国际会计chapter3

- 格式:doc

- 大小:49.00 KB

- 文档页数:6

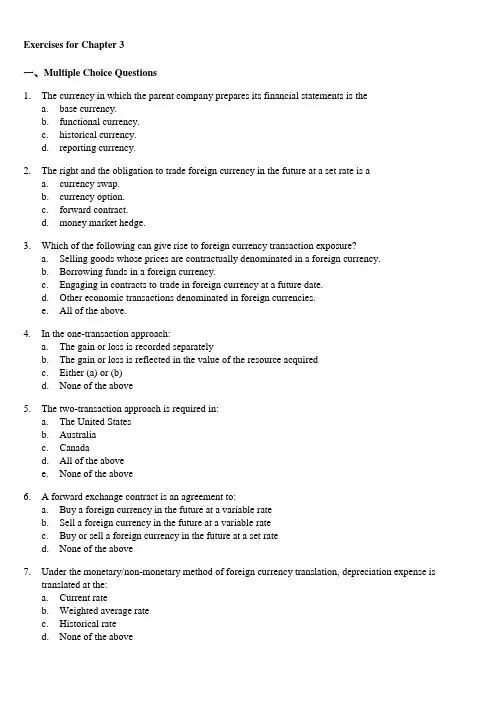

Exercises for Chapter 3一、Multiple Choice Questions1.The currency in which the parent company prepares its financial statements is thea. base currency.b. functional currency.c. historical currency.d. reporting currency.2. The right and the obligation to trade foreign currency in the future at a set rate is aa. currency swap.b. currency option.c. forward contract.d. money market hedge.3. Which of the following can give rise to foreign currency transaction exposure?a. Selling goods whose prices are contractually denominated in a foreign currency.b. Borrowing funds in a foreign currency.c. Engaging in contracts to trade in foreign currency at a future date.d. Other economic transactions denominated in foreign currencies.e. All of the above.4. In the one-transaction approach:a. The gain or loss is recorded separatelyb. The gain or loss is reflected in the value of the resource acquiredc. Either (a) or (b)d. None of the above5. The two-transaction approach is required in:a. The United Statesb. Australiac. Canadad. All of the abovee. None of the above6. A forward exchange contract is an agreement to:a. Buy a foreign currency in the future at a variable rateb. Sell a foreign currency in the future at a variable ratec. Buy or sell a foreign currency in the future at a set rated. None of the above7. Under the monetary/non-monetary method of foreign currency translation, depreciation expense istranslated at the:a. Current rateb. Weighted average ratec. Historical rated. None of the above8. Under the temporal method, translation gains and losses appear in:a. the stockholders' equity sectionb. the income statement as a normal operating itemc. the income statement as an extraordinary itemd. None of the above9. Under the current rate methoda. all assets and liabilities are translated at the current year's average exchange rate.b. foreign currency translation gains and losses do not affect the income statement.c. all revenues and expenses are translated using the current exchange rate.d. the income statement contains a cumulative translation adjustment amount.10. Under SFAS No. 52, the temporal method of translation is used whena. the local currency is the functional currency.b. the local currency is the reporting currency.c. the parent's currency is the functional currency.d. the parent's currency is the reporting currency.11. Under SFAS No. 52, the current rate method of translation is used whena. the local currency is the functional currency.b. the local currency is the reporting currency.c. the parent's currency is the functional currency.d. the parent's currency is the reporting currency.12. Under SFAS No. 52, a hyperinflationary economy is defined as one that has inflation of approximately:a. 100 percent per yearb. 100 percent or more over a three year periodc. 25 percent per yeard. None of the above13. Under SFAS No. 52, the primary currency in which a company conducts its business is called the:a. Core currencyb. Functional currencyc. Hard currencyd. Convertible currency14. Under which translation method is the foreign currency translation gain or loss taken to stockholders'equity?a. The current rate methodb. The temporal methodc. The conversion methodd. None of the above15. When a foreign subsidiary's functional currency is its local currency and its financial statements areprepared in the local currency then SFAS No. 52 requires that:a. The current method be used in translating financial statements.b. The temporal method be used in remeasuring financial statements.c. The temporal method be used in translating financial statements.d. The current method be used in remeasuring financial statements.16. According to SFAS No. 52, a self-sustaining, autonomous foreign subsidiarya. has a low volume of transactions with the parent.b. has sales mainly denominated in the parent's currency.c. has the U.S. dollar as its functional currency.d. obtains financing primarily from the parent.e. should be disclosed as a separate geographic segment.17. According to SFAS No. 52, an integral foreign subsidiarya. has a low volume of transactions with the parent.b. must be 100 percent owned by the parent.c. obtains most of its financing locally.d. depends on the parent for its revenues and expenses.e.has an active local sales market for its products.18.The Indian subsidiary of a U.S. software firm purchased an office building on January 22, 2004, for IndianRupees (IRs.) 10 million when the exchange rate was IRs. 50 = US$1. On December 31, 2004 (the parent’s fiscal year-end), the exchange rate was Irs. 52 = US$1. The average exchange rate for the year 2004 was Irs. 51 = US$1. If the Indian subsidiary’s primary operating environment is conside red to be India, under the requirements of SFAS No. 52, at what amount will the office building be included in the consolidated financial statements at December 31, 2004?