(完整版)中级宏观经济学付费版题库4经济增长Ⅰ

- 格式:doc

- 大小:60.10 KB

- 文档页数:27

宏观经济学试卷试题题库及答案《宏观经济学》试题一一、单项选择题1、宏观经济学的中心理论是()A、价格决定理论;B、工资决定理论;C、国民收入决定理论;D、汇率决定理论。

2、表示一国在一定时期内生产的所有最终产品和劳务的市场价值的总量指标是()A、国民生产总值;B、国内生产总值;C、名义国民生产总值;D、实际国民生产总值。

3、GNP核算中的劳务包括()A、工人劳动;B、农民劳动;C、工程师劳动;D、保险业服务。

4、实际GDP等于()A、价格水平除以名义GDP;B、名义GDP除以价格水平;C、名义GDP乘以价格水平;D、价格水平乘以潜在GDP。

5、从国民生产总值减下列项目成为国民生产净值()A、折旧;B、原材料支出;C、直接税;D、间接税。

6、从国民生产净值减下列项目在为国民收入()A、折旧;B、原材料支出;C、直接税;D、间接税。

二、判断题1、百姓生产总值中的最终产品是指有形的物质产品。

()2、今年建成并出售的房屋和去年建成而在今年出售的房屋都应计入今年的国民生产总值。

()3、同样的打扮,在生产中作为工作服就是中间产品,而在日常糊口中穿就是最终产品。

()4、百姓生产总值一定大于国内生产总值。

()5、居民购房支出属于个人消费支出。

()6、从理论上讲,按支出法、收入法和部门法所计算出的国民生产总值是一致的。

()7、所谓净出口是指出口减进口。

()8、在三部门经济中如果用支出法来计算,GNP等于消费+投资+税收。

()三、简答题1、比较实际国民生产总值与名义国民生产总值。

2、比较百姓生产总值与人均百姓生产总值。

3、为什么住房建筑支出作为投资支出的一部分?4、假定A为B提供服务应得报酬400美元,B为A提供服务应得报酬300美元,AB商定相互抵消300美元,结果A只收B100美元。

应如何计入GNP?(一)答案一、C、A、D、B、A、D;二、错、错、对、错、错、对、对、错;三、1、实际国民生产总值与名义国民生产总值的区别在于计算时所用的价格不同。

一、单选题1、经济增长一般用()指标表示。

A.平均工资B.GDP或人均GDPC.平均预期寿命D.财政收入正确答案:B2、Yt表示t时期的总产出,Yt-1表示(t-1)时期的总产出,则t-1期到t期的经济增长率可以表示为()。

A.Yt / Yt-1B.(Yt - Yt-1)/ YtC.(Yt - Yt-1)/ Yt-1D.Yt - Yt-1正确答案:C3、根据关于经济增长计算的70法则,若人均实际GDP年增长率为1%,则初始的GDP值翻一番的时间大约为()。

A.70年B.50年C.100年D.35年正确答案:A4、在总量生产函数Y=AF(K,L)中,A表示()。

A.资本B.劳动C.技术进步D.劳动力正确答案:C5、根据人均资本生产函数图,随着人均资本水平提高,人均GDP水平将()。

A.随之提高B.随之减少C.保持不变D.无法确定正确答案:A6、影响产出变化的实物资本不包括()。

A.机器B.设备C.厂房D.人才正确答案:D7、在总生产函数中,技术进步因素包括()。

A.管理流程的改善B.产品质量提高C.企业结构升级D.以上都对正确答案:D8、在每名工人的人力资本与技术水平保持不变的情况下,每增加1单位的实物资本,带来的产出增长数量()。

A.递增B.递减C.保持不变D.先递减后递增正确答案:B9、除了劳动、资本投入对经济增长的贡献外,()也是一国经济增长的关键因素。

A.全要素生产率的提高B.政治制度C.地理位置D.国土面积正确答案:A10、在同样的人均资本水平上,()是推动人均产出水平不断提升的关键。

A.自然资源禀赋B.技术进步C.人口总数D.国土面积正确答案:B11、新古典经济增长理论模型重要的结论为:()是长期人均实际GDP增长的关键。

A.生产率增长B.国土面积C.人口总数D.自然资源禀赋正确答案:A12、相对于内生经济增长模型,新古典经济增长模型对于技术的理解是()。

A.技术水平是不变的B.技术是内生的C.技术是外生的D.没有考虑技术因素正确答案:C13、2018年诺贝尔经济学奖获得者之一保罗.罗默可以作为()的创始人,他认为技术变革速度是受市场体系内在运行决定的,知识资本的积累是经济增长的关键因素。

