forum on tax gap

- 格式:pdf

- 大小:842.91 KB

- 文档页数:82

2023年12月六级英语tax cut解析The Importance of Tax Cuts in December 2023In December 2023, the government introduced a new tax cut policy aimed at stimulating the economy and reducing the financial burden on individuals and businesses. This move is expected to have a significant impact on various sectors of society and the economy as a whole. In this article, we will analyze the implications of the tax cuts and discuss how they might affect different stakeholders.First and foremost, the tax cuts are likely to benefit individual taxpayers by putting more money in their pockets. With lower tax rates, people will have more disposable income to spend on goods and services, which could boost consumer spending and stimulate economic growth. This, in turn, could lead to increased demand for goods and services, driving up production and creating more job opportunities.Moreover, businesses are also expected to benefit from the tax cuts. With lower corporate tax rates, companies will have more capital to invest in expansion, innovation, and hiring new employees. This could potentially lead to increased productivity,competitiveness, and profitability, thereby creating a more conducive environment for business growth and development.Furthermore, the tax cuts could have a positive effect on the overall economy by increasing GDP growth and reducing the budget deficit. As more money circulates in the economy, businesses will generate higher revenues, leading to increased tax receipts for the government. This could help offset the revenue loss from the tax cuts and contribute to a more balanced budget in the long run.Additionally, the tax cuts could attract more foreign investment and improve the country's competitiveness on the global stage. Lower tax rates make the country more attractive to foreign investors, who may see it as a more favorable destination for their investments. This could lead to an influx of foreign capital, technology, and expertise, which could further stimulate economic growth and create new opportunities for domestic businesses.However, it is important to consider the potential drawbacks of the tax cuts as well. Lower tax rates could lead to a reduction in government revenue, which may affect public services and welfare programs. This could result in cuts to essential services such as healthcare, education, and social welfare, which couldhave a negative impact on vulnerable populations and exacerbate income inequality.Moreover, the tax cuts could also widen the wealth gap between the rich and the poor. While high-income earners may benefit the most from lower tax rates, low-income individuals and families may not see significant changes in their financial situation. This could lead to social unrest and dissatisfaction among the population, which could undermine the long-term stability and prosperity of the country.In conclusion, the tax cuts introduced in December 2023 have the potential to stimulate economic growth, boost consumer spending, and attract foreign investment. However, it is essential for policymakers to carefully consider the potential consequences of these tax cuts and take proactive measures to mitigate any negative effects on the economy and society. By striking a balance between promoting economic growth and ensuring social equity, the government can maximize the benefits of the tax cuts and create a more prosperous and inclusive society for all.。

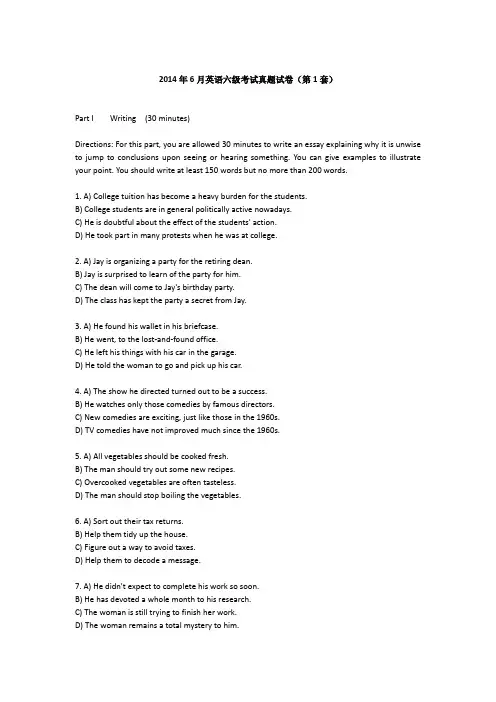

2014年6月英语六级考试真题试卷(第1套)Part I Writing (30 minutes)Directions: For this part, you are allowed 30 minutes to write an essay explaining why it is unwise to jump to conclusions upon seeing or hearing something. You can give examples to illustrate your point. You should write at least 150 words but no more than 200 words.1. A) College tuition has become a heavy burden for the students.B) College students are in general politically active nowadays.C) He is doubtful about the effect of the students' action.D) He took part in many protests when he was at college.2. A) Jay is organizing a party for the retiring dean.B) Jay is surprised to learn of the party for him.C) The dean will come to Jay's birthday party.D) The class has kept the party a secret from Jay.3. A) He found his wallet in his briefcase.B) He went, to the lost-and-found office.C) He left his things with his car in the garage.D) He told the woman to go and pick up his car.4. A) The show he directed turned out to be a success.B) He watches only those comedies by famous directors.C) New comedies are exciting, just like those in the 1960s.D) TV comedies have not improved much since the 1960s.5. A) All vegetables should be cooked fresh.B) The man should try out some new recipes.C) Overcooked vegetables are often tasteless.D) The man should stop boiling the vegetables.6. A) Sort out their tax returns.B) Help them tidy up the house.C) Figure out a way to avoid taxes.D) Help them to decode a message.7. A) He didn't expect to complete his work so soon.B) He has devoted a whole month to his research.C) The woman is still trying to finish her work.D) The woman remains a total mystery to him.8. A) He would like to major in psychology too.B) He has failed to register for the course.C) Developmental psychology is newly offered.D) There should be more time for registration.Questions 9 to 11 are based on the conversation you have just heard.9. A) The brilliant product, design.B) The new color combinations.C) The unique craftsmanship.D) The texture of the fabrics.10. A) Unique tourist attractions.B) Traditional Thai silks.C) Local handicrafts.D) Fancy products.11. A) It will be on the following weekend.B) It will be out into the countryside.C) It will last only one day.D) It will start tomorrow.Questions 12 to 15 are based on the conversation you have just heard.12. A) A good secondary education.B) A pleasant neighbourhood.C) A happy childhood.D) A year of practical training.13. A) He ought to get good vocational training.B) He should be sent to a private school.C) He is academically gifted.D) He is good at carpentry.14. A) Donwell School.B) Enderby High.C) Carlton Abbey.D) Enderby Comprehensive.15. A) Put Keith in a good boarding school.B) Talk with their children about their decision.C) Send their children to a better private school.D) Find out more about the five schools.Passage OneQuestions 16 to 18 are based on the conversation you have just heard.16. A) It will be brightly lit.B) It will be well ventilated.C) It will have a large space for storage.D) It will provide easy access to the disabled.17. A) On the first floor.B) On the ground floor.C) Opposite to the library.D) On the same floor as the labs.18. A) To make the building appear traditional.B) To match the style of construction on the site.C) To cut the construction cost to the minimum.D) To embody the subcommittee's design concepts.Passage TwoQuestions 19 to 22 are based on the passage you have just heard.19. A) Sell financial softwareB) Write financial software.C) Train clients to use financial software.D) Conduct research on financial software.20. A) Unsuccessful. B) Rewarding. C) Tedious. D) Important.21. A) He offered online tutorials.B) He held group discussions.C) He gave the trainees lecture notes.D) He provided individual support.22. A) The employees were a bit slow to follow his instruction.B) The trainees' problems has to be dealt with one by one.C) Nobody is able to solve all the problems in a couple of weeks.D) The fault might he in his style of presenting the information.Passage ThreeQuestions 23 to 25 are based on the passage you have just heard.23. A) Their parents tend to overprotect them.B) Their teachers meet them only in class.C) They have little close contact with adults.D) They rarely read any books about adults.24. A) Real-life cases are simulated for students to learn law.B) Writers and lawyers are brought in to talk to students.C) Opportunities are created for children to become writers.D) More Teacher and Writer Collaboratives are being set up.25. A) Sixth-graders can teach first-graders as well as teachers.B) Children are often the best teachers of other children.C) Paired Learning cultivates the spirit of cooperation.D) Children like to form partnerships with each other.Tests may be the most unpopular part of academic life. Students hate them because they produce fear and __26__ about being evaluated, and a focus on grades instead of learning for learning's sake.But tests are also valuable. A well-constructed test __27__ what you know and what you still need to learn. Tests help you see how your performance __28__ that of others. And knowing that you'll be tested on __29__ material is certainly likely to __30__ you to learn the material more thoroughly.However, there's another reason you might dislike tests: You may assume that tests have the power to __31__ your worth as a person. If you do badly on a test, you may be tempted to believe that you've received some __32__ information about yourself from the professor, information that says you're a failure in some significant way.This is a dangerous-and wrong-headed-assumption. If you do badly on a test, it doesn't mean you're a bad person or stupid. Or that you'll never do better again, and that your life is __33__. If you don't do well on a test, you're the same person you were before you took the test-no better, no worse. You just did badly on a test. That's it.__34__, tests are not a measure of your value as an individual-they are a measure only of how well and how much you studied. Tests are tools; they are indirect and _35__ measures of what we know.Questions 36 to 45 are based on the following passage.For investors who desire low risk and guaranteed income, U. S. government bonds are a secure investment because these bonds have the financial backing and full faith and credit of the federal government. Municipal bonds, also secure, are offered by local governments and often have __36__ such as tax-free interest. Some may even be __37__. Corporate bonds are a bit more risky.Two questions often __38__ first-time corporate bond investors. The first is "It 1 purchase a corporate bond, do I have to hold it until the maturity date?" The answer is no. Bonds are bought and sold daily on __39__ securities exchanges. However, if you decide to sell your bond before its maturity date, you're not guaranteed to get the face value of the bond. For example, if your bond does not have __40__ that make it attractive to other investors, you may be forced to sell your bond at a __41__, i.e., a price less than the bond's face value. But if your bond is highly valued by other investors, you may be able to sell it at a premium, i.e., a price above its face value. Bond prices generally __42__ inversely (相反的) with current market interest rates. As interest rates go up, bond prices fall, and vice versa (反之亦然) Thus, like all investments, bonds have a degree of risk.The second question is "How can I __43__ the investment risk of a particular bond issue?" Standard & Poor's and Moody's Investors Service rate the level of risk of many corporate and government bonds. And __44__, the higher the market risk of a bond, the higher the interest rate. Investors will invest in a bond considered risky only if the __45__ return is high enough.注意:此部分试题请在答题卡2 上作答。

