会计专业英语复习资料

- 格式:pdf

- 大小:122.43 KB

- 文档页数:7

会计专业英语-CAL-FENGHAI.-(YICAI)-Company One1一、words and phrases1.残值 scrip value2.分期付款 installment3.concern 企业4.reversing entry 转回分录5.找零 change6.报销 turn over7.past due 过期8.inflation 通货膨胀9.on account 赊账10.miscellaneous expense 其他费用11.charge 收费12.汇票 draft13.权益 equity14.accrual basis 应计制15.retained earnings 留存收益16.trad-in 易新,以旧换新17.in transit 在途18.collection 托收款项19.资产 asset20.proceeds 现值21.报销 turn over22.dishonor 拒付23.utility expenses 水电费24.outlay 花费25.IOU 欠条26.Going-concern concept 持续经营27.运费 freight二、Multiple-choice question1.Which of the following does not describe accounting( C )A. Language of businessB. Useful ofr decision makingC. Is an end rathe than a means to an end.ed by business, government, nonprofit organizations, and individuals.2.An objective of financial reporting is to ( B )A. Assess the adequacy of internal control.B.Provide information useful for investor decisions.C.Evaluate management results compared with standards.D.Provide information on compliance with established procedures.3.Which of the following statements is(are) correct( B )A.Accumulated depreciation represents a cash fund being accumulated for the replacement of plant assets.B.A company may use different depreciation methods in its financial statements and its income tax return.C.The cost of a machine includes the cost of repairing damage to the machine during the installation process.D.The use of an accelerated depreciation method causes an asset to wear out more quickly than does use of the unit-of-product method.4. Which of the following is(are) correct about a company’s balance sheet( B )A.It displays sources and uses of cash for the period.B.It is an expansion of the basic accounting equationC.It is not sometimes referred to as a statement of financial position.D.It is unnecessary if both an income statement and statement of cash flows are availabe.5.Objectives of financial reporting to external investors and creditors include preparing information about all of the following except. ( A )rmation used to determine which products to poducermation about economic resources, claims to those resources, and changes in both resources and claims.rmation that is useful in assessing the amount, timing, and uncertainty of future cash flows.rmation that is useful in making ivestment and credit decisions.6.Each of the following measures strengthens internal control over cash receipts except. ( C )A.The use of a petty cash fund.B.Preparation of a daily listing of all checks received through the mail.C.The use of cash registers.D.The deposit of cash receipts in the bank on a daily basis.7.The primary purpose for using an inventory flow assumption is to. ( A )A.Offset against revenue an appropriate cost of goods sold.B.Parallel the physical flow of units of merchandise.C.Minimize income taxes.D.Maximize the reported amount of net income.8.In general terms, financial assets appear in the balance sheet at. ( B )A.Current valueB.Face valueC.CostD.Estimated future sales value.9.If the going-concem assumption is no longer valid for a company except. ( C )nd held as an ivestment would be valued at its liquidation value.B.All prepaid assets would be completely written off immediately.C.Total contributed capital and retained earnings would remain unchanged.D.The allowance for uncollectible accounts would be eliminated.10.Which of the following explains the debit and credit rules relating to the recording of revenue and expenses( C )A.Expenses appear on the left side of the balance sheet and are recorded by debits;revenue appears on the right side of the balance sheet and is reoorded by credits.B. Expenses appear on the left side of the income statement and are recorded by debits; Revenue appears on the right side of the income statement and is recorded by credits.C.The effects of revenue and expenses on owners’ equity.D.The realization principle and the matching principle.11.Which of the following statements is(are) correct( B )A.Accumulated depreciation represents a cash fund being accumulated for the replacement of plant assets.B.The cost of a machine do not includes the cost of repairing damage to the machine during the installation prcess.C.A company may use same depreciation methods in its finacial statements and its income tax return.D.The use of an accelerated depreciation method causes an asset to wear out more quickly than does use of the straight-line method.12.A set of financial statements ( B ) except.A.Is intended to assist users in evaluating the financial position, profitability, and future prospects of an entity.B.Is intended to assist the Intemal Revenue Service in detemining the amount of income taxes owed by a business organization.C.Includes notes disclosing information necessary for the proper interpretation of the statements.D.Is intended to assist investors and creditors in making decisions inventory the allocation of economic resources.13.The primary purpose for using an inventory flow assumption is to. ( B )A.Parallel the physical flow of units of merchandise.B.Offset against revenue an appropriate cost of goods soldC.Minimize income taxes.D.Maximize the reported amount of net income.14.Indicate all correct answers. In the accounting cycle. ( D )A.Transactions are posted before they are journalized.B.A trial balance is prepared after journal entries haven’t been posted.C.The Retained Earnings account is not shown as an up-to-date figure in the trial balance.D.Joumal entries are posted to appropriate ledger accounts.15.According to text, Objectives of Financial Reporting by Business Enterprises. ( D )A.Extemal users have the ability to prescribe information they want.rmation is always based on exact measures.C.Financial reporting is usually based on industries or the economy as a whole.D.Financial accounting does not directly measure the value of a business enterprise.16.Indicate all correct answers. Dividends except ( A )A.Decrease owners’ equity.B.Decrease net incomeC.Are recorded by debiting the Cash accountD.Are a business expense17.Which of the following practices contributes to efficient cash management ( C )A.Never borrow money-maintain a cash balance sufficient to make all necessary payments.B.Record all cash receipts and cash payments at the end of the month when reconciling the bank statements.C.Prepare monthly forecasts of planned cash receipts, payments, and anticipated cash balances up to a year in advance.D.Pay each bill as soon as the invoice arrives.18.Which of the following would you expect to find in a correctly prepared income statement ( A )A.Revenues earned during the period.B.Cash balance at the end of the period.C.Contributions by the owner during the period.D.Expenses incurred during the next period to earn revenues.19.Which of the following are important factors in ensuring the integrity of accounting information ( D )A.Institutional factors, such as standards for preparing information.B.Professional organizations, such as the American Institute of CPAs.petence’ judgment’ and ethical behavior of individual accountants’D.All of the above.三、Practices11.On Jan.1, 2000, Mark Co, acquired equipment to use in its operations. The equipment has an estimated useful life of 10 years and an estimated salvage value of $5,000. The depreciation applicable to this equipment was $40,000 for 2000, calculated under the sum-of –the-years’–digits method. Required: Determine the acquisition cost of the equipment. ( C )A.$210,000B.$250,000C.$225.000D.$200,0002. On Jan.2, 2002, Mark Co, acquired equipment to use in its operations. The equipment has an estimated useful life of 10 years and an estimated salvage value of $5,000. The depreciation applicable to this equipment was $24,000 for 2004, calculated under the sum-of –the-years’–digits method (4%). Required: Determine the acquisition cost of the equipment. ( C )A.$220,000B.$250,000C.$224.000D.$200,0003. October 1, 2005, Coast Financial Ioaned Bart Corporation $3000,000, receiving in exchange a nine-month, 12 percent note receivable. Coast ends its fiscal year on December 31 and makes adjusting entries to accrue interest earned on all notes receivable. The interest earned on the note receivable from Bart Corporation during 2006 will amount to. ( A )A.$9,000B.$18,000C.$27.000D.$36,000Question: What is the reconciled balance ( B )A.$4,187B.$4,085C.$4,090D.$4,000Required: Choose the reconciled balance. ( D )A.$3,220B.$3,250C.$3,200D.$3,225Required:Calculate the cost of goods available for sale(C)A.$475,000B.$474,000C.$470,000D.$473,000Required: Calculate the cost of goods sold ( D )A.$225,000B.$254,000C.$250,000D.$253,0008.At the end of the current year, the accounts receivable account has a debit balance of $60,000 and net sales for the year total $100,000. The allowance account before adjunstment has adebit balance of a $500, and uncollectible accounts expense is estimated at 1% of net sales. Question: The entry for the above bad debts is ( A )A.Dr. Bad Debt Accts. $1,500B.Dr. Bad Debt Accts. $500Cr. Allowance Doubtful Accts. $1,500 Cr. Allowance Doubtful Accts. $500C. Dr. Bad Debt Accts. $1,000D. Dr. Bad Debt Accts. $1,500Cr. Accts Rec. $1,000 Cr. Accts Rec. $1,5009.The balance sheet items to The Oven Bakery(arranged in alphabetical order)were as follows at August 1,2005.(You are to compute the missing figure for retained earnings.)(4%)REQUIRED:Find Retained earnings at August 1 2005(D)A.$420,000B.$44,000C.$40,000D.$48,000Practices2Sue began a public accounting practice and completed these transactions during first month of the current year.Required: Choose the entries to record the following transactons.1.Invested $50,000 cash in a public accounting practice begun this day. ( A )A.Dr. Cash $50,000B.Dr. Capital Stock $50,000Cr. Capital Stock $50,000 Cr. Cash $50,0002.Paid cash for three monts’ office rent in advance $900(B)A.Dr. Rent Exp. $900B.Dr. Prepaid Rent $900Cr. Cash $900 Cr. Cash $9003.Paid the premium on two insurance policies, $300. ( )A.Dr. Prepaid Insurance $300B.Dr. Insurance Exp $300Cr. Cash $300 Cr. Cash $300pleted accounting work for Sun Bank on credit $1000. ( A )A.Dr. Accts Rec $1000B.Dr. Cash $1000Cr.Accounting Revenue $1000 Cr.Accounting Revenue $10005.Paid the monthly utility bills of the accounting office $300 ( A )A.Dr Utility Exp $300B.Dr office Exp $300Cr. Cash $300 Cr. Cash $300Linda began a public accounting practice and completed these transactons during first month of the current year.Required: Choose the entries to record the following transactons.6.Invested $20,000 cash in a public accounting practice begun this day. ( A )A.Dr Cash $20,00B.Dr Capital Stock $20,000Cr. Capital Stock $20,000 Cr. Cash $20,007.Paid cash for three months’ office rent in advance $1200.( B )A.Dr. Rent Exp $1200B.Dr. Prepaid Rent $1200Cr. Cash $1200 Cr. Cash $12008.Purchased offfice supplies $100 and office equipment $2,000 on credit. ( B )A.Dr. Office Equipment $2,000B.Dr.Office Equipment $2,000Office Supplies $100 Office Supplies $100Cr. Accts Rec. $2,100 Cr.Accts Pay. $2,100pleted accounting work for Jack Hall and collected $2000 cash therefore. ( B )A.Dr. Accts Rec $2000B.Dr. Cash $2000Cr.Accounting Revenue $2000 Cr.Accounting Revenue $200010.Purchase additional office equipment on credit $2500.( A )A.Dr.Office equipment $2500B.Dr. Office equipment $2500Cr.Accts Pay $2500 Cr.Accts Rec $2500四、Translation:1)The mechanics of double-entry accounting are such that every transaction is recorded in the debit side of one or more accounts and in the credit side of one or more accounts with equal debits and credits. Such form of combination is called accounting entry. Where there are only two accounts affected. 2)the debit and credit amounts are equal. If more than two accounts are affceted, the total of the debit entries must equal the total of the credit entries. The double-entry accounting is used by virtually every business organization, regardless of whether the company’s accounting records are maintained manually or by computer.1.The mechanics of double-entry accounting.( B )A.会计两次记账的制度B.复式记账机制C.会计的重复记账体制2.the debit and credit amounts are equal. ( A )A.借方金额与贷方金额是相等的B.借出金额与贷款金额是相等的C.借入金额与贷款金额是相等的Most accounting methods are based on the assumption that the business enterprise will have a long life. Experience indicates that.1)inspite of numerous business failures, companies have a fairly highcontinuance rate. Accountants do not believe that business firms will last indefinitely, but they do expect them to last long enouthto 2)fulfill their objectives and commitments.3.in spite of numerous business failures, companies have a fairly high continuance rate. ( B )A.可惜有许多企业失败,但公司仍有较高的持续经营比率。