Name: __________________________ Date: _____________1. When a government spends more than it collects in taxes, it runs a:A) trade deficit.B) trade surplus.C) budget surplus.D) budget deficit.2. Government debt equals the:A) difference between current government purchases and taxes.B) difference between saving and investment.C) sum of past budget deficits and surpluses.D) M1 money supply.3. The amount by which government spending exceeds government revenues is called the______, and the accumulation of past government borrowing is called the ______.A) deficit; debtB) debt; deficitC) devaluation; deflationD) deflation; devaluation4. The government budget deficit is the ______, and government debt is the ______.A) amount by which imports exceed exports; amount by which government spendingexceeds government revenueB) amount by which government spending exceeds government revenue; amount bywhich imports exceed exportsC) amount by which government spending exceeds government revenue;accumulation of past government borrowingD) accumulation of past government borrowing; amount by which governmentspending exceeds government revenue5. If the debt of the U.S. federal government in 2008 was divided equally among thepeople in the United States, then the debt per person would equal approximately:A) $3,500.B) $35,000.C) $53,000.D) $153,000.6. Compared to the size of government debt as a percentage of GDP in other majorindustrial countries, the federal government of the United States:A) is one of the most heavily indebted governments.B) has accumulated a relatively small debt.C) has accumulated somewhat greater than average debt.D) is one of the least indebted governments.7. Historically, the primary cause of increases in government debt is:A) printing too much money.B) cutting taxes.C) increasing interest rates.D) financing wars.8. The large increase in U.S. government debt between 1980 and 1995 was unusualbecause it occurred:A) during peacetime.B) during an extended recessionary period.C) without increased government spending.D) without tax cuts.9. Relative to the size of GDP, the U.S. federal government debt was at its maximum:A) at the end of the Revolutionary War.B) at the end of the Civil War.C) at the end of World War II.D) following the 9/11 terrorist attacks in 2001.10. Holding other factors constant, the ratio of government debt to GDP can decrease as aresult of any of the following changes except:A) decreases in government spending.B) increases in GDP.C) decreases in tax revenues.D) decreases in transfer payments.11. If government debt is not changing, then:A) the economy is at long-run equilibrium.B) the government's budget must be balanced.C) GDP must equal the natural rate of output.D) capital per worker is constant.12. The factors most responsible for forecasts of the U.S. government debt spiraling out ofcontrol in the next half century are the projected:A) slowdowns in the rates of technological change and human capital growth.B) decrease in high-skilled domestic workers and the increase in immigration oflow-skilled workers into the United States.C) aging of the U.S. population and rising health care costs.D) increase in international competition and the outsourcing of U.S. jobs.13. An increase in the elderly population of a country affects fiscal policy most directlybecause:A) the elderly generally are not required to pay taxes.B) governments provide pensions and health care for the elderly.C) the elderly favor high interest rates on their savings.D) governments spend more on education as the proportion of the elderly increases.14. Which of the following is the most likely explanation of the August 2011 decision byStandard and Poor's to reduce its credit rating on U.S. government bonds?A) A U.S. government debt default was not a likely outcome, but was a possibility tooccur in the short term.B) The U.S. government budget deficit was too large.C) Strategies to reduce predicted U.S. government future budget deficits did notappear likely, making default a possibility.D) Foreign governments were no longer willing to lend to the U.S. government.15. In a time of inflation when the government budget is balanced in the conventional sense,the real (i.e., deflated) value of the government debt is:A) growing at the rate of inflation.B) growing, but at a rate less than the rate of inflation.C) constant.D) decreasing at the rate of inflation.16. In a time of inflation when the real (i.e., deflated) value of the government debt isconstant, then the conventionally:A) reported government budget will show a deficit equal to the inflation rate times theoutstanding debt.B) reported government budget will show a deficit equal to less than the inflation ratetimes the outstanding debt.C) reported government budget will be balanced.D) measured government budget will show a surplus equal to the inflation rate timesthe outstanding debt.17. Assume that the nominal interest rate is 11 percent, the inflation rate is 8 percent, andgovernment debt at the beginning of the year equals $4 trillion. By how much is the government budget deficit overstated as a result of inflation?A) $0.12 trillionB) $0.32 trillionC) $0.44 trillionD) $0.80 trillion18. A deficit adjusted for inflation should include only government spending used to make_____ interest payments.A) realB) nominalC) foreignD) domestic19. If the government debt, D, equals $5 trillion, the nominal interest rate is 7 percent, andthe real interest rate is 3 percent, then nominal budget deficit overstates the real deficit by $ ___ trillion.A) 0.35B) 0.20C) 0.15D) 0.0720. Current measures of the U.S. federal government's budget deficit account for all of thefollowing except:A) government expenditures.B) government revenues.C) changes in government indebtedness.D) changes in government capital assets.21. If capital budgeting procedures were employed, then a budget deficit would bemeasured as:A) the sum of government debt.B) the change in government debt.C) the change in government debt minus the change in government capital assets.D) the change in government capital assets.22. When the federal government incurs additional debt to acquire an asset, under currentbudgeting procedures the deficit ______, while under capital budgeting procedures the deficit ______.A) does not change; increasesB) increases; does not changeC) does not change; decreasesD) decreases; does not change23. Capital budgeting is a procedure that:A) adjusts the deficit for inflation.B) estimates what the deficit would be if the economy were operating at the naturalrate of output.C) accounts for assets as well as liabilities.D) measures the impact of fiscal policy on the lifetime incomes of individuals ofdifferent ages.24. Under capital budgeting, all of the following transactions would affect the federalbudget deficit except the federal government's:A) sending a check to a welfare recipient.B) sending a check to the state of Massachusetts.C) selling a highway to the state of New York and using the proceeds to retire federaldebt.D) selling an office building.25. The amount the government would owe if a borrower were to default on agovernment-guaranteed loan is an example of:A) capital budgeting.B) a contingent liability.C) a cyclically adjusted liability.D) Ricardian equivalence.26. One item that is considered part of the federal debt is:A) Treasury bills.B) future Social Security benefits.C) student loans, which may go into default.D) potential liabilities of savings and loan associations.27. The debt of the United States government is underreported in the view of manyeconomists because all of the following liabilities are excluded except:A) future pensions of government employees.B) debt owed to foreigners.C) future Social Security benefits.D) government guarantees of student loans.28. The cyclically adjusted budget deficit:A) adjusts the deficit for inflation.B) estimates what the deficit would be if the economy were operating at the naturalrate of output.C) accounts for assets as well as liabilities.D) measures the impact of fiscal policy on the lifetime incomes of individuals ofdifferent ages.29. An estimate of what government spending and tax revenue would be if the economywere operating at its natural rate of output and employment is called the ______ budget.A) cyclically adjustedB) inflation-adjustedC) capital-assetD) generational accounting30. Cyclically adjusted budgets are useful because they:A) systematically account for changes in government assets and liabilities.B) reflect policy changes, but not current economic conditions.C) account for tax burdens on different generations of taxpayers.D) correctly account for the impact of inflation on government indebtedness.31. Assume that a government has a balanced budget when the economy is at fullemployment. If the economy then enters a recession, with no change in tax or spending laws, then the budget of the government is most likely to:A) remain balanced.B) be in deficit.C) be in surplus.D) be in either deficit or surplus, depending on the severity of the recession.32. Each of the following changes would allow the measured budget deficit to provide atruer picture of fiscal policy except:A) correcting for the effects of inflation.B) offsetting changes in government liabilities with changes in government assets.C) excluding some liabilities altogether.D) correcting for the effects of the business cycle.33. Measuring the size of government debt is complicated by all of the following factorsexcept:A) inflation.B) uncounted liabilities.C) capital assets of the government.D) failure of the Office of Management and Budget to disclose figures on capitalexpenditures and credit programs.34. According to the traditional view of government debt, if taxes are cut without cuttinggovernment spending, then the long-run effects will be ______ steady-state capital and ______ consumption.A) higher; higherB) lower; lowerC) higher; lowerD) lower; higher35. According to the traditional view of government debt, if taxes are cut without cuttinggovernment spending, then the short-run effects will be:A) higher output and lower unemployment.B) higher output and higher unemployment.C) no change in output or unemployment.D) no change in output and higher unemployment.36. According to the traditional view of government debt, if taxes are cut without cuttinggovernment spending, then the international effect initially will be a capital ______ anda trade ______.A) inflow; deficitB) inflow; surplusC) outflow; deficitD) outflow; surplus37. According to the traditional view of government debt, if taxes are cut without a cut ingovernment spending, then in the United States this situation will lead to ______ net indebtedness on the part of the United States to foreign countries and ______ netexports.A) more; moreB) more; fewerC) less; fewerD) less; more38. The international impacts of a debt-financed tax cut, according to the traditional view ofgovernment debt, are a(n) ______ in net exports and a domestic currency _____.A) increase; appreciationB) increase; depreciationC) decrease; depreciationD) decrease; appreciation39. According to the traditional viewpoint of government debt, a tax cut without a cut ingovernment spending:A) stimulates consumer spending in the short run and reduces national saving.B) stimulates consumer spending in the short run and reduces private saving.C) has no effect on consumer spending but reduces national saving.D) has no effect on consumer spending but reduces private saving.40. According to the traditional viewpoint of government debt, a tax cut without a cut ingovernment spending:A) raises consumption in both the short run and the long run.B) lowers consumption in both the short run and the long run.C) raises consumption in the short run but lowers it in the long run.D) lowers consumption in the short run but raises it in the long run.41. According to the traditional view of government debt (as in the Mundell–Flemingmodel), if taxes are cut without cutting government spending, then the short-run effects are a(n) ______ of the dollar and a(n) ______ in net exports.A) appreciation; increaseB) appreciation; decreaseC) depreciation; increaseD) depreciation; decrease42. According to the traditional view of government debt (as in the IS–LM model), if taxesare cut without cutting government spending, then in the short run interest rates will ______ and investment will ______.A) increase; increaseB) increase; decreaseC) decrease; decreaseD) decrease; increase43. According to supply siders, tax cuts can raise total tax revenue if the tax cuts generatelarge enough:A) decrease in aggregate supply.B) increase in aggregate supply.C) decrease in the money supply.D) increase in the money supply.44. Government tax policy can affect aggregate supply as well as aggregate demand,because changes in taxes change the:A) supply of money in the economy.B) length of the inside lag of fiscal policy.C) incentives to work and invest.D) tradeoff between inflation and unemployment.45. Ricardian equivalence refers to the same impact of financing government:A) whether by printing money or raising taxes.B) in the long run as in the short run.C) whether by debt or taxes.D) in an open economy as in a closed economy.46. The logic of Ricardian equivalence implies that:A) tax cuts do not influence consumer spending but changes in government spendingdo.B) neither tax cuts nor changes in government spending affect consumer spending.C) tax cuts combined with future decreases in government spending will decreaseconsumer spending.D) if the government cuts taxes and increases current government spending, consumerspending will increase.47. According to the theory of Ricardian equivalence, if consumers are forward-looking,they will view a tax cut combined with no plans to reduce government spending as______, so their consumption will ______.A) additional disposable income; increase.B) additional disposable income; remain unchanged.C) a rescheduling of taxes into the future; increase.D) a rescheduling of taxes into the future; remain unchanged.48. According to the theory of Ricardian equivalence, tax cuts combined with no plans toreduce government spending ______ public saving and ______ private saving.A) reduce; reduceB) reduce; increaseC) increase; increaseD) increase; reduce49. A debt-financed tax cut will ______ saving in the traditional view and ______ saving inthe view of Ricardian equivalence.A) increase; increaseB) decrease; decreaseC) decrease; increaseD) decrease; not change50. A debt-financed tax cut will ______ current consumption in the traditional view and______ current consumption in the view of Ricardian equivalence.A) increase; increaseB) increase; decreaseC) increase; not changeD) decrease; decrease51. All of the following are arguments against Ricardian equivalence except:A) consumers make consumption decisions myopically.B) consumers are rational and forward-looking in consumption decision-making.C) consumers are borrowing-constrained.D) consumers do not expect future taxes to fall on them.52. Suppose a household considers only current income in making consumption decisions.This is an example of:A) Ricardian equivalence.B) the permanent-income hypothesis.C) myopia.D) the life-cycle model.53. The Ricardian view on fiscal policy makes less sense if people are:A) rational and practice foresight.B) shortsighted and not fully rational.C) able to plan for the future.D) able to borrow without constraint.54. In response to a tax cut, the consumption of a consumer who is borrowing-constrained______, whereas the consumption of a forward-looking, unconstrained consumer acting in accord with Ricardian equivalence ______.A) increases; increasesB) increases; remains unchangedC) remains unchanged; remains unchangedD) remains unchanged; increases55. When President George H. W. Bush lowered tax withholding in 1992 without loweringthe amount of taxes owed, surveys showed that:A) almost everyone spent the higher take-home pay.B) almost everyone saved the higher take-home pay.C) a majority of respondents said they would spend the higher take-home pay, but asignificant minority said they would save it.D) a majority of respondents said they would save the higher take-home pay, but asignificant minority said they would spend it.56. Given a reduction in income tax withheld, but no change in income tax owed,households that act according to Ricardian equivalence would ______ the extratake-home pay, while those facing binding borrowing constraints would ______ the extra-take home pay.A) spend; spendB) spend; saveC) save; saveD) save; spend57. Proponents of Ricardian equivalence argue that the relevant decision-making unit is the:A) individual.B) household.C) infinitely lived family.D) community.58. Proponents of Ricardian equivalence argue that if taxes are cut without cuttinggovernment spending and taxes are not expected to increase in the future until after an individual expects to be dead, then the individual will:A) spend all of the increase in income.B) spend some of the increase in income and save the rest.C) use the increase in income to buy government bonds to help finance the deficit.D) save all of the increase in income and leave it as a bequest to his or her children.59. From the Ricardian point of view, a consumer should not raise his or her consumptionwhen taxes are cut but government spending is not cut because:A) the government is going to raise taxes by exactly as much as the cut in the nextyear.B) the government is going to raise taxes by exactly as much as the cut plus interest inthe next year.C) the government is sure to raise taxes by an amount equal in present value to thedebt incurred this year, sometime in the taxpayer's lifetime.D) even if the government does not raise enough extra taxes during the taxpayer'slifetime to pay off, in present value, the debt incurred this year, the taxpayer shouldmake provision for the taxes that will be levied on his or her heirs.60. Assume that nobody cares about the economic well-being of future generations. Thenthe Ricardian equivalence view of the effect of debt-financed tax cuts is:A) totally invalid.B) still fully valid because the government has the option to levy taxes to pay off thefull debt in just a few years.C) still fully valid as long as the government cuts spending also.D) still partially valid because most of the taxpayers will live and pay taxes for asubstantial number of years after the tax cut.61. The strategic bequest motive hypothesizes that parents:A) leave bequests to children because they care about their children's well-being.B) leave bequests to children who are borrowing-constrained.C) make larger bequests the larger the quantity of taxes that will be shifted to theirchildren.D) use the threat of disinheritance to control their children's behavior.62. The experience of the 1980s:A) clearly contradicted the Ricardian equivalence view because national saving wasvery low.B) clearly supported the Ricardian equivalence view, for people saved little onlybecause they were optimistic, as confirmed by the stock market.C) will provide a clear answer on the validity of Ricardian equivalence as soon aseconomists are able to analyze it with their computers.D) may be used to argue both in favor of and against the Ricardian equivalence viewof the tax cuts.63. In the United States, having a balanced budget is currently enforced for:A) the federal government.B) no state governments.C) all state governments.D) many state governments.64. One reason for not requiring a balanced federal budget at all times is that with abalanced-budget rule:A) expenditures are not limited because, if the government wants to raiseexpenditures, it just raises taxes.B) in a recession even the automatic stabilizing powers of our system of taxes andtransfers could not work.C) the distorting features of the tax system are minimized.D) it is possible to shift the burden of a war from current to future generations.65. Tax smoothing is a desirable policy because it:A) reduces the distortions of incentives caused by taxes.B) reduces budget deficits in periods of recession.C) eliminates the impact of automatic stabilizers.D) is consistent with a balanced budget.66. One way to shift the tax burden from the current generation to future generations is tofinance a war:A) by raising taxes.B) by printing money.C) by running a budget surplus.D) by running a budget deficit.67. To minimize the disincentives of very high taxes, a policy of tax smoothing requires abudget ______ in years of unusually low government revenue and a budget ______ in years of unusually high government expenditures.A) surplus; deficitB) deficit; surplusC) surplus; surplusD) deficit; deficit68. Using fiscal policy, including automatic stabilizers, to stabilize output over a businesscycle is not consistent with:A) rational expectations.B) inflation targeting.C) the natural-rate hypothesis.D) a strict balanced-budget rule.69. A strict balanced-budget rule would:A) permit the use of fiscal policy for stabilization.B) allow the use of tax smoothing to reduce tax distortions.C) redistribute tax burdens across generations.D) restrain political incompetence and opportunism.70. Monetary policy is linked to fiscal policy when government spending is financed by:A) taxes.B) borrowing from banks.C) borrowing from foreigners.D) printing money.71. The real value of government debt is reduced by:A) expected inflation.B) expected deflation.C) unexpected inflation.D) unexpected deflation.72. Financing a budget deficit by ______ leads to inflation, and inflation ______ the realvalue of government debt.A) issuing debt; increasesB) issuing debt; decreasesC) printing money; increasesD) printing money; decreases73. Hyperinflations typically occur when governments:A) attempt to keep the unemployment rate below the natural rate.B) finance spending with the inflation tax.C) set inflation targets too high.D) use discretionary monetary policy to stabilize output.74. To force politicians to judge whether government spending is worth the costs, someeconomists have argued for:A) a balanced-budget rule for fiscal policy.B) a constant money-growth rule for monetary policy.C) avoiding the assumption of any contingent liabilities.D) the application of Ricardian equivalence.75. The possibility of capital flight is likely to be greater at higher levels of governmentdebt because there is a greater:A) temptation to default on the debt.B) likelihood that the government will begin issuing indexed bonds.C) probability that a balanced budget will be adopted by the government.D) potential for tax smoothing policies to be eliminated.76. High levels of government debt that raise investors' fear of a government default on debtwill result in capital ______ and a(n) ______ of the country's exchange rate.A) outflows; depreciationB) outflows; appreciationC) inflows; depreciationD) inflows; appreciation77. Indexed bonds produce all of the following benefits except:A) less inflation risk.B) more financial innovation.C) better government incentives.D) lower rates of inflation.78. A measure of the expected rate of inflation can be found by the:A) yield on nominal bonds plus the yield on index bonds.B) yield on nominal bonds minus the yield on index bonds.C) observed rate of inflation minus the yield on real bonds.D) observed rate of inflation minus the yield on nominal bonds.79. Inflation-indexed government bonds have all of the following benefits except:A) eliminating inflation.B) reducing the government's incentive to produce surprise inflation.C) encouraging financial innovation.D) eliminating inflation risk.80. If the government levies a one-time temporary tax on the young and gives the proceedsto the elderly, and both generations follow the life-cycle consumption pattern but are not altruistically linked:A) both the young and the old will consume more.B) there will be a net increase in overall consumption.C) there will be a net decrease in overall consumption.D) there will be no change in overall consumption.81. If the government levies a one-time temporary tax on the young and gives the proceedsto the elderly, and both generations follow the life-cycle consumption pattern and arealtruistically linked:A) both the young and the old will consume more.B) there will be a net increase in overall consumption.C) there will be a net decrease in overall consumption.D) there will be no change in overall consumption.82. If an individual should subtract the present value of future tax obligations due to thegovernment deficit from his or her disposable income, this situation suggests that, inaggregate analysis, the government deficit should be subtracted from disposable income.That is, instead of C = a + b(Y –T), we should use: C = a + b((Y –T – (G –T)), or = a + b(Y –G).a. Using this consumption function and the further relations:I = IG = GT = TY = C + I + Gwrite the equilibrium equation determining Y as a function of a, I, G, and T.b. If b equals 0.5, what are the numerical values of the multipliers for I, G, and T, respectiv83. Compare the traditional view versus the view of Ricardian equivalence of the effects ofa debt-financed tax cut on:a. national saving,b. current consumption, andc. the real interest rate.84. Many people are concerned about the budget deficit of the U.S. federal government.Suggest at least three possible negative economic effects of a budget deficit and threepossible economic benefits of a budget deficit.85. The U.S. Treasury reports the budget deficit or surplus of the federal government. Giveat least one reason why the measured budget deficit might overstate the “true” deficitand at least one reason the measured figure might understate the “true” deficit.86. Explain how tax cuts can affect both aggregate demand and aggregate supply.87. What is Ricardian equivalence? Give at least three reasons why Ricardian equivalencemight not correctly describe an economy.88. Countries seeking to adopt the euro as their currency must meet certain criteria,including the requirements to keep their government budget deficit equal to 3 percent or less of GDP, and to hold government debt levels below 60 percent of GDP. Discuss why there are fiscal policy criteria for joining a monetary union.89. Graphically illustrate the traditional view of the short-run impacts of a debt-financed taxcut on:a. interest rates and output in a closed economy in the short run, using the IS–LM model.b. exchange rates and output in a small open economy with a flexible exchange rate in therun, using the Mundell–Fleming model.90. Graphically illustrate the traditional view of the long-run impacts of a debt-financed taxcut on :a. saving, investment, and real interest rate using the classical model (Chapter 3).b. steady state capital per worker and output per worker using the Solow growth model.91. Using the model of aggregate demand–aggregate supply to illustrate the traditionalview, graphically compare the short-run and long-run impact of debt-financed tax cuts on:a. output,b. prices.92. War is the generator of debt burden for countries. How does war generate debt for acountry?。

