注册会计师最新考试英语加试题样

- 格式:doc

- 大小:53.50 KB

- 文档页数:7

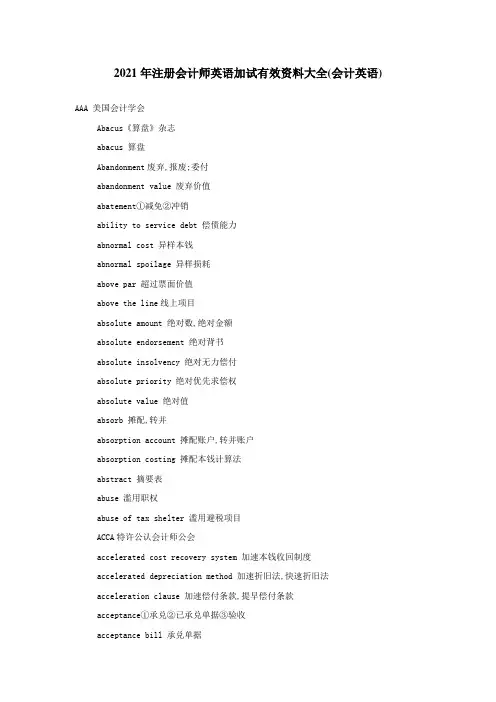

2021年注册会计师英语加试有效资料大全(会计英语)AAA 美国会计学会Abacus《算盘》杂志abacus 算盘Abandonment废弃,报废;委付abandonment value 废弃价值abatement①减免②冲销ability to service debt 偿债能力abnormal cost 异样本钱abnormal spoilage 异样损耗above par 超过票面价值above the line线上项目absolute amount 绝对数,绝对金额absolute endorsement 绝对背书absolute insolvency 绝对无力偿付absolute priority 绝对优先求偿权absolute value 绝对值absorb 摊配,转并absorption account 摊配账户,转并账户absorption costing 摊配本钱计算法abstract 摘要表abuse 滥用职权abuse of tax shelter 滥用避税项目ACCA特许公认会计师公会accelerated cost recovery system 加速本钱收回制度accelerated depreciation method 加速折旧法,快速折旧法acceleration clause 加速偿付条款,提早偿付条款acceptance①承兑②已承兑单据③验收acceptance bill 承兑单据acceptance register 承兑单据记录簿acceptance sampling验收抽样access time 存取时刻accommodation 融通accommodation bill 融通单据accommodation endorsement 融通背书account①账户,会计科目②账簿,报表③账目,账项④记账accountability 经营责任,会计责任accountability unit 责任单位Accountancy 《会计》杂志accountancy 会计accountant 会计员,会计师accountant general 会计主任,总会计accounting in charge 主管会计师accountant,s legal liability 会计师的法律责任accountant,s report 会计师报告accountant,s responsibility 会计师职责account form 账户式,账式accounting①会计②会计学accounting assumption 会计假定,会计假设accounting basis 会计基准,会计大体方式accounting changes 会计变更accounting concept 会计概念accounting control 会计操纵accounting convention 会计常规,会计老例accounting corporation 会计公司accounting cycle 会计循环accounting data 会计数据accounting doctrine 会计信条accounting document 会计凭证accounting elements 会计要素accounting entity 会计主体,会计个体accounting entry 会计分录accounting equation 会计等式accounting event 会计事项accounting exposure 会计暴露,会计暴露风险accounting firm 会计事务所Accounting Hall of Fame 会计名人堂accounting harmonization 会计和谐化accounting identity 会计恒等式acounting income 会计收益accounting information 会计信息avoidable cost 可幸免本钱back charge 欠费费用back date 倒填日期,填早日期backed bill 背书单据back-end load后期负担backer①单据担保人②财务支持人backlog depreciation 欠提折旧back order 欠交定货back pay 欠付工资back tax 欠交税款back-to-back credit 对开信誉证back-to-back loan对销贷款back wardation 倒价backward integration 逆向归并bad check 空头支票bad debt 呆账,呆账账户bad debt account 呆账账户bad debt expense 呆账费用bad debt ratio 呆账比率bad debt recovery 呆账收回bailment 寄销,寄托bailout 抽资bailout period 投资返还期balance①余额②平稳balance budget 平稳预算balance due 结欠余额balance fund 平稳基金balance of account 账户余额balance of payment 国际收支差额balance of retained earnings 留存收益余额balance sheet 资产欠债表balance sheet account 资产欠债表账户balance sheet analysis 资产欠债表分析balance sheet audit 资产欠债表审计balance sheet date 结账日期balance sheet ratio 资产欠债表比率balance sheet total 资产欠债表总额balloon payment 漂浮式付款CA 特许会计师cable transfer 电汇calculation 计算calculator 计算器calendar year 日历年度call ①期前归还,期前兑回②催交股款③买方期权callable bond 可提早兑回债券callable preferred stock 可提早兑回优先股call loan 活期拆放贷款call option 股票购买期权call premium 提早兑回溢价call price 提早兑回价钱call provision 提早兑回条款cancelable lease 可取消租约cancelled check 注销支票C & F 货价加运费C & I 货价加保险费capacity①生产能力②偿债能力capacity cost 生产能力本钱,经营能力本钱capacity to borrow 借款能力capacity to contract 订约能力,订约资格capital 资本金,资本capital account 资本账户capital addition 资本增置capital allowance 资本减免capital and liabilities ratio 资本欠债比率capital appreciation 资本升值capital asset 资本性资产capital asset pricing model 资本性资产计价模型capital authorized 额定资本,法定资本capital budget 资本预算capital cost 资本本钱capital deficit 资本亏绌capital