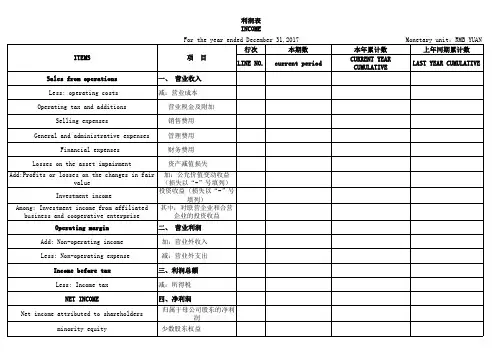

利润及利润分配表英文模版

- 格式:doc

- 大小:53.00 KB

- 文档页数:1

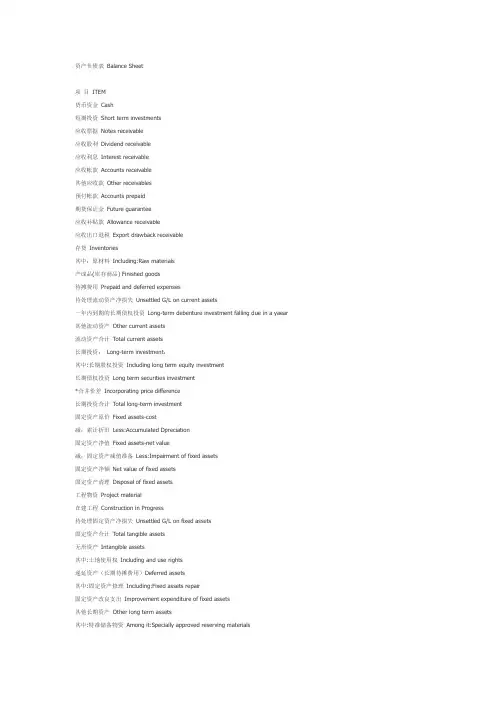

资产负债表Balance Sheet项目ITEM货币资金Cash短期投资Short term investments应收票据Notes receivable应收股利Dividend receivable应收利息Interest receivable应收帐款Accounts receivable其他应收款Other receivables预付帐款Accounts prepaid期货保证金Future guarantee应收补贴款Allowance receivable应收出口退税Export drawback receivable存货Inventories其中:原材料Including:Raw materials产成品(库存商品) Finished goods待摊费用Prepaid and deferred expenses待处理流动资产净损失Unsettled G/L on current assets一年内到期的长期债权投资Long-term debenture investment falling due in a yaear 其他流动资产Other current assets流动资产合计Total current assets长期投资:Long-term investment:其中:长期股权投资Including long term equity investment长期债权投资Long term securities investment*合并价差Incorporating price difference长期投资合计Total long-term investment固定资产原价Fixed assets-cost减:累计折旧Less:Accumulated Dpreciation固定资产净值Fixed assets-net value减:固定资产减值准备Less:Impairment of fixed assets固定资产净额Net value of fixed assets固定资产清理Disposal of fixed assets工程物资Project material在建工程Construction in Progress待处理固定资产净损失Unsettled G/L on fixed assets固定资产合计Total tangible assets无形资产Intangible assets其中:土地使用权Including and use rights递延资产(长期待摊费用)Deferred assets其中:固定资产修理Including:Fixed assets repair固定资产改良支出Improvement expenditure of fixed assets其他长期资产Other long term assets其中:特准储备物资Among it:Specially approved reserving materials无形及其他资产合计Total intangible assets and other assets递延税款借项Deferred assets debits资产总计Total Assets资产负债表(续表) Balance Sheet项目ITEM短期借款Short-term loans应付票款Notes payable应付帐款Accounts payab1e预收帐款Advances from customers应付工资Accrued payro1l应付福利费Welfare payable应付利润(股利) Profits payab1e应交税金Taxes payable其他应交款Other payable to government其他应付款Other creditors预提费用Provision for expenses预计负债Accrued liabilities一年内到期的长期负债Long term liabilities due within one year 其他流动负债Other current liabilities流动负债合计Total current liabilities长期借款Long-term loans payable应付债券Bonds payable长期应付款long-term accounts payable专项应付款Special accounts payable其他长期负债Other long-term liabilities其中:特准储备资金Including:Special reserve fund长期负债合计Total long term liabilities递延税款贷项Deferred taxation credit负债合计Total liabilities* 少数股东权益Minority interests实收资本(股本) Subscribed Capital国家资本National capital集体资本Collective capital法人资本Legal person"s capital其中:国有法人资本Including:State-owned legal person"s capital 集体法人资本Collective legal person"s capital个人资本Personal capital外商资本Foreign businessmen"s capital资本公积Capital surplus盈余公积surplus reserve其中:法定盈余公积Including:statutory surplus reserve公益金public welfare fund补充流动资本Supplermentary current capital* 未确认的投资损失(以“-”号填列)Unaffirmed investment loss未分配利润Retained earnings外币报表折算差额Converted difference in Foreign Currency Statements所有者权益合计Total shareholder"s equity负债及所有者权益总计Total Liabilities & Equity利润表INCOME STATEMENT项目ITEMS产品销售收入Sales of products其中:出口产品销售收入Including:Export sales减:销售折扣与折让Less:Sales discount and allowances产品销售净额Net sales of products减:产品销售税金Less:Sales tax产品销售成本Cost of sales其中:出口产品销售成本Including:Cost of export sales产品销售毛利Gross profit on sales减:销售费用Less:Selling expenses管理费用General and administrative expenses财务费用Financial expenses其中:利息支出(减利息收入) Including:Interest expenses (minusinterest ihcome) 汇兑损失(减汇兑收益)Exchange losses(minus exchange gains)产品销售利润Profit on sales加:其他业务利润Add:profit from other operations营业利润Operating profit加:投资收益Add:Income on investment加:营业外收入Add:Non-operating income减:营业外支出Less:Non-operating expenses加:以前年度损益调整Add:adjustment of loss and gain for previous years利润总额Total profit减:所得税Less:Income tax净利润Net profit现金流量表Cash Flows StatementPrepared by:Period: Unit:Items1.Cash Flows from Operating Activities:01)Cash received from sales of goods or rendering of services02)Rental receivedValue added tax on sales received and refunds of value03)added tax paid04)Refund of other taxes and levy other than value added tax07)Other cash received relating to operating activities08)Sub-total of cash inflows09)Cash paid for goods and services10)Cash paid for operating leases11)Cash paid to and on behalf of employees12)Value added tax on purchases paid13)Income tax paid14)Taxes paid other than value added tax and income tax17)Other cash paid relating to operating activities18)Sub-total of cash outflows19)Net cash flows from operating activities2.Cash Flows from Investing Activities:20)Cash received from return of investments21)Cash received from distribution of dividends or profits22)Cash received from bond interest incomeNet cash received from disposal of fixed assets,intangible 23)assets and other long-term assets26)Other cash received relating to investing activities27)Sub-total of cash inflowsCash paid to acquire fixed assets,intangible assets28)and other long-term assets29)Cash paid to acquire equity investments30)Cash paid to acquire debt investments33)Other cash paid relating to investing activities34)Sub-total of cash outflows35)Net cash flows from investing activities3.Cash Flows from Financing Activities:36)Proceeds from issuing shares37)Proceeds from issuing bonds38)Proceeds from borrowings41)Other proceeds relating to financing activities42)Sub-total of cash inflows43)Cash repayments of amounts borrowed44)Cash payments of expenses on any financing activities45)Cash payments for distribution of dividends or profits46)Cash payments of interest expenses47)Cash payments for finance leases48)Cash payments for reduction of registered capital51)Other cash payments relating to financing activities52)Sub-total of cash outflows53)Net cash flows from financing activities4.Effect of Foreign Exchange Rate Changes on Cash Increase in Cash and Cash EquivalentsSupplemental Information1.Investing and Financing Activities that do not Involve in Cash Receipts and Payments56)Repayment of debts by the transfer of fixed assets57)Repayment of debts by the transfer of investments58)Investments in the form of fixed assets59)Repayments of debts by the transfer of investories2.Reconciliation of Net Profit to Cash Flows from Operating Activities62)Net profit63)Add provision for bad debt or bad debt written off64)Depreciation of fixed assets65)Amortization of intangible assetsLosses on disposal of fixed assets,intangible assets66)and other long-term assets (or deduct:gains)67)Losses on scrapping of fixed assets68)Financial expenses69)Losses arising from investments (or deduct:gains)70)Defered tax credit (or deduct:debit)71)Decrease in inventories (or deduct:increase)72)Decrease in operating receivables (or deduct:increase)73)Increase in operating payables (or deduct:decrease)74)Net payment on value added tax (or deduct:net receipts75)Net cash flows from operating activities Increase in Cash and Cash Equivalents76)cash at the end of the period77)Less:cash at the beginning of the period78)Plus:cash equivalents at the end of the period79)Less:cash equivalents at the beginning of the period80)Net increase in cash and cash equivalents现金流量表的现金流量声明拟制人:时间:单位:项目1.cash流量从经营活动:01 )所收到的现金从销售货物或提供劳务02 )收到的租金增值税销售额收到退款的价值03 )增值税缴纳04 )退回的其他税收和征费以外的增值税07 )其他现金收到有关经营活动08 )分,总现金流入量09 )用现金支付的商品和服务10 )用现金支付经营租赁11 )用现金支付,并代表员工12 )增值税购货支付13 )所得税的缴纳14 )支付的税款以外的增值税和所得税17 )其他现金支付有关的经营活动18 )分,总的现金流出19 )净经营活动的现金流量2.cash流向与投资活动:20 )所收到的现金收回投资21 )所收到的现金从分配股利,利润22 )所收到的现金从国债利息收入现金净额收到的处置固定资产,无形资产23 )资产和其他长期资产26 )其他收到的现金与投资活动27 )小计的现金流入量用现金支付购建固定资产,无形资产28 )和其他长期资产29 )用现金支付,以获取股权投资30 )用现金支付收购债权投资33 )其他现金支付的有关投资活动34 )分,总的现金流出35 )的净现金流量,投资活动产生3.cash流量筹资活动:36 )的收益,从发行股票37 )的收益,由发行债券38 )的收益,由借款41 )其他收益有关的融资活动42 ),小计的现金流入量43 )的现金偿还债务所支付的44 )现金支付的费用,对任何融资活动45 )支付现金,分配股利或利润46 )以现金支付的利息费用47 )以现金支付,融资租赁48 )以现金支付,减少注册资本51 )其他现金收支有关的融资活动52 )分,总的现金流出53 )的净现金流量从融资活动4.effect的外汇汇率变动对现金增加现金和现金等价物补充资料1.investing活动和筹资活动,不参与现金收款和付款56 )偿还债务的转让固定资产57 )偿还债务的转移投资58 )投资在形成固定资产59 )偿还债务的转移库存量2.reconciliation净利润现金流量从经营活动62 )净利润63 )补充规定的坏帐或不良债务注销64 )固定资产折旧65 )无形资产摊销损失处置固定资产,无形资产66 )和其他长期资产(或减:收益)67 )损失固定资产报废68 )财务费用69 )引起的损失由投资管理(或减:收益)70 )defered税收抵免(或减:借记卡)71 )减少存货(或减:增加)72 )减少经营性应收(或减:增加)73 )增加的经营应付账款(或减:减少)74 )净支付的增值税(或减:收益净额75 )净经营活动的现金流量增加现金和现金等价物76 )的现金,在此期限结束77 )减:现金期开始78 )加:现金等价物在此期限结束79 )减:现金等价物期开始80 ),净增加现金和现金等价物。

