国际经济学第九版答案

- 格式:docx

- 大小:14.15 KB

- 文档页数:12

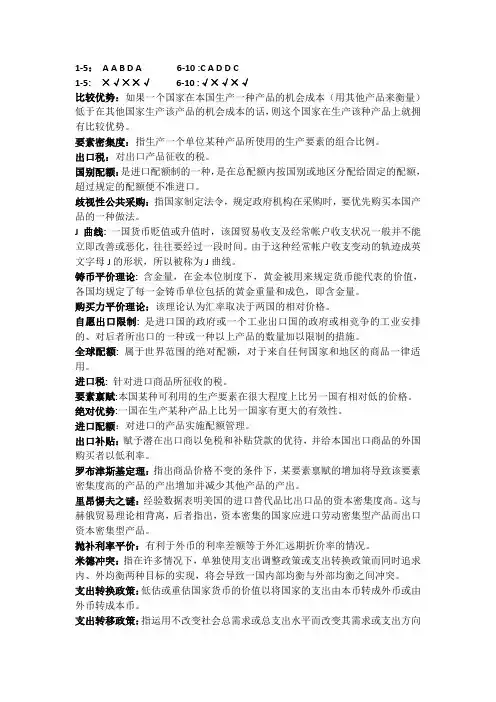

1-5:A A B D A 6-10 :C A D D C1-5: ×√××√6-10 :√×√×√比较优势:如果一个国家在本国生产一种产品的机会成本(用其他产品来衡量)低于在其他国家生产该产品的机会成本的话,则这个国家在生产该种产品上就拥有比较优势。

