中英文对照的标准版审计报告

- 格式:doc

- 大小:18.00 KB

- 文档页数:4

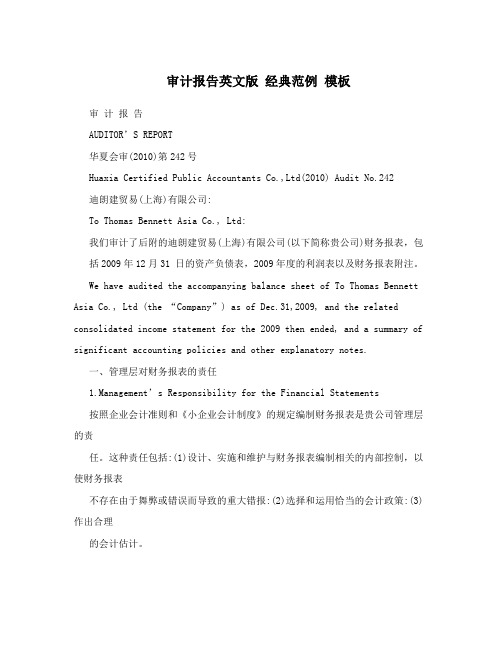

审计报告英文版经典范例模板审计报告AUDITOR’S REPORT华夏会审(2010)第242号Huaxia Certified Public Accountants Co.,Ltd(2010) Audit No.242迪朗建贸易(上海)有限公司:To Thomas Bennett Asia Co., Ltd:我们审计了后附的迪朗建贸易(上海)有限公司(以下简称贵公司)财务报表,包括2009年12月31 日的资产负债表,2009年度的利润表以及财务报表附注。

We have audited the accompanying balance sheet of To Thomas Bennett Asia Co., Ltd (the “Company”) as of Dec.31,2009, and the related consolidated income statement for the 2009 then ended, and a summary of significant accounting policies and other explanatory notes.一、管理层对财务报表的责任1.Management’s Responsibility for the Financial Statements按照企业会计准则和《小企业会计制度》的规定编制财务报表是贵公司管理层的责任。

这种责任包括:(1)设计、实施和维护与财务报表编制相关的内部控制,以使财务报表不存在由于舞弊或错误而导致的重大错报:(2)选择和运用恰当的会计政策:(3)作出合理的会计估计。

The management is responsible for the preparation and fair presentation of these financial statements in accordance with the Accounting Standards for Small Business Enterprises and China Accounting System for Small Business Enterprises. This responsibility includes: (i) designing, implementing and maintaining internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error; (ii)selecting and applying appropriate accounting policies; and (iii) making accounting estimates that are reasonable in the circumstances.二、注册会计师的责任2. Auditor’s Responsibility我们的责任是在实施审计工作的基础上对财务报表发表审计意见。

AUDITOR ’ S REPORTYue Hua Shen / Yan Zi (2014)No.0002ICPA filing number: 020201401000420To all shareholders of ****** Co., Ltd:We have audited the accompanying financial statements of ****** Co.,Ltd (“ Your Company ” ), which comprise the balance sheet as of31 December 2013, the income statement,statement of changes in owner'sequity and cash flow statement for the year then ended, and notes to thefinancial statements.I. Management’ s responsibility for the financial statementsManagement of your Company is responsible for the preparation and fair presentation of financial statements. This responsibility includes: (1)in accordance with the Accounting Standards for Business Enterprises and its relevant provisions, preparing the financial statements andreflecting fair presentation; (2) designing, implementing and maintainingthe necessary internal control in order to free financial statements frommaterial misstatement, whether due to fraud or error.II. Auditors' responsibilityOur responsibility is to express an opinion on these financialstatements based on our audit. We conducted our audit in accordancewith Chinese Certified Public Accountants Auditing Standards.Those standards require that we comply with ethical requirements and plan andperform the audit to obtain reasonable assurance whether the financial statements are free from material misstatement.An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements.The procedures selected depend on the auditors'judgment, including the assessment of the risks of material misstatement of the financial statements,whether due to fraud or error.In making those risk assessments, we consider the internal control relevant to the preparationand fair presentation of the financial statements in order to design audit procedures that are appropriate in the circumstances,but not for the purpose of expressing an opinion on the effectiveness of the internal control.An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of accounting estimates made by management,as well as evaluating the overall presentation of the financial statements.We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.III.OpinionIn our opinion, the financial statements of your Company have beenprepared in accordance with the Accounting Standards for BusinessEnterprise and its relevant provisions in all material respect, and presentfairly the financial position of your Company as of 31 December 2013,and the results of its operations and cash flows for the year then ended.Guangdong Huaxin Accounting Firm (general partner)Guangdong, ChinaChinese Certified Public Accountant:Chinese Certified Public Accountant:January 3, 2014BALANCE SHEETAS OF 31 DECEMBER 2013Unit: RMB YuanCompany: ****** Co., LtdAsset Ending Beginnin Liabilities and all Ending Beginninbalance g parties ’equity (or balance gBalance shareholders' equity)Balance Current Assets:Current liabilities:Monetary funds Short-termborrowingsTransaction financial Transaction financialasset liabilitiesNotes receivable Notes payableAccount receivable Account payableAccount paid in Account received inadvance advanceInterest receivable Employee’scompensationpayableDividend receivable Tax payableOther account Interest payablereceivableInventories Dividend payableNon-current assets Other accountdue within 1 year payableOther current assets--Non-currentliabilities due within 1yearTotal current assets-Other currentliabilitiesNon-current assets:Total current-liabilitiesAvailable for sale Non-currentfinancial assets liabilities:Maturity investments Long-termborrowingsLong-term account Bonds payablereceivablesLong-term equity Long-term accountinvestment payableInvesting property Special payablesFixed asset Accrued liabilitiesProject in Deferred tax liabilitiesconstructionEngineering material Other non-currentliabilitiesFixed asset disposal Total non-current--liabilitiesProduction biological Total liabilities-assetsOil and gas assets Owner ’s equity( orshareholders’equity)Intangible assets Paid-in capital(orshare capital)Development Capital surplus-expenseGoodwill Less: Treasury StockLong-term expense Earned surplusto be apportionedDeferred tax assets Retained earnings-Other non-current Total owner’s equity-assets(or shareholders’equity)Total non-current-assetsTotal assets-Total liabilities and-owner’ s equity(orshareholders’equity)Prepared by:Audited by:Finance Manager:CompanyLeader:INCOME STATEMENTFOR THE YEAR ENDED 31 DECEMBER 2013Unit: RMBYuanCompany: ****** Co., LtdItems Cumulative Amount inamount in this last yearyearI. Operating incomeMinus: Operating costTaxes and associate chargesSelling and distribution expensesAdministrative expenses-Financial expense-Asset impairment lossPlus: gain from change in fair value( losswith ‘- ‘ )Gain from investment ( loss with‘-‘)Including:income form investment onaffiliated enterprise and joint enterpriseII. Operating profit (loss with‘-‘)-Plus: non-business income--Less: non-business expenseIncluding:loss from non-current assetdisposalIII. Total profit (loss with‘-‘)-Less: Income taxIV. Net profit (loss with‘-‘)-V. Earnings per share(I) basic earnings per share(II) diluted earnings per shareVI. Other comprehensive earningsVII. Total comprehensive earnings-Prepared by:Audited by:Finance Manager:Company Leader:CASH FLOW STATEMENTFOR THE YEAR ENDED 31 DECEMBER 2013Unit: RMBYuanCompany: ****** Co., LtdItems Times Amount in Cumulative this year amount in lastyear1.Cash flows arising from operating 0 activities:Cash received from sales of goods or 1 rending ofservicesRefund of tax and fare received2 Other cash received relating to3 operating activitiesSub-total of cash inflows4 Cash paid for goods and services5 Cash paid to and on behalf of employees6 Tax and fare paid7 Other cash paid relating to operating8 activitiesSub-total of cash outflows9 Net cash flow from operating activities10 2. Cash flows arising from investment0 activitiesCash received from return of11 investmentsCash received from investment income12 Net cash received from disposal of fixed13 assets, intangible assets and otherlong-term assetsNet cash received from disposal of14 subsidiaries and other business unitsOther cash received relating to15investment activitiesSub-total of cash inflows16 Cash paid for acquiring fixed assets,17 intangible assets and other long-term assetsCash paid for acquiring investments18 Net cash received from subsidiaries and19 other business unitsOther cash paid relating to investment20 activitiesSub-total of cash outflows21 Net cash flow from investing activities22 3.Cash flows arising from financing 0 activities:Cash received from absorbing 23 investmentCash received from borrowings24 