审计方法练习题doc

- 格式:doc

- 大小:435.00 KB

- 文档页数:8

审计学考试试题1. 简答题

(1) 什么是审计?

(2) 为什么需要进行审计?

(3) 审计的主要原则有哪些?

2. 选择题

(1) 下列哪项不属于审计的目标?

A. 保证资产的安全

B. 确保财务报表的准确性

C. 持续监控企业经营状况

D. 提供决策建议

(2) 以下哪个是审计人员的职责?

A. 制定企业年度预算

B. 负责编制财务报表

C. 发现并报告财务报表中的错误

D. 进行市场营销活动

3. 简答题

(1) 解释内部审计和外部审计的区别。

(2) 说明审计师在进行审计工作时的职责。

4. 计算题

某公司在年末进行财务报表审计,审计发现公司资产总额为

500,000元,负债总额为200,000元,净资产为300,000元。

请计算该公司的负债率和资产收益率。

5. 案例分析

某公司因为经营问题导致财务报表出现错误,审计师在审计过程中发现了这些错误并做出了相应的处理。

请就此案例分析审计师在发现并纠正错误时应该采取的措施和应对策略。

以上就是审计学考试试题的内容,希望能够帮助您对审计学知识有更深入的了解。

祝您考试顺利!。

审计实训练习单选题:1、在对甲公司应收账款审计时,注册会计师获取的下列审计证据,其中可靠性最强的通常是()。

A、甲公司与购货方签订的合同B、注册会计师向购货方函证的回函C、甲公司产品销售的出库凭证D、甲公司管理层提供的声明书【正确答案】 B【答案解析】选项ACD属于来自于被审计单位内部的证据,而选项B是来源于被审计单位外部的证据。

外部证据比来源于被审计单位内部的证据更可靠,所以选择选项B。

2、下列有关审计要素的说法中不正确的是()。

A、注册会计师为审计业务的三方关系人之一B、管理层也可能成为审计报告的预期使用者,但不是唯一的预期使用者C、审计证据包括支持和佐证管理层认定的信息,但不包括与这些认定相矛盾的信息D、审计报告为审计要素之一【正确答案】 C【答案解析】审计证据既包括支持和佐证管理层认定的信息,也包括与这些认定相矛盾的信息。

3、下列各项中与甲公司财务报表层次重大错报风险评估最相关的是()。

A、甲公司销售信用政策变更B、甲公司控制环境薄弱C、甲公司的生产成本计算过程相当复杂D、甲公司持有大量高价值且易被盗窃的资产【正确答案】 B【答案解析】财务报表层次的重大错报风险与财务报表整体存在广泛联系,此类风险通常与控制环境有关。

内控的好坏是影响财务报表层次重大错报风险评估的直接因素,选项ACD都是相对具体的,针对某类具体项目层次的。

4、注册会计师在对W公司进行审计时,发现W公司有一笔赊销给甲公司的业务没有记录,则其主要违反财务报表中应收账款的相关认定是()。

A、发生B、存在C、完整性D、计价和分摊【正确答案】 C【答案解析】因为本题针对的是应收账款的认定,所以主要与期末账户余额相关的认定有关,选项A是与所审计期间各类交易和事项相关的认定,所以错误;选项B是不存在的资产、负债和所有者权益记录,是多记,而不是漏记,与题干意思不符;选项D是资产、负债和所有者权益所记录的金额不正确,强调的是金额的恰当。

5、审计由三方面关系人构成,依次是()。

《审计技术与⽅法》期末复习题,DOC 第⼀章审计技术⽅法概论⼀、选择题1.审计⽅法的主要作⽤不包括( A )A 保证审计独⽴性B 贯彻审计制度C 树⽴审计权威 D提⾼审计效益2.不属于审计发展道路上出现的审计模式是( D )A 账⽬基础审计B 制度基础审计C 风险基础审计 D资产负债表审计3. 审计⽅法体系包括( C )A.审核稽查⽅法、审计记录⽅法、审计评价⽅法和审计报告⽅法B.审计规划⽅法、审计实施⽅法和审计报告⽅法C.审计规划⽅法、审计实施⽅法和审计管理⽅法D.审计系统检查法和审计技术4.( D )的说法不正确。

A.审计⽅法服务于审计⽬标B.审计⽅法应包括正确应⽤审计标准C.审计⽅法贯穿于审计全过程D.审计⽅法是⼀种取证的技术⼿段5.收集审计证据时所采⽤的各种⽅式和技术,在审计⽅法体系中,叫做( C )A.审计记录⽅法B.审计评价⽅法C.审计稽察⽅法D.审计管理⽅法6.( A )不是审计⽅法选⽤的基本原则。

A.依靠群众选择审计⽅法B.依据审计⽅式选择审计⽅法C.依据审计⼈员素质选择审计⽅法D.根据审计结论的保证程度选择审计⽅法7.审计⽅法体系中审计实施⽅法⼜可划分为( A )三部分。

A.审核稽查⽅法、记录⽅法和报告⽅法D.检查分析⽅法、记录⽅法和报告⽅法⼆、思考题1.简述审计⽅法的涵义和特征2.简述审计⽅法的选⽤原则3.简述审计技术⽅法模式的发展4.试论审计⽅法体系的结构及其主要内容第⼆章审计⽅法的⽬标⼀、选择题1.评价被审计单位内部控制制度属于审计( A )阶段的⼯作内容。

A.准备阶段B.实施阶段C.报告阶段 D终结阶段2.审计证据的可靠程度不受到( D )因素的影响。

A.提供证据⼈的独⽴程度B.证据提供者的知识⽔平C.证据本⾝的证据⼒D.证据获取的难易程度3、下列哪项属于内部证据( B )A、成本审计时复算成本所取得的成本计算单B、被审计单位编制的凭证、账簿、报表及其他有关资料C、审计⼈员在监督库存现⾦清点时所取得的现⾦余额表D、专门⼈员对⽀票真伪鉴定结论4、审计⼈员对存货监督盘点所获得的证据可以证实存货的( C )。

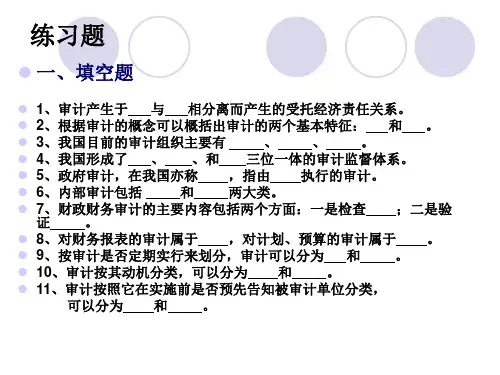

《审计学》练习题1、审计的对象,可以高度概括为被审计单位的(经济活动)。

2、以下有关审计方法的表述中,不正确的是(风险导向审计是以审计风险的防止或发现并纠正为重心)。

3、以下关于会计师事务所向审计客户提供评估服务的说法中正确的是(向审计客户提供评估服务可能会产生自我评价对独立性产生的不利影响)。

4、下列有关审计业务约定书的说法中错误的是(审计业务约定书的具体内容和格式不会因不同的被审计单位而不同)。

5、下列内容中,不应当在审计业务约定书中列示的是(被审计单位以前年度接受审计的情况)。

6、审计业务约定书除基本应该考虑的内容外,根据情况的需要,还应当进行特殊考虑的因素和事项是(组成部分管理层相对于母公司的独立程度)。

1、下列关于审计方法的表述中,正确的有(制度基础审计方法是指以控制测试为基础的抽样审计;风险导向审计方法是以审计风险模型为基础进行的审计;审计方法从账项基础审计发展到风险导向审计,都是注册会计师为了适应审计环境的变化而作出的调整)。

2、注册会计师通过执行审计工作对财务报表发表审计意见,注册会计师发表审计意见必须包含的内容有(财务报表是否符合适用的会计准则和相关会计制度的规定;财务报表是否在所有重大方面公允地反映被审计单位的财务状况、经营成果和现金流量)。