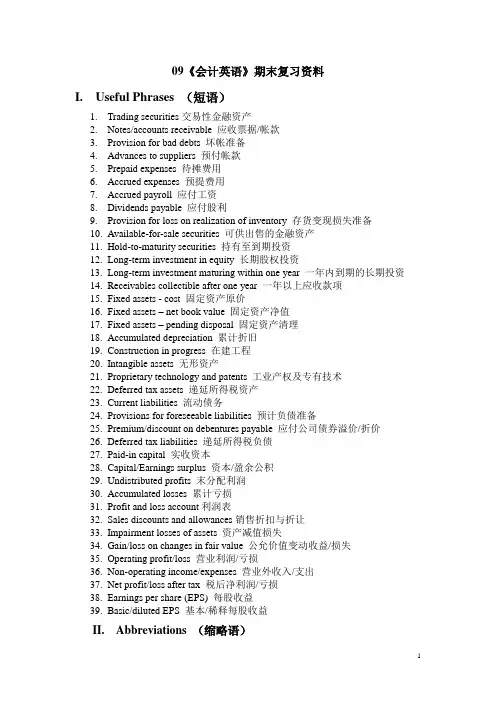

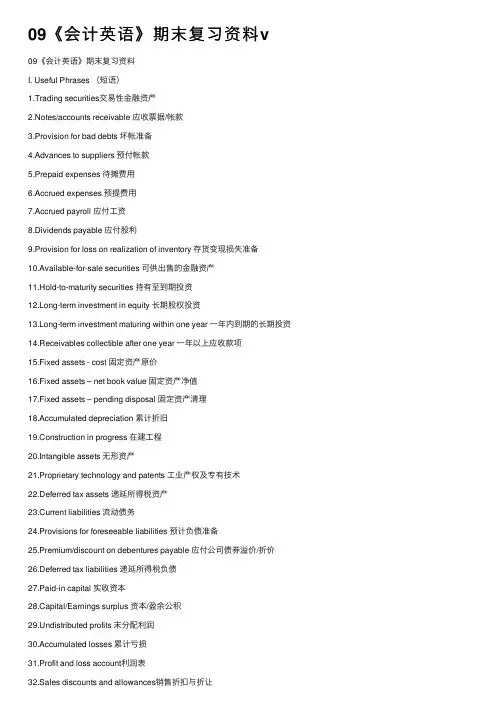

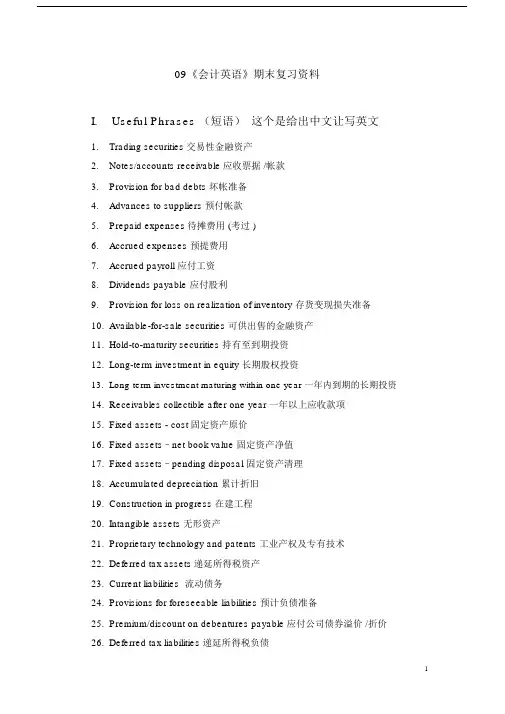

09《会计英语》期末复习资料I. Useful Phrases (短语)1.Trading securities交易性金融资产2.Notes/accounts receivable 应收票据/帐款3.Provision for bad debts 坏帐准备4.Advances to suppliers 预付帐款5.Prepaid expenses 待摊费用6.Accrued expenses 预提费用7.Accrued payroll 应付工资8.Dividends payable 应付股利9.Provision for loss on realization of inventory 存货变现损失准备10.Available-for-sale securities 可供出售的金融资产11.Hold-to-maturity securities 持有至到期投资12.Long-term investment in equity 长期股权投资13.Long-term investment maturing within one year 一年内到期的长期投资14.Receivables collectible after one year 一年以上应收款项15.Fixed assets - cost 固定资产原价16.Fixed assets – net book value 固定资产净值17.Fixed assets – pending disposal 固定资产清理18.Accumulated depreciation 累计折旧19.Construction in progress 在建工程20.Intangible assets 无形资产21.Proprietary technology and patents 工业产权及专有技术22.Deferred tax assets 递延所得税资产23.Current liabilities 流动债务24.Provisions for foreseeable liabilities 预计负债准备25.Premium/discount on debentures payable 应付公司债券溢价/折价26.Deferred tax liabilities 递延所得税负债27.Paid-in capital 实收资本28.Capital/Earnings surplus 资本/盈余公积29.Undistributed profits 末分配利润30.Accumulated losses 累计亏损31.Profit and loss account利润表32.Sales discounts and allowances销售折扣与折让33.Impairment losses of assets 资产减值损失34.Gain/loss on changes in fair value 公允价值变动收益/损失35.Operating profit/loss 营业利润/亏损36.Non-operating income/expenses 营业外收入/支出 profit/loss after tax 税后净利润/亏损38.Earnings per share (EPS) 每股收益39.Basic/diluted EPS 基本/稀释每股收益II. Abbreviations (缩略语)1.GAAP : Generally Accepted Accounting Principles .公认会计原则2.FASB : Financial Accounting Standards Board. 财务会计准则委员会3.AICPA: American Institute of Certified Public Accountants. 美国注册会计师协会4.CICPA : Chinese Institute of Certified Public Accountants. 中国注册会计师协会5.MOF : the Ministry of Finance财政部6.SL Method : straight-line method. 直线法P.252/77.ROA : return on assets.资产报酬率P.267/78.EPS : earning per share.每股收益P.351/99.P/E Ratio : the price/earning ration 市盈率10.SCF : the statement of cash flows 现金流量表III. Questions (回答问题)Lesson 1 --- Home Assignments1.What are the four financial statements prepared by a proprietorship toprovide information for decision making?√They are: income statement (profit and loss account), statement of owner’s equity (capital statement, statement of retained earnings), balance sheet and cash flow statement.2.What is the proper formula presentation of the accounting equation? √Assets = Liabilities + [owner’s equity + (Revenue – Expenses)]3.What are the four key ethical standards that are expected of professionalaccountants?They are: integrity, confidentiality, competence, and objectivity.Exercise 1 - 2: p.2Foreman Corporation, engaged in a service business, completed the following selected transactions during the period: √1)Issued additional capital stock, receiving cash;2)Purchased supplies on account;3)Returned defective supplies purchased on account and not yet paid for;4)Received cash as a refund from the erroneous overpayment of anexpense;5)Charged customers for services sold on account;6)Paid utilities expense;7)Paid a creditor on account;8)Received cash on account from charge customers;9)Paid cash dividends to stockholders;10)Determined the amount of supplies used during the month.Using a tabular form with column headings entitled Transactions, Assets, Liabilities, and Capital respectively, indicate the effect of each transaction. Use + for increase and – for the decrease.Lesson 2 --- Home Assignments1.Does debit always mean increase and credit always mean decrease? √No, it does not. And debit or credit should not be confused with increase or decrease. It depends on which side of an account is used for debit or credit.2.Given that assets have economic value and that they have debit balances,why do expenses also have debit balances?√Because expenses have the effect of decreasing capital, and just as decreases in capital are recorded as debit, increases in expense accounts are recorded as debits. Lesson 3---Home Assignments1.Briefly explain the matching principle.√The matching principle states that expenses should be deducted (matched against) from the revenues earned in the same period.2.Why is an unearned revenue a liability?√Unearned revenue is a liability because the business owes the customer a good or service.Lesson 7---Home Assignments1.What do determinable current liabilities include? P.291 √They include trade accounts payable, current notes payable, current maturities of long-term obligations, cash dividends payable, accrued liabilities, and prepayments or deposits from customers.2.What does non-current liabilities represent? P.306√It represents obligations of the firm that generally are due more than one year after the balance sheet date.Lesson 8---Home Assignments1.What determines the yield rate of a company’s stock?√Dividends per share divided by market price per share determine the yield rate ofa company‘s stock.2.What is P/E ratio?√The Price/Earning (P/E) ratio is the ratio of the market price per share to earnings per share.Lesson 9---Home Assignments1.What are the three categories into which the SCF should be classified?They are a) cash flow from operating activities, b) cash flow from investing activities, cash flow from financing activities.2.What is the usefulness of the SCF?√From SCF, the information users can know the reasons for the difference between net income and net cash flows from operating activities.IV. E-C Translation (英汉语篇翻译)1.Preparing a Trial BalanceAccountants usually complete the posting of journal entries to the ledger accounts at the end of each month if they are using a manual system. With a computerized system, each posting is done automatically as each journal entry is recorded. The equality of debits and credits in the ledger should be verified at the end of each accounting period. T o verify the accuracy of the recording process, accountants prepare a trial balance of the ledger accounts.A trial balance not only provides a check on the equality of debits and credits but also is a useful summary of account balances for preparing financial statements.[参考译文] 编制试算表若使用的是手工录入系统的话,会计师通常是在每个月的月底完成日记帐到分类帐的过帐工作;若是用计算机系统的话,则每次过帐均在完成每笔日记帐的同时就自动完成了。

会计英语知识点归纳总结English: In accounting, there are several key concepts and principles that serve as the foundation for financial reporting. The accrual principle dictates that revenue and expenses should be recognized when they are incurred, regardless of when cash is actually received or paid. The matching principle requires that expenses should be matched to the revenue they help to generate, ensuring that the true cost of earning that revenue is accurately reflected. The going concern concept assumes that a business will continue to operate indefinitely, allowing for the long-term allocation of costs and recognition of assets. The consistency principle mandates that once an accounting method is chosen, it should be consistently applied from one period to the next. And the materiality principle states that financial information should only be disclosed if omitting or misstating it could influence the economic decisions of users.中文翻译: 在会计中,有几个关键概念和原则为财务报告奠定了基础。