要素密集度:指生产一个单位某种产品所使用的生产要素的组合比例。

出口税:对出口产品征收的税。

国别配额:是进口配额制的一种,是在总配额内按国别或地区分配给固定的配额,超过规定的配额便不准进口。

歧视性公共采购:指国家制定法令,规定政府机构在采购时,要优先购买本国产品的一种做法。

J曲线:一国货币贬值或升值时,该国贸易收支及经常帐户收支状况一般并不能立即改善或恶化,往往要经过一段时间。

由于这种经常帐户收支变动的轨迹成英文字母J的形状,所以被称为J曲线。

铸币平价理论: 含金量,在金本位制度下,黄金被用来规定货币能代表的价值,各国均规定了每一金铸币单位包括的黄金重量和成色,即含金量。

购买力平价理论:该理论认为汇率取决于两国的相对价格。

自愿出口限制: 是进口国的政府或一个工业出口国的政府或相竞争的工业安排的、对后者所出口的一种或一种以上产品的数量加以限制的措施。

全球配额: 属于世界范围的绝对配额,对于来自任何国家和地区的商品一律适用。

进口税: 针对进口商品所征收的税。

要素禀赋:本国某种可利用的生产要素在很大程度上比另一国有相对低的价格。

绝对优势:一国在生产某种产品上比另一国家有更大的有效性。

进口配额:对进口的产品实施配额管理。

出口补贴:赋予潜在出口商以免税和补贴贷款的优待,并给本国出口商品的外国购买者以低利率。

罗布津斯基定理:指出商品价格不变的条件下,某要素禀赋的增加将导致该要素密集度高的产品的产出增加并减少其他产品的产出。

里昂惕夫之谜:经验数据表明美国的进口替代品比出口品的资本密集度高。

这与赫俄贸易理论相背离,后者指出,资本密集的国家应进口劳动密集型产品而出口资本密集型产品。

Chapter 9 The Political Economy of Trade TheoryMultiple Choice Questions1. The efficiency case made for free trade is that as trade distortions such as tariffsare dismantled and removed,(a) government tariff revenue will decrease, and therefore national economicwelfare will decrease.(b) government tariff revenue will decrease, and therefore national economicwelfare will increase.(c) deadweight losses for producers and consumers will decrease, henceincreasing national economic welfare.(d) deadweight losses for producers and consumers will decrease, hencedecreasing national economic welfare.(e) None of the above.Answer: C2. The opportunity to exploit economies of scale is one of the gains to be made fromremoving tariffs and other trade distortions. These gains will be found by adecrease in(a) world prices of imports.(b) the consumption distortion loss triangle.(c) the production distortion loss triangle.(d) Both (b) and (c).(e) None of the above.Answer: E3. It is argued that special interest groups are likely to take over and promoteprotectionist policies, which may lead to an increase in national economic welfare.This argument leads to(a) a presumption that in practice a free trade policy is likely to be better thanalternatives.(b) a presumption that trade policy should be shifted to Non-GovernmentalOrganizations, so as to limit taxpayer burden.(c) a presumption that free trade is generally a second-best policy, to be avoided iffeasible alternatives are available.(d) a presumption that free trade is the likely equilibrium solution if thegovernment allows special interest groups to dictate its trade policy.(e) None of the above.Answer: A4. The optimum tariff is(a) the best tariff a country can obtain via a WTO negotiated round ofcompromises.(b) the tariff, which maximizes the terms of trade gains.(c) the tariff, which maximizes the difference between terms of trade gains andterms of trade loses.(d) not practical for a small country due to the likelihood of retaliation.(e) not practical for a large country due to the likelihood of retaliation.Answer: E5. The optimum tariff is most likely to apply to(a) a small tariff imposed by a small country.(b) a small tariff imposed by a large country.(c) a large tariff imposed by a small country.(d) a large tariff imposed by a large country.(e) None of the above.Answer: B6. The prohibitive tariff is a tariff that(a) is so high that it eliminates imports.(b) is so high that it causes undue harm to trade-partner economies.(c) is so high that it causes undue harm to import competing sectors.(d) is so low that the government prohibits its use since it would lose animportant revenue source.(e) None of the above.Answer: A7. The existence of marginal social benefits which are not marginal benefits for theindustry producing the import substitutes(a) is an argument supporting free trade and non-governmental involvement.(b) is an argument supporting the use of an optimum tariff.(c) is an argument supporting the use of market failures as a trade-policy strategy.(d) is an argument rejecting free trade and supporting governmental involvement.(e) None of the above.Answer: D8. The domestic market failure argument is a particular case of the theory of(a) the optimum, or first-best.(b) the second best.(c) the third best.(d) the sufficing principle.(e) None of the above. Answer: B9. The difficulty of ascertaining the right second-best trade policy to follow(a) reinforces support for the third-best policy approach.(b) reinforces support for increasing research capabilities of government agencies.(c) reinforces support for abandoning trade policy as an option.(d) reinforces support for free-trade options.(e) None of the above.Answer: D10. The authors of the text believe that(a) second-best policy is worse than optimal policy.(b) special interest groups generally enhance national welfare.(c) national welfare is likely to be enhanced by the imposition of an optimal tariff.(d) market Failure arguments tend to support free-trade policy.(e) there is no such thing as national welfare.Answer: E11. The simple model of competition among political parties long used by politicalscientists tends to lead to the practical solution of selecting the(a) optimal tariff.(b) prohibitive tariff.(c) zero (free-trade) tariff.(d) the tariff rate favored by the median voter.(e) None of the above.Answer: D12. The median voter model(a) works well in the area of trade policy.(b) is not intuitively reasonable.(c) tends to result in biased tariff rates.(d) does not work well in the area of trade policy.(e) None of the above.Answer: D13. The fact that trade policy often imposes harm on large numbers of people, andbenefits only a few may be explained by(a) the lack of political involvement of the public.(b) the power of advertisement.(c) the problem of collective action.(d) the basic impossibility of the democratic system to reach a fair solution.(e) None of the above.Answer: C14. Protectionism tends to be concentrated in two sectors:(a) agriculture and clothing.(b) high tech and national security sensitive industries.(c) capital and skill intensive industries.(d) industries concentrated in the South and in the Midwest of the country.(e) None of the above.Answer: A15. Judging by the changes in the height of tariff rates in major trading countries, theworld has been experiencing a great(a) trade liberalization.(b) surge of protectionism.(c) lack of progress in the trade-policy area.(d) move towards regional integration.(e) None of the above.Answer: A16. The World Trade Organization (WTO) was organized as a successor to the(a) IMF.(b) UN.(c) UNCTAD.(d) GATT.(e) The World Bank.Answer: D17. The WTO was established by the ____________of multilateral trade negotiations.(a) Kennedy Round(b) Tokyo Round(c) Uruguay Round(d) Dillon Round(e) None of the above.Answer: C18. The Smoot-Hawley Tariff Act of 1930 has generally been associated with(a) falling tariffs.(b) free trade.(c) intensifying the worldwide depression.(d) recovery from the worldwide depression.(e) Non-tariff barriers. Answer: C19. A trade policy designed to alleviate some domestic economic problem by exportingit to foreign countries is know as a(n)(a) international dumping policy.(b) countervailing tariff policy.(c) beggar thy neighbor policy.(d) trade adjustment assistance policy.(e) None of the above.Answer: C20. The General Agreement on Tariffs and Trade and the World Trade Organizationhave resulted in(a) termination of export subsidies applied to manufactured goods.(b) termination of import tariffs applied to manufactures.(c) termination of import tariffs applied to agricultural commodities.(d) termination of international theft of copyrights.(e) None of the above.Answer: E21. The General Agreement on Tariffs and Trade and the World Trade Organizationhave resulted in(a) the establishment of universal trade adjustment assistance policies.(b) the establishment of the European Union.(c) the reciprocal trade clause.(d) reductions in trade barriers via multilateral negotiations.(e) None of the above.Answer: D22. Trade theory suggests that Japan would gain from a subsidy the United Statesprovides its grain farmers if the gains to Japanese consumers of wheat products more than offsets the losses to Japanese wheat farmers. This would occur as long as Japan(a) is a net importer in bilateral trade flows with the United States.(b) is a net importer of wheat.(c) has a comparative advantage in wheat.(d) has an absolute advantage in producing wheat.(e) None of the above.Answer: B23. Countervailing duties are intended to neutralize any unfair advantage that foreignexporters might gain because of foreign(a) tariffs.(b) subsidies.(c) quotas.(d) Local-Content legislation.(e) None of the above.Answer: B24. Throughout the post-World War II era, the importance of tariffs as a trade barrierhas(a) increased.(b) decreased.(c) remained the same.(d) fluctuated wildly.(e) demonstrated a classic random walk with a mean-reversion tendency.Answer: B25. In 1980 the United States announced an embargo on grain exports to the SovietUnion in response to the Soviet invasion of Afghanistan. This embargo was mainly resisted by(a) U.S. grain consumers of bread.(b) U.S. grain producers.(c) foreign grain producers.(d) U.S. communists.(e) None of the above.Answer: B26. Export embargoes cause greater losses to consumer surplus in the target country(a) the lesser its initial dependence on foreign produced goods.(b) the more elastic is the target country’s demand schedule.(c) the more elastic is the target country’s domestic supply.(d) the more inelastic the target country’s supply.(e) None of the above.Answer: D27. The strongest political pressure for a trade policy that results in higherprotectionism comes from(a) domestic workers lobbying for import restrictions.(b) domestic workers lobbying for export restrictions.(c) domestic workers lobbying for free trade.(d) domestic consumers lobbying for export restrictions.(e) domestic consumers lobbying for import restrictions.Answer: A28. The average tariff rate to data on dutiable imports in the United States isapproximately(a) 5 % of the value of imports.(b) 15% of the value of imports.(c) 20 % of the value of imports.(d) 25% of the value of imports.(e) more than 25% of the value of imports. Answer: A29. In 1990 the United States imposed trade embargoes on Iraq’s international trade.This would induce smaller losses in Iraq’s consumer surplus the(a) less elastic Iraq’s demand schedule.(b) more elastic Iraq’s demand schedule.(c) greater is Iraq’s dependence on foreign products.(d) more inelastic is Iraq’s supply schedule.(e) None of the above.Answer: B30. The World Trade Organization provides for all of the following except(a) the usage of the most favored nation clause.(b) assistance in the settlement of trade disagreements.(c) bilateral tariff reductions.(d) multilateral tariff reductions.(e) None of the above.Answer: C31. Which organization determines procedures for the settlement of internationaltrade disputes?(a) World Bank(b) World Trade Organization(c) International Monetary Organization(d) International Bank for Reconstruction and Development(e) The League of NationsAnswer: B32. The WTO’s int ervention against clean air standards(a) has earned it universal approval.(b) was done in order to limit national sovereignty.(c) has resulted in much criticism.(d) has resulted in much criticism among professional economists.(e) None of the above.Answer: C33. Under U.S. commercial policy, the escape clause results in(a) temporary quotas granted to firms injured by import competition.(b) tariffs that offset export subsidies granted to foreign producers.(c) a refusal of the U.S. to extradite anyone who escaped political oppression.(d) tax advantages extended to minority-owned exporting firms.(e) tariff advantages extended to certain Caribbean countries in the U.S. market. Answer: A34. Under U.S. commercial policy, which clause permits the modification of a tradeliberalization agreement on a temporary basis if serious injury occurs to domestic producers as a result of the agreement?(a) Adjustment assistance clause(b) Escape clause(c) Most favored nation clause(d) Prohibitive tariff clause(e) None of the above.Answer: B35. Today U.S. protectionism is concentrated in(a) high tech industries.(b) labor-intensive industries.(c) industries in which Japan has a comparative advantage.(d) computer intensive industries.(e) capital-intensive industries.Answer: B36. The reason protectionism remains strong in the United States is that(a) economists can produce any result they are hired to produce.(b) economists cannot persuade the general public that free trade is beneficial.(c) economists do not really understand how the real world works.(d) the losses associated with protectionism are diffuse, making lobbying by thepublic impractical.(e) None of the above.Answer: D37. An issue never confronted effectively by GATT, but considered an important issuefor WTOis that of(a) the promotion of freer World trade(b) the promotion of freer World commodity trade(c) the promotion of freer World services trade(d) the lowering of tariff rates(e) None of the above.Answer: C38. The political wisdom of choosing a tariff acceptable to the median U.S. voter is(a) a good example of the principle of the second best.(b) a good example of the way in which actual tariff policies are determined.(c) a good example of the principle of political negotiation.(d) is not evident in actual tariff determination.(e) None of the above.Answer: D39. A game-theory explanation of the paradox that even though all countries wouldbenefit if each chose free trade, in fact each tends to follow protectionist policies is(a) Trade war(b) Collective action(c) Prisoner’s dilemma(d) Benefit—Cost analysis(e) None of the above.Answer: C40. When the U.S. placed tariffs on French wine, France placed high tariffs on U.S.chickens. This is an example of:(a) deadweight losses(b) multilateral negotiations(c) bilateral trade negotiations(d) international market failures(e) none of the aboveAnswer: E41. The quantitative importance of U.S. protection of the domestic clothing industry isbest explained by the fact that(a) this industry is an important employer of highly skilled labor(b) this industry is an important employer of low skilled labor(c) most of the exporters of clothing into the U.S. are poor countries.(d) a politically well organized sector in the U.S.(e) None of the aboveAnswer: DEssay Questions1. Developing countries have often attempted to establish cartels so as to counterthe actual or perceived inexorable downward push on the prices of their exported commodities. OPEC is the best well known of these. How are such cartelsexpected to help the developing countries? At times importing countries profess support for such schemes. Can you think of any logical basis for such support?How are cartels like monopolies, and how are they different from monopolies. Why is there a presupposition among economists that such schemes are not likely to succeed in the long run?Answer: Such cartels are expected to shift the exporters’ terms of trade in their favor. Also they are expected to produce the maximum profit, which themarket will bear. Importing countries may benefit from the price stabilitygenerated by the cartel. Cartels are like monopolies in that their totaloutput is the same as that which would be generated by a singlemonopoly. They differ from monopolies in that the monopoly profits needto be divided among the producing countries, which have different coststructures.2. The United States appears at times to have a totally schizophrenic attitude towardprotectionism. The United States was the country that proposed theestablishment of the World Trade Organization as early as the late 1940s, andwas also the only industrialized country that refused to ratify this at that time.The United States has consistently argued on the side of multinational free trade in GATT Rounds, and yet maintains many protectionist laws such as those which reserve oil shipments from Alaska to U.S. flag carriers. How can you explain this apparent lack of national consistency on this issue?Answer: This reflects the fact that international trade typically has many winners and relatively fewer, but politically powerful losers. Short of guaranteed(constitutional?) non-conditional compensatory mechanisms, the basicconflict between these two groups will always be there.3. Presumably, since the United States is a large country in many of its internationalmarkets, a positive optimum tariff exists for this country. It follows therefore that when any legislator or government official who promotes zero-tariff free tradepolicies, is by definition not acting in the public’s best interest. Discuss.Answer: Technically this is true. However, this is true only within the context of a generally myopic view of international relations. If the tariff imposingcountry is large enough to make a substantial difference in its welfare byseeking an optimum tariff, then it cannot hope to remain invisible, as itspolicies are substantially harming its trade partners. Foreignrepercussions are almost a certainty. In such a “game” it is not at allcertain that seeking the optimum tariff dominates alternative strategies. 4. It may be demonstrated that any protectionist policy, which effectively shifts realresources to import competing industries or sectors will harm export industries or sectors. This may, for example, happen by the strengthening U.S. dollar in theforeign exchange market. Would you propose therefore that export industrieslobby against protectionism in International Trade Commission proceedings?What of consumer advocates? Discuss the pros and the problems of such asuggestion.Answer: Actually this is an interesting idea. It is well known that the public interest is put on hold as the ITC considers only the squeaky wheels ofthose allegedly hurt by trade. While “consumers” may be tooamorphous a group to successfully organize and pursue a politicalagenda, the exporters and consumer advocates may be able to form acounter weight to the import competing industries.5. It is argued that the United States would be foolish to maintain a free-tradestance in a world in which all other countries exploit child or prisoner labor, or are protectionist. On the other hand, Ricardo’s classic demonstration of thesources and effects of comparative advantage cogently demonstrates thatregardless of other country policy, free trade remains the first best policy for a country to follow, since it will maximize its consumption possibilities (conditional upon other country policies). Explain. Discuss the contradiction with theargument in the preceding paragraph.Answer: In the context of the Ricardian model, it is true that gains from trade are strictly a result of world terms of trade, which differ from domesticmarginal rates of substitution. In such a world, the reason why foreigngoods are cheap is of no concern to domestic consumers. However, in aworld which allows for large-scale labor migration, ignoring laborconditions abroad may ultimately result in living standards for domesticworkers to be dragged down.精品资料6. It has been claimed that foreign governments have attempted to influence votes inthe U.S. that would promote policies of protectionism within the U.S. On thesurface this appears to be totally illogical and counter intuitive, as this wouldpresumably lessen the possibilities of foreigners’ expor ts to the U.S.Answer: This would make sense only if the form of protectionism is a tariff.However, if it is a quota, then the scarcity rents may be captured byestablished foreign producers. Hence, the reaction of the Japanese toautomobile quotas was to dramatically increase the high-end, highlyprofitable automobiles. This would be even more self-evident if theprotectionism took the form of a Voluntary Export Restraint (VER), or adetailed formalized bilateral cartel, such as the old Multi-Fibre Agreement.Quantitative/Graphing ProblemsAssume that Boeing (U.S.) and Airbus (European Union) both wish to enter the Hungarian market with the next new generation airliner. They both have identical cost and demand conditions (as indicated in the graph above).1. Assume that Boeing is the first to enter the Hungarian market. Without agovernment subsidy what price would they demand, and what would be their total profits?Answer: $12 Million, $162. What is the consumer surplus enjoyed by Hungarian consumers of Boeing aircraftin the above situation?Answer: $8 Million可修改精品资料3. Suppose the European government provides Airbus with a subsidy of $4 for eachairplane sold, and that the subsidy convinces Boeing to exit the Hungarianmarket. Now Airbus would be the monopolist in this market. What price would they charge, and what would be their total profits?Answer: $10 Million, and $36 Million可修改精品资料4. What would be the cost of the subsidy to European taxpayers?Answer: $24 Million5. What happens to the Consumer Surplus of Hungarian customers as a result ofthis subsidy?Answer: An increase of $10 Million.6. What is the revenue gain or loss for Europe as a whole (including taxpayers)?Answer:A gain of $12 Million.7. The U.S. producer Boeing, and the European Airbus are contemplating the nextgeneration mid-sized fuel efficient generation of air carrier. If both produce their respective models, then each would lose $50 million (because the world market is just not large enough to enable either to capture potential scale economies if they had to share the world market). If neither produce, then each one’s net gainwould of course be zero. If either one produces while the other does not, then the producer will gain $500 million.(a) What is the correct strategy for either company?Answer: enter the market first. Then the other company knows that if it also enters, it will not be able to cover costs.(b) What is the correct strategy for a government seeking to maximize nationaleconomic welfare?Answer: Subsidize its producer. If this allows it to enter first, then we get the same solution as answer (a) above.(c) If a national government decides to subsidize its aircraft producer, how highshould be the subsidy?Answer: Any figure above $50 million (e.g. $55 million). This would promise positive profits regardless of the decision of the competitor. The“winner” then may turn out to be that country whose voters are leastsensitive to on-the-books, transparent subsidies given to richcorporations (these subsidies will have to continue year after year untilthe other country stops its subsidies).可修改。

