UCP500跟单信用证统一惯例中英文对照

- 格式:doc

- 大小:180.00 KB

- 文档页数:29

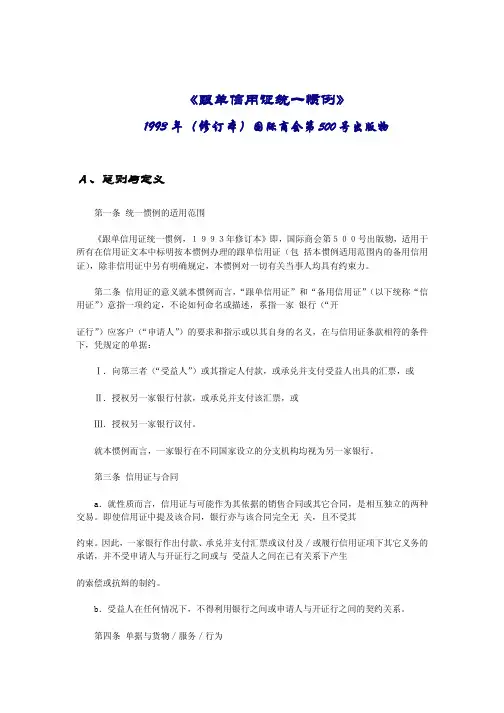

《跟单信用证统一惯例》1993年(修订本)国际商会第500号出版物A、总则与定义第一条统一惯例的适用范围《跟单信用证统一惯例,1993年修订本》即,国际商会第500号出版物,适用于所有在信用证文本中标明按本惯例办理的跟单信用证(包括本惯例适用范围内的备用信用证),除非信用证中另有明确规定,本惯例对一切有关当事人均具有约束力。

第二条信用证的意义就本惯例而言,“跟单信用证”和“备用信用证”(以下统称“信用证”)意指一项约定,不论如何命名或描述,系指一家银行(“开证行”)应客户(“申请人”)的要求和指示或以其自身的名义,在与信用证条款相符的条件下,凭规定的单据:Ⅰ.向第三者(“受益人”)或其指定人付款,或承兑并支付受益人出具的汇票,或Ⅱ.授权另一家银行付款,或承兑并支付该汇票,或Ⅲ.授权另一家银行议付。

就本惯例而言,一家银行在不同国家设立的分支机构均视为另一家银行。

第三条信用证与合同a.就性质而言,信用证与可能作为其依据的销售合同或其它合同,是相互独立的两种交易。

即使信用证中提及该合同,银行亦与该合同完全无关,且不受其约束。

因此,一家银行作出付款、承兑并支付汇票或议付及/或履行信用证项下其它义务的承诺,并不受申请人与开证行之间或与受益人之间在已有关系下产生的索偿或抗辩的制约。

b.受益人在任何情况下,不得利用银行之间或申请人与开证行之间的契约关系。

第四条单据与货物/服务/行为在信用证业务中,各有关当事人处理的是单据,而不是单据所涉及的货物、服务或其它行为。

第五条开立或修改信用证的指示a.开证指示、信用证本身、对信用证的修改指示或修改书本身均必须完整和明确。

为防止混淆和误解,银行应劝阻有关方:Ⅰ.勿在信用证或其任何修改书中,加注过多细节Ⅱ.在指示开立、通知或保兑一个信用证时,勿引用先前开立的信用证(参照前证),而该前证受到已被接受及/或未被接受的修改所约束。

b.有关开立信用证的一切指示和信用证本身,如有修改时,有关修改的一切指示和修改书本身都必须明确表明据以付款、承兑或议付的单据。

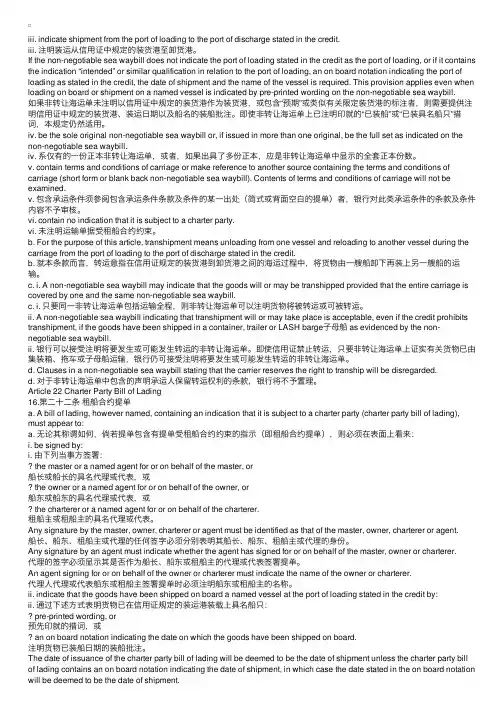

iii. indicate shipment from the port of loading to the port of discharge stated in the credit.iii. 注明装运从信⽤证中规定的装货港⾄卸货港。