09《会计英语》期末复习资料v09《会计英语》期末复习资料I. Useful Phrases (短语)1.Trading securities交易性⾦融资产2.Notes/accounts receivable 应收票据/帐款3.Provision for bad debts 坏帐准备4.Advances to suppliers 预付帐款5.Prepaid expenses 待摊费⽤6.Accrued expenses 预提费⽤7.Accrued payroll 应付⼯资8.Dividends payable 应付股利9.Provision for loss on realization of inventory 存货变现损失准备10.Available-for-sale securities 可供出售的⾦融资产11.Hold-to-maturity securities 持有⾄到期投资12.Long-term investment in equity 长期股权投资13.Long-term investment maturing within one year ⼀年内到期的长期投资14.Receivables collectible after one year ⼀年以上应收款项15.Fixed assets - cost 固定资产原价16.Fixed assets – net book value 固定资产净值17.Fixed assets – pending disposal 固定资产清理18.Accumulated depreciation 累计折旧19.Construction in progress 在建⼯程20.Intangible assets ⽆形资产21.Proprietary technology and patents ⼯业产权及专有技术22.Deferred tax assets 递延所得税资产23.Current liabilities 流动债务24.Provisions for foreseeable liabilities 预计负债准备25.Premium/discount on debentures payable 应付公司债券溢价/折价26.Deferred tax liabilities 递延所得税负债27.Paid-in capital 实收资本28.Capital/Earnings surplus 资本/盈余公积29.Undistributed profits 末分配利润30.Accumulated losses 累计亏损31.Profit and loss account利润表32.Sales discounts and allowances销售折扣与折让33.Impairment losses of assets 资产减值损失34.Gain/loss on changes in fair value 公允价值变动收益/损失35.Operating profit/loss 营业利润/亏损36.Non-operating income/expenses 营业外收⼊/⽀出/doc/1d062803f78a6529657d5300.html profit/loss after tax 税后净利润/亏损38.Earnings per share (EPS) 每股收益39.Basic/diluted EPS 基本/稀释每股收益II. Abbreviations (缩略语)1.GAAP : Generally Accepted Accounting Principles .公认会计原则2.FASB : Financial Accounting Standards Board. 财务会计准则委员会3.AICPA: American Institute of Certified Public Accountants. 美国注册会计师协会4.CICPA : Chinese Institute of Certified Public Accountants. 中国注册会计师协会5.MOF : the Ministry of Finance财政部6.SL Method : straight-line method. 直线法P.252/77.ROA : return on assets.资产报酬率P.267/78.EPS : earning per share.每股收益P.351/99.P/E Ratio : the price/earning ration 市盈率10.SCF : the statement of cash flows 现⾦流量表III. Questions (回答问题)Lesson 1 --- Home Assignments1.What are the four financial statements prepared by a proprietorship toprovide information for decision making?√They are: income statement (profit and loss account), statement of owner’s equity (capital statement, statement of retained earnings), balance sheet and cash flow statement.2.What is the proper formula presentation of the accounting equation? √Assets = Liabilities + [owner’s equity + (Revenue – Expenses)]3.What are the four key ethical standards that are expected of professionalaccountants?They are: integrity, confidentiality, competence, and objectivity.Exercise 1 - 2: p.2Foreman Corporation, engaged in a service business, completed the following selected transactions during the period: √1)Issued additional capital stock, receiving cash;2)Purchased supplies on account;3)Returned defective supplies purchased on account and not yet paid for;4)Received cash as a refund from the erroneous overpayment of anexpense;5)Charged customers for services sold on account;6)Paid utilities expense;7)Paid a creditor on account;8)Received cash on account from charge customers;9)Paid cash dividends to stockholders;10)Determined the amount of supplies used during the month.Using a tabular form with column headings entitled Transactions, Assets, Liabilities, and Capital respectively, indicate the effect of each transaction. Use + for increase and – for the decrease.Lesson 2 --- Home Assignments1.Does debit always mean increase and credit always mean decrease? √No, it does not. And debit or credit should not be confused with increase or decrease. It depends on which side of an account is used for debit or credit.2.Given that assets have economic value and that they have debit balances,why do expenses also have debit balances?√Because expenses have the effect of decreasing capital, and just as decreases in capital are recorded as debit, increases in expense accounts are recorded as debits. Lesson 3---Home Assignments1.Briefly explain the matching principle.√The matching principle states that expenses should be deducted (matched against) from the revenues earned in the same period.2.Why is an unearned revenue a liability?√Unearned revenue is a liability because the business owes the customer a good or service.Lesson 7---Home Assignments1.What do determinable current liabilities include? P.291 √They include trade accounts payable, current notes payable, current maturities of long-term obligations, cash dividends payable, accrued liabilities, and prepayments or deposits from customers.2.What does non-current liabilities represent? P.306√It represents obligations of the firm that generally are due more than one year after the balance sheet date.Lesson 8---Home Assignments1.What determines the yield rate of a company’s stock?√Dividends per share divided by market price per share determine the yield rate ofa company‘s stock.2.What is P/E ratio?√The Price/Earning (P/E) ratio is the ratio of the market price per share to earnings per share.Lesson 9---Home Assignments1.What are the three categories into which the SCF should be classified?They are a) cash flow from operating activities, b) cash flow from investing activities, cash flow from financing activities.2.What is the usefulness of the SCF?√From SCF, the information users can know the reasons for the difference between net income and net cash flows from operating activities.IV. E-C Translation (英汉语篇翻译)1.Preparing a Trial BalanceAccountants usually complete the posting of journal entries to the ledger accounts at the end of each month if they are using a manual system. With a computerized system, each posting is done automatically as each journal entry is recorded. The equality of debits and credits in the ledger should be verified at the end of each accounting period. T o verify the accuracy of the recording process, accountants prepare a trial balance of the ledger accounts.A trial balance not only provides a check on the equality of debits and credits but also is a useful summary of account balances for preparing financial statements.[参考译⽂] 编制试算表若使⽤的是⼿⼯录⼊系统的话,会计师通常是在每个⽉的⽉底完成⽇记帐到分类帐的过帐⼯作;若是⽤计算机系统的话,则每次过帐均在完成每笔⽇记帐的同时就⾃动完成了。

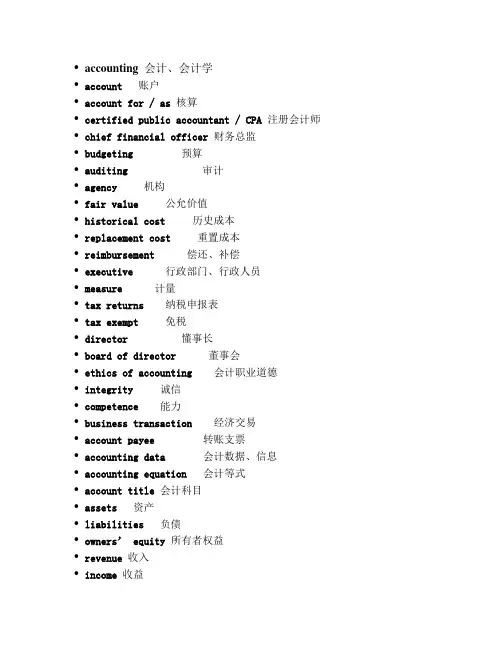

•accounting 会计、会计学•account 账户•account for / as 核算•certified public accountant / CPA 注册会计师•chief financial officer 财务总监•budgeting 预算•auditing 审计•agency 机构•fair value 公允价值•historical cost 历史成本•replacement cost 重置成本•reimbursement 偿还、补偿•executive 行政部门、行政人员•measure 计量•tax returns 纳税申报表•tax exempt 免税•director 懂事长•board of director 董事会•ethics of accounting 会计职业道德•integrity 诚信•competence 能力•business transaction 经济交易•account payee 转账支票•accounting data 会计数据、信息•accounting equation 会计等式•account title 会计科目•assets 资产•liabilities 负债•owners’ equity 所有者权益•revenue 收入•income 收益•gains 利得•abnormal loss 非常损失•bookkeeping 账簿、簿记•double-entry system 复式记账法•tax bearer 纳税人•custom duties 关税•consumption tax 消费税•service fees earned 服务性收入•value added tax / VAT 增值税•enterprise income tax 企业所得税•individual income tax 个人所得税•withdrawal / withdrew 提款、撤资•balance 余额•mortgage 抵押•incur 产生、招致•apportion 分配、分摊•accounting cycle会计循环、会计周期•entry分录、记录•trial balance试算平衡•worksheet 工作草表、工作底稿•post reference / post .ref过账依据、过账参考•debit 借、借方•credit 贷、贷方、信用•summary/ explanation 摘要•insurance 保险•premium policy 保险单•current assets 流动资产•long-term assets 长期资产•property 财产、物资•cash / currency 货币资金、现金•accounts receivable 应收账款•provision for bad debts /allowance for uncollectible account / doubtdebts 坏帐准备•recoveries 追回款•direct write-off method 直接冲销法•allowance method 备抵法•contra account 备抵账户•prepaid expense 预付、待摊费用•prepayment / advance to supplies 预付账款•inventory 存货•merchandise inventory库存商品•finished goods 产成品•semi-finished goods 半成品•good in process 在产品•construction in process 在建工程•warehousing 仓库•FIFO /LIFO/ weight average / specific identification存货发出成本计价的四种方法•overhead 企业经费•long-term equity investment 长期投资•fixed assets / plant assets 固定资产•useful life 使用寿命•residual value / salvage value 残值•unit –production method 单位产量法•depreciation per unit单位折旧额•accumulated depreciation 累计折旧•accelerate method 加速折旧法•DDB method 法双倍余额递减•SYD method 年数总和法•disposal of fixed assets 固定资产清理•intangible assets 无形资产•patents 专利权•trademarks 商标权•goodwill 商誉•deferred assets 递延资产•operating lease 经营租赁•capital lease 融资租赁•capital expenditure 资本性支出•revenue expenditure 收益性支出•amortize 分期偿还(债务)•other cash equivalent 其他货币资金•order / draft 汇票•deposit 存款、订金•IOUS 借据•postdated check延付支票(不属于流动资产)•outstanding check 未付支票•not sufficient funds check 资金不足支票•electronic funds transfer 电子资金转账•service charges / handling charge 手续费•petty cash 备用金•bank statement 银行对账单•bank reconciliation 银行余额调节表•receipt 收入、收据•reimburse 偿还、报销 vt •disbursement 支付、支出•creditor 债权人•promissory note 本票•dishonor 拒绝承兑、拒付• trade discount 商业折扣•cash discount / sales discount 现金折扣•sales returns and allowance 销售折让•perpetual inventory system 永续盘存制•periodic inventory system 定期盘存制•expiration / maturity 到期、截止•obligation ; liability义务•liabilities 负债•book value账面价值•face value ; par value票面价值•discount 折价、贴现、折扣•account payable应付账款•not payable应付票据•taxes payable 应交税费•vat-input 增值税进项税•vat-output 增值税销项税•commercial accepted draft 商业承兑汇票•bank accepted draft 银行承兑汇票•short-term loan 短期借款•advance from customer / unearned revenues 预收账款•interests 利息•dividends 股利•pay off 偿付清、还清•salaries payable 应付职工薪酬•wages 基本工资•bonus 奖金、红利•pension payment 养老保险•medical insurance premiums 医疗保险金•housing reserves 住房公积金•non-monetary welfare 非货币性福利•employee 雇员、员工•bond 债券•premium 溢价、保险金、佣金•due date / maturity date 到期应付日、到期日•paid-in capital 实收资本•capital stock 股本•capital reserve 资本公积•surplus reserve 盈余公积•undistributed profit 未分配利润•retained earnings 留存收益•common stock 普通股•preferred stock 优先股•Corporation limited / Co. LTD 股份•Single proprietorship / sole proprietorship 独有企业•Partnership 合伙企业•Fees earned 酬金、酬劳•Real estate 房地产、不动产•Commision 回扣、佣金•General journal 日记总账•Special journal 特种日记账•general ledger 总分类账•subsidiary ledger 明细分类账•original document / source document 原始凭证•chart of account title 会计科目表•primary operating revenue 主营业务收入•operating expense 经营费用、期间费用•revenues realization principle 收入实现制•accrual basis 权责发生制•matching principle 配比性原则•prudence principle 谨慎性原则•time period 时间分期•balance sheet 资产负债表•income statement 利润表•statement of cash flow 现金流量表• revenue / sales 营业收入•cost of goods sold / cost of sales 营业成本•sales taxes and extra charges / operating taxes 营业税金与附加•selling expense 销售费用•advertising expense 广告费用•general and administrative expense 管理与总务费用、管理费用•utility expense 公共事业费用•financing expense 财务费用•loss of assets impairment 资产减值损失•changes of fair value assets 公允减值变动•income from investment 投资收益•gross profit 毛利、利润总额•net profit 净利润•current ratio 流动比率•quick ratio 速度比率•debts to total assets ratio 资产负债比•capitalization ratio 资本化比率•times interests earned ratio 已获利息倍数•EBIT 息税前利润•inventory turnover 存货周转率•rate of return on assets 资产报酬率•profit margin 边际利润•earning per share 每股收益•liquidity ratio 流动性比率•financing leverage ratio财务杠杆比率•efficiency ratio效用比率•profitability ratio盈利能力比率•trend analysis 趋势分析法•common-size analysis 结构分析法•ration analysis比率分析法。