Other cash relating to financing25 activitiesSub-total of cash inflows26 Cash paid for settling debt27 Cash paid for distribution of dividends28or profit or reimbursing interestOther cash payments relating to 29 financing activitiesSub-total of cash outflows30 Net cash flow from financing activities31 4. Influence on cash due to fluctuation in34 exchange rate increase in cash and cash 35 equivalentsAdd : Balance of cash and cash 36 equivalents at the beginning of the year6. Balance of cash and cash equivalents37 at the end of the yearSupplementary information:0 Attached project of cash flow statement0 1. Net profit is adjusted to cash flow of0 operating activitiesNet profit38 Impairment of assets39 Fixed asset depreciation, depletion of oil40 and gas assets and depreciation of productive biological assetsAmortization of intangible assets41 Amortization of long-term prepaid42 expensesTreatment of losses of fixed assets,43 intangible assets and other long-term assetsLoss on retirement of fixed assets44 Loss of changes in fair value45 Finance costs46 Investment losses47 Decrease in deferred income tax assets48 Increase in deferred income tax liabilities49 Decrease in inventories50 Decrease in operating receivables51 Increase in operating payables52 Others53 Net cash flow from operating activities54 2.Investing and financing activities not 0 relating to cashDebt into capital55 Convertible debt due within one year56 Finance leased fixed assets57 increase in cash and cash 0 equivalentsBalance of cash at the end of this period58Less: balance of cash at the beginning of59this periodAdd: balance of cash equivalents at the60end of this periodLess: balance of cash equivalents at the61beginning of this periodNet increase in cash and cash62equivalentsPrepared by:Audited by:Finance Manager:CompanyLeader:STATEMENT OF CHANGES IN OWNERS’ EQUITYFOR THE YEAR ENDED 31 DECEMBER 2013Company: ****** Co., LtdItems Amount in this year Amount in last yearPaid-Capit Earne Retai Total Paid Cap Earn Ret Totaup al d ned owne-up ital ed aine lcapit surpl surpl earni rs'capi surp surp d ownal us us ngs equit tal lus lus ear ers'实用标准文案I. balance at the end of last yearAdd:change of accounting policy Correction of errorsinprevious periodII.Balance at the beginning of this year III. Increase/ decrease ofy nin equigs ty -------------------------------------amount in this year “(-”means decrease)(I) Net profit(II)Gains and losses directly included in the owners ’ equity change amount in fair value ------------------实用标准文案of financial assets available for sale2.Influence of changes in other owners'equity of investors under the equity method3.Influence of income tax relating to the owners’equity project --------------------4. OthersSubtotal of (I) and (II) (III)Input an reduced capital of owners1. Input capital of owners2.Amount of shares included in the-----------------------------------owners ’ equity3. Others--------实用标准文案(IV) Profit distribution1.Withdrawing earned surplus2.Distribution to all owners (or shareholders)3.Others(V)Internal carrying forward of owners ’equity1.Capital surplus transfers to paid-in capital(or share capital)2.Earned surplus transfers to paid-in capital(or share capital)3.Earned surplus makes up losses ------------------------------------------------------------------------------4. Others--------IV. Balance at the end------of this periodLegal representative:Person in charge of accounting:Leader ofaccounting department:****** CO., LTDNOTES TO THE FINANCIAL STATEMENTSFOR THE YEAR ENDED DECEMBER 31, 2013(All amounts in RMB Yuan)I. Company Profile******* Co., Ltd. (hereinafter referred to as the "Company") is a limitedliability company (Sino-foreign joint venture) jointly invested andestablished by **** Co., Ltd. and ******* Limited on 24 June 2013. OnDecember 26, 2013, the shareholders have been changed to***** CO., LTD and ******* LIMITED.Business License of Enterprise Legal Person License No.:Legal Representative:Registered Capital: RMB(Paid-in Capital: RMB)Address:Business Scope: Financing and leasing business; leasing business; purchase of leased property from home and abroad; residue value treatment and maintenance of leased property;c onsulting andguarantees of lease transaction (articles involved in the industry licensemanagement would be dealt in terms of national relevant stipulations)II. Declaration on following Accounting Standard for BusinessEnterprisesThe financial statements made by the Company are in accordance withthe requirements of Accounting Standard for Business Enterprises, whichreflects the financial position, financial performance and cash flow of theCompany truly and completely.III. Basic of preparation of financial statementsThe Company implements the Accounting Standards for BusinessEnterprises(‘ Finance and Accounting[2006]No.3” ) issued by theMinistry of Finance on February 15, 2006 and the successive regulations.The Company prepares its financial statements on a going concern basis,and recognizes and measures its accounting items in compliance withthe Accounting Standards for Business Enterprises–Basic Standardsand other relevant accounting standards,application guidelines and criteria for interpretation of provisions as well as the significantaccounting policies and accounting estimates on the basis of actual transactions and events.IV. The main accounting policies, accounting estimates and changesFiscal yearThe Company adopts the calendar year as its fiscal year from January 1to December 31.Functional currencyRMB was the functional currency of the Company.Accounting measurement attributeThe Company adopts the accrual basis for accounting treatments and double-entry bookkeeping of borrowing for financial accounting.Thehistorical c ost is generally as the measurement attribute, and whenaccounting elements determined are in line with the requirements of Accounting Standards for Enterprises and can be reliably measured, the replacement cost, net realizable value and fair value can be used for measurement.Accounting method of foreign currency transactionsThe Company’s foreign currency transactions adopt approximate spotexchange rate of the transaction date to convert into RMB in accordancewith systematic and rational method; on the balance sheet date,theforeign currency monetary items use the spot exchange rate of the balance sheet date. All balances of exchange arising from differencesbetween the balance sheet date spot exchange rate and the initialrecognition or the former balance sheet date spot exchange rate, exceptthat the exchange gains and losses arising by borrowing foreign currencyfor the construction or production of assets eligible for capitalization aretransacted in accordance with capitalization principles,are included inprofit or loss in this period;the foreign currency non-monetary items measured at historical cost will still be converted with the spot exchangerate of the transaction date.The standard for recognizing cash equivalentWhen making the cash flow statement, cash on hand and depositsreadily to be paid will be recognized as cash, and short-term (usually nomore than three months), highly liquid and readily convertible to knownamounts of cash with insignificant risk of changes in value arerecognized as cash equivalent.Financial InstrumentsClassification, recognition and measurement of financial assets- The company at the time of initial recognition of financial assets dividesit into the following four categories: financial assets measured at fairvalue with changes included in the profit or loss of this period, loans andreceivables, financial assets available for sale and held-to-maturityinvestments. Financial assets are measured at fair value when initially recognized. Relevant t ransaction costs of financial assets measured atfair value with changes included in the profit or loss of this period arerecognized in profit or loss of this period, and relevant transaction costsof other categories of financial assets are recognized in the amount initially recognized.