If the non-negotiable sea waybill does not indicate the port of loading stated in the credit as the port of loading, or if it contains the indication “intended” or similar qualification in relation to the port of loading, an on board notation indicating the port of loading as stated in the credit, the date of shipment and the name of the vessel is required. This provision applies even when loading on board or shipment on a named vessel is indicated by pre-printed wording on the non-negotiable sea waybill.如果⾮转让海运单未注明以信⽤证中规定的装货港作为装货港,或包含“预期”或类似有关限定装货港的标注者,则需要提供注明信⽤证中规定的装货港、装运⽇期以及船名的装船批注。

即使⾮转让海运单上已注明印就的“已装船”或“已装具名船只”措词,本规定仍然适⽤。

iv. be the sole original non-negotiable sea waybill or, if issued in more than one original, be the full set as indicated on the non-negotiable sea waybill.iv. 系仅有的⼀份正本⾮转让海运单,或者,如果出具了多份正本,应是⾮转让海运单中显⽰的全套正本份数。

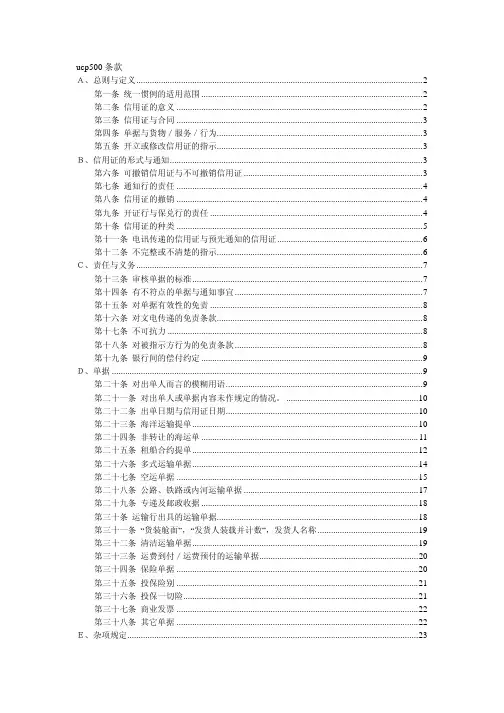

跟单信用证统一惯例(ICC UCP600中英文对照版)第一条UCP的适用范围第二条定义第三条解释第四条信用证与合同第五条单据与货物、服务或履约行为第六条兑用方式、截止日和交单地点第七条开证行责任第八条保兑行责任第九条信用证及其修改的通知第十条修改第十一条电讯传输的和预先通知的信用证和修改第十二条指定第十三条银行之间的偿付安排第十四条单据审核标准第十五条相符交单第十六条不符单据、放弃及通知第十七条正本单据及副本第十八条商业发票第十九条涵盖至少两种不同运输方式的运输单据第二十条提单第二十一条不可转让的海运单第二十二条租船合同提单第二十三条空运单据第二十四条公路、铁路或内陆水运单据第二十五条快递收据、邮政收据或投邮证明第二十六条“货装舱面”、“托运人装载和计数”、“内容据托运人报称”及运费之外的费用第二十七条清洁运输单据第二十八条保险单据及保险范围第二十九条截止日或最迟交单日的顺延第三十条信用证金额、数量与单价的伸缩度第三十一条部分支款或部分发运第三十二条分期支款或分期发运第三十三条交单时间第三十四条关于单据有效性的免责第三十五条关于信息传递和翻译的免责第三十六条不可抗力第三十七条关于被指示方行为的免责第三十八条可转让信用证第三十九条款项让渡Article 1 Application of UCP第一条统一惯例的适用范围The Uniform Customs and Practice for Documentary Credits, 2007 Revision, ICC Publication no. 600(“UCP”) are rules that apply to any documentary credit (“credit”) (including, to the extent to which they may be applicable, any standby letter of credit) when the text of the credit expressly indicates that it is subject to these rules. They are binding on all parties thereto unless expressly modified or excluded by the credit.跟单信用证统一惯例,2007年修订本,国际商会第600号出版物,适用于所有在正文中标明按本惯例办理的跟单信用证(包括本惯例适用范围内的备用信用证)。

