克鲁格曼国贸理论第十版课后习题答案 CH8

- 格式:doc

- 大小:67.50 KB

- 文档页数:6

国贸易》第八章题及答案《际习《国际贸易》第八章习题及答案第八章跨国公司、对外直接投资与国际贸易一、单项选择题1.由母公司提供全部资本,独立经营,获取全部利润或承担全部损失的子公司,在中国称为()。

A.股权式合资企业B.外商独资企业C.契约式合资企业D.共同经营企业2.不同国家或地区两个以上的法人、自然人共同投资兴建的,并由投资各方共同经营、共担风险、共负盈亏的企业称为()。

A.股权式合资企业B.外商独资企业C.契约式合资企业D.共同经营企业3.两个或两个以上的国家或地区的投资者,在某一国家或地区,以合同为基础建立起来的经济组织称为()。

A.股权式合资企业B.外商独资企业C.契约式合资企业D.共同经营企业4.国际生产折中理论是由英国经济学家()于 20 世纪 70 年代提出来的。

A.海默 B.金德尔伯格 C.邓宁 D.小岛清5.帝国主义经济的主要特征即是垄断,二战后,()为主要形式。

A.卡特尔B.辛迪加 C.托拉斯 D.跨国公司6.跨国公司实行()做法,加强对国外市场的垄断和争夺。

A.高度集中统一B.限制性商业 C.在公司内实行价格转移 D.非价格竞争7.()是对外直接投资的载体。

A.卡特尔B.辛迪加C.托拉斯D.跨国公司8.对外直投部门结构不断发生变化,二战后,特别 20 世纪 60 年代后,()最主要。

A.铁路B.建筑业C.矿业 .D.制造业9.()理论认为,如果在国外生产比国内能使企业获得更大利润,就会导致对外直接投资。

A.所有权优势B.内部化优势C.产品优势D.区位优势10.当所有权优势得到满足时,如果企业将其加以内部化,即在企业内部充分利用这种优势,比向外出让可能更为有利,就具备()。

A.所有权优势B.内部化优势C.产品优势D.区位优势二、多项选择题1.按国际资本移动的期限长短划分,国际资本移动可分为()。

A.私人投资 B.短期投资 C.公共投资 D.中长期投资2.以资本来源及用途的标准划分,国际资本移动可分为()。

Chapter 11Trade Policy in Developing Countries⏹Chapter OrganizationImport-Substituting IndustrializationThe Infant Industry ArgumentPromoting Manufacturing Through ProtectionismCase Study: Mexico Abandons Import-Substituting IndustrializationResults of Favoring Manufacturing: Problems of Import-Substituting IndustrializationTrade Liberalization since 1985Trade and Growth: Takeoff in AsiaBox: India’s BoomSummary⏹Chapter OverviewThe final two chapters on international trade, Chapters 11 and 12, discuss trade policy considerations in the context of specific issues. Chapter 11 focuses on the use of trade policy in developing countries and Chapter 12 focuses on new controversies in trade policy.Although there is great diversity among developing countries, they share some common policy concerns. These include the development of domestic manufacturing industries, the uneven degree of development within the country, and the desire to foster economic growth and improve living standards. This chapter discusses both the successful and unsuccessful trade policy strategies that have been applied by developing countries in attempts to address these concerns.Many developing countries pose the creation of a significant manufacturing sector as a key goal of economic development. One commonly voiced argument for protecting manufacturing industries is the infant industry argument, which states that developing countries have a potential comparative advantage in manufacturing and can realize that potential through an initial period of protection. This argument assumes market failure in the form of imperfect capital markets or the existence of externalities in production. Such a market failure makes the social return to production higher than the private return. Without some government support, the argument goes, the amount of investment that will occur in this industry will be less than socially optimal levels. Government support can theoretically raise investment up to the socially optimal level. Given these arguments, many nations have attempted import-substituting industrialization, where government support is focused on those industries that compete directly with imports. In the 1950s and 1960s, the strategy was quite popular and did lead to a dramatic reduction in imports in some countries. The overall result, though, was not a success. The infant industry argument did not always hold, as protection could let young industries survive but could not make them efficient. The methods used to protect industries© 2015 Pearson Education Limited60 Krugman/Obstfeld/Melitz •International Economics: Theory & Policy, Tenth Editionwere often complex and overlapped across industries, in some cases leading to exorbitantly high rates of protection. Furthermore, protection often led to an inefficiently small scale of production within countries by creating competition over monopoly profits that would not have existed without protection. By the late 1980s, most countries had shifted away from the strategy, and the chapter includes a case study of Mexico’s change from import substitution to a more open strategy.Since 1985, many developing countries have abandoned import substitution and pursued (sometimes aggressively) trade liberalization. The chapter notes two sides of the experience. On the one hand, trade has gone up considerably and changed in character. Developing countries export far more of their GDP than prior to liberalization, and more of it is in manufacturing as opposed to primary commodities. On the other hand, the growth experience of these countries has not been universally good, and it is difficult to tell if the success stories are due to trade or due to reforms that came at the same time as liberalization. While countries such as the “Asian Tigers,” China and India, have experienced spectacular rates of growth following trade liberalization, only part of this growth can be attributed to trade reform. Furthermore, countries such as Brazil and Mexico that have also moved toward freer trade have not experienced the same rates of economic growth.Answers to Textbook Problems1. The countries that seem to benefit most from international trade include many of the countries of thePacific Rim: South Korea, Taiwan, Singapore, Hong Kong, Malaysia, Indonesia, and others. Though the experience of each country is somewhat different, most of these countries employed some kind of infant industry protection during the beginning phases of their development but then withdrew protection relatively quickly after industries became competitive on world markets. Concerningwhether their experiences lend support to the infant industry argument or argue against it is still a matter of controversy. However, it appears that it would have been difficult for these countries to engage in export-led growth without some kind of initial government intervention. Similarly, both China and India have experienced rapid economic growth following economic liberalization and increased openness. Although part of their growth may be attributed to a reduction in trade barriers, other factors certainly played a role. This disparity is underscored by the fact that nations such as Mexico and Brazil also liberalized trade but have yet to see comparable rates of economic growth. 2. The Japanese example gives pause to those who believe that protectionism is always disastrous.However, Japanese success does not demonstrate that protectionist trade policy was responsible for that success. Japan was an exceptional society that had emerged into the ranks of advanced nations before World War II and was recovering from wartime devastation. It is arguable that economicsuccess would have come anyway, so the apparent success of protection represents a “pseudo-infant industry” case of the kind discussed in the text.3. a. The initial high costs of production would justify infant industry protection if the costs to thesociety during the period of protection were less than the future stream of benefits from a mature, low-cost industry.b. An individual firm does not have an incentive to bear development costs itself for an entireindustry when these benefits will accrue to other firms. The first firm will not factor in how itsinvestment benefits other firms, yielding an inefficiently low level of investment relative to thesocial optimum. There is a stronger case for infant industry protection in this instance because of the existence of market failure in the form of the appropriability of technology.© 2015 Pearson Education Limited4. India ceased being a colony of Britain in 1948; thus, its dramatic break from all imports in favor ofhomemade products following WWII was part of a political break from colonialism. In fact, thepreference for homemade clothing production over British-produced textiles was one of the early battles leading up to independence in India. The presence of a domestic manufacturing lobby inMexico (as opposed to recently deposed colonial firms in India) may have helped keep Mexico open to importing capital goods necessary in the manufacturing process.5. In some countries, the infant industry argument simply did not appear to work well. Such protectionwill not create a competitive manufacturing sector if there are basic reasons why a country does not have a competitive advantage in a particular area. This was particularly the case in manufacturing where many low-income countries lack skilled labor, entrepreneurs, and the level of managerialacumen necessary to be competitive in world markets. The argument is that trade policy alone cannot rectify these problems. Often manufacturing was also created on such a small scale that it made the industries noncompetitive where economies of scale are critical to being a low-cost producer.Moreover protectionist policies in less-developed countries have had a negative impact on incentives, which has led to “rent-seeking” or corruption.。