简述缓解国际重复征税的方法随着全球经济的快速发展和国际贸易的日益频繁,国际重复征税问题日益突出。

重复征税指的是在跨国经营活动中,由于不同国家之间的税收体系和立法规定的差异,导致同一项经济活动被多次征税的情况。

这不仅给企业的经营带来不便,也阻碍了国际贸易的顺利进行。

为了解决这一问题,国际社会在过去几十年中提出了一系列的方法和机制。

本文将从多边合作、双边协议、税务安排和信息交流等方面来探讨缓解国际重复征税的方法。

一、多边合作多边合作是缓解国际重复征税问题的重要手段之一。

在国际社会中,各国可以通过签订多边税收协议,共同制定统一的税收规则和准则,以避免同一项经济活动被多次征税。

例如,联合国通过《联合国模式双重征税和避免税务协定》等文件,为各国提供了一个基础性的框架,鼓励各国之间进行税收协商和合作,以解决双重征税问题。

此外,国际货币基金组织、世界贸易组织等国际组织也可以发挥重要的作用,促进各国之间的合作和协商,推动国际税收体系的改革和完善。

二、双边协议除了多边合作,双边协议也是缓解国际重复征税问题的有效途径。

双边协议是指两个国家之间就税收问题进行协商和达成的协议。

通过双边协议,两个国家可以就双重征税、避免税务漏洞和信息交流等问题进行合作,以减少重复征税的发生。

例如,中国与许多国家签订了双边税收协定,规定了双方之间的税收权利和义务,避免了同一项经济活动被多次征税。

同时,双边协议还可以为企业提供更加稳定和可预测的税收环境,促进投资和贸易的发展。

三、税务安排税务安排是缓解国际重复征税问题的另一种方法。

通过税务安排,企业可以利用各国之间的税收优惠政策和税务规定,来减少重复征税的发生。

例如,企业可以选择在税收优惠较大的地区设立子公司或分支机构,以实现税收优惠。

此外,企业还可以通过转让定价、利润分配和资金调度等方式,合理调整跨国经营活动的税务安排,以减少重复征税的风险。

然而,税务安排也需要符合各国的法律和法规,避免滥用税收制度和逃避税收的行为。

表达不公平的现状和规则的具体例子英语作文全文共3篇示例,供读者参考篇1Title: The Current Unfairness in Society and Rules: Examples and ReflectionIn today's society, unfairness is a common issue that affects many people in various aspects of their lives. From work opportunities to social norms, there are instances of unfairness that create disparities and hinder progress for individuals. In this essay, we will explore specific examples of unfairness in society and rules and reflect on how these can be addressed.One of the most prevalent examples of unfairness in society is the gender pay gap. Despite advancements in gender equality, women still earn less than men for the same work. According to the World Economic Forum's Global Gender Gap Report 2020, women earn on average 63% of what men earn globally. This disparity is not only unfair but also perpetuates inequality in the workforce and limits women's economic empowerment.Another example of unfairness in society is racial discrimination. People of color often face barriers in education,employment, and social opportunities due to systemic racism. This manifests in lower graduation rates, higher unemployment rates, and limited access to resources for minority communities. The Black Lives Matter movement has brought attention to these injustices, calling for systemic change to address racial inequality.In addition to societal unfairness, there are also examples of unfair rules and regulations that perpetuate disparities. One such example is the criminal justice system, where marginalized communities are disproportionately targeted and face harsher sentencing. Studies show that people of color are more likely to be arrested, convicted, and incarcerated compared to their white counterparts, highlighting the need for reform in the justice system.Furthermore, regulations in the healthcare system can also contribute to unfairness. High medical costs and lack of access to affordable care can disproportionately affect low-income individuals and lead to disparities in health outcomes. This lack of healthcare equity perpetuates cycles of poverty and limits opportunities for those who are already marginalized.To address these examples of unfairness in society and rules, it is essential to advocate for policy changes and promoteawareness of these issues. Governments, organizations, and individuals must work together to create a more just and equitable society for all. This can be achieved through implementing laws that protect marginalized groups, providing resources for those in need, and fostering a culture of inclusivity and respect.In conclusion, unfairness in society and rules is a pressing issue that affects individuals on a global scale. By examining specific examples of unfairness and discussing ways to address them, we can work towards creating a more equitable and just society for all. It is crucial to recognize the impact of unfairness and take proactive steps to promote equality and fairness in all aspects of life.篇2Title: The Unfair Reality: Examples of Unfairness in Modern SocietyIntroductionIn today's world, despite advancements in various fields, unfairness still exists in different aspects of life. From gender inequality to socio-economic disparities, examples of injustice can be seen all around us. This essay will explore some specificexamples of unfairness in modern society, highlighting the need for change and fairer rules and regulations.Examples of Unfairness1. Gender Pay GapOne of the most widely discussed forms of unfairness is the gender pay gap. Studies have shown that women, on average, earn less than men for the same work. This unjust practice is a result of various factors, including discrimination and stereotypes. Despite efforts to address this issue, the pay gap persists, demonstrating the need for stricter regulations and enforcement mechanisms to ensure equal pay for equal work.2. Racial DiscriminationAnother example of unfairness is racial discrimination, which continues to impact individuals and communities around the world. People of color often face systemic barriers that limit their opportunities for education, employment, and advancement. This form of injustice is deeply rooted in historical prejudices and biases, highlighting the importance of implementinganti-discrimination policies and promoting diversity and inclusion in all sectors of society.3. Access to HealthcareAccess to quality healthcare is a basic human right, yet disparities in healthcare services persist in many countries. People from marginalized communities, including low-income individuals and minorities, often face barriers to accessing proper medical care, leading to poorer health outcomes. This inequality in healthcare highlights the need for policies that ensure universal access to affordable and equitable healthcare services for all.4. Educational InequalityEducational inequality is another prevalent form of unfairness that affects individuals from disadvantaged backgrounds. Students in underprivileged schools often lack access to resources and opportunities that are essential for academic success. This disparity in education perpetuates social and economic inequalities, emphasizing the need for policies that address the root causes of educational inequality and provide equal opportunities for all students.ConclusionIn conclusion, unfairness exists in various forms in modern society, affecting individuals and communities in profound ways. It is imperative that we address these injustices by advocating for fairer rules and regulations that promote equality and justice forall. By recognizing and challenging unfair practices, we can work towards building a more equitable and inclusive society where everyone has the opportunity to thrive and succeed. Let us strive for a world where fairness and justice prevail, and where every individual is treated with dignity and respect.