JETBLUE AIRWAYS IPO Valuation

- 格式:docx

- 大小:31.66 KB

- 文档页数:10

一,蓝汛概况1,公司介绍:2010年9月9日,北京蓝汛通信技术有限责任公司(ChinaCache International Holdings Ltd),正式向美国证券交易委员会(SEC)递交了在美首次公开募股(IPO)申请书F-1文件,公司计划以“CCIH”为股票代码在纳斯达克交易所上市,拟融资1亿美元,美银美林和德意志银行将担任本次发售主承销商。

蓝汛(ChinaCache)创立于1998年,是中国最大的CDN(内容分发加速网络)服务提供商。

蓝汛在中国CDN市场曾长期处于垄断地位,2009年仍占53%市场份额。

2,管理团队公司创始人王松和寇晓红夫妇分别担任董事会主席兼CEO以及高级副总裁,两人各拥有25.40%的股份,但是整个管理团队61.90%。

独立董事里包括微软公司全球资深副总裁、微软(中国)有限公司董事长张亚勤,以及51job的COO以及执行CFO凯瑟琳•简。

王松曾在中国外交学院学习法语,并且参加过北大光华管理学院的EMBA培训。

创立蓝汛公司前,曾先后在“Northern China Computer Technologies Institute”任职计算机辅助设计工程师、波士顿科技公司(Boston Technology, Inc)任大中华区高级顾问、2000 Resources北京分公司首席商务代表。

关于另一创始人,也即王松夫人寇晓红,没有找到任何媒体报道过的资料。

蓝汛通信于2007年年底开始启动纳斯达克的上市计划,中间先后空降了多位有外企工作背景的高管,其中不少是来自于思科、朗讯等跨国企业。

3,盈利模式蓝汛的绝大部分收入来源于CDN业务。

CDN全称为Content Delivery Network,即内容分发网络。

通过在现有的Internet中增加一层新的网络架构,将网站的内容发布到最接近用户的网络“边缘”,使用户可以就近取得所需的内容,解决Internet网络拥挤的状况,提高用户访问网站的响应速度,来改善用户的访问体验。