$200,000$192,308$196,078d.IRs. 10 millione.None of the above.19.The Indian subsidiary of a U.S. software firm purchased an office building on January 22, 2004, for IndianRupees (IRs.) 10 million when the exchange rate was IRs. 50 = US$1. On December 31, 2004 (the parent’s fiscal year-end), the exchange rate was Irs. 52 = US$1. The average exchange rate for the year 2004 was Irs. 51 = US$1. If the Indian subsidiary’s primary operating environment is considered to be the United States, under the requirements of SFAS No. 52, at what amount will the office building be included in the consolidated financial statements at December 31, 2004?$200,000$192,308$196,078d.IRs. 10 millione.None of the above.Use the following information to answer questions 20-25.The Comfy Couch Co. purchases raw materials on account from a Mexican company on June 2, 2004. The total amount of the invoice is 3 million Mexican pesos and is due on August 2, 2004. Comfy Couch Co.’s fiscal year ends on June 30, 2004. Listed below is the exchange rate between the Mexican peso and the US dollar on the relevant dates.Spot rate on June 2 MP 9.50 = US$1Spot rate on June 30 MP 9.60 = US$1Spot rate on August 2 MP 9.65 = US$1Forward rate for August 2 (on June 2) MP 9.70 = US$1In questions 20-23, assume that Comfy Couch Co. did not have a forward contract and that it does its accounting in accordance with SFAS No. 52.20.What is the US dollar value of the payable on June 2, 2004?$315,789$312,500$310,881$309,278e.None of the above.21.How much will Comfy Couch Co. pay (in US$) on August 2, 2004?a. US$315,789$312,500$310,881$309,278e.None of the above.22.What is the foreign currency gain or loss that Comfy Couch must recognize on June 30, 2004?a.Gain of US$3,289b.Gain of US$4,908c.Gain of US$6,511d.Gain of US$3,222e.None of the above.23.What is the foreign currency gain or loss that Comfy Couch must recognize on August 2, 2004?a.Gain of US$6,511b.Gain of US$3,222c.Gain of US$1,603d.Gain of US$1,619e.None of the above.24.If Comfy Couch entered into a forward contract on June 2, 2004, what is the dollar value of the payable?$315,789$312,500$310,881$309,278e.None of the above.25.If Comfy Couch entered into a forward contract on June 2, 2004, what amount in US dollars will it pay onAugust 2, 2004?$315,789$312,500$310,881$309,278e.None of the above.二、True/False Questions1. A currency option is a contract that provides the right and the obligation to trade a foreign currency at a setexchange rate on or before a given date.2. An indirect foreign currency quote represents how much of the foreign currency can be purchased for oneunit of the domestic currency.3. The bid rate represents the price at which a financial institution is willing to buy a currency.4. If the spot rate is higher than the forward rate for a particular currency, then that currency would be sellingat a premium.5. Quotation exposure, backlog exposure, and billing exposure are various stages of foreign currencytranslation exposure.6. All foreign transactions are also foreign currency transactions.7. Under the one-transaction approach, the transaction is not considered to be completed until the finalsettlement.8. Under the two-transaction approach, a company's foreign currency receivable or payable are considered aseparate transaction distinct from the transaction to buy goods or services.9. Under the current rate method of translation, all current assets are translated at the year end rate andnon-current assets are translated at the applicable historical rates.10. Under the current rate method, gains or losses from translation are shown in the cumulative translationadjustment account in the balance sheet.11. In the foreign currency context, there is no distinction between the terms conversion and translation.12. Using the current exchange rate to translate current assets and