =2×1.43=2.86 3、(10分)(1)债券资本成本=8%×(1-30%)÷(1-2%)=5.71%(2)优先股资本成本=10%÷(1-3%)=10.3l % (3)普通股资本成本=8%÷(1-6%)+5%=13.51% (4)该筹资组合方案的综合资本成本率为:综合资本成本率=5.71%×0.5+10.31%×0.25+13.51%×0.25=15.10% (3分)五、计算分析题(本题共1小题,共25分)解:(1)项目每年折旧额=4120=30(万元)(2)NPV 1=42×0.893=37.506(万元) NPV 2=87×0.797=69.339(万元) NPV 3=132×0.712=93.984(万元) NPV 4=217×0.636=138.012(万元)未来报酬的总现值= NPV 1+ NPV 2+ NPV 3+ NPV 4 =338.841(万元) 该项目的净现值=未来报酬的总现值-初始投资额现值 =338.841-140 =198.841(万元) 所以该项目可行 (3)略。

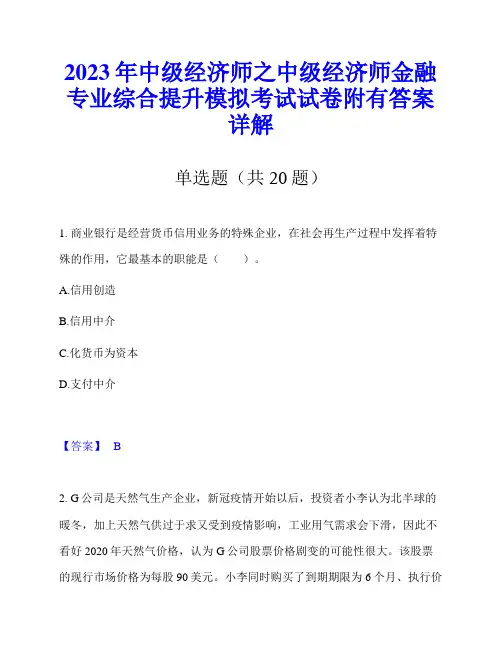

2023年中级经济师之中级经济师金融专业综合提升模拟考试试卷附有答案详解单选题(共20题)1. 商业银行是经营货币信用业务的特殊企业,在社会再生产过程中发挥着特殊的作用,它最基本的职能是()。

A.信用创造B.信用中介C.化货币为资本D.支付中介【答案】 B2. G公司是天然气生产企业,新冠疫情开始以后,投资者小李认为北半球的暖冬,加上天然气供过于求又受到疫情影响,工业用气需求会下滑,因此不看好2020年天然气价格,认为G公司股票价格剧变的可能性很大。

该股票的现行市场价格为每股90美元。

小李同时购买了到期期限为6个月、执行价格为95美元的一个看涨期权和一个看跌期权来进行套利。

看涨期权成本为8美元,看跌期权成本为10美元。

A.2B.3C.-3D.-2【答案】 A3. 某机构投资者与某证券公司签订了证券交易委托代理协议.按照证券交易品种开立了股票交易账户,并且也开立了用于证券交易资金清算的专用资金账户。

A.集合竞价B.连续竞价C.投标竞价D.招标竞价【答案】 B4. 金融工具的流动性是指()。

A.金融工具能迅速变现B.金融工具能迅速转让流通C.金融工具能在金融市场上简便快捷地转让变现而不致遭受损失D.金融工具能在金融市场上以市场价格迅速变现【答案】 C5. 根据《信托公司治理指引》,我国信托公司的公司治理应体现的基本原则是()最大化。

A.受益人利益B.受托人利益C.委托人利益D.受托人权利【答案】 A6. 一个国家在一定时期内,国际收支如果是顺差,则增加外汇储备,中央银行增加基础货币投资,货币供应量()。

