外文翻译--资本结构、股权结构与公司绩效

- 格式:doc

- 大小:55.50 KB

- 文档页数:7

资本结构、股权结构与公司绩效外文翻译中文2825字1868单词外文文献:Capital structure, equity ownership and firm performanceDimitris Margaritis, Maria Psillaki 1Abstract:This paper investigates the relationship between capital structure, ownership structure and firm performance using a sample of French manufacturing firms. We employ non-parametric data envelopment analysis (DEA) methods to empirically construct the industry’s ‘best practice’frontier and measure firm efficiency as the distance from that frontier. Using these performance measures we examine if more efficient firms choose more or less debt in their capital structure. We summarize the contrasting effects of efficiency on capital structure in terms of two competing hypotheses: the efficiency-risk and franchise value hypotheses. Using quantile regressions we test the effect of efficiency on leverage and thus the empirical validity of the two competing hypotheses across different capital structure choices. We also test the direct relationship from leverage to efficiency stipulated by the Jensen and Meckling (1976) agency cost model. Throughout this analysis we consider the role of ownership structure and type on capital structure and firm performance.Firm performance, capital structure and ownershipConflicts of interest between owners-managers and outside shareholders as well as those between controlling and minority shareholders lie at the heart of the corporate governance literature (Berle and Means, 1932; Jensen and Meckling, 1976;Shleifer and Vishny, 1986). While there is a relatively large literature on the effects of ownership on firm performance (see for example, Morck et al., 1988; McConnell and Servaes, 1990; Himmelberg et al., 1999), the relationship between ownership structure and capital structure remains largely unexplored. On the other hand, a voluminous literature is devoted to capital structure and its effects on corporate performance –see the surveys by Harris and Raviv (1991) and Myers (2001). An emerging consensus that comes out of the corporate governance literature (see Mahrt-Smith, 2005) is that the interactions between capital structure and ownership structure impact on firm values. Yet theoretical arguments alone cannot unequivocally predict these relationships (see Morck et al., 1988) and the empirical evidence that we have often appears to be contradictory. In part these conflicting results arise from difficulties empirical researchers face in obtaining direct measures of the magnitude of agency costs that are not confounded by factors that are beyond the control of management (Berger and Bonaccorsi di Patti, 2006). In the remainder of this section we briefly review the literature in this area focusing on the main hypotheses of interest for this study.Firm performance and capital structureThe agency cost theory is premised on the idea that the interests of the company’s managers and its shareholders are not perfectly aligned. In their seminal paper Jensen and Meckling (1976) emphasized the importance of the agency costs of equity arising from the separation of ownership and control of firms whereby managers tend to maximize their own utility rather than the value of the firm. These conflicts may occur in situations where managers have incentives to take1来源:Journal of Banking & Finance , 2010 (34) : 621–632,本文翻译的是第二部分excessive risks as part of risk shifting investment strategies. This leads us to Jensen’s (1986) “free cash flow theory”where as stated by Jensen (1986, p. 323) “the pro blem is how to motivate managers to disgorge the cash rather than investing it below the cost of capital or wasting it on organizational inefficiencies.”Thus high debt ratios may be used as a disciplinary device to reduce managerial cash flow waste through the threat of liquidation (Grossman and Hart, 1982) or through pressure to generate cash flows to service debt (Jensen, 1986). In these situations, debt will have a positive effect on the value of the firm.Agency costs can also exist from conflicts between debt and equity investors. These conflicts arise when there is a risk of default. The risk of default may create what Myers (1977) referred to as an“underinvestment”or “debt overhang”problem. In this case, debt will have a negative effect on the value of the firm. Building on Myers (1977) and Jensen (1986), Stulz (1990) develops a model in which debt financing is shown to mitigate overinvestment problems but aggravate the underinvestment problem. The model predicts that debt can have both a positive and a negative effect on firm performance and presumably both effects are present in all firms. We allow for the presence of both effects in the empirical specification of the agency cost model. However we expect the impact of leverage to be negative overall. We summarize this in terms of our first testable hypothesis. According to the agency cost hypothesis (H1) higher leverage is expected to lower agency costs, reduce inefficiency and thereby lead to an improvement in firm’s performance.Reverse causality from firm performance to capital structure But firm performance may also affect the choice of capital structure. Berger and Bonaccorsi di Patti (2006) stipulate that more efficient firms are more likely to earn a higher return for a given capital structure, and that higher returns can act as a buffer against portfolio risk so that more efficient firms are in a better position to substitute equity for debt in their capital structure. Hence under the efficiency-risk hypothesis (H2), more efficient firms choose higher leverage ratios because higher efficiency is expected to lower the costs of bankruptcy and financial distress. In essence, the efficiency-risk hypothesis is a spin-off of the trade-off theory of capital structure whereby differences in efficiency, all else equal, enable firms to fine tune their optimal capital structure.It is also possible that firms which expect to sustain high efficiency rates into the future will choose lower debt to equity ratios in an attempt to guard the economic rents or franchise value generated by these efficiencies from the threat of liquidation (see Demsetz, 1973; Berger and Bonaccorsi di Patti, 2006). Thus in addition to a equity for debt substitution effect, the relationship between efficiency and capital structure may also be characterized by the presence of an income effect. Under the franchise-value hypothesis (H2a) more efficient firms tend to hold extra equity capital and therefore, all else equal, choose lower leverage ratios to protect their future income or franchise value.Thus the efficiency-risk hypothesis (H2) and the franchise-value hypothesis (H2a) yield opposite predictions regarding the likely effects of firm efficiency on the choice of capital structure. Although we cannot identify the separate substitution andincome effects our empirical analysis is able to determine which effect dominates the other across the spectrum of different capital structure choices.Ownership structure and the agency costs of debt and equity.The relationship between ownership structure and firm performance dates back to Berle andMeans (1932) who argued that widely held corporations in the US, in which ownership of capital is dispersed among small shareholders and control is concentrated in the hands of insiders tend to underperform. Following from this, Jensen and Meckling (1976) develop more formally the classical owner-manager agency problem. They advocate that managerial share-ownership may reduce managerial incentives to consume perquisites, expropriate shareholders’wealth or to engage in other sub-optimal activities and thus helps in aligning the interests of managers and shareholders which in turn lowers agency costs. Along similar lines, Shleifer and Vishny (1986) show that large external equity holders can mitigate agency conflicts because of their strong incentives to monitor and discipline management.In contrast Demsetz (1983) and Fama and Jensen (1983) point out that a rise in insider share-ownership stakes may also be associated with adverse ‘entrenchment’effects tha t can lead to an increase in managerial opportunism at the expense of outside investors. Whether firm value would be maximized in the presence of large controlling shareholders depends on the entrenchment effect (Claessens et al., 2002; Villalonga and Amit, 2006; Dow and McGuire, 2009). Several studies document either a direct (e.g., Shleifer and Vishny, 1986; Claessens et al., 2002; Hu and Zhou, 2008) or a non-monotonic (e.g., Morck et al., 1988;McConnell and Servaes, 1995; Davies et al., 2005) relationship between ownership structure and firm performance while others (e.g., Demsetz and Lehn, 1985; Himmelberg et al., 1999; Demsetz and Villalonga, 2001) find no relation between ownership concentration and firm performance.Family firms are a special class of large shareholders with unique incentive structures. For example, concerns over family and business reputation and firm survival would tend to mitigate the agency costs of outside debt and outside equity (Demsetz and Lehn, 1985; Anderson et al., 2003) although controlling family shareholders may still expropriate minority shareholders (Claessens et al., 2002; Villalonga and Amit, 2006). Several studies (e.g., Anderson and Reeb, 2003a; Villalonga and Amit, 2006; Maury, 2006; King and Santor, 2008) report that family firms especially those with large personal owners tend to outperform non-family firms. In addition, the empirical findings of Maury (2006) suggest that large controlling family ownership in Western Europe appears to benefit rather than harm minority shareholders. Thus we expect that the net effect of family ownership on firm performance will be positive.Large institutional investors may not, on the other hand, have incentives to monitor management (Villalonga and Amit, 2006) and they may even coerce with management (McConnell and Servaes, 1990; Claessens et al., 2002; Cornett et al., 2007). In addition, Shleifer and Vishny (1986) and La Porta et al. (2002) argue that equity concentration is more likely to have a positive effect on firm performance in situations where control by large equity holders may act as a substitute for legal protection in countries with weak investor protection and less developed capital markets where they also classify Continental Europe.We summarize the contrasting ownership effects of incentive alignment and entrenchment on firm performance in terms of two competing hypotheses. Under the ‘convergence-of-interest hypothesis’(H3) more concentrated ownership should have a positive effect on firm performance. And under the ownership entrenchment hypothesis (H3a) the effect of ownership concentration on firm performance is expected to be negative.The presence of ownership entrenchment and incentive alignment effects also has implications for the firm’s capital structure choice. We assess these effects empirically. As external blockholders have strong incentives to reduce managerial opportunism they may prefer to use debtas a governance mechanism to control management’s consumption of perquisites (Grossman and Hart, 1982). In that case firms with large external blockholdings are likely to have higher debt ratios at least up to the point where the risk of bankruptcy may induce them to lower debt. Family firms may also use higher debt levels to the extent that they are perceived to be less risky by debtholders (Anderson et al., 2003). On the other hand the relation between leverage and insider share-ownership may be negative in situations where managerial blockholders choose lower debt to protect their non-diversifiable human capital and wealth invested in the firm (Friend and Lang, 1988). Brailsford et al. (2002) report a non-linear relationship between managerial share-ownership and leverage. At low levels of managerial ownership, agency conflicts necessitate the use of more debt but as managers become entrenched at high levels of managerial ownership they seek to reduce their risks and they use less debt. Anderson and Reeb (2003) find that insider ownership by managers or families has no effect on leveragewhile King and Santor (2008) report that both family firms and firms controlled by financial institutions carry more debt in their capital structure.外文翻译:资本结构、股权结构与公司绩效摘要:本文通过对法国制造业公司的抽样调查,研究资本结构、所有权结构和公司绩效的关系。