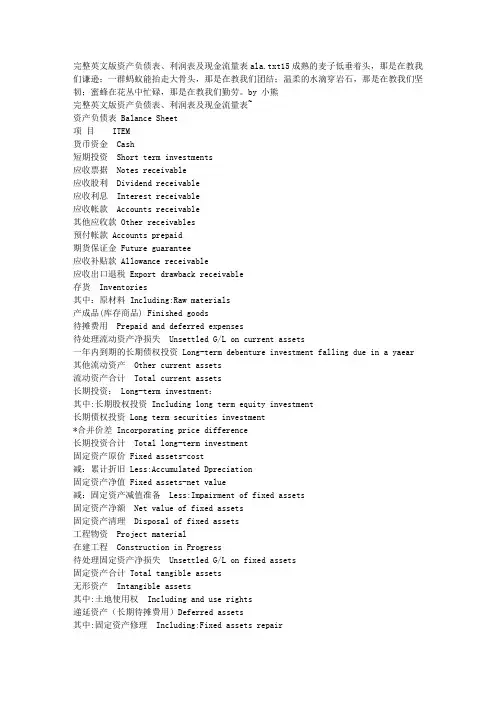

完整英文版资产负债表、利润表及现金流量表ala.txt15成熟的麦子低垂着头,那是在教我们谦逊;一群蚂蚁能抬走大骨头,那是在教我们团结;温柔的水滴穿岩石,那是在教我们坚韧;蜜蜂在花丛中忙碌,那是在教我们勤劳。

by 小熊完整英文版资产负债表、利润表及现金流量表~资产负债表 Balance Sheet项目 ITEM货币资金 Cash短期投资 Short term investments应收票据 Notes receivable应收股利 Dividend receivable应收利息 Interest receivable应收帐款 Accounts receivable其他应收款 Other receivables预付帐款 Accounts prepaid期货保证金 Future guarantee应收补贴款 Allowance receivable应收出口退税 Export drawback receivable存货 Inventories其中:原材料 Including:Raw materials产成品(库存商品) Finished goods待摊费用 Prepaid and deferred expenses待处理流动资产净损失 Unsettled G/L on current assets一年内到期的长期债权投资 Long-term debenture investment falling due in a yaear 其他流动资产 Other current assets流动资产合计 Total current assets长期投资: Long-term investment:其中:长期股权投资 Including long term equity investment长期债权投资 Long term securities investment*合并价差 Incorporating price difference长期投资合计 Total long-term investment固定资产原价 Fixed assets-cost减:累计折旧 Less:Accumulated Dpreciation固定资产净值 Fixed assets-net value减:固定资产减值准备 Less:Impairment of fixed assets固定资产净额 Net value of fixed assets固定资产清理 Disposal of fixed assets工程物资 Project material在建工程 Construction in Progress待处理固定资产净损失 Unsettled G/L on fixed assets固定资产合计 Total tangible assets无形资产 Intangible assets其中:土地使用权 Including and use rights递延资产(长期待摊费用)Deferred assets其中:固定资产修理 Including:Fixed assets repair固定资产改良支出 Improvement expenditure of fixed assets其他长期资产 Other long term assets其中:特准储备物资 Among it:Specially approved reserving materials 无形及其他资产合计 Total intangible assets and other assets递延税款借项 Deferred assets debits资产总计 Total Assets资产负债表(续表) Balance Sheet项目 ITEM短期借款 Short-term loans应付票款 Notes payable应付帐款 Accounts payab1e预收帐款 Advances from customers应付工资 Accrued payro1l应付福利费 Welfare payable应付利润(股利) Profits payab1e应交税金 Taxes payable其他应交款 Other payable to government其他应付款 Other creditors预提费用 Provision for expenses预计负债 Accrued liabilities一年内到期的长期负债 Long term liabilities due within one year其他流动负债 Other current liabilities流动负债合计 Total current liabilities长期借款 Long-term loans payable应付债券 Bonds payable长期应付款 long-term accounts payable专项应付款 Special accounts payable其他长期负债 Other long-term liabilities其中:特准储备资金 Including:Special reserve fund长期负债合计 Total long term liabilities递延税款贷项 Deferred taxation credit负债合计 Total liabilities* 少数股东权益 Minority interests实收资本(股本) Subscribed Capital国家资本 National capital集体资本 Collective capital法人资本 Legal person"s capital其中:国有法人资本 Including:State-owned legal person"s capital集体法人资本 Collective legal person"s capital个人资本 Personal capital外商资本 Foreign businessmen"s capital资本公积 Capital surplus盈余公积 surplus reserve其中:法定盈余公积 Including:statutory surplus reserve公益金 public welfare fund补充流动资本 Supplermentary current capital* 未确认的投资损失(以“-”号填列) Unaffirmed investment loss未分配利润 Retained earnings外币报表折算差额 Converted difference in Foreign Currency Statements所有者权益合计 Total shareholder"s equity负债及所有者权益总计 Total Liabilities & Equity利润表 INCOME STATEMENT项目 ITEMS产品销售收入Sales of products其中:出口产品销售收入 Including:Export sales减:销售折扣与折让 Less:Sales discount and allowances产品销售净额Net sales of products减:产品销售税金Less:Sales tax产品销售成本 Cost of sales其中:出口产品销售成本Including:Cost of export sales产品销售毛利 Gross profit on sales减:销售费用 Less:Selling expenses管理费用General and administrative expenses财务费用Financial expenses其中:利息支出(减利息收入) Including:Interest expenses (minusinterest ihcome) 汇兑损失(减汇兑收益) Exchange losses(minus exchange gains)产品销售利润Profit on sales加:其他业务利润Add:profit from other operations营业利润Operating profit加:投资收益Add:Income on investment加:营业外收入Add:Non-operating income减:营业外支出Less:Non-operating expenses加:以前年度损益调整Add:adjustment of loss and gain for previous years利润总额 Total profit减:所得税 Less:Income tax净利润 Net profit现金流量表Cash Flows StatementPrepared by: Period: Unit:Items1.Cash Flows from Operating Activities:01)Cash received from sales of goods or rendering of services02)Rental receivedValue added tax on sales received and refunds of value03)added tax paid04)Refund of other taxes and levy other than value added tax07)Other cash received relating to operating activities08)Sub-total of cash inflows09)Cash paid for goods and services10)Cash paid for operating leases11)Cash paid to and on behalf of employees12)Value added tax on purchases paid13)Income tax paid14)Taxes paid other than value added tax and income tax17)Other cash paid relating to operating activities18)Sub-total of cash outflows19)Net cash flows from operating activities2.Cash Flows from Investing Activities:20)Cash received from return of investments21)Cash received from distribution of dividends or profits22)Cash received from bond interest incomeNet cash received from disposal of fixed assets,intangible 23)assets and other long-term assets26)Other cash received relating to investing activities27)Sub-total of cash inflowsCash paid to acquire fixed assets,intangible assets28)and other long-term assets29)Cash paid to acquire equity investments30)Cash paid to acquire debt investments33)Other cash paid relating to investing activities34)Sub-total of cash outflows35)Net cash flows from investing activities3.Cash Flows from Financing Activities:36)Proceeds from issuing shares37)Proceeds from issuing bonds38)Proceeds from borrowings41)Other proceeds relating to financing activities42)Sub-total of cash inflows43)Cash repayments of amounts borrowed44)Cash payments of expenses on any financing activities45)Cash payments for distribution of dividends or profits46)Cash payments of interest expenses47)Cash payments for finance leases48)Cash payments for reduction of registered capital51)Other cash payments relating to financing activities52)Sub-total of cash outflows53)Net cash flows from financing activities4.Effect of Foreign Exchange Rate Changes on Cash Increase in Cash and Cash EquivalentsSupplemental Information1.Investing and Financing Activities that do not Involve in Cash Receipts and Payments56)Repayment of debts by the transfer of fixed assets57)Repayment of debts by the transfer of investments58)Investments in the form of fixed assets59)Repayments of debts by the transfer of investories2.Reconciliation of Net Profit to Cash Flows from Operating Activities62)Net profit63)Add provision for bad debt or bad debt written off64)Depreciation of fixed assets65)Amortization of intangible assetsLosses on disposal of fixed assets,intangible assets66)and other long-term assets (or deduct:gains)67)Losses on scrapping of fixed assets68)Financial expenses69)Losses arising from investments (or deduct:gains)70)Defered tax credit (or deduct:debit)71)Decrease in inventories (or deduct:increase)72)Decrease in operating receivables (or deduct:increase)73)Increase in operating payables (or deduct:decrease)74)Net payment on value added tax (or deduct:net receipts75)Net cash flows from operating activities Increase in Cash and Cash Equivalents76)cash at the end of the period77)Less:cash at the beginning of the period78)Plus:cash equivalents at the end of the period79)Less:cash equivalents at the beginning of the period80)Net increase in cash and cash equivalentsby 小熊。

