2015年ACCA考试F6mock6月份考题

- 格式:pdf

- 大小:2.97 MB

- 文档页数:11

2015年6月ACCA考试《公司报告(International)》真题(总分:100.00,做题时间:180分钟)一、Section A –THIS ONE question is compulsory and MUST be attempted(总题数:1,分数:50.00)Kutchen, a public limited company, operates in the technology sector and has investments in other entities operatingin the sector. The draft statements of financial position at 31 March 2015 are as follows: The following information is relevant to the preparation of the group financial statements: 1. On 1 October 2014, Kutchen acquired 70% of the equity interests of House, a public limited company. Thepurchase consideration comprised 20 million shares of $1 of Kutchen at the acquisition date and 5 million shareson 31 March 2016 if House’s net profit after taxation was at least $4 million for the year ending on that date.The market price of Kutchen’s shares on 1 October 2014 was $2 per share and that of House was $4•20 pershare. It is felt that there is a 20% chance of the profit target being met. Kutchen wishes to measure the non-controlling interest at fair value at the date of acquisition. At acquisition, thefair value of the non-controlling interest (NCI) in House was based upon quoted market prices. On 1 October2014, the fair value of the identifiable net assets acquired was $48 million and retained earnings of House were$18 million and other components of equity were $3 million. The excess in fair value is due to non-depreciableland. No entries had been made in the financial statements of Kutchen for the acquisition of House. 2. On 1 April 2014, Kutchen acquired 80% of the equity interests of Mach, a privately owned entity, for aconsideration of $57 million. The consideration comprised cash of $52 million and the transfer of non-depreciable land with a fair value of $5 million. The carrying amount of the land at the acquisition date was$3 million and the land has only recently been transferred to the seller of the shares in Mach and is still carriedat $3 million in the financial records of Kutchen at 31 March 2015. The only consideration shown in thefinancial records of Kutchen is the cash paid for the shares of Mach. At the date of acquisition, the identifiable net assets of Mach had a fair value of $55 million, retained earningswere $12 million and other components of equity were $4 million. The excess in fair value is due to non-depreciable land. Mach had made a net profit attributable to ordinary shareholders of $3•6 million for theyear to 31 March 2014. Kutchen wishes to measure the non-controlling interest at fair value at the date of acquisition. The NCI is to befair valued using a public entity market multiple method. Kutchen has identified two companies who arecomparable to Mach and who are trading at an average price to earnings ratio (P/E ratio) of 21. Kutchen hasadjusted the P/E ratio to 19 for differences between the entities and Mach, for the purpose of fair valuing theNCI.3. Kutchen had purchased an 80% interest in Niche for $40 million on 1 April 2014 when the fair value of theidentifiable net assets was $44 million. The partial goodwill method had been used to calculate goodwill and animpairment of $2 million had arisen in the year ended 31 March 2015. There were no other impairment chargesor items requiring reclassification. The holding in Niche was sold for $50 million on 31 March 2015 and thegain on sale in Kutchen’s financial statements is currently recorded in other components of equity. The carryingvalue of Niche’s identifiable net assets other than goodwill was $60 million at the date of sale. Kutchen hadcarried the investment in Niche at cost.4. Kutchenhas decided to restructure one of its business segments. The plan was agreed by the board of directorson 1 January 2015 and affects employees in two locations. In the first location, half of the factory units havebeen closed by 31 March 2015 and the affected employees’ pension benefits have been frozen. Any newemployees will not be eligible to join the defined benefit plan. After the restructuring, the present value of thedefined benefit obligation in this location is $8 million. The following table relates to location 1. Value before restructuring Location 1 –$m Present value of defined benefit obligation (10) Fair value of plan assets 7 Net pension liability (3) In the second location, all activities have been discontinued. It has been agreed that employees will receive apayment of $4 million in exchange for the pension liability of $2•4 million in the unfunded pension scheme.Kutchen estimates that the costs of the above restructuring excluding pension costs will be $6 million. Kutchenhas not accounted for the effects of the restructuring in its financial statements because it is planning a rightsissue and does not wish to depress the share price. Therefore there has been no formal announcement of therestructuring. The pension liability is shown in non-current liabilities. 5. Kutchen manufactures equipment for lease or sale. On 31 March 2015, Kutchen leased out equipment under a10-year finance lease. The selling price of the leased item was $50 million and the net present value of theminimum lease payments was $47 million. The carrying value of the leased asset was $40 million and thepresent value of the residual value of the product when it reverts back to Kutchen at the end of the lease term is$2•8 million. Kutchen has shown sales of $50 million and cost of sales of $40 million in its financial statements. 6. Kutchen has impairment tested its non-current assets. It was decided that a building located overseas wasimpaired because of major subsidence. The building was acquired on 1 April 2014 at a cost of 25 million dinarswhen the exchange was 2 dinars to the dollar. The building is carried at cost. At 31 March 2015, the recoverableamount of the building was deemed to be 17•5 million dinars. The exchange rate at 31 March 2015 is 2•5 dinars to the dolla r. Buildings are depreciated over 25 years. The tax base and carrying amounts of thenon-current assets before the impairment write down were identical.The impairment of the non-current assets is not allowable for tax purposes. Kutchen has not made anyimpairment or deferred tax adjustment for the above. Kutchen expects to make profits for the foreseeable futureand assume the tax rate is 25%. No other deferred tax effects are required to be taken into account other than on the above non-current assets. Required: (分数:50.01)(1).(a)Prepare the consolidated statement of financial position for the Kutchen Group as at 31 March 2015. (35 marks)(分数:16.67)_________________________________________________________________________________ _________正确答案:( Contingent consideration should be valued at fair value and will have to take into account the various milestones set underthe agreement. The expected value is (20% x 5 million shares) 1 million shares x $2, i.e. $2 million. There will be noremeasurement of the fair value in subsequent periods. If this were a liability, there would be remeasurement. The contingentconsideration will be shown in OCE. The fair value of the consideration is therefore 20 million shares at $2 plus $2 million(above), i.e. $42 million. The purchase should be accounted for as follows: Dr Investment in House $42 million Cr Ordinary share capital $20 million Cr Other components of equity $22 million The fair value of the NCI is 30% x 13 million x $4•20 =$16•38 million The fair value adjustment for land is $(48 –Share capital 13 –Retained earnings 18 –OCE 3)m, i.e. $14million. Working 2 Mach Net profit of Mach for the year to 31 March 2014 is $3•6 million. The P/E ratio (adjusted) is 19. Therefore the fair value ofMach is 19 x $3•6 million, i.e. $68•4 million. The NCI has a 20% holding; therefore the fair value of the NCI is $13•68 million. The land transferred as part of the purchase consideration should be valued at its acquisition date fair value of $5 million.Therefore the increase of $2 million over the carrying amount should be shown in retained earnings. The fair value adjustment for land is $13m (55 –Share capital 26 –Retained earnings 12 –OCE 4), i.e. $13 million. Total goodwill is therefore $(15•68 + 10•38) million, i.e. $26•06 million. Working 7 Finance lease Kutchen should have shown the lease receivable at the lower of the fair value of the asset and the present value of theminimum lease payments, i.e. $47 million. Therefore an adjustment of $3 million will have to be made to profit or loss andthe lease receivable. Similarly, the cost of transaction should have been $(40 –2•8) million, i.e. $37•2 million as the assetreverts back to Kutchen at the end of the lease. Therefore an adjustment should be made to profit or loss and lease recei vableof $2•8 million. Dr Profit or loss $3 million Cr Lease receivable $3 million Dr Lease receivable $2•8 million Cr Profit or loss $2•8 million (The net amount of $0•2 million could be adjusted in this case.) The finance lease receivable figure in the financial statements will be $(50 –3 + 2•8 + 14 + 8)m, i.e. $71•8 million Pensions After restructuring, the present value of the pension liability in location 1 is reduced to $8 million. Thus there will be anegative past service cost in this location of $(10 –8) million, i.e. $2 million. As regards location 2, there is a settlementand a curtailment as all liability will be extinguished by the payment of $4 million. Therefore there is a loss of $(2•4 –4) million, i.e. $1•6 million. The changes to the pension scheme in locations 1 and 2 will both affect profit or lossas follows: Location 1 Dr Pension obligation $2m Cr Retained earnings $2m Location 2 Dr Pension obligation $2•4m Dr Retained earnings $1•6m Cr Current liabilities $4m Even though there has been no formal announcement of the restructuring, Kutchen has started implementing it and therefore it must be accounted for under IAS 37 Provisions, Contingent Liabilities and Contingent Assets A provision of $6 million should also be made at the year end. Deferred taxation and impairment Carrying amount of building at 31 March 2015 $(25 –1 depreciation) million, i.e. 24 million dinars/2 = $12 million. Recoverable amount of building at 31 March 2015 17•5 million dinars/2•5 = $7 million. Impairment loss to profit or loss = $5 million. The tax base and carrying amount of the non-current assets are the same before the impairment charge. After the impairmentcharge, there will be a difference of $5 million. This will create a deferred tax asset of $5 million x 25%, i.e. $1•25 million.As Kutchen expects to make profits for the foreseeable future, this can be recognised in the financial statements. )(2).(b) When Kutchen acquired the majority shareholding in Mach, there was an option on the remaining non-controlling interest (NCI), which could be exercised at any time up to 31 December 2015. On 30 April 2015, Kutchenacquired the remaining NCI which related to the purchase of Mach. The payment for the NCI was structured sothat it contained a fixed initial payment and a series of contingent amounts payable over the following two years.The contingent payments were to be based on the future profits of Mach up to a maximum amount. Kutchen feltthat the fixed initial payment was an equity transaction. Additionally, Kutchen was unsure as to whether thecontingent payments were either equity, financial liabilities or contingent liabilities. After a board discussion which contained disagreement as to the accounting treatment, Kutchen is preparing todisclose the。