国际经济学克鲁格曼课后习题答案章集团标准化办公室:[VV986T-J682P28-JP266L8-68PNN]第一章练习与答案1.为什么说在决定生产和消费时,相对价格比绝对价格更重要?答案提示:当生产处于生产边界线上,资源则得到了充分利用,这时,要想增加某一产品的生产,必须降低另一产品的生产,也就是说,增加某一产品的生产是有机会机本(或社会成本)的。

生产可能性边界上任何一点都表示生产效率和充分就业得以实现,但究竟选择哪一点,则还要看两个商品的相对价格,即它们在市场上的交换比率。

相对价格等于机会成本时,生产点在生产可能性边界上的位置也就确定了。

所以,在决定生产和消费时,相对价格比绝对价格更重要。

2.仿效图1—6和图1—7,试推导出Y商品的国民供给曲线和国民需求曲线。

答案提示:3.在只有两种商品的情况下,当一个商品达到均衡时,另外一个商品是否也同时达到均衡?试解释原因。

答案提示:4.如果生产可能性边界是一条直线,试确定过剩供给(或需求)曲线。

答案提示:5.如果改用Y商品的过剩供给曲线(B国)和过剩需求曲线(A国)来确定国际均衡价格,那么所得出的结果与图1—13中的结果是否一致?6.答案提示:国际均衡价格将依旧处于贸易前两国相对价格的中间某点。

7.说明贸易条件变化如何影响国际贸易利益在两国间的分配。

答案提示:一国出口产品价格的相对上升意味着此国可以用较少的出口换得较多的进口产品,有利于此国贸易利益的获得,不过,出口价格上升将不利于出口数量的增加,有损于出口国的贸易利益;与此类似,出口商品价格的下降有利于出口商品数量的增加,但是这意味着此国用较多的出口换得较少的进口产品。

对于进口国来讲,贸易条件变化对国际贸易利益的影响是相反的。

8.如果国际贸易发生在一个大国和一个小国之间,那么贸易后,国际相对价格更接近于哪一个国家在封闭下的相对价格水平?答案提示:贸易后,国际相对价格将更接近于大国在封闭下的相对价格水平。

克鲁格曼国际经济学课后答案【篇一:克鲁格曼《国际经济学》(国际金融)习题答案要点】lass=txt>第12章国民收入核算和国际收支1、如问题所述,gnp仅仅包括最终产品和服务的价值是为了避免重复计算的问题。

在国民收入账户中,如果进口的中间品价值从gnp中减去,出口的中间品价值加到gnp中,重复计算的问题将不会发生。

例如:美国分别销售钢材给日本的丰田公司和美国的通用汽车公司。

其中出售给通用公司的钢材,作为中间品其价值不被计算到美国的gnp中。

出售给日本丰田公司的钢材,钢材价值通过丰田公司进入日本的gnp,而最终没有进入美国的国民收入账户。

所以这部分由美国生产要素创造的中间品价值应该从日本的gnp中减去,并加入美国的gnp。

2、(1)等式12-2可以写成ca?(sp?i)?(t?g)。

美国更高的进口壁垒对私人储蓄、投资和政府赤字有比较小或没有影响。

(2)既然强制性的关税和配额对这些变量没有影响,所以贸易壁垒不能减少经常账户赤字。

不同情况对经常账户产生不同的影响。

例如,关税保护能提高被保护行业的投资,从而使经常账户恶化。

(当然,使幼稚产业有一个设备现代化机会的关税保护是合理的。

)同时,当对投资中间品实行关税保护时,由于受保护行业成本的提高可能使该行业投资下降,从而改善经常项目。

一般地,永久性和临时性的关税保护有不同的效果。

这个问题的要点是:政策影响经常账户方式需要进行一般均衡、宏观分析。

3、(1)、购买德国股票反映在美国金融项目的借方。

相应地,当美国人通过他的瑞士银行账户用支票支付时,因为他对瑞士请求权减少,故记入美国金融项目的贷方。

这是美国用一个外国资产交易另外一种外国资产的案例。

(2)、同样,购买德国股票反映在美国金融项目的借方。

当德国销售商将美国支票存入德国银行并且银行将这笔资金贷给德国进口商(此时,记入美国经常项目的贷方)或贷给个人或公司购买美国资产(此时,记入美国金融项目的贷方)。

最后,银行采取的各项行为将导致记入美国国际收支表的贷方。

国际贸易理论与实务教材习题答案第一章绪论【试一试】单项选择题(P2)1.通常所说的国际贸易货物额是指()。

A.世界出口货物总额 B. 世界进口货物总额C.世界进出口货物总额 D. 世界贸易量2.一般情况下,随着一国参与国际分工的程度加深,其对外贸易依存度将会()。

A.提高 B. 下降C.不变 D. 变化方向不确定3.一国的进出口贸易收支状况用()来反映。

A.对外贸易额 B. 贸易差额C.对外贸易量 D. 国际贸易量4.转口贸易又称()A.直接贸易 B. 间接贸易C.过境贸易 D. 中转贸易5.能指明一国出口货物和服务的去向与进口货物和服务的来源,并能反映出一国与其他国家或国家集团之间经济贸易联系程度的指标是()。

A.对外贸易地理方向 B. 国际贸易地理方向C.对外贸易商品结构 D. 国际贸易商品结构参考答案:1. A、2. A、3. B、4. D、5. A课堂讨论1-1;1994-2002年我国贸易条件系数为何持续下降?(P5)参考答案:(1)国内市场对进口商品的需求增长;(2)外商投资企业的“转移价格”效应;(3)出口企业恶性价格竞争。

课堂讨论1-2:结合以上表格数据,分析我国对外贸易发展存在的结构性问题是什么?(P6)参考答案:(1)从外贸依存度所反映的贸易规模来看,我国已经是贸易大国,但从商品结构看,尚属贸易弱国;(2)重要资源性商品、关键设备和零部件的外贸依存度过高,存在贸易安全隐患;(3)服装、纺织及家电等产业出口依存度过高;(4)对发达国家市场依赖性过高;(5)贸易条件恶化,我国对国外的供给依赖远远大于国外对我国产品的需求依赖,容易陷入比较优势陷阱;(6)外贸规模增大,但对国内经济的贡献在相对下降。

