BPI翻译初稿

- 格式:doc

- 大小:1.71 MB

- 文档页数:12

本科毕业论文外文翻译外文译文题目:不确定条件下生产线平衡:鲁棒优化模型和最优解解法学院:机械自动化专业:工业工程学号: 201003166045学生姓名: 宋倩指导教师:潘莉日期: 二○一四年五月Assembly line balancing under uncertainty: Robust optimization modelsand exact solution methodÖncü Hazır , Alexandre DolguiComputers &Industrial Engineering,2013,65:261–267不确定条件下生产线平衡:鲁棒优化模型和最优解解法安库·汉泽,亚历山大·多桂计算机与工业工程,2013,65:261–267摘要这项研究涉及在不确定条件下的生产线平衡,并提出两个鲁棒优化模型。

假设了不确定性区间运行的时间。

该方法提出了生成线设计方法,使其免受混乱的破坏。

基于分解的算法开发出来并与增强策略结合起来解决大规模优化实例.该算法的效率已被测试,实验结果也已经发表。

本文的理论贡献在于文中提出的模型和基于分解的精确算法的开发.另外,基于我们的算法设计出的基于不确定性整合的生产线的产出率会更高,因此也更具有实际意义。

此外,这是一个在装配线平衡问题上的开创性工作,并应该作为一个决策支持系统的基础。

关键字:装配线平衡;不确定性; 鲁棒优化;组合优化;精确算法1.简介装配线就是包括一系列在车间中进行连续操作的生产系统。

零部件依次向下移动直到完工。

它们通常被使用在高效地生产大量地标准件的工业行业之中。

在这方面,建模和解决生产线平衡问题也鉴于工业对于效率的追求变得日益重要。

生产线平衡处理的是分配作业到工作站来优化一些预定义的目标函数。

那些定义操作顺序的优先关系都是要被考虑的,同时也要对能力或基于成本的目标函数进行优化。

就生产(绍尔,1999)产品型号的数量来说,装配线可分为三类:单一模型(SALBP),混合模型(MALBP)和多模式(MMALBP)。

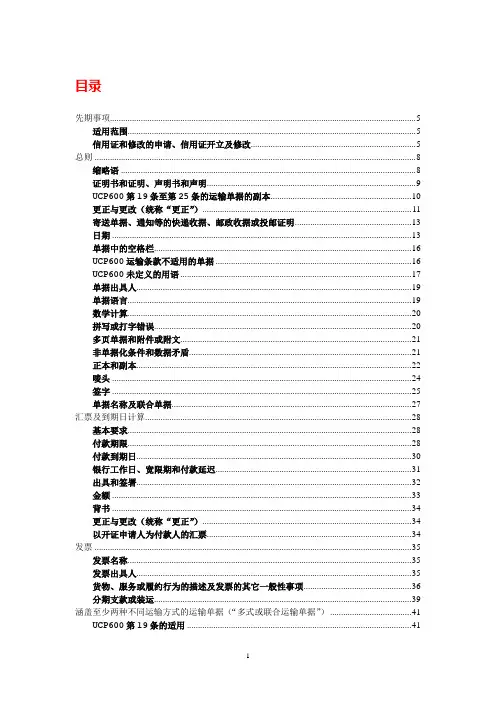

目录先期事项 (5)适用范围 (5)信用证和修改的申请、信用证开立及修改 (5)总则 (8)缩略语 (8)证明书和证明、声明书和声明 (9)UCP600第19条至第25条的运输单据的副本 (10)更正与更改(统称“更正”) (11)寄送单据、通知等的快递收据、邮政收据或投邮证明 (13)日期 (13)单据中的空格栏 (16)UCP600运输条款不适用的单据 (16)UCP600未定义的用语 (17)单据出具人 (19)单据语言 (19)数学计算 (20)拼写或打字错误 (20)多页单据和附件或附文 (21)非单据化条件和数据矛盾 (21)正本和副本 (22)唛头 (24)签字 (25)单据名称及联合单据 (27)汇票及到期日计算 (28)基本要求 (28)付款期限 (28)付款到期日 (30)银行工作日、宽限期和付款延迟 (31)出具和签署 (32)金额 (33)背书 (34)更正与更改(统称“更正”) (34)以开证申请人为付款人的汇票 (34)发票 (35)发票名称 (35)发票出具人 (35)货物、服务或履约行为的描述及发票的其它一般性事项 (36)分期支款或装运 (39)涵盖至少两种不同运输方式的运输单据(“多式或联合运输单据”) (41)UCP600第19条的适用 (41)多式运输单据的出具、承运人、承运人身份的识别及签署 (42)装船批注、装运日期、收货、发送或接管地、装货港或出发地机场 (44)最终目的地、卸货港或目的地机场 (46)正本多式运输单据 (47)收货人、指示方、托运人和背书、被通知人 (47)转运、部分装运,以及提交多套多式运输单据时如何确定交单期 (49)清洁多式运输单据 (51)货物描述 (52)目的地交货代理人的名称与地址 (52)更正与更改(统称“更正”) (52)运费和额外费用 (53)凭多套多式运输单据放货 (54)提单 (55)UCP600第20条的适用 (55)提单的出具、承运人、承运人身份的识别及签署 (55)装船批注、装运日期、前程运输、收货地及装货港 (57)卸货港 (61)正本提单 (62)收货人、指示方、托运人和背书、被通知人 (62)转运、部分装运,以及提交多套提单时如何确定交单期 (64)清洁提单 (65)货物描述 (66)卸货港交货代理人的名称与地址 (66)更正和更改(统称“更正”) (67)运费和额外费用 (67)凭多套提单放货 (68)不可转让海运单 (70)UCP600第21条的适用 (70)不可转让海运单的出具、承运人、承运人身份的识别及签署 (70)装船批注、装运日期、前程运输、收货地及装货港 (72)卸货港 (76)正本不可转让海运单 (77)收货人、指示方、托运人和被通知人 (77)转运、部分装运,以及提交多套不可转让海运单时如何确定交单期 (79)清洁不可转让海运单 (80)货物描述 (81)卸货港交货代理人的名称与地址 (82)更正和更改(统称“更正”) (82)运费和额外费用 (82)租船提单 (84)UCP600第22条的适用 (84)租船提单的签署 (85)装船批注、装运日期、前程运输、收货地及装货港 (85)卸货港 (89)正本租船提单 (90)收货人、指示方、托运人和背书、被通知人 (91)部分装运以及提交多套租船提单时如何确定交单期 (93)清洁租船提单 (94)货物描述 (95)更正和更改(统称“更正”) (95)运费和额外费用 (95)凭多套租船提单放货 (96)租船合同 (97)空运单据 (98)UCP600第23条的适用 (98)空运单据的出具、承运人、承运人的身份识别及签署 (98)接受待运、装运日期和对实际发送日期的要求 (100)出发地机场和目的地机场 (101)正本空运单据 (101)收货人、指示方和被通知人 (102)转运、部分装运以及提及多套空运单据时如何确定交单期 (103)清洁空运单据 (105)货物描述 (105)更正和更改(统称“更正”) (106)运费和额外费用 (106)公路、铁路和内陆水路运输单据 (108)公路、铁路或内陆水路运输单据的出具、承运人、承运人的身份识别及签署 (108)装运地和目的地 (109)正本和第二联的公路、铁路或内陆水路运输单据 (110)收货人、指示方和被通知人 (111)转运、部分装运以及提及多套公路、铁路或内陆水路运输单据时如何确定交单期 (112)清洁公路、铁路或内陆水路运输单据 (114)货物描述 (115)更正和更改(统称“更正”) (115)运费和额外费用 (116)保险单据及承保范围 (117)UCP600第28条的适用 (117)保险单据的出具人、签署及正本保险单据 (117)日期 (119)保险金额和比例 (120)承保险别 (122)被保险人和背书 (122)保险单据的一般性条款和条件 (123)保费 (123)原产地证明 (125)基本要求和功能满足 (125)原产地证明的出具人 (125)原产地证明的内容 (126)装箱单 (128)基本要求和功能满足 (128)装箱单的出具人 (128)装箱单的内容 (128)重量单 (130)基本要求和功能满足 (130)重量单的出具人 (130)重量单的内容 (130)受益人证明 (132)基本要求和功能满足 (132)受益人证明的签署 (132)受益人证明的内容 (132)分析、检验、健康、植物检疫、数量、质量和任何其它证明(统称“证明”) (134)基本要求和功能满足 (134)证明的出具人 (135)证明的内容 (135)先期1事项Preliminary Considerations适用范围Scope of the publicationPara I:This publication is to be read in conjunction with UCP600 and not in isolation.本出版物应当结合UCP600进行解读,不应孤立解读。

英汉互译你方9月4日来函收到。

承告你们对肉类罐头有兴趣,并考虑试订。

We have received your letter of September 4 informing us that you find our canned meat satisfactory and that you consider placing a trial order with us.我们另邮寄样品一批,深信一旦你们有机会查看样品之后,定会承认该货品质优良,价格合理。

Under separate cover, we are sending you a range of samples and when you have a chance to examine them, we feel confident that you will agree that the goods are both excellent in quality and very reasonable in price.收到你公司5月14日询价,得悉你对我们手工制人造革手套感兴趣。

现将你所需的详细资料,具有插图的目录和价格单附寄给你。

We have received your enquiry of 14th May and learn of your interest in our handmade artificial leather gloves. We are enclosing our illustrated catalogue and price list giving the details you ask for.所附价格单和图解目录将给你提供有关你方最感兴趣的型号的具体情况。

The enclosed price list and illustrated catalogue will give you details of the model in which you are especially interested.我们确认已向你方电报下列商品实盘,以9月20日前复到有效。

