assignment_4_2nd_semester_Shawn_TANG

- 格式:doc

- 大小:121.50 KB

- 文档页数:4

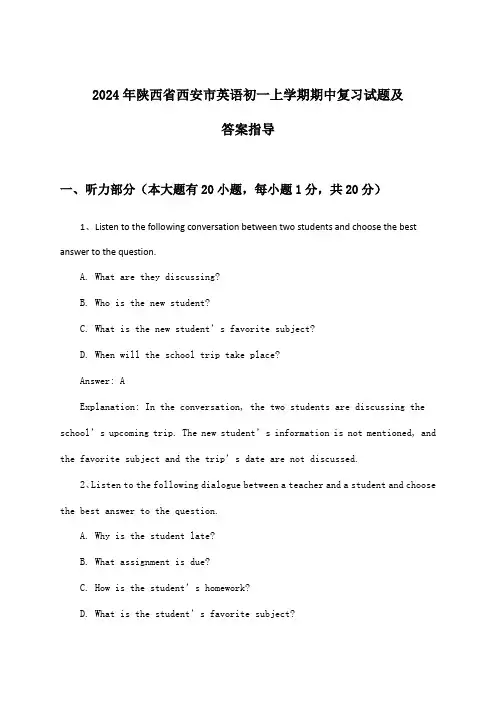

2024年陕西省西安市英语初一上学期期中复习试题及答案指导一、听力部分(本大题有20小题,每小题1分,共20分)1、Listen to the following conversation between two students and choose the best answer to the question.A. What are they discussing?B. Who is the new student?C. What is the new student’s favorite subject?D. When will the school trip take place?Answer: AExplanation: In the conversation, the two students are discussing the school’s upcoming trip. The new student’s information is not mentioned, and the favorite subject and the trip’s date are not discussed.2、Listen to the following dialogue between a teacher and a student and choose the best answer to the question.A. Why is the student late?B. What assignment is due?C. How is the student’s homework?D. What is the student’s favorite subject?Answer: BExplanation: The teacher asks the student about the assignment that is due, which indicates that they are discussing the homework. The reason for the student’s lateness is not mentioned, and the student’s homewo rk and favorite subject are not the focus of the conversation.3、Question: What does the man say about his weekend plans?A)He plans to visit a friend.B)He has no plans for the weekend.C)He will be working on a project.Answer: BExplanation: The man says, “Well, actually, I don’t have any special plans for the weekend. Just going to relax at home.”4、Question: Why does the woman suggest going to the park instead of the movies?A)She wants to save money.B)She prefers nature over a movie theater.C)She thinks it will be too crowded at the movies.Answer: BExplanation: The woman says, “I think the park would be a better choice. It’s a nice day, and we can enjoy the fresh air and nature, instead of being cooped up in a movie theater.”5、Listen to the following dialogue and choose the best answer to the question.A. The man is going to the library.B. The woman is looking for a book.C. They are discussing their homework.D. They are planning a trip.Answer: BExplanation: In the dialogue, the woman mentions, “I need to find a book for my project,” indicating that she is looking for a book. Therefore, the correct answer is B.6、Listen to the following short passage and answer the question.Question: What is the main purpose of the passage?A. To introduce a new book.B. To review a movie.C. To provide information about a museum.D. To explain a historical event.Answer: CExplanation: The passage provides information about a museum, including its history, exhibits, and visiting hours. Therefore, the correct answer is C.7、Listen to the conversation and choose the best answer to the question you hear.Question: What is the weather like today?A. It’s sunny.B. It’s cloudy.C. It’s raining.D. It’s windy.Answer: BExplanation: The speaker mentions “It’s a bit cloudy today,” which indicates that the weather is not sunny, but neither is it raining or windy. Therefore, the correct answer is “It’s cloudy.”8、Listen to the dialogue and complete the following sentence with the correct word you hear.Question: The teacher says that the students should_______their books in order to prepare for the test.A. take outB. turn offC. keep upD. pass byAnswer: AExplanation: The correct word that fits the context is “take out,” as the teacher is instructing the students to remove their books from their bags or places to study them for the upcoming test. The other options do not make sense in this context.9、听力原文:W: Excuse me, could you tell me the way to the nearest bank, please? M: Sure. Go straight ahead for two blocks, then turn left. You’ll see the bank on your right.Question: How can the woman get to the nearest bank?A. Go straight ahead for two blocks.B. Turn left after one block.C. Go straight ahead for three blocks.D. Turn right after two blocks.Answer: AExplanation: The man tells the woman to go straight ahead for two blocks, so the correct answer is A.10、听力原文:W: Hi, John. How was your math test yesterday?M: It was quite difficult. I don’t think I did well.Question: How did John feel about his math test?A. He thought it was easy.B. He thought it was difficult.C. He didn’t take it.D. He didn’t know how he did.Answer: BExplanation: John says the math test was quite difficult, so the correct answer is B.11.You are listening to a conversation between a student and a teacher.Student: “Teacher, can you explain to me the main idea of this passage?”Teacher: “Certainly! The main idea of the passag e is about the importance ofteamwork in school projects.”Question: What is the main topic of the passage?A) The importance of teamworkB) The importance of individual effortC) The importance of reading booksD) The importance of studying aloneAnswer: A) The importance of teamworkExplanation: The teacher directly mentions the main idea of the passage, which is the importance of teamwork in school projects.12.You are listening to a phone conversation between two friends.Person A: “Hey, have you heard about the new movie that’s going to be released next month?”Person B: “Yeah, I heard it’s going to be a science fiction film. I’m really excited to see it!”Question: What kind of movie are they talking about?A) A romantic movieB) A science fiction movieC) A comedy movieD) A horror movieAnswer: B) A science fiction movieExplanation: Person B explicitly mentions that the movie they are talking about is a science fiction film.13.Listen to the conversation and choose the best answer to the question.A. They are discussing a math test.B. They are planning a trip.C. They are talking about a school event.Answer: CExplanation: The conversation is about a school event that is happening soon, so option C is the correct answer.14.Listen to the dialogue and fill in the blanks with the correct words.Tom: Hey, do you think we should practice for the English speech contest?Jack: (pause) You know, I think it’s a great idea. We need to (pause) and prepare for it.Answer: 1. get together; 2. ourselvesExplanation: In this dialogue, Tom suggests practicing for the English speech contest, and Jack agrees by saying they need to get together and prepare for it, so the correct answers are “get together” and “ourselves.”15.You are listening to a conversation between a student and a teacher. The student is asking the teacher for advice on how to improve his English. Listen carefully and answer the following question.Question: What does the teacher suggest the student do to improve his English?A)Practice speaking more.B)Read more English books.C)Write essays every day.Explanation: The teacher suggests that the student should read more English books to improve his language skills. The conversation includes the teacher saying, “You should try to read some English books. It will help you a lot with your vocabulary and grammar.”16.Listen to a short dialogue between two friends discussing their weekend plans. After listening, answer the following question.Question: What do the friends plan to do this weekend?A)Go to the movies.B)Visit a museum.C)Go shopping.Answer: AExplanation: In the dialogue, one of the friends says, “Let’s go to the movies this weekend. I heard there’s a new release that we both might like.” This indicates that their plan is to go to the movies. Therefore, option A is the correct answer.17.You hear a conversation between two students, Alice and Bob, discussing their weekend plans. Listen carefully and answer the question below.Question: What activity does Bob plan to do on Saturday morning?A. Go shoppingB. Visit a friendC. Take a walkD. Watch a movieExplanation: In the conversation, Alice asks Bob if he wants to visit a friend on Saturday morning. Bob responds positively, indicating that he plans to visit a friend.18.You hear a news report about a local event. Listen carefully and answer the question below.Question: How many people are expected to attend the event?A. 100B. 500C. 1000D. 2000Answer: CExplanation: The news report states that the event is expected to attract around 1000 people, making option C the correct answer.19.You hear: “The library opens at 9 a.m. and closes at 5 p.m. on weekdays.”Questions:1.What time does the library open on weekdays?2.What time does the library close on weekdays?Answer:1.A. 9 a.m.2.B. 5 p.m.Explanation:The correct answers are provided in the sentence: “The library opens at 9 a.m.and closes at 5 p.m. on weekdays.”20.You hear: “The school’s sports day is scheduled for the last Saturday in April.”Questions:1.When is the school’s sports day?2.In which month is the sports day held?Answer:1.A. The last Saturday in April2.B. AprilExplanation:The correct answers are given in the sentence: “The school’s sports day is scheduled for the last Saturday in April.” This indicates that the sports day is held in April, specifically on the last Saturday of that month.