《宏观经济学》学习指导(2007年2月第四版)南京审计学院经济学院西方经济学教研室目录第一部分《宏观经济学》教学辅导第二部分习题第十二章国民收入核算第十三章简单国民收入决定理论第十四章产品市场和货币市场的一般均衡第十五、十六章宏观经济政策分析与实践第十七章总需求——总供给模型第十八章失业与通货膨胀第十九、二十章开放经济条件下的宏观经济学第二十一章经济增长和经济周期理论第二十二章新古典宏观经济学与新凯恩斯主义经济学第三部分习题参考答案第一部分《宏观经济学》教学辅导一、课程概述(一)课程属性及课程介绍宏观经济学是财经类院校经济学类和工商管理类专业本科生学科共同课,是一门研究经济总体行为的经济学科,由宏观经济理论和宏观经济政策两部分组成。

宏观经济理论以国民收入决定理论为核心,分析产出、消费、储蓄、投资、物价水平、利率、货币需求和货币供给等经济变量之间的关系,探讨经济增长、经济周期、失业和通货膨胀等宏观经济学问题;宏观经济政策以理论研究为依据,主要分析政府财政货币政策的目标、工具、机制和效应。

本课程的体系安排以凯恩斯主义宏观经济理论为主体框架,并且融合新古典宏观经济学、新凯恩斯主义经济学和新增长理论。

由于宏观经济计量模型以及案例分析的广泛运用,通过本课程的学习,将为进一步学习其它经济学课程建立理论基础,而且能够掌握宏观经济学分析工具,用来认识和理解现实中的宏观经济,尤其是中国宏观经济。

总体上说,宏观经济学可大体分为五个部分:第一部分即第一章。

第一章包含两部分内容:一是宏观经济学概述,介绍宏观经济学与微观经济学的关系,宏观经济学的形成、发展,以及宏观经济运行模型、研究对象与框架结构。

二是介绍国民收入及其核算理论,以及国民收入核算中的重要恒等式。

第二部分包括第二、三、四、五、六章,主要介绍凯恩斯主义宏观经济学的国民收入决定理论。

其中,第二、三、四、五章是总需求分析模型,这一分析是凯恩斯主义的基本方法,它假定总供给存在过剩或资源没有得到充分利用,或者说在需求变化时价格水平可以保持不变,所以总供给也就不能成为国民收入的制约力量;第六章是引入总供给后的国民收入决定理论,由于价格水平既定不变的假定并不符合实际,这就严重地制约了总需求分析的解释能力,因此就有必要研究总需求与总供给共同决定国民收入的模型。