本科毕业设计(论文)中英文对照翻译(此文档为word格式,下载后您可任意修改编辑!)文献出处:Ashkanasy N M. The study on capital structure theory and the optimization of enterprise capital [J]. Journal of Management, 2016, 5(3): 235-254.原文The study on capital structure theory and the optimization ofenterprise capital structureAshkanasy N MAbstractIn this paper, corporate finance is an important content of modern enterprise management decision. Around the existence of optimal capitalstructure has been a lot of controversy. Given investment decisions, whether an enterprise to change its value by changing the capital structure and the cost of capital, namely whether there is a market make the enterprise value maximization, or make the enterprise capital structure of minimizing the cost of capital? To this problem has different answers in different stages of development, has formed many theory of capital structure.Key words: Capital structure; financial structure; Optimization; Financial leverage1 IntroductionIn financial theory, capital structure due to the different understanding of "capital" in the broad sense and narrow sense two explanations: one explanation is that the "capital" as all funding sources, the structure of the generalized capital structure refers to the entire capital, the relationship between the contrast of their own capital and debt capital, as the American scholar Alan c. Shapiro points out that "the company's capital structure - all the debt and equity financing; an alternative explanation is that if the" capital "is defined as a long-term funding sources, capital structure refers to the narrow sense of their own capital and long-term debt capital, and the tension and the short-term debt capital as the business capital management. Whether it is a broad concept ornarrow understanding of the capital structure is to discuss the proportion of equity capital and debt capital relations. 2 The capital structure theory Capital structure theory has experienced a process of gradually forming, developing and perfecting. First proposed the theory of American economist David Durand (David Durand) thinks that enterprise's capital structure is in accordance with the method of net income, net operating income method and traditional method, in 1958 di Gayle Anne (Franco Modigliani and Miller (Mertor Miller) and put forward the famous MM theory, created the modern capital structure theory, on this basis, the later generations and further put forward many new theory: 2.1 Net Income Theory (Net Income going) Net income theory on the premise of two assumptions --, investors with a fixed proportion of investment valuation or enterprise's net income. Enterprises to raise debt funds needed for a fixed rate. Therefore, the theory is that: the enterprise use of debt financing is always beneficial, can reduce the comprehensive cost of capital of enterprise. This is because the debt financing in the whole capital of enterprise, the bigger the share, the comprehensive cost of capital is more c lose to the cost of debt, and because the cost of debt is generally low, so, the higher the debt level, comprehensive capital cost is lower, the greater the enterprise value. When the debt ratio reached 100%, the firm will achieve maximum value.2.2 Theory of Net Operating Income (Net Operating Income going) Netoperating income theory is that, regardless of financial leverage, debt interest rates are fixed. If enterprises increase the lower cost of debt capital, but even if the cost of debt remains unchanged, but due to the increased the enterprise risk, can also lead to the rising cost of equity capital, it a liter of a fall, just offset, the enterprise cost of capital remain unchanged. Is derived as a result, the theory "" does not exist an optimal capital structure of the conclusion.2.3 Traditional Theory (Traditional going) Traditional theory is that the net income and net operating income method of compromise. It thinks, the enterprise use of financial leverage although will lead to rising cost of equity, but within limits does not completely offset the benefits of using the low cost of debt, so can make comprehensive capital cost reduction, increase enterprise value. But once exceed this limit, rights and interests of the rising cost of no longer can be offset by the low cost of debt, the comprehensive cost of capital will rise again. Since then, the cost of debt will rise, leading to a comprehensive capital costs rise more rapidly. Comprehensive cost of capital from falling into a turning point, is the lowest, at this point, to achieve the optimal capital structure. The above three kinds of capital structure theory is referred to as "early capital structure theory", their common features are: three theories are in corporate and personal income tax rate is zero under the condition of the proposed. Three theories and considering the capital structure of the dual effects of the cost of capital and enterprise value.Three theories are prior to 1958. Many scholars believe that the theory is not based on thorough analysis.3 Related theories3.1 Balance TheoryIt centered on the MM theory of modern capital structure theory development to peak after tradeoff theory. Trade-off theory is based on corporate MM model and miller, revised to reflect the financial pinch cost (also known as the financial crisis cost) and a model of agent cost.(1) the cost of financial constraints. Many enterprises always experience of financial constraints, some of them will be forced to go bankrupt. When the financial constraints but also not bankruptcy occurs, may appear the following situation: disputes between owners and creditors often leads to inventory and fixed assets on the material damaged or obsolete. Attorney fees, court fees and administrative costs to devour enterprise wealth, material loss and plus the legal and administrative expenses referred to as the "direct costs" of bankruptcy. Financial pinch will only occur in business with debt, no liability companies won't get into the mud. So with more debt, the fixed interest rate, and the greater the profitability of the probability of large leading to financial constraints and the cost of the higher the probability of occurrence. Financial pinch probability high will reduce the present value of the enterprise, to improve the cost ofcapital.(2) the agency cost. Because shareholders exists the possibility of using a variety of ways from the bondholders who benefit, bonds must have a number of protective constraint clauses. These terms and conditions in a certain extent constrained the legal management of the enterprise. Also must supervise the enterprise to ensure compliance with these terms and conditions, the cost of supervision and also upon the shareholders with higher debt costs. Supervise cost that agency cost is will raise the cost of debt to reduce debt interest. When the tax benefits and liabilities of financial constraints and agency costs when balance each other, namely the costs and benefits offset each other, determine the optimal capital structure. Equilibrium theory emphasizes the liabilities increase will cause the risk of bankruptcy and rising costs, so as to restrict the enterprise infinite pursuit of the behavior of tax preferential policies. In this sense, the enterprise the best capital structure is the balance of tax revenue and financial constraints caused by all kinds of costs as a result, when the marginal debt tax shield benefit is equal to the marginal cost of financial constraints, the enterprise value maximum, to achieve the optimal capital structure.3.2 Asymmetric Information TheoryAsymmetric Information and found)Due to the trade-off theory has long been limited to bankruptcy cost and tax benefit both conceptual framework, to the late 1970 s, the theory is centered on asymmetricinformation theory of new capital structure theory. So-called asymmetric information is in the information management and investors are not equal, managers than investors have more and more accurate information, and managers try to existing shareholders rather than new seeks the best interests of shareholders, so if business prospect is good, the manager will not issue new shares, but if the prospects, will make the cost of issuing new shares to raise too much, this factor must be considered in the capital structure decision. The significance of these findings to the enterprise's financial policy lies in: first it prompted enterprise reserve a certain debt capacity so as to internal lack of funding for new investment projects in the future debt financing. In addition, in order to avoid falling stock prices, managers often don't have to equity financing, and prefer to use external funding. The central idea is: internal financing preference, if you need external finance, preferences of creditor's rights financing. Can in order to save the ability to issue new debt at any time, the number of managers to borrow is usually less than the number of enterprises can take, in order to keep some reserves. Ross (s. Ross) first systematically introduce the theory of asymmetric information from general economics enterprise capital structure analysis, then, tal (e. Talmon), haeckel (Heikel) development from various aspects, such as the theory. After the 1980 s, thanks to the new institutional economics, and gradually formed a financial contract theory, corporate governance structure theory of capitalstructure theory, both of which emphasize enterprise contractual and incomplete contract, financial contract theory focuses on the design of optimal financial contract, and the arrangement of enterprise governance structure theory focuses on the right, focuses on the analysis of the relationship between capital structure and corporate governance.4 the capital structure theory of adaptability analysis On the one hand, capital structure theory especially the theory of modern capital structure is the important contribution is not only put forward "the existence of the optimal capital structure" this financial proposition, and that the optimal combination of the capital structure, objectively and make us on capital structure and its influence on the enterprise value have a clear understanding. The essence of these theories has direct influence and infiltrate into our country financial theory, and gives us enlightenment in many aspects: Because of various financing way, channel in financing costs, risks, benefits, constraints, as well as differences, seeking suitable capital structure is the enterprise financial management, especially the important content of financing management, must cause our country attaches great importance to the financial theory and financial practice. Capital structure decision despite the enterprise internal and external relationships and factor of restriction and influence, but its decision-making is the enterprise, the enterprise to the factors related to capital structure and the relationship between the quantitativeand qualitative analysis, discusses some principles and methods of enterprise capital structure optimization decision. Any enterprise capital structure in the design, all should leave room, maintain appropriate maneuver ability of financing, the financing environment in order to cope with the volatility and deal with unexpected events occur at any time. In general, businesses leverage ratio is high, has an adverse effect on the whole social and economic development, easily led to the decrease of the enterprise itself the economic benefits and losses and bankruptcies, deepen the entire social and economic development is not stable, increase the financial burden, cause inflation, not conducive to the transformation of industrial structure, and lower investment efficiency. Therefore, the enterprise capital structure should be in accordance with the business owners, creditors, and the public can bear the risk of the society in different aspects.译文资本结构理论与企业资本结构优化Ashkanasy N M摘要企业融资是现代企业经营决策的一项重要内容。