篇3The Concept of Unfairness in Society and Its Impact on RulesIntroductionThe concept of unfairness is a prevalent issue in society that can manifest itself in various ways, leading to disparities and injustices. This essay will examine the current state of unfairness in society and explore specific examples of unfair rules that perpetuate inequality. By shedding light on these issues, we can gain a better understanding of how unfairness operates and its impact on societal structures.Unfairness in SocietyUnfairness in society can take many forms, ranging from economic inequality to discrimination based on race, gender, or socio-economic status. These disparities can exacerbate existing inequalities and create barriers to opportunities for marginalized groups. For example, in the United States, income inequality hasreached historic levels, with the wealthiest 1% of the population holding a disproportionate amount of wealth compared to the rest of the population. This disparity is often perpetuated by unfair tax policies and economic structures that favor the wealthy at the expense of the less fortunate.Additionally, discrimination based on race and gender continues to be pervasive in many aspects of society, from hiring practices to access to education and healthcare. For example, studies have shown that women and people of color are often paid less than their white male counterparts for the same work, highlighting the systemic nature of discrimination in the workforce.Unfair Rules and Their ImpactUnfair rules are often put in place to maintain existing power structures and uphold the interests of those in positions of privilege. These rules can perpetuate inequality and limit opportunities for marginalized groups, further entrenching social disparities. For example, voting laws that restrict access to the ballot for certain populations, such as people of color orlow-income individuals, can disenfranchise these groups and undermine the democratic process. Similarly, zoning laws that segregate neighborhoods based on income levels canperpetuate economic inequality and limit opportunities for upward mobility.In the realm of education, unfair rules can also have a significant impact on students from marginalized backgrounds. For example, the use of standardized testing as a measure of academic achievement can disadvantage students who come from low-income or under-resourced schools, as they may not have access to the same resources and support as their wealthier peers. This can perpetuate existing disparities in educational outcomes and limit opportunities for students to succeed.Addressing Unfairness in SocietyIn order to address unfairness in society, it is essential to challenge existing power structures and advocate for policies that promote equity and justice for all. This can involve implementing fair tax policies that redistribute wealth more equitably, as well as advocating for voting rights laws that ensure access to the ballot for all eligible citizens. Additionally, promoting diversity and inclusion in the workforce can help to combat discrimination and create more opportunities for marginalized groups to succeed.Furthermore, addressing unfairness in education can involve rethinking traditional assessment methods and implementingpolicies that provide more support for students from underprivileged backgrounds. This can include investing in resources for low-income schools, as well as implementing measures to ensure that all students have access to quality education regardless of their socio-economic status.ConclusionIn conclusion, unfairness in society is a pervasive issue that can manifest itself in various ways, perpetuating existing inequalities and limiting opportunities for marginalized groups. By examining specific examples of unfair rules and their impact, we can gain a better understanding of how unfairness operates and work towards creating a more just and equitable society. Through advocating for policies that promote equity and justice, we can address the root causes of unfairness and create a more inclusive and equitable society for all.。

税收饶让概述 税收饶让亦称“饶让抵免”或“虚拟抵免”是指在处理避免国际双重课税事务中,居住国(或国籍国)政府对跨国纳税⼈从⾮居住国(或⾮国籍国)得到减免的那部分税收视同已经缴纳,给予抵免。

跨国纳税⼈已纳居住国(或国籍国)境外所得税或⼀般财产税税额,如果低于其来源或存在于境外⾮居住国(或⾮国籍国)的跨国所得或跨国⼀般财产价值,按照居住国(或国籍国)税法规定计算的应纳税额,即抵免限额,其低于的差额税款仍应向居住国(或国籍国)补缴。

这种抵免机制使跨国纳税⼈从⾮居住国(或⾮国籍国)给予的减免税待遇中得不到实惠,使⾮居住国(或⾮国籍国)政府的⿎励外商投资和吸引国外技术的税收优惠措施也⽆从发挥实际效果。

因此经过有关国际税收协定,由投资者和技术输出者的居住国(或国籍国)政府承担税收饶让义务,即把这部分减免税款视同已经缴纳,予以抵免,从⽽避免上述⽭盾的发⽣。

税收饶让多属发达国家单⽅⾯对发展中国家减免税所承担的协定义务。

但是,发展中国家之间签订税收协定,也可以按照对等原则,相互给予对⽅的减免税以税收饶让。

税收饶让是在对国际重复征税采⽤抵免法给予免除的条件下产⽣的,但它所免除的不是国际重复征税,⽽是并未向⾮居住国缴纳过的税收,它实际上是对跨国纳税⼈的⼀种税收优惠。

税收饶让这种特殊的抵免,主要⽤于发达国家发展中国家间。

发展中国家以税收优惠政策来吸引外资和先进技术,为保证其税收优惠真正落实到跨国纳税⼈⾝上,要求发达国家实⾏税收饶让给予配合。

税收饶让通常需要通过签订双边税收协定的⽅式予以确定。

税收饶让的⽅式 ⽬前国际上实⾏的税收饶让⽅式主要有两种,⼀是差额饶让抵免,指居住国政府对其居民来源于⾮居住国的所得按⾮居住国税法规定税率计算的税额与按税收协定限制税率缴税额之差额,视同已纳税额⽽给予的抵免。

⼆是定率饶让抵免,指居住国政府对其居民在⾮居住国⽆论得到多少减免优惠,均按⼀个固定抵免税率⽽给予的抵免。

这⼀固定抵免税率将由缔约国双⽅在税收协定中加以明确。

2023年6月10日雅思大作文真题全解,附高分范文6.10雅思大作文真题解析+高分范文话题:社会话题—人们是否应该交税题目:Some people think we should keep all the money we earn and not pay taxes to the state. To what extent do you agree or disagree?写作思路:公民纳税是合理合法的事情。

政府需要用税收的钱来维持社会的正常运转,比如建设和维护基础设施,提供各种公共服务。

此外,税收制度也是一种财富再分配的机制,高收入群体缴纳的税收比例更高。

政府将用税收资助弱势群体,建立社会保障体系,促进了社会的稳定和发展。

所以,除了部分低收入、困难的免税群体,大部分人都需要缴税。

雅思写作真题范文Taxes play a vital role in funding public services andensuring societal well-being. While some people arguefor keeping all the money earned and question thenecessity of paying taxes to the state, I disagree with thisopinion.Admittedly,individuals with low ines can retain allthe money they earn, which is a mon policy adoptedby many countries worldwide. This is to ensure everymember of society has the money to meet their basicsurvival needs.However, when a person s inesurpasses a certain threshold, they should fulfill theirobligation of paying taxes to the state.One primary reason for paying taxes is that governmentsneed money to maintain criticalinfrastructure andprovide public services. Education, healthcare.transportation, and public safety are all supported by taxrevenue. Without adequate funds, these essentialservices would suffer, affecting people' s lives andhindering societal progress. By contributing a portion oftheir earnings through taxes, individuals activelyparticipate in building a well-functioning society.真题范文Moreover, taxation serves as a mechanism forredistribution of wealth and the promotion of socialstability.In most tax systems, individuals with higherines contribute a larger proportion of their earningsThis policy can help address socioeconomic disparitiesand provide a safety net for the vulnerable members ofsociety. lf people were allowed to keep all the moneythey earn, it would widen the gap between the rich andthe poor, leading to various social problems, such asresentment towards the wealthy or even an increase inviolent crimes.In conclusion,I disagree with the idea of keeping all themoney people earn without paying taxes, as it fails toacknowledge the crucial role that taxation plays insustaining and advancing society重点词汇与语料fund提供资金necessity必要性retain保留surpass超过threshold门槛obligation义务infrastructure基础设施revenue收入adequate足够的hinder阻碍well-functioning 运转良好的mechanism机制重点词汇与语料redistribution重新分配disparity差距safety net安全保障vulnerable弱势的resentment憎恨sustain维持以上就是关于《2023年6月10日雅思大作文真题全解,附高分范文》介绍。