、概念辨析1 •国内生产总值(GDP)与国民生产总值(GNP )2.政府支出与政府购买3.国民生产总值与国民收入4.消费者价格指数与 GDP 消胀指数5.固定汇率制与可变汇率制6.预算盈余与充分就业预算盈余7.真实汇率与购买力平价8.经常账户与资本账户9 •商品市场均衡曲线(IS)与货币市场均衡曲线(LM)10 .边际消费倾向与边际储蓄倾向1 1 .法定贬值与真实贬值1 2 .凯恩斯消费理论与 LC-PIH 消费理论、简述题(图解题)1 、恒等式“储蓄等于投资” (如果是四部门经济则为“国民储蓄等于国民投资” )在传统意义上很好理解,比如你把钱存银行,银行贷款给企业投资。

那么假设人把钱放枕头底下,该恒等式还成立吗?2. 如果甲乙两个国家合并成一个国家,对 GDP 总和会有什么影响(假定两国产出不变)?3.在实行累进税制的国家,比例所得税为何能对经济起到自动稳定器的作用?4.写出现代菲利普斯曲线方程,配以图形简述其如何解释经济中的滞胀现象?5.货币需求对利率的弹性越大,货币政策就越无效的判断是否正确6.政府采购支出增加一定会挤出私人投资和导致通货膨胀吗?7.古典学派和凯恩斯主义的总供给观点各自基于怎样的假定前提以及适合在什么情况下分析宏观经济问题?8.在国民收入核算中, Y C I G NX ;在均衡收入的决定中,只有当 Y AD 时, Y CI G NX 才会成立。

这是否存在矛盾,并请说明理由。

9 .名义货币存量的增加使 AD 曲线上移的程度恰恰与名义货币增加的程度一致,为什么?10 .封闭经济中的IS曲线和开放经济中的IS曲线哪一个更陡峭?11 •贸易伙伴收入提高、本国货币真实贬值将对本国IS曲线产生何种影响?1 2 .凯恩斯学派认为货币政策的传递机制包含哪些环节?最主要的环节是什么?13 .经济处于充分就业状态。

若政府要改变需求构成,从消费转向投资,但不允许超过充分就业水平。

需要采取何种形式的政策组合?运用IS—LM 模型进行分析。

一、概念辨析1.真实GDP 与潜在GDP2.国内生产总值(GDP)与国民生产总值(GNP)3、消费者价格指数(CPI)与生产者价格指数(PPI)4.固定汇率制与可变汇率制5.预算盈余与充分就业预算盈余6.真实汇率与购买力平价7.经常账户与资本账户8.商品市场均衡曲线(IS)与货币市场均衡曲线(LM)9.边际消费倾向与边际储蓄倾向10.法定贬值与真实贬值二、简述题(图解题)1.在实行累进税制的国家,比例所得税为何能对经济起到自动稳定器的作用?2.写出现代菲利普斯曲线方程,配以图形简述其如何解释经济中的滞胀现象?3.货币需求对利率的弹性越大,货币政策就越无效的判断是否正确?4.政府采购支出增加一定会挤出私人投资和导致通货膨胀吗?5、古典学派和凯恩斯主义的总供给观点各自基于怎样的假定前提以及适合在什么情况下分析宏观经济问题?6.在国民收入核算中,NX+≡;在均衡收入的决定中,只有当ADY++GICY=时,NX++=才会成立。

这是否存在矛盾,并请说明理由。

GICY+7、名义货币存量的增加使AD曲线上移的程度恰恰与名义货币增加的程度一致,为什么?8、封闭经济中的IS曲线和开放经济中的IS曲线哪一个更陡峭。

9.贸易伙伴收入提高、本国货币真实贬值将对本国IS曲线产生何种影响?10、凯恩斯学派认为货币政策的传递机制包含哪些环节?最主要的环节是什么?11、经济处于充分就业状态。

若政府要改变需求构成,从消费转向投资,但不允许超过充分就业水平。

需要采取何种形式的政策组合?运用IS—LM模型进行分析。

12、考虑两种紧缩方案,一种是取消投资补贴;另一种是提高所得税率。

运用IS—LM模型分析两种政策对收入、利率与投资的影响。

13、利用IS—LM模型分析价格沿AD曲线变动,利率会发生什么变化?14、利用IS—LM模型分析在固定汇率、资本完全流动的情况下,一国为何无法采用独立的货币政策?三、计算题1、在以下列函数描述的经济体中,考察税收对均衡收入决定的作用。

宏观经济学最新题库(带答案版)————————————————————————————————作者:————————————————————————————————日期:第十二章国民收入核算一、名词解释1.国内生产总值(GDP):经济社会(一国或一个地区)在一定时期(通常指一年)内使用生产要素生产的全部最终产品(物品或劳务)的市场价值。

2. 国民收入(NI):从国内生产总值中扣除间接税和企业转移支付加政府补助金,就得到一国生产要素在一定时期内提供生产性服务所得报酬即工资、利息、利润和租金的总和意义上的国民收入。

3.个人可支配收入:从个人收入中扣除向政府缴纳的税金,即得个人可支配收入。

人们可以用来消费和储蓄的收入。

4.国民生产总值:是一个国民概念,指一国国民所拥有的全部生产要素在一定时期内生产的最终产品的市场价值。

5.实际国内生产总值:用从前某一年作为基期价格计算出来的全部最终产品的市场价值。

6.GDP折算指数:是名义的GDP和实际的GDP的比率。

7.最终产品:在一定时期内生产的并由其最后使用者购买的产品和劳务。

二、判断题1. 宏观经济学以收入分析中心,故又可称收入理论。

√2. GDP被定义为经济社会在一定时期内运用生产要素所生产的全部产品的市场价值。

×3. 一个在日本工作的美国公民的收入是美国GDP的一部分,也是日本GNP的一部分。

×4. GDP中扣除资本折旧,就可以得到NDP。

√5. 2012年我国城镇居民个人可支配收入为200543元,它是人们可用来消费或储蓄的收入。

√6. 四部门经济的投资储蓄恒等式为I=S+(T-G)+(M-X+Kr)。

√7. GDP折算指数是实际GDP与名义GDP的比率。

×8. 国民收入核算体系将GDP作为核算国民经济活动的核心指标。

√9. 政府转移支付应计入国内生产总值GDP 中。

×10. 若某企业年生产50万$的产品,只销售掉40万$的产品,则当年该企业所创造的GDP为40万$。

Name:__________________________ Date:_____________1。

The Solow growth model describes:A)how output is determined at a point in time。

B)how output is determined with fixed amounts of capital and labor。

C)how saving, population growth, and technological change affectoutput over time.D)the static allocation, production, and distribution of theeconomy's output。

2。

Unlike the long—run classical model in Chapter 3, the Solow growth model:A)assumes that the factors of production and technology are thesources of the economy's output.B)describes changes in the economy over time.C)is static。

D)assumes that the supply of goods determines how much output isproduced。

3.In the Solow growth model, the assumption of constant returns to scalemeans that:A)all economies have the same amount of capital per worker.B)the steady—state level of output is constant regardless of thenumber of workers。