--Financial assets measured at fair value with changes included in theprofit or loss of this period refer to the short-term sales financial assets, including financial assets held for trading or financial assets measured atfair value with changes included in the profit or loss of this period designated upon initial recognition by the management. Financial assets measured at fair value with changes included in the profit or loss of thisperiod are subsequently measured at fair value, and the interest or cash dividends obtained during the holding period will be recognized as investment income, and the gains or losses of the change in fair value atthe end of this period are recognized in the profit or loss in this period. When it is disposed, the difference between the fair value and the initial recorded amount is recognized as investment income, while adjusting gains from changes in the fair value.--Loans and receivables: the non-derivative financial assets without theprice in an active market and with fixed and determinable recovery costare classified as loans and receivables. Loans and receivables adopt theeffective interest method and take amortized cost for subsequent measurement,and gains or losses arising from derecognition,impairment or amortization are included in the profit or loss of this period.-- Financial assets available for sale: including non-derivative financial assets available for sale recognized initially and other non-derivative financial assets except for loans and receivables, held-to-maturity investments and trading financial assets.Financial assets available for sale are subsequently measured at fair value,and interest or cash dividends obtained during the holding period will be recognized as investment income, and gains or losses arising from the changes in fairvalue at the end of this period are recognized directly in owners' equityuntil the financial asset is derecognized or impaired and then is recognized as the profit or loss in this period.--Held-to-maturity investments: the non-derivative financial assets withclear intention and ability to hold to maturity by the management of the company, a fixed maturity date and fixed or determinable payments areclassified as held-to-maturity investments. Held-to-maturity investmentsadopt the effective interest method and take amortized cost for subsequentmeasurement,and gains or losses arisingfromderecognition, impairment or amortization are included in the profit orloss of this period.Classification, recognition and measurement of financial liabilities- The company at the time of initial recognition of financial liabilitiesdivides it into the following two categories: financial liabilities measuredat fair value with changes included in the profit or loss of this period andother financial liabilities. Financial liabilities are measured at fair value when initially recognized. Relevant transaction costs of financial liabilitiesmeasured at fair value with changes included in the profit or loss of thisperiod are recognized in profit or loss of this period, and relevant transaction costs of other financial liabilities are recognized in the amount initially recognized.-- Financial liabilities measured at fair value with changes included in theprofit or loss of this period include the trading financial liabilities andfinancial liabilities measured at fair value with changes included in theprofit or loss of this period designated upon initial recognition. Financialliabilities are subsequently measured at fair value, and the gains or lossesof the change in fair value are recognized in the profit or loss in this period.--Other financial liabilities: adopting the effective interest method andtaking amortized cost for subsequent measurement. The gains or lossesarising from derecognition or amortization is included in the profit or loss of this period.Requirements for derecognition of financial liabilitiesFinancial liabilities shall be entirely or partially derecognized if the present obligations derived from them are entirely or partiallydischarged.Where the Company enters into an agreement with a creditor so as to substitute the current financial liabilities with new ones,and the contract clauses of which are substantially different from thoseof the current ones, it shall recognize the new financial liabilities in placeof the current ones. Where substantial revisions are made to some or allof the contract clauses of the current financial liabilities,the Company shall recognize the new financial liabilities after revision of the contractclauses in place of the current ones entirely or partially.Upon entire or partial derecognition of financial liabilities,differences between the carrying amounts of the derecognized financial liabilities and the consideration paid (including non-monetary assets surrenderedor new financial liabilities assumed) are charged to profit or loss for thecurrent period.Where the Company redeems part of its financial liabilities,it shall allocate the carrying amounts of the entire financial liabilities betweenthe relative fair values of the parts that continue to be recognized andthe derecognized parts on the redemption date. Differences between thecarrying amounts allocated to the derecognized parts and the consideration paid (including non-monetary assets surrendered and thenew financial liabilities assumed)are charged to profit or loss for the current period.Recognition and measurement for transfer of financial assetsIf the Company has transferred nearly all of the risks and rewards relatingto the ownership of the financial assets to the transferee, they shall bederecognized. If it retains nearly all of the risks and rewards relating tothe ownership of the financial assets, they shall not be derecognized andwill be recognized as a financial liability. If the Company has not transferred nor retained nearly all of the risks and rewards relating to the ownership of the financial assets: (1) to give up the control of thefinancial assets to be derecognized; (2) not giving up control of the financial asset to be recognized based on the extent of its continuing involvement in the transferred financial assets and liabilities arerecognized accordingly.If the transfer of entire financial assets satisfy the criteria for derecognition,differences between the amounts of the following twoitems shall be recognized in profit or loss for the current period: (1) thecarrying amount of the transferred financial asset; (2) the aggregateconsideration received from the transfer plus the cumulative amounts ofthe changes in the fair values originally recognized in the owners’ equity.If the partial transfer of financial assets satisfy the criteria for derecognition,the carrying amounts of the entire financial assets transferred shall be split into the derecognized and recognized parts according to their respective fair values and differences between the amounts of the following two items are charged to profit or loss for thecurrent period: (1) the carrying amounts of the derecognized parts;(2) The aggregate consideration for the derecognized parts plus the portionof the accumulative amounts of the changes in the fair values of the derecognized parts which are originally recognized in the owners’equity.Determination of the fair value of financial instruments-If financial instruments trade in an active market, the quoted price in anactive market determines its fair value; if financial instrument trade not inan active market, the valuation techniques determine the fair value.Valuation techniques include recent market transaction price reference to the familiar situation and volunteer transaction, current fair valuereference to other substantially similar financial instruments, discountedcash flow method and option pricing model and so on.Test and Provisions for impairment loss on financial assets--Except trading financial assets, the Company makes assessment on thecarrying values of financial assets at the balance sheet date. If there isevidence that the fair value of specific financial asset has been impaired,provisions for impairment loss is made accordingly.