个人所得税英文参考文献个人所得税英语参考文献一:[1]José Félix Sanz-Sanz. The Laffer curve in schedular multi-rate income taxes with non-genuine allowances: An application to Spain[J]. Economic Modelling,2019,.[2]Craig Brett,John A. Weymark. Voting over selfishly optimal nonlinear income tax schedules[J]. Games and Economic Behavior,2019,.[3]Mónica Unda Gutiérrez. A Tale of Two Taxes: the Diverging Fates of the Federal Property and Income Tax Decrees in post-Revolutionary Mexico[J]. Investigaciones de Historia Económica - Economic History Research,2019,.[4]Sim Choon Ling,Abdullah Osman,Safizal Muhammad,Sin Kit Yeng,Lim Yi Jin. Goods and Services Tax (GST) Compliance among Malaysian Consumers: The Influence of Price, Government Subsidies and Income Inequality[J]. Procedia Economics and Finance,2019,35.[5]Martin Lopez-Daneri. NIT Picking: The Macroeconomic Effects of a Negative Income Tax[J]. Journal of Economic Dynamics and Control,2019,.[6]Tad Miller,Lindsay Miller,Jeffrey Tolin. Provision for income tax expense ASC 740: A teaching note[J]. Journal of Accounting Education,2019,35.[7]Petr David,Lucie Formanová。

Narrow the gap between rich and poorFirst, wage income and capital income, such as business profits, dividends, stock investment profit, part-time income, JiangKeFei, payment and so on in the proportion of total income plays an more and more important. At the same time, because there are some unfair "reverse adjustment" policy position higher - income groups often get higher welfare allocation, and lower group instead - many in the "system" of the "new rich" to maintain possession of social welfare resources scarcity, continue to enjoy within the system of welfare and in-kind subsidies, housing, medical insurance, pension, salary, and so on welfare and physical benefits.Second, the monetary capital and human capital that the rich usually have had the characteristics of high yields and rapid appreciation. Under the market mechanism, monetary capital gains arithmetic progression according to geometric progression growth and wage income according to growth, capital gains in the proportion of total social wealth increment increasingly rising, wealth to the rich quickly concentrated trend is inevitable. In addition, many rich people have higher human capital, such as highly educated, rich management experience, or other elements is consistent with the requirement of market economy, such as bold, bold innovation, and social communication ability, etc., are more likely to occupy a high return professional position, to obtain high yield.socialOn education, education is not fully implemented and there isa gap in the level of education in the provinces, and the cost of education is too high.The medical system is not healthy. There are still problems in the countryside that are difficult to see.Housing, housing security is not sound, and the housing industry is poorly regulated.The social security system is not sound, and there is no social security system covering the whole country.In conclusion, there are two reasons why the gap between rich and poor in our country should not be eliminated.The first is that the development effort is not enough, and many problems in development have not been solved.countermeasures"The main paradox of the current wealth gap in our country is not that the rich are too rich, but that the poor are too poor," said Lin. "The majority of the poor are in the countryside, so the gap between the urban and rural areas is widening, because the poor people in the cities are also having income distribution." The poor are poor, but the poor are too poor. So the wealth gap must be solved by the poor. The key to solve the gap between rich and poor is "to get rich to the poor", the major source of income for the poor that is labor, be they rich will need to focus on developing labor intensive industries or through technical training, enabling them to use education andtechnical training to share to expand the middle class and promotion opportunity, let them engaged in the technology industry, so as to improve their employment and income, narrowing the gap between rich and poor. And our country can also rely on labor and skilled workers to develop rapidly. The key is to change the thinking of development, implement the scientific outlook on development, transform the mode of economic growth, and develop the economy according to comparative advantage.Engels once pointed out, "all, or at least all the citizens of a country, or all the members of a society should have equal political status and social status." Deng xiaoping also said "we is a socialist country, the national income distribution to make all the people who benefit.. And the current our country social security system more perfect, mainly in the city, and the vast rural and mountainous areas are no good social security system. So in the process of narrowing the gap between rich and poor, we must consider to establish a perfect social security system, set up the minimum wage, maximum hours and safeguard the legitimate interests of the poor.1, the state:(1) to improve the distribution of wealth, both to be efficient and to speak fairness and to social responsibility.(2) perfect the tax policy, the provinces according to the actual situation of the income tax threshold, impose heavy tax, as well as the high luxury consumption, strengthen the supervision of tax and prevent enterprise, personal taxevasion.(3) the establishment of a comprehensive, systematic, moderate, fair and effective social security system. The system should cover urban and rural areas, covering the four areas of old-age, unemployment, medical, work-related injuries and accidents.(4) to regulate market competition mechanism, crack down on counterfeit and shoddy goods, market monopoly and other illegal activities, and realize the equality of opportunity under the law.(5) we will improve the education system in our country, increase the investment of education and set up the education supervision system, and put "teacher DE" in the teacher's performance appraisal.(6) regulate the real estate sector, crack down on the behavior of bidding up prices, improve the housing guarantee mechanism, and strengthen the supervision of the housing guarantee system.(7) to establish an objective and effective performance review mechanism, and to strengthen supervision over the performance inspection of the provinces. We will improve the ranks of the cadres and crack down on corruption.(8) the government should not only "transfusions" in the process of poverty alleviation, but also more importantly "hematopoiesis".2, the society:(1) expand the employment channel and provideemployment opportunities for people with low income levels, such as migrant workers.(2) to properly guide the public opinion and treat people of different professions, such as farmers, businessmen and intellectuals equally.(3) using the news media rationally enables people to establish the right view of consumption.3, individual:(1) the poor should make themselves out of poverty through reasonable and legal means, improve their own quality and expand their survival skills.(2) the rich should conscientiously fulfill the social responsibility, on a voluntary basis, and took out a portion of their wealth, through charity, to help the poor regions and vulnerable groups, to improve their health, culture, education and living conditions.The 18th national congress of the communist party of China (CPC) proposed the reform of income distribution.-- we must stick to the path of common prosperity. Common prosperity is the fundamental principle of socialism with Chinese characteristics. To adhere to the socialist basic economic system and distribution system, adjust the pattern of national income distribution, increase the intensity of redistribution adjustment, focus on solving the problem ofincome distribution gap is bigger, make development more fair benefit all the people, has made steady progress toward the direction of common prosperity.-- people's living standards have been comprehensively improved. Equal basic public services in general, the level of education and innovation personnel training level increased significantly, into the ranks of reinvigorating China through human resource development and human resource power, basic education modernization. More jobs. The income distribution gap narrowed, the middle income group continued to expand, and the target of poverty reduction was greatly reduced. Social security covers all, and everyone enjoys basic medical and health services, the housing guarantee system is basically formed, and the social harmony and stability.(3) make every effort to increase the income of the residents. Achieve development achievements Shared by the people, must deepen the reform of the income distribution system, efforts to achieve people's income growth and economic development, increasing labor remuneration and improving labor productivity, raise the proportion of household income in the national income distribution, increase the proportion of labor remuneration in primary distribution. The first distribution and redistribution should be both efficient and equitable, and more equitable distribution. Perfect elements such as labor, capital, technology and management according to the contribution to participate in the distribution of primary distribution mechanism, speed up and improve the tax, social security and transfer payments as the main means of redistribution adjustment mechanism. We will deepen the reformof the wage system in enterprises and institutions, and implement the system of collective bargaining on wages for enterprises to protect the income of labor. We will increase the income of residents' property in multiple channels. We will regulate income distribution, protect legitimate incomes, increase income for low-income people, adjust excessively high incomes, and ban illegal income.。

