2014年ACCA新大纲解析-F3

- 格式:doc

- 大小:234.00 KB

- 文档页数:10

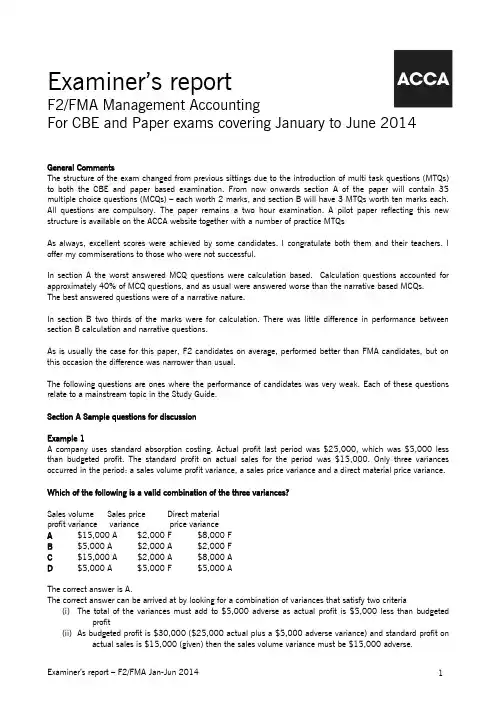

Examiner’s reportF2/FMA Management AccountingFor CBE and Paper exams covering January to June 2014 General CommentsThe structure of the exam changed from previous sittings due to the introduction of multi task questions (MTQs) to both the CBE and paper based examination. From now onwards section A of the paper will contain 35 multiple choice questions (MCQs) – each worth 2 marks, and section B will have 3 MTQs worth ten marks each. All questions are compulsory. The paper remains a two hour examination. A pilot paper reflecting this new structure is available on the ACCA website together with a number of practice MTQsAs always, excellent scores were achieved by some candidates. I congratulate both them and their teachers. I offer my commiserations to those who were not successful.In section A the worst answered MCQ questions were calculation based. Calculation questions accounted for approximately 40% of MCQ questions, and as usual were answered worse than the narrative based MCQs.The best answered questions were of a narrative nature.In section B two thirds of the marks were for calculation. There was little difference in performance between section B calculation and narrative questions.As is usually the case for this paper, F2 candidates on average, performed better than FMA candidates, but on this occasion the difference was narrower than usual.The following questions are ones where the performance of candidates was very weak. Each of these questions relate to a mainstream topic in the Study Guide.Section A Sample questions for discussionExample 1A company uses standard absorption costing. Actual profit last period was $25,000, which was $5,000 less than budgeted profit. The standard profit on actual sales for the period was $15,000. Only three variances occurred in the period: a sales volume profit variance, a sales price variance and a direct material price variance.Which of the following is a valid combination of the three variances?Sales volume Sales price Direct materialprofit variance variance price varianceA $15,000 A $2,000 F $8,000 FB $5,000 A $2,000 A $2,000 FC $15,000 A $2,000 A $8,000 AD $5,000 A $5,000 F $5,000 AThe correct answer is A.The correct answer can be arrived at by looking for a combination of variances that satisfy two criteria(i)The total of the variances must add to $5,000 adverse as actual profit is $5,000 less than budgetedprofit(ii)As budgeted profit is $30,000 ($25,000 actual plus a $5,000 adverse variance) and standard profit on actual sales is $15,000 (given) then the sales volume variance must be $15,000 adverse.Only alternative A meets both of these criteria. D was the most popular choice by candidates, suggesting that most understood criteria 1, but not criteria 2.Questions on standard cost operating statements have been mentioned in previous reports and are a commonly amongst the worst answered questions on the paper.Example 2A company has prepared flexed budgets at two activity levels. The cost per unit of three costs is given below. All three costs behave in a linear manner with respect to activity.Activity level (units)10,000 15,000CostX $3·0 per unit $2·0 per unitY $1·0 per unit $1·0 per unitZ $3·5 per unit $3·0 per unitIs each of the costs variable, semi-variable or fixed?X Y ZA Variable Fixed Semi-variableB Variable Fixed VariableC Fixed Variable Semi-variableVariable FixedD FixedThe correct answer is C.The key to the question is to understand that for variable costs the cost per unit is constant, whilst for fixed costs the total cost is constant. Cost X can quickly be identified as a fixed cost as the total cost between the two output levels is unchanged (10,000 units x $3 = 15,000 units x $2). Cost Y is a variable cost because the cost per unit is constant. Cost D meets neither of these criteria because it contains elements of both fixed and variable cost, and therefore is a semi variable cost. Alternatives A and B were selected by majority of candidates, suggesting some confusion between cost per unit and total cost.Example 3An accountant wishes to use the following spreadsheet to calculate budgeted production units.Which formula should be entered in cell B5?A =B3-C4+B4B =B3-B4C =B3+C4D =B3+C4-B4The correct answer is DTo arrive at this answer candidates had to understand that production units = sales units + closing inventory of finished goods – opening inventory of finished goods, and that the opening inventory for August was the closing inventory for July.Alternative B was the most popular answer presumably on the basis that it totalled the column. Alternatives A and C were selected by only small percentages of candidates.Section BSection B contained 3 questions, one from each of syllabus areas C Budgeting, D Standard Costing and E Performance Measurement. This approach will continue in future papers. The balance of MCQ questions in section A was altered to reflect this change and to preserve the overall balance of the paper. The pilot paper reflects the new weightings. This balance of questions will be used in future papers.Common problems with section B questions included the following∙An apparent lack of knowledge of the net present value (NPV) technique. Many candidates appeared to confuse it with net book value (NBV) and unnecessarily calculated depreciation provisions over the asset’s life. Many candidates were unable to suggest one advantage of using net present value.∙An inability to calculate material price and usage variances and fixed overhead volume variances.∙An inability to explain the causes of variances.∙An imprecise knowledge of commonly used accounting ratios. Return on capital employed should not be calculated by any profit figure divided any asset figure. Its formal definition is operating profit divided by ordinary shareholder’s funds plus non-current liabilities.∙Weak understanding of a businesses’ performance. A significant minority of candidates did not know which ratios measured liquidity and which measured gearing. For the paper exam, many provided weak commentary, such as “the gearing ratio is higher”. This alone does not tell whether this a good or bad, and greater clarity is required for full marks. Again for paper exam only, there were often poor layout of calculations, making it very difficult to understand what candidates were trying to do.Future candidates are advised to:• Study the whole syllabus, because the paper will cover the full syllabus.• Practise as many multiple choice questions as possible.• Read questions very carefully in the examination.• Try to attempt the “easy” examination questions first.• Not to spend too much time on apparently “difficult” questions.• Attempt all questions in the examination (there are no negative marks for incorrect answers).∙For those taking paper exam, present section B answers as tidily as possible∙For those taking CBE exam, read each requirement carefully• Read previous Examiner’s Reports.。