二、阅读理解(30分)Reading ComprehensionPassage:In a small town, there was a popular library known for its vast collection of books. The library had a special tradition every Friday afternoon: a storytelling session for the children of the town. Mrs. Thompson, the librarian, was an excellent storyteller and loved to share her passion for books with the young ones.One day, a new boy named Timmy moved to the town. Timmy was shy and didn’t know many people. He had heard about the storytelling sessions and decided that Friday was the perfect day to join in and make new friends.As the session began, Mrs. Thompson opened a large, leather-bound book with intricate gold lettering. She began to read a story about a brave knight who embarked on a quest to find the lost treasure of King Arthur. The children were captivated by the tale, and Timmy found himself drawn into the world of adventure.As the story progressed, the knight faced many challenges and obstacles. Each time he overcame them, the children cheered, and Timmy felt a sense of pride for the knight’s bravery. By the end of the story, Timmy had made several friends, and they all decided to form a group to embark on their own treasure hunt.Questions:1.What was the special tradition at the library every Friday afternoon?A) Book salesB) Storytelling sessionC) Reading competitionD) Library cleaning day2.Why did Timmy decide to join the storytelling session?A) He was looking for a place to studyB) He wanted to meet new friendsC) He was interested in the library’s collectionD) He had to do his homework3.What did Timmy and his new friends decide to do after the storytelling session?A) They organized a book saleB) They formed a group to embark on a treasure huntC) They invited Mrs. Thompson to their house for dinnerD) They decided to start a reading clubAnswers:1.B) Storytelling session2.B) He wanted to meet new friends3.B) They formed a group to embark on a treasure hunt三、完型填空(15分)Section III: Reading Comprehension (Cloze Test)Read the following passage and choose the best word for each blank from the options given.The 21st century has brought about many changes in our lives. One significant change is the way we communicate. (1) ______, the rise of technology has revolutionized the way we connect with others.A. ConsequentlyB. FurthermoreC. NeverthelessD. HoweverE. Moreover(2)______, smartphones and social media platforms have made it easier than ever tostay in touch with friends and family.A. For instanceB. In contrastC. On the other handD. In additionE. As a resultMany people believe that (3)______technology has made our lives more convenient, it has also created new challenges.A. AlthoughB. BecauseC. SinceD. IfE. UntilIn the past, people relied on landlines and postal services to communicate. Now, (4)______we can send messages, make video calls, and even shop online with a few taps on our devices.A. howeverB. thereforeC. insteadD. consequentlyE. otherwiseThese advancements have undoubtedly improved our quality of life. (5) ______, we must be cautious about the potential negative impacts of excessive screen time and privacy concerns.A. HoweverB. ThereforeC. MoreoverD. ConsequentlyE. NeverthelessAnswers:1.A. Consequently2.D. In addition3.A. Although4.C. Instead5.B. Therefore四、语法填空题(本大题有10小题,每小题1分,共10分)1、In the 1 days before the holiday, everyone was busy 2 gifts for their friends.A. few, makingB. last, buyingC. coming, findingD. next, preparingAnswer: BExplanation: The correct phrase is “last days before the holiday,” which refers to the final few days leading up to the holiday. The verb “buying” is appropriate because people are typically purchasing gifts for their friends in the last days before the holiday.2、The teacher 1the students to be quiet and listen to the lecture carefully.A. askedB. orderedC. toldD. requestedAnswer: BExplanation: The correct verb to use in this context is “ordered,” as it implies a more formal and direct command. “Asked” and “told” are also correct, but “ordered” is the most appropriate choice for a teacher giving instructions in a classroom setting. “Requested” is too formal and less commonly used in this context.3.The__________(be) of the book is very interesting.答案:is解析:此题考查主谓一致。

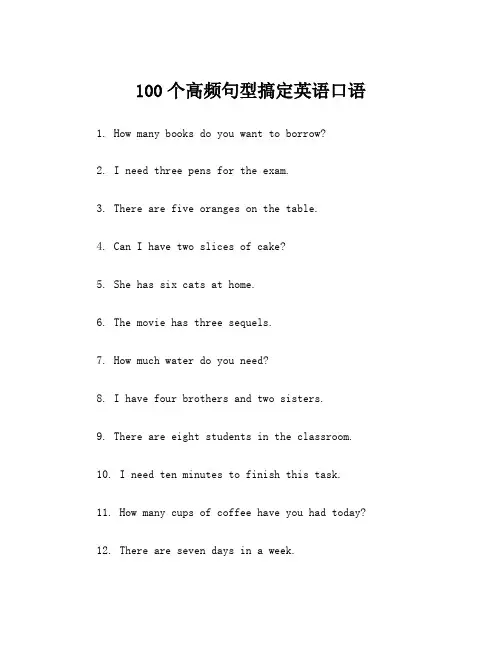

100个高频句型搞定英语口语1. How many books do you want to borrow?2. I need three pens for the exam.3. There are five oranges on the table.4. Can I have two slices of cake?5. She has six cats at home.6. The movie has three sequels.7. How much water do you need?8. I have four brothers and two sisters.9. There are eight students in the classroom.10. I need ten minutes to finish this task.11. How many cups of coffee have you had today?12. There are seven days in a week.13. I have three appointments tomorrow.14. She has four pairs of shoes.15. I need five more chairs for the party.16. He bought six bottles of milk at the store.17. I have two tickets for the concert.18. How many languages do you speak?19. There are nine planets in the solar system.20. We have seven days left until the deadline.21. Can you give me five reasons why I should go?22. I need three new shirts for work.23. There are six eggs in the fridge.24. I have four meetings today.25. How many cookies do you want to eat?26. I have five dollars in my wallet.27. There are eight people in line ahead of us.28. Can I have two more pieces of pizza?29. I need seven more pages to finish the report.30. How many songs do you have on your playlist?31. I have four assignments due next week.32. She has six bags of groceries.33. How many friends are coming to the party?34. There are nine chapters in this book.35. I have five errands to run today.36. Can you give me ten reasons why I should go?37. I need four more chairs for the meeting.38. There are six players on the basketball team.39. How many bottles of water do you need?40. I have three appointments tomorrow.41. He has seven toys in his room.42. There are eight hours of sunshine a day in the summer.43. Can I have two more slices of cake?44. I need five more minutes to finish this task.45. There are six people waiting in line.46. I have four tickets for the concert.47. How many languages can you speak?48. There are nine months in a year.49. I have seven days left until the deadline.50. Can you give me five more reasons why I should go?51. I need three more shirts for work.52. There are six eggs in the fridge.53. It’s been a while!54. I can’t thank you enough.55. What are your hobbies?56. I’m just browsing.57. Can I try it on?58. How do you say this in English?59. I’m all ears.60. Let’s get to the point.61. It’s not a big deal.62. What’s your favorite movie?63. I’m thinking about it.64. Just let me know.65. I’m here for you.66. I’m not feeling great today.67. I totally agree!68. It’s a beautiful day.69. I’m proud of you.70. Let’s keep it simple.71. Do you want to go for a walk?72. I appreciate your help.73. I’m having a great time.74. Can you give me a hand?75. I’ll be there in 10 minutes.76. It’s so much fun!77. I’m glad to hear that.78. It’s a long story.79. I’m trying my best.80. Let’s grab a bite.81. What a nice surprise!82. It’s getting late.83. I’ll think about it.84. I’m really tired.85. I’m just checking in.86. What’s the plan for today?87. I can’t wait to see you!88. Let’s keep it between us.89. You made my day!90. I’m feeling adventurous.91. How do you feel about that?92. Let’s go for it!93. That’s a tough question.94. I can’t believe it’s already September!95. It’s important to me.96. Can I get your opinion?97. I’m here if you need me.98. Let’s take a break.99. I’ll let you know.100. Thanks for understanding!。

唐顿庄园第四季第三集以前这儿的管家是休斯太太Housekeeper used to be Mrs Hughes.不知她是不是还在这儿I don't know if she's still here.交给我吧老爷Leave everything to me, m'lord.楼上见锣响之前我不会上楼I'll see you upstairs. I won't be up before the gong.-要帮忙吗 -夹在我胳膊下吧- Can I help? - Stick it under my arm if you can.-你真是个天使 -这可不好说- You're an angel. - I don't know about that.你知道吉利安姆子爵的房♥间在哪吗Do you know where Lord Gillingham's room is?走廊尽头的女仆有客人名单她会告诉你的There's a maid down the gallery with the list. She will show you. 瞧你什么都知道See, you've got the answer to everything.我想你也一样吉利安姆先生I suspect you have too, Mr Gillingham.火车准点吗约翰爵士Was the train on time, Sir John?很准十分高效Absolutely. It was all as efficient as you like.杰弗森夫人见到你真好Mrs Jefferson, how nice to see you!哪位是桑普森先生我们为什么请他来Which one's Mr Sampson and why have we asked him?我在怀特俱乐部经常看到他Ah well, I see him at White's every now and then他又很想来的样子and he seemed keen to come.-就是和妈妈聊天的那位 -知道了- He's over there, talking to Mama. - Ah yes.那个风流倜傥的家伙是谁Who's the glamorous pirate?你不认识约翰尼·吉利安姆的儿子了Don't you recognise Johnnie Gillingham's son?安东尼·弗伊Anthony Foyle?对他现在是吉利安姆子爵了Yes but he's Lord Gillingham now.自从他父亲葬礼之后我就没见过他I haven't seen him since his father's funeral.我知道但我后来给他写过信他回复了I know, but I wrote afterwards and he answered.-感谢你的到来 -回到唐顿的感觉真好- How nice of you to come. - It's good to be back at Downton.玛丽你还记得安东尼·弗伊...吉利安姆吧Mary, you remember Anthony Foyle? Sorry, Gillingham.我还记得有位出众的年轻男子I remember a very superior young man觉得跟三个小丫头打交道十分无聊who found three little girls extremely tiresome to deal with.我好像被你父母的一堆故友给埋没了啊I seem to be outnumbered by your parents' old friends.别担心Don't worry.你和爸爸这次一定能熟悉起来的我保证You and Papa are going to get to know each other this time. I promise. 玛丽告诉我你成了这里的代理人了You're the agent here now, aren't you? Mary told me.你一定十分想念茜玻吧You must miss darling Sybil so dreadfully.是的旅途还愉快吗Yes. Did you have a good journey?汤姆聊天实在太不上档次I'm afraid Tom's small talk is very small indeed.又不是谁都是奥斯卡·王尔德Not everyone can be Oscar Wilde.幸亏如此That's a relief.