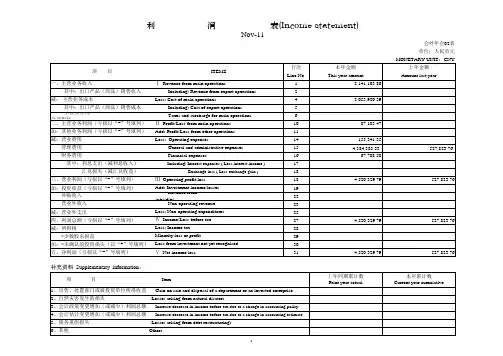

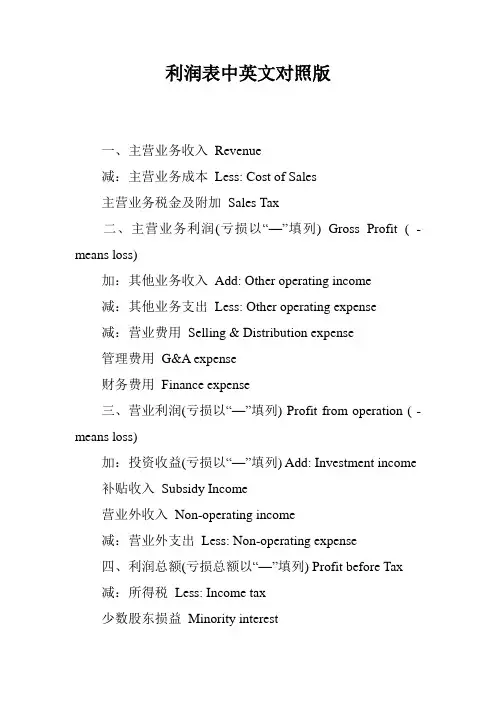

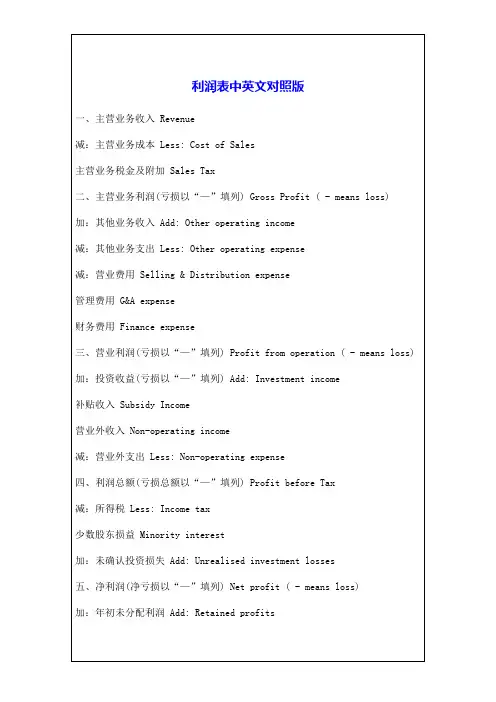

利润表中英文对照版一、主营业务收入Revenue减:主营业务成本Less: Cost of Sales主营业务税金及附加Sales Tax二、主营业务利润(亏损以“—”填列) Gross Profit ( - means loss)加:其他业务收入Add: Other operating income减:其他业务支出Less: Other operating expense减:营业费用Selling & Distribution expense管理费用G&A expense财务费用Finance expense三、营业利润(亏损以“—”填列) Profit from operation ( - means loss)加:投资收益(亏损以“—”填列) Add: Investment income 补贴收入Subsidy Income营业外收入Non-operating income减:营业外支出Less: Non-operating expense四、利润总额(亏损总额以“—”填列) Profit before Tax减:所得税Less: Income tax少数股东损益Minority interest加:未确认投资损失Add: Unrealised investment losses五、净利润(净亏损以“—”填列) Net profit ( - means loss)加:年初未分配利润Add: Retained profits其他转入Other transfer-in六、可供分配的利润Profit available for distribution( - means loss)减:提取法定盈余公积Less: Appropriation of statutory surplus reserves提取法定公益金Appropriation of statutory welfare fund提取职工奖励及福利基金Appropriation of staff incentive and welfare fund提取储备基金Appropriation of reserve fund提取企业发展基金Appropriation of enterprise expansion fund利润归还投资Capital redemption七、可供投资者分配的利润Profit available for owners distribution减:应付优先股股利Less: Appropriation of preference shares dividend提取任意盈余公积Appropriation of discretionary surplus reserve应付普通股股利Appropriation of ordinary sharesdividend转作资本(或股本)的普通股股利Transfer from ordinary shares dividend to paid in capital八、未分配利润Retained profit after appropriation补充资料:Supplementary Information:1. 出售、处置部门或被投资单位收益Gains on disposal of operating divisions or investments2. 自然灾害发生损失Losses from natural disaster3. 会计政策变更增加(或减少)利润总额Increase (decrease) in profit due to changes in accounting policies4. 会计估计变更增加(或减少)利润总额Increase (decrease) in profit due to changes in accounting estimates5. 债务重组损失Losses from debt restructuring。

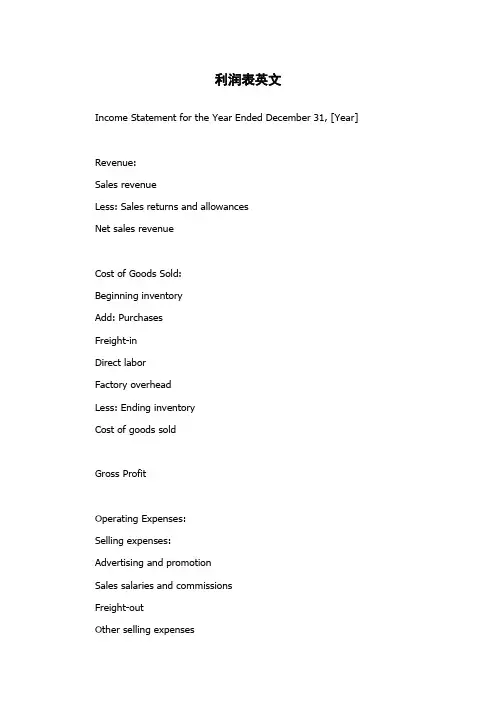

利润表英文Income Statement for the Year Ended December 31, [Year]Revenue:Sales revenueLess: Sales returns and allowancesNet sales revenueCost of Goods Sold:Beginning inventoryAdd: PurchasesFreight-inDirect laborFactory overheadLess: Ending inventoryCost of goods soldGross ProfitOperating Expenses:Selling expenses:Advertising and promotionSales salaries and commissionsFreight-outOther selling expensesGeneral and administrative expenses: Office salariesOffice rentOffice suppliesInsuranceOther general and administrative expenses Total operating expensesOperating IncomeOther Income:Interest incomeGain on sale of assetsOther incomeTotal Other IncomeIncome Before TaxesIncome TaxesNet IncomeNotes to Financial Statements:1. Revenue Recognition: Sales revenue is recognized when the title to goods is transferred to the customer, which generally occurs upon shipment or delivery of goods. Sales returns and allowances are estimated based on historical experience and are recorded as a reduction of sales revenue at the time of sale.2. Cost of Goods Sold: Cost of goods sold includes all costs directly attributable to the production of goods, including raw materials, direct labor, and factory overhead. Ending inventory is valued at the lower of cost or market.3. Operating Expenses: Selling expenses are those expenses incurred to market and distribute products, and general and administrative expenses are those expenses necessary to manage the business as a whole.4. Other Income: Interest income represents interest earned on cash and cash equivalents, while gain on sale of assets represents the excess of sales price over the carrying value of assets sold. Other income includes non-operating income.5. Income Taxes: Income taxes are calculated based on the federal and state statutory rates and are adjusted for tax credits and deductions.6. Earnings Per Share: Earnings per share are calculated by dividing net income by the weighted average number of common shares outstanding during the period.7. Significant Accounting Policies: Refer to the accompanying notes for a summary of significant accounting policies adopted.。

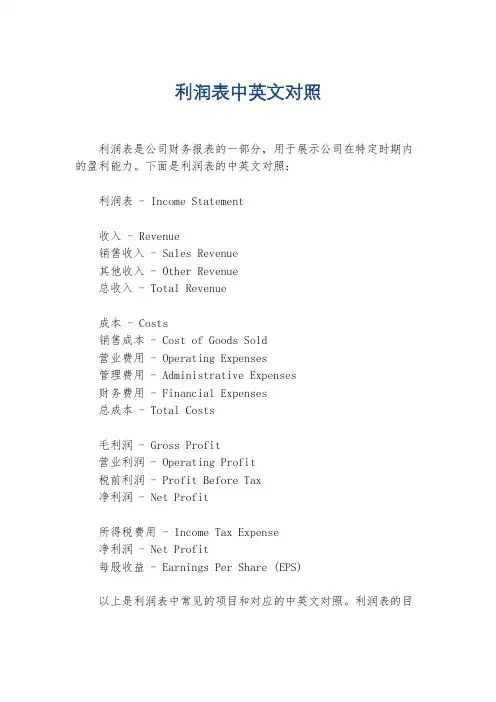

利润表中英文对照

利润表是公司财务报表的一部分,用于展示公司在特定时期内的盈利能力。

下面是利润表的中英文对照:

利润表 - Income Statement

收入 - Revenue

销售收入 - Sales Revenue

其他收入 - Other Revenue

总收入 - Total Revenue

成本 - Costs

销售成本 - Cost of Goods Sold

营业费用 - Operating Expenses

管理费用 - Administrative Expenses

财务费用 - Financial Expenses

总成本 - Total Costs

毛利润 - Gross Profit

营业利润 - Operating Profit

税前利润 - Profit Before Tax

净利润 - Net Profit

所得税费用 - Income Tax Expense

净利润 - Net Profit

每股收益 - Earnings Per Share (EPS)

以上是利润表中常见的项目和对应的中英文对照。

利润表的目

的是向投资者、股东和其他利益相关方展示公司在特定时期内的盈利情况,以便他们能够评估公司的财务状况和经营业绩。

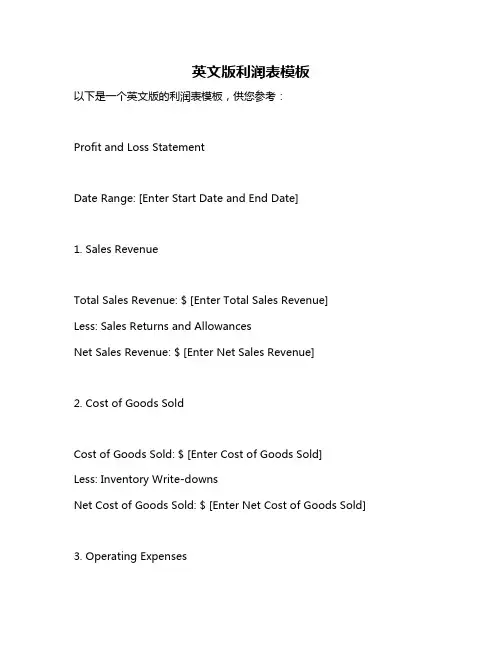

英文版利润表模板以下是一个英文版的利润表模板,供您参考:Profit and Loss StatementDate Range: [Enter Start Date and End Date]1. Sales RevenueTotal Sales Revenue: $ [Enter Total Sales Revenue] Less: Sales Returns and AllowancesNet Sales Revenue: $ [Enter Net Sales Revenue]2. Cost of Goods SoldCost of Goods Sold: $ [Enter Cost of Goods Sold] Less: Inventory Write-downsNet Cost of Goods Sold: $ [Enter Net Cost of Goods Sold] 3. Operating ExpensesMarketing Expenses: $ [Enter Marketing Expenses] Administrative Expenses: $ [Enter Administrative Expenses] Research and Development Expenses: $ [Enter Research and Development Expenses]Total Operating Expenses: $ [Enter Total Operating Expenses] Less: Operating Income from Discontinued OperationsNet Operating Expenses: $ [Enter Net Operating Expenses]4. Other Income and ExpensesInterest Income: $ [Enter Interest Income]Interest Expense: $ [Enter Interest Expense]Foreign Exchange Gains (Losses): $ [Enter Foreign Exchange Gains (Losses)]Other Income and Expenses: $ [Enter Other Income and Expenses] Total Other Income and Expenses: $ [Enter Total Other Income and Expenses]Less: Other Income from Discontinued OperationsNet Other Income and Expenses: $ [Enter Net Other Income and Expenses]5. Profit (Loss) before TaxationNet Sales Revenue - Net Cost of Goods Sold - Net Operating Expenses - Net Other Income and Expenses: $ [Enter Profit (Loss) before Taxation]Less: Income from Discontinued Operations before TaxationNet Profit (Loss) before Taxation: $ [Enter Net Profit (Loss) before Taxation]6. TaxationCurrent Tax Provision: $ [Enter Current Tax Provision]Deferred Tax Provision: $ [Enter Deferred Tax Provision]Total Tax Provision: $ [Enter Total Tax Provision]Net Profit (Loss) after Taxation: $ [Enter Net Profit (Loss) after Taxation]。

