利用作业成本法(ABC)衡量商业贷款组合的盈利能力【外文翻译】

- 格式:doc

- 大小:54.50 KB

- 文档页数:12

Kaplan和Norton访谈系列(一)【编者按】从本期开始将陆续推出暨南大学丁友刚及姚姿翻译的Kaplan和Norton系列访谈。

本文是1998年12月,Kaplan教授首次访问印度,并在清奈市举办的印度工业联合会的第二届“全面成本管理”国际研讨会上作了关于综合成本系统的主题讲演之后,《今日商业》(BusinessToday)杂志社的R.Sridharan对他进行了一个小时的访问。

这次关于作业成本法和平衡记分卡的独家访谈摘录如下:R.Sridharan:Kaplan先生,成本作为一个管理学的概念,在20世纪里发生了怎样的变化?Kaplan:15年前,那些和成本系统打交道的人都认为成本系统是用来衡量过去的。

现在我们认识到我们需要从未来的角度考察成本。

我们必须要了解我们当前所作所为的结果是什么,以及这些所作所为将对未来成本的影响方式。

作业成本法能帮助我们理解那些影响成本的决策。

因此,成本已经从被动的记录职能转变成一种主动的,并且能够对未来产生影响的职能。

这使得财务人员进一步成为管理团队的成员,成为价值增值过程的一部分,而不仅仅是簿记员。

R.Sridharan:没错。

那成本系统在过去的几十年里是如何发展的呢?Kaplan:从相互脱节的财务报告阶段,也就是我称之为的第一阶段开始,成本系统的发展已经经历了第二和第三阶段,数据和财务报告的质量都得到了改善。

最好的公司是处于第三阶段的。

在这些公司,成本数据都是根据特定目的需要而计算加工的,但成本数据仍然是独立的。

到第四阶段,管理报告和控制系统将得到充分整合,同时为内部报告和外部报告提供所需要的信息。

这套整合的系统不仅能够为经营和战略控制提供业绩信息,同时能够准确衡量产品和顾客盈利能力。

R.Sridharan:作业成本法已经成为新经济时代成本计算系统的基础。

但是大多数公司仍然不是很清楚如何实施作业成本法。

您是怎么做的呢?Kaplan:首先,要明确作业成本法的目标,同时要建立一个团队。

成本管理外文文献及翻译关键词:成本管理管理措施在市场经济条件下,随着全球经济一体化的发展,市场竞争日趋激烈,企业利润空间缩小。

在这种情况下,业务成本的高低水平,直接决定企业的盈利能力和竞争实力的大小。

因此,加强企业成本管理业务已经成为一个生存和发展的必然选择。

从成本管理的目的来看,许多企业局限于降低成本,但较少从成本效益的降低来着手,主要依靠储蓄成效方面来实现的,不能合乎成本效益。

传统的成本管理目的已经减少,以降低成本,节约成本为基本手段。

从成本管理的角度来分析这一目标成本管理,不难发现,成本降低是有条件和限制的,在某些情况下,成本控制可能导致产品质量和企业效益下滑。

此外,绝大多数企业在成本管理也都缺乏整体观念,大多数公司都有一个共同的现象,那就是,依靠财务人员进行管理成本。

在成本管理过程的实施中,一些企业只注重成本核算,一些企业领导只关心财务和成本报表,从而使用报表来管理成本。

这种做法虽然减少了成本的一定作用,但归根结底,成本会计或事后控制,没有做到在成本控制和过程控制发生之前,不可替代成本费用管理。

(三)成本信息严重失真在中国,有相当数量的企业有成本信息不真实的情况下,这种状况正在恶化。

成本信息失真主要是由以下原因引起:首先,成本仅在材料,人工,制造费用的环节成为了一个焦点,现代企业的产品开发正在日益增加,却忽略了测试和中间试验和售后服务上与内容相关的投入成本的小群产品,对这些产品不完整的,不正确的评价,在整个生命周期成本效益过程起着非常重要的作用。

第二是成本核算方法不当造成的失真。

一个高度劳动密集型企业,在过去几年中,简单的假设(即直接人工小时或生产为基础分配间接费用),通常不会严重的引起扭曲产品成本的核算。

但在现代制造业环境中,直接劳动成本所占的比例显著下降,而制造成本的比例大幅增加,因此,使用传统的成本计算方法会产生不合理的行为,利用传统的成本核算,在产品成本信息中将导致严重的扭曲,使企业错误的选择产品的方向。

作业成本法的概念及计算方式作业成本法(Activity-based costing,简称ABC)是一种通过对企业各项作业进行精确配算,以获取更准确的产品与服务成本信息的成本管理方法。