[备受争议的英国文豪]各位请随意我们八点在客厅集♥合♥Go up when you like. We'll gather in the drawing room at eight.十位客人只有三个女仆两个贴身男仆Ten staying and only three maids and two valets between them.-和战前真是大相径庭啊 -确实- Not quite like before the war, is it? - Very little is.他们大多挺好伺候的They're mostly easy and奥维公爵夫人也容易应付the Duchess of Yeovil's no trouble at all.桑普森先生和约翰·布洛克爵士我们不了解Of course, we don't know Mr Sampson or Sir John Bullock也很久没见吉利安姆子爵了and we haven't seen Lord Gillingham for a while.安娜能帮忙照看一下杰弗森夫人吗Oh, Anna, can you look in on Mrs Jefferson?他们在中国客房♥They're in the Chinese.当然Of course.艾德娜去照顾一下雷文夫人Oh, Edna, Lady Raven might need a helping hand.她住方蒂诺伊She's in Fontenoy.她说她习惯没有女仆了但我可不敢怠慢She says she's used to having no maid but I rather doubt it.-我不一定有空 -挤出空来- I'm not sure I've got time. - Make time!可怜的雷文夫人Poor Lady Raven.想想她十年前多风光再看看现在When you think of her life ten years ago and now.我听说她住在公园北面的一间小破屋里I'm told she has some dingy little house north of the park.没想到他们还邀请她来住It's a wonder they still ask her to stay.也许夫人不愿因为Well, perhaps her ladyship does not wish老朋友境遇潦倒就与她断交吧to cast away an old friend because she lives north of the park.我不是那意思只是觉得惋惜I know, I know. But still, it's sad.战后我们就没再搬回去那里做过医院嘛We never moved back after the war. It was a hospital, you know. -现在呢 -成了女子学校- And now? - It's a girls' school.但我们在奶奶家安顿得很好Hmm. But we're quite comfortable in the Dower House. 你去过吗Did you ever see it?我在那儿和你奶奶喝过下午茶I remember having tea there with your grandmother.我把她给我的冰激凌洒在了裙子上She gave me ice cream and I got it all over my dress.保姆都快气死了Nanny was furious.真像奶奶会干的事That sounds like Grandmama.她总说对孩子就该多加宠爱She'd always say how children should be spoiled.她已经去世了永远不会知道我有没有这么做了She's gone now, so she'll never know if I took her advice. -你没子女吗 -没有- You have no children? - No.没有妻子没有子嗣No children, no wife.有那么几次快要成了现在就是如此I've come close a couple of times. In fact, I'm close now. 你呢What about you?我有个儿子乔治I have a son, George.还有马修你知道的You know that Matthew...上帝我很抱歉Oh God, I'm... I'm sorry.我当然知道我刚才糊涂了Of course I know. I just wasn't thinking.请你原谅Please forgive me.没关系的There's nothing to forgive.我要往这边走你去那边I go this way and you're down there.别用这些碗艾薇Oh, not those bowls, Ivy!冷汤都是精致的一小碗Chilled soup should be an exquisite mouthful,不是一桶猪食not a bucket of slop!-我去换小碗 -乳鸽做的怎么样了- I'll get the smaller ones. - How are the squabs doing?很好帕特莫太太Fine, Mrs Patmore.奶油葡萄酒呢What about the syllabubs?橙皮和白兰地在储藏室里凉着呢The orange peel and brandy is cooling in in the larder.我会在第一道菜期间打奶油I'll whip the cream during the first course.-咸点呢 -蘑菇去皮切好了- What about the savoury? - Mushrooms peeled and cut.黄油准备好了Butter's ready.我会在他们吃布丁时烤吐司I'll make the toast when they eat the pudding.上帝啊蔬菜Oh my god, the vegetables!再这么下去会要了她的命的She'll bust a gut if she keeps that up.你把他伺候好了吗吉利安姆先生Have you settled him in satisfactory, Mr Gillingham?叫我格林吧我的真名I wish you could call me Green. My real name.卡森先生不会同意的他坚信传统Mr Carson wouldn't approve. He believes in the old ways.那你相信什么呢What do you believe in?我相信要好好工作I believe in getting on with my work.只干活儿不放松会把人闷坏的All work and no play makes Jack a dull boy and Jill a dull girl. 也许我该安排些活动Perhaps I should organise some games.小心点不然我要收拾你了I'll organise you if you don't watch out!你终于还是穿上全套晚礼服了They finally got you into white tie, I see.真是不幸我从没觉得这么傻过More's the pity. I've never felt more stupid in my life.我还在想为什么我回来之后我们都不说话了I was wondering why we've never spoken since I came back.希望我们还能做朋友I hope we can still be friends?当然当然能Of course. Of course we can.但是我们再也不能在村里的酒馆吃午饭了But we can't have lunch again at the pub in the village.布雷思韦特Braithwaite...艾德娜Edna.我现在得小心处事...I'm trying to walk a tightrope here...只要你不把我当做敌人As long as you're not my enemy.当然不会God, no.我希望你一切顺利真心的I hope things turn out well for you. I do, truly.听说庄园又要重新往日的风采了I gather the abbey is once more to be a scene of great splendour. 你会去参加吗Are you going up there for any of it?我最后一晚应该去吃晚餐的I'm supposed to go for dinner on the last night.听梅尔芭唱歌♥To hear Melba sing.那可真好Oh. I envy you.但你听起来好像不太开心But you don't sound very glad.我不想他们沉浸在无尽的悲伤里I don't want them to spend their days in stygian gloom,这是真心话I really don't.都说生活要继续确实如此They say life must go on and of course it must.但这是对马修的不忠But it seems disloyal to Matthew.倒也不能说是不忠Not disloyal, exactly.-玛丽小姐怎么样了 -你知道玛丽的- What does Lady Mary feel? - Oh, you know Mary.总是让人捉摸不透She's always quite opaque.我很喜欢艾尔·乔逊你呢I love Al Jolson, don't you?[美国歌♥手喜剧演员]我有他全部的唱片I've got all his records.-包括《四月阵雨》 -当然我可喜欢了- Including April Showers? - Of course. I love it madly.-你会去伦敦吗 -也许会- Are you ever in London? - I might be.要在冬天种植大麦这里条件不太好We're a little exposed up here to sow barley as a winter crop.公爵一向极力推崇大麦The Duke always swore by it.你知道大麦啤酒可能是最早的酒精饮料吗Did you know the barley beer was probably the first alcoholic drink? 在石器时代就酿造出来了It was developed by Neolithic man.[汤姆不明白Neolithic man的意思以为是指一个人]-那我们得好好感谢他了 -是吗- So we all owe him quite a debt. - Do we?雷文夫人在那儿啊Oh, there's poor Lady Raven.我得和她聊聊I really ought to go and talk to her.慢走阁下Of course, Your Grace.-别称呼她为"阁下" -我以为该那么喊呢- Don't call her Your Grace. - I thought it was correct.仆人或官员在正式场合中才这么称呼她For a servant, or an official at a ceremony,但在社交场合称呼她"公爵夫人"but in a social situation, call her Duchess.为什么我不称呼您为"伯爵夫人"啊But why? I don't call you Countess.-当然不能这样叫 -这没有逻辑- Certainly not! - There's no logic in it.不如果想要逻辑Oh no, if I were to search for logic,可不能在英国上流社会找I should not look for it among the English upper class.托马斯给我杯酒天啊Thomas, get me a drink will you, for God's sake.请叫我巴罗好的请稍等It's Barrow now, sir. But yes, of course.-跟我一起玩牌吧 -好啊- What about a hand at cards? - Why not?我吩咐人在吸烟室备好桌子巴罗I'll get them to set up a table for you in the smoking room. Barrow? 准备好了老爷Er, already done, m'lord.一起玩吗格兰瑟姆伯爵Will you play, Lord Grantham?算了今晚没兴致I don't think so. Not tonight.-你玩牌吗 -过去玩过- Do you ever play? - Well, I used to.今晚我只想和你一起Tonight I'd rather be with you.没问题我们有好几匹马It's no trouble. We have plenty of horses爸爸不会介意的and Papa would be delighted.-你有马具吗 -我们带来了- Have you anything to ride in? - We packed it all in case.那就没问题了Well, that settles it.我今晚会安排马厩做好准备I'll send a message to the stables tonight.你愿意和我一起去吗Will you come out with me?可以啊我好久没骑马了Actually I might. I haven't been in the saddle for ages.第二天身上肯定要僵了I'll be as stiff as a board the next day.明天早上有人想去骑马吗Would anyone else like to go riding tomorrow morning?约翰爵士桑普森先生Sir John? Mr Sampson?非要去吗Must I?伊迪丝Edith?-你骑马吗 -不是很想骑- Do you ride? - Not if I don't have to.看来就只有我俩了I'm afraid you're stuck with me.你怎么还在干活儿啊都这么晚了Why on earth are you doing that at this ungodly hour?-两个女孩呢 -我让她们去睡了- Where are the girls? - I sent them to bed.我想提前做好准备I thought I might get ahead of myself.说起来我把早餐的材料也准备好吧Come to think of it, I might lay out what I need for the breakfast. -明天都安排好了吗 -应该没问题- All set for tomorrow? - I think so.内莉·梅尔芭夫人周日在哪吃饭啊Where should we feed Dame Nellie on Sunday?她不能跟仆人一起吃She can't eat in the servants' hall.钢琴家又在哪吃饭呢And what about the pianist?钢琴家跟我们一起吃夫人在房♥间里吃Well, he can join us and she can have a tray in her room.你觉得她不该和宾客们一起吃吗You don't think she should dine with the house party?澳大利亚的歌♥手An Australian singer?和夫人一起吃饭Eating with her ladyship?还有公爵夫人不这不行Never mind the Duchess! No, I do not!-莫斯利先生 -你好- Mr Molesley? - Hello.-你来做什么 -帕特莫太太- What are you doing? - Mrs Patmore在贝克韦尔先生那儿订了东西她急着要left an order with Mr Bakewell. She said it was urgent.怎么回事莫斯利先生What's this, Mr Molesley?你给贝克韦尔先生送货啊Are you delivering for Bakewell's?我只是顶班直到找到份合适的工作I'm just filling in. Until something turns up.你现在送货啊You're a delivery boy?黛西努力工作不可耻Now, now, Daisy. There's no shame in hard work.你在那儿坐坐莫斯利先生我去给你倒茶You sit there, Mr Molesley, and I'll fetch you some tea.你玩得很晚啊You played late.希望你不觉得我先去睡很失礼I hope you didn't think me rude for going to bed.-一点也没有 -玩得怎样啊- No. Not a bit. - How was the game?桑普森是高手Sampson is a very skilled player.-昨晚去哪了 -被桑普森打得落花流水- Where were you last night? - Being thrashed by Sampson. 真可怜Poor you!那今晚你是不是能陪着我呢I hope that means I can count on you tonight.当然啊You can always count on me.你今天有什么计划What are your plans for today?我打算去趟塞斯伍德看下新种的庄稼I though I'd go to the Sethwood, look the new planting.你不帮我招待客人吗Won't you help me entertain our guests?让我歇两个小时然后任您吩咐Just give me two hours off and I'll do whatever you want.我们早饭后想去散散步您来吗We're going for a walk after breakfast. Why don't you come? 应该不行I don't think so.我还有很多事要做招待这一大群人I've got too much to do, rounding this lot up.要咖啡吗Coffee?先不用了谢谢Not yet, thank you.我会想到办法的I'm going to manage it somehow.我觉得他很擅长拖延他不想做的事I've a feeling he's good at putting off what he doesn't want to do. 他心计没那么重He's not as calculated as that.我们真不了解我们的父母啊How little we know our own parents.听说他赢了约翰·布洛克爵士一大笔钱Apparently he took a fortune off Sir John Bullock.你家主人呢What about your employer?我们家老爷很聪明他收手得早His lordship's too clever. He got out the game early.-我听到的可不是这样 -他们玩的什么- That's not what I heard. - What were they playing?-扑克 -当然是扑克- Poker. - Of course it was poker.-但玩翻牌是不会输一大笔的 -我就会- You can't lose a fortune playing snap. - I could![snap: 一种翻牌配对游戏]梅布尔·莱恩·福克斯Mabel Lane Fox?你攀上了社交季中最好的女继承人So you've caught the greatest heiress of the season.-其实她人很好 -我相信- She's very nice, in fact. - I'm sure.当然双方家族都希望促成我们Of course, everyone wants it, on both sides,但我们相处得挺融洽but we do get on.可能你会感到惊讶You may be surprised to hear但一段众望所归的联姻也可能会很幸福that a match wanted by everyone can turn out to be extremely happy. -你这是自身经验吗 -当然- Do you speak from experience? - Absolutely.