international(国际经济学)课后习题及答案----------------------- Page 1-----------------------Review Questions and Condensed Answers forInternational Trade TheoriesChapter 1 World Trade and the National EconomyReview Questions::::1( What features distinguish international from domestic transactions?2( What can you say about the growth of world trade in both nominal and real terms? Was itfaster than the growth of output?3( Evaluate the statement,” the United States is a closed economy, hence foreign trade is ofno consequence to it.”4( Distinguish between export industries, import-competing industries and nontraded goods.Give examples of each.5( Using the figure in table 1-3, what can you say about the trade structure of the USA andJapan.Condensed Answers to Review Questions::::1. The text discusses ways that international transactions differfrom domestic ones.i. International trade requires that transactions be conductedbetween twocurrencies mediated by an exchange rate. Domestic transactions are conductedin a single currency.ii. Commercial policies that operate to restrict international transactions cannot, ingeneral, be imposed on domestic trade. Such policies include tariffs, quotas,voluntary export restraints, export subsidies, and exchange controls.iii. Countries pursue different domestic macroeconomic policieswhich result indivergent rates of economic growth, inflation, and unemployment.iv. More statistical data exist on the nature, volume, and value of internationaltransactions than exist in domestic trade.v. Factors of production are more mobile domestically than internationally.vi. Countries exhibit different demand patterns, sales techniques,and marketingrequirements. Many of these are due to culture and custom. Someresult fromdifferences in government regulations. Included here are health, safety,environmental, and technical rules.2. The real volume of world exports grew at an annual rate of more than 6 percent between1950 and 2000. Global output grew at an annual rate of 4 percent. Export growth inexcess of output growth reflects the increased openness to trade of many countries.3. The United States is a relatively closed economy since the share of trade in GDP issmaller than that of most other industrial nations. In 2000, U.S. exports of goods andservices were 11 percent of GDP. The U.S. economy is less dependent on the foreignsector than other major economies, but to say that foreign trade is of no consequence is anexaggeration. The U.S. economy has become increasingly open and, therefore, moreimpacted by trade developments over time. This trend is likely to continue. Curtailingimports would, for example, have a big effect on consumers' ability to buy some goods----------------------- Page 2-----------------------(e.g. tropical products) and would raise the prices of others. The absence of certain keycommodities and material inputs would greatly disrupt areas of U.S. industry.4. a. Export industries send a substantial share of their output abroad. Ratios ofexports to GDP are much higher than the average ratio for all industries. Netexporting industries are those for which exports exceed imports. U.S. netexporting industries include farm products, chemicals, certain types of machinery,and aerospace products.b. Import-competing industries are domestic industries that sharethe domesticmarket with a substantial import presence. These activities haveratios ofimports to GDP that are much higher than the average ratio for all industries.U.S. import-competing industries include fuels, automobiles,clothing, footwear,and iron and steel.c. Nontraded goods are those which, because of their nature and characteristics, arenot easily exported or imported. Examples are hair-dressing, movie theaters,meals, construction activity, and health-care.5. Table 1.3 contains figures on the trade structure of the U.S. and Japan. The U.S. is a netexporter of food, certain ores, chemicals, and other machinery and transport equipment,and is a net importer of raw materials, mining products, fuels, nonferrous metals, iron andsteel, semimanufactures, office and telecommunications equipment, automotive products,textiles and clothing, and other consumer goods. Japan is a net exporter of iron and steel,chemicals, semimanufactures, office and telecommunications equipment, automotiveproducts, other machinery and transport equipment, and other consumer goods. Importsexceed exports in food, raw materials, and textiles and clothing.----------------------- Page 3-----------------------Chapter 2 Why Nations TradeReview Questions::::1( a. In what sense are the cost data of footnote 4 related to the figures of scheme 1?b. Based on the figures of footnote 4, determine the:Direction of trade once it develops.Limits to mutually beneficial trade.Limits to a sustainable exchange trade.2. Evaluate the following statements:a. In international trade, domestic cost ratios determine the limits of mutually beneficial trade,whereas demand considerations show where, within these limits, the actual exchange ratio will lie.b. Comparative advantage is a theoretical concept. It cannot be used to explain any real-worldphenomena.c. The opening up of trade raises the price of export goods; hence trade is inflationary.d. The concept of absolute advantage offers explainations for East Germany’s high unemploymentrates in the 1990s.3. a. Use the theory of comparative advantage to explain why it pays for:The USA to export grains and import oil.Russia to export oil and import grains.b. Why does the popular press believe that grain exports are inflnationary? What is wrongwith this porposition?Condensed Answers to Review Questions:1. a. Scheme 1 is based on labor productivity comparisons, while Footnote 4presentsper unit cost data. Production cost ratios are inversely related to productivitymeasures.b. i. Textiles will be exported from the U.K. and wheat from the U.S.ii. The U.S. will trade only if one yard of textiles costs less than3 bushels ofwheat. The U.K. will trade only if 1 yard of textiles can be exchangedfor more than 2 bushels of wheat.iii. The value of the ? must be between $1 and $1.502. a. Consider Figure 2.2. The domestic cost ratios define limits of mutually beneficialtrade. Within the region of mutually beneficial trade the actual exchange rate willbe determined by the relative intensity of each country's demand for the othercountry's product. A full analysis requires an understanding of reciprocal demandcurves, but the following general principle might help heuristically. If the Britishare more eager to buy U.S. wheat than the Americans are eager for British textiles,the exchange ratio falls close to the U.K. domestic cost ratio and the U.S. can beviewed as capturing a greater share of the gains from trade.b. Since the real world does not conform to the convenienttwo-country, two-goodassumptions, the simple theoretical model is not immediately applicable.However, we can generalize the model to many goods and many nations. Thefundamental truth remains. Countries export those goods in which their relativeproduction costs are lower and import those goods for which the relative costs arehigher.----------------------- Page 4-----------------------c. While trade tends to raise the prices of exportables in the domestic economy, theeffect of trade is to lower the average price level of all goods. Trade givesconsumers an opportunity to consume at lower world prices. Many goods will becheaper when purchased from foreign supply sources. Trade also conveysprocompetitive effects, stimulates the adoption of new technologies, and allowsfirms to achieve efficient scale production levels. Thus, trade is anti-inflationary.d. The reunification of the Germany economy in 1990 was undertaken on the basisthat a unit of the deutschmark, the West German currency, should be equal in valueto a unit of the ostmark, the East German currency. At this exchange rate, goodsproduced in East Germany were almost universally more expensive to producethan their counterparts in the West. Labor productivity in East Germanmanufacturing was found to be about 35% of the West German level. Underthese conditions the East German manufacturing sector collapsed. Investors werereluctant to purchase East German factories and large scale closures and dismissalsresulted.3. a. The U.S. enjoys a comparative advantage in grains. It also produces oil, but will gain byspecializing in grain production and using proceeds of exported agriculturalproducts to purchase oil from nations that produce oil relatively more efficiently.Russia is relatively more efficient in the production of oil and will gain bypurchasing grain from the U.S. in exchange for oil.b. The popular press asserts that by exporting grain from the U.S. (say to the former U R)we are lowering the domestic supply of grain and raising the domestic U.S. price of grain. Sincegrain is an important ingredient in many food products, grain exports are believed to increase theprice of those products. However, the price of grain is determined in world markets. U.S.exports alone cannot permanently raise the domestic U.S. price. If the domestic U.S. grainpricerose above the world price, the U.S. would be a net importer of grains and the domestic price wouldfall.----------------------- Page 5-----------------------Chapter 3 The Commodity Composition of TradeReview Questions::::1( Does the factor proportions theory provide a good explanation of intraindustry trade? Ifnot, can you outline an alternative explaination for the growing phenomenon?2( Explain the dynamic nature of comparative advantage using Japan’s experience as anexample.3( Once the United States acquires a comparative advantage in jet aircraft production it canbe sure of a dominant position in the global market forever. Do you agree with thisstatement? Explain.Condensed Answers to Review Questions1. The factor proportions theory is better suited to explain interindustry trade, or the exchangebetween countries of totally different commodities, than intraindustry trade, which is thetwo-way trade of similar commodities. The growth of intraindustry trade is greatest inimperfectly competitive industries characterized by economies of scale. Here, scaleeconomies force firms in each industry to specialize in a narrow range of products withineach industry to achieve efficient scale operations. Intraindustry specialization combinedwith diverse consumer tastes gives rise to two-way trade within the same industryclassification.2. Japan's comparative advantage in the immediate post-war period was in labor intensivegoods. The high level of saving and investment transformed Japan into a relatively capitalabundant country. Its advantage in the labor-intensive industries was lost as wages rose.Moreover, Japan increased its technological capability through high spending on R&D.Now Japan's advantage lies in the production of high-tech, capital intensive goods similar tothe U.S. This in large part explains the increasing trade friction between the twocountries.3. Once the U.S. acquires a comparative advantage in jet aircraft, it is likely to enjoy a dominantposition in the global marketplace for years, but not forever. Jet aircraft production is characterizedby huge economies of scale due largely to research and development costs. High capitalrequirements and scale economies pose large entry barriers. It is extremely difficult for a countryto enter into aircraft production once the U.S. has the lead. The new firm would initially have asmall market share and would be unable to compete on a cost basis. The new market entrant wouldrequire considerable government support and encouragement. This was the case with the EuropeanAirbus.----------------------- Page 6-----------------------Chapter 4 Protection of Domestic Industries: The TariffReview Questions::::1( A tariff on textiles is equivalent to a tax on consumers and a subsidy to the textileproducers and workers.2( Explain the concept of effective rate of protection.a. What does the effective rate on final goods depend upon and how?b. In what way does the effective rate analysis help to illuminate these policy issues:Deepening of production in LDCsEscalation of tariff rates by degree of processing in industrial countries3. A tariff lowers the real income of the country, while at the same time it distributes income fromconsumers to the governments and to the import-competing industry.Condensed Answers to Review Questions:1. The effect of a tariff is comparable to the combined effects of a tax on consumers and a subsidy toproducers. Using Figure 4.3, one can show a tariff results in a transfer of resources from theconsumers (who lose P P fd ) to the producers (who gain P P ec). With a non-prohibitive tariff, the2 3 2 3government will also gain revenue efmn. Whether the two schemes are equivalent depends on theexact nature of the tax and subsidy scheme.2. a. The effective rate of protection measures the percentage increase in domesticvalue added per unit of output made possible by tariffs on the output and onmaterial inputs. Determinants of the effective rate include thetariff on the finalproduct, tariffs on the imported material inputs, and the free trade value added perunit of output which is influenced by intermediate input coefficients. Effectiverates are positively related to the tariff on the final product and negatively related toboth tariffs on imported inputs and the free trade value added. A derivation ofthe formula appears in footnote 10, and footnote 12 interprets that formula.b. "Deepening" of production in LDCs involves import substitution industrializationpolicy. A final assembly plant is given a protective tariff and imported inputs areaccorded duty free treatment. As a second stage, the LDC begins to deepenproduction by manufacturing inputs and according them protection. By imposingtariffs on imported inputs, the LDC is reducing effective protection for the finalgood.Because of relatively high rates of protection on finished goods and low protectionon unfinished goods and raw materials, effective tariff rates in developed countriesmay be as much as double their nominal counterparts. Developing countriesmaintain that such tariff structures fatally harm their efforts to increase exports offinished manufactures.3. Again using Figure4.3, the loss in real income is shown by triangles cen and mfd.Redistribution has been given in 8a.----------------------- Page 7-----------------------Chapter 5 Nontariff Barriers (NTBs) to TradeReview Question::::Suppose the USA steel industry is seeking protection from foreign imports. Compare andcontrast the following measures of restricting steel industries: a tariff, a quota, and voluntaryexport restraints.Condensed Answers to Review Question:There are a variety of ways in which a tariff may be considered to be less harmful than an equivalentquota:i. The revenue effect. Tariffs provide revenue. Quotas do not automatically providerevenue. Under a quota, revenue accrues to holders of import licenses.Depending on the quota scheme, licenses may be held by domestic importers, foreign exporters, foreign governments, or domestic officialswho may use them to encourage bribery. Only through auctioning or selling licenses can the government capture quota rents.ii. Performance under demand and supply changes. Any amount of imports can enterunder a tariff, but with a quota import volumes are fixed. When demandgrows, or there is a shortfall in supply, the quota does not permit a quantityadjustment. The domestic price can depart significantly from the worldprice. Under a tariff, the domestic price cannot rise above the worldprice by more than the tariff rate. Thus, a tariff is less harmful than aquota.iii. Impact on Exporters. When a tariff is levied on an imported good it is usually rebatedwhen the good is exported. The same is not true for a quota. Quotas maytherefore be more harmful to export performance.iv. Curbing monopoly power. Quotas curtail monopoly power less than an equivalent tariff.v. Terms of Trade Effects. Quotas provide no incentive for exporting nations to absorb partof the price increase; tariffs do if the exporting nation wishes to retainmarket share.vi. Quality Upgrading. Quotas give an incentive for the exporting country to engage in qualityupgrading. Ad valorem tariffs do not provide an incentive for this behavior but specific duties do.VERs share all of the undesirable effects of quotas. When the exporter does the restricting, there isno opportunity to sell import licenses. Quota rents accrue toforeign exporters orgovernments under a VER. Therefore, VERs are more costly to society than anequivalent quota with licenses sold or a tariff. Quantitative restrictions like VERsare discriminatory. VERs are also hard to monitor. Since shipments from thirdparty countries are unrestricted, transshipment throughnonrestricted countries is amajor problem. One advantage of VERs is they do not invite retaliation sincethey are profitable to foreign exporters and governments.Tariffs, quotas and VERs may be equivalent in terms of effects on the domestic price and thevolumeof imports. This may be shown using diagram 5-1. However, there are important differencesdiscussed in 1a. above.----------------------- Page 8-----------------------Chapter 6 International and Regional Trade Organizations Among Developed CountriesReview Questions::::1. Explain the following terms:Trade creation of a customs union.Trade diversion of a customs union.2.What are the conflicts between the WTO and the environmental movement?Condensed Answers to Review Questions:1. Trade creation refers to the replacement of high cost production in each member by importsfrom another member. This effect is favorable to world welfare. Tradediversion is the diversion of trade from a nonmember to a higher cost member.This is unfavorable because it reduces worldwide resource allocative efficiency(See Figure 4-8).The basic approach to calculating welfare effects associated with customs union formation is toconstruct hypothetical estimates of what member country trade patterns wouldhave been in the absence of integration, comparing these with actual trade flows,and attributing any difference to integration. Effects ofintegration can be isolatedby using trade flow data pertaining to nonmember "normalizer" countries over thesame period to suggest what trade patterns would have been expected for memberswithout integration. Assume, in the absence of integration, both total (internalplus external) and external member imports would have grown at the same rates asthe corresponding imports in the normalizer. The normalizer's external importsrefer to its imports from third countries (i.e. intra-trade is excluded). Thenormalizer's internal imports are imports of normalizer countries from each other(e.g. intra-trade). The preintegration member country total import level ismultiplied by the corresponding normalizer import growth rate to yield an estimateof hypothetical total imports without integration. When compared with actualtotal imports, an estimate of trade creation is obtained. Trade diversion isestimated by multiplying the member country preintegration external import levelby the normalizer's rate of change of external imports to yield hypothetical membercountry external imports. The excess of hypothetical over actual external importsconstitutes trade diversion. The European Union (EU) is a customs unioncomprised of 15 West European countries.2. WTO rules often conflict with both international environmental agreements and nationalenvironmental laws. For example, a 1991 GATT panel upheld a Mexican challenge to aU.S. law banning importation of tuna caught indolphin-killing purse-seine nets.GATT/WTO provisions are concerned with products and not production methods.----------------------- Page 9-----------------------Chapter 7 International Mobility of Productive FactorsReview Question::::What is the meaning of DFI? List some of the factors that induce companies to invest abroad.Condensed Answers to Review Question:Direct Foreign Investment refers to international capital movement that gives a company controlover a foreign subsidiary. It may be the purchase of an existing company, a substantial part of itsshares, or the establishment of a new enterprise. It should be contrasted with portfolio investmentthat gives, by and large, no control over foreign assets.The motives are diverse and any particular investment may involve one or more of the followingi. investment in extractive industries to secure raw material supplies;ii. investment in manufacturing industry to take advantage of cheaper foreign labor;iii. to locate production close to foreign markets and avoid transportation costs;iv. to take advantage of incentives offered by host countries;v. to circumvent tariff barriers;vi. changes in the exchange values of currencies; andvii. marketing considerations.。

