FRM一级考前必做100真题

- 格式:pdf

- 大小:664.30 KB

- 文档页数:44

frm一级题库2023

一、单项选择题

1.在2023年FRM考试中,一级考试的合格分数线是多少?

2. A. 400

3. B. 500

4. C. 600

5. D. 700

6.FRM一级考试中,风险管理基础占比多少?

7. A. 15%

8. B. 25%

9. C. 35%

10. D. 45%

11.FRM一级考试中,数量分析占比多少?

12. A. 10%

13. B. 15%

14. C. 20%

15. D. 25%

16.FRM一级考试中,金融市场与产品占比多少?

17. A. 20%

18. B. 25%

19. C. 30%

20. D. 35%

21.FRM一级考试中,估值与风险建模占比多少?

22. A. 15%

23. B. 20%

24. C. 25%

25. D. 30%

二、多项选择题

1.下列哪些科目是FRM一级考试的重要内容?

2. A. 风险管理基础

3. B. 数量分析

4. C. 公司金融

5. D. 金融市场与产品

6. E. 估值与风险建模

7.在FRM一级考试中,下列哪些知识点是考生需要掌握的?

8. A. 市场风险的管理方法

9. B. 信用风险的计算方式

10. C. 操作风险的识别与评估

11. D. 企业价值的评估方法

12. E. 对冲策略的有效性分析

三、简答题

1.请简述FRM一级考试的主要目的。

2.在FRM一级考试中,考生应具备哪些基本能力?。

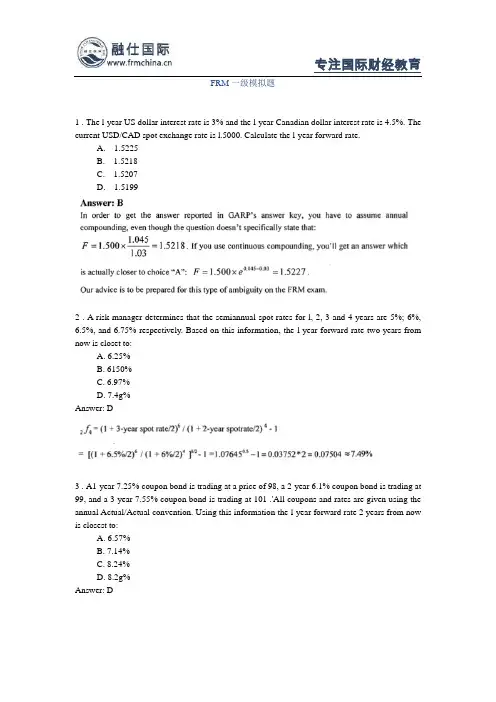

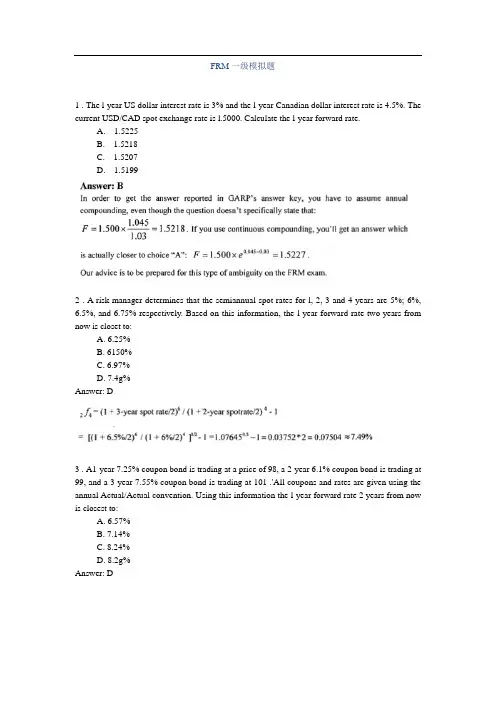

FRM一级模拟题1 . The l-year US dollar interest rate is 3% and the l-year Canadian dollar interest rate is 4.5%. The current USD/CAD spot exchange rate is l.5000. Calculate the l-year forward rate.A. 1.5225B. 1.5218C. 1.5207D. 1.51992 . A risk manager determines that the semiannual spot rates for l, 2,3 and4 years are 5%; 6%, 6.5%, and 6.75% respectively. Based on this information, the l-year forward rate two years from now is closet to:A. 6.25%B. 6150%C. 6.97%D. 7.4g%Answer: D3 . A1-year 7.25% coupon bond is trading at a price of 98, a 2-year 6.1% coupon bond is trading at 99, and a 3-year 7.55% coupon bond is trading at 101 .'All coupons and rates are given using the annual Actual/Actual convention. Using this information the l-year forward rate 2 years from now is closest to:A. 6.57%B. 7.14%C. 8.24%D. 8.2g%Answer: D4 . The price of a three-year zero coupon government bond is 85.16. The price of a similar four-year bond is 79.81. What is the one-year implied forward rate form year 3 to year 4? Answer: D5 . A buffalo farmer is concerned that the price he can get for his buffalo herd will be less than he has forecasted. To protect himself from price declines in the herd, the farmer has decided to hedge with live cattle futures. Specifically, he has entered into the appropriate number of cattle future positions for September delivery that he believes will help offset any buffalo price declines during the winter slaughter season. The appropriate position and the likely sources of basis risk in the hedge are, respectively:A. Short; choice of futures delivery date.B. Short; choice of futures asset.C. Short; choice of futures delivery date and asset.D. Long; choice of futures delivery date and asset.Answer: CThe farmer needs to be short the futures contracts. The two sources of basis risk confronting the farmer wⅢresult from the fact that he is using a cattle contract to offset the price movement of his buffalo herd, Cattle prices and buffalo prices may not be perfectly positively correlated. As a result, the correlation between buffalo 'and cattle prices will have an impact on the basis of the cattle futures contract and spot buffalo meat. The delivery date is a problem in this situation, because the farmer's hedge horizon is winter, which probably will not commence until December or January. In order to maintain a hedge during this period, the farmer will have to enter into another futures contract, which will introduce an additional source of basis risk.。

fr考试试题及答案FR考试试题及答案一、选择题(每题2分,共20分)1. 以下哪个选项是FR考试中不涉及的领域?A. 金融分析B. 风险管理C. 人力资源管理D. 投资组合管理答案:C2. FR考试中,以下哪个工具不是用于评估信用风险的?A. 信用评分模型B. 压力测试C. 敏感性分析D. 期权定价模型答案:D3. 在FR考试中,以下哪个因素不是影响市场风险的因素?A. 利率变动B. 汇率变动C. 股价波动D. 员工满意度答案:D4. FR考试中,以下哪个不是流动性风险管理的方法?A. 资产负债匹配B. 建立紧急流动性基金C. 增加员工培训D. 多元化投资组合答案:C5. 在FR考试中,以下哪个不是操作风险的来源?A. 人为错误B. 系统故障C. 市场波动D. 法律变更答案:C6. FR考试中,以下哪个不是风险管理的基本原则?A. 识别风险B. 评估风险C. 转移风险D. 忽视风险答案:D7. 在FR考试中,以下哪个不是风险管理框架的组成部分?A. 风险识别B. 风险评估C. 风险监控D. 风险消除答案:D8. FR考试中,以下哪个不是风险管理策略?A. 风险避免B. 风险转移C. 风险接受D. 风险增加答案:D9. 在FR考试中,以下哪个不是风险管理工具?A. 衍生品B. 保险C. 风险分散D. 市场调研答案:D10. FR考试中,以下哪个不是风险管理的目标?A. 保护资产B. 增加收益C. 确保合规性D. 减少损失答案:B二、填空题(每题2分,共20分)1. FR考试中,风险管理的核心目标是_________和_________。