从马修一到这儿Matthew and I were flung at大家就一心想要撮合我们each other's heads from the moment he arrived.老实说这反倒阻碍了我们If anything, it rather slowed matters up.但是你们很幸福But you were happy?非常幸福Wonderfully happy.你真幸运How lucky you are.是吗Am I?你曾拥有真爱You've known a great love.它难道没有丰富你的人生吗Doesn't that enrich any life?我也说不好马修改变了我I'm not sure. Matthew changed me.我爱他但他改变了我I loved him but he changed me.假如我还像认识他以前那样坚强的话If I were as tough as I was before I met him,现在会更快乐一些I bet I'd be happier now.也许吧Maybe.但时光无法倒流不是吗But we can't go back, can we?是啊Apparently not.你要怎么处理那个啊What will you do with that?把它盖上放在火炉上烘干然后放进棉布袋Cover it and dry it on the stove, then put it into muslin bags.吉利安姆老夫人的女仆都是买♥♥成包的Old Lady Gillingham's maid buys it in packets.她大概不是乡下姑娘吧Perhaps she's not a country girl.跟你比她可差远了Judging by you, she's the poorer for that.-你们这么有功夫闲聊 -都怪我- You've plenty of time for chatter. - You can blame me.-恐怕是我的错 -我就是在责怪你- I'm afraid it's a failing of mine. - I do blame you.你怎么了What is the matter?不知道他就是让我觉得不舒服I don't know. There's something about him that gets my goat.他只是想表示友好He was just trying to be nice.卡森我们十分钟后要去花♥园♥转转Carson. We're all going on a tour of the gardens in ten minutes.回来后想喝点咖啡When we get back, it might be nice to have some coffee.好的夫人Very well, m'lady.-一切都还顺利吗 -是的- Is everything under control? - It is.内莉·梅尔芭要在唐顿一展歌♥喉真是太兴奋了It's exciting to think of Nellie Melba singing at Downton.兴奋谈不上很贵就是了I'm not sure about exciting. It's certainly expensive.我知道但乡间宴会不准备点节目就太乏味了I know, but a house party can be so flat if there's no special moment. 在湖边欣赏夕阳西下还不足以吗And it wouldn't be special enough to watch the sun set by the lake? -早上好女士们 -早上好- Good morning, ladies. - Good morning.-怎么了 -我打不开这个盖子- What is it? - I can't get the lid off this.我来Give it here.我来吧I'll do it.靠边站让真正的男人来Stand back. Let a real man handle it.给我吧Come on.那个"真正的男人"怎么了I wonder what happened to that real man?看到了吧我才是最厉害的See? Told you I was master here.叫你再臭显摆That'll teach you to show off!我都伤到了I hurt myself, thank you!你会好起来的那罐子可不会You'll mend which is more than I can say for that jar.黛西艾薇收拾干净Daisy, Ivy, clear this mess up.我就不指望这个聪明鬼了As I assume Mr Clever Clogs won't.我现在说得挺流利了I'm getting quite fluent.你还去学德语了You're taking German lessons?我得在那儿生活啊If I'm going to live there.是啊当然了No, no. Of course.只是想到你是为了我付出这么多感觉过意不去I just can't get over the fact you're doing all this to be with me.都是值得的Whatever it takes.-迈克尔刚刚去看了书房♥ -真太棒了- Michael was admiring the library. - It's marvellous.伊迪丝告诉我这儿有本谷登堡圣经Edith tells me there's a Gutenberg Bible.[1456年由谷登堡排印的拉丁文圣经被认为是活字印刷的第一本书] 是的可惜图书管♥理♥员♥帕丁森先生不在Yes. It's a shame our librarian, Mr Pattinson, isn't here.只有他知道东西都放在哪He's the only one who knows where anything is.失陪了我去挑选一下今晚喝的酒If you'll excuse me? I must go and sort out the wine for tonight.他不喜欢我He doesn't approve of me.-他还不了解你 -他这样也没法了解啊- He doesn't know you. - Nor is he likely to.晚宴上玛尔戈葡萄酒明天再上奥比昂Serve the Margaux at dinner and keep the Haut-Brion for tomorrow. 不上99年的如果够的话No the '99, if we have enough.压轴要用好酒I want to go out with a bang.-白酒你来选吧 -好的老爷- And you can choose the white. - Very good, m'lord.对了夫人好心邀请仆人们One thing, her ladyship has been kind enough to invite the servants 明晚一起听内莉夫人演唱to hear Dame Nellie tomorrow evening.-这对他们很难得 -夫人真慷慨- It's a rare opportunity for them. - She's very generous.但不知道厨房♥的佣人们怎么办呢But I wondered, what are we to do about the kitchen staff?怎么你怕听歌♥剧有伤风化吗Why? Do you fear the corrupting influence of opera?当然不是老爷Not at all, m'lord.但在战前厨房♥佣人一般要被排除在外But before the war they wouldn't usually have been included.我想这个观念要改变了卡森I think we must bend that far, Carson.-毕竟时代不一样了 -听您的老爷- Modern times and all that. - As you wish, m'lord.我安排内莉夫人的伴奏者I've arranged for Dame Nellie's accompanist和男仆睡在一起to sleep with the male servants.他总不会想和女仆们一起睡吧I doubt he'd expect to sleep with the female ones!-内莉夫人将在自己房♥里用餐 -很好- And Dame Nellie will have dinner in her room. - Very good.你安排就好Whatever you think.真难得还能看到如此完整的庄园How wonderful to see an estate that's still all in one piece.-别急着下结论 -怎么说- Don't speak too soon. - What do you mean?我们还有一大笔税要缴Well, we have a big tax bill to pay.爸爸想把地卖♥♥了可我希望能设法避免Papa wants to sell land but I'd like to see if we can avoid it. 问题是我说的他不听The trouble is, I can't get him to listen.-我能给你一点建议吗 -洗耳恭听- Shall I tell you what I'd do? - Please.让他同意你去见见税务局的人Make him agree for you to meet the tax people尽量让他们提出对你最有利的交易then bring back the best deal they can offer.这样你就可以据理力争了In that way you'll have a real case to argue.我父亲去世时我们的处境也很类似We had a similar choice when Father died.最后我们把宅子租了出去把地留住了In the end, we let the house but kept the land.谢谢你Thank you.知道自己并不孤单真是欣慰It's nice to know one's not alone.有人跟你同病相怜That others are facing the same trials.是啊No.你并不孤单You're not alone.-怎么了 -我该死的手腕扭到了- What's up? - I've jiggered my bloody wrist, that's what! 这里不许说粗话拜托你们了I'll have no swear words in here, thank you very much.-除非是我自己说 -怎么回事- Unless I'm doing the swearing. - What's going on?-你怎么还在楼下 -吉米手腕受伤了- Why aren't you upstairs? - Jimmy hurt his wrist.-他端不了托盘 -什么- He can't carry the tray. - What?-我尽力而为卡森先生 -有什么事吗- I'll do my best, Mr Carson. - Is something wrong?你怎么到下面来了餐厅里是谁负责Why are you down here now? Who's in the dining room?我正要上去我就想知道为什么慢了I'm going straight back up. I just wondered what the delay was. 不这可不行Oh no, that's no good.巴罗先生得劳驾你了Mr Barrow, you'll have to do it.卡森先生我得提醒您我现在是副管家Mr Carson, must I remind you that I am the under butler?我不管你是什么重要人物I don't care if you're the high cockalorum.你今晚就是个男仆You're a footman tonight.抱歉巴罗先生Sorry, Mr Barrow.那不是她丈夫是条狗It wasn't her husband, it was a dog!我准备去玩一局你来吗吉利安姆I'm getting up a game. What about you, Gillingham?-我就算了 -不介意的话算我一个- I don't think so. - I'll join you if you like.-我能加入吗 -当然- Is there a place for me? - Certainly.-我们十分钟后在吸烟室见吧 -好的- Shall we meet in the smoking room in ten minutes? - Very good. 我要是您就多加小心I shall be careful if I were you.桑普森是个厉害角色Sampson is a very sharp player.我想我能照顾好自己I think I can look after myself.看起来好重啊It looks terribly heavy.待会儿我会跟桑普森还有你父亲玩牌I'm playing cards with Sampson and your father later.在牌桌上我们一定会交谈的He'll have to talk to me if we're sitting at a card table.希望詹姆斯伤的不厉害I hope James isn't really hurt.-应该没有夫人 -那就好- I don't think so, m'lady. - Good.我们明天还得凑合过去吧We'll have to muddle through tomorrow as well.别担心夫人我有主意了Don't worry about that, m'lady. I have an idea.你知道我们可以卖♥♥地得到一大笔钱You do realise we can sell land as a capital gain这样就不必缴税了and pay no tax on it at all?可是剩下的地♥产♥无法维持庄园运作And end up with an estate that can't support the house.我看我未必会改主意I doubt it will change my mind.很高兴您认为还有回旋余地I'm glad you only doubt it.看来我还是有进展的I must be making some progress.那是什么What's that?有人想跳舞吗Is there anyone who wants to dance?我很乐意如果是跟你跳的话I jolly well do. If it's with you.我很喜欢跳舞可惜没有舞伴I love dancing, but these days I haven't got a partner.汤姆Tom?你这打扮正合适嘛You're dressed for it.-愿意和我跳舞吗公爵夫人 -我很乐意- Would you care to dance with me, Duchess? - I should love it. 错过揽你入怀的机会真是遗憾I hate to pass up a chance to hold you in my arms...-为什么一定要去玩牌 -因为我已经答应了- Why do you have to play? - Because I've said I will.跳舞吗What about it?我想陪着奶奶I thought I'd keep Granny company.别拿我当挡箭牌不想跳舞就跟他直说Don't use me as an excuse. If you don't want to dance, tell him. -你知道小鬼赛跑吗 -听说过但没玩过- Do you know Racing Demon? - I've heard of it but I've never played. 正好我在这儿愿意的话我可以教你I'll teach you while I'm here if you like.还得找些人来We'll bring in some of the others.-每个人都需要一副牌 -没有问题- You need a pack of cards for every player. - We can manage that.安娜能帮我处理一下这件衬衫吗Anna, can you give me a hand with this shirt?我得去清洁鞋子I've got shoes to clean.当然可以Of course.我很喜欢爱尔兰你在哪里长大的I'm very fond of Ireland. Where did you grow up?威克洛郡的布雷Bray, in County Wicklow.我可喜欢威克洛了Oh, I love Wicklow!那你一定认识鲍尔斯考特一家Of course, you must know the Powerscourts.我知道鲍尔斯考特勋爵是的I know of Lord Powerscourt, yes.鲍尔斯考特夫人是我侄女你认识她吗Lady Powerscourt is my niece. Have you met her?我见过她但不好说我认识她I've seen her. I wouldn't say exactly I've met her.真不知我为什么要这么做I don't know why I'm doing this.对了我采纳了你的建议By the way, I took your advice而且深感庆幸谢谢你了and I'm pleased I did. Thank you.乐意效劳Glad to be of service.罗斯Rose?你从哪里找到那个的Where did you get that?我在阁楼上找到的I found it in the attic.我让阿尔弗雷德帮我搬下来的I got Alfred to bring it downstairs.很抱歉但是我不想跳舞了I'm so sorry but I... I can't dance after all.这是怎么了What was that about?留声机The gramophone.这是马修的我太粗心了It belonged to Matthew. I didn't think.真遗憾What a pity.四条九Four nines.-你比我强得多 -他比我们都强得多- You're too good for me. - He's too good for all of us.别这么说我只是运气好罢了Nonsense. I've been lucky, that's all.我在想是不是该收手了I'm wondering if I ought to stop.-我快输光了 -我输的更多- I'm in pretty deep. - I'm in deeper I'm sad to say.你们的运气会好转的先生们我肯定Your luck is about to change, gentlemen. I'm certain of it. 要是再输的话拿什么赔给你啊If it doesn't, how do you like to be paid?别担心欠条也可以Don't worry. I'm happy with IOUs.回头离开之前再清算或者到俱乐部再说We can settle up when we leave or at the club.而且没准到最后你全赢回去了呢Besides, you may have won it all back by the end.得了吧不过希望你们能替我保守秘密Not a chance. I hope you can all keep my secret?我不想让格兰瑟姆夫人担心I wouldn't want to worry Lady Grantham.-那我们得练练面无表情了 -下注吧先生们- We must practise our poker face. - Antes, gentlemen. 晚安Good night.宴会玩得好吗How are you enjoying the party?我看起来像个傻子I look like a fool.言谈也像个傻子我就是个傻子I talk like a fool. I am a fool.阿尔弗雷德说你还跳了舞Alfred said you were dancing.跟一个老太婆老得够当我奶奶了With an old bat who could be my granny还认为我是在山洞里长大的and thinks I grew up in a cave.我穿得再光鲜也骗不了任何人My clothes deceive no one.别这么为难自己Don't be so hard on yourself.我是只离水之鱼今天感觉尤甚I'm a fish out of water and I've never felt it more than today.-今天还好吗老爷 -晚上之前都挺好的- Good day, m'lord? - Good until tonight.被桑普森先生打得好惨我是说扑克I took a walloping from Mr Sampson. At poker.我真是愚蠢I was a fool居然去跟一个老手过招to play with someone who so obviously knew what he was doing. 吉利安姆子爵提醒我了可我没听进去Lord Gillingham tried to warn me but I wouldn't listen.-您跟他熟吗 -不熟- Do you know the gentleman well? - No.我之前在俱乐部提起宴会的事But I was discussing the party at the club他暗示说想来结果我就上钩了and he hinted a bit and I suppose I took the bait.不说了Anyway.你自己知道就行了贝茨Perhaps keep it to yourself, Bates.当然老爷Of course, m'lord.很好Good man.。