2015年6月ACCA考试《专业会计师》真题(总分:100,做题时间:120分钟)一、Section A – This ONE question is compulsory and MUST be attempted(总题数:1,分数:50.00)1.Lysus surgical supplies was founded 20 years ago by entrepreneur Simon Mara who has been the company’s chief executive since t he outset. Incorporated as a private company, Lysus began by importing small surgical devices such as syringes and bandages, and selling them to hospitals, clinics and medical facilities. But the company began to grow rapidly when Mr Mara realised the potential of a growing market in knee and hip joint replacements as the population in many countries was rapidly ageing due to the wider availability of more effective, low cost medicines.Fifteen years ago, he began to manufacture the surgical hip and knee joints used for most joint replacement surgery.As a company operating in the surgical supplies industry, Lysus has always been subject to regulation and must complete compliance reports every year to declare that it is using surgical grade materials for its manufacturing and also that it maintains the requisite level of hygiene in its processes. These reports are a legal compliance matter and must be signed by two directors. Lysus surgical supplies has been a private family (or ‘insider’) company throughout it s history. Owned jointly by Simon Mara, his wife and brother, Mr Mara owns 51% of the shares, his wife, 20% and his brother 29%. All three are directors of Lysus surgical supplies. As the company grew, they sought to employ members of the extended family as much as possible, partly to provide them with jobs and partly to ‘give a feeling of family’ in the company. It was often described as a ‘tight-knit’ culture with family members occupying the senior positions and with few appointments made from outside the company to important roles. When the company grew to a certain size, Mr Mara decided that he needed a qualified accountant on the board of directors to help with investment appraisals, costings, cash flow management, compliance issues and financial reporting. He eventually appointed Amy Tsang, a relatively inexperienced but ambitious person to the board. This was her first role as finance director. Simon Mara was known to be a strong and domineering person. Some former employees described him as a bully who was unable to discuss matters in a calm manner. He was described as quick to anger and capable of intimidating even his senior colleagues such that they would feel unable to challenge him at all. This was also the case with Amy Tsang, the new finance director. She found him overbearing and impossible to challenge. She always did as he asked,even when she felt uncomfortable with what she was being asked to do. When the joint replacement industry became more competitive, Mr Mara had the idea that he could reduce the company’s unit costs by switching some of the surgical-grade materials used in manufacture for a cheaper industrial grade instead. Such a switch would be undetectable to the surgeons using the artificial joints but did increase the risk of fracture and deterioration once the replacement joints were used in a patient. Mr Mara asked Amy Tsang, as an accountant and finance director, to produce detailed costing calculations for the switch and to forecast how this change would affect profits. She also calculated the costs of retooling the factory to allow the industrial grade material to be used. Later, on Mr Mara’s instruction, she approved the investment and oversaw the changes in manufacturing and the purchasing processes, in the full knowledge that such changes were both illegal and unethical. Mr Mara assumed that because many of the senior employees were family members, and that he could control Amy Tsang,that the switch toindustrial grade material would go undetected. The problem came to the public attention some time later when joints made from the inferior material began to deteriorate and immobilise previously mobile patients. The industrial grade material used in the joints often caused infection in patients and some vulnerable patients died of the effects of the product failure. John Qua was the investigative journalist who brought the problems at Lysus to national attention. He thought that the problems arose as a result of a probity risk and that the probity or integrity failure was on the part of Mr Mara and Amy Tsang. Mr Qua’s mother had received a Lysus hip joint and subsequently experienced a great deal of pain and distress when the joint deteriorated, producing some unfortunate side effects including blood poisoning. Although his mother was able to have the joint safely removed and replaced by a better quality artificial joint, John Qua researched further and found other patients who had not been so fortunate. It was John Qua’s investigations into Lysus which alerted the regulatory authorities to the use of the inferior materials in the joints. It soon emerged that the cause of the increased failure of the implants was the use of the inferior industrial-grade material. When the regulator responsible for the safety of surgical supplies disc overed, thanks to John Qua’s research, why the joints degraded, they investigated the use of the inferior materials. The legal officers investigating the case noted that two directors had signed the most recent compliance reports, certifying that the company was fully compliant with material usage and quality standards. These were Simon Mara and Amy Tsang. John Qua was angry with Lysus surgical supplies, because of how his mother and others had suffered. He was particularly angry with Simon Mara and Amy Tsang. As a business journalist, he often wrote articles on the behaviour and performance of listed companies. He became convinced that it was in the public interest for producers of surgical supplies, such as Lysus, to be subject to the regulatory requirements of listed companies. In a published article, he wrote: …whenever I look at company failures such as that at Lysus, I become increasingly convinced that robust ways of embedding risk awareness and risk management are essential in all companies and not just in listed companies. It was the fact that Mr Mara could get away with his offences that is most worrying. He bullied a young accountant,Miss Tsang, into highly unprofessional behaviour, and without the systems in place to enable the offence to be challenged internally, he initially got away with it. Had a whistleblowing system been in place, or a separation of roles at the head of the company, Mr Mara could not have done this terrible thing. Someone would have challenged him and told him not to be so unethical and arrogant. The result is that, with such a high impact business risk having been realised, innocent people working for Lysus may lose their jobs whilst patients may have to suffer the effects of this for many years. Once the case came to the public attention, Mr Mara was arrested and prosecuted for the illegal sale of non-compliant surgical materials. Amy Tsang was also prosecuted and then investigated by her professional accounting body. After an appeal, she was ‘struck off’, thereby preventing her from working as an accountant in the future. The company itself was wound up after sales declined, and all 130 employees lost their jobs. Patients continue to suffer the effects of the defective joint replacements and will do for several years into the future. Required:(分数:50.00)(1).(a) Distinguish between the governance of a family-owned company like Lysus anda publicly listed company,and explain how Mr Mara may not have committed the offences he did if Lysus had been a publicly listed company. (10 marks)(分数:12.50)_________________________________________________________________________________ _________正确答案:(Family and listed companies A family business, when incorporated as a company, is an example of a private limited company. This means that the shares are privately held and are not available for members of the investing public to buy and sell. This is in contrast to a public company, which is listed on a stock exchange and in which members of the public, including private and institutional shareholders, can purchase or sell shares. Being a public listed or public limited company carries a number of requirements,imposed either by statute or the stock exchange, which do not apply to private companies. These requirements include compliance with a number of corporate governance provisions which include the adoption of certain governance structures,adherence with internal control and internal audit standards, and the external reporting of some types of information. A private limited company, in contrast, must comply with company law and tax regulations, but is not subject to listing rules. Mr Mara’s behaviour was highly unethical and also illegal, given the regulatory regime controlling surgical supplies in the country in which he was based. His abuse of his office as CEO of Lysus was made possible by a number of failures, linked in part to the nature and culture of the company. The first such factor was the ‘tight-knit’ family culture which enabled the decision to be made and then go unchallenged among the senior management including his wife, brother and Amy Tsang. The unwillingness to appoint from outside meant that senior members of the company became familiar with Mr Mara’s management style and may, over time, have come to consider his behaviour as ‘normal’. The fact that Mr Mara was such a domineering figure may have become accepted rather than challenged by other directors, partly because of family ties and their prior knowledge of his character and management style. The fact that the company was family-dominated may have made it difficult for others to confront Mr Mara about his style as such an approach may have negatively affected family relationships. Being a family or ‘insider’ dominated business meant that the company did not have any external shareholders. This means that there was no need to account to public shareholders for either the performance of the company or its postures on such issues as ethics. External scrutiny of board performance was not present and Mr Mara was therefore not subject to questioning from anybody outside of the company who might have had a different view on his management than the other members of the company. Because it was not a listed company, there was no regulatory necessity for Lysus to employ governance structures and systems capable of detecting and challenging his irregular behaviour. Had Lysus had, for example, an internal control system which included a control over inbound materials or product design, the replacement of the surgical-grade material with industrial-grade would have been detected and an alert raised as it would have not have been in compliance with the regulations on surgical supplies. Likewise, a formal internal audit system would have been capable of investigating any regulatory non-compliance. This could have then been reported in internal reports and, if deemed necessary, to external authorities. A criticism common to many family-controlled companies is the lack of external expertise in the form of an effective non-executive presence. Although some companies employ non-executive directors (NEDs) on a voluntary and ‘best practice’basis, the private company status of Lysus usually means that there is no regulatory requirement to do so. The purposes of NEDs in a listed company are to represent the strategic interests of shareholders and to populate the main board committees.These committees, in turn, provide a level of assurance to shareholders of probity, transparency and robustness.)(2).(b) Criticise Amy Tsang’s behaviour as the finance director and a qualified。