Absorción吸入,吸收;吸入作用,吸收作用Acceso a terceros第三方准入Aceite crudo原油Aceite in situ原地石油储量Aceite lubricante润滑油Aceite amargo含硫原油Acidificación(油田的)酸化,酸化作业Acuífero带水的,含水的;地下蓄水层,地下含水层Aditivo可添加的,应添加的;添加物,添加剂,外加剂Agencia internacional de energía国际能源机,国际能源署Almacenamiento diurnoAnhidro无水的,干的Arenas alquitranosas沥青砂Barrena de perforación钻头Barril de aceite equivalente桶油当量Barriles por día日产油桶数Biodegradable生物可降解的,能被生物分解成无害物的Block地块,岩块,段块,区块Bmc Billón metros cúbicos的缩写,万亿立方米Bombeo neumático气举BpcBillón (109)pies cúbicos的缩写,万亿立方英尺Btx芳烃(苯、甲苯、二甲苯)Buque-tanque de casco doble双壳油船Cabeza de pozo井口,井口装置,井口采油树Campo de gas气田Campo de gas condensado凝析气田Campo de gas seco干气田Campo verdeA menudo usado para referirse a la planeación de instalaciones para gas natural licuado las cuales...Cantidad diaria contratada日平均天然气供给量Capa rocosa盖层Capacidad de ducto管线输送能力Capacidad disponible有效容量Carga a granel散装货Carga básica基本负荷Carga de alimentación进料,原料Carga pico峰值负荷,最高负荷Carta del tratado de energía能源宪章条约Casquete de gas气顶Catalizador催化剂Celda de combustible燃料电池recirculación de gas天然气回注,天然气再利用Combustible bunker船用燃料油(这里不是指船上储存燃油的设施,见网上相关解释)Combustible diesel柴油Combustóleos燃料油Comisión federal reguladora de energía (FERC)(美国)源监管委员会Compañía multinacional跨国公司,多国公司Compuesto混合的,复合的;混合物,化合物Concesión给以,准予;让步,退步;(政府给个人或企业使用土地或开发矿山等的)特许权,经营权;租界,租借地Condensado浓缩的,凝析的Conversión de biomasa生物质转化Coquización焦化过程,焦化处理Un proceso de desintegración térmica para romper las moléculas grandes en otras más pequeñas con la...Corriente abajo石油上游企业Corriente arriba石油下游企业CriogeniaEl proceso de producción, mantenimiento y utilización a muy bajas temperaturas (abajo de -46°C).Crudo de activo油公司可支配的份额原油Crudo ligero轻质油Desarrollo sustentable可持续发展Desfogue排气降压解析开采Un método de producción de gas/condensado del yacimiento permitiendo la depresión del mismo sin...Desintegración裂变;蜕变Destilación fraccionada分馏Detector de gas气体探测器Diablo一种清管器Distribución分配,分发;分布,布局Ducto油气集输管线Ducto de transmisión天然气集输管网Endulzamiento脱硫Transpaleta manual 手动手盘搬运工具Núcleo 岩心Corazonamiento取心Energía geotérmica地热能源Energía renovable可再生能源Esquisto de petróleo油页岩Querógeno干酷根Estación de compresión(天然气)加压站,增压站Estación de recompresión气体二次增压站Factor de carga负载系数,加载因子Falla断层Financiamiento de proyecto项目融资Fraccionamiento分馏,分馏过程Fracciones ligeras轻质馏分Fracciones pesadas重质馏分Fuera de pico非峰值输气量Gas a ventas销售气量Gas crudo粗柴油;瓦斯油Gas amargo含硫气体Gas asociado伴生气Gas combustible可燃气体Gas de carbónGas elaborado mediante la destilación destructiva de carbón bituminoso. Los principales componentes...Gas discontinuoGas disponible sujeto a acuerdos que permiten la terminación o la interrupción de la entrega por...Gas doméstico民用气Gas dulce脱硫气体,低硫气体Gas embotellado瓶装液化气Gas en solución溶解气Gas húmedo湿气Gas inerte惰气,惰性气体Gas licuado de petróleo液化石油气Gas natural天然气Gas natural crudo未精制的天然气,原天然气Gas natural licuado液化天然气Gas pobre干气,贫气gas seco干气,贫气Gas rico富气Gas sintético合成气Gasificación气化,气化作用Gasificación de aceite油气化Gasóleo瓦斯油,粗柴油,汽油GolpeteoUn sonido metálico de golpeteo en un motor causado por un desajuste entre las características del...Gravedad API API重度Gravedad específica比重Hidrocarburo碳氢化合物,烃Hidrodesintegración加氢裂化,加氢裂化作用,Hidrodesulfuración氢化脱硫,氢化脱硫作用Hidrógeno氢Hidrotratamiento加氢处理|,氢化处理.