--Measurement of impairment of financial assets measured atamortized costIf there is objective evidence that the financial asset measured at amortized costhas been impaired, the carrying amount of the financialasset is written down to the present value of estimated future cash flows (excluding future credit losses that have not yet occurred), and the amount of reduction is recognized as impairment loss and is recognizedin the profit or loss of this period. The Company carries out the impairment test of significant single financial asset separately, carries outthe impairment test on insignificant single financial asset from a single or combination of angles, and carries out the impairment test on single asset without objective evidence of impairment along with the financialassets with similar credit risk characteristics to constitute a combination, but does not carry out the impairment test on the provision for impairment of financial assets based on the single in the portfolio. In the subsequent period, if there is objective evidence that the value of financial asset has been restored and recognized relevant to the objective matters occurring after the impairment, previously recognizedimpairment loss shall be reversed and charged into the profit or loss ofthis period. But the book value after the reversal should not exceed theamortized cost at the reversal date of the financial assets supposed no provision for impairment.When the financial assets measured at amortized cost actually occur loss, offset against the related provision forimpairment.-- Available for sale financial assetsIf there is objective evidence that an impairment of available for salefinancial assets occurs,even though the financial asset has not been derecognised, the cumulative loss of decrease of the faire value originally recorded in the owner's equity should be transferred out and charged into the current profit and loss.The cumulative loss is the initial acquisition cost of available for sale financial assets, deducting the fairvalue of the withdrawing principal and amortization amount and impairment loss as well as net impairment amount originally charged into the profit or loss.Recognition and provision for bad debts of accounts receivableIf there is objective evidence that receivables are impaired at the end ofthis period, the carrying value will be written down to its present value of estimated future cash flows, and the amount of reduction is recognizedas impairment loss and is recognized in the current profit or loss. Presentvalue of estimated future cash flows is determined through future cashflows (excluding credit losses that have not been incurred) discounted atthe original effective interest rate,taking into account the value of related collateral(less estimated disposal costs, etc.).Original effective interest rate is the actual interest rate when the receivables are recognized initially.The estimated future cash flows of short-term receivables have small difference from the present value,and the estimated future cash flows are not discounted in determining the related impairment loss.The significant single receivables are separately carried out impairmenttest at the end of this period, and if there is objective evidence that theimpairment has occurred, based on the difference of the present value offuture cash flows less than the book value, the impairment loss is recognized and the provision of bad debts is done. The significant singleamount refers to top five receivable balances or the sum of payments accounting for more than 10% of receivable balances.If there is objective evidence that the individual non-significant receivables impairment has occurred, separate impairment test is done,the impairment loss is recognized and the provision for bad debts is done;other individual non-significant receivables and receivables not impaired after separate test are together divided into several combinations for impairment testing with aging as the similar credit risk characteristics,to determine the impairment loss and do provision for bad debts.In addition to separate provision for impairment of receivables,the company is based on the actual loss rate of receivable portfolio with thesame or similar to the previous year and aging as the similar credit risk characteristics, and combines the current situation to determine the ratioof provision for bad debts as follows:Aging Ratio of provisionWithin one year5%。

中国注册会计师审计报告英文版Here is a 619-word essay on the topic of "Chinese Certified Public Accountant Audit Report in English":The role of the certified public accountant (CPA) in China has become increasingly important in recent years as the country's economy has continued to grow and evolve. One of the key responsibilities of CPAs in China is the preparation of audit reports, which provide an independent, objective assessment of a company's financial statements and overall financial health.The Chinese CPA audit report serves several critical functions. First and foremost, it provides assurance to shareholders, lenders, regulators, and other stakeholders that a company's financial information is accurate, reliable, and prepared in accordance with relevant accounting standards. This gives these stakeholders confidence in the company's financial position and performance, which is essential for making informed investment and lending decisions.The audit report also plays a crucial role in corporate governance by holding company management accountable for their financialreporting. Through the audit process, CPAs scrutinize a company's accounting records, internal controls, and overall financial reporting practices. If any material misstatements or irregularities are identified, these will be disclosed in the audit report. This helps to deter fraudulent or misleading financial reporting and promotes transparency.From the company's perspective, the audit report can provide valuable insights that help to improve financial reporting and internal control processes. CPAs often make recommendations for areas of improvement based on their findings, which management can then act upon. This can ultimately lead to stronger financial discipline and more effective risk management within the organization.In addition to the annual statutory audit, Chinese CPAs may also be engaged to perform other types of audit and assurance services. These can include reviews of interim financial statements, audits of specific business units or subsidiaries, and evaluations of a company's internal control systems. The scope and nature of these engagements will depend on the particular needs and requirements of the client.The Chinese CPA audit report itself typically follows a standardized format and structure. It will begin with an introductory section thatidentifies the client, the period covered by the audit, and the applicable accounting standards used. This is followed by the auditor's opinion, which expresses the CPA's conclusion on whether the financial statements are fairly presented in all material respects.The report will then include details on the audit procedures performed, the evidence gathered, and any significant findings or issues identified. This provides transparency on the auditor's work and the basis for their opinion. If the auditor has any reservations or qualifications about the financial statements, these will be clearly disclosed in the report.Finally, the report will conclude with the auditor's signature, license number, and the date the report was issued. This ensures accountability and traceability should any questions or issues arise in the future.Overall, the Chinese CPA audit report plays a vital role in promoting trust and confidence in the country's financial markets. By providing independent, objective assurance on a company's financial information, CPAs help to protect the interests of investors, lenders, and other stakeholders. As the Chinese economy continues to grow and evolve, the importance of the CPA audit report is only likely to increase in the years ahead.。