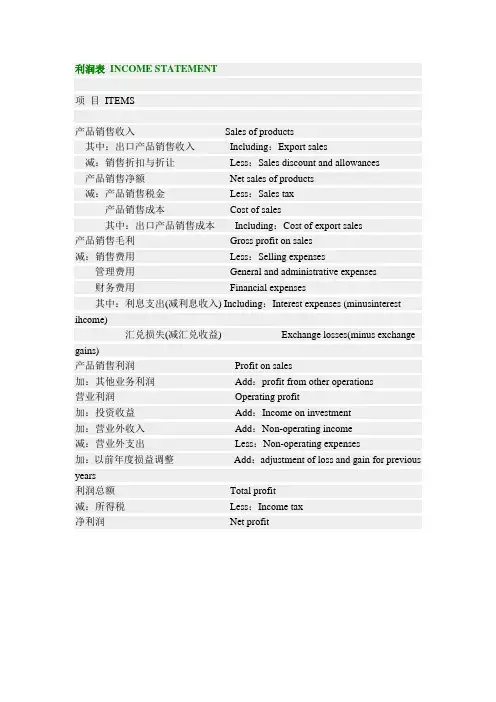

利润表INCOME STATEMENT项目ITEMS产品销售收入Sales of products其中:出口产品销售收入Including:Export sales减:销售折扣与折让Less:Sales discount and allowances产品销售净额Net sales of products减:产品销售税金Less:Sales tax产品销售成本Cost of sales其中:出口产品销售成本Including:Cost of export sales产品销售毛利Gross profit on sales减:销售费用Less:Selling expenses管理费用General and administrative expenses财务费用Financial expenses其中:利息支出(减利息收入) Including:Interest expenses (minusinterest ihcome)汇兑损失(减汇兑收益)Exchange losses(minus exchange gains)产品销售利润Profit on sales加:其他业务利润Add:profit from other operations营业利润Operating profit加:投资收益Add:Income on investment加:营业外收入Add:Non-operating income减:营业外支出Less:Non-operating expenses加:以前年度损益调整Add:adjustment of loss and gain for previous years利润总额Total profit减:所得税Less:Income tax净利润Net profit。