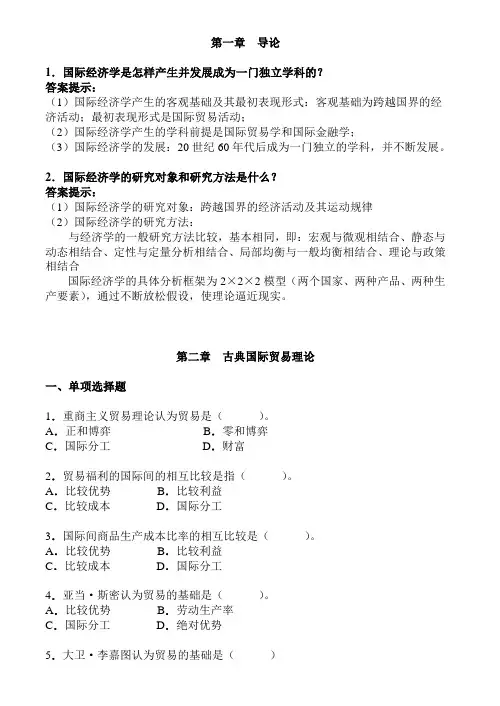

第一章导论1.国际经济学是怎样产生并发展成为一门独立学科的?答案提示:(1)国际经济学产生的客观基础及其最初表现形式:客观基础为跨越国界的经济活动;最初表现形式是国际贸易活动;(2)国际经济学产生的学科前提是国际贸易学和国际金融学;(3)国际经济学的发展:20世纪60年代后成为一门独立的学科,并不断发展。

