CFA考试二级最详细笔记

- 格式:doc

- 大小:300.50 KB

- 文档页数:43

超详细版CFA二级考经今年6月的CFA二级成绩刚出来,我5A3B2C顺利通过。

这个成绩比那些大牛们还相差甚远,但我也不认为这是个低空飘过的分数。

两个C分别是Quantitative和FixedIncome,都是权重最小的(今年的FixedIncome破天荒只出了一个itemset),5个A里面却包括了Equity和FSA这样权重很大的科目。

根据权重来安排复习计划很重要,我考一级的时候就是这个战略,最后是以6A4B的成绩通过的,6个A里面依然包括着Equity、FSA和Ethics这些大权重topic。

但无论怎么复习终归还是有些点复习不到或者考试时候忘记,这是难以避免的,既然70%就可以通过,另外30%就要合理挥霍一下嘛。

为了攒人品和为后来者提供一些建议,我把我复习每一个topic的经验分享一下。

首先介绍一下我的学术背景:美国综合排名60位左右的大学经济学本科毕业(辅修数学和金融),现在在综合排名40左右的大学读金融研究生。

鉴于我开始读研究生的时候已经考完二级了,所以研究生的背景对于这次考试的通过可以忽略不计。

我在大学的时候修过几门金融的课程,但是真正把所有知识体系梳理清楚和对金融有清晰认识是复习CFA一级的时候。

一级虽然难度不高,但是知识点体系庞大,通过一级可以为以后的金融学习奠定一个很好的基础。

我正式开始复习二级是三月初,时间比较充裕,但如果你上班上课很紧张的话我建议从年初就要开始准备了。

Ethical &Professional StandardsEthics的面孔在所有topic里面既熟悉又陌生。

熟悉在那一条条一级就已经考过的道德准则,陌生在做练习题的时候照样一题题地做错。

Ethics比一级多加了一个Softdollar standard和Research objectivity standard, 看似仅仅是对道德准则中两条小准则的延伸,字面的表达也很好理解,但是无奈做题就是做不对。

CFA二级备考知识点CFA是能力证书,备考过程其实就是知识积累、能力培养的过程,变专业知识为个人的实际能力,才是投资CFA 考试的最高收益,而不能仅为一纸证书。

1、端正复习心态备战任何一项考试,首先必须端正复习心态。

对打算参加二级考试者来说,考试费用较高,牵涉精力较大,更需要考虑清楚。

CFA是能力证书,备考过程其实就是知识积累、能力培养的过程,变专业知识为个人的实际能力,才是投资CFA考试的最高收益,而不能仅为一纸证书。

2、制定复习策略复习策略决定着考生备考的方向和实际效果,特别是CFA二级这样的高难度考试,考生在复习时必须做到心中有数,而不能摸石头过河。

以下三点对考生备考CFA二级非常关键:①在理解基础上记忆相对于一级考试,二级考试更偏重于对基础知识的应用,因此,考生不能死记硬背,而应注重对阅读资料的理解,在理解的基础上进行记忆。

②把握新增的知识点二级考试是一级考试的延伸,很多复习资料在一级考试中已经涉及,在时间有限的情况下,考生应将更多的精力放在新增的知识点上面,进行重点突破。

③适当参加专业培训专业教师的指导有助于考生更好地理解知识、分析重点,增强复习的针对性。

3、抓住关键知识点CFA一级考试重点是金融基本概念和公式,而二级考试重点是资产定价理论的运用和投资组合管理(和往年注重会计理论有所不同),考生在备考中要注意关键知识点的变化。

此外,二级考试对会计科目的要求进一步提高,在一级基础会计的基础上,新增了公司并购会计、投资会计、外币会计和养老金会计等专题,还要求考生能辨识财务报表中的“会计骗术”。

4、安排有效训练答题速度仍然是通过CFA二级考试的关键,因此,考生在复习中,不仅要掌握知识原理,还要进行适当和有效的题目训练。

训练的目的除了巩固学习成果,还要提高做题速度。

在最后的冲刺阶段,一定要进行一到两次的模考,以便找到薄弱环节,及时弥补不足。

5、适当选用参考材料CFA二级有多本厚厚的教材,阅读量非常大,因此,考生常有这样的疑问:这些参考书要不要通读?还是只需读专业机构出版的辅导讲义(Study Notes)?一般来说,应以官方教材为本,以Study Notes为纲,即简单的内容直接看Notes,重点和难点的内容则应读原版的教材,此外,还要根据自己的复习进度选择一些习题集。

CFA二级所得税的学习笔记分享CFA二级所得税的学习笔记分享1、Income tax expense = Taxes payable +Deferred income tax expense, 这右边第二项正的就是deferred taxliability,负的就是deferred tax asset。

这个公式简单理解成所得税费用就包括实际交税(cashitem)和应该补交或可以抵扣的那部分税(non-cash item)。

这也表明,deferred taxasset/liability这两个科目的产生都是以difference will reverse in future years为前提的。

2、Deferredtax liability之所以产生,是因为今年实际交税少了,以后还是要补的,所以可简单理解成负债。

也就是说taxes payable< income tax expense, ie. Taxable income < pretax income. Deferredtax asset相反的产生过程,无需多讲。

但它有valuation allowance,也是一个备抵项目,但需要记住的是valuationallowance applies exclusively to deferred taxasset。

也是,出于谨慎性原则,对于资产才要备抵一下,负债从来不算这个的。

另外,涉及到备抵账户的,往往是管理层操纵业绩的一种手段,这种职业敏感性是要不断加强的。

比如allowance就会增加tax expense, 那相应净利润就会减少。

3、Deferred tax liability/asset的计算:列出两张表,分别based on tax return和financial reporting,然后两相比较,很容易得出。

4、Liabilitymethod和Deferred method的最大区别:the treatment of changes in tax rates. Thedeferred method is unaffected by changes in tax rates while theliability method adjusts deferred assets and liabilities to reflect thenew tax rates.5、Change in tax rates: 在Liabilitymethod方法之下,税率变动,账面上的deferredasset/ability也要revalue来反映今后它们reverse的当前价值。