外文翻译Capital Structure and Firm Performance Material Source: Board of Governors of the Federal Reserve SystemAuthor: Allen N. BergerAgency costs represent important problems in corporate governance in both financial and nonfinancial industries. The separation of ownership and control in a professionally managed firm may result in managers exerting insufficient work effort, indulging in perquisites, choosing inputs or outputs that suit their own preferences, or otherwise failing to maximize firm value. In effect, the agency costs of outside ownership equal the lost value from professional managers maximizing their own utility, rather than the value of the firm.Theory suggests that the choice of capital structure may help mitigate these agency costs. Under the agency costs hypothesis, high leverage or a low equity/asset ratio reduces the agency costs of outside equity and increases firm value by constraining or encouraging managers to act more in the interests of shareholders. Since the seminal paper by Jensen and Meckling (1976), a vast literature on such agency-theoretic explanations of capital structure has developed (see Harris and Raviv 1991 and Myers 2001 for reviews). Greater financial leverage may affect managers and reduce agency costs through the threat of liquidation, which causes personal losses to managers of salaries, reputation, perquisites, etc. (e.g., Grossman and Hart 1982, Williams 1987), and through pressure to generate cash flow to pay interest expenses (e.g., Jensen 1986). Higher leverage can mitigate conflicts between shareholders and managers concerning the choice of investment (e.g., Myers 1977), the amount of risk to undertake (e.g., Jensen and Meckling 1976, Williams 1987), the conditions under which the firm is liquidated (e.g., Harris and Raviv 1990), and dividend policy (e.g., Stulz 1990).A testable prediction of this class of models is that increasing the leverage ratio should result in lower agency costs of outside equity and improved firm performance, all else held equal. However, when leverage becomes relatively high, further increases generate significant agency costs of outside debt – including higher expected costs of bankruptcy or financial distress – arising from conflicts between bondholders and shareholders.1 Because it is difficult to distinguish empiricallybetween the two sources of agency costs, we follow the literature and allow the relationship between total agency costs and leverage to be non-monotonic.Despite the importance of this theory, there is at best mixed empirical evidence in the extant literature (see Harris and Raviv 1991, Titman 2000, and Myers 2001 for reviews). Tests of the agency costs hypothesis typically regress measures of firm performance on the equity capital ratio or other indicator of leverage plus some control variables. At least three problems appear in the prior studies that we address in our application.First, the measures of firm performance are usually ratios fashioned from financial statements or stock market prices, such as industry-adjusted operating margins or stock market returns. These measures do not net out the effects of differences in exogenous market factors that affect firm value, but are beyond management’s control and therefore cannot reflect agency costs. Thus, the tests may be confounded by factors that are unrelated to agency costs. As well, these studies generally do not set a separate benchmark for each firm’s performance that would be realized if agency costs were minimized.We address the measurement problem by using profit efficiency as our indicator of firm performance. The link between productive efficiency and agency costs was first suggested by Stigler (1976), and profit efficiency represents a refinement of the efficiency concept developed since that time.2 Profit efficiency evaluates how close a firm is to earning the profit that a best-practice firm would earn facing the same exogenous conditions. This has the benefit of controlling for factors outside the control of management that are not part of agency costs. In contrast, comparisons of standard financial ratios, stock market returns, and similar measures typically do not control for these exogenous factors. Even when the measures used in the literature are industry adjusted, they may not account for important differences across firms within an industry –such as local market conditions – as we are able to do with profit efficiency. In addition, the performance of a best-practice firm under the same exogenous conditions is a reasonable benchmark for how the firm would be expected to perform if agency costs were minimized.Second, the prior research generally does not take into account the possibility of reverse causation from performance to capital structure. If firm performance affects the choice of capital structure, then failure to take this reverse causality into account may result in simultaneous-equations bias. That is, regressions of firmperformance on a measure of leverage may confound the effects of capital structure on performance with the effects of performance on capital structure.We address this problem by allowing for reverse causality from performance to capital structure. We discuss below two hypotheses for why firm performance may affect the choice of capital structure, the efficiency-risk hypothesis and the franchise-value hypothesis. We construct a two-equation structural model and estimate it using two-stage least squares (2SLS). An equation specifying profit efficiency as a function of the firm’s equity capital ratio and other variables is use d to test the agency costs hypothesis, and an equation specifying the equity capital ratio as a function of the firm’s profit efficiency and other variables is used to test the net effects of the efficiency-risk and franchise-value hypotheses. Both equations are econometrically identified through exclusion restrictions that are consistent with the theories.Third, some, but not all of the prior studies did not take ownership structure into account. Under virtually any theory of agency costs, ownership structure is important, since it is the separation of ownership and control that creates agency costs (e.g., Barnea, Haugen, and Senbet 1985). Greater insider shares may reduce agency costs, although the effect may be reversed at very high levels of insider holdings (e.g., Morck, Shleifer, and Vishny 1988). As well, outside block ownership or institutional holdings tend to mitigate agency costs by creating a relatively efficient monitor of the managers (e.g., Shleifer and Vishny 1986). Exclusion of the ownership variables may bias the test results because the ownership variables may be correlated with the dependent variable in the agency cost equation (performance) and with the key exogenous variable (leverage) through the reverse causality hypotheses noted above.To address this third problem, we include ownership structure variables in the agency cost equation explaining profit efficiency. We include insider ownership, outside block holdings, and institutional holdings.Our application to data from the banking industry is advantageous because of the abundance of quality data available on firms in this industry. In particular, we have detailed financial data for a large number of firms producing comparable products with similar technologies, and information on market prices and other exogenous conditions in the local markets in which they operate. In addition, some studies in this literature find evidence of the link between the efficiency of firms and variables that are recognized to affect agency costs, including leverage andownership structure (see Berger and Mester 1997 for a review).Although banking is a regulated industry, banks are subject to the same type of agency costs and other influences on behavior as other industries. The banks in the sample are subject to essentially equal regulatory constraints, and we focus on differences across banks, not between banks and other firms. Most banks are well above the regulatory capital minimums, and our results are based primarily on differences at the margin, rather than the effects of regulation. Our test of the agency costs hypothesis using data from one industry may be built upon to test a number of corporate finance hypotheses using information on virtually any industry.We test the agency costs hypothesis of corporate finance, under which high leverage reduces the agency costs of outside equity and increases firm value by constraining or encouraging managers to act more in the interests of shareholders. Our use of profit efficiency as an indicator of firm performance to measure agency costs, our specification of a two-equation structural model that takes into account reverse causality from firm performance to capital structure, and our inclusion of measures of ownership structure address problems in the extant empirical literature that may help explain why prior empirical results have been mixed. Our application to the banking industry is advantageous because of the detailed data available on a large number of comparable firms and the exogenous conditions in their local markets. Although banks are regulated, we focus on differences across banks that are driven by corporate governance issues, rather than any differences in-regulation, given that all banks are subject to essentially the same regulatory framework and most banks are well above the regulatory capital minimums.Our findings are consistent with the agency costs hypothesis – higher leverage or a lower equity capital ratio is associated with higher profit efficiency, all else equal. The effect is economically significant as well as statistically significant. An increase in leverage as represented by a 1 percentage point decrease in the equity capital ratio yields a predicted increase in profit efficiency of about 6 percentage points, or a gain of about 10% in actual profits at the sample mean. This result is robust to a number of specification changes, including different measures of performance (standard profit efficiency, alternative profit efficiency, and return on equity), different econometric techniques (two-stage least squares and OLS), different efficiency measurement methods (distribution-free and fixed-effects), different samples (the “ownership sample” of banks with detailed ownership data and the “full sample” of banks), and the different sample periods (1990s and 1980s).However, the data are not consistent with the prediction that the relationship between performance and leverage may be reversed when leverage is very high due to the agency costs of outside debt.We also find that profit efficiency is responsive to the ownership structure of the firm, consistent with agency theory and our argument that profit efficiency embeds agency costs. The data suggest that large institutional holders have favorable monitoring effects that reduce agency costs, although large individual investors do not. As well, the data are consistent with a non-monotonic relationship between performance and insider ownership, similar to findings in the literature.With respect to the reverse causality from efficiency to capital structure, we offer two competing hypotheses with opposite predictions, and we interpret our tests as determining which hypothesis empirically dominates the other. Under the efficiency-risk hypothesis, the expected high earnings from greater profit efficiency substitute for equity capital in protecting the firm from the expected costs of bankruptcy or financial distress, whereas under the franchise-value hypothesis, firms try to protect the expected income stream from high profit efficiency by holding additional equity capital. Neither hypothesis dominates the other for the ownership sample, but the substitution effect of the efficiency-risk hypothesis dominates for the full sample, suggesting a difference in behavior for the small banks that comprise most of the full sample.The approach developed in this paper can be built upon to test the agency costs hypothesis or other corporate finance hypotheses using data from virtually any industry. Future research could extend the analysis to cover other dimensions of capital structure. Agency theory suggests complex relationships between agency costs and different types of securities. We have analyzed only one dimension of capital structure, the equity capital ratio. Future research could consider other dimensions, such as the use of subordinated notes and debentures, or other individual debt or equity instruments.译文资本结构与企业绩效资料来源: 联邦储备系统理事会作者:Allen N. Berger 在财务和非财务行业,代理成本在公司治理中都是重要的问题。