A.等额扩张B.数倍扩张C.等额收缩D.数倍收缩【答案】 B7. 现金漏损率是指现金漏损与()之间的比率。

A.存款总额B.派生存款C.库存现金D.原始存款【答案】 A8. 在我国的债券回购市场上,回购期限是()。

A.1个月以内B.3个月以内C.6个月以内D.1年以内【答案】 D9. ()是指外国银行在美国发行的可转让定期存单。

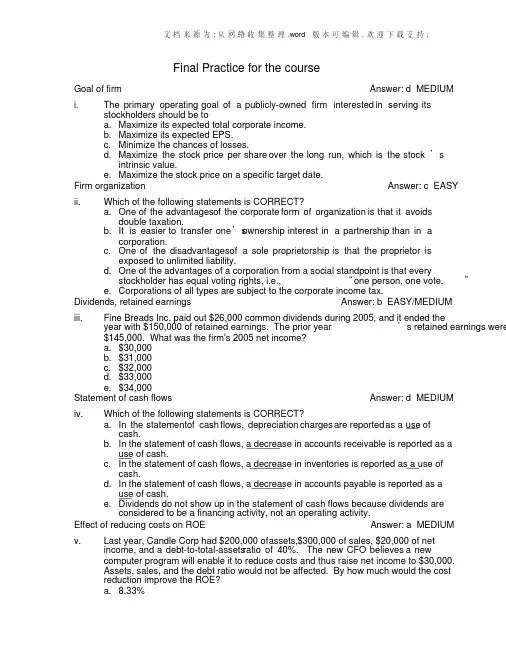

Final Practice for the courseGoal of firm Answer: d MEDIUMi. The primary operating goal of a publicly-owned firm interested in serving itsstockholders should be toa. Maximize its expected total corporate income.b. Maximize its expected EPS.c. Minimize the chances of losses.d. Maximize the stock price per share over the long run, which is the stock’sintrinsic value.e. Maximize the stock price on a specific target date.Firm organization Answer: c EASYii. Which of the following statements is CORRECT?a. One of the advantages o f the corporate form of organization is that it avoidsdouble taxation.b. It is easier to transfer one’s ownership interest in a partnership than in acorporation.c. One of the disadvantages o f a sole proprietorship is that the proprietor isexposed to unlimited liability.d. One of the advantages of a corporation from a social standpoint is that everystockholder has equal voting rights, i.e., “one person, one vote.”e. Corporations of all types are subject to the corporate income tax.Dividends, retained earnings Answer: b EASY/MEDIUMiii. Fine Breads Inc. paid out $26,000 common dividends during 2005, and it ended the year with $150,000 of retained earnings. The prior year’s retained earnings were $145,000. What was the firm's 2005 net income?a. $30,000b. $31,000c. $32,000d. $33,000e. $34,000Statement of cash flows Answer: d MEDIUMiv. Which of the following statements is CORRECT?a. In the statement o f cash flows, depreciation charges are reported as a use ofcash.b. In the statement of cash flows, a decrease in accounts receivable is reported as ause of cash.c. In the statement of cash flows, a decrease in inventories is reported as a use ofcash.d. In the statement of cash flows, a decrease in accounts payable is reported as ause of cash.e. Dividends do not show up in the statement of cash flows because dividends areconsidered to be a financing activity, not an operating activity.Effect of reducing costs on ROE Answer: a MEDIUMv. Last year, Candle Corp had $200,000 of a ssets, $300,000 of sales, $20,000 of net income, and a debt-to-total-assets ratio of 40%. The new CFO believes a newcomputer program will enable it to reduce costs and thus raise net income to $30,000.Assets, sales, and the debt ratio would not be affected. By how much would the costreduction improve the ROE?a. 8.33%b. 8.67%c. 9.00%d. 9.33%e. 9.67%Du Pont equation: basic calculation Answer: b EASY vi. Midwest Lumber had a profit margin of 5.1%, a total assets turnover of 1.6, and an equity multiplier of 1.8. What was the firm's ROE?a. 14.39%b. 14.69%c. 14.99%d. 15.29%e. 15.59%Current ratio Answer: e EASY vii. A firm wants to strengthen its financial position. Which of the following actions would INCREASE its current ratio?a. Borrow using short-term debt and use the proceeds t o repay debt that has amaturity of more than one year.b. Reduce the company’s days’ sales outstanding ratio to the industry average anduse the resulting cash savings to purchase plant and equipment.c. Use cash to increase inventory holdings.d. Use cash to repurchase some of the company’s own stock.e. Issue new stock and use some of the proceeds to purchase additional inventoryand hold the remainder of the funds received as cash.Estimating the 1-year forward rate Answer: e MEDIUM viii. Suppose the interest rate on a 1-year T-bond is 5.0% and that on a 2-year T-bond is6.0%. Assuming the pure expectations theory is correct, what is the market'sforecast for 1-year rates 1 year from now?a. 6.65%b. 6.74%c. 6.83%d. 6.92%e. 7.01%Default risk premium Answer: b EASYix. If 10-year T-bonds have a yield of 5.2%, 10-year corporate bonds yield 7.5%, the maturity risk premium on all 10-year bonds is 1.1%, and corporate bonds have a0.2% liquidity premium versus a zero liquidity premium for T-bonds, what is thedefault risk premium on the corporate bond?a. 2.00%b. 2.10%c. 2.20%d. 2.30%e. 2.40%Amortization Answer: a MEDIUMx. Which of the following statements regarding a 30-year, $100,000 mortgage with a nominal interest rate of 10%, compounded monthly, is NOT CORRECT?a. The monthly payments will decline over time.b. The proportion of the monthly payment that represents interest will be lowerfor the last payment than for the first payment on the loan.c. The total dollar amount of principal being paid off each month gets larger asthe loan approaches maturity.d. The amount paid toward interest in the first payment would be lower if thenominal interest rate were 8%.e. Over 90% of the first payment goes toward interestPV of an annuity due Answer: a EASY xi. Your father is about to retire, and he wants to buy an annuity that will provide him with $50,000 of income a year for 20 years, with the first payment comingimmediately. The going rate on such annuities is 6%. How much would it cost himto buy the annuity today?a. $607,905.82b. $416,110.34c. $517,513.68d. $615,976.84e. $488,349.15Comparing the effective cost of two bank loans Answer: e MEDIUM/HARD xii. Bank A offers to lend you $10,000 at a nominal rate of 6%, simple interest, with interest paid monthly. Bank B offers to lend you the $10,000, but it will charge 7%,simple interest, with interest paid at the end of the year. What is the difference in theeffective annual rates charged by the two banks?a. 1.17%b. 1.12%c. 0.91%d. 1.28%e. 0.83%Interest rate price risk Answer: b EASY/MEDIUM xiii. Assume that all interest rates in the economy decline from 10% to 9%. Which of the following bonds will have the largest percentage increase in price?a. A 10-year bond with a 10% coupon.b. A 10-year zero coupon bond.c. An 8-year bond with a 9% coupon.d. A 1-year bond with a 15% coupon.e. A 3-year bond with a 10% coupon.Determining the coupon rate Answer: c MEDIUM/HARD xiv. Moussawi Ltd's outstanding bonds have a $1,000 par value, and they mature in 5 years. Their yield to maturity is 9%, based on semiannual compounding, and thecurrent market price is $853.61. What is the bond's annual coupon interest rate?a. 5.10%b. 5.20%c. 5.30%d. 5.40%e. 5.50%Constant growth rate Answer: b EASY xv. Hahn Manufacturing is expected to pay a dividend of $1.00 per share at the end of the year (D1 = $1.00). The stock sells for $40 per share, and its required rate of return is11%. The dividend is expected to grow at a constant rate, g, forever. What is Hahn's expected growth rate?a. 8.00%b. 8.50%c. 9.00%d. 9.50%Nonconstant growth stock price Answer: a HARD xvi. The Ehrhardt Company's last dividend was $2.00. The dividend growth rate is expected to be constant at 3% for 2 years, after which dividends are expected to growrequired return (r s) is 12%. What is Erhardt's at a rate of 8% forever. Erhardt’scurrent stock price?a. $49.20b. $51.40c. $53.80d. $55.10e. $57.30WACC Answer: c MEDIUM xvii. Which of the following statements about the cost of capital is CORRECT?a. A change in a company’s target capital structure cannot affect its WACC.b. WACC calculations should be based on the before-tax costs of all the individualcapital components.c. If a company’s tax rate increases, then, all else equal, its weighted average cost ofcapital will decrease.d. Flotation costs associated with issuing new common stock normally lead to adecrease in the WACC.e. An increase in the risk-free rate will normally lower the marginal costs of bothdebt and equity financing.Risk and project selection Answer: b MEDIUMxviii. Wagner Inc estimates that its average-risk projects have a WACC of 10%, its below-average risk projects have a WACC of 8%, and its above-average risk projects have aWACC of 12%. Which of the following projects (A, B, and C) should the companyaccept?a. Project A is of average risk and has a return of 9%.b. Project B is of below-average risk and has a return of 8.5%.c. Project C is of above-average risk and has a return of 11%.d. None of the projects should be accepted.e. All of the projects should be accepted.WACC Answer: a MEDIUM xix. You were hired as a consultant to Locke Company, and you were provided with the following data: Target capital structure: 40% debt, 10% preferred, and 50%common equity. The interest rate on new debt is 7.5%, the yield on the preferred is7.0%, the cost of retained earnings is 11.50%, and the tax rate is 40%. The firm willnot be issuing any ne w stock. What is the firm’s WACC?a. 8.25%b. 8.38%c. 8.49%d. 8.61%e. 8.76%Component cost of preferred stock Answer: e EASY xx. Klieman Company’s perpetual preferred stock sells for $90 per share and pays a $7.50 annual dividend per share. If the company were to sell a new preferred issue, itwould incur a flotation cost of 5.00% of the price paid by investors. What is thecompany's cost of preferred stock?b. 7.79%c. 8.21%d. 8.57%e. 8.77%Component cost of debt Answer: a MEDIUM xxi. Several years ago the Haverford Company sold a $1,000 par value bond that now has25 years to maturity and an 8.00% annual coupon that is paid quarterly. The bondcurrently sells for $900.90, and the company’s tax rate is 40%. What is thecomponent cost of debt for use in the WACC calculation?a. 5.40%b. 5.73%c. 5.98%d. 6.09%e. 6.24%Component cost of retained earnings: DCF, D0Answer: b MEDIUM xxii. Assume that Mary Brown Inc. hired you as a consultant to help it estimate the cost of capital. You have been provided with the following data: D0 = $1.20; P0 = $40.00;and g = 7% (constant). Based on the DCF approach, what is Brown's cost of equityfrom retained earnings?a. 10.06%b. 10.21%c. 10.37%d. 10.54%e. 10.68%NPV, IRR, and MIRR Answer: a MEDIUM xxiii. Which of the following statements is CORRECT?a. If a project with normal cash flows has an IRR greater than the WACC, theproject must have a positive NPV.b. If Project A’s IRR exceeds Project B’s, then A must have the higher NPV.can never exceed its IRR.c. A project’s MIRRd. If a project with normal cash flows has an IRR less than the WACC, the projectmust have a positive NPV.e. If the NPV is negative, the IRR must also be negative.Discounted payback (nonconstant cash flows; 4 years) Answer: d MEDIUM xxiv. Reynolds Bikes is considering a project that has the following cash flow and WACC data. What is the project's discounted payback?WACC = 10%Year: 0 1 2 3 4Cash flows: -$1,000 $525 $485 $445 $405a. 1.66 yearsb. 