完整英文版资产负债表、现金流量表及利润表第一篇:完整英文版资产负债表、现金流量表及利润表精品文档就在这里-------------各类专业好文档,值得你下载,教育,管理,论文,制度,方案手册,应有尽有------------------------------资产负债表 Balance Sheet 项目 ITEM 货币资金 Cash短期投资 Short term investments 应收票据 Notes receivable 应收股利 Dividend receivable 应收利息 Interest receivable 应收帐款Accounts receivable 其他应收款Other receivables 预付帐款Accounts prepaid 期货保证金Future guarantee 应收补贴款Allowance receivable应收出口退税 Export drawback receivable 存货 Inventories其中:原材料Including:Raw materials 产成品(库存商品)Finished goods待摊费用 Prepaid and deferred expenses待处理流动资产净损失 Unsettled G/L on current assets一年内到期的长期债权投资Long-term debenture investment falling due in a yaear 其他流动资产 Other current assets 流动资产合计 Total current assets 长期投资: Long-term investment:其中:长期股权投资 Including long term equity investment 长期债权投资Long term securities investment *合并价差Incorporating price difference 长期投资合计Total long-term investment 固定资产原价 Fixed assets-cost减:累计折旧Less:Accumulated Dpreciation 固定资产净值Fixed assets-net value减:固定资产减值准备 Less:Impairment of fixed assets 固定资产净额Net value of fixed assets 固定资产清理Disposal of fixed assets 工程物资Project material 在建工程Construction in Progress待处理固定资产净损失 Unsettled G/L on fixed assets 固定资产合计 Total tangible assets 无形资产 Intangible assets其中:土地使用权 Including and use rights 递延资产(长期待摊费用)Deferred assets 其中:固定资产修理Including:Fixed assets repair固定资产改良支出 Improvement expenditure of fixed assets --------------------------精品文档-------精品文档就在这里-------------各类专业好文档,值得你下载,教育,管理,论文,制度,方案手册,应有尽有------------------------------其他长期资产 Other long term assets其中:特准储备物资Among it:Specially approved reserving materials 无形及其他资产合计T otal intangible assets and other assets 递延税款借项 Deferred assets debits 资产总计 Total Assets 资产负债表(续表)Balance Sheet 项目 ITEM短期借款 Short-term loans 应付票款 Notes payable 应付帐款Accounts payab1e 预收帐款 Advances from customers 应付工资Accrued payro1l 应付福利费 Welfare payable 应付利润(股利)Profits payab1e 应交税金 Taxes payable其他应交款Other payable to government 其他应付款Other creditors 预提费用Provision for expenses 预计负债Accrued liabilities一年内到期的长期负债Long term liabilities due within one year 其他流动负债Other current liabilities 流动负债合计Total current liabilities 长期借款Long-term loans payable 应付债券Bonds payable长期应付款long-term accounts payable 专项应付款Special accounts payable 其他长期负债 Other long-term liabilities 其中:特准储备资金Including:Special reserve fund 长期负债合计 Total long term liabilities 递延税款贷项 Deferred taxation credit 负债合计 Total liabilities * 少数股东权益 Minority interests 实收资本(股本)Subscribed Capital 国家资本National capital 集体资本Collective capital 法人资本Legal person“s capital其中:国有法人资本Including:State-owned legal person”s capital 集体法人资本Collective legal person“s capital 个人资本Personal capital--------------------------精品文档-------精品文档就在这里-------------各类专业好文档,值得你下载,教育,管理,论文,制度,方案手册,应有尽有------------------------------外商资本Foreign businessmen”s capital 资本公积Capital surplus 盈余公积 surplus reserve其中:法定盈余公积 Including:statutory surplus reserve 公益金public welfare fund补充流动资本 Supplermentary current capital* 未确认的投资损失(以“-”号填列)Unaffirmed investment loss 未分配利润 Retained earnings外币报表折算差额Converted difference in Foreign Currency Statements 所有者权益合计 Total shareholder"s equity 负债及所有者权益总计 Total Liabilities & Equity利润表 INCOME STATEMENT 项目 ITEMS产品销售收入Sales of products 其中:出口产品销售收入Including:Export sales减:销售折扣与折让Less:Sales discount and allowances 产品销售净额 Net sales of products 减:产品销售税金 Less:Sales tax 产品销售成本Cost of sales其中:出口产品销售成本 Including:Cost of export sales 产品销售毛利Gross profit on sales 减:销售费用Less:Selling expenses 管理费用 General and administrative expenses 财务费用 Financial expenses其中:利息支出(减利息收入)Including:Interest expenses(minusinterest ihcome)汇兑损失(减汇兑收益)Exchange losses(minus exchange gains)产品销售利润 Profit on sales 加:其他业务利润Add:profit from other operations 营业利润 Operating profit加:投资收益Add:Income on investment 加:营业外收入Add:Non-operating income 减:营业外支出Less:Non-operating expenses加:以前年度损益调整 Add:adjustment of loss and gain for previous years 利润总额Total profit减:所得税Less:Income tax 净利润Net profit--------------------------精品文档-------精品文档就在这里-------------各类专业好文档,值得你下载,教育,管理,论文,制度,方案手册,应有尽有------------------------------现金流量表Cash Flows Statement Prepared by: Period: Unit: Items1.Cash Flows from Operating Activities:01)Cash received from sales of goods or rendering of services02)Rental receivedValue added tax on sales received and refunds of value03)added tax paid04)Refund of other taxes and levy other than value added tax07)Other cash received relating to operating activities08)Sub-total of cash inflows09)Cash paid for goods and services10)Cash paid for operating leases11)Cash paid to and on behalf of employees12)Value added tax on purchases paid13)Income tax paid14)Taxes paid other than value added tax and income tax17)Other cash paid relating to operating activities18)Sub-total of cash outflows19)Net cash flows from operating activities 2.Cash Flows from Investing Activities:20)Cash received from return of investments21)Cash received from distribution of dividends or profits22)Cash received from bond interest incomeNet cash received from disposal of fixed assets,intangible 23)assets and other long-term assets26)Other cash received relating to investing activities27)Sub-total of cash inflowsCash paid to acquire fixed assets,intangible assets 28)and other long-term assets29)Cash paid to acquire equity investments30)Cash paid to acquire debt investments33)Other cash paid relating to investing activities34)Sub-total of cash outflows35)Net cash flows from investing activities 3.Cash Flows fromFinancing Activities:36)Proceeds from issuing shares37)Proceeds from issuing bonds38)Proceeds from borrowings41)Other proceeds relating to financing activities42)Sub-total of cash inflows43)Cash repayments of amounts borrowed--------------------------精品文档-------精品文档就在这里-------------各类专业好文档,值得你下载,教育,管理,论文,制度,方案手册,应有尽有------------------------------44)Cash payments of expenses on any financing activities45)Cash payments for distribution of dividends or profits46)Cash payments of interest expenses47)Cash payments for finance leases48)Cash payments for reduction of registered capital51)Other cash payments relating to financing activities52)Sub-total of cash outflows53)Net cash flows from financing activities 4.Effect of Foreign Exchange Rate Changes on Cash Increase in Cash and Cash EquivalentsSupplemental Information1.Investing and Financing Activities that do not Involve in Cash Receipts and Payments56)Repayment of debts by the transfer of fixed assets57)Repayment of debts by the transfer of investments58)Investments in the form of fixed assets59)Repayments of debts by the transfer of investories 2.Reconciliation of Net Profit to Cash Flows from OperatingActivities62)Net profit63)Add provision for bad debt or bad debt written off64)Depreciation of fixed assets65)Amortization of intangible assetsLosses on disposal of fixed assets,intangible assets 66)and other long-term assets(or deduct:gains)67)Losses on scrapping of fixed assets68)Financial expenses69)Losses arising from investments(or deduct:gains)70)Defered tax credit(or deduct:debit)71)Decrease in inventories(or deduct:increase)72)Decrease in operating receivables(or deduct:increase)73)Increase in operating payables(or deduct:decrease)74)Net payment on value added tax(or deduct:net receipts75)Net cash flows from operating activities Increase in Cash and Cash Equivalents76)cash at the end of the period77)Less:cash at the beginning of the period78)Plus:cash equivalents at the end of the period--------------------------精品文档-------精品文档就在这里-------------各类专业好文档,值得你下载,教育,管理,论文,制度,方案手册,应有尽有------------------------------79)Less:cash equivalents at the beginning of the period80)Net increase in cash and cash equivalents现金流量表的现金流量声明拟制人:时间:单位:项目1.cash流量从经营活动:01)所收到的现金从销售货物或提供劳务02)收到的租金增值税销售额收到退款的价值03)增值税缴纳04)退回的其他税收和征费以外的增值税07)其他现金收到有关经营活动08)分,总现金流入量09)用现金支付的商品和服务)用现金支付经营租赁)用现金支付,并代表员工)增值税购货支付)所得税的缴纳)支付的税款以外的增值税和所得税)其他现金支付有关的经营活动)分,总的现金流出)净经营活动的现金流量2.cash流向与投资活动:)所收到的现金收回投资)所收到的现金从分配股利,利润)所收到的现金从国债利息收入现金净额收到的处置固定资产,无形资产)资产和其他长期资产)其他收到的现金与投资活动)小计的现金流入量用现金支付购建固定资产,无形资产)和其他长期资产)用现金支付,以获取股权投资)用现金支付收购债权投资33)其他现金支付的有关投资活动34)分,总的现金流出35)的净现金流量,投资活动产生3.cash流量筹资活动:36)的收益,从发行股票37)的收益,由发行债券38)的收益,由借款--------------------------精品文档-------精品文档就在这里-------------各类专业好文档,值得你下载,教育,管理,论文,制度,方案手册,应有尽有------------------------------41)其他收益有关的融资活动42),小计的现金流入量43)的现金偿还债务所支付的44)现金支付的费用,对任何融资活动45)支付现金,分配股利或利润46)以现金支付的利息费用47)以现金支付,融资租赁48)以现金支付,减少注册资本51)其他现金收支有关的融资活动52)分,总的现金流出53)的净现金流量从融资活动4.effect的外汇汇率变动对现金增加现金和现金等价物补充资料1.investing活动和筹资活动,不参与现金收款和付款56)偿还债务的转让固定资产57)偿还债务的转移投资58)投资在形成固定资产59)偿还债务的转移库存量2.reconciliation净利润现金流量从经营活动62)净利润63)补充规定的坏帐或不良债务注销64)固定资产折旧65)无形资产摊销损失处置固定资产,无形资产66)和其他长期资产(或减:收益)67)损失固定资产报废68)财务费用69)引起的损失由投资管理(或减:收益)70)defered税收抵免(或减:借记卡)71)减少存货(或减:增加)72)减少经营性应收(或减:增加)73)增加的经营应付账款(或减:减少)74)净支付的增值税(或减:收益净额75)净经营活动的现金流量增加现金和现金等价物76)的现金,在此期限结束--------------------------精品文档-------精品文档就在这里-------------各类专业好文档,值得你下载,教育,管理,论文,制度,方案手册,应有尽有------------------------------ 77)减:现金期开始78)加:现金等价物在此期限结束79)减:现金等价物期开始80),净增加现金和现金等价物--------------------------精品文档-------第二篇:完整英文版资产负债表、利润表及现金流量表资产负债表 Balance Sheet项目ITEM货币资金Cash短期投资Short term investments应收票据Notes receivable应收股利Dividend receivable应收利息Interest receivable应收帐款Accounts receivable其他应收款 Other receivables预付帐款 Accounts prepaid期货保证金 Future guarantee应收补贴款 Allowance receivable应收出口退税 Export drawback receivable存货Inventories其中:原材料 Including:Raw materials产成品(库存商品)Finished goods待摊费用Prepaid and deferred expenses待处理流动资产净损失Unsettled G/L on current assets一年内到期的长期债权投资Long-term debenture investment falling due in a yaear其他流动资产Other current assets流动资产合计Total current assets长期投资: Long-term investment:其中:长期股权投资 Including long term equity investment长期债权投资 Long term securities investment*合并价差 Incorporating price difference长期投资合计Total long-term investment固定资产原价 Fixed assets-cost减:累计折旧 Less:Accumulated Dpreciation固定资产净值 Fixed assets-net value减:固定资产减值准备Less:Impairment of fixed assets固定资产净额Net value of fixed assets固定资产清理Disposal of fixed assets工程物资Project material在建工程Construction in Progress待处理固定资产净损失Unsettled G/L on fixed assets固定资产合计 Total tangible assets无形资产Intangible assets其中:土地使用权Including and use rights递延资产(长期待摊费用)Deferred assets其中:固定资产修理Including:Fixed assets repair固定资产改良支出 Improvement expenditure of fixed assets 其他长期资产 Other long term assets其中:特准储备物资Among it:Specially approved reserving materials无形及其他资产合计Total intangible assets and other assets 递延税款借项 Deferred assets debits资产总计Total Assets资产负债表(续表)Balance Sheet项目ITEM短期借款Short-term loans应付票款Notes payable应付帐款Accounts payab1e预收帐款Advances from customers应付工资Accrued payro1l应付福利费 Welfare payable应付利润(股利)Profits payab1e应交税金Taxes payable其他应交款 Other payable to government其他应付款 Other creditors预提费用Provision for expenses预计负债Accrued liabilities一年内到期的长期负债Long term liabilities due within one year其他流动负债Other current liabilities流动负债合计 Total current liabilities长期借款Long-term loans payable应付债券Bonds payable长期应付款 long-term accounts payable专项应付款 Special accounts payable其他长期负债Other long-term liabilities其中:特准储备资金 Including:Special reserve fund长期负债合计Total long term liabilities递延税款贷项Deferred taxation credit负债合计Total liabilities* 少数股东权益Minority interests实收资本(股本)Subscribed Capital国家资本National capital集体资本Collective capital法人资本Legal person“s capital其中:国有法人资本Including:State-owned legal person”s capital集体法人资本Collective legal person“s capital个人资本Personal capital外商资本Foreign businessmen”s capital资本公积Capital surplus盈余公积surplus reserve其中:法定盈余公积Including:statutory surplus reserve公益金public welfare fund补充流动资本Supplermentary current capital* 未确认的投资损失(以“-”号填列)Unaffirmed investment loss未分配利润 Retained earnings外币报表折算差额Converted difference in Foreign Currency Statements所有者权益合计Total shareholder"s equity 负债及所有者权益总计Total Liabilities & Equity利润表 INCOME STATEMENT项目 ITEMS产品销售收入Sales of products其中:出口产品销售收入Including:Export sales减:销售折扣与折让Less:Sales discount and allowances产品销售净额 Net sales of products减:产品销售税金 Less:Sales tax产品销售成本Cost of sales其中:出口产品销售成本 Including:Cost of export sales产品销售毛利Gross profit on sales减:销售费用Less:Selling expenses管理费用 General and administrative expenses财务费用 Financial expenses其中:利息支出(减利息收入)Including:Interest expenses(minusinterest ihcome)汇兑损失(减汇兑收益)Exchange losses(minus exchange gains) 产品销售利润 Profit on sales加:其他业务利润 Add:profit from other operations营业利润 Operating profit加:投资收益 Add:Income on investment加:营业外收入 Add:Non-operating income减:营业外支出 Less:Non-operating expenses加:以前损益调整Add:adjustment of loss and gain for previous years利润总额T otal profit减:所得税Less:Income tax净利润Net profit现金流量表Cash Flows StatementPrepared by: Period: Unit:Items1.Cash Flows from Operating Activities:01)Cash received from sales of goods or rendering of services02)Rental receivedValue added tax on sales received and refunds of value03)added tax paid04)Refund of other taxes and levy other than value added tax07)Other cash received relating to operating activities08)Sub-total of cash inflows09)Cash paid for goods and services10)Cash paid for operating leases11)Cash paid to and on behalf of employees12)Value added tax on purchases paid13)Income tax paid14)Taxes paid other than value added tax and income tax17)Other cash paid relating to operating activities18)Sub-total of cash outflows19)Net cash flows from operating activities2.Cash Flows from Investing Activities:20)Cash received from return of investments21)Cash received from distribution of dividends or profits22)Cash received from bond interest incomeNet cash received from disposal of fixed assets,intangible 23)assets and other long-term assets26)Other cash received relating to investing activities27)Sub-total of cash inflowsCash paid to acquire fixed assets,intangible assets28)and other long-term assets29)Cash paid to acquire equity investments30)Cash paid to acquire debt investments33)Other cash paid relating to investing activities34)Sub-total of cash outflows35)Net cash flows from investing activities3.Cash Flows from Financing Activities:36)Proceeds from issuing shares37)Proceeds from issuing bonds38)Proceeds from borrowings41)Other proceeds relating to financing activities42)Sub-total of cash inflows43)Cash repayments of amounts borrowed44)Cash payments of expenses on any financing activities45)Cash payments for distribution of dividends or profits46)Cash payments of interest expenses47)Cash payments for finance leases48)Cash payments for reduction of registered capital51)Other cash payments relating to financing activities52)Sub-total of cash outflows53)Net cash flows from financing activities4.Effect of Foreign Exchange Rate Changes on Cash Increase in Cash and Cash EquivalentsSupplemental Information1.Investing and Financing Activities that do not Involve inCash Receipts and Payments56)Repayment of debts by the transfer of fixed assets57)Repayment of debts by the transfer of investments58)Investments in the form of fixed assets59)Repayments of debts by the transfer of investories2.Reconciliation of Net Profit to Cash Flows from OperatingActivities62)Net profit63)Add provision for bad debt or bad debt written off64)Depreciation of fixed assets65)Amortization of intangible assetsLosses on disposal of fixed assets,intangible assets66)and other long-term assets(or deduct:gains)67)Losses on scrapping of fixed assets68)Financial expenses69)Losses arising from investments(or deduct:gains)70)Defered tax credit(or deduct:debit)71)Decrease in inventories(or deduct:increase)72)Decrease in operating receivables(or deduct:increase)73)Increase in operating payables(or deduct:decrease)74)Net payment on value added tax(or deduct:net receipts75)Net cash flows from operating activities Increase in Cash and Cash Equivalents76)cash at the end of the period77)Less:cash at the beginning of the period78)Plus:cash equivalents at the end of the period79)Less:cash equivalents at the beginning of the period80)Net increase in cash and cash equivalents第三篇:资产负债表、利润表现金流量表三者关系三者之间的钩稽关系有:(1)损益表及利润分配表中的未分配利润=资产负债表中的未分配利润(2)资产负债表中现金及其等价物期末余额与期初余额之差=现金流量表中现金及其等价物净增加(3)利润表中的净销货额-资产负债表中的应收账款(票据)增加额+预收账款增加额=现金流量表中的销售商品、提供劳务收到的现金(4)资产负债表中除现金及其等价物之外的其他各项流动资产和流动负债的增加(减少)额=现金流量表中各相关项目的减少(增加)额。