第二章国际贸易理论【试一试】单项选择题(P12)1.绝对成本理论的代表人物是()。

A.亚当.斯密 B. 大卫.李嘉图C.赫克歇尔 D. 俄林2.在李嘉图的比较成本学说中,国际贸易产生的原因是由于两国的()。

Chapter 4Specific Factors and Income Distribution⏹Chapter OrganizationThe Specific Factors ModelBox: What Is a Specific Factor?Assumptions of the ModelProduction PossibilitiesPrices, Wages, and Labor AllocationRelative Prices and the Distribution of IncomeInternational Trade in the Specific Factors ModelIncome Distribution and the Gains from TradeThe Political Economy of Trade: A Preliminary ViewIncome Distribution and Trade PoliticsCase Study: Trade and UnemploymentInternational Labor MobilityCase Study: Wage Convergence in the Age of Mass MigrationCase Study: Foreign Workers: The Story of the GCCSummaryAPPENDIX TO CHAPTER 4: Further Details on Specific FactorsMarginal and Total ProductRelative Prices and the Distribution of Income⏹Chapter OverviewIn Chapter 3, the Ricardian model of trade was introduced with labor as the single factor of production exhibiting constant returns to scale. Although informative, this model fails to highlight the observed opposition to free trade. In this chapter, the Specific Factors model is presented to gain a better understanding of the distributional effects of trade. After trade, the exporting industry expands, while the import competing industry shrinks. As a result, the factor specific© 2015 Pearson Education Limitedto the exporting industry gains from trade, while the factor specific to the import competing industry loses from trade. However, the aggregate gains from trade are greater than the losses.The Specific Factors model assumes that there is one factor that is mobile between sectors (commonly thought of as labor) and production factors that are specific to each sector. The chapter begins with a simple economy producing two goods: cloth and food. Cloth is produced using labor and its specific factor, capital. Food is produced using labor and its specific factor, land. Given that capital and labor are specific to their respective industries, the mix of goods produced by a country is determined by share of labor employed in each industry. The key difference between the Ricardian model and the Specific Factors model is that in the latter, there are diminishing returns to labor. For example, production of food will increase as labor is added, but given a fixed amount of land, each additional worker will add less and less to food production.As we assume that labor is perfectly mobile between industries, the wage rate must be identical between industries. With competitive labor markets, the wage must be equal to the price of each good times the marginal product of labor in that sector. We can use the common wage rate to show that the economy will produce a mix of goods such that the relative price of one good in terms of the other is equal to the relative cost of that good in terms of the other. Thus, an increase in the relative price of one good will cause the economy to shift its production toward that good.With international trade, the country will export the good whose relative price is below the world relative price. The world relative price may differ from the domestic price before trade for two reasons. First, as in the Ricardian model, countries differ in their production technologies. Second, countries differ in terms of their endowments of the factors specific to each industry. After trade, the domestic relative price will equal the world relative price. As a result, the relative price in the exporting sector will rise, and the relative price in the import competing sector will fall. This will lead to an expansion in the export sector and a contraction of the import competing sector.Suppose that after trade, the relative price of cloth increases by 10 percent. As a result, the country will increase production of cloth. This will lead to a less than 10 percent increase in the wage rate because some workers will move from the food to the cloth industry. The real wage paid to workers in terms of cloth (w/P C) will fall, while the real wage paid in terms of food (w/P F) will rise. The net welfare effect for labor is ambiguous and depends on relative preferences for cloth and food. Owners of capital will unambiguously gain because they pay their workers a lower real wage, while owners of land will unambiguously lose as they now face higher costs. Thus, trade benefits the factor specific to the exporting sector, hurts the factor specific to the import competing sector, and has ambiguous effects on the mobile factor. Despite these asymmetric effects of trade, the overall effect of trade is a net gain. Stated differently, it is theoretically possible to redistribute the gains from trade to those who were hurt by trade and make everyone better off than they were before trade.Given these positive net welfare effects, why is there such opposition to free trade? To answer© 2015 Pearson Education LimitedChapter 4 Specific Factors and Income Distribution 15this question, the chapter looks at the political economy of protectionism. The basic intuition is that the though the total gains exceed the losses from trade, the losses from trade tend to be concentrated, while the gains are diffused. Import tariffs on sugar in the United States are used to illustrate this dynamic. It is estimated that sugar tariffs cost the average person $7 per year. Added up across all people, this is a very large loss from protectionism, but the individual losses are not large enough to induce people to lobby for an end to these tariffs. However, the gains from protectionism are concentrated among a small number of sugar producers, who are able to effectively coordinate and lobby for continued protection. When the losses from trade are concentrated among politically influential groups, import tariffs are likely to be seen. Ohio, a key swing state in U.S. presidential elections and a major producer of both steel and tires, is used as an example to illustrate this point with both Presidents Bush and Obama supporting tariffs on steel and tires, respectively.Although the losers from trade are often able to successfully lobby for protectionism, the chapter highlights three reasons why this is an inefficient method of limiting the losses from trade. First, the actual impact of trade on unemployment is fairly low, with estimates of only 2.5 percent of unemployment directly attributable to international trade. Second, the losses from trade are driven by one industry expanding at the expense of another. This phenomenon is not specific to international trade and is also seen with changing preferences or new technology. Why should policy be singled out to protect people hurt by trade and not for those hurt by these other trends? Finally, it is more efficient to help those hurt by trade—by redistributing the gains from trade in the form of safety nets for those temporarily unemployed and worker retraining programs to ease the transition from import competing to export sectors—than it is to limit trade to protect existing jobs.Finally, the chapter uses the framework of the Specific Factors model to analyze the distributional effects of international labor migration. With free migration of labor across borders, wages must equalize among countries. Workers will migrate from low-wage countries to high-wage countries. As a result, wages in the low-wage countries will rise, and those in the high-wage countries will fall. Though the net effect of free migration is positive, there will be both winners and losers from migration. Workers who stayed behind in the low-wage country will benefit, as will owners of capital in the high-wage country. Workers in the high-wage country will be hurt, as will owners of capital in the low-wage country. We also need to consider the education levels of migrants relative to the country they move to. Immigrants to the United States, for example, tend to be concentrated in the lowest educational groups. Thus, migration is likely to only have negative effects on the wages of the least educated Americans while raising the wages of those with more education.Answers to Textbook Problems1. A country would opt for international trade even though the workers in the importcompetitive sector face the risk of losing their jobs. This is mainly because if the gains that the consumer realizes if more imports were allowed and the associated increase in employment in the export sectors. Under perfect labor mobility, if the real wage inThailand is higher than Bangladesh, then labor movement from Bangladesh to Thailand takes place. This reduces the labor force and raises the wage rates in Bangladesh.Similarly a movement in labor to Thailand increases the labor force and reduces the real wage rate in Thailand. The movement between two countries will continue until the wages in these two countries are equalized.2. a.b.The curve in the PPF reflects diminishing returns to labor. As production of Q1increases, the opportunity cost of producing an additional unit of Q1 will rise. Basically,as you increase the number of workers producing Q1 with a fixed supply of capital, each additional worker will contribute less to the production of Q1 and represents anincreasingly large loss of potential production of Q2.3. a. Draw the marginal product of labor times the price for each sector given that the totallabor allocated between these sectors must sum to 100. Thus, if there are 10 workers© 2015 Pearson Education LimitedChapter 4 Specific Factors and Income Distribution 17employed in Sector 1, then there are 90 workers employed in Sector 2. If there are 50workers employedin Sector 1, then there are 50 workers employed in Sector 2. For simplicity, define P 1 = 1 andP 2 = 2 (it does not matter what the actual prices are in determining the allocation oflabor, only that the relative price P 2/P 1 =2).In competitive labor markets, the wage is equal to price times the marginal product oflabor. With mobile labor between sectors, the wage rate must be equal betweensectors. Thus, the equilibrium wage is determined by the intersection of the two P ⨯MPL curves. Looking at the diagram above,it appears that this occurs at a wage rate of 10 and a labor supply of 30 workers inSector 1(70 workers in Sector 2).b. From part (a), we know that 30 units of labor are employed in Sector 1 and 70 units oflabor are employed in Sector 2. Looking at the table in Question 2, we see that theselabor allocations will produce 48.6 units of good 1 and 86.7 units of good 2.At this production point (Q 1 = 48.6, Q 2 = 86.7), the slope of the PPF must be equal to-P 1/P 2, which is -½. Looking at the PPF in Question 2a, we see that it is roughly equalto -½.© 2015 Pearson Education Limitedc. If the relative price of good 2 falls to 1.3, we simply need to redraw the P ⨯ MPLdiagram withP 1 = 1 and P 2 =1.3.The decrease in the price of good 2 leads to an increase in the share of labor accruingto Sector 1. Now, the two sectors have equal wages (P ⨯ MPL ) when there are 50workers employed in both sectors.Looking at the table in Question 2, we see that with 50 workers employed in bothSectors 1 and 2, there will be production of Q 1 = 66 and Q 2 = 75.8.The PPF at the production point Q 1 = 66, Q 2 = 75.78 must have a slope of -P 1/P 2 = -1/1.3 = -0.77. d. The decrease in the relative price of good 2 led to an increase in production of good 1and a decrease in the production of good 2. The expansion of Sector 1 increases the income of the factor specific to Sector 1 (capital). The contraction of Sector 2decreases the income of thefactor specific to Sector 2 (land).Chapter 4 Specific Factors and Income Distribution 194. a. The increase in the capital stock in Home will increase the possible production of good 1,but have no effect on the production of good 2 because good 2 does not use capital inproduction. As a result, the PPF shifts out to the right, representing the greaterquantity of good 1 that Home can now produce.b. Given the increased production possibility for Home, the relative supply of home (definedas Q 1/Q 2) is further to the right than the relative supply for Foreign. As a result, therelative price of good 1 is lower in Home than it is in Foreign.c. If both countries open to trade, Home will export good 1, and Foreign will export good 2.d. Owners of capital in Home and owners of land in Foreign will benefit from trade, whileowners of land in Home and owners of capital in Foreign will be hurt. The effects onlabor will be ambiguous because the real wage in terms of good 1 will fall (rise) in Home(Foreign) and the real wage in terms of good 2 will rise (fall) in Home (Foreign). The net welfare effect for labor will depend on preferences in each country. For example, iflabor in Home consumes relatively more of good 2, they will gain from trade. If labor in Home consumes relatively more of good 1, they will lose from trade.5. The real wage in Home is 10, while real wage in Foreign is 18. If there is free movement oflabor, then workers will migrate from Home to Foreign until the real wage is equal in each country. If 4 workers move from Home to Foreign, then there will be 7 workers employed in each country, earning a real wage of 14 in each country.We can find total production by adding up the marginal product of each worker. After trade, total production is 20 + 19 + 18 + 17 + 16 + 15 + 14 = 119 in each country for total world production of 238. Before trade, production in Home was 20 + 19 + 18 = 57. Production in Foreign was 20 + 19 + … + 10 = 165. Total world production before trade was 57 + 165 = 222. Thus, trade increased total output by 16.Workers in Home benefit from migration, while workers in Foreign are hurt. Landowners in Home are hurt by migration (their costs rise), while landowners in Foreign benefit.6. If only 2 workers can move from Home to Foreign, there will be a real wage of 12 in Homeanda real wage of 16 in Foreign.a. Workers in Foreign are hurt as their wage falls from 18 to 16.b. Landowners in Foreign benefit as their costs fall by 2 for each worker employed.c. Workers who stay at home benefit as their wage rises from 10 to 12.d. Landowners in Home are hurt as their costs rise by 2 for each worker employed.e. The workers who do move benefit by seeing their wages rise from 10 to 16.7. If the price of wheat increases by 10%, then the labor demand in the wheat sector wouldincrease by the same 10 percent. In other words, the curve defined by MPLw × Pw would increase by 10 percent. On the other hand, if the price of paddy remains the same and only there is an increase in the price of wheat, this result in an increase in the wage rate less than the increase in the price of wheat. In the present case the wage rate will increase less than 10 percent.© 2015 Pearson Education Limited。