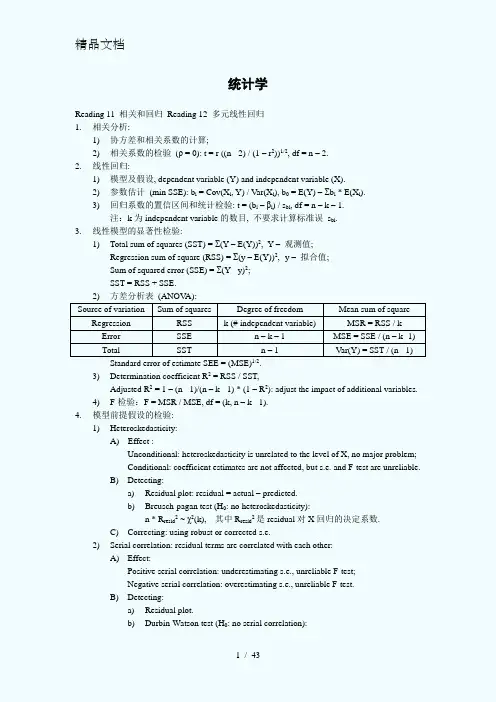

统计学Reading 11 相关和回归Reading 12 多元线性回归1. 相关分析:1) 协方差和相关系数的计算;2) 相关系数的检验(ρ = 0): t = r ((n - 2) / (1 – r2))1/2, df = n – 2.2. 线性回归:1) 模型及假设, dependent variable (Y) and independent variable (X).2) 参数估计(min SSE): b i = Cov(X i, Y) / Var(X i), b0 = E(Y) –Σb i * E(X i).3) 回归系数的置信区间和统计检验: t = (b i–βi) / s bi, df = n – k – 1.注:k为independent variable的数目, 不要求计算标准误s bi.3. 线性模型的显著性检验:1) Total sum of squares (SST) = Σ(Y – E(Y))2, Y –观测值;Regression sum of square (RSS) = Σ(y – E(Y))2, y –拟合值;Sum of squared error (SSE) = Σ(Y - y)2;SST = RSS + SSE.2) 方差分析表(ANOV A):Source of variation Sum of squares Degree of freedom Mean sum of square Regression RSS k (# independent variable) MSR = RSS / k Error SSE n – k – 1 MSE = SSE / (n – k -1) Total SST n – 1 Var(Y) = SST / (n - 1)Standard error of estimate SEE = (MSE)1/2.3) Determination coefficient R2 = RSS / SST,Adjusted R2 = 1 – (n - 1)/(n – k - 1) * (1 – R2): adjust the impact of additional variables.4) F-检验:F = MSR / MSE, df = (k, n – k - 1).4. 模型前提假设的检验:1) Heteroskedasticity:A) Effect :Unconditional: heteroskedasticity is unrelated to the level of X, no major problem;Conditional: coefficient estimates are not affected, but s.e. and F-test are unreliable.B) Detecting:a) Residual plot: residual = actual – predicted.b) Breusch-pagan test (H0: no heteroskedasticity):n * R resid2 ~ χ2(k), 其中R resid2是residual对X回归的决定系数.C) Correcting: using robust or corrected s.e.2) Serial correlation: residual terms are correlated with each other:A) Effect:Positive serial correlation: underestimating s.e., unreliable F-test;Negative serial correlation: overestimating s.e., unreliable F-test.B) Detecting:a) Residual plot.b) Durbin-Watson test (H0: no serial correlation):DW ≈ 2(1 - r), 其中r是残差的自相关系数, 0 ≤ DW ≤ 4.C) Correcting: corrected s.e. for both serial correlation and heteroskedasticity.3) Multicollinearity: independent variables are highly correlated with each other:A) Effect: individual variables are not significant (large s.e.) but their combination is.B) Detecting:a) None of individual coefficient is significant, but F-test is.b) Correlations between variables (> 0.7).注:两变量间的相关系数并未考虑变量线性组合的相关性,因此低相关系数并不一定意味着不存在multicollinearity.C) Correcting: omit correlated variables or take stepwise regression.4) Model misspecification: 不合适地选取解释变量(实际意义不对或不满足线性模型的前提假设)或不恰当的变量转换等.5. Dummy variable (0 – 1 variable):1) Independent dummy variable: linear regression is appropriate.注:n classes → (n - 1) dummy variable.2) Qualitative dependent variable (Y取0, 1): ordinary regression may not be appropriate, use logit regression model or discriminate model.Reading 13 时间序列分析1. Trend model:1) Linear: x t = b0 + b1t + εt;2) Log-linear: ln(x t) = b0 + b1t + εt, 常用于为增长率建模.2. Autoregressive model (AR):1) AR(p): x t = b0 + b1x t-1 + … + b p x t-p + εp, lag: 1, … , p.2) Covariance stationarity:a) Constant and finite E(X t): mean-reverting level for AR(1) E(X t) = b0 / (1 – b1).Random walks (unit root process): x t = b0 + x t-1 + εt不是平稳过程.b) Constant and finite Var(X t);c) Constant and finite Cov(X t, X t-k):对AR平稳序列, 自相关系数Cor(X t, X t-k) = ρk→ 0.3) Forecasting:a) In-sample (within the range of data) and out-sample forecasts.b) Short time series: more stable (no dramatic change);Long-time series: more reliable.c) Predicting power: root mean squared error (RMSE) on the out-sample data.3. AR模型的检验与修正:1) Nonstationarity:a) Detecting: Dickey-Fuller (DF) test or unit root test:For AR(1): x t– x t-1 = b0 + (b1 - 1)x t-1 + εt, H0: b1 = 1, t-test with modified s.e.b) Correcting - differencing:For random walks: 令y t = x t– x t-1, 有y t = b0 + εt.2) Serial correlation (residual terms should not exhibit serial correlation):a) Detecting:H0: Cor(εt, εt-k) = 0 for any lag k; t = Cor(εt, εt-k) / (1 / T) 1/2, df = T – p - 1.注: T – number of effective observations, T = n – p.一般线性回归中的DW检验不适用于AR模型。