1.82 yearsc. 2.03 yearsd. 2.36 yearse. 2.41 yearsIRR (uneven cash flows; 4 years) Answer: a EASY/MEDIUM xxv. Rockmont Recreation Inc. is considering a project that has the following cash flowdata. What is the project's IRR? Note that a project's projected IRR can be lessthan the WACC (and even negative), in which case it will be rejected.Year: 0 1 2 3 4Cash flows: -$1,000 $250 $230 $210 $190a. -5.15%b. -3.44%c. -1.17%d. 2.25%e. 3.72%NPV vs IRR (size differences) Answer: c MEDIUM/HARDxxvi. Pettway Inc. is considering Projects S and L, whose cash f lows are shown below.These projects are mutually exclusive, equally risky, and not repeatable. If thedecision is made by choosing the project with the higher IRR, how much value willbe forgone? Note that under some conditions choosing projects on the basis of theIRR will cause $0.00 value to be lost.WACC = 12%Year: 0 1 2 3 4CF S: -$1,025 $375 $380 $385 $390CF L: -$2,153 $750 $759 $768 $777a. $15.57b. $21.49c. $27.52d. $33.69e. $37.39Relevant cash flows Answer: e EASYxxvii. Which of the following is NOT a cash flow that should be included in the analysis of a project?a. Changes in net operating working capital.b. Shipping and installation costs.c. Cannibalization effects.d. Opportunity costs.e. Sunk costs that have been expensed for tax purposes.Sunk costs Answer: d EASY/MEDIUMxxviii. Which of the following statements is CORRECT?a.An example of a sunk cost is the cost associated with restoring the site of astrip mine once the ore has been depleted.b.Sunk costs must be considered if the IRR method is used but not if the firmrelies on the NPV method.c. A good example of a sunk cost is a situation where a bank opens a new office,and that new office leads t o a decline in deposits of the bank’s other offices.d. A good example of a sunk cost is money that a banking corporation spent lastyear to investigate the site for a new office, expensed those funds for taxpurposes, and now is deciding whether or not to go forward with the project.e.If sunk costs are considered and reflected in a project’s cash flows, then theproject’s calculated NPV will be higher than it otherwise would be.Beta coefficient Answer: d MEDIUMxxix. Stock A has a beta of 1.5 and Stock B has a beta of 0.5. Which of the following statements must be true about these securities? (Assume the market is inequilibrium.)a. When held in isolation, Stock A has more risk than Stock B.b. Stock B would be a more desirable addition to a portfolio than Stock A.c. Stock A would be a more desirable addition to a portfolio than Stock B.d. In equilibrium, the expected return on Stock A will be greater than that onStock B.e. In equilibrium, the expected return on Stock B will be greater than that onStock A.Required return Answer: b MEDIUM xxx. In the next year, the market risk premium, (r M - r RF), is expected to fall, while the risk-free rate, r RF, is expected to remain the same. Given this forecast, which ofthe following statements is CORRECT?a. The required return for all stocks will fall by the same amount.b. The required return will fall for all stocks, but it will fall more for stocks withhigher betas.c. The required return will fall for all stocks, but it will fall less for stocks withhigher betas.d. The required return will increase for stocks with a beta less than 1.0 and willdecrease for stocks with a beta greater than 1.0.e. The required return on all stocks will remain unchanged.Portfolio beta Answer: e EASYxxxi. Tom Skinner has $45,000 invested in a stock with a beta of 0.8 and another $55,000 invested in a stock with a beta of 1.4. These are the only twoinvestments in his portfolio. What is his portfolio’s beta?a. 0.93b. 0.98c. 1.03d. 1.08e. 1.13Portfolio beta Answer: c HARDxxxii. Assume that you manage a $10.00 million mutual fund that has a beta of 1.05 anda 12.00% required return. The risk-free rate is 4.75%. You now receive another$10.00 million, which you invest in stocks with an average beta of 0.65. What isthe required rate of return on the new $20.00 million portfolio? (Hint: You mustfirst find the market risk premium, then find the new portfolio beta.)a. 10.02%b. 10.54%c. 10.62%d. 11.31%e. 12.62%Coefficient of variation Answer: bxxxiii. Ripken Iron Works faces the following probability distribution:Stock’s ExpectedState of Probability of Return if thisthe Economy State Occurring State OccursBoom 0.25 25%Normal 0.50 15Recession 0.25 5What is the coefficient of variation on the company’s stock?a. 0.06b. 0.47c. 0.54d. 0.67e. 0.71CAPM Answer: b MEDIUMxxxiv. Apex Roofing's stock has a beta of 1.50, its required return is 14.00%, and the risk-free rate is 5.00%. What is the required rate of return on the stock market?(Hint: First find the market risk premium.)a. 10.50%b. 11.00%c. 11.50%d. 12.00%e. 12.50%i. Goal of firm Answer: d MEDIUMThe primary operating goal should be to maximize the long-runstock price, or the intrinsic value.ii. Firm organization Answer: c EASY iii. Dividends, retained earnings Answer: b EASY/MEDIUM iv. Statement of cash flows Answer: d MEDIUM v. Effect of reducing costs on ROE Answer: a MEDIUM vi. Du Pont equation: basic calculation Answer: b EASY vii. Current ratio Answer: e EASY viii. Estimating the 1-year forward rate Answer: e MEDIUM ix. Default risk premium Answer: b EASY x. Amortization Answer: a MEDIUMStatement a is false, because monthly payments will not decline overtime, they will stay the same. Statement b is true, because thepercentage paid toward interest declines over time. Statement c istrue, because interest due for every payment gets progressivelysmaller, which means that the portion toward principal gets larger.Statement d is true, because if the interest rate is lower, less ispaid toward interest. Statement e is true. Therefore, answer choicea is the correct answer.xi. PV of an annuity due Answer: a EASYBGN modexii. Comparing the effective cost of two bank loans Answer: e MEDIUM/HARD xiii. Interest rate price risk Answer: b EASY/MEDIUM Statement b is correct, because the longer-term, lowest couponbond will have the greatest price effect due to interest rates.xiv. Determining the coupon rate Answer: c MEDIUM/HARD xv. Constant growth rate Answer: b EASYxvi. Nonconstant growth stock price Answer: a HARDxvii. WACC Answer: c MEDIUMStatement c is true, because if the tax rate increases the taxdeductibility benefits of debt financing increase, resulting in alower WACC. The other statements are false.xviii. Risk and project selection Answer: b MEDIUMThe project whose return is greater than its risk-adjusted cost ofcapital should be selected. Only Project B meets this criterion.xix. WACC Answer: a MEDIUMxx. Component cost of preferred stock Answer: e EASYxxi. Component cost of debt Answer: a MEDIUMxxii. Component cost of retained earnings: DCF, D0Answer: b MEDIUMxxiii.NPV, IRR, and MIRR Answer: a MEDIUMxxiv. Discounted payback (nonconstant cash flows; 4 years) Answer: d MEDIUMxxv. IRR (uneven cash flows; 4 years) Answer: a EASY/MEDIUMxxvi. NPV vs IRR (size differences) Answer: c MEDIUM/HARDxxvii.Relevant cash flows Answer: e EASYxxviii. Sunk costs Ans xxix. Beta coefficient Answer: d MEDIUMxxx.Required return Answer: b MEDIUMThe easiest way to see this is to write out the CAPM: r s = r RF + (r M–r RF)b. Clearly, a change in the market risk premium is going to have themost effect on firms with high betas. Consequently, statement b is thecorrect choice.xxxi.Portfolio beta Answer: e EASYxxxii.Portfolio beta Answer: c HARDxxxiii.Coefficient of variation Answer: bThe expected rate of return will equal 0.25(25%)+0.5(15%) + 0.25(5%)= 15%. The variance of the expected return is:0.25(25% - 15%)2 + 0.5(15% -15%)2 + 0.25(5% - 15%)2 = 0.0050.The standard deviation is the square root of 0.0050 = 0.0707.And, CV = 0.0707/0.15 = 0.47.xxxiv. CAPMAnswer: b MEDIUM。

