FD-0014 Posting of Late Charge

- 格式:doc

- 大小:77.00 KB

- 文档页数:4

毛衫一般问题中英文对照(总56页)--本页仅作为文档封面,使用时请直接删除即可----内页可以根据需求调整合适字体及大小--答1:你说法的那些都是一些织法,比如:织法--织机1 plain / jersey 单边2 tubular 元筒3 jersey tubular 单边元仝4 rib 坑条5 half milano 三平6 full needle 四平7 half cardigan 珠地8 cable 扭绳9 pointelle 挑孔10 raised stitch谷波11 ripple /ottoman 谷波12 ruffle / ripple / ottoman / bourrelet 谷波13 picot 狗牙边14 full milano /double knits 打鸡15 stripe / border 间色16 horzontal striped 横间17 vertical striped 直间18 torque/twisting 扭骨19 stripe 间色20 racking stitch /zig-zag stitch缦花/缦波21 links 令士22 plait / flated 冚毛23 reversed stitch底针24 fashioning narrow 收花25 fashioning mark 收花26 exelet stitch网眼组织27 crochet stitch手勾边28 tubular 元仝29 seeds stitch 1X1令士30 float jacquard 有底毛拨花(单)31 half milano /semi double knit 三平32 links / lynx stitch / purl 令士33 full milano / double knit 打鸡34 pack / zigzag stitch曼波35 tuck stitch / fancy stitch打花36 packed half cardigan 曼花珠地37 1X1rib single / double 1X1单/双39 cable 扭绳40 full cardigan 柳条41 wall stitch搬针42 double jacquard 拨花(双)43 pointelle / eyelet / lace 挑孔44 tub jacquard 元筒拨花45 reverse jersey 反底单边46 plaiting / plated 冚毛其它1. intarsia 挂毛2. jacquard 拨花3. 50 half cardigan stitch珠地4. full cardigan stitch柳条5. hand crochet 手勾6. computer knit 电机7. auto machine 电机8. tuck stitch打花1.組織結构名稱單邊 plain jersey, single knit坑條,羅紋 rib三平 half milano,semi-double knit打雞 full milano四平 double knit柳條 full cardigan珠地half cardigan扭繩 cable搬針 racking stitch打花 tuck stitch谷波ottman/ripple撥花 zig-zag stitch挑吼 point elle間色,條子 stripe令士 links 2.3.4.5.代号英语简称代号英语简称AC ACETATE醋纤PU POLYURETHANE/SPANDEX氨纶PC ACRYLIC腈纶RA RAMIE苎麻WP ALPACA羊驼SE SILK蚕丝WA ANGORA兔毛VI VISCOSE RAYON粘纤WK CAMEL驼绒WO WOOL羊毛WS CASHMERE羊绒MC MODAL木代尔CO COTTON棉LC LYOCELL绿赛尔CU CUPRAMMONIUMRAYON铜纤维TS TENCEL天丝WL LAMBWOOL羔毛BM BAMBOO竹纤维LI LINEN亚麻SB SOYBEAN大豆纤维ME METALLIC金纤维AL ALBUMEN蛹蛋白纤维MD POLYNOSIC粘胶HM HEMP大麻WM MOHAIR马海毛RY RAYON人造丝PA POLYAMIDE/NYLON锦纶JU JUTE黄麻PE POLYESTER涤纶LY LYCRA莱卡常见纺织品材料分特数、支数、旦数换算对照表分特数(T)英制支数(S)公制支数(N)旦数(D)国际纺织常用单位1米=码1码=米1公斤=磅1磅=公斤1米=英寸1英寸=米1支(英制)=840码1支(公制)=1000米1公支=英支1英支=公支6.7.8.9.10.11.12.2. 布料成分名称acetate 醋脂纤维acetate醋脂纤维acrylic 腈纶aliginatefiber 藻酸纤维asbestos fibre 石棉纤维bast 树内皮blend fiber 混合纤维braid饰带cashmere山羊绒cellulose ester 醋、人造丝cellulose纤维素felting 制毡材料filament 长纤维flax亚麻纤维hemp 大麻jute黄麻man-made fiber人造纤维modacrylic 变性腈纶mohair马海毛polyamide 聚烯烃纤维polyester涤纶、聚脂纤维polyethylene 聚乙烯纤维polymer高聚物polyolefin聚烯烃纤维polypropylene丙沦rayon 人造丝regenerated fiber 再生纤维spandex/elastomer 弹性纤维staple 短纤纱synthetic 合成纤维synthetic 合成纤维textuered yarn变形纱tufting 裁绒viscose 粘胶纤维woven fabric 梭织布3. 纤维缩写代号纤维名称缩写代号天然纤维丝S 麻L 人造纤维粘胶纤维R 醋酯纤维 CA 三醋酯纤维 CTA 铜氨纤维 CVP富强纤维 Polynosic 蛋白纤维 PROT 纽富纤维 Newcell合成纤维碳纤维 CF聚苯硫醚纤维 PPS 聚缩醛纤维 POM酚醛纤维 PHE 弹性纤维 PEA聚醚酮纤维PEEK 预氧化腈纶PANOF 改性腈纶MAC 维纶PVAL 聚乙烯醇缩乙醛纤维 PVB 氨纶PU 硼纤维EF 含氯纤维CL 高压型阳离子可染聚酯纤维CDP 常压沸染阳离子可染纤维ECDP 聚乳酸纤维PLA 聚对苯二甲酸丙二醇酯纤维PTT 聚对苯二甲酸丁二醇酯纤维PBT 聚萘二甲酸乙二醇酯纤维PEN 聚乙烯、聚丙烯共混纤维ES 氯纶Pvo 聚对本二氧杂环已酮纤维PDS 弹性二烯纤维ED 同位芳香族聚酰胺纤维PPT 对位芳香族聚酰胺纤维PPTA 芳砜纶PDSTA 聚酰亚胺纤维Pi 超高强高模聚乙烯纤维CHMW-PE其他金属纤维MTF 玻璃纤维GE4. 洗水嘜朮語一、干洗Dry Cleaning一般干洗 dryclean专业干洗 Professionally Dryclean商业干洗Commercially Dryclean以干洗为最佳 Drycleanning Recommened短干洗周期 Short Cycle干洗剂抽脱时间最短 Minimum Extraction低水分 Reduced or Low Moisture干洗过程中不可加水分 No water In System不可用蒸汽 No Steam二、水洗 Washing可机洗 Machine Washable不可水洗 Do not Wash 不可商业洗涤 Do not have Commercially Launder可用家庭式洗涤 Home Launder手洗 Hand Wash手洗不可搓压 Hand Wash do not Rub冷水洗 Cold Wash温水洗 Warm Wash热水洗 Hot Wash不可水煮 Do not Boil少洗衣量Small Load温和洗衣程序 Delicate/Gentle Cycle持久压力程序 Durable Press Cycle /Permanent分开洗涤 Wash Separately可与类似色衣物同时洗涤 With Like Color与深色衣物分开洗涤 Wash Dark Color Separetely翻出底面洗涤Wash Inside Out不可拧干 No Wring/ Do not Wring不可拧绞 No Twist/ Do not Twist温水清洗 Warm Rinse冷水清洗 Cold Rinse彻底清洗 Rinse Thoroughly不可脱水 No Spin/ Do not Spin普通旋转速度脱水 Normal Spin较短较慢程序脱水 Reduced Spin不可浸泡 Do not Soak只可用皂片 Use Pure Soap Flake only只可抹洗或擦洗 Damp Wipe only三、漂白 Bleaching 需要时漂白 Bleaching when Needed不可漂白 No bleach / Do not Bleach只可用非氯性漂白剂 Only Non-Chlorine Bleach四、干衣 Drying滴干 Drip Dry 挂干 Line Dry荫凉挂干 Line Dry in Shade避热挂干 Line Dry away from Heat 用烘干机烘干 Tumble Dry用烘干机中温烘干 Tumble Warm用烘干机低温烘干 Tumble Cool平铺晒干 Flat Dry定位干衣 Block to Dry用蒸汽烘干Steam Dry不用蒸汽 No Steam / Do not Steam风柜吹干 Cabinet Dry Cool五、熨烫 Ironing and Pressing热烫 Hot Iron温烫 Warm Iron低温烫 ColdIron不可熨 Do not Iron反面熨 Iron on Wrong Side用蒸汽熨烫 SteamPress/Iron在湿润时熨烫 Iron Damp用布间隔熨烫 Use Press Cloth好东西大家分享毛衫部分做法中英文对照jersey knit / plain 单边reverse jersey 反底单边jersey roll 单边卷边tubular 圆筒full needle 四平half milano 三平cast off 套针milano / full milano 打鸡full cardigan 柳条half cardigan 珠地jacquard 拨花intarsia 无底毛拨花intarsta 挂毛ottoman 谷波rib 坑条1×1 single 1×1 单flat back 底密针links 令士deminauations 收花full fashion 收花diminution / dart 搬针cross stitch 搭针cable 扭绳lace / eyelet 挑窿self start 原身出clean finish 原身较结crossing rib v-tip v领尖位做搭坑/针tight tension 字码较结tatting 梭织法crochet 锁边hand crochet 手勾边hand stitch 手钉bar tack 机钉over lock / bar tack 鈒骨cover stitch / flat lock 嵌虾松embroidery 车花drop stitch 放针mitred 挑杏嘴rivet 撞钉bead 钉珠pleat 打褶mending 查补light-inspection 照灯knitting 织衫linking 缝衫sewing 车线start-over 驳线shave 修剪washing 洗水pressing 烫衫over-lap 胸贴 / 领贴重搭printing 印花dye 染色stripe / contrast color 间色tip 撞色plaited 嵌毛twisted 拼毛miscellancous 混杂encase 包入shrink 收缩mutilate 使残缺whip 紧绕于某物上/包缝区分英语略语中文日本语A alternately alt 交叉,留一段空间交互に、一段おきにB back 后面/向后后begin beg 开始始めC continue cont 继续続けるchain ch 连锁锁crochet 钩针编织かぎ针编みcast on (casting on) 开始织作り目(する)、编み始めcast off (casting off) 织完了伏止め(する)、编み终わりcable stitch c 编绳子一样的交叉织なわ编、交差编みcable needle 绳编针なわ编针crossed stitch cr 交叉交差D double dble 双针ダブルdouble crochet dc 细针织细编みdouble treble dtr 长针织长々编みdecrease dec 减针减らし目(する)draw through a loop从绒线处拉掉针数渡り(糸ループ)から目を引き抜くdrop one stitch 两针里放掉一针一目落とす、一目ほどくE edge 边缘縁F following foll 下一个次のflat knitting 平针平编みflont 前面前fasten off 拧起来しぼって止めるG garter stitch (K every row) garter st 停步织法ガーター编みH hem 边缘ヘム、縁half treble 中长针中长编みhalf double crochet 中长针中长编みI inch in 英寸,2。

单证基础知识(共5篇)第一篇:单证基础知识联发纺织单证基本常识一、单证员工作流程λ外销合同中的条款以及L/C条款的审核λ核查出货计划λ报商检合同λ制作托书订舱λ准备报关资料λ制作财务发票λ登记台帐λ根据客户要求跟货代确认提单λ做船运资料给客户λ制作银行议付资料λ及时跟进货款和核销单的回笼λ按时提交退税资料λ保管信用证及制作议付留底资料λ协助财务核实帐目,以及运费发票的及时清理,佣金的按时支付。

二、单证员工作职责1、外销合同中的条款以及L/C条款的审核:根据跟单员的P/I及具体要求核对外销合同,原则上公司不接受寄正本提单给客户。

因此在与客户签订外销合同时一定要注意关于提单的这项条款。

另外还要注意核查L/C中是否存在软条款(即我们公司无法提供的一些文件或资料)。

2、核查出货计划:督促跟单员每周三报下周(从本周三到下下周三)的出货计划。

校对单价、数量、成交方式、运输方式等是否与客户的合同或L/C一致。

若有不符,应及时反映并纠正。

由于海关从2008年1月1号起将对报关数量与商检数量的比对进行控制,为了避免因商检的原因而不能报关的情况出现,要求单证员在做商检时一律以米报检。

3、制作商检合同:商检合同中一定要注明货物的品名、规格、数量、单价、金额、起运港、目的港,并列明商检合同项下的厂编号、包装性质、件数及面料组织。

一份商检只能对应一份报关单。

一般商检合同需在货物出境日前4 天内报给商检员(具体时间可根据货代对到单的要求来操作)。

4、制作托书订舱:托单的制作必须明确注明托运人、收货人、通知人、起运港、目的港、准确的唛头、件数、毛重、体积、出运日、托运日、运费付款方式、品名(具体根据客户或L/C 的规定)等。