它的核心理念是将企业的活动、作业和成本之间的关系进行解构,从而实现对成本的准确计算与管理。

作业成本法首先识别出企业的各项活动和作业,并将成本分配给这些活动和作业的过程,然后再将这些成本分配给各个产品或服务。

与传统的成本分配方法相比,作业成本法更为准确,能够更好地指导企业进行成本控制和决策。

首先是作业活动分析。

作业活动分析是指对企业的各项活动进行细致的分析,以确定与作业相关的活动。

首先需要确定活动,在ABC中,活动被解构为更小的单位,称为作业。

作业是一项可计量的任务或任务组合,是完成特定产品或服务所必需的一系列活动。

例如,对于汽车制造企业来说,焊接、喷漆、装配等都可以作为作业。

接下来是作业成本分配。

作业成本分配是指将企业产生的成本分配到各个作业上,并通过作业来分配到各个产品或服务上。

具体的步骤如下:1.确定成本驱动因素:成本驱动因素是影响作业成本发生的主要因素,也是作业成本分配的基础。

例如,在汽车制造企业中,焊接作业的成本驱动因素可能是焊接时间或焊接的工件数量。

2.识别成本对象:成本对象是指使该成本发生的原因。

在作业成本法中,成本对象可以是产品、客户、项目等。

确定成本对象是为了将成本更准确地分配给具体的对象。

3.计算活动成本池:活动成本池是指与其中一活动相关的成本总和。

活动成本池主要由直接成本和间接成本构成。

直接成本是与这一活动直接相关的成本,而间接成本则是与多个活动相关的成本。

4.计算作业成本:作业成本是在活动成本池的基础上,根据成本驱动因素将成本分配到各个作业上的过程。

这一过程通常使用成本驱动因素来计算作业成本,例如,在焊接作业中,可以通过焊接时间来计算作业的成本。

5.分配作业成本到成本对象:最后一步是将作业成本分配到具体的成本对象上。

译文一:作为战略管理工具的作业成本法和经济增加值的整合研究译文二:_______THE RESEARCH OF INTEGRATED ACTIVITY-BASED COSTING ANDECONOMIC VALUE ADDED SYSTEM AS A STRATEGIC MANAGEMENT TOOLNarcyz RoztockiState Un iversity of New YorkABSTRACTThis paper describes a field study which examines the implementation of an integrated Activity-Based Cost ing and Econo mic Value Added System in two small manu facturi ng firms. The results of this study suggest that this in tegrated approach outperforms both traditi onal cost acco un ti ng and sta ndard Activity-Based Costi ng methods. Furthermore, the findings from two small compa nies show that there liability of cost in formatio n obta ined by this in tegrated system in creases substa ntially whe n differe nces in capital usage exist. Factors that could create these differences in capital usage and lead to distorted cost information are discussed. Using actual data from the field study, possible distortions to product cost as a result of a homogenous capital cost allocati on are also exam in ed. Fin ally, the impact of this in tegrated approach on the decisi on-mak ing、strategic pla nning and Ion g-term bus in ess performa nee of the two participat ing compa nies is discussed.KEYWORDS Activity-Based Cost ing; Econ omic Value Added; strategic man ageme ntIn troducti onIn today ' bus in ess en vir onment, many manu facturi ng compa nies are fac ing a fierce competitio n in domestic and global markets impleme nti ng strategic man ageme nt tools, in order to in crease their competitive ness. Activity-Based Costi ng (ABC) and Econo mic Value Added(EVA) are two such examples of these strategic management tools.Traditionally, ABC and Economic Value Added methods have been used separately. ABC has been used as a costing system, mainly to improve operating efficiency; while Economic Value Added has been used as a financial performance measure, mainly to improve financial efficiency. In recent years, some researchers have proposed that ABC should be combined with Economic Value Added to create an integrated costing and performance system(Hubbell, 1996a; Hubbell, 1996b; Cooper & Slagmulder, 1999; Roztocki & Needy, 1999c). The ABC component of this integrated system would focus on operating expenses while the Economic Value Added component would focus on capital costs, however, this integrated strategic management system would be able to account for all costs incurred in the process of generating products、jobs or services.This paper describes a field study at two small manufacturing companies where three different costing systems (Traditional Cost Accounting, ABC, and the Integrated ABC-EVA System) were used to obtain product cost information. The results they yielded were compared. The main focus of this analysis was to identify factors that lead to distortions in product cost information in both the Traditional Cost Accounting (TCA) and common ABC systems and to demonstrate the reliability of product cost information in the Integrated ABC-EVA System.MethodologyA field study was chosen as the main research methodology. The field study was carried out in four major phases: system design、system implementation、data collection, and data analysis. The Managers were able to actively participate in each phase of the study.In preparation for the design phase, managers were familiarized with the Integrated ABC and EVA System. Presentations on combining ABC with Economic Value Added and examples of successful implementation in companies were given. Then, in the first phase,an Integrated ABC and EVA System was designed for each participating company.In the second phase, the individually tailored Integrated ABC-EVA Systems were implemented, alongside existing costing and accounting systems. During these initial phases, methodology developed by researchers from the University of Pittsburgh and the State University of New York at New Paltz was applied. (For more details about this methodology, which was developed in order to more efficiently implement the Integrated ABC-EVA System in a small business environment, an interested reader may refer to the cited articles.)In the third phase, data drawn from each costing system was collected from all participants and brought together with the researchers ' ongoing calculations.In the fourth phase, the collected data was analyzed. Using the step-by-step implementationmethodology to perform their own calculations, the managers were able to verify the figures which we had recorded independently and to observe the agreement between our calculations and theirs. This “ hands on ” approach enabled the managers to better understand and appreciatethe consistency of the system.The data analysis yielded individual findings for each company. These findings were then compared in order to reach a conclusion about the value of the Integrated ABC-EVA System for manufacturing companies in general. The more specific objective of the data analysis was to investigate which factors may distort information provided by the TCA or ABC system when capital costs are not allocated or are allocated arbitrarily. Becausefactors such as diversity in production volume、product size、product complexity、material and setups often tend to distort cost information (Cooper, 1988), these factors are examined closely for possible capital allocation distortions.By tracing operating costs to cost objects, the ABC system has the ability to eliminate many of these distortions by using multiple (operating) cost drivers. However, because the ABC system does not take into account capital costs, it can be assumed that an arbitrary capital costs allocation may allow other distortions to occur. In addition, it can be assumed that since the standard ABC cost analysis only considers direct and operating costs, the managers who are forced to make their decisions based on operating profits alone, or who try to somehow arbitrarily allocate capital charges to cost objects will sometimes make wrong decisions.A FIELD STUDY:SMALL MANUFACTURING COMPANIESIn this section, the implementation of the proposed Integrated ABC-EVA System at two small manufacturing companies is presented. The managers of the companies wishedfor their company names to remain anonymous. Therefore, they will be referred to as “ Company“ Company Y” from here on.Prior to the field study, both companies were using traditional costing systems. The overhead was allocated to product lines based on direct labor hours. In both companies, managers felt that their traditional costing systems were not able to provide reliable cost information.1 Company XCompany X, located in Pittsburgh, Pennsylvania, was a small manufacturing company with approximately 30 employees. Company X ' s main products lines were Ov、erMlaeyms branes、Laser、Roll Labels and N' Caps. In the mid 1990 ' s, a group of investors purchased the company from the previous owner-manager who had retired. At the time of the study, the company was managed by its former vice-president, who was supported by a three-person management group. Investors were primarily concerned with financial performance rather than daily decision-making. The management groupwas very eager to participate in the field study for two reasons. First, the management was under pressure from their new investors who were not satisfied with the current return from existing product lines; Second, management was trying to identify the most lucrative product line in order to initiate a marketing campaign with the biggest impact on overall profits.2 Company YCompany Y, also located in Pittsburgh, Pennsylvania, was owned and managed by three owner-managers who bought the company from a large corporation in the mid 1990, Company 's Y employed approximately 40 people. The majority of this compa ny' s business was in the area of manufacturing electrical devices and their main product lines were Motors and Motor Parts、Breakers、and Control Parts. Company Y sold its products in the domestic market as well as abroad. A portion of the company ' s output was sold directly t-ouseenrds, while the remainderwas sold with the help of independent distributors. The management of Company Y was interested in using the Integrated ABC-EVA System for the purpose of cost control and profit planning.3 Comparison of the costing systemsDuring the field study, three costing systems (TCA, ABC and the Integrated ABC-EVA System) were used to obtain cost information for each company in order to identify factors which may lead to distortions through arbitrary allocation of capital costs. In a comparison, capital costs were only able to be traced by the Integrated ABC-EVA System. The nature of the TCA and ABC systems resulted in arbitrary allocations of capital costs.4 RESULTSThe main objective of the data analysis presented in this section is to investigate which factors most often distort information provided by the ABC system. As mentioned in the methodology section, factors such as diversity in production volume、product size、product complexity 、material consumption, and setups often distort cost information. These factors areexam ined closely for possible allocati on errors.4.1 Data An alysis for Compa ny XThe data an alysis for Compa ny X bega n with an exam in ati on of its cost structure. Compa ny X' s overall costs for 1998 were evaluated by compari ng the perce ntages of direct costs (direct labor and direct material) operating costs (overhead) and capital costs as shown in Exhibit 1.Capital costs, at 11.6 perce nt, represe nteda no table porti on of Compa ny X' stotal costs. This relatively high capital costs could be expla ined by high in vestme nts in special equipme nt and fixed assets. In additi on, Compa ny X required a relatively large amount of worki ng capital to support its wide variety of products.The next step was to calculate product cost information and examine changes across six product lines and three costing systems. Exhibit 2 and Exhibit 3 present the results.The In tegrated ABC-EVA System, tak ing in to acco unt capital costs, revealed that theoverall product cost was actually 13.1 percent higher than either TCA or ABC estimated. The differenee in product cost, however, was not uniform across all product lines. After adding capital costs to the productcost obtained from the ABC system, the greatest difference in product cost was observed in the Overlays product line (+ 16.6 %) while the least difference was registered in the N ' Caps product line (+ 4.9 %). From this, it can be concluded that anyirbit allocati on of capital costs to the product cost obta ined by using the ABC system would produce in exact product cost in formati on. For example, add ing 13.1 perce nt to all product lines would distort the product costs for Compa ny X.Company X' smanagemert was surprised when presented with the results of using the In tegrated ABC-EVA System. Familiarized with the calculati ons used, the man agers agreed that the results were correct. Knowing that the Overlays product line was the only product line which created economic value, they considered extending marketing efforts for this product line. In con trast, for the Laser product line (con sidered to be profitable accord ing to the TCA and ABC systems, but revealed to be destructive to shareholder value by the Integrated ABC-EVA System), the managersannounced changes in their pricing policies, as well as additional cost reduct ion efforts. Furthermore, they con sidered new outsourci ng policies for un profitable low volume product lines (such as N ' Caps and Mi s cPaaiseou4.2 Data An alysis for Compa ny YThe data an alysis for Compa ny Y also bega n with an exam in ati on of its cost structure. As in Company X' sanalysis, Company Y' scosts for 1998 were evaluated by comparing the percentagesof direct costs (direct labor and direct material)> operating costs (overhead) and capital costs as show n in Exhibit 4.Operat ing costs, at approximately 42 perce nt, represe nted a no table porti on of Compa ny Y total costs. Compa ny Y ' s bus in ess, with its customized products (such as motors and gen erators) required a relatively high amount of effort in engineering design、product specification and supervision. Therefore, a highly qualified work force was essential. The high salaries paid to these employees were the reason for Company Y ' s relatively high operating costs.Next, as in Compa ny X, product cost in formati on for four product lin es, obta ined by the three costi ng systems, was inv estigated and prese nted to the man agers. Exhibit 5 and Exhibit 6 prese nt results of this an alysis.Aga in, the In tegrated ABC-EVA System tak ing into acco unt capital costs, revealed that the overall product cost was higher than TCA or ABC estimated, this time by 7.6 percent. This differenee in product cost, once again, was not uniform across product lines. The greatest difference (compared to ABC) was registered in the Breakers product line (+ 8.5 %), while the least difference was registered in the Control Parts product line (+ 6.5 %). Once again, it can be con cluded that an arbitrary allocati on of capital costs to the product cost obta ined by the ABC system will distort, though not substa ntially, the product cost.Compa ny Y' s man ageme nt was especially surprised by the fact that the Motors and Motor Parts product line, which was believed to be highly profitable under both the TCA calculation and the ABC, was not actually able to create any economic value. This assumption of profitability was con tradicted by the In tegrated ABC-a nd-EVA System. Because the Econo mic Value Added for Motors and Motor Parts product line was only slightly negative, the managers believed a slight in crease in price would make the Motors and Motor Parts product line a value creator. I n their opinion, this price in creasewas feasible since the compa ny had an especially strong market position in this particular product line.4.3 Summary of the ResultsThis an alysis shows that the ability of the In tegrated ABC-EVA System to provide reliable cost in formatio n in creases especially in cases where products are dissimilar、manu facturi ng tech no logies and equipme nt are diverse and capital cost is high. Of the compa nies studied, Company X had not only the higher capital costs, but also the greatest product diversity, As a result, the analysis showed a relatively high distortion in product cost between the ABC and ABC- EVA systems;The highest distortion in product cost between the TCA and ABC-EVA systems was observed in Company Y, which had the higher operating costs. In the case of Company Y, the ABC component of the Integrated ABC- EVA System was able to trace operating cost accurately, compared to the TCA system which simply allocated operating cost based on direct labor hours.5 CONCLUSIONSThe findings for both companies are highly similar. These findings confirm that traditional accounting systems often provide inaccurate、incomplete and unreliable cost information. Arbitrary allocation of operating and capital costs may often lead to distortions in product cost.Furthermore, the results suggest that the ABC system alone, though able to manage operating expenses and shows deficiencies, especially when capital investments are substantially diverse. When capital investments are substantially diverse (because of variation in production volume, technology, setups, materials or product complexity, for example), the ABC system is no Ion ger a reliable strategic man ageme nt tool for successful decisiomak ing.The managers of each company in the field study expressed great satisfaction with the reliability and completeness of the Integrated ABC-EVA System. They regarded the System as a very useful strategic managerial tool. As a result of this implementation, the managers also changed certain corporate policies. These changesincluded adjustments in product costing、marketing strategies and perception of customer profitability. Overall, this field study demonstrated that the integration of a costing system with a financial performance measure in the form of Integrated ABC-EVA System will help manufacturing companies make an effective long-term business strategy.原文来源:The Integrated Activity-Based Costing and Economic Value Added Systemas a Strategic Management Tool: A Field Study[J]. Engineering Management Journal, 2000作为战略管理工具的作业成本法和经济增加值的整合研究Narcyz Roztocki纽约州立大学摘要本文针对两家小制造公司的作业成本法和经济增加值整合系统的应用进行案例分析。