2022-2023年初级经济师之初级金融专业考前冲刺模拟卷附答案详解单选题(共20题)1. 介于资金提供者和资金使用者之间进行债权债务关系转移的中介通常称为()。

A.投资类金融中介B.间接金融中介C.封闭型金融中介D.直接金融中介【答案】 B2. 向中央银行融通资金的形式不包括()。

A.再贷款B.调整法定存款准备金C.在公开市场上出售证券D.再贴现【答案】 B3. 长期债券一般没有()发行方式。

A.平价B.折价C.溢价D.等价【答案】 B4. 按照我国有关规定,当经营自营业务的证券公司与客户做出相同的委托时,应该()。

A.自营业务的指令优先于客户的指令B.客户的指令应优先于自营业务的指令C.自营业务的指令和客户指令同时实行D.视情况而定【答案】 B5. 承兑银行在承兑汇票到期日预先向承兑申请人收取票款的会计分录为()A.借:单位活期存款——承兑申请人户贷:应解汇款B.借:银行存款贷:应解汇款C.借:贴现资产贷:单位活期存款——承兑申请人户D.借:贴现负责贷:单位活期存款——承兑中请人户【答案】 A6. 1988年的“巴塞尔协议”规定商业银行的附属资本不能超过总资本的()。

A.20%B.40%C.50%D.60%【答案】 C7. (2017年真题)关于证券投资风险的说法,错误的是()A.财务风险可分散或回避B.利率风险属于系统性风险C.多元化证券投资可分散政策风险D.国债、金融债券和公司证券的信用风险依次上升【答案】 C8. 金融机构无法以合理的成本迅速增加负债或变现资产获得足够的资金,从而影响其盈利水平,这种风险是()。

A.信用风险B.利率风险C.流动性风险D.市场风险【答案】 C9. 在国际结算中,汇款结算工具的传送方向与资金流向相同,所以汇款属于()。

A.外汇B.结汇C.售汇D.顺汇【答案】 D10. 下列不属于流动性分析指标中合规性监管指标的是()。

A.流动性覆盖率B.存贷比C.流动性比例D.贷款拨备率【答案】 D11. 我国《商业银行法》规定,设立城市商业银行的注册资本最低限额为()亿元人民币。

中级经济师之中级经济师金融专业模拟卷含答案讲解单选题(共20题)1. 根据《商业银行风险监管核心指标》,在我国衡量资产安全性的指标为信用风险的相关指标,其中全部关联度不应高于()。

A.60%B.50%C.40%D.55%【答案】 B2. 我国小额贷款公司的主要资金来源是股东缴纳的资本金、来自不超过两个银行业金融机构的融入资金以及()。

A.公众存款B.政府出资C.发行债券D.捐赠资金【答案】 D3. 商业银行衡量汇率变动对全行财务状况影响的方法是()。

A.缺口分析B.久期分析C.外汇敞口与敏感性分析D.情景模拟【答案】 C4. 张先生需要借款10000元,借款期限为2年,当前市场年利率为6%。

他向银行进行咨询,A银行给予张先生单利计算的借款条件;B银行给予张先生按年复利利的借款条件;C银行给予张先生按半年计算复利的借款条件。

A.1000B.1200C.1400D.1500【答案】 B5. 金融机构通过负债业务和资产业务,为资金供求双方提供服务,这一操作体现出金融机构的职能……()A.资金融通职能B.支付结算职能C.降低交易成本职能D.减少信息成本职能【答案】 A6. ()是指有关主体(主要是跨国公司)在因合并财务报表而引致的不同货币的相互折算中,因汇率在一定时间内发生意外变动,而蒙受账面经济损失的可能性。

A.交易风险B.折算风险C.经济风险D.投资风险【答案】 B7. 商业银行的负债中最重要的是()。

A.同业拆借B.向中央银行的贷款C.存款D.发行债券【答案】 C8. “太多的货币追求太少的商品”描述的通货膨胀类型是()通货膨胀。

A.需求拉动型B.预期型C.结构型D.成本推进型【答案】 A9. 短期融资券的最长期限为()天。

A.30B.60C.90D.365【答案】 D10. 从中央银行提高存款准备金率到该政策抑制通货膨胀的效果显现,这中间的时间跨度称为()时滞。

A.认识B.外部C.决策D.行动【答案】 B11. 在金融交易中,逆向选择和道德危害产生的根源是()。

初级经济师之初级金融专业考前冲刺模拟考试试卷附有答案详解单选题(共20题)1. 银行无力为负债的减少或资产的增加提供融资而造成损失或破产的风险称为()。

A.声誉风险B.信用风险C.流动性风险D.市场风险【答案】 C2. 按照发行条件不同,金融债券可分为()。

A.普通金融债券和特殊金融债券B.短期金融债券和长期金融债券C.溢价金融债券、平价金融券和贴现金融债券D.普通金融债券、累进利息金融债券和贴现金融债券【答案】 D3. 商业汇票的收款人或持票人向付款人提示付款时,应在汇票背面记载()字样。

