公司理财 习题库 Chap016

- 格式:doc

- 大小:135.50 KB

- 文档页数:21

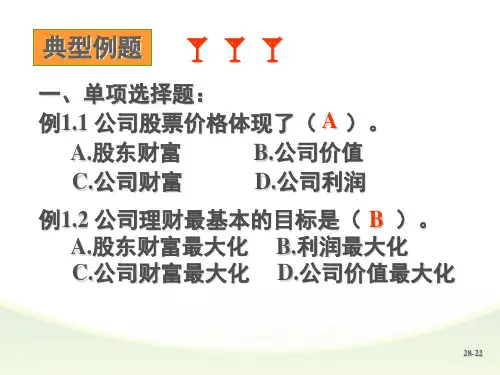

公司理财习题答案(五篇)第一篇:公司理财习题答案公司理财习题答案篇一:公司理财习题答案第一章公司理财导论1.代理问题谁拥有公司?描述所有者控制公司管理层的过程。

代理关系在公司的组织形式中存在的主要原因是什么?在这种环境下,可能会出现什么样的问题? 解:股东拥有公司;股东选举董事会,董事会选举管理层(股东→董事会→管理层);代理关系在公司的组织形式中存在的主要原因是所有权和控制权的分离;在这种情况下,可能会产生代理问题(股东和管理层可能因为目标不一致而使管理层可能追求自身或别人的利益最大化,而不是股东的利益最大化)。

2.非营利企业的目标假设你是一家非营利企业(或许是非营利医院)的财务经理,你认为什么样的财务管理目标将会是恰当的? 解:所有者权益的市场价值的最大化。

3.公司的目标评价下面这句话:管理者不应该只关注现在的股票价值,因为这么做将会导致过分强调短期利润而牺牲长期利润。

解:错误;因为现在的股票价值已经反应了短期和长期的的风险、时间以及未来现金流量。

4.道德规范和公司目标股票价值最大化的目标可能和其他目标,比如避免不道德或者非法的行为相冲突吗?特别是,你认为顾客和员工的安全、环境和社会的总体利益是否在这个框架之内,或者他们完全被忽略了?考虑一些具体的情形来阐明你的回答。

解:有两种极端。

一种极端,所有的东西都被定价。

因此所有目标都有一个最优水平,包括避免不道德或非法的行为,股票价值最大化。

另一种极端,我们可以认为这是非经济现象,最好的处理方式是通过政治手段。

一个经典的思考问题给出了这种争论的答案:公司估计提高某种产品安全性的成本是30万美元。

然而,该公司认为提高产品的安全性只会节省20万美元。

请问公司应该怎么做呢?”5.跨国公司目标股票价值最大化的财务管理目标在外国会有不同吗?为什么? 解:财务管理的目标都是相同的,但实现目标的最好方式可能是不同的(因为不同的国家有不同的社会、政治环境和经济制度)。

《公司理财》考试范围:第3~7章,第13章,第16~19章,其中第16章和18章为较重点章节。

书上例题比较重要,大家记得多多动手练练。

PS:书中课后例题不出,大家可以当习题练练~考试题型:1.单选题10分 2.判断题10分 3.证明题10分 4.计算分析题60分 5.论述题10分注:第13章没有答案第一章1.在所有权形式的公司中,股东是公司的所有者。

股东选举公司的董事会,董事会任命该公司的管理层。

企业的所有权和控制权分离的组织形式是导致的代理关系存在的主要原因。

管理者可能追求自身或别人的利益最大化,而不是股东的利益最大化。

在这种环境下,他们可能因为目标不一致而存在代理问题。

2.非营利公司经常追求社会或政治任务等各种目标。

非营利公司财务管理的目标是获取并有效使用资金以最大限度地实现组织的社会使命。

3.这句话是不正确的。

管理者实施财务管理的目标就是最大化现有股票的每股价值,当前的股票价值反映了短期和长期的风险、时间以及未来现金流量。

4.有两种结论。

一种极端,在市场经济中所有的东西都被定价。

因此所有目标都有一个最优水平,包括避免不道德或非法的行为,股票价值最大化。

另一种极端,我们可以认为这是非经济现象,最好的处理方式是通过政治手段。

一个经典的思考问题给出了这种争论的答案:公司估计提高某种产品安全性的成本是30美元万。

然而,该公司认为提高产品的安全性只会节省20美元万。

请问公司应该怎么做呢?”5.财务管理的目标都是相同的,但实现目标的最好方式可能是不同的,因为不同的国家有不同的社会、政治环境和经济制度。

6.管理层的目标是最大化股东现有股票的每股价值。

如果管理层认为能提高公司利润,使股价超过35美元,那么他们应该展开对恶意收购的斗争。

如果管理层认为该投标人或其它未知的投标人将支付超过每股35美元的价格收购公司,那么他们也应该展开斗争。

然而,如果管理层不能增加企业的价值,并且没有其他更高的投标价格,那么管理层不是在为股东的最大化权益行事。

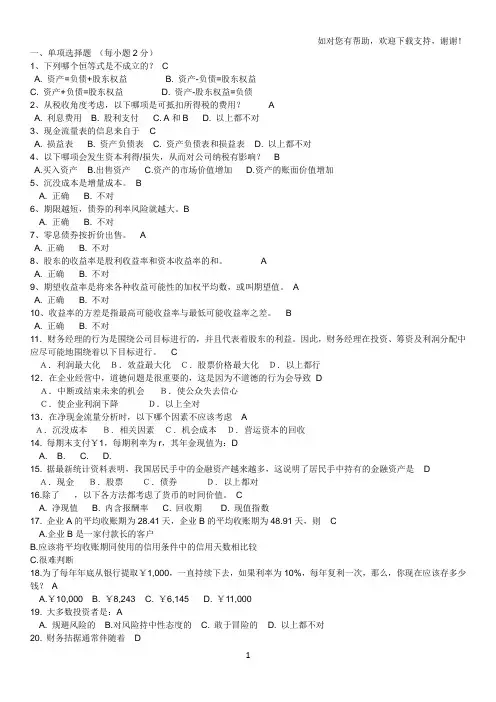

一、单项选择题(每小题2分)1、下列哪个恒等式是不成立的? CA. 资产=负债+股东权益B. 资产-负债=股东权益C. 资产+负债=股东权益D. 资产-股东权益=负债2、从税收角度考虑,以下哪项是可抵扣所得税的费用? AA. 利息费用B. 股利支付C. A和BD. 以上都不对3、现金流量表的信息来自于 CA. 损益表B. 资产负债表C. 资产负债表和损益表D. 以上都不对4、以下哪项会发生资本利得/损失,从而对公司纳税有影响? BA.买入资产B.出售资产C.资产的市场价值增加D.资产的账面价值增加5、沉没成本是增量成本。

BA. 正确B. 不对6、期限越短,债券的利率风险就越大。

BA. 正确B. 不对7、零息债券按折价出售。

AA. 正确B. 不对8、股东的收益率是股利收益率和资本收益率的和。

AA. 正确B. 不对9、期望收益率是将来各种收益可能性的加权平均数,或叫期望值。

AA. 正确B. 不对10、收益率的方差是指最高可能收益率与最低可能收益率之差。

BA. 正确B. 不对11.财务经理的行为是围绕公司目标进行的,并且代表着股东的利益。

因此,财务经理在投资、筹资及利润分配中应尽可能地围绕着以下目标进行。

CA.利润最大化B.效益最大化C.股票价格最大化D.以上都行12.在企业经营中,道德问题是很重要的,这是因为不道德的行为会导致 DA.中断或结束未来的机会B.使公众失去信心C.使企业利润下降D.以上全对13.在净现金流量分析时,以下哪个因素不应该考虑 AA.沉没成本B.相关因素C.机会成本D.营运资本的回收14. 每期末支付¥1,每期利率为r,其年金现值为:DA. B. C. D.15. 据最新统计资料表明,我国居民手中的金融资产越来越多,这说明了居民手中持有的金融资产是 DA.现金B.股票C.债券D.以上都对16.除了,以下各方法都考虑了货币的时间价值。

CA. 净现值B. 内含报酬率C. 回收期D. 现值指数17. 企业A的平均收账期为28.41天,企业B的平均收账期为48.91天,则 CA.企业B是一家付款长的客户B.应该将平均收账期同使用的信用条件中的信用天数相比较C.很难判断18.为了每年年底从银行提取¥1,000,一直持续下去,如果利率为10%,每年复利一次,那么,你现在应该存多少钱?AA.¥10,000B. ¥8,243C. ¥6,145D. ¥11,00019. 大多数投资者是:AA. 规避风险的B.对风险持中性态度的C. 敢于冒险的D. 以上都不对20. 财务拮据通常伴随着 DA. 客户和供应商的回避B. 以较低的售价出售产品C.大量的行政开支D. 以上全是21.公司里的代理问题是由代理关系产生的,代理成本在一定程度上 AA.减少了代理问题B.增大了代理问题C.对代理问题的解决没有用D.以上全不对22.半强式效率市场要求股票价格反映 BA. 股票价值的所有信息B. 股票价值的所有公开信息C. 过去股票价格的信息D. 以上全不对23. 最佳资本结构表明 AA. 企业应该适当举债B.资本结构与企业价值无关C. 企业举债越多越好D.以上全错24.仅考虑企业的融资成本的大小,企业通常融资的顺序为: CA. 留存收益、债务、发行新股B. 债务、发行新股、留存收益C.债务、留存收益、发行新股D. 留存收益、发行新股、债务25.可转换债券是一种融资创新工具,这是因为通常它具有: AA. 看涨期权和美式期权的特征B.看涨期权和欧式期权的特征C. 看跌期权和欧式期权的特征D. 看跌期权和美式期权的特征26.下列哪些项是不可以抵减所得税的。

筹资活动投资活动 营运活动 分配活动二、多项选择题1. 企业财务管理的原则有*( A.风险与收益均衡原则 C.责权利相结合原则2. 财务管理目标的主要观点有(A 利润最大化 )oB.资源优化配置原则 D.动态平衡原则)。

B.股东财富最大化 D.企业发展最大化3.财务管理的经济环境主要包括( )。

A.经济发展周期B.通货膨胀C.经济政策4. 股东财富最大化的优点()。

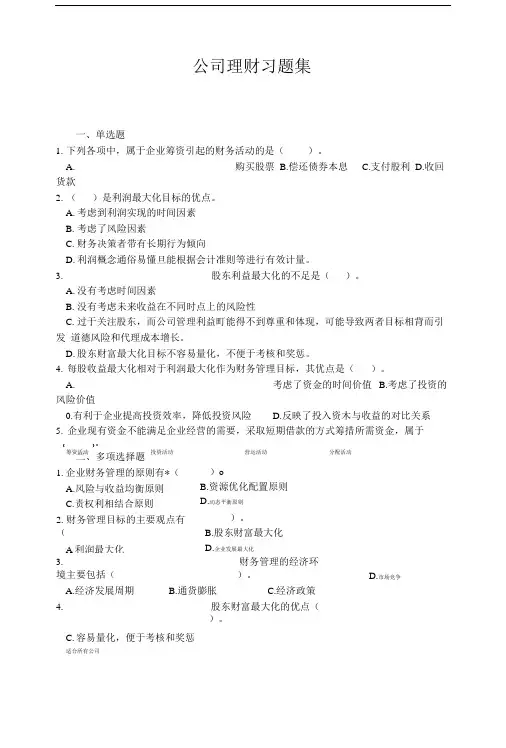

考虑了风险因素 D.市场竞争C. 容易量化,便于考核和奖惩适合所有公司公司理财习题集一、单选题1. 下列各项中,属于企业筹资引起的财务活动的是( )。

A.购买股票 B.偿还债券本息 C.支付股利 D.收回货款2. ()是利润最大化目标的优点。

A. 考虑到利润实现的时间因素B. 考虑了风险因素C. 财务决策者带有长期行为倾向D. 利润概念通俗易懂旦能根据会计准则等进行有效计量。

3.股东利益最大化的不足是()。

A. 没有考虑时间因素B. 没有考虑未来收益在不同时点上的风险性C. 过于关注股东,而公司管理利益町能得不到尊重和体现,可能导致两者目标相背而引发 道德风险和代理成本增长。

D. 股东财富最大化目标不容易量化,不便于考核和奖惩。

4. 每股收益最大化相对于利润最大化作为财务管理目标,其优点是( )。

A.考虑了资金的时间价值 B.考虑了投资的风险价值0.有利于企业提高投资效率,降低投资风险D.反映了投入资木与收益的对比关系5. 企业现有资金不能满足企业经营的需要,采取短期借款的方式筹措所需资金,属于()O)。