必须与所有合作货代签订合同,原则上以CIF和CNF作为成交方式的走我公司的指定货代(傲湃、环亚、华星、意天、华丰等);FOB价的则走客户的指定货代。

5、准备报关资料:首先要核对开票通知单中的单价是否与合同一致,数量是否在合同数的正负范围内,数量、包装件数是否在报检范围之内。

1. revocable L/C/irrevocable L/C 可撤销信用证/不可撤销信用证2.confirmed L/C/unconfirmed L/C 保兑信用证/不保兑信用证3.sight L/C/usance L/C 即期信用证/远期信用证4.transferable L/C(or)assignable L/C(or)transmissible L/C /untransferable L/C 可转让信用证/不可转让信用证5.divisible L/C/undivisible L/C 可分割信用证/不可分割信用证6.revolving L/C 循环信用证7.L/C with T/T reimbursement clause 带电汇条款信用证8.without recourse L/C/with recourse L/C 无追索权信用证/有追索权信用证9.documentary L/C/clean L/C 跟单信用证/光票信用证10.deferred payment L/C/anticipatory L/C 延付信用证/预支信用证11.back to back L/Creciprocal L/C 对背信用证/对开信用证12.traveller's L/C(or:circular L/C) 旅行信用证Names of Parties Concerned1. opener 开证人(1)applicant 开证人(申请开证人)(2)principal 开证人(委托开证人)(3)accountee 开证人(4)accreditor 开证人(委托开证人)(5)opener 开证人(6)for account of Messrs 付(某人)帐(7)at the request of Messrs 应(某人)请求(8)on behalf of Messrs 代表某人(9)by order of Messrs 奉(某人)之命(10)by order of and for account of Messrs 奉(某人)之命并付其帐户(11)at the request of and for account of Messrs 应(某人)得要求并付其帐户(12)in accordance with instruction received from accreditors 根据已收到得委托开证人得指示2.beneficiary 受益人 (1)beneficiary 受益人 (2)in favour of 以(某人)为受益人(3)in one's favour 以……为受益人 (4)favouring yourselves 以你本人为受益人3.drawee 付款人(或称受票人,指汇票) (1)to drawn on (or :upon) 以(某人)为付款人(2)to value on 以(某人)为付款人 (3)to issued on 以(某人)为付款人4.drawer 出票人5.advising bank 通知行 (1)advising bank 通知行 (2)the notifying bank 通知行 (3)advised through…bank通过……银行通知(4)advised by airmail/cable through…bank通过……银行航空信/电通知6.opening bank 开证行(1)opening bank 开证行 (2)issuing bank 开证行 (3)establishing bank 开证行7.negotiation bank 议付行(1)negotiating bank 议付行(2)negotiation bank 议付行8.paying bank 付款行9.reimbursing bank 偿付行10.the confirming bank 保兑行Amount of the L/C 信用证金额1. amount RMB¥…金额:人民币2.up to an aggregate amount of Hongkong Dolla rs…累计金额最高为港币……3.for a sum (or :sums) not exceeding a total of GBP…总金额不得超过英镑……4.to the extent of HKD…总金额为港币……5.for the amount of USD…金额为美元……6.for an amount not exceeding total of JPY…金额的总数不得超过……日元的限度The Stipulations for The shipping Documents1. available against surrender of the following documents bearing our credit number and the full n ame and address of the opener 凭交出下列注名本证号码和开证人的全称及地址的单据付款2.drafts to be accompanied by the documents marked(×)below 汇票须随附下列注有(×)的单据3.accompanied against to documents hereinafter 随附下列单据4.accompanied by following documents 随附下列单据5.documents required 单据要求6.accompanied by the following documents marked(×)in duplicate 随附下列注有(×)的单据一式两份7.drafts are to be accompanied by…汇票要随附(指单据)……Draft(Bill of Exchange)1.the kinds of drafts 汇票种类(1)available by drafts at sight 凭即期汇票付款(2)draft(s) to be drawn at 30 days sight 开立30天的期票(3)sight drafs 即期汇票(4)time drafts 远期汇票2.drawn clauses 出票条款(注:即出具汇票的法律依据)(1)all darfts drawn under this credit must contain the clause “Drafts drawn Under Bank of…credit No.…dated…”本证项下开具的汇票须注明“本汇票系凭……银行……年……月……日第…号信用证下开具”的条款(2)drafts are to be drawn in duplicate to our order bearing the clause “Drawn under United Malaya n Banking Corp.Bhd.Irrevocable Letter of Credit No.…dated July 12, 1978”汇票一式两份,以我行为抬头,并注明“根据马来西亚联合银行1978年7月12日第……号不可撤销信用证项下开立”(3)draft(s) drawn under this credit to be marked:“Drawn under…Bank L/C No.……Dated (issuing date of credit)”根据本证开出得汇票须注明“凭……银行……年……月……日(按开证日期)第……号不可撤销信用证项下开立”(4)drafts in duplicate at sight bearing the clauses“Drawn under…L/C No.…dated…”即期汇票一式两份,注明“根据……银行信用证……号,日期……开具”(5)draft(s) so drawn must be in scribed with the number and date of this L/C 开具的汇票须注上本证的号码和日期(6)draft(s) bearing the clause:“Drawn under documentary credit No.…(shown above) of…Bank”汇票注明“根据……银行跟单信用证……号(如上所示)项下开立”Invoice1. signed commercial invoice 已签署的商业发票(in duplicate 一式两 in triplicate 一式三份 in quadruplicate 一式四份 in quintuplicate 一式五份 in sextuplicate 一式六份 in septuplicate 一式七份 in octuplicate 一式八份 in nonuplicate 一式九份 in decuplicate 一式十份)2.beneficiary's original signed commercial invoices at least in 8 copies issued in the name of the b uyer indicating (showing/evidencing/specifying/declaration of) the merchandise, country of origin and any other relevant information. 以买方的名义开具、注明商品名称、原产国及其他有关资料,并经签署的受益人的商业发票正本至少一式八份3.Signed attested invoice combined with certificate of origin and value in 6 copies as reuired for i mports into Nigeria. 以签署的,连同产地证明和货物价值的,输入尼日利亚的联合发票一式六份4.beneficiary must certify on the invoice…have been sent to the accountee 受益人须在发票上证明,已将……寄交开证人5.4% discount should be deducted from total amount of the commercial invoice 商业发票的总金额须扣除4%折扣6.invoice must be showed: under A/P No.… date of expiry 19th Jan. 1981 发票须表明:根据第……号购买证,满期日为1981年1月19日7.documents in combined form are not acceptable 不接受联合单据bined invoice is not acceptable 不接受联合发票Bill of Loading ---提单1. full set shipping (company's) clean on board bill(s) of lading marked "Freight Prepaid" to order of shipper endorsed to … Bank, notifying buyers 全套装船(公司的)洁净已装船提单应注明“运费付讫”,作为以装船人指示为抬头、背书给……银行,通知买方2.bills of lading made out in negotiable form 作成可议付形式的提单3.clean shipped on board ocean bills of lading to order and endorsed in blank marked "Freight Pre paid" notify: importer(openers,accountee) 洁净已装船的提单空白抬头并空白背书,注明“运费付讫”,通知进口人(开证人)4.full set of clean "on board" bills of lading/cargo receipt made out to our order/to order and endor sed in blank notify buyers M/S … Co. calling for shipment from China to Hamburg marked "Freig ht prepaid" / "Freight Payable at Destination" 全套洁净“已装船”提单/货运收据作成以我(行)为抬头/空白抬头,空白背书,通知买方……公司,要求货物字中国运往汉堡,注明“运费付讫”/“运费在目的港付”5.bills of lading issued in the name of…提单以……为抬头6.bills of lading must be dated not before the date of this credit and not later than Aug. 15, 1977 提单日期不得早于本证的日期,也不得迟于1977年8月15日7.bill of lading marked notify: buyer,“Freight Prepaid”“Liner terms”“received for shipment” B/L n ot acceptable 提单注明通知买方,“运费预付”按“班轮条件”,“备运提单”不接受8.non-negotiable copy of bills of lading 不可议付的提单副本Certificate of Origin1.certificate of origin of China showing 中国产地证明书 stating 证明 evidencing 列明 specifying 说明 indicating 表明 declaration of 声明2.certificate of Chinese origin 中国产地证明书3.Certificate of origin shipment of goods of … origin prohibited 产地证,不允许装运……的产品4.declaration of origin 产地证明书(产地生明)5.certificate of origin separated 单独出具的产地证6.certificate of origin "form A" “格式A”产地证明书7.genetalised system of preference certificate of origin form "A" 普惠制格式“A”产地证明书Packing List and Weight List1.packing list deatiling the complete inner packing specification and contents of each package载明每件货物之内部包装的规格和内容的装箱单2.packing list detailing…详注……的装箱单3.packing list showing in detail…注明……细节的装箱单4.weight list 重量单5.weight notes 磅码单(重量单)6.detailed weight list 明细重量单7.weight and measurement list 重量和尺码单Inspection Certificate1. certificate of weight 重量证明书2.certificate of inspection certifying quality & quantity in triplicate issued by C.I.B.C. 由中国商品检验局出具的品质和数量检验证明书一式三份3.phytosanitary certificate 植物检疫证明书4.plant quarantine certificate 植物检疫证明书5.fumigation certificate 熏蒸证明书6.certificate stating that the goods are free from live weevil 无活虫证明书(熏蒸除虫证明书)7.sanitary certificate 卫生证书8.health certificate 卫生(健康)证书9.analysis certificate 分析(化验)证书10.tank inspection certificate 油仓检验证明书11.record of ullage and oil temperature 空距及油温记录单12.certificate of aflatoxin negative 黄曲霉素检验证书13.non-aflatoxin certificate 无黄曲霉素证明书14.survey report on weight issued by C.I.B.C. 中国商品检验局签发之重量检验证明书15.inspection certificate 检验证书16.inspection and testing certificate issued by C.I.B.C. 中国商品检验局签发之检验证明书Other Documents1. full tet of forwarding agents' cargo receipt 全套运输行所出具之货物承运收据2.air way bill for goods condigned to…quoting our credit number 以……为收货人,注明本证号码的空运货单3.parcel post receipt 邮包收据4.Parcel post receipt showing parcels addressed to…a/c accountee 邮包收据注明收件人:通过……转交开证人5.parcel post receipt evidencing goods condigned to…and quoting our credit number 以……为收货人并注明本证号码的邮包收据6.certificate customs invoice on form 59A combined certificate of value and origin for developing countries 适用于发展中国家的包括价值和产地证明书的格式59A海关发票证明书7.pure foods certificate 纯食品证书bined certificate of value and Chinese origin 价值和中国产地联合证明书9.a declaration in terms of FORM 5 of New Zealand forest produce import and export and regultio ns 1966 or a declaration FORM the exporter to the effect that no timber has been used in the packi ng of the goods, either declaration may be included on certified customs invoice 依照1966年新西兰林木产品进出口法格式5条款的声明或出口人关于货物非用木器包装的实绩声明,该声明也可以在海关发票中作出证明10.Canadian custtoms invoice(revised form)all signed in ink showing fair market value in currenc y of country of export 用出口国货币标明本国市场售价,并进行笔签的加拿大海关发票(修订格式)11.Canadian import declaration form 111 fully signed and completed 完整签署和填写的格式111加拿大进口声明书The Stipulation for shipping Terms1. loading port and destinaltion装运港与目的港(1)despatch/shipment from Chinese port to…从中国港口发送/装运往……(2)evidencing shipment from China to…CFR by steamer in transit Saudi Arabia not later than 15th July, 1987 of the goods specified below 列明下面的货物按成本加运费价格用轮船不得迟于1987年7月15日从中国通过沙特阿拉伯装运到……2.date of shipment 装船期(1)bills of lading must be dated not later than August 15, 1987 提单日期不得迟于1987年8月15日(2)shipment must be effected not later than(or on)July 30,1987 货物不得迟于(或于)1987年7月30日装运(3)shipment latest date…最迟装运日期:……(4)evidencing shipment/despatch on or before…列明货物在…年…月…日或在该日以前装运/发送(5)from China port to … not later than 31st August, 1987 不迟于1987年8月31日从中国港口至……3.partial shipments and transhipment 分运与转运(1)partial shipments are (not) permitted (不)允许分运(2)partial shipments (are) allowed (prohibited) 准许(不准)分运(3)without transhipment 不允许转运 (4)transhipment at Hongkong allowed 允许在香港转船(5)partial shipments are permissible, transhipment is allowed except at…允许分运,除在……外允许转运 (6)partial/prorate shipments are perimtted 允许分运/按比例装运(7)transhipment are permitted at any port against, through B/lading 凭联运提单允许在任何港口转运Date & Address of Expiry1. valid in…for negotiation until…在……议付至……止2.draft(s) must be presented to the negotiating(or drawee)bank not later than…汇票不得迟于……交议付行(受票行)3.expiry date for presention of documents…交单满期日4.draft(s) must be negotiated not later than…汇票要不迟于……议付5.this L/C is valid for negotiation in China (or your port) until 15th, July 1977 本证于1977年7月15日止在中国议付有效6.bills of exchange must be negotiated within 15 days from the date of bills of lading but not later than August 8, 1977 汇票须在提单日起15天内议付,但不得迟于1977年8月8日7.this credit remains valid in China until 23rd May, 1977(inclusive) 本证到1977年5月23日为止,包括当日在内在中国有效8.expiry date August 15, 1977 in country of beneficiary for negotiation 于1977年8月15日在受益人国家议付期满9.draft(s) drawn under this credit must be presented for negoatation in China on or before 30th Au gust, 1977 根据本证项下开具的汇票须在1977年8月30日或该日前在中国交单议付10.this credit shall cease to be available for negotiation of beneficairy's drafts after 15th August, 1 977 本证将在1977年8月15日以后停止议付受益人之汇票11.expiry date 15th August, 1977 in the country of the beneficiary unless otherwise 除非另有规定,(本证)于1977年8月15日受益人国家满期12.draft(s) drawn under this credit must be negotiation in China on or before August 12, 1977 after which date this credit expires 凭本证项下开具的汇票要在1977年8月12日或该日以前在中国议付,该日以后本证失效13.expiry (expiring) date…满期日……14.…if negotiation on or before…在……日或该日以前议付15.negoation must be on or before the 15th day of shipment 自装船日起15天或之前议付16.this credit shall remain in force until 15th August 197 in China 本证到1977年8月15日为止在中国有效17.the credit is available for negotiation or payment abroad until…本证在国外议付或付款的日期到……为止18.documents to be presented to negotiation bank within 15 days after shipment 单据需在装船后15天内交给议付行19.documents must be presented for negotiation within…days after the on board date of bill of lad ing/after the date of issuance of forwarding agents' cargo receipts 单据需在已装船提单/运输行签发之货物承运收据日期后……天内提示议付The Guarantee of The Opening Bank1. we hereby engage with you that all drafts drawn under and in compliance with the terms of this credit will be duly honored 我行保证及时对所有根据本信用证开具、并与其条款相符的汇票兑付2.we undertake that drafts drawn and presented in conformity with the terms of this credit will be duly honoured 开具并交出的汇票,如与本证的条款相符,我行保证依时付款3.we hereby engage with the drawers, endorsers and bona-fide holders of draft(s) drawn under and in compliance with the terms of the credit that such draft(s) shall be duly honoured on due present ation and delivery of documents as specified (if drawn and negotiated with in the validity date of t his credit) 凡根据本证开具与本证条款相符的汇票,并能按时提示和交出本证规定的单据,我行保证对出票人、背书人和善意持有人承担付款责任(须在本证有效期内开具汇票并议付)4.provided such drafts are drawn and presented in accordance with the terms of this credit, we her eby engage with the drawers, endorsors and bona-fide holders that the said drafts shall be duly hon oured on presentation 凡根据本证的条款开具并提示汇票,我们担保对其出票人、背书人和善意持有人在交单时承兑付款5.we hereby undertake to honour all drafts drawn in accordance with the terms of this credit 所有按照本条款开具的汇票,我行保证兑付In Reimbursement1.instruction to the negotiation bank 议付行注意事项(1)the amount and date of negotiation of each draft must be endorsed on reverse hereof by the neg otiation bank 每份汇票的议付金额和日期必须由议付行在本证背面签注(2)this copy of credit is for your own file, please deliver the attached original to the beneficaries本证副本供你行存档,请将随附之正本递交给受益人(3)without you confirmation thereon (本证)无需你行保兑(4)documents must be sent by consecutive airmails 单据须分别由连续航次邮寄(注:即不要将两套或数套单据同一航次寄出)(5)all original documents are to be forwarded to us by air mail and duplicate documents by sea-ma il 全部单据的正本须用航邮,副本用平邮寄交我行(6)please despatch the first set of documents including three copies of commercial invoices direct t o us by registered airmail and the second set by following airmail 请将包括3份商业发票在内的第一套单据用挂号航邮经寄我行,第二套单据在下一次航邮寄出(7)original documents must be snet by Registered airmail, and duplicate by subsequent airmail 单据的正本须用挂号航邮寄送,副本在下一班航邮寄送(8)documents must by sent by successive (or succeeding) airmails 单据要由连续航邮寄送(9)all documents made out in English must be sent to out bank in one lot 用英文缮制的所有单据须一次寄交我行2.method of reimbursement 索偿办法(1)in reimbursement, we shall authorize your Beijing Bank of China Head Office to debit our Head Office RMB Yuan account with them, upon receipt of relative documents 偿付办法,我行收到有关单据后,将授权你北京总行借记我总行在该行开立的人民币帐户(2)in reimbursement draw your own sight drafts in sterling on…Bank and forward them to our Lo ndon Office, accompanied by your certificate that all terms of this letter of credit have been compl ied with 偿付办法,由你行开出英镑即期汇票向……银行支取。