Índice de viscosidad粘度系数Índice Wobbe沃泊指数IPIECA国际石油工业环境保护协会Kerosina煤油Kilocaloría千卡,大卡Kilowatt-hora千瓦时Levantamiento sismológico地震调查Licuefacción del gas气体液化Limpieza de tanques清罐Líquidos del gas natural天然气凝析液,气体汽油Lluvia ácida酸雨Lodo de perforación钻井液,泥浆Medidor de gas气体计量表Mercado spot现货市场Mercaptano 硫醇Metro cúbico立方米Mezcla Brent布兰特混合油Miliariobillón的同义词,万亿Módulo(海上石油平台上的)设备舱Molécula分子Monómero单体,单分子物体|Mpcs标准千立方英尺Nafta NAFTA是North American Free TradeAgreement的简称Negro de humo碳黑NetbackNúmero de acres准许的油气勘探区域面积Número de cetano十六烷值Número de octano辛烷值Oapec阿拉伯石油输出国组织Odorización天然气加臭,天然气加臭处理Odorizante气体增味剂Ofgas(英国)煤气供应办公室OlefinasGrupo de hidrocarburos, incluyendo etileno y propileno, de especial importancia como insumo a la...Operador油田操作方,油公司Pozo de aforo评价井Pozo de exploración探井Pozo de prueba探井Pozo de gas气井Pozo desviado斜井Pozo seco干井Precio de playa海底原油在海上处理后之陆上价格Presión absoluta绝对压力Presión atmosférica大气压力Presión crítica临界压力Presión manométrica表压Procesamiento del gas天然气的处理Producto de destilación馏分Productos blancos透明石油产品Productos negros黑色石油产品Promedio diario de despacho(石油或天然气的)日输总量Protección catódica阴极保护Punto de escurrimiento倾点Punto de toma(天然气)接入点Quemador de campo天然气燃烧火把Recuperación Mejorada del Petróleo (EOR)提高采收率Recuperación primaria一次采油Recuperación secundaria二次采油Recuperación terciaria三次采油Refinería提炼厂Refinería del Petróleo炼油厂Refinería con esquema hydroskimming轻度加氢炼油厂Registro acústico检波器registro sónico检波器Relación reservas a producción储采比Reservas probadas 证实储量,探明储量Reservas posibles概算储量,可能储量Reservas probables推定储量,控制储量Reservas recuperables可采储量Reventón井喷Roca del yacimiento油层,含油岩层Rocas ígneas火成岩,火山岩Rocas metamórficas变质岩Rocas sedimentarias沉积岩Sarta de perforación钻杆串Sinclinal向斜,向斜岩层Sistema de recolección de gas收集天然气系统Solvente溶媒,溶剂Temperatura crítica临界温度Terminal de gas natural licuado液化天然气终端,液化天然气接收站Tiempo perdido por daños因设备损坏而产生的损失时间Toneladas de aceite equivalente吨油当量Tonelaje de peso muerto (DWT)载重吨Torre de perforación钻塔,钻井架Trampa(石油)圈闭Trampa de líquido(天然气集输管线上安装的)集液器Trampa estratigráfica岩性圈闭Trampa estructural构造圈闭Transferencia barco a barco船靠船输油Transportación común联合运输Transportador combinado兼用船Transportador de LNG 液化天然气运输船Transportador de crudo油轮Transportador ultra grande de crudo超大油轮Tratamiento del gas天然气的处理Trillón de pies cúbicos万亿方英尺Tubería de producción marina海上采油管线Turbina a gas燃气轮机Turbina a gas ciclo combinado联合循环燃气轮机Unidad de moneda Europea ECU欧洲货币单位Unidad flotante de almacenamiento海上储油装置,浮式储油装置Unidad térmica británica (BTU)英国热量单位Valoración de un campo油田评估Volátil飞行的,能飞的;挥发的Vulcanización(橡胶的)硫化,硬化Yacimiento矿层,矿床;油藏,油田Yacimiento de gas气田Yacimiento de gascondensado凝析气田。