expenditure 资本支出capital gain 资本利得,资本收益capital impairment 资本减损capital intensive 资本密集capital investment 资本投资daily cash report 现金收支日报daily statement 日报表damages损害补偿data 资料,数据data base 数据库data base management system数据库治理系统data processing 数据处置data retrieval 数据检索date 日期date backward 填早日期date due 到期日date forward 填迟日期date of balance sheet 资产欠债表日期,结账日期date of payment 发放股利日期,发薪日期day book 日记簿days purchases in accounts payable 应付账款占用天数days sales in accounts receivable应收账款收款天数days sales in inventory 存货销售天数dBase 数据库治理程序DCF 折现现金流量dead account 呆账dead capital 呆滞资本dead stock 呆滞存货,冷背存货deal 交易,生意dealer 证券经销商debenture(bond) 信誉债券,无担保债券debenture capital债券资本debit①借方②借记debit and credit convention 借贷常规debit 借方余额debit card 记账卡,取款卡debit entry 借方分录debit memorandum 借方通知单debt 债务debt and equity securities债务和产权证券E & OE 如有遗漏,有权更正earmark 指定用途,专款专用earmarked loan 用贷款earned income 劳动所得,劳动收入earned income credit 劳动收入税收减免earned surplus 营业盈余,已获盈余earnest 定金,保证金earning power 盈利能力,收益能力earnings ①收益,盈余②劳动所得,劳动收入earnings before interest and tax支付利息和税款前收益earnings coverage ratio 收益偿债能力比率earnings dilution 收益稀释earnings-dividend ratio 收益股利比率earnings per share 每股收益earnings quality收益质量earnings rate收益比率economic appraisal 经济评判economic benefits 经济效益economic cost 经济本钱economic entity 经济主体,经济实体economic income 经济收益economic interest 经济权益economic life经济年限economic obligation 经济债务economic order quantity 经济定货量economic resource 经济资源economic value 经济价值ED (会计准那么)发布草案effective interest method 实际利息法effective interest rate实际利率effectiveness 成效effective rate of return 实际收益率effective tax rate 实际税率efficiency 效率efficiency audit 效率审计efficiency variance效率不同efficient portfolio 有效证券组合投资electronic cash register 电子现金出纳机face value 票面价值,面值factor 应收账款代理商factoring 应收账款代理经营,应收账款转售factory cost工厂本钱factory ledger 工厂分类账factory overhead工厂间接费用failure 经营失败fair market price(value) 公平市价,公司市场价值fairness公正性,公平性fair rate of return公平收益率,公平收益率fair transfer price公平划拨价钱,公平划拨价钱false entry 虚假分录false returns 谎报税单FASB Statements 《财务会计准那么公报》favorable financial leverage 有利财务杠杆作用favorable variance 有利不同,顺差feasibility analysis 可行性分析feasible solution 可行解Fed联邦储蓄系统Federal Deposit Insurance Corporation 联邦存款保险公司federal income tax 联邦所得税Federal Insurance Contribution Act Tax联邦社会保险税Federal Reserve Banks 联邦储蓄银行federal unemployment tax 联邦失业保险税federal withholding tax 代扣联邦税fee 劳务费,公费feedback 反馈FEI 高级财务治理人员协会fellow members 正式会员fictitious asset 虚列资产fictitious liability 虚列欠债fidelity bond 忠诚保证,忠诚保险fiduciary 财产受托人gain 利得,收益gain and loss account损益账户garnishee 第三债务人garnishment 扣押,扣发gearing 财务传动作用gearing ratio 财务传动比率general accountant 总会计师,总会计General Accounting Office 审计总署General Agreement on Tariffs and Trade 关税与贸易总协定general and administrative expense 一样治理费用general auditor 总审计师,总审计general cash 一般现金general cashier出纳主任,总出纳general creditor 一般债权人general crossed check 一般划线支票general fund 一般基金general journal 一般日记账general ledger 总分类账generally accepted accounting principles公认会计原那么generally accepted auditing standards公认审计准那么general meeting of stockholders 股东大会general mortgage 一般抵押general mortgage bond 一般抵押债券general partner 一般合股人general price index 一样物价指数general price level accounting 一样物价水平会计general purpose financial statement 通用财务报表,通用会计报表general standard( of audit)审计一样准那么。