答案:保护资产;减少损失2. 在FR考试中,_________风险是指由于市场因素(如利率、汇率、股价等)的变动而对企业财务状况产生影响的风险。

答案:市场风险3. FR考试中,_________风险是指由于企业内部操作失误、欺诈、系统故障等原因导致的风险。

答案:操作风险4. 在FR考试中,_________风险是指由于企业信用状况变化而影响其融资成本和能力的风险。

FRM一级练习题(2)1、If the daily, 95% confid ence l evel value at risk (VaR) of a portfolio is correctly estimated to be USD 10,000, one would expect that:A. In 1 out of 20 days, the portfolio value will decline by USD 10,000 or l ess.B. In 1 out of 95 days, the portfolio value will decline by USD 10,000 or l ess.C. In 1 out of 95 days, the portfolio value will decline by USD 10,000 or more.D. In 1 out of 20 days, the portfolio value will decline by USD 10,000 or more.2、By reducing the risk of financial distress and bankruptcy, a firm's use of derivatives contracts to hedge its cash fl ow uncertainty will:A. Lower its value due to the transaction costs of derivatives trading.B. Enhance its value since investors cannot hedge such risks by themselves.C. Have no impact on its value as investors can costl essly diversify this risk.D. Have no impact as only systematic risks can be hedged with derivatives.3、An analyst at CAPM Research Inc. is projecting a return of 21% on portfolio A. The market risk premium is 11%, the volatility of the market portfolio is 14%, and the risk-free rate is 4.5%. Portfolio A has a beta of 1.5. According to the Capital Asset Pricing Model (CAPM), which of the foll owing statements is true?A. The expected return of portfolio A is greater than the expected return of the market portfolio.B. The expected return of portfolio A is less than the expected return of the market portfolio.C. The expected return of portfolio A has l ower volatility than the market portfolio.D. The expected return of portfolio A is equal to the expected return of the market portfolio.4、Suppose portfolio A has an expected return of 8% and volatility of 20%, and its beta is 0.5. Suppose the market has an expected return of 10% and volatility of 25%. Finally, suppose the risk-free rate is 5%. What is Jensen's alpha for portfolio A?A. 10%B. 1%C. 0.5%D. 15%5、Which of the foll owing statements regarding Metallgesellschaft's failure is incorrect?A. The futures and swap positions Metallgesellschaft entered into introduced significant credit risk for the company.B. An oil market move from a state of contango to normal backwardation and margin calls created a major cash crunch for Metallgesellschaft.C. Metallgesellschaft engaged in a stack-and-roll hedge, and as spot prices began to decrease more than futures prices, roll over losses could not be recovered.D. Because of the size of its position in heating and gasoline oil futures, Metallgesellschaft was exposed to market liquidity risk and had difficulty liquidating its position.6、Which of the foll owing statements is incorrect?A. Existing risk models often rely on historical data and are most precise for short horizons, like days.B. Market crises often involve a dramatic withdrawal of liquidity from the market.C. During crisis periods, firms will often make multipl e losses that exceed daily VaRs, and these losses can be large enough to substantially weaken them.D. When evaluating risks associated with a potential crisis period, existing risk models generally fail to effectively incorporate the risk of a decrease in liquidity but do effectively capture the distribution of large losses over an extended horizon beyond one day.7、If cov(z, x + y) = 0 , which of the foll owing must be true?A. cov(z, x) = 0, cov(z, y) = 0B. cov(z, x) * cov(z, y) = 0C. cov(z, x) ! 0, cov(z, y) ! 0D. None of the above8、Angela Santori buys two stocks, stock X and stock Y. Suppose that the only information she has about the return distributions is that the probability of a stock price decrease in one year for stock X is 23% and for stock Y is 39%. What is the highest possibl e probability that both stock prices increase in one year?A. 61%B. 46.97%C. 23%D. 77%9、John is forecasting a stock's performance in 2010 conditional on the state of the economy of the country in which the firm is based. He divides the economy's performance into three categories of "good," "neutral," and"poor" and the stock's performance into three categories of " increase," "constant," and "d ecrease."He estimates:1、The probability that the state of the economy is good is 20%. If the state of the economy is good, theprobability that the stock price increases is 80% and the probability that the stock price decreases is 10%.2. The probability that the state of the economy is neutral is 30%. If the state of the economy is neutral, theprobability that the stock price increases is 50% and the probability that the stock price decreases is 30%.3. If the state of the economy is poor, the probability that the stock price increases is 15% and theprobability that the stock price decreases 70%.Billy, his supervisor, asks him to estimate the probability that the state of the economy is neutral given that the stock performance is constant. John's best assessment of that probability is closest to:A. 20%B. 15.5%C. 19.6%D. 38.7%10、You built a linear regression model to analyze annual salaries for a developed country. You incorporated two independent variables, age and experience, into your model. Upon reading the regression results, you noticed that the coefficient of "experience" is negative, which appears to be counterintuitive. In addition, you have discovered that the coefficients have l ow t-statistics but the regression mod el has a high R2. What is the most likely cause of these results?A. Incorrect standard errorsB. HeteroskedasticityC. Serial correlationD. Multicollinearity参与FRM的考生可按照复习计划有效进行,另外高顿网校官网考试辅导高清课程已经开通,还可索取FRM 考试通关宝典,针对性地讲解、训练、答疑、模考,对学习过程进行全程跟踪、分析、指导,可以帮助考生全面提升备考效果。

FRM一级练习题(1)1、An investment manager is given the task of beating a benchmark. Hence the risk shoul d be measured in terms ofA. Loss relative to the initial investmentB. Loss relative to the expected portfolio valueC. Loss relative to the benchmarkD. Loss attributed to the benchmark2、Based on the risk assessment of the CRO, Bank United's CEO decid ed to make a large investment in a levered portfolio of CDOs. The CRO had estimated that the portfolio had a 1% chance of l osing $1 billion or more over one year, a loss that would make the bank insolvent. At the end of the first year the portfolio has lost $2 billion and the bank was cl osed by regulator. Which of the foll owing statement is correct?A. The outcome d emonstrates a risk management failure because the bank did not eliminate the possibility of financial distress.B. The outcome demonstrates a risk management failure because the fact that an extremely unlikely outcome occurred means that the probability of the outcome was poorly estimated.C. The outcome demonstrates a risk management failure because the CRO failed to go to regulators to stop the shutd own.D. Based on the information provid ed, one cannot determine whether it was a risk management failure.3、An analyst at CARM Research Inc. is projecting a return of 21% on Portfolio A. The market risk premium is 11%, the volatility of the market portfolio is 14%, and the risk-free rate is 4.5%. Portfolio A has a beta of 1.5. According to the capital asset pricing model which of the foll owing statements is true?A. The expected return of Portfolio A is greater than the expected return of the market portfolio.B. The expected return of Portfolio is less than the expected return of the market portfolio.C. The return of Portfolio A has l ower volatility than the mark t portfolio.D. The e peered return of Portfolio A is equal to the expected return of the market portfolio.4、Suppose Portfolio A has an expected return of 8%, volatility of 20%, and beta of 0.5. Suppose the market has an expected return of 10% and volatility of 25%. Finally suppose the risk-free rate is 5%. What is Jensen’s Alpha for Portfolio A?A. 10.0%B. 1.0%C. 0.5%D. 15%5、Which of the foll owing statement about the Sharpe ratio is false?A. The Sharpe ratio consid ers both the systematic and unsystematic risk of a portfolio.B. The Sharpe ratio is equal to the excess return of a portfolio over the risk-free rate divided by the total risk of the portfolio.C. The Sharpe ratio cannot be used to evaluate relative performance of undiversified portfolios.D. The Sharpe ratio is derived from the capital market line.6、A portfolio manager returns 10% with a volatility of 20%. The benchmark returns 8% with risk of 4%. The correlation between the two is 0.98. The risk-free rate is 3%. Which of the foll owing statement is correct?A. The portfolio has higher SR than the benchmark.B. The portfolio has negative IR.C. The IR is 0.35.D. The IR is 0.29.7、In perfect markets risk management expenditures aimed at reducing a firm' diversifiable risk serve toA. Make the firm more attractive to sharehol ders as long as costs of risk management are reasonable.B. Increase the firm's value by lowering its cost of equity.C. Decrease the firm's value whenever the costs o f such risk management are positive.D. Has no impact on firm value.8、By reducing the risk of financial distress and bankruptcy, a firm's use of d erivatives contracts to hedge it cash fl ow uncertainty willA. Lower its value due to the transaction costs of derivative trading.B. Enhance its value since investors cannot hedge such risks by themselves.C. Have no impact on its value as investor costless diversify this risk.D. Have no impact as only systematic risks can be hedged with derivatives.参与FRM的考生可按照复习计划有效进行,另外高顿网校官网考试辅导高清课程已经开通,还可索取FRM 考试通关宝典,针对性地讲解、训练、答疑、模考,对学习过程进行全程跟踪、分析、指导,可以帮助考生全面提升备考效果。

