金融英语期末复习重点词汇解释

- 格式:doc

- 大小:44.50 KB

- 文档页数:3

金融英语相关词汇导言金融英语是金融领域中经常使用的专业术语和常用词汇的总称。

对于从事金融工作或有意从事金融行业的人来说,了解和掌握金融英语相关词汇是非常重要的。

本文将介绍一些常用的金融英语词汇,帮助读者对金融领域的术语和词汇有更深入的了解。

1. 金融市场词汇•Stocks: 股票,代表一家公司的所有权份额。

在金融市场中,股票是最常见的一种投资工具。

•Bonds: 债券,是政府、公司或机构向投资者发行的一种债务凭证。

债券是一种固定收益类投资工具。

•Commodities: 商品,指可供生产或消费的原材料或产品,例如黄金、石油等。

•Indices: 指数,用于衡量特定市场的整体表现。

常见的指数包括道琼斯指数、纳斯达克指数等。

•Futures: 期货,是一种以标准化合约形式交易的金融产品。

期货合约规定了在未来某个时间按特定价格交割一定数量标的资产。

•Options: 期权,是一种金融衍生品,允许持有者在未来的特定时期以事先约定的价格购买或卖出资产。

•Exchange: 交易所,是买卖金融产品的场所,提供市场交易的基础设施和服务。

2. 金融机构与职位•Bank: 银行,主要提供存款、贷款和支付服务等金融服务。

•Investment Bank: 投资银行,主要为企业和机构提供融资、股票发行、企业并购等金融服务。

•Commercial Bank: 商业银行,主要为个人和企业提供存款、贷款、信用卡等金融服务。

•Retail Bank: 零售银行,主要为个人客户提供各类银行服务。

•Central Bank: 中央银行,担负着制定货币政策、发行货币等职责。

•Fund: 基金,是一种集合投资工具,通过从多个投资者集资,并投资于多种金融产品。

•Broker: 经纪人,作为中介,代表客户进行投资交易或购买金融产品。

•Analyst: 分析师,负责分析金融市场和公司财务状况等信息,为投资决策提供建议。

•Trader: 交易员,负责在金融市场上进行实时交易,以获取利润。

frm 全科必备金融专业英语词汇金融专业是一个广泛且充满挑战的领域,它涉及到许多复杂的概念和术语。

在这篇文章中,我将为你介绍一些金融专业英语词汇,这些词汇对于金融专业的学习和实践非常重要。

1. 资金流动性(liquidity):指的是一个资产可以快速、方便地被转换成现金的能力。

在金融领域,流动性是一个非常关键的概念,它对于评估资产的价值和风险至关重要。

2. 资产管理(asset management):是指对个人或机构的资产进行管理和投资的活动。

资产管理的目标是最大化资产的价值,同时控制风险。

3. 投资组合(investment portfolio):是指一个人或机构所拥有的所有投资的集合。

投资组合的构建需要考虑投资者的风险承受能力和投资目标,以平衡风险和回报。

4. 风险管理(risk management):是一种评估、控制和减少风险的过程。

风险管理是金融机构和投资者的重要职责,它包括识别和评估风险,并采取适当的措施来管理和减少风险。

5. 金融衍生品(financial derivatives):是一种金融工具,它的价值是基于一个或多个基础资产的价值。

金融衍生品包括期货合约、期权合约和互换合约等。

6. 股票市场(stock market):是一种交易股票的市场。

股票市场是企业融资的重要途径,也是投资者获取回报的渠道。

7. 货币政策(monetary policy):是由中央银行制定和执行的政策,旨在控制货币供应量和利率,以影响经济的总需求和通货膨胀率。

8. 保险业(insurance industry):是指提供保险服务的行业。

保险业的主要功能是向个人和企业提供风险保障,以分散和转移风险。

9. 财务报表(financial statements):是企业向外部利益相关者提供的关于其财务状况和业绩的信息。

财务报表包括资产负债表、利润表和现金流量表等。

10. 金融市场(financial market):是指进行金融交易的场所或平台。

金融英语词汇表金融英语词汇表本文为金融英语词汇表,旨在帮助读者更好地理解和应用金融领域的专业术语。

以下是一些常见的金融英语词汇和它们的解释:1. Assets(资产)- 可以转化为现金或带来经济利益的资源或所有权。

2. Liabilities(负债)- 公司或个人欠债的金额或法律责任。

3. Equity(股权)- 企业或个人拥有的资产减去负债后的余额。

4. Income(收入)- 公司或个人在一定期间内实现的销售额或盈利额。

5. Expenses(费用)- 公司或个人在一定期间内发生的成本或支出。

6. Interest(利息)- 贷款或存款所产生的费用或收益。

7. Market value(市值)- 资产、证券或股权在市场上的估值。

8. Bond(债券)- 证明借款人向债权人承诺按照特定条件偿还借款本金和利息的文件。

9. Stock(股票)- 公司向股东发行的所有权证明书。

10. Mutual fund(共同基金)- 资金由多个投资者集资形成,由专业基金经理管理和投资的投资基金。

11. Dividend(股息)- 公司向股东发放的利润分红。

12. Foreign exchange(外汇)- 一国货币兑换成另一国货币的行为或货币的兑换比率。

13. Exchange rate(汇率)- 一种货币兑换为另一种货币的比率。

14. Inflation(通货膨胀)- 货币供应增加,物价上涨的现象。

15. Recession(经济衰退)- 经济活动放缓和经济增长停滞的时期。

以上仅为部分金融英语词汇表,希望对读者对金融领域的专业术语有所帮助。

了解和掌握这些词汇,对于学习和实践金融知识非常重要。

在金融职业生涯或金融决策中,正确理解和运用这些术语能够提高工作效率和决策准确性。

希望这份金融英语词汇表对您有帮助,如果您还想了解更多金融英语词汇,可以进一步扩展您的金融词汇量。

祝您在金融领域取得更好的成就!。

第三章Capacity 生产能力;产能CAPEX 资本支出Capital Adequacy Ratio 资本充足比率Capital base 资本金;资本基楚Capital expenditure 资本支出Capitalization >资本值Capital markets 资本市场;资金市场Capital raising 融资;筹集资金Capped floater 封顶浮动利率债券Carry trade 利率差额交易;套利外汇交易;息差交易例如:当利率偏低,投资者便借入短息(1%)买长债(4%),稳赚可观息差;及/或当美元汇价看低,便借入美元买进看升的亚洲股、汇市。

Carrying cost 利息成本;持有成本;资金成本差额Carrying value 账面价值Cash-settled warrant 现金认股权证Cash earnings per share 每股现金盈利Cash flow 现金流量CBO 债券抵押债券(参见Collateralized Bond Obligation)CCASS 中央结算及交收系统CD 存款证CDO 债务抵押债券(参见Collateralized Debt Obligation)CDS 参见Credit Default Swap栏目CEDEL 世达国际结算系统(即欧洲货币市场结算系统)Ceiling 上限Ceiling-floor agreement 上下限协议Central Clearing & Settlement System 中央结算及交收系统CEO 行政总栽;行政总监;首席执行官CEPA 即2003年6月29日于香港签署的《内地与香港关于建立更紧密经贸关系的安排》,是英文"The Closer Economic Partnership Arrangement (CEPA) between Hong Kong andthe Mainland"的简称。