Chapter 6The Standard Trade Model⏹Chapter OrganizationA Standard Model of a Trading EconomyProduction Possibilities and Relative SupplyRelative Prices and DemandThe Welfare Effect of Changes in the Terms of TradeDetermining Relative PricesEconomic Growth: A Shift of the RS CurveGrowth and the Production Possibility FrontierWorld Relative Supply and the Terms of TradeInternational Effects of GrowthCase Study: Has the Growth of Newly Industrializing Countries Hurt Advanced Nations?Tariffs and Export Subsidies: Simultaneous Shifts in RS and RDRelative Demand and Supply Effects of a TariffEffects of an Export SubsidyImplications of Terms of Trade Effects: Who Gains and Who Loses?International Borrowing and LendingIntertemporal Production Possibilities and TradeThe Real Interest RateIntertemporal Comparative AdvantageSummaryAPPENDIX TO CHAPTER 6: More on Intertemporal Trade⏹Chapter OverviewPrevious chapters have highlighted specific sources of comparative advantage that give rise to international trade. This chapter presents a general model that admits previous models as special cases. This “standard trade model” is the workhorse of international trade theory and can be used to address a wide range of issues. Some of these issues, such as the welfare and distributional effects of economic growth, transfers between nations, and tariffs and subsidies on traded goods, are considered in this chapter.28 Krugman/Obstfeld/Melitz •International Economics: Theory & Policy, Tenth EditionThe standard trade model is based upon four relationships. First, an economy will produce at the point where the production possibilities curve is tangent to the relative price line (called the isovalue line). Second, indifference curves describe the tastes of an economy, and the consumption point for that economy is found at the tangency of the budget line and the highest indifference curve. These two relationships yield the familiar general equilibrium trade diagram for a small economy (one that takes as given the terms of trade), where the consumption point and production point are the tangencies of the isovalue line with the highest indifference curve and the production possibilities frontier, respectively.You may want to work with this standard diagram to demonstrate a number of basic points. First, an autarkic economy must produce what it consumes, which determines the equilibrium price ratio; and second, opening an economy to trade shifts the price ratio line and unambiguously increases welfare. Third, an improvement in the terms of trade (ratio of export prices to import prices) increases welfare in the economy. Fourth, it is straightforward to move from a small country analysis to a two-country analysis by introducing a structure of world relative demand and supply curves, which determine relative prices.These relationships can be used in conjunction with the Rybczynski and the Stolper-Samuelson theorems from the previous chapter to address a range of issues. For example, you can consider whether the dramatic economic growth of China has helped or hurt the United States as a whole and also identify the classes of individuals within the United States who have been hurt by China’s particular growth biases. In teaching these points, it might be interesting and useful to relate them to current events. For example, you can lead a class discussion on the implications for the United States of the provision of forms of technical and economic assistance to the emerging economies around the world or the ways in which a world recession can lead to a fall in demand for U.S. exports.The example provided in the text considers the popular arguments in the media that growth in China hurts the United States. The analysis presented in this chapter demonstrates that the bias of growth is important in determining welfare effects rather than the country in which growth occurs. The existence of biased growth and the possibility of immiserizing growth are discussed. The Relative Supply (RS) and Relative Demand (RD) curves illustrate the effect of biased growth on the terms of trade. The new termsof trade line can be used with the general equilibrium analysis to find the welfare effects of growth. A general principle that emerges is that a country that experiences export-biased growth will have a deterioration in its terms of trade, while a country that experiences import-biased growth has an improvement in its terms of trade. A case study argues that this is really an empirical question, and the evidence suggests that the rapid growth of countries like China has not led to a significant deterioration of the U.S. terms of trade nor has it drastically improved China’s terms of trade.The second area to which the standard trade model is applied is the effects of tariffs and export subsidies on welfare and terms of trade. The analysis proceeds by recognizing that tariffs or subsidies shift both the relative supply and relative demand curves. A tariff on imports improves the terms of trade, expressed in external prices, while a subsidy on exports worsens terms of trade. The size of the effect depends upon the size of the country in the world. Tariffs and subsidies also impose distortionary costs upon the economy. Thus, if a country is large enough, there may be an optimum, nonzero tariff. Export subsidies, however, only impose costs upon an economy. Internationally, tariffs aid import-competing sectors and hurt export sectors, while subsidies have the opposite effect.The chapter then closes with a discussion of international borrowing and lending. The standard trade model is adapted to trade in consumption across time. The relative price of future consumption is defined as 1/(1 r), where r is the real interest rate. Countries with relatively high real interest rates (newly industrializing countries with high investment returns for example) will be biased toward future consumption and will effectively “export” future consumption by borrowing from established developed countries with relatively lower real interest rates.Chapter 6 The Standard Trade Model 29Answers to Textbook Problems1.If the relative price of palm oil increases in relation to the price of lubricants, this would increase theproduction of palm oil, because Indonesia exports palm oil. Similarly, an increase in relative price of lubricants leads to a shift along the indifference curve, towards lubricants and away from palm oil for Indonesia. This is because Palm oil is relatively expensive, hence reducing palm oil consumption in Indonesia.Expensive palm oil increases the relative income of Indonesia. The income effect would induce more for the consumption of palm oil whereas the substitution effect acts to make the economy consume less of palm oil and more of lubricants. However, if the income effect outweighs the substitution effect, then the consumption of palm oil would increase in Indonesia.2.In panel a, the re duction of Norway’s production possibilities away from fish cause the production of fish relative to automobiles to fall. Thus, despite the higher relative price of fish exports, Norway moves down to a lower indifference curve representing a drop in welfare.In panel b, the increase in the relative price of fish shifts causes Norway’s relative production of fish to rise (despite the reduction in fish productivity). Thus, the increase in the relative price of fish exports allows Norway to move to a higher indifference curve and higher welfare.3. The terms of trade of the home country would worsen. This is because a strong biased productiontowards cloth would increase the home country’s supply of cloth and shifts the supply curve to the right. At the same time, the production of wheat would decline relative to the production of cloth. An increased supply of cloth would reduce the price at the domestic and at the international market. The reduction in international price of cloth would worsen the terms of trade of the home country as the home country exports. On the other hand, if the home country’s production grows in favor of wheat, the terms of trade would improve in favor of the home country. This is because wheat is imported by the home country.30 Krugman/Obstfeld/Melitz •International Economics: Theory & Policy, Tenth Edition4. The difference from the standard diagram is that the indifference curves are right angles rather thansmooth curves. Here, a terms of trade increase enables an economy to move to a higher indifference curve. The income expansion path for this economy is a ray from the origin. A terms of tradeimprovement moves the consumption point further out along the ray.5. The terms of trade for Japan, a manufactures (M) exporter and a raw materials (R) importer, is the worldrelative price of manufactures in terms of raw materials (p M/p R). The terms of trade change can be determined by the shifts in the world relative supply and demand (manufactures relative to raw materials) curves. Note that in the following answers, world relative supply (RS) and relative demand (RD) are always M relative to R. We consider all countries to be large, such that changes affect the worldrelative price.a. An oil supply disruption from the Middle East decreases the supply of raw materials, whichincreases the world relative supply of manufactures to raw materials. The world relative supplycurve shifts out, decreasing the world relative price of manufactured goods and deterioratingJapan’s terms of trade.b. Korea’s increased automobile production increases the supply of manufactures, which in creasesthe world RS. The world relative supply curve shifts out, decreasing the world relative price ofmanufactured goods and deteriorating Japan’s terms of trade.c. U.S. development of a substitute for fossil fuel decreases the demand for raw materials. Thisincreases world RD, and the world relative demand curve shifts out, increasing the world relative price of manufactured goods and improving Japan’s terms of trade. This occurs even if no fusion reactors are installed in Japan because world demand for raw materials falls.d. A harvest failure in Russia decreases the supply of raw materials, which increases the world RS.The world relative supply curve shifts out. Also, Russia’s demand for manufactures decreases,which reduces world demand so that the world relative demand curve shifts in. These forcesdecrease the world relative price of manufactured goods and deteriorate Japan’s terms of trade.e. A reduction in Japan’s tariff on raw materials will raise its internal relative price of manufactures(p M/p R). This price change will increase Japan’s RS and decrease Japan’s RD, which increases the world RS and decreases the world RD (i.e., world RS shifts out and world RD shifts in). The worldrelative price of manufactures declines, and Japan’s terms of tr ade deteriorate.6. The declining price of services relative to manufactured goods shifts the isovalue line clockwise sothat relatively fewer services and more manufactured goods are produced in the United States, thus reducing U.S. welfare.Chapter 6 The Standard Trade Model 31 7. These results acknowledge the biased growth that occurs when there is an increase in one factor ofproduction. An increase in the capital stock of either country favors production of good X, while an increase in the labor supply favors production of good Y. Also, recognize the Heckscher-Ohlin result that an economy will export that good that uses intensively the factor which that economy has in relative abundance. Country A exports good X to country B and imports good Y from country B. The possibility of immiserizing growth makes the welfare effects of the terms of trade improvement due to export-biased growth ambiguous. Import-biased growth unambiguously improves welfare for the growing country.a. The relative price of good X falls, causing country A’s terms of trade to worsen. A’s welfare mayincrease or, less likely, decrease, and B’s welfare increases.b. The relative price of good Y rises, causing A’s terms of trade to improve. A’s welfare increases,and B’s welfare decreases.c. The relative price of good X falls, causing country B’s terms of trade to improve. B’s welfareincreases, and A’s welfare decreases (they earn less for the same quantity of exports).d. The relative price of good X rises, causing country B’s terms of trade to worsen. B’s welfare mayi ncrease or, less likely, decrease, and A’s welfare increases.8. Immiserizing growth occurs when the welfare deteriorating effects of a worsening in an economy’sterms of trade swamp the welfare improving effects of growth. For this to occur, an economy must undergo very biased growth, and the economy must be a large enough actor in the world economy such that its actions spill over to adversely alter the terms of trade to a large degree. This combination of events is unlikely to occur in practice.9. India opening its markets to world trade should be good for the United States if the change reducesthe relative price of goods that China sends to the United States and hence increases the relative price of goods that the United States exports. Obviously, any sector in the United States hurt by trade with China would be hurt again by India, but on net, the United States wins. Note that here we are making different assumptions about what India produces and what is tradable than we are in Question 6. Here we are assuming India exports products that the United States currently imports and China currently exports. China will lose by having the relative price of its export good driven down by the increased production in India.10. An import tariff makes the imported goods more expensive in the domestic market as compared tothe world market. In a two commodity system e.g. food and cloth, an imposition of import tariff on cloth makes the cloth more expensive for people in the domestic market. Eventually, the internal price of food is cheaper than the relative price in the external market. This pushes the domesticproducers to produce cloth as the relative price is higher. The home consumers shift theirconsumption from cloth to food. Hence, the relative supply of food will fall and the relative demand will increase. With an increase in the world’s relative price for food the homes terms of trade also increases.Similarly, an export subsidy on food makes the opposite effect on the relative supply and demand than the import tariff on cloth. The effect is that the relative supply of food rises while the relative demand for the world declines. Hence, this reduces the home’s terms of trade as the relative price of food falls in the world market.32 Krugman/Obstfeld/Melitz •International Economics: Theory & Policy, Tenth EditionThe parties emphasize on the reduction of tariff to increase its trade with the partner country under the free trade agreements. When a tariff is reduced by both the partner countries, it increases the trade volume between the two countries. The reduction of tariff and free flow of commodities between the partner countries reduces the market price of the commodity and increases the purchasing power of the consumers in both countries. The agreement on the reduction of tariff is bilateral, meaning both countries agree to reduce the tariff, which ultimately increases the terms of trade for both.11. When a country borrows for the present consumption, it is liable to make the payment in future bysacrificing its future consumption. This means, in future the country has to return the principalborrowing amount with some interest rate. If a country borrows 1 unit at present, it has to return (1+ r) times in future, where r is the real interest rate. Hence, the relative price of future consumption is1/(1+r). This shows there is an inverse relation between the interest rate and the relative price offuture consumption. Higher the real interest rate, lower will be the relative price of futureconsumption and vice-versa.12. Comparative advantage in international borrowing and lending is driven by the relative price of futureconsumption and, more specifically, the real interest rate. As the real interest rate rises, the relative price of future consumption 1/(1 r) falls. Effectively, a country with a high real interest rate is one that has high returns on investment. Such a country will prefer to borrow today and take advantage of the high return on investment and enjoy the fruits of current investment with high returns in the future.a. Countries like Argentina and Canada should have high real interest rates as there are largeinvestment opportunities that have yet to be exploited. These countries will have a low price offuture consumption and will be biased toward exporting future consumption, preferring toborrow today.b. Countries like the United Kingdom in the 19th century or the United States today will haverelatively lower real interest rates as they already have a high level of capital and limited returnson new investments. As a result, the relative price of future consumption is high, and they will be biased toward exporting present consumption, preferring to lend today.c. The discovery of large oil reserves that do not require a significant investment to extract will causereal interest rates in Saudi Arabia to fall (large increase in wealth). This will cause the relativeprice of future consumption to rise, making it more likely that Saudi Arabia will have a PPFbiased toward exporting present consumption. Saudi Arabia will increase their current lending as a result of these oil discoveries.d. Oil discovered in Norway that requires a significant investment to extract will have the oppositeeffect as in answer c. This oil cannot turn into wealth until a significant investment is made, soreal interest rates in Norway will rise with this increased demand for investment funds. Higher real interest rates drive the relative price of future consumption down. As a result, Norway will bemore likely to export future consumption, borrowing today.e. High levels of productivity in South Korea imply that South Korean real interest rates are highgiven the lucrative investment opportunities in the country. As in answer d, higher real interestrates should drive the relative price of future consumption down and bias South Korea’sintertemporal PPF toward exporting future consumption.。