6月英语六级长篇阅读文章来源及答案2014年6月英语六级长篇阅读文章来源及答案2014年6月英语六级长篇阅读文章来源及答案2014年6月英语六级长篇阅读文章来源本文选自2013年4月9日的 American Enterprise InstituteLessons from a feminist paradise on Equal Pay DayOn the surface, Sweden appears to be a feminist paradise. Look at any global survey of gender equity and Sweden will be near the top. Family-friendly policies are its norm —with 16 months of paid parental leave, special protections for part-time workers, and state-subsidized preschools where, according to a government website, “gender-awareness education is increasingly common.” Due to an unofficial quota system, women hold 45 percent of positions in the Swedish parliament. They have enjoyed the protection of government agencies with titles like the Ministry of Integration and Gender Equality and the Secretariat of Gender Research. So why are American women so far ahead of their Swedish counterparts in breaking through the glass ceiling?In a 2012 report, the World Economic Forum found that when it comes to closing the gender gap in “economic participation and opportunity,” the United States is ahead of not only Sweden but also Finland, Denmark, the Netherlands, Iceland, Germany, and the United Kingdom. Sweden’s r ank in the report can largely be explained by its political quota system. Though the United States has fewer women in the workforce (68 percent compared to Sweden’s 77 percent), American women who choose to be employed are far more likely to work full-time and to hold high-level jobs as managers or professionals. Comparedto their European counterparts, they own more businesses, launch more start start-ups, and more often work in traditionally male fields. As for breaking the glass ceiling in business, American women are well in the lead, as the chart below shows.What explains the American advantage? How can it be that societies like Sweden, where gender equity is relentlessly pursued and enforced, have fewer female managers, executives, professionals, and business owners than the laissez-faire United States? A new study by Cornell economists Francine Blau and Lawrence Kahn gives an explanation.Generous parental leave policies and readily available part-time options have unintended consequences: instead of strengthening women’s attachment to the workplace, they appear to weaken it. In addition to a 16-month leave, a Swedish parent has the right to work six hours a day (for a reduced salary) until his or her child is eight years old. Mothers are far more likely than fathers to take advantage of this law. But extended leaves and part-time employment are known to be harmful to careers — for both genders. And with women a second factor comes into play: most seem to enjoy the flex-time arrangement (once known as t he “mommy track”) and never find their way back to full-time or high-level employment. In sum: generous family-friendly policies do keep more women in the labor market, but they also tend to diminish their careers.According to Blau and Kahn, Swedish-style paternal leave policies and flex-time arrangements pose a second threat to women’s progress: they make employers wary of hiring women for full-time positions at all. Offering a job to a man is the safer bet. He is far less likely to take a year of parental leave and then return on a reduced work schedule for the next eight years.I became aware of the trials of career-focused European women a few years ago when I met a post-doctoral student from Germany who was then a visiting fellow at Johns Hopkins. She was astonished by the professional possibilities afforded to young American women. Her best hope in Germany was a government job ––prospects for women in the private sector were dim. “In Germany,” she told me, “we have all the benefits, but employers don’t want to hire us.”Swedish economists Magnus Henrekson and Mikael Stenkula addressed the following question in their 2009 study: why are there so few female top executives in the European egalitarian welfare states? Their answer: “Broad-based welfare-state policies impede women’s representation in elite competitive positions.”It is tempting to declare the Swedish policies regressive and hail the American system as superior. But that would be shortsighted. The Swedes can certainly take a lesson from the United States and look for ways to clear a path for their high-octane female careerists. But most women are not committed careerists. When the Pew Research Center recently asked American parents to identify their "ideal" life arrangement, 47 percent of mothers said they would prefer to work part-time and 20 percent said they would prefer not to work at all. Fathers answered differently: 75 percent preferred full-time work. Some version of the Swedish system might work well for a majority of American parents, but the United States is unlikely to fully embrace the Swedish model. Still, we can learn from their experience.Despite its failure to shatter the glass ceiling, Sweden has one of the most powerful and innovative economies in the world. Inits 2011-2012 survey, the World Economic Forum ranked Sweden as the world’s third most competitive economy; the United States came in fifth. Sweden, dubbed the "rockstar of the recovery" in the Washington Post, also leads the world in life satisfaction and happiness. It is a society well worth studying, and its efforts to conquer the gender gap impart a vital lesson —though not the lesson the Swedes had in mind.Sweden has gone farther than any nation on earth to integrate the sexes and to offer women the same opportunities and freedoms as men. For decades, these descendants of the Vikings have been trying to show the world that the right mix of enlightened policy, consciousness raising, and non-sexist child rearing would close the gender divide once and for all. Yet the divide persists.A 2012 press release from Statistics Sweden bears the title “Gender Equality in Sweden Treading Water” and notes: The total income from employment for all ages is lower for women than for men.One in three employed women and one in ten employed men work part-time.Women’s working time is influenced by the number and age of their children, but men’s working time is not affected by these factors.Of all employees, only 13 percent of the women and 12 percent of the men have occupations with an even distribution of the sexes.Confronted with such facts, some Swedish activists and legislators are demanding more extreme and far-reaching measures, such as replacing male and female pronouns with a neutral alternative and monitoring children more closely tocorrect them when they gravitate toward gendered play. When it came to light last year that mothers, far more than fathers, chose to stay home from work to care for their sick toddlers, Ulf Kristersson, minister of social security, quickly commissioned a study to determine the causes of and possible cures for this disturbing state of affairs.I have another suggestion for Kristersson and his compatriots: acknowledge the results of your own 40-year experiment. The sexes are not interchangeable. When Catherine Hakim, a sociologist at the London School of Economics, studied the preferences of women and men in Western Europe, her results matched those of the aforementioned Pew study. Women, far more than men, give priority to domestic life. The Swedes should consider the possibility that the current division of labor is not an artifact of sexism, but the triumph of liberated preference.In the 1940s, the American playwright, congresswoman, and conservative feminist Clare Boothe Luce made a prediction about what would happen to men and women under conditions of freedom:It is time to leave the question of the role of women in society up to Mother Nature — a difficult lady to fool. You have only to give women the same opportunities as men, and you will soon find out what is or is not in their nature. What is in women’s nature to do they will do, and you won’t be able to stop them. But you will also find, and so will they, that what is not in their nature, even if they are given every opportunity, they will not do, and you won’t be able to make them do it.In Luce’s day, sex-role stereotypes still powerfully limited women’s choices. More than half a century later, women in theWestern democracies enjoy the equality of opportunity of which she spoke. Nowhere is this more true than Sweden. And although it was not the Swedes’ intention, they have demonstrated to the world what the sexes will and will not do when offered the same opportunities.Today is Equal Pay Day. But as most feminists know by now, the wage g ap is largely the result of women’s vocational choices and how they prefer to balance home and family. To close the gap, it won’t be enough to change society or reform the workplace ––it is women’s elemental preferences that will have to change. But look to Sweden: women’s preferences remain the same.Not only feminists, but also liberal and conservative policymakers should pay attention. Sweden is not the “tax and spend” welfare state of old ––while the rest of the world is floundering in debt, Sweden (along with its Nordic neighbors) has been downsizing, reforming entitlements, and balancing its books. The budget deficit in Sweden is about 0.2 percent of its GDP; in the United States, it’s 7 percent. But Sweden’s generous family-friendly policies remain in place. The practical, problem-solving Swedes have judged them to be a good investment. They may be right.Swedish family policies, by accommodating women’s preferences so effectively, are reducing the number of women in elite competitive positions. The Swedes will find this paradoxical and try to find solutions. Let us hope these do not include banning gender pronouns, policing children’s play, implementing more gender quotas, or treating women’s special attachment to home and family as a social injustice. Most mothers do not aspire to elite, competitive full-time positions:the Swedish policies have given them the freedom and opportunity to live the lives they prefer. Americans should look past the gender rhetoric and consider what these Scandinavians have achieved. On their way to creating a feminist paradise, the Swedes have inadvertently created a haven for normal mortals.参考答案:长篇阅读 Lessons From a Feminist ParadiseJ 46. Sweden has done more than other nations to close the gender gap, but it continues to exist.I 47. Sweden is one of the most competitive economies in the world and its people enjoy the greatest life satisfaction.M 48. More American women hold elite job positions in business than Swedish women.D 49. Swedish family-friendly policies tend to exert a negative influence on women’s career.A 50. The quota system in Sweden ensures women’s better representation in government.H 51. Though the Swedish model appears workable for most American parents, it may not be accepted by them in its entirely.M 52. Swedish women are allowed the freedom and opportunity to choose their own way of life.E 53. Swedish employers are hesitant about hiring women for full-time positions because of the family-friendly policies.A 54. Gender-awareness education is becoming more and more popular in state-subsidized preschools in Sweden.C 55. Some lawmakers in Sweden propose the genderless pronouns be used in the Swedish language.【点评】我们知道瑞典是一个男女平等意识非常强的国家,这篇文章对这种平等政策带来的问题,展开了讨论。