2.国际经济学的研究对象和研究方法是什么?答案提示:(1)国际经济学的研究对象:跨越国界的经济活动及其运动规律(2)国际经济学的研究方法:与经济学的一般研究方法比较,基本相同,即:宏观与微观相结合、静态与动态相结合、定性与定量分析相结合、局部均衡与一般均衡相结合、理论与政策相结合国际经济学的具体分析框架为2×2×2模型(两个国家、两种产品、两种生产要素),通过不断放松假设,使理论逼近现实。

第二章古典国际贸易理论一、单项选择题1.重商主义贸易理论认为贸易是()。

A.正和博弈B.零和博弈C.国际分工D.财富2.贸易福利的国际间的相互比较是指()。

A.比较优势B.比较利益C.比较成本D.国际分工3.国际间商品生产成本比率的相互比较是()。

A.比较优势B.比较利益C.比较成本D.国际分工4.亚当·斯密认为贸易的基础是()。

A.比较优势B.劳动生产率C.国际分工D.绝对优势5.大卫·李嘉图认为贸易的基础是()A.比较优势B.劳动生产率C.国际分工D.绝对优势二、多项选择题1.古典国际贸易理论讨论的主要问题包括()A.绝对优势B.比较优势C.规模经济D.消费者偏好E.比较利益2、大卫·李嘉图的理论的假设前提有()。

A.生产要素只在一国内部自由流动B.生产要素在一国国内及国际间均自由流动C.政府对贸易进行干预D.贸易国的生产成本不变E.商品的价值由劳动量决定三、判断题1.重商主义贸易理论认为国际贸易利益是通过损害他国利益实现的。

2.贸易差额论代表着晚期重商主义理论的核心思想。

国际经济学答案国际贸易理论(一)1【单选题】下面哪一个基本经济单位在私有制出现之前就存在?(D)A、郡县B、国家C、氏族D、家庭2【单选题】哪位经济学家为开放的宏观经济学做出主要贡献?(B)A、庇古B、凯恩斯C、李嘉图D、亚当·斯密3【多选题】国际经济学的主要内容包括(ABC)。

A、国际金融理论及其对策B、开放经济下的宏观经济学C、国际贸易理论及其对策D、企业利润最大化的产量决定4【判断题】在资源稀缺条件下,如何对资源进行有效配置是西方经济学研究的主要问题。

(√)5【判断题】马克思主义经济学的分支之一是国际经济学。

(×)国际贸易理论(二)1【单选题】凯恩斯哪部书的出版是宏观经济学的迅速发展的标志?(B)A、《国富论》B、《就业、利息与货币通论》C、《政治算术》D、《资本论》2【单选题】针对(D)提出了资源的“稀缺性”。

A、当代资源情况B、能够使用的资源C、允许使用的资源D、人的欲望3【单选题】萨伊认为下面哪一项不是生产要素?(D)A、土地B、资本C、劳动力D、人口4【判断题】西方经济学是所有经济学产生的源头。

(√)5【判断题】朝鲜是目前国际上相对开放的国家。

(×)国际贸易理论(三)1【单选题】经济运行的(A)可以用来经济学与国际经济学的关系。

A、个体B、目的C、主体D、范围2【单选题】下面哪一项是国际经济交往的主要方式?(B)A、国际分工B、生产要素跨国界流动C、开放经济D、商品跨国界流通3【单选题】下面哪一项属于大卫·李嘉图的经典假设?(B)A、要素在国与国之间可完全流动B、要素在国与国之间完全不可流动C、要素在国与国之间不可完全流动D、要素在一国之内不可完全流动4【判断题】在现代社会,唯一的生产和消费的基本单位是家庭。

(×)5【判断题】国际经济学中存在效率和公平问题。

(√)国际贸易理论(四)1【单选题】下面哪一项是经济学最早出现的名称?(C)A、产业学B、贸易学C、家政学D、交换学2【单选题】谁说过“要在国际与国内贸易之间划出一条明显的界限既是不可能的,也是没有必要的。

第三章复习题(1),本国共有1200单位的劳动,能生产两种产品:苹果和香蕉。

苹果的单位产品劳动投入是3,香蕉的单位劳动产品投入时2。

a.画出本国的生产可能性边界。

b.用香蕉衡量的苹果的机会成本是多少?c.贸易前,苹果对香蕉的相对价格是多少?为什么?答:a.本国的生产可能性边界曲线是一条直线,在400(1200/3)处与苹果轴相截,在600(1200/2)处与香蕉轴相截,如图2-7所示。

b.用香蕉衡量苹果的机会成本是3/2。

生产1单位苹果需要3单位的劳动,生产1单位香蕉需要2单位的劳动。

如果放弃1单位苹果的生产,这将释放出3单位的劳动。

这2单位的劳动可以被用来图2-7 本国生产可能生产3/2单位的香蕉。

c.劳动的流动性可以使得各个部门的工资趋同,竞争可以使得商品的价格等于它们的生产成本。

这样,相对价格等于相对成本,而相对成本等于工资乘以苹果的单位劳动产品投入。

因为各个部门工资相等,所以价格比率等于单位产品劳动投入的比率,即生产苹果所需的3单位劳动与生产香蕉所需的2单位劳动比率。

(2)假设本国的情况和习题1相同。

外国拥有800单位的劳动,外国苹果的单位劳动投入是5,香蕉的单位产品劳动投入是1。

a.画出外国的生产可能性边界。

b.画出世界相对供给曲线。

答:a.外国的生产可能性边界曲线是一条直线,在160(800/5)处与苹果轴相截,在800(800/1)处与香蕉轴相截。

如图2-8所示。

b.世界相对供给曲线可以由苹果和香蕉的相对价格和相对供给量绘出。

如图2-9。

从图2-9可以看出,苹果对香蕉的最低相对价格是3/2,在这个价格上,苹果的世界相对供给曲线是水平的。

在3/2的相对价格上,本国对苹果的最大供给量是400,外国对香蕉的供给量是800,这时,相对供给量为1/2。

只要相对价格保持在3/2和5之间,相对供给量就不变。

如果相对价格成为5,两个国家都会生产苹果,香蕉的产量为零。

这时,相对供给曲线是水平的。

所以,从图2-9中可以看出,相对价格为3/2时,相对供给在0到1/2之间;相对价格在3/2和5之间时,相对供给保持1//2不变;当相对价格为5时,相对供给从1/2图2-9 世界相对供图2-8 外国生产可能曲到无穷大。