飞利信目标价

飞利信(FLEX)是全球领先的电子制造服务商,为各行业提

供设计、制造和供应链解决方案。

根据最新的分析和数据,我认为飞利信的目标价应该位于70-75美元之间。

首先,飞利信在全球拥有广泛而稳定的客户基础,包括技术、医疗设备、汽车、电信和工业等领域的众多知名公司。

这为公司提供了稳定的收入来源和长期合作伙伴,使得公司能够在竞争激烈的市场中保持领先地位。

其次,飞利信通过不断的创新和技术升级,不断提高产品质量和生产效率。

公司拥有一支经验丰富的研发团队,并与许多科技公司合作,共同推动行业的发展。

这些努力使得公司能够满足客户不断提高的要求,并扩大市场份额。

第三,飞利信在供应链管理方面表现出色。

公司通过与全球供应商建立紧密的合作关系,确保原材料供应的稳定性和质量。

同时,公司还积极推动合作伙伴和供应商的可持续发展,从而提高整个供应链的效益。

这种优势可以帮助公司在不确定的环境下有效抵御风险,提高盈利能力。

第四,飞利信在全球范围内的市场份额不断扩大。

公司在亚洲、欧洲和美洲等地设有多个生产基地和销售网络,能够更好地满足当地市场的需求。

随着全球电子制造服务领域的持续增长,飞利信有望继续扩大市场份额,增加收入来源。

综上所述,鉴于飞利信在客户基础、创新能力、供应链管理和

市场份额等方面的优势,以及电子制造服务市场的持续增长,我认为飞利信的目标价应该位于70-75美元之间。

然而,需要注意的是,市场风险和竞争压力可能会影响公司的表现,投资者应该谨慎判断风险与收益。

列举三个美洲航空公司及其代码美洲是一个有着丰富航空资源的大陆,许多航空公司在这里运营航班。

在这篇文章中,我将介绍三个知名美洲航空公司及其代码,为你提供有关这些公司的详细信息。

第一个美洲航空公司是美国航空(American Airlines),其代码为AA。

美国航空成立于1930年,总部位于德克萨斯州的达拉斯。

作为全球最大的航空公司之一,美国航空拥有庞大的航班网络覆盖全球各地。

他们的航线覆盖美洲、欧洲、亚洲等地,提供高质量的航班服务。

美国航空以其优质的客舱服务和持续创新的飞行体验而著名。

第二个美洲航空公司是加拿大航空(Air Canada),其代码为AC。

加拿大航空成立于1937年,总部位于蒙特利尔。

作为加拿大最大的航空公司,Air Canada提供多达200多个目的地的航班服务。

他们的航线覆盖北美洲、欧洲、亚洲和南美洲等地区。

加拿大航空以其卓越的飞行安全记录和专业的客户服务而备受赞誉。

第三个美洲航空公司是巴西航空(LATAM Airlines),其代码为JJ。

巴西航空成立于1976年,总部位于巴西圣保罗。

巴西航空是南美洲最大的航空公司之一,同时也是全球最大的航空联盟之一-南美洲航空(LATAM Airlines Group)的成员。

他们的航线网络覆盖南美洲、北美洲、欧洲、澳洲和非洲。

巴西航空以其出色的客户体验、现代化的机队配置和高科技设备而受到旅客们的喜爱。

这三家美洲航空公司作为该地区最重要的代表之一,不仅提供了广泛的航线选择,还致力于提供卓越的客户服务和安全保障。

无论是商务旅客还是休闲度假者,选择其中之一的航空公司都能获得高品质的体验和便利的服务。

无论你要去哪里,这些航空公司都能满足你的需求,为你带来舒适的旅程体验。

世界十大航空公司排行榜:

1.英国航空公司(BRITISHI AIRWAYS):总部英国伦敦希斯罗国际机场.

2.法国航空公司(AIR FRANCE):总部法国巴黎戴高乐国际机场.

3.德国汉莎航空公司(Lufthansa):总部德国法兰克福国际机场和慕尼黑国际机场.

4.新加坡航空公司(SINGAPORE AIRLINES):总部新加坡章宜国际机场.

5.美国联合航空公司(UNITED AIRLINES):总部美国芝加哥奥黑国际机场,丹佛国际机场,旧金山国际机场,洛杉矶国际机场.

6.日本航空公司(Japan Airlines):总部日本东京成田国际机场,大阪关西国际机场.

7.荷兰皇家航空公司(KLM):总部荷兰阿姆斯特丹斯西霍普国际机场.

8.美国航空公司(American Airlines):总部美国达拉斯国际机场,洛杉矶国际机场,休斯顿国际机场.

9.美国西北航空公司(NORTHWEST AIRLINES):总部美国明尼安纳波利斯国际机场,底特律国际机场,纽约肯尼迪国际机场.

10.澳大利亚快达航空公司(QANTAS):总部澳大利亚悉尼金斯福德国际机场,墨尔本国际机场。

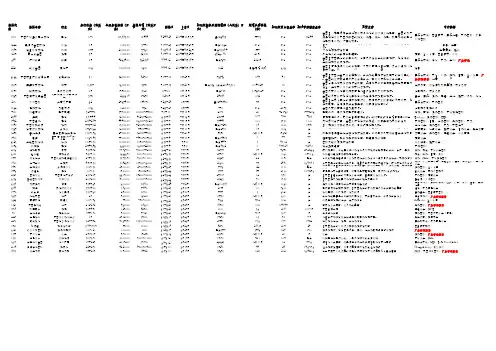

超额认购倍数(倍)2013年历史市盈率2014年预测市盈率主要业务中介机构股票代码股票名称行业发行价格(港币元)公开发售股份(万股)集资总额(港币万元)招股日上市日2013年度税后利润情况(人民币;万元)1811中国广核美亚电力控股电力 1.71103,393.0018,4949.24-9.292014年10月3日美元6933557.3N.A.102.44集团是一家电源种类和地理分布多元化的亚洲独立发电商,集团的资产组合摩根士丹利、国泰君安、摩根大通、中银国际、汇丰、工银国际8222壹照明集团控股灯饰0.51,000.003,4409.19-9.232014年9月29日港币1,062N.A.N.A.N.A.集团为一间具规模的香港灯饰及设计师品牌家具及配件产品零售连锁公司。

丰盛、华富1395强泰环保控股环保0.5520,000.007,7609.16-9.192014年9月26日港币3,389.4557N.A.N.A.污水处理服务供应商华富嘉洛、康弘1285嘉士利集团食品 3.71,000.0032,0009.15-9.182014年9月25日6926。