2015年6月ACCA考试《财务报告(International)》真题(总分:100.00,做题时间:180分钟)一、Section A – ALL 20 questions are compulsory and MUST be attempted (总题数:20,分数:40.00)1.Faithful representation is a fundamental characteristic of useful information within the IASB’s Conceptual framework for financial reporting. Which of the following accounting treatments correctly applies the principle of faithful representation?(分数:2.00)A.Reporting a transaction based on its legal status rather than its economic substanceB.Excluding a subsidiary from consolidation because its activities are not compatible with those of the rest of the groupC.Recording the whole of the net proceeds from the issue of a loan note which is potentially convertible to equity shares as debt (liability)D.Allocating part of the sales proceeds of a motor vehicle to interest received even though it was sold with 0%(interest free) finance √解析:The substance is that there is no ‘free’ finance; its cost, as such, is built into the selling price.2.Which of the following statements relating to intangible assets is true? (分数:2.00)A.All intangible assets must be carried at amortised cost or at an impaired amount; they cannot be revaluedupwardsB.The development of a new process which is notexpected to increase sales revenues may still be recognised asan intangible asset √C.Expenditure on the prototype of a new engine cannot be classified as an intangible asset because the prototypehas been assembled and has physical substanceD.Impairment losses for a cash generating unit are first applied to goodwill and then to other intangible assets beforebeing applied to tangible assets解析:A new process may produce benefits (and therefore be recognised as an asset) other than increased revenues, e.g. it may reduce costs. 3.Each of the following events occurred after the reporting date of 31 March 2015, but before the financial statementswere authorised for issue.Which would be treated as a NON-adjusting event under IAS 10 Events After the Reporting Period?(分数:2.00)A.A public announcement in April 2015 of a formal plan to discontinue an operation which had been approved bythe board in February 2015 √B.The settlement of an insurance claim for a loss sustained in December 2014C.Evidence that $20,000 of goods which were listed as part of the inventory in the statement of financial positionas at 31 March 2015 had been stolenD.A sale of goods in April 2015 which had been held in inventory at 31 March 2015. The sale was made at aprice below its carrying amount at 31 March 2015解析:A board decision to discontinue an operation does not create a liability. A provision can only be made on the announcement of a formal plan (as it then raises a valid expectation that the discontinuance will be carried out). As this announcement occurs during the year ended 31 March 2016, this a non-adjusting event for the year ended 31 March 2015. 4.Metric owns an item of plant which has a carrying amount of $248,000 as at 1 April 2014. It is being depreciatedat 12?% per annum on a reducing balance basis. The plant is used to manufacture a specific product which has been suffering a slow decline in sales. Metric hasestimated that the plant will be retired from use on 31 March 2017. The estimated net cash flows from the use ofthe plant and their present values are: On 1 April 2015, Metric had an alternative offer from a rival to purchase the plant for $200,000. At what value should the plant appear in Metric’s statement of financial position as at 31 March 2015?(分数:2.00)A.$248,000B.$217,000C.$214,600 √D.$200,000解析:Is the lower of its carrying amount ($217,000) and recoverable amount ($214,600) at 31 March 2015. Recoverable amount is the higher of value in use ($214,600) and fair value less (any) costs of disposal ($200,000)). Carrying amount = $217,000 (248,000 – (248,000 x 12·5%)) Value in use is based on present values = $214,6005.Pact acquired 80% of the equity shares of Sact on 1 July 2014, paying $3·00 for each share acquired. Thisrepresented a premium of 20% over the market price of Sact’s shares at that date.Sact’s shareholders’funds (equity) as at 31 March 2015 were: The only fair value adjustment required to Sact’s net assets on consolidation was a $20,000 increase in the value of its land. Pact’s policy is to value non-controlling interests at fair value at the date of acquisition. For this purpose the marketprice of Sact’s shares at that date can be deemed to be representative of the fair value of the shares held by the non-controlling interest. What would be the carrying amount of the non-controlling interest of Sact in the consolidated statement offinancial position of Pact as at 31 March 2015? (分数:2.00)A.$54,000B.$50,000C.$56,000 √D.$58,000解析:Market price of Sact’s shares at acquisition was $2·50 (3·00 –(3·00 x 20/120)), therefore NCI at acq was $50,000 (100,000x 20% x $2·50). NCI share of the post-acq profit is $6,000 (40,000 x 9/12 x 20%). Therefore non-controlling interest as at 31 March 2015 is $56,000.6.The IASB’s Conceptual framework for financial reporting defines recognition as the process of incorporating in the financial statements an item which meets the definition of an element and satisfies certain criteria. Which of the following elements should be recognised in the financial statements of an entity in the mannerdescribed?(分数:2.00)A.As a non-current liability: a provision for possible hurricane damage to property for a company located in an area which experiences a high incidence of hurricanesB.In equity: irredeemable preference shares √C.As a trade receivable: an amount of $10,000 due from a customer which has been sold (factored) to a financecompany with no recourse to the sellerD.In revenue: the whole of the proceeds from the sale of an item of manufactured plant which has to be maintainedby the seller for three years as part of the sale agreement。