Chapter 9 The Political Economy of Trade TheoryMultiple Choice Questions1. The efficiency case made for free trade is that as trade distortions such as tariffs are dismantled andremoved,(a) government tariff revenue will decrease, and therefore national economic welfare will decrease.(b) government tariff revenue will decrease, and therefore national economic welfare will increase.(c) deadweight losses for producers and consumers will decrease, hence increasing national economicwelfare.(d) deadweight losses for producers and consumers will decrease, hence decreasing national economicwelfare.(e) None of the above.Answer: C2. The opportunity to exploit economies of scale is one of the gains to be made from removing tariffs andother trade distortions. These gains will be found by a decrease in(a) world prices of imports.(b) the consumption distortion loss triangle.(c) the production distortion loss triangle.(d) Both (b) and (c).(e) None of the above.Answer: E3. It is argued that special interest groups are likely to take over and promote protectionist policies, whichmay lead to an increase in national economic welfare. This argument leads to(a) a presumption that in practice a free trade policy is likely to be better than alternatives.(b) a presumption that trade policy should be shifted to Non-Governmental Organizations, so as to limittaxpayer burden.(c) a presumption that free trade is generally a second-best policy, to be avoided if feasible alternativesare available.(d) a presumption that free trade is the likely equilibrium solution if the government allows specialinterest groups to dictate its trade policy.(e) None of the above.Answer: A4. The optimum tariff is(a) the best tariff a country can obtain via a WTO negotiated round of compromises.(b) the tariff, which maximizes the terms of trade gains.(c) the tariff, which maximizes the difference between terms of trade gains and terms of trade loses.(d) not practical for a small country due to the likelihood of retaliation.(e) not practical for a large country due to the likelihood of retaliation.Answer: E5. The optimum tariff is most likely to apply to(a) a small tariff imposed by a small country.(b) a small tariff imposed by a large country.(c) a large tariff imposed by a small country.(d) a large tariff imposed by a large country.(e) None of the above.Answer: B6. The prohibitive tariff is a tariff that(a) is so high that it eliminates imports.(b) is so high that it causes undue harm to trade-partner economies.(c) is so high that it causes undue harm to import competing sectors.(d) is so low that the government prohibits its use since it would lose an important revenue source.(e) None of the above.Answer: A7. The existence of marginal social benefits which are not marginal benefits for the industry producing theimport substitutes(a) is an argument supporting free trade and non-governmental involvement.(b) is an argument supporting the use of an optimum tariff.(c) is an argument supporting the use of market failures as a trade-policy strategy.(d) is an argument rejecting free trade and supporting governmental involvement.(e) None of the above.Answer: D8. The domestic market failure argument is a particular case of the theory of(a) the optimum, or first-best.(b) the second best.(c) the third best.(d) the sufficing principle.(e) None of the above.Answer: Bword格式-可编辑-感谢下载支持9. The difficulty of ascertaining the right second-best trade policy to follow(a) reinforces support for the third-best policy approach.(b) reinforces support for increasing research capabilities of government agencies.(c) reinforces support for abandoning trade policy as an option.(d) reinforces support for free-trade options.(e) None of the above.Answer: D10. The authors of the text believe that(a) second-best policy is worse than optimal policy.(b) special interest groups generally enhance national welfare.(c) national welfare is likely to be enhanced by the imposition of an optimal tariff.(d) market Failure arguments tend to support free-trade policy.(e) there is no such thing as national welfare.Answer: E11. The simple model of competition among political parties long used by political scientists tends to lead tothe practical solution of selecting the(a) optimal tariff.(b) prohibitive tariff.(c) zero (free-trade) tariff.(d) the tariff rate favored by the median voter.(e) None of the above.Answer: D12. The median voter model(a) works well in the area of trade policy.(b) is not intuitively reasonable.(c) tends to result in biased tariff rates.(d) does not work well in the area of trade policy.(e) None of the above.Answer: D13. The fact that trade policy often imposes harm on large numbers of people, and benefits only a few maybe explained by(a) the lack of political involvement of the public.(b) the power of advertisement.(c) the problem of collective action.(d) the basic impossibility of the democratic system to reach a fair solution.(e) None of the above.Answer: C14. Protectionism tends to be concentrated in two sectors:(a) agriculture and clothing.(b) high tech and national security sensitive industries.(c) capital and skill intensive industries.(d) industries concentrated in the South and in the Midwest of the country.(e) None of the above.Answer: A15. Judging by the changes in the height of tariff rates in major trading countries, the world has beenexperiencing a great(a) trade liberalization.(b) surge of protectionism.(c) lack of progress in the trade-policy area.(d) move towards regional integration.(e) None of the above.Answer: A16. The World Trade Organization (WTO) was organized as a successor to the(a) IMF.(b) UN.(c) UNCTAD.(d) GATT.(e) The World Bank.Answer: D17. The WTO was established by the ____________of multilateral trade negotiations.(a) Kennedy Round(b) Tokyo Round(c) Uruguay Round(d) Dillon Round(e) None of the above.Answer: C18. The Smoot-Hawley Tariff Act of 1930 has generally been associated with(a) falling tariffs.(b) free trade.(c) intensifying the worldwide depression.(d) recovery from the worldwide depression.(e) Non-tariff barriers.Answer: Cword格式-可编辑-感谢下载支持19. A trade policy designed to alleviate some domestic economic problem by exporting it to foreigncountries is know as a(n)(a) international dumping policy.(b) countervailing tariff policy.(c) beggar thy neighbor policy.(d) trade adjustment assistance policy.(e) None of the above.Answer: C20. The General Agreement on Tariffs and Trade and the World Trade Organization have resulted in(a) termination of export subsidies applied to manufactured goods.(b) termination of import tariffs applied to manufactures.(c) termination of import tariffs applied to agricultural commodities.(d) termination of international theft of copyrights.(e) None of the above.Answer: E21. The General Agreement on Tariffs and Trade and the World Trade Organization have resulted in(a) the establishment of universal trade adjustment assistance policies.(b) the establishment of the European Union.(c) the reciprocal trade clause.(d) reductions in trade barriers via multilateral negotiations.(e) None of the above.Answer: D22. Trade theory suggests that Japan would gain from a subsidy the United States provides its grain farmersif the gains to Japanese consumers of wheat products more than offsets the losses to Japanese wheat farmers. This would occur as long as Japan(a) is a net importer in bilateral trade flows with the United States.(b) is a net importer of wheat.(c) has a comparative advantage in wheat.(d) has an absolute advantage in producing wheat.(e) None of the above.Answer: B23. Countervailing duties are intended to neutralize any unfair advantage that foreign exporters might gainbecause of foreign(a) tariffs.(b) subsidies.(c) quotas.(d) Local-Content legislation.(e) None of the above.Answer: B24. Throughout the post-World War II era, the importance of tariffs as a trade barrier has(a) increased.(b) decreased.(c) remained the same.(d) fluctuated wildly.(e) demonstrated a classic random walk with a mean-reversion tendency.Answer: B25. In 1980 the United States announced an embargo on grain exports to the Soviet Union in response to theSoviet invasion of Afghanistan. This embargo was mainly resisted by(a) U.S. grain consumers of bread.(b) U.S. grain producers.(c) foreign grain producers.(d) U.S. communists.(e) None of the above.Answer: B26. Export embargoes cause greater losses to consumer surplus in the target country(a) the lesser its initial dependence on foreign produced goods.(b) the more elastic is the target country’s demand schedule.(c) the more elastic is the target country’s domestic supply.(d) the more inelastic the target country’s supply.(e) None of the above.Answer: D27. The strongest political pressure for a trade policy that results in higher protectionism comes from(a) domestic workers lobbying for import restrictions.(b) domestic workers lobbying for export restrictions.(c) domestic workers lobbying for free trade.(d) domestic consumers lobbying for export restrictions.(e) domestic consumers lobbying for import restrictions.Answer: A28. The average tariff rate to data on dutiable imports in the United States is approximately(a) 5 % of the value of imports.(b) 15% of the value of imports.(c) 20 % of the value of imports.(d) 25% of the value of imports.(e) more than 25% of the value of imports.Answer: Aword格式-可编辑-感谢下载支持29. In 1990 the United States imposed trade embargoes on Iraq’s international trade. This would inducesmaller losses in Iraq’s consumer surplus the(a) less elastic Iraq’s demand schedule.(b) more elastic Iraq’s demand schedule.(c) greater is Iraq’s dependence on foreign products.(d) more inelastic is Iraq’s supply schedule.(e) None of the above.Answer: B30. The World Trade Organization provides for all of the following except(a) the usage of the most favored nation clause.(b) assistance in the settlement of trade disagreements.(c) bilateral tariff reductions.(d) multilateral tariff reductions.(e) None of the above.Answer: C31. Which organization determines procedures for the settlement of international trade disputes?(a) World Bank(b) World Trade Organization(c) International Monetary Organization(d) International Bank for Reconstruction and Development(e) The League of NationsAnswer: B32. The WTO’s int ervention against clean air standards(a) has earned it universal approval.(b) was done in order to limit national sovereignty.(c) has resulted in much criticism.(d) has resulted in much criticism among professional economists.(e) None of the above.Answer: C33. Under U.S. commercial policy, the escape clause results in(a) temporary quotas granted to firms injured by import competition.(b) tariffs that offset export subsidies granted to foreign producers.(c) a refusal of the U.S. to extradite anyone who escaped political oppression.(d) tax advantages extended to minority-owned exporting firms.(e) tariff advantages extended to certain Caribbean countries in the U.S. market.Answer: A34. Under U.S. commercial policy, which clause permits the modification of a trade liberalization agreementon a temporary basis if serious injury occurs to domestic producers as a result of the agreement?(a) Adjustment assistance clause(b) Escape clause(c) Most favored nation clause(d) Prohibitive tariff clause(e) None of the above.Answer: B35. Today U.S. protectionism is concentrated in(a) high tech industries.(b) labor-intensive industries.(c) industries in which Japan has a comparative advantage.(d) computer intensive industries.(e) capital-intensive industries.Answer: B36. The reason protectionism remains strong in the United States is that(a) economists can produce any result they are hired to produce.(b) economists cannot persuade the general public that free trade is beneficial.(c) economists do not really understand how the real world works.(d) the losses associated with protectionism are diffuse, making lobbying by the public impractical.(e) None of the above.Answer: D37. An issue never confronted effectively by GATT, but considered an important issue for WTOis that of(a) the promotion of freer World trade(b) the promotion of freer World commodity trade(c) the promotion of freer World services trade(d) the lowering of tariff rates(e) None of the above.Answer: C38. The political wisdom of choosing a tariff acceptable to the median U.S. voter is(a) a good example of the principle of the second best.(b) a good example of the way in which actual tariff policies are determined.(c) a good example of the principle of political negotiation.(d) is not evident in actual tariff determination.(e) None of the above.Answer: Dword格式-可编辑-感谢下载支持39. A game-theory explanation of the paradox that even though all countries would benefit if each chose freetrade, in fact each tends to follow protectionist policies is(a) Trade war(b) Collective action(c) Prisoner’s dilemma(d) Benefit—Cost analysis(e) None of the above.Answer: C40. When the U.S. placed tariffs on French wine, France placed high tariffs on U.S. chickens. This is anexample of:(a) deadweight losses(b) multilateral negotiations(c) bilateral trade negotiations(d) international market failures(e) none of the aboveAnswer: E41. The quantitative importance of U.S. protection of the domestic clothing industry is best explained bythe fact that(a) this industry is an important employer of highly skilled labor(b) this industry is an important employer of low skilled labor(c) most of the exporters of clothing into the U.S. are poor countries.(d) a politically well organized sector in the U.S.(e) None of the aboveAnswer: DEssay Questions1. Developing countries have often attempted to establish cartels so as to counter the actual or perceivedinexorable downward push on the prices of their exported commodities. OPEC is the best well known of these. How are such cartels expected to help the developing countries? At times importing countriesprofess support for such schemes. Can you think of any logical basis for such support? How are cartels like monopolies, and how are they different from monopolies. Why is there a presupposition amongeconomists that such schemes are not likely to succeed in the long run?Answer: Such cartels are expected to shift the exporters’ terms of trade in their favor. Also they are expected to produce the maximum profit, which the market will bear. Importing countries maybenefit from the price stability generated by the cartel. Cartels are like monopolies in that theirtotal output is the same as that which would be generated by a single monopoly. They differfrom monopolies in that the monopoly profits need to be divided among the producingcountries, which have different cost structures.2. The United States appears at times to have a totally schizophrenic attitude toward protectionism. TheUnited States was the country that proposed the establishment of the World Trade Organization as early as the late 1940s, and was also the only industrialized country that refused to ratify this at that time. The United States has consistently argued on the side of multinational free trade in GATT Rounds, and yet maintains many protectionist laws such as those which reserve oil shipments from Alaska to U.S. flag carriers. How can you explain this apparent lack of national consistency on this issue?Answer: This reflects the fact that international trade typically has many winners and relatively fewer, but politically powerful losers. Short of guaranteed (constitutional?) non-conditionalcompensatory mechanisms, the basic conflict between these two groups will always be there.3. Presumably, since the United States is a large country in many of its international markets, a positiveoptimum tariff exists for this country. It follows therefore that when any legislator or government official who promotes zero-tariff free trade policies, is by definition not acting in the public’s best interest.Discuss.Answer: Technically this is true. However, this is true only within the context of a generally myopic view of international relations. If the tariff imposing country is large enough to make asubstantial difference in its welfare by seeking an optimum tariff, then it cannot hope toremain invisible, as its policies are substantially harming its trade partners. Foreignrepercussions are almost a certainty. In such a “game” it is not at all certai n that seeking theoptimum tariff dominates alternative strategies.4. It may be demonstrated that any protectionist policy, which effectively shifts real resources to importcompeting industries or sectors will harm export industries or sectors. This may, for example, happen by the strengthening U.S. dollar in the foreign exchange market. Would you propose therefore that export industries lobby against protectionism in International Trade Commission proceedings? What ofconsumer advocates? Discuss the pros and the problems of such a suggestion.Answer: Actually this is an interesting idea. It is well known that the public interest is put on hold as the ITC considers only the squeaky wheels of those allegedly hurt by trade. While “consumers”may be too amorphous a group to successfully organize and pursue a political agenda, theexporters and consumer advocates may be able to form a counter weight to the importcompeting industries.5. It is argued that the United States would be foolish to maintain a free-trade stance in a world in which allother countries exploit child or prisoner labor, or are protectionist. On the other hand, Ricardo’s classic demonstration of the sources and effects of comparative advantage cogently demonstrates that regardless of other country policy, free trade remains the first best policy for a country to follow, since it willmaximize its consumption possibilities (conditional upon other country policies). Explain. Discuss the contradiction with the argument in the preceding paragraph.Answer: In the context of the Ricardian model, it is true that gains from trade are strictly a result of world terms of trade, which differ from domestic marginal rates of substitution. In such aworld, the reason why foreign goods are cheap is of no concern to domestic consumers.However, in a world which allows for large-scale labor migration, ignoring labor conditionsabroad may ultimately result in living standards for domestic workers to be dragged down.word格式-可编辑-感谢下载支持6. It has been claimed that foreign governments have attempted to influence votes in the U.S. that wouldpromote policies of protectionism within the U.S. On the surface this appears to be totally illogical and counter intuitive, as this would presumably lessen the possibilities of foreigners’ expor ts to the U.S.Answer: This would make sense only if the form of protectionism is a tariff. However, if it is a quota, then the scarcity rents may be captured by established foreign producers. Hence, the reactionof the Japanese to automobile quotas was to dramatically increase the high-end, highlyprofitable automobiles. This would be even more self-evident if the protectionism took theform of a Voluntary Export Restraint (VER), or a detailed formalized bilateral cartel, such asthe old Multi-Fibre Agreement.Quantitative/Graphing ProblemsAssume that Boeing (U.S.) and Airbus (European Union) both wish to enter the Hungarian market with the next new generation airliner. They both have identical cost and demand conditions (as indicated in the graph above).1. Assume that Boeing is the first to enter the Hungarian market. Without a government subsidy what pricewould they demand, and what would be their total profits?Answer: $12 Million, $162. What is the consumer surplus enjoyed by Hungarian consumers of Boeing aircraft in the above situation?Answer: $8 Million3. Suppose the European government provides Airbus with a subsidy of $4 for each airplane sold, and thatthe subsidy convinces Boeing to exit the Hungarian market. Now Airbus would be the monopolist in this market. What price would they charge, and what would be their total profits?Answer: $10 Million, and $36 Million4. What would be the cost of the subsidy to European taxpayers?Answer: $24 Million5. What happens to the Consumer Surplus of Hungarian customers as a result of this subsidy?Answer: An increase of $10 Million.6. What is the revenue gain or loss for Europe as a whole (including taxpayers)?Answer:A gain of $12 Million.7. The U.S. producer Boeing, and the European Airbus are contemplating the next generation mid-sizedfuel efficient generation of air carrier. If both produce their respective models, then each would lose $50 million (because the world market is just not large enough to enable either to capture potential scaleeconomies if they had to share the world market). If neither produce, then each one’s net gain would of course be zero. If either one produces while the other does not, then the producer will gain $500 million.(a) What is the correct strategy for either company?Answer: enter the market first. Then the other company knows that if it also enters, it will not be able to cover costs.(b) What is the correct strategy for a government seeking to maximize national economic welfare?Answer: Subsidize its producer. If this allows it to enter first, then we get the same solution as answer(a) above.(c) If a national government decides to subsidize its aircraft producer, how high should be the subsidy?Answer: Any figure above $50 million (e.g. $55 million). This would promise positive profits regardless of the decision of the competitor. The “winner” then may turn out to be that countrywhose voters are least sensitive to on-the-books, transparent subsidies given to richcorporations (these subsidies will have to continue year after year until the other country stopsits subsidies).。