1、以下对保密要求的说法中不正确的是(在终止与客户或雇佣单位的关系之后,注册会计师可以披露其在执业过程中获知的信息)。

2、保密原则要求会员应当对在职业活动中获知的信息予以保密。

下列情形对保密原则构成了不利影响的是(利用因职业活动而获知的涉密信息为第三方谋取利益)。

3、以下属于具体业务层面的防范措施的是(轮换鉴证业务项目组合伙人和高级员工)。

4、注册会计师应当评价已识别对客观性的不利影响的重要程度并在必要时采取防范措施消除不利影响或将其降低至可接受水平。

下列防范措施中不能降低不利影响的是(与客户管理层讨论可能产生不利影响的事项)。

5、项目组成员与客户存在重要且密切的商业关系,这属于(自身利益)导致的不利影响。

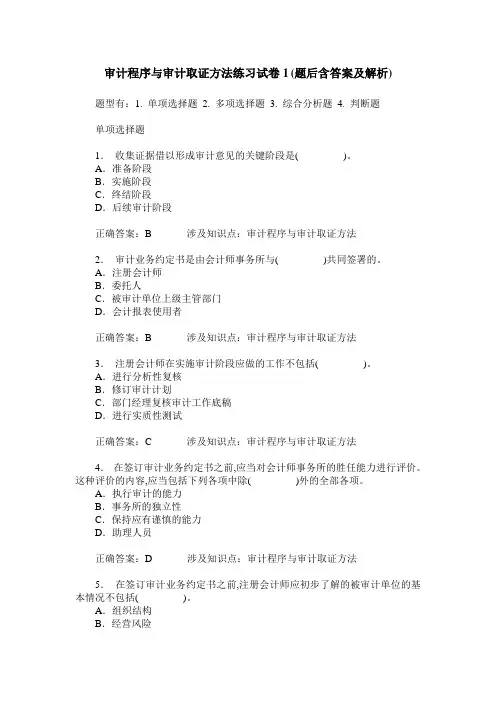

审计程序与审计取证方法练习试卷1(题后含答案及解析)题型有:1. 单项选择题 2. 多项选择题 3. 综合分析题 4. 判断题单项选择题1.收集证据借以形成审计意见的关键阶段是( )。

A.准备阶段B.实施阶段C.终结阶段D.后续审计阶段正确答案:B 涉及知识点:审计程序与审计取证方法2.审计业务约定书是由会计师事务所与( )共同签署的。

A.注册会计师B.委托人C.被审计单位上级主管部门D.会计报表使用者正确答案:B 涉及知识点:审计程序与审计取证方法3.注册会计师在实施审计阶段应做的工作不包括( )。

A.进行分析性复核B.修订审计计划C.部门经理复核审计工作底稿D.进行实质性测试正确答案:C 涉及知识点:审计程序与审计取证方法4.在签订审计业务约定书之前,应当对会计师事务所的胜任能力进行评价。

这种评价的内容,应当包括下列各项中除( )外的全部各项。

A.执行审计的能力B.事务所的独立性C.保持应有谨慎的能力D.助理人员正确答案:D 涉及知识点:审计程序与审计取证方法5.在签订审计业务约定书之前,注册会计师应初步了解的被审计单位的基本情况不包括( )。

A.组织结构B.经营风险C.控制风险D.以前年度接受审计的情况正确答案:C 涉及知识点:审计程序与审计取证方法6.在实际审计工作中,往往把审阅法与( )结合起来加以运用。

A.监盘B.函证法C.观察法D.核对法正确答案:D 涉及知识点:审计程序与审计取证方法7.函证法是通过发信函、电函给有关单位询问证实有关经济业务真实情况的一种方法,这种方法适用于对( )的查证。

A.流动资产B.存货C.无形资产D.往来款项正确答案:D 涉及知识点:审计程序与审计取证方法8.( )指审计人员对被审计单位的原始凭证及会计记录的数据所进行的重新验算或另行计算而取得审计证据的方法。

A.计算法B.观察法C.核对法D.分析性复核正确答案:A 涉及知识点:审计程序与审计取证方法多项选择题9.审计程序是指审计工作从开始到结束的整个过程,一般包括( )。

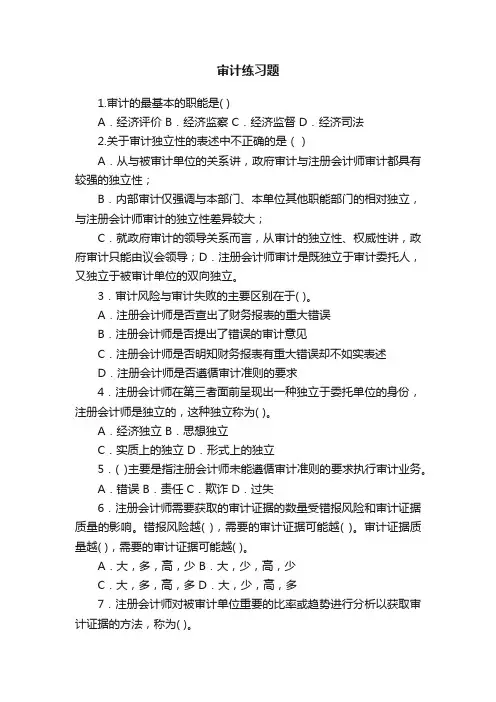

审计练习题1.审计的最基本的职能是( )A.经济评价 B.经济监察 C.经济监督 D.经济司法2.关于审计独立性的表述中不正确的是()A.从与被审计单位的关系讲,政府审计与注册会计师审计都具有较强的独立性;B.内部审计仅强调与本部门、本单位其他职能部门的相对独立,与注册会计师审计的独立性差异较大;C.就政府审计的领导关系而言,从审计的独立性、权威性讲,政府审计只能由议会领导;D.注册会计师审计是既独立于审计委托人,又独立于被审计单位的双向独立。

3.审计风险与审计失败的主要区别在于( )。

A.注册会计师是否查出了财务报表的重大错误B.注册会计师是否提出了错误的审计意见C.注册会计师是否明知财务报表有重大错误却不如实表述D.注册会计师是否遵循审计准则的要求4.注册会计师在第三者面前呈现出一种独立于委托单位的身份,注册会计师是独立的,这种独立称为( )。

A.经济独立 B.思想独立C.实质上的独立 D.形式上的独立5.( )主要是指注册会计师未能遵循审计准则的要求执行审计业务。

A.错误 B.责任 C.欺诈 D.过失6.注册会计师需要获取的审计证据的数量受错报风险和审计证据质量的影响。

错报风险越( ),需要的审计证据可能越( )。

审计证据质量越( ),需要的审计证据可能越( )。

A.大,多,高,少 B.大,少,高,少C.大,多,高,多 D.大,少,高,多7.注册会计师对被审计单位重要的比率或趋势进行分析以获取审计证据的方法,称为( )。

A.计算 B.检查C.分析程序 D.比较4.有关审计证据相关性说法中错误的是( )。

A.检查期后应收账款收回的记录和文件可以提供有关存在和计价的审计证据,但是不一定与期未截止是否适当相关8.由发生认定推导的审计目标是确认已记录的交易是( )。

A.真实的 B.完整的C.按正确金额反映的 D.接近于资产负债表日的交易记录于恰当的期间9.下列各项中,属于具体审计目标中分类目标的是( )。

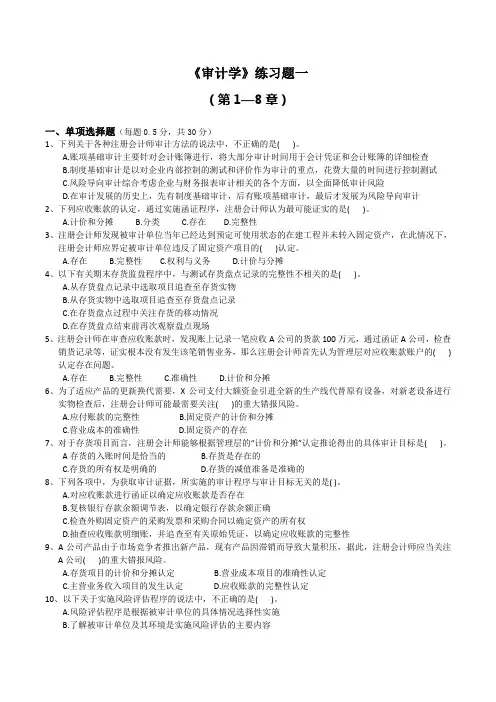

《审计学》练习题一(第1—8章)一、单项选择题(每题0.5分,共30分)1、下列关于各种注册会计师审计方法的说法中,不正确的是( )。

A.账项基础审计主要针对会计账簿进行,将大部分审计时间用于会计凭证和会计账簿的详细检查B.制度基础审计是以对企业内部控制的测试和评价作为审计的重点,花费大量的时间进行控制测试C.风险导向审计综合考虑企业与财务报表审计相关的各个方面,以全面降低审计风险D.在审计发展的历史上,先有制度基础审计,后有账项基础审计,最后才发展为风险导向审计2、下列应收账款的认定,通过实施函证程序,注册会计师认为最可能证实的是( )。

A.计价和分摊B.分类C.存在D.完整性3、注册会计师发现被审计单位当年已经达到预定可使用状态的在建工程并未转入固定资产,在此情况下,注册会计师应界定被审计单位违反了固定资产项目的( )认定。

A.存在B.完整性C.权利与义务D.计价与分摊4、以下有关期末存货监盘程序中,与测试存货盘点记录的完整性不相关的是( )。

A.从存货盘点记录中选取项目追查至存货实物B.从存货实物中选取项目追查至存货盘点记录C.在存货盘点过程中关注存货的移动情况D.在存货盘点结束前再次观察盘点现场5、注册会计师在审查应收账款时,发现账上记录一笔应收A公司的货款100万元,通过函证A公司,检查销货记录等,证实根本没有发生该笔销售业务,那么注册会计师首先认为管理层对应收账款账户的( )认定存在问题。