A.“委托收款”B.“不得更改”C.“汇票”D.“承兑”【答案】 A4. 金融企业会计实务中的“清算资金往来”属于( )科目。

A.资产类B.负债类C.损益类D.资产负债共同类【答案】 D5. 人民币由商业银行和其他金融机构现金业务库通过不同渠道进入流通领域称为()。

A.现金发行B.现金投放C.现金归行D.现金回笼【答案】 B6. 跨国式金融监管体制的典型代表为()。

A.美国B.法国C.欧盟D.加拿大【答案】 C7. 某人购买了50份A公司的可转换债券,每份面额为50元,转换价格为10元,则他在规定的期限内可换得股票()股。

A.250B.100C.50D.5【答案】 A8. 根据贷款五级分类,不良贷款是指()类贷款。

A.逾期、呆滞、可疑B.关注、次级、可疑C.次级、可疑、损失D.关注、次级、损失【答案】 C9. 我国《商业银行法》规定,设立商业银行的注册资本最低限额为()人民币。

A.1亿元B.5亿元C.10亿元D.20亿元【答案】 C10. 与商业性金融机构相比,下列不属于政策性金融机构特点的是()。

A.特殊的经营目标B.特殊的经营理念C.特殊的服务领域D.特殊的资金来源【答案】 B11. (2017年真题)下列信用工具中,属于直接融资信用工具的是()A.银行承兑汇票B.信用证C.旅行支票D.股票【答案】 D12. 租赁设备或工具短期使用权的租赁形式是()A.金融租赁B.杠杆租赁C.经营租赁D.财务租赁【答案】 C13. 根据资金性质及经济内容划分,商业银行会计科目包括资产类、负债类、所有者权益和()A.损益类B.收入类C.成本类D.现金类【答案】 A14. 根据2005年施行的《短期融资券管理办法》,企业发行融资券时实行余额管理,待偿还融资券余额不得超过企业化净资产的()。

2022-2023年中级经济师之中级经济师金融专业综合提升模拟题库含答案讲解单选题(共20题)1. 按资金的偿还期限分,金融市场可以分为()。

A.一级市场和二级市场B.同业拆借市场和长期债券市场C.货币市场和资本市场D.回购市场和债券市场【答案】 C2. 假设交易主体甲参与金融衍生品市场活动的主要目的是为了促成交易、收取佣金,则此时甲扮演的角色是()A.经纪人B.投机者C.套期保值者D.套利者【答案】 A3. 在我国,经营小额贷款业务但不吸收公众存款的金融机构是()。

A.小额贷款公司B.金融租赁公司C.汽车金融公司D.财务公司【答案】 A4. 基金的规模在发行前已确定,在发行完毕后的规定期限内,其份额固定不变。

这种基金是指()。

A.封闭式基金B.开放式基金C.契约型基金D.公司型基金【答案】 A5. 期权费减去内在价值后剩余的部分是指()。

A.期权的内涵价值B.期权的合约价值C.期权的执行价值D.期权的时间价值【答案】 D6. 中央银行实施货币政策的时滞效应中,作为货币政策调控对象的金融部门对中央银行实施货币政策的反应过程,称为()。

A.认识时滞B.决策时滞C.内部时滞D.外部时滞【答案】 D7. 在我国,负责监管互联网信托业务的机构是()A.中国人民银行B.中国银保监会C.中国证监会D.商务部【答案】 B8. 与其他金融机构相比,商业银行的最明显特征是()。

A.以盈利为目的B.提供金融服务C.吸收活期存款D.执行国家金融政策【答案】 C9. 将币种与金额相同,但方向相反、交割期限不同的两笔或两笔以上交易结合在一起的外汇交易是()。

A.即期外汇交易B.远期外汇交易C.掉期交易D.货币互换交易【答案】 C10. 在金融系统中,直接经营各种存贷业务的是()。

A.中央银行B.商业银行C.保险公司D.证券公司【答案】 B11. 商业银行无法以合理成本及时获得充足资金,用于偿付到期债务、履行其他支付义务和满足正常业务开展的其他资金需求的风险是()。

一、单项选择题(只有一个正确答案)【1】某公司有80000份流通在外的债券,这些债券均按照面值进行交易,市场中具有相同特征的债券的税前到期收益率为8.5%。

公司同时有4百万流通在外的普通股,该股票的贝塔系数为1.1,市场价格为40美元每股。

若市场中无风险利率为4%,市场风险溢价是8%,税率为35%,则该公司的加权平均资本成本是()。

A: 7.10%B: 7.39%C: 10.38%D: 10.65%答案: C【2】公司发行新股会导致()。

A: 公司的控制权被稀释B: 公司的股价上升C: 公司的融资成本提高D: 公司投资机会的增加答案: A【3】某钢铁企业并购某石油公司,这种并购方式属于()。

A: 杠杆收购B: 横向收购C: 混合收购D: 纵向收购答案: D【4】下述关于破产成本的描述中正确的是()。

A: 破产过程中涉及的管理费用属于间接的破产成本B: 公司的债权人比股东更有动力阻止企业破产C: 当公司陷入财务危机时,其资产会变得更有价值D: 有价值员工的流失是一种间接的破产成本答案: D【5】反映企业在一段时期内的经营结果的报表被称为()A: 损益表B: 资产负债表C: 现金流量表D: 税务报表答案: A【6】企业财务管理的目标与企业的社会责任之间的关系是()。

A: 两者相互矛盾B: 两者没有联系C: 两者既矛盾又统一D: 两者完全一致答案: C【7】根据简化资产负债表模型,公司在金融市场上的价值等于()。

A: 有形固定资产加上无形固定资产B: 销售收入减去销货成本C: 现金流入量减去现金流出量D: 负债的价值加上权益的价值答案: D【8】如果股利和资本利得适用相同的所得税率,两者的纳税效果仍然会不同,是因为()。

A: 资本利得纳税是实际发生的,而股利纳税只在账面体现B: 股利纳税是实际发生的,而资本利得纳税只在账面体现C: 股利所得税在股利分派之后交纳,而资本利得税可以延迟到股票出售的时候D: 资本利得税在股利分派之后交纳,而股利所得税可以延迟到股票出售的时候答案: C【9】甲方案在五年中每年年初付款2000元,乙方案在五年中每年年末付款2000元,若利率相同,则两者在第五年年末时的终值()。

2022-2023年证券从业之金融市场基础知识考前冲刺模拟考试试卷含答案讲解单选题(共20题)1. 按照证券类机构业务类型分类,信用风险主要来自但不限于以下()业务。

A.①②③B.①②③④C.①②③④⑤D.①③④⑤【答案】 C2. 下列关于金融风险的作用机制说法正确的是()。

A.Ⅱ、Ⅲ、ⅣB.Ⅰ、Ⅱ、ⅢC.Ⅰ、Ⅱ、Ⅲ、ⅣD.Ⅰ、Ⅱ、Ⅳ【答案】 C3. A公司目前的资产总额是8000万元,负债总额为3000万元,发行在外的普通股股数是1000万股,无优先股,因此A公司的股票账面价值为A.8B.3C.5D.11【答案】 C4. 下面对理事会会议表述不正确的是()。