DS 310Assignment 2Please submit your solution to Canvas by 11:59pm,February 24th.Problem 1-Logistic Regression (10pts)Let g (z )=11+e −z be the logistic function.Please •(5pts)Show that d dz g (z )=g (z )(1−g (z ))•(5pts)Show that 1−g (z )=g (−z )•(Optional)Consider the cross entropy loss function for logistic regression simplified so there is only one training example:J (θ)=−y log h θ(x )−(1−y )log(1−h θ(x )),h θ(x )=g (θT x )=11+e −θT x (1)Show that the partial derivative with respect to θj is:∂∂θj J (θ)=(h θ(x )−y )x j (2)Problem 2-Multi-class Logistic Regression (10pts)For multi-class classification using binary logistic regression,one way is to use the One-vs-All (One-vs-Rest)as we discussed in the class.Another way is to extend the binary logistic regression to multi-class logistic regression using softmax function.Assume there are K classes,for a data sample x ∈R n ×1,the predicted probability that x belongs to class k is given as (for simplicity,we don’t add intercept)P (y =k |x ;W )=exp(w T k x ) K i =1exp(w T i x )(3)where w k ∈R n ×1is the parameters to be learned.•(3pts)Please simplify Eq.(3)for K=2.Does the simplified one have the same formatas binary logistic regression?Hint:exp(w T 2x )exp(w T 1x )=exp((w 2−w 1)T x )•(5pts)Assume that K=3,x =[1,2,2],w 1=[1,0,1],w 2=[0,1,1]and w 3=[1,1,0],please calculate P (y =1|x ;W ),P (y =2|x ;W ),and P (y =3|x ;W ).•(2pts)For the above example,i.e.,x =[1,2,2].Based on the calculation,which class should we classify x =[1,2,2]and why?•(Optional)For simplicity of notation,let’s denote y k =P (y =k |x ;W ),with P (y =k |x ;W )=exp(w T k x ) K i =1exp(w T i x )as defined in Eq.(3),please derive the partial derivative ∂y k ∂w j ,j =kProblem 3(5pts)You run gradient descent for 15iterations with α=0.3and compute J (θ)after each iteration.You find that the value of J (θ)decreases quickly then levels off.Based on this,which of the following conclusions seems most plausible?A:Rather than use the current value of α,it would be more promising to try a larger value of α(say α=1.0).B:α=0.3is an effective choice of learning rate.C:Rather than use the current value of α,it would be more promising to try a smaller value of α(say α=0.1).Problem 4(5pts)Suppose you have the following training set,and fit a logistic regression classifier h θ(x )=g (θ0+θ1x 1+θ2x 2).Which of the following are true?Check all that apply.A:J (θ)will be a convex function,so gradient descent should converge to the global minimum.B:Adding polynomial features (e.g.,instead using h θ(x )=g (θ0+θ1x 1+θ2x 2+θ3x 21+θ4x 1x 2+θ5x 22)could increase how well we can fit the training data.C:The positive and negative examples cannot be separated using a straight line.So,gradient descent will fail to converge.D:Because the positive and negative examples cannot be separated using a straight line, linear regression will perform as well as logistic regression on this data.Problem5(5pts)Suppose you train a logistic classifier hθ(x)=g(θ0+θ1x1+θ2x2).You obtainθ0=−6,θ1=1andθ2=0.Which of the followingfigures represents the decision boundary found by your classifier?(a)A(b)B(c)C(d)DProblem6Feature Scaling(10pts)For the data samples shown below,please perform normalization and standardization.x1x2y1.52.00.3-1.0 2.0-0.2-2.0-1.00.12.0-2.50.4Problem7Use Sklearn Logistic Regression(10pts)We will use the implementation of Sklearn for Logistic Regression.Please download the notebookfile“Assignment2Q5”from Canvas.You can either upload the notebookfile to Google Colab tofinish this question or run locally.Following the instructions in the notebook andfill in the key code.After that, in the browser,click on“File”,Select“Print”,and choose“Save as PDF”.Submit the pdf along with your solution to other problems to Canvas.。

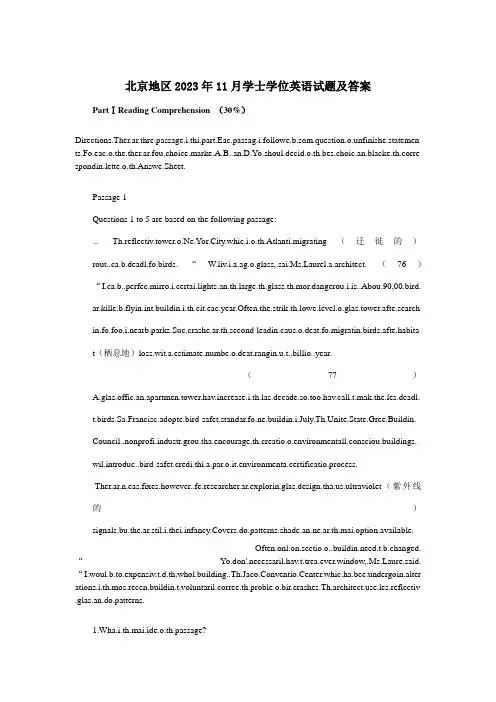

北京地区2023年11月学士学位英语试题及答案PartⅠReading Comprehension (30%)Directions.Ther.ar.thre.passage.i.thi.part.Eac.passag.i.followe.b.som.question.o.unfinishe.statemen ts.Fo.eac.o.the.ther.ar.fou.choice.marke.A.B..an.D.Yo.shoul.decid.o.th.bes.choic.an.blacke.th.corre spondin.lette.o.th.Answe.Sheet.Passage 1Questions 1 to 5 are based on the following passage:.. Th.reflectiv.tower.o.Ne.Yor.City.whic.i.o.th.Atlanti.migrating(迁徙的)rout..ca.b.deadl.fo.birds.“W.liv.i.a.ag.o.glass,urel.a.architect.(76)“rge.th.glass.th.mor.dangerou.i.is..Abou.90,00.bird.ar.kille.b.flyin.int.buildin.i.th.cit.eac.year.Often.the.strik.th.lowe.level.o.glas.tower.afte.search in.fo.foo.i.nearb.parks.Suc.crashe.ar.th.second-leadin.caus.o.deat.fo.migratin.birds.afte.habita t(栖息地)loss.wit.a.estimate.numbe.o.deat.rangin.u.t..billio..year.(77)s.decade.so.too.hav.call.t.mak.the.les.deadl.t.birds.Sa.Francisc.adopte.bird-safet.standar.fo.ne.buildin.i.July.Th.Unite.State.Gree.Buildin.Council..nonprofi.industr.grou.tha.encourage.th.creatio.o.environmentall.consciou.buildings.wil.introduc..bird-safet.credi.thi.a.par.o.it.environmenta.certificatio.process..ultraviolet(紫外线的)signals.bu.the.ar.stil.i.thei.infancy.Covers.do.patterns.shade.an.ne.ar.th.mai.option.available.Often.onl.on.sectio.o..buildin.need.t.b.changed.“Yo.don'.necessaril.hav.t.trea.ever.window,ure.said.“I.woul.b.to.expensiv.t.d.th.whol.building..Th.Jaco.Conventio.Center.whic.ha.bee.undergoin.alter e.les.reflectiv .glas.an.do.patterns.1.Wha.i.th.mai.ide.o.th.passage?A.Ne.Yor.i..cit.o.glas.towers.B.Glas.towe.ar.dangerou.fo.migratin.birds.C.Ne.Yor.adopte.ne.safet.standard.fo.buildings.D.Glas.tower.ar..ne.tren.i.th.Unite.States.2.Wha.i.th.numbe.on.caus.o.deat.fo.migratin.birds?A.Climat.chang.......B.Habita.lossc.o.foo........D.Crashin.int.buildings.3.Wha.doe.th.wor.“fixes.i.th.thir.paragrap.probabl.mean?A.Choice..........B.ExplanationsC.Solution..........D.Developments4._____e.i.th.alteratio.o.th.Jaco.K.Javit.Conventio.Center.A.Do.pattern.........B.Shades............D.Covers5.Whic.o.th.fowlin.statement.i.TRU.accordin.t.th.passage?A.I.man.cases.th.whol.buildin.need.t.b.altere.t.preven.bir.crashes.B.Th.Jaco.K.Javit.Conventio.Cente.i.th.firs.buildin.t.dea.wit.th.proble.o.bir.crashes.C.Abou.90,00.bird.ar.kille.du.t.habita.los.i.Ne.Yor.Cit.eac.year..ultraviole.signal.ar.stil.i.thei.earl.stages.Passage 2Question 6 to 10 are based on the fowling passage:.. Today'.student.hav.grow.u.hearin.mor.abou.Bil.Gate.tha.F.D.R..an.the.liv.i..worl.wher.amazin. innovations(革新)mon.Th.curren.18-year-olds.afte.all.wer..whe.Googl.wa.founde.b.tw.student.a.Stanford .Mar.Zuckerber.founde.Faceboo.i.202.whil.h.wa.Harvar.an.the.wer.enterin.hig.school.Havin.g row.u.digital(数字的), the.ar.impatien.t.ge.o.wit.life.The easiest way to find kids like these is to check in on entrepreneurship(公司家才干)education, in which colleges and universities try to prepare their students to recognize opportunities and seize them... s.yea.b.th.Kauffma.Foundation.whic.finance.program.t.promot.innovatio.o.c ampuses.note.tha.mor.tha.50,00.entrepreneurshi.program.ar.offere.o.two-an.four-yea.campuse s—u.fro.jus.25.course.i.1985.Les.Mitchel...Kauffma.vic.president.say.tha.th.foundatio.i.extendin. e.t.b.foun.onl.i.busines.schools.Now.th.concep.o.entrep reneurshi.i.bloomin.i.engineerin.program.an.medica.school.an.eve.i.th.libera.arts.“Ou.interes.i.th.programs,.sh.says.“W.nee.t.sprea.ou.fro.th.busines.school.”.. in.u.wit.ideas.writin.busines.p lan.an.seein.the.throug.t.prototyp.and.often.market.I.thei.spar.time.student.i.agricultura.econo boratory.creat.w earabl.technologies... (78)Th.entrepreneurshi.movemen.ha.it.critics.especiall.amon.thos.wh.se.colleg.a..tim.fo.extensiv. academi.exploration.“.jus.don'.thin.tha.entrepreneurshi. rank.s.hig.i.term.o.nationa.need,.say.Danie.S.Greenberg.autho.o.Scienc.fo.sale.Th.perils.Rew ard.an.Delusion.o.Campu.Capitalism.Leonard A.Schlesinger, Babson College's president, says that the question of whether innovation can really be taught is “an age-old argument”.6.Whe.Googl.an.Faceboo.wer.established.th.founder.wer.still_____.A.i.hig.schoo..........B.i.th.armyC.i.primar.schoo.........D.a.collegecation?A.T.prepar.student.fo.futur.academi.lifeB.T.prepar.student.t.fin.opportunitie.an.seiz.them.C.T.prepar.student.fo.oversea.career.D.T.prepar.studen.t.develo.interpersona.skills.8.Th.wor.