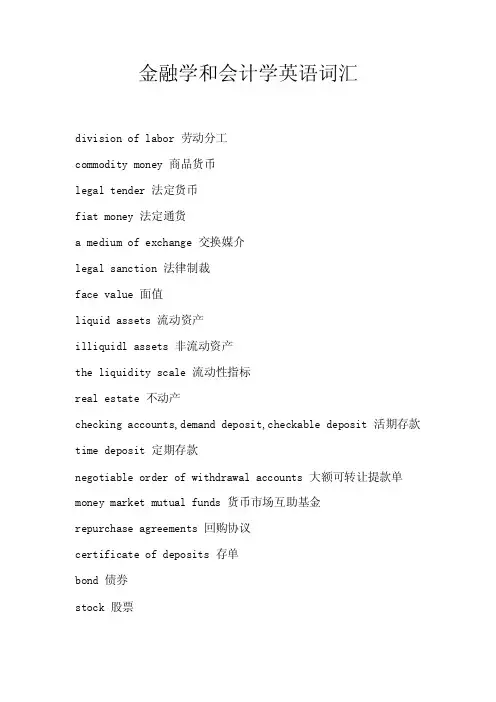

金融学和会计学英语词汇division of labor 劳动分工commodity money 商品货币legal tender 法定货币fiat money 法定通货a medium of exchange 交换媒介legal sanction 法律制裁face value 面值liquid assets 流动资产illiquidl assets 非流动资产the liquidity scale 流动性指标real estate 不动产checking accounts,demand deposit,checkable deposit 活期存款time deposit 定期存款negotiable order of withdrawal accounts 大额可转让提款单money market mutual funds 货币市场互助基金repurchase agreements 回购协议certificate of deposits 存单bond 债券stock 股票travelers'checks 旅行支票small-denomination time deposits 小额定期存款large-denomination time deposits 大额定期存款bank overnight repurchase agreements 银行隔夜回购协议bank long-term repurchase agreements 银行长期回购协议thrift institutions 存款机构financial institution 金融机构commercial banks 商业银行a means of payment 支付手段a store of value 储藏手段a standard of value 价值标准reserve 储备note 票据discount 贴现circulate 流通central bank 中央银行the Federal Reserve System 联邦储备系统credit union 信用合作社paper currency 纸币credit creation 信用创造branch banking 银行分行制unit banking 单一银行制out of circulation 退出流通capital stock 股本at par 以票面价值计electronic banking 电子银行banking holding company 公司银行the gold standard 金本位the Federal Reserve Board 联邦储备委员会the stock market crash 股市风暴reserve ratio 准备金比率deficit 亏损roll 展期wholesale 批发default 不履约auction 拍卖collateralize 担保markup 价格的涨幅dealer 交易员broker 经纪人pension funds 养老基金face amount 面值commerical paper 商业票据banker's acceptance 银行承兑汇票Fed fund 联邦基金eurodollar 欧洲美元treasury bills 国库券floating-rate 浮动比率fixed-rate 固定比率default risk 拖欠风险credit rating 信誉级别tax collection 税收money market 货币市场capital market 资本市场original maturity 原始到期期限surplus funds 过剩基金宏观经济的 macroeconomic通货膨胀 inflation破产 insolvency有偿还债务能力的 solvent合同 contract汇率 exchange rate紧缩信贷 tighten credit creation 私营部门 private sector财政管理机构 fiscal authorities宽松的财政政策 slack fiscal policy税法 tax bill财政 public finance财政部 the Ministry of Finance平衡预算 balanced budget继承税 inheritance tax货币主义者 monetariest增值税 VAT (value added tax)收入 revenue总需求 aggregate demand货币化 monetization赤字 deficit经济不景气 recession经济好转 turnabout复苏 recovery成本推进型 cost push货币供应 money supply生产率 productivity劳动力 labor force实际工资 real wages成本推进式通货膨胀 cost-push inflation 需求拉动式通货膨胀 demand-pull inflation 双位数通货膨胀 double- digit inflation极度通货膨胀 hyperinflation长期通货膨胀 chronic inflation治理通货膨胀 to fight inflation最终目标 ultimate goal坏的影响 adverse effect担保 ensure贴现 discount萧条的 sluggish认购 subscribe to支票帐户 checking account货币控制工具 instruments of monetry control 借据 IOUs(I owe you)本票 promissory notes货币总监 controller of the currency拖收系统 collection system支票清算或结算 check clearing资金划拨 transfer of funds可以相信的证明 credentials改革 fashion被缠住 entangled货币联盟 Monetary Union再购协议 repo精明的讨价还价交易 horse-trading欧元 euro公共债务 membership criteria汇率机制 REM储备货币 reserve currency劳动密集型 labor-intensive股票交易所 bourse竞争领先 frontrun牛市 bull market非凡的牛市 a raging bull规模经济 scale economcies买方出价与卖方要价之间的差价 bid-ask spreads 期货(股票) futures经济商行 brokerage firm回报率 rate of return股票 equities违约 default现金外流 cash drains经济人佣金 brokerage fee存款单 CD(certificate of deposit)营业额 turnover资本市场 capital market布雷顿森林体系 The Bretton Woods System经常帐户 current account套利者 arbitrager远期汇率 forward exchange rate即期汇率 spot rate实际利率 real interest rates货币政策工具 tools of monetary policy银行倒闭 bank failures跨国公司 MNC ( Multi-National Corporation) 商业银行 commercial bank商业票据 comercial paper利润 profit本票,期票 promissory notes监督 to monitor佣金(经济人) commission brokers套期保值 hedge有价证券平衡理论 portfolio balance theory 外汇储备 foreign exchange reserves固定汇率 fixed exchange rate浮动汇率 floating/flexible exchange rate 货币选择权(期货) currency option套利 arbitrage合约价 exercise price远期升水 forward premium多头买升 buying long空头卖跌 selling short按市价订购股票 market order股票经纪人 stockbroker国际货币基金 the IMF七国集团 the G-7监督 surveillance同业拆借市场 interbank market可兑换性 convertibility软通货 soft currency限制 restriction交易 transaction充分需求 adequate demand短期外债 short term external debt汇率机制 exchange rate regime直接标价 direct quotes资本流动性 mobility of capital赤字 deficit本国货币 domestic currency外汇交易市场 foreign exchange market国际储备 international reserve利率 interest rate资产 assets国际收支 balance of payments贸易差额 balance of trade繁荣 boom债券 bond资本 captial资本支出 captial expenditures商品 commodities商品交易所 commodity exchange期货合同 commodity futures contract普通股票 common stock联合大企业 conglomerate货币贬值 currency devaluation通货紧缩 deflation折旧 depreciation贴现率 discount rate归个人支配的收入 disposable personal income 从业人员 employed person汇率 exchange rate财政年度fiscal year自由企业 free enterprise国民生产总值 gross antional product 库存 inventory劳动力人数 labor force债务 liabilities市场经济 market economy合并 merger货币收入 money income跨国公司 Multinational Corproation 个人收入 personal income优先股票 preferred stock价格收益比率 price-earning ratio优惠贷款利率 prime rate利润 profit回报 return on investment使货币升值 revaluation薪水 salary季节性调整 seasonal adjustment关税 tariff失业人员 unemployed person效用 utility价值 value工资 wages工资价格螺旋上升 wage-price spiral收益 yield补偿贸易 compensatory trade, compensated deal 储蓄银行 saving banks欧洲联盟 the European Union单一的实体 a single entity抵押贷款 mortgage lending业主产权 owner's equity普通股 common stock无形资产 intangible assets收益表 income statement营业开支 operating expenses行政开支 administrative expenses现金收支一览表 statement of cash flow贸易中的存货 inventory收益 proceeds投资银行 investment bank机构投资者 institutional investor垄断兼并委员会 MMC招标发行 issue by tender定向发行 introduction代销 offer for sale直销 placing公开发行 public issue信贷额度 credit line国际债券 international bonds欧洲货币Eurocurrency利差 interest margin以所借的钱作抵押所获之贷款 leveraged loan 权利股发行 rights issues净收入比例结合 net income gearing常用的经济学金融学中英文词汇及解释Equilibrium,competitive 竞争均衡见竟争均衡(competitive equilibrium)。