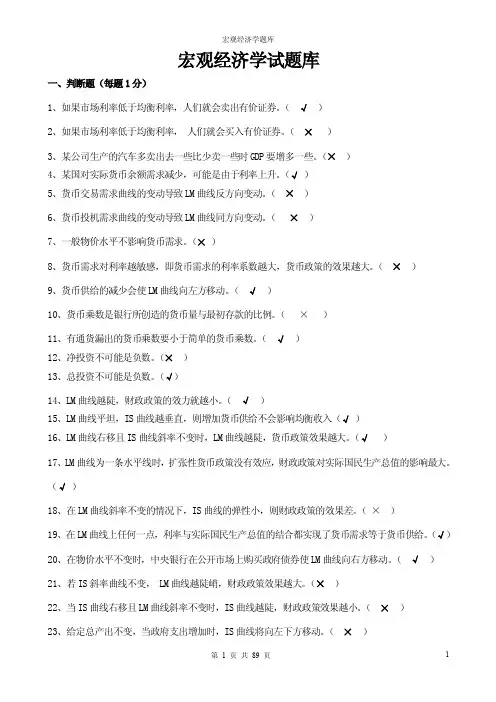

宏观经济学试题库一、判断题(每题1分)1、如果市场利率低于均衡利率,人们就会卖出有价证券。

(√)2、如果市场利率低于均衡利率,人们就会买入有价证券。

(×)3、某公司生产的汽车多卖出去一些比少卖一些时GDP要增多一些。

(×)4、某国对实际货币余额需求减少,可能是由于利率上升。

(√)5、货币交易需求曲线的变动导致LM曲线反方向变动。

(×)6、货币投机需求曲线的变动导致LM曲线同方向变动。

(×)7、一般物价水平不影响货币需求。

(×)8、货币需求对利率越敏感,即货币需求的利率系数越大,货币政策的效果越大。

(×)9、货币供给的减少会使LM曲线向左方移动。

(√)10、货币乘数是银行所创造的货币量与最初存款的比例。

(×)11、有通货漏出的货币乘数要小于简单的货币乘数。

(√)12、净投资不可能是负数。

(×)13、总投资不可能是负数。

(√)14、LM曲线越陡,财政政策的效力就越小。

(√)15、LM曲线平坦,IS曲线越垂直,则增加货币供给不会影响均衡收入(√)16、LM曲线右移且IS曲线斜率不变时,LM曲线越陡,货币政策效果越大。

(√)17、LM曲线为一条水平线时,扩张性货币政策没有效应,财政政策对实际国民生产总值的影响最大。

(√)18、在LM曲线斜率不变的情况下,IS曲线的弹性小,则财政政策的效果差。

(×)19、在LM曲线上任何一点,利率与实际国民生产总值的结合都实现了货币需求等于货币供给。

(√)20、在物价水平不变时,中央银行在公开市场上购买政府债券使LM曲线向右方移动。

(√)21、若IS斜率曲线不变, LM曲线越陡峭,财政政策效果越大。

(×)22、当IS曲线右移且LM曲线斜率不变时,IS曲线越陡,财政政策效果越小。

(×)23、给定总产出不变,当政府支出增加时,IS曲线将向左下方移动。

(×)24、如果净税收增加10亿元,会使IS曲线左移税收乘数乘以10亿元。

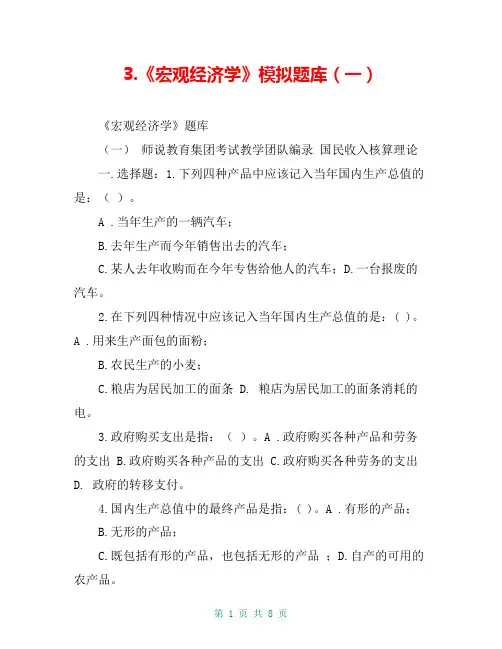

3.《宏观经济学》模拟题库(一)《宏观经济学》题库(一)师说教育集团考试教学团队编录国民收入核算理论一.选择题:1.下列四种产品中应该记入当年国内生产总值的是:()。