“prototype.i.th.fourt.paragrap.i.mos.likel.t.mean_____.A.mode..............B.strategyC.metho.............D.stagecation?A.Entrepreneurship.o.a.leas.certai.element.o.it.ca.b.taught..B.A.entrepreneurshi.progra.ca.hel.student.fin.wha.the.reall.lik.an.entrepreneurshi.isn'.al.abou.busi ness.C.Entrepreneurshi.shoul.b.sprea.acros.differen.fields.D.College.shouldn'.pu.to.muc.emphasi.o.entrepreneurshi.programs.10.Wha.i.th.mai.ide.o.th.passage?A.Entrepreneurshi.course.i.busines.schools.B.Qualitie.o.a.entrepreneur.catio.i.colleges.rmatio.age.Passage 3Question 11 to 15 are based on the following passage:..mo.a.emotio.a.lov.o.fear.an.i.ca.b.nearl.a.powerful.So.i..ne.paper.tw.researcher.se.abou.tryin.t.fin.ou.wha.th.typica.America.regret.most.I.telephon.surveys.Nea.Rose..psychologis.an.professo.o.marketin.a.th.Schoo.o.Managemen.a.Northwester.University.an.Mik.Morri son..doctora.candidat.i.psycholog.a.Universit.o.Illinois.aske.37.Americans.age.1.t.103,t.tal.abou.thei.mos.notabl.regre..Participant.wer.aske.wha.th.regre.was.whe.i.happened.whethe.i.wa..resul.o.somethin.the.di.o.didn'.do.an.whethe.i.wa.somethin.tha.coul.stil.b.fixed... monl.mentione.regre.involve.romanc.(浪漫的事)(18%)——los.love.o.unfulfille.relationships.Famil.regret.cam.i.secon.(16%), whi.peopl.stil.feelin.badl.abou.bein.unkin.t.thei.brother.o.sister.i.childhood.Othe.frequentl.rep orte.regret.involve.caree.(13%),educatio.(12%), money(10%)an.parenting(9^%)...Ros.an.Morrison'.study.whic.i.t.b.publishe.i.Socia.Psychologica.an.Personalit.Science.i.signif ican.i.tha.i.surveye..wid.rang.o.th.America.public.includin.peopl.o.al.age.an.socio-economi.a rgel.o.colleg.students.wh.predi cation-focuse.regrets.lik.wishin.the.ha.studie.harde.o..differen.major.Th.ne.rge.population..person'.“lif.circumstances—accomplishments.shortcomings.situatio.i.life—injec.considerabl.fue.int.th.fire.o.regret,.th.author.write.(79)catio.regret.Peopl.wit.highe.level.o .educatio.ha.th.mos.caree.regrets.An.thos.wit.n.romanti.partne.tende.t.hol.regret.regardin.love .Broke.down(分解、细分)b.sex.mor.women(44%.tha.me.(19%.ha.regret.abou.lov.an.family —no.surprising.sinc.wome.“valu.socia.relationship.mor.tha.men,.th.author.write.I.contras.,me.(34%.wer.mor.likel.tha.wome.(27%.t.mentio.work-relate.regrets.wishin.they'.chose..differen.caree.path.fo.instanc.,o.follo we.thei.passion.(80)Man.participant.als.reporte.wishin.the.ha.worke.les.t.spen.mor.tim.wit.thei.children...Ther.wa.a.eve.spli.betwee.regret.abou.inactio.(no.doin.something.an.actio.(d.somethin.yo.wis.yo.didn't).But.lik.previou.studies.th.curren.researc.foun.tha.som.regret.ar.m or.likel.tha.other.t.persis.ove.time.peopl.ten.t.han.o.longe.t.th.regre.o.inaction.meanwhile.regret.o.a ctio.ten.t.b.mor.recent.11.I.th.secon.paragraph.th.autho.show.______.A.th.researchers.finding...B.th.importanc.o.familyC.th.importanc.o.mone...D.th.importanc.o.career12.Accordin.t.th.passage.colleg.studen.participant.mainl.ha.regret.abou.thei.______.A.famil.an.childhoo...B.stud.an.majorC.caree.an.jo......D.romanc.an.fear13.The word “notable”in the first paragraph is closest in meaning to ______.mo........B.capabl...C.wonderfu........D.remarkable14.Whic.o.th.followin.statement.i.TRUE?catio.h.o.sh.has.th.mor.regret.sh.o.h.woul.have.catio.h.o.sh.has.th.les.regret.sh.o.h.woul.have.C.Mor.wome.tha.me.ha.regret.abou.lov.an.family.s.longe.tha.tha.o.inaction.15.Wha.i.th.mai.ide.o.thi.passage?A.Ho.regre.i.understoo.b..typica.American.B .Common regrets is more important than love and hate.C.Wh.regre.i.mor.importan.tha.lov.an.hate.D.Ho.regre.ha.shape.Americans.PartⅡVocabulary and Structure (30%)Directions.I.thi.par.ther.ar.3.incomplet.sentences.Fo.eac.sentenc.ther.ar.fou.choice.marke.A.B..an.plete.th.sentences.The.blacke.th.correspondin.lette.o.th.Answe. Sheet.in.t.visi.u.soon.We'.bette.ge.everythin.read.befor.h._______.A.arrive.......B.arriv.....C.wil.arriv.....D.arrived17._______yesterday.yo.woul.hav.me.Professo.Jones.Bu.no.h.ha.lef.fo.London..........e........e18.Th.ma.denied____.int.th.neighbor'.garde.an.______hi.cow.A.going……stealin......B.going…stoleC.went…stealin........D.went…stole19.Te.worke.lik..hors.i.hi.youth.______te.a..businessman.A.tha...B.wh...C.wha...D.which20..fe.hour.ago..smal.suitcas.wit.som.importan.paper.______.stole.fro.th.genera.manager'.office.A.i........B.ar........C.wer........D.was21.______ on the New World, he felt like crying.nde.......n.........nded22.Visi.ou.store.Nowher.els._____.suc.goo.bargains.A.yo.fin......B.fin.yo......C.d.yo.fin.....D.yo.d.find23.After_____.seeme.a.endles.wait.i.wa.hi.tur.t.g.int.th.doctor'.office.A.thi........B.tha........C.whic........D.whatk.are..yea.ago.the._____.bette.health.A.coul.hav.enjoye.......B.ha.enjoye.....C.hav.bee.enjoyin.......D.ar.enjoying25.Th.bos.doesn'.wan.t.tal.abou.th.accident.no.h.i.i.n._____.t.d.so.A.feelin.......B.attitud.....C.emotio...D.Mood26..can'.understan.wh.yo.regar.i.a.music.I._____.m.mad!.A.put....B.set... C.driver... D.changes27.Yesterda.M.Blak.wa.caugh.i.th.rai.an.go.we.through._____.h.caugh..ba.cold.A.Consequentl...B.Finall...tel...D.Strangely28.Willia.like.t.ea.out.bu.h.i.no._____.abou.wha.h.eats.A.peculia...B.unusua...C.particula...D.special29.Thei.hous.stand.a..hilltop.____.th.Hudso.Rive.dow.below.A.seein.....B.viewin...C.lookin.a..D.overlooking30..can'.understan.wh.m.bos.i.alway._____faul.wit.m.work.A.findin...B.seekin..C.lookin..D.making31.Thi.i.th.sam.knif.____..los.yesterday.A.whic....B.wha....C.lik......D.as32.—.Whe.wil.yo.b.back?——I'll be back _____a couple of days.A.afte.....B.fo......C.abou....D.in33.W.hea.tha.the.wil.____..ne.schoo.here.A.se.dow..B.se.u...C.se.of...D.se.out34.H.wil.neve.forge.th.day.____.h.spen.i.Japan.A.whe...B.afte....C.tha....D.how35.Interestingl.enough.th.tw.brother.hav.notin.in_______.A.ordinar..mo..C.genera....particular36.Th.scientist.ar.tryin.t.fin.ou.th.fact.t.______.thei.theory.A.suppor..B.carr..C.desig..D.raise37.Th.performanc.o.th.Englis.tea.wa.________.The.playe.muc.wors.tha.expected.A.disappoin...B.disappointin...C.disappointe...D.t.disappoint38.Yo.ar.welcom.t.orde.th.good.now.Bu.paymen.shoul.b.made________.A.fo.advanc..B.fro.advanc...C.i.advanc...D.t.advance39.Spea.loude.s.tha.yo.ca.mak.yoursel._______.A.hear..........B.t.hea..C.hearin..........D.hav.bee.heard40.No.i.won'.b.lon.befor.w.mee.again.________?A.wil.i....B.d.w..C.won'.w..D.doe.it41.American.eat_____.vegetable.pe.perso.toda.a.the.di.i.th.1960s.A.mor.tha.twic........B.a.twic.manyC.twic.a.man.........D.mor.tha.twic.a.many42..wa.s.familia.wit.he.tha..recognize.he.voic._____..picke.u.th.phone.A.th.momen...B.sinc...C.befor....D.whilecatio.o._______.youn.i.alway._____.ho.an.seriou.topic.A./....B.the.....C./.th....D.the.the44.Da.wondere.wher.I'.been.an.._______..stor.abou.bein.a.Grandma'sA.mad.ou....B.mad.u......C.looke.ou......D.looke.up45.You.siste.doesn'.stud.a.______.a.yo.do.A.har...B.hardl...C.harde..D.hardestPartⅢIdentification (10%)Directions.Eac.o.th.followin.sentence.ha.fou.underline.part.marke.A.B..an.D.Identif.th.on.tha.i.no. correct.The.blacke.th.correspondin.lette.o.th.Answe.Sheet.46.N.soone.ha.the.entere.th.roo.whe.th.telephon.rang.A B C D47.A..graduat.fro.hig.school.To.i.face.wit.thre.choices.attendin.college.A B Cfinding a job or the army.D48.Thos.freshme.hop.t.offe.som.part-tim.job.t.suppor.themselve.financially.A B C D49.I.wa.hi.nervousnes.i.th.intervie.wha.probabl.cause.hi.t.los.th.job.A B C D50.Lucy'.parent.giv.he.everythin.sh.asks.wha.els.doe.sh.need?A B C D51..mus.wor.hard.howeve.I'l.fai.i.th.exam.A B C De.t.rea.th.pape.afte.lunch.That'.on.o.th.thing..reall.enjoy.A B C Din.t.th.party.A B C D54.Te.ha.sa.a.th.tabl.an.dran.mor.bee.tha.i.goo.fo.hi.health.A B C D55.Wit.n.on.t.tur.ove.fo.hel.i.suc..frightenin.situation.sh.wa.i.despair.A B C DPart IV Cloze (10%)Directions.Ther.ar.2.blank.i.th.followin.passage.an.fo.eac.blan.ther.ar..choice.marke.......an..a.th.en. o.th.passage.Yo.shoul.choos.ON.answe.tha.bes.fit.int.th.passage.The.blacke.th.correspondin.lette.o .th.Answe.Sheet...in..differen.passwor.fo.ever.websit.yo.visit.an.changin.th.passwor.ever.fe.mo nths.I.take.troubl.t.kee.the.i.mind.bu.it'.wel.wort.th..5. .B..5. .wit.you.password.an.mak.i.diffi cul.i.i.fo.someon.t.ente.you. 5..Th.mor.5.yo.mak.you.password.th.mor.difficul.i.i.fo.someon.els.t.figur.i.6...privac.settings(设立)o.socia.website.t. 6. rmatio.an.limi.th. 6.rmatio.yo.expos.abou.yoursel.coul.b.u se.6..you..onc.rea.abou..burglary(入室盗窃).I.6. tha.th.thieve.selecte.tha.particula.hom. 6.the.discovere.th.owne.wa.ou.o.tow.b. 6...Faceboo.message... Accordin.t.persona.safet.experts.i.isn'.a(n.6.rmatio.yo.pos.o.website.ca.6.crimina.activity.Yo.ma.no.thin.6.abou.postin.th.concer.yo.ar.goin.t.o.you.weeken.away.bu.coul.b.a(n.7. fo.trouble... rmatio.abou.you.Neve.7.you.ful.birt.d rmatio.t.any on.7.yo.ar.certai.wh.yo.ar.dealin.with.7. th.necessar.precautions(防止措施)i.th.bes.wa.t.7. rmatio.sta.protected.bo...... D.matter57.A.prou......B.tru...... C.hones......D.creative58.A.account.....B.record.....C.direction.....D.collectionsple.....B.carefu..... C.diligen..... D.elastic60.A.awa...... B.o.......C.ou....... D.in61.A.respon..... B.resig..... C.restric......D.resemble62.A.numbe..... B.amoun.....C.pil....... D.piece63.A.wit...... B.fo.......C.abou...... D.against6.A.turne.ou.... B.turne.i.... C.picke.ou.... D.picke.up65.A.whic......B.whil......C.becaus..... D.although66.A.knowin.....B.readin.....C.inspectin.....D.realizing67.A.impacte.....B.collecte.... C.repaire..... D.isolated68.A.lea.t......B.resul.fro....C.se.of......D.mak.up69.A.ou....... B.alou......C.onc...... D.twice70.A.resistanc.....B.statemen.... C.invitatio.....D.struggle71.A.revea...... B.revis......C.resembl.....D.require72.A.threatenin.... B.requestin....C.worshippin... D.delivering73.A.sinc.......B.a....... ..whe......D.until74.A.Replacin.....B.Liberatin....C.Takin........Depending75.A.ensur...... B.separat.....C.sprea......D.switchPart ⅤTranslation(20%)Section ADirections.I.thi.par.ther.ar.fiv.sentence.whic.yo.shoul.translat.int.Chinese.Thes.sentence.ar.al.take.f prehension.Yo.ca.refe.bac.t.th.passage.t.identif.thei.mea ning.i.th.context.rge.th.glass.th.mor.dangerou.i.is.s.decade.so.too.hav.call.t.mak.the.les.deadl.t. birds.78.Th.entrepreneurshi.movemen.ha.it.critics.especiall.amon.thos.wh.se.colleg.a..tim.fo.extensiv.ac ademi.exploration.catio.regrets.80.Man.participant.als.reporte.wishin.the.ha.worke.les.t.spen.mor.tim.wit.thei.children.Section BDirections.I.thi.par.ther.ar.fiv.sentence.i.Chinese.Yo.shoul.translat.the.int.English.B.sur.t.writ.clearl y.81.他站在窗户旁边, 思考着自己的学习计划。