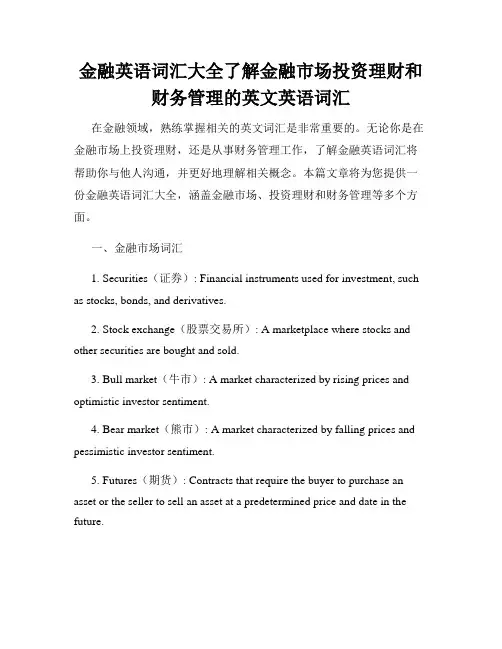

金融英语词汇大全了解金融市场投资理财和财务管理的英文英语词汇在金融领域,熟练掌握相关的英文词汇是非常重要的。

无论你是在金融市场上投资理财,还是从事财务管理工作,了解金融英语词汇将帮助你与他人沟通,并更好地理解相关概念。

本篇文章将为您提供一份金融英语词汇大全,涵盖金融市场、投资理财和财务管理等多个方面。

一、金融市场词汇1. Securities(证券): Financial instruments used for investment, such as stocks, bonds, and derivatives.2. Stock exchange(股票交易所): A marketplace where stocks and other securities are bought and sold.3. Bull market(牛市): A market characterized by rising prices and optimistic investor sentiment.4. Bear market(熊市): A market characterized by falling prices and pessimistic investor sentiment.5. Futures(期货): Contracts that require the buyer to purchase an asset or the seller to sell an asset at a predetermined price and date in the future.6. Options(期权): Financial derivatives that give the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price and date.7. Exchange rate(汇率): The rate at which one currency can be exchanged for another currency.8. IPO (Initial Public Offering)(首次公开募股): The first sale of stock by a company to the public.二、投资理财词汇1. Portfolio(投资组合): A collection of financial assets, such as stocks, bonds, and cash, held by an investor.2. Diversification(多元化投资): Spreading investments across different assets to reduce risk.3. Risk tolerance(风险承受能力): The degree to which an investor is willing to accept the potential loss in an investment.4. Return on Investment (ROI)(投资回报率): The percentage gain or loss on an investment relative to the amount invested.5. Asset allocation(资产配置): The distribution of investments across various asset classes, such as stocks, bonds, and real estate.6. Mutual fund(共同基金): An investment vehicle that pools money from multiple investors to invest in a diversified portfolio of securities.7. Hedge fund(对冲基金): An investment fund that employs various strategies to generate high returns, often taking both long and short positions.8. Stock market index(股票市场指数): A measurement of the performance of a group of stocks representing a particular market or sector.三、财务管理词汇1. Financial statement(财务报表): A formal record of a company's financial activities, including the balance sheet, income statement, and cash flow statement.2. Budget(预算): A financial plan that estimates income and expenses over a specific period of time.3. Cash flow(现金流): The movement of money in and out of a business or individual's accounts.4. Revenue(收入): The income generated from sales of goods or services.5. Expenses(费用): The costs incurred in the operation of a business or individual's daily life.6. Asset(资产): Anything of value owned by a business or individual, such as cash, inventory, or real estate.7. Liability(负债): Debts or obligations owed by a business or individual.8. Gross profit(毛利润): The difference between revenue and the cost of goods sold.以上是一份金融英语词汇大全,涵盖了金融市场、投资理财和财务管理等方面的词汇。

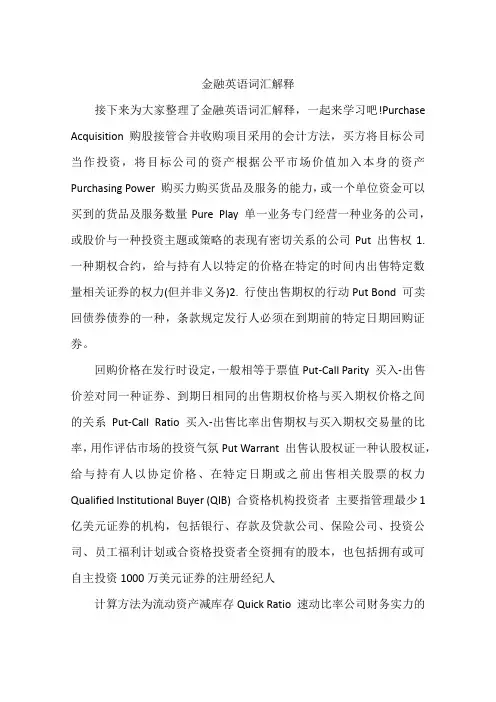

金融英语词汇解释接下来为大家整理了金融英语词汇解释,一起来学习吧!Purchase Acquisition 购股接管合并收购项目采用的会计方法,买方将目标公司当作投资,将目标公司的资产根据公平市场价值加入本身的资产Purchasing Power 购买力购买货品及服务的能力,或一个单位资金可以买到的货品及服务数量Pure Play 单一业务专门经营一种业务的公司,或股价与一种投资主题或策略的表现有密切关系的公司Put 出售权1. 一种期权合约,给与持有人以特定的价格在特定的时间内出售特定数量相关证券的权力(但并非义务)2. 行使出售期权的行动Put Bond 可卖回债券债券的一种,条款规定发行人必须在到期前的特定日期回购证券。

回购价格在发行时设定,一般相等于票值Put-Call Parity 买入-出售价差对同一种证券、到期日相同的出售期权价格与买入期权价格之间的关系Put-Call Ratio 买入-出售比率出售期权与买入期权交易量的比率,用作评估市场的投资气氛Put Warrant 出售认股权证一种认股权证,给与持有人以协定价格、在特定日期或之前出售相关股票的权力Qualified Institutional Buyer (QIB) 合资格机构投资者主要指管理最少1亿美元证券的机构,包括银行、存款及贷款公司、保险公司、投资公司、员工福利计划或合资格投资者全资拥有的股本,也包括拥有或可自主投资1000万美元证券的注册经纪人计算方法为流动资产减库存Quick Ratio 速动比率公司财务实力的指标。