A .当年生产的一辆汽车;B.去年生产而今年销售出去的汽车;C.某人去年收购而在今年专售给他人的汽车;D.一台报废的汽车。

2.在下列四种情况中应该记入当年国内生产总值的是:( )。

A .用来生产面包的面粉;B.农民生产的小麦;C.粮店为居民加工的面条D. 粮店为居民加工的面条消耗的电。

3.政府购买支出是指:()。

A .政府购买各种产品和劳务的支出 B.政府购买各种产品的支出 C.政府购买各种劳务的支出D. 政府的转移支付。

4.国内生产总值中的最终产品是指:( )。

A .有形的产品;B.无形的产品;C.既包括有形的产品,也包括无形的产品;D.自产的可用的农产品。

5.按支出法,应计入私人国内总投资的项目是:( )。

A .个人购买的小汽车;B.个人购买的游艇;C.个人购买的服装;D.个人购买的住房。

6.国民收入核算中,最重要的是核算:( )。

A .国民收入;B.国内生产总值;C.国民生产净值;D.个人可支配收入。

7.国内生产净值与国民收入的差是:( )。

A .间接税;B.直接税;C. 折旧;D.公司未分配利润。

8.国内生产总值与国内生产净值之间的差是:( )。

A .间接税;B.直接税;C.折旧额D. 个人所得税。

9.下面不属于流量的是:( )。

A .净出口;B.折旧;C.转移支付;D.国家债务。

10.社会保障支出属于( )。

A .政府购买支出;B.转移支付;C.税收;D.消费。

11.对政府雇员支付的报酬属于( )。

A .政府购买支出;B.转移支出;C.税收;D.消费。

12.下面不属于国民收入部分的是( )。

A .租金收入;B.福利支付;C.工资;D.利息。

13.如果xx年底的物价指数是128,xx年底的物价指数是134,那么,1988年的通胀率是( )。

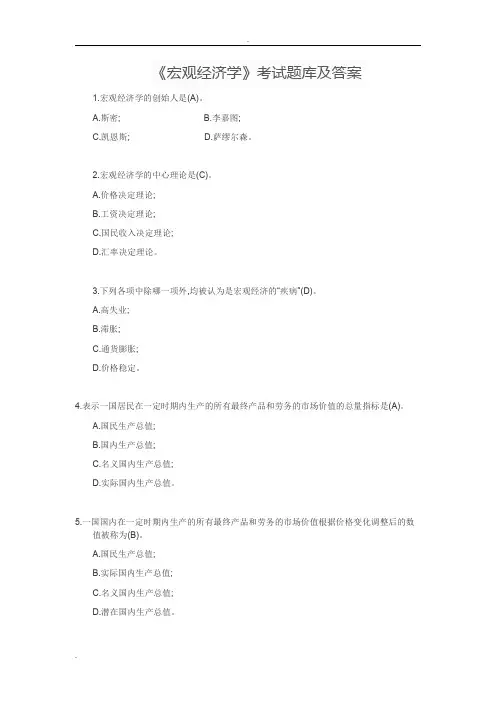

《宏观经济学》考试题库及答案1.宏观经济学的创始人是(A)。

A.斯密;B.李嘉图;C.凯恩斯;D.萨缪尔森。

2.宏观经济学的中心理论是(C)。

A.价格决定理论;B.工资决定理论;C.国民收入决定理论;D.汇率决定理论。

3.下列各项中除哪一项外,均被认为是宏观经济的“疾病”(D)。

A.高失业;B.滞胀;C.通货膨胀;D.价格稳定。

4.表示一国居民在一定时期内生产的所有最终产品和劳务的市场价值的总量指标是(A)。

A.国民生产总值;B.国内生产总值;C.名义国内生产总值;D.实际国内生产总值。

5.一国国内在一定时期内生产的所有最终产品和劳务的市场价值根据价格变化调整后的数值被称为(B)。

A.国民生产总值;B.实际国内生产总值;C.名义国内生产总值;D.潜在国内生产总值。

6.实际GDP等于(B)。

A.价格水平/名义GDP;B.名义GDP/价格水平×100;C.名义GDP乘以价格水平;D.价格水平乘以潜在GDP。

7.下列各项中属于流量的是(A)。

A.国内生产总值;B.国民债务;C.现有住房数量;D.失业人数。

8.存量是(A)。

A.某个时点现存的经济量值;B.某个时点上的流动价值;C.流量的固体等价物;D.某个时期内发生的经济量值。

9.下列各项中哪一个属于存量?(C)。

A.国内生产总值;B.投资;C.失业人数;D.人均收入。

10.古典宏观经济理论认为,利息率的灵活性使得(B)。

A.储蓄大于投资;B.储蓄等于投资;C.储蓄小于投资;D.上述情况均可能存在。

11.古典宏观经济理论认为,实现充分就业的原因是(C)。

A.政府管制;B.名义工资刚性;C.名义工资灵活性;D.货币供给适度。

12.根据古典宏观经济理论,价格水平降低导致下述哪一变量减少(C)。

A.产出;B.就业;C.名义工资;D.实际工资。

13.在凯恩斯看来,造成资本主义经济萧条的根源是(A)。

A.有效需求不足;B.资源短缺;C.技术落后;D.微观效率低下。

Name: __________________________ Date: _____________1. The rate of inflation is the:A) median level of prices.B) average level of prices.C) percentage change in the level of prices.D) measure of the overall level of prices.2. The definition of the transactions velocity of money is:A) money multiplied by prices divided by transactions.B) transactions divided by prices multiplied by money.C) money divided by prices multiplied by transactions.D) prices multiplied by transactions divided by money.3. If there are 100 transactions in a year and the average value of each transaction is $10,then if there is $200 of money in the economy, transactions velocity is ______ times per year.A) 0.2B) 2C) 5D) 104. If the transactions velocity of money remains constant while the quantity of moneydoubles, the:A) price of the average transaction must double.B) number of transactions must remain constant.C) price of the average transaction multiplied by the number of transactions mustremain constant.D) price of the average transaction multiplied by the number of transactions mustdouble.5. The quantity equation, viewed as an identity, is a definition of the:A) quantity of money.B) quantity of transactions.C) price level.D) transactions velocity of money.6. The income velocity of money:A) is defined in the identity MV = PY.B) is defined in the identity MV = PT.C) is the same thing as the transactions velocity of money.D) is the same as the number of times a dollar bill changes hands.7. The transactions velocity of money indicates the _____ in a given period, while theincome velocity of money indicates the _____ in a given period.A) number of transactions; amount of income earnedB) quantity of money used for transactions; quantity of money paid as incomeC) number of times a dollar bill changes hands; number of times a dollar bill enterssomeone's incomeD) volume of transactions; flow of income8. Real money balances equal the:A) sum of coin, currency, and balances in checking accounts.B) amount of money expressed in terms of the quantity of goods and services it canpurchase.C) number of dollars used as a medium of exchange.D) quantity of money created by the Federal Reserve.9. If the average price of goods and services in the economy equals $10 and the quantity ofmoney in the economy equals $200,000, then real balances in the economy equal:A) 10.B) 20,000.C) 200,000.D) 2,000,000.10. The demand for real money balances is generally assumed to:A) be exogenous.B) be constant.C) increase as real income increases.D) decrease as real income increases.11. If the quantity of real money balances is kY, where k is a constant, then velocity is:A) k.B) 1/k.C) kP.D) P/k.12. If the demand for real money balances is proportional to real income, velocity will:A) increase as income increases.B) increase as income decreases.C) vary directly with the interest rate.D) remain constant.13. When the demand for money parameter, k, is large, the velocity of money is ______ andmoney is changing hands ______A) large; frequentlyB) large; infrequentlyC) small; frequentlyD) small; infrequently14. Consider the money demand function that takes the form (M/P)d= kY, where M is thequantity of money, P is the price level, k is a constant, and Y is real output. If the money supply is growing at a 10 percent rate, real output is growing at a 3 percent rate, and k is constant, what is the average inflation rate in this economy?A) 3 percentB) 7 percentC) 10 percentD) 13 percent15. The income velocity of money increases and the money demand parameter k ______when people want to hold ______ money.A) increases; moreB) increases; lessC) decreases; moreD) decreases; less16. The quantity equation for money, by itself:A) may be thought of as a definition for velocity of money.B) implies that the velocity of money is constant.C) implies that the price level is proportional to the money supply.D) implies that real gross domestic product (GDP) is proportional to the moneysupply.17. The quantity theory of money assumes that:A) income is constant.B) velocity is constant.C) prices are constant.D) the money supply is constant.18. If income velocity is assumed to be constant, but no other assumptions are made, thelevel of ______ is determined by M.A) pricesB) incomeC) transactionsD) nominal GDP19. If velocity is constant and, in addition, the factors of production and the productionfunction determine real GDP, then:A) the price level is proportional to the money supply.B) real GDP is proportional to the money supply.C) the price level is fixed.D) nominal GDP is fixed.20. In the long run, according to the quantity theory of money and the classicalmacroeconomic theory, if velocity is constant, then ______ determines real GDP and ______ determines nominal GDP.A) the productive capability of the economy; the money supplyB) the money supply; the productive capability of the economyC) velocity; the money supplyD) the money supply; velocity21. According to the quantity theory of money, ultimate control over the rate of inflation inthe United States is exercised by:A) the Organization of Petroleum Exporting Countries (OPEC).B) the U.S. Treasury.C) the Federal Reserve.D) private citizens.22. According to the quantity theory of money, if money is growing at a 10 percent rate andreal output is growing at a 3 percent rate, but velocity is growing at increasingly faster rates over time as a result of financial innovation, the rate of inflation must be:A) increasing.B) decreasing.C) 7 percent.D) constant.23. If the money supply increases 12 percent, velocity decreases 4 percent, and the pricelevel increases 5 percent, then the change in real GDP must be ______ percent.A) 3B) 4C) 9D) 1124. Percentage change in P is approximately equal to the percentage change in:A) M.B) M minus percentage change in Y.C) M minus percentage change in Y plus percentage change in velocity.D) M minus percentage change in Y minus percentage change in velocity.25. Using average rates of money growth and inflation in the United States over manydecades, Friedman and Schwartz found that decades of high money growth tended to have ______ rates of inflation and decades of low money growth tended to have ______ rates of inflation.A) high; highB) high; lowC) low; lowD) low; high26. Using decade-long data across countries from 2000–2010, countries with high moneygrowth tend to have _____ inflation.A) highB) lowC) constantD) decreasing27. The right of seigniorage is the right to:A) levy taxes on the public.B) borrow money from the public.C) draft citizens into the armed forces.D) print money.28. “Inflation tax” means that:A) as the price level rises, taxpayers are pushed into higher tax brackets.B) as the price level rises, the real value of money held by the public decreases.C) as taxes increase, the rate of inflation also increases.D) in a hyperinflation, the chief source of tax revenue is often the printing of money.29. The inflation tax is paid:A) only by the central bank.B) by all holders of money.C) only by government bond holders.D) equally by every household.30. The percentage of government revenue raised by printing money has usually accountedfor:A) more than 10 percent of government revenue in the United States.B) less than 3 percent of government revenue in the United States.C) less than 3 percent of government revenue in Italy.D) less than 3 percent of government revenue in Greece.31. During the American Revolution, the price of gold measured in continental dollarsincreased to more than ______ times its previous level.A) 2B) 10C) 50D) 10032. The real interest rate is equal to the:A) amount of interest that a lender actually receives when making a loan.B) nominal interest rate plus the inflation rate.C) nominal interest rate minus the inflation rate.D) nominal interest rate.33. If the nominal interest rate is 1 percent and the inflation rate is 5 percent, the realinterest rate is:A) 1 percent.B) 6 percent.C) –4 percent.D) –5 percent.34. If the real interest rate declines by 1 percent and the inflation rate increases by 2 percent,the nominal interest rate must:A) increase by 2 percent.B) increase by 1 percent.C) remain constant.D) decrease by 1 percent.35. If the real interest rate and real national income are constant, according to the quantitytheory and the Fisher effect, a 1 percent increase in money growth will lead to rises in:A) inflation of 1 percent and the nominal interest rate of less than 1 percent.B) inflation of 1 percent and the nominal interest rate of 1 percent.C) inflation of 1 percent and the nominal interest rate of more than 1 percent.D) both inflation and the nominal interest rate of less than 1 percent.36. The one-to-one relation between the inflation rate and the nominal interest rate, theFisher effect, assumes that the:A) money supply is constant.B) velocity is constant.C) inflation rate is constant.D) real interest rate is constant.37. According to the quantity theory a 5 percent increase in money growth increasesinflation by ___ percent. According to the Fisher equation a 5 percent increase in the rate of inflation increases the nominal interest rate by _____.A) 1; 5B) 5; 1C) 1; 1D) 5; 538. According to the quantity theory and the Fisher equation, if the money growth increasesby 3 percent and the real interest rate equals 2 percent, then the nominal interest rate will increase:A) 2 percent.B) 3 percent.C) 5 percent.D) 6 percent.39. In the classical model, according to the quantity theory and the Fisher equation, anincrease in money growth increases:A) output.B) velocityC) the nominal interest rate.D) the real interest rate.40. Evidence from the past 40 years in the United States supports the Fisher effect andshows that when the inflation rate is high, the ______ interest rate tends to be ______.A) nominal; highB) nominal; lowC) real; highD) real; low41. The ex ante real interest rate is equal to the nominal interest rate:A) minus the inflation rate.B) plus the inflation rate.C) minus the expected inflation rate.D) plus the expected inflation rate.42. When a person purchases a 90-day Treasury bill, he or she cannot know the:A) ex post real interest rate.B) ex ante real interest rate.C) nominal interest rate.D) expected rate of inflation.43. Equilibrium in the market for goods and services determines the ______ interest rateand the expected rate of inflation determines the ______ interest rate.A) ex ante real; ex ante nominalB) ex post real; ex post nominalC) ex ante nominal; ex post realD) ex post nominal; ex post real44. The ex ante real interest rate is based on _____ inflation, while the ex post real interestrate is based on _____ inflation.A) expected; actualB) core; actualC) actual; expectedD) expected; core45. According to the Fisher effect, the nominal interest rate moves one-for-one withchanges in the:A) inflation rate.B) expected inflation rate.C) ex ante real interest rate.D) ex post real interest rate.46. A positive relationship between nominal interest rates and inflation in the United Statesis obvious in:A) both recent data and nineteenth-century data.B) recent data but not nineteenth-century data.C) nineteenth-century data but not recent data.D) neither nineteenth-century data nor recent data.47. The ex post real interest rate will be greater than the ex ante real interest rate when the:A) rate of inflation is increasing.B) rate of inflation is decreasing.C) actual rate of inflation is greater than the expected rate of inflation.D) actual rate of inflation is less than the expected rate of inflation.48. In recent U.S. experience, inflation has:A) been persistent from year to year, whereas in the nineteenth century inflation hadlittle persistence.B) been persistent from year to year, and this was also true in the nineteenth century.C) not been persistent from year to year, although it was persistent in the nineteenthcentury.D) not been persistent from year to year, and the same was true in the nineteenthcentury.49. The opportunity cost of holding money is the:A) nominal interest rate.B) real interest rate.C) federal funds rate.D) prevailing Treasury bill rate.50. The real return on holding money is:A) the real interest rate.B) minus the real interest rate.C) the inflation rate.D) minus the inflation rate.51. If the real return on government bonds is 3 percent and the expected rate of inflation is 4percent, then the cost of holding money is ______ percent.A) 1B) 3C) 4D) 752. The general demand function for real balances depends on the level of income and the:A) real interest rate.B) nominal interest rate.C) rate of inflation.D) price level.53. If the nominal interest increases, then:A) the money supply increases.B) the money supply decreases.C) the demand for money increases.D) the demand for money decreases.54. Consider the money demand function that takes the