A.存在B.完整性C.准确性D.计价和分摊6、为了适应产品的更新换代需要,X公司支付大额资金引进全新的生产线代替原有设备,对新老设备进行实物检查后,注册会计师可能最需要关注( )的重大错报风险。

A.应付账款的完整性B.固定资产的计价和分摊C.营业成本的准确性D.固定资产的存在7、对于存货项目而言,注册会计师能够根据管理层的“计价和分摊”认定推论得出的具体审计目标是( )。

A存货的入账时间是恰当的 B.存货是存在的C.存货的所有权是明确的D.存货的减值准备是准确的8、下列各项中,为获取审计证据,所实施的审计程序与审计目标无关的是( )。

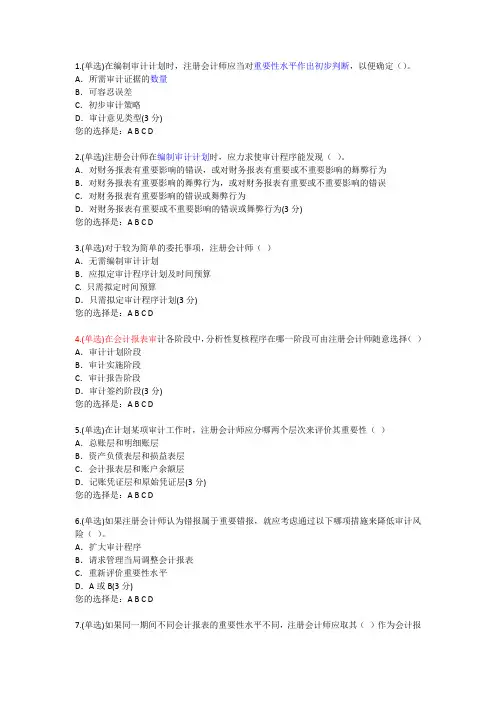

1.(单选)在编制审计计划时,注册会计师应当对重要性水平作出初步判断,以便确定()。

A.所需审计证据的数量B.可容忍误差C.初步审计策略D.审计意见类型(3分)您的选择是:A B C D2.(单选)注册会计师在编制审计计划时,应力求使审计程序能发现()。

A.对财务报表有重要影响的错误,或对财务报表有重要或不重要影响的舞弊行为B.对财务报表有重要影响的舞弊行为,或对财务报表有重要或不重要影响的错误C.对财务报表有重要影响的错误或舞弊行为D.对财务报表有重要或不重要影响的错误或舞弊行为(3分)您的选择是:A B C D3.(单选)对于较为简单的委托事项,注册会计师()A.无需编制审计计划B.应拟定审计程序计划及时间预算C. 只需拟定时间预算D.只需拟定审计程序计划(3分)您的选择是:A B C D4.(单选)在会计报表审计各阶段中,分析性复核程序在哪一阶段可由注册会计师随意选择()A.审计计划阶段B.审计实施阶段C.审计报告阶段D.审计签约阶段(3分)您的选择是:A B C D5.(单选)在计划某项审计工作时,注册会计师应分哪两个层次来评价其重要性()A.总账层和明细账层B.资产负债表层和损益表层C.会计报表层和账户余额层D.记账凭证层和原始凭证层(3分)您的选择是:A B C D6.(单选)如果注册会计师认为错报属于重要错报,就应考虑通过以下哪项措施来降低审计风险()。

A.扩大审计程序B.请求管理当局调整会计报表C.重新评价重要性水平D.A或B(3分)您的选择是:A B C D7.(单选)如果同一期间不同会计报表的重要性水平不同,注册会计师应取其()作为会计报表层次的重要性水平。

A.最高者B.最低者C.平均数D.加权平均数(3分)您的选择是:A B C D8.(单选)在规划一项审计时,注册会计师应()。

A.考虑是否可以根据内部控制调查问卷的结果缩小实质性测试的范围B.根据审计目的对重要性水平作初步判断C.起草一份管理当局声明函草稿D.确定内部控制与事先规定的是否一致(3分)您的选择是:A B C D9.(单选)在审计计划阶段,执行分析性复核程序的以下六个系统性步骤中(a.确定将要执行的计算/比较;b.估计期望值;c.执行计算/比较;d.分析数据及确认重大差异;e.调查重大的非预期差异;f.依据问题的严重程度确定对审计计划的影响),调换各个步骤的先后次序一般将影响分析性复核的效率或效果。

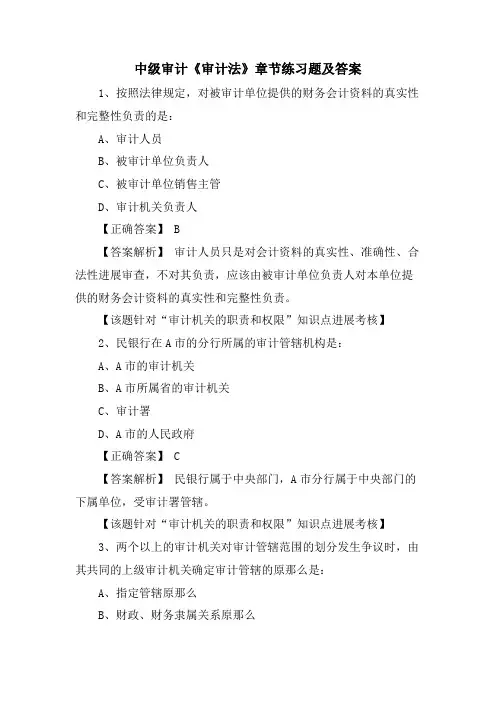

中级审计《审计法》章节练习题及答案1、按照法律规定,对被审计单位提供的财务会计资料的真实性和完整性负责的是:A、审计人员B、被审计单位负责人C、被审计单位销售主管D、审计机关负责人【正确答案】 B【答案解析】审计人员只是对会计资料的真实性、准确性、合法性进展审查,不对其负责,应该由被审计单位负责人对本单位提供的财务会计资料的真实性和完整性负责。

【该题针对“审计机关的职责和权限”知识点进展考核】2、民银行在A市的分行所属的审计管辖机构是:A、A市的审计机关B、A市所属省的审计机关C、审计署D、A市的人民政府【正确答案】 C【答案解析】民银行属于中央部门,A市分行属于中央部门的下属单位,受审计署管辖。

【该题针对“审计机关的职责和权限”知识点进展考核】3、两个以上的审计机关对审计管辖范围的划分发生争议时,由其共同的上级审计机关确定审计管辖的原那么是:A、指定管辖原那么B、财政、财务隶属关系原那么C、国有资产监视管理原那么D、指定隶属关系原那么【正确答案】 A【答案解析】指定管辖原那么是指两个以上的审计机关对审计管辖范围的划分发生争议时,由其共同的上级审计机关确定审计管辖的原那么。

【该题针对“审计机关的职责和权限”知识点进展考核】4、具有法定性、强制性特征的审计类型是:A、国家审计B、审计C、内部审计D、社会审计【正确答案】 A【答案解析】国家审计具有法定性、强制性,其目的是对依法应当承受审计的财政收支、财务收支的真实、合法和效益进展审计监视,维护国家财政经济秩序,提高财政资金使用效益,促进廉政建立,保障国民经济和社会安康开展。

【该题针对“审计法概述”知识点进展考核】5、以下关于审计程序的说法中,不正确的选项是:A、审计程序从阶段上可以分为选择审计方法、审计证据、形成审计结论三个阶段B、遇有办理紧急事项、被审计单位严重违法违规等特殊情况,经本级人民政府批准,审计机关可以直接持审计通知书实施审计C、审计组对审计事项实施审计后,向审计机关提出审计组的审计报告D、审计机关应当将审计机关的审计报告和审计决定送达被审计单位和有关主管机关、单位,审计决定自送达之日起生效【正确答案】 A【答案解析】审计程序从阶段上可以分为审计方案、审计实施和审计报告三个阶段。