计算方法为流动资产减库存,然后除以流动负债。

也称为酸性测试比率Quiet Filing 安静申请指促意不包括重要细节的首次公开上市申请。

发行人向美国证监会提交安静申请的目的在于展开新证券发行的申请过程,未提交资料必须在补充文件中披露。

这种申请方式所需的时间一般比传统申请方法要长Quiet Period 静止期在首次公开上市的过程中,静止期指美国证监会禁止发行人进行公开推销活动的时期。

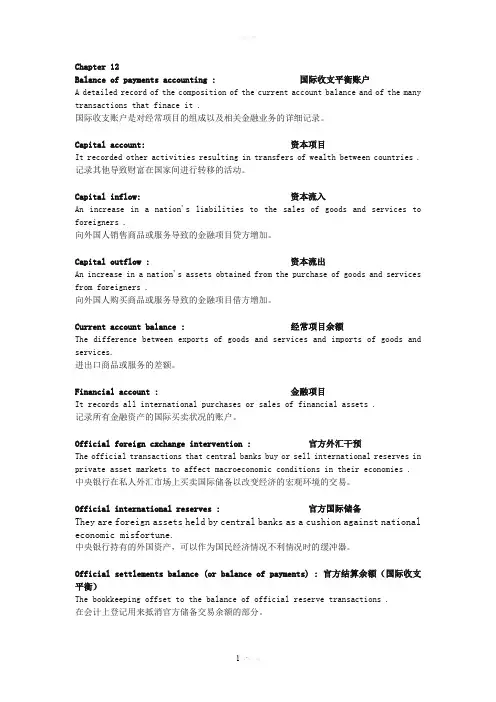

Chapter 12Balance of payments accounting : 国际收支平衡账户A detailed record of the composition of the current account balance and of the many transactions that finace it .国际收支账户是对经常项目的组成以及相关金融业务的详细记录。

Capital account: 资本项目It recorded other activities resulting in transfers of wealth between countries . 记录其他导致财富在国家间进行转移的活动。

Capital inflow: 资本流入An increase in a nation's liabilities to the sales of goods and services to foreigners .向外国人销售商品或服务导致的金融项目贷方增加。

Capital outflow : 资本流出An increase in a nation's assets obtained from the purchase of goods and services from foreigners .向外国人购买商品或服务导致的金融项目借方增加。

Current account balance : 经常项目余额The difference between exports of goods and services and imports of goods and services.进出口商品或服务的差额。

Financial account : 金融项目It records all international purchases or sales of financial assets .记录所有金融资产的国际买卖状况的账户。

金融专业英语词汇大全一、基本金融术语1. 金融(Finance):指货币的筹集、分配和管理活动。

2. 银行(Bank):提供存款、贷款、支付结算等金融服务的机构。

3. 证券(Securities):代表财产所有权或债权的凭证,如股票、债券等。

4. 投资(Investment):将资金投入到某个项目或资产,以获取收益的行为。

5. 债务(Debt):借款人向债权人承诺在一定期限内偿还本息的义务。

6. 股票(Stock):股份有限公司发行的,代表股东对公司所有权和收益分配权的凭证。

7. 债券(Bond):债务人向债权人发行的,承诺按一定利率支付利息并在到期日偿还本金的债务凭证。

8. 利率(Interest Rate):资金的价格,反映资金借贷的成本。

9. 汇率(Exchange Rate):一种货币兑换另一种货币的比率。

10. 通货膨胀(Inflation):货币购买力下降,物价普遍持续上涨的现象。

二、金融衍生品词汇1. 金融衍生品(Financial Derivatives):基于现货金融工具派生出来的新型金融工具。

2. 期货(Futures):双方约定在未来某一时间、按约定的价格买卖某种标的物的合约。

3. 期权(Options):买卖双方在未来一定期限内,按约定价格买入或卖出某种标的物的权利。

4. 掉期(Swap):双方约定在未来某一时间,相互交换一系列现金流的合约。

5. 远期合约(Forward Contract):双方约定在未来某一时间、按约定的价格买卖某种标的物的合约。

三、金融机构及监管部门词汇1. 中央银行(Central Bank):国家金融政策制定和执行的机构,如中国人民银行。

2. 商业银行(Commercial Bank):以盈利为目的,提供存款、贷款、支付结算等金融服务的银行。

3. 证券公司(Securities Company):从事证券经纪、投资咨询、资产管理等业务的金融机构。

金融英语相关的名词解释金融英语相关名词解释随着全球经济的不断发展,金融行业的重要性也日益凸显。

作为一门专业英语,金融英语涉及许多专业术语和常用词汇。

本文将介绍一些金融英语中常见的名词,以帮助读者更好地理解金融行业。

1. 资产管理(Asset Management):指对个人或机构的资金进行投资和管理,以达到最佳的收益目标。

资产管理公司(Asset Management Company)通常管理客户的投资组合,以最大限度地实现资本增长,同时控制风险。

2. 证券(Securities):是金融市场上可以交易的股票、债券或其他可转让的金融资产。

常见的证券类型包括股票(Stocks)、债券(Bonds)、期权(Options)和期货(Futures)等。

3. 股票交易所(Stock Exchange):是买卖股票和其他证券的场所。

世界上最著名的股票交易所包括纽约证券交易所(New York Stock Exchange)、伦敦证券交易所(London Stock Exchange)等。

4. 利率(Interest Rate):是金融市场上的一个重要指标,表示借款或存款所支付的利息。

央行通过调整利率可以对经济进行调控,提高或降低货币供应,影响市场利率。

5. 期货(Futures):是一种标准化的合约,规定在未来某一特定日期或时间,以事先约定的价格买入或卖出商品或金融资产。

期货合约通常用于对冲风险或投机目的。

6. 债券(Bonds):是一种借贷工具,发行者承诺按照约定在未来的某个日期支付一定的本金和利息。

债券通常由政府、公司或金融机构发行,是一种较为安全的投资品种。

7. 风险管理(Risk Management):指在金融活动中识别、评估和控制潜在风险的过程。

风险管理的目标是为了减少可能的损失,并确保金融机构或个人的可持续发展。

8. 金融衍生品(Financial Derivatives):是衍生自基础金融资产的合约,如期权、期货和掉期。

English Terms 中⽂翻译详情解释/例⼦DJIA 道琼斯⼯业平均指数道琼斯⼯业平均指数是30种在纽约股票交易所及纳斯达克交易所买卖的重要股票的股价加权平均。

道琼斯⼯业平均指数于1896年由Charles Dow 始创DJTA 道琼斯交通平均指数道琼斯交通平均指数是20种在美国买卖的交通业股票的股价加权平均。

道琼斯⼯业平均指数于1884年始创DJUA 道琼斯公⽤事业平均指数道琼斯公⽤事业平均指数是15种在美国买卖的公⽤事业股票的股价加权平均。

道琼斯⼯业平均指数于1929年始创Data Mining 数据探索⼀种数据库应⽤,旨在探索⼤量数据之中存在的潜在模式Days Payable Outstanding (DPO) 应付账款天数备注:公式也可以作:应收账款/(信⽤成本/天数)Days Sales Outstanding (DSO) 应收账款天数备注:公式也可以作:应收账款/(信⽤销售额/天数)Debenture 公司 ?/TD> ⽆抵押债务,只依赖借⽅信⽤质量作为⽀持,并⽆抵押品,协议属于契约形式Debit 借项、借⽅增加资产或减低负债的会计⼊项Debt 债务⼀名⼈⼠或⼀家公司亏⽋其他⼈⼠或公司的⾦钱Debt Equity Ratio 债务股本⽐衡量公司财务贡杆的指标,计算⽅法为将公司的长期债务除以股东权益,显⽰公司建⽴资产的资⾦来源中股本与债务的⽐例备注:部分投资者在计算时只采⽤需要⽀付利息的长期债务,⽽不采⽤总负债总负债股东权益Debt Equity Swap 债换股交易⼀种再融资安排,债权⼈获得公司的股权,因⽽注销该公司亏⽋的债项Debt Financing 债务融资⼀家公司通过向个⼈及/或机构投资者出售债券、票据筹集营运资⾦或资本开⽀。