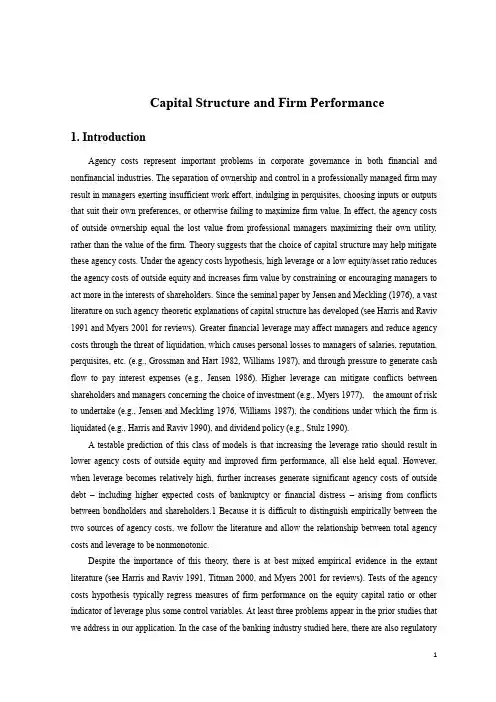

中英文对照外文翻译(文档含英文原文和中文翻译)The effect of capital structure on profitability : an empirical analysis of listed firms in Ghana IntroductionThe capital structure decision is crucial for any business organization. The decision is important because of the need to maximize returns to various organizational constituencies, and also because of the impact such a decision has on a firm’s ability to deal with its competitive environment. The capital structure of a firm is actually a mix of different securities. In general, a firm can choose among many alternative capital structures. It can issue a large amount of debt or very little debt. It can arrange lease financing, use warrants, issue convertible bonds, sign forward contracts or trade bond swaps. It can issue dozens of distinct securities in countless combinations; however, it attempts to find the particular combination that maximizes its overall market value.A number of theories have been advanced in explaining the capital structure of firms. Despite the theoretical appeal of capital structure, researchers in financial management have not found the optimal capital structure. The best that academics and practitioners have been able to achieve are prescriptions that satisfy short-term goals. For example, the lack of a consensus about what would qualify as optimal capital structure has necessitated the need for this research. A better understanding of the issues at hand requires a look at the concept of capital structure and its effect on firm profitability. This paper examines the relationship between capital structure and profitability of companies listed on the Ghana Stock Exchange during the period 1998-2002. The effect of capital structure on the profitability of listed firms in Ghana is a scientific area that has not yet been explored in Ghanaian finance literature.The paper is organized as follows. The following section gives a review of the extant literature on the subject. The next section describes the data and justifies the choice of the variables used in the analysis. The model used in the analysis is then estimated. The subsequent section presents and discusses the results of the empirical analysis. Finally, the last section summarizes the findings of the research and also concludes the discussion.Literature on capital structureThe relationship between capital structure and firm value has been the subject of considerable debate. Throughout the literature, debate has centered on whether there is an optimal capital structure for an individual firm or whether the proportion of debt usage is irrelevant to the individual firm’s value. The capital structure of a firm concerns the mix of debt and equity the firm uses in its operation. Brealey and Myers (2003) contend that the choice of capital structure is fundamentally a marketing problem. They state that the firm can issue dozens of distinct securities in countless combinations, but it attempts to find the particular combination that maximizes market value. According to Weston and Brigham (1992), the optimal capital structure is the one that maximizes the market value of the firm’s outstanding shares.Fama and French (1998), analyzing the relationship among taxes, financing decisions, and the firm’s value, concluded that the debt does not concede tax b enefits. Besides, the high leverage degree generates agency problems among shareholders and creditors that predict negative relationships between leverage and profitability. Therefore, negative information relating debt and profitability obscures the tax benefit of the debt. Booth et al. (2001) developed a study attempting to relate the capital structure of several companies in countries with extremely different financial markets. They concluded thatthe variables that affect the choice of the capital structure of the companies are similar, in spite of the great differences presented by the financial markets. Besides, they concluded that profitability has an inverse relationship with debt level and size of the firm. Graham (2000) concluded in his work that big and profitable companies present a low debt rate. Mesquita and Lara (2003) found in their study that the relationship between rates of return and debt indicates a negative relationship for long-term financing. However, they found a positive relationship for short-term financing and equity.Hadlock and James (2002) concluded that companies prefer loan (debt) financing because they anticipate a higher return. Taub (1975) also found significant positive coefficients for four measures of profitability in a regression of these measures against debt ratio. Petersen and Rajan (1994) identified the same association, but for industries. Baker (1973), who worked with a simultaneous equations model, and Nerlove (1968) also found the same type of association for industries. Roden and Lewellen (1995) found a significant positive association between profitability and total debt as a percentage of the total buyout-financing package in their study on leveraged buyouts. Champion (1999) suggested that the use of leverage was one way to improve the performance of an organization.In summary, there is no universal theory of the debt-equity choice. Different views have been put forward regarding the financing choice. The present study investigates the effect of capital structure on profitability of listed firms on the GSE.MethodologyThis study sampled all firms that have been listed on the GSE over a five-year period (1998-2002). Twenty-two firms qualified to be included in the study sample. Variables used for the analysis include profitability and leverage ratios. Profitability is operationalized using a commonly used accounting-based measure: the ratio of earnings before interest and taxes (EBIT) to equity. The leverage ratios used include:. short-term debt to the total capital;. long-term debt to total capital;. total debt to total capital.Firm size and sales growth are also included as control variables.The panel character of the data allows for the use of panel data methodology. Panel data involves the pooling of observations on a cross-section of units over several time periods and provides results that are simply not detectable in pure cross-sections or pure time-series studies. A general model for panel data that allows the researcher to estimate panel data with great flexibility and formulate the differences in the behavior