国际会计复习---业务题答案版2011

- 格式:doc

- 大小:221.50 KB

- 文档页数:24

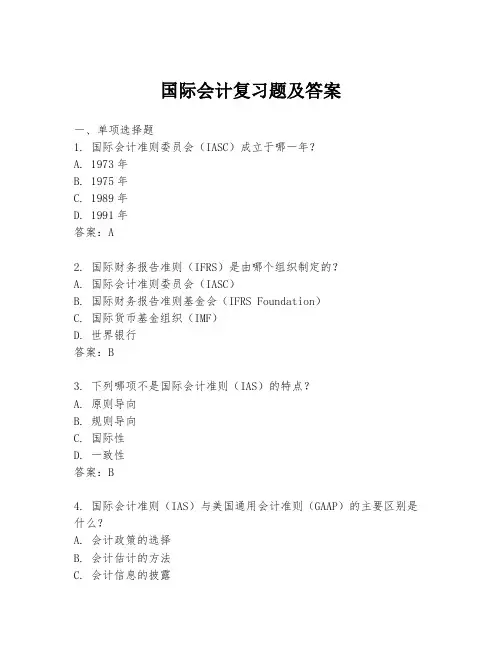

国际会计复习题及答案一、单项选择题1. 国际会计准则委员会(IASC)成立于哪一年?A. 1973年B. 1975年C. 1989年D. 1991年答案:A2. 国际财务报告准则(IFRS)是由哪个组织制定的?A. 国际会计准则委员会(IASC)B. 国际财务报告准则基金会(IFRS Foundation)C. 国际货币基金组织(IMF)D. 世界银行答案:B3. 下列哪项不是国际会计准则(IAS)的特点?A. 原则导向B. 规则导向C. 国际性D. 一致性答案:B4. 国际会计准则(IAS)与美国通用会计准则(GAAP)的主要区别是什么?A. 会计政策的选择B. 会计估计的方法C. 会计信息的披露D. 会计准则的制定机构答案:D5. 国际会计准则第8号(IAS 8)主要涉及哪方面的会计处理?A. 外币交易B. 资产减值C. 会计政策变更D. 错误更正答案:D二、多项选择题1. 国际会计准则(IAS)中,哪些属于财务报表的主要组成部分?A. 资产负债表B. 利润表C. 现金流量表D. 所有者权益变动表答案:ABCD2. 根据国际会计准则,下列哪些项目需要在财务报表中披露?A. 会计政策B. 会计估计变更C. 重大会计差错D. 财务报表的编制基础答案:ABCD3. 国际会计准则中,哪些因素会影响外币交易的会计处理?A. 汇率变动B. 交易性质C. 报告货币D. 经济环境答案:ABC三、判断题1. 国际会计准则(IAS)和国际财务报告准则(IFRS)是同一概念的不同表述。

(错误)2. 国际会计准则第21号(IAS 21)要求企业必须以功能货币报告外币交易。

(错误)3. 国际会计准则第39号(IAS 39)涉及金融工具的确认和计量。

(正确)四、简答题1. 简述国际会计准则第12号(IAS 12)中关于所得税会计处理的主要原则。

2. 描述国际会计准则第16号(IAS 16)中关于固定资产折旧方法的选择标准。

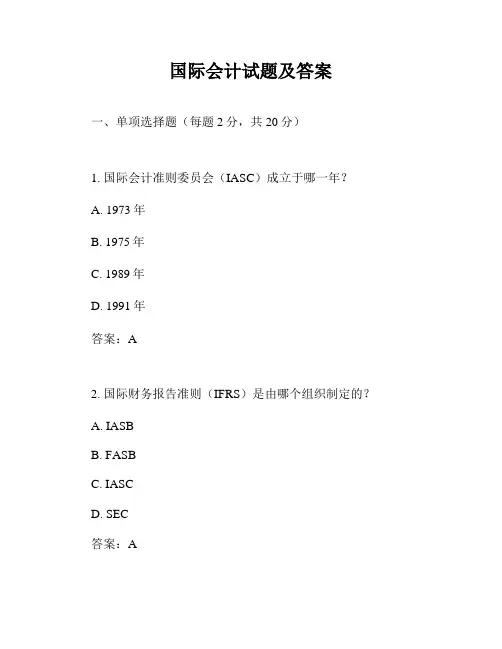

国际会计试题及答案一、单项选择题(每题2分,共20分)1. 国际会计准则委员会(IASC)成立于哪一年?A. 1973年B. 1975年C. 1989年D. 1991年答案:A2. 国际财务报告准则(IFRS)是由哪个组织制定的?A. IASBB. FASBC. IASCD. SEC答案:A3. 以下哪个不是国际会计准则(IAS)?A. IAS 1B. IAS 16C. IAS 39D. FAS 56答案:D4. 国际会计准则中,关于外币交易的会计处理规定在哪个准则中?A. IAS 21B. IAS 24C. IAS 29D. IAS 39答案:A5. 国际会计准则中,关于合并财务报表的规定在哪个准则中?A. IAS 27B. IAS 28C. IAS 31D. IAS 33答案:A6. 国际会计准则中,关于资产减值的规定在哪个准则中?A. IAS 36B. IAS 37C. IAS 38D. IAS 39答案:A7. 国际会计准则中,关于收入确认的规定在哪个准则中?A. IAS 11B. IAS 18C. IAS 34D. IAS 41答案:B8. 国际会计准则中,关于租赁的规定在哪个准则中?A. IAS 17B. IAS 18C. IAS 19D. IAS 20答案:A9. 国际会计准则中,关于金融工具的规定在哪个准则中?A. IAS 32B. IAS 33C. IAS 39D. IAS 40答案:C10. 国际会计准则中,关于退休福利计划的规定在哪个准则中?A. IAS 19B. IAS 26C. IAS 35D. IAS 37答案:A二、多项选择题(每题3分,共15分)1. 以下哪些是国际会计准则的主要目标?A. 促进全球财务报告的一致性B. 提高财务报告的透明度和可比性C. 减少不同国家会计准则之间的差异D. 增加会计信息的用户答案:A, B, C2. 国际会计准则委员会(IASC)的主要工作包括哪些?A. 制定和发布国际会计准则B. 协调各国会计准则的差异C. 监督国际会计准则的实施情况D. 提供会计教育和培训答案:A, B, C3. 国际会计准则中,以下哪些属于财务报表的主要组成部分?A. 资产负债表B. 利润表C. 现金流量表D. 所有者权益变动表答案:A, B, C, D4. 国际会计准则中,以下哪些因素会影响外币交易的会计处理?A. 汇率变动B. 交易的性质C. 外币的可兑换性D. 交易的金额答案:A, B, C5. 国际会计准则中,以下哪些属于资产减值的迹象?A. 资产的市价持续下跌B. 资产的使用寿命缩短C. 资产的技术或商业过时D. 资产的维护成本增加答案:A, B, C, D三、判断题(每题2分,共20分)1. 国际会计准则委员会(IASC)已经更名为国际会计准则理事会(IASB)。

Answers of Discussion Questions for International AccountingChapter 18. Given the increased globalization of the last few decades, can small domestic business survive? What advantage and disadvantages do they have compared to MNEs?在近十几年全球化加剧的情况下,国内的小企业能生存下去么?与跨国企业相比,它们有什么优势和劣势?全球化就是在全球的范围内利用各种要素增值。

从这些角度看国内的企业已经做了很多全球化工作。

全球化不一定是大企业的任务,中小企业同样可以全球化。

在全球化的战略上,需要确定三个目标:提高效率,管理风险和适应、学习与创新,才能建立全球竞争优势,利用国家差异获得成本优势,利用全球经营获得规模经济,利用多产品和多市场经营获得范围经济。