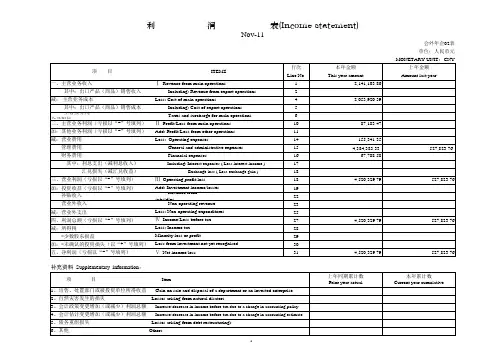

Exhibit 18-b: Scanned Copies of Audit ReportBeijing Nseer Technology Co., Ltd.Audit Report of 2014JSLSZ (2015) No. 1008ContentsProject Contents No. Audit Report 1-2 Balance Sheet 3 Statement of Profit and Profit Distribution 4 Cash Flow Statement 5 Affiliated Notes to Accounting Statement 6-12Audit ReportJSLSZ (2015) No. 1008 Beijing Nseer Technology Co., Ltd.We have audited the accompanying balance sheet of Beijing Nseer Technology Co., Ltd., including the balance sheet on Dec. 31, 2014, statement of profit and profit distribution, cash flow statement, and notes to the fanatical statements.I. Management’s Responsibility for the Financial Statements.The management is responsible for the preparation and fair presentation of these financial statements in accordance with the Accounting Standards for Business Enterprises and China Accounting System for Business Enterprises. This responsibility includes: (1) designing, implementing and maintaining internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error; (2) selecting and applying appropriate accounting policies; and (3) making accounting estimates that are reasonable in the circumstances.II. Auditor’s ResponsibilityOur responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit in accordance with the Standards on Auditing for Certified Public Accountants. Those standards require that we comply with ethical requirements and plan and perform the audit to obtain reasonable assurance whether the financial statements are free from material misstatement.An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity’s preparation and fair presentation of the financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of accounting estimates made by management, as well as evaluating the overall presentation of the financial statements.We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis forour audit opinion.III. Audit opinionIn our opinion, the financial statements of Beijing Nseer Technology Co., Ltd. is prepared in accordance with the Accounting Standards for Business Enterprises, and give a true and fair view of the financial position of the Beijing Nseer Technology Co., Ltd. as of Dec. 31, 2014, and of its financial performance and its cash flows for the Year 2014Attached:1. Balance Sheet on December 31, 2014 of Beijing Nseer Technology Co., Ltd.2. Statement of Profit and Profit Distribution Table in 2014 of Beijing Nseer Technology Co., Ltd.3. Cash Flow Statement in 2014 of Beijing Nseer Technology Co., Ltd.4. Affiliated Notes to Accounting Statement in 2014 of Beijing Nseer Technology Co., Ltd.Beijing Shoulv CPAs (LLP) Chinese Certified Public Accountant: Jianhua Hu (Seal)Beijing China Chinese Certified Public Accountant: Fujun Yan (Seal)January 15, 2015Integrity, Objectivity and FairnessBeijing Institute of Certified PublicAccountantsBOCPA 15A06637060168220Balance SheetDec. 31, 2014Preparation Unit: Beijing Nseer Technology Co., Ltd. Unit : YuanProfit StatementPreparation Unit: Beijing Nseer Technology Co., Ltd. 2014 Unit: YuanCash Flow StatementPreparation Unit: Beijing Nseer Technology Co., Ltd. 2014 Unit: YuanBeijing Nseer Technology Co., Ltd.Affiliated Notes to Accounting Statement 2014(Unit: Yuan)I. Profile of the CompanyBeijing Nseer Technology Co., Ltd. was founded in August 8, 2000. The company obtains the corporate business license after the approval of Haidian Branch of Beijing Administration for Industry & Commerce; registration No.: 3347; company type: limited liability company; registered capital: RMB 10,000,000.00; paid up capital: RMB 9,200,000.00; regal representative: Youtao Liu.Registered address: Room 404 and 405, Block E, Building 1, No. 12, Shangdixinxi Road, Haidian District, Beijing Business Scope: licensed operating items: noneGeneral operating items: technology development, transfer, consultation, training, service; sales for developed products, telecommunications equipment, cultural office supplies, electronic components, computer hardware and software and peripheral equipment, hardware and electrical equipment, chemical products (excluding hazardous chemicals and a class of precursor chemicals), building materials, steel products, arts and crafts: undertaking the computer network project (Except the projects that do not obtained the administrative permission). The next time contribution time is April 19, 2014, and the intellectual property contribution is RMB 7,200,000.00.II. Principal Accounting Policy1. Accounting System: Enterprise Accounting System2. Fiscal Year: from January 1 to December 31of each calendar year.3. Bookkeeping Currency: bookkeeping currency is Ren Min Bi.4. Bookkeeping Basis and Pricing Principle: the company adopts the accrual system as the base of bookkeeping principle, and takes historic cost as the pricing basis.5. Accounting Method of Foreign Currency Operations:Foreign currency operations adopt the spot rate of the transaction date as the exchange rate convert, equivalent RMBfor bookkeeping.6. Determining Standard of Cash Equivalent:When the cash flow statement is prepared, cash equivalents represent short-term (expire within 3 months since the purchase date), highly liquid investments that are readily convertible into known amounts of cash and that are subject to an insignificant risk of change in value. Equity investment is regarded as cash equivalent.7. Accounting Method of Fixed Assets(1) Standard of fixed assets: the(1) House buildings, machinery equipment, transportation equipment and other equipment, measuring implement and tool related to the production and articles that do not belong to production operations with the service life of more than one year.(2) Category of the fixed assets: transportation equipment, office equipment, etc.(3) Valuation of the fixed assets: valuated according to the actual cost.8. Intangible assets(1) Valuation of the intangible assetsThe intangible assets shall be initially measured according to its cost.The cost of outsourcing intangible assets shall include the purchase price, relevant taxes and other necessary expenditures directly attributable to intangible assets for the expected purpose. Where the payment of purchase price for intangible assets is delayed beyond the normal credit conditions, which is of financing intention, the cost of intangible assets shall be determined on the basis of the current value of the purchase price.Entry value of the intangible assets obtained through enterprise’s consolidation by merger under the same control shall be determined according to book value of the combined party.(2) Service life and amortization of intangible assetsa. Intangible assets with limited service livesLand usage right is averagely amortized according to the service life period. If the price of outsourcing land and buildings cannot be reasonably allocated between the land usage right and buildings, they will be all regarded as fixed assets.For the end of each period, the service life of the intangible assets with limited service and amortization method will be reviewed: if necessary, the service life needs to be adjusted. For the intangible assets with limited service life, they should be amortized according to the straight line method within the time limit of bringing economic benefits for enterprises. b. Intangible assets with uncertain service lifeIntangible assets with uncertain service life do not need to be amortized, and impairment test can be done at the end of the period.(3) Intangible assets write-downWhen the recoverable amount of the intangible assets is lower than its book value, the book value can be written down to the recoverable amount.(4) Partition of research stage and development stage for internal R&D projectWhether the R&D activities of the company have the basic conditions for forming a new product or new technology as the main judgment basis, dividing the research stage and development stage.Whether the research activities that have been already carried out will shift to development or they will form intangible assets after development have large uncertainty, the R&D project is in R&D phase; when the R&D project has the basic conditions of forming a new product or new technology to a large extent, the R&D project will enter in development stage.The expenses in the R&D phase will be included in the current profits and losses when happened; the expenses in the R&D phase can be determined as the intangible assets when they satisfy the following conditions:●Completing the intangible assets to make them has the feasibility of usage and sales in technology;●The management has the intention of completing the intangible assets and usage or sales;●Can prove how the intangible assets can produce economic benefits;●Having enough support of technical resources, financial resources and other resources to complete thedevelopment of intangible assets, and have the capacity to use and sell the intangible assets;●Expenses belonging to the development phase of the intangible assets can be reliably measured.Expenses that do not satisfy the above conditions in the development phase are included in the current profits and losses when happened; expenses that have been capitalized in the development stage are listed as development expenses in balance sheet, and they will be switched to the intangible assets since the date that the project reaches intended serviceable condition.9. Revenue recognition principleAmount of revenue should be determined according to the fair value of the received or receivable contract or agreement price when this group sells goods or renders service in the routine operating activities. Revenue is listed as the net amount of deducting value-added tax, commercial discounts, sales allowance and sales return.(1) Sales of GoodsThe company has already transferred the main risk and return of goods property right to the buyer: the company neither conserve the continuous management right related to property right, nor implement effective control to the sold goods; amount of revenue can be measured reliably; the relevant economic profit may flow into the enterprise; when relevant happened or going-to-happen costs can be measured reliably, sales revenue of goods is confirmed to be implemented. (2) Rendering serviceWhen the total revenue and total cost of rendering service transaction can be measured reliably, the economic profit relevant to transaction may flow into the enterprise. When the completion degree of service can be confirmed reliably, sales revenue of goods is confirmed to be implemented.(3) Transferring assets usage rightWhen economic interest relevant to transaction may flow into the enterprise, and amount of revenue can be measured reliably, revenue amount for transferring usage right is confirmed as per following occasions:a. Interest revenue amount can be confirmed as per time and actual interest rate for fund of the enterprise used by others.b. Royalty revenue amount can be confirmed by charging time and method regulated in relevant contracts or agreements.c. Rental property revenue:①Provided with rental contract, agreement or other settlement notice recognized by tenant.②Fulfilling the obligations regulated by the contract, issuing rental invoice, and the price has been obtained or confirmed to obtained;③Product cost for rental development can be measured reliably.10. Staff SalaryStaff salary mainly includes wage, bonus, subsidy & allowance, staff welfare fee, social insurance fee & housing fund, labor union fee, staff education fee, and other expenses relevant to rendering service of staff.The due staff salary shall be confirmed during rendering service to staff, and shall be calculated into relevant asset cost and fee according to benefit object of staff rendering service.11. Accounting disposal method for income taxDue tax method is adopted to calculate the income tax. The income tax is prepaid as per each quarter of the year, and shall be settled as per total annual tax payment amount approved tax authority within 5 months after ending of the year.III. Instructions for alterations of important accounting policy and accounting estimation, and instruction for important accounting mistake correction:By the end of balance sheet date of the asset, the company has no alterations on accounting policy and accounting estimation, and without corrected accounting mistakes.IV. Contingency:By the end of balance sheet date, the company has no important contingencies that need to be disclosed.V. Items after asset balance sheet dateBy the end of approval date of this accounting sheet, the company has no important items after asset balance sheet date that needs to be disclosed.VI. Explanation on Items of Financial Sheet (unless otherwise noted, the unit of amount is RMB Yuan)1. Monetary Capital2. ReceivablesAging Analysis3. Other ReceivablesAging Analysis4.5. Inventory6. Deferred ExpensesBeijing Nseer Technology Co., Ltd.December 31, 20147. Fixed assets8. Intangible assets8. Short-term loan9. Accounts payable Aging analysis10. Advance payment Aging analysis11. Tax payable12. Other Payables Aging Analysis13. Paid Up Capital14. Undistributed Profits15. Main operating revenue16. Main operating costNo. 100297755Business License(Duplicate) (1-1)Registered No.: 2321Name Beijing Shoulv CPAs (LLP) TypeLimited Liability PartnershipMain Place of BusinessRoom 771, Block A, Songlanpu Village, Shahe Town, Changping District, BeijingManaging Partner Jianhua Hu Foundation Date October 13, 2014Term of the Partnership From October 13, 2014 to October 12, 2064Business ScopeAuditing enterprise accounting statement, issuing audit report; verifying enterprise capital, issuing capital verification report; transacting the audit business of enterprise merger, division, and liquidation matters, and issuing relevant report; basic construction of annual financial statements audit; bookkeeping agency; accounting consultation, management consultation, tax consultation: accounting training; other business prescribed by laws and regulations.(Next contribution time will be December 31, 2064)Online scanning to get more informationRegistration Authority:October 13, 2014Beijing Administrative Bureau for Industry and Commerce Changping Branch(Seal)Website of Enterprise Credit Information Publicity System: Supervised by ate Administration of Industry and Commerce of P.R.C.Certificate No.: NO 006875Accounting FirmPractising CertificateName : Beijing Shoulv CPAs (LLP) Chief Accountant: Jianhua Hu Main Place of Business:Room 771, Block A, SonglanpuVillage,ShaheTown,ChangpingDistrict, BeijingStyle: Limited Liability Partnership Accounting Firm No.: 11010211Registered capital (contribution amount): 0Establishment Approved No.: JCHXK [2014] No. 0080 Establishment Approved On: September 30, 2014Notes1.The certificate is granted by the financial authority to qualify CPAs ’ statutory businesses. 2.The certificate shall be updated by the financial authority in case of any record alteration. 3.The certificate shall not be counterfeited, altered, lent and transerred. 4.The certificate shall be returned to the financial authority in case the accounting firm ceases its business.Authorized by : Beijing Municipal Bureau of Finance (seal)September 30, 2014Ministry of Finance of the People ’s Republic ofChina。