FRM一级模拟题1 . A stock currently trades at $10. At the end of three months, the stock will either be $11 0r $9. The continuously compounded risk-free rate of interest is3.5 percent per year. The value of a 3-month European call option with astrike price of $10 is closest to:A. $1.07B. $0.54C. $0.81D. $0.95Answer: B2.The current price of a non-dividend paying stock-is $75. The annual volatility of the stock is 18.25%, and the current continuously compounded risk-free interest rate is 5 %. A 3-year European call option exists that has a strike price of $90. Assuming that 'the price of the stock will rise or fall by a proportional amount each year, and that the probability that the stock will rise in any one year is 60 %, what is the value of the European call option?A. $22.16B. $12.91C. $3.24D. $7.36Answer: D3 . You have been asked to find the value of an Asian option on the short rate. The Asian option gives the holder an amount equal to the average value of the short rate over the period to expiration less the strike rate. To value this option with a one-factor binomial model of interest rates, what method would you recommend using?A. The backward induction method, since it is the fastest.B. The simulation method, using 'path averages since the option is path-dependent.C. The simulation method, using path averages since the option is path-independent.D. Either the backward induction method or the simulation method, since both methods return the same value.Answer: BThe payoff for an Asian option (or average price option) on the short rate is dependent on the path of the average value of short rates. Furthermore, Asian options must be valued using simulation techniques because they cannot be exercised early.4 . Suppose you believe that Company A's stock price is going to decline from its current level of $82.50 sometime during the next5 months. For $510.25 you could buy a 5-month put option giving you the right to sell 100 shares at a price of $83.00 per share. If you bought the put option contract for $510.25 and Company A's stock price actually dropped to $63.00, your profit net of the premium paid would beA. $1,950.00B. $1,439.75C. $1,489.75D. $2,000.00Answer: C5 . We buy an SPX put (multiplieF$250) at l,250 for a premium of 20 points. The S&P500 closes at l,235 0n the settlement day. What is our profit/loss from this trade?A. $0B. $500C. -$1,250D. -$3,750Answer: CIn return for buying this option, we paid a premium of 20x $250 = $5,000. As the settlement level is lower than the strike we make (1,250 - 1,235)x 250 = $3,750. Subtracting the premium from the profit made at settlement, our net loss is $1,250.。

frm一级考试真题一级考试主要是看理解与掌握金融资产定价理论与方法,同时也是对金融资产定价相关知识的一个检验。

一级考试最大的特点是题目的难度较大;但相对来说难度也是中等的。

本次的试题以“新冠肺炎疫情”为主题,考察了金融资产定价理论与方法中涉及到的风险评估与风险管理。

本题共有11个问题:新冠肺炎疫情对金融资产估值影响的分析方法以及影响?新冠肺炎疫情对市场利率与金融资产定价体系会有什么影响?金融资产定价模型有哪些关键要素?1.对于新冠肺炎疫情的分析,以下哪个因素会影响新冠肺炎的估值?对于疫情的相关分析,需要考虑两个变量:政府对疫情的反应程度(paradox)和新冠肺炎对经济的影响(predictive)。