第一章练习与答案1.为什么说在决定生产和消费时,相对价格比绝对价格更重要?答案提示:当生产处于生产边界线上,资源则得到了充分利用,这时,要想增加某一产品的生产,必须降低另一产品的生产,也就是说,增加某一产品的生产是有机会机本(或社会成本)的。

生产可能性边界上任何一点都表示生产效率和充分就业得以实现,但究竟选择哪一点,则还要看两个商品的相对价格,即它们在市场上的交换比率。

相对价格等于机会成本时,生产点在生产可能性边界上的位置也就确定了。

所以,在决定生产和消费时,相对价格比绝对价格更重要。

2.仿效图1—6和图1—7,试推导出Y商品的国民供给曲线和国民需求曲线。

答案提示:3.在只有两种商品的情况下,当一个商品达到均衡时,另外一个商品是否也同时达到均衡?试解释原因。

答案提示:4.如果生产可能性边界是一条直线,试确定过剩供给(或需求)曲线。

答案提示:5.如果改用Y商品的过剩供给曲线(B国)和过剩需求曲线(A国)来确定国际均衡价格,那么所得出的结果与图1—13中的结果是否一致?答案提示:国际均衡价格将依旧处于贸易前两国相对价格的中间某点。

6.说明贸易条件变化如何影响国际贸易利益在两国间的分配。

答案提示:一国出口产品价格的相对上升意味着此国可以用较少的出口换得较多的进口产品,有利于此国贸易利益的获得,不过,出口价格上升将不利于出口数量的增加,有损于出口国的贸易利益;与此类似,出口商品价格的下降有利于出口商品数量的增加,但是这意味着此国用较多的出口换得较少的进口产品。

对于进口国来讲,贸易条件变化对国际贸易利益的影响是相反的。

7.如果国际贸易发生在一个大国和一个小国之间,那么贸易后,国际相对价格更接近于哪一个国家在封闭下的相对价格水平?答案提示:贸易后,国际相对价格将更接近于大国在封闭下的相对价格水平。

8.根据上一题的答案,你认为哪个国家在国际贸易中福利改善程度更为明显些?答案提示:小国。

9*.为什么说两个部门要素使用比例的不同会导致生产可能性边界曲线向外凸?答案提示:第二章答案1.根据下面两个表中的数据,确定(1)贸易前的相对价格;(2)比较优势型态。

国际经济学试题(完整版)及答案(题库)一、选择题1. 下列哪一项不属于国际贸易的基本类型?A. 有形贸易B. 无形贸易C. 出口贸易D. 转口贸易答案:A2. 比较优势理论的提出者是:A. 亚当·斯密B. 大卫·李嘉图C. 约翰·梅纳德·凯恩斯D. 保罗·萨缪尔森答案:B3. 购买力平价理论认为,汇率决定于:A. 物价水平B. 货币供给C. 贸易平衡D. 经济增长率答案:A4. 要素禀赋理论认为,国际贸易的基础是:A. 比较优势B. 贸易平衡C. 要素丰裕D. 货币供给答案:C5. 国际生产综合论认为,跨国公司进行国际投资的主要动机是:A. 降低成本B. 扩大市场C. 获取资源D. 以上都是答案:D6. 货币贬值对一国经济可能产生的影响是:A. 出口增加,进口减少B. 出口减少,进口增加C. 出口增加,进口增加D. 出口减少,进口减少答案:A7. 下列哪项不是贸易壁垒?A. 关税B. 非关税壁垒C. 自由贸易区D. 区域经济一体化答案:C8. 国际收支平衡表上,经常账户包括:A. 货币和黄金B. 转移和收入C. 商品和劳务D. 资本账户答案:C9. 国际货币基金组织(IMF)的主要目标是:A. 促进国际货币合作B. 稳定汇率C. 减少国际收支不平衡D. 以上都是答案:D10. 下列哪项不是国际贸易政策?A. 自由贸易政策B. 保护贸易政策C. 贸易战D. 闭关锁国政策答案:C二、判断题1. 国际贸易可以促进各国资源的有效配置。