完整英文版资产负债表、利润表及现金流量表展开全文完整英文版资产负债表、利润表及现金流量表资产负债表 Balance Sheet项目 ITEM货币资金 Cash短期投资 Short term investments应收票据 Notes receivable应收股利 Dividend receivable应收利息 Interest receivable应收帐款 Accounts receivable其他应收款 Other receivables预付帐款 Accounts prepaid期货保证金 Future guarantee应收补贴款 Allowance receivable应收出口退税 Export drawback receivable存货 Inventories其中:原材料 Including:Raw materials产成品(库存商品) Finished goods待摊费用 Prepaid and deferred expenses待处理流动资产净损失 Unsettled G/L on current assets一年内到期的长期债权投资Long-term debenture investment falling due in a yaear其他流动资产 Other current assets流动资产合计 Total current assets长期投资: Long-term investment:其中:长期股权投资 Including long term equity investment长期债权投资 Long term securities investment*合并价差 Incorporating price difference长期投资合计 Total long-term investment固定资产原价 Fixed assets-cost减:累计折旧 Less:Accumulated Dpreciation固定资产净值 Fixed assets-net value减:固定资产减值准备 Less:Impairment of fixed assets固定资产净额 Net value of fixed assets固定资产清理 Disposal of fixed assets工程物资 Project material在建工程 Construction in Progress待处理固定资产净损失 Unsettled G/L on fixed assets固定资产合计 Total tangible assets无形资产 Intangible assets其中:土地使用权 Including and use rights递延资产(长期待摊费用)Deferred assets其中:固定资产修理 Including:Fixed assets repair固定资产改良支出 Improvement expenditure of fixed assets 其他长期资产 Other long term assets其中:特准储备物资Among it:Specially approved reserving materials无形及其他资产合计 Total intangible assets and other assets 递延税款借项 Deferred assets debits资产总计 Total Assets资产负债表(续表) Balance Sheet项目 ITEM短期借款 Short-term loans应付票款 Notes payable应付帐款 Accounts payab1e预收帐款 Advances from customers应付工资 Accrued payro1l应付福利费 Welfare payable应付利润(股利) Profits payab1e应交税金 Taxes payable其他应交款 Other payable to government其他应付款 Other creditors预提费用 Provision for expenses预计负债 Accrued liabilities一年内到期的长期负债Long term liabilities due within one year其他流动负债 Other current liabilities流动负债合计 Total current liabilities长期借款 Long-term loans payable应付债券 Bonds payable长期应付款 long-term accounts payable专项应付款 Special accounts payable其他长期负债 Other long-term liabilities其中:特准储备资金 Including:Special reserve fund长期负债合计 Total long term liabilities递延税款贷项 Deferred taxation credit负债合计 Total liabilities* 少数股东权益 Minority interests实收资本(股本) Subscribed Capital国家资本 National capital集体资本 Collective capital法人资本 Legal person"s capital其中:国有法人资本Including:State-owned legal person"s capital集体法人资本 Collective legal person"s capital个人资本 Personal capital外商资本 Foreign businessmen"s capital资本公积 Capital surplus盈余公积 surplus reserve其中:法定盈余公积 Including:statutory surplus reserve公益金 public welfare fund补充流动资本 Supplermentary current capital* 未确认的投资损失(以“-”号填列)Unaffirmed investment loss未分配利润 Retained earnings外币报表折算差额Converted difference in Foreign Currency Statements所有者权益合计 Total shareholder"s equity负债及所有者权益总计 Total Liabilities & Equity利润表 INCOME STATEMENT项目 ITEMS产品销售收入Sales of products其中:出口产品销售收入 Including:Export sales减:销售折扣与折让 Less:Sales discount and allowances 产品销售净额Net sales of products减:产品销售税金Less:Sales tax产品销售成本 Cost of sales其中:出口产品销售成本Including:Cost of export sales产品销售毛利 Gross profit on sales减:销售费用 Less:Selling expenses管理费用General and administrative expenses财务费用Financial expenses其中:利息支出(减利息收入) Including:Interest expenses (minusinterest ihcome)汇兑损失(减汇兑收益)Exchange losses(minus exchange gains)产品销售利润Profit on sales加:其他业务利润Add:profit from other operations营业利润Operating profit加:投资收益Add:Income on investment加:营业外收入Add:Non-operating income减:营业外支出Less:Non-operating expenses加:以前年度损益调整Add:adjustment of loss and gain for previous years利润总额 T otal profit减:所得税 Less:Income tax净利润 Net profit现金流量表Cash Flows StatementPrepared by: Period: Unit:Items1.Cash Flows from Operating Activities:01)Cash received from sales of goods or rendering of services02)Rental receivedValue added tax on sales received and refunds of value03)added tax paid04)Refund of other taxes and levy other than value added tax07)Other cash received relating to operating activities08)Sub-total of cash inflows09)Cash paid for goods and services10)Cash paid for operating leases11)Cash paid to and on behalf of employees12)Value added tax on purchases paid13)Income tax paid14)Taxes paid other than value added tax and income tax17)Other cash paid relating to operating activities18)Sub-total of cash outflows19)Net cash flows from operating activities2.Cash Flows from Investing Activities:20)Cash received from return of investments21)Cash received from distribution of dividends or profits22)Cash received from bond interest incomeNet cash received from disposal of fixed assets,intangible 23)assets and other long-term assets26)Other cash received relating to investing activities27)Sub-total of cash inflowsCash paid to acquire fixed assets,intangible assets28)and other long-term assets29)Cash paid to acquire equity investments30)Cash paid to acquire debt investments33)Other cash paid relating to investing activities34)Sub-total of cash outflows35)Net cash flows from investing activities3.Cash Flows from Financing Activities:36)Proceeds from issuing shares37)Proceeds from issuing bonds38)Proceeds from borrowings41)Other proceeds relating to financing activities42)Sub-total of cash inflows43)Cash repayments of amounts borrowed44)Cash payments of expenses on any financing activities45)Cash payments for distribution of dividends or profits46)Cash payments of interest expenses47)Cash payments for finance leases48)Cash payments for reduction of registered capital51)Other cash payments relating to financing activities52)Sub-total of cash outflows53)Net cash flows from financing activities4.Effect of Foreign Exchange Rate Changes on Cash Increase in Cash and Cash EquivalentsSupplemental Information1.Investing and Financing Activities that do not Involve in Cash Receipts and Payments56)Repayment of debts by the transfer of fixed assets57)Repayment of debts by the transfer of investments58)Investments in the form of fixed assets59)Repayments of debts by the transfer of investories2.Reconciliation of Net Profit to Cash Flows from Operating Activities62)Net profit63)Add provision for bad debt or bad debt written off64)Depreciation of fixed assets65)Amortization of intangible assetsLosses on disposal of fixed assets,intangible assets66)and other long-term assets (or deduct:gains)67)Losses on scrapping of fixed assets68)Financial expenses69)Losses arising from investments (or deduct:gains)70)Defered tax credit (or deduct:debit)71)Decrease in inventories (or deduct:increase)72)Decrease in operating receivables (or deduct:increase)73)Increase in operating payables (or deduct:decrease)74)Net payment on value added tax (or deduct:net receipts75)Net cash flows from operating activities Increase in Cash and Cash Equivalents76)cash at the end of the period77)Less:cash at the beginning of the period78)Plus:cash equivalents at the end of the period79)Less:cash equivalents at the beginning of the period80)Net increase in cash and cash equivalents现金流量表的现金流量声明拟制人:时间:单位:项目1.cash流量从经营活动:01 )所收到的现金从销售货物或提供劳务02 )收到的租金增值税销售额收到退款的价值03 )增值税缴纳04 )退回的其他税收和征费以外的增值税07 )其他现金收到有关经营活动08 )分,总现金流入量09 )用现金支付的商品和服务10 )用现金支付经营租赁11 )用现金支付,并代表员工12 )增值税购货支付13 )所得税的缴纳14 )支付的税款以外的增值税和所得税17 )其他现金支付有关的经营活动18 )分,总的现金流出19 )净经营活动的现金流量2.cash流向与投资活动:20 )所收到的现金收回投资21 )所收到的现金从分配股利,利润22 )所收到的现金从国债利息收入现金净额收到的处置固定资产,无形资产23 )资产和其他长期资产26 )其他收到的现金与投资活动27 )小计的现金流入量用现金支付购建固定资产,无形资产28 )和其他长期资产29 )用现金支付,以获取股权投资30 )用现金支付收购债权投资33 )其他现金支付的有关投资活动34 )分,总的现金流出35 )的净现金流量,投资活动产生3.cash流量筹资活动:36 )的收益,从发行股票37 )的收益,由发行债券38 )的收益,由借款41 )其他收益有关的融资活动42 ),小计的现金流入量43 )的现金偿还债务所支付的44 )现金支付的费用,对任何融资活动45 )支付现金,分配股利或利润46 )以现金支付的利息费用47 )以现金支付,融资租赁48 )以现金支付,减少注册资本51 )其他现金收支有关的融资活动52 )分,总的现金流出53 )的净现金流量从融资活动4.effect的外汇汇率变动对现金增加现金和现金等价物补充资料1.investing活动和筹资活动,不参与现金收款和付款56 )偿还债务的转让固定资产57 )偿还债务的转移投资58 )投资在形成固定资产59 )偿还债务的转移库存量2.reconciliation净利润现金流量从经营活动62 )净利润63 )补充规定的坏帐或不良债务注销64 )固定资产折旧65 )无形资产摊销损失处置固定资产,无形资产66 )和其他长期资产(或减:收益)67 )损失固定资产报废68 )财务费用69 )引起的损失由投资管理(或减:收益)70 ) defered税收抵免(或减:借记卡)71 )减少存货(或减:增加)72 )减少经营性应收(或减:增加)73 )增加的经营应付账款(或减:减少)74 )净支付的增值税(或减:收益净额75 )净经营活动的现金流量增加现金和现金等价物76 )的现金,在此期限结束77 )减:现金期开始78 )加:现金等价物在此期限结束79 )减:现金等价物期开始80 ),净增加现金和现金等价物。