优势:除部分未改制的国有中小企业来说,一般来讲,中小企业经营机制灵活,活力较强,二是以市场为导向,贴近市场,贴近用户,市场化程度高。

企业经营灵活,调整快,进入市场快。

三是形成了自身的产业比较优势。

四是很多企业都进行了技术改进,更新了制造设备,改进了技术工艺,企业竞争力得到增强。

劣势:低水平重复建设,存在大量“小而全”。

二是多数中小企业生产设备相对陈旧,技术和工艺比较落后。

三是多数中小企业开发设计能力低,缺少自主创新能力,主要靠模仿,跟随在大企业后面亦步亦趋,难以提供自己的特色产品与服务,难以获得主动发展。

四是中小企业产品多属于劳动密集型,技术含量低,附加值不高,在激烈的市场中难以实现资金的较快积累。

五是财力不足,企业发展和提高缺乏资金支持。

六是人才缺乏,尤其缺乏高素质的管理人才和创新人才。

建议:1.发挥现有优势,克服营销竞争力的诸多问题,采取对策,抓住机遇,赢得挑战。

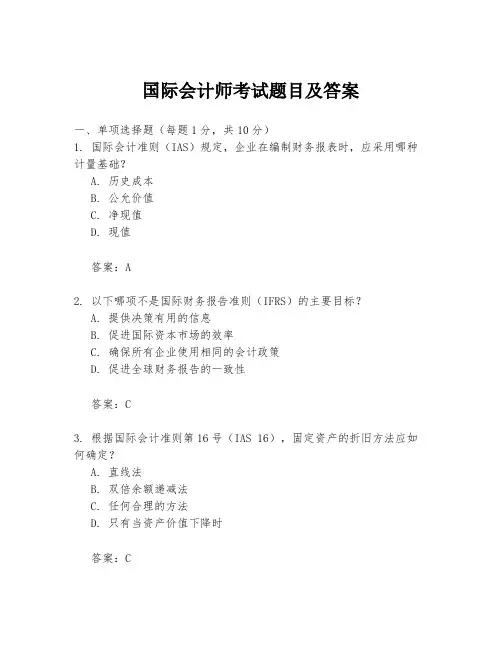

国际会计师考试题目及答案一、单项选择题(每题1分,共10分)1. 国际会计准则(IAS)规定,企业在编制财务报表时,应采用哪种计量基础?A. 历史成本B. 公允价值C. 净现值D. 现值答案:A2. 以下哪项不是国际财务报告准则(IFRS)的主要目标?A. 提供决策有用的信息B. 促进国际资本市场的效率C. 确保所有企业使用相同的会计政策D. 促进全球财务报告的一致性答案:C3. 根据国际会计准则第16号(IAS 16),固定资产的折旧方法应如何确定?A. 直线法B. 双倍余额递减法C. 任何合理的方法D. 只有当资产价值下降时答案:C4. 国际会计准则第36号(IAS 36)规定,当资产的可回收金额低于其账面价值时,应如何处理?A. 继续持有资产B. 立即出售资产C. 计提减值准备D. 增加资产账面价值答案:C5. 国际会计准则第18号(IAS 18)规定,收入的确认应基于什么原则?A. 成本加成原则B. 风险和报酬转移原则C. 现金收付实现制D. 权责发生制答案:D6. 根据国际会计准则第1号(IAS 1),财务报表的呈现应遵循什么原则?A. 重要性原则B. 一致性原则C. 可比性原则D. 所有上述原则答案:D7. 国际会计准则第38号(IAS 38)涉及的是什么类型的资产?A. 固定资产B. 无形资产C. 存货D. 投资性房地产答案:B8. 国际会计准则第21号(IAS 21)主要涉及哪种货币的会计处理?A. 企业本位货币B. 外币C. 任何货币D. 法定货币答案:B9. 国际会计准则第32号(IAS 32)规定,金融工具的分类应基于什么?A. 金融工具的类型B. 金融工具的用途C. 企业持有金融工具的意图D. 金融工具的公允价值答案:C10. 国际会计准则第39号(IAS 39)主要涉及的是什么?A. 金融资产和金融负债的分类B. 金融资产和金融负债的计量C. 金融资产和金融负债的披露D. 所有上述内容答案:D二、多项选择题(每题2分,共10分)11. 根据国际会计准则第8号(IAS 8),以下哪些项目应在财务报表中披露?A. 会计政策B. 会计估计的变更C. 会计政策变更的影响D. 所有上述项目答案:D12. 国际会计准则第12号(IAS 12)涉及的税种包括以下哪些?A. 所得税B. 增值税C. 消费税D. 营业税答案:A13. 根据国际会计准则第23号(IAS 23),在进行资本化时,以下哪些成本可以计入资产成本?A. 借款费用B. 管理费用C. 销售费用D. 直接材料和直接人工成本答案:A, D14. 国际会计准则第27号(IAS 27)要求对联营企业的投资采用哪种会计政策?A. 成本法B. 权益法C. 公允价值法D. 历史成本法答案:B15. 国际会计准则第37号(IAS 37)规定,以下哪些情况需要计提预计负债?A. 法律诉讼B. 环境清理义务C. 产品质量保证D. 所有上述情况答案:D三、简答题(每题5分,共20分)16. 简述国际会计准则第41号(IAS 41)。

国际会计期末复习题及答案----7cec3524-6ead-11ec-8715-7cb59b590d7d1.英国会计模式和美国会计模式有什么不同?相似之处:第一,两国都有非政府组织制定会计准则,两国会计准则委员会制定准则的程序基本相同。

其次,美国和英国都有强大的会计专业。

不同点:第一,英国没有像美国证券交易委员会那样的对公司财务会计准则的制定保持着监督和最终修订权利的政府机构,而是通过《公司法》管理公司事务,会计准则的要求不能违反公司法的要求。

其次,除了为投资者和债权人提供有用的决策信息外,英国企业财务报告的目标还应明确提出“社会管理责任”。

增值报表中反映的增值应分配给投资者、员工和政府,其中一部分应再次投资于企业,这在美国会计模式中是不可用的。

2.简要描述霍斯特的四个国家文化维度对会计的影响?(1)个人主义与集体主义:决定了一个国家会计职业界的发达情况。

倾向于个人主义的国家,政府对会计管理干预较少,更注重职业判断。

倾向于集体主义的国家,政府对会计的管理干预比较多,统一会计规则,会计职业判断比较少。

(2)权距大小:权距较大的国家一般采用统一的会计制度;权力距离相对较小的国家通常通过公认的会计准则来规范会计实务。

(3)不确定性规避的强与弱:对会计的影响:规避程度高的社会,会计实务中倾向于保守、保密、透明性低。

规避程度弱的社会,不会倾向于采用稳健主义的会计方法。

(4)阳刚之气的强弱:对会计的影响:在一个阳刚之气很强的社会,会计更加公平和公开;在一个脆弱的社会里,会计更加保守和保密。

3.简述国家会计协调化的含义?(1)协调化一个过程,不可能一蹴而就;(2)协调化是限制和缩小会计差异的过程;(3)协调化是形成一套可接受的标准(准则)和惯例的过程;(4)协调化是能产生共同协作结果的有序结构的过程;(5)协调化是促进各国会计实务和财务信息的可比性的过程。

4.致力于国家会计协调和同化的六个国际组织:(1)联合国国际会计和报告准则政府间专家工作组(会计准则专家组);(权威国际论坛)(2)欧洲联盟(欧盟);(致力于区域协调的最强大国家联盟)(3)经济合作与发展组织(经合组织)会计工作组;(代表发达国家的利益)(4)国际证券委员会组织(IOSCO);(国家证券监管机构国际组织)(5)国际会计师联合会(IFAC);(6)国际会计准则委员会(IASC)。

第三章比较会计模式一、单项选择题1、下列属于北欧会计模式特征的是(B )A强调公司按“真实和允许”的观点提供财务报告B以公司利益为导向的C服从于集中计划经济 D 服从于谁只需要2、通过“公认会计原则”,以保护证券市场投资人的利益为主要目的会计模式是(B )A英国会计模式B美国会计模式C法国-西班牙-意大利会计模式D北欧会计模式3、强调公司应按“真实和公允”(true and fair)的观点提供财务报告,主要是为了保护投资人和债权人的利益的会计模式是(A)A英国会计模式B美国会计模式C法国—西班牙—意大利会计模式D北欧会计模式4、以公司利益为导向的会计模式是(D)A英国会计模式B美国会计模式C前苏联会计模式D北欧会计模式二、多项选择题1、会计模式的内容可以包括(ABCD)A会计目的B会计原则C会计准则D会计的组织和管理体制2、流传颇广的阿伦的会计模式国际分类中,主要的会计模式有(ABCDE)A英国会计模式B美国会计模式C法国-西班牙-意大利会计模式D北欧会计模式E苏联会计模式F 中国会计模式3、下列国家的会计准则是由民间机构制定的是(AB )A美国B 英国C法国D中国4、下列对美国会计模式描述正确的是(ABC )A“公认会计原则”是其基本特征B 有官方支持和影响下的民间机构制定会计准则C税务会计与财务会计相背离D年度审计和财务报告的要求普遍适用于所有企业。

