For my long-term care insurance system design thinking_2713

- 格式:doc

- 大小:37.00 KB

- 文档页数:6

英语作文个关于保险政策的电子邮件全文共3篇示例,供读者参考篇1Dear Family,I have something really important to tell you about! At school today, we learned all about insurance policies. I know it might sound like a boring grown-up topic, but it's actually really fascinating. Let me explain what I learned.An insurance policy is kind of like a magic force field that protects you and your stuff from bad things happening. It's a contract you sign that says if something goes wrong, the insurance company will help pay for it or fix it. Isn't that amazing? It's like having a bunch of super heroes ready to swoop in and save the day whenever trouble comes knocking.There are different types of insurance for different types of bad things that could happen. One of the most common ones is health insurance. This is the kind of policy that makes sure you don't have to pay a bajillion dollars if you get really sick or hurt. Without health insurance, just one trip to the hospital could cost more money than our whole family makes in a year! But withinsurance, they'll cover most of those huge costs. All you have to pay is a small fee called a co-pay or deductible. It's like having a bulletproof vest for your piggy bank.Another super important type of insurance is car insurance. We all know cars can be major trouble-makers. They break down, get dented in accidents, or sometimes even get stolen by dastardly car-nabbers! If you don't have car insurance and any of those things happen, you're going to be super sad when you see how much it costs to fix or replace your vehicle. But if you're covered by insurance, they'll take care of most or all of those expenses. It's like having a protective force field around your car at all times.Then there's homeowners insurance, which craft a mighty shield around your house and belongings. If your home ever gets damaged by a fire, tornado, hurricane, or rambunctious elephant rampage, the insurance company will pay for repairs or replacement stuff. They've even got your back if an evil burglar breaks in and steals your prized possessions. With homeowners insurance, you can rest easy knowing your castle is protected by an invisible force field.There are also insurance policies for other situations, like if you accidentally injure someone else or damage their property.Insurance can swoop in like a superhero and make sure you don't get sued for all your money. It's total peace of mind!Of course, nothing in life is completely free. You have to pay premiums to the insurance company every month or year to keep your policies active. That's kind of like paying a membership fee to join the Protection Squad. The higher your premiums, the more coverage you get. But you don't want to pay too much if you'll never actually use the insurance. It's a bit of a balancing act.Insurance companies make money by taking everyone's premiums and using them to pay out for the few people who actually end up making claims that year. It's kind of like a ginormous community piggy bank. If only a handful of people break their piggy banks, there's plenty of money to go around and cover them. As long as most people's little piggies stay safe and sound, the whole system works out!I think insurance policies are a completely brilliant idea. Knowing that burglars, bullies, and baddies can't ever take away my family's home, health, or treasures makes me feel so safe and secure. We may not be wealthy mogillionaires, but insurance makes us richer than royalty when it comes to protection.I hope you found my explanation helpful and not just a bunch of boring grown-up gibberish. Now you know all about the awesome force fields called insurance policies! Maybe you can enlighten the other grown-ups about this stuff next time they talk about being "covered." Let's just keep our force field facts between us kids for now.Your Buddy,[Your Name]篇2Subject: My Dad's New Job and Insurance StuffHey friends!I've got some exciting news to share with you all! My dad recently started a new job working for a big insurance company. At first, I wasn't sure what insurance was all about, but after he explained it to me, I realized it's actually really important and interesting stuff!You see, insurance is like a safety net that protects you and your family from unexpectedevents that could cost a whole lot of money. Like if your house catches on fire or gets damaged in a storm, insurance can help pay for repairs or even build you abrand new house. Or if you get into a car accident and your vehicle gets totaled, insurance will cover the cost of a new car. Neat, right?My dad's company offers all sorts of different insurance policies. A policy is basically a contract that says what kinds of events or damages the insurance will cover. There's home insurance to protect your house, car insurance for your vehicles, health insurance for medical expenses, life insurance in case something happens to you or your parents, and even insurance for pets, travel, and businesses!Health insurance is a really important one. It helps pay the huge bills if you have to go to the hospital or see a doctor. My dad says that without health insurance, even a simple doctor's visit can cost hundreds of dollars out of your own pocket! With insurance, you just pay a smaller fee called a co-pay or deductible.Another cool thing about insurance is that it protects you from having to pay for accidents that aren't your fault. Like if someone breaks into your home and steals your TV or jewelry, your home insurance will reimburse you for those lost items. Or if you get into a fender bender and it was clearly the other driver'smistake, their car insurance will cover the cost of fixing your vehicle's damage.Sometimes bad things just happen out of nowhere, like natural disasters or house fires. But having insurance gives you peace of mind that your family will be taken care of financially if anything unexpected occurs. All you have to do is pay a monthly or yearly premium to the insurance company, and they'll take care of the rest!When my dad first started explaining insurance to me, I'll admit, it sounded a bit confusing and boring. But the more I learned, the more I realized how incredibly important and useful it is for every family to have proper insurance coverage. It's like having a trusty back-up plan for life's unexpected curveballs.In fact, my parents are going to look into getting additional insurance policies for our family soon. They want to make sure we're fully protected in case of emergencies, illnesses, accidents or other crazy situations. We might get extra coverage for things like dental care, vision care, disability benefits, and even insurance for our family dog Buster! Apparently, some pet insurance will reimburse you for vet bills. How cool is that?So while insurance might seem kind of complicated with all the different policy types and coverage details, it's basically just away to minimize your risk and safeguard your finances. Knowing my family is properly insured gives me a really reassured feeling. If any stressful, costly events come our way, we'll be able to handle it without going completely broke!My dad's new insurance job has been really fascinating to learn about. He even brought home some coloring book samples that insurance companies hand out to help explain policies to kids. Between that and his easy-to-understand explanations, I feel like quite the young insurance expert now!Who knows, maybe I'll follow in his footsteps and work in the insurance field myself one day. Though I guess firefighting could be another fun career option - that way, I'd get to be the one rushing in to save people from the types of disasters that insurance protects against! Regardless, I'm just glad my dad is working hard to ensure our family is properly covered for any curveballs life might throw our way.Well, that's the latest scoop from me! I'd better sign off now and get started on my math homework. But let me know if you have any other questions about insurance - I'll be happy to share what I've learned from dear ole dad's fascinating new gig!Talk to you soon,[Your Name]篇3Dear Mrs. Thompson,Today in class we learned all about insurance policies! Insurance is something grown-ups pay for to help keep them safe if bad things happen. There are different kinds of insurance for different situations. Let me tell you what I learned!One type of insurance is health insurance. This helps pay for doctor visits, medicine, hospital stays, and other medical stuff if you get really sick or hurt. My mom and dad have health insurance through their jobs. That way, if I break my arm playing soccer or get the flu, we don't have to pay the full huge cost for the doctor ourselves. The insurance company chips in!Another kind of insurance is car insurance. All adults who drive cars need this one. Car insurance protects you if you get into a car accident. It can pay to fix or replace your car if it's damaged and also help with medical bills for anyone who gets injured. Without car insurance, you'd have to pay thousands and thousands of dollars out of your own pocket if you crashed your car. No thanks!Then there's homeowners insurance. This covers your house if something bad happens to it, like a fire, tornado, burglary, or the big tree in the yard falls over onto your roof during a storm. My parents have homeowners insurance just in case, so they don't have to worry about our house and everything inside being ruined with no way to afford repairs or replacements.Life insurance is a little different. It's a policy that pays money to your family if you die, to help them out without your income. That sounds like a sad topic for kids, but grown-ups need to think ahead and be prepared. Nobody wants to, but people do pass away sometimes, even when they're still working and their family depends on their paychecks. Life insurance makes sure the survivors have enough money to pay bills and get by.There's also insurance for businesses, like if you own a restaurant and need coverage in case a customer gets food poisoning and sues you. Or insurance for when you travel, to cover costs if your luggage gets lost or stolen. There are so many possibilities where insurance can help!Basically, insurance is meant to protect you from things going really, really wrong in life and costing a huge amount of money you can't afford. You pay a company a smaller fee eachmonth, and they agree to cover the much larger costs if disaster strikes. It's a way of preparing ahead of time and not being financially ruined by unexpected calamities.The insurance company makes money by charging you more in fees over time than they'll likely have to pay out for any single disaster. But if that house fire or cancer treatment does happen to you, you're really glad you had insurance rather than being stuck with the full 500,000 bill!Of course, insurance policies are pretty complicated, with lots of fine print covering exactly what situations they'll pay out for and how much. My parents spend a lot of time reviewing the details and making sure they have the right coverage for our family's needs. But the basic idea is simple: insurance = protection from life's expensive nightmares.Grown-ups, does this make sense? I tried to explain what I learned as best I could! Let me know if you have any other questions. I'll be studying different insurance policies each week so I can really understand this important adult concept.See you in class!Timmy。