英文版公司审计报告Title: Company Audit ReportThis comprehensive audit report aims to provide a detailed analysis of the financial statements, internal controls, and operational efficiency of the company. The audit was conducted in accordance with internationally recognized auditing standards and guidelines to ensure accuracy, reliability, and transparency of the reported information.$$I. Introduction$$The audit was initiated to evaluate the company's financial position, performance, and compliance with applicable laws and regulations. The audit team comprised qualified auditors with extensive experience in the industry, ensuring a thorough and unbiased assessment.**II. Audit Scope and Objectives**The audit scope encompassed the financial statements, including the balance sheet, income statement, cash flow statement, and related notes. The objectives were to assess the fairness, accuracy, and completeness of the financialstatements, evaluate the effectiveness of internal controls, and identify any potential risks or issues that may affect the company's financial health.**III. Financial Statement Audit**The audit team conducted a detailed review of the financial statements, comparing them with supporting documents and records. The audit focused on revenue recognition, cost allocation, asset valuation, andliability accounting. The team also examined the company's accounting policies and procedures to ensure compliancewith accounting standards.Overall, the financial statements were found to be fair, accurate, and complete, reflecting the company's financial position and performance. However, the audit identified a few minor inconsistencies and inaccuracies in the recording of certain transactions, which were promptly rectified by the company.**IV. Internal Control Audit**The audit team evaluated the effectiveness of the company's internal controls, including financial reporting,risk management, and compliance with policies and procedures. The audit focused on the design and implementation of controls, as well as their operating effectiveness.The audit revealed that the company has established robust internal controls, which are generally effective in ensuring the accuracy and reliability of financial reporting. However, the team identified a few areas for improvement, such as enhancing the segregation of duties and improving the monitoring of financial transactions. The company has been advised to address these issues to further strengthen its internal controls.**V. Operational Efficiency Audit**The audit team also assessed the operational efficiency of the company, examining its processes, systems, and resources. The audit aimed to identify any inefficiencies or bottlenecks that may hinder the company's performance. The audit found that the company has well-established operational processes and systems that support its business activities. However, there are opportunities for improvement in terms of optimizing resource utilization andenhancing the efficiency of certain processes. The audit team has provided recommendations to the company for implementing these improvements.**VI. Compliance Audit**The audit team also examined the company's compliance with applicable laws, regulations, and industry standards. This included a review of the company's tax filings, labor practices, and environmental policies.The audit concluded that the company has generally adhered to the required standards and regulations. However, the team identified a few areas where the company could further enhance its compliance efforts, such as improving its documentation and reporting procedures.**VII. Conclusion**Overall, the audit report provides a positive assessment of the company's financial health, internal controls, and operational efficiency. While some minor issues and areas for improvement were identified, the company has demonstrated a commitment to addressing these issues and enhancing its overall performance.The audit team recommends that the company continue to strengthen its internal controls, optimize its operational processes, and enhance its compliance efforts to maintain its financial stability and competitiveness in the market. It is important to note that this audit report represents a snapshot of the company's financial and operational status at a specific point in time. Continuous monitoring and periodic audits are essential to ensure that the company maintains its financial integrity and operational efficiency over time.。

AUDITOR’S REPORTYue Hua Shen / Yan Zi (2014) No. 0002ICPA filing number: 0000420To all shareholders of ****** Co., Ltd:We have audited the accompanying financial statements of ****** Co., Ltd (“Your Company”), which comprise the balance sheet as of 31 December 2013, the income statement,statement of changes in owner's equity and cash flow statement for the year then ended, and notes to the financial statements.I. Management’s responsibility for the financial statementsManagement of your Company is responsible for the preparation and fair presentation of financial statements. This responsibility includes: (1) in accordance with the Accounting Standards for Business Enterprises and its relevant provisions, preparing the financial statements and reflecting fair presentation; (2) designing, implementing and maintaining the necessary internal control in order to free financial statements from material misstatement, whether due to fraud or error.II. Auditors' responsibilityOur responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit in accordance with Chinese Certified Public Accountants Auditing Standards. Those standards require that we comply with ethical requirements and plan and perform the audit to obtain reasonable assurance whether the financial statements are free from material misstatement.An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The proceduresselected depend on the auditors' judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, we consider the internal control relevant to the preparation and fair presentation of the financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the internal control. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of accounting estimates made by management, as well as evaluating the overall presentation of the financial statements.We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.III. OpinionIn our opinion, the financial statements of your Company have been prepared in accordance with the Accounting Standards for Business Enterprise and its relevant provisions in all material respect, and present fairly the financial position of your Company as of 31 December 2013, and the results of its operations and cash flows for the year then ended.Guangdong Huaxin Accounting Firm (general partner)Guangdong, ChinaChinese Certified Public Accountant:Chinese Certified Public Accountant:January 3, 2014BALANCE SHEETAS OF 31 DECEMBER 2013 Unit: RMB Yuan Company: ****** Co., LtdPrepared by: Audited by: Finance Manager: Company Leader:INCOME STATEMENTFOR THE YEAR ENDED 31 DECEMBER 2013 Unit: RMB Yuan Company: ****** Co., LtdPrepared by: Audited by: Finance Manager: Company Leader:CASH FLOW STATEMENTFOR THE YEAR ENDED 31 DECEMBER 2013 Unit: RMB Yuan Company: ****** Co., LtdPrepared by: Audited by: Finance Manager: Company Leader:STATEMENT OF CHANGES IN OWNERS’ EQUITYFOR THE YEAR ENDED 31 DECEMBER 2013Company: ****** Co., LtdLegal representative: Person in charge of accounting: Leader ofaccounting department:****** CO., LTDNOTES TO THE FINANCIAL STATEMENTSFOR THE YEAR ENDED DECEMBER 31, 2013(All amounts in RMB Yuan) I. Company Profile******* Co., Ltd. (hereinafter referred to as the "Company") is a limited liability company (Sino-foreign joint venture) jointly invested and established by **** Co., Ltd. and ******* Limited on 24 June 2013. On December 26, 2013, the shareholders have been changed to ***** CO., LTD and ******* LIMITED.Business License of Enterprise Legal Person License No.:Legal Representative:Registered Capital: RMB (Paid-in Capital: RMB )Address:Business Scope: Financing and leasing business; leasing business; purchase of leased property from home and abroad; residue value treatment and maintenance of leased property; consulting and guarantees of lease transaction (articles involved in the industry license management would be dealt in terms of national relevant stipulations)II. Declaration on following Accounting Standard for Business EnterprisesThe financial statements made by the Company are in accordance with the requirements of Accounting Standard for Business Enterprises, which reflects the financial position, financial performance and cash flow of the Company truly and completely.III. Basic of preparation of financial statementsThe Company implements the Accounting Standards for Business Enterprises (‘Finance and Accounting [2006] No. 3”) issued by the Ministry of Finance on February 15, 2006 and the successive regulations. The Company prepares its financial statements on a going concern basis, and recognizes and measures its accounting items in compliance with the Accounting Standards for Business Enterprises –Basic Standards and other relevant accounting standards, application guidelines and criteria for interpretation of provisions as well as the significant accounting policies and accounting estimates on the basis of actual transactions and events.IV. The main accounting policies, accounting estimates and changes Fiscal yearThe Company adopts the calendar year as its fiscal year from January 1 to December 31.Functional currencyRMB was the functional currency of the Company.Accounting measurement attributeThe Company adopts the accrual basis for accounting treatments and double-entry bookkeeping of borrowing for financial accounting. The historical cost is generally as the measurement attribute, and when accounting elements determined are in line with the requirements of Accounting Standards for Enterprises and can be reliably measured, thereplacement cost, net realizable value and fair value can be used for measurement.Accounting method of foreign currency transactionsThe Company’s foreign currency transactions adopt approximate spot exchange rate of the transaction date to convert into RMB in accordance with systematic and rational method; on the balance sheet date, the foreign currency monetary items use the spot exchange rate of the balance sheet date. All balances of exchange arising from differences between the balance sheet date spot exchange rate and the initial recognition or the former balance sheet date spot exchange rate, except that the exchange gains and losses arising by borrowing foreign currency for the construction or production of assets eligible for capitalization are transacted in accordance with capitalization principles, are included in profit or loss in this period; the foreign currency non-monetary items measured at historical cost will still be converted with the spot exchange rate of the transaction date.The standard for recognizing cash equivalentWhen making the cash flow statement, cash on hand and deposits readily to be paid will be recognized as cash, and short-term (usually no more than three months), highly liquid and readily convertible to known amounts of cash with insignificant risk of changes in value are recognized as cash equivalent.Financial InstrumentsClassification, recognition and measurement of financial assets- The company at the time of initial recognition of financial assets divides it into the following four categories: financial assets measured at fair value with changes included in the profit or loss of this period,loans and receivables, financial assets available for sale and held-to-maturity investments. Financial assets are measured at fair value when initially recognized. Relevant transaction costs of financial assets measured at fair value with changes included in the profit or loss of this period are recognized in profit or loss of this period, and relevant transaction costs of other categories of financial assets are recognized in the amount initially recognized.-- Financial assets measured at fair value with changes included in the profit or loss of this period refer to the short-term sales financial assets, including financial assets held for trading or financial assets measured at fair value with changes included in the profit or loss of this period designated upon initial recognition by the management. Financial assets measured at fair value with changes included in the profit or loss of this period are subsequently measured at fair value, and the interest or cash dividends obtained during the holding period will be recognized as investment income, and the gains or losses of the change in fair value at the end of this period are recognized in the profit or loss in this period. When it is disposed, the difference between the fair value and the initial recorded amount is recognized as investment income, while adjusting gains from changes in the fair value.--Loans and receivables: the non-derivative financial assets without the price in an active market and with fixed and determinable recovery cost are classified as loans and receivables. Loans and receivables adopt the effective interest method and take amortized cost for subsequent measurement, and gains or losses arising from derecognition, impairment or amortization are included in the profit or loss of this period.-- Financial assets available for sale: including non-derivativefinancial assets available for sale recognized initially and other non-derivative financial assets except for loans and receivables, held-to-maturity investments and trading financial assets. Financial assets available for sale are subsequently measured at fair value, and interest or cash dividends obtained during the holding period will be recognized as investment income, and gains or losses arising from the changes in fair value at the end of this period are recognized directly in owners' equity until the financial asset is derecognized or impaired and then is recognized as the profit or loss in this period.-- Held-to-maturity investments: the non-derivative financial assets with clear intention and ability to hold to maturity by the management of the company, a fixed maturity date and fixed or determinable payments are classified as held-to-maturity investments. Held-to-maturity investments adopt the effective interest method and take amortized cost for subsequent measurement, and gains or losses arising from derecognition, impairment or amortization are included in the profit or loss of this period.Classification, recognition and measurement of financial liabilities - The company at the time of initial recognition of financial liabilities divides it into the following two categories: financial liabilities measured at fair value with changes included in the profit or loss of this period and other financial liabilities. Financial liabilities are measured at fair value when initially recognized. Relevant transaction costs of financial liabilities measured at fair value with changes included in the profit or loss of this period are recognized in profit or loss of this period, and relevant transaction costs of other financial liabilities are recognized in the amount initially recognized.-- Financial liabilities measured at fair value with changes included in the profit or loss of this period include the trading financial liabilities and financial liabilities measured at fair value with changes included in the profit or loss of this period designated upon initial recognition. Financial liabilities are subsequently measured at fair value, and the gains or losses of the change in fair value are recognized in the profit or loss in this period.