商务英语常用单词与写作带翻译商务英语常用单词与写作范文带翻译在真实的商务贸易中,常用的一些英语术语非常多,下面店铺带来关于商务英语常用单词与写作范文,供大家参考学习。

1、商業書信寫法(BUSINESS LETTER WRITING)1)、原則(Rules)--------Attention; interest;Desire;Action;2)、6C’s--------Clearness;correctness;conciseness;consideration;character;3)、Element(構成元素)------letterhead(company name;address,conact Number;);reference number;date;inside Address;salutation;2、報價(Quotation)報價是一種以特定條款提供產品的承諾。

詢價者如覺得價格合理,便可確認接受訂貨,因此報價者(OFFEROR)必須小心處理報價條款,如因錯報價格而無法供貨,則會對商譽有損。

報價通常是由買方提供予買方,即賣方報價(SELLING OFFER),但亦有由買方提出價格,由賣方決定是否接受,稱為習方報價(BUYING OFFER)或出價(BID)。

一般報價可分實盤(FIRM OFFER/OFFER WITH ENGAGEMENT)及虛盤(No-firm /offer without engaement).實盤報價會詳細列明數量、交易條款及報價有效期,只要受盤人(OFFERENCE)在有效期內確認,便可達成交易。

如貨品價格經常浮動,或貨品供應不穩定,報價者可指明價屬虛盤,或加上保留條件,如以最后確認為准、以貨物尚未售出為准或報價可隨時變更等。

報價亦可以報價單(PRICE LIST)形式發出,此種報價并無特定對象,只作回復一般詢價時使用,并于報價單上說明以最后確認為准。

至于投標是一種要求報價的方法,買方會列明要求及投標方法,由市場上的公司自稈竟投,再從中選取可提供最有利條件的公司。

外文文献翻译原文及译文标题:私人资本和公共资本外文翻译2019文献出处:Alvar Kangur, Chris Papageorgiou. European Economic Review, Volume 118, September 2019, Pages 296-311译文字数:4000 多字英文On the substitution of private and public capital in productionAlvar Kangur,Chris PapageorgiouAbstractMost macroeconomic models assume that aggregate output is generated by a specification for the production function with total physical capital as a key input. Implicitly this assumes that private and public capital stocks are perfect substitutes. In this paper, we test this assumption by estimating a nested-CES production function whereas the two types of capital are considered separately along with labor as inputs. The estimation is based on our newly developed dataset on public and private capital stocks for 151 countries over a period of 1960–2014 consistent with Penn World Table version 9. We find evidence against perfect substitutability between public and private capital, especially for emerging and LIDCs, with the point estimate of the elasticity of substitution estimated closely around 3.Keywords: Public capital, Private capital, Elasticity of substitution, Production functionIntroductionAfter two generations of research papers focused on identifying the effect of public capital on economic activity, a broad consensus has beenreached pointing to the favorable contributions of public capital to economic growth especially in early stages of economic development. Bom and Lighthart (2014) provide one way of summarizing these results by means of a meta-analysis using 578 estimates of output elasticity of public capital estimates. This analysis finds a long-run elasticity in the order of 12%, that increases to about 19% for core public capital and exhibits substantial heterogeneity across various dimensions, including income and regional differences. Allowing for cross-country heterogeneity, Calderón et al. (2015) find that the elasticity of output with respect to infrastructure capital ranges between 0.07 and 0.10. Kangur and Papageorgiou (2017) document the evolution of the literature throughout the two generations of research papers. The first generation dates back to the seminal work of Aschauer (1989) which documents substantial growth effects of public capital and was later refined throughout the second generation of research on various methodological grounds as summarized extensively by Romp and de Haan (2007).Yet, macroeconomic models have largely assumed that public and private capital are perfectly substitutable in the aggregate production function or they are combined under the straitjacket of Cobb–Douglas aggregation function. Whether these prevalent assumptions are valid is an empirical question that this paper aims to answer by estimating the elasticity of substitution (ES) of the two types of capital.This paper makes two contributions. First, we construct public and private investment and capital stock series for 151 countries covering 1960–2014. In doing so we ensure that at any point in time public and private investment and amortization levels are ex ante consistent with the aggregate economy-wide capital stock, investment, and amortization series reported in the Penn World Table (PWT) version 9. By treating these economy-wide series as observables and imposing the consistency requirements we are able to avoid making assumptions on historical or steady-state public and private investment growth rates typically required by existing approaches.Second, with this new capital stock data at hand we examine whether public and private capital are complementary or substitutable in the aggregate production process. This is important as it challenges existing formulations of production functions that favor either a Cobb–Douglas aggregation between the two types of capital or, even more extreme, no disaggregation of the two types of capital thus implying that they are perfect substitutes. We show that for the entire sample of countries neither of the dominant assumptions in the literature are supported by the evidence which obtains a point estimate of the ES between public and private capital of around 3. Furthermore, there exists substantial heterogeneity in these estimates across groups of countries the ES is shown to be higher for emerging countries than LIDCs while foradvanced countries it is found to be well characterized by a Cobb–Douglas technology. These results hold well under various robustness tests including on alternative production structure, methodological approaches, and data sources.MethodologyConstruction of public capital stocks for a large set of countries that would be comparable across-countries as well as to the concepts of private or aggregate economy-wide capital stocks generally used in growth models is a notoriously hard task. While most empirical applications accumulate capital stocks with the perpetual inventory method, the practitioners have to overcome numerous obstacles due to lack of data on investment flows, measurement errors, estimates of (time- varying) depreciation rates, as well as methodological complexities in setting the initial conditions.Many studies avoid these challenges by using a variety of measures of physical infrastructure such as kilometers of paved roads or kilowatts of electricity-generating capacity that generally are more readily available. At the same time these are only partial measures of the aggregate public capital stock as they do not correct for quality, capture only some core aspects of public infrastructure, are not necessarily additive in terms of investment and amortization flows, and thus do not capture the overall general government activities. As such, mapping the estimates of publiccapital productivity or any deep parameters obtained from various measures of physical capital into production functions is not straightforward. Accumulating the public capital stocks with the perpetual inventory method can be problematic as well.To overcome the difficulties in setting the initial condition for the public sector capital stock Kamps (2006) applies an “asymptotic limit” approach by setting the capital stock in 1860—a 100 years before the start of the empirical estimation period—to zero and using an artificial investment series over a period of 1860–1959 to get an initial capital stock estimate for 1960. The artificial investment series is constructed by applying an average investment growth over a period for which the data are available (1960–2001 in case of Kamps, 2006) backwards from the earliest year when the actual data are available. His sensitivity tests show that errors from the starting condition in 1860 and from assuming an artificial investment series diminish over time and do not have material effect on the dynamics of capital stock from 1960 onwards or on the econometric estimates of public capital elasticities.The “asymptotic” approach has been applied successfully in several studies. Arslanalp et al. (2010) derive the capital stocks for 48 countries using public–private investment shares from the IMF World Economic Outlook (WEO) database, whereas Gupta et al. (2014) extend the coverage to 122 developing countries and introduce an efficiency-adjustment for 52 middle- and