第一章练习与答案1.为什么说在决定生产和消费时,相对价格比绝对价格更重要?答案提示:当生产处于生产边界线上,资源则得到了充分利用,这时,要想增加某一产品的生产,必须降低另一产品的生产,也就是说,增加某一产品的生产是有机会机本(或社会成本)的。

生产可能性边界上任何一点都表示生产效率和充分就业得以实现,但究竟选择哪一点,则还要看两个商品的相对价格,即它们在市场上的交换比率。

相对价格等于机会成本时,生产点在生产可能性边界上的位置也就确定了。

所以,在决定生产和消费时,相对价格比绝对价格更重要。

2.仿效图1—6和图1—7,试推导出Y商品的国民供给曲线和国民需求曲线。

答案提示:3.在只有两种商品的情况下,当一个商品达到均衡时,另外一个商品是否也同时达到均衡?试解释原因。

答案提示:4.如果生产可能性边界是一条直线,试确定过剩供给(或需求)曲线。

答案提示:5.如果改用Y商品的过剩供给曲线(B国)和过剩需求曲线(A 国)来确定国际均衡价格,那么所得出的结果与图1—13中的结果是否一致?答案提示:国际均衡价格将依旧处于贸易前两国相对价格的中间某点。

6.说明贸易条件变化如何影响国际贸易利益在两国间的分配。

答案提示:一国出口产品价格的相对上升意味着此国可以用较少的出口换得较多的进口产品,有利于此国贸易利益的获得,不过,出口价格上升将不利于出口数量的增加,有损于出口国的贸易利益;与此类似,出口商品价格的下降有利于出口商品数量的增加,但是这意味着此国用较多的出口换得较少的进口产品。

对于进口国来讲,贸易条件变化对国际贸易利益的影响是相反的。

7.如果国际贸易发生在一个大国和一个小国之间,那么贸易后,国际相对价格更接近于哪一个国家在封闭下的相对价格水平?答案提示:贸易后,国际相对价格将更接近于大国在封闭下的相对价格水平。

8.根据上一题的答案,你认为哪个国家在国际贸易中福利改善程度更为明显些?答案提示:小国。

9*.为什么说两个部门要素使用比例的不同会导致生产可能性边界曲线向外凸?答案提示:第二章答案1.根据下面两个表中的数据,确定(1)贸易前的相对价格;(2)比较优势型态。

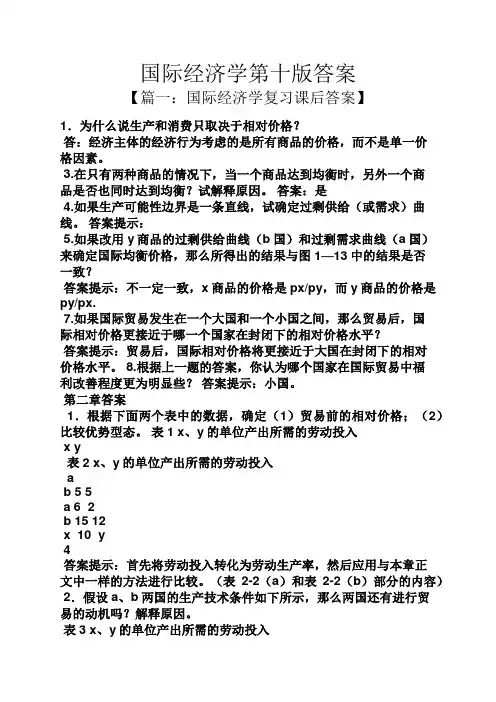

国际经济学第十版答案【篇一:国际经济学复习课后答案】1.为什么说生产和消费只取决于相对价格?答:经济主体的经济行为考虑的是所有商品的价格,而不是单一价格因素。

3.在只有两种商品的情况下,当一个商品达到均衡时,另外一个商品是否也同时达到均衡?试解释原因。

答案:是4.如果生产可能性边界是一条直线,试确定过剩供给(或需求)曲线。

答案提示:5.如果改用y商品的过剩供给曲线(b国)和过剩需求曲线(a国)来确定国际均衡价格,那么所得出的结果与图1—13中的结果是否一致?答案提示:不一定一致,x商品的价格是px/py,而y商品的价格是py/px.7.如果国际贸易发生在一个大国和一个小国之间,那么贸易后,国际相对价格更接近于哪一个国家在封闭下的相对价格水平?答案提示:贸易后,国际相对价格将更接近于大国在封闭下的相对价格水平。

8.根据上一题的答案,你认为哪个国家在国际贸易中福利改善程度更为明显些?答案提示:小国。

第二章答案1.根据下面两个表中的数据,确定(1)贸易前的相对价格;(2)比较优势型态。

表1 x、y的单位产出所需的劳动投入x y表2 x、y的单位产出所需的劳动投入ab 5 5a 6 2b 15 12x 10 y4答案提示:首先将劳动投入转化为劳动生产率,然后应用与本章正文中一样的方法进行比较。

(表2-2(a)和表2-2(b)部分的内容) 2.假设a、b两国的生产技术条件如下所示,那么两国还有进行贸易的动机吗?解释原因。

表3 x、y的单位产出所需的劳动投入x ya 4 2b 8 4答案提示:从绝对优势来看,两国当中a国在两种产品中都有绝对优势;从比较优势来看,两国不存在相对技术差异。