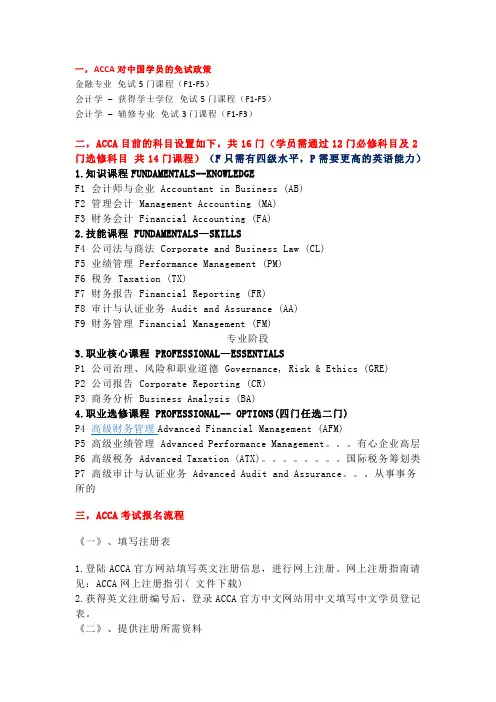

一,ACCA对中国学员的免试政策金融专业免试5门课程(F1-F5)会计学–获得学士学位免试5门课程(F1-F5)会计学–辅修专业免试3门课程(F1-F3)二,ACCA目前的科目设置如下,共16门(学员需通过12门必修科目及2门选修科目共14门课程)(F只需有四级水平,P需要更高的英语能力)1.知识课程FUNDAMENTALS--KNOWLEDGEF1 会计师与企业 Accountant in Business (AB)F2 管理会计 Management Accounting (MA)F3 财务会计 Financial Accounting (FA)2.技能课程 FUNDAMENTALS—SKILLSF4 公司法与商法 Corporate and Business Law (CL)F5 业绩管理 Performance Management (PM)F6 税务 Taxation (TX)F7 财务报告 Financial Reporting (FR)F8 审计与认证业务 Audit and Assurance (AA)F9 财务管理 Financial Management (FM)专业阶段3.职业核心课程 PROFESSIONAL—ESSENTIALSP1 公司治理、风险和职业道德 Governance, Risk & Ethics (GRE)P2 公司报告 Corporate Reporting (CR)P3 商务分析 Business Analysis (BA)4.职业选修课程 PROFESSIONAL-- OPTIONS(四门任选二门)P4 高级财务管理Advanced Financial Management (AFM)P5 高级业绩管理 Advanced Performance Management。

有心企业高层P6 高级税务 Advanced Taxation (ATX)。

ACCA机考F1-F4考试题型及考试重点ACCA考试Fundamental level F阶段最开始的考试科目F1-F4就是机考科目,2018年3月以后,ACCA考试科目F5-F9也将全面进入机考时代。

当然,如果你已经免考ACCA F阶段了,这篇文章就可以略过了,But,如果你还需要跟ACCA F阶段继续周旋和鏖战,那么,以下内容,你要仔细看喽!ACCA考试科目F1-F4的考试内容分为2大模块,Section A &Section B, Section A以单选,多选和判断题为主要类型的题目。

每题1-2分,这个部分的题目,单选判断不必说,对则得分,错则不得分。

多选题则有统一标准,全对才得分,如果出现任一单一选项错误,也不得分。

所以,在做这类题目时,知识点掌握全面扎实才是得分王道!Section B 里面以多任务题为主,什么叫多任务题?题目会引入较长的案例分析,还有图表需要理解分析,题目会以单选或者多选的形式出现,这里的单选选项会超过4个,增加了选择难度,而这个部分的多选,如果能够选对部分选项也能够拿到部分分数,而不会像Section A里面的多选题卡分卡的那么严格。

以上2段内容讲述清楚了题目模块和题目类型,下面我们一起来看一下F1-F4题目分值分布:F1 / FABSection A (总计76分):46道题,每道题1分或2分Section B (总计24分):6道多任务题MTQs,每道题4分F2 / FMASection A (总计70分):35道题,每道题2分Section B (总计30分):3道多任务题,每道题10分F3 / FFASection A (总计70分):35道题,每道题2分Section B (总计30分):2道多任务题,每道题15分F4Section A (总计70分):45道客观题,其中20道题每题1分;25道题每题2分Section B (总计30分):5道多任务题,每道题6分考试开始前,监考人员会宣读考场纪律;考生需要在电脑上输入个人信息,监考人员会核对考生的身份;身份核对后,电脑上会显示出3页考试操作指南,考生仔细阅读,得到监考人员的允许后才可点击考试科目,开始考试。