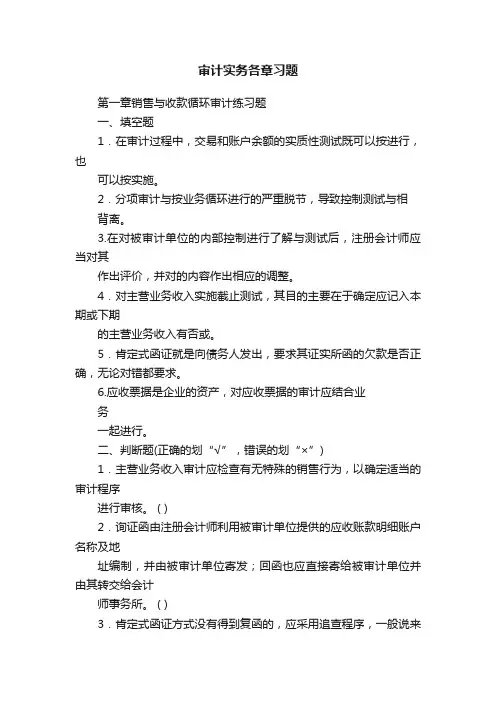

审计实务各章习题第一章销售与收款循环审计练习题一、填空题1.在审计过程中,交易和账户余额的实质性测试既可以按进行,也可以按实施。

2.分项审计与按业务循环进行的严重脱节,导致控制测试与相背离。

3.在对被审计单位的内部控制进行了解与测试后,注册会计师应当对其作出评价,并对的内容作出相应的调整。

4.对主营业务收入实施截止测试,其目的主要在于确定应记入本期或下期的主营业务收入有否或。

5.肯定式函证就是向债务人发出,要求其证实所函的欠款是否正确,无论对错都要求。

6.应收票据是企业的资产,对应收票据的审计应结合业务一起进行。

二、判断题(正确的划“√”,错误的划“×”)1.主营业务收入审计应检查有无特殊的销售行为,以确定适当的审计程序进行审核。

( )2.询证函由注册会计师利用被审计单位提供的应收账款明细账户名称及地址编制,并由被审计单位寄发;回函也应直接寄给被审计单位并由其转交给会计师事务所。

( )3.肯定式函证方式没有得到复函的,应采用追查程序,一般说来应第二次乃至第三次发送询证函,如果仍得不到答复,注册会计师应考虑采用必要的替代审计程序。

( ) 4.如果函证结果表明没有审计差异,则注册会计师可以合理地推论,全部应收账款总体是正确的。

( )三、单项选择题1.下列各项中,不属于应收票据实质性测试的审计目标的是( )。

A.确定应收票据的内部控制是否存在、有效且得到一贯遵循B.确定应收票据是否存在、完整并归被审计单位所有C.确定应收票据的年末余额是否正确D.确定应收票据在财务报表上的披露是否恰当2.注册会计师对被审计单位实施销货业务的截止测试,其主要目的是检查( )。

A.年底应收账款的真实性B.是否存在过多的销货折扣C.销货业务的人账时间是否正确D.销货退回是否已经核准3.对大额逾期应收账款如无法获取询证函回函,则注册会计师应( )。

A.审查所审计期间应收账款回收情况B.了解大额应收账款客户的信用情况C.审查与销货有关的销售订单、发票、发运凭证等文件D.提请被审计单位提高坏账准备提取比例4.注册会计师在实施产品销售收入的截止测试时主要目的在于发现( )。

《财务管理学院》53套讲座+ 17945份资料《销售经理学院》56套讲座+ 14350份资料《销售人员培训学院》72套讲座+ 4879份资料一、判断正误1、如果注册会计师确定的重要性水平较低,审计风险就较低。