对于政府做出的反应程度,需要考虑两个因素:一是政府对疫情管控力度是否足够(rasmust);二是新冠肺炎对经济的影响(value)。

答案:政府对疫情反应程度对疫情结束后股市的估值产生巨大影响,进而影响到股市盈利水平。

此外,疫情在不同国家之间存在较大差异。

所以,应该考虑各国政府采取的不同应对措施对股市价值产生影响而决定股市估值水平。

2.对新冠肺炎疫情估值影响,下列哪种分析方法能充分说明?【答案】 C。

解析:对于新冠肺炎疫情,目前采用的技术并不能完全预测风险变化结果。

对于风险调整后的收益(长期),其影响主要体现在两个方面:对未来现金流折现)的影响;以及投资价值损失)。

但并不是所有的疫情冲击都会对收益产生影响(有正面影响的也有负面影响)。

对未来现金流(长期)影响最大的是疫情冲击导致的投资价值下降问题。

因此,虽然疫情冲击可以直接影响现金流(长期),但短期内还是会对投资价值产生一定影响。

对于投资价值损失)的影响,根据 FRM理论(最优经济参数)并考虑企业正常运营可能面临的不确定性和非线性风险后,最终确定长期投资价值影响系数并求得相应的参数范围。

因此本题可以说采用了最优经济参数作为判断标准进行相关分析。

3.从疫情爆发到疫苗研发成功,至少需要一个周期?答:如果想要研发出一种有效的疫苗,至少需要一个周期。

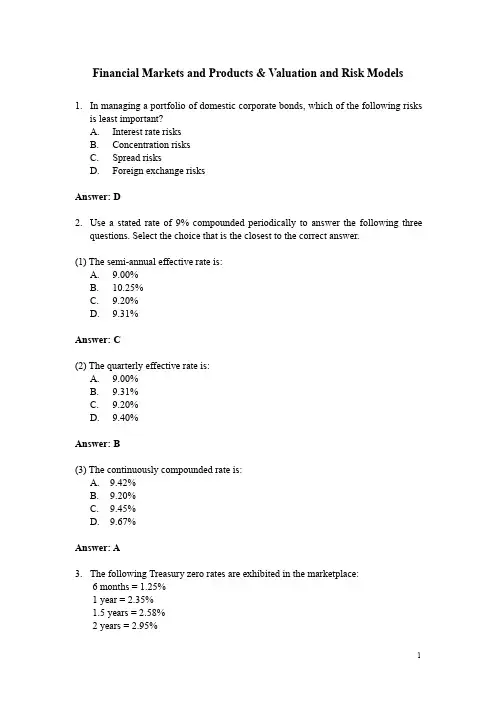

Financial Markets and Products & Valuation and Risk Models1.In managing a portfolio of domestic corporate bonds, which of the following risksis least important?A.Interest rate risksB.Concentration risksC.Spread risksD.Foreign exchange risksAnswer: De a stated rate of 9% compounded periodically to answer the following threequestions. Select the choice that is the closest to the correct answer.(1) The semi-annual effective rate is:A.9.00%B.10.25%C.9.20%D.9.31%Answer: C(2) The quarterly effective rate is:A.9.00%B.9.31%C.9.20%D.9.40%Answer: B(3) The continuously compounded rate is:A.9.42%B.9.20%C.9.45%D.9.67%Answer: A3.The following Treasury zero rates are exhibited in the marketplace: 6 months = 1.25% 1 year = 2.35%1.5 years =2.58% 2 years = 2.95%Assuming continuous compounding, the price of a 2-year Treasury bond that paysa 6 percent semiannual coupon is closest to:A.105.20B.103.42C.108.66D.105.90Answer: D4. A two-year zero-coupon bond issued by corporate XYZ is currently rated A. Oneyear from now XYZ is expected to remain at A with 85% probability, upgraded to AA with 5% probability, and downgraded to BBB with 10% probability. The risk free rate is flat at 4%. The credit spreads are flat at 40, 80, and 150 basis points for AA, A, and BBB rated issuers, respectively. All rates are compounded annually.Estimate the expected value of the zero-coupon bond one year from now (for USD 100 face amount). Fixed Income Securities:D 92.59D 95.33D 95.37D 95.42Answer: C5.Assuming the long-term yield on a perpetual note is 5%, compute the dollar valueof a 1 bp. Increase in the yield (DV01) for a perpetual note paying a USD 1,000,000 annual coupon.A.-20,000B.-30,000C.-40,000D.-50,000Answer: C6.Given the following portfolio of bonds:What is the value of the portfolio’s DV01 (Dollar value of 1 basis point)?A.8,019B.8,294C.8,584D.8,813Answer: C7.Assuming other things constant, bonds of equal maturity will still have differentDV01 per USD 100 face value. Their DV01 per USD 100 face value will be in the following sequence of highest value to lowest value:A.Premium bonds, par bonds, zero coupon bondsB.Zero coupon bonds, Premium bonds, par bondsC.Premium bonds, zero coupon bonds, par bondsD.Zero coupon bonds, par bonds, Premium bondsAnswer: A8.Which of the following statements about standard fixed rate government bondswith no optionality is TRUE?I.Higher coupon implies shorter duration.II.Higher yield implies shorter duration.III.Longer maturity implies larger convexity.A.I and II onlyB.II and III onlyC.I and III onlyD.I, II, and IIIAnswer: D9.Which of the following is not a property of bond duration?A.For zero-coupon bonds, Macaulay duration of the bond equals its years tomaturity.B.Duration is usually inversely related to the coupon of a bond.C.Duration is usually higher for higher yields to maturity.D.Duration is higher as the number of years to maturity for a bond selling atpar or above increases.Answer: C10.Estimated price changes using only duration tend to:A.Overestimate the increase in price that occurs with a decrease in yield forlarge changes in yield.B.Underestimate the decrease in price that occurs with a increase in yield forlarge changes in yield.C.Overestimate the increase in price that occurs with a decrease in yield forsmall changes in yield.D.Underestimate the increase in price that occurs with a decrease in yield forlarge changes in yield.Answer: D11.A portfolio consists of two positions: One position is long $100M of a two yearbond priced at 101 with a duration of 1.7; the other position is short $50M of a five year bond priced at 99 with a duration of 4.1. What is the duration of the portfolio?A.0.68B.0.61C.-0.68D.-0.61Answer: D12.A zero-coupon bond with a maturity of 10 years has an annual effective yield of10%. What is the closest value for its modified duration?A.9B.10C.100D.Insufficient InformationAnswer: A13.A portfolio manager uses her valuation model to estimate the value of a bondportfolio at USD 125.482 million.The term structure is ing the same model,she estimates that the value of the portfolio would increase to USD 127.723 million if all the interest rates fell by 30bp and would decrease to USD 122.164 million if all the interest rates rose by ing these estimates,the effective duration of the bond is closest to :A. 8.38B. 16.76C. 7.38D. 14.77Answer: C14.A portfolio manager has a bond position worth USD 100 million. The position hasa modified duration of eight years and a convexity of 150 years. Assume that theterm structure is flat. By how much does the value of the position change if interest rates increase by 25 basis points?D -2,046,875D -2,187,500D -1,953,125D -1,906,250Answer: C15.An investment in a callable bond can be analytically decomposed into a:A.Long position in a non-callable bond and a short position in a put optionB.Short position in a non-callable bond and a long position in a call optionC.Long position in a non-callable bond and a long position in a call optionD.Long position in a non-callable and a short position in a call optionAnswer: D16.A European bank exchanges euros for USD, lends them at the U.S. risk-free rate,and simultaneously enters into a forward contract to sell the loan proceeds for euros at loan maturity. If the net effect of these transactions is to earn the risk-free euro rate, it is an example of:A.ArbitrageB.Spot-forward equalityC.Interest rate parityD.The law of one priceAnswer: C17.At the inception of a six-month forward contract on a stock index, the value of theindex was $1,150, the interest rate was 4.4%, and the continuous dividend was1.8%. Three months later, the value of the index is $1,075. Which of the followingstatement is True? The value of the:A.long position is $82.41.B.long position is $47.56.C.short position is $47.56.D.long position is -$82.41.Answer: D18.Assuming the 92-day and 274 day interest rate is 8% (act/360, money market yield)compute the 182-day forward rate starting in 92 days (act/360, money market yield).A.7.8%B.8.0%C.8.2%D.8.4%Answer: B19.The 1-year US dollar interest rate is 3% and the 1-year Canadian dollar interestrate is 4.5%. The current USD/CAD spot exchange rate is 1.5000. Calculate the 1-year forward rate.A. 1.5225B. 1.5218C. 1.5207D. 1.5199Answer: B20.The price of a three-year zero coupon government bond is 85.16. The price of asimilar four-year bond is 79.81. What is the one-year implied forward rate form year 3 to year 4?A. 5.4%B. 5.5%C. 5.8%D. 6.7%Answer: D21.The clearinghouse in a futures contract performs all but which of the followingroles? The clearing house:A.guarantees traders against default from another party.B.splits each trade and acts as a buyer to futures sellers and as a seller tofutures buyers.C.allows traders to reverse their position without having to contract the otherside of the position.D.guarantees the physical delivery of the underlying asset to the buyer offuture contracts.Answer: D22.A weakening of the basis is a consequence of the:A.Spot price increasing faster than the futures price over time.B.Spot price moving according to hyper-arithmetic Brownian motion.C.Futures price increasing faster than the spot price over time.D.Futures price moving according to hyper-arithmetic Brownian motion. Answer: C23.Which of the following statements best describes marking-to-market of a futurescontract? At the:A.End of the day, the maintenance margin is increased for traders who lost anddecreased for traders who gained.B.Conclusion of each trade, the gains or losses from all previous trades in thefutures contract are tallied.C.Maturity of the futures contract, the gains or losses are tallied to the trader’saccount.D.End of the day, the gains or losses are tallied to the trader’s account. Answer: D24.A trader buys one wheat contract (underlying = 5,000 bushels) at a price of $3.05per bushel. The initial margin on the contract is $4,500 and the maintenance margin is $3,750. At what price will the trader receive a maintenance margin call?A.$2.30B.$2.90C.$3.20D.$3.80Answer: B25.The S&P 500 index is trading at 1,025. The S&P 500 pays an expected dividendyield of 1.2% and the current risk-free rate is 2.75%. The value of a 3-month futures contract on the S&P 500 index is closest to:A.$1,028.98B.$1,108.59C.$984.86D.$1,025.00Answer: A26.The current spot price of gold is $325/oz and the price of 90-day gold futurescontract (nominal amount of 100 oz) is $315. If 90-day Treasury bills are trading at yields of 3.55% - 3.58% and storage and delivery costs are ignored, what is the potential arbitrage profit per contract?A.$1,266B.$1,286C.$1,334D.$1,344Answer: C27.Which of the following statements describing the role of a convenience yield inpricing commodity futures is true? The convenience yield:I.will cause contango in the futures pricing relationship.II.Effectively reduces the cost of carry in the futures pricing relationship.III.Eliminates the potential for arbitrage between the futures and spot price.IV.Accounts for additional costs for storing an asset in the futures pricing relationship.A.I onlyB.II onlyC.II, III, and IV onlyD.I and II onlyAnswer: B28.A firm is going to buy 10,000 barrels of West Texas Intermediate Crude Oil. Itplans to hedge the purchase using the Brent Crude Oil futures contract. The correlation between the spot and futures prices is 0.72. The volatility of the spot price is 0.35 per year. The volatility of the Brent Crude Oil futures price is 0.27 per year. What is the hedge ratio for the firm?A. 0.9333B. 0.5554C. 0.8198D. 1.2099Answer: A29.The hedge ratio is the ratio of derivatives to a spot position (or vice versa thatachieves an objective such as minimizing or eliminating risk. Suppose that the standard deviation of quarterly changes in the price of a commodity is 0.57, the standard deviation of quarterly changes in the price of a futures contract on the commodity is 0.85, and the covariance between the two changes is 0.3876. What is the optimal hedge ratio for a 3.-month contract?A.0.1893B.0.2135C.0.2381D.0.2599Answer: D30.Consider an equity portfolio with market value of USD 100M and a beta of 1.5with respect to the S&P 500 Index. The current S&P 500 index level is 1000 and each futures contract is for delivery of USD 250 times the index level. Which of the following strategy will reduce the beta of the equity portfolio to 0.8?A.Long 600 S&P 500 futures contractsB.Short 600 S&P 500 futures contractsC.Long 280 S&P 500 futures contractsD.Short 280 S&P 500 futures contractsAnswer: D31.Corporates normally use FRAs to:A.Lock-in the cost of borrowing in the futureB.Lock-in the cost of lending in the futureC.Hedge future currency exposuresD.Create future currency exposuresAnswer: A32.An investor has entered into a forward rate agreement(FRA) where she hascontracted to pay a fixed rate of 5 percent on $5,000,000 based on the quarterly rate in three months. If interest rates are compounded quarterly, and the floating rate is 2 percent in three months, what is the payoff at the end of the sixth month?The investor will:A.make a payment of $37,500.B.receive a payment of $37,500.C.make a payment of $75,000.D.receive a payment of $75,000.Answer: A33.Consider the following 6x9 FRA ,Assume the buyer of the FRA agrees to acontract rate of 6.35% on a notional amount of 10 million USD ,Calculate the settlement amount of the seller if the settlement rate is 6.85%. Assume a 30/360 day count basis.A.–12,500B.–12,290C.+12,500D.+12,290Answer: B34.XYZ Corporation plans to issue a 10-year bond 6 months from now. XYZ wouldlike to hedge the risk that interest rates might rise significantly over the next 6 months. In order to effect this, the treasurer is contemplating entering into a swap transaction. Under the swap, she should:A.Pay fixed and receive LIBORB.Pay LIBOR and receive fixedC.Either swap (a or b above) will workD.Neither swap (a or b above) will workAnswer: A35.Consider the following plain vanilla swap. Party A pays a fixed rate 8.29% perannum on a semiannual basis (180/360), and receives from Party B LIBOR+30 basis point. The current six-month LIBOR rate is 7.35% per annum. The notional principal is $25M. What is the net swap payment of Party AA.$20,000B.$40,000C.$80,000D.