of thecross-section elements is adopted. The relationship between debt and profitability is thus estimated in the following regression models:ROE i,t =β0 +β1SDA i,t +β2SIZE i,t +β3SG i,t + ëi,t (1) ROE i,t=β0 +β1LDA i,t +β2SIZE i,t +β3SG i,t + ëi,t (2) ROE i,t=β0 +β1DA i,t +β2SIZE i,t +β3SG i,t + ëi,t (3)where:. ROE i,t is EBIT divided by equity for firm i in time t;. SDA i,t is short-term debt divided by the total capital for firm i in time t;. LDA i,t is long-term debt divided by the total capital for firm i in time t;. DA i,t is total debt divided by the total capital for firm i in time t;. SIZE i,t is the log of sales for firm i in time t;. SG i,t is sales growth for firm i in time t; and. ëi,t is the error term.Empirical resultsTable I provides a summary of the descriptive statistics of the dependent and independent variables for the sample of firms. This shows the average indicators of variables computed from the financial statements. The return rate measured by return on equity (ROE) reveals an average of 36.94 percent with median 28.4 percent. This picture suggests a good performance during the period under study. The ROE measures the contribution of net income per cedi (local currency) invested by the firms’ stockholders; a measure of the efficiency of the owners’ invested capital. The variable SDA measures the ratio of short-term debt to total capital. The average value of this variable is 0.4876 with median 0.4547. The value 0.4547 indicates that approximately 45 percent of total assets are represented by short-term debts, attesting to the fact that Ghanaian firms largely depend on short-term debt for financing their operations due to the difficulty in accessing long-term credit from financial institutions. Another reason is due to the under-developed nature of the Ghanaian long-term debt market. The ratio of total long-term debt to total assets (LDA) also stands on average at 0.0985. Total debt to total capital ratio(DA) presents a mean of 0.5861. This suggests that about 58 percent of total assets are financed by debt capital. The above position reveals that the companies are financially leveraged with a large percentage of total debt being short-term.Table I.Descriptive statisticsMean SD Minimum Median Maximum━━━━━━━━━━━━━━━━━━━━━━━━━━━━━ROE 0.3694 0.5186 -1.0433 0.2836 3.8300SDA 0.4876 0.2296 0.0934 0.4547 1.1018LDA 0.0985 0.1803 0.0000 0.0186 0.7665DA 0.5861 0.2032 0.2054 0.5571 1.1018SIZE 18.2124 1.6495 14.1875 18.2361 22.0995SG 0.3288 0.3457 20.7500 0.2561 1.3597━━━━━━━━━━━━━━━━━━━━━━━━━━━━━Regression analysis is used to investigate the relationship between capital structure and profitability measured by ROE. Ordinary least squares (OLS) regression results are presented in Table II. The results from the regression models (1), (2), and (3) denote that the independent variables explain the debt ratio determinations of the firms at 68.3, 39.7, and 86.4 percent, respectively. The F-statistics prove the validity of the estimated models. Also, the coefficients are statistically significant in level of confidence of 99 percent.The results in regression (1) reveal a significantly positive relationship between SDA and profitability. This suggests that short-term debt tends to be less expensive, and therefore increasing short-term debt with a relatively low interest rate will lead to an increase in profit levels. The results also show that profitability increases with the control variables (size and sales growth). Regression (2) shows a significantly negative association between LDA and profitability. This implies that an increase in the long-term debt position is associated with a decrease in profitability. This is explained by the fact that long-term debts are relatively more expensive, and therefore employing high proportions of them could lead to low profitability. The results support earlier findings by Miller (1977), Fama and French (1998), Graham (2000) and Booth et al. (2001). Firm size and sales growth are again positively related to profitability.The results from regression (3) indicate a significantly positive association between DA and profitability. The significantly positive regression coefficient for total debt implies that an increase in the debt position is associated with an increase in profitability: thus, the higher the debt, the higher the profitability. Again, this suggests that profitable firms depend more on debt as their main financing option. This supports the findings of Hadlock and James (2002), Petersen and Rajan (1994) and Roden and Lewellen (1995) that profitable firms use more debt. In the Ghanaian case, a high proportion (85 percent)of debt is represented by short-term debt. The results also show positive relationships between the control variables (firm size and sale growth) and profitability.Table II.Regression model results━━━━━━━━━━━━━━━━━━━━━━━━━━━━━Profitability (EBIT/equity)Ordinary least squares━━━━━━━━━━━━━━━━━━━━━━━━━━━━━Variable 1 2 3SIZE 0.0038 (0.0000) 0.0500 (0.0000) 0.0411 (0.0000)SG 0.1314 (0.0000) 0.1316 (0.0000) 0.1413 (0.0000)SDA 0.8025 (0.0000)LDA -0.3722(0.0000)DA -0.7609(0.0000)R²0.6825 0.3968 0.8639SE 0.4365 0.4961 0.4735Prob. (F) 0.0000 0.0000 0.0000━━━━━━━━━━━━━━━━━━━━━━━━━━━━ConclusionsThe capital structure decision is crucial for any business organization. The decision is important because of the need to maximize returns to various organizational constituencies, and also because of the impact such a decision has on an organization’s ability to deal with its competitive environment. This present study evaluated the relationship between capital structure and profitability of listed firms on the GSE during a five-year period (1998-2002). The results revealed significantly positive relation between SDA and ROE, suggesting that profitable firms use more short-term debt to finance their operation. Short-term debt is an important component or source of financing for Ghanaian firms, representing 85 percent of total debt financing. However, the results showed a negative relationship between LDA and ROE. With regard to the relationship between total debt and profitability, the regression results showed a significantly positive association between DA and ROE. This suggests that profitable firms depend more on debt as their main financing option. In the Ghanaian case, a high proportion (85 percent) of the debt is represented in short-term debt.译文加纳上市公司资本结构对盈利能力的实证研究论文简介资本结构决策对于任何商业组织都是至关重要的。