B. 银行贷款基准利率D.没有风险的社会平均资金利润率无风险利率为4%,市场上所有股票的平均报酬率为12%,则 )。

11%D. 20%第二章财务管理价值观念一、单选题1 .下列指标中不能反映单项资产的风险只能反映单项资产报酬的是( )。

A. 预期报酬率B.概率C.标准差D.方差2.假设以10%的年利率借得50 000元,投资于某个寿命为10年的项目,为使该项目成为有 利的项目,每年至少应收回的现金数额为( )元。

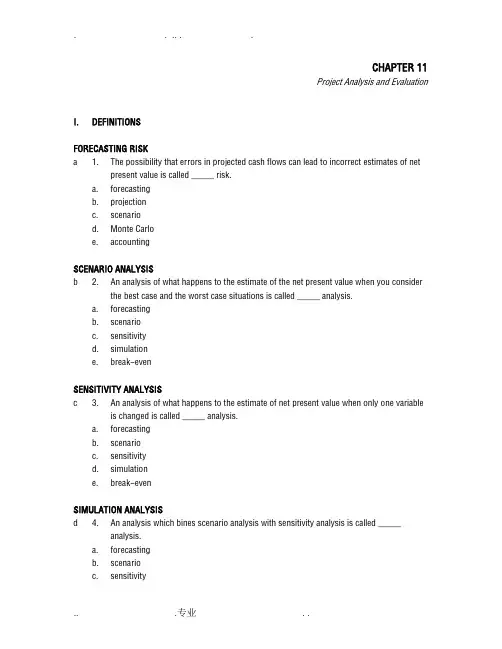

. . .. . ... .专业 . .CHAPTER 11 Project Analysis and EvaluationI. DEFINITIONSFORECASTING RISKa 1. The possibility that errors in projected cash flows can lead to incorrect estimates of netpresent value is called _____ risk.a. forecastingb. projectionc. scenariod. Monte Carloe. accountingSCENARIO ANALYSISb 2. An analysis of what happens to the estimate of the net present value when you considerthe best case and the worst case situations is called _____ analysis.a. forecastingb. scenarioc. sensitivityd. simulatione. break-evenSENSITIVITY ANALYSISc 3. An analysis of what happens to the estimate of net present value when only one variableis changed is called _____ analysis.a. forecastingb. scenarioc. sensitivityd. simulatione. break-evenSIMULATION ANALYSISd 4. An analysis which bines scenario analysis with sensitivity analysis is called _____analysis.a. forecastingb. scenarioc. sensitivityCHAPTER 11d. simulatione. break-evenBREAK-EVEN ANALYSISe 5. An analysis of the relationship between the sales volume and various measures ofprofitability is called _____ analysis.a. forecastingb. scenarioc. sensitivityd. simulatione. break-evenVARIABLE COSTSa 6. Variable costs:a. change in direct relationship to the quantity of output produced.b. are constant in the short-runregardless of the quantity of outputproduced.c. reflect the change in a variable when one more unit of output is produced.d. are subtracted from fixed costs to pute the contribution margin.e. form the basis that is used to determine the degree of operating leverage employed by afirm.FIXED COSTSb 7. Fixed costs:a. change as the quantity of output produced changes.b. are constant over the short-run regardless of the quantity of output produced.c. reflect the change in a variable when one more unit of output is produced.d. are subtracted from sales to pute the contribution margin.e. can be ignored in scenario analysis since they are constant over the life of a project.MARGINAL COSTSc 8. Marginal costs:a. are used solely for accounting and tax purposes.b. are equal to the total costs divided by the number of units produced.c. reflect changes created by producing one more unit of output.d. arethe total production expenses of a firm for some stated period of time.e. are the variable costs incurred over the entire life of a project.TOTAL COSTSd 9. Total costs:-a. must equal total revenue for a project.b. are constant no matter what quantity of output is produced.c. plus the change in retained earnings must equal total revenue.d. are the summation of all the expenses of a firm for a stated period of time.e. are equal to fixed costs plus the marginal cost.AVERAGE COSTSe 10. Average total cost:a. increases in direct proportion to an increase in output.b. is constant no matter what quantity of output is produced.c. changes as a function of the next unit of output produced.d. is the summation of all the expenses of a firm for a stated period of time.e. is equal to the average fixed cost plus the average variable cost.- - -可修编-CHAPTER 11MARGINAL REVENUEa 11. The change in revenue that occurs when one more unit of output is sold is called the_____ revenue.a. marginalb. averagec. totald. fixede. variableCONTRIBUTION MARGINb 12. The difference between the unit sales price and the variable cost per unit is called:a. operating leverage.b. the contribution margin.c. the gross profit.d. the net profit.e. the marginal revenue.ACCOUNTING BREAK-EVENc 13. The sales level that results in a project’s net ine exactly equaling zero is called the_____ break-even.a. operationalb. leveragedc. accountingd. cashe. financialCASH BREAK-EVENd 14. The sales level that results in a project’s operating cash flow exactly equaling zero iscalled the _____ break-even.a. operationalb. leveragedc. accountingd. cashe. financialFINANCIAL BREAK-EVENe 15. The sales level that results in a project’s net present value exactly equaling zero iscalled the _____ break-even.a. operational-b. leveragedc. accountingd. cashe. financialOPERATING LEVERAGEa 16. The degree to which a firm relies on fixed production costs is called its:a. operating leverage.b. financial break-even.c. contribution margin.d. cost sensitivity.e. fixed break-even.DEGREE OF OPERATING LEVERAGEb 17. The percentage change in operating cash flow relative to the percentage change inquantity sold is called the:a. marginal profit.b. degree of operating leverage.c. gross profit.d. net profit.e. financial break-even.SOFT RATIONINGc 18. The procedure of allocating a fixed amount of funds for capital spending to eachbusiness unit is called:a. marginal spending.b. average spending.c. soft rationing.d. hard rationing.e. marginal rationing.HARD RATIONINGe 19. The situation that exists when a firm has no means of financing any of its positive netpresent value projects is referred to as:a. financial stop-loss.b. contingency planning.c. marginal loss planning.d. soft rationing.e. hard rationing.- - -可修编-CHAPTER 11CAPITAL RATIONINGe 20. When firms do not have sufficient available financing to invest in all of the positivenetpresent value projects they have identified, _____ is (are) said to exist.a. excess financingb. contingency optionsc. strategic optionsd. managerial optionse. capital rationingII. CONCEPTSFORECASTING RISKa 21. Forecasting risk emphasizes the point that the soundness of any management decisionbased on the net present value of a proposed project is highly dependent upon the:a. accuracy of the cash flow projections used in the analysis.b. the time frame in which the project is implemented.c. amount of the net present value in relation to the length of the project’s life.d. level of capital spending in relation to the dollar amount of the net present value.e. frequency and duration of the project’s cash flows.SCENARIO ANALYSISd 22. The Better Bilt Co. is fairly cautious when considering new projects and thereforeanalyzes each project using the most optimistic, the most realistic, and the mostpessimistic value for each variable. The pany is conducting:a. forecasting research.b. sensitivity analysis.c. break-even analysis.d. scenario analysis.e. petitive analysis.SCENARIO ANALYSISb 23. Conducting scenario analysis helps managers see the:a. impact of an individual variable on the oute of a project.b. potential range of outes from a proposed project.c.changes in long-term debt over the course of a proposed project.d. possible range of market prices for their stock over the life of a project.e. allocation distribution of funds for capital projects under conditions of hard rationing.-SCENARIO ANALYSISd 24. When conducting a worst case scenario analysis, you should assume that:a. the sales quantity is at the upper end of your expectations.b. the highest sales price obtainable in the marketplace can be charged.c. no petition exists in the marketplace.d. your variable costs per unit are at the high end of the spectrum of possible prices.e. your fixed costs are constant and at the low end of your cost range.SCENARIO ANALYSISe 25. The base case values used in scenario analysis are the ones considered the most:a. optimistic.b.desired by management.c.pessimistic.d. conducive to creating a positive net present value.e.likely to occur.SCENARIO ANALYSISa 26. When you apply the highest sales price and the lowest costs in a project analysis, youare constructing:a. a best case scenario.b. a base case scenario.c. a worst case scenario.d. a sensitivity to fixed costs.e. a sensitivity to sales quantity.SCENARIO ANALYSISd 27. Which one of the following statements concerning scenario analysis of a proposedproject is correct?a. The worst case scenario determines the net present value of a project given that a natural disaster occurs.b. Scenario analysis assures a firm that the actual results of a project will lie within therange of returns as puted under the best and the worst case scenarios.c. Scenario analysis provides a clear signal to management to either accept or reject aproject.d. Scenario analysis only provides management with a glimpse of the possible range ofoutes that could result should a project be accepted.e. When the base case scenario results in a positive net present value, management can beassured that the proposed project will meet or exceed their expectations.- - -可修编-CHAPTER 11SENSITIVITY ANALYSISb 28. Sensitivity analysis helps you determine the:a. range of possible outes given possible ranges for every variable.b. degree to which the net present value reacts to changes in a single variable.c. net present value given the best and the worst possible situations.d. degree to which a project is reliant upon the fixed costs.e. level of variable costs in relation to the fixed costs of a project.SENSITIVITY ANALYSISe 29. Assume that you graph the changes in net present value against the changes in thevalue of a single variable used in a project. The steepness of the resulting functionillustrates the:a. degree of operating leverage within the project.b.trade-off of variable versus fixed costs utilized by the project.c. range of total outes possible from accepting a proposed project.d. contribution margin of the project at various levels of output.e.degree of sensitivity of a project’s oute to a single variable of the project.SENSITIVITY ANALYSISc 30.As the degree of sensitivity of a project to a single variable rises, the:a.lower the forecasting risk of the project.b. smaller the range of possible outes given a pre-defined range of values for theinput.c. more attention management should place on accurately forecasting the future value ofthat variable.d. lower the maximum potential value of the project.e. lower the maximum potential loss of the project.SENSITIVITY ANALYSISc 31.Sensitivity analysis is conducted by:a. holding all variables at their base level and changing the required rate of returnassigned to a project.b. changing the value of two variables to determine their interdependency.c. changing the value of a single variable and puting the resulting change in thecurrent value of a project.d. assigning either the best or the worst possible value to each variable and paring theresults to those achieved by the base case.e. managers after a project has been implemented to determine how each variable relatesto the level of output realized.-SENSITIVITY ANALYSISd 32. To ascertain whether the accuracy of the variable cost estimate for a project will havemuch effect on the final oute of the project, you should probably conduct _____analysis.a. leverageb. scenarioc. break-evend. sensitivitye. cash flowSIMULATIONd 33. Simulation analysis is based on assigning a _____ and analyzing the results.a. narrow range of values to a single variableb. narrow range of values to multiple variables simultaneouslyc. wide range of values to a single variabled. wide range of values to multiple variables simultaneouslye.single value to each of the variablesSIMULATIONe 34. The type of analysis that is most dependent upon the use of a puter is _____analysis.a. scenariob. break-evenc. sensitivityd. degree of operating leveragee. simulationVARIABLE COSTSd 35. Which one of the following is most likely a variable cost?a. office rentb. property taxesc. property insuranced.direct labor costse. management salariesVARIABLE COSTSa 36. Which of the following statements concerning variable costs is (are) correct?I. Variable costs minus fixed costs equal marginal costs.II.Variable costs are equal to zero when production is equal to zero.- - -可修编-CHAPTER 11III. An increase in variable costs increases the operating cash flow.IV.Variable costs can be ascertained with certainty when evaluating a proposed project.a. II onlyb. IV onlyc. I and III onlyd. II and IV onlye. I and II onlyVARIABLE COSTSa 37. All else constant, as the variable cost per unit increases, the:a. contribution margin decreases.b. sensitivity to fixed costs decreases.c. degree of operating leverage decreases.d. operating cash flow increases.e. net profit increases.FIXED COSTSb 38. As additional equipment is purchased, the level of fixed costs tends to _____ and thedegree of operating leverage tends to _____a. remain constant; remain constant.b. rise; rise.c. rise; fall.d. fall; rise.e. fall; fall.FIXED COSTSc 39.Fixed costs:I. are variable over long periods of time.II. must be paid even if production is halted.III. are generally affected by the amount of fixed assets owned by a firm.IV. per unit remain constant over a given range of production output.a. I and III onlyb. II and IV onlyc. I, II, and III onlyd. I, II, and IV onlye. I, II, III, and IVFIXED COSTSa 40. Which one of the following is a fixed cost in the short-run?a. a lease on a copierb. the cost of a machine operatorc. the cost of raw materialsd. the cost of building maintenancee. employee benefits for shop workersMARGINAL COSTe 41. Management wants to offer a “Thank You” sale to its customers by offering to selladditional units of a product at the lowest price possible without affecting their profits.The price management charges for these one-time sale units should be set equal to the:a. average variable cost.b. average total cost.c. average total revenue.d. marginal revenue.e. marginal cost.MARGINAL COSTd 42. The president of your firm would like to offer special sale prices to your bestcustomers under the following terms:1. The prices will apply only to units purchased in excess of those normallypurchased by the customer.2. The units purchased must be paid for in cash at the time of sale.3. The total quantity sold under these terms can not exceed the excess capacity of the firm.4. The net profit of the firm should not be affected either positively ornegatively.Given these conditions, the special sale price should be set equal to the:a. average variable cost.b. average total cost minus the marginal cost.c.sensitivity value of the variable cost.d. marginal cost.e. marginal cost minus the average fixed cost per unit.CONTRIBUTION MARGINc 43. The contribution margin must increase as:a. both the sales price and variable cost per unit increase.b. the fixed cost per unit declines.c. the gap between the sales price and the variable cost per unit widens.d. sales price per unit declines.