5、下列对英国会计模式描述正确的是(BCD )A 通过《经济法》管理公司事务,包括对公司的财务会计和报告的要求B 由民间机构制定会计准则C强调“真实”和“公允”D流行增值表,体现报告公司的社会经管责任。

6、法国会计模式的特征包括(ABC )A 以税务为导向B由政府颁布统一的会计方案C 极度稳健D实质胜于形式7、下列属于德国会计服从的法律要求包括(ABC )A 税法B商法C公司法D 民法8、下列属于德国会计模式的特征的是(ABD )A 会计服从于法律B 不要求充分披露C 按销售成本法编制损益表D 按总费用法编制损益表9、在日本的“三法体制”中,三法是指(ABD )。

《国际会计》作业答案一、名词解释:1、国际会计:国际会计是以会计的国际差异和国际惯例为研究对象,以会计的国际比较分析、跨国公司特有的会计计量、报告和控制问题、国际金融市场对会计的需求以及各种国际性组织对世界范围内会计和财务报告所进行的协调等为研究内容,将一般目的的、面向本国的会计在广泛的意义上扩展到国际环境中而形成的一门新兴会计学科2、母公司理论:母公司理论认为,合并会计报表主要为母公司的投资者服务,将合并会计报表视为母公司会计报表的补充,强调母公司或控股公司的股东权益,而忽视少数股东权益3、国际双重征税:国际双重征税是两个或两个以上的主权国家或地区的政府,在同一时期内,对参与或被认为是参与国际经济活动的同一或不同纳税人行使税收管辖权,造成对同一征税对象(国际所得)由两个以上国家或地区政府征税的情况4、现行成本:现行成本,是与已入账的历史成本相对的,一般是指在结账日或编表日反映当时市场价值或公允价值的某种金额二、计算及账务处理题(假设某中国进口商于2004年12月1日与美国出口商签订一项远期进口设备的购销合约,共计价值US$80000,货款将于60天后支付。

中国公司以人民币为记帐本位币核算经营损益,故同日,中国公司与银行签订了60天后购买US$80000的期汇合同。

有关汇率如下:2004年12月1日,即期汇率:US$1=¥8.252004年12月1日,60天远期汇率:US$1=¥8.302004年12月31日,即期汇率:US$1=¥8.202004年1月31日,即期汇率:US$1=¥8.35请就上述中国进口商利用期汇合约进行外币约定套期保值进行相应的账务处理。

解①2001.12.1借:应收账款(应收美元——银行) ¥660000 (¥8.25×80 000)期汇合同递延折价¥4000 [(¥8.30-8.25)×80 000]贷:应付账款(应付人民币——银行) ¥664000 (¥8.30×80000)②2001.12.31借:递延汇兑损益¥4 000贷:应收账款(应收美元——银行) ¥4 000 [(¥8.25-8.20)×80000]③2002.1.31借:应付账款(应付人民币——银行)¥664000贷:银行存款(人民币户) ¥664000④借:银行存款(美元户) ¥668000(¥8.35×80000)贷:应收账款(应收美元——银行)¥656000(¥660000-4000)汇兑损益¥12000⑤2002.1.31借:固定资产¥656000汇兑损益¥12000递延汇兑损益¥4000贷:银行存款(美元户)(¥8.35×80000) ¥668000期汇合同递延折价¥40002、设2004年12月15日美国购货商向某中国公司购买货物共计价值US$100000,货款将于60天后结算、收讫。

第一章涉外企业会计概述一、本章重点1、涉外企业会计的涵义2、涉外企业会计的对象及特点3、涉外企业会计的会计计信息质量要求与会计计量二、复习思考题(一)单项选择题1、涉外企业的经济业务至少涉及两种或两种以上货币结算,因此,会计处理应(D )作为记账本位币。

A.采用人民币B.采用美元C.采用欧元D.选择其中的某一种货币2、涉外企业会计核算的对象是其主要反映和监督的内容,具体是指经营过程中的(C )。

A.资产、负债和所有者权益B.收入、费用和利润C.资金运动及其所反映的经营活动D.生产经营的成本、费用支出3、存货期末计价采用成本与可变现净值孰低法,体现的会计信息质量要求是(B )。

A.历史成本要求B.谨慎性要求C.客观性要求D.配比要求4、在取得资产时,按照所支付的实际价格计价,其会计计量属性是(A )A.历史成本B.净值C.可变现净值D.公允价值(二)多项选择题1、涉外企业发生的经济业务,一般包括(ABCDE )A.进口业务B.出口业务C.对外投资业务D.对外融资业务E.吸收外币资本投资业务2、涉外企业与其他一般企业相比,会计核算除了应遵循一般会计信息质量要求和核算方法外,其特殊性主要表现在(ABDE )。

A.要选择记账本位币B.要采用外币记账方法核算外币业务C.按外国货币编制会计报表D.外币业务会产生汇兑损益的核算E.进出口业务要遵循国际贸易结算的程序和方法3、相关性要求企业会计核算所提供的信息必须满足(ABCDE )的需要。

A.国家宏观经济管理B.企业加强内部经营管理C.投资者了解企业经营情况D.债权人了解企业经营情况E.与企业有利益关系各方了解企业经营情况4、下列各项中,不属于企业资产确认范围的有(AC )。

A.约定未来购入商品B.融资租入设备C.经营租入设备D.委托加工商品E.委托代销商品(三)判断题1、具有涉外业务的企业,均称为涉外企业。

(√)2、涉外企业与一般企业的会计核算和记账方法是相同的。

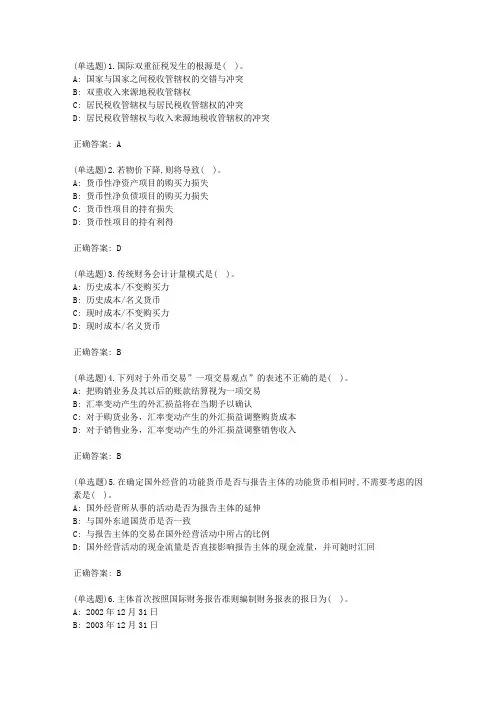

(单选题)1.国际双重征税发生的根源是( )。

A: 国家与国家之间税收管辖权的交错与冲突B: 双重收入来源地税收管辖权C: 居民税收管辖权与居民税收管辖权的冲突D: 居民税收管辖权与收入来源地税收管辖权的冲突正确答案: A(单选题)2.若物价下降,则将导致( )。

A: 货币性净资产项目的购买力损失B: 货币性净负债项目的购买力损失C: 货币性项目的持有损失D: 货币性项目的持有利得正确答案: D(单选题)3.传统财务会计计量模式是( )。

A: 历史成本/不变购买力B: 历史成本/名义货币C: 现时成本/不变购买力D: 现时成本/名义货币正确答案: B(单选题)4.下列对于外币交易”一项交易观点”的表述不正确的是( )。

A: 把购销业务及其以后的账款结算视为一项交易B: 汇率变动产生的外汇损益将在当期予以确认C: 对于购货业务,汇率变动产生的外汇损益调整购货成本D: 对于销售业务,汇率变动产生的外汇损益调整销售收入正确答案: B(单选题)5.在确定国外经营的功能货币是否与报告主体的功能货币相同时,不需要考虑的因素是( )。

A: 国外经营所从事的活动是否为报告主体的延伸B: 与国外东道国货币是否一致C: 与报告主体的交易在国外经营活动中所占的比例D: 国外经营活动的现金流量是否直接影响报告主体的现金流量,并可随时汇回正确答案: B(单选题)6.主体首次按照国际财务报告准则编制财务报表的报日为( )。

A: 2002年12月31日B: 2003年12月31日C: 2004年12月31日D: 2005年12月31日正确答案: C(单选题)7.《国际财务报告准则第1号》的规定适用于( )或以后采用国际财务报告准则首次编制会计报表的主体。