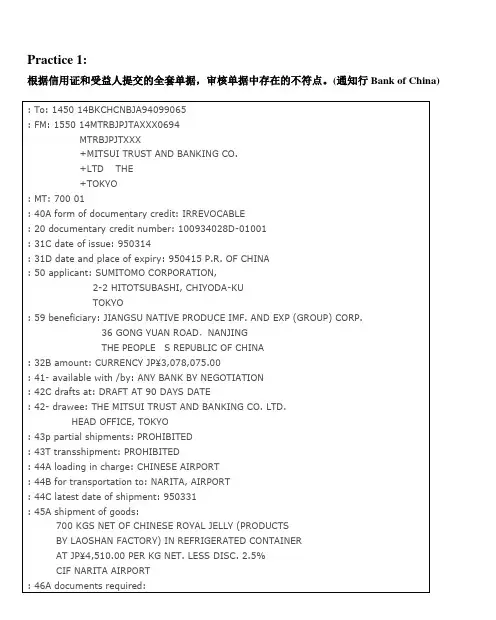

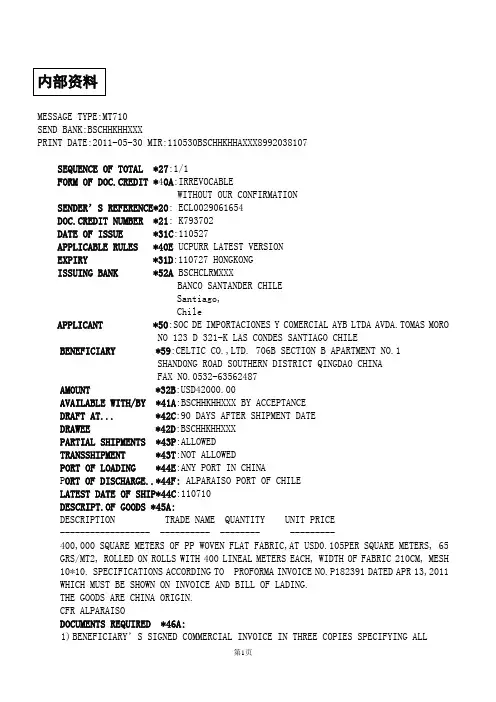

Practice 1:根据信用证和受益人提交的全套单据,审核单据中存在的不符点。

(通知行Bank of China) +LTDTHE PEOPLERIOTS AND CIVIL COMMOTIONS CLAUSE AND I.O.PTO MESSRS.,1995 CHINESE ROYAL JELLY 70 CTNS@JP4510-KG NETBANKING CO., LTD.,TOKYODated 950314At 90 DAYS sight of this FIRST of Exchange (Second of Exchange being unpaid) Pay to the order of BANK OF CHINASEVENTY FIVE ONLYthe same validity.中国人民保险公司中国人民保险公司(以下简称本公司)THIS POLICY ON INSURANCE WITNESSES THAT THE PEOPLECHINA (HEREINAFTER CALLED“THE COMPANY”)根据AT THE REQUEST OF JIANGSU NATIVE PRODUCE IMPORT & EXPORT (GROUP) CORP.(以下简称被保险人)的要求,由被保险人向本公司缴付约定的(HEREINAFTER CALLED“THE INSURED”) AND IN CONSIDERATION OF THE AGREED PREMIUM PAID TO THE COMPANY BY THE保险费,按照本保险单承保险别和背面所载条款与下列INSURED UNDERTAKES TO INSURE THE UNDERMENTIONED GOODS IN TRANSPORTATION SUBJECT TO THE CONDITION OF THIS POLICY特款承保下述货物运输保险,特立本保险单。