- - -可修编-e. the sales price minus the fixed cost per unit increases.CONTRIBUTION MARGINc 44. Given a constant sales price, the larger the contribution margin, the:a. higher the variable cost per unit as a percentage of the sales price.b. higher the cash break-even point.c. lower the financial break-even point.d. lower the fixed costs as a percentage of the sales price.e. lower the gross profit per unit sold.ACCOUNTING BREAK-EVENa 45. Which of the following statements are correct concerning the accounting break-evenpoint?I. The net ine is equal to zero at the accounting break-even point.II. The net present value is equal to zero at the accounting break-even point.III. The quantity sold at the accounting break-even point is equal to the total fixed costs plus depreciation divided by the contribution margin.IV. The quantity sold at the accounting break-even point is equal to the total fixed costs divided by the contribution margin.a. I and III onlyb. I and IV onlyc. II and III onlyd. II and IV onlye. I, II, and IV onlyACCOUNTING BREAK-EVENe 46. At the accounting break-even level of sales, the operating cash flow is equal to:a. the net present value.b. fixed costs plus depreciation.c. the contribution margin times the quantity produced.d.fixed costs plus depreciation divided by the contribution margin.e. the depreciation expense.ACCOUNTING BREAK-EVENb 47. All else constant, the accounting break-even level of sales will decrease when the:a. fixed costs increase.b. depreciation expense decreases.c. contribution margin decreases.d. variable costs per unit increase.e. selling price per unit decreases.CASH BREAK-EVENb 48. Blumberg Industries has just pleted their analysis of a proposed project. Theresults show that if the project is accepted, the firm will lose an amount of moneywhich is exactly equal to their initial investment in the project. This means that:a. the firm should accept the project as long as they are confident of the assumptions usedin the analysis.b. the fixed costs per unit are exactly equal to the contribution margin at the projectedlevel of sales.c. sales are estimated at the financial break-even point.d. the estimated cash flow is equal to the depreciation expense.e. the project has a discounted payback period exactly equal to the life of the project.CASH BREAK-EVENb 49. Which one of the following statements is correct about a project with an estimatedinternal rate of return of negative 100 percent?a. The net present value of the cash inflows is exactly equal to the initial investment inthe project.b.The estimated sales volume is equal to the cash break-even level of sales.c. The estimated sales volume is equal to the financial break-even level of sales.d. The payback period is exactly equal to the life of the project.e. The net present value of the project is equal to zero.FINANCIAL BREAK-EVENd 50. The point where a project produces a rate of return equal to the required return isknown as the:a. point of zero operating leverage.b. cash break-even point.c. accounting break-even point.d. financial break-even point.e. internal break-even point.FINANCIAL BREAK-EVENb 51. Which of the following statements are correct concerning the financial break-evenpoint of a project?I. The present value of the cash inflows equals the amount of the initial investment.II. The payback period of the project is equal to the life of the project.III. The operating cash flow is at a level that produces a net present value of zero.- - -可修编-IV. The project never pays back on a discounted basis.a. I and II onlyb. I and III onlyc. II and IV onlyd. III and IV onlye. I, III, and IV onlyFINANCIAL BREAK-EVENd 52. You would like to know the minimal level of sales needed for a project to be acceptedbased on net present value. You should pute the sales quantity needed for the:a. degree of operating leverage to equal zero.b. net ine to equal zero.c. operating cash flow to equal zero.d. discounted payback period to equal the life of the project.e. payback period to equal the life of the project.OPERATING LEVERAGEa 53. You are considering a project that you believe is quite risky. To reduce anypotentially harmful results from accepting this project, you could:a.lower the degree of operating leverage.b.lower the contribution margin.c. increase the initial cash outlay.d. increase the fixed costs per unit while lowering the contribution margin.e. lower the operating cash flow of the project.OPERATING LEVERAGEd 54. Which of the following statements are generally correct about a project with a highdegree of operating leverage?I. The project has relatively high variable costs.II. The project is capital intensive.III. The amount of the initial cash outlay is generally relatively large in relation to the size of the project.IV. The forecasting risk of the project is high.a. I and II onlyb. III and IV onlyc. I, II, and III onlyd. II, III, and IV onlye. I, II, and IV onlyOPERATING LEVERAGEb 55. Which one of the following could lower the risk of a project by lowering the degree ofoperating leverage?a.You could hire temporary workers from an employment agency rather than hire part-time employees.b.You could use sub-contractors to produce sub-assemblies of your product rather than purchase new equipment to do the work in-house.c. You could lease equipment on a long-term basis rather than buy the equipment.d. You couldlower the projected selling price per unit.e.You could change the production method to one which relies more on fixed costs andless on variable costs than the current proposed method of production.SOFT RATIONINGd 56. The Delta Mare Co. has received requests from each of the departments within theirpany for capital investment funds for next year. The management of Delta Maredecides to allocate the available funds based on the net present value (NPV) of eachproposal starting with the highest NPV first. Management is following a practice known as _____ rationing.a. net present valueb. rate of returnc. capital improvementd. softe. hardHARD RATIONINGc 57. The management of the Wish We Could Co. has numerous requests on their desksfrom division managers. These requests are seeking funds for positive net presentvalue projects with projected rates of return ranging from 8 percent to 100percent. Management determines that they must deny all funding requests due to thefinancial situation of the pany. Management is apparently in a situation referred toas:a. accounting break-even.b. financial break-even.c. hard rationing.d. zero leverage.e. maximum capital intensity.III. PROBLEMSUse this information to answer questions 58 through 62.- - -可修编-The Adept Co. is analyzing a proposed project. The pany expects to sell 2,500units, give or take 10 percent. The expected variable cost per unit is $8 and the expected fixed costs are $12,500. Cost estimates are considered accurate within a plus or minus 5 percent range. The depreciation expense is $4,000. The sale price is estimated at $16 aunit, give or take 2 percent. The pany bases their sensitivity analysis on the base casescenario.SCENARIO ANALYSISd 58. What is the sales revenue under the best case scenario?a. $40,000b. $43,120c. $44,000d. $44,880e. $48,400SCENARIO ANALYSISd 59. What is the contribution margin under the base case scenario?a. $2.67b. $3.00c. $7.92d. $8.00e. $8.72SCENARIO ANALYSISc 60. What is the amount of the fixed cost per unit under the worst case scenario?a. $4.55b. $5.00c. $5.83d. $6.02e. $6.55SENSITIVITY ANALYSISb 61.The pany is conducting a sensitivity analysis on the sales price using a salesprice estimate of $17. Using this value, the earnings before interest and taxes will be:a. $4,000b. $6,000c. $8,500d. $10,000e. $18,500SENSITIVITY ANALYSISb 62. The pany conducts a sensitivity analysis using a variable cost of $9. The totalvariable cost estimate will be:a. $21,375b. $22,500c. $23,625d. $24,125e. $24,750Use this information to answer questions 63 through 67.The Can-Do Co. is analyzing a proposed project. The pany expects to sell 12,000units, give or take 4 percent. The expected variable cost per unit is $7 and the expectedfixed cost is $36,000. The fixed and variable cost estimates are considered accuratewithin a plus or minus 6 percent range. The depreciation expense is $30,000.The tax rateis 34 percent. The sale price is estimated at $14 a unit, give or take 5 percent.SCENARIO ANALYSISa 63. What is the earnings before interest and taxes under the base case scenario?a. $18,000b. $24,000c. $36,000d. $48,000e. $54,000SCENARIO ANALYSISc 64. What is the earnings before interest and taxes under a best case scenario?a. $22,694.40b. $24,854.40c. $37,497.60d. $52,694.40e. $67,947.60SCENARIO ANALYSISc 65. What is the net ine under the worst case scenario?a. -$566.02b. -$422.40- - -可修编-c. -$278.78d. $3,554.50e. $5,385.60SENSITIVITY ANALYSISd 66. What is the operating cash flowfor a sensitivity analysis using total fixed costs of $32,000?a. $14,520b. $16,520c. $22,000d. $44,520e. $52,000SENSITIVITY ANALYSISd 67. What is the contribution margin for a sensitivity analysis using a variable cost per unit of $8?a. $3b. $4c. $5d. $6e. $7VARIABLE COSTc 68. A firm is reviewing a project with labor cost of $8.90 per unit, raw materials cost of $21.63 a unit, and fixed costs of $8,000 a month. Sales are projected at 10,000 units over the three-month life of the project. What are the total variable costs of the project?a. $216,300b. $297,300c. $305,300d. $313,300e. $329,300VARIABLE COSTd 69. A project has earnings before interest and taxes of $5,750, fixed costs of $50,000, aselling price of $13 a unit, and a sales quantity of 11,500 units. Depreciation is $7,500.What is the variable cost per unit?a. $6.75b. $7.00c. $7.25d. $7.50e. $7.75FIXED COSTb 70. At a production level of 5,600 units a project has total costs of $89,000. The variablecost per unit is $11.20. What is the amount of the total fixed costs if the productionlevel is increased to 6,100 units without increasing the total fixed assets?a. $24,126b. $26,280c. $27,090d. $27,820e. $28,626FIXED COSTe 71. A firm is considering a project with a cash break-even point of 13,500 units. Theselling price is $13 a unit and the variable cost per unit is $7. What is the projectedamount of fixed costs?a. $64,000b. $70,500c. $74,500d. $78,000e. $81,000MARGINAL COSTb 72.Ted’s Sleds produces sleds at an average variable cost per unit of $39.18 whenproduction quantity is 1,250 units. When production increases to 1,251 units theaverage variable cost declines to $39.16. What is the minimal price that Ted’s Sledscan charge for the 1,251st sled without affecting their net profits?a. $13.89b. $14.16c. $14.21d. $14.37e. $14.44CONTRIBUTION MARGINc 73. Wilson’s Meats has puted their fixed costs to be $.60 for every pound of meat- - -可修编-they sell given an average daily sales level of 500 pounds. They charge $3.89 per poundof top-grade ground beef. The variable cost per pound is $2.99. What is the contributionmargin per pound of ground beef sold?a. $.30b. $.60c. $.90d. $2.99e. $3.89CONTRIBUTION MARGINe 74. Ralph and Emma’s is considering a project with total sales of $17,500, total variablecosts of $9,800, total fixed costs of $3,500, and estimated production of 400 units. The depreciation expense is $2,400 a year. What is the contribution margin per unit?a. $4.50b. $10.50c. $14.14d. $19.09e. $19.25ACCOUNTING BREAK-EVENa 75. You are considering a new project. The project has projected depreciation of $720,fixed costs of $6,000, and total sales of $11,760. The variable cost per unit is$4.20. What is the accounting break-even level of production?a. 1,200 unitsb. 1,334 unitsc. 1,372 unitsd. 1,889 unitse. 1,910 unitsACCOUNTING BREAK-EVENb 76.The accounting break-even production quantity for a project is 5,425 units. The fixedcosts are $31,600 and the contribution margin is $6. What is the projecteddepreciation expense?a. $700b. $950c. $1,025d. $1,053e. $1,100。