A: 2002年1月1日B: 2003年1月1日C: 2004年1月1日D: 2005年1月1日正确答案: C(单选题)8.国际会计准则委员会的总部设在( )。

A: 美国纽约B: 法国巴黎C: 英国伦敦D: 德国柏林正确答案: C(单选题)9.国际会计准则委员会成立于( ) 。

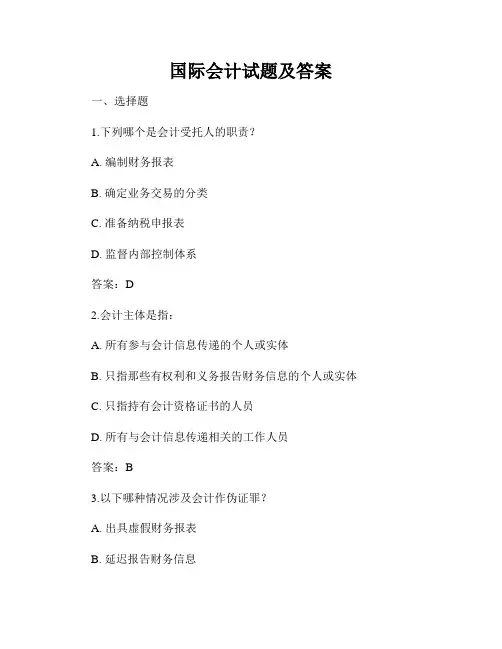

国际会计试题及答案一、选择题1.下列哪个是会计受托人的职责?A. 编制财务报表B. 确定业务交易的分类C. 准备纳税申报表D. 监督内部控制体系答案:D2.会计主体是指:A. 所有参与会计信息传递的个人或实体B. 只指那些有权利和义务报告财务信息的个人或实体C. 只指持有会计资格证书的人员D. 所有与会计信息传递相关的工作人员答案:B3.以下哪种情况涉及会计作伪证罪?A. 出具虚假财务报表B. 延迟报告财务信息C. 未按时提交纳税申报表D. 泄露会计信息答案:A4.在资产负债表中,下列哪个项目是按照流动性从高到低进行排列的?A. 现金与现金等价物B. 长期股权投资C. 长期借款D. 应付账款答案:A5.以下哪个方法用于确定资产的账面价值?A. 成本法B. 公允价值法C. 因果关系法D. 净现值法答案:A二、简答题1.解释什么是会计准则?答:会计准则是指规范会计信息编制和报告的准则和原则,用于确保财务信息的准确性、可比性和透明度。

会计准则的目的是提供一个统一的标准,使不同企业的财务报表可以进行比较和分析。

2.什么是财务报表?答:财务报表是记录企业财务状况、经营成果和现金流量等信息的文件。

主要包括资产负债表、利润表、现金流量表和所有者权益变动表。

财务报表提供了有关企业财务状况和业绩的重要信息,对于投资者、债权人和其他利益相关者来说都具有重要参考价值。

3.解释什么是会计盈余?答:会计盈余是指企业在一定时期内实现的收入减去支出后的剩余额。

它可以反映企业的盈利能力和经营状况。

会计盈余可以通过利润表来计算,也可以通过现金流量表中的经营活动产生的现金流量净额来计算。

4.解释什么是会计政策?答:会计政策是指企业在编制和报告财务报表时,所采用的会计处理方法和计量原则。

会计政策可以针对不同的会计项目和业务交易制定不同的准则。

企业应当在财务报表中明确披露其所采用的会计政策,以提高财务信息的可信度和可比性。

5.什么是财务分析?答:财务分析是对企业财务信息进行详细研究和评估的过程。

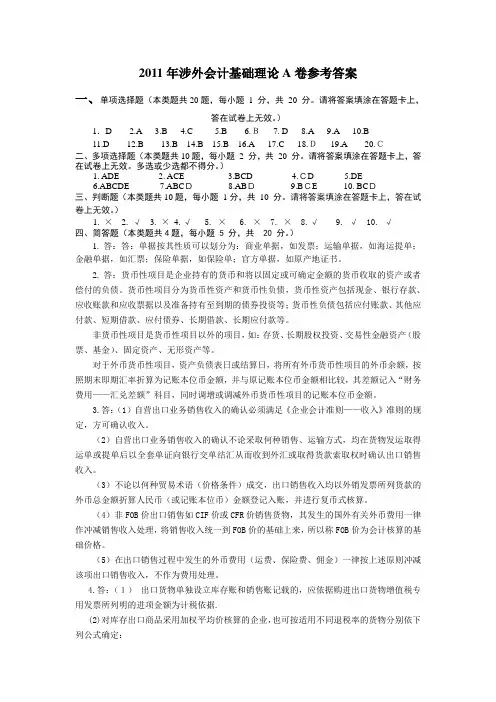

2011年涉外会计基础理论A卷参考答案一、单项选择题(本类题共20题,每小题1 分,共20 分。

请将答案填涂在答题卡上,答在试卷上无效。

)1.D 2.A 3.B 4.C 5.B 6.B7. D 8.A 9.A 10.B11.D 12.B 13.B 14.B 15.B 16.A 17.C 18.D19.A 20.C二、多项选择题(本类题共10题,每小题2 分,共20 分。

请将答案填涂在答题卡上,答在试卷上无效。

多选或少选都不得分。

)1. ADE2. ACE3.BCD4.CD5.DE6.ABCDE7.ABCD8.ABD9.BCE 10. BCD三、判断题(本类题共10题,每小题1分,共10 分。

请将答案填涂在答题卡上,答在试卷上无效。

)1.×2. √3. ×4.√5. ×6. ×7. ×8.√9. √ 10. √四、简答题(本类题共4题,每小题 5 分,共 20 分。

)1.答:答:单据按其性质可以划分为:商业单据,如发票;运输单据,如海运提单;金融单据,如汇票;保险单据,如保险单;官方单据,如原产地证书。

2.答:货币性项目是企业持有的货币和将以固定或可确定金额的货币收取的资产或者偿付的负债。

货币性项目分为货币性资产和货币性负债,货币性资产包括现金、银行存款、应收账款和应收票据以及准备持有至到期的债券投资等;货币性负债包括应付账款、其他应付款、短期借款、应付债券、长期借款、长期应付款等。

非货币性项目是货币性项目以外的项目,如:存货、长期股权投资、交易性金融资产(股票、基金)、固定资产、无形资产等。

对于外币货币性项目,资产负债表日或结算日,将所有外币货币性项目的外币余额,按照期末即期汇率折算为记账本位币金额,并与原记账本位币金额相比较,其差额记入“财务费用——汇兑差额”科目,同时调增或调减外币货币性项目的记账本位币金额。

3.答:(1)自营出口业务销售收入的确认必须满足《企业会计准则——收入》准则的规定,方可确认收入。

国际会计课后题答案整理版第1章国际会计的形成与发展一、讨论题1.1 为什么说市场国际化,特别是货币市场和资本市场的国际化是会计国际化的主要推动力?国际贸易和国际经济技术合作,促使会计成为一种国际商业语言。

特别是国际货币市场和资本市场的兴起向进入市场的贷款人或筹资者提出了应提供在国际间可比且可靠的财务信息的要求(即国际财务报告趋同化的要求),更成为会计国际化的主要推动力。

1.2 跨国公司是否在百分之百地推动会计国际化?说明你的观点。

不是。

跨国公司对推动会计国际化有其两面性:一方面,基于其跨国经营和国际筹资的需要,他们希望通过会计国际化来缩小和协调国别差异;另一方面,他们又十分重视利用各国现存的会计差异来谋取财务利益。

后者也推动了各国会计模式和重要会计方法的国际比较研究。

(注意:“会计国际化”大体上与“会计的国际协调化”概念一致,而与国际会计研究中的“国别会计”观点对立)1.3 会计随商业活动的扩展而传播,你同意这种说法吗?从历史发展的进程谈谈你的看法。

同意。

可主要就前殖民帝国的会计向其原殖民地传播、工业革命后西方会计的发展及在世界范围内的广泛传播以及第二次世界大战以后美国会计的影响在一定程度上主宰着世界各地的会计发展等历史事实,加以讨论。

1.4 哪些特定会计方法具有国际性质?把外币交易和外币报表的折算引入会计领域,是会计国际化带来的独特问题。

它与由此引发的跨国企业合并和国际合并财务报表与外币折算相互关联和制约的问题,以及各国的物价变动影响在国际合并财务报表中如何处理和调整的问题,从20世纪70年代以来,就成为国际会计研究中既需协调一致但又矛盾重重的“三大难题”。