常用贸易术语英语词汇及缩略语最牛英语口语培训模式:躺在家里练口语,全程外教一对一,三个月畅谈无阻!太平洋英语,免费体验全部外教一对一课程:.pacificenglish.A.V. (Ad. Val)从价运费A/W (All Water)全水路Acceptance Credit承兑信用证Acceptance承兑;接受Acts of God自然力Actual Total Loss实际全损Advising Bank, Notifying Bank通知行Agent代理人Agreement协议AIR TPT ALL RISKS航空运输综合险AIR TPT RISKS航空运输险Air Transport航空运输Air Waybill航空运单All Risks一切险Allowance折让;允差ANER (Asia NorthAmerica EastboundRate)亚洲北美东行运费协定Ante-dated B/L倒签提单Anticipatory L/C预支信用证Applicant申请人Arbitral Award仲裁裁决Arbitration Clause仲裁条款Arbitration仲裁Asian Development Bank亚洲开发银行Auction拍卖Auctioneer拍卖人BB/L (Bill of Lading)海运提单B/R (Buying Rate)买价BAF (Bunker AdjustmentFactor)燃油附加费Bank to Bank Credit背对背信用证Banker´s Draft银行汇票Barter易货Bearer B/L不记名提单Beneficiary受益人Bidder竞买者Bidding递盘Bilateral Trade双边贸易Bill of Exchange (Draft)汇票Bona Fide Holder善意(合法,正当)持有(票)人Bonded Warehouse保税仓库Brand Name品牌Breach of Contract违约Brokerage经纪费Business Negotiation交易磋商CC&F (Cost and Freight)成本加海运费C.C (Collect)运费到付C.O (certificate of origin)一般原产地证C.S.C (Container Service Charge)货柜服务费C.T.D.(bined Transport documents)多式联运单据C.Y. (Container Yard)货柜场C/D (customs declaration)报关单C/O (Certificate of Origin)产地证CAF (Currency Adjustment Factor)货币汇率附加费Cargo Receipt承运货物收据Cash with Order订单付款CBM (cubic metre) 立方米、立方公尺CCPIT (China Council for the Promotion of International Trade) 中国对外贸易促进委员会Certified Invoice 证实发票CFR (Cost and Freight) 成本加运费CFR Landed 成本加运费、卸货费CFS (Container Freight Station) 散货仓库CFS/CFS 散装交货(起点/终点)CFT (Cubic Feet)立方英尺Charter Party B/L租船提单CHB (Customs House Broker)报关行Check (Cheque)支票CIF (Cost, Insurance and Freight)成本加保险费、运费CIF Ex Ship´s Hold成本加保险费、运费、舱底交接CIF Landed成本加保险费、运费、卸货费CIF Liner Terms成本加保险费、运费班轮条件CIP (Carriage and Insurance Paid To)运费、保险费付至目的地CIP (Carriage Insurance Paid to)运费、保险费付至Claims索赔Clean B/L清洁提单Clean Bill光票Clean Credit光票信用证Collection Bank代收银行Collection托收bined Transport B/L多式联运提单M (modity)商品mercial Draft商业汇票mercial Invoice商业发票mission佣金modity Inspection Bureau商品检验局parative Advantage比较优势pensation Trade补偿贸易Conditional Acceptance有条件的接受Conditioned Weight公量Confirmation确认书Confirmed Letter of Credit保兑信用证Confirming Bank保兑行Consignee收货人Consignment Note寄售单Consignment寄售Consignor托运人Constructive Total Loss推定全损Consular Invoice领事发票Container B/L集装箱提单Container Transport集装箱运输Continental Bridge大陆桥Contract合同Copy B/L副本提单Counter Offer还盘Counter Purchase互购Counter Sample对等样品;回样Counter Trade对销贸易CPT (Carriage Paid To)运费付至目的地CTN/CTNS (carton/cartons)纸箱CTNR (Container)柜子Current Price现行价Customary Packing习惯包装Customs Invoice海关发票Customs Tariffs关税CY/CY整柜交货(起点/终点)DD.P.V. (duty paid value)完税价格D/A (document Against Acceptance)承兑交单D/D (Remittance by Banker´s Demand Draft)票汇D/O,D.O. (Delivery Order)到港通知、提货单D/P (document Against Payment)付款交单D/P after Sight (document against payment after Sight)远期付款交单D/P Sight (documents against Payment at Sight)即期付款交单DAF (Delivered At Frontier)边境交货Damage Caused by Heating and Sweating受热受潮险DCP (freight or carriage paid to)运费付至...价DDC (Destination Delivery Charge)目的港码头费DDP (Delivered Duty Paid)完税后交货DDU (Delivered Duty Unpaid)未完税交货Deductible免赔额defendant被诉方Deferred Payment Credit延期付款信用证Deferred Payment延期付款Demurrage (Despatch) Money速遣费DEQ (Delivered Ex Quay)目的港码头交货DES (Delivered Ex Ship)目的港船上交货DHL (DHL International Ltd.)敦豪速递公司Direct B/L直达提单Direct Trade直接贸易Dishonor拒付Distributor分销商DL/DLS (dollar/dollars)美元DOC (document)文件、单据Doc# (document Number)文件documentary Bill跟单汇票documentary Credit跟单信用证DOZ/DZ (dozen)一打Drawee受票人Drawer出票人dup. (duplicate)副本EE/D (export declaration)出口申报书EA (each)每个,各EAT (estimated time of arrival)预计到达时间Economic Integration经济一体化EEC (European Economic munity)欧洲经济共同体EMP (European Main Ports)欧洲主要港口EMS (Express Mail Special)特快专递Endorsement背书Entrepot Trade转口贸易EPS (Equipment Position Surcharges)设备位置附加费EPZ (export processing zone)出口加工区ETCL (expected time of mencement of loading)预计开始装货时间ETD (estimated time of departure)预计离港时间ETFD (expected time of finishing discharging)预计卸完时间ETFL (expected time of finishing)预计装完时间EU (European Union)欧盟Ex (Work/ExFactory)工厂交货exch. (exchange)兑换,汇票Exclusive Agent; Sole Agent独家代理Exclusive Sales包销EXP(export)出口EXQ (ex quay)码头交货价EXS (ex ship)目的港船上交货价EXW (Ex Works)工厂交货贸易价格术语trade term / price term 价格术语world / international market price 国际市场价格FOB (free on board) 离岸价C&F (cost and freight) 成本加运费价CIF (cost, insurance and freight) 到岸价freight 运费wharfage 码头费landing charges 卸货费customs duty 关税port dues 港口税import surcharge 进口附加税import variable duties 进口差价税mission 佣金return mission 回佣,回扣price including mission 含佣价net price 净价wholesale price 批发价discount / allowance 折扣retail price 零售价spot price 现货价格current price 现行价格/ 时价indicative price 参考价格customs valuation 海关估价price list 价目表total value 总值贸易保险术语All Risks 一切险F.P.A. (Free from Particular Average) 平安险W.A. / W.P.A (With Average or With Particular Average) 水渍险War Risk 战争险F.W.R.D. (Fresh Water Rain Damage) 淡水雨淋险Risk of Intermixture and Contamination 混杂、玷污险Risk of Leakage 渗漏险Risk of Odor 串味险Risk of Rust 锈蚀险Shortage Risk 短缺险T.P.N.D. ( Theft, Pilferage & Non-delivery) 偷窃提货不着险Strikes Risk 罢工险贸易机构词汇WTO (World Trade Organization) 世界贸易组织IMF (International Monetary Fund) 国际货币基金组织CTG (Council for Trade in Goods) 货币贸易理事会EFTA (European Free Trade Association) 欧洲自由贸易联盟AFTA (ASEAN Free Trade Area) 东盟自由贸易区JCCT (China-US Joint mission on merce and Trade) 中美商贸联委会NAFTA (North American Free Trade Area) 北美自由贸易区UNCTAD (United Nations Conference on Trade and Development) 联合国贸易与发展会议GATT (General Agreement on Tariffs and Trade) 关贸总协定贸易方式词汇stocks 存货,库存量cash sale 现货purchase 购买,进货bulk sale 整批销售,趸售distribution channels 销售渠道wholesale 批发retail trade 零售业hire-purchase 分期付款购买fluctuate in line with market conditions 随行就市unfair petition 不合理竞争dumping 商品倾销dumping profit margin 倾销差价,倾销幅度antidumping 反倾销customs bond 海关担保chain debts 三角债freight forwarder 货运代理trade consultation 贸易磋商mediation of dispute 商业纠纷调解partial shipment 分批装运restraint of trade 贸易管制RTA (Regional Trade Arrangements) 区域贸易安排favorable balance of trade 贸易顺差unfavorable balance of trade 贸易逆差special preferences 优惠关税bonded warehouse 保税仓库transit trade 转口贸易tariff barrier 关税壁垒tax rebate 出口退税TBT (Technical Barriers to Trade) 技术性贸易壁垒进出口贸易词汇merce, trade, trading 贸易inland trade, home trade, domestic trade 国贸易international trade 国际贸易foreign trade, external trade 对外贸易,外贸import, importation 进口importer 进口商export, exportation 出口exporter 出口商import licence 进口许口证export licence 出口许口证mercial transaction 买卖,交易inquiry 询盘delivery 交货order 订货make a plete entry 正式/完整申报bad account 坏帐Bill of Lading 提单marine bills of lading 海运提单shipping order 托运单blank endorsed 空白背书endorsed 背书cargo receipt 承运货物收据condemned goods 有问题的货物catalogue 商品目录customs liquidation 清关customs clearance 结关贸易伙伴术语trade partner 贸易伙伴manufacturer 制造商,制造厂middleman 中间商,经纪人dealer 经销商wholesaler 批发商retailer, tradesman 零售商merchant 商人,批发商,零售商concessionaire, licensed dealer 受让人,特许权获得者consumer 消费者,用户client, customer 顾客,客户buyer 买主,买方carrier 承运人consignee 收货人出口信贷export credit出口津贴export subsidy商品倾销dumping 外汇倾销exchange dumping优惠关税special preferences保税仓库bonded warehouse贸易顺差favorable balance of trade贸易逆差unfavorable balance of trade进口配额制import quotas自由贸易区free trade zone对外贸易值value of foreign trade 国际贸易值value of international trade 普遍优惠制generalized system of preferences-GSP最惠国待遇most-favored nation treatment-MFNT价格条件价格术语trade term (price term)运费freight 单价price码头费wharfage总值total value 卸货费landing charges金额amount关税customs duty 净价net price印花税stamp duty含佣价price including mission港口税portdues 回佣return mission装运港portof shipment 折扣discount,allowance卸货港port of discharge 批发价wholesale price目的港portof destination 零售价retail price进口许口证inportlicence 现货价格spot price出口许口证exportlicence期货价格forward price现行价格(时价)current price prevailingprice 国际市场价格world (International)Marketprice 离岸价(船上交货价)FOB-free on board成本加运费价(离岸加运费价)C&F-cost and freight到岸价(成本加运费、保险费价)CIF-cost,insurance and freight交货条件交货delivery轮船steamship(缩写S.S) 装运、装船shipment租船charter (the chartered ship) 交货时间time of delivery定程租船voyage charter装运期限time of shipment定期租船time charter 托运人(一般指出口商)shipper,consignor收货人consignee班轮regular shipping liner驳船lighter 舱位shipping space油轮tanker报关clearance of goods 陆运收据cargo receipt提货to take delivery of goods 空运提单airway bill正本提单original B\L选择港(任意港)optional port 选港费optional charges 选港费由买方负担optional charges to be borne by the Buyers或optional charges for Buyers account 一月份装船shipment during January或January shipment一月底装船shipment not later than Jan.31st.或shipment on or before Jan.31st.一/二月份装船shipment during Jan./Feb.或Jan./Feb. shipment在......(时间)分两批装船shipment during....in two lots 在......(时间)平均分两批装船shipment during....in two equal lots分三个月装运in three monthly shipments 分三个月,每月平均装运in three equal monthly shipments立即装运immediate shipments 即期装运prompt shipments 收到信用证后30天装运shipments within 30 days after receipt of L/C允许分批装船partial shipment not allowed partial shipment not permitted partial shipment not unacceptable 交易磋商、合同签订订单indent 订货;订购book; booking电复cable reply实盘firm offer 递盘bid; bidding 递实盘bid firm还盘counter offer发盘(发价) offer发实盘offer firm 询盘(询价)inquiry;enquiry 指示性价格price indication速复reply immediately 参考价reference price习惯做法usual practice交易磋商business negotiation 不受约束without engagement业务洽谈business discussion限**复subject to reply **限* *复到subject to reply reaching here ** 有效期限time of validity有效至**: valid till **购货合同purchase contract销售合同sales contract购货确认书purchase confirmation销售确认书sales confirmation一般交易条件general terms and conditions以未售出为准subject to prior sale 需经卖方确认subject to sellers confirmation需经我方最后确认subject to our final confirmation贸易方式INT (拍卖auction) 寄售consignment 招标invitation of tender投标submission of tender一般代理人agent总代理人general agent 代理协议agency agreement累计佣金accumulative mission 补偿贸易pensation trade(或抵偿贸易)pensating/pensatory trade (又叫:往返贸易)counter trade来料加工processing on giving materials来料装配assembling on provided parts 独家经营/专营权exclusive right独家经营/包销/代理协议exclusivity agreement 独家代理sole agency; sole agent; exclusive agency;exclusive agent品质条件品质quality原样original sample 规格specifications复样duplicate sample说明description对等样品countersample标准standard type 参考样品reference sample商品目录catalogue封样sealed sample 宣传小册pamphlet公差tolerance 货号article No.花色(搭配)assortment 样品sample 5%增减5% plus or minus代表性样品representative sample大路货(良好平均品质)fair average quality 商检仲裁索赔claim 争议disputes 罚金条款penalty仲裁arbitration不可抗力force Majeure仲裁庭arbitral tribunal产地证明书certificate of origin品质检验证书inspection certificate of quality 重量检验证书inspection certificate of weight (quantity) **商品检验局**modity inspection bureau (*.C.I.B)品质、重量检验证书inspection certificate 数量条件个数number净重net weight 容积capacity 毛作净gross for net 体积volume皮重tare毛重gross weight溢短装条款more or less clause 外汇外汇foreign exchange法定贬值devaluation 外币foreign currency法定升值revaluation 汇率rate of exchange浮动汇率floating rate 国际收支balance of payments硬通货hard currency 直接标价direct quotation软通货soft currency 间接标价indirect quotation 金平价gold standard 买入汇率buying rate通货膨胀inflation卖出汇率selling rate固定汇率fixed rate 金本位制度gold standard 黄金输送点gold points 铸币平价mint par纸币制度paper money system 国际货币基金international monetary fund 黄金外汇储备gold and foreign exchange reserve汇率波动的官定上下限official upper and lower limits of fluctuation外贸常见英文缩略词CFR(cost and freight)成本加运费价D/P(document against payment)付款交单 C.O (certificate of origin)一般原产地证CTN/CTNS(carton/cartons)纸箱DL/DLS(dollar/dollars)美元PKG(package)一包,一捆,一扎,一件等G.W.(gross weight)毛重C/D (customs declaration)报关单W (with)具有FAC(facsimile)传真EXP(export)出口MIN (minimum)最小的,最低限度M/V(merchant vessel)商船MT或M/T(metric ton)公吨INT (international)国际的INV (invoice)发票REF(reference)参考、查价STL.(style)式样、款式、类型RMB(renminbi)人民币PR或PRC(price)价格S/C(sales contract)销售确认书B/L(bill of lading)提单CIF(cost,insurance&freight)成本、保险加运费价T/T(telegraphic transfer)电汇D/A (document against acceptance)承兑交单G.S.P.(generalized system of preferences)普惠制PCE/PCS(piece/pieces)只、个、支等DOZ/DZ(dozen)一打WT(weight)重量N.W.(net weight)净重EA(each)每个,各w/o(without)没有IMP(import)进口MAX (maximum)最大的、最大限度的M或MED (medium)中等,中级的S.S(steamship)船运DOC (document)文件、单据P/L (packing list)装箱单、明细表PCT (percent)百分比EMS(express mail special)特快传递T或LTX或TX(telex)电传S/M(shipping marks)装船标记PUR (purchase)购买、购货L/C (letter of credit)信用证FOB(free on board)离岸价A at每a.a.r against all risks全险a/c account帐目A/C account current往来帐目acc acceptance;accepted承兑;已承兑a.g.b a good brand任何名牌a/o account of 记入...帐目a.p. additional premium附加保险a.r. all risks全险A/S;acc/s account sales售货清单av;A/V average平均数BBB bill book出纳簿B/D bank draft银行汇票bd. bond债券bds. boards董事会B/E bill of exchange汇票bk. bank book帐簿bkg. banking银行业B/L bill of lading提货单B.P.B bank post bill银行汇票BR bank rate银行贴现率B/R;b.r. bill receivable应收票据B.S;b.s. balance sheet资产负债表bt bought购入CC currency,coupon现金,息单C/A capital account资本CAD cash against document凭单付款canclg. cancelling 取消cat. catalogue目录CB cash book现金簿CD cash dividend现金折扣c.d. cum dividend付股息报关单C and D collection and delivery收款发货cert. certificate证明C/F carried forward转下页cge. carriage运费CH custom house海关ch.ppd charges prepaid预付费c/l certificate insurance保险证明书c&l cost and insurance保险费在价CIF cost,insurance and freight到岸价格C/O cash order现金汇票C.O.t. change over to转入COD cash on delivery货到付款. mercial:mission商业;佣金cont. contract合同cr. credit货方ctge cartage车费cur. current本月;现付CWO cash with order订货即付款cy.currency货币DD/C. deviation贴现dd. delivered交付de. deferred延期deg. degree等级dft. draft汇票div dividend;division红利;部门D/N debit note欠单;借项清单dols. dollars美元D/P documents against payment付款交单dr. debtor drawer债务人,借方d.r. dock receipt存款收条D/W deposit warrant码头仓单dely. delivery交付Eea. each每e.d. ex dividend股息除外eq. equivalent 等值exd. examined已检查exs. expenses费用Ff.i.t. free of ine tax免所得税FOB free on board离岸价格F/O for order准备出售f.p;FP fully paid付讫frt. freight运费Ggrs.wt gross weight毛重g.t.c. good till cancelled未注销前有效13个英语贸易术语详解(一)工厂交货( EXW) 本术语英文为"EX Works(…named place)",即"工厂交货(……指定地点)"。