个⼈或机构投资者借出资⾦,成为公司的债权⼈,并获得该公司还本付息的Debt Ratio 负债⽐率财务⽐率的⼀种,计算⽅法为总债务除以总资产Debt Restructuring 债务重组有未偿还债务的企业修改债务协议,以争取更有利条款的⾏为Debt Security 债务证券证明投资者向发⾏⼈借出资⾦的证券。

金融英语重点单词名词解释文件排版存档编号:[UYTR-OUPT28-KBNTL98-UYNN208]Currency:货币 The money used in a country-euros,dollars,yen, its C.. Overtime;加班时间 money received for working extra hours.Pension;养老金 money paid by a company or the government to a retired P..Mortgage;租金 repayments of money borrowed to buy a house or flat. Budget;预算 a financial plan, showing how much money a person or organization expects to earn and spend is called a budget. Shareholders;股东 the people who invest money in shares are called shareholders.Revenue;收入all the money coming into a company during a given period is revenue.Dividend股利 the part of its profit that a company pays to its shareholders is a D. Balance sheet资产负债表shows the company’s assets-the thing it owes, its liabilities-the money it owes; its capital.Assets 资产the capital a bank has and the loans it has made areit’s AAuditing审计A means examining a company’s systems of control and the accuracy or exactness of its records.External audit 外部审计is done by independent auditors; auditors who are not employees of the company.Partnerships合伙企业a P is a business arrangement in which several people work together, and share the risks and profits.Depreciation折旧reducing the value of assets in the company’s accounts.Full-disclosure principle全面披露the F principle states thatfinancial reporting must include all significant information; anything that makes a difference to the users of financial statements.Revenue recognition principle收入确认原则is that reyenue is recognized in the accounting period in which it is earned.Matching principle配比原则 which is related to revenue recognition states that each cost or expense related to revenue earned must be recorded in the same accounting period as the revenue it helped to earn.’Current assets流动资产which will be used or converted into cash in less than a year.External auditors外部审计人员independent auditors who do not work for the company Ledger 总分类账a book of accountsLiabilities;负债L are obligations to pay other organizations or people, money that the company owes, or will owe at a fate date Suppliers 供应商companies which provide raw materials or parts.Good will 商誉; the amount a company pays for another one, in excess of the net value of its assets.Retained earnings;留存收益profits from previous years that have not been distributedTangible assets有形资产 are assets with a physical existence-things you can touch-such as property, plant and equipmentCurrent liabilities流动短期负债C are expected to be paid within a year of the date of the balance sheetCreditors 应付账款largely suppliers of goods or services to the business who are not paid at the time of purchaseDeferred taxes应交税金 money that will have to be paid as tax in the future, although the payment does not have to be made now.Share premium股本溢价money made if the company sells shares at above their face value- the value written on themRetained earnings留存收益profits from previous years that have not been distributed to shareholdersReserves 公积金funds set aside from share capital and earnings, retained for emergencies or other future needsSolvency 偿债能力whether a company has enough cash to pay short-term debts, or whether it could go bankrupt-haye its assets sold to repay creditorsDirect costs直接成本those that can be directly related to the production of particular units of a product-are quite easy to calculateIndirect costs间接成本or Overheads管理费用costs and expense that cannot be identified with particular manufacturing processes or units of productionBreakeven point 盈亏平衡点is the sales volume-the number of units sold-at which the company covers its costs-pays all its expenses Withdraw money取钱Bank account银行存款at a commercial or retail bank ,and the bank generally pays interest to the depositorsGrand loans发放贷款lend money to borrowers who need more money than they have availableMerger 合并when two or more companies join togetherTakeover bid 收购 when one company offers to acquire or buy another oneDeregulated 放松管制there are now fewer restrictions and regulations than beforeUnderwrite 承销in other words, we guarantee to buy the securities ourselves if we can’t find other purchasersPension funds养老基金companies that invest money that will later be paid to retired workersFinancial stability金融稳定this involves changing interest rates. Exchange rate 汇率the price at which their currency can be converted into other currenciesDemand 需求how much is being boughtDiscount rate 贴现率is the rate the central bank sets to lend short-term funds to commercial banksSolvency偿付能力having sufficient cash available when debts have to be paidMoney markets 货币市场the M consist of a network of corporations, financial institutions ,investors and governments, which need to borrow or invest short-term capitalCommercial paper 商业票据C is a short-term loan issued by major companies ,also sold at a discount ,it is unsecured which means it is not guaranteed by the company’s assets。

金融专业英语词汇全解Cover: 补回、冲销在金融市场的交易中,作一个原先交易动作相反的买卖,称之为补回。

如原先是买进,尔后再卖出,再进行买回的动作。

亦即使原先持有的部位,得以轧平的交易行为。

Credit Risk: 信用风险在交易完成后,交易对手因故不能履行合约而可能发生缺失的风险。

Cross Hedge: 交叉避险指利用某一交易工具的买卖,以达到规避另一交易工具风险的操作。

此两种交易工具务必具有高度的有关性,才能达到避险的工具。

Easy Money: 廉价货币由于宽松的资金状况,使资金借贷者能够用比较低的利率借得所需之资金。

亦有人称之为Cheap Money。

Effective interest Rate: 有效利率以年利率表示借贷时所实现收付的利率。

尽管各国利率相同,但利率的计算方式(单利计算或者复利计算),及计算的时间基础(每天、每月、或者每年)不一致,而使得实际收付的利率是完全不一致的,这就是有效利率有的时候不一致于名目利率的原因。

European Style Option: 欧式选择权选择权买方于到期日之前,不得要求选择权卖方履约,仅能于到期日要求选择权卖方履约。

Expiry Date: 选择权合约到期日选择权买方有权向选择权卖方要求履约的最后一日。

Face Value: 面值乃股票、债券、票据或者其它支付工具上所记载的名目价格,它既是计算利息、股息的基础;也是在到期时,持有人据以请求支付的金额。

亦有人称之为:Par value。

Far Date: 远期在换汇交易或者资金拆放市场中,就是指第二个交割日,亦即距交易日比较远的交割日。

Financial Futures: 金融期货在期货交易市场中,以金融产品如利率、货币、债券等为交易标的物的期货交易。

Firm Market: 行情挺升的市场乃指在金融市场中,市场行情持续看涨的状况,因其下跌的机率比较小因而称之为“Firm Market”。

金融英语词汇解释金融指货币的发行、流通和回笼,贷款的发放和收回,存款的存入和提取,汇兑的往来等经济活动。

接下来小编为大家整理了金融英语词汇解释,一起来学习吧!Purchase Acquisition 购股接管合并收购项目采用的会计方法,买方将目标公司当作投资,将目标公司的资产根据公平市场价值加入本身的资产Purchasing Power 购买力购买货品及服务的能力,或一个单位资金可以买到的货品及服务数量Pure Play 单一业务专门经营一种业务的公司,或股价与一种投资主题或策略的表现有密切关系的公司Put 出售权1. 一种期权合约,给与持有人以特定的价格在特定的时间内出售特定数量相关证券的权力(但并非义务)2. 行使出售期权的行动Put Bond 可卖回债券债券的一种,条款规定发行人必须在到期前的特定日期回购证券。