A.理事会会议至少每季度召开一次B.会议必须有2/3以上理事出席C.其决议应当经出席会议的过半数的理事表决同意方为有效D.理事会决议应当在会议结束后两个工作日内向中国证监会报告【答案】 C5. 股权类期货是以()为基础资产的期货合约。

A.Ⅰ、Ⅱ、ⅣB.Ⅰ、Ⅲ、ⅣC.Ⅰ、ⅡD.Ⅰ、Ⅱ、Ⅲ【答案】 A6. 按照面值货币与发行债券市场的关系,国际债券可分为()和()。

A.外国债券-日本债券B.外国债券-欧洲债券C.欧洲债券-亚洲债券D.欧洲债券-日本债券【答案】 B7. 证券市场上的机构投资者包括()。

A.Ⅰ、ⅡB.Ⅱ、Ⅲ、ⅣC.Ⅰ、Ⅲ、ⅣD.Ⅰ、Ⅱ、Ⅲ、Ⅳ【答案】 D8. 享有优先认股权的股东可以()。

A.Ⅰ.ⅣB.Ⅰ.Ⅱ.Ⅲ.ⅣC.Ⅰ.Ⅱ.ⅣD.Ⅱ.Ⅲ.Ⅳ【答案】 C9. 恒生指数是由香港恒生银行于1969年11月24日起编制,最初挑选了()种有代表性的上市股票为成分股。

A.30B.33C.65D.225【答案】 B10. (2020年真题)所谓法人结算、需要证券公司以法入名义在证券登记结算机构开立()A.Ⅰ、Ⅱ、Ⅲ、ⅣB.Ⅰ、ⅢC.Ⅰ、Ⅲ、ⅣD.Ⅰ、Ⅳ【答案】 B11. 在我国金融中介体系中,信托机构属于()A.银行机构体系B.房地产中介体系C.保险中介体系D.投资中介体系【答案】 D12. (2020年真题)中证规模指数包括()等。

2022汽车金融公司知识竞赛真题模拟及答案(1)共391道题1、新城市激活或年审可以由谁完成备案()()(多选题)A. 地区经理B. 城市经理C. FAD. 销售顾问试题答案:A,B,C2、车辆交付环节中分为以下几个阶段()(多选题)A. 文件交付B. 返贷推荐C. 战败统计D. 嘘寒问暖试题答案:A,B,C3、正常情况下,特批提前结清由谁发起申请()(单选题)A. 经销店金融顾问B. 客户配偶C. 客户亲属D. 客户本人试题答案:D4、目前可接受驾照为()(多选题)A. 主申本人驾照B. 配偶驾照C. 直系亲属驾照D. 雇佣驾驶员驾照试题答案:A,B,C5、差额保全针对购买几座以下的新车()(单选题)A. 5座B. 7座C. 9座D. 12座试题答案:C6、产品介绍可以按以下哪几种来划分()(多选题)A. 按客户行业分B. 按预算需求分C. 按客户价值观分试题答案:A,B,C7、“E站专享”每家经销商共有三个职位账号需要注册,下列不需要注册的是()(单选题)A. 财务经理B. 销售经理C. 金融顾问试题答案:B8、一般常用汽车基本结构是由什么组成的()(多选题)A. 发动机C. 车身D. 电器设备试题答案:A,B,C,D9、经销店二手车置换和市场黄牛比有什么优势()(多选题)A. 安心交易B. 一站服务C. 安全评估D. 时间便捷试题答案:A,B,C,D10、提交邮寄任务时需在系统打印什么资料()(单选题)A. 归档明细表B. 归档合同清单C. 首付款证明D. 提车证明试题答案:B11、经销店收到结清资料后,应该如何处理()(多选题)A. 仔细清点资料是否完整,检查资料是否正确B. 主动通知客户到店领取资料并协助客户办理车辆解除抵押登记手续C. 客户领取资料时做好资料领取记录D. 妥善保管资料,等客户联系自己时交给客户试题答案:A,B,C12、完成每月数据总结表之后发现该月金融收益偏低。

我们在制定下月金融方案时可以朝那个方向制定()(多选题)B. 低利率C. 高手续费D. 高返佣试题答案:C,D13、道路救援客户中心热线是()(单选题)A. 4008-222-333B. 4008-333-222C. 4000-800-165D. 4008-000-165试题答案:C14、成功放款客户,非限牌城市需在多少天完成抵押归档()(单选题)A. 30天B. 45天C. 65天D. 90天试题答案:C15、根据《汽车金融公司管理办法》,汽车金融公司出资人中至少应有1名出资人具备()年以上丰富的汽车金融业务管理和风险控制经验。

第五章资本预算中的一些问题一、概念题增量现金流量、沉没成本、、营运资本、折旧、名义现金流量,实际现金流量、净现值等价年度成本、更新决策、扩展决策二、单项选择1、与投资决策有关的现金流量包括()A初始投资+营业现金流量B初始投资+营业现金流量+终结现金流量C初始投资+终结现金流量D初始投资+投资现金流量+终结现金流量2、以下说法正确的是()A沉没成本应该计入增量现金流量B机会成本是投入项目中的资源成本C营运资本是流动资产与流动负债的差额D计算增量现金流量不应考虑项目附加效应3、折旧的税盾效应说法正确的是()A 原因是折旧税前扣减B 税盾效应随利率增加而减小C依赖于未来的通货膨胀率 D 降低了项目现金流量4、名义利率为7%,通货膨胀率为2%,实际利率是()A 7% B6% C 4.9% D 2%5、在一个5年期和7年期的项目中选择,应该使用的资本预算决策是:A盈利指数B周期匹配C扩展决策D等价年度成本6、投资时机的决策原则是选择()时间进行投资A 增量现金流量最高B项目税后利润最高C净现值最高 D 成本最小三、多项选择题1、现金流量估算原则正确的是()A现金流量应该是税前现金流量 B 现金流量应该是税后现金流量C现金流量应该是增量的D如果现金流量是公司现金流量,折现率使用权益资本成本E现金流量是名义现金流量,折现率使用名义折现率2、在对是否投资新工厂时,下面那些科目应作为增量现金流量处理()A场地与现有建筑物的市场价值B拆迁成本与场地清理费用C上一年度新建通道成本D新设备使管理者精力分散,导致其他产品利润下降E 总裁专用喷气飞机的租赁费用分摊3、税率提高对净现值影响包括()A折旧税盾效应增加 B 折旧税盾效应减小C所得税增加D所得税减小E无影响4在更新决策中,现金流量的变化正确的是()A新设备购置成本B新设备购置成本—旧设备金额C新设备降低经营成本D新设备使用增加折旧的节税效应E新设备试用期末残值5、以下说法正确的是()A净现值法只能用于相同寿命期的项目比较B净现值法可应用于对不同寿命期的项目比较C 当公司面临有限资源时,可使用盈利指数法D寿命不同期的项目,可使用等价现金年度法或周期匹配法6以下对净现值计算说法正确的是()A可以用名义现金流量与名义折现率来计算B可以用实际现金流量与实际折算率计算C A,B两种方法计算结果不同D按照名义现金流量与实际利率计算的净现值偏大E按照实际现金流量与名义利率计算的净现值偏大7、以下说法正确的是()A等价年度成本大的项目可以采纳 B 等价年度成本小的项目可以采纳C在项目寿命期内是收到现金流量,等价年度成本大的项目应该被采纳D 在项目寿命期内是支出现金流量,等价年度成本小的项目应该被采纳E等价年度成本=净现值/项目持续期限四、计算题1、某公司5年中每年都会得到100000元,名义折现率为8%,通货膨胀率为4%,分别用名义折现率和实际折算率计算净现值。