OECD 国家长期照护服务现状分析李冬梅;王先益;戴小青【摘要】通过对OECD长期照护现状的考察和分析,为构建我国长期照护体系提供参考。

由于OECD国家长期照护经费支出逐年递增,几乎所有成员国根据自身国情制定了与长期照护相关的政策和相关服务项目。

许多国家通过提供现金服务、因特网等信息传播系统、供方之间的市场竞争增加受益者的选择范围,并加大对社区及居家照护服务的支持力度;通过政策支持照护者,以减轻家庭和社会的负担,让家庭充分发挥照护亲属的责任;对长期照护资格审查进行了不同程度的改革,主要包括评审程序、受益范围及服务项目等,调整服务供给量以满足不同目标人群的需求;在保证照护服务质量的前提下由护士委派照护任务给低技术照护者,以减少人力成本。

OECD国家根据自身国情出发构建了各具特色的长期照护体系,通过持续的发展与不断的改革,长期照护模式已相对健全。

%As the cost of the long term care annually increase , the member countries in OECD have estab-lished their tailored long-term care policies and service programs .They offer cash allowance and the information system to beneficiaries and introduce competition among service suppliers .Meanwhile, they strengthen the support from community and home care.They support care givers to reduce the burden of community and society and give family full play in home care.They reform the inspection of long -term care qualification and adjust the service supply to meet the needs of public.To reduce human power cost , they assign the care task from nurses to low -tech care givers.By these measures, the countries in OECD have built relatively sound long term care syste ..【期刊名称】《辽东学院学报(社会科学版)》【年(卷),期】2013(000)003【总页数】5页(P113-117)【关键词】长期照护;服务递送;资金筹集;质量管理;OECD【作者】李冬梅;王先益;戴小青【作者单位】杭州师范大学护理学院,杭州 310018;浙江省民政研究中心,杭州310007;杭州师范大学护理学院,杭州 310018; 浙江省民政研究中心,杭州310007【正文语种】中文【中图分类】C913.6长期照护又称长期护理 (Long Term Care,简称LTC),是指“在持续的一段时期内给丧失活动能力或从未有过某种程度活动能力的人提供的一系列健康护理、个人照料和社会服务项目”[1]。

卫生经济研究圆园员9年10月第36卷第10期总第390期为应对人口老龄化,各级政府出台了众多为老服务政策,不同部门发挥着不同的作用。

整体上看,首先是民政部门,长期以来开展适老、为老、养老等相关工作,并将其作为一项社会福利制度和社会救济制度;其次是卫生健康部门,提出并积极倡导“医养结合”,从服务提供方的角度开展为老工作;再次,发改部门对一些适老、为老、养老机构的立项、土地使用等进行管理。

2016年6月,人力资源社会保障部出台了《关于开展长期照护保险制度试点的指导意见》(以下简称《意见》),提出在15个城市开展长期照护保险制度试点,“探索建立以社会互助共济方式筹集资金,为长期失能人员的基本生活照料和与基本生活密切相关的医疗护理提供资金或服务保障的社会保险制度”。