回购价格在发行时设定,一般相等于票值Put-Call Parity 买入-出售价差对同一种证券、到期日相同的出售期权价格与买入期权价格之间的关系Put-Call Ratio 买入-出售比率出售期权与买入期权交易量的比率,用作评估市场的投资气氛Put Warrant 出售认股权证一种认股权证,给与持有人以协定价格、在特定日期或之前出售相关股票的权力Qualified Institutional Buyer (QIB) 合资格机构投资者主要指管理最少1亿美元证券的机构,包括银行、存款及贷款公司、保险公司、投资公司、员工福利计划或合资格投资者全资拥有的股本,也包括拥有或可自主投资1000万美元证券的注册经纪人Qualitative Analysis 定性分析根据非财务信息,例如管理质量、行业周期性、研发实力及劳工关系,利用主观判断评估证券的分析方法Quality of Earnings 盈利质量销售量较高或成本较低造成盈利的金额,相对于利用不常规会计方法,例如夸张库存造成的人造利润Quantitative Analysis 定量分析指利用公司年报及损益表提供的财务资料作出投资决策的证券分析方法Quarter (Q1, Q2, Q3, Q4) 季度(第一季度、第二季度、第三季度、第四季度)财政日历内的三个月时期,作为申报盈利及支付股息的基准时期Quick Assets 速动资产可以迅速转换成为现金或已属于现金形式的资产。

金融英语期末重点总结一、基本概念与词汇1. 资产管理:Asset Management,是指对投资者个人或机构的资金进行管理和投资的活动。

2. 负债:Liability,指一个人或机构所欠他人或其他组织的货币、商品或服务等。

3. 存款:Deposit,指将货币存入银行或其他金融机构的行为。

4. 贷款:Loan,指个人或企业从银行或其他金融机构获得的资金,并按约定的利率和条件偿还。

5. 利率:Interest Rate,是指借贷资金的价格。

通常以百分比形式表示,用于衡量借贷资金的成本或回报。

6. 风险:Risk,指在投资或经营过程中遭受亏损的可能性。

7. 股票:Stock,指公司以吸引投资者的方式发行的所有权证明,股权的一部分。

8. 债券:Bond,是指债务人(发行债券的公司或政府)向债权人(购买债券的投资者)借款的债权凭证。

9. 股息:Dividend,是指上市公司向股东分配的盈利的一部分。

10. 保险:Insurance,是指保险公司架起的经济保护的桥梁,将风险分散到各个投保人,以减轻其负担。

二、金融市场与金融产品1. 证券市场:Securities Market,是指股票、债券等金融工具的交易市场。

2. 股票市场:Stock Market,是指股票的买卖市场。

主要分为一级市场和二级市场。

3. 债券市场:Bond Market,指债券的买卖市场。

分为一级市场和二级市场。

4. 期货市场:Futures Market,是指用来进行期货交易的场所。

5. 外汇市场:Foreign Exchange Market,是指用来交换不同国家货币的市场。

6. 金融衍生品:Financial Derivatives,是指与金融资产相关的衍生产品。

包括期权、期货、互换等。

7. 互联网金融:Internet Finance,是指利用互联网技术进行金融服务的新兴业态。

8. 数字货币:Digital Currency,是指用数字技术发行和流通的货币。

Absorption 吸收,一国对最终商品和劳务的总支出,包括一国的实际消费支出、实际投资支出、实际政府支出和对进口商品和劳务的实际支出。

Absorption Approach 吸收论,一种关于国际收支和汇率决定的理论,强调一国的支出(或者称为“吸收”)及收入的作用。

根据吸收论,如果一国的实际收入超过它所吸收的商品和劳务数量,那么该国的经常账户将出现盈余;如果一国的实际收入小于它所吸收的商品和劳务数量,那么该国的经常账户将出现赤字。

Absorption Instrument 吸收工具,一国政府通过改变对国内产出的购买或通过影响消费和投资支出来提高或降低该国吸收水平的能力。

Adverse Selection 逆向选择,发行融资工具的公司将借来的资金用于低价值、高风险的投资项目的倾向。

Aggregate Demand Schedule 总需求曲线,实际收入和价格水平的各种组合,这些组合使得IS -LM 模型达到均衡,从而保证了实际收入等于总计划支出并且实际货币余额市场也实现均衡。

Aggregate Expenditures Schedule 总支出曲线,描述了在各种实际国民收入水平下相应的家庭部门、公司部门和政府部门计划支出的总和。

Aggregate Net Autonomous Expenditures 总净自主性支出,可以看作与国民收入水平无关的自主性消费、自主性投资、自主性政府支出和自主性出口支出的总量。