2、内部证据是由被审计单位内部机构或职员编制和提供的书面证据,因此,它属于可靠性极低的证据。

3、获取审计证据时,可以考虑成本效益原则,也就是说,注册会计师并不一定要获取最理想的审计证据。

4、注册会计师在了解内部控制后认为被审单位的内部控制可能防止或发现和纠正重大错报或漏报,则不应将控制风险评价为高水平。

5、注册会计师无法改变审计风险和检查风险的实际水平,但可以改变固有风险和控制风险的实际水平。

6、应收账款的重要性水平越高,所需函证数量越多。

7、注册会计师应当就被审计单位所提供的关联方交易资料的真实性、完整性向管理当局获取书面证明。

8、如果被审单位未将“一年内到期的长期借款”转列在“流动负债”项目内,则违反了“估价或分摊”的认定。

9、“存在或发生”认定所要解决的问题是,管理当局是否把应包括的项目给遗漏了。

10、为了提高工作效率,减少工作环节,会计与出纳员应由一人承担。

11、在调查表中,“否”表示该项内部控制制度较弱。

12、因为重要性水平是针对整个会计报表而言的,所以注册会计师对报表项目存在的小金额的错报或漏报可以不必考虑。

13、注册会计师在审计过程中收集的审计证据越多,得出的审计结论就越准确。

14、注册会计师对期初余额进行审计,并非为了对期初余额发表审计意见。

15、若被审计单位管理当局拒绝提供声明书或拒绝签名,CPA则可发表保留意见或无法表示意见的审计报告16、库存证券的实地盘点工作可在结账日后进行。

17、注册会计师签署双重日期的做法,全面扩大了注册会计师的责任范围。

18、应收账款的询证函应由客户(即被审计单位)签发。

19、即使某一应付账款明细账期末余额为零,注册会计师仍可将其列为函证对象。

20、银行存款函证的目的包括查找未入账的银行借款。

CHAPTER 6Multiple-Choice Questions1. The objective of the ordinary audit of financial statements is the expression of an opinion on: easy a. the fairness of the financial statements.a b. the accuracy of the financial statements.c. the accuracy of the annual report.d. the balance sheet and income statement.2. easy If the auditor believes that the financial statements are not fairly stated or is unable to reach an conclusion because of insufficient evidence, the auditor:c a. should withdraw from the engagement.b. should request an increase in audit fees so that more resources can be used to conduct theaudit.c. has the responsibility of notifying financial statement users through the auditor’s report.d. should notify regulators of the circumstances.3. Auditors accumulate evidence to:easy a. defend themselves in the event of a lawsuit.d b. justify the conclusions they have otherwise reached.c. satisfy the requirements of the Securities Acts of 1933 and 1934.d. enable them to reach conclusions about the fairness of the financial statements.4. easy The responsibility for adopting sound accounting policies and maintaining adequate internal control rests with the:b a. board of directors.b. company management.c. financial statement auditor.d. company’s internal audit department.5. easy The auditor’s best defense when material misstatements are not uncovered is to have conducted the audit:a a. in accordance with auditing standards.b. as effectively as reasonably possible.c. in a timely manner.d. only after an adequate investigation of the management team.6. easy If management insists on financial statement disclosures that the auditor finds unacceptable, the auditor can:d a. issue an adverse audit report.b. issue a qualified audit report.c. withdraw from the engagement.d. choose any of these three courses of action.7. easy If management insists on financial statement disclosures that the auditor finds unacceptable, the auditor can do all but which of the following?b a. Issue an adverse audit report.b. Issue a disclaimer of opinion.c. Withdraw from the engagement.d. Issue a qualified audit report.8. easy Which of the following is not one of the reasons that auditors provide only reasonable assurance on the financial statements?d a. The auditor commonly examines a sample, rather than the entire population oftransactions.b. Accounting presentations contain complex estimates which involve uncertainty.c. Fraudulently prepared financial statements are often difficult to detect.d. Auditors believe that reasonable assurance is sufficient in the vast majority of cases.9. (Public) easy In certifying their annual financial statements, the CEO and CFO of a public company certify that the financial statements comply with the requirements of:c a. GAAP.b. the Sarbanes-Oxley Act.c. the Securities Exchange Act of 1934.d. GAAS.10. Which of the following statements is most correct regarding errors and fraud?easy a. An error is unintentional, whereas fraud is intentional.a b. Frauds occur more often than errors in financial statements.c. Errors are always fraud and frauds are always errors.d. Auditors have more responsibility for finding fraud than errors.11. (SOX) Which of the following statements is true of a public company’s financial statements?easy a. Sarbanes-Oxley requires the CEO only to certify the financial statements.c b. Sarbanes-Oxley requires the CFO only to certify the financial statements.c. Sarbanes-Oxley requires the CEO and CFO to certify the financial statements.d. Sarbanes-Oxley neither requires the CEO nor the CFO to certify the financial statements.12. Which of the following is not one of the three categories of assertions?easy a. Assertions about classes of transactions and events for the period under auditb b. Assertions about financial statements and correspondence to GAAPc. Assertions about account balances at period endd. Assertions about presentation and disclosure13. easy If a short-term note payable is included in the accounts payable balance on the financial statement, there is a violation of the:d a. completeness assertion.b. existence assertion.c. cutoff assertion.d. classification and understandability assertion.14. Professional skepticism requires auditors to possess a(n) ______ mind. easy a. introspectiveb b. questioningc. intelligentd. unbelieving15. easy c The auditor has no responsibility to plan and perform the audit to obtain reasonable assurance that misstatements, whether caused by errors or fraud, that are not ________ are detected.a. important to the financial statementsb. statistically significant to the financial statementsc. material to the financial statementsd. identified by the client16. Fraudulent financial reporting is most likely to be committed by whom?easy a. Line employees of the company.c b. Outside members of the company’s board of directors.c. Company management.d. The company’s auditors.17. Which of the following would most likely be deemed a direct-effect illegal act?easy a. Violation of federal employment laws.c b. Violation of federal environmental regulations.c. Violation of federal income tax laws.d. Violation of civil rights laws.18. The concept of reasonable assurance indicates that the auditor is:easy a. not an insurer of the correctness of the financial statements.a b. not responsible for the fairness of the financial statements.c. responsible only for issuing an opinion on the financial statements.d. responsible for finding all misstatements.19. Tests of details of balances are specific procedures intended to:easy a. test for monetary errors in the financial statements.a b. prove that the accounts with material balances are classified correctly.c. prove that the trial balance is in balance.d. identify the details of the internal control system.20. Which of the following is the auditor least likely to do when aware of an illegal act?easy a. Discuss the matter with the client’s legal counsel.c b. Obtain evidence about the potential effect of the illegal act on the financial statements.c. Contact the local law enforcement officials regarding potential criminal wrongdoing.d. Consider the impact of the illegal act on the relationship with the company’s management.21. medium c The auditor gives an audit opinion on the fair presentation of the financial statements and associates his or her name with it when, on the basis of adequate evidence, the auditor concludes that the financial statements are unlikely to mislead:a. investors.b. management.c. a prudent user.d. the reader.22. medium The responsibility for the preparation of the financial statements and the accompanying footnotes belongs to:b a. the auditor.b. management.c. both management and the auditor equally.d. management for the statements and the auditor for the notes.23. When engaged to audit the financial statements, it is acceptable for the auditor to prepare: medium a. the financial statements for the client.d b. the footnotes for the client.c. a draft of the financial statements for the client.d. a draft of the financial statements and footnotes for the client.24. medium The auditor has considerable responsibility for notifying users as to whether or not the statements are properly stated. This imposes upon the auditor a duty to:a a. provide reasonable assurance that material misstatements will be detected.b. be a guarantor of the fairness in the statements.c. be equally responsible with management for the preparation of the financial statements.d. be an insurer of the fairness in the statements.25. medium “The auditor should not assume that management is dishonest, but the possibility of dishonesty must be considered.” This is an example of:b a. unprofessional behavior.b. an attitude of professional skepticism.c. due diligence.d. a rule in the AICPA’s Code of Professional Conduct.26. medium If the auditor were responsible for making certain that all of management’s assertions in the financial statements were absolutely correct:d a. bankruptcies could no longer occur.b. bankruptcies would be reduced to a very small number.c. audits would be much easier to complete.d. audits would not be economically feasible.27. medium The auditor’s best defense when existing material misstatements in the financial statements are not uncovered in the audit is:d a. the audit was conducted in accordance with generally accepted accounting principles.b. the financial statements are client’s responsibility.c. client is guilty of contributory negligence.d. none of the above.28. Fraudulent financial reporting is often called:medium a. management fraud.a b. theft of assets.c. defalcation.d. embezzlement.29. Which of the following statements is true?medium a. It is usually easier for the auditor to uncover frauds than errors.b b. It is usually easier for the auditor to uncover errors than frauds.c. It is usually equally difficult for the auditor to uncover errors or frauds.d. Usually, none of the above statements is true.30. medium Auditing standards make _____ distinction(s) between the auditor’s responsibilities for searching for errors and fraud.c a. littleb. a significantc. nod. various31. medium In comparing management fraud with employee fraud, the auditor’s risk of failing to discover the fraud is:b a. greater for management fraud because managers are inherently more deceptive thanemployees.b. greater for management fraud because of management’s ability to override existinginternal controls.c. greater for employee fraud because of the higher crime rate among blue collar workers.d. greater for employee fraud because of the larger number of employees in the organization.32. medium Which of the following statements is correct with respect to the auditor’s responsibilities relative to the detection of indirect-effect illegal acts?a a. The auditor has no responsibility for searching for indirect-effect illegal acts.b. The auditor has the same responsibility for searching for indirect-effect illegal acts as anyother potential misstatement that may occur.c. Auditors have responsibility for searching for any illegal act, whether direct-effect orindirect-effect.d. None of the above is correct.33. medium When comparing the auditor’s responsibility for detecting emp loyee fraud and for detecting errors, the profession has placed the responsibility:c a. more on discovering errors than employee fraud.b. more on discovering employee fraud than errors.c. equally on discovering either one.d. on the senior auditor for detecting errors and on the manager for detecting employee fraud.34. medium If several employees collude to falsify documents, the chance a normal audit would uncover such acts is:a a. very low.b. very high.c. zero.d. none of the above.35. medium When planning the audit, if the auditor has no reason to believe that illegal acts exist, the auditor should:d a. include audit procedures which have a strong probability of detecting illegal acts.b. still include some audit procedures designed specifically to uncover illegalities.c. ignore the issue.d. make inquiries of management regarding their policies for detecting and preventing illegalacts and regarding their knowledge of violations, and then rely on normal audit proceduresto detect errors, irregularities, and illegalities.36. When the auditor has reason to believe an illegal act has occurred, the auditor should:medium a. inquire of management at a level above those likely to be involved with the illegality.d b. consult with the client’s legal counsel.c. consider accumulating additional evidence to determine if there is actually an illegal act.d. do all three of the above.37. When the auditor knows that an illegal act has occurred, the auditor must:medium a. report it to the proper governmental authorities.b b. consider the effects on the financial statements, including the adequacy of disclosure.c. withdraw from the engagement.d. issue an adverse opinion.38. (Public) If an auditor uncovers an illegal act at a public company, the auditor must notify:medium a. local law enforcement officials.c b. the Public Company Accounting Oversight Board.c. the Securities and Exchange Commission.d. all of the above.39. Why does the auditor divide the financial statements into smaller segments?medium a. Using the cycle approach makes the audit more manageable.a b. Most accounts have few relationships with others and so it is more efficient to break thefinancial statements into smaller pieces.c. The cycle approach is used because auditing standards require it.d. All of the above are correct.40. medium Why does the auditor divide the financial statements into segments around the financial statement cycles?b a. Most auditors are trained to audit cycles as opposed to entire financial statements.b. The approach aids in the assignment of tasks to different members of the audit team.c. The cycle approach is required by auditing standards.d. None of the above is correct.41. The most important general ledger account included in and affecting several cycles is the: medium a. cash account.a b. inventory account.c. income tax expense and liability accounts.d. retained earnings account.42. Management assertions are:medium a a. implied or expressed representations about accounts, transactions, and disclosures in thefinancial statements.b. stated in the footnotes to the financial statements.c. explicitly expressed representations about the financial statements.d. provided to the auditor in the assertions letter, but are not disclosed on the financialstatements.43. Which of the following statements is not true?medium c a. Auditors have found that the most effective way to conduct audits is to