在世纪之交,金融工具(特别是衍生工具)的创新引发的会计处理问题,给传统的会计概念和实务带来了巨大的冲击,成为各国会计准则机构联合攻关、仍未妥善解决的难题。

此外,国际税务会计也是值得关注的课题。

1.5 你对会计国际化和国家化之间的矛盾及其消长有何看法?会计国际化和国家化的矛盾实际上反映了经济全球化与各国的国家利益之间的矛盾及其消长过程。

国际会计题(答案)国际会计题(答案)《国际会计》第⼀章国际会计的形式与发展⼀、单项选择题1、国际会计成为⼀门新的会计学科,⼤致在(A)A 20世纪70年代B 20世纪60年代C20世纪90年代D20世纪50年代2、跨国公司兴起导致的独特的会计问题是()A 国际物价变动影响的调整B 国际财务报表的合并C 外币报表的折算D 国际税务会计3、“四⼤”会计师事务所的业务扩展与委托⼈的联系使⽤的是(A)A 同⼀名称和同⼀语⾔B 不同名称和同⼀语⾔C 不同名称和不同语⾔D 同⼀名称和不同语⾔4、第⼀次国际会计师⼤会举⾏的时间、地点是(A )A 1904年圣路易斯B 1952年伦敦C 1962年纽约D 1972年悉尼5、1977年于慕尼⿊举⾏的第⼗⼀次国际会计师⼤会上创建的国际会计师联合会(IFAC)的前⾝是( A )A 会计职业界国际协调委员会(ICCAP)B 国际会计准则委员会(IASC)C 国际审计事务委员会(IAPC)D 国际会计师⼤会技术委员会⼆、多项选择题1、国际会计的三⼤课题是(ABC )A 国际物价变动影响的调整B 国际财务报表的合并C 外币报表的折算D 国际税务会计2、现有的国际性会计事务所(会计公司)中所谓的“四⼤”包括(A B C D )A普华永道B毕马威国际C德勤D永安国际E安达信国际3、国内性质的会计师事务所为从事国际业务⽽进⾏的临时协作⼀般要通过哪些途径联系?()A 国际性的职业届会议B 双⽅直接联系C 各国的执业会计师协会下设的国际联络委员会D 各国政府4、我国注册会计师考试的报考者的条件包括(AB )4、1987年美国发布了FAS95,以现⾦流量表取代了原先要求编制的()A 资产负债表B 损益表C 财务状况变动表D 增值表5、美国会计在发出存货的计价中()应⽤⽐较普遍。

A 个别计价法B 先进先出法C 后进先出法D 加权平均法⼆、多项选择题1、公允价值计量模式与历史成本计量模式的差别在于()A 前者要求在每⼀会计期间(⾄少是每⼀会计年度)总结时,对资产项⽬进⾏后续计量(重估价),以确认其减值或增值。

国际会计考试题及答案一、选择题(每题2分,共20分)1. 根据国际会计准则,下列哪项不属于会计信息质量要求?A. 可靠性B. 相关性C. 及时性D. 可比性答案:C2. 国际会计准则委员会(IASB)发布的准则适用于以下哪个组织?A. 联合国B. 国际货币基金组织(IMF)C. 国际会计准则委员会D. 世界银行答案:C3. 以下哪项不是国际会计准则(IFRS)的主要目标?A. 提供一致的会计信息B. 促进跨国投资C. 强制所有国家采用D. 提高财务报告的透明度答案:C4. 在国际会计准则下,企业应如何确认收入?A. 当收到现金时B. 当商品或服务的风险和报酬转移给买方时C. 当合同签订时D. 当商品或服务交付时答案:B5. 以下哪个不是国际会计准则中关于资产减值的规定?A. 资产的可回收金额低于其账面价值时,应计提减值准备B. 资产减值一旦计提,不得转回C. 资产减值测试应每年进行D. 资产减值测试应仅在发生减值迹象时进行答案:C6. 国际会计准则要求企业在编制财务报表时,应采用哪种货币?A. 美元B. 欧元C. 企业所在国的货币D. 任意一种货币答案:C7. 在国际会计准则下,企业合并时,应采用以下哪种方法进行会计处理?A. 购买法B. 权益结合法C. 混合法D. 以上都不是答案:A8. 国际会计准则中,关于租赁的分类有哪些?A. 经营租赁和融资租赁B. 短期租赁和长期租赁C. 直接租赁和间接租赁D. 有形资产租赁和无形资产租赁答案:A9. 国际会计准则要求企业披露哪些信息?A. 仅财务信息B. 仅非财务信息C. 财务信息和非财务信息D. 仅管理层讨论与分析答案:C10. 国际会计准则下,以下哪项不是企业需要披露的关联方交易?A. 与母公司之间的交易B. 与子公司之间的交易C. 与关联方之间的交易D. 与非关联方之间的交易答案:D二、简答题(每题10分,共30分)1. 简述国际会计准则(IFRS)的主要特点。

国际会计学习与考试指导附录A模拟试题及参考答案模拟试题1一、名词解释(每小题3分,共15分)1.国际会计协调2.母公司理论3.时态法4.国际双重征税5.全面收益二、判断题(对的打√,错的打×,每小题1.5分,共15分)1.美国会计准则是由政府授权民间机构制定的。

( )2.当远期汇率高于即期汇率时,就会形成升水收益。

( )3.采用单项交易观点对外币交易进行核算时,销货收入在销售成立时就已经确认。

( )4.时态法要求改变外币报表的计量单位,但不应该改变原有的计量属性。

( )5.当某公司拥有另一公司51%的股权时,一般需要编制合并会计报表。

( )6.英国会计模式以“真实和公允”为特征。

( )7.合并会计报表是在母、子公司账簿资料基础上编制的。

( )8.当物价上涨时,企业拥有货币性资产会发生购买力损失。

( )9.在德国,企业会计报表与税务报表不必一致。

( )10.全面收益是采用了“收入费用观”确定收益的。

( )三、简答题(每小题10分,共40分)1.为什么长期以来衍生金融工具交易被作为表外业务?这会带来什么严重后果?2.按照会计准则和制度制定的性质分类法,会计模式分为哪几类,各自的特点是什么?3.简述进行国际财务报表分析时的方法及应当注意的问题。

4.什么是避税港?简述避税港的主要特征。

四、业务题(10分)资料:假设一中国公司于2006年11月1日从美国进口一套设备,价值$100 000。

该日即期汇率为$100=803。

2006年12月31日的汇率为$100=801。

该货款于2007年1月30日付讫,该日即期汇率为$100=805。

要求:请就上述资料按单项交易观进行账务处理。

五、论述题(20分)你是否认为当代发达国家会计实务体系存在着美英模式和欧洲大陆模式的并立?其主要差异有哪些?有没有趋向协调化的可能?模拟试题1参考答案一、名词解释1.国际会计协调是指一定的组织在国际范围内为缩小各国会计和财务报告实务的差异、增进财务信息的可比性而采取措施、进行调整和促进统一的过程。