Aa?accepted?承兑AA?AuditingAdministration?(中国)审计署AAA??最佳等级abs.?abstract?摘要a/c,A/C?account?帐户、帐目a/c,A/C?accountcurrent?往来帐户、活期存款帐户A&C?addendaandcorrigenda?补遗和勘误Acc.?acceptanceoraccepted?承兑Accrd.Int?accruedinterest?应计利息Acct.?account?帐户、帐目Acct.?accountant?会计师、会计员Acct.?accounting?会计、会计学Acct.No.?accountnumber?帐户编号、帐号Acct.Tit.?accounttitle?帐户名称、会计科目ACN?airconsignment?航空托运单a/cno.?accountnumber?帐户编号、帐号Acpt.?acceptanceoraccepted?承兑A/CSPay.?accountspayable?应付帐款A/CSRec.?accountsreceivable?应收帐款ACT?advancecorporationtax?预扣公司税ACU?AsiaCurrencyUnit?亚洲货币单位A.C.V?actualcashvalue?实际现金价值a.d.,a/d?afterdate?开票后、出票后ADRS?assetdepreciationrangesystem?固定资产分组折旧法Adv.?advance?预付款ad.val.,A/V?advaloremto(accordingvalue)?从价Agt.?agent?代理人Agt.?agreement?协议、契约AJE?adjustingjournalentries?调整分录Amt.?amount?金额、总数Ann.?annuity?年金A/P?accountpaid?已付账款A/P?accountpayable?应付帐款A/P?accountingperiod?会计期间A/P?adviseandpay?付款通知A/R?accountreceivable?应收帐款A/R?attherateof?以……比例a/r?allrisks?(保险)全险Arr.?arrivals,arrived?到货、到船A/S,a/s?aftersight?见票即付A/S,acc/s?accountsales?承销帐、承销清单,售货清单ASAP?assoonaspossible?尽快ASR?acceptancesummaryreport?验收总结报告ass.?assessment?估征、征税assimt.?assignment?转让、让与ATC?averagetotalcost?平均总成本ATM?atthemoney?仅付成本钱ATM?AutomaticTellerMachine?自动取款机(柜员机)ATS?automatedtradesystem?自动交易系统ATS?automatictransferservice?自动转移服务Attn.?attention?注意Atty.?attorney?代理人auct.?auction?拍卖Aud.?auditor?审计员、审计师Av.?average?平均值a.w.?allwool?纯羊毛A/W?airwaybill?空运提单A/W?actualweight?实际重量BBA?bankacceptance?银行承兑汇票bal.?balance?余额、差额banky.?bankruptcy?破产、倒闭Bat?battery?电池b.b.?bearerbond?不记名债券B.B.,B/B?billbook?出纳簿B/B?billbought?买入票据、买入汇票b&b?bed&breakfast?住宿费和早餐费b.c.?blindcopy?密送的副本BC?buyercredit?买方信贷B/C?billsforcollection?托收汇票B.C.?bankclearing?银行清算b/d?broughtdown?转下页Bd.?bond?债券B/D?billsdiscounted?已贴现票据B/D?bankdraft?银行汇票B/E?billofentry?报关单b.e.,B/E?billofexchange?汇票BEP?breakevenpoint?保本点、盈亏临界点b/f?broughtforward?承前BF?bondedfactory?保税工厂Bfcy.?Beneficiary?受益人B/G,b/g?bondedgoods?保税货物BHC?BankHoldingCompany?银行控股公司BIS?BankofInternationalSettlements?国际清算银行bit?binarydigit?两位数Bk.?bank?银行Bk.?book?帐册b.l.,B/L?billoflading?提货单B/Loriginal?billofladingoriginal?提货单正本bldg.?building?大厦BMP?bankmasterpolicy?银行统一保险BN?banknote?钞票BO?branchoffice?分支营业处BO?buyer’soption?买者选择交割期的远期合同BOM?beginningofmonth?月初BOO?build-operate-own?建造—运营—拥有BOOM?build-operate-own-maintain?建造—运营—拥有—维护BOOT?build-operate-own-transfer?建造—运营—拥有—转让BOT?balanceoftrade?贸易余额BOY?beginningofyear?年初b.p.,B/P?billspayable?应付票据Br.?branch?分支机构BR?bankrate?银行贴现率b.r.,B/R?billsreceivable?应收票据Brok.?brokerorbrokerage?经纪人或经纪人佣金b.s.,BS,B/S?balancesheet?资产负债表B/S?billofsales?卖据、出货单Bshare?Bshare?B股BV?bookvalue?票面价值Cc.?cents?分C?cash;coupon;currency?现金、息票、通货C?centigrade?摄氏(温度)C.A.?charteredaccountant;chiefaccountant?特许会计师、主任(主管)会计师C.A.?commercialagent?商业代理、代理商C.A.?consumers'association?消费者协会C/A?capitalaccount?资本帐户C/A?currentaccount?往来帐C/A?currentassets?流动资产C.A.D?cashagainstdocumnet?交单付款can.?cancelled?注销cap.?capital?资本CAPM?capitalassetpricingmodel?固定资产计价模式C.A.S.?costaccountingstandards?成本会计标准c.b.,C.B.?cashbook?现金簿CBD?cashbeforedelivery?先付款后交货C.C.?cashier'scheck?银行本票C.C?contracredit?贷方对销c/d?carrieddown?过次页、结转下期CD?certificateofdeposit?存单c/f?carryforward?过次页、结转CG?capitalgain?资本利得CG?capitalgoods?生产资料、资本货物C.H.?customhouse?海关C.H.?clearinghouse?票据交换所Chgs?charges?费用Chq.?cheque?支票C/I?certificateofinsurance?保险凭证CIA?certifiedinternalauditor?注册内部审计员c.i.f.,C.I.F.?cost,insuranceandfreight?到岸价,货价+保险+运费C.I.T.?comprehensiveincometax?综合所得税Ck.?check?支票C.L.?callloan?短期拆放C/L?currentliabilities?流动负债C.M.A.?certificedmanagementaccountant?注册管理会计师CMEA,Comecon?CouncilforMutualEconomic Assistance?经济互助委员会CML?capitalmarketline?资本市场线性CMO?CollateralisedMortgageObligations?担保抵押贷款债务CMV?currentmarketvalue?现时市场价值CN?consignmentnote?铁路运单CN?creditnote?贷方通知书c/o?carriedover?结转后期C.O.,C/O?cashorder?现金汇票、现金订货C.O.?certificateoforigin?产地证明书Co.?company?公司COBOL?CommonBusinessOrientedLanguag e?通用商业语言CoCom?CoordinatingCommitteeforMultilat eralExportControls?多边出口控制协调委员会c.o.d,C.O.D.?cashondelivery?货到付款Col.?column?帐栏Coll.?collateral?担保、抵押物Coll.?collection?托收Com.;comm.?commission?佣金cont.?container?集装箱cont.,contr.?contract?契约、合同conv.,cv.,cvt.?convertible?可转换的、可兑换的Cor.?corpus?本金Cor.?correspodent?代理行Corp.?corporation?公司CP.?commercialpaper?商业票据C.P.A?certifiedPublicAccountant?注册公共会计师CPB?ChinaPatentBureau?中国专利局CPI?consumerpriceindex?消费者价格指数CPM?costperthousand?每一千个为单位的成本CPP?currentpurchasingpower?现行购买力Cps.?coupons?息票CPT?carriagepaidto?运费付至......C/R?company'srisk?企业风险Cr.?credit?贷记、贷方CR?carrier'srisk?承运人风险CR?currentrate?当日汇率、现行汇率CR?cashreceipts?现金收入CR?classrate?分级运费率CS?civilservant;civilservice?公务员、文职机关CS?convertiblesecurities?可转换证券C.S.?capitalstock?股本CSI?customersatisfactionindex?顾客满意指数csk.?cask?木桶CT?corporatetreasurer?公司财务主管CT?cabletransfer?电汇ct?crate?板条箱ctge?cartage?货运费、搬运费、车费Cts.?cents?分CTT?capitaltransfertax?资本转移税cu?cubic?立方CU?customsunions?关税联盟cu.cm.?cubiccentimeter?立方厘米cu.in.?cubicinch?立方英寸cu.m.?cubicmeter?立方米cu.yd.?cubicyard?立方码cum.pref.?cumulativepreference(share)?累积优先(股)cur.curr.?current?本月、当月CV?convertiblesecurity?可转换债券CVD?countervailingduties?抵消关税、反倾销税C.V.P.analysis?CostVolumeProfitanalysis?本---量---利分析C.W.O.?cashwithorder?订货付款Cy.?currency?货币CY?calendaryear?日历年CY?container?整装货柜CY?containeryard?货柜堆场、货柜集散场DD?degree;draft?度、汇票D/A?depositaccount?存款帐户D/A?documentagainstacceptance?承兑交单d/a?daysafteracceptance?承兑后......日(付款)D.A.?debitadvice?欠款报单D.B?daybook?日记帐、流水帐DBmethod?decliningbalance(depreciation) method?递减余额折旧法D.C.F.method?discountedcashflowmethod?现金流量贴现法D/D?documentarydraft?跟单汇票D.D.;D/D?demanddraft?即期汇票D/d;d/d?daysafterdate?出票后......日(付款) d.d.?drydock?干船坞DDBmethod?doubledecliningbalance(depre ciation)method?双倍递减余额折旧法D.D.D?deadlinedeliverydate?交易最后日期def.?deficit?赤字、亏损dem.?demurrage?滞期费Depr.?depreciation?折旧d.f;D.F.;d.frt.?deadfreight?空舱费D.G?dangerousgoods?危险货物diff.?difference?差额Dis.?discount?折扣、贴现dish'd;dishd?dishonored?不名誉、拒付D.I.T?doubleincome-tax(relief)?双重所得税(免征)div.;divd?dividend?红利、股息D-J?DowJones&Co.?美国道—琼斯公司DJIA?DowJonesIndustrialAverage(StockIn dex)?道—琼斯工业股票指数DJTA?DowJonesTransportationAverage?道—琼斯运输平均数DJUA?DowJonesUtilityAverage?道—琼斯公用事业平均数DK?Don'tknow?不知道DL?directloan?直接贷款DL?discretionarylimit?无条件限制DLD?deadlinedate?最后时限Dls.;Dol(s);Doll(s)?dollars?元DM?DeutscheMark;D-mark;Deutschmark;?德国马克DMCs?developingmembercountries?发展中国家DN?datenumber?日期号DN;D/N?debitnote?借记通知单DNR?donotreduce?不减少do.;dto.?ditto?同上、同前D/O?deliveryorder?发货单Doc(s)?documents?凭证、单据、文件doc.att.?documentsattached?附单据、附件Doc.code?documentcode?凭证(单据)编号D.O.G.?daysofgrace?宽限日数DOR?dateofrequest?要求日DP;D/P?documentagainstpayment?交单付款DPI?disposablepersonalincome?个人可支配收入DPOB?dateandplaceofbirth?出生时间和地点DPP?dampproofing?防潮的Dr.?debit?借记、借方D.R.;DR?discountrate?贴现率、折扣率Dr?debtor?债务人DR?depositreceipt?存单、存款收据dr.?drawer?借方DS;d/s?daysaftersight(days'sight)?见票后.......日(付款)ds.;d's?days?日dstn.?destination?日的地(港)DTC?Deposittakingcompany?接受存款公司DTC?DepositTrustCompany?储蓄信托公司dup.;dupl.;dupte.?duplicate?副本DVP?deliveryversuspayment?付款交货dy.;d/y?day;delivery?日、交货dz?dozen?一打EE.?exchange;export?交易所、输出E.&O.E.?errorsandomissionsexcepted?如有错漏,可加更正EAT?earningsaftertax?税后收益EB?exbudgetary?预算外EBIT?earningsbeforeinterestandtax?扣除利息和税金前收益EBS?ElectronicBrokingService?电子经纪服务系统EBT?earningbeforetaxation?税前盈利EC?EuropeanCommunity;EuropeanCommis sion?欧洲共同体、欧洲委员会EC?exportcredit?出口信贷EC?errorcorrected?错误更正Ec.?exemplicausa?例如Ec.?excoupon?无息票ECA?exportcreditagency?出口信贷机构ECAFE?EconomicCommissionforAsiaandthe FarEast?亚洲及远东经济委员会ECE?EconomicCommissionforEurope?欧洲经济委员会ECG?ExportCreditGuarantee?出口信用担保ECI?exportcreditinsurance?出口信用保险ECR?exportcreditrefinancing?出口信贷再融资ECT?estimatedcompletiontime?估计竣工时间ECU?EuropeanCurrencyUnit?欧洲货币单位E/D?exportdeclaration?出口申报单ED?exdividend?无红利、除息、股利除外EDD?estimateddeliverydate?预计交割日EDI?electronicdatainterchange?电子数据交换EDOC?effectivedateofchange?有效更改日期EDP?ElectronicDataProcessing?电子数据自理E.E.;e.e?errorsexcepted?如有错误,可加更正EERI?EffectiveExchangeRateIndexesofHon gKong?港汇指数EET?EastEuropeanTime?东欧时间EF?exportfinance?出口融资EF?ExchangeFund?外汇基金EFT?electronicfundstransfer?电子资金转帐EFTA?EuropeanFreeTradeArea(Association )?欧洲自由贸易区(协会)EGM?ExtraordinaryGenaralMeeting?特别股东大会EIB?Export-ImportBank?进出口银行EIL?WBEconomicIntegrationLoan?世界银行经济一体化贷款EL?exportlicense?出口许可证ELI?extralowimpurity?极少杂质EMF?EuropeanMonetaryFund?欧洲货币基金EMIP?equivalentmeaninvestmentperiod?等值平均投资期EMP?end-ofmonthpayment?月末付款EMP?Europeanmainports?欧洲主要港口EMS?EuropeanMonetarySystem?欧洲货币体系EMS?expressmailservice?邮政特快专递EMU?EuropeanMonetaryUnion?欧洲货币联盟enc?enclosed?停业encl(s).?enclosure?附件encd.?enclosed?附件End.;end.?endorsement?背书Entd.?entered?登记人EOA?effectiveonorabout?大约在.......生效EOD?everyotherday?每隔一日EOE?EuropeanOptionsExchange?欧洲期权交易EOM?endofmonth?月底EOQ?economicorderquantity?最底订货量EOS?endofseason?季末EOU?export-orientedunit?出口型单位EOY?endofyear?年终EPD?earliestpossibledate?最早可能日期EPN?exportpromissorynote?出口汇票EPOS?electronicpointofsale?电子销售点EPR?earningspriceratio?收益价格比率EPR?effectiveprotectionrate?有效保护率EPS?earningspershare?每股收益额、每股盈利额E.P.T?excessprofittax?超额利润税EPVI?excesspresentvalueindex?超现值指数EPZ?exportprocessingzone?出口加工区ERM?exchangeratemechanism?汇率机制ERS?ExportRefinanceScheme?出口再融资计划ESOP?EmployeeStockOwnershipPlan?职工持股计划Est.?estate?财产、遗产EST?EasternStandardTime?美国东部标准时间etseq.?etsequents?以下ETA?estimatedtimeofarrival?预计到达时间ETD?estimatedtiemofdeparture?预计出发时间ETDZ?EconomicandTechnologicalDevelop mentZone?经济技术开发区ETLT?equaltoorlessthan?等于或少于ETS?estimatedtimeofsailing?预计启航时间EU?EuropeanUnion?欧盟EUA?EuropeanUnitsofAccount?欧洲记帐单位ex.;exch?exchange?汇兑、况换excl.?exclusive?另外、不在内excont.?fromcontract?从合同excp.?excoupon?无息票exdiv.?exdividend?无股息Exp.?export?出口Extd.?extend?展期EXW?exworks?工厂交货价Ff?feet?英尺F?dealtinflat?无息交易的f.?following(page)?接下页f.?fairs?定期集市F.A.?faceamount?票面金额F.A.?fixedassets?固定资产F.A?freightagent?货运代理行FA?freealongside?启运港船边交货FABB?FellowoftheBritishAssociationofAcco untantsandAuditors?英国会计师和审计师协会会员FAC?facility?设施、设备FACT?factoranalysischarttechnique?因素分析图解法fad.?freedelivery(discharge,dispatch)?免费送货F.A.F.?freeatfactory?工厂交货FAIA?FellowoftheAssociationofInternationa lAccountants?国际会计协会会员F.A.Q?fairaveragequality?(货品)中等平均质量F.A.S.?freealongsideship?发运地船边交货价FASB?FinancialAccountingStandardsBoards?财务会计标准委员会FAT?fixedassettransfer?固定资产转移FAT?factoryacceptancetest?工厂验收试验FB?foreignbank?外国银行F.B.E.?foreignbillofexchange?外国汇票F.C.?fixedcapital?固定资本F.C.?fixedcharges?固定费用F.C.?futurecontract?远期合同fc.?franc?法郎FCA?FellowoftheInstituteofCharteredAccou ntants?特许会计师学会会员FCG?foreigncurrencyguarantee?外币担保FCL?fullcontainerload?整货柜装载FCL/LCL?fullcontainerload/less(than)fullco ntainerload?整装/分卸FCR?forwarder'scargoreceipt?货运代理行收据FCT?forwardingagent'scertificateoftranspor t?货运代理行领货证fd.?fund?资金FDBmethod?fixedrateondecliningbalancem ethod?定率递减余额折旧法FDI?foreigndirectinvestment?外商直接投资FDIC?FederalDepositInsuranceCorporation?联邦储蓄保险公司FE?foreignexchange?外汇FE?futureexchange?远期外汇FF?Frenchfranc?法国法郎fib?freeintobarge?驳船上的交货价FIBC?financialinstitutionbuyercreditpolicy?金融机构买方信贷险FIFO?firstin,firstout?先进先出法fin.stadg.(stndg.)?financialstanding?资信状况fin.stat.(F/S)?financialstatement?财务报表fin.yr.?financialyear?财政年度FINA?followingitemsnotavailable?以下项目不可获得FIO?freeinandout?自由进出F.I.T?freeofincometax?免交所得税fl.?florin?盾娃哈哈?financeleaseguarantee?金融租赁担保flt.?flat?无利息FMV?fairmarketvalue?合理市价FO?freeout?包括卸货费在内的运费fo.?folio?对折、页码FOB?freeonboard?(启运港)船上交货、离岸价格FOBairport?FOBairport?(启运)机场交货(价)FOBST?freeonboardstowedandtrimming?包括清理及平仓的离岸价格FOCUS?FinancialandOperationsCombinedU niformSingleReport?财务经营综合报告FOK?fillorkill?要么买进或卖出,要么取消FOR?freeonrail(orroad)?铁路或(公路)上交货价for'd.,fwd?forward;forwarded?转递FOREX?foreignexchange?外汇FOS?freeonsteamer?蒸汽船上交货(价)FOUO?forofficialuseonly?仅用于公事FOW,f.o.w.?freeonwagon?(启运站)火车上交货(价)FOX?FuturesandOptionsExchange?期货和期权交易所FP?floatingpolicy?浮动政策FP?fullypaid?已全付的FRA?forwardrateagreement?远期利率协议FRCD?floatingratecertificateofdeposit?浮动利率存单frt.,frgt.?forward?期货、远期合约freecase?nochargeforcase?免费事例FREF?fixedrateexportfinance?固定利率出口融资frt.&grat.?freightandgratuity?运费及酬金Frt.fwd?freightforward?运费待付Frt.ppd?freightprepaid?运费已付FS?finalsettlement?最后结算FSR?feasibilitystudyreport?可行性研究报告FTW?freetradewharf?码头交易FTZ?freetradezone?自由贸易区fut.?futures?期货、将来FV?facevalue?面值FVA?fairvalueaccounting?合理价值法FWD?forward(exchange)contract?远期合约F.X.?foreignexchange?外汇FXbroker?foreignexchangebroker?外汇经纪人fxd?fixed?固定的FXRN?fixedratenote?定息票据FY?fiscalyear(financialyear)?财政(务)年度fy.pd.?fullypaid?全部付讫FYI?foryourinformation?供您参考Gg?gallon;grain;gram(s);gold?加仑;格令;克;金G.A.?generalagent?总代理商、总代理人GA?goahead?办理、可行GAAP?generalAcceptedAccountingPrinciple s?通用会计准则GAAS?GenerallyAcceptedAuditingStandard?通用审计标准GAC?GeneralAdministrationofCustoms?海关总署gal.,gall?gallon?加仑gas.?gasoline?汽油GATT?GeneralAgreementonTariffsandTrad e?关税及贸易总协定GCL?governmentconcessionalloan?政府优惠贷款GDP?grossdomesticproduct?