audit the balancesheet and use analytical procedures only for other financial statements.b. Auditors have found that the most efficient way to conduct audits is to audit the balancesheet and use analytical procedures only for other financial statements.c. Auditors have found that the most efficient and effective way to conduct audits is to obtainsome combination of assurance for each class of transactions and for the ending balance in the related account.d. Auditors have found that the most efficient and effective way to conduct audits is to obtainsome combination of assurance for specified classes of transactions only.44. Which of the following statements is true?medium a. Audit objectives follow and are closely related to management assertions.a b. Management’s assertions follow and are closely related to the audit objectives.c. The auditor’s primary responsibility is to find and disclose fraudulent managementassertions.d. Assertions about presentation and disclosure deal with whether the accounts have beenincluded in the financial statements at appropriate amounts.45. medium Which of the following statements is true regarding the distinction between general audit objectives and specific audit objectives for each account balance?b a. The specific audit objectives are applicable to every account balance on the financialstatements.b. The general audit objectives are applicable to every account balance on the financialstatements.c. The general audit objectives are stated in terms tailored to the engagement.d. All of the above statements are true.46. Which of the following statements about the existence and completeness assertions is not true? medium a. The existence and completeness assertions emphasize different audit concerns.c b. Existence deals with overstatements and completeness deals with understatements.c. Existence deals with understatements and completeness deals with overstatements.d. The completeness assertion deals with unrecorded transactions.47. The occurrence assertion applies to _______.medium a. presentation and disclosure mattersb b. classes of transactions and events during the periodc. account balancesd. none of the above48. medium Which of the following management assertions is not associated with transaction-related audit objectives?b a. Occurrenceb. Classification and understandabilityc. Accuracyd. Completeness49. Which of the following statements is not true?medium a. Balance-related audit objectives are applied to account balances.d b. Transaction-related audit objectives are applied to classes of transactions.c. Balance-related audit objectives are applied to the ending balance in balance sheetaccounts.d. Balance-related audit objectives are applied to both beginning and ending balances inbalance sheet accounts.50. In testing for cutoff, the objective is to determine:medium a. whether all of the current period’s transactions are recorded.b b. whether transactions are recorded in the correct accounting period.c. a and b are correct.d. neither a nor b is correct.51. The detail tie-in objective is not concerned that the details in the account balance:medium a. agree with related subsidiary ledger amounts.b b. are properly disclosed in accordance with GAAP.c. foot to the total in the account balance.d. agree with the total in the general ledger.52. The detail tie-in is part of the_______ assertion for account balances.medium a. classificationb b. valuation and allocationc. rights and obligationsd. completeness53. medium Which of the following is not a proper match of a transaction-related audit objective and management assertion?a a. Accuracy and cutoff.b. Classification and classification.c. Posting and summarization with accuracy.d. Occurrence and occurrence.54. Which of the following statements is not correct?medium a. There are many ways an auditor can accumulate evidence to meet overall audit objectives.d b. Sufficient appropriate evidence must be accumulated to meet the auditor’s professionalresponsibility.c. It is appropriate to minimize the cost of accumulating evidence.d. Gathering evidence and minimizing costs are equally important considerations that affectthe approach the auditor selects.55. Two overriding considerations affect the many ways an auditor can accumulate evidence:medium a1. Sufficient appropriate evidence must be accumulated to meet the auditor’sprofessional responsibility.2. Cost of accumulating evidence should be minimized.In evaluating these considerations:a. the first is more important than the second.b. the second is more important than the first.c. they are equally important.d. it is impossible to prioritize them.56. medium b If the auditor has obtained a reasonable level of assurance about the fair presentation of the financial statements through understanding internal control, assessing control risk, testing controls, and analytical procedures, then the auditor:a. can issue an unqualified opinion.b. can significantly reduce other substantive tests.c. can write the engagement letter.d. needs to do additional tests of controls so that the assurance level can be increased.57. medium d After the auditor has completed all audit procedures, it is necessary to combine the information obtained to reach an overall conclusion as to whether the financial statements are fairly presented. This is a highly subjective process that relies heavily on:a. generally accepted auditing standards.b. the AICPA’s Code of Professional Conduct.c. generally accepted accounting principles.d. the auditor’s professional judgment.58. Which of the following combinations is correct?medium a. Existence relates to whether amounts included occurred.c b. Occurrence relates to whether balances exist.c. Existence relates to whether amounts included exist.d. None of the above is true.59. medium If an auditor conducted an audit in accordance with auditing standards, which of the following would the auditor likely detect?b a. Unrecorded transactions.b. Incorrect postings of recorded transactions.c. Counterfeit signatures on paid checks.d. Fraud involving collusion.60. medium Which of the f ollowing statements best describes the auditor’s responsibility with respect to illegal acts that do not have a material effect on the client’s financial statements?a a. Generally, the auditor is under no obligation to notify parties other than personnel withinthe client’s organization.b. Generally, the auditor is under an obligation to see that stockholders are notified.c. Generally, the auditor is obligated to disclose the relevant facts in the auditor’s report.d. Generally, the auditor is expected to compel the client to adhere to requirements of theForeign Corrupt Practices Act.61. medium Which of the following statements best describes the auditor’s responsibility regarding the detection of fraud?c a. The auditor is responsible for the failure to detect fraud only when such failure clearlyresults from nonperformance of audit procedures specifically described in the engagementletter.b. The auditor must extend auditing procedures to actively search for evidence of fraud in allsituations.c. The auditor must extend auditing procedures to actively search for evidence of fraudwhere the examination indicates that fraud may exist.d. The auditor is responsible for the failure to detect fraud only when an unqualified opinionis issued.62. The essence of the attest function is to:medium a. assure the consistent application of correct accounting procedures.b b. determine whether the client’s financial statements are fairly stated.c. examine individual transactions so that the auditor may certify as to their validity.d. detect collusion and fraud.63. medium The primary difference between an audit of the balance sheet and an audit of the income statement is that the audit of the income statement deals with the verification of:a a. transactions.b. authorizations.c. costs.d. cutoffs.64. challenging The auditor’s evaluation of the likelihood of material employee fraud is normally done initially as a part of:c a. tests of controls.b. tests of transactions.c. understanding the entity’s internal control.d. the assessment of whether to accept the audit engagement.65. challenging When using the cycle approach to segmenting the audit, the reason for treating capital acquisition and repayment separately from the acquisition of goods and services is that:c a. the transactions are related to financing a company rather than to its operations.b. most capital acquisition and repayment cycle accounts involve few transactions, but eachis often highly material and therefore should be audited extensively.c. both a and b are correct.d. neither a nor b is correct.66. Illegal acts are defined in SAS 54 (AU217) as:challenging a. violations of laws or government regulations.c b. violations of laws or government regulations other than errors.c. violations of laws or government regulations other than fraud.d. violations of law which would result in the arrest of the perpetrator.67. Most illegal acts affect the financial statements:challenging a. directly.b b. only indirectly.c. both directly and indirectly.d. materially if direct; immaterially if indirect.68. With respect to the detection of illegal acts, auditing standards state that the auditor provides: challenging a. no assurance that they will be detected.a b. the same reasonable assurance provided for other items.c. assurance that they will be detected, if material.d. assurance that they will be detected, if highly material.69. challenging In describing the cycle approach to segmenting an audit, which of the following statements is not true?d a. All general ledger accounts and journals are included at least once.b. Some journals and general ledger accounts are included in more than one cycle.c. The “capital acquisition and repayment” cycle is closely related to the “acquisition ofgoods and services and payment” cycle.d. The “inventory and warehousing” cycle may be audited at any time during the engagementsince it is unrelated to the other cycles.70. Which of the following journals would be included most often in the various audit cycles? challenging a. Cash receipts journal.c b. Cash disbursements journal.c. General journal.d. Sales journal.71. Transaction cycles begin and end:challenging a. at the beginning and end of the fiscal period.d b. at the balance sheet date.c. at January 1 and December 31.d. at the origin and final disposition of the company.72. challenging After general audit objectives are understood, specific audit objectives for each account balance on the financial statements can be developed. Which of the following statements is true?a a. There should be at least one specific objective for each relevant general objective.b. There will be only one specific objective for each relevant general objective.c. There will be many specific objectives developed for each relevant general objective.d. There must be one specific objective for each general objective.74. challenging An auditor should recognize that the application of auditing procedures may produce evidence indicating the possibility of errors or fraud and therefore should:a a. plan and perform the engagement with an attitude of professional skepticism.b. not rely on internal controls that are designed to prevent or detect errors or fraud.c. design audit tests to detect unrecorded transactions.d. extend the work to audit most recorded transactions and records of an entity.Essay Questions75.easyDiscuss the differences between errors, frauds, and illegal acts. Give an example of each.Answer:The primary difference between errors and frauds is that errors are unintentionalmisstatements of the financial statements, whereas frauds are intentional misstatements.Illegal acts are violations of laws or government regulations, other than frauds. Anexample of an error is a mathematical mistake when footing the columns in the salesjournal. An example of a fraud is the creation of fictitious accounts receivable. Anexample of an illegal act is the dumping of toxic waste in violation of the federalenvironmental protection laws.76.mediumDiscuss the actions an auditor should take when the auditor discovers an illegal act.Answer:The auditor should first consider the effects of the illegal act on the financial statements,including the adequacy of disclosures. If the auditor concludes that disclosures areinadequate, the audit report should be modified accordingly. The auditor should alsoconsider the effect of the illegal act on its relationship with management, andmanagement’s trustworthiness. Next, the client’s audit committee or others of equivalentauthority should be informed of the illegal act. If the client does not deal with the illegalact in a satisfactory manner, the auditor should consider withdrawing from theengagement. Finally, if the client is publicly held, the auditor may need to report thematter to the SEC.77.mediumThere are three broad categories of management assertions. Identify each of these categories.Answer:∙Assertions about classes of transactions and events for the period under audit.∙Assertions about account balances at period end.∙Assertions about presentation and disclosure.78. medium Briefly explain each management assertion related to classes of transactions and events for the period under audit.Answer:∙Occurrence. Transactions and events that have been recorded have occurred and pertain to the entity.∙Completeness. All transactions and events that should have been recorded have been recorded.∙Accuracy. Amounts and other data relating to recorded transactions and events have been recorded appropriately.∙Classification. Transactions and events have been recorded in the proper accounts.∙Cutoff. Transactions and events have been recorded in the correct accounting period.79.mediumBriefly explain each management assertion related to account balances at period end.Answer:∙Existence. Assets, liabilities, and equity interests exist.∙Completeness. All assets, liabilities, and equity interests that should have beenrecorded have been recorded.∙Valuation and allocation. Assets, liabilities, and equity interests are included in thefinancial statements at appropriate amounts and any resulting valuation adjustmentsare appropriately recorded.∙Rights and obligations. The entity holds or controls the rights to assets, and liabilitiesare the obligation of the entity.。