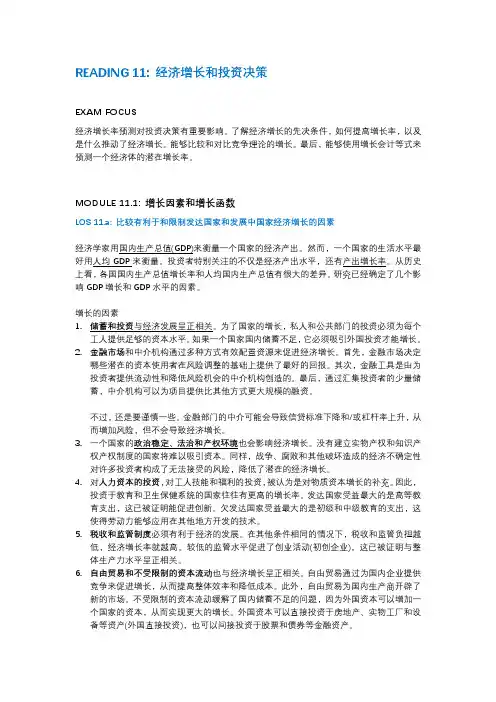

READING 11: 经济增长和投资决策EXAM FOCUS经济增长率预测对投资决策有重要影响。

了解经济增长的先决条件,如何提高增长率,以及是什么推动了经济增长。

能够比较和对比竞争理论的增长。

最后,能够使用增长会计等式来预测一个经济体的潜在增长率。

MODULE 11.1: 增长因素和增长函数LOS 11.a: 比较有利于和限制发达国家和发展中国家经济增长的因素经济学家用国内生产总值(GDP)来衡量一个国家的经济产出。

然而,一个国家的生活水平最好用人均GDP来衡量。

投资者特别关注的不仅是经济产出水平,还有产出增长率。

从历史上看,各国国内生产总值增长率和人均国内生产总值有很大的差异。

研究已经确定了几个影响GDP增长和GDP水平的因素。

增长的因素1.储蓄和投资与经济发展呈正相关。

为了国家的增长,私人和公共部门的投资必须为每个工人提供足够的资本水平。

如果一个国家国内储蓄不足,它必须吸引外国投资才能增长。

2.金融市场和中介机构通过多种方式有效配置资源来促进经济增长。

首先,金融市场决定哪些潜在的资本使用者在风险调整的基础上提供了最好的回报。

其次,金融工具是由为投资者提供流动性和降低风险机会的中介机构创造的。

最后,通过汇集投资者的少量储蓄,中介机构可以为项目提供比其他方式更大规模的融资。

不过,还是要谨慎一些。

金融部门的中介可能会导致信贷标准下降和/或杠杆率上升,从而增加风险,但不会导致经济增长。

3.一个国家的政治稳定、法治和产权环境也会影响经济增长。

没有建立实物产权和知识产权产权制度的国家将难以吸引资本。

同样,战争、腐败和其他破坏造成的经济不确定性对许多投资者构成了无法接受的风险,降低了潜在的经济增长。

4.对人力资本的投资,对工人技能和福利的投资,被认为是对物质资本增长的补充。

因此,投资于教育和卫生保健系统的国家往往有更高的增长率。

发达国家受益最大的是高等教育支出,这已被证明能促进创新。

欠发达国家受益最大的是初级和中级教育的支出,这使得劳动力能够应用在其他地方开发的技术。

CFA2笔记2Session101、IV intrinsic value 内在价值(回报现值)(大多数投资的标准)2、Going concern 继续经营3、Fair market value 愿买愿卖,了解情况下的价值4、Investment value 股票对个别购买者的价值(视个别情况而定)(对收购的人有参考价值)5、Porter’s five elements of industry structure.P126、Conglomerate discount 混合折扣,(经营多个业务,市值小于各部分价值之和(sum of theparts value))7、考虑模型时的三个问题P15 适合公司、符合输入要素、符合分析目的8、P229、IRR 未来现金流现值等于当前价格的利率10、Equity risk premium=required return on equity index –risk-free rate11、Required return for stock j=risk-free rate +p(Equity risk premium)12、Gordon growth model(常数增长模型)简单。

适用于发达经济体和市场,但不能用于变化的环境,且稳定的增长率不适合快速发展的经济体13、Supply-side estimates(macroeconomic model)仅适合发达国家,P2614、CAMP(简单,但是解释力不强)=15、Multifactor model (解释力强,但是复杂,贵)16、Fama-French model 解释小盘股高收益P2817、Pastor-Stambaugh 在Multifactor model的基础上增加了流动性因素18、Macroeconomic multifactor model19、Bulid-up method (使用历史数据,对当前市场情况估计不足)20、Bond-yield plus risk premium method 适合公司有公开交易的负债21、Public company 一般用近五年的月数据,或者近两年的周数据(快速增长市场)计算股票收益22、Beta drift:23、Beta estimates for thinly traded stocks and nonpublic company(选基准公司,去杠杆,恢复杠杆)P3324、Country spread model(用发达国家做技术,然后用发展中国家的债券和发达国家债券的利率差做为附加溢价)25、Country risk rating model 计算出发达国家的等式,用发展中国家的数据作为输入1、企业考虑竞争策略的两个核心问题:行业吸引力,竞争优势2、Porter 分析六部法P49 定义行业,定义参与者,五力优缺点分析,定义产业结构,评估各势力当前和潜在的变化,决定五力中可改变影响行业或者企业的价值的力3、P62 股利计算现金流(DDM): 支付过股利,股利支付与盈利相关,从小股东角度出发4、FCFF 经营现金流与公司投资现金的差,FCFE 资本支出、运营资本,债务融资需要之后的由股东掌握的现金。

梦轩考资网会员专供,未经同意,禁止转载!

专供,未经同意,禁止转载!

考试之家会员专供,未经允许,禁

考试之家会员专供,未经允许,

考试之家会员专供,未经允许,禁止

考试之家www.mykszj .com会员专供,未经同

梦轩考资网会员专供,未经允许,禁止转载!

考试之家会员专供,未经允许,禁止转载!

考试之家会员专供,未经允许,禁止转载!

考试之家会员专供,未经允许,禁止转载!

考试之家会员专供,未经允许,禁止转载!

考试之家会员专供,未经允许,禁止转载!