liabilities (under the current/non-currentmethod) is based on the false premise that they are similarly affected by exchange rate changes.13. The temporal method accommodates current market valuation of non-monetary assets (e.g., inventories)while the monetary/non-monetary method does not.14. A major criticism of SFAS No. 8 was that it required foreign currency translation gains and losses to beincluded in the income statement.15. Under the temporal method, translation gain or loss for the period appears in the stockholders' equitysection of the balance sheet.16. Cost of goods sold, depreciation expense, and amortization expense are translated at the average exchangerate under the temporal method and the year end exchange rate under the current rate method.17. SFAS No. 52 requires the use of the current rate method for foreign subsidiaries located inhyperinflationary environments.18. Under SFAS No. 52, functional currency is the currency of the primary operating environment in which theforeign subsidiary operates and generates cash flows.19. According to SFAS No. 52, a hyperinflationary economy is deemed to be one in which the annual inflationrate is greater than 100 percent.20. If the U.S. dollar is deemed to be the functional currency, then SFAS No. 52 requires that the current ratemethod be used.21. Since the current rate method of foreign currency translation uses a constant exchange rate to translatebalance sheet items, it preserves the original financial statement relationships in the consolidated financial statements.22. An advantage of the current rate method of foreign currency translation is that a foreign subsidiary'sfinancial statement ratios are the same before and after translation.23. IAS No. 21 requires the use of the temporal method of foreign currency translation for foreign operationsthat are integral to the operations of the reporting enterprise.24. As of June 30, 2003, Britain, Denmark and Sweden were among the European countries that adopted theeuro as their currency.25. Between January 1, 1999, and January 1, 2002, companies doing business in Euroland can enter into andsettle transactions in the national currency or the euro and must have the ability to process transactions in both currencies.。

Exercises for Chapter 3一、Multiple Choice Questions1.The currency in which the parent company prepares its financial statements is thea. base currency.b. functional currency.c. historical currency.d. reporting currency.2. The right and the obligation to trade foreign currency in the future at a set rate is aa. currency swap.b. currency option.c. forward contract.d. money market hedge.3. Which of the following can give rise to foreign currency transaction exposure?a. Selling goods whose prices are contractually denominated in a foreign currency.b. Borrowing funds in a foreign currency.c. Engaging in contracts to trade in foreign currency at a future date.d. Other economic transactions denominated in foreign currencies.e. All of the above.4. In the one-transaction approach:a. The gain or loss is recorded separatelyb. The gain or loss is reflected in the value of the resource acquiredc. Either (a) or (b)d. None of the above5. The two-transaction approach is required in:a. The United Statesb. Australiac. Canadad. All of the abovee. None of the above6. A forward exchange contract is an agreement to:a. Buy a foreign currency in the future at a variable rateb. Sell a foreign currency in the future at a variable ratec. Buy or sell a foreign currency in the future at a set rated. None of the above7. Under the monetary/non-monetary method of foreign currency translation, depreciation expense istranslated at the:a. Current rateb. Weighted average ratec. Historical rated. None of the above8. Under the temporal method, translation gains and losses appear in:a. the stockholders' equity sectionb. the income statement as a normal operating itemc. the income statement as an extraordinary itemd. None of the above9. Under the current rate methoda. all assets and liabilities are translated at the current year's average exchange rate.b. foreign currency translation gains and losses do not affect the income statement.c. all revenues and expenses are translated using the current exchange rate.d. the income statement contains a cumulative translation adjustment amount.10. Under SFAS No. 52, the temporal method of translation is used whena. the local currency is the functional currency.b. the local currency is the reporting currency.c. the parent's currency is the functional currency.d. the parent's currency is the reporting currency.11. Under SFAS No. 52, the current rate method of translation is used whena. the local currency is the functional currency.b. the local currency is the reporting currency.c. the parent's currency is the functional currency.d. the parent's currency is the reporting currency.12. Under SFAS No. 52, a hyperinflationary economy is defined as one that has inflation of approximately:a. 100 percent per yearb. 