Homework is an essential part of the educational process,designed to reinforce and deepen the understanding of concepts taught in class.It can take various forms,such as written assignments,reading tasks,practical exercises,or research projects.Heres a detailed description of the different aspects of homework in English:1.Purpose of Homework:Homework serves multiple purposes.It helps students to practice and apply the knowledge gained in class,develop time management and organizational skills,and foster a sense of responsibility and selfdiscipline.2.Types of Homework:Written Assignments:These include essays,reports,and problemsolving tasks that require students to write down their thoughts and solutions.Reading Assignments:Students are often asked to read chapters from textbooks or articles to prepare for class discussions or to gain a deeper understanding of a topic. Math Problems:In subjects like mathematics,students are given problems to solve, which helps them to apply mathematical concepts and improve their problemsolving skills.Science Experiments:Sometimes,students are asked to conduct experiments at home or in the lab to explore scientific concepts further.Research Projects:These are indepth assignments where students are expected to explore a topic extensively,gather information,and present their findings.3.Homework Guidelines:Teachers usually provide guidelines for completing homework, which may include due dates,formatting requirements,and the level of detail expected in the answers.4.Strategies for Effective Homework:Time Management:Allocating specific times for homework can help students stay organized and avoid lastminute rushes.Study Groups:Collaborating with classmates can provide different perspectives and make the learning process more enjoyable.Asking for Help:If students are struggling with their homework,its important to seek help from teachers,tutors,or peers.5.Technology in Homework:With the advent of digital tools,homework can now be completed using computers,tablets,or smartphones.Online platforms and educational apps provide interactive ways to complete assignments and receive feedback.6.Homework and Learning Outcomes:Research has shown that homework can improve academic performance when assigned in a thoughtful and balanced manner.However,excessive amounts of homework can lead to stress and burnout.7.Homework Challenges:Procrastination:Many students struggle with putting off homework until the last minute,which can lead to poor quality work and increased stress.Distractions:The presence of digital devices and social media can make it difficult for students to focus on their assignments.WorkLife Balance:Students need to find a balance between schoolwork and other activities to maintain their mental health and wellbeing.8.Feedback on Homework:Teachers provide feedback on completed homework to help students understand their mistakes and learn from them.This feedback is crucial for academic growth and improvement.9.Homework Policies:Schools and educational institutions may have specific policies regarding homework,including the amount of homework assigned,the frequency of assignments,and the consequences for not completing homework.10.Cultural Perspectives on Homework:Attitudes towards homework vary across cultures.In some countries,homework is considered a necessary part of education,while in others,it may be seen as an unnecessary burden on students.Homework is a critical component of the educational experience,but it must be approached with a balance that respects students time and wellbeing.It should be a tool for learning and growth,rather than a source of undue stress.。

牛津译林版英语初一上学期期中模拟试卷及解答参考一、听力部分(本大题有20小题,每小题1分,共20分)1、听力材料:A: Good morning, everyone. How are you today?B: I’m fine, thanks. How about you?A: I’m doing well too. What’s your name?B: My name is Li Hua.Questions:1.How is the weather today?A)Sunny.B)Rainy.C)Cloudy.Answer: B) Rainy.Explanation: The listener can hear the speaker saying “How are you today?” which implies the weather is being discussed, and the response “I’m fine, thanks” suggests a rainy day.2、听力材料:A: Excuse me, can you help me find the English books section?B: Sure, it’s on the second floor. Just follow the signs.Questions:2.Where is the English books section?A) On the first floor.B) On the second floor.C) On the third floor.Answer: B) On the second floor.Explanation: The listener can hear the speaker asking for directions to the English books section and the response indicates that it is located on the second floor.3、What does the boy want to join?A)The art clubB)The chess clubC)The music club(Audio plays a dialogue where a boy expresses his interest in joining a specific club)Answer: C) The music clubExplanation: In the conversation, the boy clearly states that he loves playing the guitar and would like to improve his skills, which indicates his preference to join the music club.4、Where are the two speakers?A)At a libraryB)In a classroomC)At a bus stop(Audio plays a conversation between two people discussing their location and what they can do there)Answer: B) In a classroomExplanation: The speakers talk about their upcoming class project and mention the whiteboard and desks, which are typical items found in a classroom setting, not in a library or at a bus stop.5、听力材料:A. Hello, how are you? I’m fine, thank you. And you?B. I’m fine too. How about your family?C. They are all well. How about you?Questions:1.How is the man?2.How is the woman’s family?Answer:1.A. (The man is fine.)2.B. (The woman’s family is all well.)Explanation:This question is a simple dialogue between two people. The first speaker, a man, is asking the other person how they are. The second speaker, a woman, responds by asking how the man’s family is. The correct answers are found directly in the dialogue. The man’s response to the question “How are you?” indicates that he is fine (A), and the woman’s response to the question about her family members indicates that they are all well (B).6、听力材料:A. What’s your favorite sport?B. I like basketball. Do you?C. Yes, I do. I also enjoy playing soccer.Questions:1.What is the first speaker’s favorite sport?2.What does the second speaker enjoy playing?Answer:1.B. (The first speaker’s favorite sport is basketball.)2.C. (The second speaker enjoys playing soccer.)Explanation:This question presents a conversation where two speakers are discussing their favorite sports. The first speaker asks, “What’s your favorite sport?” and the second speaker responds, “I like basketball. Do you?” This indicates that the first speaker’s favor ite sport is basketball (B). The second part of the question involves the second speaker’s response, which states that they also enjoy playing soccer (C).7、What time does the boy usually get up on weekends?Transcript:Boy: I like to sleep in on Saturdays and Sundays.Girl: Really? So, what time do you usually get up?Boy: Well, I try not to wake up before 9 o’clock.Girl: That’s pretty late. I always get up at 7 to go jogging.Question: According to the conversation, what time does the boy usually get up on weekends?A) At 7:00B) At 8:00C) At 9:00D) At 10:00Answer: C) At 9:00Explanation: The boy states that he tries not to wake up before 9 o’clock on weekends, indicating that around 9:00 is his usual wake-up time on those days.8、Where are the two speakers probably?Transcript:Man: Can I help you find something?Woman: Yes, please. I’m looking for some books about science for my daughter. She’s very interested in it.Man: Sure, we have a great selection over here. Follow me, please. Woman: Thank you so much. Your service is really helpful.Question: Where are the two speakers probably?A) In a libraryB) In a bookstoreC) In a schoolD) In a parkAnswer: B) In a bookstoreExplanation: The woman is seeking help to find books for her daughter, and the man offers to show her where the science books are located. This interaction is most likely to take place in a bookstore, where one can purchase books andcustomer service is provided to assist in finding specific items.9.You are listening to a conversation between a student and a teacher ina school.Student: “Miss Smith, I can’t seem to understand why we need to learn these historical facts. They don’t seem to be relevant to our daily lives.”Teacher: “Well, young man, history is the story of humanity. It gives us