-- Other financial liabilities: adopting the effective interest method and taking amortized cost for subsequent measurement. The gains or losses arising from derecognition or amortization is included in the profit or loss of this period.Requirements for derecognition of financial liabilitiesFinancial liabilities shall be entirely or partially derecognized if the present obligations derived from them are entirely or partially discharged. Where the Company enters into an agreement with a creditor so as to substitute the current financial liabilities with new ones, and the contract clauses of which are substantially different from those of the current ones, it shall recognize the new financial liabilities in place of the current ones. Where substantial revisions are made to some or all of the contract clauses of the current financial liabilities, the Company shall recognize the new financial liabilities after revision of the contract clauses in place of the current ones entirely or partially. Upon entire or partial derecognition of financial liabilities, differences between the carrying amounts of the derecognized financial liabilities and the consideration paid (including non-monetary assets surrendered or new financial liabilities assumed) are charged to profit or loss for the current period.Where the Company redeems part of its financial liabilities, it shall allocate the carrying amounts of the entire financial liabilities between the relative fair values of the parts that continue to be recognized and the derecognized parts on the redemption date. Differences between the carrying amounts allocated to the derecognized parts and the consideration paid (including non-monetary assets surrendered and the new financial liabilities assumed) are charged to profit or loss for the current period.Recognition and measurement for transfer of financial assetsIf the Company has transferred nearly all of the risks and rewards relating to the ownership of the financial assets to the transferee, they shall be derecognized. If it retains nearly all of the risks and rewards relating to the ownership of the financial assets, they shall not be derecognized and will be recognized as a financial liability. If the Company has not transferred nor retained nearly all of the risks and rewards relating to the ownership of the financial assets:(1) to give up the control of the financial assets to be derecognized; (2) not giving up control of the financial asset to be recognized based on the extent of its continuing involvement in the transferred financial assets and liabilities are recognized accordingly.If the transfer of entire financial assets satisfy the criteria for derecognition, differences between the amounts of the following two items shall be recognized in profit or loss for the current period: (1) the carrying amount of the transferred financial asset; (2) the aggregate consideration received from the transfer plus the cumulative amounts of the changes in the fair values originally recognized in the owners’ equity. If the partial transfer of financial assets satisfy the criteriafor derecognition, the carrying amounts of the entire financial assets transferred shall be split into the derecognized and recognized parts according to their respective fair values and differences between the amounts of the following two items are charged to profit or loss for the current period: (1) the carrying amounts of the derecognized parts; (2) The aggregate consideration for the derecognized parts plus the portion of the accumulative amounts of the changes in the fair values of the d erecognized parts which are originally recognized in the owners’ equity.Determination of the fair value of financial instruments- If financial instruments trade in an active market, the quoted price in an active market determines its fair value; if financial instrument trade not in an active market, the valuation techniques determine the fair value. Valuation techniques include recent market transaction price reference to the familiar situation and volunteer transaction, current fair value reference to other substantially similar financial instruments, discounted cash flow method and option pricing model and so on.Test and Provisions for impairment loss on financial assets--Except trading financial assets, the Company makes assessment on the carrying values of financial assets at the balance sheet date. If there is evidence that the fair value of specific financial asset has been impaired, provisions for impairment loss is made accordingly.-- Measurement of impairment of financial assets measured at amortized costIf there is objective evidence that the financial asset measured at amortized cost has been impaired, the carrying amount of the financial asset is written down to the present value of estimated future cash flows(excluding future credit losses that have not yet occurred), and the amount of reduction is recognized as impairment loss and is recognized in the profit or loss of this period. The Company carries out the impairment test of significant single financial asset separately, carries out the impairment test on insignificant single financial asset from a single or combination of angles, and carries out the impairment test on single asset without objective evidence of impairment along with the financial assets with similar credit risk characteristics to constitute a combination, but does not carry out the impairment test on the provision for impairment of financial assets based on the single in the portfolio. In the subsequent period, if there is objective evidence that the value of financial asset has been restored and recognized relevant to the objective matters occurring after the impairment, previously recognized impairment loss shall be reversed and charged into the profit or loss of this period. But the book value after the reversal should not exceed the amortized cost at the reversal date of the financial assets supposed no provision for impairment. When the financial assets measured at amortized cost actually occur loss, offset against the related provision for impairment.--Available for sale financial assetsIf there is objective evidence that an impairment of available for sale financial assets occurs, even though the financial asset has not been derecognised, the cumulative loss of decrease of the faire value originally recorded in the owner's equity should be transferred out and charged into the current profit and loss. The cumulative loss is the initial acquisition cost of available for sale financial assets, deducting the fair value of the withdrawing principal and amortizationamount and impairment loss as well as net impairment amount originally charged into the profit or loss.Recognition and provision for bad debts of accounts receivableIf there is objective evidence that receivables are impaired at the end of this period, the carrying value will be written down to its present value of estimated future cash flows, and the amount of reduction is recognized as impairment loss and is recognized in the current profit or loss. Present value of estimated future cash flows is determined through future cash flows (excluding credit losses that have not been incurred) discounted at the original effective interest rate, taking into account the value of related collateral (less estimated disposal costs, etc.). Original effective interest rate is the actual interest rate when the receivables are recognized initially. The estimated future cash flows of short-term receivables have small difference from the present value, and the estimated future cash flows are not discounted in determining the related impairment loss.The significant single receivables are separately carried out impairment test at the end of this period, and if there is objective evidence that the impairment has occurred, based on the difference of the present value of future cash flows less than the book value, the impairment loss is recognized and the provision of bad debts is done. The significant single amount refers to top five receivable balances or the sum of payments accounting for more than 10% of receivable balances.If there is objective