中级经济师之中级经济师金融专业考前冲刺模拟考试试卷附答案详解单选题(共20题)1. 关于证券账户开立的说法,正确的是()。

A.按照开户人的不同,开立的账户可以分为个人账户、法人账户和机构账户B.个人投资者可以凭本人身份证开立多个账户C.法人投资者可以与个人开立联合账户D.投资银行开展证券自营业务必须以本公司名义开立自营账户【答案】 D2. 目前,我国牵头负责制定预防系统性金融风险和应急处置预案的监督管理机构是()A.中国证监会B.中国人民银行C.中国银保监会D.国家外汇管理局【答案】 B3. 如果某投资者年初投入1000元进行投资,年利率8%,按复利每季度计息一次,则第一年年末该投资者的终值为()元。

A.1026.93B.1080.00C.1082.43D.1360.49【答案】 C4. 再贴现的缺点是()。

A.在调节货币供应总量的同时又调节了信贷结构B.主动权不在中央银行C.主动权不在商业银行D.以票据融资风险大【答案】 B5. 根据《中华人民共和国中国人民银行法》的规定,我国货币政策的最终目标是(),并以此促进经济增长。

A.保持货币币值稳定B.实现充分就业C.保持物价稳定D.保持利率稳定【答案】 A6. 在金本位制下,汇率的决定基础从现象上看就是()。

A.各国单位货币所具有的价值量B.各国单位货币的含金量C.各国单位货币的面值D.各国单位货币的法定购买力【答案】 B7. 社会的货币化程度,是指()。

A.金融资产总额与实物资产总额的比重B.GNP中货币交易总值所占的比例C.一定时期内社会金融活动总量与经济活动总量的比值D.各经济部门拥有的金融资产与负债的总额【答案】 B8. 以下不属于贷款经营内容的是()。

A.在贷款经营中推销银行其他产品B.选择贷款客户C.评估和控制贷款风险D.创造贷款新品种和安排合适的贷款结构【答案】 C9. 早在2003年9月,我国对金融控股集团的监管就采取()制度。

A.中央银行监管B.主监管C.统一监管D.集体监管【答案】 B10. 在一国出现国际收支逆差时,该国之所以可以采用本币贬值的汇率政策进行调节,是因为本币贬值可以使以外币标价的本国出口价格下降,而以本币标价的本国进口价格上涨,从而刺激出口,限制进口,最终有助于国际收支回复的平衡,这种效应表明,本币贬值的汇率政策主要用来调节逆差国家国际收支的()。

学习-----好资料一、单项选择题(只有一个正确答案)【1】某公司有80000份流通在外的债券,这些债券均按照面值进行交易,市场中具有相同特征的债券的税前到期收益率为8.5%。

公司同时有4百万流通在外的普通股,该股票的贝塔系数为1.1,市场价格为40美元每股。

若市场中无风险利率为4%,市场风险溢价是8%,税率为35%,则该公司的加权平均资本成本是()。

A: 7.10%B: 7.39%C: 10.38%D: 10.65%答案: C【2】公司发行新股会导致()。

A: 公司的控制权被稀释B: 公司的股价上升C: 公司的融资成本提高D: 公司投资机会的增加答案: A【3】某钢铁企业并购某石油公司,这种并购方式属于()。

A: 杠杆收购B: 横向收购C: 混合收购D: 纵向收购答案: D【4】下述关于破产成本的描述中正确的是()。

A: 破产过程中涉及的管理费用属于间接的破产成本B: 公司的债权人比股东更有动力阻止企业破产C: 当公司陷入财务危机时,其资产会变得更有价值D: 有价值员工的流失是一种间接的破产成本答案: D【5】反映企业在一段时期内的经营结果的报表被称为()A: 损益表B: 资产负债表C: 现金流量表D: 税务报表答案: A【6】企业财务管理的目标与企业的社会责任之间的关系是()。

A: 两者相互矛盾B: 两者没有联系C: 两者既矛盾又统一D: 两者完全一致答案: C【7】根据简化资产负债表模型,公司在金融市场上的价值等于()。

A: 有形固定资产加上无形固定资产更多精品文档.学习-----好资料B: 销售收入减去销货成本C: 现金流入量减去现金流出量D: 负债的价值加上权益的价值答案: D【8】如果股利和资本利得适用相同的所得税率,两者的纳税效果仍然会不同,是因为()。

A: 资本利得纳税是实际发生的,而股利纳税只在账面体现B: 股利纳税是实际发生的,而资本利得纳税只在账面体现C: 股利所得税在股利分派之后交纳,而资本利得税可以延迟到股票出售的时候D: 资本利得税在股利分派之后交纳,而股利所得税可以延迟到股票出售的时候答案: C【9】甲方案在五年中每年年初付款2000元,乙方案在五年中每年年末付款2000元,若利率相同,则两者在第五年年末时的终值()。

A: 相等B: 前者大于后者C: 前者小于后者D: 可能会出现上述三种情况中的任何一种答案: B【10】企业发行债券,在名义利率相同的情况下,对其最有利的复利计息期是()。

A: 1年B: 半年C: 1季D: 1月答案: A【11】反映股东财富最大化目标实现程度的指标是()。

A: 销售收入B: 市盈率C: 每股市价D: 净资产收益率答案: C【12】下列陈述正确的是()。

A: 合伙制企业和公司制企业都有双重征税的问题B: 独资企业和合伙制企业在纳税问题上属于同一类型C: 合伙制企业是三种企业组织形式中最为复杂的一种D: 各种企业组织形式都只有有限的寿命期答案: B【13】认为公司的价值独立于资本结构的理论是()。

A: 资本资产定价模型B: MM定理1C: MM定理2D: 有效市场假说答案: B【14】Toni's Tool公司正准备购买设备,可供选择的设备在价格、营运成本、寿命期等方更多精品文档.学习-----好资料面各不相同,这种类型的资本预算决策应()。

A: 使用净现值法B: 同时使用净现值法和内部收益率法C: 使用约当年金成本法D: 使用折旧税盾方法答案: C【15】信号模型主要探讨的是()。

A: 金融契约事前隐藏信息的逆向选择问题B: 金融契约事后隐藏行动的道德风险问题C: 公司的股利政策向管理层传递的信息D: 公司的管理层通过投资决策向资本市场传递的信息答案: A【16】Delta Mare公司总经理收到各部门下一年度资本投资的项目申请,他决定按各项目净现值由高到低进行选择,以分配可用的资金。