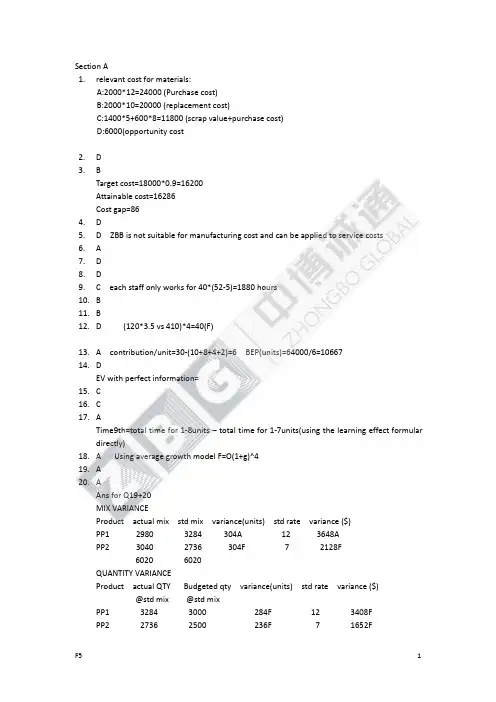

Section A1.relevant cost for materials:A:2000*12=24000(Purchase cost)B:2000*10=20000(replacement cost)C:1400*5+600*8=11800(scrap value+purchase cost)D:6000(opportunity cost2.D3.BTarget cost=18000*0.9=16200Attainable cost=16286Cost gap=864.D5.D ZBB is not suitable for manufacturing cost and can be applied to service costs6.A7.D8.D9.C each staff only works for40*(52-5)=1880hours10.B11.B12.D(120*3.5vs410)*4=40(F)13.A contribution/unit=30-(10+8+4+2)=6BEP(units)=64000/6=1066714.DEV with perfect information=15.C16.C17.ATime9th=total time for1-8units–total time for1-7units(using the learning effect formular directly)18.A Using average growth model F=O(1+g)^419.A20.AAns for Q19+20MIX VARIANCEProduct actual mix std mix variance(units)std rate variance($)PP129803284304A123648APP230402736304F72128F60206020QUANTITY VARIANCEProduct actual QTY Budgeted qty variance(units)std rate variance($)@std mix@std mixPP132843000284F123408FPP227362500236F71652FSECTION BQUESTION1(A)Machine hour required=4000*(6+4+8)=72000hoursMachine hour available=70000Machine hour in shortage=2000Therefore machine hour is the limiting factorCP1CP2CP3$$$Relevant cost of making407248Relevant cost of buying588068Cost saving/unit18820Machine hours/unit648Cost saving/machine hour32 2.5Ranking132Machine hours available700000CP1:4000*6=24000CP3:4000*8=32000CP2:3500*4=14000TOTAL:700000Therefore the company should buy another500units of CP2from external supplier.(B)Three other factors(reference point only.In final exams please write in sentences)●the loss of control over the whole production process●the quantity and the quality supplied by the external contractor●the price stability can be sustained or not.●Any other possible ways to increase the capacity of the production etc.QUESTION2(A)Payoff tables:size demand sales@20vc/unit goodwill depre net profitsmall 11013022008801201501050 11020022008801201501050medium 1701302600915.23101374.8 170200340013601203101610large 2401302600915.24201264.8 240200400014084202172(B)Maximax rule:Size demand profit Small1101301050 Medium1702001610 Large2402002172Therefore the company should buy large oneMaximin ruleSize demand profit Small1102001050 Medium1702001374.8 Large2402001264.8Therefore the company should buy medium Mini max-regretsummary(A)demand 130200size 11010501050 1701374.81610 2401264.82172regretdemand maxregret 130200size 110324.811221122 1700562562 2401100110Therefore the company should buy large oneQUESTION3(A)ABC VarianceExpenditure variance=1800*45vs84000=3000(A)Efficicency variance=(2100vs1800)*45=13500(F)Std cost driver rate=90000/2000=45/movement10500units of product should use(10500*2000)/10000=2100movements(b)Original std:0.5hr@$20/hrRevised std0.5hr*1.1@$20*0.95/hrActual std11000hrs@140800Labor rate variance-planning=18500*0.55*(20vs20*0.95)=10175F-operational=11000*0.95*20vs140800=68200FLabor efficiency var-planning=18500*(0.5vs0.55)*20=18500A-Operational=(18500*0.55vs11000)*20*0.95=15675AQUESTION4(refer to REFERENCE ANSWER FOR DEC/2011Q3) QUESTION5(a)cost pool cost driver cost($)number of driverscost driver rateproduction set-ups production runs105,000150700process testing#of tests300,0003,000100material handling cost #of materialmovements50,0001,00050ordering cost order numbers225,0002,000112.5(b)TOTAL production overheads for10,000units are:set-ups7000number of tests800number of material movements750number of order16875Total:25425Volume:10000Production overheads/unit 2.54General overheads:OAR=1.8mil/600000hrs=$3/hrTotal labor hours for10000units of products=10000/4=2500hoursGeneral o/h per unit=2500/10000*3=$0.75/unitTotal unit cost and selling price for productCost$/unitComponent cost 1.5Direct labor(15/60*8)2Production overheads 2.54General O/H0.75Total unit cost 6.79Mark-up(6.79*0.4) 2.72Selling price9.51。

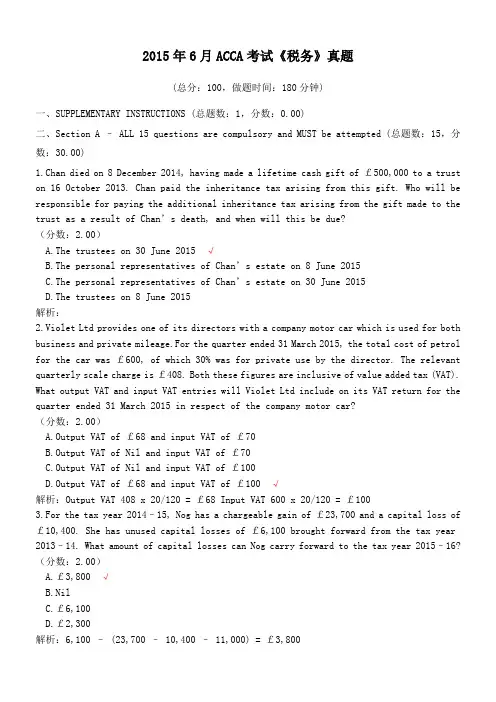

2015年6月ACCA考试《税务》真题(总分:100,做题时间:180分钟)一、SUPPLEMENTARY INSTRUCTIONS (总题数:1,分数:0.00)二、Section A – ALL 15 questions are compulsory and MUST be attempted (总题数:15,分数:30.00)1.Chan died on 8 December 2014, having made a lifetime cash gift of £500,000 to a trust on 16 October 2013. Chan paid the inheritance tax arising from this gift. Who will be responsible for paying the additional inheritance tax arising from the gift made to the trust as a result of Chan’s death, and when will this be due?(分数:2.00)A.The trustees on 30 June 2015 √B.The personal representatives of Chan’s estate on 8 June 2015C.The personal representatives of Chan’s estate on 30 June 2015D.The trustees on 8 June 2015解析:2.Violet Ltd provides one of its directors with a company motor car which is used for both business and private mileage.For the quarter ended 31 March 2015, the total cost of petrol for the car was £600, of which 30% was for private use by the director. The relevant quarterly scale charge is £408. Both these figures are inclusive of value added tax (VAT). What output VAT and input VAT entries will Violet Ltd include on its VAT return for the quarter ended 31 March 2015 in respect of the company motor car?(分数:2.00)A.Output VAT of £68 and input VAT of £70B.Output VAT of Nil and input VAT of £70C.Output VAT of Nil and input VAT of £100D.Output VAT of £68 and input VAT of £100 √解析:Output VAT 408 x 20/120 = £68 Input VAT 600 x 20/120 = £1003.For the tax year 2014–15, Nog has a chargeable gain of £23,700 and a capital loss of £10,400. She has unused capital losses of £6,100 brought forward from the tax year 2013–14. What amount of capital losses can Nog carry forward to the tax year 2015–16? (分数:2.00)A.£3,800 √B.NilC.£6,100D.£2,300解析:6,100 – (23,700 – 10,400 – 11,000) = £3,8004.For the year ended 30 November 2014, Mixiness Ltd has taxable total profits of £1,380,000 and franked investment income (FII) of £240,000. Mixiness Ltd does not have any associated companies. What is Mixiness Ltd’s corporation tax liab ility for the year ended 30 November 2014?(分数:2.00)A.£351,000B.£299,000 √C.£308,200D.£289,800解析:5.Which of the following statements correctly explains the difference between tax evasion and tax avoidance?(分数:2.00)A.Both tax evasion and tax avoidance are illegal, but tax evasion involves providing HM Revenue and Customs with deliberately false informationB.Tax evasion is illegal, whereas tax avoidance involves the minimisation of tax liabilities by the use of any lawful means √C.Both tax evasion and tax avoidance are illegal, but tax avoidance involves providing HM Revenue and Customs with deliberately false informationD.Tax avoidance is illegal, whereas tax evasion involves the minimisation of tax liabilities by the use of any lawful means解析:6.Quinn will not make the balancing payment in respect of her tax liability for the tax year 2013–14 until 17 October 2015. What is the total percentage of penalty which Quinn will be charged by HM Revenue and Customs (HMRC) in respect of the late balancing payment for the tax year 2013–14?(分数:2.00)A.15%B.10% √C.5%D.30%解析:7.Which classes of national insurance contribution is an employer responsible for paying? (分数:2.00)A.Both class 2 and class 4B.Class 1 onlyC.Both class 1 and class 1A √D.Class 2 only解析:8.Alice is in business as a sole trader. On 13 May 2014, she sold a freehold warehouse for £184,000, and this resulted in a chargeable gain of £38,600. Alice purchased a replacement freehold warehouse on 20 May 2014 for £143,000.Where possible, Alice always makes a claim to roll over gains against the cost of replacement assets. Both buildings have been, or will be, used for business purposes by Alice. What is the base cost of the replacement warehouse for capital gains tax purposes?(分数:2.00)A.£181,600B.£104,400C.£143,000 √D.£102,000解析:(184,000 – 143,000) > 38,600 The base cost is the actual cost of £143,000. There is no rollover relief because the proceeds not reinvested are greater than the chargeable gain.9.For the tax year 2013–14, Willard filed a paper self-assessment tax return on 10 August 2014. What is the deadline for Willard to make an amendment to his tax return for the tax year 2013–14, and by what date will HM Revenue and Customs (HMRC) have to notify Willard if they intend to carry out a compliance check into this return? Amendment Compliance check (分数:2.00)A.10 August 2015 31 January 2016B.10 August 2015 10 August 2015C.31 January 2016 10 August 2015 √D.31 January 2016 31 January 2016解析:10.For the tax year 2014–15, Chi has a salary of £53,000. She received child benefit of £1,771 during this tax year. What is Chi’s child benefit income tax charge for the tax year 2014–15?(分数:2.00)A.£1,771B.NilC.£1,240D.£531 √解析:1,771 x 30% ((53,000 – 50,000)/100) = £53111.Samuel is planning to leave the UK to live overseas, having always previously been resident in the UK. He will not automatically be treated as either resident in the UK or not resident in the UK. Samuel has several ties with the UK and will need to visit the UK for 60 days each tax year. However, he wants to be not resident after he leaves the UK. For the first two tax years after leaving the UK, what is the maximum number of ties。