low-income countries. The approach still has two distinctive features that can lead to measurement errors. First, the long-term average investment growth rate is not always the best proxy for the historical average, especially in countries undergoing structural changes. Second, when the aggregate capital stock is observed, it can be difficult to impose ex ante consistency between the levels of observable aggregate investment and amortization series with their private and public components.In this paper we resort to an alternative approach that derives the unobserved public and private capital stocks from the observable economy-wide capital stocks and amortization levels, as well as respective investment shares of the components. The methodology used to construct the private and public capital stock series follows that in Collier et al. (2001), Kamps (2006), Arslanalp et al. (2010), and Gupta et al. (2014). That we make an extra effort here to make our capital stock series consistent with those in PWT9, is because PWT has been widely considered as the gold standard for empirical work, and also because of the PWT9’s methodological advantages in their use of the perpetual inventory method (see Feenstra et al., 2015, Online Appendix, pp. 9–21).To sum up, we estimate the elasticity of substitution between private and public capital using our newly constructed panel data. We find that private and public capital are highly but not perfectly substitutable, withthe point estimate of the elasticity of substitution around 3. This finding is important because most macroeconomic models assume that aggregate output is generated by a production function specification with total physical capital as a key input. Implicitly this assumes that private and public capital stocks are perfect substitutes. However, since they are highly but not perfectly substitutable, neither a Leontief nor a Cobb–Douglas type aggregation should be applied to the private and public capital stocks in a production function.Sensitivity analysisIn this section, we conduct several robustness checks. First, we examine whether our baseline results are sensitive to alternative data frequencies, or to the inclusion of time fixed effects. Next, we examine whether our baseline results are robust to alternative measures of labor. Finally, we compute the standard errors using alternative bootstrapping methods.The baseline results above are estimated based on 3-year averaged data. The reason for using 3-year averaging rather than annual frequency data is twofold: first, it mitigates the business-cycle effects and other potential noise in the annual frequency data and second, it provides large sample for consistent estimation. However, we recognize that the choice of 3-year averaging is arbitrary. To the best of our knowledge, there is no method to determine the optimal data frequency in the estimation ofaggregate production functions. As a first robustness check, we investigate whether our baseline results are robust to alternative data frequencies.In the baseline estimation, we assume a constant and Hicks-neutral technical progress along time and there are no time fixed effects. One concern is that the technological growth rate can be changing over time, which can be an issue for our estimation considering that we use a large panel with a long time span. To address this concern, we include time fixed effects into the baseline estimates. Due to the complexities of NLLS estimation, the iterative optimization procedure has difficulties in converging when we include fixed effects for each single time period. As an alternate, we include time fixed effects for aggregate time periods.Controlling for human capitalIn the baseline estimates above, labor input is measured directly as total employment. One concern is that labor and labor income might not be properly measured, especially in emerging economies and LIDCs, as Gollin (2002) discussed. The mismeasure of labor input might affect the estimated elasticity of substitution and distribution between the composite capital and labor, and further affects the estimated elasticity of substitution between private and public capital. Krusell et al. (2000) find that the relative quantity of skilled labor has increased substantially since 1980, and controlling for capital-skill complementarity affects productionfunction estimations. To address this concern, we weight total employment with human capital. The human capital index is retrieved directly from PWT, and it measures the average schooling and returns to education. Instead of including total employment, we multiply total employment with the human capital index.EndogeneityIn order to address concerns over endogeneity and transmission bias we next resort to macro-econometric techniques. For this purpose we resort to a Kmenta (1967)linearized approximation to public–private capital CES nested in the Cobb–Douglas production function that allows the use of linear regression methods.Panel unit root tests overwhelmingly fail to reject the unit root in all four variables of interest: real GDP, real private capital stock, real public capital stock and the square of a ratio of public to private capital (all expressed as ratios to employment and in natural logs). At the same time, a battery of panel cointegration tests due to Pedroni, Westerlund, and Kao reject the null hypothesis of no cointegration between all four variables decisively only for emerging economies; cointegration results for LIDC are more mixed whereas for advanced countries several test specifications fail to reject the null. Estimation results are therefore most meaningful for emerging countries. We estimate the parameters of the linearized Kmenta CES function with panel group mean FMOLS developed by Pedroni,2000, Pedroni, 2001 that allows for complete endogeneity (using internal instruments) as well as heterogeneity, and includes time effects to control for simple cross-sectional dependence. The results support public–private capital substitutability for emerging countries as well as for the full sample. Results are available upon request.In summary, we find strong evidence of substitutability between public and private capital, with a point estimate of the elasticity of substitution around 3. This result is driven by emerging economies and LIDCs, and it is more robust in emerging economies. For advanced economies, estimation shows no significant results. These results hold up pretty well to a series of robustness tests.ConclusionIn this paper we find evidence against the perfect substitutability between public and private capital assumed in the literature. Using a nested CES aggregate production function that incorporates public and private capital along with labor as inputs, we obtain a point estimate of the elasticity of substitution between the two types of capital around 3. The estimation is based on a newly developed dataset on public and private capital stocks for 151 countries over a period of 1960–2014 consistent with Penn World Table version 9.Our results provide some leads about growth policies. First, abstracting from other factors of production, high substitution betweenpublic and private capital implies that, as the capital stock increases, both marginal and average products approach to a positive constant, rather than zero as prescribed by Inada conditions. Second, the empirical estimates which show that public and private capital in the production of developing economies is more substitutable than in advanced countries, are consistent with the idea that advanced economic systems require provision of public capital that is more complementary to highly specialized private sector capital, while in less advanced countries public capital is needed to fill gaps in private sector which is still quite underdeveloped. While our estimates do not allow us to identify specific channels or causes of capital substitutability, we hope that they provide a starting point to a promising line of future research.中文论生产中私人资本和公共资本的替代摘要大多数宏观经济模型假设总产出是由生产函数的规范产生的,而总实物资本是关键输入。