考试之家会员专供,未经允许,禁止转载!

考试之家会员专供,未经允许,禁止转载!

考试之家会员专供,未经允许,禁止转载!

梦轩考资网会员专供,未经允许,禁止转载!

梦轩考资网会员专供,未经允许,禁止转载!

考试之家会员专供,未经允许,禁止转载!

考试之家会员专供,未经允许,禁止转载!

载!。

cfa二级知识点总结The Chartered Financial Analyst (CFA) Level II exam is designed to test candidates' knowledge of investment tools and fundamental concepts. This exam builds on the foundational knowledge tested in Level I and focuses on more complex topics related to investment management. In this summary, we will review some of the key knowledge areas covered in the Level II exam.Ethical and Professional StandardsEthical and professional standards are a key component of the CFA program and are tested at all three levels of the exam. In Level II, candidates are required to demonstrate a deep understanding of the CFA Institute Code of Ethics and Standards of Professional Conduct. This includes knowledge of the ethical principles that guide the behavior of investment professionals, as well as the standards that govern their professional conduct.Quantitative MethodsQuantitative methods are essential tools for investment analysis. In Level II, candidates are expected to have a strong understanding of statistical concepts, including probability distributions, sampling and estimation, hypothesis testing, and regression analysis. They are also expected to be proficient in the application of these concepts to investment analysis, including the calculation and interpretation of key statistics such as alpha, beta, and the Sharpe ratio.EconomicsEconomics is a critical element of investment analysis, as it provides the foundation for understanding the behavior of markets and economies. In Level II, candidates are required to have a thorough understanding of microeconomic and macroeconomic principles, including market structure, supply and demand, economic indicators, and monetary and fiscal policy. They are also expected to be able to apply these concepts to the analysis of investment opportunities and market trends.Financial Reporting and AnalysisFinancial reporting and analysis are key skills for investment professionals, as they provide the information necessary to make informed investment decisions. In Level II, candidates are required to have a deep understanding of financial statement analysis, including the interpretation and analysis of balance sheets, income statements, and cash flow statements. They are also expected to be able to apply this knowledge to the evaluation of companies and industries.Corporate FinanceCorporate finance is an important area of study for investment professionals, as it provides the framework for understanding the financial decisions of corporations. In Level II,candidates are required to have a strong understanding of capital budgeting, cost of capital, and capital structure. They are also expected to be able to apply this knowledge to the evaluation of investment opportunities and the determination of optimal capital structures for companies.Equity InvestmentsEquity investments are a core component of many investment portfolios, and candidates are required to have a strong understanding of equity valuation methods, including dividend discount models, discounted cash flow analysis, and relative valuation techniques. They are also expected to be able to apply these methods to the valuation of individual stocks and equity portfolios.Fixed IncomeFixed income securities are an important asset class for many investors, and candidates are required to have a deep understanding of the characteristics and valuation of fixed income securities, including bonds, mortgage-backed securities, and floating rate notes. They are also expected to be able to apply this knowledge to the analysis of fixed income portfolios and the assessment of interest rate risk.DerivativesDerivatives are complex financial instruments that are used to manage risk and speculate on market movements. In Level II, candidates are required to have a strong understanding of the characteristics and valuation of futures, forwards, options, and swaps. They are also expected to be able to apply this knowledge to the analysis of derivative strategies and the assessment of derivative instruments.Alternative InvestmentsAlternative investments, such as private equity, hedge funds, and real estate, are an important component of many investment portfolios, and candidates are required to have a deep understanding of these asset classes. In Level II, candidates are expected to have a strong understanding of the characteristics and valuation of alternative investments, as well as the risks and opportunities associated with these asset classes.Portfolio ManagementPortfolio management is the process of constructing and managing investment portfolios, and candidates are required to have a thorough understanding of the principles and practices of portfolio management. In Level II, candidates are expected to be able to apply their knowledge of asset allocation, portfolio construction, and performance evaluation to the management of investment portfolios.Overall, the Level II exam covers a wide range of topics related to investment management, including ethical and professional standards, quantitative methods, economics, financialreporting and analysis, corporate finance, equity investments, fixed income, derivatives, alternative investments, and portfolio management. Candidates are required to have a deep understanding of these topics in order to pass the exam and earn the CFA designation.。

cfa二级数量知识点-回复CFA二级数量知识点CFA(Chartered Financial Analyst)二级考试是国际上公认的金融行业从业者的专业资格认证考试之一,该考试从基础的知识点到专业的实践应用都有涉及。