(√)2. 比较优势理论认为,每个国家都应该专业化生产自己具有比较优势的产品。

(√)3. 购买力平价理论认为,汇率应该保持固定不变。

(×)4. 国际生产综合论认为,跨国公司进行国际投资是为了降低成本和扩大市场。

(√)5. 货币贬值会提高一国货币的购买力。

(×)6. 贸易壁垒可以保护本国产业免受外国竞争。

(√)7. 国际收支平衡表上的资本账户反映了一国在一定时期内对外投资的净额。

国际经济学习题答案提示第四章习题答案提示1.是的。

从长远来看,低技能劳动力经过技术培训后可以成为高技术劳动力,但劳动力并不具有特殊性。

2.因为特征密度保持不变3.:劳动增加并且完全就业,则整个经济的资本-劳动比例下降,劳动力价格将下降。

劳动力增加将增加密集使用劳动力产品的产量;资本密集型产品的产量下降。

4.特定因素的增加将导致密集使用该因素的产品产量的增加。

同时,另一个部门的产出将因另一个部门释放的一些共同因素而减少。

共同生产要素的收入将增加。

5.仍然有效。

6.:随着世界市场能源价格上升,一部分劳动力将由制造业部门流到能源部门,能源部门产量增加,制造业部门的产量下降。

7*.:根据特定因素模型,特定因素在短期内无法在这两个部门之间流动。

根据本章的分析,虽然它们都是资本,但X和Y部门的资本回报是不同的,因此不会导致要素价格的均衡。

第五章练习回答技巧1.试比较重叠需求理论与要素禀赋理论的异同。

回答提示:这两种理论都解释了国际贸易的原因。

然而,两者之间也有很大的差异。

首先,这两种理论解释国际贸易的出发点不同。

要素禀赋理论是从供给侧讨论国际贸易的基础;重叠需求理论从需求的角度探讨了国际贸易的原因。

其次,要素禀赋理论主要解释发达国家与发展中国家之间的产业间贸易,即工业产品与初级产品之间的贸易,或资本密集型产品与劳动密集型产品之间的贸易;重叠需求理论适用于解释发达国家之间的产业内贸易,即制造业内部的一种水平贸易。

2.你认为重叠需求理论适合解释发展中国家之间的贸易吗?为什么?回答提示:合适。

因为不同的发展中国家在生产不同的产品方面有优势,尽管这些产品可能是劳动密集型产品。

虽然发展中国家的发展水平在总体上是相似的,但在具体产品上是不同的。

发展中国家之间也可能存在产业内贸易,这可以用需求重叠理论来解释。

3.重叠需求理论与第三章中所提到的需求逆转都是讨论需求因素对国际贸易的影响,两者之间有什么区别?答案表明,需求逆转主要解释了产业间贸易,而重叠需求理论解释了产业内贸易。

国际经济学习题答案第一章1.为什么说在决定生产和消费时,相对价格比绝对价格更重要?答案提示:当生产处于生产边界线上,资源则得到了充分利用,这时,要想增加某一产品的生产,必须降低另一产品的生产,也就是说,增加某一产品的生产是有机会机本(或社会成本)的。

生产可能性边界上任何一点都表示生产效率和充分就业得以实现,但究竟选择哪一点,则还要看两个商品的相对价格,即它们在市场上的交换比率。

相对价格等于机会成本时,生产点在生产可能性边界上的位置也就确定了。

所以,在决定生产和消费时,相对价格比绝对价格更重要2.仿效图1—6和图1—7,试推导出Y商品的国民供给曲线和国民需求曲线。

答:参见教材第一章第二节内容,将图1-6a中,以横坐标表示y商品的供给,以纵坐标表示x商品供给,得出相应生产可能性边界线,然后将图1-6b中,以横坐标表示y商品供给,以纵坐标表示y的相对价格,通过类似推导可得出国民供给曲线,国民需求曲线作类似推导可得。

3.在只有两种商品的情况下,当一个商品达到均衡时,另外一个商品是否也同时达到均衡?答:两种商品同时达到均衡。

一种商品均衡时,由其相对价格,机会成本,需求可知另一种商品得相对价格,机会成本和需求。

4.如果生产可能性边界是一条直线,试确定过剩供给(或需求)曲线。

答案提示:略,参见书上5.如果改用Y商品的过剩供给曲线(B国)和过剩需求曲线(A国)来确定国际均衡价格,那么所得出的结果与图1—13中的结果是否一致?答案提示:国际均衡价格将依旧处于贸易前两国相对价格的中间某点。

6.说明贸易条件变化如何影响国际贸易利益在两国间的分配。

答案提示:一国出口产品价格的相对上升意味着此国可以用较少的出口换得较多的进口产品,有利于此国贸易利益的获得,不过,出口价格上升将不利于出口数量的增加,有损于出口国的贸易利益;与此类似,出口商品价格的下降有利于出口商品数量的增加,但是这意味着此国用较多的出口换得较少的进口产品。

国际经济学答案国际贸易理论(一)1【单选题】下面哪一个基本经济单位在私有制出现之前就存在?(A、郡县B、国家C、氏族D、家庭2【单选题】哪位经济学家为开放的宏观经济学做出主要贡献?(A、庇古B、凯恩斯C、李嘉图D、亚当斯密3【多选题】国际经济学的主要内容包括(ABC )。

A、国际金融理论及其对策B、开放经济下的宏观经济学C、国际贸易理论及其对策D、企业利润最大化的产量决定4【判断题】在资源稀缺条件下,如何对资源进行有效配置是西方经济学研究的主要问题。

(V)5【判断题】马克思主义经济学的分支之一是国际经济学。

(X)国际贸易理论(二)1【单选题】凯恩斯哪部书的出版是宏观经济学的迅速发展的标志?(A、《国富论》B、《就业、利息与货币通论》C、《政治算术》D、《资本论》2【单选题】针对(D)提出了资源的“稀缺性”。

A、当代资源情况B、能够使用的资源C、允许使用的资源D、人的欲望3【单选题】萨伊认为下面哪一项不是生产要素?(D)A、土地B、资本C、劳动力D、人口4【判断题】西方经济学是所有经济学产生的源头。

(V)5【判断题】朝鲜是目前国际上相对开放的国家。

(X)国际贸易理论(三)1【单选题】经济运行的(A)可以用来经济学与国际经济学的关系。

A、个体B、目的C、主体D、范围2【单选题】下面哪一项是国际经济交往的主要方式?(B)A、国际分工B、生产要素跨国界流动C、开放经济D、商品跨国界流通3【单选题】下面哪一项属于大卫李嘉图的经典假设?(B)3A、要素在国与国之间可完全流动B、要素在国与国之间完全不可流动C、要素在国与国之间不可完全流动D、要素在一国之内不可完全流动4【判断题】在现代社会,唯一的生产和消费的基本单位是家庭。

(X)5【判断题】国际经济学中存在效率和公平问题。

(V)国际贸易理论(四)1【单选题】下面哪一项是经济学最早出现的名称?(C)A、产业学B、贸易学C、家政学D、交换学2【单选题】谁说过“要在国际与国内贸易之间划出一条明显的界限既是不可能的, 也是没有必要的。

For personal use only in study and research; not for commercial use第一章1.为什么说在决定生产和消费时,相对价格比绝对价格更重要?答案提示:当生产处于生产边界线上,资源则得到了充分利用,这时,要想增加某一产品的生产,必须降低另一产品的生产,也就是说,增加某一产品的生产是有机会机本(或社会成本)的。

生产可能性边界上任何一点都表示生产效率和充分就业得以实现,但究竟选择哪一点,则还要看两个商品的相对价格,即它们在市场上的交换比率。

相对价格等于机会成本时,生产点在生产可能性边界上的位置也就确定了。

所以,在决定生产和消费时,相对价格比绝对价格更重要2.仿效图1—6和图1—7,试推导出Y商品的国民供给曲线和国民需求曲线。

答:参见教材第一章第二节容,将图1-6a中,以横坐标表示y商品的供给,以纵坐标表示x商品供给,得出相应生产可能性边界线,然后将图1-6b中,以横坐标表示y商品供给,以纵坐标表示y的相对价格,通过类似推导可得出国民供给曲线,国民需求曲线作类似推导可得。

3.在只有两种商品的情况下,当一个商品达到均衡时,另外一个商品是否也同时达到均衡?答:两种商品同时达到均衡。

一种商品均衡时,由其相对价格,机会成本,需求可知另一种商品得相对价格,机会成本和需求。

4.如果生产可能性边界是一条直线,试确定过剩供给(或需求)曲线。

答案提示:略,参见书上5.如果改用Y商品的过剩供给曲线(B国)和过剩需求曲线(A国)来确定国际均衡价格,那么所得出的结果与图1—13中的结果是否一致?答案提示:国际均衡价格将依旧处于贸易前两国相对价格的中间某点。

6.说明贸易条件变化如何影响国际贸易利益在两国间的分配。

答案提示:一国出口产品价格的相对上升意味着此国可以用较少的出口换得较多的进口产品,有利于此国贸易利益的获得,不过,出口价格上升将不利于出口数量的增加,有损于出口国的贸易利益;与此类似,出口商品价格的下降有利于出口商品数量的增加,但是这意味着此国用较多的出口换得较少的进口产品。