税务英语知识点总结IntroductionTaxation is an important aspect of a country’s fiscal policy, as it is the main source of revenue for the government. Taxation involves the process of imposing charges on individuals and businesses by the government to fund public expenditures, such as infrastructure, education, healthcare, and other social services. In this summary, we will discuss various aspects of taxation, including the types of taxes, tax planning, tax evasion, and international taxation.Types of TaxesThere are several types of taxes that individuals and businesses are required to pay. Each type of tax serves a different purpose and is governed by specific rules and regulations. The main types of taxes include:1. Income Tax: This is a tax imposed on an individual's or business's income, usually calculated as a percentage of the total income earned. Income tax rates and brackets vary from country to country.2. Property Tax: Property tax is a tax levied on real estate, such as land, buildings, and other improvements. The amount of property tax is based on the value of the property.3. Sales Tax: Sales tax is a tax imposed on the sale of goods and services and is usually added to the price of the goods or services at the time of purchase. The rate of sales tax varies by jurisdiction.4. Value Added Tax (VAT): VAT is a type of consumption tax that is assessed on the value added at each stage of the production and distribution chain. It is ultimately borne by the end consumer.5. Excise Tax: Excise tax is a tax levied on certain goods, such as alcohol, tobacco, and gasoline. The tax is usually included in the price of the goods.6. Corporate Tax: Corporate tax is a tax imposed on the profits of corporations. The tax rate is usually different from the individual income tax rate.Tax PlanningTax planning involves the process of organizing one's financial affairs in a way that minimizes tax liability. There are various strategies that individuals and businesses can use to legally reduce their tax burden. Some common tax planning techniques include:1. Taking advantage of tax deductions and credits: Individuals and businesses should take advantage of all available tax deductions and credits to lower their tax liability. Deductionsand credits are available for various expenses, such as charitable contributions, mortgage interest, and education expenses.2. Retirement planning: Contributions to retirement accounts, such as 401(k) plans and IRAs, are often tax-deductible, allowing individuals to save for retirement while reducing their current tax liability.3. Estate planning: Proper estate planning can help individuals minimize estate taxes and transfer their assets to their heirs in a tax-efficient manner.4. Entity selection: Businesses should carefully consider the type of entity they want to operate as, as different types of entities are subject to different tax rules and rates.Tax EvasionTax evasion is the illegal act of deliberately avoiding paying taxes by underreporting income, inflating expenses, or hiding assets. Tax evasion is a serious offense and can result in severe penalties, including fines, imprisonment, and seizure of assets. To combat tax evasion, governments have implemented strict enforcement measures, such as audits, investigations, and penalties for non-compliance.International TaxationInternational taxation deals with the tax implications of cross-border transactions, investments, and business operations. It is a complex area of taxation that requires a thorough understanding of tax laws in different countries. Some key concepts in international taxation include:1. Double taxation: Double taxation occurs when income is taxed by two or more countries. To avoid double taxation, countries have entered into tax treaties that provide guidance on how income should be taxed and which country has the primary right to tax the income.2. Transfer pricing: Transfer pricing refers to the pricing of goods, services, and intellectual property within multinational companies. It is an important aspect of international taxation as it determines the allocation of profits among different subsidiaries of a multinational company.3. Controlled foreign corporation rules: Many countries have rules that tax the passive income of foreign subsidiaries of domestic companies, known as controlled foreign corporations. These rules are aimed at preventing the deferral of tax on passive income in low-tax jurisdictions.ConclusionIn conclusion, taxation is a complex and multifaceted area that affects individuals and businesses on a daily basis. Understanding the different types of taxes, effective tax planning strategies, the consequences of tax evasion, and the implications of internationaltaxation is essential for individuals and businesses to comply with tax laws and minimize their tax burden. By staying informed about tax laws and seeking professional advice when necessary, taxpayers can ensure that they are meeting their tax obligations while maximizing their financial resources.。