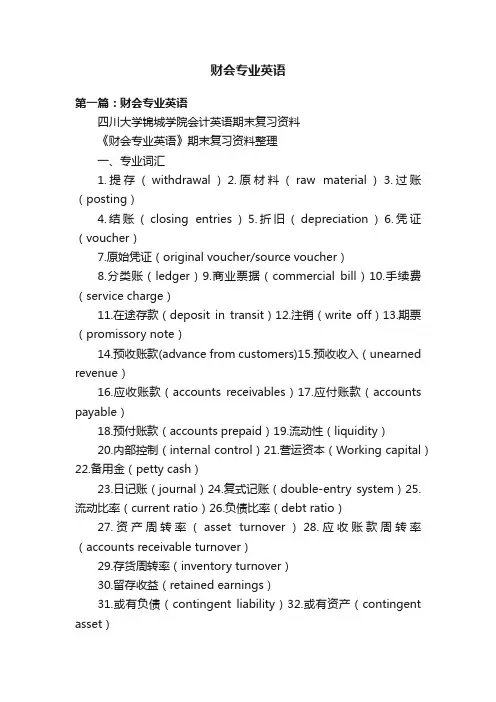

财会专业英语第一篇:财会专业英语四川大学锦城学院会计英语期末复习资料《财会专业英语》期末复习资料整理一、专业词汇1.提存(withdrawal)2.原材料(raw material)3.过账(posting)4.结账(closing entries)5.折旧(depreciation)6.凭证(voucher)7.原始凭证(original voucher/source voucher)8.分类账(ledger)9.商业票据(commercial bill)10.手续费(service charge)11.在途存款(deposit in transit)12.注销(write off)13.期票(promissory note)14.预收账款(advance from customers)15.预收收入(unearned revenue)16.应收账款(accounts receivables)17.应付账款(accounts payable)18.预付账款(accounts prepaid)19.流动性(liquidity)20.内部控制(internal control)21.营运资本(Working capital)22.备用金(petty cash)23.日记账(journal)24.复式记账(double-entry system)25.流动比率(current ratio)26.负债比率(debt ratio)27.资产周转率(asset turnover)28.应收账款周转率(accounts receivable turnover)29.存货周转率(inventory turnover)30.留存收益(retained earnings)31.或有负债(contingent liability)32.或有资产(contingent asset)33.国库券(treasury bills)34.利润表(income statement)35.资产负债表(balance sheet)36.现金流量表(cash flow statement)二、翻译1.Accounting is an information system of interpreting, recording, measuring, classifying, summarizing, reporting and describing business economic activities with monetary unit as its main criterion.The accounting information is primarily supplied to owners, managers and investors of every business, and other users to assist in the decision-making process.Therefore, accounting is also called “the language of business”.会计是一个翻译、记录、计量、认定、总结、报告和用现金作为主要标准来衡量企业经济活动的信息系统。