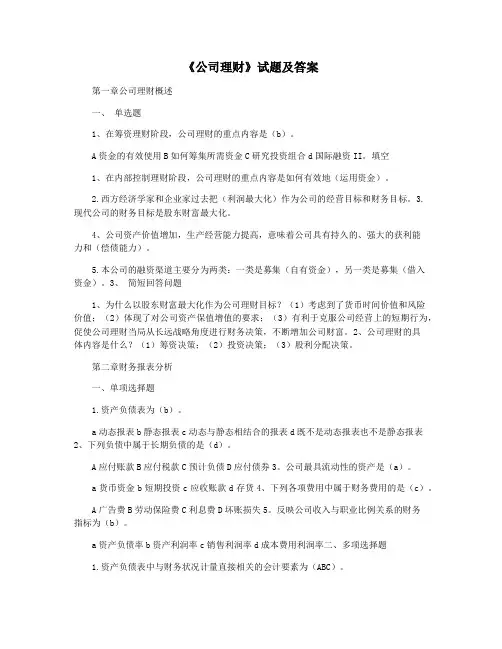

《公司理财》试题及答案第一章公司理财概述一、单选题1、在筹资理财阶段,公司理财的重点内容是(b)。

A资金的有效使用B如何筹集所需资金C研究投资组合d国际融资II。

填空1、在内部控制理财阶段,公司理财的重点内容是如何有效地(运用资金)。

2.西方经济学家和企业家过去把(利润最大化)作为公司的经营目标和财务目标。

3.现代公司的财务目标是股东财富最大化。

4、公司资产价值增加,生产经营能力提高,意味着公司具有持久的、强大的获利能力和(偿债能力)。

5.本公司的融资渠道主要分为两类:一类是募集(自有资金),另一类是募集(借入资金)。

3、简短回答问题1、为什么以股东财富最大化作为公司理财目标?(1)考虑到了货币时间价值和风险价值;(2)体现了对公司资产保值增值的要求;(3)有利于克服公司经营上的短期行为,促使公司理财当局从长远战略角度进行财务决策,不断增加公司财富。