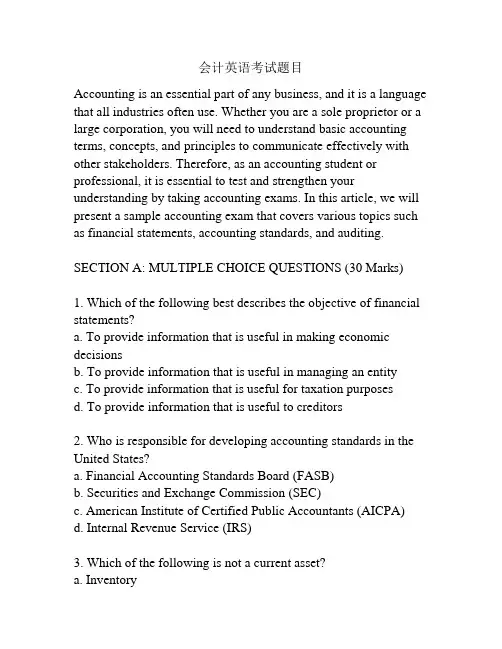

会计英语考试题目Accounting is an essential part of any business, and it is a language that all industries often use. Whether you are a sole proprietor or a large corporation, you will need to understand basic accounting terms, concepts, and principles to communicate effectively with other stakeholders. Therefore, as an accounting student or professional, it is essential to test and strengthen your understanding by taking accounting exams. In this article, we will present a sample accounting exam that covers various topics such as financial statements, accounting standards, and auditing.SECTION A: MULTIPLE CHOICE QUESTIONS (30 Marks)1. Which of the following best describes the objective of financial statements?a. To provide information that is useful in making economic decisionsb. To provide information that is useful in managing an entityc. To provide information that is useful for taxation purposesd. To provide information that is useful to creditors2. Who is responsible for developing accounting standards in the United States?a. Financial Accounting Standards Board (FASB)b. Securities and Exchange Commission (SEC)c. American Institute of Certified Public Accountants (AICPA)d. Internal Revenue Service (IRS)3. Which of the following is not a current asset?a. Inventoryb. Accounts Receivablec. Prepaid Expensesd. Buildings4. What is the formula for calculating the current ratio?a. Total Assets/ Total Liabilitiesb. Net Income/ Total Assetsc. Current Assets/ Current Liabilitiesd. Gross Profit/ Total Revenue5. Which of the following is classified as a financing activity?a. Issuing Common Stockb. Buying Inventoryc. Paying Rentd. Collecting Accounts Receivable6. What is the purpose of a bank reconciliation?a. To ensure the accuracy of the company's bank statementb. To identify any errors or discrepancies in the general ledgerc. To match the company's bank balance with its book balanced. To prepare a statement of cash flows7. What is the objective of an audit?a. To express an opinion on the fairness of financial statementsb. To detect fraud and errorsc. To provide financial advice to managementd. To ensure that the company is complying with tax regulations8. If a company has a current ratio of 2.5, what does it mean?a. The company has more current assets than current liabilitiesb. The company has twice as many liabilities as assetsc. The company has twice as many assets as liabilitiesd. The company is insolvent9. What is the purpose of an adjusting entry?a. To correct a mistake in the general ledgerb. To record a transaction that was omittedc. To adjust the balances in certain accounts at the end of the accounting periodd. To close out the balance in an account at the end of the year10. What is the difference between an operating lease and a capital lease?a. An operating lease is a short-term lease, while a capital lease is a long-term leaseb. An operating lease is an off-balance sheet item, while a capital lease is an on-balance sheet itemc. An operating