$110,000Answer: C36.A trader executes a $420 million 5-year pay fixed swap(duration 4.433) with oneclient and a $385 million 10year receive fixed swap(duration 7.581) with another client shortly afterwards. Assuming that the 5-year rate is 4.15 % and 10-year rate is 5.38 % and that all contracts are transacted at par, how can the trader hedge his net delta position?A.Buy 4,227 Eurodollar contractsB.Sell 4,227 Eurodollar contractsC.Buy 7,185 Eurodollar contractsD.Sell 7,185 Eurodollar contractsAnswer: B37.Assume an investor with a short position is about to deliver a bond and has fourbonds to choose from which are listed in the following table. The last settlement price is $95.75 (this is the quoted futures price). Determine which bond is the cheapest-to-deliver.Bond Quoted Bond Price Conversion Factor1 99 1.012 125 1.243 103 1.064 115 1.14A. Bond 1B. Bond 2C. Bond 3D. Bond 4Answer: C38.What is the lower pricing bound for a European call option with a strike price of80 and one year until expiration? The price of the underlying asset is 90, and the1-year interest rate is 5% per annum. Assume continuous compounding of interest.A.14.61B.13.90C.10.00D. 5.90Answer: B39.According to Put-Call parity, buying a call option on a stock is equivalent to:A.Writing a put, buying the stock, and selling short bonds (borrowing).B.Writing a put, selling the stock, and buying bonds (lending).C.Buying a put, selling the stock, and buying bonds (lending).D.Buying a put, buying the stock, and selling short bonds (borrowing). Answer: D40.Jeff is an arbitrage trader, and he wants to calculate the implied dividend yield ona stock while looking at the over-the-counter price of a 5-year put and call (bothEuropean-style) on that same stock. He has the following data:• Initial stock price = USD 85• Strike price = USD 90• Continuous risk-free rate = 5%• Underlying stock volatility = unknown• Call price = USD 10• Put price = USD 15What is the continuous implied dividend yield of that stock?A. 2.48%B. 4.69%C. 5.34%D.7.71%Answer: C41.The current price of a stock is $55. A put option with $50 strike price thatexpires in 3 months is available. If N(d1)=0.8133, N(d2)=0.7779, the underlying stock exhibits an annual standard deviation of 25 percent, and current risk free rates are 3.25 percent, the Black-Scholes value of the put is closet to:A.$0.75B.$1.25C.$1.50D.$5.00Answer: A42.Which of the following is the riskiest form of speculation using options contracts?A.Setting up a spread using call optionsB.Buying put optionsC.Writing naked call optionsD.Writing naked put optionsAnswer: C43.A long position in a put option can be synthetically produced by:A.Long position in the underlying and a short position in a call.B.Short position in the underlying and a long position in a call.C.Long position in the underlying and a long position in a put.D.Short position in the underlying and a short position in a put.Answer: B44.ABEX Corporation common stock is selling for $50.00 per share. Both anAmerican call option and a European call option are available on ABEX common, and each have identical strike prices and expiration dates. Which of the following statements concerning these two options is TRUE?A.Because the American and European options have identical terms and arewritten against the same common stock, they will have identical optionpremiums.B.The greater flexibility allowed in exercising the American option willnormally result in a higher market value relative to an otherwise identicalEuropean option.C.The American option will have a higher option premium, because theAmerican security markets are larger than the European markets.D.The European option will normally have a higher option premium because oftheir relative scarcity compared to American options.Answer: B45.Put option values increase as a result of increases in which of the followingfactors?I.V olatilityII.DividendsIII.Stock PriceIV.Time to expirationA.I, II, and IV onlyB.I, III, and IV onlyC.II and IV onlyD.I and III onlyAnswer: A46.Your firm has no prior derivatives trades with its counterparty Super Bank. Yourboss wants you to evaluate some trades she is considering. in particular, she wants to know which of the following trades will increase your firm’s credit risk exposure to Super Bank:I.Buying a put optionII.Selling a put optionIII.Buying a forward contractIV.Selling a forward contractA.I and II onlyB.II and IV onlyC.III and IV onlyD.I, III, and IV onlyAnswer: D47.Which of the following statements about a floor is true?A.floor is a put option and protects against a fall in interest ratesB.floor is a call option and protects against a fall in interest ratesC.floor is a put option and protects against a rise in interest ratesD.floor is a call option and protects against a rise in interest ratesAnswer: A48.You are given the following information about a call option:• Time to maturity = 2 years• Continuous risk-free rate = 4%• Continuous dividend yield = 1%• N(d1) = 0.64Calculate the delta of this option.A.-0.64B.0.36C.0.63D.0.64Answer: C49.Call and put option values are most sensitive to changes in the volatility of theunderlying when:A.both calls and puts are deep in-the-money.B.both puts and calls are deep out-of-the-money.C.calls are deep out-of-the-money and puts are deep in-the-money.D.both calls and puts are at-the-money.Answer: D50.What is the reason for undertaking a Vega hedging? To minimize the:A.Possibility of counterparty default risk.B.Potential loss as a result of a change in the volatility of the underlying sourceof risk.C.Adverse effect due to the government regulation.D.Potential loss as a result of a large movement in the underlying source ofrisk.Answer: B51.Suppose an existing short option position is delta-neutral, but has a gamma of−600. Also assume that there exists a traded option with a delta of 0.75 and a gamma of 1.50. In order to maintain the position gamma-neutral and delta-neutral, which of the following is the appropriate strategy to implement?A. Buy 400 options and sell 300 shares of the underlying asset.B. Buy 300 options and sell 400 shares of the underlying asset.C. Sell 400 options and buy 300 shares of the underlying asset.D. Sell 300 options and buy 400 shares of the underlying asset.Answer: A52.W hich of the following is not an assumption of the BS options pricing model?A. The price of the underlying moves in a continuous fashionB. The interest rate changes randomly over timeC. The instantaneous variance of the return of the underlying is constantD. Markets are perfect,i.e.short sales are allowed,there are on transaction costs or taxes,andmarkets operate continuously.Answer: B53.If risk is defined as a potential for unexpected loss, which factors contribute to therisk of a short call option position?A.Delta, vega, rhoB.Vega, rhoC.Delta, vega, gamma, rhoD.Delta, vega, gamma, theta, rhoAnswer: C54.If risk is defined as a potential for unexpected loss, which factors contribute to therisk of a long straddle position?A.Delta, vega, rhoB.Vega, rhoC.Delta, vega, gamma, rhoD.Delta, vega, gamma, theta, rhoAnswer: B55.Long a call on a stock and short a call on the same stock with a higher strike priceand same maturity is called:A. A bull spreadB. A bear spreadC. A calendar spreadD. A butterfly spreadAnswer: A56.Consider a bullish spread option strategy of buying one call option with a $30exercise price at a premium of $3 and writing a call option with a $40 exercise price at a premium of $1.50. If the price of the stock increases to $42 at expiration and the option is exercised on the expiration date, the net profit per share at expiration (ignoring transaction costs) will be:A.$8.50B.$9.00C.$9.50D.$12.50Answer: A57.An investor sells a June 2008 call of ABC Limited with a strike price of USD 45for USD 3 and buys a June 2008 call of ABC Limited with a strike price of USD40 for USD 5. What is the name of this strategy and the maximum profit and lossthe investor could incur?A.Bear Spread, Maximum Loss USD 2, Maximum Profit USD 3B.Bull Spread, Maximum Loss Unlimited, Maximum Profit USD 3C.Bear Spread, Maximum Loss USD 2, Maximum Profit UnlimitedD.Bull Spread, Maximum Loss USD 2, Maximum Profit USD 3Answer: D58.Which of the following actions would be most profitable when a trader expects asharp rise in interest rates?A.Sell a payer swaption.B.Buy a payer swaption.C.Sell a receiver swaption.D.Buy a receiver swaption.Answer: B59.Initially, the call option on Big Kahuna Inc. with 90 days to maturity trades atUSD 1.40. The option has a delta of 0.5739. A dealer sells 200 call option contracts, and to delta-hedge the position, the dealer purchases 11,478 shares of the stock at the current market price of USD 100 per share. The following day, the prices of both the stock and the call option increase. Consequently, delta increases to 0.7040. To maintain the delta hedge, the dealer shouldA.sell 2,602 sharesB.sell 1,493 sharesC.purchase 1,493 sharesD.purchase 2,602 sharesAnswer: D60.A risk manager for bank XYZ, Mark is considering writing a 6 month American put optionon a non-dividend paying stock ABC. The current stock price is USD 50 and the strike price of the option is USD 52. In order to find the no-atbitrage price of the option, Mark uses a two-step binomial tree model. The stock price can go up or down by 20% each period. Mark’s view is that the stock price has an 80% probability of going up each period and a 20% probability of going down. The risk-free rate is 12% per annum with continuous compounding.What is the risk-neutral probability of the stock price going up in a single step?A. 34.5%B. 57.6%C. 65.5%D. 80.0%Answer: B61.Given the following 30 ordered simulated percentage returns of an asset, calculatethe VaR and expected shortfall (both expressed in terms of returns) at a 90% confidence level.-16, -14, -10, -7, -7, -5, -4, -4, -4, -3, -1, -1, 0, 0, 0, 1, 2, 2, 4, 6, 7, 8, 9, 11, 12, 12, 14, 18, 21, 23A.VaR (90%) = 10, Expected shortfall = 14B.VaR (90%) = 10, Expected shortfall = 15C.VaR (90%) = 14, Expected shortfall = 15D.VaR (90%) = 18, Expected shortfall = 22Answer: B62.What is the correct interpretation of a $3 million overnight VaR figure with 99%confidence level?A.The institution can be expected to lose at most $3 million in 1 out of next100 days.B.The institution can be expected to lose at least $3 million in 95 out of next100 days.C.The institution can be expected to lose at least $3million in 1 out of next 100days.D.The institution can be expected to lose at most $6 million in 2 out of next100 days.Answer: C63.In the presence of fat tails in the distribution of returns, VaR based on thedelta-normal method would (for a linear portfolio):A.underestimate the true VaRB.be the same as the true VaRC.overestimate the true VaRD.cannot be determined from the information providedAnswer: A64.Value at risk (VaR) measures should be supplemented by portfolio stress testingbecause:A.VaR does not indicate how large the losses will be beyond the specifiedconfidence level.B.stress testing provides a precise maximum loss level.C.VaR measures are correct only 95% of the time.D.stress testing scenarios incorporate reasonably probable events.Answer: A65.Assume we calculate a one-week VaR for a natural gas position by rescaling thedaily VaR using the square-root rule. Let us now assume that we determine the “true” gas price process to be mean reverting and recalculate the VaR. Which of the following statements is true?A.The recalculated VaR will be less than the original VaRB.The recalculated VaR will be equal to the original VaRC.The recalculated VaR will be greater than the original VaRD.There is no necessary relation between the recalculated VaR and the originalVaRAnswer: A66.If a portfolio with a VaR of 200 is combined with a portfolio with a VaR of 500,the VaR of the combination could be:I.Less than 200.II.Less than 500.III.More than 200.IV.More than 500.A.I and IIB.III and IVC.I, II and IVD.II, III and IVAnswer: D67.Consider the following portfolio consisting only of stock Alpha. Stock Alpha has amarket value of $635,000 and an annualized volatility of 28%. Calculate the VaR assuming normally distributed returns with a 99% confidence interval for a 10-day holding period and 252 business days in a year. The daily expected return is assumed to be zero.A.$56,225B.$69,420C.$82,525D.$96,375Answer: C68.Babson Bank is interested in knowing the risk exposure of their assets for variousprobabilities and time horizons. Babson has estimated that the annual variance (based on a 250 day year) of their $638 million asset portfolio is 151.29. If Z1%, Z5%, Z10%, are 2.32, 1.65, and 1.28, respectively, which of the following statements is false? The maximum dollar loss that can be expected to be exceeded:A.5% of the time in any six month period is $64.74 millionB.1% of the time on any given day is $11.51 millionC.10% of the time in any given quarter is $50.22 millionD.1% of the time in any given week is $25.25 millionAnswer: A69.The VaR on a portfolio using a 1-day horizon is USD 100 million. The VaR usinga 10-day horizon is:D 316 million if returns are not independently and identically distributedD 316 million if returns are independently and identically distributedD 100 million since VaR does not depend on any day horizonD 31.6 million irrespective of any other factorsAnswer: B70.If stock returns are independently, identically, normally distribution and the annualvolatility is 30%, then the daily VaR at the 99% confidence level of a stock market portfolio is approximately。