第三章审计过程练习题一、单项选择题1. 单选题:(2.0分)注册会计师应当记录总体审计策略和具体审计计划,包括在审计工作过程中作出的任何重大更改,下列()表述不正确。

A. 注册会计师对总体审计策略的记录,应当包括为恰当计划审计工作和向项目组传达重大事项而作出的关键决策B. 注册会计师对具体审计计划的记录,应当能够反映计划实施的风险评估程序的性质、时间和范围,以及针对评估的重大错报风险计划实施的进一步审计程序的性质、时间和范围C. 注册会计师应当记录对总体审计策略和具体审计计划作出的重大更改及其理由,以及对导致此类更改的事项、条件或审计程序结果采取的应对措施D. 为了使审计计划工作规范化,注册会计师可以使用标准的审计程序表或审计工作完成核对表,不应调整标准表格参考答案: D2. 单选题:(2.0分)注册会计师可以通过设定审计程序而控制的风险是()。

A. 固有风险B. 控制风险C. 检查风险D. 重大错报风险参考答案: C3. 单选题:(2.0分)注册会计师执行年度财务报表审计时,下列各项中最有可能帮助其对重要性水平作出初步判断的是()。

A. 计划实施实质性程序时确定的预期样本量B. 被审计单位的中期财务报表C. 内部控制调查问卷D. 与管理层的沟通函参考答案: B4. 单选题:(2.0分)重要性与审计风险之间存在密切关系,注册会计师在确定审计程序的性质、时间和范围时应当考虑这种关系。

下列提法中,不正确的是( )。

A. 重要性与审计风险之间呈反向关系,即重要性水平越低,审计风险越高B. 在确定审计程序后,如果注册会计师决定接受更低的重要性水平,审计风险将增加C. 对重要的账户或交易,相应的重要性水平应越低,以便提高效果D. 对重要的账户或交易,相应的重要性水平应越低,以便提高效率参考答案: D5. 多选题:(3.0分)下列关于总体审计策略和具体审计计划的叙述正确的是()。

A. 具体审计计划比总体审计策略更加详细,其内容包括为获取充分、适当的审计证据以将审计风险降至可接受的低水平,项目组成员拟实施的审计程序的性质、时间和范围B. 为了足够识别和评估财务报表重大错报风险,具体审计计划中注册会计师应确定计划实施的风险评估程序的性质、时间和范围C. 针对评估的认定层次的重大错报风险,具体审计计划中应确定注册会计师计划实施的进一步审计程序的性质、时间和范围D. 为了能发表恰当的审计意见,具体审计计划中注册会计师应确定审计意见类型参考答案: A B C6. 多选题:(3.0分)注册会计师在审计过程中应当运用重要性原则,运用重要性原则的主要目的有()。

第七章审计方法一、单项选择题1. 在实际工作中,往往把审阅法与()结合起来加以运用。

A. 核对法B. 验算法C. 分析法D. 观察法2. 审计人员对被审计单位书面资料的有关数据进行重新计算的方法属于()。

A. 核对法B. 验算法C. 分析法D. 观察法3.()是由审计人员到被审计单位现场盘点实物,以证实书面资料同有关的财产物资相符的方法。

A. 盘存法B. 鉴定法C. 观察法D. 调节法4.()是指审计人员实地观察被审计单位的经营场所、实物资产、有关业务活动、内部控制的执行情况等,以获取审计证据的方法。

A. 函证法B. 盘存法C. 分析法D. 观察法5. 按照会计核算的处理顺序,依次对证、账、表各个环节进行审查的方法属于()。

A. 顺查法B. 逆差法C. 详查法D. 抽查法6. 从被审计单位全部会计资料中选取部分资料进行审查,根据审查结果推断全部资料有无错弊的一种审计方法属于()。

A. 顺查法B. 逆差法C. 详查法D. 抽查法7.()是指抽样结果使审计人员对内部控制的信赖超过了其实际上应予信赖的可能性。

A. 信赖不足风险B. 信赖过度风险C. 误受风险D. 误拒风险8.()是指审计人员采用不恰当的审计程序或方法,或因误解审计证据等而未能发现重大误差的可能性。

A. 信赖不足风险B. 信赖过度风险C. 误受风险D. 误拒风险9. 从8000 张现金支出凭证中抽取400 张进行审计,采用系统选样法,则抽样间隔为()。

A.10B.20C.30D.4010.()是指采用边抽样、边审查、边判断的方法,一旦能得出审计结论即可中止抽样的抽样方法。

A. 固定样本量抽样B. 停—走抽样C. 发现抽样D. 变量抽样11.“推断的总体错报= 平均错报×总体规模”属于()的计算公式。

A. 均值估计抽样法B. 差额估计抽样法C. 比率估计抽样法D. 固定样本量抽样法二、多项选择题1. 审查书面资料的方法按审查书面资料的技术可分为()。

审计练习题(四)一、单项选择题1、注册会计师王勤在对Z公司2004年度会计报表审计中发现,该公司漏列一笔交易,其影响金额占该类交易的15%。

则认为()。

A、属于重大会计差错,应调整期初留存收益及会计报表相关项目期初数,并发表否定意见B、属于非重大会计差错,不足以影响会计报表使用者对企业财务状况、经营成果和现金流量做出正确判断,应发表无保留意见C、属于个别会计报表项目违反会计法规的规定,建议进行调整D、属于账户分类及计算错误,建议更正错报,并在会计报表附注中加以说明答案:C解析:2、下列分析性复核中有可能发现已减少固定资产未在账上注销的是()。

A、本年各月间和本年度与以前各年度间的维修费的比较B、固定资产总成本除以全年产品产量C、本年与以前各年度的固定资产增减的比较D、本年计提折旧额除以固定资产总成本答案:B解析:3、重庆天华会计师事务所是一家具有证券期货资格审计的事务所,现正在对Z股份有限公司2004年会计报表进行审计。

王勤作为外勤负责人,针对助理人员在购货与付款循环审计中遇到的问题,作出正确的判断。

应付账款审计工作底稿中显示的以下准备实施的审计程序中不恰当的是()。

A、由于函证应付账款不能保证查出未记录的应付账款,因此决定不实施函证程序B、由于应付账款控制风险较高,决定仍实施应付账款的函证程序C、由于正常情况下应付账款很少被高估,因此应付账款一般不需要函证D、由于应付账款容易被漏记,因此,应对其进行函证答案:D解析:函证应付账款不能保证查出未入账的应付账款。

4、重庆天华会计师事务所是一家具有证券期货资格审计的事务所,现正在对Z股份有限公司2004年会计报表进行审计。

王勤作为外勤负责人,针对助理人员在投资与筹资循环审计中遇到的问题,作出正确的判断。

在审计权益法核算下的投资时,为了满足估价认定,注册会计师最有可能()。

A、检查股权证证明这些投资B、检查被投资公司已经审计的会计报表C、复核经纪人通知单或已注销的支票以确定投资的取得D、从财政报刊杂志上获取市场报价单、行情表答案:B解析:A主要证实存在性和所有权;CD无助于投资人有效控制的投资的估价目标的认定。

一、单项选择题1. 审计机关为了统一组织多个审计组对某一行业或者专项资金进行审计而制定的总体工作计划称为。

A.审计项目计划B.审计工作方案C.审计实施方案D.年度审计计划答案:B[解答] 本题考查重点是对“审计工作方案”的熟悉。

审计工作方案是审计机关为了统一组织多个审计组对部门、行业或者专项资金等审计项目实施审计而制定的总体工作计划。

本题选项C“审计实施方案”是审计组为了完成审计项目任务,从发送审计通知书到处理审计报告全部过程的工作安排。

因此,本题的正确答案为B。

2. 下列有关审计机关审计管辖范围的说法中,错误的是。

A.审计机关的审计管辖范围,根据被审计单位的财政、财务隶属关系或者国有资产监督管理关系确定B.审计机关之间对审计管辖范围有争议的,由其共同的上级审计机关确定C.上级审计机关对下级审计机关管辖范围内的重大审计事项可以直接进行审计D.下级审计机关可以自行决定对上级审计机关管辖范围内的审计事项进行审计答案:D[解答] 本题考查重点是对“国家审计机关的管辖范围”的了解。

上级审计机关可以将其审计管辖范围内的部分审计事项授权下级审计机关审计,法律、法规另有规定者除外。

因此,本题的正确答案为D。

3. 下列审计证据中,证明力最强的是。

A.被审计单位提供的证明材料B.被审计单位会计人员的言词证据C.有关审计事项的环境证据D.审计人员亲自编制的相关资料答案:D[解答] 本题考查重点是对“审计证据的鉴定”的了解。