本文将以CFA二级考试中数量知识点为主题,深入分析并逐步回答与数量相关的问题,帮助考生更好地理解和掌握这部分知识。

首先,我们来看一下CFA二级考试中涉及的数量知识点有哪些。

CFA二级考试中与数量相关的内容主要包括:概率论,假设检验,逻辑回归和时间序列分析。

这些内容是金融行业从业者必备的基础知识,对于投资决策和风险管理至关重要。

一、概率论概率论是研究随机事件发生的规律性的数学理论。

在金融行业,我们经常需要对风险进行估计和控制,概率论为我们提供了工具和方法。

在CFA二级考试中,常见的概率论知识点包括:随机变量和概率分布、期望和方差、联合分布和条件分布、中心极限定理等。

对于概率论的学习,我们可以从以下几个方面展开。

1.了解基本概念和常见分布:首先,我们需要掌握概率论的基本概念,例如样本空间、事件、随机变量等。

然后,需要熟悉一些重要的概率分布,例如:正态分布、二项分布、泊松分布等。

这些分布在金融领域的应用非常广泛,掌握它们的特性和应用场景是非常重要的。

2.计算期望和方差:期望和方差是描述随机变量分布特征的重要指标。

在金融行业,我们经常需要对资产的预期收益和风险进行估计。

在CFA二级考试中,常常会涉及期望和方差的计算和应用,因此我们需要学会如何计算和应用期望和方差。

3.了解联合分布和条件分布:在金融领域,我们经常需要研究两个或多个变量之间的关系。

联合分布和条件分布为我们提供了研究随机变量之间关系的工具和方法。

在CFA 二级考试中,我们需要掌握联合分布和条件分布的概念、计算和应用。

4.了解中心极限定理:中心极限定理是概率论中一个非常重要的定理。

它指出,大量独立同分布的随机变量的和或平均值的分布会趋近于正态分布。

CFA二级笔记30-固收-信用风险模型分析图片版第一部分:第二部分:文字版1. 错题笔记错题1---结构化模型vs简约模型反思:简约模型基于外部数据和宏观数据分析,B项吻合,C项用到概率分布属于结构化模型错题2---解释信用基差期限结构的特征反思:这道题可以从两个角度解读(1)材料说了,DLL是个高质量的债券,只有A项符合高质量的定义(2)为什么高质量债券的信用基差曲线是斜向上的呢?1)本身利率曲线就是斜向上的2)高质量债券,目前大环境OK,但是所谓没有“常胜将军”,大环境是具有周期性的,现在好不代表未来就好,未来环境变差的话,高质量债券也可能变成低质量,这时要求的信用基差就比较大错题3---对比资产支持证券的信用分析方法反思:关键词-homogeneous(同质性),同质性强的,基础资产池分析哦错题4---了解exposure反思:低级错误!!!看成bond1比bond2了!!!Bond1和bond2 exposure一样的,LGD就看RR了,bond2RR低,那么LGD就大2. 本章框架Reading 1: The Term Structure and Interest Rate Dynamics★★★Rading 2: The Arbitrage-Free Valuation Framework★★Reading 3: Valuation and analysis: Bonds with Embedded Options★★★Reading 4: Credit Analysis Model★★Reading 5: Credit Default Swaps★★3. 信用风险建模A. E xpected loss信用风险定义:Credit risk is the risk associated with losses from the failure of aborrower to make timely and f u lly payments of interest or principal信用风险公式:Expected loss = Probability of default * Loss given defaulti. L oss given defaultExpected loss = Probability of default * Loss given defaultLoss given default (LGD) is the amount of loss if a default occursLoss given default (%) =100% - Recovery rateLoss given default ($) = Expected exposure - Recovery ($)Recovery rate is percentage of the loss recovered from a bond in defaultExpected exposure is the projected amount of money the investor couldL ose if an event of default occurs, before factoring in possible recoveryQuestion:Are the expected exposure equal to the fair value?答案是预期敞口不等于公允价值预期敞口等于未来现金流折现+此时此刻的现金流公允价值等于未来现金流折现ii. P robability of defaultexpected loss = Probability of defaul t * Loss given defaultProbability of default (POD) is the probability that he bond issuer will not meet its contractual obligations on schedule1)Actual probability of defaultThe actual default probability for the corporate bond can observed from historical data2)Risk-neutral probability of default“Risk-neutral” follows the usage of the term in option pricingIn the risk neutral option pricing methodology, the expected value for the payoffs is discounted using the risk-free interest rate违约概率分为实际违约概率(根据历史数据推出)和风险中性概率(计算得出)风险中性概率推导逻辑:假设一年期到期回收100元100/(1+YTM):分子100是有惊无险拿到,分母YTM包含了信用风险100*RR*POD+100*(1-POD):100*RR*POD,违约情况下拿到的钱;100*(1-POD),不违约情况下拿到的钱;分母Rf 代表无风险利率那么分子的POD就是风险中性概率通过公式推导,风险中性违约概率>实违约概率(YTM不仅仅含有信用风险,还有其他风险,如流动性风险等)Th initial POD, which is called the hazard rate in statistics, is used to calcu l ate the remain in PODsHazard rate is the conditional default rate,which mean the default rate under the condition that no default happens beforeProbability of survival (POS) is under the condition that no default happens beforePOD,站在0时刻看某个时间段的违约概率(死掉概率)H azard rate,站在当前时刻某个时间段的违约概率POS,站在0时刻看个时间段的不违约概率(活下来概率)几个问题:Hazard rate = 10%(风险率)At the end of Year1/Year2,Year3What is the POD?What is the POS?What is the general formula?What is the formula for POD?What is the formula for POS?POD i+ POS i= 1?(不等于1)答案如下:B. CVAFair value of corporate bond = VND -CVAVND: the value for the corporate bond assuming no de faultCredit valuation adjustment (CVA) is the value of the cr edit risk in present value termCVA is the sum of PV of expe cted loss整个公式串起来:4. 有风险债券估值A. 例题1(0息债券,水平利率)【重点例题】Considering a 5-year, zero-coupon corporate bond with following:A flat government b ond yield curve at 3.00%The initial POD is 1.25%, which is c alled the hazard rateDefault occurs only at year end (on dat es 1, 2, 3, 4, 5) and that default will not occur on date 0The par value is $100The recovery rate is 40%To determine:(1)Fair value given the credit risk求CVA=3.115VND = 100/1.035 = 86.2609Fair value= VND -CVA= 86. 2609- 3.1539 = 83.106(2)The rate of return(3)The spread over a maturity-matching government bondGiven a price of 83.1060, we can calculate its yield to maturi ty: 100/(1+YTM)5=83.1060 > YTM= 3.77%The yield on the 5-year, zero-coupon government bond is 3.00% So the credit spread is77 basis points: 3.77%- 3.00% = 0.77%B. 例题2(付息债券,水平利率)【次重点例题】A fixed-income trader observes a 3-year, 5% annual payment corporate bond trading at $104 p er $10O of par valueThe trader determines that the conditio nal POD for each date for the bond is 1.50% given a recover y rate of 40%The government bond yield curve is flat at 2.50%(1)Based on these assumptions, does the trader deem the cor porate bond to be overvalued or undervalued?CVA=2.72If this 3-year, 5% bond were default free, its price (VND) would be$1 07.14015/(1+2.5%)+5/(1+2.5%)^2+105/(1+2.5%)^3= 107.1 401Fair value = VND - CVA= 107.1401 -2.7222= $104.4178 Therefore, this corporate bond is under valued by $0.4178if it is trading at a price of $104(2)By how much?一共有4个收益率:第一年就违约的收益率;第二年就违约的收益率;第三年就违约的收益率;3年都没有违约的收益率(3) If the trader buys the bond at $104, what are the proj ected annual rates of return?C. 例题3(付息债券,利率二叉树)【非重点】The following table displays the data for the spot rate curve The 1-year government bond has a negative yield to reflect theco nditions seen in some financial marketsWe assumes 10% vo latility in benchmark interest ratesConsider a 5-year, 3.50% annual payment, $100 par value corporate bon dThe hazard rate is 1.25% and a recovery rate of 40%第一步,构建利率二叉树:第二步,算VND:Step 2: Determine VND 1)The binomial interest rate tree for benchmark rates can be used tocalculate the VND for the bond The VND is $103.54502) This co uld also have been obtained directly using the benchmark discount factorsV (3.50x 1.002506) + (3.50 x 0.985093) + (3. 50x 0.955848) +(3.50 x 0.913225) + (103.50 x 0.870016)= $1 03.5450第三步和第四步,算CVA和最终价值:重要结论:利率波动率从10%增加到20%带来的影响10% volatility fair value of the bond = 103. 5450-3.5394=100.005620% volatility: fair value of the bond =103 5450-3.5390=100.0060The fair value of the bond will increase with a higher interest ratevolatility The reason for the small volatility impact on the fa ir value is theasymmetry in the forward rates produced by the log norm ality assumption in the interest rate model利率波动性增加,使风险债券的价值增加,CVA减少(原因:利率二叉树不对称性——上涨利率比下跌利率幅度大——那么导致价格下跌幅度比上升幅度大——敞口变小——CVA减少)D. 例题4(付息债券,利率二叉树,浮动利息)【非重点】The spot rate curve is the same with Example 3So we constr uct the 1-Year binomial interest rate tree for 10% volatilityConsider a 5-year floater" that pays annually the 1-year benchmark rate plus 0.50%Assume that for the first th ree years the annual default probability(the hazard rate) is 0 .50% and the recovery rate 20%The credit risk of the issuer then worsens: For the final two yearsthe probability of default goes up to 0.75% and the recover y rate goes down to 10%第一步,计算VND:第二步,计算CVA:注意下,第4年和第5年POD和RR不一样难点,求exposure:。