各地长期照护保险从制度设计到方案测算,坚持科学、慎重、深思熟虑的原则,借鉴其它地区试点的经验和教训,探索建立了各自的长期照护保险制度方案。

本文对长期照护保险制度覆盖人群、筹资机制的国内试点情况及国际经验进行总结归纳,提出制度建设的政策建议。

1长期照护保险的覆盖人群《意见》指出,“试点阶段,长期照护保险制度原则上主要覆盖职工基本医疗保险”。

在试点及政策实施起步阶段,由于各地区经济发展水平不均衡,农村养老服务体系不健全,选择从职工参保人群起步,在一定程度上可以避免制度试点的风险,不贪大求全,以更加稳妥的方式推进,重在探索提炼可推广、可复制的典型经验。

从16个试点地区(含北京海淀)情况看,由于长期照护保险基金主要从医疗保险基金划拨,因此覆盖人群的划分也以医保参保人群的划分为基础,主要分为三类。

一是只覆盖城镇职工基本医疗保险参保人,试点城市有广州、宁波、承德、重庆、安庆、成都、齐齐哈尔等七个城市[1~7]。

二是覆盖城镇职工和城镇居民基本医疗保险参保人,试点城市有长春、上海、青岛、南通、石河子、苏州、上饶七个城市[8~14],其中上海对城乡居民参保规定了60岁的年龄限制。

患者家属办理长期照护险流程英文回答:Eligibility for Long-Term Care Insurance.To be eligible for long-term care insurance, you must meet the following requirements:Be a resident of the United States.Be at least 18 years old.Have a valid Social Security number.Not be currently receiving Medicaid benefits.Not be terminally ill.How to Apply for Long-Term Care Insurance.To apply for long-term care insurance, you can follow these steps:1. Contact an insurance agent who specializes in long-term care insurance.2. The agent will provide you with an application form.3. Complete the application form and return it to the agent.4. The agent will submit your application to the insurance company.5. The insurance company will review your application and make a decision on whether to approve your coverage.What Information Will I Need to Provide on the Application Form?The application form will ask you for the following information:Your name, address, and date of birth.Your Social Security number.Your health history.Your financial information.Your long-term care needs.What Factors Will the Insurance Company Consider When Making a Decision on My Application?The insurance company will consider the following factors when making a decision on your application:Your age.Your health.Your financial situation.Your long-term care needs.The amount of coverage you are requesting.How Much Will Long-Term Care Insurance Cost?The cost of long-term care insurance will vary depending on the following factors:Your age.Your health.The amount of coverage you are requesting.The type of policy you choose.What Benefits Will Long-Term Care Insurance Provide?Long-term care insurance can provide the following benefits:Coverage for the cost of long-term care services, such as nursing home care, assisted living, and home health care.A lump sum payment to help you pay for long-term care expenses.Tax-free benefits that can be used to pay for long-term care services.中文回答:办理长期照护险流程。

英语介绍五险一金的作文Social insurance is a system established by the state to provide financial protection and security for its citizens. In China, the social insurance system consists of five main types of insurance and one fund, collectively known as the "Five Insurances and One Fund." These include pension insurance, medical insurance, work-related injury insurance, unemployment insurance, maternity insurance, and the housing provident fund. Let's take a closer look at each of these components.Pension InsurancePension insurance is the foundation of China's social security system. It is designed to provide financial security for individuals after they reach retirement age. Employees and employers both contribute to the pension insurance fund, with the employer typically paying a larger share. The amount of the pension benefit is based on the individual's years of employment, the amount contributed, and the average local wage level. Upon reaching the statutory retirement age, which is 60 for men and 55 for women in most cases, individuals can start receiving their pension payments.Medical InsuranceThe medical insurance system in China aims to provide affordable healthcare for all citizens. There are two main types of medical insurance: basic medical insurance and supplementary medical insurance. Basic medical insurance covers the majority of medical expenses, including outpatient and inpatient care, as well as the cost of certain medications. Supplementary medical insurance, on the other hand, provides additional coverage for more specialized or expensive treatments. Employees and employers both contribute to the medical insurance fund, and the government also provides subsidies to ensure the system's sustainability.Work-related Injury InsuranceWork-related injury insurance is designed to protect employees who suffer from work-related accidents or occupational diseases. This insurance covers the medical expenses, rehabilitation costs, and lost wages associated with such incidents. Employers are responsible for paying the premiums for this insurance, and the benefits are provided directly to the affected employees or their families.Unemployment InsuranceUnemployment insurance is a safety net for individuals who have lost their jobs through no fault of their own. It provides temporary financial assistance to help them meet their basic living expenseswhile they search for new employment. Employees and employers both contribute to the unemployment insurance fund, and the benefits are based on the individual's previous salary and the duration of their employment.Maternity InsuranceMaternity insurance is designed to provide financial support to female employees during pregnancy, childbirth, and the postpartum period. It covers the medical expenses associated with prenatal care, delivery, and postpartum recovery, as well as a portion of the employee's salary during the maternity leave period. Both employees and employers contribute to the maternity insurance fund.Housing Provident FundThe housing provident fund is a unique component of China's social insurance system. It is a mandatory savings program that enables employees to accumulate funds for the purpose of purchasing, building, or renovating their homes. Both employees and employers contribute a percentage of the employee's salary to the housing provident fund, and the funds can be withdrawn for approved housing-related expenses.The "Five Insurances and One Fund" system plays a crucial role in ensuring the social and economic well-being of China's citizens. By providing a comprehensive social safety net, it helps to alleviate thefinancial burdens associated with various life events and emergencies, such as retirement, illness, work-related injuries, unemployment, and housing needs.The implementation of this system has been a gradual process, with the government continually working to expand coverage, increase the level of benefits, and improve the overall efficiency of the system. Over the years, the social insurance system has undergone several reforms and adjustments to adapt to the changing economic and social landscape in China.One of the key challenges facing the system is ensuring its long-term sustainability. As China's population ages and the demand for social services increases, the government must find ways to maintain the financial stability of the social insurance funds and ensure that they can continue to provide adequate support to the people.Another challenge is ensuring that the system is accessible and equitable for all citizens, regardless of their employment status or geographic location. The government has made efforts to extend coverage to rural areas and the informal sector, but more work is needed to ensure that everyone has access to the necessary social protections.Despite these challenges, the "Five Insurances and One Fund" systemremains a crucial component of China's social and economic development. It not only provides a safety net for individuals and families but also contributes to the overall stability and prosperity of the country.In conclusion, the "Five Insurances and One Fund" system in China is a comprehensive social insurance system that plays a vital role in ensuring the well-being of the country's citizens. By providing financial protection and security in various life events, it helps to alleviate the burdens faced by individuals and families, and contributes to the overall social and economic development of the nation.。