审计证据的可靠性受其来源和性质的影响,并取决于获取审计证据的具体环境。

一般来讲,受个人支配程度越小,被篡改和伪造的机会越少,证据就越可靠。

审计人员直接获取的审计证据(即亲历证据)比间接获取或推论得出的审计证据更可靠。

因此,本题的正确答案为D。

4. 与国家审计相比,内部审计的特点是。

A.法定性B.强制性C.有偿性D.经常性答案:D[解答] 本题考查重点是对“内部审计的特点”的掌握。

国家审计的特点有:①法定性和强制性;②独立性;③综合性和宏观性。

第四章审计方法练习题

一、单项选择题

. 单选题:(2.0分)

顺查法不适用于( )。

A. 规模较小、业务量少的审计项目

B. 内部控制制度较差的审计项目

C. 规模较大、业务量较大的审计项目

D. 重要的审计事项

参考答案: C

2. 单选题:(2.0分)

审计调查、取证的方法不包括( )。

A. 观察法

B. 调账法

C. 查询法

D. 专题调查法

参考答案: B

3. 单选题:(2.0分)

函询是指通过向有关单位发函来了解情况取得审计证据的一种方法。

一般用于( )

A. 货币资金的审查

B. 期间费用的审查

C. 长期资产的审查

D. 往来款项的审查

参考答案: D

4. 单选题:(2.0分)

对库存现金、有价证券、贵重物品的盘存,应采用

( )。

A. 监督盘存

B. 观察盘存

C. 抽查盘存

D. 直接盘存

参考答案: A

5. 单选题:(2.0分)

统计抽样与非统计抽样具有各自不同的用途。

针对以下用于控制测试的抽样目的,适宜采用非统计抽样的是()。

A. 通过调整样本规模精确地控制抽样风险

B. 分析被测试的内部控制偏差率是否与上年相同

C. 分析被测试的内部控制偏差率比上年下降的原因

D. 通过抽样查找内部控制偏差率下降的幅度

参考答案: C

6. 单选题:(2.0分)

注册会计师运用分层抽样方法的主要目的是为了( )。

A. 减少样本的非抽样风险

B. 决定审计对象总体特征的正确发生率

C. 审计可能有较大错误的项目,并减少样本量

D. 无偏见地选取样本项目

参考答案: C

7. 单选题:(2.0分)

下列属于信赖不足风险的是( )。

A. 根据抽样结果对实际存在重大错误的账户余额得出不存在重大错误的结论

B. 根据抽样结果对实际不存在重大错误的账户余额得出存在重大错误的结论

C. 根据抽样结果对内控制度的信赖程度高于其实际应信赖的程度

D. 根据抽样结果对内控制度的信赖程度低于其实际应信赖的程度

参考答案: D

8. 单选题:(1.0分)

下列关于注册会计师对审计抽样方法运用中,不恰当的是()

A. 风险评估程序通常不涉及审计抽样,但如果注册会计师在了解内部控制的同时对内部控制运行有效性进行测试可以运用审计抽样

B. 当控制的运行留下轨迹时可以将审计抽样用于控制测试

C. 控制测试过程中注册会计师采用审计抽样

D. 审计抽样适用于细节性测试,不适用于实质性分析程序

参考答案: C

9. 多选题:(1.0分)

非直接取证的方法包括( )。

A. 顺查法

B. 逆查法

C. 详查法

D. 抽查法

E. 审查法

参考答案: A B C D

10. 多选题:(1.0分)

审阅原始凭证的内容时,应注意原始凭证( )。

A. 账户名称和会计分录是否正确

B. 反映的经济内容是否合理合法

C. 是否符合该单位的实际情况和用途

D. 人账时是否经过了必要的批准手续

E. 原始凭证的张数与记载数量是否一致

参考答案: B C D

11. 多选题:(1.0分)

审计调查、取证的方法一般包括( )。

A. 专题调查法

B. 专案调查法

C. 观察法

D. 查询法

E. 分析法

参考答案: A B C D

12. 多选题:(1.0分)

审计人员在选用审计方法时,应注意( )。

A. 审计方法的选用要考虑审计证据的数量

B. 审计方法的选用要适应审计的目的

C. 审计方法的选用要适合审计方式

D. 审计方法的选用要联系被审计单位的实际

E. 审计方法的选用要考虑审计人员的胜任能力

参考答案: B C D

13. 多选题:(1.0分)

在进行控制测试时,注册会计师如认为抽样结果无法达到其对所测试的内部控制的预期信赖程度,应当考虑( )。

A. 增加样本量

B. 执行替代审计程序

C. 修改实质性测试程序

D. 发表保留意见或否定意见

参考答案: A C

14. 多选题:(1.0分)

有关审计抽样的下列表述中,注册会计师不能认同的有( )。

A. 审计抽样适用于财务报表审计的所有审计程序

B. 统计抽样的产生并不意味着非统计抽样的消亡

C. 统计抽样能够减少审计过程中的专业判断

D. 对可信赖程度要求越高,需选取的样本量就应越大

参考答案: A C

15. 多选题:(1.0分)

审计抽样应当具备三个基本特征()。

A. 选样方法能够计量并控制审计风险在可接受的水平

B. 所有抽样单元都有被选取的机会

C. 审计测试的目的是为了评价该账户余额或交易类型的某一特征

D. 对某类交易或账户余额中低于百分之百的项目实施审计程序

参考答案: B C D

16. 多选题:(1.0分)

注册会计师必须事先准确定义构成误差的条件,下列对误差的描述正确的有()。

A. 在控制测试中,误差是指控制偏差

B. 在控制测试中,误差是指内部控制的缺陷

C. 在细节测试中,误差就是可容忍错报

D. 在细节测试中,误差是指错报

参考答案: A D

17. 多选题:(1.0分)

注册会计师在细节测试中确定样本规模时需要考虑的因素中与样本规模同向变动的有()。

A. 计总体错报

B. 可容忍错报

C. 预计总体错报

D. 可接受的误差风险

参考答案: A C

18. 多选题:(1.0分)

在以下关于统计抽样与非统计抽样的论断中,正确的是( )。

A. 同等条件下,统计抽样可能比非统计抽样的成本高,但非统计抽样可能比统计抽样的效果差

B. 统计抽样比非统计抽样要运用更多的数学方法,非统计抽样比统计抽样要运用的更多的专业判断

C. 对于抽样风险,统计抽样可以定量化控制,而非统计抽样至多是定性估计

D.

统计抽样能够科学地确定抽样规模,而非统计抽样可能在某个领域选用了过多的样本,而在另一个领域选用了过少的样本

参考答案: A B C D

19. 单选题:(1.0分)

顺查法的审查顺序与会计核算顺序并不完全一致()。

A. 正确

B. 错误

参考答案: B

20. 单选题:(1.0分)

详查法的审计顺序和过程基本上与顺查法相同,因此,其优缺点和适用范围也基本上与顺查法相同()。

A. 正确

B. 错误

21. 单选题:(1.0分)

审阅法审阅的内容很多,既包括审阅财务会计及其有关资料,又包括审阅与管理行为有关的内容()。

A. 正确

B. 错误

参考答案: A

22. 单选题:(1.0分)

采用查询法审计时,函证既可由审计人员直接寄发和收取,也可委托被审计单位代办()。

A. 正确

B. 错误

参考答案: B

23. 单选题:(1.0分)

在实物盘存法下,可以通过比较盘点记录与账面记录,来证实账面记录是否正确()。

A. 正确

B. 错误

参考答案: B

24. 单选题:(1.0分)

审查Q公司2007年度财务报表时,为证实Q公司2007年末所有应入账的应付账款是否均已入账,甲注册会计师确定Q公司2007年度发生的所有赊购业务为抽样总体。

则这一总体不完整()。

A. 正确

B. 错误

参考答案: A

25. 单选题:(1.0分)

统计抽样是以概率论和数理统计为理论基础的现代抽样方法,因此,采用统计抽样能比采用非统计抽样选取更加适当的样本。

( )

A. 正确

B. 错误

26. 单选题:(1.0分)

审计抽样是指注册会计师对某类交易或账户余额中低于百分之百的项目实施审计程序,使所有抽样单元都有被选取的机会。

()

A. 正确

B. 错误

参考答案: A

27. 单选题:(1.0分)

选取测试项目旨在帮助注册会计师确定实施审计程序的范围,在确定适当的选取测试项目的方法时,注册会计师需要考虑的是所测试认定有关的重大错报风险。

()

A. 正确

B. 错误

参考答案: B

28. 单选题:(1.0分)

无论是在控制测试中采用抽样,还是在实质性程序中采用抽样,如果依据样本推断的总体误差超过可容忍误差,经重估后的抽样风险不可接受,应增加样本量或执行替代审计程序。

()

A. 正确

B. 错误

参考答案: A

29. 单选题:(1.0分)

因为确认总体项目存在重大的差异性,注册会计师决定对总体项目进行分层。

但不论是按照金额大小进行分层,还是按照业务发生的时间进行分层,注册会计师应当对不同的层采用不同的抽样比率,即,应使属于不同层次的抽样单元被抽取的概率不同。

( )

A. 正确

B. 错误

参考答案: A。