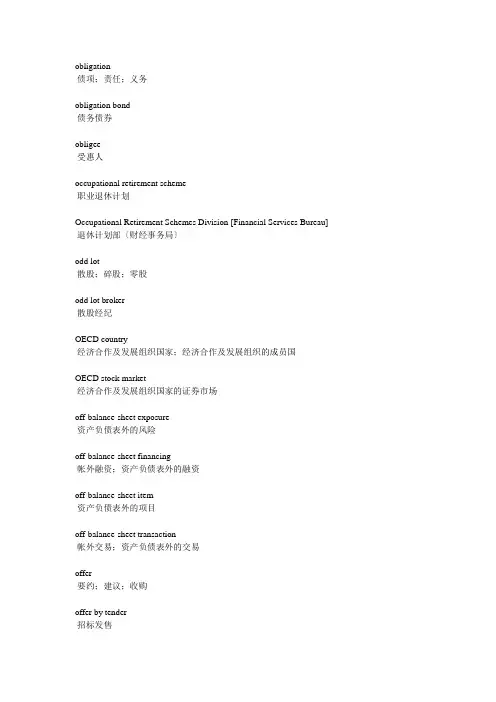

obligation债项;责任;义务obligation bond债务债券obligee受惠人occupational retirement scheme职业退休计划Occupational Retirement Schemes Division [Financial Services Bureau] 退休计划部〔财经事务局〕odd lot散股;碎股;零股odd lot broker散股经纪OECD country经济合作及发展组织国家;经济合作及发展组织的成员国OECD stock market经济合作及发展组织国家的证券市场off-balance-sheet exposure资产负债表外的风险off-balance-sheet financing帐外融资;资产负债表外的融资off-balance-sheet item资产负债表外的项目off-balance-sheet transaction帐外交易;资产负债表外的交易offer要约;建议;收购offer by tender招标发售offer document要约文件;建议文件offer for sale要约出售offer for subscription公开招股offer mechanism招股机制offer of shares for public subscription 公开招股offer period要约期offer price要约价;发盘价offer rate拆出息率offer to buy要约买入offer to lend要约贷出offer to sell要约卖出offeree受要约人offeree company受要约公司offeree shareholder受要约公司的股东offeror要约人offeror company要约公司;提出要约公司off-floor terminal离场交易终端机off-floor trading离场交易office of profit有收益的职位Office of the Commissioner for Securities and Commodities Trading 证券及商品交易监理专员办事处Office of the Commissioner of Banking银行业监理处Office of the Commissioner of Insurance保险业监理处Office of the Exchange Fund外汇基金管理局Office of the Telecommunications Authority Trading Fund电讯管理局营运基金Official Administrator遗产管理官official emolument官职薪酬official listing正式上市official rate法定汇率;官价Official Receiver破产管理署署长Official Receiver's Office破产管理署official trustee法定受托人off-market dealing场外买卖offset抵销;弥补;冲销offsetting position相抵持仓offshore bank离岸银行offshore borrowing海外借款offshore borrowing transaction 海外借款交易offshore business海外业务offshore currency deposit market 海外货币存款市场offshore fund离岸基金offshore interest海外利息offshore reinsurance income离岸再保险入息Offshore Supervisors Group离岸监理组织off-site review非实地审查off-site scrutiny非实地审核Ogaki Kyoritsu Bank, Ltd.大垣共立银行omission of income漏报入息omission of profit漏报利润on account basis记帐方式;赊帐方式on-balance-sheet item资产负债表内的项目on-cost间接成本;间接费用;附加行政费用one board lot of securities“一手”证券"one building" condition“一家分行”的规定one day rolling currency futures单日掉期外汇期货one day rolling currency futures contract 单日掉期外汇期货合约one price单一价格;不二价one-line vote整笔拨款one-off grant一次过拨款one-off itemone-off payment一次过拨款;单一笔款项one-off subsidy一次过补贴onerous tax繁苛税项;繁重税率on-floor order场内买卖盘on-lending转借on-site examination实地审查open a position“做仓”;开仓open account未清帐户;记帐交易;往来帐户open contract未平仓合约open economy开放经济open interest未平仓合约数量open market公开市场open market value公开市场价值;市值open offer [listing method]公开售股〔上市方式〕开仓订单open outcry公开叫价;公开喊价open position未平仓交易open price开仓价格open tender公开投标open-end fund开端基金open-ended investment corporation 股份不定的投资公司opening balance期初结余opening price开盘价格;开市价opening quotation开市价;开市行情opening rate开盘汇价operating account营业帐目;营业帐户;经营帐目operating agreement营运协议operating cost营运成本;运作成本;操作成本operating deficit营业亏损;经营赤字operating expenditure经营开支;营运开支;营业支出operating expenses营运开支;营业费用operating income营运收入;营业收入operating loan经营业务所需贷款operating profit营业利润operating revenue营运收入;营业收益operating services account营运服务帐目operating statement经营收支表;营业损益表operating surplus经营盈余;营业盈余operation经营;营运;投产operational fund经费operative aggregate现行总体数字operator经营者;营运者;营办商opportunity cost机会成本optimist“好友”optimum rate of expenditure最适当支出率option期权;认购权;选择权;选购权option contract期权合约option money期权费option on a futures contract期货合约期权;期货期权option on commodities商品期权option position期权持仓量option premium期权金;期权溢价optional stipulation选择性规定Options Clearing Corporation [Chicago]期权结算公司〔芝加哥〕Options Clearing House Pty Limited [Sydney] 期权结算所有限公司〔悉尼〕Options Clearing Rules《期权结算规则》options market期权市场options market maker期权“庄家”options pricing model期权定价模式options trading期权交易options trading member期权交易会员Options Trading Rules《期权交易规则》order订单;命令;买卖盘order cheque记名支票;抬头支票order for payment of money 付款指令票据order for purchase订购书order for redirection转寄令order for sale售卖令order of discharge破产解除令order of foreclosure absolute 绝对止赎令order of mail transfer信汇委托书order to pay admitted debt 偿付承认债项令order-based system以买卖盘为基础的制度ordinary annual contribution经常性每年捐款ordinary course of business通常业务运作ordinary creditor普通债权人ordinary share普通股ordinary share capital普通股股本organization expenses开办费Organization for Economic Co-operation and Development [OECD] 经济合作及发展组织〔经合组织〕Organization of Petroleum Exporting Countries [OPEC]石油出口国组织Orient First Capital Limited建银财务(香港)有限公司original estimates原来预算original executor原遗嘱执行人original issue price原本发行价original margin原始保证金;基本按金original mortgagee原承按人original mortgagor原按揭人original receipt收据正本;收条正本original securities原有的证券ORIX Asia Limited欧力士(亚洲)有限公司ornament gold饰金Osaka Securities Exchange 大阪证券交易所Oslo Stock Exchange奥斯陆证券交易所O.T.B. Card Co. Ltd.海外信用卡有限公司ounce troy金衡安士outflow of capital资本外流;资金外流outflow of fund资金外流outflow of money资金外流outgoing partner退出的合伙人outgoings支出outgoings and expenses支出及开支outlay费用;开支;支出outlying business district市区外商业区out-of-hours trading在正式交易时间以外的交易out-of-pocket expenses实付费用;付现费用out-of-the-money option无价期权;价外期权outport collection外埠代收款项output产出;产值;产量outside dealing场外买卖;场外交易outstanding未偿还;尚未支付outstanding account未清帐项;未清帐目outstanding allocation应拨未拨的款项outstanding amount未偿还的数额outstanding balance未清帐款;未清余额outstanding bill未偿付票据;未兑现票据outstanding borrowing未清偿债项outstanding claim portfolio未决申索组合outstanding commitment尚未支付的承担额outstanding derivatives contract尚未平仓的衍生工具合约outstanding loan尚未清还的贷款outstanding negotiable certificate of deposit 未兑现的可转让存款证outstanding tax欠税outstanding uncapitalized interest尚未支付且未化作本金的利息outturn结算;结算数字outward documentary bill出口跟单汇票outward remittance汇出汇款over and above inflation减除通胀因素overall average internal rate of return平均总体内部回报率overall Consumer Price Index总体消费物价指数overall domestic export本地产品出口总额overall growth rate整体增长率;总增长率overall investment总投资额;总体投资overall liquidity ratio总体流动资金比率overall price relative全面相对价格overall surplus总盈余overall tally全面总计overbuying超买;买空over-commitment超额承担overdraft透支overdraft by banks abroad海外银行同业透支overdraft by banks in foreign countries 外国银行同业透支overdraft by local banks本港银行同业透支overdraft by outport banks外埠银行同业透支overdraft of an account户口透支overdraft on banks向银行同业透支overdraft on banks abroad向海外银行同业透支overdraft on banks in foreign countries向外国银行同业透支overdraft on local banks向本港银行同业透支overdraft on outport banks向外埠银行同业透支overdraft secured抵押透支overdue逾期overdue loan过期贷款over-employed economy过度活跃的经济overhang剩余承担;未完成的承担额;过剩额overhead间接费用;间接成本overhead cost间接成本overheated economy过热的经济overheated market过热的市场overnight Hong Kong interbank offered rate 香港银行同业隔夜拆息率overnight liquidity assistance隔夜流动资金贷款overnight margin隔夜保证金;隔夜按金overnight money隔夜拆借资金;隔夜钱overnight position隔夜头寸overnight rate隔夜利率overpaid amount多缴数额overpayment of contribution多缴供款overrun超支overrun cost超额费用Oversea-Chinese Banking Corporation Ltd.华侨银行有限公司overseas bank海外银行overseas banking corporation海外银行法团overseas branch海外分行Overseas Companies Section [Companies Registry] 海外公司注册组〔公司注册处〕overseas currency balance海外货币结余overseas financial institution海外财务机构overseas interest海外利息overseas investment海外投资overseas market海外市场overseas representative office 海外代表办事处Overseas Trust Bank Ltd.海外信托银行有限公司Overseas Union Bank Ltd. 华联银行overselling超卖;卖空oversight of markets监察市场over-spending超额支出;超支overtax超额征税;征税过重over-the-counter derivative 场外交易衍生工具over-the-counter market场外交易市场over-the-counter trading场外交易;柜台交易over-the-counter transaction 场外交易;柜台交易overtrading过量交易owner-occupier allowance自住业主津贴ownership所有权;拥有权ownership in common分权共有权会计专业英语会计专业英语AccountingEnglishINTRODUCTION TO ACCOUNTING ENGLISH 5CHAPTER 1 INTRODUCTION TO ACCOUNTING 6§ 1.1 THE IMPORTANCE OF ACCOUNTING (会计的重要性) 6§ 1.2.ACCOUNTING AS A PROFESSION (会计职业) 7§ 1.3.ACCOUNTING KNOWLEDGE SYSTEM(会计学科体系) 7§ 1.4.PROFESSIONAL ACCOUNTING BODIES(专业会计团体) 8§ 1.5.ACCOUNTING POLICIES AND ACCOUNTING STANDARD 9(会计的法规体系和基本会计准则) 9§ 1.6.FUNDAMENTAL ACCOUNTING CONCEPTS (基本会计理念) 101.6. 1. FOUR BASIC ACCOUNTING ASSUMPTIONS 101.6.2. IMPORTANT BASIC ACCOUNTING PRINCIPLES 11CHAPTER 2 THE ACCOUNTING ELEMENTS AND EQUATION 132.1.THE ACCOUNTING ELEMENTS 132.1.1 ASSETS 132.1.2 LIABILITIES 负债 142.1.3 OWNER’S EQUITY 所有者权益 142.1.4 REVENUE (INCOME) 收入 152.1.5 EXPENSE (OUTCOME) 费用 152.1.6 PROFIT/ LOSS 利润或亏损 152.2. THE ACCOUNTING EQUATION 162.2.1 THE ACCOUNTING EQUITATION(会计恒等式) 162.2.2 HOW THE BUSINESS TRANSACTIONS EFFECT ON THE ACCOUNTING EQUITATION (经济业务与会计恒等式的关系) 162.2.3 CONCLUSION 18EXERCISES 18CHAPTER 3 DOUBLE ENTRY ACCOUNTING & LEDGER ACCOUNTS 193.1. THE DOUBLE ENTRY ACCOUNTING (复式记账) 193.2. APPLICATION OF DOUBLE-ENTRY ACCOUNTING PRINCIPLE (复式记账的应用) 21 3.3. THE LEDGER ACCOUNTS分类账户 223.3.1 THE LEDGER ACCOUNTS 223.3.2 PRACTICE: RECORD THE TRANSACTIONS ON THE RELEVANT LEDGER ACCOUNTS (实训: 登T型账) 233.4 TRIAL BALANCE (试算平衡) 2626TABLE 3.4 :TRIAL BALANCE (试算平衡表) 27CHAPTER 4 TRANSACTIONS & DOUBLE-ENTRY ACCOUNTING 314.1. INTRODUCTION OF BUSINESS OPERATIONS: 314.2. ACCOUNTING FOR MERCHANDISING BUSINESSES 334.2.1 ACCOUNTING FOR SUPPLYING TRANSACTIONS(供应过程的会计核算) 33--- MERCHANDISES / INVENTORY(存货, 货物) 334.2.2 ACCOUNTING FOR SALES TRANSACTIONS(销售过程的会计核算) 374.3. MANUFACTURING BUSINESS 404.3.1 INTRODUCTION OF MANUFACTURING CYCLES 404.3.2 ACCOUNTING FOR MANUFACTURING PROCESSES (生产过程的会计核算) 414.4. REVISION CLASSES 43CHAPTER 5 BASIC FINANCIAL STATEMENT 455.1. BALANCE SHEETS (资产负债表) 455.1.1 EXHIBITION5-1: BALANCE SHEET 465.1.2 PRACTICAL EXAMPLE OF BALANCE SHEET 48-- PRACTICAL EXAMPLE 1(实例 1 ): BALANCE SHEET OF ABC CO. LTD 48-- PRACTICAL EXAMPLE 2(实例 2 ): BALANCE SHEET OF TM CO. LTD 485.2. INCOME STATEMENT (OR PROFIT AND LOSS STATEMENT) (利润表) 515.2.1 EXHIBITION5-2: INCOME STATEMENT 52-- PRACTICAL EXAMPLE 1(实例 1 ): INCOME STATEMENT OF XYZ CO. LTD 53-- PRACTICAL EXAMPLE 2(实例 2 ): BALANCE SHEET OF TM CO. LTD 545.3. CASH FLOW STATEMENTS (现金流量表) 565.3.1 CLASSIFICATION OF CASH FLOWS 565.3.2 EXHIBITION5-3: CASH FLOW STATEMENT 57-- PRACTICAL EXAMPLE 1(实例 1 ): STATEMENT OF CASH FLOW XYZ CO. LTD 59 CHAPTER 6 ACCOUNTING CYCLES 616.1. STEPS IN ACCOUNTING CYCLE 616.2. RECORDING JOURNAL ENTRIES AND POSTING TO LEDGER ACCOUNTS (编制日记账和登记总账) 626.2.1 WHAT SHOULD BE POSTED? 626.3. ADJUSTING ENTRIES (账户的调整) 646.3. CLOSING ENTRIES (临时账户的结转) 67CHAPTER 7 SAMPLE DOCUMENTS 617.1. BILLS (票据) 697.1.1 汇票 697.1.1支票 707.2. INVOICES (单据) 727.2.1 合同 727.2.2海运提单 737.2.3装箱单 767.3. OTHER RELEVANT DOCUMENTS(其它凭证和文件) 78CHAPTER 8 APPENDIXES 91第一节:英语最常用口语118句 91第二节:公司部门名称对照 94第三节:常见职务中英对照 95Introduction to Accounting English会计英语概论l Why do we learn it? (为什么要学《会计英语》?)(1)跨国公司(2)国际业务(3)国际投资l What are the Learning objectives? (《会计英语》的学习目标?)1.快速掌握财会专业通用英语词汇,以提高专业英语能力。