100 percent or more over a three year periodc. 25 percent per yeard. None of the above13. Under SFAS No. 52, the primary currency in which a company conducts its business is called the:a. Core currencyb. Functional currencyc. Hard currencyd. Convertible currency14. Under which translation method is the foreign currency translation gain or loss taken to stockholders'equity?a. The current rate methodb. The temporal methodc. The conversion methodd. None of the above15. When a foreign subsidiary's functional currency is its local currency and its financial statements areprepared in the local currency then SFAS No. 52 requires that:a. The current method be used in translating financial statements.b. The temporal method be used in remeasuring financial statements.c. The temporal method be used in translating financial statements.d. The current method be used in remeasuring financial statements.16. According to SFAS No. 52, a self-sustaining, autonomous foreign subsidiarya. has a low volume of transactions with the parent.b. has sales mainly denominated in the parent's currency.c. has the U.S. dollar as its functional currency.d. obtains financing primarily from the parent.e. should be disclosed as a separate geographic segment.17. According to SFAS No. 52, an integral foreign subsidiarya. has a low volume of transactions with the parent.b. must be 100 percent owned by the parent.c. obtains most of its financing locally.d. depends on the parent for its revenues and expenses.e.has an active local sales market for its products.18.The Indian subsidiary of a U.S. software firm purchased an office building on January 22, 2004, for IndianRupees (IRs.) 10 million when the exchange rate was IRs. 50 = US$1. On December 31, 2004 (the parent’s fiscal year-end), the exchange rate was Irs. 52 = US$1. The average exchange rate for the year 2004 was Irs. 51 = US$1. If the Indian subsidiary’s primary operating environment is conside red to be India, under the requirements of SFAS No. 52, at what amount will the office building be included in the consolidated financial statements at December 31, 2004?$200,000$192,308$196,078d.IRs. 10 millione.None of the above.19.The Indian subsidiary of a U.S. software firm purchased an office building on January 22, 2004, for IndianRupees (IRs.) 10 million when the exchange rate was IRs. 50 = US$1. On December 31, 2004 (the parent’s fiscal year-end), the exchange rate was Irs. 52 = US$1. The average exchange rate for the year 2004 was Irs. 51 = US$1. If the Indian subsidiary’s primary operating environment is considered to be the United States, under the requirements of SFAS No. 52, at what amount will the office building be included in the consolidated financial statements at December 31, 2004?$200,000$192,308$196,078d.IRs. 10 millione.None of the above.Use the following information to answer questions 20-25.The Comfy Couch Co. purchases raw materials on account from a Mexican company on June 2, 2004. The total amount of the invoice is 3 million Mexican pesos and is due on August 2, 2004. Comfy Couch Co.’s fiscal year ends on June 30, 2004. Listed below is the exchange rate between the Mexican peso and the US dollar on the relevant dates.Spot rate on June 2 MP 9.50 = US$1Spot rate on June 30 MP 9.60 = US$1Spot rate on August 2 MP 9.65 = US$1Forward rate for August 2 (on June 2) MP 9.70 = US$1In questions 20-23, assume that Comfy Couch Co. did not have a forward contract and that it does its accounting in accordance with SFAS No. 52.20.What is the US dollar value of the payable on June 2, 2004?