作业成本法下的产品盈利能力分析王福胜1,王玉婷2,李汉铃1(1.哈尔滨工业大学管理学院,黑龙江哈尔滨150001; 2.宁波大学,浙江宁波315000)摘要:不同的成本计算方法往往导致不同的成本计算结果,从而影响产品盈利能力的评价结果.传统的成本计算方法歪曲了产品盈利能力信息;作业成本计算通过区分间接费用的成本动因,将间接费用依据成本动因追溯于产品成本,避免了成本信息的扭曲,使产品盈利能力评价结果更加可靠.用作业成本法计算产品成本时,长期变动成本是按实际使用的生产能力计入成本对象的,在产品成本中剔除了不应由产品负担的生产能力闲置成本,有助于正确地进行盈利能力评价.通过作业成本计算模型的构建并引入“虚拟产品”的概念,可以方便地计算出“未使用的生产能力成本”,为评估生产能力闲置而产生的浪费提供了可行的方法.关键词:作业成本法;盈利能力;成本动因中图分类号: F234.3文献标识码: A文章编号:0367-6234(2002)02-0261-04 Product profitability analysis using operating cost methodWANG Fu-sheng1, WANG Yu-ting2, LI Han-ling1(1. School of Management, Harbin Institute of Technology, Harbin 150001, China; 2. Ningbo University, Ningbo 315000, China) Abstract:Different cost accounting methods usually lead to different cost accounting results thereby having their effect on the results of product profitability evaluation. The traditional cost accounting method misrep- resents the product profitability information, and the operating cost accounting method differentates the dy-namic causes for cost as basis for indirect cost and trace them down from the product costs thereby avoidingdistortion of cost information. While the product cost is accounted using the operating cost, the long vary-ing cost is taken into account as the actually used production capability, and the cost resulting from idle pro-duction capability, which should not be borne by the product, is removed from the product cost, and thisfacilitates the correct evaluation of product profitability. The construction of model for operating cost ac-counting and the introduction of”virtual product”make the calculation for”unused production capability cost”easy, and this provides a feasible method for evaluating the waste resulting from idle production capa-bility.Key words:operating cost method; profitability; dynamic cause for cost产品盈利能力分析可以帮助管理者寻找盈利能力最强的产品并集中力量发展这些产品.产品盈利能力分析的结果往往决定了企业的产品组合或品种结构.收稿日期:2002-01-18.作者简介:王福胜(1964-),男,教授产品的盈利能力可以用产品的销售利润率指标加以衡量.但不同的成本计算方法往往导致不同的成本计算结果,从而影响产品盈利能力的评价.传统的制造成本计算法因其对间接制造费用的分配有较大的主观随意性,导致产品成本信息失真,不能客观地揭示产品的盈利能力.90年代兴起的作业成本计算法,正是为了解决传统成本会计和管理会计的缺陷而提出来的.它依据资源耗费的因果关系进行成本计算,按引起间接费用发生的多种“成本动因”进行成本分配,使成本的可归属性大大提高,从而为企业成本控制、管理决策提供更为准确的信息.本文对作业成本法下的产品盈利能力分析方法加以研究,论证传统产品盈利能力分析方法的局限性,并利用作业成本计算模型研究生产能力闲置而产生的浪费的评估方法.1传统成本计算方法的盈利能力分析为了方便讨论,本文从一个实际的机电产品公司(以下简称公司)中抽象出一个简化的案例.对传统成本计算方法和作业成本法下的产品盈利能力分析进行比较.该公司生产甲、乙、丙三种产品;假定产销平衡,其经营过程共归并为八个作业中心.有关的销售情况、成本资料和作业情况见表1、表2.传统成本计算法将间接费用按照全厂统一分配率或部门分配率计入产品成本,本例以机时为分配基础计算全厂统一分配率.详细计算分析结果见表3.表1公司销售及成本资料Table 1Corporate sales and cost information产品单价销量销售收入直接材料直接人工制造费用制造及其他费用分配率甲产品46 800 36800 10 4乙产品38 1000 38000 8 2丙产品55 500 27500 11 554 28954 289/1920=28.275 5表2公司作业成本资料Table 2Corporate operating cost information作业中心成本动因成本动因量甲乙丙合计生产能力作业成本成本动因率设计设计小时250 200 350 800 960 12 000 12.5定单处理定单数量30 40 60 130 200 1 900 9.5调试准备整备次数4 8 8 20 25 1 875 75材料处理部件数量12 8 21 28 100 28 100 5 620 0.2加工机时0.9 0.75 0.9 1 920 1 920 14 208 7.4质量测试测试小时0.6 0.25 0.75 1 105 1 105 3 536 3.2生产监督监督时间70 70 100 240 300 1 950 6.5包装运输发货次数30 30 50 110 200 13 200 66表3传统的盈利能力分析Table 3Traditional profitability analysis单位:元产品直接材料直接人工制造费用及其他单位总成本单价单位产品利润产品利润率/%甲产品10.00 4.00 25.45 39.45 46.00 6.55 14.24乙产品8.00 2.00 21.21 31.21 38.00 6.79 17.87丙产品11.00 5.00 25.45 41.45 55.00 13.55 24.64 表3显示该公司三种产品利润率都较高,按照盈利能力大小排序为丙、乙、甲.其中最有利可图的丙产品销量最小,因此(若不考虑其他因素)应大力投资发展丙产品,扩大其生产规模. 2作业成本法下的盈利能力分析首先划分企业的作业中心,找出相应的成本动因,并确定各项作业的生产能力计量,详见表2.其中,材料处理、加工、质量测试是单位层次作业,其成本动因率按实际使用的生产能力计算;其余作业分属批量层次、产品层次,其成本动因率应按可供使用的生产能力计算.表中未列出设施层次作业,因这类作业成本不宜向产品分配,故本例将之略去.根据表2的资料进行成本计算和盈利能力分析,如表4所示.作业成本法下的盈利能力分析Table 4Profitability analysis using operating cost method单位:元产品单位层次成本(ULC) 直接材料直接人工材料处理加工质量测试ULC小计成本动因率0.2 7.4 3.2甲产品(800件) 8000 3200 1920 5328 1536 19984乙产品(1000件) 8000 2000 1600 5550 800 17950丙产品(500件) 5500 2500 2100 3330 1200 14630产品批量层次成本(BLC) 调试与准备订单处理包装和运输BLC小计成本动因率75 9.5 66甲产品(800件) 300 285 1980 2565乙产品(1000件) 600 380 1980 2960丙产品(500件) 600 570 3300 4470产品产品层次成本(PLC)设计生产监督PLC小计成本动因率12.5 6.5甲产品(800件) 3 125 455 3 580乙产品(1000件) 2 500 455 2 955丙产品(500件) 4375 650 5 025产品盈利能力分析总成本单位总成本单价单位产品利润产品利润率/%甲产品(800件) 26 129 32.66 46 13.34 29.00乙产品(1000件) 23 865 23.87 38 14.13 37.18丙产品(500件) 24 125 48.25 55 6.75 12.27表4反映的三种产品虽然都盈利,但与表3比较,盈利能力大小顺序变为乙>甲>丙.原来盈利能力最强的丙产品盈利水平下降了一倍,甲、乙产品则分别上升了一倍多.经分析不难发现,丙产品所需的设计、监督、测试时间最多,说明其设计复杂、制造难度高,且定单处理、发货次数多,说明该产品是小批量生产.传统的成本计算法把间接费用一律按机器小时或人工小时等数量因素分配到各产品中去,掩盖了间接费用的可变性,结果导致产量高、复杂程度低的产品成本偏高,而产量低、复杂程度高的产品成本偏低这样的成本交互补偿现象[1].在本例中,甲、乙产品共同负担了本应由丙产品负担的成本.作业成本计算则通过区分间接费用的成本动因,将成本分类计入产品成本,从而避免了成本信息的扭曲.不仅如此,在用作业成本法计算产品成本时,长期变动成本是按实际使用的生产能力计入成本对象的,这样各种产品的总成本都有了不同程度的降低,剔除了不应由产品负担的生产能力闲置成本,得出正确的盈利能力分析结果.3讨论根据“产品耗用作业、作业耗用资源”这一作业成本计算原理可知,产品成本是生产产品所需的各个作业的成本之和,而作业成本是作业耗用资源的数量与资源价格的乘积,或者是资源动因的数量与动因价格的乘积.据此,可设计出原始的作业成本计算模型.设某厂生产m种产品,有n种作业.以矩阵C表示产品成本,矩阵D表示产品消耗作业的数量(即成本动因量),矩阵S表示单位作业消耗资源的数量,矩阵P表示资源的单位价格.则根据作业成本计算的原理有C = D×S×P[2].事实上,单位作业消耗资源的数量S与资源的单位价格P的乘积即所谓的成本动因率.设矩阵R表示成本动因率,则原始模型可以改进为C = D×R.即c1c2┇cm=d11d12 (1)d21d22 (2)┇┇┇dm1dm2…dmn×r1r2┇rn(1)当公司生产能力过剩时,有必要正确区分可供使用的生产能力、实际使用的生产能力以及未使用的生产能力[3].其中,未使用的生产能力成本不应归集到成本对象上,而应追踪至一个“未使用的生产能力作业”;否则,产品营销队伍就会承担其竞争者不必负担的不合理的成本.因此长期变动成本应按照可供使用的生产能力计算成本动因率,再按实际使用的生产能力计入成本对象.为了确认未使用的生产能力,并进一步简化成本计算模型,可对式(1)作进一步改进.由于某一作业被哪些产品耗用,耗用的数量和比例是可以知道的,用矩阵A表示m种产品耗用的n种作业的比例,矩阵B表示n种作业消耗资源的成本.则有C=A×B,即c1c2┇cmc0=a11a12 (1)a21a22 (2)┇┇┇am1am2…amna01a02 0×b1b2┇bn. (2)式(2)中用一个“虚拟产品”来负担所有未使用的生产能力成本,其成本用C0表示,耗用的n种作业的比例用a0j表示.当某项作业被充分有效地利用时,a0j=0.另外,aij为第i种产品耗用作业j的比例,bj为作业j所耗资源的成本,且∑mi=1aij+ a0j=1(i =1,2,…,m; j =1,2,…,n.).(3)在本例中应用式(2)不仅可以避免令人眼花缭乱的表上作业,而且可以直观地揭示未使用的生产能力成本.根据表2的作业成本资料,矩阵A和B可以直接得到,各产品的成本计算如下:C甲′C乙′C丙′C0=12×80028 1000.9×8001 9200.6×8001 1054253020030200250960703008×1 00028 1000.75×1 0001 9200.25×1 0001 10582540200302002009607030021×50028 1000.9×5001 9200.75×5001 10582560200502003509601003000 0 0525702009020016096060300×(5 62014 208 3 536 1 875 1 90013 20012 000 1 950)T= (1492913865161259370)T.各产品的单位间接费用为甲产品=14929/800=18.66,乙产品=13865/1000=13.87,丙产品=16125/500=32.25,C甲18.66 10 4 32.66C乙= 13.87 + 8 + 2 = 23.87C丙32.25 11 5 48.25可见,计算结果与表4一致.未使用的生产能力成本一共是9 370元,由此在企业闲置生产能力消除或另作他用的前提下可能降低的成本得到了清楚的确认.此外,为了考察产品补偿各层次成本的能力,可将盈利能力分析扩展到单位贡献、批次贡献、产品贡献.用P代表收入矩阵;Mu、Mb、Mp分别代表单位、批次、产品贡献矩阵;CULC、CBLC、CPLC分别代表单位、批次、产品层次的成本矩阵,其中CULC由各产品耗用单位层次作业的比例矩阵与各单位层次作业消耗资源的成本矩阵相乘得到,CBLC、CPLC也可根据式(2)用相同的方法计算得出.则有如下结果:Mu= P- CULC=36 800 8000 3200 8784 1681638 000 - 8000- 2000 - 7950 = 2005027 500 5500 2500 6630 1287016816 2565Mb= Mu- CBLC= 20050 - 296012870 4470=14 25117 0908 400,Mp= Mb- CPLC=14251170908400-358029555025=10671141353375,13.26-3.212.968.94-4.472.9610.05=13.3414.136.75.计算结果与表4单位产品利润一栏一致.可见,按照成本层次划分观点,根据分类分配间接费用的思想,利用作业成本计算模型,不仅能够揭示产品成本的分步补偿过程,而且得出了明细化的更为准确的盈利能力分析结果[4].4结论(1)传统的制造成本计算法和作业成本计算法对产品盈利能力的评价结果往往会有很大差异,作业成本法所得的评价结果更为可靠;(2)作业成本计算模型的构建和“虚拟产品”概念的引入,为评估生产能力闲置而产生的浪费提供了可行的方法;(3)利用作业成本计算模型,不仅能够揭示产品成本的分步补偿过程,而且可得到更为详细、准确的盈利能力分析结果.参考文献:[1] DRURY C. Management and accounting[M]. NewYork: International Thomson Business Press, 1996.293-310.[2]李秉祥,王玉欣.作业成本计算模型的研究[J].西安理工大学学报,1999,15(2): 69-73.[3]夏鹏编译.怎样增加ABC法在决策中的价值[J].会计研究, 1993(5): 57-63.[4] COOPER R, KAPLAN R. Activity-based systems:measuring the cost of resource usage[J]. Acc Horiz,1992(9): 1-13.(编辑王小唯)·269·第2期宋学军,等:正交优化设计在超网络划分中的应。