Aggregate Supply Schedule 总供给曲线,描述在各种可能的价格水平下相应的所有工人和公司的实际产出的曲线。

American Option 美式期权,在合同到期之前(包括到期日在内),持有者可以随时买入或者卖出某种证券的期权合约。

Announcement Effect 公告效应,中央银行的政策措施信号引起人们对近期市场条件变化的预期,从而导致私营市场利率或者汇率的变化。

Assignment Problem 政策指派问题,关于中央银行和财政部究竟谁应当对达到一国国内或者国际政策目标负责的问题。

金融英语词语解释全部版第一章1、Tangible Assets有形资产Value is based on physical propertiesIntangible Assets无形资产Claim to future incomeIssuer发行者The one who makes future cash paymentsInvestor 投资者The owner of the financial assetDebt Instrument债务工具Fixed dollar payments6、Equity Instrument 权益工具Dollar payment is based on earningsFixed-income instruments 固定收益证券an equity instrument that entitles the investor to receive a fixed dollar amount. . Both debt and preferred stock that pay fixed dollar amounts are called fixed-income instruments.Price discovery process价格发现过程The interactions of buyers and sellers in a financial market determine the price of the traded asset.Liquidity 流动性whether the circumstances either force or motivate an investor to sell in financial market.Spot market or cash market即期市场和现货市场The market in which a financial asset trades for immediate delivery is called the spot market or cash market.Search costs搜索成本e.g. the mone y spent to advertise one’s intention to sell orpurchase a financial asset;the value of time spent in locating a counterparty11、 derivative instrument衍生品工具A derivative instrument is a financial asset whose value derives from the value of some other asset . The contract holder has either the obligation or the choice to buy or sell a financial asset at some future time.futures/forward contracts 期货/远期合约Futures/forward contracts are obligations that must be fulfilled at maturity, it is a contract that exchanges an asset or commodity at a fixed price in the future.13、 Options contracts期权合约Options contracts are rights, not obligations, to either buy or sell a financial asset at a specified price. The buyer of the contract must pay the seller a fee, which is called the option price.14、Call option看涨期权The option grants the owner of the option the right to buy a financial asset from the other party.15、Put option看跌期权The option grants the owner of the option the right to sell a financial asset from the other party.16、Disclosure regulation信息披露监管It requires issuers of securities to make public a large amount of financial information to actual and potential investors.17、Financial activity regulation金融行为(活动监管)It consists of rules about traders of securities and trading on financial markets.18、Regulation of financial institutions金融机构监管It is the form of governmental monitoring that restricts these institutions’ activities in the vital areas of lending, borrowing,and funding.19、Regulation of foreign participants外国参与者监管It is the form of governmental activity that limits the roles foreign firms can have in domestic markets and their ownership or control of financial institutions.20、Banking and monetary regulation银行与货币监管Authorities use it to try to control cha nges in a country’s money supply, which is thought to control the level of economic activity.21、Asymmetric information信息不对称Investors and managers have uneven access to or uneven possession of information.23、Agency problem代理问题The firm’s managers who act as agents for investors, may act in their own interests to the disadvantage of the investors.第二章1、Financial intermediaries 金融中介A special and important type of financial institutionTransforming financial assets acquired through the market and constituting 组合them into a different, and more widely preferable, type of asset, which becomes their liability.1 Depository institutions存款机构Acquire the bulk of their funds by offering their liabilities to the public mostly in the form of deposits.2 Direct investments直接投资Intermediaries obtain funds from market participants and invest these funds3 Indirect investments间接投资Market participants who give their funds to the intermediaries and who thereby hold claims on these institutions4、commercial bank商业银行accepts deposits and uses the proceeds to lend funds to consumers and businesses.5、Investment company投资公司It pools the funds of market participants and uses those funds to buy a portfolio of securities such as stocks and bonds.6、Maturity intermediation期限中介The investor (depositor) often wants only a short-term claim, which the intermediary can turn into a claim on long-term assets. This function of a financial intermediary is called maturity intermediation7、Diversification分散化投资Transforming more risky assets into less risky ones.8、Information processing costs信息处理成本e.g. the opportunity cost of the time to process the information about the financial assets and its issuer, and the cost of acquiring that information.9、Contracting costs签约成本The costs of writing loan contracts or the costs of enforcing the terms of the loan agreement.9、Payment mechanisms支付机制The methods for making payments are provided by certain financial intermediaries10、Liabilities负债It means the amount and time of the cash outlays that must be made to satisfy the contractual terms of the obligations issued11、Asset/Liability management资产/负债管理The nature of the liabilities dictates the investment strategya financial institution will pursue12、Guaranteed investment contract (GIC)保障收益合同Both amounts of cash outflows and timing are known (Type I )The obligation of the life insurance company under this contract is that, for a sum of money (called a premium), it will guarantee an interest rate up to some specified maturity date13、certificates of deposit定期存单Cash outflows are not known, but timing is known (Type III)It has a stated maturity, the interest rate paid need not be fixed over the life of the deposit but may fluctuate14、Credit risk信用风险It is the risk that the obligor of a financial instrument held by a financial institution will fail to fulfill its obligation on the due date or at any time thereafter15、Settlement risk交割风险It is the risk that when there is a settlement of a trade or obligation, the transfer fails to take place as expected.It consists of counterparty risk and a form of liquidity risk.16、Counterparty risk交易对手违约风险It is the risk that a counterparty in a trade fails to satisfy its obligation17、Liquidity risk流动性风险In the context of settlement risk, it means that the counterparty can eventually meet its obligations, but not at the due date.In addition to being a part of settlement risk, it has two forms: market liquidity risk and funding liquidity risk.18、Market liquidity risk 市场流动性风险It is the risk that a financial institution is unable to transact in a financial instrument at a price near its market value19、Funding liquidity risk融资流动性风险 (资金流动性风险)It is the risk that the financial institution will be unable to obtain funding to obtain cash flow necessary to satisfy its obligations20、Market risk市场风险It is the risk to a financial institution’s economic well being that results from an adverse movement in the market price of the asset it owns or the level or the volatility of market prices. There are measures that can be used to gauge this risk.21、value-at-risk风险价值It is one of measures that can be used to gauge market riskA measure of the potential loss in a financial institution’s financial position associated with an adverse price movement ofa given probability over a specified time horizon22、Operational risk操作风险It is the risk of loss resulting from inadequate or failed internal processes, people and systems, or from external events Classified by the cause of the loss event: employees, business process, relationships, technology, and external factors23、legal risk法律风险This is the risk of loss resulting from failure to comply with laws as well as prudent ethical standards and contractual obligations24、Incentive fee激励费It is a share of the positive return which performance-based compensation in the management fee structure for hedge funds25、Absolute return绝对收益It is simply the return realized26、Relative return相对收益It is the difference between the absolute return and thereturn on some benchmark or index27、Market directional hedge fund市场导向型对冲基金It is one in which the asset manager retains some exposure to systemic risk28、Corporate restructuring hedge fund公司重组型对冲基金It is one in which the asset manager positions the portfolio to capitalize on the anticipated impact of a significant corporate event. These events include a merger, acquisition, or bankruptcy29、Convergence trading hedge fund收敛交易型对冲基金It uses a strategy to take advantage of misalignment of prices or yields, an arbitrage strategy.technically, arbitrage means riskless profit. Some strategies used by hedge funds do not really involve no risk, but instead low risk strategies of price misalignments误差30、Opportunistic hedge fund机会主义型对冲基金It has the broadest mandate of all of the four hedge fund categories. Asset managers of hedge funds can make specific bets on stocks or currencies or they could have well-diversified portfolios. These include fund of funds, and global macro hedge funds that invest opportunistically based on macroeconomic considerations in any world market.第三章1、Spread income利差收入MarginIt should allow the depository institution to meet operating expenses and earn a fair profit on its capital2、Regulatory risk监管风险It is the risk that regulators will change the rules so as to adversely impact the earnings of the institution3、Secondary reserves次级储备Securities held for the purpose of satisfying net withdrawals and customer loan demands4、Individual Banking个人银行业务It encompasses residential mortgage lending, consumer installment loans, credit card financing, brokerage services, student loans,5、Institutional banking企业银行业务It includes commercial real estate financing, leasing activities, and factoring, etc.5、Global banking国际业务It includes corporate financing, capital market and foreign exchange products and services.Most global banking activities generate fee income rather than interest income.5、Demand deposits活期存款Checking accountspay no interest and can be withdrawn upon demand6、Savings deposits储蓄存款pay interest, typically below market interest rates, do not have a specific maturity, and usually can be withdrawn upon demand7、Time deposits定期存款also called certificates of deposit, have a fixed maturity date and pay either a fixed or floating interest rate8、Reserve ratio准备金率It is the specified percentage of deposits in a non-interest-bearing account at one of the 12 Federal Reserve Banks that a bank must maintainIt is established by the Federal Reserve Board9、Required reserve法定准备金The dollar amount based on the reserve ratio that are required to be kept on deposit at a Federal Reserve Bank10、deposit computation period存款计算周期To compute the required reserve, the Federal Reserve has established a two-week period11、excess reserves超额准备金The difference is that actual reserves exceed required reserves12、Federal funds market联邦基金市场Banks temporarily short of their required reserves can borrow reserves from banks that have excess reserves The market where banks can borrow or lend reserves is called thefederal funds market13、Federal funds rate联邦基金利率The interest rate charged to borrow funds in the federal funds market14、Discount window贴现窗口The Federal Reserve Bank is the bank of last resort. Banks temporarily short of funds can borrow from the Fed at its discount window.Collateral is necessary to borrow, but not just any collateral will do, and the Fed sets the criteria for collateral quality15、Discount rate贴现率The interest rate that the Fed charges to borrow funds at the discount window16、Money center banks货币中央银行The banks that raise most of their funds from the domestic and international money markets, relying less on depositors forfunds17、Regional bank区域性银行It is one that relies primarily on deposits for funding, and makes less use of the money markets to obtain funds18、Superregional banks超级区域性银行Larger regional banks have been merging with other regional banks to form Superregional banks19、Core Capital核心资本金Tier 1 CapitalIt consists of common stockholders’ equity, certain types of preferred stock, and minority interest in consolidated subsidiaries20、Supplementary Capital补充资本金Tier 2 capitalIt includes loan-loss reserve, certain types of preferred stock, perpetual debt, hybrid capital instruments, equity contract notes, and subordinated debt21、Natural person credit unions自然人信用合作社Federal and state chartered credit unions are called natural person credit unionsProvide financial services to qualifying members of the general public22、Corporate credit unions 公司信用合作社Provide a variety of investment services, as well as payment systems, only to natural person credit unions第六章1、Premiums保费Insurance companies sell insurance policies, which are legallybinding contracts for which the policyholder pays insurance premiums2、Risk bearers 风险承担者According to the insurance contract, insurance companies promise to pay specified sums contingent on the occurrence of future events, such as death or an automobile accident. For insurance companies, they accept or underwrite给...保险;承诺支付the risk in return for an insurance premium2、Underwriting process销售过程It is deciding which applications for insurance they should accept and which ones they should reject, and if they accept, determining how much they should charge for the insurance3、Life Insurance人寿保险For life insurance, the risk insured against is the death of the “insured”.4、Health insurance健康保险In the case of health insurance, the risk insured is medical treatment of the insured.5、Property and casualty insurance财产与意外伤害保险The risk insured by Property and casualty (P&C) insurance companies is damage to various types of property. Specifically, it is insurance against financial loss caused by damage, destruction, or loss toproperty as the result of an identifiable event that is sudden, unexpected, or unusual.6、Liability Insurance责任保险The risk insured against is litigation, or the risk of lawsuits against the insured due to actions by the insured or others.7、Disability Insurance伤残险It insures against the inability of employed persons to earnan income8、Long-Term Care Insurance长期护理保险It provides custodial care for the aged who are no longer able to care for themselves9、Annuity年金It is often described as a mutual fund in an insurance wrapper. It is treated as an insurance product and as a result receives a preferential tax treatment. Specifically, the income and realized gains are not taxable if not withdrawn from the annuity product. It can be either fixed, or variable.10、Bankassurance 银行保险Insurance companies are attracted by commercial bank customer contacts. As a result, commercial bank distribution of insurance company products has grown considerably.11、Stock Insurance Company股份保险公司It is similar in structure to any corporation or public company. Shares (of ownership) are owned by independent shareholders and are traded publicly. The shareholders care only about the performance of their shares, that is, the stock appreciation and the dividends. The insurance policies are simply the products or business of the company.11、Reinsure 再保险Some insurance companies may reinsure some or all of the liabilities they incur in providing insurance. According to the reinsurance transaction, the initial insurer 保险公司,承保人transfers the risk of the insurance to another company,。