所以,两国没有进行国际贸易的动机。

3.如果一国在某一商品上具有绝对优势,那么也必具有比较优势吗?答案提示:不一定,比较优势的确定原则是两优取最优,两劣取最劣。

5.假设某一国家拥有20,000万单位的劳动,x、y的单位产出所要求的劳动投入分别为5个单位和4个单位,试确定生产可能性边界方程。

Chapter 5Resources and Trade: The Heckscher-Ohlin Model⏹Chapter OrganizationModel of a Two-Factor EconomyPrices and ProductionChoosing the Mix of InputsFactor Prices and Goods PricesResources and OutputEffects of International Trade between Two-Factor EconomiesRelative Prices and the Pattern of TradeTrade and the Distribution of IncomeCase Study: North-South Trade and Income InequalityCase Study: Skill-Biased Technological Change and Income InequalityFactor-Price EqualizationEmpirical Evidence on the Heckscher-Ohlin ModelTrade in Goods as a Substitute for Trade in Factors: Factor Content of TradePatterns of Exports between Developed and Developing CountriesImplications of the TestsSummaryAPPENDIX TO CHAPTER 5: Factor Prices, Goods Prices, and Production Decisions Choice of TechniqueGoods Prices and Factor PricesMore on Resources and Output⏹Chapter OverviewIn Chapter 3, trade between nations was motivated by differences internationally in the relative productivity of workers when producing a range of products. In Chapter 4, the Specific Factors model considered additional factors of production, but only labor was mobile between sectors. In Chapter 5, this analysis goes a step further by introducing the Heckscher-Ohlin theory.The Heckscher-Ohlin theory considers the pattern of production and trade that will arise when countries have different endowments of such factors of production as labor, capital, and land and where these factors are mobile between sectors in the long run. The basic point is that countries tend to export goods that are22 Krugman/Obstfeld/Melitz •International Economics: Theory & Policy, Tenth Editionintensive in the factors with which they are abundantly supplied. Trade has strong effects on the relative earnings of resources and, according to theory, leads to equalization across countries of factor prices. These theoretical results and related empirical findings are presented in this chapter.The chapter begins by developing a general equilibrium model of an economy with two goods that are each produced using two factors according to fixed coefficient production functions. The assumption of fixed coefficient production functions provides an unambiguous ranking of goods in terms of factor intensities. (A more realistic model allowing for substitution between factors of production is presented later in the chapter with the same conclusions.) Two important results are derived using this model. The first is known as the Rybczynski effect. Increasing the relative supply of one factor, holding relative goods prices constant, leads to a biased expansion of production possibilities favoring the relative supply of the good that uses that factor intensively.The second key result is known as the Stolper-Samuelson effect. Increasing the relative price of a good, holding factor supplies constant, increases the return to the factor used intensively in the production of that good by more than the price increase, while lowering the return to the other factor. This result has important income distribution implications.It can be quite instructive to think of the effects of demographic/labor force changes on the supply of different products. For example, how might the pattern of production during the productive years of the “Baby Boom” generation differ from the pattern of production for post–Baby Boom generations? What does this imply for returns to factors and relative price behavior? What effect would a more restrictive immigration policy have on the pattern of production and trade for the United States?The central message concerning trade patterns of the Heckscher-Ohlin theory is that countries tend to export goods whose production is intensive in factors with which they are relatively abundantly endowed. Comparing the United States and Mexico, for example, we observe a relative abundance of capital in the United States and a relative abundance of labor in Mexico. Thus, goods that intensively use capital in production should be cheaper to produce in the United States, and those that intensively use labor should be cheaper to produce in Mexico. With trade, the United States should export capital-intensive goods like computers, while Mexico should export labor-intensive goods like textiles. With integrated markets, international trade should lead to a convergence of goods prices. Thus, the prices of capital-intensive goods in the United States and labor-intensive goods in Mexico will rise. According to the Stolper-Samuelson effect, owners of a country’s abundant factors (e.g., capital owners in the United States, labor in Mexico) will gain from trade, while owners of the country’s scarce fact ors (labor in the United States, capital in Mexico) will lose from trade. The extension of this result is the Factor Price Equalization theorem, which states that trade in goods (and thus price equalization of goods) will lead to an equalization of factor prices. These income distribution effects are more or less permanent, given that factor abundances do not quickly change within a country. Theoretically, the gains from trade could be redistributed such that everyone is better off; however, such a plan is difficult to implement in practice. The political implications of factor price equalization should be interesting to students.After presenting the basic theory behind the Heckscher-Ohlin theory, the rest of the chapter examines empirical tests of the model, beginning with a pair of case studies looking at income inequality in the United States. Wages paid to skilled workers in the United States have been rising at a much faster rate than those paid to unskilled workers over the past few decades. At the same time, there has been a large increase in international trade. Given that the United States is relatively abundant in skilled labor, the Heckscher-Ohlin theory would predict that increased trade should lead to higher wages for skilled workers and lower wages for unskilled workers. On the surface, this appears to be an empirical confirmation of the theory. However, other studies argue that rising wage inequality can only partially be explained by increased trade. According to the Heckscher-Ohlin model, the increase in skilled wages should be driven by an increase in the price of skill-intensive goods following trade. However, skill-intensive goods prices have not increasedChapter 5 Resources and Trade: The Heckscher-Ohlin Model 23 by nearly the same proportion as skilled wages. If rising wage inequality in a rich country like the United States is driven by factor price equalization, then we should also observe a narrowing gap in developing countries that are exporting low-skill intensive goods. However, income inequality in these nations is actually larger than in rich countries. Finally, trade between rich and poor nations is simply not large enough to be entirely responsible for the size of the income gap. Rather, the increasing skill premium is most likely due to skill-biased technical innovations like computers that have increased the productivities of skilled workers more than that of unskilled workers.Another empirical observation testing the validity of the Heckscher-Ohlin theory is the Leontief paradox. This is the observation that the capital intensity of U.S. exports is actually lower than that of U.S. imports, exactly the opposite of what the theory would predict for a capital abundant country. Further evidence of this paradox is found in global data, with a country’s factor abundance doing a relatively poor job of predicting its trade patterns. Finally, the theory predicts a much larger volume of trade (given observed differences in factor endowments) than we actually see in the data. A country like China, for example, has a significant abundance in labor. H owever, China’s net exports of labor-intensive goods are lower than what the theory would predict. Similarly, U.S. net imports of labor-intensive goods are lower than what would be expected given its relative labor scarcity. An explanation for this “missing trade” is that the assumption of identical technology across countries is flawed. Rather, there are significant differences in productivity across countries. That said, when the sample is restricted to trade between developed and developing countries (i.e., North-South trade), the Heckscher-Ohlin theory fits well. This is clearly seen in Figure 5-12, with low-skill countries like Bangladesh, Cambodia, and Haiti exporting products that are considerably less skill-intensive than the exports of more developed nations like France, Germany, and the United Kingdom. We can also see this pattern of trade changing as countries develop, as evidenced by the increasing skill intensity of Chinese exports following China’s increased growth and development. These observations have motivated many economists to consider motives for trade between nations that are not exclusively based on differences across countries. These concepts will be explored in later chapters. Despite these shortcomings, important and relevant results concerning income distribution are obtained from the Heckscher-Ohlin theory.