国内生产总值gds.?goods?商品、货物GJ?generaljournal?普通日记帐GL?generalledger?总分类帐gm.?gram(s)?克GMP?graduatedpaymentmortgage?递增付款按揭GND?grossnationaldemand?国民总需求GNE?grossnationalexpeditures?国民支出总额GNP?grossnationalproduct?国民生产总值GOFO?goldforwardrate?黄金远期利率GP?grossprofit?毛利GPP?generalpurchasingpower?总购买能力gr.(grs.)wt.?grossweight?毛重GR?grossrevenue?毛收入GS?grosssales?销售总额GSP?generalisedsystemofpreferences?普惠制GTM?goodthismonth?本月有效GTW?goodthisweek?本星期有效HHAB?houseairbill?航空托运单HAWB?houseairwaybill?航空托运单HCA?historicalcostaccounting?历史成本会计hdqrs.?headquarters?总部hg.?hectogram?一百公克HIBOR?HongKongInterbankOfferedRate?香港银行同业拆借利率hifo?highest-in,first-out?高入先出法H.inD.C.?holderinduecourse?正当持票人Hi-Q?highquality?高质量HIRCS?highinterestratecurrencies?高利率货币hi-tech?hightechnology?高技术HKD?HongKongdollar?香港元HKI?HongKongIndex?香港指数hl.?hectoliter?百升hldg.?holding?控股Hon'd?honored?如期支付的HSCPI?HangSengConsumerPriceIndex?恒生消费价格指数HSI?HangSengIndex?恒生指数hwevr.?however?无论如何Hz?hertz?赫兹II.A.?intangibleassets?无形资产I&A?inventoryandallocations?库存和分配IAS?InternationalAccountingStandard?国际会计标准IB?investmentbanking?投资银行(业)I.B.?invoicebook?发票簿IBA?InternationalBankAssociation?国际银行家协会IBBR?interbankbidrate?银行间报价利率I.B.I?invoicebookinward?购货发票簿IBNR?incurredbutnotreported?已发生未报告I.B.O.?invoicebookoutward?销货发票簿IBOR?inter-bankofferedrate?银行间的拆借利率ICB?internationalcompetitivebidding?国际竞标ICIA?InternationalCreditInsuranceAssociati on?国际信用保险协会ICJ?InternationalCourtofJustice?国际法庭ICM?internationalcapitalmarket?国际资本市场ICONs?indexcurrencyoptionnotes?指数货币期权票据ICOR?incrementalcapital-outputratio?资本—产出增量比I.C.U.?InternationalCodeUsed?国际使用的电码IDB?industrialdevelopmentbond?工业发展债券IDB?Inter-AmericanDevelopmentBank?泛美开发银行IDB?inter-dealerbroker?交易商之间经纪人IDC?intangibledevelopmentcost?无形开发成本IDR?internationaldepositaryreceipt?国际寄存单据IE?indirectexport?间接出口I.F.?insufficientfund?存款不足IFB?invitationforbids?招标邀请I.G.?imperialgallon?英制加仑IL,I/L?importlicence?进口许可证ILC?irrevocableletterofcredit?不可撤销信用证IMF?InternationalMonetaryFund?国际货币基金组织imp.?import?进口,输入Inc.?incorporated?注册(有限)公司incl.?inclusive?包括在内incldd.?included?已包含在内incldg.?including?包含inl.haul?inlandhaulage?内陆运输费用INLO?inlieuof?代替Ins,ins.?insurance?保险inst.?instant?即期、分期付款Instal.,instal.?installment?分期付款Int.,int.?interest?利息inv.,Inv.?invoice?发票、付款通知intrans(I.T.)?intransit.?在(运输)途中inv.doc./attach.?invoicewithdocumentattac hed?附提货单的发票Inv't.,invt.?inventory?存货I-O?input-output?输入--输出IOU?Ioweyou?借据IOV?inter-officevoucher?内部传票IPN?industrialpromissorynote?工业汇票IPO?initialpublicoffering?首次发售股票IQ?importquota?进口配额IR?InlandRevenue?国内税收I.R.?inwardremittance?汇入款项IRA?individualretirementaccount?个人退休金帐户IRA?interestrateagreement?利率协议IRR?interestraterisk?利率风险IRR?internalrateofreturn?内部收益率irred.?irredeemable?不可赎回的IRS?interestrateswap?利率调期IS?InternationalSystem?公制度量衡ISIC?InternationalStandardIndustrialClassi fication?国际标准产业分类IT?informationtechnology?信息技术IT?internationaltolerance?国际允许误差I/T?incometax?所得税ITC?investmenttaxcredit?投资税收抵免ITO?InternationalTradeOrganization?国际贸易组织ITS?intermarkettradingsystem?跨市场交易系统IV?investmentvalue?投资价值JJ.,Jour.?journal?日记帐J.A.(J/A)?jointaccount?联合(共管)帐簿J.D.B.?journalday-book?分类日记帐J/F,j/f?journalfolio?日记帐页数J.V.?jointventure?合资经营企业J.V.?journalvoucher?分录凭单JVC?jointventurecompany?合资公司KK.D.?knockeddown?拆散K.D.?knockeddownprice?成交价格kg?kilogram?千克kilom.?kilometer?千米kv?kilovolt?千伏kw?kilowatt?千瓦KWH?kilowatt-hour?千瓦小时LL?listed(securities)?(证券)上市L.,(Led.)?ledger?分类帐L.?lira?里拉L.?liter?公升L.A.(L/A)?letterofauthority?授权书L.A.?liquidassets?流动资产L.B.?letterbook?书信备查簿LB?licensedbank?许可银行lb?pound?磅LC(L/C)?letterofcredit?信用证LCL/FCL?lessthancontainerload/fullcontain erload?拼装/整拆LCL/LCL?lessthancontainerload/lessthanco ntainerload?拼装/拼拆L.&D.?loansanddiscounts?放款及贴现L&D?lossanddamage?损失和损坏ldg.?loading?装(卸)货L/F?ledgerfolio?分类帐页数LG?letterofguarantee?保函Li.?liability?负债LI?letterofinterest(intent)?意向书lifo(LIFO)?lastin,firstout?后进先出法L.I.P.(LIP)?lifeinsurancepolicy?人寿保险单LIRCs?lowinterestratecurrencies?低利率货币L/M?listofmaterials?材料清单LMT?localmeantime?当地标准时间LRP?limitedrecourseproject?有限追索项目LRPF?limitedrecourseprojectfinancing?有限追索项目融资i.s.?lumpsum?一次付款总额i.s.t.?localstandardtime?当地标准时间LT?longterm?长期Ltd.?limited?有限(公司)Mm?million?百万M?maturedbond?到期的债券M?mega-?百万M?milli-?千分之一m.?meter,mile?米、英里M&A?merger&acquisition?兼并收购MA?myaccount?本人帐户Mat.?maturity?到期日Max.,max?maximum?最大量M.B.?memorandumbook?备忘录MBB?mortgage-backedbonds?抵押支持的债券MBO?managementbyobjectives?目标管理M/C?marginalcredit?信贷限额m/c?metalliccurrency?金属货币MCA?mutualcurrencyaccount?共同货币帐户MCP?mixedcreditprogram?混合信贷计划M/d?monthsafterdeposit?出票后......月M.D.?maturitydate?到期日M.D.(M/D)?memorandumofdeposit?存款(放)单M.D.?maliciousdamage?恶意损坏mdse.?merchandise?商品MEI?marginalefficiencyofinvestment?投资的边际效率mem.?memorandum?备忘录MERM?multilateralexchangeratemodel?多边汇率模型M.F.?mutualfunds?共同基金MF?mezzaninefinancing?过渡融资mfg.?manufacturing?制造的MFN?mostfavourednations?最惠国mfrs.?manufacturers?制造商mg?milligram?毫克M/I?marineinsurance?海险micro?onemillionthpart?百万分之一min?minimum?最低值、最小量MIP?monthlyinvestmentplan?月度投资计划Mk?mark?马克mks.?marks?商标mkt.?market?市场MLR?minimumlendingrate?最低贷款利率MLTG?medium-and-long-termguarantee?中长期担保M.M.?moneymarket?货币市场mm?millimeter?毫米MMDA?moneymarketdepositaccount?货币市场存款帐户MMI?majormarketindex?主要市场指数MNC?multinationalcorporation?跨(多)国公司MNE?multinationalenterprise?跨国公司MO(M.O.)?moneyorder?汇票mo.?month?月MOS?managementoperatingsystem?经营管理制度Mos.?months?月MP?marketprice?市价M/P?monthsafterpayment?付款后......月MPC?marginalpropensitytoconsume?边际消费倾向Mrge.(mtg.)?mortgage?抵押MRJ?materialsrequisitionjournal?领料日记帐MRO?maintenance,repairandoperation?维护、修理及操作MRP?manufacturer'srecommendedprice?厂商推荐价格MRP?materialrequirementplanning?原料需求计划MRP?monthlyreportofprogress?进度月报MRR?maintenance,repairandreplace?维护、修理和替换M/s?monthsofsight?见票后.......月msg?message?留言MT?mediumterm?中期M/T?mailtransfer?信汇mthly?monthly?每月MTI?medium-terminsurance?中期保险MTN?medium-termnote?中期票据MTU?metricunit?米制单位Nn.?net?净值N.A.?netassets?净资产n.a?notavailable?暂缺N.A.?non-acceptance?不承兑NA?notapplicable?不可行N.B.?notabene?注意NC?nocharge?免费N/C?netcapital?净资本n.d.?nodate?无日期N.D.?netdebt?净债务n.d.?non-delivery?未能到达ND?nextdaydelivery?第二天交割NDA?netdomesticasset?国内资产净值N.E.?netearnings?净收益n.e.?noeffects?无效n.e.?notenough?不足negb.?negotiable?可转让的、可流通的Neg.Inst.,N.I.?negotiableinstruments?流通票据nego.?negotiate?谈判N.E.S.?notelsewherespecified?未另作说明net.p.?netproceeds?净收入N/F?nofund?无存款NFD?nofixeddate?无固定日期NFS?notforsale?非卖品N.G.?netgain?纯收益NH?notheld?不追索委托N.I.?netincome?净收益N.I.?netinterest?净利息NIAT?netincomeaftertax?税后净收益NIFO?nextin,firstout?次进先出法nil?nothing?无NIM?netinterestmargin?净息差NIT?negativeincometax?负所得税N.L.?netloss?净损失NL?noload?无佣金n.m.?nauticalmile?海里NM?nomarks?无标记N.N.?noname?无签名NNP?netnationalproduct?国民生产净值NO.(no.)?number?编号、号数noa/c?noaccount?无此帐户NOP?netopenposition?净开头寸NOWa/c?negotiableorderofwithdrawal?可转让存单帐户N/P?netprofit?净利NP?noprotest?免作拒付证书N.P.?notespayable?应付票据NPC?nominalprotectioncoefficient?名义保护系数NPL?non-performingloan?不良贷款NPVmethod?netpresentvaluemethod?净现值法N.Q.A.?netquickassets?速动资产净额NQB?noqualifiedbidders?无合格投标人NR?norated?(信用)未分等级N/R?noresponsibility?无责任N.R.?notesreceivable?应收票据N.S.F.(NSF)?nosufficientfund?存款不足NSFcheck?nosufficientfundcheck?存款不足支票nt.wt.?netweight?净重NTA?nettangibleassets?有形资产净值NTBs?non-tariffsbarriers?非关税壁垒ntl?notimelost?立即NTS?nottoscale?不按比例NU?nameunknown?无名N.W.?networth?净值NWC?networkingcapital?净流动资本NX?notexceeding?不超过N.Y.?netyield?净收益NZ$?NewZealanddollar?新西兰元Oo?order?订单o.(O.)?offer?发盘、报价OA?openaccount?赊帐、往来帐o/a?onaccountof?记入......帐户o.a.?overall?全面的、综合的OAAS?operationalaccountingandanalysissy stem?经营会计分析制OB?otherbudgetary?其他预算O.B.?ordinarybusiness?普通业务O.B.(O/B)?orderbook?订货簿OB/OSindex?overbought/oversoldindex?超买超卖指数OBV?on-balancevolume?持平数量法o.c.?overcharge?收费过多OC?opencover?预约保险o/d,o.d.,(O.D.)?overdrawn?透支OD?overdraft?透支O/d?ondemand?见票即付O.E.(o.e.)?omissionexcepted?遗漏除外O.F.?oceanfreight?海运费OFC?openforcover?预约保险O.G.?ordinarygoods?中等品O.G.L.?OpenGeneralLicense?不限额进口许可证OI?originalissue?原始发行OII?overseasinvestmentinsurance?海外投资保险ok.?allcorrect?全部正确o.m.s.?outputpermanshift?每人每班产量O.P.?oldprice?原价格O.P.?openpolicy?不定额保险单opp?opposite?对方opt.?optional?可选择的ord.?ordinary?普通的OS?outofstock?无现货O/s?outstanding?未清偿、未收回的O.T.?overtime?加班OTC?over-the-countermarket?市场外交易市场OVA?overheadvarianceanalysis?间接费用差异分析OW?offerwanted?寻购启示OWE?optimumworkingefficiency?最佳工作效率oz?ounce(s)?盎司ozws.?otherwise?否则Pp?penny;??pence;per?便士;便士;每P?paidthisyear?该年(红利)已付p.?pint?品托(1/8加仑)P.A.?particularaverage;powerofattorney?单独海损;委托书P.A.?personalaccount;privateaccount?个人账户、私人账户p.a.,perann.?perannum?每年P&A?professionalandadministrative?职业的和管理的P&Iclause?protectionandindemnityclause?保障与赔偿条款P&L?profitandloss?盈亏,损益P/A?paymentofarrival?货到付款P/C?pricecatalog;pricecurrent?价格目录;现行价格P/E?price/earning?市盈率P/H?pier-to-house?从码头到仓库P/N?promissorynote?期票,本票P/P?postedprice?(股票等)的牌价PAC?putandcall?卖出和买入期权pat.?patent?专利PAYE?payasyouearn?所得税预扣法PAYE?payasyouenter?进入时支付PBT?profitbeforetaxation?税前利润pc?piece;prices?片,块;价格pcl.?parcel?包裹pd?paid?已付perpro.?perprocurationem?(拉丁)由...代理PF?projectfinance?项目融资PFD?preferredstock?优先股pk?peck?配克(1/4蒲式耳)PMO?postalmoneyorder?邮政汇票P.P.?paybackperiod?(投资的)回收期POE?portofentry?报关港口POPadvertising?point-of-purchaseadvertisi ng?购物点广告POR?payonreturn?收益PR?paymentreceived?付款收讫PS?postscript?又及PV?parvalue;presentvalue?面值;现值Qq.?quarto?四开,四开本Q.?quantity?数量QB?qualifiedbuyers?合格的购买者QC?qualitycontrol?质量控制QI?quarterlyindex?季度指数qr.?quarter?四分之一,一刻钟QT?questionedtrade?有问题交易QTIB?QualifiedTerminalInterestPropertyTr ust?附带可终止权益的财产信托quad.?quadruplicate?一式四份中的一份quotn.?quotation?报价q.v.?quodvide(whichsee)?参阅q.y.?query?查核RR?optionnottraded?没有进行交易的期权R.?response;registered;return?答复;已注册;收益r.?rate;rupee;ruble?比率;卢比;卢布RAD?researchanddevelopment?研究和开发RAM?diverseannuitymortgage?逆向年金抵押RAN?revenueanticipationnote?收入预期债券R&A?railandair?铁路及航空运输R&D?researchanddevelopment?研究与开发R&T?railandtruck?铁路及卡车运输R&W?railandwater?铁路及水路运输R/A?refertoacceptor?洽询(汇票)承兑人R/D?refertodrawer?(银行)洽询出票人RB?regularbudget?经常预算RCA?relativecomparativeadvantage?相对比较优势RCMM?registeredcompetitivemarketmaker?注册的竞争市场自营商rcvd.?received?已收到r.d.?runningdays=consecutivedays?连续日RDTC?registereddeposittakingcompany?注册接受存款公司Re.?subject?主题re.?withreferenceto?关于RECEIVEDB/L?receivedforshipmentbilloflad ing?待装云提单REER?realeffectiveexchangerate?实效汇率ref.?referee;reference;refer(red)?仲裁者;裁判;参考;呈递REO?realestateowned?拥有的不动产REP?importreplacement?进口替代REPOffice?representativeoffice?代办处,代表处REPO,repu,RP?RepurchaseAgreement?再回购协议req.?requisition?要货单,请求REVOLVER?revolvingletterofcredit?循环信用证REWR?readandwrite?读和写RIEs?recognizedinvestmentexchanges?认可的投资交易(所)Rl?roll?卷RLB?restrictedlicensebank?有限制牌照银行RM?remittance?汇款rm?room?房间RMB?RENMINBI?人民币,中国货币RMS?RoyalMailSteamer?皇家邮轮RMSD?RoyalMailSpecialDelivery?皇家邮政专递RMT?RailandMaritimeTransportUnion?铁路海运联盟ROA?returnonasset?资产回报率ROC?returnoncapital?资本收益率ROE?returnonequity?股本回报率ROI?returnoninvestment?投资收益ROP?registeredoptionprincipal?记名期权本金ro-ro?roll-on/roll-offvessel?滚装船ROS?returnonsales?销售收益率RPB?RecognizedProfessionalBody?认可职业(投资)机构RPI?retailpriceindex?零售物价指数RPM?resalepricemaintenance?零售价格维持措施(计划)rpt.?repeat?重复RRP?ReverseRepurchaseAgreement?逆回购协议RSL?ratesensitiveliability?利率敏感性债务RSVP?pleasereply?请回复RT?RoyaltyTrust?特权信托RTM?registeredtrademark?注册商标Rto?ratio?比率RTO?roundtripoperation?往返作业RTS?rateoftechnicalsubstitution?技术替代率RTW?righttowork?工作权利RUF?revolvingunderwritingfacility?循环式包销安排RYL?referringtoyourletter?参照你方来信RYT?referringtoyourtelex?参照你方电传SS?nooptionoffered?无期权出售S?splitorstockdivided?拆股或股息S?signed?已签字s?second;shilling?秒;第二;先令SA?semi-annualpayment?半年支付SA?SouthAfrica?南非SAA?specialarbitrageaccount?特别套作账户SAB?specialassessmentbond?特别估价债券sae?stampedaddressedenvelope?已贴邮票、写好地址的信封SAFE?StateAdministrationofForeignExchan ge?国家外汇管理局SAIC?StateAdministrationforIndustryandC ommerce?(中国)国家工商行政管理局SAP?StatementofAuditingProcedure?《审计程序汇编》SAR?SpecialAdministrativeRegion?特别行政区SAS?StatementofAuditingStandard?《审计准则汇编》SASE?self-addressedstampedenvelope?邮资已付有回邮地址的信封SAT?(China)StateAdministrationofTaxation?(中国)国家税务局SATCOM?satellitecommunication?卫星通讯SB?shortbill?短期国库券;短期汇票SB?salesbook;savingbond;savingsbank?售货簿;储蓄债券;储蓄银行SBC?SwissBankCorp.?瑞士银行公司SBIC?Small??BusinessInvestmentCorporat ion?小企业投资公司SBIP?smallbusinessinsurancepolicy?小型企业保险单SBLI?SavingsBankLifeInsurance?储蓄银行人寿保险SBN?StandardBookNumber?标准图书号SC?salescontract?销售合同sc?scilicetnamely?即SC?suppliercredit?卖方信贷SCF?suppliercreditfinance?卖方信贷融资Sch?schilling?(奥地利)先令SCIRR?specialCIRR?特别商业参考利率SCL?securitycharacteristicline?证券特征线SCORE?specialclaimonresidualequity?对剩余财产净值的特别要求权SD?standarddeduction?标准扣除额SDB?specialdistrictbond?特区债券SDBL?sightdraft,billofladingattached?即期汇票,附带提货单SDH?synchronousdigitalhierarchy?同步数字系统SDR?straightdiscountrate?直线贴现率SDRs?specialdrawingrights?特别提款权SE?shareholders'equity?股东产权SE?StockExchange?股票交易所。