Article 4 Credits v. Contracts第四条信用证与合同a. A credit by its nature is a separate transaction from the sale or other contract on which it may be based. Banks are in no way concerned with or bound by such contract, even if any reference whatsoever to it is included in the credit. Consequently, the undertaking of a bank to honour, to negotiate or to fulfil any other obligation under the credit is not subject to claims or defences by the applicant resulting from its relationships with the issuing bank or the beneficiary.A beneficiary can in no case avail itself of the contractual relationships existing between banks or between the applicant and the issuing bank.a. 就性质而言,信用证与可能作为其依据的销售合同或其它合同,是相互独立的交易。

即使信用证中提及该合同,银行亦与该合同完全无关,且不受其约束。

因此,一家银行作出兑付、议付或履行信用证项下其它义务的承诺,并不受申请人与开证行之间或与受益人之间在已有关系下产生的索偿或抗辩的制约。

受益人在任何情况下,不得利用银行之间或申请人与开证行之间的契约关系。

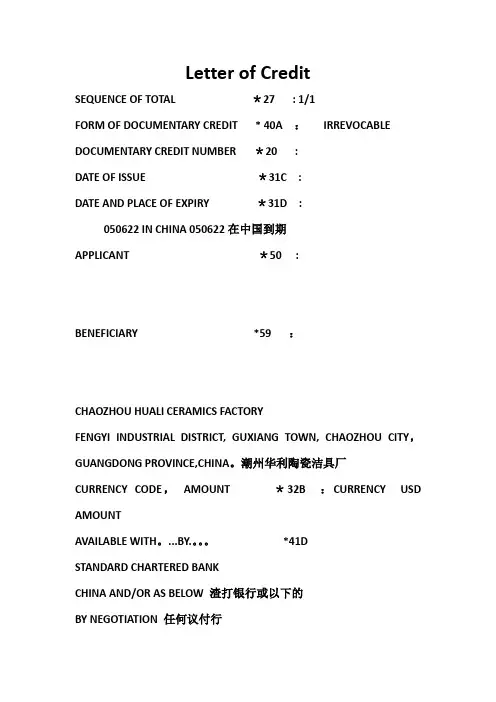

Letter of CreditSEQUENCE OF TOTAL *27 : 1/1FORM OF DOCUMENTARY CREDIT * 40A :IRREVOCABLE DOCUMENTARY CREDIT NUMBER *20 :DATE OF ISSUE *31C :DATE AND PLACE OF EXPIRY *31D :050622 IN CHINA 050622在中国到期APPLICANT *50:BENEFICIARY *59 :CHAOZHOU HUALI CERAMICS FACTORYFENGYI INDUSTRIAL DISTRICT, GUXIANG TOWN, CHAOZHOU CITY,GUANGDONG PROVINCE,CHINA。

潮州华利陶瓷洁具厂CURRENCY CODE,AMOUNT *32B :CURRENCY USD AMOUNTAVAILABLE WITH。

...BY.。

*41DSTANDARD CHARTERED BANKCHINA AND/OR AS BELOW 渣打银行或以下的BY NEGOTIATION 任何议付行DRAFT AT 42C :DRAWEE 42A:PARTIAL SHIPMENTS 43P :NOT ALLOWED 不可以TRANSHIPMENT 43T :LOADING ON BOARD/DISPATCH/TAKING IN CHARGE AT/FROM 44A:TRANSPORTATION TO 44B :LATEST DATE OF SHIPMENT 44C :ESCRIPTION OF GOODS AND/OR SERVICES 45A : OCUMENTS REQUIRED 46A :+SIGNED COMMERCIAL INVOICE IN QUINTUPLICATE MADE OUT IN THE NAME OF APPLICANT INDICATING CIF VALUE AND THE ORIGINE OF THE GOODS SHIPPED.+PACKING LIST/WEIGHT MEMO IN QUADRUPLICATE MENTIONNING TOTAL NUMBER OF CARTONS AND GROSS WEIGHTAND MEASUREMENTS PER EXPORT CARTON.*FREIGHT PAYABLE AT DESTINATION AND BEARING THE NUMBER OF THISCREDIT。