Priorities for the 2015 Federal BudgetWe sincerely thank the Standing Committee on Finance for soliciting views on the 2015 federal budget and for the opportunity to provide recommendations. The Canadian Chamber network is the largest, most broadly-based business association in Canada representing 200,000 businesses of all sizes, in all sectors of the economy and in all regions of the country. Our members create the jobs, pay the taxes, power the growth and contribute the leadership that provides the quality of life we enjoy in our country.Executive SummaryBased on extensive advice from members, the Canadian Chamber of Commerce has nine key recommendations for the 2015 federal budget, which will support prosperity, competitiveness and innovation, and which align with the government’s priority themes:Increasing the competitiveness of Canadian businesses through research, development, innovation and commercialization1.Create an “innovation box” regime that would reduce the normalcorporate tax rate for income derived from patented inventionsdeveloped in Canada.Maximizing the number and types of jobs for Canadians2.Improve the mobility and employment of skilled trades workersacross Canada by changing tax policy to address the relocation costsof skilled trades workers.3.Increase apprenticeship completions by creating a financial incentivefor those employers who retain apprentices in their third or fourthyear of training.4.Invest in labour market information to close the skills gap.5.Assess the impact of recent changes to the Temporary Foreign WorkerProgram.6.Establish a Development Finance Institution (DFI) to promote privatesector trade and investment in developing countriesEnsuring prosperous and secure communities, including through support for infrastructure7. A long-term, transparent and predictable infrastructure strategy.Improving Canada’s taxation and regulatory regimes8.Conduct a comprehensive review to create a streamlined, broad-based tax system with lower rates and fewer tax credits forindividuals and corporations.9.Push for a comprehensive internal trade agreement that is even moreambitious than our major trade agreements Recommendations:Increasing the competitiveness of Canadian businesses through research, development, innovation and commercialization1.The Canadian Chamber of Commerce recommends adopting an“innovation box” regime in Canada that would reduce the normalcorporate tax rate for income derived from developing andcommercially exploiting patented inventions and other intellectualproperty connected to new or improved products, services and relatedinnovative processes to the benefit of Canada.Canada still lags many countries in terms of total spending andcommercializing new technologies. More needs to be done, particularlywhen governments around the world are looking at adopting taxincentive regimes to encourage companies to exploit and commercializeintellectual property in their jurisdictions.A number of countries (the U.K., Belgium, Luxembourg, France, Spain,Hungary, Ireland, Switzerland and China) have adopted a “patent box”tax regime which sharply reduced the normal corporate tax rate onincome derived from the exploitation of patents. In lieu of a broad taxcredit, such as the scientific research and experimental development tax(SRED), which provides general tax relief on R&D activities, instead abusiness that created a patent or new idea in Canada would see therevenues that arose from that idea taxed at a much lower rate.An “innovation box” regime would encourage companies to locateintellectual property activity and the new high-value jobs associated with the development, of innovation in Canada. It would promote andenhance the innovation capacity of sectors that leverage science andtechnology innovations. Firms in all sectors will have a greater incentiveto adopt, commercialize or otherwise exploit the output of the R&Dprocess here in Canada.Maximizing the number and types of jobs for Canadians.2.Improve the mobility and employment of skilled trades workers acrossCanada: To fill short-term labour market needs in remote locations,companies may offer allowances or reimbursements for housing, traveland child care costs in order to attract Canadian workers. Thesepayments are considered taxable benefits for employees. In otherinstances, employers may be unable to offer sufficiently attractiverelocation packages to entice Canadian workers to move on a temporarybasis. This may be the case with small firms which are subcontractorscompeting for work on large-scale projects.While the challenges to mobility are not restricted to skilled workers, the human resource demands of projects in the resource sector suggest thatCanadian workers’ temporary relocation should be encouraged as muchas possible. Given that the government is constraining the TFW program in the hopes employers will incent Canadian worker mobility with higher wages, it is frustrating that the Crown itself opportunistically taxes these incentives. Instead, measures should be taken to overcome the costs ofskilled tradespeople relocating for short-term employment opportunities.The government should introduce a change in tax policy to address therelocation costs of skilled trades workers who would be willing to moveon a temporary basis for employment.3.Increase apprenticeship completions in the skilled trades: To addressthe large number of uncompleted apprenticeships, the governmentshould create a financial incentive for those employers who retainapprentices in their third or fourth year of training, to support the policy goal of increasing the number of certified trades workers. This incentiveshould be in addition to (and not in lieu of) the existing tax credit foremployers for their level 1 and 2 apprentices.4.Invest in labour market information to close the skills gap: The skillsgap and mismatches in Canada are challenging employers, educators and governments to respond. Unfortunately, Canadian employers andpolicymakers currently lack sufficiently granular and reliable labourmarket information (LMI) in several areas. To address these shortfalls,the government should expand the Job Vacancy Survey from the level of economic regions to the local/CMA level, wherever possible; reintroduce and upgrade the Workplace and Employee Survey; renew the Youth inTransition Survey; review and sustain the National Graduate Survey and the Five-Year Follow-up of Graduates on a longer-term basis; and ensure the Minister of Employment and Social Development, as chair of theForum of Labour Market Ministers, leads and facilitates the collectionand coordination of data from key stakeholders, among other measures.5.Temporary Foreign Worker Program: Given the major changes to theprogram in 2014, it is possible that businesses may need to retrench their operations and lay off Canadian employees if insufficient numbers offoreign workers are available to fill labour market needs. Thegovernment should assess the business and employment impacts of theprogram changes and application processing time, and instituteflexibility in particular with respect to the refusal to process certainapplications in areas of unemployment at or higher than 6 per cent, andwith respect to the per-employer cap on low-wage workers.6.Establish a Development Finance Institution (DFI) to promote privatesector trade and investment in developing countries. Every othercountry in the G-7 already has such an institution and a Canadian DFIcould work hand-in-hand with developing countries, the private sector,the Trade Commissioner Service and other government agencies toidentify opportunities for projects and support their implementationwhile retaining poverty reduction as the overarching objective. The initial capital injection would be an investment in building a new Canadianinstitution which could be leveraged to raise additional funds. To beeffective, the organization would require strong capabilities in bothdevelopment policy and private sector finance.Ensuring prosperous and secure communities, including through support for infrastructure7. A long-term, transparent and predictable infrastructure strategy. Overthe past 30 years investments in core public infrastructure have dropped off significantly. The result is that many of Canada’s roads, bridges andwater systems are collapsing. According to the Federation of CanadianMunicipalities, 30% of municipal infrastructure is at risk. Congestion isalso a major problem- some estimates place the cost to the Canadianeconomy at close to $15 Billion per year – and three of our largest cities:Vancouver, Toronto and Montreal are among the most traffic-congestedcities in North America.There is a strong correlation between infrastructure investment andproductivity: Our research has found that a sustained 10% annualincrease in infrastructure investment has the potential to reduce the costs of manufacturing by 5%.Canada needs is a long term infrastructure investment strategy that must: •Be predictable and transparent, a permanent fixture of federal expenditures much like health and public safety;•Encourage the use of asset management plans;•Increase coordination between the various levels of government and with the private sector;•Increase partnerships with the private sector where applicable;and•Focus on areas with the greatest return on economic productivity such as trade enabling infrastructure.Improving Canada’s taxation and regulatory regimes8. A comprehensive review to create a streamlined, broad-based taxsystem with lower rates and fewer tax credits for individuals andcorporations. Canada’s tax system is in urgent need of reform. It hasbecome increasingly complex, multi-layered, and a costly challenge forCanadian businesses of all sizes. The World Economic Forum’s GlobalCompetitiveness report cites tax rates and regulations as two of the topfive challenges to doing business in Canada. A streamlined and moreefficient tax regime would free up time and capital for Canadiancompanies so that they can focus on growing their business, investingand creating jobs.According to a study by the Fraser Institute, the costs of complying withthe Canadian tax system are estimated at $14 to $18 billion per year. Acomprehensive could overhaul Canada’s tax system to reduce itscomplexity by reviewing and clarifying the language used in tax law;recommending changes to existing legislation that is not achieving itspurpose or entails costs that outweigh the revenue being raised orprotected; and evaluate all tax preferences (credits, deductions,exemptions, rebates) with a view of eliminating those that are not cost effective or are not achieving their intended purpose. The increase in revenue from eliminating credits could then be used to lower rates.9.The greatest improvement to the Canadian regulatory environmentwould be a reduction in internal trade barriers. Accordingly, theCanadian Chamber of Commerce would like to see a comprehensive internal trade agreement that is no less ambitious than our major trade agreements (such as CETA/ Canada-South Korea). This agreementshould include the principal of mutual recognition so that goods and services are able to be sold between the provinces even if there are minor differences in regulations or standards. Any exception must be in the interests of consumers and should be supported by evidence-basedrationale. Provinces should work towards a common regulatoryframework to reduce costs and red tape. The agreement must betransparent and enforceable with an accessible and affordable dispute resolution mechanism.。

2020年6月英语六级阅读真题及答案2020年6月英语六级阅读真题及答案Section ADirections:In this section, there is a passage with ten blanks,You are required to select One word for each blank from a list of choices given in a word bank following the passage.Read the passage through carefully before making your choices. Each choice in the bamk is identified by aletter.Please mark the corresponding letter for each item on Answer Sheet 2 with a single line through the centre You may not use any of the words in the bank more than once.For investors who desire low risk and guaranteed income,U.S. Government bonds are a secure investment because these bonds have the financial backing and full faith and credit of the federal government.Municipal bonds,also secure,are offered by local governmengts and oftenhave____36______such as tax-free interest.Some may even be____37______.Corportate bonds are a bit more risky.Two questions often_____38_____first-time corportate bond investors.The first is”If I purchase a corportate bond,do I have to hold it until the matueity date?”The answer isno.Bonds are bought and sold daily on ____39_____securities exchanges.However,if your bond does not have____40_____ that make it attractive to other investors, you may be forced to sell your bond at a____41____i.e., a price less than the bond’s face value. But if your bond is highly valued byother investors, you may be able to sell it at a premium,i.e., a price above its face value. Bond pricesgcncrally____42____ inversely (相反地)with current market interest rates. As interest rates go up, bond pnccs tall, and vice versa (反之亦然).Thus, like all investments,bonds have a degree of risk.The second question is “How can I ___43_______ the investment risk of a particular bond issue?” Sta ndard & Poor’s and Moody’s Investors Service rate the level of risk of many corporate and government bonds. And ____44______, the higher the market risk of a bond,the higher the interest rate. Investors will invest in a bond considered risky only if the _____45_____return is high enough.注意:此部分试题请在答题卡2上作答。