cfa二级知识笔记一、资产估值方法1.市场法市场法是一种根据市场上可观察到的交易活动来确定资产价值的方法。

在估值过程中,需考虑市场上的供求关系以及交易价格等因素。

2.收益法收益法是一种基于资产未来收益预测来确定资产价值的方法。

通过考虑资产未来现金流的折现值来估算其价值。

3.成本法成本法是一种基于资产的取得成本来确定资产价值的方法。

按照成本法估值时,需要考虑资产的取得成本以及与资产相关的折旧或折耗等因素。

二、风险管理1.风险类型常见的风险类型包括市场风险、信用风险、流动性风险、操作风险、汇率风险等。

投资者在进行投资决策时,需要综合考虑各类风险因素。

2.投资组合理论投资组合理论是指通过选择不同的资产组合来实现风险和收益的最优平衡。

通过将不同风险资产进行组合,投资者可以降低总体风险,并最大化投资组合的收益。

3.衍生品市场衍生品市场是指用于交易金融衍生品的市场。

金融衍生品包括期货合约、期权合约、互换合约等,可以用于对冲风险、进行套利交易等。

三、资本市场1.股票市场股票市场是指用于交易股票的市场。

投资者可以通过购买股票来购买公司的所有权,享受公司的盈利分红,并在未来股价上涨时获取资本利润。

2.债券市场债券市场是指用于发行和交易债券的市场。

债券是一种固定收益证券,发行人向持有人承诺在未来的某个时间段内支付固定的利息。

3.外汇市场外汇市场是指用于进行外汇交易的市场。

投资者可以通过汇率波动来获取利润,同时外汇市场也是跨国企业进行资金结算的重要场所。

四、财务报表分析1.资产负债表资产负债表是一种反映企业资产、负债、所有者权益状况的财务报表。

通过分析资产负债表可以了解企业的资产结构和资金使用情况。

2.利润表利润表是一种反映企业利润状况的财务报表。

通过分析利润表可以了解企业的营业收入、成本、利润等信息。

3.现金流量表现金流量表是一种反映企业现金流量状况的财务报表。

通过分析现金流量表可以了解企业的现金流量来源和运用情况。

以下是一些关于CFA二级考试的知识点笔记:

1. 财务报告与分析:这部分考察的是对财务报告的解读、编制和分析能力,包括如何评估财务报告的质量,如何分析和解释关键的财务指标,以及如何使用这些信息来评估公司的业绩和财务状况。

2. 经济学:这部分考察的是对微观经济学和宏观经济学的基本理解,包括需求和供给分析、市场结构、生产成本、货币和财政政策等。

3. 投资组合管理:这部分考察的是对投资组合理论和实践的理解,包括资产配置、风险评估和管理、投资策略的制定和执行等。

4. 财务报表分析:这部分考察的是对财务报表的理解和解析能力,包括如何分析资产负债表、利润表和现金流量表,如何评估公司的盈利能力、偿债能力和运营效率等。

5. 权益投资:这部分考察的是对权益投资的基本理解,包括股票市场的运作、股票分析和选择、股票估值等。

6. 固定收益投资:这部分考察的是对固定收益市场和产品的理解,包括债券市场的运作、债券分析和选择、债券估值等。

7. 衍生品投资:这部分考察的是对衍生品市场和产品的理解,包括期货、期权、互换等衍生品的运作、分析和估值。

8. 其他投资:这部分考察的是对其他投资产品的理解,包括房地产、私募股权、对冲基金等。

以上知识点只是其中的一部分,要成为一名优秀的CFA持证人,需要全面掌握CFA的知识体系,不断提升自己的专业素养和实践能力。

CFA二级笔记14-权益-RI模型本章框架一、concepts of residual income1、basic concepts2、calculations of residual income2.1 basic formula(重点)2.2 fundamental determinations of RI2.3 alternative formula to calculate RI3、residual income forecast(重点)3.1 clean surplus relationship3.1 violation of clean surplus relationship【错题2】反思:对violation of clean surplus relationship不熟悉OCI记录在资产负债表,OCI绕过了利润表直接影响到equity,进而影响到book value per share3.2 balance sheet adjustments for fair value3.3 intangible asset3.3 non-recurring items3.4 other aggressive accounting practices3.5 international considerations4、commercial implementations4.1 economic value added【错题1】反思:MVA公式不熟悉二、valuation of modes1、single stage model【错题3】反思:不熟悉single-stage 的公式,纯属猜对【错题4】反思:猜对的,同样对single stage公式不熟悉2、multi-stage models2.1 using future P/B ratio2.2 using persistence factor【错题5】反思:这道题也是猜对的;主要是时间轴没画对以及多阶段模型判断错误三、model comparison。