2015年6月ACCA考试《高级审计与认证业务(International)》真题(总分:100,做题时间:180分钟)一、Section A – BOTH questions are compulsory and MUST be attempted(总题数:2,分数:60.00)1.You are a manager in the audit department of Craggy & Co, a firm of Chartered Certified Accountants, and you have just been assigned to the audit of Ted Co, a new audit client of your firm, with a financial year ended 31 May 2015.Ted Co, a newly listed company, is a computer games designer and developer, and has grown rapidly in the last few years. The audit engagement partner, Jack Hackett, has sent you the following email: Notes from meeting with Len Brennan Ted Co was formed ten years ago by Dougal Doyle, a graduate in multimedia computing. The company designs,develops and publishes computer games including many highly successful games which have won industry awards.In the last two years the company invested $100m in creating games designed to appeal to a broad, global audience and sales are now made in over 60 countries. The software used in the computer games is developed in this country,but the manufacture of the physical product takes place overseas. Computer games are largely sold through retail outlets, but approximately 25% of Ted Co’s revenue is generated through sales made on the company’s website. In some countries Ted Co’s products are distributed under licences which give the licence holder the exclusive right to sell the products in that country. The cost of each licence to the distributor depends on the estimated sales in the country to which it relates, and licences last for an average of five years. The income which Ted Co receives from the sale of a licence is deferred over the period of the licence. At 31 May 2015 the total amount of deferred income recognised in Ted Co’s statement of financial position is $18 million. As part of a five-year strategic plan, Ted Co obtained a stock market listing in December 2014. The listing and related share issue raised a significant amount of finance, and many shares are held by institutional investors. Dougal Doyle retains a 20% equity shareholding, and a further 10% of the company’s shares are held by his family members. Despite being listed, the company does not have an internal audit department, and there is only one non-executive director on the board. The se problems, which Ted Co’s management is hoping to resolve in the next few months, are explained in the company’s annual report, as required by the applicable corporate governance code. Recently, a small treasury management function was established to man age the company’s foreign currency transactions, which include forward exchange currency contracts. The treasury management function also deals with short-term investments. In January 2015, cash of $8 million was invested in a portfolio of equity shares held in listed companies, which is to be held in the short term as a speculative investment. The shares are recognised as a financial asset at cost of $8 million in the draft statement of financial position. The fair value of the shares at 31 May 2015 is $6 million. As a listed company, Ted Co is required to disclose its earnings per share figure. Dougal Doyle would like this to be based on an adjusted earnings figure which does not include depreciation or amortisation expenses. The previous auditors of Ted Co, a small firm called Crilly & Co, resigned in September 2014. The audit opinion on the financial statements for the year ended 31 May 2014 was unmodified. Extract of draft financial statements and results of preliminary analytical review Statement of profit or loss(extract) Required: Respond to the email from the audit partner. (31 marks) Note: The split of the mark allocation is shown in the partner’s email. Professional marks will be awarded for the presentation, clarity of explanations and logical flow of the briefing notes. (4 marks)(分数:35.00)_________________________________________________________________________________ _________正确答案:(Briefing notes To: Jack Hackett, audit partner From: Audit manager Regarding: Audit planning of Ted Co Introduction These briefing notes are prepared for the use of the audit team in planning the audit of Ted Co, our firm’s new audit client which develops and publishes computer games. The briefing notes discuss the planning matters in respect of this being an initial audit engagement; evaluate the audit risks to be considered in planning the audit; and recommend audit procedures in respect of short-term investments and the earnings per share figure disclosed in the draft financial statements. (a)In an initial audit engagement there are several factors which should be considered in addition to the planning procedures which are carried out for every audit. ISA 300 Planning an Audit of Financial Statements provides guidance in this area. ISA 300 suggests that unless prohibited by laws or regulation, arrangements should be made with the predecessor auditor,for example, to review their working papers. Therefore communication should be made with Crilly & Co to request access to their working papers for the financial year ende d 31 May 2014. The review of the previous year’s working papers would help Craggy & Co in planning the audit, for example, it may highlight matters pertinent to the audit of opening balances or an assessment of the appropriateness of Ted Co’s accountingpo licies. It will also be important to consider whether any previous years’ audit reports were modified, and if so, the reason for the modification. As part of the client acceptance process, professional clearance should have been sought from Crilly & Co. Any matters which were brought to our firm’s attention when professional clearance was obtained should be considered for their potential impact on the audit strategy. There should also be consideration of the matters which were discussed with Ted Co’s manage ment in connection with the appointment of Craggy & Co as auditors. For example, there may have been discussion of significant accounting policies which may impact on the planned audit strategy. Particular care should be taken in planning the audit procedures necessary to obtain sufficient appropriate audit evidence regarding opening balances, and procedures should be planned in accordance with ISA 510 Initial Audit Engagements – Opening Balances. For example, procedures should be performed to determine whether the opening balances reflect the application of appropriate accounting policies and determining whether the prior period’s closing balances have been correctly brought forward into the current period. With an initial audit engagement it is particularly important to develop an understanding of the business, including the legal and regulatory framework applicable to the company. This understanding must be fully documented and will help the audit team to perform effective analytical review procedures and to develop an appropriate audit strategy. Obtaining knowledge of the business will also help to identify whether it will be necessary to plan for the use of auditors’ experts. Craggy & Co may have quality control procedures in place for use in the case of initial engagements, for example, the involvement of another partner or senior individual to review the overall audit strategy prior to commencing significant audit procedures. Compliance with any such procedures should be fully documented. Given that this is a new audit client, that it is newly listed, and because of other risk factors to be discussed in the next part of these briefing notes, whendeveloping the audit strategy consideration should be given to using an experienced audit team in order to reduce detection risk. (b)Management bias The first audit risk identified relates to Ted Co becoming a listed entity during the year. This creates an inherent risk at the financial statement level and is caused by the potential for management bias. Management will want to show good results to the new shareholders of the company, in particular the institutional shareholders, and therefore there is an incentive for the overstatement of revenue and profit. The analytical review shows a significant increase in pro fit before tax of 48•1%,indicating potential overstatement. There is a related risk of overstatement due to Dougal Doyle and his family members retaining a 30% equity interest in Ted Co, which is an incentive for inflated profit so that a high level of dividend can be paid. It appears that governance structures are not strong, for example, there are too few non-executive directors, and therefore Dougal Doyle is in a position to be able to dominate the board and to influence the preparation of the financial statements.This increases the risk of material misstatement due to management bias. There is also a risk that management lacks knowledge of the reporting requirements specific to listed entities, for example, in relation to the calculation and disclosure of earnings per share which is discussed later in these briefing notes. E-commerce With 25% of revenue generated through the company’s website, this represents a significant revenue stream, and the income generated through e-commerce is material to the financial statements. E-commerce gives rise to a number of different audit risks, including but not limited to the following. For the auditor, e-commerce can give rise to detection risk, largely due to the paperless nature of the transactions and the fact there is likely to be a limited audit trail, making it difficult to obtain audit evidence. For the same reason, control risk is increased, as it can be hard to maintain robust controls unless they are embedded into the software which records the transaction. The auditor may find it difficult to perform tests on the controls of the system unless audit software is used, as there will be few manual controls to evaluate. A risk also arises in terms of the recognition of sales revenue, in particular cut-off can be a problem where sales are made online as it can be difficult to determine the exact point at which the revenue recognition criteria of IAS 18 Revenue have been met. Hence, over or understatement of revenue is a potential risk to be considered when planning the audit. Ted Co also faces risks relating to the security of the system, for example, risks relating to unauthorised access to the system,and there is an increased risk of fraud. All of these risks mean that there is high audit risk in relation to the revenue generated from the company’s website. Licence income The licence income which is deferred in the statement of financial position represents 13•4% of total assets and is therefore material. There is a risk that the accounting treatment is not appropriate, and there are two separate risks which need to be considered.First, it may be the case that the revenue from the sale of a licence should not be deferred at all. The revenue recognition criteria of IAS 18 need to be applied to the transaction, and if, for example, it were found that Ted Co has no ntinuing management involvement and that all risk and reward had been transferred to the buyer, then the revenue should be recognised immediately and not deferred. This would mean a significant understatement of revenue and profit. Second, if it is appropriate that the revenue is deferred, for example, if Ted Co does retain managerial involvement and has retained the risk and reward in relation to the licence arrangement, then the period over which the revenue is recognised could be inappropriate, resulting in over or understated revenue in the accounting period. Foreign exchange transactions Ted Co’s products sell in over 60 countries and the products are manufactured overseas, so the。