用基追踪分解法进行疏松层的反演Rui Zhang and John Castagna摘要对于反射系数的地震反射数据的反演可以通过预先定义的反射模型作为基函数来进行计算。

基追踪分解含有一系列的地震层响应的小波函数,当利用这种方法时,这个过程是稀疏层反演而不是稀疏脉冲反演,并且最终提高了薄层的分辨率。

理论合成数据和实际地震数据都能证明这个效果。

引言由于地震子波的限带特性,使得层状介质构造的反射地震记录的反演复杂化了。

因此,存在无数个反射率模型能够很好的匹配这个数据。

然而,如果我们先应用一个先验约束,并且这个约束是适当的,那么我们就会发现一个有用的解决方法。

常规的稀疏脉冲反演(SSI)是一种流行的方法,它的思想是认为介质阻抗结构应该随着稀疏度的不同来转化为反射率系列,以便匹配具有特定限制的数据。

然而,稀疏性和薄层分辨率间的平衡会制约薄层的分辨率。

这个能够通过楔形模型得到证明。

我们制定的这个反演方法与稀疏脉冲反演是相似的,都是利用这样的事实用有限层的叠加来代替局部的介质阻抗结构,并且用有限层的响应来代替本来的地震记录。

如果地震波频带宽度和信噪比允许,那么这个反演结果可以使一些稀疏层参数化,这样一来就能解决比反射率系列上一个简单的稀疏性约束的更薄的地层。

这种方法与谱反演是相似的(例如Puryear 和Castagna(2008)),然而基追踪分解在时间域内已被运用(Chen et al.(2001)).Nguyen 和Castagna(2010)已经用了替换法-匹配追踪-用地震信息的一些先验信息。

我们把这种反演方法叫做基追踪分解(BPI)。

这个方法形成了一种稳定的,有效的适合于这个数据的解法。

和稀疏脉冲反演一样,这个方法不需要出示模型。

基追踪反演(BPI)作为这个地震反射记录的一阶近似,这个地震记录可以简单的认为是子波和反射系数的卷积;就是反射系数矩阵和子波核函数的乘积。

子波核矩阵是一个对角矩阵,它的每一列代表的是一系列时间顺序矩阵,这个时间就是地震记录的时间。

因此这个褶积也可以写作:d Gm n =+ (1)其中,d 是地震数据;m 是反射序列;G 是子波核矩阵;n 是噪音。

我们注意到,这个褶积的矩阵形式能够使一个时变子波合并到正演模型中去。

基追踪(Chen et al.(2001))找到了最小1L 范数的最小二乘解,这个最小二乘解是通过使目标函数最小的解得到的: 21min d Gm m λ⎡⎤-+⎣⎦ (2)其中下标分别表示2L 和1L 范数,λ是控制解得稀疏度的正规化参数。

在一般的基追踪反演中,d 是地震数据,G 是预定义的地震响应的时间序列的组合,m 是使方程2达到最小的这些响应的加权值。

G 中得地震响应可以通过地震子波和反射模式的褶积得到,并且这个反射模式是基于对地质分层的理解。

把与G 中地震响应有关的反射率模式乘以加权值m ,并且求和,就得到了反射率级数解。

在利用BPI 进行稀疏层反演时,我们在一些预先给定的厚度上构造了一系列的对称和非对称的层放射对。

我们通过地质上的先验信息、地震带宽和信噪比能够确定上述范围。

地震模型可以产生地震层响应的序列G ,让这个反射对和这个地震模型做卷积即可。

如果薄层的顶部和底部的反射系数是c 和d ,那么可以用两个脉冲函数来代替反射系数,()c t δ和()d t n t δ+∆,其中n t ∆是薄层的时间厚度,t ∆是地震采样频率。

根据Puryear 和Castagna(2008),偶极子分解可以把反射体对分解成一个偶数和一个奇数对,如方程3和图1所示:()()()()0;e r t t n t r t t n t δδδδ=++∆=-+∆ (3)()()0e c t d t n t ar br δδ++∆=+ (4)原始反射系数对 奇数对 偶数对图1:任意的反射系数对1r 和2r 都可以用奇数和偶数组的和代替。

奇数组有相同的幅度和符号,偶数组有相同的幅度和相反的符号。

这个楔形体包括有奇数和偶数对,它是随着地层时间厚度变化的一系列的偶极子反射体。

这个地层时间厚度是未知的(n t ∆),因此随着先验信息的变化,n 也是变化的。

特别的,根据对地层分辨率大小的需要和对地震数据质量的要求,我们可以选择最小的n 值。

最大的n 通常可以使n t ∆比这个调谐厚度更大。

每层的反射系数的和构成了这整个反射系数序列,其中m 是地层号,M 是总的地层数。

()()()(),,011*,,,*,,,N M n m e n m n m r t a r t m n t b r t m n t ===∆+∆∑∑ (5)把地震子波和方程5的两边进行褶积,得到地震记录的方程为:()()()(),,011*,,,*,,,N M n m e n m n m s t a w t m n t b w t m n t ===∆+∆∑∑ (6)其中,e w 和0w 是地震响应,这个响应构成了G 。

我们可以应用基追踪分解法来求解方程6中的系数,n m a 和,n m b 。

最终的反射率反演可以通过方程5给出。

因为地震道分解和反射率的分解具有相同的系数,所以最终的反射率可以通过上述系数的乘法和相似的反射体核矩阵来计算。

理论数据的测试方程2中的规则化参数λ旨在平衡反向反射系数的分辨率和噪音。

增大参数λ会减小反向反射系数序列的分辨率,并且如果减小参数λ也许会引起噪音的增大。

实际上,合适的λ的值是有数据和经验共同决定的。

稀疏脉冲反演(SSI )是一种交替的最小1L 范数的反演方法。

和SSI 不同,BPI 用了原始的二元井约束算法(Chen et al.(2001)),然而SSI 只解决了原始的方程(Taylor et al.(1979)). BPI 和SSI 都有平衡参数λ来控制反演的输出,然而这两种方法的值没有可比性。