2017年CFA二级考试知识点梳理2017年6月CFA考试就快到了,你做好准备了吗?尤其是准备考CFA二级的考生是不是更加紧张了,毕竟虽说CFA二级的考试Topics跟一级一样,但是客观的说二级的难度是一级的2倍,这也是很多人Fail的第一个坎儿。

今天浦江财经就把CFA二级考试知识点梳理一遍。

在临近考试前半个月到一个月左右的时间里浦江财经建议把CFA协会官网上的科目练习题,官方教材的科目练习题以及近五年左右的mock都做一遍,心理上要有看到题目往上扑的冲动,保持求战欲!总体的复习思路是“不做新题,注重错题”。

研究错题的价值要超过mock的正确率,如果你做错的题在考试中还是做错,就是悲剧,考生可以按照每个session整理错题,CFA考试可以说是没有明确范围的,任何你认为细小的点都可能成为考题,甚至是答题。

不能认为反正是小概念,真题中不会出现。

要知道这题目为什么错。

3小时做一套题目,每个session或每个case旁边记下每部分的用时,做到心中有数,考场上才能合理规划时间。

练习essay question时,一定要完整书写考试过程,模拟三小时的紧张度。

你不是证监会,所有走势波动都能在心里默默完成。

最后关头,不要偷懒,否则考场上一定给你颜色看。

CFA一级、二级不会特别紧张,每场考试一般都能留下20-40分钟不等的时间。

三级上午考试的时间管理特别重要,原则上是1分钟得1分。

一定要追求性价比,不会的先扔掉,最后回过来补。

上午题做在50-60%之间,下午题追求60-70%以上就能过了。

许多考生把上午题涂满作为对的起自己的标准,可见时间非常紧张。

实际上,如果通过严格的训练,中国考生可以做到提前半小时做完。

当然了,做题也不是盲目的,还要梳理好二级知识点,然后对应做题。

CFA二级考试中财务是难点,麻烦的是估值,股票、债券、衍生工具等,繁琐又重要。

对于这些难点就应该花费更多的时间,多看几遍notes,多做题。

浦江财经介绍几个合适的CFA复习方法:1、熟悉CFA知识点第一周过一遍notes,从比重较大的equity investments和financial reporting analysis开始看起,然后逐步看至比重小的模块(比重太小的可以选择放弃不看,但不推荐)。

统计学Reading 11 相关和回归Reading 12 多元线性回归1. 相关分析:1) 协方差和相关系数的计算;2) 相关系数的检验(ρ = 0): t = r ((n - 2) / (1 – r2))1/2, df = n – 2.2. 线性回归:1) 模型及假设, dependent variable (Y) and independent variable (X).2) 参数估计(min SSE): b i = Cov(X i, Y) / Var(X i), b0 = E(Y) –Σb i * E(X i).3) 回归系数的置信区间和统计检验: t = (b i–βi) / s bi, df = n – k – 1.注:k为independent variable的数目, 不要求计算标准误s bi.3. 线性模型的显著性检验:1) Total sum of squares (SST) = Σ(Y – E(Y))2, Y –观测值;Regression sum of square (RSS) = Σ(y – E(Y))2, y –拟合值;Sum of squared error (SSE) = Σ(Y - y)2;SST = RSS + SSE.3) Determination coefficient R2 = RSS / SST,Adjusted R2 = 1 – (n - 1)/(n – k - 1) * (1 – R2): adjust the impact of additional variables.4) F-检验:F = MSR / MSE, df = (k, n – k - 1).4. 模型前提假设的检验:1) Heteroskedasticity:A) Effect :Unconditional: heteroskedasticity is unrelated to the level of X, no major problem;Conditional: coefficient estimates are not affected, but s.e. and F-test are unreliable.B) Detecting:a) Residual plot: residual = actual – predicted.b) Breusch-pagan test (H0: no heteroskedasticity):n * R resid2 ~ χ2(k), 其中R resid2是residual对X回归的决定系数.C) Correcting: using robust or corrected s.e.2) Serial correlation: residual terms are correlated with each other:A) Effect:Positive serial correlation: underestimating s.e., unreliable F-test;Negative serial correlation: overestimating s.e., unreliable F-test.B) Detecting:a) Residual plot.b) Durbin-Watson test (H0: no serial correlation):DW ≈ 2(1 - r), 其中r是残差的自相关系数, 0 ≤ DW ≤ 4.C) Correcting: corrected s.e. for both serial correlation and heteroskedasticity.3) Multicollinearity: independent variables are highly correlated with each other:A) Effect: individual variables are not significant (large s.e.) but their combination is.B) Detecting:a) None of individual coefficient is significant, but F-test is.b) Correlations between variables (> 0.7).注:两变量间的相关系数并未考虑变量线性组合的相关性,因此低相关系数并不一定意味着不存在multicollinearity.C) Correcting: omit correlated variables or take stepwise regression.4) Model misspecification: 不合适地选取解释变量(实际意义不对或不满足线性模型的前提假设)或不恰当的变量转换等.5. Dummy variable (0 – 1 variable):1) Independent dummy variable: linear regression is appropriate.注:n classes → (n - 1) dummy variable.2) Qualitative dependent variable (Y取0, 1): ordinary regression may not be appropriate, use logit regression model or discriminate model.Reading 13 时间序列分析1. Trend model:1) Linear: x t = b0 + b1t + εt;2) Log-linear: ln(x t) = b0 + b1t + εt, 常用于为增长率建模.2. Autoregressive model (AR):1) AR(p): x t = b0 + b1x t-1 + … + b p x t-p + εp, lag: 1, … , p.2) Covariance stationarity:a) Constant and finite E(X t): mean-reverting level for AR(1) E(X t) = b0 / (1 – b1).Random walks (unit root process): x t = b0 + x t-1 + εt不是平稳过程.b) Constant and finite Var(X t);c) Constant and finite Cov(X t, X t-k):对AR平稳序列, 自相关系数Cor(X t, X t-k) = ρk→ 0.3) Forecasting:a) In-sample (within the range of data) and out-sample forecasts.b) Short time series: more stable (no dramatic change);Long-time series: more reliable.c) Predicting power: root mean squared error (RMSE) on the out-sample data.3. AR模型的检验与修正:1) Nonstationarity:a) Detecting: Dickey-Fuller (DF) test or unit root test:For AR(1): x t– x t-1 = b0 + (b1 - 1)x t-1 + εt, H0: b1 = 1, t-test with modified s.e.b) Correcting - differencing:For random walks: 令y t = x t– x t-1, 有y t = b0 + εt.2) Serial correlation (residual terms should not exhibit serial correlation):a) Detecting:H0: Cor(εt, εt-k) = 0 for any lag k; t = Cor(εt, εt-k) / (1 / T) 1/2, df = T – p - 1.注: T – number of effective observations, T = n – p.一般线性回归中的DW检验不适用于AR模型。