英语作文-商业健康保险如何应对个人健康管理费用In the landscape of personal health management, commercial health insurance plays a pivotal role. It serves as a bridge between the individual's need for comprehensive healthcare and the financial means to access it. The rising costs of healthcare services and the unpredictable nature of medical emergencies make health insurance not just a safety net, but a necessary tool in managing personal health expenses.Commercial health insurance typically offers a range of plans, each designed to cater to different levels of healthcare needs and budget constraints. From basic coverage, which may include hospitalization and emergency services, to more comprehensive plans that cover preventive care, prescription drugs, and even alternative treatments, the options are extensive. The key is to find a balance between the coverage and the cost, ensuring that one is not over-insured, leading to unnecessary premiums, nor under-insured, resulting in out-of-pocket expenses that could be financially crippling.One of the most significant advantages of commercial health insurance is its ability to negotiate with healthcare providers for lower costs. Due to the volume of clients they represent, insurance companies can often secure services at rates much lower than the individual could on their own. This negotiating power is crucial in keeping healthcare costs in check and making them more predictable for the insured.Moreover, health insurance companies are increasingly offering wellness programs and incentives for healthy living. These programs, which may include discounts on gym memberships, free health screenings, and rewards for non-smokers, aim to reduce the overall healthcare costs by encouraging a healthier lifestyle. Preventive care, recognized for its long-term cost-saving potential, is often emphasized in these programs.The administrative aspect of health insurance also simplifies the process of managing healthcare expenses. By handling the majority of paperwork and direct payments to healthcare providers, insurance companies relieve individuals of the burden of navigatingthe complex healthcare system. This convenience is invaluable, especially during times of illness when one's energy and focus should be on recovery rather than financial concerns.However, it's not without its challenges. The complexity of insurance policies can sometimes lead to confusion about coverage limits, exclusions, and the claims process. It's essential for individuals to thoroughly understand their policy details and to communicate with their insurance provider to clarify any uncertainties. An informed insured is an empowered one, capable of making decisions that best suit their health and financial situation.In conclusion, commercial health insurance is a critical component in managing personal health expenses. Its ability to provide financial protection, negotiate healthcare costs, promote preventive care, and simplify the administrative process makes it an indispensable ally in the pursuit of health and financial stability. As healthcare costs continue to rise, the role of health insurance becomes ever more important, ensuring that individuals can access the care they need without the fear of financial ruin. 。

与医养康护和保险融合相关的英文文献As the population ages, the demand for healthcare and long-term care services is increasing. This has led to a growing interest in integrating medical care and long-term care, known as "integrated care". In addition, there is a growing recognition of the importance of incorporating insurance into integrated care models to provide financial protection for the elderly and their families.One approach to integrating medical care and long-term care is through the concept of "health and long-term care". This approach emphasizes the coordination of medical and long-term care services to provide comprehensive and continuous care for the elderly. By combining medical care with long-term care, it is possible to better address the complex and interconnected needs of the elderly population.Incorporating insurance into integrated care models is also crucial for ensuring the financial sustainability of these programs. Insurance can help to cover the costs of medical and long-term care services, as well as provide financial protection for the elderly and their families.This is particularly important as the cost of healthcareand long-term care continues to rise.One example of the integration of medical care, long-term care, and insurance is the development of "Medicare Advantage" plans. These plans, offered by private insurance companies, provide coverage for both medical care and long-term care services. By bundling these services together, Medicare Advantage plans can provide more comprehensive coverage for the elderly.In summary, the integration of medical care, long-term care, and insurance is essential for meeting the complex needs of the aging population. By coordinating these services, it is possible to provide better care for the elderly while also ensuring their financial security.随着人口的老龄化,对医疗保健和长期护理服务的需求正在增加。