lease is an expense, while a capital lease is a liabilityd. An operating lease is a sales transaction, while a capital lease is a rental agreementSECTION B: SHORT ANSWER QUESTIONS (30 Marks)1. Define the term "accounting equation."2. Describe the difference between a debit and a credit.3. What is the purpose of the balance sheet?4. Explain the difference between a cash flow statement and an income statement.5. What is the difference between an expense and a liability?6. What is goodwill?7. Define the term "accounts payable."8. What is a trial balance?9. What is the difference between accounts receivable and accounts payable?10. What is the difference between GAAP and IFRS?SECTION C: PROBLEM SOLVING QUESTIONS (40 Marks) 1. A company has the following financial information:Total Revenue: $200,000Cost of Goods Sold: $60,000Net Income: $30,000Accounts Receivable: $20,000Accounts Payable: $10,000Inventory: $15,000Accumulated Depreciation: $5,000Property, Plant, and Equipment: $75,000Calculate the following ratios:a. Gross Profit Ratiob. Accounts Receivable Turnover Ratioc. Inventory Turnover Ratiod. Debt-to-Equity Ratioe. Return on Equity Ratio2. A company has the following transactions during the year:Sales Revenue: $250,000Accounts Receivable Balance (Jan 1): $40,000Accounts Receivable Balance (Dec 31): $50,000Bad Debt Expense: $2,500Write-offs for bad debt: $1,500Cash Received from Customers: $220,000Calculate the following:a. Net Salesb. Gross Profitc. Net Incomed. Accounts Receivable Turnover Ratio (use beginning balance)3. A company has the following balances before adjusting entries: Prepaid Insurance: $3,000 (represents three months of insurance) Salaries Payable: $2,500 (pertains to December salaries)Rent Expense: $1,200 (paid for three months ending in February) What adjustment entries are needed for the above balances and what are the new balances?4. A company has the following balances at the beginning of the year:Cash: $30,000Accounts Receivable: $20,000Inventory: $10,000Property, Plant, and Equipment: $50,000Accounts Payable: $15,000Notes Payable (long-term): $20,000Common Stock: $25,000Retained Earnings: $30,000During the year, the company had the following transactions: Sales Revenue: $100,000Cost of Goods Sold: $35,000Depreciation Expense: $5,000Rent Expense: $10,000Salary Expense: $12,000Dividends Paid: $7,000Notes Payable Paid: $10,000Calculate the following:a. Net Incomeb. Retained Earnings (ending balance)c. Debt-to-Equity Ratiod. Return on Equity RatioConclusionIn conclusion, an accounting exam is an important tool for evaluating a student's or a professional's understanding of accounting concepts, principles and standards. This exam covered various topics such as financial statements, accounting standards, auditing, current assets and liabilities, adjusting entries, lease types, and accounting ratios. As you prepare to take your accountingexam, ensure that you have covered all the topics and have practiced enough to develop your problem-solving skills. Good luck!。