外文翻译原文Corporate Ownership Structure and Firm Performance: evidence from Greek firmsMaterial Source:Author:Panayotis Kapopoulos and Sophia LazaretouThe Berle-Means (1932) thesis implies that diffuse ownership adversely affects firm performance.We test this hypothesis by assessing the impact of the structure of ownership on profitability, taking into account the endogeneity of ownership structure and modelling separately inside and outside ownership.Table 3 presents the result s from the model estimation using Tobin’s Q as a firm performance measure when managerial ownership is taken into account. It uses the total sample size (175 firms) and compares OLS estimates to 2SLS estimates. Table 4 uses the smaller firm sample size (163 firms) excluding utilities and financial institutions. Focusing on OLS estimates for the profitability equation, we note that profitability is always statistically dependent on at least one measure of ownership structure. The regression coefficient of the fraction of shares owned by important outside investors takes a positive sign and is statistically significant. This implies that outside investor shareholdings affect Tobin’s Q ratio positively. This finding is consistent with what one would expect: greater ownership concentration by outside investors may lead to superior performance. The second measure of ownership concentration, namely the fraction of shares owned by management, also has a positive effect on performance, although the coefficient is statistically significant at much lower levels of significance (10 per cent or 15 per cent). This result is consistent with the finding that the simple correlation coefficient between the two ownership variables is 0.54. Moreover, the results shown in the tables for the 2SLS estimates confirm the finding for the effect of ownership concentration on profitability. The coefficients of both ownership variables, important SH and managerial SH, have the correct positive sign and are statistically significant either at a much higher (1 per cent) or a lower (10 per cent) level of significance.Another finding shown in Tables 3 and 4 is the negative effect of thedebt-to-assets ratio on profitability. In all OLS and 2SLS estimates,leverage negatively affects profitability. The distribution-to-sales ratio is positive, as expected, but strongly insignificant. Market concentration consistently has a positive effect on profitability. The coefficient of the CR4 concentration index takes a positive sign and is sometimes statistically significant at the 10 per cent level or better. However, when we adopt a Herfindahl indicator, our data do not support this finding. The coefficient, even though it has the correct sign, is everywhere insignificant. The picture is reversed when we estimate equation (1) with 2SLS. Nevertheless, the data do not seem to support the usual finding of industrial organisation studies that profitability is partly driven by industry concentration.One might expect that high profitability leads management to acquire more shares and, therefore, causes managerial shareholdings to be greater. OLS estimates show that Tobin’s Q is empirically significant in explaining the variation in the structure of corporate ownership. In all regressions (of either sample size), the coefficient of Tobin’s Q is positive and significant at a high level of significance. However, the results for the 2SLS equation estimates of the Tobin’s Q cast doubt on this result. The 2SLS estimates are positive but hardly significant (lower than 15 per cent).As Demsetz and Lehn (1985) have shown, the ownership structure of the media industry is more concentrated than that of industries concerning manufacturing, utility and financial firms. We find that the dummy variable Media is positive and significant at 5 per cent (OLS estimate) or 10 per cent (2SLS estimate). In the profitability equation it enters negatively, but it is insignificant. The positive coefficient on media industry suggests that, ceteris paribus, ownership is more concentrated in media firms with non-profit maximising goals relative to firms operating in other industries. In other words, the utility (U) and financial (F) dummies isolate the impact of “systematic regulation”. As shown in the tables, the OLS estimates for U and F dummies have the expected negative sign and are sometimes significant. These findings, however, are not confirmed by 2SLS estimates.Finally, OLS and 2SLS estimates suggest that size does not seem to be able to explain variations in ownership structure. Using the total firm sample size, the coefficient on firm size, as measured by the book value of total assets, is negative as expected, but insignificant. However, the picture changes when we exclude utilities and financial institutions; firm size becomes significant.So far, we have treated only the fraction of shares owned by management as the endogenous component of corporate ownership structure. Equations (1) and (2) are estimated treating important outside investors’ shareholdings as the endogenous variable in equation (2). Tables 5 and 6 report the OLS and 2SLS estimates. As shown, both measures of ownership structure explain variations in Tobin’s Q. However, as OLS and 2SLS estimates reveal, the coefficient of Tobin’s Q is more strongly statistically significant in the ownership structure equation, implying that firm performance as measured by Tobin’s Q has a stronger effect on the fraction of shares owned by important outside investors than it does on managerial shareholdings. Therefore, as the findings suggest, important SH is likely to be more strongly endogenous.The low value of the simple correlation coefficient between Tobin’s Q and the accounting profit rate (0.157) suggests that we cannot consider the two measures of performance to be redundant. Therefore, we can re-estimate equations (1) and (2) using the accounting rate of return as an alternative measure of firm performance in place of Tobin’s Q.We note that the coefficients that link ownership variables to firm profitability are weaker compared with the estimates obtained using Tobin’s Q. Specifically, important shareholdings continue to have a positive and significant (although at a lower than 10 per cent level) effect on profit rate, whereas managerial shareholdings are everywhere insignificant. Moreover, in all estimates of the ownership structure equation (of either sample size), the profit rate positively and significantly affects managerial shareholdings. Overall, the results provide no reason to alter considerably the conclusions we reach concerning theownership–performance relationship.This paper brings together various aspects of corporate finance and firm performance and examines whether variations across firms in observed ownership structures result in systematic variations in observed firm performance in the context of a small European capital market. We test this hypothesis by assessing the impact of the structure of ownership on performance using data for 175 Greek listed firms. We use two measures of performance –namely, Tobin’s Q and the accounting profit rate –and consider two measures of ownership –namely, the fraction of shares owned by management and the fraction of shares owned by important investors. The paper is primarily motivated by a lack of evidence regarding the relationship between ownership structure and firm performance in Greek firms. Moreover, ownership is modelled as multi-dimensional and endogenously determined.Empirical findings indicate that there exists a linear positive relationship between profitability and ownership structure. Both measures of ownership, managerial shareholdings and important shareholdings, positively influence Tobin’s Q.The results suggest that the greater the degree to which shares are concentrated in the hands of outside or inside shareholders, the more effectively management behaviour is monitored and disciplined, thus resulting in better performance. The results from our study also yield evidence for the endogeneity of ownership structure. We find that profitability is a positive predictor of ownership structure measures, suggesting that the coefficient of a single equation model on the ownership–profitability relationship is biased because of its failure to take into account the complexity of interests involved in an ownership structure. On the one side, Greek data reveal a significant positive impact of ownership structure on profitability. On the other side, there exists evidence that superior firm performance leads to an increase in the value of stock options owned by management or large shareholders, which if exercised, would increase their share ownership.We also find that profitability is negatively related to the debt-to-assets ratio. This evidence reveals the existence of reducing effects of the differences between the interest obligations incurred when borrowing took place and the interest rates that prevailed during the ample period. The statistical insignificance of the relationship between profitability and distribution-to-sales ratio indicates that our model fails to expl ain differences in measurements of Tobin’s Q that are caused by accounting artefacts. Lastly, we find that profitability is positively related to market concentration (measured by CR4 concentration ratio). This can be considered either as the result of scale economies in most of the sectors of our sample or as a consequence of the fact that larger firms in markets with oligopoly structure are able to exercise market power. However, when we use the Herfindahl index as a proxy for the degree of concentration, we cannot detect a strongly significant relationship with firm performance.A striking evidence of our empirical analysis is the significant positive relationship found between media dummy and ownership structure. This result, in conjunction with the finding that the media dummy enters negatively the profitability equation (even though it is insignificant), means that firms in the media industry with high “amenity potential” could not be used to produce these non-profit amenities if they were more diffused. This result might explain the recent attemptsof the Greek government to reform the corporate governance legislation so as to forbid concentration of a share above 1 per cent in the hands of the same shareholder. This legal reform aims at excluding chiefly those that undertake the construction of public works from a strict management control of media firms so as to reduce corruption incentives.A caveat is in order. As we have already mentioned, the Athens Stock Exchange reports only the percentage of shares that is either equal or larger than 5 per cent of outstanding shares. According to the current institutional framework, firms do not have the legal obligation to announce changes in voting rights for those owners with a share below 5 per cent. Consequently, the lack of data for equity owners with a share below 5 percent imposes a constraint on our empirical analysis. It causes a discontinuity in the observations used in the construction of the ownership structure variable. A more rigorous definition of that variable would take into account the fraction of shares owned by a firm’s shareholders or management, each of whom owns at least 1 per cent of outstanding shares.Suggestions for further research include the development and estimation of a generalised non-linear model specification. Some authors (Morck et al., 1988; Welch, 2003) have estimated the relationship between managerial share ownership and profitability in the context of a non-linear single equation model. However, they do not control for the possible endogeneity of a firm’s ownership structure. It might be interesting to address the issue of a non-monotonic relationship by developing a non-linear equation model taking into account both endogeneity and non-linearity. Further,the data sample used in this study covers a relatively large number of Greek listed firms for the year 2000. One would expect to calculate the variables for a longer period of two or five years so as to avoid the impact of the business cycle. Data availability is a serious constraint in our analysis. The Athens Stock Exchange started to publish information concerning the changes in voting rights only from 2000. Therefore, it might be informative to replicate the estimates using panel data for some years after 2000. In this case, however, the firm sample would change and the results might not be comparable. Also, firm coverage would be limited, since we require a minimum of a three-year presence for each firm in the sample.译文公司股权结构与公司绩效:数据来自希腊公司资料来源: 作者:Panayotis Kapopoulos and Sophia Lazaretou在Berle 和Means(1932)的论文中提出所有权对企业的绩效产生不利影响。