2、公司理财的具体内容是什么?(1)筹资决策;(2)投资决策;(3)股利分配决策。

第二章财务报表分析一、单项选择题1.资产负债表为(b)。

a动态报表b静态报表c动态与静态相结合的报表d既不是动态报表也不是静态报表2、下列负债中属于长期负债的是(d)。

A应付账款B应付税款C预计负债D应付债券3。

公司最具流动性的资产是(a)。

a货币资金b短期投资c应收账款d存货4、下列各项费用中属于财务费用的是(c)。

A广告费B劳动保险费C利息费D坏账损失5。

反映公司收入与职业比例关系的财务指标为(b)。

a资产负债率b资产利润率c销售利润率d成本费用利润率二、多项选择题1.资产负债表中与财务状况计量直接相关的会计要素为(ABC)。

a资产b负债c所有者权益d成本费用e收入利润2、与利润表中经营成果的计量有直接联系的会计要素有(bcd)。

资产B收入C成本和费用D利润E所有者权益iii填写空白1、资产的实质是(经济资源)。

2.公司所有者权益金额为(资产)减去(负债)后的余额。

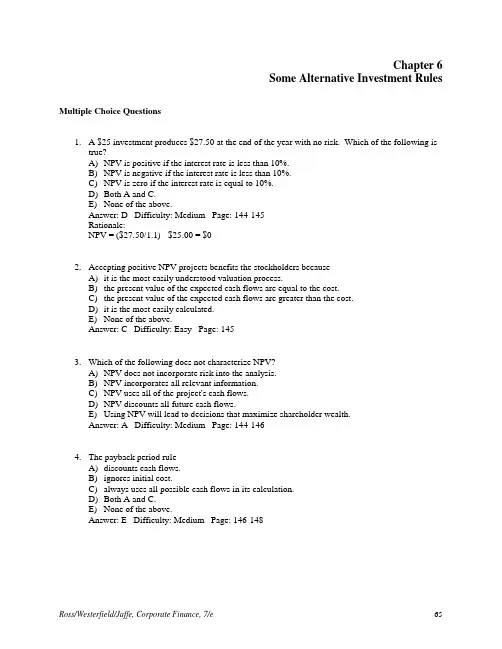

Chapter 6Some Alternative Investment Rules Multiple Choice Questions1. A $25 investment produces $27.50 at the end of the year with no risk. Which of the following istrue?A) NPV is positive if the interest rate is less than 10%.B) NPV is negative if the interest rate is less than 10%.C) NPV is zero if the interest rate is equal to 10%.D) Both A and C.E) None of the above.Answer: D Difficulty: Medium Page: 144-145Rationale:NPV = ($27.50/1.1) - $25.00 = $02. Accepting positive NPV projects benefits the stockholders becauseA) it is the most easily understood valuation process.B) the present value of the expected cash flows are equal to the cost.C) the present value of the expected cash flows are greater than the cost.D) it is the most easily calculated.E) None of the above.Answer: C Difficulty: Easy Page: 1453. Which of the following does not characterize NPV?A) NPV does not incorporate risk into the analysis.B) NPV incorporates all relevant information.C) NPV uses all of the project's cash flows.D) NPV discounts all future cash flows.E) Using NPV will lead to decisions that maximize shareholder wealth.Answer: A Difficulty: Medium Page: 144-1464. The payback period ruleA) discounts cash flows.B) ignores initial cost.C) always uses all possible cash flows in its calculation.D) Both A and C.E) None of the above.Answer: E Difficulty: Medium Page: 146-1485. The payback period rule accepts all investment projects in which the payback period for the cashflows isA) equal to the cutoff point.B) greater than the cutoff point.C) less than the cutoff point.D) positive.E) None of the above.Answer: C Difficulty: Easy Page: 1476. Consider an investment with an initial cost of $20,000 and is expected to last for 5 years. Theexpected cash flow in years 1 and 2 are $5,000, in years 3 and 4 are $5,500 and in year 5 is $1,000.The total cash inflow is expected to be $22,000 or an average of $4,400 per year. Compute the payback period in years.A) 3.18 yearsB) 3.82 yearsC) 4.00 yearsD) 4.55 yearsE) None of the above.Answer: B Difficulty: Medium Page: 146-147Rationale:Payback Period = ($5,000 + $5,000 + $5,500 = $15,500 for 3 years; remainder $20,000 $15,500 = 4,500. $4,500/$5,500 = .81818 = .82) = Payback Period = 3.82 years7. An investment project is most likely to be accepted by the payback period rule and not accepted bythe NPV rule if the project hasA) a large initial investment with moderate positive cash flows over a very long period of time.B) a very large negative cash flow at the termination of the project.C) most of the cash flows at the beginning of the project.D) All projects approved by the payback period rule will be accepted by the NPV rule.E) The payback period rule and the NPV rule cannot be used to evaluate the same type of projects.Answer: B Difficulty: Medium Page: 1478. The payback period rule is a convenient and useful tool becauseA) it provides a quick estimate of how rapidly the initial investment will be recouped.B) results of a short payback rule decision will be quickly seen.C) it does not take into account time value of money.D) All of the above.E) None of the above.Answer: D Difficulty: Medium Page: 146-1489. An investment with an initial cost of $15,000 produces cash flows of $5,000 annually for 5 years. Ifthe cash flow is evenly spread out over the year and the firm can borrow at 10%, the discounted payback period is _____ years.A) 3B) 3.2C) 3.75D) 4E) 5Answer: C Difficulty: Medium Page: 149Rationale:Discounted Payback: A.1,n10. An investment project has the cash flow stream of $-250, $75, $125, $100, and $50. The cost ofcapital is 12%. What is the discount payback period?A) 3.15 yearsB) 3.38 yearsC) 3.45 yearsD) 3.60 yearsE) 4.05 yearsAnswer: B Difficulty: Medium Page: 149Rationale:23 43 yr. CF: $250 - $66.96 - $99.65 - $71.18 = $12.21 + Fraction = $12.21/$31.78 = .3811. The discounted payback period ruleA) considers the time value of money.B) discounts the cutoff point.C) ignores uncertain cash flows.D) is preferred to the NPV rule.E) None of the above.Answer: A Difficulty: Easy Page: 14912. The payback period ruleA) determines a cutoff point so that all projects accepted by the NPV rule will be accepted by thepayback period rule.B) determines a cutoff point so that depreciation is just equal to positive cash flows in the paybackyear.C) requires an arbitrary choice of a cutoff point.D) varies the cutoff point with the interest rate.E) Both A and D.Answer: C Difficulty: Easy Page: 14713. The average accounting return is determined byA) dividing the yearly cash flows by the investment.B) dividing the average cash flows by the investment.C) dividing the average net income by the average investment.D) dividing the average net income by the initial investment.E) dividing the net income by the cash flow.Answer: C Difficulty: Medium Page: 15014. The investment decision rule that relates average net income to average investment is theA) discounted cash flow method.B) average accounting return method.C) average payback method.D) average profitability index.E) None of the above.Answer: B Difficulty: Easy Page: 15015. Modified internal rate of returnA) handles the multiple IRR problem by combining cash flows until only one change in signchange remains.B) requires the use of a discount rate.C) does not require the use of a discount rate.D) Both A and B.E) Both A and C.Answer: D Difficulty: Medium Page: 157-15816. The shortcoming(s) of the average accounting return (AAR) method is (are)A) the use of net income instead of cash flows.B) the pattern of income flows has no impact on the AAR.C) there is no clear-cut decision rule.D) All of the above.E) None of the above.Answer: D Difficulty: Medium Page: 15117. The two fatal flaws of the internal rate of return rule areA) arbitrary determination of a discount rate and failure to consider initial expenditures.B) arbitrary determination of a discount rate and failure to correctly analyze mutually exclusiveinvestment projects.C) arbitrary determination of a discount rate and the multiple rate of return problem.D) failure to consider initial expenditures and failure to correctly analyze mutually exclusiveinvestment projects.E) failure to correctly analyze mutually exclusive investment projects and the multiple rate ofreturn problem.Answer: E Difficulty: Medium Page: 154-15618. A mutually exclusive project is a project whoseA) acceptance or rejection has no effect on other projects.B) NPV is always negative.C) IRR is always negative.D) acceptance or rejection affects other projects.E) cash flow pattern exhibits more than one sign change.Answer: D Difficulty: Easy Page: 15419. A project will have more than one IRR ifA) the IRR is positive.B) the IRR is negative.C) the NPV is zero.D) the cash flow pattern exhibits more than one sign change.E) the cash flow pattern exhibits exactly one sign change.Answer: D Difficulty: Easy Page: 15620. Using internal rate of return, a conventional project should be accepted if the internal rate of returnisA) equal to the discount rate.B) greater than the discount rate.C) less than the discount rate.D) negative.E) positive.Answer: B Difficulty: Easy Page: 15221. An investment cost $10,000 with expected cash flows of $3,000 for 5 years. The discount rate is15.2382%. The NPV is ___ and the IRR is ___ for the project.A) $0; 15.2382%.B) $3.33; 27.2242%.C) $5,000; 0%.D) Can not answer without one or the other value as input.E) None of the above.Answer: A Difficulty: Medium Page: 145 - 15322. The internal rate of return may be defined asA) the discount rate that makes the NPV cash flows equal to zero.B) the difference between the market rate of interest and the NPV.C) the market rate of interest less the risk-free rate.D) the project acceptance rate set by management.E) None of the above.Answer: A Difficulty: Easy Page: 15223. The Balistan Rug Company is considering investing in a new loom that will cost $12,000. The newloom will create positive end of year cash flow of $5,000 for each of the next 3 years. The internal rate of return for this project isA) 10%.B) 11%.C) 12%.D) 13%.E) 14%.Answer: C Difficulty: Medium Page: 15324. The Carnation Chemical Company is investing in an incinerator to dispose of waste. Theincinerator costs $2.5 million and will generate end-of-year cash of $1 million for the next 3 years.The internal rate of return for this project isA) 6.4%.B) 8.6%.C) 9.7%.D) 10.4%.E) 12.0%.Answer: C Difficulty: Medium Page: 15325. The graph of NPV and IRR showsA) the NPV at different discount rates.B) the NPV of 0 at the IRR as NPV cuts the horizontal axis.C) the NPV at a 0% discount rateD) All of the above.E) None of the above.Answer: D Difficulty: Medium Page: 153-15426. Two sign changes in the cash flows results in how many internal rates of return?A) 0B) 1C) 2D) 3E) 4Answer: C Difficulty: Medium Page: 15627. Which of the following correctly orders the investment rules of average accounting return (AAR),internal rate of return (IRR), and net present value (NPV) from the most desirable to the leastdesirable?A) AAR, IRR, NPVB) AAR, NPV, IRRC) IRR, AAR, NPVD) NPV, AAR, IRRE) NPV, IRR, AARAnswer: E Difficulty: Easy Page: 144-15828. A project will have only one internal rate of return ifA) all cash flows after the initial expense are positive.B) average accounting return is positive.C) net present value is negative.D) net present value is positive.E) net present value is zero.Answer: A Difficulty: Easy Page: 152-15729. LaPorte Company is considering a project that would involve an initial cash outflow of $1,000. Atthe end of year 1, the cash inflow is $1,500 and at the end of year 2, there is another cash outflow of $200. Calculate the modified internal rate of return if the cost of capital is 10%.A) 22.1%B) 27.6%C) 31.8%D) 35.2%E) None of the above within 1 percentage point.Answer: C Difficulty: Medium Page: 157-158Rationale:30. The problem of multiple IRRs can occur whenA) there is only one sign change in the cash flows.B) the first cash flow is always positive.C) the cash flows decline over the life of the project.D) there is more than one sign change in the cash flows.E) None of the above.Answer: D Difficulty: Medium Page: 15631. The elements that cause problems with the use of the IRR in projects that are mutually exclusive areA) the discount rate and scale problems.B) timing and scale problems.C) the discount rate and timing problems.D) scale and reversing flow problems.E) timing and reversing flow problems.Answer: B Difficulty: Medium Page: 159-16332. If there is a conflict between mutually exclusive projects due to the IRR, one shouldA) drop the two projects immediately.B) spend more money on gathering information.C) depend on the NPV as it will always provide the most value.D) depend on the AAR because it does not suffer from these same problems.E) None of the above.Answer: C Difficulty: Easy Page: 159-16333. The profitability index is the ratio ofA) average net income to average investment.B) internal rate of return to current market interest rate.C) net present value of cash flows to internal rate of return.D) net present value of cash flows to average accounting return.E) present value of cash flows to initial investment cost.Answer: E Difficulty: Easy Page: 16434. Under capital rationing the profitability index is used to select investments by itsA) excess profit to achieve the highest payoff.B) reward per dollar cost to achieve the highest incremental NPV.C) incremental IRR to maximize the total rate of return.D) capital usage rate to stay within budget.E) None of the above.Answer: B Difficulty: Medium Page: 16535. Which of the following statement is true?A) One must know the discount rate to compute the NPV of a project but one can compute the IRRwithout referring to the discount rate.B) One must know the discount rate to compute the IRR of a project but one can compute the NPVwithout referring to the discount rate.C) Payback accounts for time value of money.D) There will always be one IRR regardless of cash flows.E) Average accounting return is the ratio of total assets to total net income.Answer: A Difficulty: Easy Page: 16336. Graham and Harvey (2001) found that ___ and ___ were the two most popular capital budgetingmethods.A) Internal Rate of Return; Payback PeriodB) Internal Rate of Return; Net Present ValueC) Net Present Value; Payback PeriodD) Modified Internal Rate of Return; Internal Rate of ReturnE) Modified Internal Rate of Return; Net Present ValueAnswer: B Difficulty: Easy Page: 166Essay Questions37. The Ziggy Trim and Cut Company can purchase equipment on sale for $4,300. The asset has athree-year life, will produce a cash flow of $1,200 in the first and second year, and $3,000 in the third year. The interest rate is 12%. Calculate the project's payback. Also, calculate project's IRR.Should the project be taken? Check your answer by computing the project's NPV.Difficulty: Medium Page: 146; 152Answer:Payback - 2.63 years.IRR = 10.41%. Do not take project as IRR < 12%Reject the project NPV = ($136.60)38. The Ziggy Trim and Cut Company can purchase equipment on sale for $4,300. The asset has athree-year life, will produce a cash flow of $1,200 in the first and second year, and $3,000 in the third year. The interest rate is 12%. Calculate the project's Discounted Payback and Profitability Index assuming end of year cash flows. Should the project be taken? If the Average Accounting Return was positive, how would this affect your decision?Difficulty: Medium Page: 149,150,152Answer:Time 0 – Cash flows = $-4,300, Present Value of Cash flows = $-4,300Time 1 and 2 – Cash flows = $1,200 each period, Present Value of Cash flows = $2,028.06 for both periods, Sum of Present Value of Cash flows = $-2,271.94 at the end of time 2PI = CFAT t /Initial Investment = $4,163.40/$4,300 = .968 = .97Both measures indicate rejection. A positive accounting rate of return should not change thedecision. DPP and PI indicate that the cost of capital is not being covered.39. The Walker Landscaping Company can purchase a piece of equipment for $3,600. The asset has atwo-year life, will produce a cash flow of $600 in the first year and $4,200 in the second year. The interest rate is 15%. Calculate the project's payback assuming steady cash flows. Also calculate the project's IRR. Should the project be taken? Check your answer by computing the project'sNPV.Difficulty: Medium Page: 146, 152Answer:Payback = 1.714 yearsCalculated IRR = 16.67%. Accept the project. NPV = $97.54.40. The Walker Landscaping Company can purchase a piece of equipment for $3,600. The asset has atwo-year life, will produce a cash flow of $600 in the first year and $4,200 in the second year. The interest rate is 15%. Calculate the project's Discounted Payback and Profitability Index assuming steady cash flows. Should the project be taken? If the Average Accounting Return was positive, how would this affect your decision?Difficulty: Medium Page: 149,150,152Answer:Time 0 – Cash flows = $-3,600, Present Value of Cash flows = $-3,600DPP = 1+($3,078.26/$3,175.80) = 1.969 = 1.97 yearsPI = ∑CFAT tBoth measures indicate acceptance. A positive accounting rate of return would be consistent with this decision. Reliance on AAR should not be the key, as DPP and PI indicate earning a rate greater than cost of capital.41. Cutler Compacts will generate cash flows of $30,000 in year one, and $65,000 in year two.However, if they make an immediate investment of $20,000, they can expect to have cash streams of $55,000 in year 1 and $63,000 in year 2 instead. The interest rate is 9%. Calculate the NPV of the proposed project. Why would the IRR be a poor choice in this situation?Difficulty: Hard Page: 144,156Answer:Use incremental cash flow approach: NPV $1,252, accept project.With more than one sign change, there will be more than one IRR.42. Given the cash flow stream of the following mutually exclusive projects, prove through theincremental investment that Project B, with the higher NPV, will be preferred to project A. Use a discount rate of 13%.Project A:Time 0 = $-500; Time 1 = $150; Time 2: $245; Time 3 = $320; NPV = $46.39; IRR = 17.76% Project B:Time 0 = $-800; Time 1 = $360; Time 2: $360; Time 3 = $360; NPV = $50.01; IRR = 16.65% Difficulty: Hard Page: 159Answer:Incremental investment in B: $-300 $210 $115 $40 NPV = $3.6343. The IRR rule is said to be a special case of the NPV rule. Explain why this is so and why it hassome limitations NPV does not?Difficulty: Medium Page: 154Answer:• At some K, NPV = $0; by definition, when NPV=0, K=IRR.• Problems occur due to conflicts with mutually exclusive projects, timing and size problems, multiple sign changes present problem for IRR• NPV always the best choice44. The NPV and Profitability Index give the same results when there is no conflict. In the case of amutually exclusive set of investments, explain the potential conflict and the way it should be solved with supporting examples.Difficulty: Hard Page: 165Answer:Please refer to the text for the answer, page 165.45. The NPV and Profitability Index give the same results when there is no conflict. In the case ofcapital rationing, explain the potential conflict and the way it should be solved with supportingexamples.Difficulty: Hard Page: 165-166Answer:Please refer to the text for the answer, pages 165 - 166.Ross/Westerfield/Jaffe, Corporate Finance, 7/e 75。