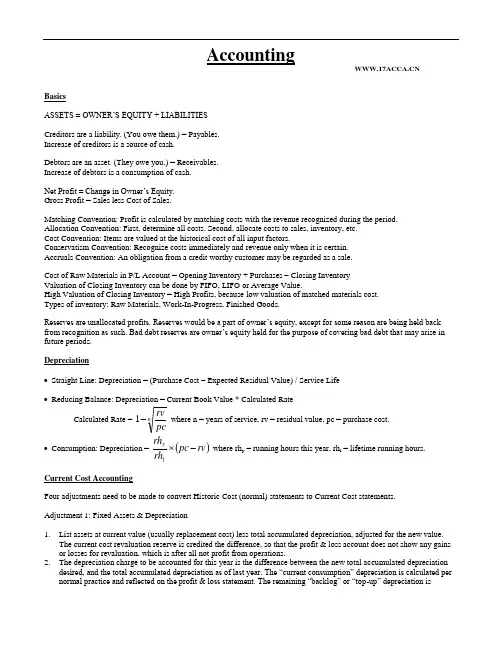

AccountingBasicsASSETS = OWNER’S EQUITY + LIABILITIESCreditors are a liability. (You owe them.) = Payables.Increase of creditors is a source of cash.Debtors are an asset. (They owe you.) = Receivables.Increase of debtors is a consumption of cash.Net Profit = Change in Owner’s Equity.Gross Profit = Sales less Cost of Sales.Matching Convention: Profit is calculated by matching costs with the revenue recognized during the period.Allocation Convention: First, determine all costs. Second, allocate costs to sales, inventory, etc.Cost Convention: Items are valued at the historical cost of all input factors.Conservatism Convention: Recognize costs immediately and revenue only when it is certain.Accruals Convention: An obligation from a credit worthy customer may be regarded as a sale.Cost of Raw Materials in P/L Account = Opening Inventory + Purchases – Closing InventoryValuation of Closing Inventory can be done by FIFO, LIFO or Average Value.High Valuation of Closing Inventory = High Profits, because low valuation of matched materials cost.Types of inventory: Raw Materials, Work-In-Progress, Finished Goods.Reserves are unallocated profits. Reserves would be a part of owner’s equity, except for some reason are being held back from recognition as such. Bad debt reserves are owner’s equity held for the purpose of covering bad debt tha t may arise in future periods.Depreciation• Straight Line: Depreciation = (Purchase Cost – Expected Residual Value) / Service Life• Reducing Balance: Depreciation = Current Book Value * Calculated Rate Calculated Rate = npcrv -1 where n = years of service, rv = residual value, pc = purchase cost. • Consumption: Depreciation = ()rv pc rh rh l y -⨯ where rh y = running hours this year, rh l = lifetime running hours. Current Cost AccountingFour adjustments need to be made to convert Historic Cost (normal) statements to Current Cost statements.Adjustment 1: Fixed Assets & Depreciation1. List assets at current value (usually replacement cost) less total accumulated depreciation, adjusted for the new value.The current cost revaluation reserve is credited the difference, so that the profit & loss account does not show any gains or losses for revaluation, which is after all not profit from operations.2. The depreciation charge to be accounted for this year is the difference between the new total accumulated depreciationdesired, and the total accumulated depreciation as of last year. The “current consumption” depreciation is calculated per normal practice and reflected on the profit & loss statement. The remaining “backlog” or “top -up” depreciation isDEBITED from the current cost revaluation reserve, because it reflects a lower starting book value of the asset in question than is otherwise shown.Adjustment 2: Cost of Sales1.Find a suitable price index for the beginning of the year, end of the year and average through the year. Convert all pricesfrom historic dollars to index-average dollars by dividing by the index at the relevant time and multiplying by the average index.2.Determine current cost of sales by: (opening inventory + purchases) – closing inventory, all in adjusted current values.3.Cost of Sales Adjustment is the difference between historic cost of sales and current cost of sales. This adjustment isadded to cost of sales (reducing profit) and also added to the current cost revaluation reserve.4.Closing inventory value must be listed at the current prices. Adjust closing inventory value by the appropriate priceindex, and add the resulting adjustment to the valuation on the balance sheet and also to the current cost revaluation reserve.Adjustment 3: Monetary Working Capital1.Determine the opening and closing MWC (debtors etc. less creditors etc., but not including cash because cash is notWORKING capital). Subtract opening from closing to determine this year’s change in MWC.2.Isolate the volume change component of the change in MWC by taking the difference of the opening and closing valuesas expressed in current dollars. (Convert to current dollars using indexes as in the Cost of Sales adjustment.)3.Find the price increase component by subtracting the volume change component from the total change from step 1.4.Deduct the price increase component from operating profit and add it to the current cost revaluation reserve. Adjustment 4: Gearing Ratio Adjustment1.Determine the gearing ratio. Find net borrowings (loans less cash but not including creditors) and net operating assets(net borrowings plus owner’s equity plus all reserves). Gearing ratio is net borrowings divided by net operating assets and is usually expressed as a percentage.2.Multiply the three previous adjustments by the gearing ratio to determine the amount which should be “backed out”(because loan payments are fixed at historical price levels).3.Credit this amount to operating profits and debit this amount from the current cost revaluation reserve.Ratio AnalysisLiquidity Ratios:Current Ratio = Current Assets / Current Liabilities. Measures ability to pay bills. Rule of thumb: 2.Quick Ratio = (Current Assets – Inventory) / Current Liabilities. Measures ability to pay bills NOW. Rule of thumb: 1. Profitability Ratios:Profit Margin = Profit after interest and taxes / Sales.Return on Total Assets = Profit after interest and taxes / Total assets.Return on Specific Assets = Profit after interest and taxes / Inventory.Return on Own er’s Equity = Profit attributable to parent company / Owner’s equity.Return On Investment (from Dupont Chart) = Profit/Sales x Total Asset Turnover.Capital Structure Ratios:Fixed to Current Asset Ratio = Fixed assets / Current assets. Meaningless without industry average to compare to.Debt Ratio = Total debt / Total assets. Also known as the gearing or leverage ratio.Times Interest Earned = (Profit before tax + Interest charges) / Interest charges. Measures the company’s ability to weather loss of profit or increase in interest rates without defaulting on loan obligations.Efficiency Ratios:Inventory Turnover = Sales / Inventory. Measures number of times inventory is turned over during a year.Average Collection Period = Debtors / Sales per day. Calculates the average number of days a debtor goes before paying. Fixed Assets Turnover = Sales / Fixed assets. Measures how hard assets are worked. Be careful about asset valuation. If a company has more up-to-date (therefore higher) asset values on the books, their ratio will look worse.Stock Market Ratios:Earnings Per Share = Profit after tax, minority interests and extraordinary items / Number of ordinary shares in issue.Price to Earnings = Market price / EPS. Measures how many years of profit you must spend to buy a share.Dividend Yield = Dividend per share / Market value per share. Expressed as a percentage.Dividend Cover = Net profit of the year / Dividend payout. Shows the degree to which the dividend is reasonable to pay out. Off-Balance Sheet TransactionsCompanies can use a variety of means to control what appears on their financial statements for any of the obvious reasons. This is usually illegal, depending. Tactics are:Controlled non-subsidiaries – owning less than 50% of a company but structuring it in such a way as to retain management control, perhaps by owning all the voting stock but also issuing non-voting stock.Consignment inventories –arranging for inventory to be owned by someone else so you don’t have to report it as an asset. Example: A car dealership might not take possession of a car until it is sold, even though it is obvious that the car on the lot is a productive asset to the dealership.Debt factoring – If debts (accounts receivable) are sold to a third party for collection, they can be written off the books. However, if the deal with the third party includes a right of recourse against the company, the debts to all intents and purposes still belong to the company and should (but might not be) reported as such.Acquisitions & MergersGoodwill is the amount paid in a takeover over and above the book value of the company being bought. It represents hidden assets, tangible and intangible, that the buying company is willing to pay for. Goodwill can be written off immediately at the time of purchase, or capitalized over its useful lifetime. It depends on management attitudes and the nature of what constitutes the goodwill.BrandsBrands are intangible assets. Brands include names and appearances, but also include technical know-how such as the recipe for an item of confectionery or the water content in malt whisky. Some companies report their brands as assets on the balance sheet. Some of the reasons for doing this are:-Smaller companies which desire to be left alone can use brands to increase their book value, making it more costly for predator companies to attempt takeovers;-Aggressive predator companies can use brand assets to drive up their share prices, reducing the number of shares they must use to finance share-swap takeovers;-Highly leveraged companies can use brands can be used to increase non-loan assets, reducing their apparent debt ratio;-If brands are listed as separate assets, they can be capitalized during a merger or takeover, reducing the amount of goodwill and the problem of figuring out how to deal with it.However, if you do put brands on the balance sheet, you have to depreciate them over their expected useful life. This will reduce profits, which abrogates some of the advantages of putting the brand on the balance sheet in the first place. It is hardto know the useful life of a brand. Some companies claim that brands have an indefinite life, but auditors are not convinced. Valuing a brand is also difficult. Two methods that are sometimes used:Historic Cost – all costs involved in developing and maintaining the brand are capitalized. This method claims to be objective, but it is difficult to know if any given expense was for developing a brand or simply for selling product. In essence, previously written-off costs are reintroduced as capital items.Earnings Method – Management attempts to attribute the actual earnings of the company to specific brands and then apply a multiplier to this figure which reflects the brand strength over the foreseeable future. This method is very subjective and based on wild guesses about future earnings potential.Research & DevelopmentR&D expenditure is usually written off in the year it is incurred. However, some companies claim that since they expect to derive benefit in future years from their R&D expenditure, it should be capitalized and depreciated. This is especially true of companies where R&D represents a major percentage of total expenditures, for example software companies. The problem is that there are usually major technical and commercial risks associated with R&D, so the conservatism principle says that it should be written off immediately.Management AccountingIt is important to remember that management accounting is a service function that provides information relevant to a decision, but does not actually make the decision. Other factors besides cost and money information are generally considered in decision-making.Cost AccountingJob Costing: Costs are allocated (apportioned) to individual finished items. Direct costs are allocated to the units to which they apply, and overheads are allocated according to some scheme.Process Costing: Used where identification of individual finished items is impossible. Example: Oil refining. Process costing collects information about all costs during an accounting period and divides those costs by the total quantity output. Variable Costs: Costs which vary directly with output, and for which if output were zero, cost would be zero. Example: Raw materials.Fixed Costs: Costs which are the same regardless of output. Example: Factory rent.Semi-Variable Costs: Costs which vary with output, but not as directly as variable costs. Example: Depreciation of factory machinery. Machinery will wear out faster while it is being used, but it will lose value at some rate even sitting idle.Break-Even Point: The sales quantity where total costs equal total revenue at a given price. Or you can plot just profit per volume, particularly if you want to compare different cost structures (ie, with or without the big new machine). Contribution Margin = Sales Revenue – Variable CostsContribution Margin Ratio, aka Profit/Volume Ratio = Contribution Margin Per Unit / Sales RevenueBreak-Even Point = Fixed Costs / Contribution Margin RatioAssumptions underpinning cost-volume-profit analysis (break-even analysis):-All costs can be identified as variable and fixed.-All costs behave precisely as either variable or fixed.-Sales price per unit is known in advance and remains constant with all output volumes.-Sales mix is maintained precisely as volume changes.