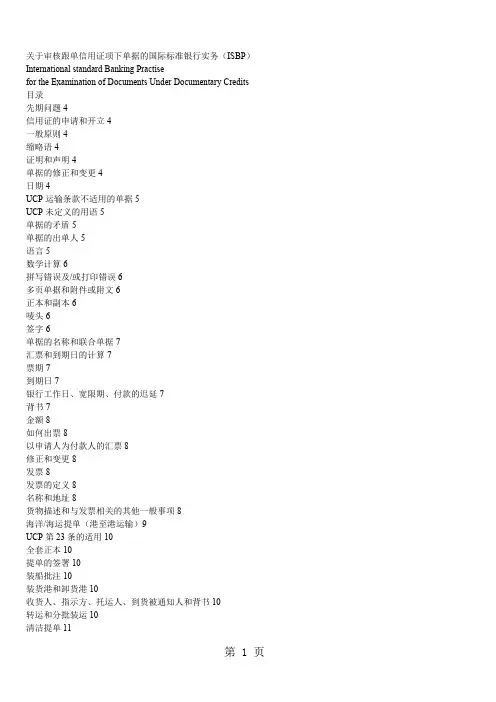

关于审核跟单信用证项下单据的国际标准银行实务(ISBP)International standard Banking Practisefor the Examination of Documents Under Documentary Credits 目录先期问题4信用证的申请和开立4一般原则4缩略语4证明和声明4单据的修正和变更4日期4UCP运输条款不适用的单据5UCP未定义的用语5单据的矛盾5单据的出单人5语言5数学计算6拼写错误及/或打印错误6多页单据和附件或附文6正本和副本6唛头6签字6单据的名称和联合单据7汇票和到期日的计算7票期7到期日7银行工作日、宽限期、付款的迟延7背书7金额8如何出票8以申请人为付款人的汇票8修正和变更8发票8发票的定义8名称和地址8货物描述和与发票相关的其他一般事项8海洋/海运提单(港至港运输)9UCP第23条的适用10全套正本10提单的签署10装船批注10装货港和卸货港10收货人、指示方、托运人、到货被通知人和背书10转运和分批装运10清洁提单11货物描述11修正和变更11运费和额外费用11货物涉及一套以上提单11租船合约提单11UCP第25条的适用11全套正本11租船合约提单的签署11装船批注11装货港和卸货港11收货人、指示方、托运人、到货被通知人和背书11 分批装运11清洁租船合约提单11货物描述11修正和变更11运费和额外费用11多式联运单据11UCP第26条的适用12全套正本12多式联运单据的签署12装船批注12接管地、发运地、装货地和目的地12收货人、指示方、托运人、到货被通知人和背书12 转运和分批装运12清洁多式联运单据13货物描述13修正和变更13运费和额外费用13货物涉及一套以上提单13空运单据13UCP第27条的适用13正本空运单据13空运单据的签署13货物收妥待运、装运日期与对实际发运日期的要求13 出发地机场和目的地机场14收货人、指示方和到货被通知人14转运和分批装运14清洁空运单据15货物描述15修正和变更15运费和额外费用15公路、铁路或内河运输单据15UCP第28条的适用15公路、铁路或内河运输单据的正本和第二联15公路、铁路或内河运输单据的承运人与签署15指示方、到货被通知人和背书15分批装运15货物描述15修正和变更15运费和额外费用15保险单据15UCP第34-36条的适用15保险单据的出单人15投保风险15日期16币种和金额16被保险人和背书16原产地证明16基本要求16原产地证明的出具人16原产地证明的内容16先期问题信用证的申请和开立1、信用证独立于基础交易,即使信用证对该基础交易作了明确的援引。

Article 16 Discrepant Documents, Waiver and Notice第十六条不符单据及不符点的放弃与通知a. When a nominated bank acting on its nomination, a confirming bank, if any, or the issuing bank determines that a presentation does not comply, it may refuse to honour or negotiate.a. 当按照指定行事的被指定银行、保兑行(如有)或开证行确定提示不符时,可以拒绝兑付或议付。

b. When an issuing bank determines that a presentation does not comply, it may in its sole judgement approach the applicant for a waiver of the discrepancies. This does not, however, extend the period mentioned in sub-article 14(b).b. 当开证行确定提示不符时,可以依据其独立的判断联系申请人放弃有关不符点。