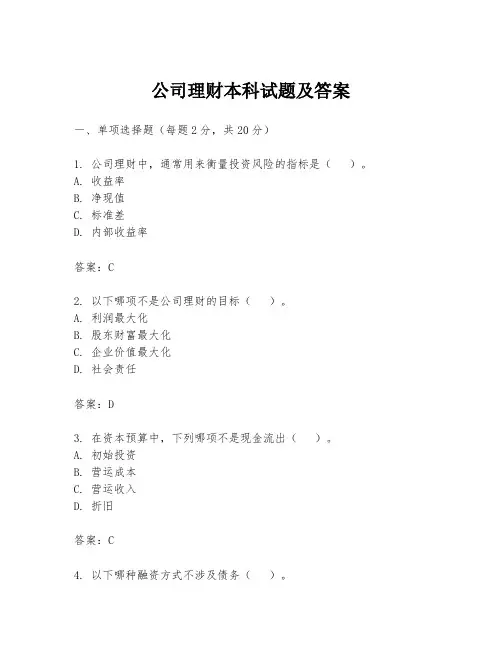

公司理财本科试题及答案一、单项选择题(每题2分,共20分)1. 公司理财中,通常用来衡量投资风险的指标是()。

A. 收益率B. 净现值C. 标准差D. 内部收益率答案:C2. 以下哪项不是公司理财的目标()。

A. 利润最大化B. 股东财富最大化C. 企业价值最大化D. 社会责任答案:D3. 在资本预算中,下列哪项不是现金流出()。

A. 初始投资B. 营运成本C. 营运收入D. 折旧答案:C4. 以下哪种融资方式不涉及债务()。

A. 发行债券B. 发行股票C. 银行贷款D. 租赁融资答案:B5. 以下哪种策略是公司用来降低财务风险的()。

A. 杠杆收购B. 多元化投资C. 集中投资D. 增加债务答案:B6. 公司理财中,净现值(NPV)为正意味着()。

A. 项目不可行B. 项目可行C. 项目收益为零D. 项目收益为负答案:B7. 以下哪项不是公司理财中的资本结构决策()。

A. 债务与权益的比例B. 股利政策C. 投资决策D. 融资方式的选择答案:C8. 公司理财中,以下哪项不是现金流量的组成部分()。

A. 现金收入B. 现金支出C. 折旧费用D. 非现金支出答案:D9. 以下哪项是公司理财中的风险评估方法()。

A. 敏感性分析B. 净现值分析C. 投资回收期D. 内部收益率答案:A10. 以下哪项不是公司理财中的财务报表分析工具()。

A. 比率分析B. 现金流量表C. 杜邦分析D. 资产负债表答案:D二、多项选择题(每题3分,共15分)1. 以下哪些因素会影响公司的资本成本()。

A. 利率水平B. 公司信用评级C. 市场风险溢价D. 通货膨胀答案:A、B、C2. 公司理财中,以下哪些属于投资决策()。

A. 资本预算B. 股利政策C. 营运资本管理D. 风险管理答案:A、C3. 以下哪些是公司理财中的风险管理工具()。

A. 期权B. 期货C. 保险D. 衍生品答案:A、B、C、D4. 以下哪些是公司理财中的财务分析工具()。

《公司理财》(刘曼红)(第⼆版)部分习题参考答案【思考与练习题】部分习题参考答案第3章6.该公司资产负债表为⽇7.公司2007年的净现⾦流为-25万元。

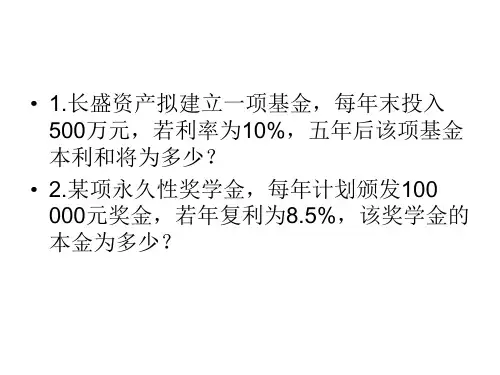

8.各⽐例如下:第4章4.(1)1628.89元;(2)1967.15元;(3)2653.30元5. 现在要投⼊⾦额为38.55万元。

6. 8年末银⾏存款总值为6794.89元(前4年可作为年⾦处理)。

7.(1)1259.71元;(2)1265.32元;(3)1270.24元;(4)1271.25元;(5)其他条件不变的情况下,同⼀利息期间计息频率越⾼,终值越⼤;到连续计算利息时达到最⼤值。

8.(1)每年存⼊银⾏4347.26元;(2)本年存⼊17824.65元。

9.基本原理是如果净现值⼤于零,则可以购买;如果⼩于零,则不应购买。

NPV=-8718.22,⼩于零,故不应该购买。

第5章8.(1)该证券的期望收益率=0.15×8%+0.30×7%+0.40×10%+0.15×15%=9.55%标准差=2.617%(2)虽然该证券期望收益率⾼于⼀年期国债收益率,但也存在不确定性。

因此不能确定是否值得投资。

9.(1)两种证券的期望收益、⽅差与标准差(2)根据风险与收益相匹配的原则,⽬前我们还不能确定哪种证券更值得投资。

10.各证券的期望收益率为:%4.11%)6%12(9.0%6%15%)6%12(5.1%6%1.11%)6%12(85.0%6%2.13%)6%12(2.1%6=-?+==-?+==-?+==-?+=A A B A r r r r11. (1)该组合的期望收益率为15.8% (2)组合的β值945.051==∑=ii ip w ββ(3)证券市场线,图上组合中每种股票所在位置第6章5.(1)当市场利率分别为:8%;6%;10%时,该债券的价格分别为:39.8759.376488.4983769.010004622.1240)2/1(1000)2/1(40%1010004.456612.5434564.010005903.1340)2/1(1000)2/1(408%8.11487.5531.5955537.010008775.1440)2/1(1000)2/1(406%2040)(2020102020102020100=+=?+?=+++=≈+=?+?=+++==+=?+?=+++=+=∑∑∑===r r B r r B r r B PV PV B t tt tt t时,则当市场利率为时,则当市场利率为时,则当市场利率为次。

1?单选题?分)资产未来创造的现金流入现值称为?A. 资产的价格B. 资产的分配C. 资产的价值D. 资产的体量2?单选题?分)谁承担了公司运营的最后风险?A .债权人B.股东C..管理层D.委托人3?单选题?分)金融市场有哪些类型?A.货币市场B.资本市场C.期货市场D.以上都是4?单选题?分)以下哪项是债券价值评估方式?A.现值估价模型B.到期收益率C.债券收益率D.以上都是5?单选题?分)融资直接与间接的划分方式取决于?A.融资的受益方B.金融凭证的设计方C.融资来源D.融资规模6?单选题?分)以下哪种不是财务分析方法?A. 比较分析B. 对比分析C. 趋势百分比分析D. 财务比例分析7?单选题?分)以下哪个不是价值的构成?A. 现金流量B. 现值C. 期限D. 折现率8?单选题?分)比率分析的目的是为了?A. 了解项目之间的关系B. 了解金融发展变化C. 分析资金流动趋势D. 分析金融风险9?单选题?分)影响公司价值的主要因素是?A. 市场B. 政策C. 信息D. 时间10?单选题?分)以下哪种是内部融资方式?A. 留存收益B. 股票C. 债券D. 借款11?单选题?分)什么是营运资本?12?单选题?分)PMT所代表的含义是?A. 现值B. 终值C. 年金D. 利率13?单选题?分)金融市场的作用是什么?A. 资金的筹措与投放B. 分散风险C. 降低交易成本D. 以上都是14?单选题?分)以下哪项不是财务管理的内容?A. 筹资B. 融资C. 信贷D. 营运资本管理15?单选题?分)微观金融的研究对象是什么?A. 机构财政B. 账目管理C. 股市投资D. 公司理财16?单选题?分)计划经济时代企业的资金来源是?A. 个人B. 公司C. 银行D. 财政17?单选题?分)宏观金融的研究对象是什么?A. 货币流通B. 资产分配C. 货币政策D. 金融历史18?单选题?分)以下哪项不是以资产或股权为基础的收益率指标?A. 投入资本收益率B. 总资产收益率C. 净资产收益率D. 销售毛利率19?单选题?分)我国资本市场的开启最初是为了?|A. 为国企解困B. 与国外市场同步C. 发展经济D. 发展教育20?单选题?分)财务分析首要解决的问题是?A. 报表数据的真实性B. 报表数据的丰富性C. 报表数据的相关性D. 报表数据的完整性答案:1-5CBDDB6-10BBACA11-15ACDCD 16-20DCDAA。

《公司理财》考试范围:第3~7章,第13章,第16~19章,其中第16章和18章为较重点章节。

书上例题比较重要,大家记得多多动手练练。

PS:书中课后例题不出,大家可以当习题练练~考试题型:1.单选题10分 2.判断题10分 3.证明题10分 4.计算分析题60分 5.论述题10分注:第13章没有答案第一章1.在所有权形式的公司中,股东是公司的所有者。

股东选举公司的董事会,董事会任命该公司的管理层。

企业的所有权和控制权分离的组织形式是导致的代理关系存在的主要原因。

管理者可能追求自身或别人的利益最大化,而不是股东的利益最大化。

在这种环境下,他们可能因为目标不一致而存在代理问题。

2.非营利公司经常追求社会或政治任务等各种目标。

非营利公司财务管理的目标是获取并有效使用资金以最大限度地实现组织的社会使命。

3.这句话是不正确的。

管理者实施财务管理的目标就是最大化现有股票的每股价值,当前的股票价值反映了短期和长期的风险、时间以及未来现金流量。

4.有两种结论。

一种极端,在市场经济中所有的东西都被定价。

因此所有目标都有一个最优水平,包括避免不道德或非法的行为,股票价值最大化。

另一种极端,我们可以认为这是非经济现象,最好的处理方式是通过政治手段。

一个经典的思考问题给出了这种争论的答案:公司估计提高某种产品安全性的成本是30美元万。

然而,该公司认为提高产品的安全性只会节省20美元万。

请问公司应该怎么做呢?”5.财务管理的目标都是相同的,但实现目标的最好方式可能是不同的,因为不同的国家有不同的社会、政治环境和经济制度。

6.管理层的目标是最大化股东现有股票的每股价值。

如果管理层认为能提高公司利润,使股价超过35美元,那么他们应该展开对恶意收购的斗争。

如果管理层认为该投标人或其它未知的投标人将支付超过每股35美元的价格收购公司,那么他们也应该展开斗争。

然而,如果管理层不能增加企业的价值,并且没有其他更高的投标价格,那么管理层不是在为股东的最大化权益行事。

第一章财务管理概述[学习重点和难点]学习重点:在了解财务管理的基本内容和基本职责的基础上,掌握财务管理的目标以及优缺点;熟悉两权分离下产生的委托代理关系和由此而产生的代理问题,以及解决的途径。

了解金融市场的类型和作用,了解公司理财的重要假说,即有效市场假说的基本含义。

学习难点:如何理解股东财富最大化、委托代理关系、代理问题的表现和影响结果、金融资产的价值,以及有效市场假说对公司融资和经理人管理的影响。

在学习过程中要明确相关概念的含义,深入理解基本财务原理的内涵。

习题与案例一、单项选择题1.下列不属于公司财务管理内容的是( )。

A.资本预算管理B.长期融资管理C.营运资本管理D.业绩考核管理答案:D。

2.股东通常用来协调与经营者之间利益的方法主要是A.监督和激励B.解聘和激励C.激励和接收D.解聘和接收答案:A。

3.下列不属于股东财富最大化理财目标优点的是( )。

A.考虑了获取收益的时间因素和风险因素B.克服了追求利润的短期行为C.能够充分体现所有者对资本保值与增值的要求D.适用于所有公司答案:D。

股东财富最大化其实就是股价尽可能地高,股东财富的计算:股价与股数的乘积。

股价等于预期未来现金流入量的现值之和,折现率的选取已经考虑了风险。

D项说法太绝对。

4.根据资产负债表模式,可将公司财务管理分为长期投资管理、长期融资管理三部分,股利政策应属于的财务管理范畴是( )。

A.营运资本管理B.长期投资管理C.长期融资管理D.以上都不是答案:C。

公司发行股票融资的代价就是要派股利给股东。

5.无论从市场功能上还是从交易规模上看,构成整个金融市场核心部分的是()A.外汇市场B.商品期货市场C.期权市场D.有价证券市场答案:D6.下列不属于公司财务经理基本职能的是( )。