9028.51N.A.N.A.历史悠久的大型饼干制造商。

招商、第一上海、国泰君安、兴证699神州租车租车8.542,634.00362,3899.9-9.122014年9月19日港币-670202.05N.A.N.A.集团是中国最大的租车公司,为客户提供全面的租车服务,包括短租、长租摩根士丹利、瑞信、中金、华兴、广发香港2221创业集团房地产0.8610,000.0086009.9-9.122014年9月19日1822适度超额认购 6.06N.A.集团是香港建筑行业的承建商,主要於香港从事地基、土木工程及一般屋宇锴盛6166中国宏泰产业市镇发展市镇开发 3.132,800.00927107.15-7.188月25日763460.97 4.1N.A.集团是中国大型产业市镇规划、开发及运营服务供应商中的先行者之一。

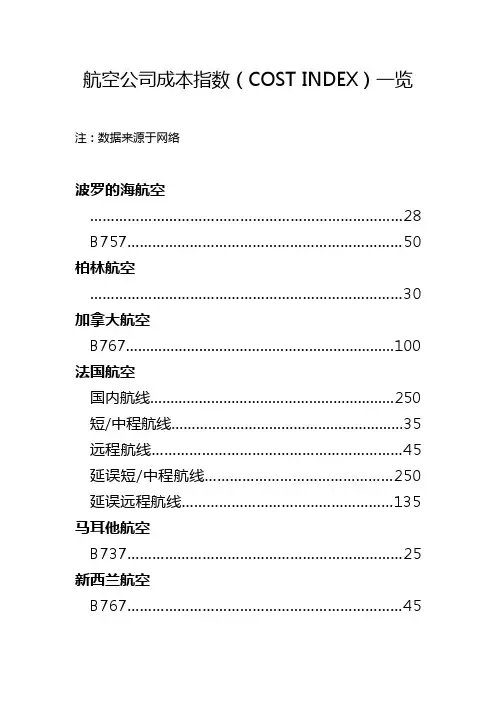

航空公司成本指数(COST INDEX)一览注:数据来源于网络波罗的海航空 (28)B757 (50)柏林航空 (30)加拿大航空B767 (100)法国航空国内航线 (250)短/中程航线 (35)远程航线 (45)延误短/中程航线 (250)延误远程航线 (135)马耳他航空B737 (25)新西兰航空B767 (45)奥地利航空 (35)英国航空A319/A320/A321爬升 0A319/A320/A321巡航 (20)B737-300/-400/-500爬升 0B737-300/-400/-500巡航 (28)B747爬升 0B747巡航 (90)B757/B767爬升 0B757/B767巡航 (40)B777爬升 0B777巡航 (100)英国米兰德航空 (40)国泰航空B747 (80)中华航空B747 (80)神鹰航空B757 (18)B767 (30)易捷航空A319/A320 (12)A321 (23)以色列航空B737............................................................15-30 B747短/中程 (39)B757............................................................20-40 B767短/中程................................................30-40 B767长程......................................................40-45 B777长程 (71)阿联酋航空A330 (25)FlyGlobespan航空B737-700 (14)B737-800 (13)FlyNiki航空 (35)汉堡国际航空A319 (40)B737 (30)荷兰皇家航空A330爬升 (60)A330巡航................................................150/300 A330下降 (30)B737爬升 (30)B737巡航 (15)B747爬升 (150)B747巡航 (300)B747下降 (50)B777爬升 (50)B777巡航 (100)B777下降 (20)F70/F100爬升 (30)F70/F100巡航 (15)MD11爬升 (50)MD11巡航 (100)MD11下降 (20)汉莎航空A300 (35)其它空客 (30)B737-300 (25)B747 (70)汉莎货运航空 (80)卢森堡航空 (50)北俄罗斯航空B737-500 (27)澳洲航空国内航线 (40)国际航线............................................................20* *为满足航班时刻/工作时长要求,最大可达250。

阿里巴巴提交赴美IPO申请计划融资10

亿美元-

; 中国电子商务巨头阿里巴巴6日提交了赴美首次公开募股(IPO)申请,计划10亿美元,但尚未披露具体上市地点。

; 阿里巴巴提交的上市招股说明书显示,该公司计划通过IPO融资10亿美元。

不过,美国投行Chardan资本市场公司高级副总裁柳艺告诉记者,招股说明书通常会不断修改,他预计阿里巴巴最终IPO融资额在160亿到200亿美元之间,将成为美国历史上最大的IPO之一。