与信用证有关的英语- []1.revocable L/C/irrevocable L/C 可撤销信用证/不可撤销信用证2.confirmed L/C/unconfirmed L/C 保兑信用证/不保兑信用证3.sight L/C/usance L/C 即期信用证/远期信用证4.transferable L/C(or)assignable L/C(or)transmissible L/C /untransferableL/C 可转让信用证/不可转让信用证5.divisible L/C/undivisible L/C 可分割信用证/不可分割信用证6.revolving L/C 循环信用证7.L/C with T/T reimbursement clause 带电汇条款信用证8.without recourse L/C/with recourse L/C 无追索权信用证/有追索权信用证9.documentary L/C/clean L/C 跟单信用证/光票信用证10.deferred payment L/C/anticipatory L/C 延付信用证/预支信用证11.back to back L/Creciprocal L/C 对背信用证/对开信用证12.traveller's L/C(or:circular L/C) 旅行信用证----Names of Parties Concerned1. opener 开证人(1)applicant 开证人(申请开证人)(2)principal 开证人(委托开证人)(3)accountee 开证人(4)accreditor 开证人(委托开证人)(5)opener 开证人(6)for account of Messrs 付(某人)帐(7)at the request of Messrs 应(某人)请求(8)on behalf of Messrs 代表某人(9)by order of Messrs 奉(某人)之命(10)by order of and for account of Messrs 奉(某人)之命并付其帐户(11)at the request of and for account of Messrs 应(某人)得要求并付其帐户(12)in accordance with instruction received from accreditors 根据已收到得委托开证人得指示2.beneficiary 受益人(1)beneficiary 受益人(2)in favour of 以(某人)为受益人(3)in one's favour 以……为受益人(4)favouring yourselves 以你本人为受益人3.drawee 付款人(或称受票人,指汇票)(1)to drawn on (or :upon) 以(某人)为付款人(2)to value on 以(某人)为付款人(3)to issued on 以(某人)为付款人4.drawer 出票人5.advising bank 通知行(1)advising bank 通知行(2)the notifying bank 通知行(3)advised through…bank 通过……银行通知(4)advised by airmail/cable through…bank 通过……银行航空信/电通知6.opening bank 开证行(1)opening bank 开证行(2)issuing bank 开证行(3)establishing bank 开证行7.negotiation bank 议付行(1)negotiating bank 议付行(2)negotiation bank 议付行8.paying bank 付款行9.reimbursing bank 偿付行10.the confirming bank 保兑行Amount of the L/C 信用证金额1. amount RMB¥… 金额:人民币2.up to an aggregate amount of Hongkong Dollars… 累计金额最高为港币……3.for a sum (or :sums) not exceeding a total of GBP… 总金额不得超过英镑……4.to the extent of HKD… 总金额为港币……5.for the amount of USD… 金额为美元……6.for an amount not exceeding total of JPY… 金额的总数不得超过……日元的限度----- The Stipulations for the shipping Documents1. available against surrender of the following documents bearing our credit number and the full name and address of the opener 凭交出下列注名本证号码和开证人的全称及地址的单据付款2.drafts to be accompanied by the documents marked(×)below 汇票须随附下列注有(×)的单据3.accompanied against to documents hereinafter 随附下列单据4.accompanied by following documents 随附下列单据5.documents required 单据要求6.accompanied by the following documents marked(×)in duplicate 随附下列注有(×)的单据一式两份7.drafts are to be accompanied by… 汇票要随附(指单据)……----Draft(Bill of Exchange)1.the kinds of drafts 汇票种类(1)available by drafts at sight 凭即期汇票付款(2)draft(s) to be drawn at 30 days sight 开立30天的期票(3)sight drafts 即期汇票(4)time drafts 远期汇票2.drawn clauses 出票条款(注:即出具汇票的法律依据)(1)all drafts drawn under this credit must contain the clause "Drafts drawn Under Bank of…credit No.…dated…" 本证项下开具的汇票须注明"本汇票系凭……银行……年……月……日第…号信用证下开具"的条款(2)drafts are to be drawn in duplicate to our order bearing the clause "Drawn under United Malayan Banking Corp.Bhd.Irrevocable Letter of Credit No.…dated July 12, 1978" 汇票一式两份,以我行为抬头,并注明"根据马来西亚联合银行1978年7月12日第……号不可撤销信用证项下开立"(3)draft(s) drawn under this credit to be marked:"Drawn under…Bank L/CNo.……Dated (issuing date o f credit)" 根据本证开出得汇票须注明"凭……银行……年……月……日(按开证日期)第……号不可撤销信用证项下开立"(4)drafts in duplicate at sight bearing the clauses"Drawn under…L/CNo.…dated…" 即期汇票一式两份,注明"根据……银行信用证……号,日期……开具"(5)draft(s) so drawn must be in scribed with the number and date of thisL/C 开具的汇票须注上本证的号码和日期(6)draft(s) bearing the clause:"Drawn under documentary creditNo.…(shown above) of…Bank" 汇票注明"根据……银行跟单信用证……号(如上所示)项下开立"---Invoice1. signed commercial invoice 已签署的商业发票(in duplicate 一式两in triplicate 一式三份in quadruplicate 一式四份in quintuplicate 一式五份in sextuplicate 一式六份in septuplicate 一式七份in octuplicate 一式八份in nonuplicate 一式九份in decuplicate 一式十份)2.beneficiary's original signed commercial invoices at least in 8 copiesissued in the name of the buyer indicating(showing/evidencing/specifying/declaration of) the merchandise, country of origin and any other relevant information. 以买方的名义开具、注明商品名称、原产国及其他有关资料,并经签署的受益人的商业发票正本至少一式八份3.Signed attested invoice combined with certificate of origin and value in 6copies as reuired for imports into Nigeria. 以签署的,连同产地证明和货物价值的,输入尼日利亚的联合发票一式六份4.beneficiary must certify on the invoice…have been sent to the accountee受益人须在发票上证明,已将……寄交开证人5.4% discount should be deducted from total amount of the commercialinvoice 商业发票的总金额须扣除4%折扣6. invoice must be showed: under A/P No.… date of expiry 19th Jan. 1981 发票须表明:根据第……号购买证,满期日为1981年1月19日7.documents in combined form are not acceptable 不接受联合单据bined invoice is not acceptable 不接受联合发票Bill of Loading ---提单1. full set shipping (company's) clean on board bill(s) of lading marked "Freight Prepaid" to order of shipper endorsed to … Bank, notifying buyers 全套装船(公司的)洁净已装船提单应注明"运费付讫",作为以装船人指示为抬头、背书给……银行,通知买方2.bills of lading made out in negotiable form 作成可议付形式的提单3.clean shipped on board ocean bills of lading to order and endorsed in blank marked "Freight Prepaid" notify: importer(openers,accountee) 洁净已装船的提单空白抬头并空白背书,注明"运费付讫",通知进口人(开证人)4.full set of clean "on board" bills of lading/cargo receipt made out to our order/to order and endorsed in blank notify buyers M/S … Co. calling for shipment from China to Hamburg marked "Freight prepaid" / "Freight Payable at Destination" 全套洁净"已装船"提单/货运收据作成以我(行)为抬头/空白抬头,空白背书,通知买方……公司,要求货物字中国运往汉堡,注明"运费付讫"/"运费在目的港付"5.bills of lading issued in the name of… 提单以……为抬头6.bills of lading must be dated not before the date of this credit and not later than Aug. 15, 1977 提单日期不得早于本证的日期,也不得迟于1977年8月15日7.bill of lading marked notify: buyer,"Freight Prepaid""Liner terms""received for shipment" B/L not acceptable 提单注明通知买方,"运费预付"按"班轮条件","备运提单"不接受8.non-negotiable copy of bills of lading 不可议付的提单副本-----Certificate of Origin1.certificate of origin of China showing 中国产地证明书stating 证明evidencing 列明specifying 说明indicating 表明declaration of 声明2.certificate of Chinese origin 中国产地证明书3.Certificate of origin shipment of goods of … origin prohibited 产地证,不允许装运……的产品4.declaration of origin 产地证明书(产地生明)5.certificate of origin separated 单独出具的产地证6.certificate of origin "form A" "格式A"产地证明书7.genetalised system of preference certificate of origin form "A" 普惠制格式"A"产地证明书-----Packing List and Weight List1.packing list deatiling the complete inner packing specification and contents of each package载明每件货物之内部包装的规格和内容的装箱单2.packing list detailing… 详注……的装箱单3.packing list showing in detail… 注明……细节的装箱单4.weight list 重量单5.weight notes 磅码单(重量单)6.detailed weight list 明细重量单7.weight and measurement list 重量和尺码单----Inspection Certificate1. certificate of weight 重量证明书2.certificate of inspection certifying quality & quantity in triplicate issued byC.I.B.C. 由中国商品检验局出具的品质和数量检验证明书一式三份3.phytosanitary certificate 植物检疫证明书4.plant quarantine certificate 植物检疫证明书5.fumigation certificate 熏蒸证明书6.certificate stating that the goods are free from live weevil 无活虫证明书(熏蒸除虫证明书)7.sanitary certificate 卫生证书8.health certificate 卫生(健康)证书9.analysis certificate 分析(化验)证书10.tank inspection certificate 油仓检验证明书11.record of ullage and oil temperature 空距及油温记录单12.certificate of aflatoxin negative 黄曲霉素检验证书13.non-aflatoxin certificate 无黄曲霉素证明书14.survey report on weight issued by C.I.B.C. 中国商品检验局签发之重量检验证明书15.inspection certificate 检验证书16.inspection and testing certificate issued by C.I.B.C. 中国商品检验局签发之检验证明书----Other Documents1. full tet of forwarding agents' cargo receipt 全套运输行所出具之货物承运收据2.air way bill for goods condigned to…quoting our credit number 以……为收货人,注明本证号码的空运货单3.parcel post receipt 邮包收据4.Parcel post receipt showing parcels addressed to…a/c accountee 邮包收据注明收件人:通过……转交开证人5.parcel post receipt evidencing goods condigned to…and quoting our credit number 以……为收货人并注明本证号码的邮包收据6.certificate customs invoice on form 59A combined certificate of value and origin for developing countries 适用于发展中国家的包括价值和产地证明书的格式59A海关发票证明书7.pure foods certificate 纯食品证书bined certificate of value and Chinese origin 价值和中国产地联合证明书9.a declaration in terms of FORM 5 of New Zealand forest produce import and export and regultions 1966 or a declaration FORM the exporter to the effect that no timber has been used in the packing of the goods, either declaration may be included on certified customs invoice 依照1966年新西兰林木产品进出口法格式5条款的声明或出口人关于货物非用木器包装的实绩声明,该声明也可以在海关发票中作出证明10.Canadian custtoms invoice(revised form)all signed in ink showing fair market value in currency of country of export 用出口国货币标明本国市场售价,并进行笔签的加拿大海关发票(修订格式)11.Canadian import declaration form 111 fully signed and completed 完整签署和填写的格式111加拿大进口声明书----The Stipulation for Shipping Terms1. loading port and destinaltion装运港与目的港(1)despatch/shipment from Chinese port to… 从中国港口发送/装运往……(2)evidencing shipment from China to…CFR by s teamer in transit Saudi Arabia not later than 15th July, 1987 of the goods specified below 列明下面的货物按成本加运费价格用轮船不得迟于1987年7月15日从中国通过沙特阿拉伯装运到……2.date of shipment 装船期(1)bills of lading must be dated not later than August 15, 1987 提单日期不得迟于1987年8月15日(2)shipment must be effected not later than(or on)July 30,1987 货物不得迟于(或于)1987年7月30日装运(3)shipment latest date… 最迟装运日期:……(4)evidencing shipment/despatch on or before… 列明货物在…年…月…日或在该日以前装运/发送(5)from China port to … not later than 31st August, 1987 不迟于1987年8月31日从中国港口至……3.partial shipments and transhipment 分运与转运(1)partial shipments are (not) permitted (不)允许分运(2)partial shipments (are) allowed (prohibited) 准许(不准)分运(3)without transhipment 不允许转运(4)transhipment at Hongkong allowed 允许在香港转船(5)partial shipments are permissible, transhipment is allowed except at… 允许分运,除在……外允许转运(6)partial/prorate shipments are perimtted 允许分运/按比例装运(7)transhipment are permitted at any port against, through B/lading 凭联运提单允许在任何港口转运13.exp iry (expiring) date… 满期日……14.…if negotiation on or before… 在……日或该日以前议付15.negoation must be on or before the 15th day of shipment 自装船日起15天或之前议付16.this credit shall remain in force until 15th August 197 in China 本证到1977年8月15日为止在中国有效17.th e credit is available for negotiation or payment abroad until… 本证在国外议付或付款的日期到……为止18.documents to be presented to negotiation bank within 15 days after shipment 单据需在装船后15天内交给议付行19.documents must be presented for negotiation within…days after the o n board date of bill of lading/after the date of issuance of forwarding agents' cargo receipts 单据需在已装船提单/运输行签发之货物承运收据日期后……天内提示议付-----The Guarantee of the Opening Bank1. we hereby engage with you that all drafts drawn under and in compliance with the terms of this credit will be duly honored 我行保证及时对所有根据本信用证开具、并与其条款相符的汇票兑付2.we undertake that drafts drawn and presented in conformity with the terms of this credit will be duly honoured 开具并交出的汇票,如与本证的条款相符,我行保证依时付款3.we hereby engage with the drawers, endorsers and bona-fide holders of draft(s) drawn under and in compliance with the terms of the credit that such draft(s) shall be duly honoured on due presentation and delivery of documents as specified (if drawn and negotiated with in the validity date of this credit) 凡根据本证开具与本证条款相符的汇票,并能按时提示和交出本证规定的单据,我行保证对出票人、背书人和善意持有人承担付款责任(须在本证有效期内开具汇票并议付)4.provided such drafts are drawn and presented in accordance with the terms of this credit, we hereby engage with the drawers, endorsors and bona-fide holders that the said drafts shall be duly honoured on presentation 凡根据本证的条款开具并提示汇票,我们担保对其出票人、背书人和善意持有人在交单时承兑付款5.we hereby undertake to honour all drafts drawn in accordance with the terms of this credit 所有按照本条款开具的汇票,我行保证兑付----In Reimbursement1.instruction to the negotiation bank 议付行注意事项(1)the amount and date of negotiation of each draft must be endorsed on reverse hereof by the negotiation bank 每份汇票的议付金额和日期必须由议付行在本证背面签注(2)this copy of credit is for your own file, please deliver the attached original to the beneficaries 本证副本供你行存档,请将随附之正本递交给受益人(3)without you confirmation thereon (本证)无需你行保兑(4)documents must be sent by consecutive airmails 单据须分别由连续航次邮寄(注:即不要将两套或数套单据同一航次寄出)(5)all original documents are to be forwarded to us by air mail and duplicate documents by sea-mail 全部单据的正本须用航邮,副本用平邮寄交我行(6)please despatch the first set of documents including three copies of commercial invoices direct to us by registered airmail and the second set by following airmail 请将包括3份商业发票在内的第一套单据用挂号航邮经寄我行,第二套单据在下一次航邮寄出(7)original documents must be snet by Registered airmail, and duplicate by subsequent airmail 单据的正本须用挂号航邮寄送,副本在下一班航邮寄送(8)documents must by sent by successive (or succeeding) airmails 单据要由连续航邮寄送(9)all documents made out in English must be sent to out bank in one lot 用英文缮制的所有单据须一次寄交我行2.method of reimbursement 索偿办法(1)in reimbursement, we shall authorize your Beijing Bank of China Head Office to debit our Head Office RMB Yuan account with them, upon receip t of relative documents 偿付办法,我行收到有关单据后,将授权你北京总行借记我总行在该行开立的人民币帐户(2)in reimbursement draw your own sight drafts in sterling on…Bank and forward them to our London Office, accompanied by your certificate that all terms of this letter of credit have been complied with 偿付办法,由你行开出英镑即期汇票向……银行支取。