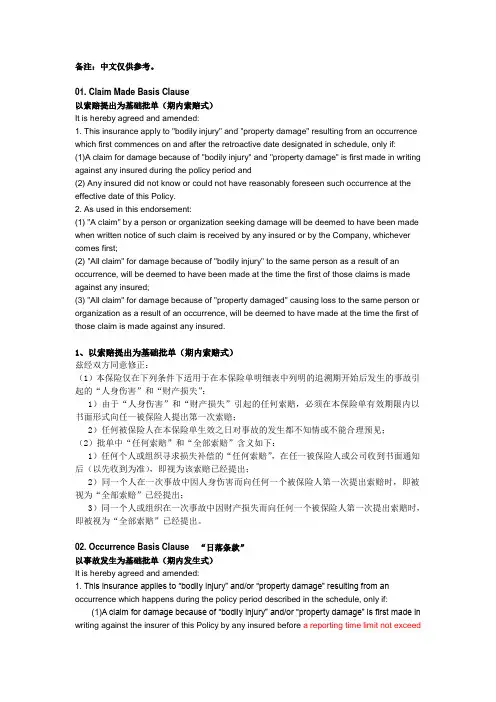

备注:中文仅供参考。

01. Claim Made Basis Clause以索赔提出为基础批单(期内索赔式)It is hereby agreed and amended:1. This insurance apply to "bodily injury" and "property damage" resulting from an occurrence which first commences on and after the retroactive date designated in schedule, only if:(1)A claim for damage because of "bodily injury" and "property damage" is first made in writing against any insured during the policy period and(2) Any insured did not know or could not have reasonably foreseen such occurrence at the effective date of this Policy.2. As used in this endorsement:(1) "A claim" by a person or organization seeking damage will be deemed to have been made when written notice of such claim is received by any insured or by the Company, whichever comes first;(2) "All claim" for damage because of "bodily injury" to the same person as a result of an occurrence, will be deemed to have been made at the time the first of those claims is made against any insured;(3) "All claim" for damage because of "property damaged" causing loss to the same person or organization as a result of an occurrence, will be deemed to have made at the time the first of those claim is made against any insured.1、以索赔提出为基础批单(期内索赔式)兹经双方同意修正:(1)本保险仅在下列条件下适用于在本保险单明细表中列明的追溯期开始后发生的事故引起的“人身伤害”和“财产损失”:1)由于“人身伤害”和“财产损失”引起的任何索赔,必须在本保险单有效期限内以书面形式向任一被保险人提出第一次索赔;2)任何被保险人在本保险单生效之日对事故的发生都不知情或不能合理预见;(2)批单中“任何索赔”和“全部索赔”含义如下:1)任何个人或组织寻求损失补偿的“任何索赔”,在任一被保险人或公司收到书面通知后(以先收到为准),即视为该索赔已经提出;2)同一个人在一次事故中因人身伤害而向任何一个被保险人第一次提出索赔时,即被视为“全部索赔”已经提出;3)同一个人或组织在一次事故中因财产损失而向任何一个被保险人第一次提出索赔时,即被视为“全部索赔”已经提出。