-All production is sold.Direct Costs, aka Traceable Costs: Costs which can be directly identified with production. Strong overlap with variable costs but not precisely the same thing.Indirect Costs, aka Common Costs: Costs which cannot be directly identified with production. Often fixed costs. Manufacturing Overhead: Depreciation on factory equipment; energy costs for running the factory; salaries of foremen, supervisors, QA inspectors.Non-Manufacturing Overhead: Depreciation on office equipment; computers and motor vehicles; building rent; salaries of office and sales staff and general management.Product Costs: Costs which can be attached to production items without undue difficulty. Product costs contain a mixture of fixed, variable, direct and indirect costs.Period Costs: Costs which are best treated in time periods. Again, period costs contain a mixture of fixed, variable, direct and indirect costs.Controllable & Non-Controllable Costs: Refers to whether management has the ability to choose whether or not to incur the costs. Costs can only be said to be controllable or not from the point of view of a particular manager. For example, the company’s insurance premiums are non-controllable by a shift supervisor but controllable by the finance director. Controllability is also influenced by the time-scale involved. In the very short term no cost is controllable by anyone. Theconcept of controllable costs is important in budgeting. Managers should be held to budgetary accountability for their controllable costs only.Standard Cost: The engineered and researched cost that is budgeted for each item of production.Actual Cost: Period-by-period measurement of the actual expenditure for each item of production.Engineered Costs: Costs which are unavoidable if the company wants to continue production. Example: Raw materials for a given product design. There is no way to avoid a certain amount of steel if you want to build a car.Discretionary Costs: Costs which need not be incurred every accounting period at the level management has come to expect. Examples: Administrative support, R&D, machine maintenance.Beware the unitizing of fixed costs. If fixed costs are $20,000 and variable costs are $100 per unit, then as quantity moves from 100 to 200, variable costs per unit remain $100 but fixed costs per unit changes from $200 to $100. Making decisions based on a fixed cost per unit is deceptive if quantity can change.To determine how to allocate resources, determine the limiting factor and then calculate contribution per limiting factor.Job CostingPlantwide Overhead Rate = Budgeted Total Overhead / Budgeted Production Quantity (single product firm)Multi-product firms require an “activity base” like direct labor cost or machine hours. This is then used as the denominator to get a company-wide overhead rate. At the end of the year, most likely the actual total overhead and actual production quantity will be different. The amount by which the actual overheads differ from the total allocated overheads will be credited or debited directly to the profit & loss account.Departmental Overhead Rate = various different overhead amounts and activity bases for the various different departments. Machine calibration might use machine hours as an activity base. Personnel might use total headcount. But some method must be applied to allocate these various overheads to cost items (production).Direct Method. Manufacturing departments are each allocated a share of support department overheads, by their percentage consumption of activity bases. For example, if machining has 75 employees and fabrication has 25, then $50,000 of budgeted personnel overhead will be allocated as $37,500 to machining and $12,500 to fabrication. Once this is done, the total budgeted overhead to be dealt with by each manufacturing departments will be known. In order to allocate this to actual cost items, the manufacturing departments will also be given activity bases. So if machining has a total of $125,000 overhead allocated, and is budgeted to use 2500 machine-hours, machining will be assigned a $50/machine-hour overhead rate.Step Method. The step method recognizes that support departments provide services to other support departments as well as to production. The first support department’s overhead is allocated to all other departments, etc., until only manufacturing departments are left. The order in which departments’ costs are allocated could be decreasing order of total overhead, decreasing order of percentage of services rendered to other support departments, or some other scheme. When determining any support department’s activity base, ignore that department’s consumption of its own resources. IE, if total company head count is 200, but personnel (which goes first) has 10 staff, the total activity base is 190. The second and subsequent service departments must allocate not only their original overhead, but also their share of overhead from earlier allocations.Joint Products & By-ProductsA joint product is two or more products which must appear together during the process of production. If management has the option of not allowing the second product to appear, it is not considered a joint product. By-products are joint products where the secondary product is considered undesirable or low-value compared to the main product.Joint products present a problem: How should costs be allocated between the two (or more) products? Some methods: Equal Shares: All costs are simply divided in half (or whatever) and allocated to each individual product.Physical Characteristics: Costs are allocated based on some measurable quantity, like weight or volume.Sales Value at Split-Off: Costs are allocated based on the value which could be realized if the products were sold immediately, without further processing, at the split-off point.Ultimate Net Sales Value: Costs are allocated based on the net value realized if the goods are sold after all further processing that the company plans to perform.By-Product Zero Value: All costs are allocated to the main product, with the by-product produced at zero value. If any of the by-product is sold, it is credited to sales. Any of the by-product that is kept in inventory is listed on the balance sheet, but at a zero cost.Process CostingAn equivalent unit of production is an assessment of the degree of completion of a unit under each major component of cost. For example, if four million litres of paint are in work-in-progress inventory and are considered 25% finished, work-in-progress is valued as one million litres of equivalent units. Equivalent units can be assessed for each major cost category (raw materials, labor). The purpose is to assign a number of equivalent units to each accounting period so that costs can be allocated to production. The problem is opening and closing inventory that may be partially completed at any given time. For each cost category, sum: 1. Effort expended this period to complete opening inventory, not counting whatever was done in the previous period. 2. Units started and completed during the period. 3. Effort expended during the period on closing inventory.In allocating direct costs, add the balance sheet value of opening inventory to the expenditure during the period for each category (materials, labor). Divide by total equivalent units to get cost per equivalent unit.[More process costing stuff in Module 10 was skipped]Absorption & Variable CostingFull Costing aka Absorption Costing: Calculate Cost of Sales including fixed costs allocated to production. Report net profits less other, unallocated expenses. Fixed costs are bundled into the cost of sales figure.Variable Costing aka Direct Costing: Calculate Contribution Margin by subtracting Variable Cost of Sales from revenue. Then subtract fixed costs as a lump sum. Only variable costs are allocated to production; fixed costs are listed separately. Denominator Volume Variance. Under absorption costing, fixed costs are allocated based on overhead rates that use the budgeted production quantity as a denominator. Unless the actual production quantity exactly equals the budgeted production quantity, too much or too little fixed cost will be reported. At the end of the year, the actual production quantity and actual fixed costs are known. The denominator volume variance is the actual fixed costs less the amount of fixed costs that were allocated to production in the cost of sales figure. In other words, the denominator volume variance is an adjustment so that the correct amount of fixed costs will appear on the profit and loss statement.Absorption and variable costing can also produce different profit figures. If units are either drawn from or added to inventory (ie when sales does not equal actual production), the two costing systems will assign a different value to the opening and closing inventories. Variable costing places items into inventory at their variable cost only. Absorption costing places items into inventory bearing their share of overhead costs. Example: Assume opening inventory is zero. 10,000 items are produced but only 9,000 are sold. The variable cost of each item is $50 and fixed costs are $200,000. Variable costing will show a closing inventory value of $50,000. However, absorption costing adds a $20 share of overhead to the value of each item. As a result, absorption costing will show a closing inventory value of $70,000. Absorption costing must therefore also show a cost of sales figure that is $20,000 less than that shown under variable costing, hence $20,000 more profit. The reverse situation, where items are drawn from inventory and more are sold than produced, will result in lower profit under absorption costing. Decision-Making1.Define the problem and list all feasible alternatives.2.Cost the alternatives. The relevant costs to consider are solely those that differ between the alternatives under review.3.Assess the qualitative factors. Most decisions involve more than just considering the accounting numbers.4.Make the decision.It is essential that a company-wide viewpoint is taken rather than a departmental one.Again beware the unitizing of fixed costs. Full cost figures can be deceptive because the temptation is to vary them with production. IE if we plan to make 1,000 widgets and their manufacturing cost is shown as $50 each, it is tempting to assume that if we only make 800, the total cost will now be $40,000. But if that $50 included $20 worth of allocated overhead, then the actual cost to make 800 will be $44,000, and at the new production level the cost per unit will now be $55. When unitized, variable costs appear fixed and fixed costs appear variable.Costs which have already been incurred are called sunk costs and should be ignored when looking for relevant costs. Since the cost has already been incurred, and this fact cannot be changed, the cost will not differ between any possible alternative decisions to be made. Therefore it is not a relevant cost, as per the definition in Step Two above. Relevant costs are always future costs and therefore always involve cash flows. But even future costs are not relevant if they are unavoidable across all alternatives being considered.Closing Down a UnitIt is fundamental that variable costs are kept separate from fixed costs in decisions concerning the suspension of activities. It is also tempting, but potentially misleading, to ignore fixed costs as non-relevant. Fixed costs most likely change when a unit is shut down. Qualitative factors are also likely to be important. It is also likely that there will be special one-time costs associated with closing the unit.Special Sales OrdersCompanies are often presented with opportunities to sell at lower than normal prices. These orders might arise because of an unusually high quantity, a perceived strategic value, etc. It is misleading to compare the offered price to the full cost of manufacturing. If the offered price is higher than the variable cost of manufacturing, it makes a contribution to fixed costs and therefore benefits the company. This is not to say that a company should always accept offers to buy at any price above variable costs. However, such an offer should not be rejected outright simply because it is higher than the full cost of manufacturing. Other factors, such as demand for the product, future business that might result from the sale, etc., must be considered before deciding to accept or deny the order.Decision to Process FurtherUsually in the context of a by-product or joint product, a company may have to decide whether to sell a given product as it stands or apply further processing to increase the eventual sales value. The problem is that in deciding whether or not to apply additional processing to one or the other of two joint products, the method of allocating costs between the two products can sharply affect the outcome of the decision. The answer is to ignore costs that are not relevant. The only relevant costs are the additional money spent on the further processing, and the additional revenue generated by the increase in sales.BudgetingReasons for budgeting: Co-ordination, planning, motivation, control.Problems with budgeting:-Time taken. Budgeting should start as late in the year as possible consistent with getting agreement by the start of the new year.-Lack of top management commitment. Line managers will not take budget processes seriously if they see top management disregarding their own budget constraints. Top management must be aware of their own budgetaryresponsibilities.-Dictatorial control. If budgets are simply dictated from on high, line managers will see them as a form of punishment rather than an exercise in goal-setting. Budget planning requires consultation and co-ordination with all levels.-Responsibilities are blurred. Managers should be held responsible for their own controllable costs only. If they are held responsible for non-controllable costs, they will cease to care about their budget performance.-Circumstances can change. If a budget is produced at the beginning of the year, by the end of the year it may no longer have much relevance to reality. This problem can be addressed in one of two ways. First, the original budget can be maintained as a benchmark to measure performance, but all variances caused by external events are adjusted before management performance is measured. Second, the company can adopt a rolling budget that can be amended as soon as disturbances become evident.-Budgeting rewards inefficiency. If two departments have the same initial budget, but only one is run efficiently to drive down costs, then in the next year’s budget rounds the efficient department will be penalized with a budget cu t. This is particularly likely when budget changes are dictated as across-the-board percentages. The solution is for top management to adopt a more rigorous approach to budgetary planning and encourage competition for surplus resources within the organization.。