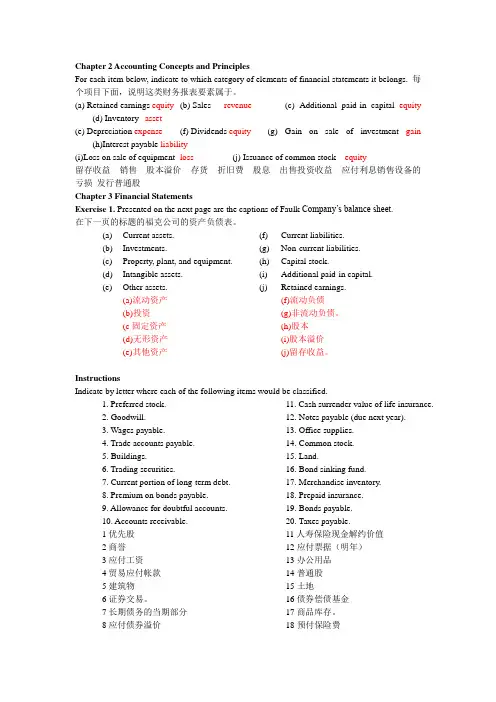

Chapter 2 Accounting Concepts and PrinciplesFor each item below, indicate to which category of elements of financial statements it belongs. 每个项目下面,说明这类财务报表要素属于。

(a) Retained earnings equity (b) Sales revenue(c) Additional paid-in capital equity(d) Inventory asset(e) Depreciation expense(f) Dividends equity(g) Gain on sale of investment gain(h)Interest payable liability(i)Loss on sale of equipment loss(j) Issuance of common stock equity留存收益销售股本溢价存货折旧费股息出售投资收益应付利息销售设备的亏损发行普通股Chapter 3 Financial StatementsExercise 1. Presented on the next page are the captions of Faulk Company’s balance sheet.在下一页的标题的福克公司的资产负债表。

(a) Current assets. (f) Current liabilities.(b) Investments. (g) Non-current liabilities.(c) Property, plant, and equipment. (h) Capital stock.(d) Intangible assets. (i) Additional paid-in capital.(e) Other assets. (j) Retained earnings.(a)流动资产(b)投资(c固定资产(d)无形资产(e)其他资产(f)流动负债(g)非流动负债。

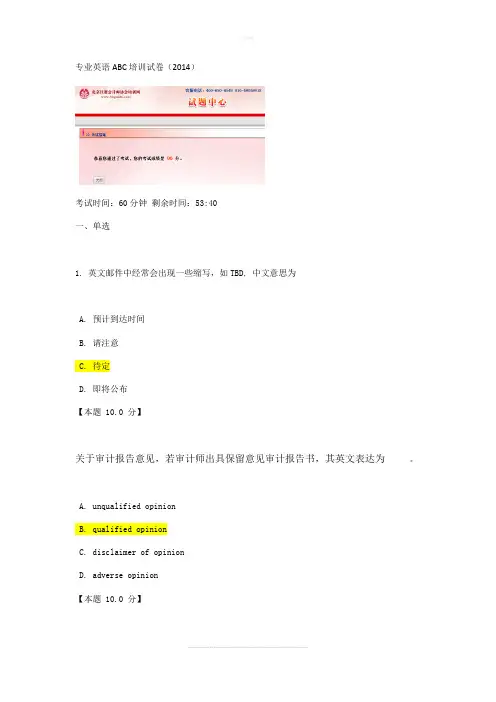

专业英语ABC培训试卷(2014)考试时间:60分钟剩余时间:53:40一、单选1. 英文邮件中经常会出现一些缩写,如TBD, 中文意思为A. 预计到达时间B. 请注意C. 待定D. 即将公布【本题 10.0 分】关于审计报告意见,若审计师出具保留意见审计报告书,其英文表达为。

A. unqualified opinionB. qualified opinionC. disclaimer of opinionD. adverse opinion【本题 10.0 分】3.The objective of the IAASB is to serve the public interest by setting auditing and assurance standards and facilitating the of international and national standards to enhance the quality and uniformity of practice throughout the world and to strengthen public confidence in the global auditing and assurance profession.(IAASB的目标是通过颁布审计与鉴证准则,促进国际与国家准则____,在全球范围内提高服务质量和统一性,以及加强公众对全球审计、鉴证职业的信任,从而为公众利益服务。