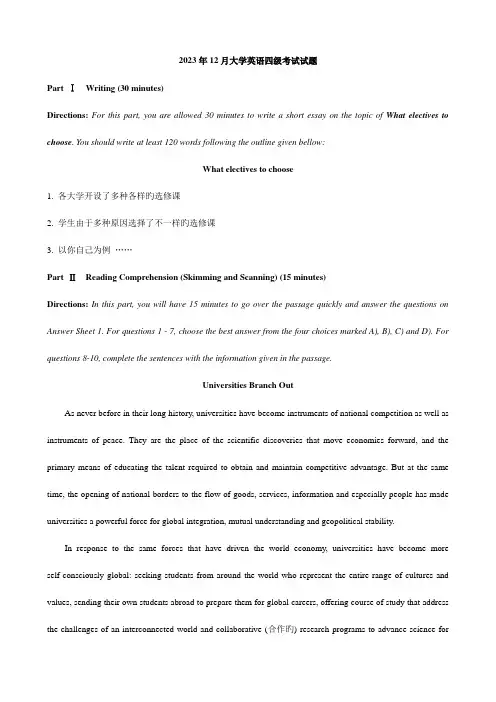

2023年12月大学英语四级考试试题Part ⅠWriting (30 minutes)Directions:For this part, you are allowed 30 minutes to write a short essay on the topic of What electives to choose. You should write at least 120 words following the outline given bellow:What electives to choose1. 各大学开设了多种各样旳选修课2. 学生由于多种原因选择了不一样旳选修课3. 以你自己为例……Part ⅡReading Comprehension (Skimming and Scanning) (15 minutes)Directions: In this part, you will have 15 minutes to go over the passage quickly and answer the questions on Answer Sheet 1. For questions 1 - 7, choose the best answer from the four choices marked A), B), C) and D). For questions 8-10, complete the sentences with the information given in the passage.Universities Branch OutAs never before in their long history, universities have become instruments of national competition as well as instruments of peace. They are the place of the scientific discoveries that move economies forward, and the primary means of educating the talent required to obtain and maintain competitive advantage. But at the same time, the opening of national borders to the flow of goods, services, information and especially people has made universities a powerful force for global integration, mutual understanding and geopolitical stability.In response to the same forces that have driven the world economy, universities have become more self-consciously global: seeking students from around the world who represent the entire range of cultures and values, sending their own students abroad to prepare them for global careers, offering course of study that address the challenges of an interconnected world and collaborative (合作旳) research programs to advance science forthe benefit of all humanity.Of the forces shaping higher education none is more sweeping than the movement across borders. Over the past three decades the number of students leaving home each year to study abroad has grown at an annual rate of 3.9 percent, from 800,000 in 1975 to 2.5 million in 2023. Most travel from one developed nation to another, but the flow from developing to developed countries is growing rapidly. The reverse flow, from developed to developing countries, is on the rise, too. Today foreign students earn 30 percent of the doctoral degrees awarded in the United States and 38 percent of those in the United Kingdom. And the number crossing borders for undergraduate study is growing as well, to 8 percent of the undergraduates at America's best institutions and 10 percent of all undergraduates in the U.K. In the United States, 20 percent of the newly hired professors in science and engineering are foreign-born, and in China many newly hired faculty members at the top research universities received their graduate education abroad.Universities are also encouraging students to spend some of their undergraduate years in another country. In Europe, more than 140,000 students participate in the Erasmus program each year, taking courses for credit in one of 2,200 participating institutions across the continent. And in the United States, institutions are helping place students in summer internships (实习) abroad to prepare them for global careers. Yale and Harvard have led the way, offering every undergraduate at least one international study or internship opportunity -- and providing the financial resources to make it possible.Globalization is also reshaping the way research is done. One new trend involves sourcing portions of a research program to another country. Yale professor and Howard Hughes Medical Institute investigator Tian Xu directs a research center focused on the genetics of human disease at Shanghai's Fudan University, in collaboration with faculty colleagues from both schools. The Shanghai center has 95 employees and graduate students working in a 4,300-square-meter laboratory facility. Yale faculty, postdoctors and graduate students visitregularly and attend videoconference seminars with scientists from both campuses. The arrangement benefits both countries; Xu's Yale lab is more productive, thanks to the lower costs of conducting research in China, and Chinese graduate students, postdoctors and faculty get on-the-job training from a world-class scientist and his U. S. team.As a result of its strength in science, the United States has consistently led the world in the commercialization of major new technologies, from the mainframe computer and the integrated circuit of the 1960s to the Internet infrastructure (基础设施) and applications software of the 1990s. The link between university-based science and industrial application is often indirect but sometimes highly visible: Silicon Valley was intentionally created by Stanford University, and Route 128 outside Boston has long housed companies spun off from MIT and Harvard. Around the world, governments have encouraged copying of this model, perhaps most successfully in Cambridge, England, where Microsoft and scores of other leading software and biotechnology companies have set up shop around the university.For all its success, the United States remains deeply hesitant about sustaining the research-university model. Most politicians recognize the link between investment in science and national economic strength, but support for research funding has been unsteady. The budget of the National Institutes of Health doubled between 1998 and 2023, but has risen more slowly than inflation since then. Support for the physical sciences and engineering barely kept pace with inflation during that same period. The attempt to make up lost ground is welcome, but the nation would be better served by steady, predictable increases in science funding at the rate of long-term GDP growth, which is on the order of inflation plus 3 percent per year.American politicians have great difficult recognizing that admitting more foreign students can greatly promote the national interest by increasing international understanding. Adjusted for inflation, public funding for international exchanges and foreign-language study is well below the levels of 40 years ago. In the wake ofSeptember 11, changes in the visa process caused a dramatic decline in the number of foreign students seeking admission to U. S. universities, and a corresponding surge in enrollments in Australia, Singapore and the U. K. Objections from American university and business leaders led to improvements in the process and a reversal of the decline, but the United States is still seen by many as unwelcoming to international students.Most Americans recognize that universities contribute to the nation's well-being through their scientific research, but many fear that foreign students threaten American competitiveness by taking their knowledge and skills back home. They fall to grasp that welcoming foreign students to the United States has two important positive effects: first, the very best of them stay in the States and -- like immigrants throughout history -- strengthen the nation; and second, foreign students who study in the United States become ambassadors for many of its most cherished (珍视) values when they return home. Or at least they understand them better. In America as elsewhere, few instruments of foreign policy are as effective in promoting peace and stability as welcoming international university students.1. From the first paragraph we know that present-day universities have become ______.A) more popularized than ever beforeB) in-service training organizationsC) a powerful force for global integrationD) more and more research-oriented2. Over the past decades, the enrollment of overseas students has increased ______.A) at an annual rate of 8 percent B) at an annual rate of 3.9 percentC) by 800,000 D) by 2.5 million3. In the United States, how many of the newly hired professors in science and engineering are foreign-born?A) 38%. B) 10%. C) 30% D) 20%.4. How do Yale and Harvard prepare their undergraduates for global careers?A) They give them chances for international study or internship.B) They arrange for them to participate in the Erasmus program.C) They offer them various courses in international politics.D) They organize a series of seminars on world economy.5. An example illustrating the general trend of universities' globalization is ______.A) Yale's establishing branch campuses throughout the worldB) Yale's student exchange program with European institutionsC) Yale's helping Chinese universities to launch research projectsD) Yale's collaboration with Fudan University on genetic research6. What do we learn about Silicon Valley from the passage?A) It is known to be the birthplace of Microsoft Company.B) It was intentionally created by Stanford University.C) It is where the Internet infrastructure was built up.D) It houses many companies spun off from MIT and Harvard.7. What is said about the U.S. federal funding for research?A) It has increased by 3 percent.B) It doubled between 1998 and 2023.C) It has been unsteady for years.D) It has been more than sufficient.8. The dramatic decline in the enrollment of foreign students in the U. S. after September 11 was caused by _______________________________.9. Many Americans fear that American competitiveness may be threatened by foreign students who will ______________________________.10. The policy of welcoming foreign students can benefit the U. S. in that the very best of them will stay and __________________________________.Part ⅢListening Comprehension (35 minutes)Section ADirections:In this section, you will hear 8 short conversations and 2 long conversations. At the end of each conversation, one or more questions will be asked about what was said. Both the conversation and the questions will be spoken only once. After each question there will be a pause. During the pause, you must read the four choices marked [A], [B], [C] and [D], and decide which is the best answer. Then mark the corresponding letter on Answer Sheet 2 with a single line through the centre.Questions 11 to 18 are based on the conversation you have just heard.11. [A] She used to be in poor health. [C] She was somewhat overweight.