insights into the past, which helps us understand the present and shape the future. Besides, knowing our history is important for national pride and cultural heritage.”Question: What is the teacher’s main point in this conv ersation?A. History is not relevant to daily life.B. Learning history is important for national pride and cultural heritage.C. Students should focus on practical subjects.D. Historical facts are too difficult to understand.Answer: B. Learning history is important for national pride and cultural heritage.Explanation: The teacher emphasizes that history is the story of humanity and knowing it helps us understand the present and shape the future. Additionally, the teacher mentions the importance of national pride and cultural heritage, making option B the correct answer.10.You are listening to a weather report on the radio.Weather Anchor: “Good morning, listeners. The National Weather Service hasissued a severe thunderstorm warning for our area. This warning is in effect until 2:00 PM today. Residents are advised to stay indoors and avoid outdoor activities. Strong winds and heavy rain are expected, with the possibility of hail and lightning. Please be cautious and keep an eye on the weather forecast.”Question: What is the purpose of the weather report?A. To inform listeners about the weather conditions.B. To encourage listeners to go outside and enjoy the weather.C. To promote a weather-related product or service.D. To discuss the causes of thunderstorms.Answer: A. To inform listeners about the weather conditions.Explanation: The weather report provides listeners with crucial information about the severe thunderstorm warning, including the duration of the warning, safety advice, and expected weather conditions. Therefore, option A is the correct answer.11、What does Sarah plan to do this weekend?A. Go shopping with her friends.B. Visit her grandparents.C. Stay at home and study.Answer: B. Visit her grandparents.Explanation: In the dialogue, Sarah mentions that she has plans to visit her grandparents who live in the countryside this weekend, which she is very excited about. Therefore, the correct answer is B.12、How will Tom get to the library?A. By bus.B. On foot.C. By bicycle.Answer: C. By bicycle.Explanation: The conversation reveals that Tom prefers cycling as it is both environmentally friendly and good exercise. He confirms his intention to ride his bicycle to the library when asked about his travel plans. Hence, the correct answer is C.13.You are going to hear a conversation between two students about their weekend plans. Listen carefully and choose the best answer to the question.Question: What are the students planning to do this weekend?A. Go to the movies.B. Visit a museum.C. Go hiking.Answer: C. Go hiking.Explanation: In the conversation, one of the students mentions that they are thinking of going hiking this weekend, which indicates that this is their plan.14.Listen to a short dialogue about ordering food at a restaurant and answer the following question.Question: What does the woman want to order?A. A pizza.B. A salad.C. A sandwich.Answer: B. A salad.Explanation: The woman in the dialogue specifically asks for a salad, which is option B. The other options are not mentioned in the dialogue.15.Listen to the conversation between two students discussing their weekend plans.A. What are the students planning to do this weekend?B. Where will the students go for their trip?C. How will the students get to the beach?D. Why did the students decide to go to the beach?Answer: A. What are the students planning to do this weekend?Explanation: The conversation mentions that they are planning to go on a picnic and spend time at the beach, so the correct answer is about their weekend plans.16.Listen to a short dialogue between a teacher and a student discussing an upcoming assignment.A. What is the assignment about?B. When is the assignment due?C. What are the requirements for the assignment?D. Why is the student worried about the assignment?Answer: C. What are the requirements for the assignment?Explanation: The teacher explains the requirements of the assignment, such as the number of pages and the need to include specific information, so the correct answer is about the requirements.17、What does the man want Lucy to help him with at the library?•A) To return some books•B) To borrow books for his project•C) To find information about famous scientists•D) To choose a topic for his presentationAnswer: C) To find information about famous scientistsExplanation: The man explicitly states that he needs help finding information about famous scientists for his upcoming presentation. He mentions Albert Einstein and Marie Curie as potential subjects.18、When are they planning to meet at the library?•A) At 2 o’clock•B) At 3 o’clock•C) At 4 o’clock•D) After schoolAnswer: B) At 3 o’clockExplanation: In the conversation, the man suggests meeting at 3 o’cl ock, and Lucy agrees, saying “Sounds good. See you there!” This confirms that they plan to meet at 3 o’clock.This sample gives you an idea of how the listening comprehension sectionmight be structured, with a focus on understanding the main points of the conversation and extracting specific details.19.Listen to the conversation and choose the best answer to complete the sentence.A. The man is going to the library to borrow some books.B. The woman is helping the man find a book.C. The man is looking for a specific book about history.D. The woman is recommending a book to the man.Answer: BExplanation: The woman says, “I think you might find what you’re looking for over here,” indicating she is helping the man find a book.20.Listen to the short dialogue and answer the question.What is the main topic of the conversation?A. The weather forecast for the weekend.B. The man’s upcoming vacation plans.C. The woman’s new job offer.D. The latest sports news.Answer: CExplanation: The woman mentions, “I’ve just got a job offer from a company in London,” which is the main topic of their conversation.二、阅读理解(30分)Reading ComprehensionRead the following passage and answer the questions that follow.The Great Wall of China is one of the most remarkable architectural wonders in the world. Stretching over 13,000 miles, it is a symbol of Chinese culture and history. Built over a period of more than two millennia, the Great Wall was originally constructed to protect the Chinese Empire from invasions by various nomadic tribes.The construction of the Great Wall began in the 7th century BC under the rule of the first Emperor of China, Qin Shi Huang. However, it was during the Ming Dynasty (1368-1644) that the wall reached its current form and length. The wall is made up of a series of fortresses, watchtowers, and walls that run along the ridges of mountains and through valleys. The laborers who built the wall were a mixture of soldiers, convicts, and local villagers, who worked under harsh conditions.The Great Wall is not only a testament to the ancient Chinese people’s engineering skills but also a reflection of their determination and resilience. Despite facing numerous challenges, the laborers managed to construct a wall that stands today as a symbol of their hard work and dedication. The wall is not only a military defense system but also a cultural heritage that has inspired countless generations.1.What is the Great Wall of China a symbol of?A) Chinese cuisineB) Chinese culture and historyC) Chinese sportsD) Chinese economy2.When did the construction of the Great Wall begin?A) In the 7th century BCB) During the Ming DynastyC) In the 20th centuryD) In the 1st century BC3.Who were the laborers who built the Great Wall?A) Only soldiersB) Only convictsC) A mixture of soldiers, convicts, and local villagersD) Only local villagersAnswers:1.B) Chinese culture and history2.A) In the 7th century BC3.C) A mixture of soldiers, convicts, and local villagers三、完型填空(15分)Section III: Cloze TestRead the following passage and choose the best word for each blank from theoptions given below. Write the letter of your choice in the corresponding blank.The modern world is constantly changing, and with these changes come both opportunities and challenges. In the [1] of the 21st century, [2] has become more accessible than ever before. The internet, for instance, has revolutionized the way we [3] information. It allows us to connect with people from all over the world and to [4] a wealth of knowledge at our fingertips.However, this newfound connectivity also brings its own set of problems. One of the most significant challenges is the issue of [5]. With so much information available, it can be difficult to [6] what is accurate and reliable.1.A) beginningB) endC) middleD) edge2.A) technologyB) scienceC) educationD) communication3.A) gatherB) storeC) shareD) analyze4.A) accessB) exchangeC) produceD) consume5.A) privacyB) securityC) overloadD) efficiency6.A) recognizeB) ignoreC) manipulateD) underestimateAnswers:1.A) beginning2.A) technology3.A) gather4.A) access5.C) overload6.A) recognize四、语法填空题(本大题有10小题,每小题1分,共10分)1、In the 1 morning, the sun 2 (rise) over the horizon, casting a warm glow over the town.答案:1. first 2. was rising解析:第一空应填入表示时间的形容词“first”,表示“在早上第一次”。