深化税收征管改革的意见英文版Opinions on Deepening Tax Collection and Administration ReformThe following English translation of "深化税收征管改革的意见" is for reference only:1. Strengthening taxpayer services. Enhancing the quality of taxpayer services by optimizing service procedures, improving service efficiency, and providing convenient and accessible online platforms for taxpayers to fulfill their obligations.2. Improving tax collection and administration efficiency. Utilizing advanced information technologies, such as big data and artificial intelligence, to enhance tax risk analysis, improve tax auditing capabilities, and ensure fair tax collection and administration.3. Enhancing tax law enforcement and compliance. Strengthening law enforcement efforts, combating tax evasion, and improving the effectiveness of tax inspections. Enhancing compliance awareness among taxpayers through education and publicity campaigns.4. Expanding tax base and optimizing tax structure. Exploring new sources of taxation, promoting tax reform measures, and optimizing tax incentives to support the development of key industries, small and medium-sized enterprises, and innovation-driven enterprises.5. Promoting international tax cooperation. Strengthening international tax cooperation, actively participating in the formulation of international tax rules, and preventing tax avoidance and evasion.6. Enhancing institutional and mechanism innovation. Continuously improving the tax collection and administration system, optimizing organizational structure, and streamlining administrative procedures to create a better business environment.It is important to note that the above translation is for informational purposes only and may not reflect the official translation. For accurate and authoritative information, please refer to the original Chinese version or official government documents.。

财经专业英语词汇(V财经专业英语词汇(V-W)财经专业英语词汇(V-W)valid and subsisting bill 有效及现存的汇票valid bilateral netting arrangement 有效双边净额结算协议valid branch registration certificate 有效分行登记证valid business registration certificate 有效商业登记证valid discharge 有效责任解除valid endorsement 有效背书valuable consideration 有值代价valuation 估值;估价valuation balance sheet 估值资产负债表valuation date 估值日期valuation effect 估值效果valuation list 估价册valuation of assets 资产估值valuation report 估值报告valuation strain 估值负担value 价值value at cost 成本值value index 价值指数value index for construction works 建筑工程价格指数value of cash-sweep chances 现金彩票活动的中彩机会的价值value of cash-sweep tickets sold 现金彩票活动售出的彩票价值value of construction works 建筑工程总值value of distribution 分派价值value of export 出口货值value of gross output 总产量的价值value of import 进口货值value of property 财产的价值value of re-export 转口货值value of sum assured 承保款项值value of the consideration 代价所值value-added product 附加值产品value-added tax [vat] 增值税value-at-risk model 风险数值模式value-for-money 衡工量值;合乎经济原则;合乎经济效益;物有所值value-for-money audit 衡工量值式审计;衡工量值式核数value-for-money criterion 衡工量值的准则value-for-money study 衡工量值式研究valuer 估价员;估价师;估值师value-weighted index 价值加权指数variable 变数;变动因素variable interest investment 浮息投资variable interest securities 浮息证券variation 波动variation of contract 更改合约的条款vendor 卖方;出售人;售卖人venture capital 创业资金;风险资本venture capital fund 创业资本基金venture capital market 创业资金市埸venture company 创业公司very substantial acquisition 非常重大的收购事项vested annuity 既得年金vested estate 既得产业权vested interest 既得权益;既得利益vested liabilities 既有负债vested reversionary bonus 既得的复归红利vesting date 归属日期vesting order 归属令viability 健全性;稳健性;财政上可行性vienna stock exchange 维也纳证券交易所vietnam finance company limited 越南财务有限公司virement 转帐visible trade 有形贸易visible trade account 有形贸易帐visible trade deficit 有形贸易逆差visible trade gap 有形贸易差额volatility 波动不定;股价波动volume index 物量指数volume of business 营业总额volume of trading 交投量;交易量volume of transaction 成交额;交易量voluntarily surrender 自愿交回voluntary agreement 无偿协议voluntary chargeable agreement for sale 可予征收印花税的无偿买卖协议voluntary code 自律守则voluntary disclosure of tax evasion 自动表白逃税情形voluntary disposition 无偿产权处置voluntary liquidation 自动清盘voluntary settlement 无偿授产安排voluntary winding-up 自动清盘vote 拨款vote on account 临时拨款vote on account warrant 临时拨款令;临时支款授权书vote on supplementary warrant 追加备付款项令;追加支款授权书voting of fund 拨款voting share 有表决权股份voucher 凭单;支款凭证;付款凭证;付款凭单wage 工资waiver 宽免;豁免;放弃waiver of fees 宽免费用waiver of loan 免除还款warehouse 仓库warrant 认股权证;拨款令;支款授权书warrant exercisable 可行使的认股权证warrant exercised [listing method] 行使认股权证〔上市方式〕warrant issue prospectus 认股权证发行章程warrant stock 认股权证;认购股权证书warrant to subscribe 认购权证wash sale 虚假销售;对销交易wayfoong credit limited wayfoong finance ltd. wayward and erratic movement 反复及不正常的变动weak 疲弱;偏软weak consumer spending 消费疲弱wealth effect 财富效应weight 权数weighted average 加权平均数weighted average of exchange rate 汇率的加权平均数weighted market capitalization 加权资本市值;加权市价总值weighted mean salary 加权平均薪金weighting system of the consumer price index 消费物价指数的权数模式well-capitalized 资本雄厚wellington stock exchange 惠灵顿证券交易所west germany's commerzbank index 西德商银指数westdeutsche landesbank girozentrale 西德意志州银行〔西德银行〕western european economies of greatest reference to hong kong 与本港经济最有关系的西欧国家western industrialized economy 西方工业国家westpac banking corporation 西太平洋银行whitewashed transaction 清洗交易wholesale bank 批发银行wholesale banking 批发银行业务wholesale tax 批发税wholly-owned subsidiary 全资附属公司w.i. carr indosuez capital asia limited 惠嘉融资亚洲有限公司wider margin of variation 较大幅度的偏差width of two tax bands 两个税阶的幅度wilful evasion 蓄意逃税will 遗嘱;意愿winding-up 清盘;结束winding-up order 清盘令winding-up petition 清盘呈请winding-up proceeding 清盘程序windsor declaration 《温莎声明》wing hang bank ltd. 永亨银行有限公司wing hang finance company limited 永亨财务有限公司wing lung bank limited 永隆银行有限公司wing lung finance limited 永隆财务有限公司winnipeg commodities exchange 温尼伯商品交易所winnipeg commodity clearing limited 温尼伯商品结算有限公司with recourse letter of credit 有追索权信用证withdrawal of offer 撤回要约withholding tax 预扣税;预扣税项without-profit business 不可分红业务with-profit business 可分红业务workforce 工作人口working balance 周转余额;营运结余working capital 营运资金;周转资金working group on corporate governance [stock exchange of hong kong limited] 公司管治工作小组〔香港联合交易所有限公司〕working group on financial facilities 财政设施工作小组working group on hong kong's economic relationship with china 香港与中国经济关系工作小组working group on new market development [stock exchange of hong kong limited] 新市场发展工作小组〔香港联合交易所有限公司〕working party on financial disclosure 财务资料披露工作小组working party on payment and settlement system  支付及交收系统工作小组working population 工作人口works account 工程帐world bank 世界银行world bank group 世界银行集团world bank/international monetary fund annual meeting 世界银行/国际货币基金组织年会world competitiveness report 19xx [published by the international institute for management development and the world economic forum] 《一九xx年世界竞争力报告书》〔由国际管理发展研究所与世界经济论坛出版〕world economic forum 世界经济论坛world gold council 世界黄金协会world trade organization [wto] 世界贸易组织〔世贸组织〕worldwide profit 来自世界各地的利润wound-up company 清盘公司write back 拨回;回记write down 减记write off 注销;撇帐write up 增记written commitment 书面承担written-down value 折余价值written-down value on disposal 变卖时折余价值财经专业英语词汇(V-W) 相关内容:。