FRM一级模拟题1 . The l-year US dollar interest rate is 3% and the l-year Canadian dollar interest rate is 4.5%. The current USD/CAD spot exchange rate is l.5000. Calculate the l-year forward rate.A. 1.5225B. 1.5218C. 1.5207D. 1.51992 . A risk manager determines that the semiannual spot rates for l, 2,3 and4 years are 5%; 6%, 6.5%, and 6.75% respectively. Based on this information, the l-year forward rate two years from now is closet to:A. 6.25%B. 6150%C. 6.97%D. 7.4g%Answer: D3 . A1-year 7.25% coupon bond is trading at a price of 98, a 2-year 6.1% coupon bond is trading at 99, and a 3-year 7.55% coupon bond is trading at 101 .'All coupons and rates are given using the annual Actual/Actual convention. Using this information the l-year forward rate 2 years from now is closest to:A. 6.57%B. 7.14%C. 8.24%D. 8.2g%Answer: D4 . The price of a three-year zero coupon government bond is 85.16. The price of a similar four-year bond is 79.81. What is the one-year implied forward rate form year 3 to year 4? Answer: D5 . A buffalo farmer is concerned that the price he can get for his buffalo herd will be less than he has forecasted. To protect himself from price declines in the herd, the farmer has decided to hedge with live cattle futures. Specifically, he has entered into the appropriate number of cattle future positions for September delivery that he believes will help offset any buffalo price declines during the winter slaughter season. The appropriate position and the likely sources of basis risk in the hedge are, respectively:A. Short; choice of futures delivery date.B. Short; choice of futures asset.C. Short; choice of futures delivery date and asset.D. Long; choice of futures delivery date and asset.Answer: CThe farmer needs to be short the futures contracts. The two sources of basis risk confronting the farmer wⅢresult from the fact that he is using a cattle contract to offset the price movement of his buffalo herd, Cattle prices and buffalo prices may not be perfectly positively correlated. As a result, the correlation between buffalo 'and cattle prices will have an impact on the basis of the cattle futures contract and spot buffalo meat. The delivery date is a problem in this situation, because the farmer's hedge horizon is winter, which probably will not commence until December or January. In order to maintain a hedge during this period, the farmer will have to enter into another futures contract, which will introduce an additional source of basis risk.X。