evidence that the individual non-significant receivables impairment has occurred, separate impairment test is done, the impairment loss is recognized and the provision for bad debts is done; other individual non-significant receivables and receivables notimpaired after separate test are together divided into several combinations for impairment testing with aging as the similar credit risk characteristics, to determine the impairment loss and do provision for bad debts.In addition to separate provision for impairment of receivables, the company is based on the actual loss rate of receivable portfolio with the same or similar to the previous year and aging as the similar credit risk characteristics, and combines the current situation to determine the ratio of provision for bad debts as follows:Fixed assets and depreciation accounting methodRecognition criteria of fixed assets: fixed assets refer to tangible assets held for the purpose of producing commodities, providing services, renting or business management with useful lives exceeding one accounting year and high unit value.Classification of fixed assets: buildings and constructions, machinery equipment, transport equipment and office equipment.Fixed assets pricing and depreciation method: the fixed assets is priced based on actual cost and depreciated in a straight-line method. The estimated useful lives, estimated residual rate and annual depreciation rate of various categories of fixed assets are listed as follows:Impairment of fixed assets: the Company checks the fixed assets term by term at the end of the reporting period, and if the market continuing to fall or technological obsolescence, damage, long-term idle and other reasons result in fixed assets recoverable amount lower than its book value, in accordance with the difference provision for impairment of fixed assets, the impairment loss is recognized in fixed assets and can not be reversed in a subsequent accounting period. The recoverable amount is recognized based on the fair value of the assets deducting the net amount after disposal expenses and the present value of cash flows of the estimated future assets. The present value of the future cash flows of the asset is determined in accordance with the resulting estimated future cash flows in the process of continuous use and final disposal to select its appropriate discount rate and the amount of the discount. Accounting method of construction in progressThe construction in progress is priced on the actual cost, to temporarily transfer to fixed assets when reaching the intended use state in accordance with the project budget and the actual cost of the project, and to adjust the book value of fixed assets according to the actual cost after handling final settlement of accounts. Acquisition, constructionor production of assets eligible for capitalization borrowed specifically or the interest on general borrowing costs and auxiliary expenses of specific borrowings occurred can be included in the cost of capital assets and subsequently recognized in the current profit or loss before the acquisition, construction or production of the qualifying asset reaches the intended use state or the sale state.Impairment of construction in progress: the Company conducts a comprehensive inspection of construction in progress at the end of the reporting period; if the construction in process is stopped for long time and will not be constructed in the next three years and the construction in progress brings great uncertainty to the economic benefits of enterprises due to backward performance or techniques and the construction in progress occurs impairment, the balance of recoverable amount of single construction in progress lower than the book value of construction in progress is for impairment provisions of construction in progress. Impairment loss on the construction in progress shall not be reversed in subsequent accounting periods once recognized.The pricing and amortizing of intangible assetsPricing of the intangible assets---The cost of outsourcing intangible assets shall be priced based on the actual expenditure directly attributable to intangible assets for the expected purpose.--- Expenditure on internal research and development projects is charged into the current profit or loss, and expense in the development stage can be recognized as intangible costs if meeting the criteria for capitalization.--- Intangible assets of investment is in accordance with the agreed valueof the investment contract or agreement as costs, excluding not fair agreed value of the contract or agreement.--- Intangible assets of the debtor obtained in the non-cash asset cover debt method can be accepted; if the receivable creditor’s right is changed into intangible assets, then record according to the fair value of intangible assets.--- For non-monetary transaction intangible assets, the fair value and related taxes payable of non-monetary assets should be the accounting cost.Amortization of intangible assets: as for the intangible assets with limited service life, it is amortized by straight-line method when it is available for use within the service period. As for unforeseeable period of intangible assets bringing future economic benefits to the company, it is regarded as intangible assets with uncertain service life, and intangible assets with uncertain service life can not be amortized. The Company’s intangible assets include land use rights, forest land use rights and the production and marketing information management software. The land use rights are amortized averagely in accordance with 50 years of service life, forest land use rights are amortized averagely in accordance with 30 years of service life, and the production and marketing information management software are amortized averagely in accordance with 5 years of service life.Expenditures arising from development phase on internal research and development projects can be recognized as intangible assets when satisfying all of the following conditions: (1) there is technical feasibility of completing the intangible assets so that they will be available for use or sale; (2) there is intention to complete and use orsell the intangible assets; (3) the method that the intangible assets generate economic benefits, including existence of a market for products produced by the intangible assets or for the intangible assets themselves, shall be proved. Or, if to be used internally, the usefulness of the intangible assets shall be proved; (4) adequate technical, financial, and other resources are available to complete the development of intangible assets, and the Company has the ability to use or sell the intangible assets; (5) the expenditures arising from development phase of the intangible assets can be measured reliably.Impairment of intangible assets: the Company conducts a comprehensive inspection on intangible assets at the end of the reporting period. If the intangible assets have been replaced by other new technologies so as to seriously affect its capacity to create economic benefits for the enterprise, the market value of certain intangible assets sharply fall and is not expected to recover in the remaining amortization period, certain intangible asset has exceeded the legal time limit but still has some value in use as well as the intangible asset impairment has occurred, the provision for impairment is done according to the difference between the individual estimated recoverable amount and the book value. Impairment loss on the intangible asset shall not be reversed in subsequent accounting periods once recognized.Accounting method of capitalization of borrowing costsBorrowing costs that are directly attributable to the acquisition, construction or production of qualifying assets for capitalization should be charged into the relevant costs of assets and therefore should be capitalized. Borrowing costs incurred after qualifying assets for capitalization reaches the estimated use state are charged to profit or。