A.投资管理B.核算管理C.收益分配管理D.融资管理答案:B 。

7.按照索取权获得方式的不同分类,股东对于公司收益的索取权是A.剩余索取权B.固定索取权C.法定索取权D.或有索取权答案:A。

CHAPTER 16Raising Capital I. DEFINITIONSVENTURE CAPITALa 1. The financing provided for start-up, often high-risk, private business enterprises iscalled:a. venture capital.b. junk bonds.c. flotation costs.d. initial public offerings.e. financial futures.REGISTRATION STATEMENTb 2. The document(s) filed with the SEC disclosing all material information relating to thefirm making an offering of public securities is called the:a. offering prospectus.b. registration statement.c. red herring filing.d. indenture contract.e. SEC Form 13-J.REGULATION Ac 3. The SEC regulation that exempts public issues of less than $5 million from mostregistration requirements is called:a. the Green Shoe Provision.b. the red herring Provision.c. Regulation A.d. Regulation Q.e. the Open Markets Exemption.PRELIMINARY PROSPECTUSd 4. The preliminary prospectus distributed to investors during the SEC waiting period isoften called a(n):a. indenture contract.b. signature form 10-W.c. letter of comment.d. red herring.e. Green Shoe.CHAPTER 16LETTER OF COMMENTe 5. The _____ is transmitted to the prospective issuing firm by the SEC when they havesuggestions for changes to the registration statement and/or its supporting documents.a. indenture contractb. Green Shoe statementc. Regulation A statementd. preliminary prospectuse. letter of commentPROSPECTUSa 6. The legal document describing details of the issuing corporation and its securityoffering to potential investors is called the:a. prospectus.b. tombstone advertisement.c. letter of comment.d. Regulation A statement.e. rights offering.TOMBSTONEb 7. Advertisements in, for example, The Wall Street Journal announcing a corporation’spublic offering of securities, along with a list of the investment banks handling theoffering, are called:a. red herrings.b. tombstones.c. Green Shoes.d. registration statements.e. letters of comment.GENERAL CASH OFFERc 8. An issue of securities offered for sale to the general public on a direct cash basis iscalled a _____ offering.a. best effortsb. firm commitmentc. general cashd. rightse. red herringRIGHTS OFFERd 9. A public offering of securities where existing shareholders of the firm have the firstopportunity to buy the new securities is called a _____ offering.a. best effortsb. firm commitmentc. general cashd. rightse. red herringCHAPTER 16 INITIAL PUBLIC OFFERINGe 10. A corporation’s first sale of equity made available to the pub lic is called a(n):a. share repurchase program.b. shelf registration filing.c. private placement.d. seasoned equity offering (SEO).e. initial public offering (IPO).SEASONED EQUITY OFFERINGd 11. A public offering of equity by a corporation that has previously issued securities to thepublic is called a(n):a. share repurchase program.b. shelf registration filing.c. private placement.d. seasoned equity offering (SEO).e. initial public offering (IPO).UNDERWRITERSc 12. The investment bank(s) that act as intermediaries between the company issuingsecurities and the investing public are called:a. privileged intermediaries.b. venture capitalists.c. underwriters.d. standby investors.e. primary investors.UNDERWRITING SYNDICATEb 13. A group of underwriters formed to share the risk in marketing and distributing a sale ofsecurities to the investing public is called a(n):a. cartel.b. syndicate.c. cooperative venture capital system.d. oligopoly.e. insider consortium.UNDERWRITING SPREADa 14. The difference between the underwriters’ buying price and the offering price of thesecurities to the public is called the:a. spread.b. underpricing.c. filing fee.d. new issue premium.e. extortion premium.CHAPTER 16FIRM COMMITMENT OFFERSe 15. The type of underwriting where a syndicate buys the entire issue from the issuing firmand assumes full financial responsibility for any unsold shares, is called a _____offering.a. best effortsb. shelfc. direct rightsd. private placemente. firm commitmentBEST EFFORTS OFFERSa 16. The type of underwriting where a syndicate sells as much of the issue as possible, butcan return any unsold securities to the issuing firm without any further financialresponsibility, is called a _____ offering.a. best effortsb. shelfc. direct rightsd. private placemente. firm commitmentDUTCH AUCTION UNDERWRITINGc 17. The type of underwriting in which the offer price is set based on competitive biddingby investors is called _____ underwriting.a. open marketb. open auctionc. Dutch auctiond. tombstonee. discretionaryAFTERMARKETb 18. The period after a new issue is initially sold to the public is referred to as the:a. private placement market.b. aftermarket.c. waiting period.d. filing period.e. tombstone period.OVERALLOTMENT OPTIONc 19. The contract provision whereby the underwriting syndicate may, at their option,purchase additional securities from the issuing corporation at the initial offering priceis called:a. Regulation A.b. the Red Herring provision.c. the Green Shoe provision.d. the best efforts option.e. the direct rights option.CHAPTER 16 IPO UNDERPRICINGd 20. The phenomenon where the price of newly-issued shares in the marketplace increasesabove the initial offering price is called:a. Green Shoe pricing.b. yield burning.c. yield bumping.d. underpricing.e. aftermarket support.EX-RIGHTS DATEe 21. The first day that a stock trades in the market without a recently declared right attachedto the stock is called the:a. pre-issue date.b. aftermarket.c. declaration date.d. holder-of-record date.e. ex-rights date.HOLDER-OF-RECORD DATEd 22. The date on which existing shareholders are designated as the recipients of stock rightsis called the:a. pre-issue date.b. offering date.c. declaration date.d. holder-of-record date.e. ex-rights date.STANDBY UNDERWRITINGa 23. A rights offering in which the underwriting syndicate agrees to purchase theunsubscribed portion of the issue is called _____ underwriting.a. standbyb. best effortsc. firm commitmentd. direct feee. tombstoneOVERSUBSCRIPTION PRIVILEGEb 24. The privilege that allows existing shareholders to purchase unsubscribed shares in arights offering at the subscription price is called the _____ privilege.a. standbyb. oversubscriptionc. open offerd. new issuese. overallotmentCHAPTER 16DILUTIONc 25. A loss in shareholder value as measured in terms of percentage ownership in the firm,market value of the firm, book value of equity, or earnings per share is known as:a. oversubscription.b. underpricing.c. dilution.d. rights pricing.e. downsampling.TERM LOANSe 26. Direct business loans from a limited number of investors to a corporation withmaturities typically ranging from one to five years are called:a. private placements.b. debt SEOs.c. notes payable.d. debt IPOs.e. term loans.PRIVATE PLACEMENTSa 27. Loans provided directly from a limited number of investors to a corporation withmaturities typically in excess of five years are called:a. private placements.b. debt SEOs.c. notes payable.d. debt IPOs.e. term loans.SHELF REGISTRATIONb 28. Registration permitted under SEC Rule 415 allowing a company to register just once ina two-year period for all security issuances it expects to make during that time periodis called:a. standby registration.b. shelf registration.c. Regulation A.d. Regulation Q.e. private registration.II. CONCEPTSVENTURE CAPITALe 29. Venture capitalists often are:I. individuals.II. insurance companies.III. university endowment funds.IV. pension funds.a. II and IV onlyb. I, II, and IV onlyc. II, III, and IV onlyd. I, II, and III onlye. I, II, III, and IVCHAPTER 16 VENTURE CAPITALd 30. Venture capital is primarily found through:a. internet web sites.b. a bidding process.c. newspaper advertisements.d. personal contacts.e. letters submitted to venture capital firms.VENTURE CAPITALd 31. Which one of the following statements concerning venture capital are correct?I. Venture capitalists often hold voting preferred stock.II. Venture capital is relatively easy to acquire in today’s market.III. Venture capitalists frequently assume active roles in the management of the financed firm.IV. Venture capitalists often assume 40 percent or more ownership in a firm as a condition of financing.a. I and III onlyb. II and IV onlyc. III and IV onlyd. I, III, and IV onlye. I, II, III, and IVVENTURE CAPITALb 32. Which one of the following statements concerning venture capitalists is correct?a. All venture capitalists become actively involved in the day-to-day management of thefinanced firm.b. Financial strength is a key consideration when selecting a venture capitalist.c. Venture capitalists seldom offer any benefit other than the funds they provide.d. Most venture capitalists are long-term investors in a firm.e. H ow a venture capitalist handled other ventures has no relevance to you when you areseeking funding.ISSUING SECURITIESd 33. All new interstate security issues are regulated by the:a. registration statement.b. Green Shoe provision.c. Securities Exchange Act of 1934.d. Securities Act of 1933.e. Federal Reserve Act of 1931.ISSUING SECURITIESd 34. The Securities and Exchange Commission:a. verifies the accuracy of the information contained in the prospectus.b. verifies the accuracy of the information contained in the red herring.c. examines the registration statement during the Green Shoe period.d. is concerned only that the rules and regulations are adhered to.e. determines the final offer price once they have approved the registration statement.CHAPTER 16UNDERWRITINGc 35. Underwriters generally:a. pay a spread to the issuing firm.b. provide only best efforts underwriting in the U.S.c. r eceive less compensation under a competitive agreement than under a negotiatedagreement.d. handle an entire issue within their own firm.e. pass the risk of unsold shares back to the issuing firm.UNDERWRITINGe 36. With firm commitment underwriting, the issuing firm:a. is unsure of the total amount of funds they will receive until after the offering iscompleted.b. is unsure of the number of shares they will issue until after the offering is completed.c. knows exactly how many shares will be purchased by the general public during theoffer period.d. accepts the entire risk of the stock offer.e. knows up-front the amount of money they will receive from the stock offering. UNDERWRITINGb 37. With Dutch auction underwriting:a. each winning bidder pays the price they bid.b. all successful bidders pay the same price.c. all bidders receive at least a portion of the quantity on which they bid.d. the selling firm receives the maximum possible price for each item sold.e. the bidder for the largest quantity receives the first allocation of the item.IPOS AND UNDERPRICINGe 38. If an IPO is underpriced then:a. investors in the IPO are generally unhappy with the underwriters.b. the issue is less likely to sell out.c. the stock price will generally decline on the first day of trading.d. the issuing firm is guaranteed to be successful in the long term.e. the issuing firm “leaves money on the table”.IPOS AND UNDERPRICINGe 39. Arguments that have been presented to support IPO underpricing include:I. counteracting the “winner’s curse”.II. rewarding institutional investors for sharing their opinion of a stock’s market value.III. diminishing the risk to the underwriter who has agreed to a firm commitment underwriting.IV. diminishing the odds that investors will sue investment banks.a. I and III onlyb. II and IV onlyc. I and II onlyd. I, II, and III onlye. I, II, III, and IVCHAPTER 16 IPOS AND UNDERPRICINGa 40. The first day returns on IPOs:a. vary significantly over time.b. are limited by the SEC to a maximum of 50 percent.c. were unusually high during the early 1990s.d. tend to greatly increase the funding received by the issuing firms.e. cannot exceed 100 percent.IPO ALLOCATIONSa 41. Which one of the following statements is correct?a. The IPOs which are the most underpriced are generally the most oversubscribed.b. You will always receive your desired allotment of IPO shares if you agree to purchaseshares in every IPO.c. As long as you submit your order during the waiting period you will receive thenumber of shares you desire for every IPO issue.d. The allocation of shares you receive will tend to be greater the more the issue isunderpriced.e. IPO allocations are generally more restrictive when an IPO is overpriced.IPO ALLOCATIONSd 42. An individual investor with a small portfolio who wishes to purchase 100 shares of anIPO is more likely to receive an allocation of shares when:a. an IPO is substantially oversubscribed than when it is not.b. they bid a higher amount as their offer price.c. an IPO is underpriced than when it is correctly priced.d. the odds are greater that the IPO will lose money once it commences trading.e. the issuing firm is young and has minimal, if any, sales in the prior year. SEASONED OFFERINGSb 43. A news release stating that a firm is going to do a