⏹Answers to Textbook Problems1. a. The first step is to compute the opportunity costs of both cloth and food. We are given thefollowing resource constraints:a KC=2, a LC=2, a KF=3, a LF=1L =2,000; K =3,000Each unit of cloth is produced with 2 units of capital and 2 units of labor. Each unit of food isproduced with 3 units of capital and 1 unit of labor. Furthermore, the economy is endowed with2,000 units of labor and 3,000 units of capital. Given these values, we can define the followingresource constraints:2Q C + Q F≤ 2,000 → Labor constraint2Q C+ 3Q F≤ 3,000 → Capital constraintSolve these two constraints for the quantity of food produced:Q F≤ 2,000 - 2Q CQ F≤ 1,000 - 2/3Q CThis gives us two budget constraints for food production that must both be met. The productionpossibilities frontier traces out these budget constraints for food and cloth production.24 Krugman/Obstfeld/Melitz •International Economics: Theory & Policy, Tenth EditionLooking at the diagram, we see that production of both food and cloth will take place when therelative price of cloth is between the two opportunity costs of cloth. The opportunity cost of cloth is given by the slopes of the two components of the production possibilities frontier above, 2/3and 2. When cloth production is low, the economy will be using relatively more labor to produce cloth, and the opportunity cost of cloth is 2/3 a unit of food. However, as cloth production rises,the economy runs scarce on labor and must take capital away from food production, raising theopportunity cost of cloth to 2 units of food.As long as the relative price of cloth lies between 2/3 and 2 units of food, the economy will produce both goods. If the price of cloth falls below 2/3, then the economy should completely specialize in food production (too low a compensation for producing cloth). If the price of cloth rises above 2, complete specialization in cloth will occur (too low a compensation for producing food).b. Note the input requirements for each good. One unit of cloth can be produced using 2 units ofcapital and 2 units of labor. One unit of food is produced using 3 units of capital and 1 unit oflabor. In a competitive market, the unit cost of each good must be equal to the output price.Q C= 2K+ 2L→P C= 2r+ 2wQ F= 3K+L→P F= 3r+wThis gives us two equations and two unknowns (r and w). Solve for the factor prices:w=P F- 3rP C= 2r+ 2(P F- 3r) = 2r+ 2P F- 6r= 2P F- 4r***r= (2P F-P C)/4***w= (3P C- 2P F)/4c. Looking at the two expressions in part (b), we see that an increase in the price of cloth will causethe rental rate of capital to fall and the wage rate to laborers to rise. This makes sense, as cloth isa labor-intensive good. An increase in its price will lead to greater production of cloth and anincrease in demand for the factor it uses intensively—labor.d. The capital stock increases to 4,000. The labor constraint will remain unchanged, keeping themaximum price of cloth at 2 units of food. The new capital constraint is given by:2Q C+ 3Q F≤ 4,000Solving for Q F yields:Q F≤ 1,333 - 2/3Q CThus, the minimum price of cloth is also unchanged at 2/3 units of food. The only difference now is that the production possibilities frontier will have a larger horizontal intercept (if cloth is on the horizontal axis). Compared to Figure 5-1, the new production possibilities frontier will interceptthe x-axis at 2,000 instead of 1,500.e. The actual production point for cloth and food will depend on the relative prices of cloth and food.If we assume that the economy is producing at a point such that all resources are being utilized(point 3 in Figure 5-1), then we can compute the quantities of cloth and food by setting the resource constraints equal to one another:Q F= 1,333 - 2/3Q C= 2,000 - 2Q C2Q C- 2/3Q C= 2,000 - 1,3334/3Q C= 667Q C= 500Q F= 1,333 - 2/3 ⨯ 500 = 1,000Chapter 5 Resources and Trade: The Heckscher-Ohlin Model 25f. Prior to the expansion of the capital stock, the economy was producing 750 units of cloth and500 units of food. After the expansion, cloth production fell to 500, while food productionincreased to 1,000. This is precisely what the Rybczynski effect predicts will happen.2.Abundance is defined in terms of a ratio not in terms of the absolute quantities. E.g. If the total amountof capital in Australia is three times that of New Zealand, but New Zealand would still be considered a capital abundant country since the Australia has more than three times the labour that of New Zealand.The definition of abundance is in relative terms by comparing the ratio of labour to capital in two countries. This means, if a country is abundant in labour in comparison to other country, then it cannot be abundant in capital in comparison to the same country. Hence, no country is abundant in both labour and Capital.a.Capital labour ratio in Australia is =90000/45 = 2000 Capital labour ratio in Malaysia is=75000/30 = 2500Malaysia has more capital per labour. The greater capital labour ratio of Malaysia shows this is the capital abundant country.b.Australia has the comparative advantage in the production of cloth. The opportunity cost ofproducing the cloth by Australia is lower than that of Malaysia. According to the Heckscher-Ohlin Theorem, Australia has the comparative advantage in the production of cloth because they are relatively well endowed than Malaysia. Australia would export cloth to Malaysia.3. This question is similar to an issue discussed in Chapter4. What matters is not the absolute abundance of factors but their relative abundance. Poor countries have an abundance of labor relative to capital when compared to more developed countries. For example, consider a large, rich country like the United States and a small, poor country like Guatemala. Though the United States has more land, natural resources, capital, and labor than Guatemala, what matters for trade is the relative abundance of these factors. The ratio of labor to capital is likely to be much higher in Guatemala than in the United States, reflecting a relative scarcity of capital in Guatemala and abundance in the United States. This makes labor relatively cheaper and capital more expensive in Guatemala than in the United States. Notice that this difference in factor prices is not driven by how much labor Guatemala has compared to the United States, but by the proportion of labor to other factors within each country.4. In the Ricardian model, labor gains from trade through an increase in its purchasing power. This result does not support labor union demands for limits on imports from less affluent countries. The Heckscher-Ohlin model directly addresses distribution effects by considering how trade impacts the owners of factors of production. In the context of this model, unskilled U.S. labor loses from trade because this group represents the relatively scarce factors in this country. The results from the Heckscher-Ohlin model support labor union demands for import limits. This is a rational policy as labor unions representing unskilled workers are hurt directly by trade that favors the export of skill-intensive goods (and import of low-skill goods). However, the unions may be better served lobbying for resources to increase skill levels among its membership, given that the gains from trade overall will exceed the losses to a particular sector.26 Krugman/Obstfeld/Melitz •International Economics: Theory & Policy, Tenth Edition5. Specific programmers may face wage cuts due to the competition from India, but this is not inconsistentwith skilled labor wages rising. By making programming more efficient in general, this development may have increased wages for others in the software industry or lowered the prices of the goods overall.In the short run, though, it has clearly hurt those with sector-specific skills who will face transition costs.There are many reasons to not block the imports of computer programming services (or outsourcing of these jobs). First, by allowing programming to be done more cheaply, it expands the production possibilities frontier of the United States, making the entire country better off on average. Necessary redistribution can be done, but we should not stop trade that is making the nation as a whole better off.In addition, no one trade policy action exists in a vacuum, and if the United States blocked theprogramming imports, it could lead to broader trade restrictions in other countries.6. The factor proportions theory states that countries export those goods whose production is intensivein factors with which they are abundantly endowed. One would expect the United States, whichhas a high capital/labor ratio relative to the rest of the world, to export capital-intensive goods if the Heckscher-Ohlin theory holds. Leontief found that the United States exported labor-intensive goods.Bowen, Leamer, and Sveikauskas found, for the world as a whole, the correlation between factor endowment and trade patterns to be tenuous. The data do not support the predictions of the theory that countries’ exports and imports reflect th e relative endowments of factors.7. The factor price equalization is based on the fact that free trade would lead to the convergence of wages between these countries. The theory says that when trade between two countries resumes, the relative prices of the goods converge, this converge in turn, causes the convergence of the relative prices of capital and labor. This says that when two countries are engaged in trading the goods, in an indirect way these two countries are in effect trading the factors of production. In other words, a country in abundant in labor is trading the goods produced in high ratio of labor to capital for goods produced with a low labor capital ratio. That means the country is exporting the labor and importing the capital. This says that the trade leads to the equalization of two countries factor prices.But practically, in the real world, factor prices are not equalized. Mainly, the wage rates in the developing countries are substantially lower than that of the developed countries. This may be due to the following reasons. First, the difference is may be due to the difference in the quality of labor. Second, the countries operate in different technologies of production even for the same products. Third, in the real world the prices are not fully equalized by the international trade. Fourth, many countries do not involve sufficiently in the production which relatively involve more abundant factors. Some countries even with higher labor to capital ratio involve more in the capital intensive technology. The factor price equalization does not occur if the countries involved in trading of their relative scarce resource used products. In the real world situation one or more of these factors mentioned above arises in international trade, hence the difference in wages across countries.。