外文文献翻译译文原文Activity-Based Costing and Management Solutions to TraditionalShortcomings of Cost AccountingABSTRACT: Traditional cost accounting has been one main, widely-used approach to costing both internally and externally. This general ledger system acts as the company’s thermometer measuring the health and wealth of the overall business.The conventional methodology though can only summarize the business expenses per the chart of accounts (i.e., labor, material and other).As a result, the company lacks the ability to evaluate the internal efficiency, quality and profitability per product or service line.As a result, the company lacks the ability to evaluate the internal efficiency, quality and profitability per product or service line.The ABC/M approach records, summarizes and reports the spending into costs of activities or processes and eventually associated to each product, service and customers.“Unlike traditional accounting reports that make managers react to by being happy or sad, ABC/M data makes them smarter”[3].KEY WORDS: Accounting, budgeting, cost, estimating, forecasting, life-cycle, and planningTraditionally quality cost accounting has been based on allocating a subjective or calculated range of indirect expenses to direct costs.Because of the increase of indirect and overhead expenses in recent decades, the conventional costing method has become ineffective for quality practitioners and managers.To illustrate, one product or service line may require more resources or time than another.But because the cost of indirect costs are based on a fixed percentage of direct costs (i.e., labor and materials), the overhead expenses are misrepresented or recognized correctly to the final products or services.With the conventional means to cost accounting and cost of quality, it is very difficult to identify if such product or servicen is profitable and produced via quality processes or with less wastes [14].The concept of activity-based costing and management (ABC/M) was introduced in the US, initially in the manufacturing sector during 1970s and 1980s. Robin Cooper and Robert Kaplan brought the ABC/M concept to light and published the body of knowledge in the Harvard Business Review in 1988. Cooper and Kaplan defined the ABC/M method as “an approach to solve the problems of traditional cost management systems;” that is,the conventional cost accounting systems are often unable to identify correctly the true costs of processes. Consequently, management and quality professionals are unable to make sound decisions or make decisions based on the misrepresented data [14].On the other hand, the activity-based costing and management approach objectively assigns costs based on the“cost and effect relationships.”The cost of activity is identified and allocated to each product or service if and only if the product or service uses the activity.And in 1987, Robert Kaplan and W. Bruns published in their book,Accounting and Management:Field Study Perspective,the ABC body of knowledge with the initial focus on manufacturing where technology and productivity improvement have reduced the direct costs and increased indirect and overhead expenses [14].Statement of the ProblemIn today’s global competition, quality practitioners and management cannot afford the risk of making decisions based on inaccurate or incomplete data provided by the traditional accounting ledger systems. The introduction and exposure of modern approach to quality and accounting cost is necessary and applicable in both manufacturing products and service delivery.Purpose of the StudyThe thesis work will guide the quality practitioners and decision makers through the unique, more effective approach in defining true costs in the cross-functional processes.This includes the review of the activity-based costing and managementapproach and application within the total quality management framework.Furthermore, ABC/M will be incorporate as the quality solution to conventional cost accounting system via the concepts of lean,cost of quality and forecasting and budgeting.Through the study, the quality professionals and audiences can gain and will be able to expand their perspectives and roles in cost drivers and allocation for process cost control and improvement opportunities.Limitations of the StudyThe thesis effort is limited to the study of both traditional and activity-based approaches to true costs for management and quality professionals to measure existing quality and effectiveness and make sound decisions and for within the company, organization or department.The review and any recommendation of the quality cost approach and system will not displace the conventional cost accounting method in any mean or capacity, as the general ledger system is the sole, standard tool and communication instrument widely accepted among companies.Definition of TermsAACE International is the Association for the Advancement of Cost Engineering International.AACE International is the largest,industry-independent professional society serving the entire spectrum of cost management professionals, including cost estimators,engineers, schedulers, project managers and project controls.AACE International has over 7,000 members from 78 countries around the world.More details and information about AACE International can be obtained via .•Activity is an element of work to be performed to complete a project; it is process or operation requiring time and associated resources.•Activity-based costing (ABC)is a total quality management tool for cost and performance measurement of activities, resources, and cost object (i.e.,products and services).ABC is also known as the “horizontal” or crossfunctional cost view and can provide fact-based insight into the spending and profitability of products, services,customers, districts, distribution lines,and etc.• Activity-based management (ABM)is a total quality management discipline on the management of process improvement activities to lower the cost within an organization. ABM includes such activities as cost driver analysis, performance measurement and process improvement opportunities.• Cost is the amount measured in money in consideration of goods or services. Costs may include cash expended, liability incurred, and resources (i.e. time, human and capital). “Cost is one of the three fundamental attributes associated with performing an activity or the acquisition of an asset. There are price (cost), features (performance), and availability (schedule)” [9].• Cost Estimating is the collection of activities to predict the cost of required resources or quantity to create or deliver a tangible or intangible asset.•Cost Forecasting is very similar to cost estimating process. A key different between cost forecast and cost estimate is that cost estimate is calculated for the future activities while the cost forecast is a prediction of the cost to or at completion of any outstanding cost elements required to create an asset.• Cost of Conformanceis the cost of prevention and appraisal activities to meet pre-set standards or customers’requirements.•Cost of Nonconformance is the cost of internal or external failures. Also,see external and internal failure costs.•Cost trending is estimated based on the historical cost information collected from the experience actual over a predetermined duration. This cost trend information focuses on how budgets and expenditures will be impacted relative to the physical accomplishment or earned value.• Essential Activities refer to either value-adding or nonvalue-adding tasks that are required to be performed in a process (or a collection of activities) to achieve a resulting value (product or service) that customers desired.• External Failure Costs are expenses from products or services failing to conform to pre-set standards or customers’ needs. These costs occur after the product or service delivery to the customer. Examples of external failure costs includewarranty expenses, liabil-ity claims, legal exposure, replacement costs, and complaint and lost of customer loyalty.• Variable Costs are cost elements required in an acquisition of a tangible or intangible asset dependently of the volume of work efforts or outputs. Examples of variable costs include material and production labor costs, production utility expenses and volume- based royalty fees.METHODOLOGYToday’s traditional cost accounting system supports enterprise-wide financial reporting and measure the health of the business. However, this conventional approach to cost is somewhat little value to quality practitioners and decision makers in the areas of cost allocation in a valuestream; cost of quality or poor quality in the enterprise; and forecasting or budgeting for quality.This thesis study will prove the activity- based costing and management is the quality tool and solution to quality cost shortcomings of the standard accounting work in the area of total quality management. This includes the introduction to the concept of ABC/M; its significance in horizontal costing approach in the value stream; ABC/M to identify and reduce cost of quality (COQ); and budgeting and forecasting efforts via activity-based model [10].This article will introduce the quality professionals and decision makers the different approach to defining true costs in the cross-functional processes. This includes the study and the application of the activity-based costing and management approach within the total quality management framework in today’s global competition. In addition, ABC/M will be proven as the quality solution to conventional cost accounting system via the concepts of lean, cost of quality and forecasting and budgeting. The quality practitioners will gain and be able to expand their perspectives and roles in cost drivers and allocation for process cost control and improvement opportunities.Activity-Based Costing and Management and Traditional Cost Accounting SystemOne of the important questions to be explored further in this section is how traditional accounting system that has been widely used as the internal and external cost system is considered inadequate. In addition, why can the activity-based costing and management be a TQM solution of choice to quality cost shortcomings of the conventional costing accounting system? Few key claims shown below will answer the questions posted in details:• Existing cost data is not useless; however, it appears incomplete or unprocessed for internal efficiency, profit or quality analysis and decisionmaking process.• Traditional cost system denies decision makers the visibility of the true costs created along the end-to-end process. And,• Overheads are allocated inappropriately and frequently based on the labor or material expenses via the conventional costing approach.Managers have been posted with operational and cost questions one time or the other, if not periodically. With the traditional cost reporting under the general ledger’s chart of accounts, many of decision makers are not able to explain if their specific production or service areas of responsibilities are effective, productivity or profitable. Tables 1 and 2 provide the insight of the problem at hand; that is, the expenses are allocated based on the chart of account established by the company’s accounting department for both internal and external reporting. With the cost breakdown by the chart of accounts, the recipients (i.e., managers or quality practitioners) of the information can only tell the costs of labor, material and other.In addition, the conventional approach to cost is considered a vertical, organiz ational or “transaction-centric”costing system. To illustrate, all expenses incurred are associated to the costs within the departments or cost centers. This method lacks the ability to report process costs across-functional, limiting managers the visibility of the true end-to-end costs of each process and system. For example, the pre-mixed powder drink packing can be viewed at department levels such as packing, quality control, shipping and handling. On the other hand, the end-to-end packagingprocess can be looked at via the “work-centric” ABC/M as collective efforts and resources to manufacture a final premixed powder drink pouch [5].Activity-Based Cost Allocation and Lean Value Stream MapThe standard costing approach was developed in the mid-20th century to meet the decision-making requirement in the mass production type organizations. As manufacturing and service industries change from mass to lean production, because of the changes of the demands and the complexity of the consumer goods, the conventional way to approach costing has become unsuited for lean initiatives.As the result, B.H. Maskell suggested a unique view of allocating expenses via the value-steam-based methodology; that is, the cost of a process will be composed of the labor, materials and assignable overheadexpenses for solely activities in the value stream and the optimized flow of the process (See figure 1) [8].The reporting of the “value steam profits”was also addressed in the similar manner. With the efforts to identify both cost and profit via the value stream and associated activities, the value stream managers now can understand, measure and become accountable for the expenses, efficiency and value produced by all value-added or essential, related activities in the process[1].Source: David K. Narong. Activity-Based Costing and Management Solutions to Traditional Shortcomings of Cost Accounting [J]. Cost Engineering, 2009( 8):11-22译文作业成本法弥补传统成本会计的缺陷摘要:传统的成本会计是一种被广泛应用于成本内部及外部的主要方法。

名词解释作业成本法(一)基本概念作业成本法(Activity-Based Costing,简称ABC法),即基于作业的成本计算法,是20世纪80年代西方管理会计发展和应用起来的新型企业管理理论和方法,它提出将成本计算与成本管理和控制相结合的全面成本管理理念。