国际会计考试题和答案一、单项选择题(每题2分,共20分)1. 国际会计准则委员会(IASC)成立于哪一年?A. 1973年B. 1989年C. 1995年D. 2001年答案:A2. 国际财务报告准则(IFRS)是由哪个组织制定的?A. 国际会计准则委员会(IASC)B. 国际财务报告准则基金会(IFRS Foundation)C. 美国财务会计准则委员会(FASB)D. 欧洲财务报告咨询组(EFRAG)答案:B3. 以下哪项不是国际会计准则(IAS)的一部分?A. IAS 1 - 财务报表的呈报B. IAS 16 - 固定资产C. IAS 39 - 金融工具:确认和计量D. FAS 123 - 股票补偿答案:D4. 国际会计准则中,关于收入确认的原则是什么?A. 收入应在实现时确认B. 收入应在收到现金时确认C. 收入应在合同签订时确认D. 收入应在交付商品或服务时确认答案:D5. 国际会计准则中,关于外币交易的会计处理,以下哪项是正确的?A. 外币交易应以交易发生时的汇率进行初始确认B. 外币交易应以资产负债表日的汇率进行初始确认C. 外币交易应以平均汇率进行初始确认D. 外币交易应以即期汇率进行初始确认答案:D6. 国际会计准则中,关于合并财务报表的编制,以下哪项是正确的?A. 只有当母公司拥有子公司超过50%的股份时,才需要编制合并财务报表B. 即使母公司拥有子公司的股份不足50%,但能够控制子公司,也需要编制合并财务报表C. 母公司与子公司之间的交易不需要在合并财务报表中进行抵消D. 合并财务报表中,子公司的资产和负债应以母公司的汇率进行折算答案:B7. 国际会计准则中,关于资产减值的测试,以下哪项是正确的?A. 资产减值测试应在每个会计年度进行B. 资产减值测试应在每个季度进行C. 资产减值测试应在资产发生减值迹象时进行D. 资产减值测试应在资产价值恢复时进行答案:C8. 国际会计准则中,关于租赁的分类,以下哪项是正确的?A. 所有租赁都应作为经营租赁处理B. 所有租赁都应作为融资租赁处理C. 租赁的分类取决于租赁的性质和目的D. 租赁的分类取决于租赁的期限和租金支付方式答案:C9. 国际会计准则中,关于退休福利的会计处理,以下哪项是正确的?A. 退休福利应作为负债在资产负债表中确认B. 退休福利应作为费用在利润表中确认C. 退休福利应作为资产在资产负债表中确认D. 退休福利应作为收入在利润表中确认答案:A10. 国际会计准则中,关于环境成本的会计处理,以下哪项是正确的?A. 环境成本应作为费用在利润表中确认B. 环境成本应作为资产在资产负债表中确认C. 环境成本应作为负债在资产负债表中确认D. 环境成本不需要在财务报表中确认答案:C二、多项选择题(每题3分,共30分)11. 国际会计准则中,以下哪些项目属于财务报表的主要组成部分?A. 资产负债表B. 利润表C. 现金流量表D. 所有者权益变动表E. 财务报表附注答案:A, B, C, D, E12. 国际会计准则中,以下哪些因素可能影响收入的确认?A. 风险和报酬的转移B. 控制权的转移C. 经济利益的流入D. 合同的签订E. 现金的收到答案:A, B, C13. 国际会计准则中,以下哪些因素可能影响资产减值的判断?A. 资产的公允价值下降B. 资产的使用寿命缩短C. 资产的用途改变D. 资产的维护成本增加E. 资产的可回收金额低于账面价值答案:A, B, C, D, E14. 国际会计准则中,以下哪些因素可能影响租赁的分类?A. 租赁的期限B. 租赁的租金支付方式C. 租赁资产的所有权转移D. 租赁资产的残值E. 租赁资产的维修和保养责任答案:A, B, C, D, E15. 国际会计准则中,以下哪些因素可能影响退休福利的会计处理?A. 退休福利计划的性质B. 退休福利的支付方式C. 退休福利的计算方法D. 退休福利的基金状况E. 退休福利的支付时间答案:A, B, C, D, E16. 国际会计准则中,以下哪些项目属于财务报表附注的披露内容?A. 会计政策B. 会计估计变更C. 重要会计差错更正D. 财务报表的编制基础E. 财务报表的批准报出答案:A, B, C, D, E17. 国际会计准则中,以下哪些因素可能影响外币交易的会计处理?A. 交易的货币种类B. 交易的金额C. 交易的日期D. 交易的汇率E. 交易的结算方式答案:A, C, D, E18. 国际会计准则中,以下哪些因素可能影响合并财务报表的编制?A. 控制关系的存在B. 合并范围的确定C. 合并方法的选择D. 合并报表的编制时间E. 合并报表的披露要求答案:A, B, C, D, E19. 国际会计准则中,以下哪些因素可能影响环境成本的会计处理?A. 环境法规的要求B. 环境风险的评估C. 环境成本的计量D. 环境成本的确认时点E. 环境成本的披露要求答案:A, B, C, D, E20. 国际会计准则中,以下哪些因素可能影响金融工具的会计处理?A. 金融工具的性质B. 金融工具的分类C. 金融工具的公允价值D. 金融工具的风险管理E. 金融工具的披露要求答案:A, B, C, D, E三、判断题(每题2分,共20分)21. 国际会计准则要求所有企业必须使用公允价值计量其资产和负债。