form (M/P)d = Y/4i, where M is thequantity of money, P is the price level, Y is real output, and i is the nominal interest rate.What is the average velocity of money in this economy?A) iB) 4iC) 1/4iD) 0.2555. If the Fed announces that it will raise the money supply in the future but does notchange the money supply today,A) both the nominal interest rate and the current price level will decrease.B) the nominal interest rate will increase and the current price level will decrease.C) the nominal interest rate will decrease and the current price level will increase.D) both the nominal interest rate and the current price level will increase.56. If the money supply is held constant, then an increase in the nominal interest rate will______ the demand for money and ______ the price level.A) increase; increaseB) increase; decreaseC) decrease; increaseD) decrease; decrease57. If the demand for money depends on the nominal interest rate, then via the quantitytheory and the Fisher equation, the price level depends on:A) only the current money supply.B) only the expected future money supply.C) both the current and expected future money supply.D) neither the current nor the expected future money supply.58. According to the classical theory of money, reducing inflation will not make workersricher because firms will increase product prices ______ each year and give workers ______ raises.A) more; largerB) more; smallerC) less; largerD) less; smaller59. According to the classical theory of money, inflation does not make workers poorerbecause wages increase:A) faster than the overall price level.B) more slowly than the overall price level.C) in proportion to the increase in the overall price level.D) in real terms during periods of inflation.60. Survey evidence indicates that economists worry ______ the general public does aboutprices increasing more rapidly than their incomes.A) more thanB) less thanC) about the same asD) more intensely than61. Which of the following is NOT an effect of expected inflation?A) causes lower real wages.B) leads to shoeleather costs.C) increases menu costs.D) leads to taxing of nominal capital gains that are not real.62. The inconvenience associated with reducing money holdings to avoid the inflation tax iscalled:A) menu costs.B) shoeleather costs.C) variable yardstick costs.D) fixed costs.63. The costs of reprinting catalogs and price lists because of inflation are called:A) menu costs.B) shoeleather costs.C) variable yardstick costs.D) fixed costs.64. Inflation ______ the variability of relative prices and ______ allocative efficiency.A) increases; increasesB) increases; decreasesC) decreases; decreasesD) decreases; increases65. Devoting resources to avoiding the costs of expected inflation leads to:A) eliminating the costs of expected inflation.B) fewer relative price changes.C) economic inefficiency.D) a decrease in the transaction velocity of money.66. Variable inflation hurts both debtors and creditors because:A) inflation makes the money-fixed assets of creditors worth less.B) inflation makes the money-fixed liabilities of debtors worth less.C) most debtors and creditors are risk averse.D) most debtors and creditors are risk neutral.67. In the case of an unanticipated inflation:A) creditors with an unindexed contract are hurt because they get less than theyexpected in real terms.B) creditors with an indexed contract gain because they get more than they contractedfor in nominal terms.C) debtors with an unindexed contract do not gain because they pay exactly what theycontracted for in nominal terms.D) debtors with an indexed contract are hurt because they pay more than theycontracted for in nominal terms.68. The costs of unexpected inflation, but not of expected inflation, are:A) menu costs.B) the arbitrary redistribution of wealth between debtors and creditors.C) unintended distortions of individual tax liabilitiesD) the costs of relative price variability.69. Between 1880 and 1896, the price level in the United States fell 23 percent. Thismovement was ______ for bankers of the Northeast and ______ for farmers of theSouth and West.A) bad; badB) good; goodC) good; badD) bad; good70. A variable rate of inflation is undesirable because:A) debtors and creditors cannot protect themselves by indexing contracts.B) shoeleather costs are greater under variable inflation than under constant inflation.C) menu costs are greater under variable inflation than under constant inflation.D) variable inflation leads to greater uncertainty and risk as compared to constantinflation.71. One possible benefit of moderate inflation is:A) a reduction in boredom attributable to the changing prices.B) the elimination of menu costs.C) better functioning labor markets.D) increased certainty about the future.72. If inflation is 6 percent and a worker receives a 4 percent nominal wage increase, thenthe worker's real wage:A) increased 4 percent.B) increased 2 percent.C) decreased 2 percent.D) decreased 6 percent.73. If nominal wages cannot be cut, then the only way to reduce real wages is by:A) adjustments via inflation.B) unions.C) legislation.D) productivity increases.74. A rate of inflation that exceeds 50 percent per month is typically referred to as a(n):A) conflagration.B) hyperinflation.C) deflation.D) disinflation.75. Compared to periods of lower rates of inflation, during a hyperinflation all of thefollowing occur except:A) shoeleather costs increase.B) menu costs become larger.C) relative prices do a better job of reflecting true scarcity.D) tax distortions increase.76. Hyperinflations ultimately are the result of excessive growth rates of the money supply;the underlying motive for the excessive money growth rates is frequently agovernment's:A) desire to increase prices throughout the economy.B) need to generate revenue to pay for spending.C) responsibility to increase nominal interest rates by increasing expected inflation.D) inability to conduct open-market operations.77. Which of the following would most likely be called a hyperinflation?A) Price increases averaged 300 percent per year.B) The inflation rate was 10 percent per year.C) Real GDP grew at a rate of 12 percent over a year.D) A stock market index rose by 1,000 points over a year.78. In instances of hyperinflation, the delays involved in collecting taxes often result in:A) decreased real government tax revenue.B) large capital gains for creditors.C) higher shoeleather costs of inflation.D) higher ex ante real interest rates.79. During hyperinflation real tax revenue of the government often drops substantiallybecause of the:A) delay between when a tax is levied and when it is collected.B) significantly greater menu costs of printing tax forms.C) additional deductions taken for increased shoeleather costs.D) greater uncertainty associated with extreme rates of inflation.80. The major source of government revenue in most countries that are experiencinghyperinflation is:A) customs duties.B) income taxes.C) seigniorage.D) borrowing.81. In practice, in order to stop a hyperinflation, in addition to stopping monetary growth,the government must:A) lower taxes and raise government spending.B) raise taxes and reduce government spending.C) change from one kind of currency to another.D) call for a new election.82. To end a hyperinflation, a government trying to reduce its reliance on seignioragewould:A) print more money.B) raise taxes and cut spending.C) lower taxes and increase spending.D) lower interest rates.83. Most hyperinflations end with _____ reforms that eliminate the need for _____.A) monetary; taxesB) monetary; currencyC) fiscal; seigniorageD) fiscal; currency84. The hyperinflation experienced by interwar Germany illustrates how fiscal policy can beconnected to monetary policy when government expenditures are financed by:A) new taxes.B) borrowing in the open market.C) printing large quantities of money.D) selling gold.85. In Zimbabwe in the 1990s the government resorted to printing money to pay the salariesof government employees because:A) it was a means to avoid price controls.B) of high rates of inflation.C) of declining tax revenues.D) of a need to stimulate the economy.86. Which of the following is an example of a relative price?A) the real interest rateB) the capital stockC) the dollar wage per hourD) the price level87. Variables expressed in terms of physical units or quantities are called ______ variables.A) realB) nominalC) endogenousD) exogenous88. Variables expressed in terms of money are called ______ variables.A) realB) nominalC) endogenousD) exogenous89. An example of a real variable is the:A) dollar wage a person earns.B) quantity of goods produced in a year.C) price level.D) nominal interest rate.90. An example of a nominal variable is the:A) money supply.B) quantity of goods produced in a year.C) relative price of bread.D) real wage.91. The classical dichotomy:A) cannot hold if money is “neutral.”B) is said to hold when the values of real variables can be determined without anyreference to nominal variables or the existence of money.C) fully describes the world in which we live, especially in the short run.D) arises because money depends on the nominal interest rate.92. According to the classical dichotomy, when the money supply decreases, _____ willdecrease.A) real GDPB) consumption spendingC) the price levelD) investment spending93. The concept of monetary neutrality in the classical model means that an increase in themoney supply will increase:A) real GDP.B) real interest rates.C) nominal interest rates.D) both saving and investment by the same amount.94. The characteristic of the classical model that the money supply does not affect realvariables is called:A) the monetary basis.B) monetary policy.C) the quantity theory of money.D) monetary neutrality95. The theoretical separation of real and monetary variables is called:A) the classical dichotomy.B) monetary neutrality.C) the Fisher effect.D) the quantity theory of money.96. If the price level depends on both the current money supply and future expected moneysupplies, in order to stop a hyperinflation, a central bank may try to establish credibility by:A) achieving increased political independence from the government.B) increasing revenue from seigniorage.C) encouraging increased government spending and tax cuts.D) undertaking larger open-market purchases.97. A small country might want to use the money of a large country rather than print its ownmoney if the small country:A) is likely to be unstable, whereas the large country is likely to be stable.B) is likely to be stable, whereas the large country is likely to be unstable.C) needs the revenue for seigniorage.D) wants to control its own inflation rate.98. The phrase “inflation is repudiation” applies only if:A) inflation is expected.B) the government has no debt.C) the government is a creditor.D) the government is a debtor.99. If consumption depends positively on the level of real balances, and real balancesdepend negatively on the nominal interest rate in a neoclassical model, then:A) the classical dichotomy still holds.B) a rise in money growth leads to a fall in consumption and a rise in investment.C) a rise in money growth leads to a rise in consumption and a fall in investment.D) a rise in money growth leads to a rise in both consumption and investment.100. If consumption depends positively on the level of real balances and real balances depend negatively on the nominal interest rate in a neoclassical model, then the nominal interest rate:A) declines when the money growth rate rises.B) is unchanged when the money growth rate rises.C) rises 1 percent for each 1 percent rise in the money growth rate.D) rises less than 1 percent for each 1 percent rise in the money growth rate.101. Assume that a series of inflation rates is 1 percent, 2 percent, and 4 percent, while nominal interest rates in the same three periods are 5 percent, 5 percent, and 6 percent,respectively.a. What are the ex post real interest rates in the same three periods?b. If the expected inflation rate in each period is the realized inflation rate in the previousperiod, what are the ex ante real interest rates in periods two and three?c. If someone lends in period two, based on the ex ante inflation expectation in part b, willor she be pleasantly or unpleasantly surprised in period 3 when the loan is repaid?102. Mary Tsai is paid $3,000 every 30 days. Her salary is deposited directly in her bank.She spends all her money at a constant rate over the 30 days and must pay cash. She can(1) withdraw all of the money at once; (2) withdraw half at once and the rest after 15days; (3) withdraw one-third at once, one-third after 10 days, and one-third at 20 days;or (4) make any number of evenly spaced withdrawals. Each withdrawal costs her $2 interms of time and inconvenience. For each day that Mary has a dollar in the bank, shegets .03 cents (.0003 per dollar) in interest. Thus, if she withdraws half of her moneyimmediately and half in 15 days, she has $1,500 in the bank for 15 days and earns $6.75 interest.a. Create a table showing transaction costs, interest earned, and total net earnings (+) or coassociated with one, two, three, or four withdrawals per month.b. How many withdrawals per month lead to the largest net earnings? If Mary chooses thisnumber, what will be her average amount of cash on hand over the 30 days?103. Assume that the demand for real money balance (M/P) is M/P = 0.6Y– 100i, where Y is national income and i is the nominal interest rate (in percent). The real interest rate r isfixed at 3 percent by the investment and saving functions. The expected inflation rateequals the rate of nominal money growth.a. If Y is 1,000, M is 100, and the growth rate of nominal money is 1 percent, what must i abe?b. If Y is 1,000, M is 100, and the growth rate of nominal money is 2 percent, what must i aP be?104. A classical economist wears a T-shirt printed with the slogan “Fast Money Raises My Interest!” Use the quantity theory of money and the Fisher equation to explain theslogan.105. In classical macroeconomic theory, the concept of monetary neutrality means that changes in the money supply do not influence real variables. Explain why changes inmoney growth affect the nominal interest rate, but not the real interest rate.106. Econoland finances government expenditures with an inflation tax.a. Explain who pays the tax and how it is paid.b. What are costs of the tax, assuming the tax rate is expected?。