seasoned offering generally tends tocause the stock price of that firm to:a. increase.b. decrease.c. remain constant.d. respond but the direction of the response is not predictable as shown in past studies.e. decrease momentarily and then immediately increase substantially within the hour. COSTS OF ISSUING SECURITIESb 44. Which one of the following is NOT a cost of issuing securities?a. Green Shoe optionb. red herring optionc. abnormal returnsd. gross spreade. management timeCHAPTER 16COSTS OF ISSUING SECURITIESd 45. Which one of the following statements is correct concerning the costs of issuingsecurities?a. Domestic bonds are generally more expensive to issue than equity IPOs.b. The total direct costs of an equity IPO is typically 15 percent of the amount raised.c. A seasoned offering is typically more expensive on a percentage basis than an IPO.d. There tend to be substantial economies of scale when issuing securities.e. The costs of issuing convertible bonds tend to be less on a percentage basis than thecosts of issuing straight debt.RIGHTS OFFERINGa 46. Existing shareholders:a. may be granted a preemptive right by a firm’s articles of incorporation to maintaintheir proportional ownership position.b. are required to purchase shares in every new equity offering in an amount equal totheir proportional ownership of the firm.c. do not have the option of selling any of the rights they are granted in a rightsoffering.d. are generally well advised to let the rights they receive expire.e. can maintain their proportional ownership position without purchasing additionalshares when there is a seasoned equity offering.RIGHTS OFFERINGe 47. To purchase shares in a rights offering, you generally just need to:a. pay the subscription amount in cash.b. submit the required form along with the required number of rights.c. pay the difference between the market price of the stock and the subscription price.d. submit the required number of rights along with a payment for the amount of thedifference between the market price of the stock and the subscription price.e. submit the required number of rights along with the subscription price.RIGHTS OFFERINGd 48. The value of a right granted by a rights offering depends upon:I. the number of rights required to purchase one new shareII. the market price of the securityIII. the subscription priceIV. the price-earnings ratio of the stocka. II and III onlyb. II and IV onlyc. I and II onlyd. I, II, and III onlye. I, II, III, and IVDILUTIONb 49. Before a seasoned stock offering, you owned 500 shares of a firm that had 120,000shares outstanding. After the seasoned offering, you still owned 500 shares but thenumber of shares outstanding rose to 135,000. This is an example of _____ dilution.a. market valueb. percentage ownershipc. earnings per shared. book valuee. equityDILUTIONc 50. Which one of the following statements is correct concerning dilution related to a newproject?a. As long as the book value of a firm increases when a project is undertaken, the bookvalue per share will remain constant.b. As long as the market value of a firm increases when a project is undertaken, themarket value per share will increase.c. Even if the market value of a firm increases when a project is undertaken, the marketvalue per share can decrease.d. The proportionate ownership of each shareholder always remains constant when newprojects are taken on.e. The market price per share of stock tends to increase when the net present value of aproject that is taken on is negative.LONG-TERM DEBTb 51. Which one of the following statements is correct concerning the issuance of long-termdebt?a. A direct long-term loan has to be registered with the SEC.b. D irect placement debt tends to have more restrictive covenants than publicly issueddebt.c. Distribution costs are lower for public debt than for private debt.d. It is easier to renegotiate public debt than private debt.e. Wealthy individuals tend to dominate the private debt market.SHELF REGISTRATIONe 52. Shelf registration grants a firm some flexibility:I. in the number of securities sold in a single day.II. in whether or not a public issue is registered with the SEC.III. as to whether they register a securities issue with the SEC or with the Federal Reserve.IV. in the timing of a securities sale.a. I and III onlyb. II and IV onlyc. I and II onlyd. III and IV onlye. I and IV onlyIII. PROBLEMSISSUING SECURITIESb 53. You decide to take your company public by offering a total of 50,000 shares ofcommon stock to the public in an initial public offering (IPO). You hire an underwriterwho arranges a full commitment underwriting and suggests an initial selling price of$28 a share with an 8 percent spread. As it turns out, the underwriters only sell 48,500shares. How much cash will you receive from your IPO?a. $1,249,360b. $1,288,000c. $1,299,360d. $1,308,600e. $1,400,000ISSUING SECURITIESa 54. Wexford Industries offers 60,000 shares of common stock to the public in an initialpublic offering (IPO). The underwriters agree to pay $35 a share and to provide theirservices in a best efforts underwriting. The offer price is set at $39. After completingtheir sales efforts the underwriters determine that they were able to sell a total of48,250 shares. How much cash did Wexford Industries receive from their IPO?a. $1,688,750b. $1,703,250c. $1,881,750d. $2,100,000e. $2,340,000DUTCH AUCTIONb 55. You decide to sell an additional 1,500 shares of stock in your firm through a Dutchauction. The bids that you receive include:Bidder Quantity PriceA 1,000 $42B 200 $41C 100 $40D 1,000 $39E 1,200 $38How much will you receive in total from selling the additional 1,500 shares? Ignore alltransaction and flotation costs.a. $57,000b. $58,500c. $60,750d. $60,782e. $63,000b 56. Bid Wars, Inc. is selling 1,200 shares of stock through a Dutch auction. The bids theyreceived are:Bidder Quantity PriceA 100 $27B 600 $26C 800 $22D 1,200 $21E 1,500 $19How much cash will Bid Wars receive from selling these shares of stock? Ignore alltransaction and flotation costs.a. $25,200b. $26,400c. $28,720d. $29,300e. $32,400DUTCH AUCTIONb 57. Grizzley Bare, Inc. is offering 1,500 shares of stock in a Dutch auction. The bidsinclude:Bidder Quantity PriceA 750 $56B 300 $54C 1,000 $52D 100 $51E 500 $50How much cash will Grizzley Bare receive from selling these shares? Ignore alltransaction and flotation costs.a. $77,000b. $78,000c. $80,400d. $80,633e. $84,000IPO ALLOCATIONSb 58. You have placed an order to purchase 100 shares of every IPO that comes to market.The next two IPOs are each priced at $20 a share and will begin trading on the sameday. You are allocated 10 shares of IPO A and 100 shares of IPO B. At the end of thefirst day of trading, IPO A was selling for $42 a share and IPO B was selling for $16 ashare. What is your total profit or loss on these two IPOs as of the end of the first dayof trading?a. -$400b. -$180c. $20d. $220e. $1,800d 59. Maria has an outstanding order with her stock broker to purchase 300 shares of everyIPO. The next three IPOs are each priced at $24 a share and will all start trading on thesame day. Maria is allocated 100 shares of IPO A, 50 shares of IPO B, and 300 sharesof IPO C. On the first day of trading IPO A opened at $24.50 a share and ended the dayat $26.50 a share. IPO B opened at $29 a share and finished the day at $33 a share. IPOC opened at $23 a share and ended the day at $17 a share. What is Maria’s total profitor loss on these three IPOs as of the end of the first day of trading?a. -$12,200b. -$2,800c. -$2,300d. -$1,400e. $700IPO ALLOCATIONSd 60. There are two IPOs that will commence trading next week. Juan places an order to buy400 shares of IPO A. Bonita places an order to purchase 200 shares of IPO A and 200shares of IPO B. Both IPOs are priced at $25 a share. Juan is allocated 200 shares ofIPO A. Bonita is allocated 100 shares of IPO A and 100 shares of IPO B. At the end ofthe first day of trading, IPO A is selling for $29 a share and IPO B is selling for $22 ashare. What is the difference in the total profits or losses that Juan and Bonita have asof the end of the first day of trading?a. $400b. $500c. $600d. $700e. $800FLOTATION COSTSd 61. Your firm is expanding and you need $10 million to help fund this growth. Youestimate that you can sell new shares of stock for $30 a share. You also estimate that itwill cost you $300,000 for legal, accounting, and other costs related to the stock issue.The underwriters have agreed to a 7 percent spread. How many shares of stock mustyou sell if you are going to have $10 million available for your expansion needs?a. 320,872 sharesb. 358,423 sharesc. 367,367 sharesd. 369,176 sharese. 388,423 sharesFLOTATION COSTSe 62. Betsy’s Flags wa nts to raise $5 million to open a new distribution center. The companyestimates the issue costs including the legal and accounting fees will be $210,000. Theunderwriters have set the stock price at $18 a share and the underwriting spread at 7.5percent. How many shares of stock does Betsy’s have to sell to meet their cash need?a. 269,251 sharesb. 300,300 sharesc. 310,872 sharesd. 311,153 sharese. 312,913 sharesc 63. Winter’s Edge needs $45 million to finance a new facility and new snow removalequipment. The management has met with underwriters who feel that the firm couldsell additional shares of stock at $26 a share with an 8 percent underwriting spread.The estimated issue costs are $475,000. How many shares of stock will Wi nter’s Edgeneed to sell if they choose firm commitment underwriting for their new facility andequipment?a. 1,749,038 sharesb. 1,871,471 sharesc. 1,901,129 sharesd. 1,948,718 sharese. 2,053,219 sharesSHARES NEEDED IN A RIGHTS OFFERINGc 64. Yo u would like to expand your firm’s operations into a neighboring state but you need$4 million in additional funding to do this. After talking with your key shareholders,you decide to raise the necessary funds through a rights offering with a subscriptionprice of $30 a share. The current market price of your stock is $38 a share. How manyshares of stock will you need to sell through the rights offering to fund your expansionplans?a. 105,263 sharesb. 125,000 sharesc. 133,333 sharesd. 250,000 sharese. 500,000 sharesSHARES NEEDED IN A RIGHTS OFFERINGc 65. Down South, Inc. wants to raise $14 million through a rights offering so they can builda new retail super store. How many shares of stock will the firm need to sell throughthis offering if the current stock price is $52 a share and the subscription price is $45 ashare?a. 269,231 sharesb. 288,660 sharesc. 311,111 sharesd. 328,660 sharese. 333,333 sharesNUMBER OF RIGHTSd 66. Turner Wins! plans on raising $20 million through a rights offering. The subscriptionprice is set at $20. Currently, the company has 2.4 million shares outstanding with acurrent market price of $24.50 a share. Each shareholder will receive one right for eachshare of stock they currently own. How many rights will be needed to purchase onenew share of stock in this offering?a. 1.2 rightsb. 1.3 rightsc. 2.0 rightsd. 2.4 rightse. 4.5 rightsa 67. Thursday’s N’ Mor wants to raise $1 million through a rights offering to renovate theircurrent facilities. The subscription price for the offering is set at $25 a share. Currently,the company has 90,000 shares of stock outstanding at a market price of $29 a share.Each shareholder will receive one right for each share of stock they own. How manyrights will be needed to purchase one new share of stock in this offering?a. 2.25 rightsb. 2.50 rightsc. 2.61 rightsd. 2.90 rightse. 4.00 rightsNUMBER OF RIGHTSd 68. Ben and Jennie’s wants to expand their operations into the coo kie business. They need$20 million to build a bakery and establish a distribution system. Currently, the firmhas 1,300,000 shares of stock outstanding. The market price of the stock is $34 a share.Ben and Jennie’s decides to raise the needed capital thr ough a rights offering whereinevery stockholder will receive one right for every share of stock they own. Thesubscription price will be $28. How many rights will be needed to purchase one newshare of stock in this offering?a. 1.21 rightsb. 1.27 rightsc. 1.54 rightsd. 1.82 rightse. 2.21 rightsVALUE OF A RIGHTc 69. Frank Enterprises is sponsoring a rights offering wherein every shareholder willreceive one right for every share of stock they own. The new shares in this offering arepriced at $25 plus 5 rights. The current market price of Frank Enterprises stock is $31 ashare. What is the value of one right?a. $0b. $.60c. $1.00d. $1.20e. $1.50VALUE OF A RIGHTa 70. The stock of Violets 4 U is currently selling for $46 a share. The company has decidedto raise funds through a rights offering wherein every shareholder will receive oneright for every share of stock they own. The new shares being offered are priced at $40plus four rights. What is the value of one right?a. $1.20b. $1.50c. $2.40d. $3.60e. $6.00。