International accounting Exercise (2011)A. Complete the following sentences1.We view accounting as consisting of three broad areas: (measurement)、(disclosure) and (auditing). (Measurement)is the process of identifying, categorizing, and quantifying economic activities or transactions. (Disclosure) focuses on issues such as what is to be reported, when ,by what means, and to whom.2. Double-entry originates in the (Italy ) city states.3. Hofstede’s four cultural dimensions are: (individualism vs. collectivism) , (high power distance vs.low power distance),(high uncertainty avoidance vs low uncertainty avoidance ) and (masculinity vs. femininity).4. The four culture dimensions that affect a nation’s financial repor ting practices by Gray refer to ( professionalism vs. statutory control),(uniformity vs. flexibility), (conservatism vs. optimism ) and (secrecy vs. transparency).5. In the countries that the sources of finance mainly rely on the (Capital market or equity market),such as US and UK. Disclosure are extensive to meet the requirements of widespread public ownership.6.In the countries that the sources of finance mainly rely on the (banks or credit system ),such as Japan and Switzerland. In order to protect the creditor, extensive public disclosure are not considered necessary.7.The legal system of Western world can be considered two different types, one is (code law or civil law) and the other is (common law or case law).8. In (code law or civil law) countries, laws are an all-embracing. Accounting standards and procedures are incorporated into national laws.9.Accounting standard setting normally involves a combination of (private) and (public) sector groups. The (private) sector includes the accounting profession and other groups affected by the financial reporting process. The (public )sector includes such agencies as tax authorities. ministries responsible for commercial law, and securities commissions.10.One key distinction in financial reporting is weather accounting is oriented toward (a fair presentation) of financial position and results of operations or toward (compliance withlegal )requirements and tax laws.11.Accounting in the United States is regulated by a private sector body (the Financial Accounting Standards board, or FASB), but a governmental agency (the Securities and Exchange Commission, or SEC)underpins the authority of its standards. SEC have right to supervise and revise to the standard finally .12.The accounting “(the true and fair)” view appear in United Kingdom(companies law)(1948) first.13.In France, large companies must also prepare documents relating to ( the prevention of business bankruptcies) and (a social report).14.The following three exchange rates can be used to translate foreign currency balances to domestic currency. they are (current rate.),(historical rate )and(average rate)15. In France ,Business expenses are deductible for tax purpose only if they are (fully booked) and reflected in annual financial statements.16. In France, CNCC is a professional society composed of certified public auditors. Administered by ( Ministry of Justice).17. A feature of French accounting is the dichotomy between (individual company) financial statements and those for the (consolidated)group.18.Conservative(balance sheet )valuations are central to (creditor protection). This creates a tendency to undervalue(低估) assets and overvalue liabilities19. (Certified public accountants)in Germany are called WPs. Or (enterprise examiners ).20. In German, the second-tier(二级)body of auditors is named( Book Examiners), who are only allowed to audit small and medium-sized companies21. There are two classification auditors in Japan. One engaged in (statutory audit), the other engaged in (independent ) audit.22. One of the accounting paradoxes(悖论)in ( Netherlands) is that it is a code law country but it’s accounting is oriented toward fair presentation.23.The Dutch flexibility toward accounting measurements may be most evident in permitting the use of ( current value )for tangible assets such as inventory and depreciable assets.24.The majority countries in the world use the direct quote . except (U.K. or British) and ( U.S. or America ).25.There are two accounting treatments for foreign currency transaction ,one is(single-transaction ) perspective and the other is( two-transaction ) perspective.26. In a (direct quote ), the exchange rate specifies the number of domestic currency units needed to acquire a unit of foreign currency.27.Under a ( deferral ) method ,translation gains and losses are listed on the balance sheet. It is regarded as a single item ”“Translation adjustment”, list at the part of “owner’s equity”. 28.Under (No deferral ) method translation gains and losses are listed on the income statement. It is regarded as ”“Translation gains or losses”,list after “management expenses”.29.There are four methods can be used in foreign currency translation. They are(current rate ) method, (current-noncurrent) method,(monetary-nonmonetary) method and (temporal )method.30. Use ( current )rate to translate statement items should not give rise to translation gains or losses, so it can preserves the original cost equivalent of a foreign currency item in the reporting currency.31. Exchange gains and losses can be divided two parts :( translation ) gains and losses and (transaction ) gains and losses.32. Under ( current rate ) method all foreign assets and liabilities translated at the current rate. But except for the items owner’s equity.33. Under (current rate ) method ,the consolidated statements preserve the original financial statement relationships such as financial ratios.34. (monetary-nonmonetary ) method views monetary assets and liabilities exposed to exchange rate risk.35.Under(temporal ) method, foreign currency balances at historical cost are translated at historical rates, and foreign currency balances at current cost or market value are translated at the current rate.36.A subsidiary company perspective requires the ( current rate ) translation method in order to preserve relationship exiting in the foreign currency statements.37. General price level change refers to a movement in the prices of all goods and services in an economy on average. Positive price movement is termed ( inflation ). Negative price movement is called ( deflation ).38 .Holding gain refers to the (increase) in the current cost of a nonmonetary asset.39. An excessive rate of inflation as when the general level of prices in an economy increases by more than 25 percent per annum is called( hyperinflation ).40. Inflation is the increase in the general level of prices of all ( goods ) and (services) in an economy.41. Accounting for the financial statement effects of general price-level changes is called the (Historical cost-constant purchasing power )model.42. GPL is a cost ratio that compares the cost of a basket of goods in the current period with the cost of that same basket in a (base or prior ) period.43. Purchasing power gain or loss is the difference between the net monetary items measured by (constant purchasing power currency) unit with the net monetary items measured by (nominal currency) unit.44. Under general price level accounting, net income is the sum of the two numbers ,one is adjusted operating income ,the other is ( purchasing power gain or loss ).45.Current cost-based net income include two parts, one is (realized income,)the other is (unrealized holding gains. )46. At present, primary derivative financial instruments may be classified into following categories: (futures contract),(option contract),(forward contract )and (swap contract).47. The recognition of derivative financial instruments can be mainly divided into three phases: (initial recognition),(subsequent recognition) and (de- recognition).48. Accounting for the financial statement effects of general price-level changes is calledthe(historical cost-constant purchasing power) model. Accounting for specific price changes is referred to as the (current cost )model49. Under the ( European ) options , the buyer will make a choice at the end of time. Under the (American ) options , the buyer will make a choice before the end of time.50.( Exercise Price ) means the trading price of a option contract that both sidesagreement.(Exercise Value )is the profit get by the buyer. It is a intrinsic value of a option.51.( Interest rate swap ) means the exchange of the debts which use the same currency at different interest rate.52. The three types of hedging are:( fair value hedging),( cash flow hedging ) and hedging for a firm’s net investment of overseas operating .53. (Tax neutrality) means that taxes have no effect on resource allocation decisions. If taxes influence the allocation of resources ,the result will probably be less than optimal. 54.( Taxes equity) means that taxpayers who are similarly situated should pay the same tax55. The government of the host country levy taxes on the benefit from (dividend),( interest )and (royalty payments) that gained by foreign investor is called ( withholding tax ).56.The principles on the income from a foreign country Including (territorial) principle, (person) principle and ( world ) principle.57. The method of avoidance of international double taxation usually consist of( tax deductions), (tax credit ), (tax exemption.) and (bilateral tax treaties).58. There are two basic tax administration systems in the world ,one is (classical ) system ,the other is(integrated) system.59.The countries or areas those with few natural resources offer permanent tax inducements fora business. They are called(Tax havens).60.(Bilateral Tax treaties) refers to the agreements between countries on taxation of income and withholding taxesB. Choose the Correct Answer for Each Item Below1. In general ,which of the following items is not the basic characteristic of Fair Presentation Accounting?( d )a. with a common law legal systemb. shareholders as the principal source of finance.c. auditors exercise more judgment and auditing profession tends to be more development and self-regulated .d. the public sector is relatively more influential in standards setting.2.In which country the financial accounting and taxation are separated? (b)a. Germanyb. United Kingdomc. Japand. France3. In general ,which of the following items is not the basic characteristic of Legal Compliance Accounting?(c)a. have a code law legal systemb. rely heavily on banks and the governments as sources of finance.c. the private sector is relatively more influential in standards setting.d. have a close linkage between financial and tax accounting.4.In the chapter of” Comparative Accounting”, what are the three areas that we have compared? (abc)a. accounting regulation and enforcementb. financial reportingc. accounting measurements.d. disclosure5.Which is the most important accounting regulation of France? (a)a. PCGb. Code de Commercec. Accounting actd. Company Law6. In France, which organization has real regulatory power. ( b)a. CNC (National Accounting Board)b. CRC (Accounting Regulation Committee)c. AMF (Financial Markets Authority)d. OEC (Institute of Public Accountants)7.In which country the legal permit the professional accountant's on-the-job condition is the same as certified accountant. So, more than 85 certified accountants are the certified public auditor at the same time . (a)a. Franceb. Germanyc. Japand. Netherland8.In France, besides basic financial reporting such as balance sheet and income statement, large companies must also prepare documents relating to (ab )a. the prevention of business bankruptciesb. social reportc. cash flow statementd. selected quarterly data9. A leading Japanese scholar refers to Japan Accounting regulation as a “triangular legal system”. Which one of the following is not belong to the system? ( d )a. Commercial Codeb. Securities and Exchange Lawc. Corporate Income Tax Lawd. Civil Law10. In Japan, the financial statements and supporting schedules of small and medium-sized companies are subject to audit only by (a ).a. Statutory Auditorsb. Independent Auditorc. Enterprise Examinerd. Book Examiner11. In Japan, the financial statements of publicly held companies must be audited in accordance with the Securities and Exchange Law by ( ab ).a. Statutory Auditorsb. Independent Auditorc. Enterprise Examinerd. Book Examiner12. In Japan, ( a )do not need any particular professional qualifications and are employed by the company on a full-time basis.a. Statutory Auditorsb. Independent Auditorc. Enterprise Examinerd. Book Examiner13. Which one of the following reporting is the unique to Japan? ( d )a. balance sheetb. income statementc. cash flow statementd. proposal for appropriation of retained earnings14. (c ) is the important accounting regulation of Netherlands.a. Commercial Codeb. Tax Lawc. Civil Coded. Securities and Exchange Law15. The first country to develop an accountancy profession is ( c ).a. Franceb. Germanyc. United Kingdomd. United State16. The “true and fair view” begin to appear first in ( c) Companies Law (1948)a. Franceb. Germanyc. United Kingdomd. United State17.In Britain ,( b ) is empowered to issue accounting Standards.a. Financial Reporting Councilb. Accounting Standards Boardc. Financial Reporting Review Paneld. Urgent Issues Task Force18. Which one of the following foreign currency translation method belongs to single rate method( a )a. current rate methodb. current-noncurrent methodc. monetary-nonmonetary methodd. temporal method19. what methods belong to Multiple rate methods.