资本结构与公司绩效:来自约旦的证据最优资本结构的主题一直是许多研究的主题。

有人认为,高盈利的公司不一定比低盈利的公司拥有更高的负债比率。

也有人认为,具有高增长率的企业有较高的债务权益比率。

破产成本(代理公司规模)也被认为是一个重要的影响资本结构因素(Kraus and Litzenberger, 1973; Harris and Raviv, 1991)。

如果这三个因素被认为是资本结构的决定因素,那么这些因素可以用来确定公司绩效。

在实践中,企业经理人都能够找出最佳的资本结构,减少一家公司的融资成本,从而最大限度地提高公司的收入回报。

如果一个公司的资本结构影响公司业绩,那么它是合理的预期,该公司的资本结构会影响公司的健康和其违约的可能性。

从债权人的角度看,它是可能的,银行的债务权益比艾滋病在了解银行的风险管理策略,以及如何确定违约的可能性,陷入财务困境的企业。

总之,对于学者和从业人员来说,资本结构和公司业绩的问题是重要的。

当前文件的目的是研究资本结构对公司业绩在约旦的效果。

有一个缺乏有关资本结构的影响表现在发达国家和发展中国家的企业的经验证据。

在资本结构上以前的证据大多来自企业资产负债率的决定因素。

据作者所知,这项研究提供了第一次尝试探讨约旦的资本结构对公司绩效。

我们之所以选择约旦为例,这一主题是其独特性,我们在下面讨论。

首先,我们的研究期间约旦的经济一直受到中东地区的大量外部冲击。

在1990-1991年爆发了第一次海湾战争。

同时由于这场战争,移民工人和难民回归,增加了在约旦的贫困和失业水平。

例如,在那段时间(世界银行,2003),超过30万人从海湾国家返回约旦。

此外,在约旦河西岸和加沙地带发生的持续不断的冲突,和2003年的第二次海湾战争对约旦的旅游和投资的产生了负面影响。

此外,约旦受到于2000年9月开始的巴勒斯坦起义1的严重影响。

巴勒斯坦起义对大部分出口到这些邻国的约旦公司的公司业绩产生负面影响。

股权结构与公司业绩外文翻译外文翻译Ownership Structure and Firm Performance: Evidence from IsraelMaterial Source: Journal of Management and Governance Author: Beni Lauterbach and Alexander Vaninsky1.IntroductionFor many years and in many economies, most of the business activity was conducted by proprietorships, partnerships or closed corporations. In these forms of business organization, a small and closely related group of individuals belonging to the same family or cooperating in business for lengthy periods runs the firm and shares its profits.However, over the recent century, a new form of business organization flourished as non-concentrated-ownership corporations emerged. The modern diverse ownership corporation has broken the link between the ownership and active management of the firm. Modern corporations are run by professional managers who typically own only a very small fraction of the shares. In addition, ownership is disperse, that is the corporation is owned by and its profits are distributed among many stockholders.The advantages of the modern corporation are numerous. It relievesfinancing problems, which enables the firm to assume larger-scale operations and utilize economies of scale. It also facilitates complex-operations allowing the most skilled or expert managers to control business even when they the professional mangers do not have enough funds to own the firm. Modern corporations raise money sell common stocks in the capital markets and assign it to the productive activities of professional managers. This is why it is plausible to hypothesize that the modern diverse-ownership corporations perform better than the traditional “closely held” business forms.Moderating factors exist. For example, closely held firms may issue minority shares to raise capital and expand operations. More importantly, modern corporations face a severe new problem called the agency problem: there is a chance that the professional mangers governing the daily operations of the firm would take actions against the best interests of the shareholders. This agency problem stems from the separation of ownership and control in the modern corporation, and it troubled many economists before e.g., Berle and Means, 1932; Jensen andMeckling, 1976; Fama and Jensen 1983. The conclusion was that there needs to exist a monitoring system or contract, aligning the manager interests and actions with the wealth and welfare of the owners stockholdersAgency-type problems exist also in closely held firms becausethere are always only a few decision makers. However, given the personal ties between the owners and mangers in these firms, and given the much closer monitoring, agency problems in closely held firms seem in general less severe.The presence of agency problems weakens the central thesis that modern open ownership corporations are more efficient. It is possible that in some business sectors the costs of monitoring and bonding the manager would be excessive. It is also probable that in some cases the advantages of large-scale operations and professional management would be minor and insufficient to outweigh the expected agency costs. Nevertheless, given the historical trend towards diverse ownership corporations, we maintain the hypothesis that diverse-ownership firms perform better than closely held firms. In our view, the trend towards diverse ownership corporations is rational and can be explained by performance gains.2. Ownership Structure and Firm PerformanceOne of the most important trademarks of the modern corporation is the separation of ownership and control. Modern corporations are typically run by professional executives who own only a small fraction of the shares.There is an ongoing debate in the literature on the impact and merit of the separation of ownership and control. Early theorists such as Williamson 1964 propose that non-owner managers prefer their owninterests over that of the shareholders. Consequently, non-owner managed firms become less efficient than owner-managed firms.The more recent literature reexamines this issue and prediction. It points out the existence of mechanisms that moderate the prospects of non-optimal and selfish behavior by the manager. Fama 1980, for example, argues that the availability and competition in the managerial labor markets reduce the prospects that managers would act irresponsibly. In addition, the presence of outside directors on the board constrains management behavior. Others, like Murphy 1985, suggest that executive compensation packages help align management interests with those of the shareholders by generating a link between management pay and firm performanceHence, non-owner manager firms are not less efficient than owner-managed firms. Most interestingly, Demsetz and Lehn 1985 conclude that the structure of ownership varies in ways that are consistent with value imization. That is, diverse ownership and non-owner managed firms emerge when they are more worthwhile.The empirical evidence on the issue is mixed see Short 1994 for a summaryPart of the diverse results can be attributed to the difference across the studies in the criteria for differentiation between owner and non-owner manager controlled firms. These criteria, typically based on percentage ownership by large stockholders, are less innocuous and more problematic than initially believed because, as demonstrated by Morck,Shleifer and Vishny 1988 and McConnell and Servaes 1990, the relation between percentage ownership and firm performance is nonlinear. Further, percent ownership appears insufficient for describing the control structure. Two firms with identical overall percentage ownership by large blockholders are likely to have different control organizations, depending on the identity of the large stockholders.In this study, we utilize the ownership classification scheme proposed by