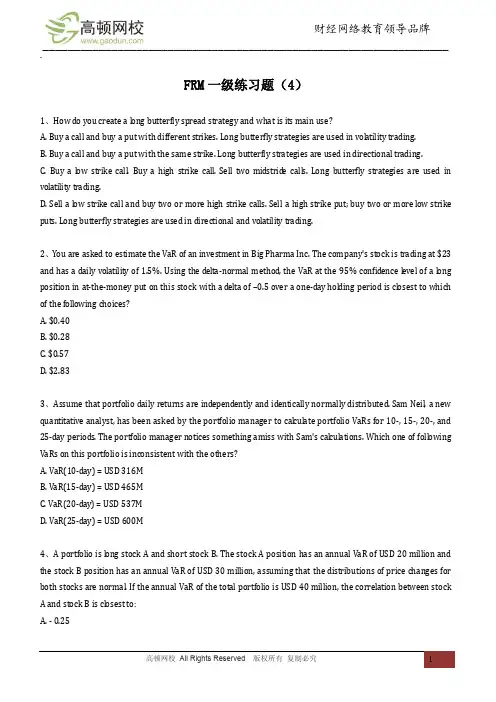

FRM一级练习题(4)1、How do you create a long butterfly spread strategy and what is its main use?A. Buy a call and buy a put with different strikes. Long butterfly strategies are used in volatility trading.B. Buy a call and buy a put with the same strike. Long butterfly strategies are used in directional trading.C. Buy a l ow strike call. Buy a high strike call. Sell two midstride calls. Long butterfly strategies are used in volatility trading.D. Sell a l ow strike call and buy two or more high strike calls. Sell a high strike put; buy two or more l ow strike puts. Long butterfly strategies are used in directional and volatility trading.2、You are asked to estimate the VaR of an investment in Big Pharma Inc. The company's stock is trading at $23 and has a daily volatility of 1.5%. Using the delta-normal method, the VaR at the 95% confidence level of a l ong position in at-the-money put on this stock with a delta of –0.5 over a one-day holding period is cl osest to which of the foll owing choices?A. $0.40B. $0.28C. $0.57D. $2.833、Assume that portfolio daily returns are independently and identically normally distributed. Sam Neil, a new quantitative analyst, has been asked by the portfolio manager to calculate portfolio VaRs for 10-, 15-, 20-, and 25-day periods. The portfolio manager notices something amiss with Sam's cal culations. Which one of foll owing VaRs on this portfolio is inconsistent with the others?A. VaR(10-day) = USD 316MB. VaR(15-day) = USD 465MC. VaR(20-day) = USD 537MD. VaR(25-day) = USD 600M4、A portfolio is l ong stock A and short stock B. The stock A position has an annual VaR of USD 20 million and the stock B position has an annual VaR of USD 30 million, assuming that the distributions of price changes for both stocks are normal. If the annual VaR of the total portfolio is USD 40 million, the correlation between stock A and stock B is cl osest to:A. - 0.25B. 0.25C. 0.5D. - 0.55、An investor is long a short-term at-the-money (ATM) put option on an underlying portfolio of equities with a notional value of USD 100,000. If the 95% VaR of the und erlying portfolio is 10.4%, which of the foll owing statements about the VaR of the option position is correct?A. The VaR of the option position is slightly more than USD 5,200 when second-order terms are considered.B. The VaR of the option position is slightly more than USD 10,400 when second-order terms are considered.C. The VaR of the option position is slightly less than USD 5,200 when second-ord er terms are considered.D. The VaR of the option position is slightly less than USD 10,400 when second-order terms are considered.6、A five-year corporate bond paying an annual coupon of 8% is sold at a price refl ecting a yield to maturity of 6%. One year passes and the interest rates remain unchanged. Assuming a flat term structure and hol ding all other factors constant, the bond's price during this period will have:A. Increased.B. Decreased.C. Remained constant.D. Cannot be determined with the data given.7、Sam Ho's manager was worried about the volatility in interest rates and, d esiring steady income, was looking at perpetuities. Perpetuities are bonds that pay a steady coupon forever. Sam Ho's manager was keen on a USD 1.0 million face value perpetuity bond yielding 5.50% with a coupon of 6.50% paying every six months. Sam Ho's manager was in a hurry and asked Sam to quickly cal culate the price of the bond expressed per USD 100 of face value of the bond.The price is closest to:A. 84.61B. 100.95C. 108.95D. 118.188、From the time of issuance until the bond matures, which of the foll owing bonds is most likely to exhibit negative convexity?A. A putable bondB. A callable bondC. An option-free bond selling at a discountD. A zero-coupon bond9、Which of the foll owing statements is incorrect, given the foll owing one-year rating transition matrix?From/To (%) AAA AA A BBB BB B CCC/C D NonRatedAAA 87.4 7.37 0.46 0.09 0.06 0.00 0.00 0.00 4.59AA 0.6 86.65 7.78 0.58 0.06 0.11 0.02 0.01 4.21A 0.05 2.05 89.96 5.50 0.43 0.16 0.03 0.04 4.79BBB 0.02 0.21 3.58 84.13 4.39 0.77 0.19 0.29 6.14BB 0.04 0.08 0.33 5.27 75.73 7.36 0.94 1.20 9.06B 0.00 0.07 0.20 0.28 5.21 72.95 4.23 5.71 11.36CCC/C 0.08 0.00 0.31 0.39 1.31 9.74 46.83 28.83 12.52A. BBB l oans have a 4.08% chance of being upgraded over one year.B. BB loans have a 75.73% chance of staying at BB over one year.C. BBB l oans have a 95.92% chance of being d owngrad ed over one year.D. BB l oans have a 18.56% chance of being d owngraded over one year.10、An analyst is doing a study on the effect on option prices of changes in the price of the underlying asset. The analyst wants to find out when the deltas of calls and puts are most sensitive to changes in the price of the underlying. Assume that the options are European and that the Black-Scholes formula holds. An increase in the price of the underlying has the largest absolute value impact on delta for:A. Calls d eep in-the-money and puts deep out-of-the-moneyB. Deep in-the-money puts and callsC. Deep out-of-the-money puts and callsD. At-the-money puts and calls参与FRM的考生可按照复习计划有效进行,另外高顿网校官网考试辅导高清课程已经开通,还可索取FRM 考试通关宝典,针对性地讲解、训练、答疑、模考,对学习过程进行全程跟踪、分析、指导,可以帮助考生全面提升备考效果。