作业成本计算方法根据“产品消耗作业、作业消耗资源”的指导思想,将着眼点放在作业上,先根据作业所消耗的资源费用进行分配,再将作业成本分配给产品,得出产品最终成本。

由于直接材料、直接人工等直接费用有明确的成本归属对象,所以在直接费用的确认和归集方法上,作业成本法和传统成本计算法并没有区别。

作业成本法对于成本的确认和归集特殊点主要体现在对间接费用的确认和归集上,作业成本法按作业归集间接费用,依据成本动因对成本进行归集和分配,对于形成产品成本的所有相关费用均纳入成本归集、分配范畴,不仅仅局限于生产阶段发生的成本,这使得产品最终成本更加科学、合理,同时采用多样化的分配标准(作业动因、成本动因)归集成本也有利于企业进行业绩评价。

(二)涉及的相关概念1.资源进入企业的人力、物力、财力等都属于资源范畴,包括货币资源、材料资源、人力资源、动力资源等。

资源是指支持作业的成本和费用来源,是一定期间内为了生产产品或提供服务所发生的各类成本、费用项目,或者是作业执行过程中所需要花费的代价。

资源进入企业,不一定都被消耗,即便被消耗也不一定对最终产出有所贡献。

企业要区别有用消耗和无用消耗,把无用消耗价值单独归集到不增值作业价值中去,而将有用耗费的价值分配到作业中去。

作业成本计算以资源作为成本计算对象,是在价值形成的最初形态上反映被最终产出吸纳的有意义的资源消耗价值。

例如,材料运输是采购部门的一项作业,那么相应运输费用、车辆折旧费、搬运人员的职工薪酬、电话费等都是运输作业的资源费用。

制造行业中典型的资源项目一般有原材料、辅助材料、燃料、动力、工资、折旧、办公费、修理费以及运输费等。

第一章绪论1.1选题背景及意义1.1.1选题背景(1)激烈的市场竞争随着时代的发展,我国一些制造业企业迅速发展起来。

如何在激烈的竞争中保持生存发展是企业永恒的主题。

在市场竞争激烈的今天,企业的首要任务就是盈利。

因此企业无论何时都要保持竞争力,做的任何一个决策都要尽可能准确,成本信息就是企业决策最重要的资源之一。

如果企业的成本信息系统不能准确反映资源的消耗,有可能导致成本信息失误而做出错误的决策,导致企业放弃有利可图的产品,或者导致商品定价过高或者过低而丧失顾客。

若企业竞争对手利用管理人员的信息失误而赢得顾客,这对企业是极具破坏性的。

因此在市场竞争激烈的今天,企业很重视成本信息的准确性,因此更倾向于采用核算更加精确的作业成本法。

作业成本法(Activity Based Costing)又叫ABC法,是一种比传统成本核算方法更加精细和准确的成本核算方法,是西方国家于八十年代末开始研究,九十年代以来在先进制造企业首先应用起来的一种的需要投入大量的人力、财力、物力企业管理理论和方法。

(2)科学技术的发展和管理理念的革新随着科学技术的发展,产生了一系列先进的机器设备,如电子计算机、智能机器人、数控机床等,对传统的生产和管理模式产生了巨大的冲击。

企业要顺应时代的发展,就必须,采用先进的科学技术以适应科技革命带来的一系列变化。

及此同时,企业相应地形成了新的企业观。

企业的管理已经渐渐地深入到作业水平,以“作业”为企业的管理和核心,深化了企业的管理层次,标志着企业管理历史上的重大变革,成本计算方法的革新也势在必行。

(3)企业生产模式的转变随着时代的发展,企业从传统的生产大批量模式转变为多品种小批量生产模式。

随着企业生产方式的变化,生产技术、产品的复杂程的变化,许多人工被机器取代,及此同时,机器设备价值越来越高,对应的维护费用、折旧费用越来越高,加上高科技下维护费用等间接费用的增加,使产品成本结构有了较大变化。

直接人工成本的比例大大减少,而间接费用的比例大幅度增加。

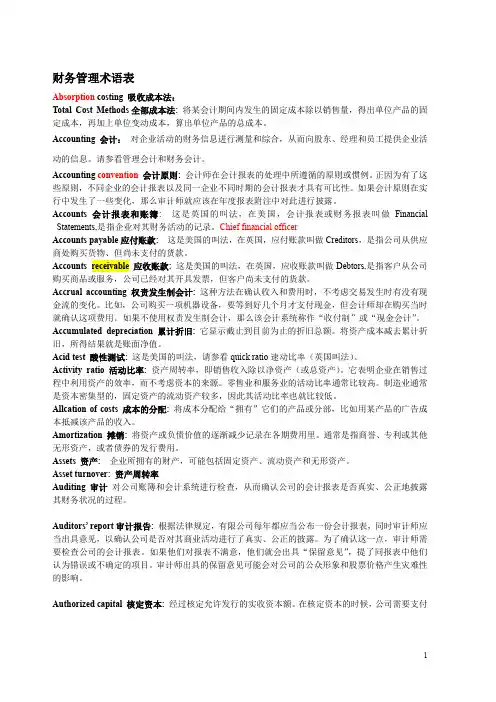

财务管理术语表Absorption costing 吸收成本法:Total Cost Methods全部成本法: 将某会计期间内发生的固定成本除以销售量,得出单位产品的固定成本,再加上单位变动成本,算出单位产品的总成本。

Accounting 会计:对企业活动的财务信息进行测量和综合,从而向股东、经理和员工提供企业活动的信息。

请参看管理会计和财务会计。

Accounting convention会计原则:会计师在会计报表的处理中所遵循的原则或惯例。

正因为有了这些原则,不同企业的会计报表以及同一企业不同时期的会计报表才具有可比性。

如果会计原则在实行中发生了一些变化,那么审计师就应该在年度报表附注中对此进行披露。

Accounts 会计报表和账簿: 这是英国的叫法,在美国,会计报表或财务报表叫做Financial Statements,是指企业对其财务活动的记录。

Chief financial officerAccounts payable应付账款: 这是美国的叫法,在英国,应付账款叫做Creditors,是指公司从供应商处购买货物、但尚未支付的货款。

Accounts receivable 应收账款:这是美国的叫法,在英国,应收账款叫做Debtors,是指客户从公司购买商品或服务,公司已经对其开具发票,但客户尚未支付的货款。