Ang, Hauser and Lauterbach 1997. This scheme distinguishes between non-owner managed firms, firms controlled by concerns, firms controlled by a family, and firms controlled by a group of individuals partners. Obviously, the control structure in each of these firm types is different. Thus, some new perspectives on the relation between ownership structure and firm performance might emerge.3. DataWe employ data from a developing economy, Israel, where many forms of business organization coexist. The sample includes 280 public companies traded on the Tel-Aviv Stock Exchange TASE during 1994. For each company we collect data on the 1992?1994 net income profits after tax, 1994 total assets, 1994 equity, 1994 top management remuneration, and 1994 ownership structure. All data is extracted from the companies financial reports except for the classification of firms according to their ownership structure, which is based on the publica tions, “Holdings ofInterested Parties” issued by the Israel Securities Authority, “Meitav Stock Guide,” and “Globes Stock Exchange Yearbook”.The initial sample included all firms traded on the TASE about 560 at the time. However, sample size shrunk by half because: 1 according to the Israeli Security Authority the Israeli counterpart of the US SEC only 434 companies provided reliable compensation reports; 2 147 companies have a negative 1992?94 average net income, which makes them unsuitable for the methodology we employ; and 3 for 7 firms we could not determine the ownership structure.The companies in the sample represent a rich variety of ownership structures, as illustrated in Figure 1. Nine percent of the firms do not have any majority owner. Among majority owned firms, individuals family firms or partnerships of individuals own 72% and the rest are controlled by concerns. About half 49% of the individually-controlled firms are dominated by a partnership of individuals and the rest 51% are dominated by families. Professional non-owner CEOs are found in about 15% of the individually controlled firms.4. Methodology: Data Envelopment AnalysisIn this study, we measure relative performance using Data Envelopment Analysis DEA. Data Envelopment Analysis is currently a leading methodology in Operations Research for performance evaluations see Seiford and Thrall, 1990, and previous versions of it have been usedin Finance by Elyasiani andMehdian, 1992, for example.The main advantage of Data Envelopment Analysis is that it is a parameter-free approach. For each analyzed firm, DEA constructs a “twin” comparable virtual firm consisting of a portfolio of other sample firms. Then, the relative performance of the firm can be determined. Other quantitative techniques such as regression analysis are parametric, that is it estimates a “production function” and assesses each firm performance according to its residual relative to the fitted fixed parameters economy-wide production function. We are not claiming that parametric methods are inadequate. Rather, we attempt a different and perhaps more flexible methodology, and compare its results to the standard regression methodology Findings.The equity ratio variable represents expectation that given the firm size, the higher the investments of stockholders equity, the higher their return net income. Finally, the CEO and top management compensation variables are controlling for the managers’ input. One of our central points is that top managers’ actions and skills affect firm output. Hence, higher pay mangers who presumably are also higher-skill are expected to yield superior profits. Rosen 1982 relates executives’ pay and rank in the organization to their skills and abilities, and Murphy 1998 discusses in de tail the structure of executive pay and its relation to firm’s performance.The DEA analysis and the empirical estimation of the relative performance of different organizational forms are repeated in four separate subsets of firms: Investment companies, Industrial companies, Real-estate companies, and Trade and services companies. This sector analysis controls for the special business environment of the firms and facilitates further examination of the net effect of ownership structure on firm performance.5.Empirical Results The main results of the empirical findings reviewed above are that majority Control by a few individuals diminishes firm performance, and that professional non-owner managers promote performance. The conclusions about individual control and professional management are reinforced by two other findings. First, it appears that firms without professional managers and firms controlled by individuals are more likely to exhibit negative net income.Second, Table IV also presents results of regressions of net income, NET INC, on leverage, size, professional manager dummy, and individual control dummy.6. ConclusionsThe empirical analysis of 280 firms in Israel reveals that ownership structure impacts firm performance, where performance is estimated as the actual net income of the firm divided by the optimal net income given the firm’s inputs. We find that:Out of all organizational forms, family owner-managed firms appearleast efficient in generating profits. When all firms are considered, only family firms with owner managers have an average performance score of less than 30%, and when performance is measured relative to the business sector, only family firms with owner-managers have an average score of less than 50%.2Non-owner managed firms perform better than owner-managed firms. These findings suggest that the modern form of business organization, namely the open corporation with disperse ownership and non-owner managers, promotes performance Critical readers may wonder how come “efficient” and “less-efficient” organizational structures coexist. The answer is that we probably do not document a long-term equilibrium situation. The lower-performing family and partnership controlled firms are likely, as time progresses, to transform into public-controlled non-majority owned corporations.A few reservations are in order. First, we do not contend that every company would gain by transforming into a disperse ownership public firm. For example, it is clear that start-up companies are usually better off when they are closely held. Second, there remain questions about the methodology and its application Data Envelopment Analysis is not standard in Finance. Last, we did not show directly that transforming into a disperse ownership public firm improves performances. Future research should further explore any performance gains from the separation ofownership and control.译文股权结构与公司业绩资料来源:管理治理杂志作者:贝尼?劳特巴赫和亚历山大?范尼斯基多年来,在许多经济体中的大多数商业活动是由独资企业、合伙企业或者非公开企业操作管理的。