)A. consolidationB. harmonizationC. combinationD. convergence【本题 10.0 分】4. 国际审计与鉴证准则委员会(IAASB),它由哪个组织建立?A. The Institute of Chartered Financial Analysts (ICFA)B. Global Association of Risk Professionals (GARP)C. International Federation of Accountants (IFAC)D. International Accounting Standards Board (IASB)【本题 10.0 分】5.The objective of a reasonable assurance engagement is a reduction in assurance engagement risk to an acceptably low level in the circumstances of the engagement as the basis for a of the practitioner’s conclusion.(合理保证鉴证业务的目标是将鉴证业务风险降至该业务环境下可接受的低水平,以此作为以方式提出结论的基础。

会计英语考试试题会计英语考试试题在现代社会中,会计是一项非常重要的职业。

会计师需要具备广泛的知识和技能,包括对财务报表的准确分析和解读能力。

为了评估会计师的专业能力,会计英语考试成为了一个重要的指标。

本文将探讨一些常见的会计英语考试试题,以帮助读者更好地了解这个领域。

第一部分:会计基础知识1. 什么是会计?请简要解释会计的定义和目的。

会计是一种记录、分类和总结财务信息的方法。

它的目的是提供对企业或个人财务状况的准确描述,以便做出决策和评估经济活动的结果。

2. 解释以下财务报表的含义和用途:资产负债表、利润表和现金流量表。

资产负债表显示了企业在特定日期的资产、负债和所有者权益。

它用于评估企业的财务状况和偿债能力。

利润表显示了企业在特定时期的收入、费用和利润。

它用于评估企业的盈利能力和经营绩效。

现金流量表显示了企业在特定时期的现金流入和流出情况。

它用于评估企业的现金流动性和经营活动的效率。

3. 什么是会计准则?为什么会计准则对于会计师非常重要?会计准则是规定会计报告和财务信息披露的规则和原则。

它们确保了财务报表的准确性、可比性和可靠性。

会计师必须遵守会计准则,以确保他们的工作符合行业标准和法律要求。

第二部分:会计英语词汇和短语1. 解释以下会计英语词汇:assets、liabilities、revenue、expenses、equity。

- Assets:资产,指企业拥有的具有经济价值的资源。

- Liabilities:负债,指企业对外部债权人的经济责任。

- Revenue:收入,指企业从经营活动中获得的货币或货币等价物。

- Expenses:费用,指企业在经营活动中发生的支出。

- Equity:所有者权益,指企业所有者对企业资产的权利。

2. 请用会计英语表达以下概念:资产负债表、利润表、现金流量表、净利润、应收账款、应付账款。

- Balance sheet:资产负债表- Income statement:利润表- Cash flow statement:现金流量表- Net profit:净利润- Accounts receivable:应收账款- Accounts payable:应付账款第三部分:会计原则和准则1. 解释以下会计原则和准则:货币计量原则、实体概念、持续经营原则、费用匹配原则。