The people’s bank of china (which marked the beginning of a new chapter in the chinese banking history)Monetary statistics(货币统计)The lending facilities(贷款工具)Credit(信用,贷款)Interest subsidies(利息补贴;贴息)Off-site surveillance(非现场监管)Monetary policy instruments(货币政策工具)Financial risks(金融风险)Anti-money laundering(反洗钱)Credit information market(征信市场)Central bank(中央银行)Joint-equity commercial bank(股份制商业银行)Policy bank(政策性银行)Reform and opening up(改革开放)Macro-adjustment(宏观调控)Fixed asset(固定资产)Foreign exchange reserve(外汇储备)Currency distribution(现金调拨)Policy-related credit(政策性贷款)Benchmark interest rate(基准利率)Credit insurance(信用保险)state administration of foreign exchange(外汇管理局)The international bank for reconstruction and development(IBRD)(国际复兴开发银行)The international development association(IDA)(国际开发协会)The multilateral investment guarantee agency(MIGA)( 多边投资担保机构)Less developed countries(LDC)(不发达国家)Joint ventures(合资企业)Invite bid or tender(招标)Stock exchange(证券交易所)Grace period(宽限期)Foreign exchange reserve position(外汇储备头寸)Per capita income(人均收入)Subscribed capital(认缴股本)Annual report(年报)Host country(东道国)Hard loan(条件苛刻的贷款)(loans at prevailing market interest rates and are granted only to sound borrowers for periods not exceeding 25 years)International finance corporation(国际金融公司)Payments facilities(支付工具)Savers(the end-users of the financial system )Investors(who want to borrow money to buy capital goods or increase the scale of their bussiness)Financial intermediaries(the institutions which attempt to serve the needs of bothlenders and borrowers)Brokers and advisers(which attempt to ensure that lenders and borrowers ,buyers and sellers have the facts they need to strike a fair bargain)Regulators(who control their financial institutions and regulate dealings in securities markets with the objects of ensuring their institutions are able to honour their commitments)Transactions costs(交易成本)Market makers(做市商)(professional dealers whose funtion is to ensure that lenders and borrowers are always able to find a counterpart for their deals)Fiancial instruments(金融工具)Liability(债务)Ordinary shares(普通股)Investment trust(信托投资公司)Building society(房屋互助协会)Venture capital(风险资本)Discount house(贴现行)Note-issuing authority(货币发行机构)II owe you(IOU)(欠条)Derivative instrument(衍生工具)Liquidity(流动性)Financial market(金融市场)Medium of exchange(交易媒介)(a commodity or token that is generally accepted in exchange goods and services)Unit of account(价值尺度)(an agreed meaure for staing the prices of goods and services)Store of value(价值储存)(any commodity or token that can be held and exchanged later for goods and services)standard of deferred payment(支付手段)(an agreed measure that enables contracts to be written for futrue receipts and payments )Commodity money(商品货币)(a physical money that is valued in its right and also used as a means of payment)Convertible paper money(可兑换货币)(when a paper claim to a commodity circulates as a means of payment)Fiat money (法币)(legal tender ,especially paper currency ,authorized by a government but not based on or convertible into gold or silver)Fractional backing(部分支持)Private debt money(私人账务货币)(a loan that the borrower promised to repay in currency on demend)Coincidence(同时发生)Opportunity cost(机会成本)Double coincidence of wants(双方需求一致)Debasement(贬值)Greenback(美元)Checkable deposit(支票存款)The bretton woods system((布雷顿森林体系)International liquidity(国际清偿能力)Commodity standard(商品本位)Gold standard(金本位)Gold point(黄金输送点)(汇率变动的上下临界值)Par value(平价)Fiat system(不兑现制度)No-monetary gold(非货币性黄金)The gold exchange standard(金汇兑本位制)Balance of payments surplus(deficit)国际收支平衡(赤字)Mint parity(铸币平价)(两国单位货币含金量之比)International reserve assets(国际储备资产)Internal and external target(国内外目标)Capital control(资本控制)Hedgers(套期保值者)(risk averse,who use such contracts to insure against the extreme changes in exchange and interest rates or stock market prices)Traders(交易商)(who use such contracts as a means of gearing up their exposures at low cost with a view to profit)Arbitrageur(套利人)(whose existence is about the exploitation of opportunities for profit which thrown up by price anomalies between different instruments and markets)Clearing house (清算中心)Floors of commodity exchanges(商品交易所)Delivery of an asset(商品交割)Floors of exchange(股票交易所)Open outcry(公开叫价)Initial margin(初始保证金)Variation margin(追加保证金)Marked to market(盯市)Settlement price(交割价)Over –the- counter(柜台交易)Equity option(股票期权)Life Insurance policies(人寿保险单)Joint policies(联合保险单)。