; 近年美国最大的IPO为脸谱公司在2012年5月的上市,融资额为160亿美元。

; 柳艺说,尽管阿里巴巴招股说明书尚未披露上市地点,但只会是纽交所或纳斯达克交易所中的一家。

; 柳艺认为,阿里巴巴的IPO申请最快将在2到4周通过美国证交会的批准。

通常一家公司从首次提交招股说明书到通过美国证交会批准需3个月左右时间。

; 阿里巴巴的上市承销商为瑞士信贷银行、德意志银行、高盛、摩根大通、摩根士丹利和花旗集团。

; 招股说明书还显示,阿里巴巴的创始人马云持有公司8.9%的股份,为最大个人股东。

日本电信企业软银公司持有阿里巴巴34.4%的股份,为最大股东。

JETBLUE AIRWAYS IPO Valuation 1 CONTENTS Executive Summary………………………………………………………………………………………............2 Analysis…………………………………………………………………………………………...........................3 1. Advantages and Disadvantages of Going Public……………………………………………………………...3 2. IPO Pricing Approaches……………………………………………………………………………………...3 2.1 P/E Multiple………………………………………………………………………………………..........3 2.2 EBIT Multiple……………………………………………………………………… ...........................4 2.3 DCF model…………………………………………………………………………………………….. 4 3. Recommendation………………………………………………………………………………………….....6 Appendix 1, P/E Multiple Analysis………………………………………………………………………............7 Appendix 2, EIBT Multiple Analysis……………….…………………………………………………............7 Appendix 3, Cost of Capital(WACC)……………………………………………………………………............8 Appendix 4, DCF Share Price Valuation…………………………………………………………………............9 Appendix 5, Sensitivity Analysis………………………………………………………………………............10 2

Executive Summary Founded in February 1999, JetBlue Airways has experienced the rapid growth in the past decade, especially made profit during the sharp downturn in the airline travel following the Sept 11 attacks. It becomes one of the most popular low-fare airlines in USA for offering the comfortable point-to-point air travel with unique amenities (for example, leather seats and live-feed TV monitors). The high profit comes from the successful control on cost. JetBlue affords greater economies of scale because the airline had only one model of aircraft A320 which is reliable and fuel-efficient. Therefore, the pilots training process is quiet easy and effective. Besides, based on the internet service, most of employees work at home, saving administrative expenses. To support JetBlue’s growth and offset portfolio losses by VC investors, management was ready to raise additional capital through a public equity offering. From the prospectus, we can see the capital was mainly used for working capital and capital expenditure, including purchasing aircrafts. The lead underwriter for the JetBlue IPO, Morgan Stanley, had initially calculated a price per share of $22 to $24. However, with sizeable excess demand for the 5.5 million shares being offered; they had adjusted the range upwards ($25 to $26). This report utilized three different share valuation methods: 1) Price/earnings multiple (comparison pricing); 2) EBIT multiple (comparison pricing); and 3) Discounted free cash flows(fundamentals pricing). We conclude that the JetBlue offering price should be $26 to $29. The current suggested price is underpricing and will leave too much money on the table. 3

Analysis 1. Advantages and Disadvantages of Going Public It was beneficial for company to develop more destinations and increase the competitiveness. From a financing perspective, JetBlue investors will gain access to a more liquid equity market, which will reduce JetBlue’s cost of capital from the much higher cost of private equity. Additionally, the new equity will lower the debt to equity ratio. With a lower debt to equity ratio, JetBlue will then have increased access to the debt market with more favorable terms and take advantage of the tax advantages provided by debt financing. Last but not least, increasing market potential also benefits the firm and makes it easy to market the product because the public will be more familiar with the products. However, issuing common stock does have disadvantages. Obviously, there are some direct fees for company. JetBlue will have to pay legal, accounting, and underwriting fees associated with public offerings. Also, information will be available to the competitors after listing on the stock market. Management may lose control of its decision-making abilities. Finally, the price sometimes does not represent the true value of the company so that the company may suffer from losing wealth. 2. IPO Pricing Approaches Since JetBlue management claim not to pay any dividends on their common stock, we choose to use the Market Multiple Approach and DCF Approach to evaluate the stock price rather than using The Dividend Growth Model. 2.1 P/E Multiple In our analysis, we choose only low-cost and positive airline as samples (AirTran, Frontier, Ryanair, Southwest and WestJet). Because of the small sample size and the frontier’s outlying performance, we prefer to choose the median number of the PE Multiple sample to represent JetBlue’s trailing and leading PE multiple. For Trailing, the earnings/share is 1.14(Diluted Earnings Per Common Share in Exhibit 3). For Leading, the earnings/share is 1.30(Pro forma basic Earnings Per Common Share in Exhibit 3). The Price/Share is