[B] She was popular among boys. [D] She didn't do well at high school.12. [A] At the airport. [C] In a hooking office.[B] In a restaurant. [D] At the hotel reception.13. [A] Teaching her son by herself. [C] Asking the teacher for extra help.[B] Having confidence in her son. [D] Telling her son not to worry.14. [A] Have a short break. [C] Continue her work outdoors.[B] Take two weeks off. [D] Go on vacation with the man.15. [A] He is taking care of this twin brother. [C] He is worried about Rod's health.[B] He has been feeling ill all week. [D] He has been in perfect condition.16. [A] she sold all her furniture before she moved house.[B] She still keeps some old furniture in her new house.[C] She plans to put all her old furniture in the basement.[D] She brought a new set of furniture from Italy last month.17. [A] The woman wondered why the man didn't return the book.[B] The woman doesn't seem to know what the book is about.[C] The woman doesn't find the book useful any more.[D] The woman forgot lending the book to the man.18. [A] Most of the man's friends are athletes.[B] Few people share the woman's opinion.[C] The man doesn't look like a sportsman.[D] The woman doubts the man's athletic ability.Questions 19 to 22 are based on the conversation you have just heard.19. [A] She has packed it in one of her bags. [C] She has probably left it in a taxi.[B] She is going to get it at the airport. [D] She is afraid that she has lost it.20. [A] It ends in winter. [C] It will last one week.[B] It will cost her a lot. [D] It depends on the weather.21. [A] The plane is taking off soon. [C]There might be a traffic jam.[B] The taxi is waiting for them. [D] There is a lot of stuff to pack.22. [A] At home. [C] At the airport.[B] In the man's car. [D] By the side of a taxi.Questions 23 to 25 are based on the conversation you have just heard.23. [A] She is thirsty for promotion, [C] She is tired o f her present work.[B] She wants a much higher salary. [D] She wants to save travel expenses.24. [A] Translator. [C] Language instructor.[B] Travel agent. [D] Environmental engineer.25. [A] Lively personality and inquiring mind. [C] Devotion and work efficiency.[B] Communication skills and team spirit. [D] Education and experience.Section BDirections: In this section you will hear 3 short passages. At the end of each passage, you will hear some questions. Both the passage and the questions will be spoken only once. After you hear a question, you must choose the best answer from the four choices marked [A], [B], [C] and [D]. Then mark the corresponding letter on Answer Sheet 2 with a single line through the centre.Passage OneQuestions 26 to 29 are based on the passage you have just heard.26. [A] They care a lot about children. [C] They want to enrich their life experience.[B] They need looking after in their old age. [D] They want children to keep them company.27. [A] They are usually adopted from distant places.[B] Their birth information is usually kept secret.[C] Their birth parents often try to conceal their birth information.[D] Their adoptive parents don't want them to know their birth parents.28. [A] They generally hold bad feelings towards their birth parents.[B] They do not want to hurt the feelings of their adoptive parents.[C] They have mixed feelings about finding their natural parents.[D] They are fully aware of the expenses involved in the search.29. [A] Early adoption makes for closer parent-child relationship.[B] Most people prefer to adopt children from overseas.[C] Understanding is the key to successful adoption.[D] Adoption has much to do with love.Passage TwoQuestions 30 to 32 are based on the passage you have just heard.30. [A] He suffered from mental illness. [C] He turned a failing newspaper into a success.[B] He bought The Washington Post. [D] He was once a reporter for a major newspaper.31. [A] She was the first woman to lead a big U.S. publishing company.[B] She got her first job as a teacher at the University of Chicago.[C] She committed suicide because of her mental disorder.[D] She took over her father's position when he died.32. [A] People came to see the role of women in the business world.[B] Katharine played a major part in reshaping Americans' mind.[C] American media would be quite different without Katharine.[D] Katharine had exerted an important influence on the world.Passage ThreeQuestions 33 to 35 are based on the passage you have just heard.33. [A] It'll enable them to enjoy the best medical care. [C] It'll protect them from possible financial crises.[B] It'll allow them to receive free medical treatment. [D] It'll prevent the doctors from overcharging them.34. [A] They can't immediately get back the money paid for their medical cost.[B] They have to go through very complicated application procedures.[C] They can only visit doctors who speak their native languages.[D] They may not be able to receive timely medical treatment.35. [A] They don't have to pay for the medical services.[B] They needn't pay the entire medical bill at once.[C] They must send the receipts to the insurance company promptly.[D] They have to pay a much higher price to get an insurance policy.Section CDirections:In this section, you will hear a passage three times. When the passage is read for the first time, you should listen carefully for its general idea. When the passage is read for the second time, you are required to fill in the blanks numbered from 36 to 43 with the exact words you have just heard. For blanks numbered from 44 to 46 you are required to fill in the missing information. For these blanks, you can either use the exact words you have jest heard or write down the main points in your own words. Finally, when the passage is read for the third time, you should check what you have written.More and more of the world's population are living in towns or cities. The speed at which cities are growing in the less developed countries is (36) . Between 1920 and 1960 big cities in developed countries (37) two and a half times in size, but in other parts of the world the growth was eight times their size.The (38) size of growth is bad enough, but there are now also very (39) signs of trouble in the (40) of percentages of people living in towns and percentages of people working in industry. During the nineteenth century cities grew as a result of the growth of industry. In Europe, the (41) of people living in cities was always smaller than that of the (42) working in factories. Now, however, the (43) is almostalways true in the newly industrialized world: (44)Without a base of people working in industry, these cities cannot pay for their growth; (45) There has been little opportunity to build water supplies or other facilities. (46) , a growth in the number of hopeless and despairing parents and starving children.Part ⅣReading Comprehension (Reading in Depth) (25 minutes)Section ADirections:In this section, there is a passage with ten blanks. You are required to select one word for each blank from a list of choices given in a word bank following the passage. Read the passage through carefully before making your choices. Each choice in the bank is identified by a letter. Please mark the corresponding letter for each item on Answer Sheet 2 with a single line through the centre. You may not use any of the words in the bank more than once.As war spreads to many comers of the globe, children sadly have been drawn into the center of conflicts. In Afghanistan, Bosnia, and Colombia, however, groups of children have been taking part in peace education (47) . The children, after learning to resolve conflicts, took on the (48) of peacemakers. The Children's Movement for Peace in Colombia was even nominated (提名) for the Nobel Peace Prize in 1998. Groups of children (49) as peacemakers studied human rights and poverty issues in Colombia, eventually forming a group with five other schools in Bogota known as The Schools of Peace.The classroom (50) opportunities for children to replace angry, violent behaviors with (51) , peaceful ones. It is in the classroom that caring and respect for each person empowers children to take a step(52) toward becoming peacemakers. Fortunately, educators have access to many online resources that are(53) useful when helping children along the path to peace. The Young Peacemakers Club, started in 1992, provides a Website with resources for teachers and (54) on starting a Kindness Campaign. The WorldCenters of Compassion for Children International call attention to children's rights and how to help the (55) of war. Starting a Peacemakers' Club is a praiseworthy venture for a class and one that could spread to