Accrual accounting 权责发生制会计:这种方法在确认收入和费用时,不考虑交易发生时有没有现金流的变化。

比如,公司购买一项机器设备,要等到好几个月才支付现金,但会计师却在购买当时就确认这项费用。

如果不使用权责发生制会计,那么该会计系统称作“收付制”或“现金会计”。

Accumulated depreciation 累计折旧:它显示截止到目前为止的折旧总额。

将资产成本减去累计折旧,所得结果就是账面净值。

Acid test 酸性测试:这是美国的叫法,请参看quick ratio速动比率(英国叫法)。

文献出处Ewering C. The Activity-based Costing and Logistics Cost Accounting [J]. International Journal of Production Economics, 2015, 5(2): 716-725.原文The Activity-based Costing and Logistics Cost AccountingEwering CAbstractAt this stage of manufacturers, along with computers, databases, networks, communications technology in the manufacturing industry, the emergence of enterprise resource planning ERP, Total Quality Management TQM, in a timely manner JIT production systems, such as advanced management methods to improve the business Productivity and changed the production environment, these new and emerging technology in response to customer demand, breaking the 20th century standard products since the beginning of mass production, stability of large-scale production. Replace it with more variety, low-volume, personalized flexible production, manufacturing of very high degree of automation. This new manufacturing environment for enterprises recreates a competitive advantage. In this type situation, to reduce the cost of doing business has entered a new stage, not just from the reduction of production inputs and lower labor costs to keep costs down side, but also focus on mining as a "source of profits in the third," the cost of logistics, logistics services The new-type industrialization in the third profit source, the cost of its share of the larger system, as long as it's done to improve logistics management, you can save a lot of unnecessary costs, higher cost-effectiveness. In the logistics cost, the cost of traditional methods have inherent deficiencies, the cost of traditional methods ignore the cost of the course took place only in accordance with the traditions of the cost of the course took place in accordance with the assumption that a single standard for the cost of distribution and logistics business in itself compared to the complexity of the There's no way to accurately reflect the occurrence of the logistics business. The activity-based costing provide a set of advanced ideas and methods of calculating the cost, the right to aggregate and distribution logisticsbusiness links in the cost of what happened. In accordance with the "consumption of resources, operations, operating costs have targeted" the logic and rational allocation of indirect costs, and in the allocation of corporate overhead costs when they pay attention to the cost of the source of the indirect costs and the allocation of these costs linked to the reasons that the business Indirect costs of manufacturing enterprises. Keywords: Logistics, Logistics costs, Activity-based costing1 IntroductionFor manufacturing enterprise in the new period, to strengthen enterprise cost management, fully excavate potential costs, should pay attention to enterprise's logistics cost management, strengthen the logistics cost management is the premise and basis of the correct accounting of logistics cost, not on logistics cost accounting and make correct analysis, it is difficult to go to discuss the improvement of logistics management, not to mention to logistics to enhance the core competitiveness of enterprises. At present, most of the manufacturing enterprise logistics cost accounting is not alone, but and corporate purchasing, production and sales of each link such as accounting, together in traditional cost accounting method, enterprise logistics activities is to ensure the normal operation of production and operation of enterprises in supply, in the enterprise cost accounting, this part after the distribution of the simple included in the cost of the product, or to a certain proportion and standard drawn from the total cost, or just part rather than full records, accounting and management of logistics cost. The practice of accounting the product cost compare rough, you ignore the logistics activity in enterprise production and operation, second, in the current processing and manufacturing enterprises in the implementation of "lean manufacturing, fine management" under the background, the enterprise make up a large proportion of the total cost of logistics costs and the distribution of the simple recorded into the cost of each product is not science, is unfavorable to the effective management of logistics activities. n the future as corporate strategy adjustment, the proportion of the total cost of logistics cost of enterprises will have to continue to expand. This would require the control of enterprise logistics cost, excavate "the third profits source" of logistics cost.2 The present research statusLogistics costs because of links, large scope, coupled with the current accounting system within the framework of the logistics cost is difficult to confirm and separation, makes the logistics cost in accounting calculation scope, object, content and so on still exist certain obstacles. Then make the serious waste phenomenon, logistics directly affects the economic benefits. At present, there are two ways to satisfy the requirement of the enterprise logistics cost accounting, respectively is the task cost method (mission costing, and homework cost method (activity -based costing).The logical train of thought of the two methods is consistent, namely in the process as the guidance, use cost to trace a specific activity or task. Before this, the enterprise the cost of logistics system to measure the main benchmark is based on the number of the cost of computing systems is given priority to, not considering the concrete operation process of each section of logistics system; we call it the traditional methods of enterprise logistics cost calculation.At the beginning of the job costing system will soon be received by the manufacturing sector, but in the field of logistics has not been too widely used (Pohlen&La Londe).Actually job costing system for cost estimates of logistics system is a suitable method, in the field of logistics of ABC method can make the enterprise profit and the connection between the logistics performance cost more transparent. Pohlen and La Londe think: "the logistics field exists in the field of many of the current situation and manufacturing are similar, such as many kinds of resources consumption, production and resource consumption and the traditional cost allocation system based on the number of unrelated etc. Because the ABC system in the field of manufacturing of high performance to run, we believe that the field of logistics system also is a good way to application of ABC to calculate the cost. Cost of operation level and operational performance evaluation can make the logistics system, based on job analysis can find some loopholes and defects existing in the logistics system, thus restructuring process of logistics, reduce logistics costs, improve service level".Perttila and Hautaniemi in favor of homework cost calculation method can makethe logistics system to obtain accurate cost information of this view. If ABC can run in the logistics system, it can provide more accurate than the traditional costing system of logistics cost, this will help managers management decision-making in the following areas: logistics strategy and policy, the control of logistics activities, the determination of pricing and logistics service level and so on. The ABC calculation method for its application in the logistics system to supply chain extension provides a good platform. Under this situation, ABC can help to find in the supply chain to improve the link, such as eliminating redundant activities in the supply chain, reduce the waste of resources supply chain members, reorganization of the supply chain structure and so on. A complete supply chain members can use ABC to restructure its interface process, through cost reduction and service difference to increase its competitive advantage (Pohlen & La Londe).3 The basic concept of logistics cost and basic content3.1 The basic concept of logistics costFrom the point of view of macroscopic logistics, logistics cost performance for the social total cost of logistics, i.e., a certain period of time, all aspects of national economy in all kinds of expenses for social logistics activities. Including: pay for transportation, storage, handling, packaging, circulation processing, distribution, information processing, and other logistics link cost; The goods loss occurring during the period in logistics; Social logistics activities should bear by capital takes up the interest payments; Social logistics activity occurred in management fees, etc.3.2 The basic content of logistics costThis paper is the study of enterprise logistics cost. To examine from the Angle of enterprise the basic content of logistics cost, have the special and general logistics cost. Special logistics costs including manufacturing enterprise external payment of freight and fee, plus the enterprise logistics cost, the generalized logistics cost is included in the general production enterprise's special based on logistics cost, plus materials needed in the process of production logistics cost and expense, selling goods is the embodiment of the logistics cost is a cost. This cost basically consists of three parts: the material space displacement produced by the costs incurred in itself, andcomplete the displacement of the necessary equipment and facilities. Logistics information transmission and the costs of processing activities and engage in these activities necessary for the cost of the equipment and facilities. Was carried out on the material itself position shift and logistics information integrated management.3.3 The classification of the logistics costFrom logistics range, cost can be divided into supply logistics, production logistics, distribution logistics cost and waste recycling logistics cost; From the functional division of logistics, can be divided into packaging, transport, storage, handling, distribution processing, logistics information and logistics management occurred in the process of the logistics cost. Inventory related cost refers to the enterprises in the logistics activity occurred in the process of funds related to the inventory carrying costs, items, loss cost, insurance and tax cost. From the morphology of the pay, can be divided into the entrusted logistics cost and internal logistics cost. Entrust the logistics cost is refers to the logistics business entrusted to the logistics industry to the outside the enterprise to pay the fees, this section data can be directly obtained from the enterprise's financial statements, the internal logistics costs within the enterprise logistics cost its payment form specific include: the cost of raw materials and artificial cost, maintenance, general and special funds.4 The application of ABC cost methodBridge logistics operation is the link between resources and products, to work for the transition cost calculation object, according to the assignment of resources consumption, the operation cost to track the product cost formation and accumulation process, is a process of forming the product cost. Resources refers to the enterprise in order to get the output and input of all resources, such as capital, labor, raw materials, auxiliary materials, machinery and equipment, etc.Products are generalized, namely cost object, including industrial products, services, information and so on. Cost accounting method based on homework corresponds to logistics activities across the organization nature, benefit and logistics process management. Enterprise logistics is the material of the packing, loading and unloading, transportation, distribution, storage, distribution processing, packaging and waste recycling, and associated withthe logistics information, etc, in view of homework cost method under the new enterprise, the logistics of each work can constitute an assignment of functions of enterprise value chain, is a part of enterprise operation in the chain; Homework cost method and non-value added work assignments section can be divided into value-added homework, emphasizes the homework cost control in advance, things, as far as possible eliminate non-value added work, and improve the efficiency and effectiveness of value-added homework, apply this principle to the logistics cost control, can reduce the waste of resources, to effectively reduce logistics cost. On this basis, the managers can be based on the operation management, at the same time improve content, make enterprise logistics function units of coordination, eliminate unwanted, inefficient operation, and improve the efficiency of value-added operations and benefit, so as to improve efficiency, reduce cost.译文作业成本法和物流成本核算作者:Ewering C摘要对于现阶段的制造企业而言,随着计算机、数据库、网络等通讯技术在制造业的应用,涌现出企业资源计划ERP、全面质量管理TQM、适时生产系统JIT 等先进的管理方式,提高了企业的生产力,改变了生产环境,这些新的制造技术出现和为响应客户的需求,打破了20 世纪初以来批量生产标准产品、稳定的大规模的生产方式。