然而,这并不因此延长14条(b)款中述及的期限。

c. When a nominated bank acting on its nomination, a confirming bank, if any, or the issuing bank decides to refuse to honour or negotiate, it must give a single notice to that effect to the presenter.c. 当按照指定行事的被指定银行、保兑行(如有)或开证行决定拒绝兑付或议付时,必须一次性通知提示人。

跟单信用证统一惯例(ICC UCP600中英文对照版)《跟单信用证统一惯例(UCP600)》第1条统一惯例的适用范围跟单信用证统一惯例2007年修订本,即国际商会第600号出版物,适用于任何在正文中明确表明按本惯例办理的跟单信用证(包括在其适用范围内的备用信用证)。

除非在信用证中明确对其适用予以修改或排除,本统一惯例的条文对有关各方都有约束力。

第2条定义就本惯例而言:“通知行”意指应开证行请求通知信用证的银行。

“申请人”意指提出开立信用证申请的一方。

“银行日”意指银行在其营业地正常营业,按照本惯例行事的行为得以在银行履行的日子。

“受益人”意指信用证中受益的一方。

“相符交单”意指与信用证中的条款及条件、本惯例中所适用的规定及国际标准银行实务相一致的交单。

“保兑”意指保兑行在开证行之外对于相符交单做出兑付或议付的确定承诺。

“保兑行”意指应开证行的授权或请求对信用证加具保兑的银行。

“信用证”意指一项约定,无论其如何命名或描述,该约定不可撤销并因此构成开证行对于相符交单予以兑付的确定承诺。

“兑付”意指:a. 对于即期付款信用证即期付款。

b. 对于延期付款信用证发出延期付款承诺并到期付款。

c. 对于承兑信用证承兑由受益人出具的汇票并到期付款。

“开证行”意指应申请人请求或代表其自身开立信用证的银行。

“议付”意指被指定银行在其应获得偿付的银行日或在此之前,通过向受益人预付或者同意向受益人预付款项的方式购买相符交单项下的汇票(汇票付款人为被指定银行以外的银行)及/或单据。

“指定银行”意指有权使用信用证的银行,对于可供任何银行使用的信用证而言,任何银行均为指定银行。

“交单”意指信用证项下单据被提交至开证行或被指定银行,抑或按此方式提交的单据。

“交单人”意指做出提示的受益人、银行或其他一方。

第3条释义就本惯例而言:在适用的条款中,词汇的单复数同义。

信用证是不可撤销的,即使信用证中对此未作指示也是如此。

单据可以通过手签、签样印制、穿孔签字、盖章、符号表示的方式签署,也可以通过其它任何机械或电子证实的方法签署。

UCP500条款UCP500条款--------------------------------------------------------------------------------《跟单信用证统一惯例》1993年(修订本)国际商会第500号出版物A、总则与定义第一条统一惯例的适用范围《跟单信用证统一惯例,1993年修订本》即,国际商会第500号出版物,适用于所有在信用证文本中标明按本惯例办理的跟单信用证(包括本惯例适用范围内的备用信用证),除非信用证中另有明确规定,本惯例对一切有关当事人均具有约束力。

第二条信用证的意义就本惯例而言,"跟单信用证"和"备用信用证"(以下统称"信用证")意指一项约定,不论如何命名或描述,系指一家银行("开证行")应客户("申请人")的要求和指示或以其自身的名义,在与信用证条款相符的条件下,凭规定的单据:Ⅰ.向第三者("受益人")或其指定人付款,或承兑并支付受益人出具的汇票,或Ⅱ.授权另一家银行付款,或承兑并支付该汇票,或Ⅲ.授权另一家银行议付。