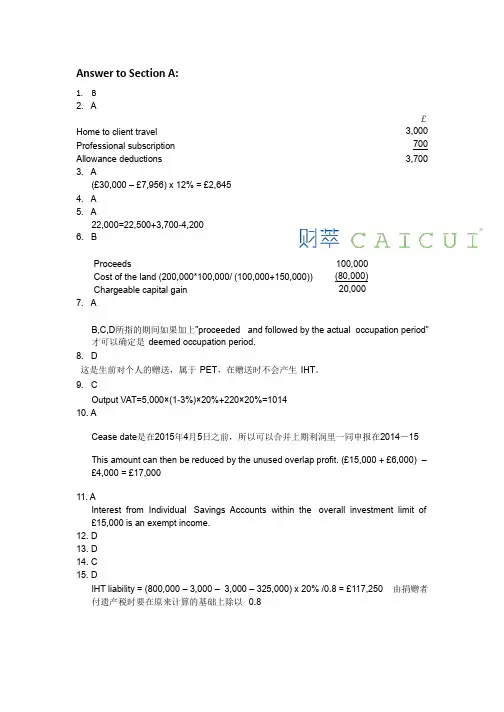

Answer to Section A:1. B2. A£ 3,000 700 Home to client travel Professional subscription Allowance deductions 3,7003. A(£30,000 – £7,956) x 12% = £2,645 4. A5. A22,000=22,500+3,700-4,2006. BProceeds100,000 (80,000) 20,000Cost of the land (200,000*100,000/ (100,000+150,000)) Chargeable capital gain 7. AB,C,D 所指的期间如果加上”proceeded and followed by the actual occupation period” 才可以确定是 deemed occupation period.8. D这是生前对个人的赠送,属于 PET ,在赠送时不会产生 IHT 。

9. COutput VAT=5,000×(1-3%)×20%+220×20%=1014 10. ACease date 是在2015年4月5日之前,所以可以合并上期利润里一同申报在2014-15 This amount can then be reduced by the unused overlap profit. (£15,000 + £6,000) – £4,000 = £17,00011. AInterest from Individual Savings Accounts within the overall investment limit of £15,000 is an exempt income. 12. D 13. D 14. C 15. DIHT liability = (800,000 – 3,000 – 3,000 – 325,000) x 20% /0.8 = £117,250 付遗产税时要在原来计算的基础上除以 0.8由捐赠者Answer to Section B1. Flick Pick (TX 06/12 Q1)Answer: all figures are in one pound, unless indicated otherwise (a)Other income (Total income)Trading profit (W2)(W3)(W4) Employment income (W1) Property income (W5) Total (net) income8,220 34,388 5,940 48,548 -10,000 38,548Less: Personal allowance (W6) Taxable incomeWorking 1 Employment income Salary 25,665 Benefit:-accommodation benefit (W1.1) -furniture benefit 9,400*0.2 Total6,843 1,880 34,388 Working 1.1 accommodation benefit basic rate: annual value4,600 2,243 6,843additional charge: (144,000-75,000)*3.25% taxable benefit:Working 2 tax -adjusted trading profitYear ended 30 April 2015=29,700- 300 (W2.1) =29,400 Working 2.1 capital allowanceprivate -used carsBusiness use %Capital allowanceTWDV B/D addition 0 18,750 18,750 -500 Balance WDA (8%*4/12) Total60%300 30018,250Working 3 Partnership profit allocationFlickArtTotalTotal29,400 (W2)-2,000less: salary to art Remaining 6,000*4/12=2,00016,44027,400 profit sharing10,960-27,400ratio(4:6) Total10,960 18,440 Working 4 sole trader basis tax year Basis periodProfit2014/15from 1/1/2015-6/4/201510,960 (W3)*3/4=8,220Working 5 property income Rental 660*12 7,920 council tax -1,320 -660 W&T allowance Total(7,920-1,320)*10%5,940Working 6 Personal allowances Adjusted net income= 49,065Born on or after 6 April 1948, so the standard PA of 10,000 should be used(b)3D Ltd will be responsible for paying class 1 NIC (both primary and secondary contributions) in respect of Flick’s salary.3D Ltd will be responsible for paying class 1A NIC in respect of Flick’s taxable benefits. Flick will be responsible for paying class 2 NIC in respect of her trading income. Flick will be responsible for paying class 4 NIC in respect of her trading income Tutorials:1.第一个税务年度所对应的 basis period 应该为公司成立日至第一个税务年度日(06/04/20XX) 2. For accommodation benefit, since the property was acquired more than 6 years before being provided to Flick, the market value at the date it was provided to her is used as the cost of providing the benefit, instead of the original cost.3. Cost of replacing furniture 和 wear & tear allowance 只能选其一抵减,本题中 flick 选择 使用 wear & tear allowance.4.对于求 trading income 的综合题,必须按照规定步骤按顺序计算:1.先求 tax -adjusted trading profit. 2. Partnership profit allocation 3. Basis period assessment.2. Neung Ltd (a ) Associates● ● Second Ltd and Fourth Ltd are not associated companies as Neung Ltd has ashareholding of less than 50% in Second Ltd, and Fourth Ltd is dormant. Third Ltd and Fifth Ltd is associated companies as Neung Ltd has ashareholding of over 50% in each case, and both are trading companies.(b ) Neung Ltd – Corporation tax computation for the year ended 31 March 2015£Trading profit(W1) 358,766(25,200 + 12,600) 37,800396,566Interest income Taxable total profitFranked investment income Augmented profits(37,800/90%) 42,000438,566Corporation tax at marginal rate £396,566 at 21% 83,279(139) Marginal relief1/400 * (500,000 – 438,566) x396,566/438,566 Corporation tax liability83,140(W1) Trading profit£622,536 11,830 Operating profit Depreciation Amortisation7,000 Less: Deduction for lease premium (w2) Capital allowances (w3) Trading profit(4,340) (278,260) 358,766(W2) Deduction for lease premium£140,000 (53,200 86,800 4,340Premium paidLess: £140,000*2%*(20-1)) Assessment on landlordAllowable deduction per year(£86,800/20)(W3) Capital allowancesMain poolSpecial rate poolAllowanceTWDV b/f4,80012,700Additional (no AIA ) Motor car (1) Motor car (2) Additional ( with AIA)15,40028,600 Ventilation system Less: AIA 270,000 (270,000) 28,100 270,000Balance 33,400 (6,012) WDA (18%) WDA (8%) 6,012 2,248 (2,248) 25,852TWDV C/F Total allowance27,388278,260 (W4) Corporation tax rateNeung Ltd has two associated companies; therefore there are three associated companies in total. £ 500,000 100,000Upper limit (£1,500,000/3) Lower limit (£ 300,000/3)3. TomOrdinary shares in Kapook plc(W1)Ordinary shares in Jooba Ltd (no gain no loss transfer between spouses) Antique table (W2)13,600- 3,500- UK Government securities (exempt) Chargeable gains 17,100 (6,100) 11,000 (11,000)Less: losses b/f (W3) Net chargeable gainsLess: annual exempt amount Taxable gainsTom therefore has a nil liability to capital gains tax in 2014/15 and capital losses carried forward of £ (15,900 – 6,100) = £9,800.(w1) The shares in Kapook plc are valued at the lower of: (a) 3.70 + ¼ × (3.90 – 3.70) = 3.75; (b) (3.60 + 3.80)/2 = 3.70The disposal is first matched against the purchase on 24 July 2014 (this is within the following 30 days) and then against the shares in the share pool. The cost of the shares disposed of is, therefore, £23,400 (5,800 + 17,600).No. of sharesCost£ £ Purchase 19 February 2004 Purchase 6 June 20098,000 6,00016,200 14,600 30,800 (17,600) 13,20014,000 (8,000) 6,000 Disposal 20 July 2014 £30,800 × 8,000/14,000 Balance c/f£ Deemed proceeds (10,000 × £3.70) Less: cost 37,000 (23,400) 13,600Chargeable gains(w2) The antique table is a non -wasting chattel. £ proceeds 8,700 (5,200) 3,500Less: cost Chargeable gainsThe maximum gain is 5/3 × £(8,700 − 6,000) = £4,500. The chargeable gain is the lower of £3,500 and £4,500, so it is £3,500.(w3)The set off of the brought forward capital losses is restricted to £6,100 (17,100 – 11,000) so that chargeable gains are reduced to the amount of the annual exempt amount.4. IHT£CLT (20/06/2007) 280,000 Less annual exemption - - 2007/08 2006/07 (3,000) (3,000) 274,000IHT liability274,000 x 0% = 0£PET (05/10/2013)255,000 Less annual exemption - - 2013/14 2012/13(3,000) (3,000) 249,000The PET is initially exemption from IHT liability.Death date: 12/03/2015CLT (20/06/2007) was made more than 7 years ago, so there is no additional IHT liability incurred.£PET (05/10/2013)249,0000 422,500 (W1) – 274,000 = 148,500 x 0% 249,000 – 148,500 = 100,500 x 40% IHT liability40,200 40,200Value of death estate£850,000 460,000 275,000 PropertyBuilding society depositsProceeds of life assurance policy Less Funeral cost(18,000) 1,567,000422,500 – 249,000 = 173,500 x 0%1,567,000 – 173,500 = 1,393,500 x 40%557,400557,400IHT liability(W1)Nil rate band for Nicola in tax year 2014/15 is 325,000 + 325,000 x (1 – 70%) = £422,500. 5.(a) (1) Wind can use both schemes because its expected taxable turnover for the next 12month does not exceed £1,350,000 exclusive of VAT; in addition, for both of the schemes the company is up to date with its VAT returns.(2) With the cash accounting scheme, output VAT will be accounted for one monthlater than at present since the scheme will result in the tax point becoming the date that payment is received from customers and the recovery of input VAT will not be affected as these are paid in cash.(3) With the annual accounting scheme, the reduced administration in only having tofile one VAT return each year should have save overtime costs.此处的考点为special scheme,注意三种不同的scheme的使用条件以及各自的优缺点,在回答优缺点时注意结合题目所给具体条件答题(b) (1) from suppliers situated outside EUWind Ltd will have to pay VAT of £8,000 (40,000×20%) to HM Revenue and Customs at the time of importation, and this will be reclaimed as input VAT on the VAT return for the period during which the equipment is imported.(2) From supplier situated within EUVAT will have to be accounted for according to the date of acquisition. This will be the Earlier of date that a VAT invoice is issued or the 15th day of the month following the Month in which the equipment transported to UK.The VAT charged of £8,000 will be declared on Wind Ltd’ VAT return as output VAT, But will then be reclaimed as input VAT on the same VAT return.6.(a) Sophie Shape – Schedule of tax paymentsDue date Tax year Payment £31 July 20152014–15Second payment on account 3,240 6,480 (5,240 + 1,240) x 50%31 January 20162014–15Balancing payment 5,98012,460 (6,100 + 1,480 + 4,880) – 6,480 (3,240 x 2)31 January 20162015–16First payment on account 3,790 7,580 (6,100 + 1,480) x 50%(b) (1) If Sophie’s payments on account for 2014–15 were reduced to nil, then she would be charged intereston the payments due of £3,240 from the relevant due date to the date of payment.(2) A penalty based on the amount of underpaid tax will be charged as the claim to reduce the payments on account to nil would appear to be made fraudulently or negligently.(c) (1) Unless the return is issued late, the latest date when Sophie can file a paperself-assessment tax return for 2014–15 is 31 October 2015.(d) (1) If HM Revenue and Customs (HMRC) intend to carry out a compliance check into Sophie’s 2014-15 tax return they will have to notify her within 12 months of the date when they receive the return.(2) HMRC has the right to carry out a compliance check as regards the completeness and accuracy of any return, and such a check may be made on a completely random basis.(3) However, compliance checks are generally carried out because of a suspicion that income has been undeclared or because deductions have been incorrectly claimed. For example, where accounting ratios are out of line with industry norms.X。