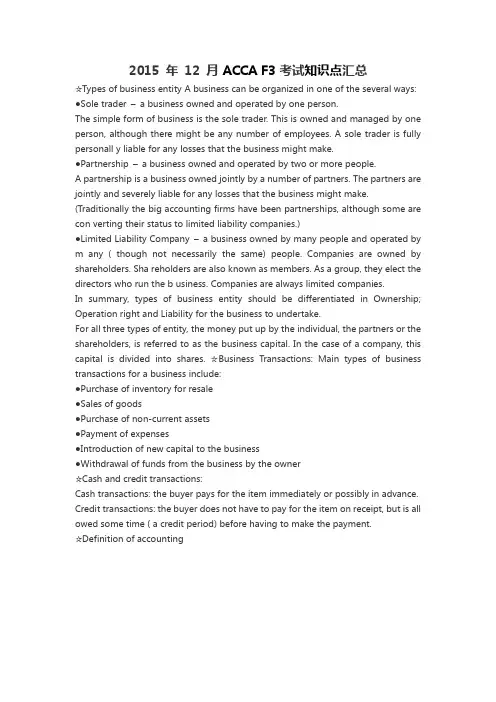

2015 年12 月ACCA F3考试知识点汇总☆Types of business entity A business can be organized in one of the several ways: ●Sole trader –a business owned and operated by one person.The simple form of business is the sole trader. This is owned and managed by one person, although there might be any number of employees. A sole trader is fully personall y liable for any losses that the business might make.●Partnership –a business owned and operated by two or more people.A partnership is a business owned jointly by a number of partners. The partners are jointly and severely liable for any losses that the business might make. (Traditionally the big accounting firms have been partnerships, although some are con verting their status to limited liability companies.)●Limited Liability Company –a business owned by many people and operated by m any ( though not necessarily the same) people. Companies are owned by shareholders. Sha reholders are also known as members. As a group, they elect the directors who run the b usiness. Companies are always limited companies.In summary, types of business entity should be differentiated in Ownership; Operation right and Liability for the business to undertake.For all three types of entity, the money put up by the individual, the partners or the shareholders, is referred to as the business capital. In the case of a company, this capital is divided into shares. ☆Business Transactions: Main types of business transactions for a business include:●Purchase of inventory for resale●Sales of goods●Purchase of non-current assets●Payment of expenses●Introduction of new capital to the business●Withdrawal of funds from the business by the owner☆Cash and credit transactions:Cash transactions: the buyer pays for the item immediately or possibly in advance. Credit transactions: the buyer does not have to pay for the item on receipt, but is all owed some time ( a credit period) before having to make the payment.☆Definition of accountingRecording : transactions must be recorded as they occur in order to provide up-to-dat e information for management.Summarizing: the transactions for a period are summarized in order to provide inform ation about the company to interested parties.☆Types of accountingFinancial accounting vs management accountingAccounting reports users include:●Management: Need information about the company’s financial situation as it is curre ntly and it is expected to be in the future. This is to enable them to manage the business efficiently and to make effective decisions.●Investors: The providers of risk, capital and their advisers are concerned with theris k inherent in, and return provided by, their investments. They need information to help th em determine whether they should buy, hold or sell.●Trade payables/ Suppliers: Suppliers and other trade payables. Suppliers and other tr ade payables are interested in information that enables them to determine whether amounts owing to them will be paid when due. Trade payables are likely to be interested in an enterprise over a shorter period than lenders unless they are dependent upon the continuanc e of an enterprise as a major customer.●Shareholders: Shareholders are also interested in market value of shares as well as information which enables them to assess the ability of the enterprise to pay dividends.●Lenders: Lenders are interested in information that enables them to determine wheth er their loans, and the interest attaching to them, will be paid when due.●Customers: Customers have an interest in information about the continuance of an e nterprise, especially when they have a long term involvement with or are dependent on, th e enterprise.●Government and their agencies: Governments are their agencies are interested in the allocation of resources and, therefore, the activities of enterprises. They also require infor mation in order to regulate the activities of enterprises, determine taxation policies and as the basis for national income and similar statistics.●Employees: Employees and their representative groups are interested in information a bout the stability and profitability of their employers. They are also interested in informati on which enables them to assess the ability of the enterprise to prove remuneration, retire ment benefits and employment opportunities.●General public: Enterprises affect members of the public in an variety of ways. For example, enterprises may make a substantial contribution to the local economy in many ways including the number of people they employ and their patronage of local suppliers. Financial statements may assist the public by providing information about the trends and recent developments in the prosperity of the enterprise and the range of its activities.☆The business entity conceptThe business entity concept●States that financial accounting information relates only to the activities of the busin ess entity and not to the activities of its owner.●The business entity is treated as separate from its owners.☆Financial Statements include:- a statement of financial position at the end of the period- a statement of comprehensive income for the period- a statement of changes in equity for the period- statement of cash flows for the period- notes, comprising a summary of accounting policies and other explanatory notes The statement of financial position:Statement of Financial Position: showing the financial position of a business at a poin t of time. The Vertical format of the SFP: (Statement of Financial Position as at31 December 2007)●The top half of the balance sheet shows the assets of the business.●The bottom half of the balance sheet shows the capital and liabilities of the busines s.A Statement of financial position at the end of the period (Balance Sheet): W Xang Balance Sheet as at December 31 20X6The horizontal format of the SFP: (Statement of Financial Position as at 31 Decembe r 2007)●The left half of the balance sheet shows the assets of the business.●The right half of the balance sheet shows the capital and liabilities of the business. W XangStatement of Financial Position as at 31 December 20x6☆The accounting equationFinancial accounting is based upon a very simple idea:The amount of resources supplied by the owner is called capital. The actual resources that are then in the business are called assets. Usually, people other than the owner have supplied some, of the assets, for example, a supplier supplies stock of goods on credit. The business is said to owe a liability towards these suppliers. The following accounting equation always holds true:The accounting equation:ASSETS = PROPRITOR’S CAPITAL + LIABILITIES- Any point in time, the assets of the business will be equal to its liabilities plus the capital of the business;- Assets less liabilities equal the capital of the business, which is known as netassets. - Each and every transaction that the business makes or enters into has two aspects to it and have a double effect on the business and the accounting equation. This is known as the duality concept.Duality concept: Each and every transaction that the business makes or enters into ha s two aspects to it and has a double effect on the business and the accounting equations. This is known as duality concept.if A=C+L=0 .......①C=A-L........