就本惯例而言,一家银行在不同国家设立的分支机构均视为另一家银行。

第三条信用证与合同a.就性质而言,信用证与可能作为其依据的销售合同或其它合同,是相互独立的两种交易。

即使信用证中提及该合同,银行亦与该合同完全无关,且不受其约束。

因此,一家银行作出付款、承兑并支付汇票或议付及/或履行信用证项下其它义务的承诺,并不受申请人与开证行之间或与受益人之间在已有关系下产生的索偿或抗辩的制约。

b.受益人在任何情况下,不得利用银行之间或申请人与开证行之间的契约关系。

第四条单据与货物/服务/行为在信用证业务中,各有关当事人处理的是单据,而不是单据所涉及的货物、服务/或其它行为。

第五条开立或修改信用证的指示a.开证指示、信用证本身、对信用证的修改指示或修改书本身均必须完整和明确。

关于审核跟单信用证项下单据的国际标准银行实务(ISBP)International standard Banking Practisefor the Examination of Documents Under Documentary Credits 目录先期问题4信用证的申请和开立4一般原则4缩略语4证明和声明4单据的修正和变更4日期4UCP运输条款不适用的单据5UCP未定义的用语5单据的矛盾5单据的出单人5语言5数学计算6拼写错误及/或打印错误6多页单据和附件或附文6正本和副本6唛头6签字6单据的名称和联合单据7汇票和到期日的计算7票期7到期日7银行工作日、宽限期、付款的迟延7背书7金额8如何出票8以申请人为付款人的汇票8修正和变更8发票8发票的定义8名称和地址8货物描述和与发票相关的其他一般事项8海洋/海运提单(港至港运输)9UCP第23条的适用10全套正本10提单的签署10装船批注10装货港和卸货港10收货人、指示方、托运人、到货被通知人和背书10转运和分批装运10清洁提单11修正和变更11运费和额外费用11货物涉及一套以上提单11租船合约提单11UCP第25条的适用11全套正本11租船合约提单的签署11装船批注11装货港和卸货港11收货人、指示方、托运人、到货被通知人和背书11 分批装运11清洁租船合约提单11货物描述11修正和变更11运费和额外费用11多式联运单据11UCP第26条的适用12全套正本12多式联运单据的签署12装船批注12接管地、发运地、装货地和目的地12收货人、指示方、托运人、到货被通知人和背书12 转运和分批装运12清洁多式联运单据13货物描述13修正和变更13运费和额外费用13货物涉及一套以上提单13空运单据13UCP第27条的适用13正本空运单据13空运单据的签署13货物收妥待运、装运日期与对实际发运日期的要求13 出发地机场和目的地机场14收货人、指示方和到货被通知人14转运和分批装运14清洁空运单据15货物描述15修正和变更15运费和额外费用15公路、铁路或内河运输单据15UCP第28条的适用15公路、铁路或内河运输单据的正本和第二联15公路、铁路或内河运输单据的承运人与签署15指示方、到货被通知人和背书15货物描述15修正和变更15运费和额外费用15保险单据15UCP第34-36条的适用15保险单据的出单人15投保风险15日期16币种和金额16被保险人和背书16原产地证明16基本要求16原产地证明的出具人16原产地证明的内容16先期问题信用证的申请和开立1、信用证独立于基础交易,即使信用证对该基础交易作了明确的援引。

4.第七条开证⾏的a. Provided that the stipulated documents are presented to the nominated bank or to the issuing bank and that they constitute a complying presentation, the issuing bank must honour if the credit is available by:倘若规定的单据被提交⾄被指定银⾏或开证⾏并构成相符提⽰,开证⾏必须按下述信⽤证所适⽤的情形予以兑付:i. sight payment, deferred payment or acceptance with the issuing bank;i. 由开证⾏即期付款、延期付款或者承兑;ii. sight payment with a nominated bank and that nominated bank does not pay;ii. 由被指定银⾏即期付款⽽该被指定银⾏未予付款;iii. deferred payment with a nominated bank and that nominated bank does not incur its deferred payment undertaking or, having incurred its deferred payment undertaking, does not pay at maturity;iii. 由被指定银⾏延期付款⽽该被指定银⾏未承担其延期付款,或者虽已承担延期付款但到期未予付款;iv. acceptance with a nominated bank and that nominated bank does not accept a draft drawn on it or, having accepted a draft drawn on it, does not pay at maturity;iv. 由被指定银⾏承兑⽽该被指定银⾏未予承兑以其为付款⼈的汇票,或者虽已承兑以其为付款⼈的汇票但到期未予付款;v. negotiation with a nominated bank and that nominated bank does not negotiate.v. 由被指定银⾏议付⽽该被指定银⾏未予议付。

1 / 1

十万种考研考证电子书、题库视频学习平台

圣才电子书

Article 36 Force Majeure

第三十六条 不可抗力

A bank assumes no liability or responsibility for the consequences arising out of the interruption of its business by Acts of God, riots, civil commotions, insurrections, wars, acts of terrorism, or by any strikes or lockouts or any other causes beyond its control.

银行对由于天灾、暴动、骚乱、叛乱、战争、恐怖主义行为或任何罢工、停工或其无法控制的任何其他原因导致的营业中断的后果,概不负责。

A bank will not, upon resumption of its business, honour or negotiate under a credit that expired during such interruption of its business.