这种决策行为被称为()。

A: 净现值决策B: 收益率决策C: 软性资本预算D: 硬性资本预算答案: C【17】相关系数衡量的是()。

A: 单项证券收益变动的大小B: 两种证券之间收益变动的大小和方向C: 单项证券收益变动的方向D: 股票价格的波动性答案: B【18】杜邦财务分析法的核心指标是()。

A: 资产收益率B: EBITC: ROED: 负债比率答案: C【19】有一项年金,前3年无现金流入,后5年每年初流入500元,年利率为10%,其现值为()元。

已知:(P/A, 10%, 4)=3.1699;(P/F, 10%, 3)=0.7513;(P/F, 10%, 4)=0.6830;(P/F, 10%, 5)=0.6209;(P/F, 10%, 6)=0.5645;(P/F, 10%, 10)=0.5132A: 1994.59B: 1566.42更多精品文档.学习-----好资料C: 1813.48D: 1423.21答案: B【20】反映债务与债权人之间的关系是()。

A: 企业与政府之间的关系B: 企业与债权人之间的财务关系C: 企业与债务人之间的财务关系D: 企业与职工之间的财务关系答案: B二、多项选择题【21】股东财富最大化作为企业财务管理的目标,其优点有()。

A: 有利于克服企业在追求利润上的短期行为B: 考虑了风险与收益的关系C: 考虑了货币的时间价值D: 便于客观、准确地计算E: 有利于社会资源的合理配置答案: A B C E【22】代理成本论认为债务筹资可能降低由于两权分离产生的代理问题,主要表现在()。

A: 减少股东监督经营者的成本B: 可以用债权回购股票减少公司股份C: 增加负债后,经营者所占有的份额可能增加D: 破产机制会减少代理成本E: 可以改善资本结构答案: A B C D【23】市场投资组合是()。

A: 收益率为正数的资产构成的组合B: 包括所有风险资产在内的资产组合C: 由所有现存证券按照市场价值加权计算所得到的组合D: 一条与有效投资边界相切的直线E: 市场上所有价格上涨的股票的组合答案: B C【24】下列收益率属于尚未发生的有()。

A: 实际收益率B: 无风险收益率C: 要求的收益率D: 持有期收益率E: 预期收益率答案: C E【25】金融市场利率的决定因素包括()。

A: 纯利率B: 通货膨胀补偿率C: 流动性风险报酬率D: 期限风险报酬率更多精品文档.学习-----好资料E: 违约风险报酬率答案: A B C D E【26】公司是否发放股利取决于()。

A: 公司是否有盈利B: 公司未来的投资机会C: 公司管理层的决策D: 投资者的意愿E: 政府的干预答案: A B C【27】企业通过筹资形成的两种不同性质的资金来源有()。

A: 流动资金B: 存货C: 债务资金D: 权益资金E: 应收账款答案: C D【28】决定债券价值的因素主要有()。

A: 债券的票面利率B: 期限C: 债券收益率D: 市场利率E: 发行人答案: A B C【29】下列属于公司的资金来源的有()。

A: 发行债券取得的资金B: 累计折旧C: 购买政府债券D: 取得银行贷款E: 购买其他公司的股票答案: A B D【30】影响公司的资本结构决策的因素包括()。

A: 公司的经营风险B: 公司的债务清偿能力C: 管理者的风险观D: 管理者对控制权的态度E: 企业的经营周期答案: A B C D E三、判断题【31】经营者与股东因利益不同而使其目标也不尽一致,因此两者的关系在本质上是无法协调的。

()A:正确: B:错误答案: 错误更多精品文档.学习-----好资料【32】在有限合伙企业中,有限合伙人比一般合伙人享有对企业经营管理的优先权。

()A:正确: B:错误答案: 错误【33】2年后的1000元按贴现率10%折成现值时,按年折现的现值比按半年折现的现值大。

()A:正确: B:错误答案: 正确【34】决策树分析是一种用图表方式反映投资项目现金流序列的方法,特别适用于在项目周期内进行一次决策的情况。

()A:正确: B:错误答案: 错误【35】相关系数介于-1和1之间;其数值越大,说明其相关程度越大。

()A:正确: B:错误答案: 错误【36】营运资本持有量的高低,影响着企业的收益和风险水平。

()A:正确: B:错误答案: 正确【37】对于同一债券,市场利率下降一定幅度引起的债券价值上升幅度往往要低于由于市场利率上升同一幅度引起的债券价值下跌的幅度。

()A:正确: B:错误答案: 错误【38】财务管理对资金营运活动的要求是不断降低营运的成本和风险。

()A:正确: B:错误答案: 错误【39】风险调整贴现率法就是通过调整净现值计算公式的分子,将贴现率调整为包括风险因素的贴现率,然后再进行项目的评价。

()A:正确: B:错误答案: 错误【40】投资组合的有效集是最小方差组合向下的一段曲线。

A:正确: B:错误答案: 错误【41】广义资本结构包括负债权益比的确定以及股利支付率的确定两项主要内容。

()A:正确: B:错误答案: 正确【42】企业的销售增长率越高,反映企业的资产规模增长势头越好。

()A:正确: B:错误答案: 错误【43】独资企业的利润被征收了两次所得税。

()A:正确: B:错误答案: 错误【44】以股东财富最大化作为财务管理的目标有益于社会资源的合理配置,从而实现社会效益最大化。

()A:正确: B:错误答案: 正确更多精品文档.学习-----好资料【45】在考虑公司所得税的情况下,公司负债越多,或所得税税率越高,则公司的加权平均资本成本就越大。

()A:正确: B:错误答案: 错误【46】企业在追求自己的目标时,会使社会受益,因此企业目标和社会目标是一致的。

A:正确: B:错误答案: 错误【47】通货膨胀溢价是指已经发生的实际通货膨胀率而非预期未来的通货膨胀率。

()A:正确: B:错误答案: 错误【48】权益性投资比债券型投资的风险低,因而其要求的投资收益率也较低。

()A:正确: B:错误答案: 错误【49】股东财富最大化目标与利润最大化目标相比,其优点之一是考虑了取得收益的时间因素和风险因素。

A:正确: B:错误答案: 正确【50】在投资既定的情况下,公司的股利政策可以看作是投资活动的一个组成部分。

()A:正确: B:错误答案: 错误四、简答题【51】简述影响债券价值的因素。

答案: 债券价值与投资者要求的收益率(当前市场利率) 成反向变动关系(1分);当债券的收益率不变时,债券的到期时间与债券价格的波动幅度之间成正比关系(1分);债券的票面利率与债券价格的波动幅度成反比关系(不适用于1年期债券或永久债券)(1分);当市场利率变动时,长期债券价格的波动幅度大于短期债券的波动幅度(1分);债券价值对市场利率的敏感性与债券所要产生的预期未来现金流的期限结构有关(1分)。