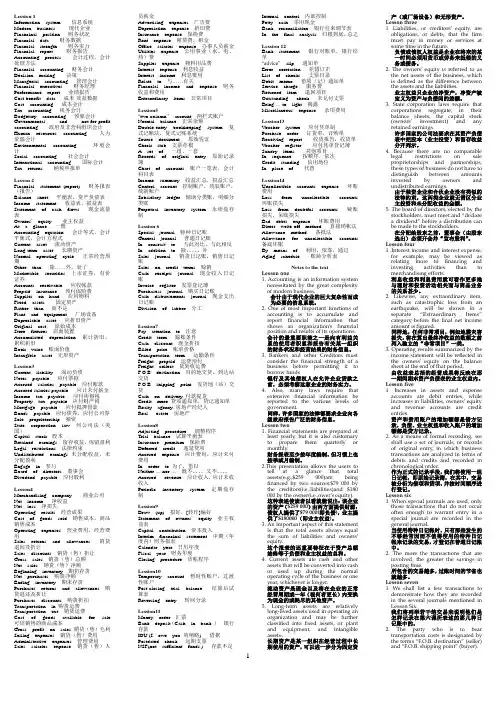

Lession 1Information system 信息系统Modern business 现代企业Financinal position 财务状况Financial data 财务数据Financial strength 财务实力Financial report 财务报告Accounting process 会计过程,会计处理方法Financial accounting 财务会计Decision making 决策Managerial accounting 管理会计Financial executives 财务经理Performance report 业绩报告Cost-benefit data 成本-效益数据Cost accounting 成本会计T ax accounting 税务会计Budgetary accounting 预算会计Governmental and not-for-profit accounting 政府及非营利组织会计Human resources accounting 人力资源会计Environmental accounting 环境会计Social accounting 社会会计International accounting 国际会计T ax returns 纳税申报单Lesson 2Financial statement (report) 财务报表(报告)Balance sheet 平衡表,资产负债表Income statement 收益表,损益表Statement of cash flows 现金流量表Owners’equity 业主权益At a glance 一瞥Accounting equation 会计等式,会计平衡式,会计方程式Current asset 流动资产Long-term asset 长期资产Normal operating cycle 正常经营周期Other than 除……外,处了Marketable securities 上市证券,有价证券Accounts receivable 应收帐款Prepaid insurance 预付保险费Supplies on hand 在用物料Fixed assets 固定资产Rather than 而不是Plant and equipment 厂场设备Depreciable asset 应折旧资产Original cost 原始成本Store fixtures 店面装置Accumulated depreciation 累计折旧,累积折旧Book value 账面价值Intangible asset 无形资产Lession3Current liability 流动负债Notes payable 应付票据Accrued salaries payable 应付账款Accured salaries payable 应计未付薪金Income tax payable 应付所得税Property tax payable 应付财产税Mortgage payable 应付抵押借款Bonds payable 应付债券,应付公司券Sole proprietorship 独资State corporation law 州公司法(美国)Capital stock 股本Retained earnings 留存收益,保留盈利Legal restrictions 法律约束Undistributed earnings 未分配收益,未分配盈利Engage in 参与Board of directors 董事会Divedend payable 应付股利Lesson4Merchandising company 商业公司Net income 净收益Net loss 净损失Operating results 经营成果Cost of goods sold 销售成本,商品销售成本Operating expenses 营业费用,经营费用Sales returns and allowances 销货退回及折让Sales discounts 销货(售)折让Gross sales 销货(售)总额Net sales 销货(售)净额Beginning inventory 期初存货Net purchases 购货净额Ending inventory 期末存货Purchases returns and allowances 购货退还及折让Purchases discounts 购货折扣Transportation in 购货运费Transportation out 销货运费Cost of goods available for sale 可供销售的商品成本Gross profit on sales 销货(售)毛利Selling expenses 销货(售)费用Administrative expenses 管理费用Sales salaries expense 销货(售)人员薪金Advertising expenses 广告费Depreciation expense 折旧费Insurance expense 保险费Rent expense 租赁费,租金Office salaries expense 办事人员薪金Utilities expense 公用事业(水、电、热)费Supplies expense 物料用品费Interest expense 利息收益Interest income 利息费用Relate to 与……有关Financial income and ex pense 财务收益和费用Extraordinary items 非常项目Lession5“two-column”account 两栏式账户Normal balance 正常余额Double-entry bookkeeping system 复式记账法,复式记账系统Source document 原始凭证Check stub 支票存根A set of 一组,一套Records of original entry 原始记录簿Chart of accounts 账户一览表,会计科目表Income summary 收益汇总,损益汇总Control account 控制账户,统驭账户,统制账户Subsidiary ledger 辅助分类账,明细分类账Perpetual inventory system 永续盘存制Lession 6Special journal 特种日记账General journal 普通日记账In consrast to 与此对比,与此相反In addition to 除。

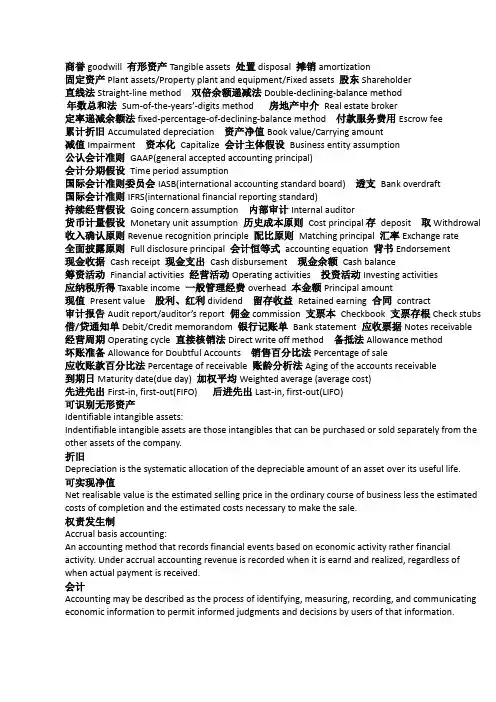

商誉goodwill 有形资产Tangible assets 处置disposal 摊销amortization固定资产Plant assets/Property plant and equipment/Fixed assets 股东Shareholder直线法Straight-line method 双倍余额递减法Double-declining-balance method年数总和法Sum-of-the-years’-digits method房地产中介Real estate broker定率递减余额法fixed-percentage-of-declining-balance method付款服务费用Escrow fee累计折旧Accumulated depreciation资产净值Book value/Carrying amount减值Impairment资本化Capitalize会计主体假设Business entity assumption公认会计准则GAAP(general accepted accounting principal)会计分期假设Time period assumption国际会计准则委员会IASB(international accounting standard board) 透支Bank overdraft国际会计准则IFRS(international financial reporting standard)持续经营假设Going concern assumption 内部审计Internal auditor货币计量假设Monetary unit assumption 历史成本原则Cost principal存deposit 取Withdrowal 收入确认原则Revenue recognition principle 配比原则Matching principal 汇率Exchange rate全面披露原则Full disclosure principal 会计恒等式accounting equation 背书Endorsement现金收据Cash receipt现金支出Cash disbursement 现金余额Cash balance筹资活动Financial activities经营活动Operating activities投资活动Investing activities应纳税所得Taxable income一般管理经费overhead 本金额Principal amount现值Present value股利、红利dividend 留存收益Retained earning 合同contract审计报告Audit report/auditor’s report佣金commission 支票本Checkbook 支票存根Check stubs 借/贷通知单Debit/Credit memorandom银行记账单Bank statement应收票据Notes receivable 经营周期Operating cycle直接核销法Direct write off method 备抵法Allowance method坏账准备Allowance for Doubtful Accounts 销售百分比法Percentage of sale应收账款百分比法Percentage of receivable 账龄分析法Aging of the accounts receivable到期日Maturity date(due day) 加权平均Weighted average (average cost)先进先出First-in, first-out(FIFO)后进先出Last-in, first-out(LIFO)可识别无形资产Identifiable intangible assets:Indentifiable intangible assets are those intangibles that can be purchased or sold separately from the other assets of the company.折旧Depreciation is the systematic allocation of the depreciable amount of an asset over its useful life.可实现净值Net realisable value is the estimated selling price in the ordinary course of business less the estimated costs of completion and the estimated costs necessary to make the sale.权责发生制Accrual basis accounting:An accounting method that records financial events based on economic activity rather financial activity. Under accrual accounting revenue is recorded when it is earnd and realized, regardless of when actual payment is received.会计Accounting may be described as the process of identifying, measuring, recording, and communicating economic information to permit informed judgments and decisions by users of that information.An asset is a resource controlled by the enterprise as a result of past events and from which future economic benefits are expected to flow to the enterprise.现金cash:Accountants define cash as money on deposit in banks and any items that a bank will accept for deposit.企业已付银行未付Outstanding checks:Checks issued and recorded by the company but not yet presented to the bank for payment.应收账款Accounts receivable:Accounts receivable are liquid assets, usually being converted into cash within a period of 30 to 60 days.收入Revenue:Revenue is the gross inflow of economic benefits during the period arising in the course of the ordinary activities of an entity when those inflows result in increase in equity, other than increases relating to contributions from equity participants.收益应按照实收款项和应收款项的公允价值计算.Revenue shall be measured at the fair value of the consideration received or receivable.交易中所产生的收益一般是按照会计主体和资产购买或使用双方的协议决定的.The amount of revenue arising on a transaction is usually determined by agreement between the entity and the buyer or user of the asset.存货应该按照”成本”和”可实现净值”底的计算Inventories shall be measured at the lower of cost and net realisable value.存货包括那些买入是以卖出为目地的物品. 比如, 零售商买入机器设备是为再销售, 或者那些为了出售而买入的土地和其他的房产.Inventories encompass goods purchased and held for resale including, for example, merchandise purchased by retailer and held for resale, or land and other property held for resale.存货成本应该包括所有购买的费用, 生产的费用和其他那些发生在使存货转移到目前地点和状态的费用.the cost of inventories shall comprise all costs of purchase, costs of conversion and other costs incurred in bringing the inventories to their present location and condition.资产净值:Carrying amount is the amount at which an asset is recognised after deducting any accumulated depreciation and accumulated impairment losses.折旧:Depreciation is the systematic allocation of the depreciable amount of an asset over its useful life.残值:The residual value is the estimated amount that an entity would currently obtain from disposal of the asset, after deducting the estimated costs of disposal, if the asset were already of the age and in the condition expected at the end of its useful life.Amortisation is the systematic allocation of the depreciable amountof an intangible asset over its useful life.开发:开发是指在进行商业性的生产或使用前,将研究成果或其他知识应用于某项计划或设计,以生产出新的或具有实质性改进的材料,装置,产品,工艺,系统或服务。