2007年注册会计师考试英语加试题样及答案 1、 Give a brief explanation for the following terms(10%) (1) Journal entry (2) Going concern (3) Matching principle (4) Working capital (5) Revenue expenditure 2. Please read the following passage carefully and fill in each of the 11 blanks with a word most appropriate to the content (10%) (1) The double-entry system of accounting takes its name from the fact that every business transaction is recorded by (____) types of entries: 1: (_____) entries to one or more accounts and 2: credit entries to one or more accounts. In recording any transaction, the total dollar amount of the (______) entries must (_____) the total dollar amount of credit entries. (2) Often a transaction affects revenues or expenses of two or more different periods, in these cases, an (_____) entries are needed to (_____) to each period the appropriate amounts of revenues and expenses. These entries are performed at the (_____) of each accounting period but (_____) to preparing the financial statements. (3) Marketable securities are highly (_____) investments, primarily in share stocks and bounds, (____) can be sold (_____) quoted market prices in organized securities exchanges. 3.Translate the following Chinese statements into English (18%) (1) 财务报表反映一个企业的财务状况和经营成果,是根据公认会计准则编制的。这些报表是为许多不同的决策者,许多不同的目的而提供的。 纳税申报单则反映应税收益的计算,是由税法和税则规定的概念。在许多情况下,税法和公认会计准则相似,但两者却存在实质上的不同。 (2) 审计师不保证财务报表的准确性,他们仅就财务报表的公允性发表专家意见。然而注册会计师事务所的声誉来自于他们对审计工作的一丝不苟和审计报告的可靠性。 4. Translate the following statements into Chinese (12%) (1) Accounting principles are not like physical laws; they do not exist in nature, awaiting discovery man. Rather, they are developed by man, in light of what we consider to be the most important objectives of financial reporting. In many ways generally accepted accounting principles are similar to the rules established for an organized sport shuch as football or basketball. (2) Accounting have devised procedures whereby the flows of cash receipts and payments are spread over a period of time in a certain way to derive income, which is representative of the economic performance of the firm for the given period. The income concept as applied in the real world involves numerous decisions and judgmenmts. 5. Multiple choice questions (choose the best for your answer) (10%) (1) The CPA firm auditing XY Recording Service found that retained earning were understated and liabilities were overstated. Which of the following errors could have been the cause? A. Making the adjustment entry for depreciation expenses twice; B. Failure to recored interest accrued on a note payable; C. Failure to make the adjusting entry to recored revenue which had been earned but not yet billed to clients; D. Faillure to recored the earned portion of fees received in advance. (2) How will net income be affected by the amortization of a discount on bonds payable? A. Interest expense is increased, so net income is decreased; B. Interest expense is decreased, so net income is increased; C. Interest expense is increased, so net income is increased; D. Interest expense is decreased, so net income is decreased; (3) A stock dividend A. Increase the debt-to-equity ratio of a firm; B. Decrease future earnings per share; C. Decrease the size of the firm; D. Increase sharholder‘s wealth; E. None of the above. (4) A company had sales in both 1999 and 2000 of $200000. Cost of sales for 1999 was $140000. In computing the cost of sales for 1999, an item of inventory purchased in 1999 for $50 was incorrectly written down to current replacement cost of $35. The item is currently selling in 2000 for $100, its normal selling price. As a result of this error: A. Income for 1999 is overstated; B. Cost of sales for 2000 will be overstated; C. Income for 2000 will be overstated; D. Income for 2000 will not be affected. E. None of the above. (5)Using the data presented below, calculate the cost of sales for the BC Company for 1999. Current ratio 3.5 Quick ratio 3.0 Current liabilities 12/31/1999 $600000 Inventory 12/31/1999 $500000 Inventory turnover 8.0 The cost of sales for the BC Company for 1999 was: A. $1600000; B. $2400000; C. $3200000; D. $6400000; E. None of these. (6) W Company computed the following items from its financial records for 1999: Price-earning ratio 12 Pay-out ratio 0.6 Assets turnover ratio 0.9 The dividend yield on W‘s common stock for 1999 is : A. 5% B. 7.2% C. 7.5% D. 10.2% (7) the data about Accounts receivable of Newton Company for 1999 as follows: Accounts receivable 12/31/1999 $150000 Allowance for uncollectible accounts 12/31/1999 5000(credit) Bad debt expenses for the year 2000 During 1999 recoveries on bad debts previously written off were correctly recorded at $500. If the beginning balance in the allowance for uncollectible accounts was $4700, What was the amount of accounts receivable written off as bad debts during 1999: A. $1200 B. $1800 C. $2200 D. $2400 (8) Which one of the following items would likely increase earnings per share (EPS) of a corporation? A. Declaration of a stock dividend; B. Declaration of a stock split; C. Purchase treasury stock; D. A reduction in the amount of cash dividends paid; E. None of above; (9) The primary purpose for using an inventory flow assumption is to: A. Parallel the physical flow of units merchandise; B. Offset against revenue an appropriate cost of goods sold; C. Minimize income taxes; D. Maximize the reported amount of net income.