银行恢复营业时,对于在营业中断期间已逾期的信用证,不再进行承付或议付。

Article 28 Insurance Document and Coverage第二十八条保险单据及保险范围a. An insurance document, such as an insurance policy, an insurance certificate or a declaration under an open cover, must appear to be issued and signed by an insurance company, an underwriter or their agents or their proxies.a. 保险单据,例如保险单或预约保险项下的保险证明书或者声明书,必须看似由保险公司或承保人或其代理人或代表出具并签署。

Any signature by an agent or proxy must indicate whether the agent or proxy has signed for or on behalf of the insurance company or underwriter.代理人或代表的签字必须标明其系代表保险公司或承保人签字。

b. When the insurance document indicates that it has been issued in more than one original, all originals must be presented.b. 如果保险单据表明其以多份正本出具,所有正本均须提交。

c. Cover notes will not be accepted.c. 暂保单将不被接受。

d. An insurance policy is acceptable in lieu of an insurance certificate or a declaration under an open cover.d. 可以接受保险单代替预约保险项下的保险证明书或声明书。

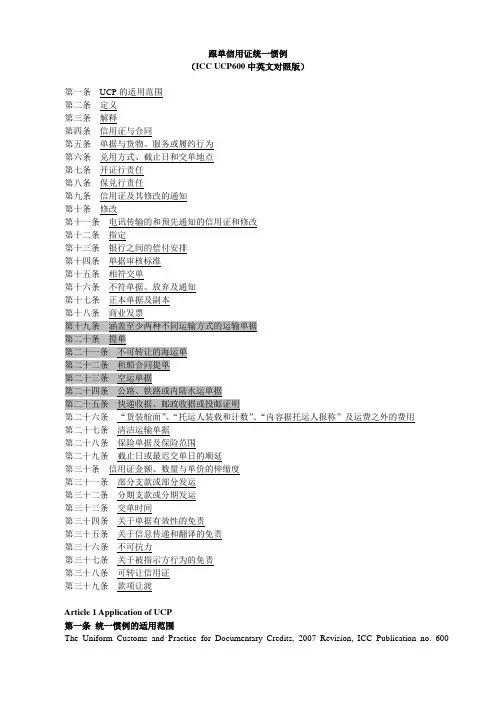

《跟单信用证统一惯例》1993年(修订本) Uniform Customs and Practice for Documentary Credits 国际商会第500号出版物 (ICC Publication No.500) A、总则与定义 General Provisions and Definitions 第一条 统一惯例的适用范围 Application of UCP 《跟单信用证统一惯例,1993年修订本》即,国际商会第500号出版物,适用于所有在信用证文本中标明按本惯例办理的跟单信用证(包括本惯例适用范围内的备用信用证),除非信用证中另有明确规定,本惯例对一切有关当事人均具有约束力。The Uniform Customs and Practice for Documentary Credits, 1993 Revision, ICC Publication No.500, shall apply to all Documentary Credits (including to the extent to which they may be applicable, Standby Letter(s) of Credit) where they are incorporated into the text of the Credit. They are binding on all parties thereto, unless otherwise expressly stipulated in the Credit. 第二条 信用证的意义就本惯例而言,“跟单信用证”和“备用信用证”(以下统称“信用证”)意指一项约定,不论如何命名或描述,系指一家银行(“开证行”)应客户(“申请人”)的要求和指示或以其自身的名义,在与信用证条款相符的条件下,凭规定的单据:for the purposes of these Articles, the expressions “Documentary Credit(s)” and “Standby Letter(s) of Credit” (hereinafter referred to as “Credit(s)”) mean any arrangement, however named or described, whereby a bank (the Issuing Bank) acting at the request and on the instructions of a customer (the Applicant ) or on its own behalf, Ⅰ.向第三者(“受益人”)或其指定人付款,或承兑并支付受益人出具的汇票,或 is to make a payment to or to the order of a third party (the Beneficiary), or is to accept and pay bills of exchange (Draft(s) drawn by the Beneficiary, or Ⅱ.授权另一家银行付款,或承兑并支付该汇票,或 authorizes another bank to effect such payment, or to accept and pay such bills of exchange (Draft(s)), or Ⅲ.授权另一家银行议付。Authorises another bank to negotiate. 就本惯例而言,一家银行在不同国家设立的分支机构均视为另一家银行。For the purpose of these Articles, branches of a bank in different countries are considered another bank. 第三条 信用证与合同 a.就性质而言,信用证与可能作为其依据的销售合同或其它合同,是相互独立的两种交易。即使信用证中提及该合同,银行亦与该合同完全无关,且不受其约束。因此,一家银行作出付款、承兑并支付汇票或议付及/或履行信用证项下其它义务的承诺,并不受申请人与开证行之间或与受益人之间在已有关系下产生的索偿或抗辩的制约。Credits, by their nature, are separate transactions from the sales or other contract(s) on which they may be based and banks are in no way concerned with or bound by such contracts, even if any references whatever to such contract(s) is included in the Credit. Consequently, the undertaking of a bank to pay, accept and pay draft(s) or negotiate and/or to fulfill any other obligation under the Credit, is not subject to claims or defenses by the Applicant resulting from his relationships with the Issuing Bank or the Beneficiary. b.