09《会计英语》期末复习资料eful Phrases (短语)这个是给出中文让写英文1.Trading securities交易性金融资产2.Notes/accounts receivable应收票据 /帐款3.Provision for bad debts 坏帐准备4.Advances to suppliers 预付帐款5.Prepaid expenses待摊费用 (考过 )6.Accrued expenses 预提费用7.Accrued payroll 应付工资8.Dividends payable 应付股利9.Provision for loss on realization of inventory 存货变现损失准备10.Available-for-sale securities 可供出售的金融资产11.Hold-to-maturity securities 持有至到期投资12.Long-term investment in equity 长期股权投资13.Long-term investment maturing within one year 一年内到期的长期投资14.Receivables collectible after one year 一年以上应收款项15.Fixed assets - cost固定资产原价16.Fixed assets–net book value 固定资产净值17.Fixed assets–pending disposal 固定资产清理18.Accumulated depreciation 累计折旧19.Construction in progress 在建工程20.Intangible assets 无形资产21.Proprietary technology and patents 工业产权及专有技术22.Deferred tax assets递延所得税资产23.Current liabilities 流动债务24.Provisions for foreseeable liabilities 预计负债准备25.Premium/discount on debentures payable应付公司债券溢价 /折价26.Deferred tax liabilities 递延所得税负债27.Paid-in capital 实收资本28.Capital/Earnings surplus 资本 /盈余公积29.Undistributed profits 末分配利润30.Accumulated losses 累计亏损31.Profit and loss account利润表32.Sales discounts and allowances销售折扣与折让33.Impairment losses of assets资产减值损失34.Gain/loss on changes in fair value 公允价值变动收益 /损失35.Operating profit/loss 营业利润 / 亏损36.Non-operating income/expenses营业外收入 /支出 profit/loss after tax 税后净利润 /亏损38.Earnings per share (EPS)每股收益39.Basic/diluted EPS 基本 /稀释每股收益II.Abbreviations (缩略语)这个是给简写让你写出英语跟中文1.GAAP : Generally Accepted Accounting Principles .公认会计原则2.FASB : Financial Accounting Standards Board.财务会计准则委员会3.AICPA : American Institute of Certified Public Accountants.美国注册会计师协会4.CICPA : Chinese Institute of Certified Public Accountants.中国注册会计师协会5.MOF : the Ministry of Finance财政部6.SL Method : straight-line method.直线法P.252/77.ROA :return on assets资.产报酬率P.267/78.EPS :earning per share每.股收益P.351/99.P/E Ratio : the price/earning ration市盈率10.SCF : the statement of cash flows现金流量表III.Questions (回答问题)Lesson 1 --- Home AssignmentsDiscussion Questions: p.221.What are the four financial statements prepared by a proprietorship toprovide information for decision making?√They are: income statement (profit and loss account), statement of owner’s equity (capital statement, statement of retained earnings), balance sheet and cash flow statement.2.What is the proper formula presentation of the accounting equation?√Assets = Liabilities + [owner ’s equity + (Revenue–Expenses)]Exercise 1 - 2: p.23Foreman Corporation, engaged in a service business,completed the following selected transactions during the period:√1)Issued additional capital stock, receiving cash;2)Purchased supplies on account;3)Returned defective supplies purchased on account and not yet paid for;4)Received cash as a refund from the erroneous overpayment of anexpense;5)Charged customers for services sold on account;6)Paid utilities expense;7)Paid a creditor on account;8)Received cash on account from charge customers;9)Paid cash dividends to stockholders;10)Determined the amount of supplies used during the month.Lesson 2 --- Home AssignmentsDiscussion Questions: p.631.Does debit always mean increase and credit always mean decrease?√No, it does not. And debit or credit should not be confused with increase ordecrease. It depends on which side of an account is used for debit or credit.2.Given that assets have economic value and that they have debit balances,why do expenses also have debit balances?√Because expenses have the effect of decreasing capital, and just as decreases incapital are recorded as debit, increases in expense accounts are recorded as debits. Lesson 3---Home AssignmentsAnswer the following questions:1.Briefly explain the matching principle. (考过)√The matching principle states that expenses should be deducted (matched against) from the revenues earned in the same period.2.Why is an unearned revenue a liability? √Unearned revenue is a liability because the business owes the customer a good or service.Lesson 7---Home Assignments1.What do determinable current liabilities include? P.291 √They include trade accounts payable, current notes payable, current maturities of long-term obligations, cash dividends payable, accrued liabilities, and prepayments or deposits from customers.2.What does non-current liabilities represent? P.306 √It represents obligations of the firm that generally are due more than one yearafter the balance sheet date.3.What does the major portion of non-current liabilities consist of?P.306It consists of notes and bonds payable.Lesson 8---Home AssignmentsAnswer the following questions:1.What determines the yield rate of a company’s stock? √Dividends per share divided by market price per share determine the yield rateof a company‘s stock.2.What is P/E ratio? √The Price/Earning (P/E) ratio is the ratio of the market price per share toearnings per share.Lesson 9---Home AssignmentsAnswer the following questions:1.What are the three categories into which the SCF should be classified?They are a) cash flow from operating activities, b) cash flow from investing activities, cash flow from financing activities. √2.What is the usefulness of the SCF?√From SCF, the information users can know the reasons for the difference between net income and net cash flows from operating activities.IV .E-C Translation (英汉语篇翻译)让你写中文意思P.49/L.21.Preparing a Trial BalanceAccountants usually complete the posting of journal entries to the ledger accounts at the end of each month if they are using a manual system. With a computerized system, each posting is done automatically as each journal entry is recorded. The equality of debits and credits in the ledger should be verified at the end of each accounting period. To verify the accuracy of the recording process, accountants prepare a trial balance of the ledger accounts. A trial balance not only provides a check on the equality of debits and credits but also is a useful summary of account balances for preparing financial statements.[参考译文 ]编制试算表(考过)若使用的是手工录入系统的话,会计师通常是在每个月的月底完成日记帐到分类帐的过帐工作;若是用计算机系统的话,则每次过帐均在完成每笔日记帐的同时就自动完成了。

Unit 1 Financial information about a business is needed by many outsiders .These outsiders include owners, bankers, other creditors, potential investors, labor unions, government agencies ,and the public ,because all these groups have supplied money to the business or have some other interest in the business that will be served by information about its financial position and operating results. 许多企业外部的人士需要有关企业的财务信息,这些外部人员包括所有者、银行家、其他债权人、潜在投资者、工会、政府机构和公众,因为这些群体对企业投入了资金,或享有某些利益,所以必须得到企业财务状况和经营成果信息。 Unit 2 Each proprietorship, partnership, and corporation is a separate entity. 每一独资企业、合伙企业和股份公司都是一个单独的主体。

In accrual accounting, the impact of events on assets and equities is recognized on the accounting records in the time periods when services are rendered or utilized instead of when cash is received or disbursed. That is revenue is recognized as it is earned, and expenses are recognized as they are incurred – not when cash changes hands .if the cash basis accounting were used instead of the accrual basis, revenue and expense recognition would depend solely on the timing of various cash receipts and disbursements.

会计英语期末知识点总结1. Basic Concepts of Accounting1.1. Financial AccountingFinancial accounting is the process of recording, summarizing, and reporting financial transactions of a business to external parties such as investors, creditors, and regulators. It provides a comprehensive view of the financial performance and position of a company.1.2. Managerial AccountingManagerial accounting is the process of providing financial and non-financial information to internal management for decision making, planning, and control. It focuses on providing relevant and timely information to support the management in making informed decisions.1.3. Accounting PrinciplesGenerally Accepted Accounting Principles (GAAP) are a set of guidelines and rules that govern the accounting practices and procedures in the United States. These principles ensure consistency and comparability in financial reporting.1.4. Double-Entry AccountingDouble-entry accounting is a system in which every financial transaction has equal and opposite effects on at least two different accounts. This system ensures accuracy and completeness in recording financial transactions.1.5. Accrual Basis vs. Cash Basis AccountingAccrual basis accounting recognizes revenues when earned and expenses when incurred, regardless of when cash is received or paid. Cash basis accounting, on the other hand, recognizes revenues and expenses only when cash is received or paid.2. Financial Statements2.1. Balance SheetA balance sheet is a financial statement that shows the financial position of a company at a specific point in time. It presents the assets, liabilities, and equity of the business, providinga snapshot of its financial health.2.2. Income StatementAn income statement, also known as a profit and loss statement, shows the revenues, expenses, and profits (or losses) of a company over a specific period of time. It provides a summary of the company's financial performance.2.3. Statement of Cash FlowsThe statement of cash flows shows the sources and uses of cash in a company's operating, investing, and financing activities. It provides insights into the cash flow dynamics of a business.2.4. Statement of Retained EarningsThe statement of retained earnings shows the changes in a company's retained earnings over a specific period, including net income, dividends, and other adjustments. It reconciles the beginning and ending balances of retained earnings.3. Key Principles in Accounting3.1. Historical Cost PrincipleThe historical cost principle requires assets to be recorded at their original cost, rather than their current market value. This principle ensures reliability and objectivity in financial reporting.3.2. Revenue Recognition PrincipleThe revenue recognition principle states that revenues should be recognized when earned, regardless of when cash is received. This principle ensures that revenues are matched with the expenses incurred to generate them.3.3. Matching PrincipleThe matching principle requires expenses to be recognized in the same period as the revenues they help generate. This principle ensures that the income statement accurately reflects the profitability of a company.3.4. Full Disclosure PrincipleThe full disclosure principle requires companies to disclose all relevant information in their financial statements and footnotes, providing a complete and transparent view of their financial position and performance.3.5. Consistency PrincipleThe consistency principle requires companies to use the same accounting methods and techniques from one period to the next, providing consistent and comparable financial information.In conclusion, accounting is a vital function in any business organization. It provides crucial information that helps in decision-making, planning, and control. By understanding the basic concepts, financial statements, and key principles in accounting, stakeholders can make informed judgments about the financial health and performance of a company.。