②Illustration:1). Carl sets up in business by opening a coffee shop –Carl’s Coffee. He puts $5,00 0 into a business bank account.The opening accounting equation is:Assets (Cash in bank)= Capital + Liabilities($5,000) = ($5,000) + ($0)2). Carl buys furniture (chairs and tables) for the shop for $1,500, paying the supplie r out of the business bank account.The accounting equation after this transaction is:Assets Capital + Liabilties( Cash in bank $3,500) = ($5,000) ($0)(Furniture $ 1,500)3). Now Carl spends a further $2,000 to buy coffee-making equipment and $800 on crockery and cutlery, paying cash out of the business bank account.The accounting equation after this transaction is:Assets Capital + Liabilties(Cash in Bank $700) = ($5,000) ($0)(Equipment $2,000)(Fitting & Fixture $800)(Furniture $1,500)4). Carl persuades his bank to lend $1,000 to develop the business. The bank loan is accounted for as a liability of the business.The accounting equation is now as follows:Assets Capital + Liabilties(Cash in Bank $1,700) = ($5,000) ($1,000)(Equipment $2,000)( Fitting & Fixture $800)(Furniture $ 1,500)5). Carl now buys coffee, tea, milk, sugar, biscuits and cakes for $700, and pays in cash from the business bank account.The accounting equation is now as follows:Assets Capital + Liabilties(Inventory $700) = ($5,000) ($1,000)(Equipment $2,000)(Fitting & Fixture $800)(Furniture $1,500)(Cash in Bank $ 1,000)6). In his first day of trading, Carl uses up $650 of his inventory, and makes sales t otaling $1,050. All his sales are in cash.The accounting equation at the end of the day is as follows:Assets Capital + Liabilities(Inventory $50) = (Beginning $5,000) ($1,000)(Equipment $2,000) ( Profit $400)(Fitting & Fixture $800)(Furniture $1,500)( Cash in bank $2,050)☆Classification of Assets and LiabilitiesAssets: An asset is something owned or controlled by the business that will result in future economic benefits to the business. ( an inflow of cash or other assets.) Such as:Current assets:are assets owned by the business with the intention of turning them int o cash within one year (accounting period).This definition allows inventory or receivables to quality as current assets, even if the y may not be realized into cash within 12 months.Non-current asset: is an asset held for and used in operation(rather than for selling to customer), with a view to earning income or making profits from its use, for over more than one year ( accounting period).Liability: is something owed by the business to someone else.Current liability: These include the debts of the business that are repayable within the next 12 months.Non-current liabilities: are liabilities that do not need to be settled for at least one ye ar. (excluding the current portion of the debt)Capital: Capital is a type of liability. It represents the owner’s net investment in the business. Capital appears as a credit balance on the balance sheet.Assets –Liabilities = PROPRIETOR’S CAPITALNet Assets =( Total )Assets –(Total) LiabilitiesCapital (at SFP date) = Capital introduced + Profit –DrawingsDrawing: Drawings are any amounts taken out of the business by the owner for their own personal use. Drawings will reduce the capital balance reported on the balance sheet.Include:●Money taken out of the business●Goods taken for personal use●Personal expenses paid by the businessIncome statementIncome statement:Mr. W XangIncome statement for the year ended 31 December 20X6●Showing the financial performance of a business over a period of time.●Reports revenue and expenses for the period.●The sales revenue shows the income from goods sold in the year●The cost of buying the goods sold must be deducted from the revenue●The current year’s sales will include goods bought in the previous year, so this ope ning inventory must be added to the current year’s purchases.●Some of this year’s purchases will be unsold at 31/12/20x6 and this closing invento ry must be deducted from purchases to be set off against next year’s sales.●The first part gives gross profit. The second part gives net profit.The I.S. prepared following the accruals concept.Accrual concept:●Income and expenses are recorded in the I.S. as they are earned / incurred regardles s of whether cash has been received/ paid.(Sales revenue: income from goods sold in the year, regardless of whether those good s have been paid for.)☆Relationship between a statement of financial position and a statement of income●The balance sheets are not isolated statements, they are linked over time with the in come statement●As the business records a profit in the income statement, that profit is added to the capital section of the balance sheet, along with any capital introduced. Cash taken out of the business by the proprietor, called drawings, is deducted. Illustration –the accounting equation:The transactions:Day 1 Avon commences business introduction $1,000 cash.Day 2 Buys a motor car for $400 cash.Day 3 Buys inventory for $200 cash.Day 4 Sells all the goods bought on Day 3 for $300 cash.Day 5 Buys inventory for $400 on credit.SFP at the end of each day’s transactions:Solution:Day 1 Assets (Cash $1,000) = Capital ($1,000) + Liabilities ($0)Day 2 Assets (Motor $400) = Capital ($1,000) + Liabilities ($0)(Cash $600)Day 3 Assets ( Inventory $200) = Capital($1,000) + Liabilities ($0)(Motor $400)(Cash $400)Day 4 Assets ( Motor$ 400) = Capital + Liabilities ($0)(Cash $700) (Beginning$1,000)(Profit $100)Day 5 Assets (Inventory $ 400) = Capital + Liabilities( Motor$ 400) (Beginning$1,000)($400)(Cash $700) (Profit $100)Avon Statement of Financial Position as at end of Day 5Example: Continuing from the illustration above, prepare the SFP at the end of each day after accounting for the transactions below:Day 6 Sells half of the goods bought on Day 5 on credit for $250.Day 7 Pays $200 to his supplier.Day 8 Receives $100 from a customer.Day 9 Proprietor draws $75 in cash.Day 10 Pays rent of $40 in cash.Day 11 Receives a loan of $600 repayable in two years.Day 12 Pays cash of $30 for insurance.Your starting point is the SFP at the end of Day 5, from the illustration above. Prepare: SFP at the end of Day 12I.S. for the first 12 days of trading.Solution:Day 6 Assets (Inventory $ 200) = Capital + Liabilities( Motor$ 400) (Beginning$1,000)($400)(Cash $700) (Profit $150)(A/Receivable$250)Day 7 Assets (Inventory $ 200) = Capital + Liabilities( Motor$ 400) (Beginning$1,000)($200)(Cash $500) (Profit $150)(A/Receivable$250)Day 8 Assets (Inventory $ 200) = Capital + Liabilities ( Motor$ 400) (Beginning$1,000)($200)(Cash $600) (Profit $150)(A/Receivable$150)Day 9 Assets (Inventory $ 200) = Capital + Liabilities ( Motor$ 400) (Beginning$1,000)($200)(Cash $525) (Profit $150)(A/Receivable$150) (Drawing $75)Day 10 Assets (Inventory $ 200) = Capital + Liabilities ( Motor$ 400) (Beginning$1,000)($200)(Cash $485) (Profit $110)(A/Receivable$150) (Drawing $75)Day 11 Assets (Inventory $ 200) = Capital + Liabilities ( Motor$ 400) (Beginning$1,000)($200)(Cash $1,085) (Profit $110) ($600)(A/Receivable$150) (Drawing $75)Day 12 Assets (Inventory $ 200) = Capital + Liabilities (Motor$ 400) (Beginning$1,000)($200)(Cash $1,055) (Profit $80 ) ($600)(A/Receivable$150) (Drawing $75)AvonStatement of Financial Position as at end of Day 12AvonIncome statement for the period ended at Day 12Session 3 Double entry bookkeeping☆The duality concept and double entry bookkeepingDuality concept: each and every transaction has a double effect on the business and t he accounting equations.(A= C + L)Rules of double entry bookkeeping:●Each time a transaction is recorded, both effects must be taken into account.●These two effects are equal and opposite such that the accounting equation will al ways prove correct.Assets –Liabilities = Capital●Traditionally, one effect is referred to as the debit side ( Dr.) and the other as the credit side of the entry (Cr.)☆Ledger accounts, debits and creditsLedger account:●transactions are recorded in the relevant ledger accounts. There is a ledger account for each asset, liability, revenue and expenses’item, and for the owner’s capi tal.●Each account has two sides: the debit and credit sides.●The duality concept means that each transaction will affect two ledger accounts ●One account will be debited and the other credited●Whether an entry is to debit or credit side of an account depend on the types of account and the transaction.。