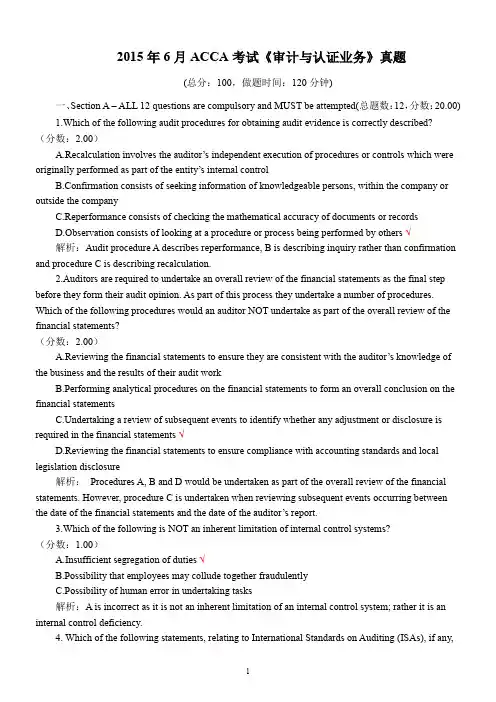

2015年6月ACCA考试《审计与认证业务》真题(总分:100,做题时间:120分钟)一、Section A – ALL 12 questions are compulsory and MUST be attempted(总题数:12,分数:20.00)1.Which of the following audit procedures for obtaining audit evidence is correctly described?(分数:2.00)A.Recalculation invo lves the auditor’s independent execution of procedures or controls which were originally performed as part of the entity’s internal controlB.Confirmation consists of seeking information of knowledgeable persons, within the company or outside the companyC.Reperformance consists of checking the mathematical accuracy of documents or recordsD.Observation consists of looking at a procedure or process being performed by others √解析:Audit procedure A describes reperformance, B is describing inquiry rather than confirmation and procedure C is describing recalculation.2.Auditors are required to undertake an overall review of the financial statements as the final step before they form their audit opinion. As part of this process they undertake a number of procedures. Which of the following procedures would an auditor NOT undertake as part of the overall review of the financial statements?(分数:2.00)A.Reviewing the financial statemen ts to ensure they are consistent with the auditor’s knowledge of the business and the results of their audit workB.Performing analytical procedures on the financial statements to form an overall conclusion on the financial statementsC.Undertaking a review of subsequent events to identify whether any adjustment or disclosure is required in the financial statements √D.Reviewing the financial statements to ensure compliance with accounting standards and local legislation disclosure解析:Procedures A, B and D would be undertaken as part of the overall review of the financial statements. However, procedure C is undertaken when reviewing subsequent events occurring between the date of the financial statements and the date of the auditor’s report.3.Which of the following is NOT an inherent limitation of internal control systems?(分数:1.00)A.Insufficient segregation of duties √B.Possibility that employees may collude together fraudulentlyC.Possibility of human error in undertaking tasks解析:A is incorrect as it is not an inherent limitation of an internal control system; rather it is an internal control deficiency.4. Which of the following statements, relating to International Standards on Auditing (ISAs), if any,is/are correct? (1) International Standards on Auditing (ISAs) are issued by the International Accounting Standards Board (IASB)and provide guidance on the performance and conduct of an audit (2) In the event that ISAs differ from local legislation in a specific country, auditors must comply with the requirements of the ISAs(分数:2.00)A.1 onlyB.2 onlyC.Both 1 and 2D.Neither 1 nor 2 √解析:Statement 1 is incorrect as ISAs are issued by the International Auditing and Assurance Standards Board rather than the IASB who issue accounting standards. Statement 2 is incorrect as ISAs do not override local legislation.5. Which TWO of the following statements regarding the use of analytical procedures during the PLANNING stage of the audit are correct? (1) Analytical procedures are useful when forming an overall conclusion as to whether the financial statements are consistent with the auditor’s understanding of the company (2) Analytical procedures can be used to obtain relevant and reliable audit evidence (3) Analytical procedures can assist in identifying the risks of material misstatement (4) Analytical procedures can assist in identifying unusual transactions and events(分数:2.00)A.1 and 2B.2 and 3C.3 and 4 √D.2 and 4解析:Statement 1 refers to the use of analytical procedures at the final review or completion stage of the audit. Statement 2 refers to the use of analytical procedures to obtain substantive evidence during the fieldwork stage of the audit.6. Which of the following substantive procedures provides evidence over the COMPLETENESS of non-current assets?(分数:1.00)A.Select a sample of assets included in the non-current asset register and physically verify them at the client premisesB.Review the repairs and maintenance expense account to identify any items of a capital nature √C.For assets disposed of, agree the sale proceeds to supporting documentation and cash book解析:Procedure A gives assurance over existence and procedure C verifies valuation rather than completeness.7.Which of the following is NOT a principle of the UK Corporate Governance Code?(分数:2.00)A.There should be a rigorous and transparent procedure for the appointment of new directors to the boardB.The board should use the annual general meeting (AGM) to communicate with investorsC.The non-executive chairman should decide on the remuneration of all directors √D.All directors should receive induction training on joining the board解析:C is incorrect as the UK Corporate Governance Code states that no director should be involved in setting their own remuneration.Hence the non-executive chairman cannot set his own remuneration.8.Which of the following is a substantive audit procedure for wages and salaries?(分数:1.00)A.Inspect a sample of clock cards for evidence of authorisation by a responsible officialB.Recalculate a sample of payroll deductions such as employment taxes to confirm accuracy √C.Attempt to access and make changes to the payroll master file using the log on for a junior clerk解析:A and C are incorrect as they are tests of control for the payroll cycle rather than substantive procedures.9.Which of the following statements, relating to the auditor’s responsibilities regarding subsequent events, if any,is/are correct? (1) Auditors do not have a responsibility to perform procedures to identify subsequent events after the date of the auditor’s report (2) Where a material adjust ing subsequent event is identified after the financial statements are issued, but prior to approval by the shareholders, the auditor should include a qualified opinion in their audit report if management refuses to adjust the financial statements for the event(分数:2.00)A.1 only √B.2 onlyC.Both 1 and 2D.Neither 1 nor 2解析:Statement 2 is not correct as if an event occurs after the financial statements are issued, the auditor has already signed the audit report and so is not able to now include a qualified opinion.10. Is the following statement true or false? A significant change in the ownership of an existing audit client is a factor which makes it appropriate for the auditor to review the terms of engagement.(分数:1.00)A.True √B.False解析:Where there is a significant change in ownership of the company, ISA 210 Agreeing the Terms of Audit Engagements recommends that a new audit engagement letter is sent to avoid misunderstandings.11. Which of the following statements relating to internal and external auditors is correct?(分数:2.00)A.Internal auditors are required to be members of a professional bodyB.Internal auditors’ scope of work should be determined by those charged with governance√C.External auditors report to those charged with governance。