这两种方法是被测试独立的决定的。

这个使得SSI 和BPI 的结果的比较困难了,因为他们的结果依赖于参数的选择。

在这个研究中,对于每一个反演方法,我们用了较大范围的λ的值;正向反射率系列和反向反射率系列的相关性是有这两种反演方法的所有的λ值决定的,并且这个BPI 的最好的结果与SSI 的结果是可比的。

正向和反向的反射率系列之间的相关系数在数量上结合了脉冲的准确位置和相对大小。

对于给定的振幅和时间厚度,一个任意的反射率系列是通过1ms 采用得到的。

在每一样点的反射系数是-0.2和0.2之间的任意值(图2b 所示)。

图2a 是由40HZ 的雷克子波和反射系数褶积后的地震记录。

并且这个地震记录加入了信噪比为10的高斯噪音。

小的SSI λ突出了噪音(图2c 和2d )。

大的SSI λ产生的反向反射系数序列太稀疏了(图2g 和2h )。

SSI λ的极值会引起反向和正向反射率系列之间的矛盾。

对于这个合成理论数据的例子,能够得到最好的反演结果的规则化参数是在410-和310-之间。

在410-和310-之间进行进一步的测试(图2i 到2n )。

图3展示了BPI 反向反射率系列的结果,它利用的数据与图2a 和图2b 中的合成数据是相同的。

和这个SSI 的结果一样,小的BPI λ放大了噪音的幅度(图3c 和3d ),大的BPI λ产生稀疏的结果(图3g 和3h )。

这个相关的最大值是在2和3之间(图3i 到3n )。

图2:(a )合成地震记录,包含40HZ 的雷克子波和10%的随机噪音;(b )正向反射率系列;(c )到(n )展示了随着SSI λ的变化的SSI 的值;(c )6SSI 10λ-=;(d ) 5SSI 10λ-=;(e )4SSI 10λ-=;(f )3SSI 10λ-=;(g) 2SSI 10λ-=;(h )1SSI 10λ-=;(i )4SSI 210λ-=⨯;(j )4SSI 310λ-=⨯;(k )4SSI 410λ-=⨯;(l )4SSI 510λ-=⨯;(m )4SSI 610λ-=⨯;(n )4SSI 710λ-=⨯。

图3:(a )合成地震记录,包含40HZ 的雷克子波和随机噪音;(b )正向反射率系列;(c )到(n )展示了随着BPI λ的变化的BPI 的值;(c )2BPI 10λ-=;(d ) 1BPI 10λ-=;(e ) BPI 2λ=;(f )BPI 3λ=;(g) BPI 500λ=;(h )BPI 600λ=;(i )BPI 2.1λ=;(j )BPI 2.2λ=;(k )BPI 2.3λ=;(l )BPI 2.4λ=;(m )BPI 2.5λ=;(n )BPI 2.6λ=。

图4给出了前面测试中反向和正向的反射率系列之间的相关值。

图4a 展示了SSI 测试中SSI λ在4210-⨯左右时这个最大的相关值在0.8附近。

图4b 展示了BPI 测试中BPI λ在2.2左右时这个最大的相关值在0.9附近。

除了添加10%的噪音外,对于BPI 和SSI 的理论数据的测试,在相同的反射率系列上我们又计算了0%和40%的噪音情况(图4a 和4b )。

就像我们预测的那样,在这两个测试中噪音都能够降低相关系数,但是BPI降低的百分比要小于SSI的情况。

图4:(a)依据于图2中的相同合成理论数据的SSI法的λ相关曲线。

在SSI结果和正向反λ为横轴来画图。

(b)依据于图2中的相同射率系列之间来计算反射系数,并以正规因素SSI合成理论数据的BPI法的λ相关曲线。

在BPI结果和正向反射率系列之间来计算反射系数,λ为横轴来画图。

(c)和(d)给出的是依据图2中的相同的合成理论数据并以正规因素BPI分别用BPI和SSI方法在没有噪音和40%噪音情况下的λ相关曲线。

用100个不同的任意反射率系列和相应的40HZ的雷克子波的合成地震记录来应用于上述相同的方法。

这个合成地震记录的每20分别是在10%,20%,30%,40%,50%噪音水平下的。

把BPI和SSI最好的相关系数交汇点绘制在图5中。

在大多说情况下,BPI能够更好地接近真正的反射模型。

图5:来自于BPI和SSI结果的最大的相关数的交汇点,它是在在100个不同的任意产生的合成反射率序列上计算的。

这个虚线代表了两种方法下相等的相关系数。

BPI通常更接近于真实的反射率系列。

因为BPI和SSI是一道一道的程序,所以它是值得的区研究这个反演体的横向连续性。

我们用测井反射率系列可以得到一个复杂的楔形模型,并进而构造一个复杂的二维合成理论数据的试验(如图6所示)。

这个合成地震数据是通过30HZ的地震子波加上10%的随机噪音与反射体模型褶积得到的。

BPI明显有更好的残差。

图6:左边垂直一列是一节测井反射系数。

(a)真实的反射率系数的均方根是0.0173.(b)带有10%随机噪音的合成地震记录的均方根是0.003。