受益人在任何情况下,不得利用银行之间或申请人与开证行之间的契约关系。A Beneficiary can in no case avail himself of the contractual relationships existing between the banks or between the Applicant and the Issuing Bank. 第四条 单据与货物/服务/行为 在信用证业务中,各有关当事人处理的是单据,而不是单据所涉及的货物、服务/或其它行为。In Credit operations all parties concerned deal with documents, and not with goods, services and/or other performances to which the documents may relate. 第五条 开立或修改信用证的指示 instructions to Issue/Amend Credits a.开证指示、信用证本身、对信用证的修改指示或修改书本身均必须完整和明确。Instructions for the issuance of a Credit, the Credit itself, instructions for an amendment thereto, and the amendment itself, must be complete and precise. 为防止混淆和误解,银行应劝阻有关方:In order to guard against confusion and misunderstanding, banks should discourage any attempt. Ⅰ.勿在信用证或其任何修改书中,加注过多细节 to include excessive detail in the Credit or in any amendment thereto Ⅱ.在指示开立、通知或保兑一个信用证时,勿引用先前开立的信用证(参照前证),而该前证受到已被接受及/或未被接受的修改所约束。To give instructions to issue, advise or confirm a Credit by reference to a Credit previously issued. (similar Credit) where such previous credit has been subject to accepted amendment(s), and/or unaccepted amendment(s) b.有关开立信用证的一切指示和信用证本身,如有修改时,有关修改的一切指示和修改书本身都必须明确表明据以付款、承兑或议付的单据。All instructions for the issuance of a Credit and the Credit itself and, where applicable, all instructions for amendment thereto and the amendment itself must state precisely the document(s) against which payment, acceptance or negotiation is to be made. B、信用证的形式与通知 forms and notification of Credits 第六条 可撤销信用证与不可撤销信用证 a.信用证可以是:a Credit may be Ⅰ.可撤销的,或 revocable, or Ⅱ.不可撤销的。irrevocable b.因此信用证上应明确注明是可撤销的或是不可撤销的。The Credit, therefore, should clearly indicate whether it is revocable or irrevocable. c.如无此项注明,应视为不可撤销的。In the absence of such indication the Credit shall be deemed to be irrevocable. 第七条 通知行的责任 advising bank’s liability a.信用证可经另一家银行(“通知行”)通知受益人,但通知行无须承担付款承诺之责任。如通知行决定通知,就应合理审慎地核验所通知的信用证的表面真实性。如通知行决定不通知,就必须不延误地告知开证行。A Credit may be advised to a beneficiary through another bank (the Advising Bank) without engagement on the part of the Advising Bank, but that bank, if it elects to advise the Credit, shall take reasonable care to check the apparent authenticity of the Credit which it advises. If the bank elects not to advise the Credit, it must so inform the Issuing Bank without delay. b.如通知行不能确定信用证的表面真实性,就必须不延误地告知发出该指示的银行,说明本行不能确定该信用证的真实性。如通知行仍决定通知,则必须告知受益人本行不能核对信用证的真实性。If the Advising Bank cannot establish such apparent authenticity, it must inform, without delay, the bank from which the instructions appear to have been received that it has been unable to establish the authenticity of the Credit, and if it elects nonetheless to advise the Credit, it must inform the Beneficiary that it has not been able to establish the authenticity of the Credit. 第八条 信用证的撤销 revocation of a Credit a.可撤销的信用证可以由开证行随时修改或撤销,不必事先通知受益人。A