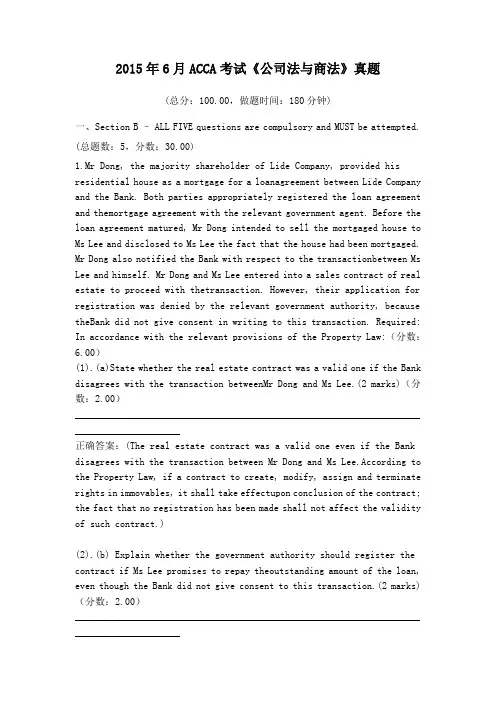

2015年6月ACCA考试《公司法与商法》真题(总分:100.00,做题时间:180分钟)一、Section B –ALL FIVE questions are compulsory and MUST be attempted. (总题数:5,分数:30.00)1.Mr Dong, the majority shareholder of Lide Company, provided his residential house as a mortgage for a loanagreement between Lide Company and the Bank. Both parties appropriately registered the loan agreement and themortgage agreement with the relevant government agent. Before the loan agreement matured, Mr Dong intended to sell the mortgaged house to Ms Lee and disclosed to Ms Lee the fact that the house had been mortgaged. Mr Dong also notified the Bank with respect to the transactionbetween Ms Lee and himself. Mr Dong and Ms Lee entered into a sales contract of real estate to proceed with thetransaction. However, their application for registration was denied by the relevant government authority, because theBank did not give consent in writing to this transaction. Required: In accordance with the relevant provisions of the Property Law:(分数:6.00)(1).(a)State whether the real estate contract was a valid one if the Bank disagrees with the transaction betweenMr Dong and Ms Lee.(2 marks)(分数:2.00)_____________________________________________________________________ _____________________正确答案:(The real estate contract was a valid one even if the Bank disagrees with the transaction between Mr Dong and Ms Lee.According to the Property Law, if a contract to create, modify, assign and terminate rights in immovables, it shall take effectupon conclusion of the contract; the fact that no registration has been made shall not affect the validity of such contract.)(2).(b) Explain whether the government authority should register the contract if Ms Lee promises to repay theoutstanding amount of the loan, even though the Bank did not give consent to this transaction.(2 marks)(分数:2.00)_____________________________________________________________________ _____________________正确答案:(The relevant government authority could lawfully refuse to register the real estate contract, even though Ms Lee promised torepay the outstanding amount of the loan. According to the Property Law, if a mortgagor transfers the mortgaged propertyduring the mortgage term, it shall receive the consent of the mortgagee or the transferee pays off the debts. Since the Bankrefused to give consent and Ms Lee merely promised to pay off the debts, the conditions to transfer a mortgaged propertywere not satisfied.)(3).(c)State whether the government authority should register the contract if Ms Lee repaid the outstanding amountof the loan, even though the Bank refused to give consent to this transaction.(2 marks)(分数:2.00)_____________________________________________________________________ _____________________正确答案:(Since Ms Lee repaid the outstanding amount of the loan and extinguished the mortgage, the government authority shouldregister the contract, as the conditions to transfer the mortgaged property have been satisfied.)2.Food Shop sent a fax to Sanyi Farm to inquire about the price of tomatoes as follows: ‘100,000 kg of tom atoes isurgently needed. Reply as soon as possible.’ Upon receipt of the fax, Sanyi Farm shipped 100,000 kg of tomatoes to Food Shop. The latter took delivery of thegoods without any objection. On selling the goods Food Shop found that the quality of tomatoes did not meet thestandard required and had to sell the goods at a 20% discount. Food Shop considered that there was no contractbetween the two parties, since its fax to Sanyi Farm did not contain the price, which was one of the essential factorsto be an effective offer. Required: In accordance with the Contract Law:(分数:6.00)(1).(a)Explain the legal nature of the fax sent by Food Shop.(2 marks)(分数:2.00)_____________________________________________________________________ _____________________正确答案:(The legal nature of the fax sent by Food Shop was an invitation to offer, not an effective offer, since this fax contained onlythe name and quantity of the goods, lacking the essential and necessary factor foran effective offer, i.e. the price of the goods.Hence, it was only an invitation to offer.)(2).(b) Describe the legal nature of the act to take delivery of the goods by Food Shop.(2 marks)(分数:2.00)_____________________________________________________________________ _____________________正确答案:(The legal nature of taking delivery of the goods by Food Shop was an acceptance. Since the delivery of the goods by SanyiFarm indicated its expression to enter into a contract with Food Shop in the way of action, it constituted an offer. Accordingto the Contract Law, an offeree may take various ways to accept the offer, such as written form, oral form or action. In thiscase Food Shop took delivery of the goods; it was an acceptance in the form of action.)(3).(c)Explain whether there was a contract between the two parties.(2 marks)(分数:2.00)_____________________________________________________________________ _____________________正确答案:(There was a contract between Sanyi Farm and Food Shop. According to relevant provisions of the Contract Law, the formationof a contract takes place by way of offer and acceptance. Where an acceptance made by the offeree reaches the offeror, acontract is formed. In this case Sanyi Farm delivered the goods, which was an offer. Food Shop, as an offeree, took over thegoods and resold the goods. This meant Food Shop accepted the offer by Sanyi Farm. Therefore, a contract was formed.)3.Zhao, Qian, Sun and Lee were four shareholders of a limited liability company specialising in bio-technology, eachholding 25% of the shares of the company. Several months later Qian intended to transfer his shares to a listed company for profit and sent notices to the otherthree shareholders asking for their consent. Zhao agreed and also expressed his willingness to buy Qian’s shares ifthe price was reasonable. Sun disagreed and claimed his right of priority to buy Qian’s shares. However, Zhao andSun could not reach an agreement as to the proportion of shares to buy. Lee kept silent upon receipt of the notice. Since Sun offered a price lower than that of the listed company, Qian entered into a contract。