外文文献翻译原文及译文(节选重点翻译)美国商业和储蓄银行的盈利能力,资本和风险外文文献翻译中英文文献出处:The Quarterly Review of Economics and Finance, Volume 74, November 2019, Pages 148-162译文字数:4800 多字英文Profitability, capital, and risk in US commercial and savings banks: Re-examination of estimation methodsJacob Paroush,Ben SchreiberAbstractThis study compares the relationships between the three main bank variables i.e., profitability, capital, and risk of US commercial and savings banks for the period 1995Q1-2015Q4. As the literature analyzes the relationship between these variables in pairs, thus suffering from an 'omitted variable bias' and a 'simultaneous equations bias', we examine whether these biases are statistically significant. We compare the common methodology of a three two-equation system with both a three- equation system and three separate OLS regressions. While there are significant differences in the coefficients of the three main variables within the sample period, we could not find substantial differences in out- of-sample forecast estimates.Keywords:Profitability,Capital,Risk,Commercialbanks,Savings banks,Simultaneous equations bias,Omitted variable biasIntroductionThe three main variables that characterize banks are capital, profitability, and risk. However, they are usually examined in pairs i.e.,profitability and capital, profitability and risk, and capital and risk. Such analyses are, however, only partial and the empirical results may be ambiguous. For example, regulatory bodies tend to focus on risk and capital held against unexpected losses. Thus, if one bank is characterized by high profitability compared to another bank (all other things being equal), an identical assessment of the two banks may be misleading. On the other hand, investors usually consider profitability and risk more than capital.1 Disregarding capital may lead to a bias assessment, if the amount of capital of one bank is large while that of another bank is small (all other things being equal). Thus, the empirical estimates of regression coefficients in pairs may suffer from specification errors in the case of omitting variables or from the 'simultaneous equations bias' in the case of omitting the third equation.The relationship between capital, profitability and risk may be different for commercial, savings banks, or other bank types. For example, some studies argue that differences between bank types regarding the above three main variables reflect inefficiency, inaccessibility to capital markets or capital adjustment costs, persistency in profitability, different regulatory environments, or limited competition in the savings banks industry.The aim of this study is, therefore, to examine whether a complete statistical modelling of the three main variables yields differentcoefficients compared to the common practice where the three main variables are examined in pairs, thus suffering from both simultaneous equations and omitted variable biases. We examine these two different bank types since they are characterized by different levels of profitability, risk and to a lesser extent, capital and they react differently to shocks.2 Thus, the coefficient differences between the two bank types can be the result of either their different characteristics or the different estimation method used.The contribution of this study is a comparison of the regression coefficients of the three main variables by three separate OLS regressions, by three two-equation systems (profitability and capital, profitability and risk, and capital and risk), and by one three-equation system of the three main variables for US commercial and savings banks. The three estimation methods are examined both in-sample and out-of-sample.The study relates to the empirical literature that examines the relationship between capital, profitability, and risk in pairs. However, to the best of our knowledge, this is the first study that compares various statistical methods used in the literature to assess profitability, capital, and risk in US banks. The results uncover different coefficients of the three main variables with regard to the estimation method used but similar accuracy measures in out-of-sample forecasts.Literature surveyThis section surveys the literature regarding the relationship between each pair of the variables: profitability, capital, and risk. Table summarizes the evidence concerning these three main variables in commercial and savings banks.Generally, the evidence is ambiguous concerning the relationships between the three main variables across bank types, countries, and estimation techniques. This evidence corroborates our choice to examine the relations for more than one bank type.The relationship between profitability and capitalBarth, Groper, and Jahera (1998) argue that the Capital Asset Ratio (hereafter CAR) is negatively correlated with Return On Assets (hereafter ROA) and Return On equity Capital (hereafter ROC). The negative relationship is obtained, ceteris paribus, in a one-period model where deposit rates are not influenced by bank risk i.e., there is no 'market discipline'. However, if the cost of funding is influenced by the capital level, a positive relationship between capital and profitability is expected as capitalized banks reduce their costs of funding, which in turn increases their profits (see also Berger, 1995). According to the Signaling Hypothesis (see Acharya, 1988), managers have 'inside information' regarding future performance. If their compensation packages include stocks and/or stock options, it will be cheaper for a safe bank than for a risky bank to signal expected improved performance in the future byincreasing capital today. Therefore, CAR entails ROC. Stiroh (2000) provides another argument for this causation. When banks increase their capital levels in order to overcome high entry barriers, they gain access to profitable activities such as issuing guarantees and subordinated notes, as well as acting as intermediators in derivative markets. In contrast to the above causation, Rime (2001) finds that earnings of Swiss banks have positive impact on capital through retained earnings, thus ROC entails CAR. However, Berger, DeYoung, Flannery, Lee, and Öztekin (2008) find for large US banks that the relationship between ROC and CAR is insignificant. Examining various European bank types, Goddard, Molyneux, and Wilson (2004) and Stolz and Wedow (2011) find a positive relationship between capital and profitability in commercial banks whilst finding a negative relationship in savings banks. Finally, Altunbas et al. (2007) report on a positive relationship between capital and profitability for both European commercial and savings banks. Such evidence is also found by Bitar, Pukthuanthong, and Walker (2018) for banks in OECD countries.The ambiguous evidence regarding the relationship between capital and profitability points to the lack of either a relevant theory or a common expectation that makes it difficult to establish hypotheses regarding this relationship and its factors.The relationship between capital and riskA negative relationship between capital and risk is expected when all deposits are insured with a flat premium rate (Osterberg & Thomson, 1989). In this case, the marginal cost of increasing bank risk and/or reducing the level of capital is zero. This is because in the view of the regulators, the insurance premium does not change with risk or capital while for the insured depositors the interest demanded on their deposits is the same as that on a riskless asset. On the other hand, when the insurance premium is adjusted for risk e.g., including the level of financial leverage, there is less incentive to change the financial leverage. The 'optimum capital buffer theory' suggests that banks have an incentive to hold more capital than required as insurance against a violation of the regulatory minimum capital requirements (Heid, Porath, & Stolz, 2004; Stolz & Wedow, 2011). This is the result of banks' inability to adjust capital and risk instantaneously and the fear of costly supervisory action or a loss of reputation by banks' stakeholders. Hence, banks with relatively large capital buffers are supposed to maintain their capital buffers despite the risk increasing or may increase both capital and risk while banks with small capital buffers aim at rebuilding an appropriate capital buffer (increase capital and decrease risk). Alfon, Argimon, and Bascunana- Ambr (2004) find a negative relationship between capital and risk in U.K. banks. They suggest several explanations for the actual capital levels, which are substantially higher than the regulatory requirements (seealso Berger et al, 2008). Altunbas et al. (2007) find a positive relationship by commercial European banks while a negative relationship is found among savings European banks. Such a negative relationship is also found by Van Roy (2005) regarding US banks and by Lee and Hsieh (2013) concerning commercial and cooperative Asian banks, Lately, Bitar et al. (2018) found that risk-based capital ratios have no impact on bank risks. Flannery and Rangan (2008) explain the capital build-up of US banks during the 90 s by higher risk levels (among other reasons). Cebenoyan and Strahan (2004) find that banks which used the loan sales market for risk management purposes held less capital and were more profitable but riskier than other banks. In contrast, Shrieves and Dahl (1992) and Rime (2001) find a non-negative relationship between capital and risk. Moreover, Jokipii and Milne (2011) report on a positive relationship between capital buffers and risk and that the adjustment pace is dependent on the degree of bank capitalization (see also Berger et al., 2008). Notice that similar to the relationship between capital and profitability the results regarding capital and risk are ambiguous, as well.The relationship between risk and profitabilityIn a competitive business environment where symmetrical information between the bank and its borrowers prevails, one can expect (ex-ante) a positive relationship between profitability and risk. Thisshould be the result of the risk premium demanded by a bank from its borrowers and by the bank stakeholders (See also Saunders, Strock, & Travlos, 1990; Shrieves & Dahl, 1992). However, realized (ex-post) risk should harm profitability thus, a negative relationship between profitability and risk, is usually evidenced (see Athanasoglou, Brissimis, & Delis, 2008; Stolz & Wedow, 2011). This relationship is examined in particular across the business cycle. For example, Athanasoglou et al. (2008) find a significant negative relationship between ROA and credit risk for Greek banks during the period 1985–2001, regardless of the business cycle phase. In contrast, Bolt, de Haan, Hoeberichts, van Oordt, and Swank (2012) find for OECD banks during the period 1979–2007 that bank profitability behaved pro-cyclically. The co-movement was especially strong during severe recessions, and it was mainly due to credit risk. Finally, Tan (2016) finds neither positive nor negative relations for Chinese banks during the period 2003-2011.The evidence so far concerning the relationships between profitability, capital, and risk reflect indecisive relations thus, room for further empirical examination of different periods, bank types, and geographical areas.3. The data and estimation resultsThis section describes the data used in this study and the estimates of the various statistical methods.The database consists of US commercial and savings banks under the supervision of the FDIC (5338 and 844 institutions, respectively in 2015Q4) for the period 1995Q1–2015Q4 (84 quarters). All banks are insured by the Federal Deposit Insurance Corporation (FDIC) either through the Bank Insurance Fund (BIF) or through the Savings Association Insurance Fund (SAIF). Commercial banks include national banks and depository trust companies while the savings banking category includes savings banks and savings and loan institutions supervised by the Office of Thrift Supervision (OTS). The quarterly data of banks are obtained from the FDIC's web site, based on Quarterly Call Reports of all commercial and savings banks. This means that our sample data reflect the entire US banking system rather than particular banks. The advantage of the database is its reliability, consistency, and the lack of sample biases as it contains all insured US banks.The figure clearly presents differing behavior between the two bank types and across the sample period. Generally, by the Bai and Perron procedure there are three sub periods: before, at, and after the great financial crisis. The first sub period (1995Q1-2007Q4, hereafter expansion period) is characterized by high ROA and relatively low PROV. The second sub period (2008Q1-2009Q2, hereafter contraction period) reflects the great financial crisis and its consequences i.e., high PROV and decreasing of both ROA and CAR. The third sub period(2009Q3-2015Q4) reflects a recovery from the crisis yet, to lower levels of ROA and PROV. During the expansion period, the ROA (PROV) is much larger (smaller) than that of the contraction period as expected, while CAR is modestly higher during the contraction period (from 9.0% to 9.8% in commercial banks and from 9.3% to 10.3% in savings banks). The differing development of CAR versus both ROA and PROV is mainly explained by the Basel (I and II) and the TARP (Troubled Assets Relief Program) regulatory measures that positively affected banks' capital across the sample period (see Flannery & Rangan, 2008; Lee & Hsieh, 2013). Thus, one can notice substantial and different changes across the sample period concerning the three main variables between the two bank types. In what follows, we test the differentials between capital, profitability, and risk of US commercial and savings banks using Eq(4).ConclusionsThis study examines the relations between the three main variables of any financial institution i.e., capital, profitability, and risk. The common methodology in the literature analyzes the three main variables in pairs (two-equation system) namely, capital and profitability, capital and risk, and profitability and risk. Thus, it suffers from both the 'simultaneous equations bias' and the 'omitted variable bias'. As there is no relevant theory regarding the trilateral relationship among the three main variables and bank types, we examine whether these biases arestatistically significant by comparing the common methodology results with both: a complete simultaneous analysis of the above three variables in a three-equation system and with three different OLS regressions run on the main variables, separately. The comparison is done for both in- sample and out-of-sample periods. The data, which include all insured US commercial and savings banks for the period 1995Q1 – 2015Q4, reveal substantial differences between commercial and savings banks' coefficients. We find that changes in profitability (ΔROA) and in capital (ΔCAR) are positively related, changes in profitability (ΔROA) and in risk (ΔPROV) are negatively related, and changes in capital (ΔCA R) and in risk (ΔPROV) are mostly negatively correlated. While other studies often find differences in the coefficients' signs between commercial and savings banks, we find identical signs but significant differences in magnitude. These significant differences foster our argument that the 'simultaneous equations bias' and the 'omitted variables bias', are of importance in examining the in-sample relations between the three main variables. In contrast, the three-equation system does not outperform the other two methods in terms of goodness of fit or forecast capabilities.译文美国商业和储蓄银行的盈利能力,资本和风险:重新评估雅各布·帕鲁什,本·施莱伯摘要本研究比较了1995 年第一季度到2015 年第四季度期间三个主要银行变量之间的关系,即盈利能力,资本和美国商业和储蓄银行的风险。