ACCA考试共有15个考试科目,其中AB(F1)、MA(F2)、FA(F3)、LW(F4)、PM(F5)、TX(F6)、FR(F7)、AA(F8)、FM(F9)为F阶段课程,共9个科目,SBL、SBR、AFM(P4)、APM(P5)、ATX(P6)、AAA(P7)为P阶段课程,共6个科目。

ACCA课程中,F阶段科目全部为必修课,P阶段科目中SBL、SBR为必修课,其他为选修课(4选2参加考试),ACCA考试一共考过13科即可变成ACCA准会员。

考试之前一定要对ACCA有全面的了解,知己知彼方能百战不殆。

AB (F1)1英文名:Accountant in Business2中文名:会计师与企业3课程内容:主要是帮助无任何商业背景知识的学员初步建立人力资源、企业组织、商业环境及相互之间影响关系的相关知识内容。

内容涵盖:企业组织,公司管理,会计和报告体系,内部财务控制,人力资源管理,会计职业道徳。

4科目联系:AB(F1)是SBL课程中《公司治理,风险管理与职业道德》和《商务分析》的基础。

5考试时间:2小时(机考)6考试分值:A部分一一30道单选题(每题2分,共计60分)一一16道单选题(每题1分,共计16分)B部分一一情景为基础的6道多任务题(由单选、多选、判断题构成,每题4分,共计24分)7课程难度:☆☆8时间花费:☆☆☆2019年全球平均通过率:82.50%MA (F2)1英文名:Management Accounting2中文名:管理会计3课程内容:主要向学员介绍了管理会计体系的主要元素以及管理会计如何发挥支持企业决策, 制定企业决策的作用。

内容涵盖:管理会计,管理信息,成本会计,预算和标准成本,业绩衡量,短期决策方法。

4科目联系:MA(F2)《管理会计》是PM(F5)《业绩管理》和APM(P5)《高级业绩管理》的基础。

5考试时间:2小时(机考)6考试分值:A部分一一35道单选题(每题2分,共计70分)B部分一一3道多任务题(由计算、简单、论述题构成,每题10分,共计30分)7课程难度:☆☆8时间花费:☆☆☆2019年全球平均通过率:65.00%FA (F3)1英文名:Financial Accounting2中文名:财务会计3课程内容:主要向学员介绍了财务会计准则、相关会计科目账户建立以及准确财务信息的提供。

浅谈对acca的认识ACCA在国内受到热捧,是非常适合大学生考取的国际高端财经证书。

下面就带大家认识一下ACCA比较重要的几点。

1)全面完善的课程体系。

ACCA课程使学员全面掌握财务、财务管理、审计、税务及经营战略等方面的专业知识,提升分析能力并拓宽战略思维。

2)理论与实际的密切结合。

ACCA的专业资格是理论知识与实际经验的高度紧密结合。

新考试大纲充分表达了雇主和专业人士的意见,反映了现代商务社会对财会人员的要求。

3)对专业价值和职业操守的重点强调。

ACCA创举性地开设了在线职业操守训练课程,它给予学员一系列的职业操守的理念,并设置了多个自我测试题,检验学员职业操守的价值观和行为。

取得ACCA会员资格要完成三个“E”,即通过考试、完成在线职业操守训练课程、并取得三年相关工作经验。

4)国际标准与本地实情的和谐统一。

ACCA考试大纲以国际会计准则/国际财务报告准则和国际审计准则作为依据设计考试内容,并提供了包括中国在内的40多种不同国家和地区的法律与税务方面的试卷,这使得ACCA成为最切合中国实际的国际性会计师资格。

5)公平一致的考试标准。

ACCA的专业资格考试采用全球统一标准,即统一教材、统一考试、统一评卷,最后会员取得全球统一的证书。

6)遍布全球的考点网络。

学员在一个国家向ACCA注册后,可根据需要在全球350多个考点中选择、更换适合自己的考试中心。

7)认证与学位的相互补充。

ACCA在全球范围内寻求与优秀院校的广泛合作。

满足一定的条件后,ACCA学员将有机会获得英国牛津-布鲁克斯大学应用会计理学士学位。

8)灵活的学习方式。

学员可以根据自己的实际情况,选择参加培训班或自修以及网上培训来完成ACCA考试。

急速通关计划 ACCA全球私播课大学生雇主直通车计划周末面授班寒暑假冲刺班其他课程。

新手导航:ACCA报考指南及常见相关问题汇总2009年6月ACCA各科考试通过率教材真题下载:[ACCA]—2009年6月考题及答案超级汇总版[ACCA]ACCA历年全球统考考题汇总[ACCA]—历年试题下载汇总(P1—P7,F1—F9)[ACCA]—新旧大纲历年试题下载汇总(P1—P7,F1—F9)ACCA教材下载—F1_chapter1-3(word版)ACCA教材下载—F5_word版[ACCA]—2009年F4模拟试题课件及讲义:[ACCA]—2009年12月份各科讲义下载汇总F4—公司法和商法—讲义下载09年12月f4讲义09.6 F9讲义及练习[ACCA考试]《F1 会计师与企业Accountant in Business (AB)》讲座课件下载[ACCA考试]《F2 管理会计Management Accounting(MA)》讲座课件下载[ACCA考试]《F3 财务会计Financial Accounting (FA)》讲座课件下载[ACCA考试]《F7 财务报告Financial Reporting (FR)》讲座课件下载[ACCA考试]《F8 审计与认证服务Audit and Assurance Services(AAS)》讲座课件下载备考辅导:F5复习资料F9复习资料整理分享2009年11月考官文章汇总资料2009年10月考官文章汇总资料2009年12月ACCA考试tips大全!ACCA字典会计科目中英对照经验分享:[经验分享]ACCA看书有诀窍[经验分享]中国ACCA第一人:吴卫军[经验分享]我的ACCA考试经验、教训以及建议[经验分享]F7,F9 的攻略(ACCA考试总结)[经验分享]ACCA考试高手的经验[经验分享]ACCA考试技巧与学习方法[经验分享]ACCA工作经验-work Experience[经验分享]—ACCA考试试题的特点及做题技巧分析[经验分享]—ACCA考试技巧与学习方法![经验分享]—ACCA三遍循环法[经验分享]—ACCA考试实战攻略(1)[经验分享]—ACCA考试实战攻略(2)[ACCA考试]《F3 财务会计 Financial Accounting (FA)》讲座课件下载ACCA F6 真题[ACCA]ACCA各Paper考官一览表[ACCA考试]《F1 会计师与企业 Accountant in Business (AB)》讲座课件下载[ACCA考试]2007年12月开始执行的新大纲的模拟试题[ACCA]ACCA历年全球统考考题汇总[ACCA]教材相关问题汇总[转贴]我是这样考过ACCA的(word版)[转贴]ACCA考试经验及P1.2-P2.2攻略(完整下载版)[转帖]ACCA看书有诀窍[转帖]中国ACCA第一人:吴卫军[转帖]我的ACCA考试经验、教训以及建议[ACCA考试]《F8 审计与认证服务 Audit and Assurance Services(AAS)》讲座课件下载[ACCA考试]《F2 管理会计 Management Accounting(MA)》讲座课件下载[ACCA考试]《F7 财务报告 Financial Reporting (FR)》讲座课件下载[ACCA]ACCA 考试报考指南ACCA 考试介绍特许公认会计师公会(The Association of Chartered Certified Accountants,简称ACCA) 成立于1904年,是目前全球最大的国际会计师组织。