( bcd )a. current rate methodb. current-noncurrent methodc. monetary-nonmonetary methodd. temporal method20.Under( d ) , foreign currency balances at historical cost are translated at historical rates, and foreign currency balances at current cost or market value are translated at the current rate.a. current rate methodb. current-noncurrent methodc. monetary-nonmonetary methodd. temporal method21. ( c) method views monetary assets and liabilities exposed to exchange rate risk.a. Current rate methodb. Current-noncurrent methodc. Monetary-nonmonetary methodd. Temporal method22 Under( bcd)method, depreciation, amortization charges at historical rates in effect whenrelated assets are acquired.a. current rate methodb. current-noncurrent methodc. monetary-nonmonetary methodd. temporal method23.Under( a )method, depreciation, amortization charges at current rates .a. current rate methodb. current-noncurrent methodc. monetary-nonmonetary methodd. temporal method24.Functional currency can be the( abc ) currency.a. parentb. localc. another foreignd. any25. Generally we select the (b) currency as functional currency when sales market of a subsidiary company is largely in the host country and denominated in local currency.a. parentb. localc. another foreignd. any26..( a ) belongs to monetary assets .a. cashb. inventoryc. equipmentd. land27.( b ) belongs to nonmonetary assets.a. cashb. inventoryc. accounts receivabled. notes receivable28. ( d ) will bring purchasing gains during a period of inflation.a. cashb. inventoryc. accounts receivabled. accounts payable29. ( ac ) will bring purchasing loss during a period of inflation.a. cashb. inventoryc. accounts receivabled. accounts payable30. ( b ) will bring holding gains during a period of inflation.a. cashb. inventoryc. accounts receivabled. accounts payable31. During a period of price changes, assets recorded at their original acquisition costs resulting in an overstatement in reported income. This will not lead to( d).a. higher taxesb. higher dividendsc. higher wagesd. underestimate income32. Accounting for the financial statement effects of general price-level changes is called the ( a )model.a. historical cost-constant purchasing powerb. historical cost-nominal purchasing powerc. current cost-constant purchasing powerd. current cost- nominal purchasing power33. During inflation, a firm holding monetary assets experiences a ( a ).a .purchasing power loss b. purchasing power gain c. holding loss d. holding gain34. Current cost-based net income generally include three items. They are(abc )a. current cost-based operating incomeb. realized holding gainsc. unrealized holding gainsd. unrealized operating income35. Under current cost accounting model,( c ) need to adjusted from historical cost to current cost.a. cashb. accounts receivablec. inventoryd. short-term debt36. (abc ) belongs to basis financial instruments.a. common stockb. corporate bondsc. accounts receivabled. bonds option investment37. ( d) belongs to derivative financial instruments.a. common stockb. corporate bondsc. accounts receivabled. bonds option investment38.( a ) is regarded as a standardized forward contract.a. futures contractb. option contractc. swap contractd. commodity contract39. ( c )refers to the account treatment for a financial instruments at the settlement date.a .Initial recognitionb .Subsequent recognitionc. De-recognitiond. Accounting recognition40. According to the choice of the initial recognition time point ,there are two accounting model use for dealing with derivative financial instruments .(ab)a. transaction date accountingb. settlement date accountingc. initial date accountingd. subsequent date accounting41. Under the ( b) options , the buyer will make a choice before the end of time.a. Europeanb. Americanc. calld. put42. Withholding tax refers to the tax imposed on ( abc ) to foreign investors.a. dividendb. interestc. royaltyd. operating earnings43. ( a) is called border tax.a. Customs dutiesb. Export dutiesc. Withholding taxd. Corporate tax44. A company operating abroad encounters a variety of taxes, which is not one of them?( d )a. corporate income taxb. withholding taxc. Border taxd. business tax45.What are the important factors that can affect the tax burden of a business?( abc )a. tax ratesb. taxable incomec. social overhead costsd. economic level46.The principles on the income from a foreign country of China is ( c )a. territorial principleb. person principlec. world principled. source jurisdiction principle47. In ( a ) ,businesses that purchase real estate may get tax preference from 6% to10% at the year of purchasea. Americab. Englandc. Germany D. China48. Under( a ), Corporate income is taxed twice.a. classical systemb. integrated systemc. tax-split Systemd. tax- credit system49. The complicating Variables that affect the International Transfer Pricing including (abcd).a. tax considerationsb. tariff considerationsc. competitive factorsd. environmental risks50.OECD identifies several broad methods of ascertaining an arm’s-length price. Theyare(abcd )a. comparable uncontrolled price methodb. comparable uncontrolled transaction methodc. resale price methodd. cost-plus pricing methodC. Explain to the Concepts1. International accountingInternational accounting is a area of accounting which study on how to treatment specific accounting practice of a multinational company or how to provide information of an entity to non-domestic readers2.GoodwillGoodwill is capitalized as the difference between fair value of the consideration given in the exchange and the fair values of the underlying net assets acquired.4.direct quoteThe exchange rate specifies the number of domestic currency units needed to acquire a unit of foreign currency.5.indirect quoteThe exchange rate specifies the price of a unit of the domestic currency in terms of the foreign currency.6.current rateThe exchange rate in effect at the relevant financial statement date.7.functional currencyThe primary currency in which an entity does business and generates and spends cash. It is usually the currency of the country where the entity is located and thecurrency in which the books of record are maintained8.historical rateThe foreign exchange rate that prevailed when a foreign currency asset or liability was first acquired or incurred.9.monetary itemsObligations to pay or rights to receive a fixed number of currency units in the future.10.settlement dateThe date on which a payable is paid or a receivable is collected.11. general price level changeRefers to a movement (change) in the prices of all goods and services in an economy on average.12. specific price changeRefers to the movement (a change) in the price of a specific good or service caused by changes in demand and supply.13. general purchasing power equivalentsCurrency amounts that have been adjusted for changes in the general level of prices.14. specific price change.The change in the price of specific commodity, such as inventory or equipment.15. holding gainIncrease in the current cost of a nonmonetary asset.16. hyperinflationAn excessive rate of inflation as when the general level of prices in an economy increases by more than 25 percent per annum.17. purchasing powerThe general ability of a monetary unit to command goods and services.18. monetary gainsIncrease in general purchasing power that occur when monetary liabilities are held during a period of inflation.19. monetary lossesDecreases in general purchasing power that occur when monetary assets are held during a period of inflation.20.GPLGPL is a cost ratio that compares the cost of a basket of goods in the current period with the cost of that same basket in a prior or base period.D. Answer the questions below1. What factors are contributing to the importance of international accounting as a field of study?Growth and spread of multinational operationsGlobal competitionCross-border mergers and acquisitionsInternationalization of capital markets2.What are the major influence factors of the accounting pattern?1) sources of finance2)legal system3)taxation4)political and economic ties5)inflation6)level of economic development7)education level8)culture3. How many components are included in a typical annual financial report of a large U.S. corporations? What are they?A typical annual financial report of a large U.S. corporation includes the following components:(1)report of management(2)report of independent auditors(3)Primary financial statements (income statement, balance sheet, statement of cash flows,statement of comprehensive income, and statement of stockholders’equity)(4)management discussion and analysis of results of operations and financial condition(5)notes to financial statements(6)five-or ten-year comparison of selected financial data(7)selected quarterly data.4 .Please explain the main contents of the Director’s reports in British.The director’s report addresses principal business activities, review of operations and likely developments, important post-balance sheet events, recommended dividends, names of the directors and their shareholdings, and political and charitable contributions.5.British financial reporting generally include 7 parts, what are they?(1)Director’s report(2)Profit and loss account and balance sheet(3)cash flow statement(4)Statement of total recognized gains and losses(5)Statements of accounting policies(6)Notes that are referenced to the financial statements(7)Auditor’s report6. Fluctuating exchange rates cause several major issues in accounting for foreign currency translation, what are they?(1)Which exchange rate should be used to translate foreign currency balances to domesticcurrency?(2)Which foreign currency assets and liabilities are exposed to exchange rate changes?(3)How should translation gains and losses be accounted for?E. Judgment of the item below is false or true1. Domestic accounting is an information specialty providing information about a firm to users of that information as a basis for economic decisions. √2. International accounting is a branch of accounting. It resolves the specific accounting practice of a multinational company or providing information of an entity to non-domestic readers.√3.Accounting can be divided into three broad areas : measurement ,disclosure and auditing. √4.In the history of accounting ,double-entry originates in the British city states. ×5.In the history of accounting, Dutch enhance periodic income measurement.√6. Hofstede’s four cultural dimensions are: Professionalism vs. statutory control, Uniformity vs. flexibility, conservatism vs. optimism and Secrecy vs. transparency .×7. In the countries that the sources of finance mainly rely on the banks, such as US and UK. Disclosure are extensive to meet the requirements of widespread public ownership.×8.The legal system of Western world can be considered two different types, one is code law and the other is civil law. ×9.In most common law countries, accounting rules are establish by private-sector professional organizations.√10.In Sweden and Germany, financial accounting is separated from tax accounting.×11.In Netherlands, tax legislation determine accounting standard.×12. Accounting in Sweden developed from the microeconomic approach. ×13. Accounting developed from macroeconomic approach in the Netherlands.×14. Accounting developed as independent discipline in the U.K and the U.S.√15.Under Uniform approach, Accounting is standardized by central government and used as a tool for administrative control. Japan is the example.×16. The private sector who set the accounting standards includes the accounting profession and other groups affected by the financial reporting process. √17.The accounting practice emphasize Fairness and Substance over Form when the orientations of accounting is compliance with legal requirements .×18. When the orientations of accounting is compliance with legal requirements, financial and tax accounting are unified that there will be no deferred tax .√19.In France, a company whose employee exceed 300 peoples should be considered a large company. It has more disclosure obligation.√20.In Germany, auditor must report to the state prosecutor all criminal acts that they find in the course of auditing. √21. In Britain, more than 85 certified accountants are the certified public auditor at the same time ×22. Creditor protection is a fundamental concern of German accounting .√23. British accounting is designed to compute a prudent income amount that leaves creditors unharmed after distributions are made to owners. ×24.In Germany, WPs and Book Examiner are legally sanctioned to conduct independent audit examinations of companies.√25. In Japan, the commercial Code is administered by the Ministry of finance.×26.In America, expenses can be claimed for tax purposes only if they are fully booked.×27. In Japan ,both statutory and independent auditors must audit large corporations. √28. In the Netherlands, independent auditors may complain to the enterprise chamber if it believes that a company’s financial statements don’t conform to applicable law. ×29.In a indirect quote, the exchange rate specifies the number of domestic currency units needed to acquire a unit of foreign currency.×30.Domestic currency equivalents are obtained by multiplying foreign currency balances by direct。