Post test 1 基本概念1. Things of value owned by an entity: assetsMoney: cashClaims of creditors: liabilitiesClaims of investors: equity2. 2 types of sources of funds:Stronger claim: liabilitiesLesser claim: equity3. A balance sheet reports the status of an entity ....at a point of time.4. Give the fundamental accounting equation: Assets = Liabilities + Equity5. The above equation is consistent with what concept?: Dual-aspect concept6. Money-measurement concept states that accounting reports only facts that can be expressed in monetary amounts.7. A balance sheet does not report all the facts about a business. What concept limits the amount or type of information that can be reported? Money-measurement concept8. Brown Company has 10000 dollar cash. Its owner withdraws 100 dollars for his own use. The owner is (no better or worse off) than he was before. Brown company now has (less) cash. The fact that this event affects the owner differently than it affects the company is an illustration of the entity concept.9. The entity concept states that accounts are kept for entities as distinguished from the persons who own those entities.11. The going-concern concept is: Accounting assumes that an entity will continue to operate indefinitely.12. The asset-measurement concept is: if reliable information is available, accounting focuses on the fair value of assets. Nonmonetary assets are reported at their original cost.13. An item can be reported as an asset if it passes 3 of the following: item is valuable, item was acquired at a measurable cost, item is owned or controlled by the entity.14. Goodwill is a favorable name or reputation purchased by the entity.15. An asset is classified as current if it is cash or is expected to be converted into cash in the near future, usually within one year.16. A liability is classified as current if it becomes due in the near future, usually within one year.17. Marketable securities are current assets. Investments are noncurrent assets.19. An insurance policy paid in advance of the time period covered is an example of a prepaid expense.20. A building, an item of equipment, and an automobile may all be examples of plant and property.21.Parker Company operates a furniture store. On December 31,2005,it had 30 desks that it was holding for sale. These would be reported as inventory. The desk that is used by the president of Parker Company would be reported as plant and property.22.Fox Company sold $1,000 of goods on credit to Golden Company. This would be recorded as an account receivable of Fox Company and as an account payable of Golden Company.23. Indicate whether the following statements about the balance sheet of a corporation are true or false:a. Assets list all the valuable things owned by the entity----Fb. The amount reported for the paid-in capital item is approximately the fair value of the stock-----Fc. The amount reported for total equity is approximately the fair value of the corporation’s stock---Fd. Total equities (also called “net worth”) show approximately what the entity is worth.----Fe. Retained earnings is the amount of cash retained in the entity.-----FPost test 2 资产负债表的变更:收入的核算1.On January 2, John Brown started the Brown Company. In January, Brown Company did the following things:a. It received $5,000 cash from John Brown as its capital.b. It borrowed $10,000 from a bank, giving a note therefor.c. It purchased $4,000 of inventory for cash.d. It sold $2,000 of its inventory for $6,000 to a customer, who paid $3,500 cash and agreed to pay $2,500 within 30 days.e. It purchased an auto for $7,000. It paid $2,000 down and gave a note to the automobile dealer for the remaining $5,000f. Brown withdrew $1,000 cash for his personal use.g. Brown was offered $10,000 for his equity in the business, but he refused the offer.On a separate piece of paper, prepare a rough draft of a balance sheet for Brown Company as of the close to business January 31, and an income statement for January.Brown CompanyBalance Sheet as of Jan31AssetsCash……………………………………$11,500Accounts Receivable…………………2,500 Inventory………………………………….2,000 Automobile………………………………7,000 Total………………………………………$23,000Liabilities and EquityNotes Payable………………………$15,000Paid-in Capital…………………………5,000Retained Earnings……………………3,000 Total……………………………………$23,000Brown CompanyIncome Statement for January Revenue...........................$6,000Expense ...........................$2,000Income ............................$4,0002.Brown Company's income was $4,000, but its Retained Earnings was only $3,000. Reread the first frame and choose the item (a-g) that explains the difference. f3.John Brown claims that the inventory as of January 31 is worth $6,000, as shown by the fact that inventory costing $2,000 was actually sold for $6,000. Would you change the balance sheet ?...(No). This is an illustration of the asset-measurement concept. Nonmonetary assets are reported at their cost rather than their worth or fair value.Post test 3 会计记录和系统1. On March 5, Kay Company purchased $6,000 of inventory, paying cash.Prepare a journal entry for this transaction below.Journal2001 Transactions Dr. Cr.March 5Inventory6,000Cash6,0002. On March 10, Kay Company made a $15,000 sale to a customer who paid $6,000 cash and agreed to pay to the other $9,000 in 30 days. The merchandise sold had cost $8,000. Prepare a journal entry for the sale, below.Journal2001 Transactions Dr. Cr.March 10Cash6,000Accounts Receivable9,000Revenues15,0003. On March 10, Kay Company made a sale for $15,000 for merchandise that had cost $8,000. Prepare a journal entry to record the cost of the sale below.Journal2001 Transactions Dr. Cr.March 10 Expenses8,000Inventory8,0004. Recall from the previous frames that revenues from the sale on March 10 were $15,000 and that the merchandise sold had cost $8,000. Prepare the closing entries.Journal2005 Transactions Dr. Cr.March 31Revenues15,000Retained earnings15,000March 31Retained earnings8,000Expenses8,0005-10. Omit11. A critic said that the company had $25,000 cash at the beginning ofMarch and $25,000 at the end of March, and since its cash balance was unchanged, it couldn't be said to have any income in March. This criticism is (incorrect).12. The reason the criticism is incorrect is because income is an increase inretained earnings, not necessarily in cash. For example, the sales revenue of Kay Company in March was $15,000 and its income was $7,000 even though $9,000 was received in cash.Post test 4 营业收入和货币资产1. The conservation concept states that increases in equity are recognized only when they are reasonably certain, while decreases in equity are recognized as soon as they are reasonably possible.2. The materiality concept states: disregard trivial matters but disclose all important matters.3. What is the length of the usual accounting period? One year. Financial statements prepared for shorter periods are called interim statements.4. Cash accounting reports items that increase or decrease cash. Accrual accounting reports items that change equity or retained earnings, even though these changes may not affect cash.5. Increases in equity associated with the entity’s operations during a periodare revenues, and decreases are expenses. The difference between them is labeled income.6. The realization concept states that revenues are recognized when goods or services are delivered.7. H Company manufactures a table in August and places it in its retail store in September. R Smith, a customer, agrees to buy the table in October, it is delivered to him in November, and he pays the bill in December. In what month is the revenue is recognized? (November)8. The receipt of cash is a debit to Cash. What is the offsetting credit and (type of account) for the following types of sales transactions?Account Crediteda. Cash received prior to delivery. Advances from customers (a liability)b. Cash received in same period as delivery. Revenuec. Cash received after the period of delivery. Accounts receivable (an asset)9. Similarly, revenue is a credit entry. What is the offsetting debit whenrevenue is recognized in each of these periods?Account Debiteda. Revenue recognized prior to receipt of cash. Accounts receivableb. Revenue recognized in same period as receipt of cash. Cashc. Revenue recognized in the period following receipt of cash. Advances from customers10. In February, H Company agrees to sell a table to a customer for $600,and the customer makes a down payment of $100 at that time. The cost of the table is $400. The table is delivered to the customer in March, and the customer pays the remaining $500 in April. Give the journal entries (if any) that would be made in February, March, and April for both the revenue and expense aspects of this transaction. February:Cash100Advances from customers100March:Accounts receivable500Advances from customers100Revenue600March:Expenses400Inventory400April:Cash500Accounts receivable50011. At the end of 2005, M Company had accounts receivable of $200,000,and it estimated that $2,000 of this amount was a bad debt. Its revenue in 2005, with no allowance for the bad debts, was $600,000.A. What account should be debited for the $2,000 bad debt? RevenueB. What account should be credited? Allowance for doubtful accountsC. What amount would be reported as net accounts receivable on the balance sheet? $198,000D. What amount would be reported as revenue on the 2005 income statement? $598,00012. In 2006, the $2,000 of bad debt was written off.A. What account should be debited for this written off? Allowance for doubtful accountsB. What account should be credited? Accounts receivablePost test 5 费用的核算;损益表1. An expenditure occurs in the period in which goods or services are acquired. An expense occurs in the period in which goods or services are consumed.2. A certain asset was acquired in May. There was therefore an expenditure in May. At the end of May, the item was either on hand, or it was not. If it was on hand, it was an asset; If it was not on hand, it was an expense in May.3. Productive assets are unexpired costs. Expenses are expired costs.4. The matching concept states that costs associated with the revenues of a period are expenses of that period.5. Expenses of a period consist of:a. costs of the goods and services delivered during that period.b. other expenditures that benefit operations of the period.c. losses6. If Brown company pays rent prior to the period that the rent covers, the amount is initially reported as credit to cash and a debit to Prepaid Rent, which is an asset account. If Brown Company pays the rent after the period covered, the amount is initially recorded as a debit to Rent Expense and a credit to Accrued Rent, which is a liability account.7. A brand new machine owned by Fay Company was destroyed by fire in 2005. It was uninsured. It has been purchased for $10,000 with the expectation that it would be useful for 5 years. The expense recorded in 2005 should be $10,000.8. Gross margin is the difference between sales revenue and cost of sales.9. gross margin percentage: (gross margin)/(sales revenue)10. The difference between revenues and expenses in an accounting period (or the amount by which equity [i.e., retained earnings] increased from operating activities during the period) is called net income.11. A distribution of earnings to shareholders is called dividends(股利).12. retained earnings at the end of the period= retained earnings at the beginning of the period + net income – dividends.Post test 6 存货和销售成本1. A dealer sells a television set for $800 cash. It had cost $600. Write journal entries for the four accounts affected by this transaction.Dr. Cash800Cr. Revenue800Dr. Cost of Sales600Cr. Inventory6002. When using the perpetual inventory method (永续盘存), a record is kept for each item, showing receipts, issues, and the amount on hand.3. Write an equation that shows how the cost of sales is determined by deduction:Cost of sales = beginning inventory + purchases – ending inventory4. Omit5. In periods of inflation, many companies use the LIFO method incalculating their taxable income because LIFO gives a higher cost of sales and hence a lower taxable income.6. A company discovers that the fair value of its inventory is $1000 lower than its cost. What journal entry should it take?Dr. Cost of Sales1,000Cr. Inventory1,0007. In a manufacturing business, what three elements enter into the cost of a manufactured item?Direct material, direct labor, and overhead.8. Period costs become an expense during the period in which they were incurred.9. Product costs become an expense during the period in which the products were sold.10. One type of overhead rate involves use of the total direct labor costs and total production overhead costs for a period. Write a ratio that shows how the overhead rate is calculated.(Total production overhead costs)/(Total direct labor costs)11. A given finished item requires $50 of direct materials and 5 hours of direct labor at $8 per hour. The overhead rate is $4 per direct labor hour. At what amount would the finished item be shown in inventory? $110= 50+ 40 + 2012. An inventory turnover of 5 is generally better than an inventory turnover of 4 because it indicates that less capital is tied up in inventory, and there is less risk that the inventory will become obsolete.Post test 7 非流动资产和折旧1. The amount at which a new plant asset is recorded in the accounts includes its purchase price plus all costs incurred to make the asset ready for its intended use (such as transportation and installation).2. A plant asset is acquired in 2005. It is expected to be worn out at the end of 10 years and to become obsolete in five years. What is its service life? ---Five years.3. Ordinarily, land is not depreciated because its service life is indefinitely long.4.A plant asset is acquired in 2005 at a cost of $20000. Its estimated service life is 10 years, and its estimated residual value is $2000 :a. The estimated depreciable cost of the asset is $18,000b. If the straight-line depreciation method is used, the depreciation rate for this asset is 10 percent.c. What amount will be recorded as depreciation expense in each year of the asset’s life?---$1,800d. What amount will be debited and what account will be credited to record this depreciation expense?Dr. Depreciation expenseCr. Accumulated depreciatione. After five years have elapsed, how would this asset be reported on the balance sheet?1) Plant------$20,0002) Less accumulated depreciation-------$9,0003) Book value-------$11,0005. A machine is purchase on January 2, 2005, for $20,000 and its has an expected life of five years and no estimated residual value.a. If the a machine is still in use six years later, what amount of depreciation expense will be reported in for the sixth year?----zerob. What amount, if any, will be reported on the balance sheet at the end of the sixth year?1) It will not be reported.-----X2) It will be reported as follows:Machine $20,000Accumulated depreciation $20,000Book value $06. A machine is purchase on January 2, 2005, for $50,000. It has an expected service life for 10 years and no residual value. Eleven years later it is sold for $3,000 cash.a. There will be a gain of $3,000b. What account will be debited and what account credited to record this amount?Dr. CashCr. Gain on disposition of assets.7. Given an example of each of the following types of assets, and give the name of the process used in writing off the cost of the second and third type.Asset type\Example\Write-off processPlant Asset\m achine, b uilding\DepreciationWasting asset\c oal, o il ,m inerals\DepletionIntangible asset\g oodwill, t rademark \Amortization8. Conoil Company purchased a producing oil property for $10,000,000 on January 2, 2005. It estimated that the property contained one million barrels of oil and that the property had a service life of 20 years. In 2005, 40,000 barrels of oil were recovered from the property. What amount should be charged as an expense in 2005?------$400,0009. Wasting assets and intangible assets are reported on the balance sheet ina different way than building, equipment, and similar plant assets. The difference is that wasting assets are reported at the net amount and plant assets are reported at cost, accumulated depreciation, and net amount. 10. In calculating its taxable income, a company tries to report its income as low as it can. In calculating its financial accounting income, a company tries to report its income as fairly as it can.11. As compared with straight-line depreciation, accelerated depreciation writes off more depreciation in the early years of an asset’s life and less in the later years. Over the whole life of asset, accelerated depreciation writes off the same total cost as straight-line depreciation.12. Companies usually use accelerated depreciation in tax accounting because it reduces taxable income and hence income tax in the early years.13. Assume an income tax rate of 40%. If a company calculated its financial accounting income (before income taxes) in 2005 as $6 million and its taxable income as$4 million, what amount would it report as income tax expense on its 2005 income statement?----$2,400,00014. Fill in the missing name on the following table:Income tax expense $100,000Income tax paid -60,000Deferred income tax $ 40,000The $40,000 would be reported on the balance sheet as a liability.。