资产负债表Balance Sheet项目ITEM货币资金Cash短期投资Short term investments应收票据Notes receivable应收股利Dividend receivable应收利息Interest receivable应收帐款Accounts receivable其他应收款Other receivables预付帐款Accounts prepaid期货保证金Future guarantee应收补贴款Allowance receivable应收出口退税Export drawback receivable存货Inventories其中:原材料Including:Raw materials产成品(库存商品) Finished goods待摊费用Prepaid and deferred expenses待处理流动资产净损失Unsettled G/L on current assets一年内到期的长期债权投资Long-term debenture investment falling due in a yaear其他流动资产Other current assets流动资产合计Total current assets长期投资:Long-term investment:其中:长期股权投资Including long term equity investment长期债权投资Long term securities investment*合并价差Incorporating price difference长期投资合计Total long-term investment固定资产原价Fixed assets-cost减:累计折旧Less:Accumulated Dpreciation固定资产净值Fixed assets-net value减:固定资产减值准备Less:Impairment of fixed assets固定资产净额Net value of fixed assets固定资产清理Disposal of fixed assets工程物资Project material在建工程Construction in Progress待处理固定资产净损失Unsettled G/L on fixed assets固定资产合计Total tangible assets无形资产Intangible assets其中:土地使用权Including and use rights递延资产(长期待摊费用)Deferred assets其中:固定资产修理Including:Fixed assets repair固定资产改良支出Improvement expenditure of fixed assets其他长期资产Other long term assets其中:特准储备物资Among it:Specially approved reserving materials 无形及其他资产合计Total intangible assets and other assets递延税款借项Deferred assets debits资产总计Total Assets资产负债表(续表) Balance Sheet项目ITEM短期借款Short-term loans应付票款Notes payable应付帐款Accounts payab1e预收帐款Advances from customers应付工资Accrued payro1l应付福利费Welfare payable应付利润(股利) Profits payab1e应交税金Taxes payable其他应交款Other payable to government其他应付款Other creditors预提费用Provision for expenses预计负债Accrued liabilities一年内到期的长期负债Long term liabilities due within one year其他流动负债Other current liabilities流动负债合计Total current liabilities长期借款Long-term loans payable应付债券Bonds payable长期应付款long-term accounts payable专项应付款Special accounts payable其他长期负债Other long-term liabilities其中:特准储备资金Including:Special reserve fund长期负债合计Total long term liabilities递延税款贷项Deferred taxation credit负债合计Total liabilities* 少数股东权益Minority interests实收资本(股本) Subscribed Capital国家资本National capital集体资本Collective capital法人资本Legal person"s capital其中:国有法人资本Including:State-owned legal person"s capital集体法人资本Collective legal person"s capital个人资本Personal capital外商资本Foreign businessmen"s capital资本公积Capital surplus盈余公积surplus reserve其中:法定盈余公积Including:statutory surplus reserve公益金public welfare fund补充流动资本Supplermentary current capital* 未确认的投资损失(以“-”号填列)Unaffirmed investment loss未分配利润Retained earnings外币报表折算差额Converted difference in Foreign Currency Statements所有者权益合计Total shareholder"s equity负债及所有者权益总计Total Liabilities & Equity利润表INCOME STATEMENT项目ITEMS产品销售收入Sales of products其中:出口产品销售收入Including:Export sales减:销售折扣与折让Less:Sales discount and allowances产品销售净额Net sales of products减:产品销售税金Less:Sales tax产品销售成本Cost of sales其中:出口产品销售成本Including:Cost of export sales产品销售毛利Gross profit on sales减:销售费用Less:Selling expenses管理费用General and administrative expenses财务费用Financial expenses其中:利息支出(减利息收入) Including:Interest expenses (minusinterest ihcome)汇兑损失(减汇兑收益)Exchange losses(minus exchange gains)产品销售利润Profit on sales加:其他业务利润Add:profit from other operations营业利润Operating profit加:投资收益Add:Income on investment加:营业外收入Add:Non-operating income减:营业外支出Less:Non-operating expenses加:以前年度损益调整Add:adjustment of loss and gain for previous years 利润总额Total profit减:所得税Less:Income tax净利润Net profit现金流量表Cash Flows StatementPrepared by:Period: Unit:Items1.Cash Flows from Operating Activities:01)Cash received from sales of goods or rendering of services02)Rental receivedValue added tax on sales received and refunds of value03)added tax paid04)Refund of other taxes and levy other than value added tax07)Other cash received relating to operating activities08)Sub-total of cash inflows09)Cash paid for goods and services10)Cash paid for operating leases11)Cash paid to and on behalf of employees12)Value added tax on purchases paid13)Income tax paid14)Taxes paid other than value added tax and income tax17)Other cash paid relating to operating activities18)Sub-total of cash outflows19)Net cash flows from operating activities2.Cash Flows from Investing Activities:20)Cash received from return of investments21)Cash received from distribution of dividends or profits22)Cash received from bond interest incomeNet cash received from disposal of fixed assets,intangible 23)assets and other long-term assets26)Other cash received relating to investing activities27)Sub-total of cash inflowsCash paid to acquire fixed assets,intangible assets28)and other long-term assets29)Cash paid to acquire equity investments30)Cash paid to acquire debt investments33)Other cash paid relating to investing activities34)Sub-total of cash outflows35)Net cash flows from investing activities3.Cash Flows from Financing Activities:36)Proceeds from issuing shares37)Proceeds from issuing bonds38)Proceeds from borrowings41)Other proceeds relating to financing activities42)Sub-total of cash inflows43)Cash repayments of amounts borrowed44)Cash payments of expenses on any financing activities45)Cash payments for distribution of dividends or profits46)Cash payments of interest expenses47)Cash payments for finance leases48)Cash payments for reduction of registered capital51)Other cash payments relating to financing activities52)Sub-total of cash outflows53)Net cash flows from financing activities4.Effect of Foreign Exchange Rate Changes on Cash Increase in Cash and Cash EquivalentsSupplemental Information1.Investing and Financing Activities that do not Involve in Cash Receipts and Payments56)Repayment of debts by the transfer of fixed assets57)Repayment of debts by the transfer of investments58)Investments in the form of fixed assets59)Repayments of debts by the transfer of investories2.Reconciliation of Net Profit to Cash Flows from Operating Activities62)Net profit63)Add provision for bad debt or bad debt written off64)Depreciation of fixed assets65)Amortization of intangible assetsLosses on disposal of fixed assets,intangible assets66)and other long-term assets (or deduct:gains)67)Losses on scrapping of fixed assets68)Financial expenses69)Losses arising from investments (or deduct:gains)70)Defered tax credit (or deduct:debit)71)Decrease in inventories (or deduct:increase)72)Decrease in operating receivables (or deduct:increase)73)Increase in operating payables (or deduct:decrease)74)Net payment on value added tax (or deduct:net receipts75)Net cash flows from operating activities Increase in Cash and Cash Equivalents76)cash at the end of the period77)Less:cash at the beginning of the period78)Plus:cash equivalents at the end of the period79)Less:cash equivalents at the beginning of the period80)Net increase in cash and cash equivalents现金流量表的现金流量声明拟制人:时间:单位:项目1.cash流量从经营活动:01 )所收到的现金从销售货物或提供劳务02 )收到的租金增值税销售额收到退款的价值03 )增值税缴纳04 )退回的其他税收和征费以外的增值税07 )其他现金收到有关经营活动08 )分,总现金流入量09 )用现金支付的商品和服务10 )用现金支付经营租赁11 )用现金支付,并代表员工12 )增值税购货支付13 )所得税的缴纳14 )支付的税款以外的增值税和所得税17 )其他现金支付有关的经营活动18 )分,总的现金流出19 )净经营活动的现金流量2.cash流向与投资活动:20 )所收到的现金收回投资21 )所收到的现金从分配股利,利润22 )所收到的现金从国债利息收入现金净额收到的处置固定资产,无形资产23 )资产和其他长期资产26 )其他收到的现金与投资活动27 )小计的现金流入量用现金支付购建固定资产,无形资产28 )和其他长期资产29 )用现金支付,以获取股权投资30 )用现金支付收购债权投资33 )其他现金支付的有关投资活动34 )分,总的现金流出35 )的净现金流量,投资活动产生3.cash流量筹资活动:36 )的收益,从发行股票37 )的收益,由发行债券38 )的收益,由借款41 )其他收益有关的融资活动42 ),小计的现金流入量43 )的现金偿还债务所支付的44 )现金支付的费用,对任何融资活动45 )支付现金,分配股利或利润46 )以现金支付的利息费用47 )以现金支付,融资租赁48 )以现金支付,减少注册资本51 )其他现金收支有关的融资活动52 )分,总的现金流出53 )的净现金流量从融资活动4.effect的外汇汇率变动对现金增加现金和现金等价物补充资料1.investing活动和筹资活动,不参与现金收款和付款56 )偿还债务的转让固定资产57 )偿还债务的转移投资58 )投资在形成固定资产59 )偿还债务的转移库存量2.reconciliation净利润现金流量从经营活动62 )净利润63 )补充规定的坏帐或不良债务注销64 )固定资产折旧65 )无形资产摊销损失处置固定资产,无形资产66 )和其他长期资产(或减:收益)67 )损失固定资产报废68 )财务费用69 )引起的损失由投资管理(或减:收益)70 )defered税收抵免(或减:借记卡)71 )减少存货(或减:增加)72 )减少经营性应收(或减:增加)73 )增加的经营应付账款(或减:减少)74 )净支付的增值税(或减:收益净额75 )净经营活动的现金流量增加现金和现金等价物76 )的现金,在此期限结束77 )减:现金期开始78 )加:现金等价物在此期限结束79 )减:现金等价物期开始80 ),净增加现金和现金等价物。