ABC成本法关于ABC成本法的理论背景ABC成本法的发展背景近一、二十年来,在电子技术革命的基础上产生了高度自动化的先进制造企业,带来了管理观念和管理技术的巨大变革,适时制JIT采购与制造系统,以及与其密切相关的零库存、单元制造、全面质量管理等崭新的管理观念与技术应运而生;高度自动化的先进制造企业,能够及时满足客户多样化,小批量的商品需求,快速地、高质量地生产出多品种少批量的产品;在这种崭新的制造环境下,企业传统采购与制造过程将发生深刻的变化;相应地,原来为传统采购与制造乃至企业决策服务的产品成本计量与控制、会计决策、业绩评价等会计理论和方法也将发生相应变革;例如,在先进制造环境下,许多人工已被机器取代,因此直接人工成本比例大大下降,固定制造费用大比例上升;70年前的间接费用仅为直接人工成本的50%~60%,而今天大多数公司的间接费用为直接人工成本的400~500%;以往直接人工成本占产品成本的40~50%,而今天不到10%,甚至仅占产品成本的3~5%;产品成本结构如此重大的变化,使得传统的“数量基础成本计算”如以工时、机时为基础的成本分摊方法不能正确反映产品的消耗,从而不能正确核算企业自动化的效益,不能为企业决策和控制提供正确有用的会计信息;其最终后果是企业总体获利水平下降;1987年哈佛商学院的Rober Kaplan和Robin Cooper两位教授所进行的研究使ABC成本法赢得了广泛的重视;ABC成本法在精确成本信息、改善经营过程、为资源决策和产品定价及组合决策提供完善的信息方面都受到了广泛的关注;目前,世界上许多先进的公司已经实施ABC成本法以改善原有的会计系统,增强企业竞争力;ABC成本法Activity-Based Costing,即作业成本法,是以作业activity 为核心,确认和计量耗用企业资源的所有作业,将耗用的资源成本准确地计入作业,然后选择成本动因,将所有作业成本分配给成本计算对象产品或服务的一种成本计算方法;ABC成本法的指导思想是:"成本对象消耗作业,作业消耗资源";ABC 成本法把直接成本和间接成本包括期间费用作为产品服务消耗作业的成本同等地对待,拓宽了成本的计算范围,使计算出来的产品服务成本更准确真实;作业是成本计算的核心和基本对象,产品成本或服务成本是全部作业的成本总和,是实际耗用企业资源成本的终结;实施ABC成本法和不实施ABC成本法的原因在国外关于ABC成本法调查的研究文献指出,在拥有ABC成本法知识的反馈者中,实施ABC成本法的原因主要有:①现存成本信息不准确;②面临相对较激烈的竞争环境,例如与日剧增的自动化生产;③目前缺少制定决策的信息,如非财务信息;④目前面临资源分配的问题;不实施ABC成本法的原因主要有:①ABC成本法太复杂太耗时;②目前的会计系统还够用;③采用ABC成本法的收益不确定;④缺少经验;⑤员工不熟悉或不愿意使用ABC成本法;③管理决策或过程中的不便;⑦高昂的实施费用;⑧选择成本动因有困难;⑨目前缺乏先进的计算机技术来降低开发ABC成本法和跟踪作业活动的费用;⑩人力资源的缺乏和过高的培训费用;使用ABC成本法的公司的特征ABC成本法的使用和公司的一些因素有关,如公司的成本结构、现行的会计体系、成本的多样性和竞争环境;A、成本结构对ABC成本法关注的主要原因在于它可以更为精确地将制造及用分配到产品上去,通过增加成本库,更多地基于作业而非产品成本,采用一种使用面更广的成本动因;引进ABC成本法的重要原因之一就是最近几年里成本结构上的变化制造费用的增加,Cooper和Kaplan,1988;基于这种假设,采用ABC成本法的公司都具有一个很显著的特征,即制造费用相对价值附加成本直接人工十制造费用很高;B、现行的会计系统引进新的会计计算方法的价值依靠现行的会计系统;有关ABC成本法的文献认为传统的会计计算方法使用的成本库和成本动因有限详见Cooper,1988b;而ABC成本法增加了成本库作业和成本动因;管理层在考虑实施ABC成本法时,通常会考虑是将ABC成本法作为一个独立的系统还是将该系统和现行的会计系统融合Cooper,1990,1991;Yvonne P.Shanaban1997认为做上述决定时应考虑到两个因素,一个是改变现行的会计系统的有效途径,另一个是开发和现行系统融合的软件成本;C、产品的多样性产品的多样性是引起传统会计系统在计算产品成本时发生成本信息扭曲的原因之一;产品的多样性包括:产品产量的多样性,规模的多样性,原材料的多样性和安装的多样性Cooper,1988a;使用ABC成本法的公司往往产品多样性程度较高;值得一提的是,没有使用ABC成本法的公司其定制化的产品多于采用ABC成本法的公司;原因有可能是,虽然定制化的产品通常意味着产品的多样性、材料的多样性和安装的多样性,但是定制化的产品通常会增加开发新的会计系统的成本,会计成本的重要性通常被定制化的程度所决定;D、竞争环境Cooper和Kaplan1991,pp372对ABC成本法使用的情况进行了描述:如果现行的会计系统是在测量成本高、竞争弱、产品的多样性低的背景下设计的,那么当测量成本变低、竞争变得激烈、产品的多样性增加时,实施ABC成本法是可行且有利的;由于经济环境越来越动荡,竞争越来越激烈,相对于ABC成本法而言,传统会计增加了由失误造成的成本,因而改善现行的会计系统显得十分重要;E、公司的规模有很多资料表明公司的规模是区别使用ABC成本法和非使用ABC 成本法的公司一个重要的特征Ask和AX,1992;Drury和Tayles,1994;Davies和Sweeting,1993;Innes和Mitchell,1995;由于大公司拥有更为强大的沟通渠道和完善的基础设施,且对信息的需求更为强烈,所以他们比小公司对ABC成本法更感兴趣;ABC成本法的预期收益和实施中的问题实施ABC成本法可能带来的收益有:提供更为精确的产品成本;为定价策略提供相应的成本信息;加强对成本有效的管理和控制;坚持改善市场营销策略;提高产品的盈利性;确保可标识的成本动因;产品盈利性的有效分析;改善成本控制;提供准确的业绩指标;与此同时,在实施ABC成本法的过程中,可能会出现一些问题:成本动因的标识;成本和成本动因间因果关系准确性的把握;实施ABC 成本法的成本;和现存会计系统的融合;向高层推销ABC成本法的思想中遇到的阻力;如何获得低层员工的支持;实施ABC成本法的公司对ABC成本法的满意程度全世界有一部分公司已经开始使用ABC成本法来改善他们旧的会计系统,究竟ABC成本法能否带来预期的效果;1987年Howell et al在由IMA和CAM-I主持的研究课题中,就实施ABC成本法之后公司对产品成本和业绩衡量的满意程度进行了研究,其研究结果如下:①所有的被调查人员报告,实施ABC成本法至少改善了会计管理系统的一个领域,同时也报道了在业绩衡量系统上的重要突破;②实施ABC成本法后,公司在产品成本上的满意程度和ABC成本法在产品定价及组合策略中的使用程度呈明显的正向关系;ABC成本法在成本削减上的满意程度和常务经理使用ABC成本法信息的程度也呈正比;这表明对ABC成本法越满意的经理人员越有可能采取实际行动有效地使用ABC成本法来影响决策;③在ABC成本法使用之前,被采访者对传统的会计信息的准确性很少有信心,传统的会计系统是为部门和外部报告而设计的,它们服务的顾客面较窄;而实施ABC成本法可以改进成本信息的准确性,ABC 成本法所提供的信息将支持产品资源决策、产品定价和组合策略,而这些也支持顾客盈利性分析;ERP中的ABC成本法ABC成本法是会计理论界首先提出来的;应当说理论本身并不复杂,但是由于企业内部流程是千变万化的,成本动因也无法标准化,因此理论的实践变得比理论本身困难得多;一般企业实施ABC成本法都会使用计算机软件;而使用ERP中的ABC成本法模块又比一般软件有更多的优势:首先,ERP的集成性使得ABC成本法完全融入整个系统,而不需要另外维护一套并行的管理会计系统;其次,成本动因数据可以自动从ERP中的其他任何模块中取得,比如销售,采购,生产,储运,人力,财务等等;而避免了复杂的系统接口设计和烦琐的数据上载过程;第三,大型ERP软件一般具有动态处理大数据量的技术基础;流程Process成本会计的一项主要任务是根据成本发生的原因将成本流归结到成本对象上去;虽然对于直接成本来说我们可以做这样明确的归结比如,对于生产定单的原材料耗用,但是当我们讨论到间接费用时,情况却并不是如此简单;一般来说,间接费用会首先流向成本中心,成本中心会计模块提供了一系列的方法可以将间接费用分配到成本对象上比如,分摊,分配,间接费用率和作业分配;但是将间接费用归结到成本中心只反映了成本产生的地点,而无法反映成本产生的原因;因此在很多时候直接从成本中心分配到成本对象是非常困难的;很多经验丰富的咨询顾问都提到过对这个问题的认识过程:刚开始接触成本中心会计时感觉成本分配的工具太多也太复杂了,多过了你所想要的;但是一旦在企业中实际使用这些工具时,却又发现工具还不够多也还不够复杂,要做到合理和公平的分配间接费用往往是非常困难的;解决这个问题的关键在于引入流程的概念;流程是ABC成本法的核心;流程反映了企业内部一个连贯的业务处理过程,流程才是间接费用产生的原因;一个流程在ERP管理会计中不是被禁锢在某个特定的成本中心里,相反它是跨职能部门的成本对象;比如一个采购流程可能跨越了采购,货物接受和质检三个成本中心;图一中兰色的矩形箭头即代表了位于间接费用处理核心位置的“流程”;企业中所有的流程都需要按标准层次结构加以维护;当然除了标准层次以外,还可以为了报表等原因任意地定义其他流程组;资源动因Resource Driver相对于流程,成本中心管理的是企业的资源,是成本发生的地点;流程会耗用各成本中心的资源,因此需要将成本中心的间接费用分配到各流程里;引起流程耗用资源的驱动因素称为资源动因;比如采购流程对采购辅助人员时间的占用;图一中以流程左侧黑色的圆圈代表资源动因;成本中心的间接费用根据资源动因分配到不同的流程上去;事实上资源动因是一种新的概念,而不是ERP中的一种新的技术;我们可以认为资源动因是对于成本分配技术的一种新的诠释;我们在成本中心和内部定单章节中介绍的成本分配技术都可以用来决定资源动因的消耗数量;一般来说,我们可以区别两种将成本中心资源分配到业务流程通过资源动因的技术类型;一种是纯粹的成本价值分配,称之为推动方式Push Approach,如图一中的分摊Assessment和分配Distribution;另一种是跟踪数量的分配,称之为拉动方式Pull Approach,如图一中的直接作业分配,非直接作业分配和“实际=目标作业分配”等作业分配技术; 对于这些技术,我们在成本中心和内部定单章节中都介绍过了,本章不再重复;从技术上来说资源动因的表现形式就是各流程消耗的成本中心作业或者各流程的统计指标;流程的统计指标也可以从物流信息系统LIS中集成获取;成本动因Cost Driver以各流程独特的成本动因来分配流程成本,而不是传统的一刀切以产品数量或工时,机器时来分配成本,是ABC成本法的精髓所在;成本动因实质上是指本质上引起流程成本的因素的计量方法;比如销售定单处理流程的成本动因是定单的数量和定单的更改次数;而生产领料流程的成本动因可能是根据生产定单的原材料体积和领用次数决定的叉车的辆次数等等;图一中我们以流程右侧的红色的圆圈代表成本动因;仅从成本动因的定义我们就能想见:成本动因的定义,计算方法和数据来源是无法标准化的;各行各业各家企业对于各种流程的成本动因是否存在共识,又是否存在一个最佳实践至少当前或短期以内是没有的;因此系统提供了一个最灵活的工具:流程模板;图一中利用流程模板,系统自动计算出某生产定单消耗了多少流程2的成本动因可能是为该定单领用原材料的叉车辆次数等等;图二解释了流程模板的结构;流程模板主要有四栏构成:对象栏回答“使用了哪些流程”或更通用的“适用哪些流程”,一般指向某个流程或流程组;数量栏回答“使用了多少这些流程”,指当前成本对象如生产定单消耗了多少数量的流程成本动因,这一栏系统允许用户调用函数,而函数是可以由用户使用ERP的编程语言自由定义的;激活条件栏回答“什么条件下这个流程适用”,指某个流程是否和当前成本对象如生产定单相关;也允许调用自定义函数;评估点回答“什么时候流程适用”,比如定单释放或关闭;由于允许使用自定义函数,ERP中的ABC成本法可以从系统中任何地方获取数据来计算成本动因的数量,甚至是外部系统;比如从工艺路线得生产定单经过的工作中心数量;从BOM得到材料项目;从物料主数据得到材料重量;从生产定单得到批量;从物流信息系统得到采购定单数量等等;在ABC成本法实施和维护中,需要注意流程模板的重用性或普遍适用性;即考虑多种可能性以减少流程模板的维护工作;如果流程不是耗用生产间接费用,而是管理资源,那么可以将流程成本分配到市场细分上,如图一所示;分配可以是分摊Assessment,也可以是流程直接分配;采用分摊时可以使用统计指标作为成本动因;结构化流程Structured Process结构化流程是一个新的工具;它是一个多层次的流程组;所有下层流程的成本动因都必须可以从上层成本动因按比例得到;因此整个结构的成本动因数量都可以倒冲出来;而最下层流程的资源动因即成本中心/作业的数量又可以从它们的成本动因得到;资源消耗数量的一部分可能是和流程产出成比例的,另一部分可能是固定的,代表不论流程实际执行情况总是要消耗的资源;结构化流程最初是为服务行业设计的;它被用来描述在多任务的流程中每个任务的标准时间;平行ABC成本法Parallel ABC上文中的ABC成本法完全融入了企业的成本流;但是ABC成本法对于企业来说是一种观念的大震荡;从某种意义上讲实施是存在相当的风险的;因此ERP中除了图一那种形式的ABC成本法外还提供了一种称为平行ABC成本法的方法;平行ABC法不产生实际的成本流,它的结果是模拟和统计的;很适合战略性的成本分析和高层次的“如果-那么”“what-if”分析;因此我们可以先在不影响实际成本流的情况下,选定某几条关键性流程实施平行ABC成本法;通过比较平行ABC法的数据和传统成本法的数据,来测试本企业实施ABC成本法的效益和可行性,以及作为培训和推广;最后再使用完全融合的ABC成本法;。