b) Correcting: increase the order p until all serial correlations are removed.3) Seasonality:a) Detecting: seasonal lag k: Cor(εt, εt-(k-1)) = 0, but Cor(εt, εt-k) ≠ 0 (同上述t检验).b) Correcting: include a seasonal lag term: x t = AR(p) + b k x t-k.4) Conditional heteroskedasticity:a) Autoregressive conditional heteroskedasticity model (ARCH):εt2 = a0 + a1 * εt-12 + ηtb) Detecting: H0: a1 = 0.4. Multivariate time series model (Y t ~ X t):1) Premise for regression model:a) Y t and X t are both stationary;b) Y t and X t are both non-stationary but cointegrated.2) Cointegration test:y t = b0 + b1x t + εt, εt is tested for a unit root using DF test.经济学Reading 14 经济增长Reading 20 经济衡量1. Measuring economic activity:1) Measures of economic activity:GNI (国民总收入) = GDP + net property income from abroad;NNI (国民净收入) = GNI – depreciation.2) GDP at current price = GDP at constant price * (1 + GDP deflator).注:GDP平减指数既包含物价变动,也包含GDP组分的变动2. Measuring economic growth:1) Growth rate in real GDP;2) Rule of 70: Approximate years for real GDP to double = 70 / growth rate (percentage).3. Sources of economic growth:1) Preconditions: incentive system – markets, property rights and monetary exchange.2) Key factors driving economic growth:a) Labor: investment in human capital;b) Capital: saving and investment in new capital;c) Entrepreneurial ability: discovery of new technologies.3) Productivity curve: labor productivity (real GDP per labor hour) ~ capital per labor houra) Growth in capital per labor hour – movement along curve, law of diminishing returns;b) Growth in technology – curve shift upwards.c) One-third rule:Labor productivity growth results from capital growth = 1/3 * growth in capital per labor hour;Labor productivity growth results from technology growth = labor productivity growth - labor productivity growth results from capital growth.4. Growth theory:1) Classical growth theory (constant subsistence level): labor productivity rises above the subsistence level → subsistence real wages rise above the minimum required → population explosion → labor productivity is driven back to the subsistence level.2) Neoclassical growth theory (constant target real rate of return = Δreal GDP per labor hour / Δcapital per labor hour): labor productivity rises due to lucky technology changes →increase in real rate of return → more investment and savings, but law of diminishing return holds → real rate of return is driven back to the target rate.注:Population growth is independent of economic growth in the neoclassical model. The technology (and productivity) may stop growing when the real interest rate is equal to the target rate of return.3) New growth theory (continuous economic growth): innovation → higher return →competition → lower return → incentive for innovation.注:Knowledge capital is public goods and it is not subject to the law of diminishing return due to the incentive for innovation.Reading 15 产业政策1. Industry regulation:1) Social regulation: for all industries, such as product quality and safety.2) Economic regulation: pricing policy for the firms within a industry:a) Cost-of-service regulation: set the maximum price;b) Rate-of-return regulation: set the maximum rate of return.2. Effects of regulation:1) Negative effects: higher costs of product response to regulation;Deregulation has negative effects in the short run, but the long-run benefits include lower cost and better products.2) Regulators’ behavior:a) Capture hypothesis: regulators will be captured by the industry that is regulated.b) Share-the-gains, share-the-pains theory: regulators will strive to all three interested parties including legislators, customers and regulated industries.Reading 16 世界贸易1. Comparative advantage:1) Concept: the lowest opportunity cost of a product. For two goods A and B, if one country has comparative advantage in A, the other must have comparative advantage in B.2) Law of comparative advantage: total production and consumption will increase if trade partners export goods with comparative advantage and import goods without advantage.2. Trade restrictions:1) Reasons for trade restrictions:a) Desire by government for tariff revenue.b) Domestic industries to gain protection (infant industry argument, anti-dumping argument).c) Other arguments not supported by economic theory in the long run: protect jobs and high wage levels.2) Trade barriers:a) Tariffs (关税): benefit protected industry and government.b) Quotas: benefit protected industry and import license holders.c) Voluntary export restraints (exporting countries voluntarily limit the quality of goods for exporting): benefit protected industries and export license holders.3. Balance-of-payments (BOP) accounts (国际收支账户) (Reading 17):1) Accounting equation: current account + capital account + official reserve account = 0.2) Current account = export – import: exchange of goods and services.3) Capital account = investment in – investment out, including equity and debt;Borrowing (capital account > 0) to finance a current account deficit.4) Official reserve account:If current account + capital account > 0 (收支盈余), official reserve account < 0 (而外汇储备增加).Reading 18 汇率1. Exchange rate:1) Quotation, currency appreciation and depreciation:a) Direct quotes: DC/FC, or FC:DC (注意后者不表示相比);b) Indirect quotes: FC/DC, or DC:FC.注:一般汇率S均指直接标价,S↑外币升值(本币贬值)。