参考答案第一章导论1.什么是国际贸易?它的研究对象是什么?答:国际也叫世界贸易,是指国际间的货物和服务的交换。

它包含着有形产品(实物产品)的交换,也包含有无形产品(劳务、技术、咨询等)的交换。

传统的国际贸易,仅指国际间各类货物的交换,不包含服务;现代的国际贸易是指世界各国(地区)之间货物和服务的交换。

国家贸易是一门研究国际间商品和劳务的产生、发展和贸易效果,揭示其特点、运动规律的学科,其研究对象和内容大体包括两个方面:国际贸易理论与国际贸易实务。

2.国际贸易和对外贸易有何关系?答:国际贸易也叫世界贸易,是指国际间的货物和服务的交换。

它包含着有形产品(实物产品)的交换,也包含有无形产品(劳务、技术、咨询等)的交换。

传统的国际贸易,仅指国际间各类货物的交换,不包含服务;现代的国际贸易是指世界各国(地区)之间货物和服务的交换。

对外贸易是指一个国家(地区)与另一个国家(地区)之间的货物与服务的交换活动。

有一些海岛国家,如英国、日本等,将对外贸易称为“海外贸易”。

国际贸易与对外贸易同属一类活动,只是从全世界范围看时,称其为国际贸易,而从一个国家或地区的角度看时,则称其为对外贸易。

3.贸易顺差和贸易逆差的含义是什么?如何正确看待贸易顺差和贸易逆差?答:贸易差额是衡量一个国家对外贸易状况的重要指标之一。

当出口总值大于进口总值时,称为贸易顺差、贸易盈余或出超;当出口总值小于进口总值时,称为贸易逆差、贸易赤字或入超。

当一国出现贸易顺差时,反映这个国家在对外贸易收支上处于有利地位;当一国出现贸易逆差时,反映这个国家在对外贸易收支上处于不利地位;不过长期顺差不一定是好事,逆差也并非绝对是坏事,从长期趋势来看,一国的进出口贸易应该基本保持平衡。

4.直接贸易和间接贸易、转口贸易和过境贸易的区别是什么?答:直接贸易是商品生产国与商品消费国不通过第三国而直接买卖商品的贸易活动。

直接贸易的双方直接谈判,直接签约,直接结算,货物直接运输。