华东理⼯⼤学中级宏观经济学题库完整第6章经济增长⼀、选择题1.⽣产函数Y=F(K,L)在下列哪种情况下规模收益不变( A )(zK,zL)=zY。

(zK,zL)=Y。

(K,L)=Y。

(K+1,L+1)—F(K,L)=12.如果⽣产数Y=F(K,L)规模收益不变,那么( D )(zK,zL)=zY。

(K/L,1)=Y/L。

=f(k),其中Y是⼈均产量,k 是⼈均资本。

D.以上全部。

3 以下关于资本的边际产量MPK的陈述,错误的是( C )= f(k+1)-f(k).会随着k的增加⽽减⼩。

C.如果资本很少,则MPK很⼩。

与⽣产函数y=(k)的斜率相等。

4.资本存量的变化等于( B )A.投资加上折旧。

B.投资减去折旧。

C.投资乘以折旧。

D.投资除以折旧。

5.如果资本平均持续50年,折旧率为( B )%,即每年。

%,即每年。

,即每年即每年2。

6.在⼀个没有⼈⼝增长的稳态⾥( D )A.⼈均资本量保持不变。

B.⼈均投资等于⼈均折旧。

C.⼈均储蓄等于⼈均折旧。

D.以上全部。

7 如果没有⼈⼝增长,⼈均资本的稳态⽔平将会上升,只要( C )A.⼈均投资量下降。

B.折旧率上升。

C.储蓄率上升。

D.以上全部。

8 如果y=k1/2,s=,折旧率δ=20%(即),⼈均资本存量的稳态⽔平等于( A )。

.。

9 在第8题描述的稳态下,⼈均储蓄量和⼈均投资量等于( A )A.0.8。

10 假设⼀个处于稳态的国家实施了提⾼储蓄率的政策。

达到新的稳态后( B )A.⼈均产量将⽐之前增长得更快。

B.⼈均产量将⽐之前⾼。

C.⼈均资本量和之前相同。

D以上全部正确。

11.资本的黄⾦律⽔平k*⾦表⽰的稳态中,下列哪项值最⾼( A )A.⼈均消费⽔平。

B.⼈均产量。

C.⼈均消费的增长率。

D. ⼈均产量的增长率。

12.不考虑⼈⼝增长,在资本的黄⾦律⽔平k*⾦处( B )(k*⾦)=δk*⾦。

=δ。

(k)达到最⼤值。

D 以上全部。

13.如果y=k1/2,δ=5%=,资本的黄⾦律⽔平k*⾦=100,那么与资本的黄⾦律⽔平相关的储蓄率是( D ) A.5%,即。

目 录第一篇 宏观经济学导论第一章 宏观经济学概述第二章 宏观经济指标的度量第二篇 总需求分析第三章 产品市场均衡:收入-支出模型第四章 产品市场和货币市场的同时均衡:IS-LM模型第五章 宏观经济政策第三篇 总供给分析第六章 对劳动力市场状况的度量第七章 凯恩斯主义的总供给曲线第八章 新古典主义的总供给曲线第四篇 长期经济增长理论第九章 索洛经济增长模型第一篇 宏观经济学导论第一章 宏观经济学概述说明:作为教材的第一章,本章系统地介绍了宏观经济学的发展史、研究对象和研究方法。

考虑到宏观经济背景非常重要,建议读者予以重视。

本章无相关习题。

第二章 宏观经济指标的度量1假设某农业国只生产两种产品:橘子和香蕉。

利用下表的资料,计算2002年和2009年该国实际GDP的变化,但要以2002年的价格来计算。

根据本题的结果证明:被用来计算实际GDP的价格的确影响所计算的增长率,但一般来说这种影响不是很大。

答:(1)以2002年的价格为基期价格:2002年该国的实际GDP为:GDP2002=50×0.22+15×0.2=14;2009年该国的实际GDP为:GDP2009=60×0.22+20×0.2=17.2;实际GDP增长率为:(17.2-14)/14×100%=22.9%。

(2)以2009年的价格为基期价格:2002年该国的实际GDP为:GDP2002=50×0.25+15×0.3=17;2009年该国的实际GDP为:GDP2009=60×0.25+20×0.3=21;实际GDP增长率为:(21-17)/17×100%=23.5%。

由22.9%与23.5%只相差0.6%,由此可见,用来计算实际GDP的价格的确影响所计算的增长率,但一般来说这种影响不是很大。

2根据国民收入核算恒等式说明:(1)税收的增加(同时转移支付保持不变)一定意味着在净出口、政府购买或储蓄-投资差额上的变化。

1、在宏观经济政策中,财政政策的工具主要包括:A. 改变政府购买水平B. 调整货币供应量C. 直接控制市场价格D. 修改企业税收政策(答案)A2、关于边际效用递减规律,以下说法正确的是:A. 随着商品消费量的增加,每增加一单位商品所带来的总效用不断增加B. 消费者在购买商品时,总是先购买效用最大的商品C. 在一定时间内,随着商品消费量的增加,每增加一单位商品所带来的额外满足感逐渐减少D. 边际效用与商品的价格直接相关(答案)C3、在货币市场中,以下哪个因素可能导致货币市场均衡利率下降?A. 货币供给减少,货币需求不变B. 货币供给不变,货币需求增加C. 货币供给增加,货币需求减少D. 货币供给和需求同时增加,但供给增加更多(答案)D4、关于通货膨胀的经济效应,下列说法错误的是:A. 通货膨胀会降低货币的购买力B. 温和的通货膨胀通常对经济有刺激作用C. 恶性通货膨胀会导致社会经济秩序混乱D. 通货膨胀总是有利于债务人(答案)D5、在国际收支平衡表中,下列哪一项属于资本账户?A. 商品和服务的进出口B. 长期资本流动C. 官方储备的变动D. 旅游收支(答案)B6、在IS-LM模型中,如果政府增加支出而同时保持税收不变,这将导致:A. IS曲线向左移动B. LM曲线向右移动C. IS曲线向右移动D. 均衡产出和利率都下降(答案)C7、关于经济增长与经济发展的关系,以下说法正确的是:A. 经济增长必然导致经济发展B. 经济发展是经济增长的基础和前提C. 经济增长是经济发展的一个方面,但不等同于经济发展D. 经济发展仅指经济总量的增加(答案)C8、在完全竞争市场中,单个厂商的需求曲线是:A. 向右下方倾斜的B. 垂直于横轴的C. 向右上方倾斜的D. 平行于横轴的(答案)B。

宏观经济学题库及答案1.宏观经济学的创始人是(A)。

A.斯密;B.李嘉图;C.凯恩斯;D.萨缪尔森。

2.宏观经济学的中心理论是(C)。

A.价格决定理论;B.工资决定理论;C.国民收入决定理论;D.汇率决定理论。

3.下列各项中除哪一项外,均被认为是宏观经济的“疾病”(D)。

A.高失业;B.滞胀;C.通货膨胀;D.价格稳定。

4.表示一国居民在一定时期内生产的所有最终产品和劳务的市场价值的总量指标是(A)。

A.国民生产总值;B.国内生产总值;C.名义国内生产总值;D.实际国内生产总值。

5.一国国内在一定时期内生产的所有最终产品和劳务的市场价值根据价格变化调整后的数值被称为(B)。

A.国民生产总值;B.实际国内生产总值;C.名义国内生产总值;D.潜在国内生产总值。

6.实际GDP等于(B)。

A.价格水平/名义GDP;B.名义GDP/价格水平×100;C.名义GDP乘以价格水平;D.价格水平乘以潜在GDP。

7.下列各项中属于流量的是(A)。

A.国内生产总值;B.国民债务;C.现有住房数量;D.失业人数。

8.存量是(A)。

A.某个时点现存的经济量值;B.某个时点上的流动价值;C.流量的固体等价物;D.某个时期内发生的经济量值。

9. 下列各项中哪一个属于存量?(C)。

A. 国内生产总值;B. 投资;C. 失业人数;D. 人均收入。

10.古典宏观经济理论认为,利息率的灵活性使得(B)。

A.储蓄大于投资;B.储蓄等于投资;C.储蓄小于投资;D.上述情况均可能存在。

11.古典宏观经济理论认为,实现充分就业的原因是(C)。

A.政府管制;B.名义工资刚性;C.名义工资灵活性;D.货币供给适度。

12.根据古典宏观经济理论,价格水平降低导致下述哪一变量减少(C)。

A.产出;B.就业;C.名义工资;D.实际工资。

13.在凯恩斯看来,造成资本主义经济萧条的根源是(A)。

A.有效需求不足;B.资源短缺;C.技术落后;D.微观效率低下。