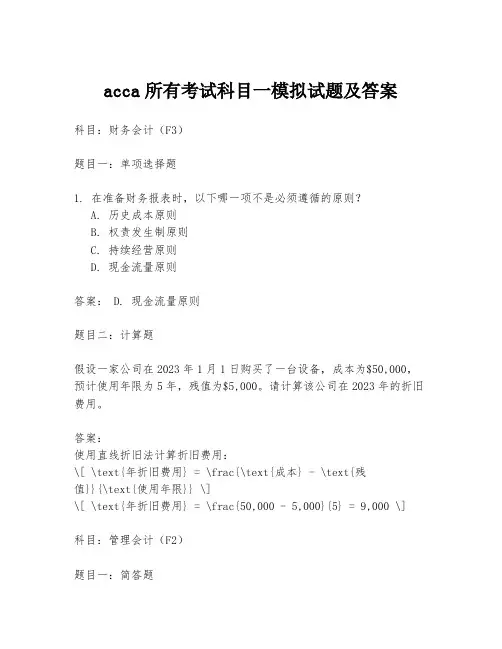

acca所有考试科目一模拟试题及答案科目:财务会计(F3)题目一:单项选择题1. 在准备财务报表时,以下哪一项不是必须遵循的原则?A. 历史成本原则B. 权责发生制原则C. 持续经营原则D. 现金流量原则答案: D. 现金流量原则题目二:计算题假设一家公司在2023年1月1日购买了一台设备,成本为$50,000,预计使用年限为5年,残值为$5,000。

请计算该公司在2023年的折旧费用。

答案:使用直线折旧法计算折旧费用:\[ \text{年折旧费用} = \frac{\text{成本} - \text{残值}}{\text{使用年限}} \]\[ \text{年折旧费用} = \frac{50,000 - 5,000}{5} = 9,000 \]科目:管理会计(F2)题目一:简答题简述标准成本和实际成本的区别。

答案:标准成本是指在理想条件下,根据预定的生产效率和成本结构计算出的成本。

实际成本则是在实际生产过程中产生的成本。

两者的主要区别在于,标准成本用于预算和控制,而实际成本用于衡量和评估实际生产过程中的成本表现。

科目:税务(F6)题目一:案例分析题某公司在2023年的总收入为$200,000,允许的税前扣除项为$50,000。

请计算该公司的应纳税所得额。

答案:\[ \text{应纳税所得额} = \text{总收入} - \text{税前扣除项} \] \[ \text{应纳税所得额} = 200,000 - 50,000 = 150,000 \]结束语:以上模拟试题及答案仅供参考,实际考试内容和难度可能会有所不同。

考生应以ACCA官方发布的考试大纲和学习材料为依据,进行系统的学习和复习。

希望所有考生都能在ACCA考试中取得优异的成绩。

ACCA F阶段知识整理ACCA考试科目一共有13门,其中F阶段考试科目一共占了9门课程,其中的重要性不言而喻,那么F阶段和P阶段有什么关联呢?P阶段应该如何选择呢?带着这些疑问一起和高顿ACCA来看看吧。

给大家整理了一套电子版ACCA备考资料,里面有很多ACCA考试资料可供大家选择。

而且在对于上班族来说,电子版的也很适合在地铁上查阅:电子版ACCA 备考资料F1 Accountant in Business这一门倾向于管理方面,课程难度不大,很多常识性的知识点,但是毕竟是ACCA第一门考试,所以刚开始大多数同学都会对很多专业词汇的英文表述不熟悉,加上F1中的知识点比较细碎,因此加大了学习的难度。

建议大家把每章的知识点自己做一个梳理总结,每一章节整理出大框架,可以很好地帮助本科的学习。

F2 Mangement Accounting这一门课是管理会计,课体总体难度不大,差异分析的部分可能有些难度,另外一些财务比率的计算需要掌握,为以后的学习打好基础。

F3 Financial Accounting这一门课是财务会计,属于基础会计学,其中会涉及到会计科目、会计分录、丁字账、试算平衡表等等一系列会计基础知识,对于没有会计基础的同学一开始会觉得一头雾水,但是入了门之后这门课程难度并不算大。

这一门课程是之后F7和P2的学习基础,一定要掌握知识点,同时积累英语专业词汇。

F4 Corporate and Business Law英美法系和大陆体系的不同在于他们使用的是判例法,因此F4中涉及到不同年代各种法律案例,并且有很多专业词汇。

以判例法为主考试难度感觉是在上升,但是通过率在上升F5 Performance Management这门课是管理会计的进阶,对于F2基础打得好的同学拿下这门课应该不在话下。

这门课程总体难度不大,重点在于掌握不同成本法及业绩评价方法的应用。

F6 Taxation这门课90%以上都是计算,是中国考生最拿手的地方。

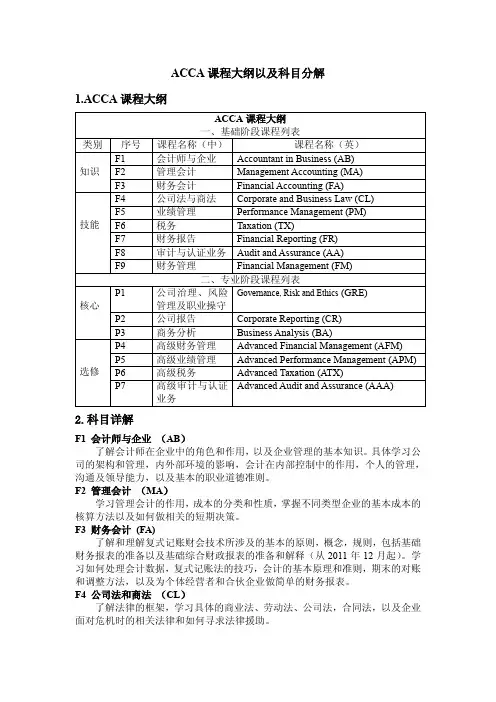

ACCA课程大纲以及科目分解1.ACCA课程大纲2.科目详解F1 会计师与企业(AB)了解会计师在企业中的角色和作用,以及企业管理的基本知识。

具体学习公司的架构和管理,内外部环境的影响,会计在内部控制中的作用,个人的管理,沟通及领导能力,以及基本的职业道德准则。

F2 管理会计(MA)学习管理会计的作用,成本的分类和性质,掌握不同类型企业的基本成本的核算方法以及如何做相关的短期决策。

F3 财务会计(FA)了解和理解复式记账财会技术所涉及的基本的原则,概念,规则,包括基础财务报表的准备以及基础综合财政报表的准备和解释(从2011年12月起)。

学习如何处理会计数据,复式记账法的技巧,会计的基本原理和准则,期末的对账和调整方法,以及为个体经营者和合伙企业做简单的财务报表。

F4 公司法和商法(CL)了解法律的框架,学习具体的商业法、劳动法、公司法,合同法,以及企业面对危机时的相关法律和如何寻求法律援助。

F5 绩效管理(PM)学习使用管理会计的技巧来做企业的预算,决策和控制,包括具体的特殊成本计算方法,企业内外部风险的评估和资源的配置,以及如何以财务和非财务的标准来做绩效评估。

F6 税法(TX)了解英国的税收体系。

掌握个人、单个企业、合伙人和集团企业主要税赋的计算,包括个人税、公司税,资本收益税,遗产税,社会保险税和增值税。

F7 财务报告(FR)学习国际会计准则,学习编制较为复杂的单一企业财务报表以及现金流量表,简单的集团财务报表,并学习如何做财务报表分析。

F8 审计与认证业务(AA)学习审计和认证业务的关系,公司的管理和内控,内部审计的职能和作用,以及与外部审计的关系。

了解审计师如何实施审计,具体包括职业道德的遵守,如何准备审计程序,评估审计风险,收集证据,应用审计准则实施审计程序和签发适当的审计报告。

F9 财务管理(FM)学习财务经理决策时面临的问题,主要包括投资、融资和股利发放的决策。

了解财务管理的外部环境,流动资金的管理技巧,投资项目的具体评估,企业财产的估价和相关风险的管理。