$315,789$312,500$310,881$309,278e.None of the above.21.How much will Comfy Couch Co. pay (in US$) on August 2, 2004?a. US$315,789$312,500$310,881$309,278e.None of the above.22.What is the foreign currency gain or loss that Comfy Couch must recognize on June 30, 2004?a.Gain of US$3,289b.Gain of US$4,908c.Gain of US$6,511d.Gain of US$3,222e.None of the above.23.What is the foreign currency gain or loss that Comfy Couch must recognize on August 2, 2004?a.Gain of US$6,511b.Gain of US$3,222c.Gain of US$1,603d.Gain of US$1,619e.None of the above.24.If Comfy Couch entered into a forward contract on June 2, 2004, what is the dollar value of the payable?$315,789$312,500$310,881$309,278e.None of the above.25.If Comfy Couch entered into a forward contract on June 2, 2004, what amount in US dollars will it pay onAugust 2, 2004?$315,789$312,500$310,881$309,278e.None of the above.二、True/False Questions1. A currency option is a contract that provides the right and the obligation to trade a foreign currency at a setexchange rate on or before a given date.2. An indirect foreign currency quote represents how much of the foreign currency can be purchased for oneunit of the domestic currency.3. The bid rate represents the price at which a financial institution is willing to buy a currency.4. If the spot rate is higher than the forward rate for a particular currency, then that currency would be sellingat a premium.5. Quotation exposure, backlog exposure, and billing exposure are various stages of foreign currencytranslation exposure.6. All foreign transactions are also foreign currency transactions.7. Under the one-transaction approach, the transaction is not considered to be completed until the finalsettlement.8. Under the two-transaction approach, a company's foreign currency receivable or payable are considered aseparate transaction distinct from the transaction to buy goods or services.9. Under the current rate method of translation, all current assets are translated at the year end rate andnon-current assets are translated at the applicable historical rates.10. Under the current rate method, gains or losses from translation are shown in the cumulative translationadjustment account in the balance sheet.11. In the foreign currency context, there is no distinction between the terms conversion and translation.12. Using the current exchange rate to translate current assets and liabilities (under the current/non-currentmethod) is based on the false premise that they are similarly affected by exchange rate changes.13. The temporal method accommodates current market valuation of non-monetary assets (e.g., inventories)while the monetary/non-monetary method does not.14. A major criticism of SFAS No. 8 was that it required foreign currency translation gains and losses to beincluded in the income statement.15. Under the temporal method, translation gain or loss for the period appears in the stockholders' equitysection of the balance sheet.16. Cost of goods sold, depreciation expense, and amortization expense are translated at the average exchangerate under the temporal method and the year end exchange rate under the current rate method.17. SFAS No. 52 requires the use of the current rate method for foreign subsidiaries located inhyperinflationary environments.18. Under SFAS No. 52, functional currency is the currency of the primary operating environment in which theforeign subsidiary operates and generates cash flows.19. According to SFAS No. 52, a hyperinflationary economy is deemed to be one in which the annual inflationrate is greater than 100 percent.20. If the U.S. dollar is deemed to be the functional currency, then SFAS No. 52 requires that the current ratemethod be used.21. Since the current rate method of foreign currency translation uses a constant exchange rate to translatebalance sheet items, it preserves the original financial statement relationships in the consolidated financial statements.22. An advantage of the current rate method of foreign currency translation is that a foreign subsidiary'sfinancial statement ratios are the same before and after translation.23. IAS No. 21 requires the use of the temporal method of foreign currency translation for foreign operationsthat are integral to the operations of the reporting enterprise.24. As of June 30, 2003, Britain, Denmark and Sweden were among the European countries that adopted theeuro as their currency.25. Between January 1, 1999, and January 1, 2002, companies doing business in Euroland can enter into andsettle transactions in the national currency or the euro and must have the ability to process transactions in both currencies.。