LC信用证经典问题1. 银行是否接受出具日期早于信用证出具日期的单据,如果接受,前提条件是什么?答:接受。

UCP500第二十二条规定:除非信用证另有规定,银行将接受出单日期早于信用证日期的单据,但该单据必须在信用证和本惯例规定的期限内提交。

2. 什么时候银行才认为,运输单据上所包括的“CLEAN ON BOARD”的条件已经满足?答:如果提单上没有明确宣称货物及/或包装状况有缺陷的条款或批注,则为清洁;提单上已有ON BOARD日期,则满足。

3. BEFORE 15TH APRIL我公司提单签发日期4月15日,可否?答:可以。

4. L/C规定装运期为AFTER 15TH APRIL,1990 UNTIL 30TH,APRIL,1990,我实际提单日期为15TH APRIL 1990或30TH APRIL,1990是否可以?答:不可以。

5. L/C在FOB条件下,要求提单在运费条款中注明:FREIGHT PAYABLE AS PER CHARTER PARTY是否可以?为什么?答:这个L/C FOB条件下,应该是指散货租船而不是走集装箱柜(走几个柜的话没听说什么人会去签租船合同CHARTER PARTY的,当然也不需要AS PER CHARTER PARTY了),一般是由买方租船,买方和船公司之间会有一个CHARTER PARTY租船合同。

对于这种散货提单,信用证即使没有什么规定,但如果是以信用证结汇,银行内部也会对这种散货提单有自己的规定(不是信用证结汇则没有这么严),1. 必须打上AS PER CHARTER PARTY,2. 需要打上CHARTER PARTY 的日期,3. 需要船长或OWNER的签名。

(有时候也可以AGENT AS THE CARRIER)对于这种散货,因为货物是直接装上船的,不像走柜那样装到集装箱柜再装上船,所以船长对责任划分很在意,一点点毛病也要跳你,不然卸货时他也怕被收货人挑针眼。

贸易实务补充教材作者:马爱军(仅供本课程使用)贸易术语一、课前准备 --- 常见专业用语和词组T rade practice 贸易实务、ICC(International Chamber of Commerce)国际商会、incoterms 2010 2010年贸易术语解释通则、C ommercial documents 商业单据、book liner space订舱、carrier 承运人、freight 运费、M ake payment付款、export clearing 出口清关、S ymbolic delivery 象征性交货、D erived term 贸易术语变形、export (import) formality 出口(进口)手续、loading charges 装船费用、D uty (paid)unpaid关税(已付)未付、actual delivery 实际交货、Current version 当前版本、trade terms 贸易术语、二、贸易术语举例1. The price shall be 200 dollars per unit FOB N ew Y ork.2. USD16 per dozen CIF N ew Y ork total amount USD 160,000.3. GBP 50 per yard FOB Shanghai.4. USD 4.5 per dozen CIF M ontreal.5. USD 10.5 per piece CIF O saka.三、贸易术语案例(FOB)1、我国某公司以FOB条件出口一批冻鸡。

合同签订后接到买方来电,称租船较为困难,委托我方代为租船,有关费用由买方负担。

为了方便履行合同,我方接受了对方的要求。

但是到装运期,我方在规定装运港也无法租到合适的船,我方提出改变装运港但买方不同意,因此,到装运期满时,货仍未装船,因销售季节即将结束,买方来函以我方未按时租船履行交货义务为由撤销合同。