2023frm百题英文回答:1. Define Financial Risk Management (FRM) and explain its importance in the financial industry.FRM is the process of identifying, assessing, and mitigating financial risks. It is a critical function in the financial industry, as it helps firms to protect themselves from losses and to improve their financial performance.Financial risks can arise from a variety of sources, including:Credit risk: The risk that a borrower will default on a loan.Market risk: The risk that the value of a financial asset will decline.Operational risk: The risk of losses due to operational errors or failures.FRM professionals use a variety of tools and techniques to identify, assess, and mitigate financial risks. These tools and techniques include:Financial modeling: FRM professionals use financial models to simulate different scenarios and to assess the potential impact of different risks.Stress testing: FRM professionals use stress testing to identify and assess the impact of extreme events on a firm's financial performance.Risk management policies and procedures: FRM professionals develop and implement risk managementpolicies and procedures to help firms to identify, assess, and mitigate financial risks.FRM is an important function in the financial industry,as it helps firms to protect themselves from losses and to improve their financial performance. FRM professionals use a variety of tools and techniques to identify, assess, and mitigate financial risks.2. Describe the different types of financial risk and provide examples of each.There are a variety of different types of financial risk, including:Credit risk: The risk that a borrower will default on a loan.Market risk: The risk that the value of a financial asset will decline.Operational risk: The risk of losses due to operational errors or failures.Liquidity risk: The risk that a firm will not be able to meet its financial obligations as they come due.Legal risk: The risk that a firm will be held liable for legal claims.Reputational risk: The risk that a firm's reputation will be damaged.Here are some examples of each type of financial risk:Credit risk: A bank lending money to a customer who has a history of bad credit.Market risk: An investor buying stocks in a company that is facing financial difficulties.Operational risk: A company experiencing a computer outage that disrupts its operations.Liquidity risk: A company that has a large amount of debt coming due but does not have sufficient cash to repay the debt.Legal risk: A company that is sued by a customer for damages.Reputational risk: A company that is accused of engaging in unethical business practices.Financial risks can have a significant impact on afirm's financial performance. It is important for firms to be aware of the different types of financial risks and to take steps to mitigate these risks.3. Explain the role of financial regulators in the financial industry.Financial regulators play a critical role in the financial industry. They are responsible for ensuring that the financial industry is safe and sound and that consumers are protected from financial fraud and abuse.Financial regulators use a variety of tools to achieve their objectives, including:Regulation: Financial regulators develop and implement regulations that govern the financial industry. These regulations are designed to protect consumers and to ensure the stability of the financial system.Supervision: Financial regulators supervise financial institutions to ensure that they are complying with regulations and that they are operating in a safe and sound manner.Enforcement: Financial regulators enforce regulations and take action against financial institutions that violate regulations.Financial regulators play a critical role in protecting consumers and ensuring the stability of the financial system. They use a variety of tools to achieve their objectives, including regulation, supervision, and enforcement.中文回答:1. 定义金融风险管理 (FRM),并解释其在金融行业中的重要性。

frm一级2020年考试答案1. 根据FRM一级2020年的考试内容,以下哪项不是风险管理的核心原则?A. 识别风险B. 评估风险C. 接受风险D. 转移风险答案:C2. 在FRM一级考试中,关于市场风险的描述,以下哪项是错误的?A. 市场风险包括股票和债券价格的波动B. 市场风险可以通过分散化投资来降低C. 市场风险是不可避免的D. 市场风险仅包括利率风险答案:D3. 在FRM一级考试中,关于信用风险的以下说法,哪项是正确的?A. 信用风险仅与企业债券相关B. 信用风险可以通过信用衍生品来对冲C. 信用风险与个人信用无关D. 信用风险是银行面临的最大风险答案:B4. 在FRM一级考试中,关于操作风险的以下说法,哪项是错误的?A. 操作风险包括欺诈行为B. 操作风险可以通过内部控制来降低C. 操作风险与市场风险无关D. 操作风险可以通过购买保险来转移答案:C5. 在FRM一级考试中,关于流动性风险的以下说法,哪项是正确的?A. 流动性风险仅与银行有关B. 流动性风险是指资产无法在不显著影响其价格的情况下迅速出售的风险C. 流动性风险可以通过持有大量现金来消除D. 流动性风险与市场流动性无关答案:B6. 在FRM一级考试中,关于风险价值(VaR)的以下说法,哪项是错误的?A. VaR是一种风险度量工具B. VaR可以预测极端市场条件下的潜在损失C. VaR通常用于市场风险的度量D. VaR不能用于信用风险的度量答案:D7. 在FRM一级考试中,关于压力测试的以下说法,哪项是正确的?A. 压力测试是一种定性风险评估方法B. 压力测试用于评估极端市场条件下的风险暴露C. 压力测试不能提供风险的量化度量D. 压力测试与情景分析无关答案:B8. 在FRM一级考试中,关于资本充足性的以下说法,哪项是错误的?A. 资本充足性是指银行持有足够的资本以吸收潜在损失B. 资本充足性可以通过提高资本比率来增强C. 资本充足性与银行的信用评级无关D. 资本充足性是银行稳健经营的重要指标答案:C结束语:以上是FRM一级2020年考试的部分答案,希望对准备考试的同学有所帮助。

FRM一级模拟题1 . A firm has just issued $1,000 face value bonds with a coupon rate of 8%, paid semi-annually, and a maturity of 15 years. If the issue price for this bond is $785.50, what is the yield-to-maturity, stated annually?A. 9.872%B . 10.365%C. 10.942%D. 11.120%Answer: CUsing a bond calculator, PV=-785.5; FV=100; N=30(15x2); PMT =40(1000x0.08/2). Solving for I/Y we get 5.47lx2=10.942.2 . Consider a $1,000 par value bond with a 7% annual coupon. The bond pays interest annually. There are 2 years remaining until maturity. What is the current yield on the bond assuming that the required return on the bond is 10%?A. 10.00%B. 7.38%C. 5.00%D. 3.52%Answer: BStep l. Price of the bond: FV = 1000; N = 2;' PMT =70(lOOOx0.07); I/Y = 10. Solving for PV we get -948Step2. Current yield=coupon income/price=70/948=7.38%3.In a stable flat yield curve environment, the price of a fixed coupon bond trading at a premium will:A. Fall with timeB. Rise with timeC. Not change with timeD. First rise and then fall with timeAnswer: AIn a stable flat yield curve environment, the price of a premium bond will fall, reaching par value at maturity.4 . Assume the prices are for settlement on June l, 2005, today's date. Assumesemiannual coupon payments:closest to:A. 0.9696/0.9858B. 0.9858/0.9546C. 0.9546/0.9696D. 0.97781'0.9696Answer: BWe must calculate the 6-month discount factor first. This is done by dividing today's price by the final payment's- par + coupon. '5 . A $1,000 par corporate bond carries a coupon rate of 6%, pays coupons semiannually, and has ten coupon payments remaining to maturity. Market rates are currently 5%. There are 90 days between settlement and the next coupon payment. The dirty and clean prices of the bond, respectively, are closest to:A. $1,043.76, $1,013.76B. $1,043.76, $1,028.76C. $1,056.73,$1,04-1.73D. $1,069.70, $1,054.70Answer: CThe dirty price of the bond is calculated as N = 10; I/Y = 2.5; PMT = 30; FV = 1,000; CPT--PV = 1,043.76. Adjusting the PV for the fact that there are only 90 days-until the receipt of the first coupon gives $1,043.76 X (1.025)90/180 = $1,056.73. Clean price = dirty price - accrued interest= $1056.73 - $30(90/180) = $1,041.73.Accrued Coupon。