other classrooms and ideally affect the culture of the (56) school.A) victims I) forwardB) technology J) especiallyC) role K) entireD) respectively L) cooperativeE) projects M) comprehensiveF) offers N) assumingG) information O) actingH) imagesSection BDirections:There are 2 passages in this section. Each passage is followed by some questions or unfinished statements. For each of them there are four choices marked A), B), C) and D). You should decide on the best choice and mark the corresponding letter on Answer Sheet 2 with a single line through the centre.Passage OneIn this age of Internet chat, videogames and reality television, there is no shortage of mindless activities to keep a child occupied. Yet, despite the competition, my 8-yoar-old daughter Rebecca wants to spend her leisure time writing short stories. She wants to enter one of her stories into a writing contest, a competition she won last year.As a writer I know about winning contests, and about losing them. I know what it is like to work hard on a story only to receive a rejection slip from the publisher. I also know the pressures of trying to live up to areputation created by previous victories. What if she doesn't win the contest again? That's the strange thing about being a parent. So many of our own past scars and dashed hopes can surface.A revelation (启示) came last week when I asked her, "Don't you want to win again?" "No," she replied, "I just want to tell the story of an angel going to first grade."I had just spent weeks correcting her stories as she spontaneously ( 自发地) told them. Telling myself that I was merely an experienced writer guiding the young writer across the hall, I offered suggestions for characters, conflicts and endings for her tales. The story about a fearful angel starting first grade was quickly "guided" by me into the tale of a little girl with a wild imagination taking her first music lesson. I had turned her contest into my contest without even realizing it.Staying back and giving kids space to grow is not as easy as it looks. Because I know very little about farm animals who use tools or angels who go to first grade, I had to accept the fact that I was co-opting (借用) my daughter's experience.While stepping back was difficult for me, it was certainly a good first step that I will quickly follow with more steps, putting myself far enough a way to give her room but close enough to help if asked. All the while I will be reminding myself that children need room to experiment, grow and find their own voices.57. What do we learn from the first paragraph?A) A lot of distractions compete for children's time nowadays.B) Children do find lots of fun in many mindless activities.C) Rebecca is much too occupied to enjoy her leisure time.D) Rebecca draws on a lot of online materials for her writing.58. What did the author say about her own writing experience?A) She was constantly under pressure of writing more.B) Most of her stories had been rejected by publishers.C) She did not quite live up to her reputation as a writer.D) Her way to success was full of pains and frustrations.59. Why did Rebecca want to enter this year's writing contest?A) She had won a prize in the previous contest.B) She wanted to share her stories with readers.C) She was sure of winning with her mother's help.D) She believed she possessed real talent for writing.60. The author took great pains to refine her daughter's stories becauseA) she wanted to help Rebecca realize her dreams of becoming a writerB) she was afraid Rebecca's imagination might run wild while writingC) she did not want to disappoint Rebecca who needed her help so muchD) she believed she had the knowledge and experience to offer guidance61. What's the author's advice for parents?A) Children should be given every chance to voice their opinions.B) Parents should keep an eye on the activities their kids engage in.C) Children should be allowed freedom to grow through experience.D) A writing career, though attractive, is not for every child to pursue.Passage TwoBy almost any measure, there is a boom in Internet-based instruction. In just a few years, 34 percent of American universities have begun offering some form of distance leaning (DL), and among the larger schools, it's closer to 90 percent. If you doubt the popularity of the trend, you probably haven't heard of the University ofPhoenix. It grants degrees entirely on the basis of online instruction. It enrolls 90,000 students, a statistic used to support its claim to be the largest private university in the country.While the kinds of instruction offered in these programs will differ, DL usually signifies a course in which the instructors post syllabi (课程大纲), reading assignments, and schedules on Websites, and students send in their assignments by e-mail. Generally speaking, face-to-face communication with an instructor is minimized or eliminated altogether.The attraction for students might at first seem obvious. Primarily, there's the convenience promised by courses on the Net: you can do the work, as they say, in your pajamas (睡衣). But figures indicate that the reduced effort results in a reduced commitment to the course. While dropout rates for all freshmen at American universities is around 20 percent, the rate for online students is 35 percent. Students themselves seem to understand the weaknesses inherent in the setup. In a survey conducted for eCornell, the DL division of Cornell University, less than a third of the respondents expected the quality of the online course to be as good as the classroom course.Clearly, from the schools' perspective, there's a lot of money to be saved. Although some of the more ambitious programs require new investments in servers and networks to support collaborative software, most DL courses can run on existing or minimally upgraded (升级) systems. The more students who enroll in a course but don't come to campus, the more school saves on keeping the lights on in the classrooms, paying doorkeepers, and maintaining parking lots. And, while there's evidence that instructors must work harder to run a DL course for a variety of reasons, they won't be paid any more, and might well be paid less.62. What is the most striking feature of the University of Phoenix?A) It boasts the largest number of students on campus.B) All its courses are offered online.C) Its online courses are of the best quality.D) Anyone taking its online courses is sure to get a degree.63. According to the passage, distance learning is basically characterized by ______.A) a minimum or total absence of face-to-face instructionB) a considerable flexibility in its academic requirementsC) the great diversity of students' academic backgroundsD) the casual relationship between students and professors64. Many students take Internet-based courses mainly because they can ______.A) save a great deal on traveling and boarding expensesB) select courses from various colleges and universitiesC) work on the required courses whenever and whereverD) earn their academic degrees with much less effort65. What accounts for the high drop-out rates for online students?A) There is no mechanism to ensure that they make the required effort.B) There is no strict control over the academic standards of the courses.C) The evaluation system used by online universities is inherently weak.D) Lack of classroom interaction reduces the effectiveness of instruction.66. According to the passage, universities show great enthusiasm for DL programs for the purpose of ______.A) building up their reputationB) upgrading their teaching facilitiesC) providing convenience for studentsD) cutting down on their expensesPart ⅤCloze (15 minutes)Directions: There are 20 blanks in the following passage. For each blank there are four choices marked A), B), C) and D) on the right side of the paper. You should choose the ONE that best fits into the passage. Then mark the corresponding letter on Answer Sheet 2 with a single line through the centre.One factor that can influence consumers is their mood state. Mood may be defined (67) a temporary and mild positive or negative feeling that is generalized and not tied (68) any particular circumstance. Moods should be (69) from emotions which are usually more intense, (70) to specific circumstances, and often conscious. (71) one sense, the effect of a consumer's mood can be thought of in (72) the same way as can our reactions to the (73) of our friends -- when our friends are happy and "up", that trends to influence us positively, (74) when they are "down", that can have a (75) impact on us. Similarly, consumers operating under a (76) mood state tend to react to stimuli (刺激原因) in a direction (77) with that mood state. Thus, for example, we should expect to see (78) in a positive mood state evaluate products in more of a (79) manner than they would when not in such a state. (80) , mood states appear capable of (81) a consumer's memory.Moods appear to be (82) influenced by marketing techniques. For example, the rhythm, pitch, and (83) of music has been shown to influence behavior such as the (84) of time spent in supermarkets or (85) to purchase products. In addition, advertising can influence consumers' moods which, in (86) , are capable of influencing consumer' reactions to products.67. A) with B) aboutC) as D) by68. A) up B) toC) under D) over69. A) divided B) derived。

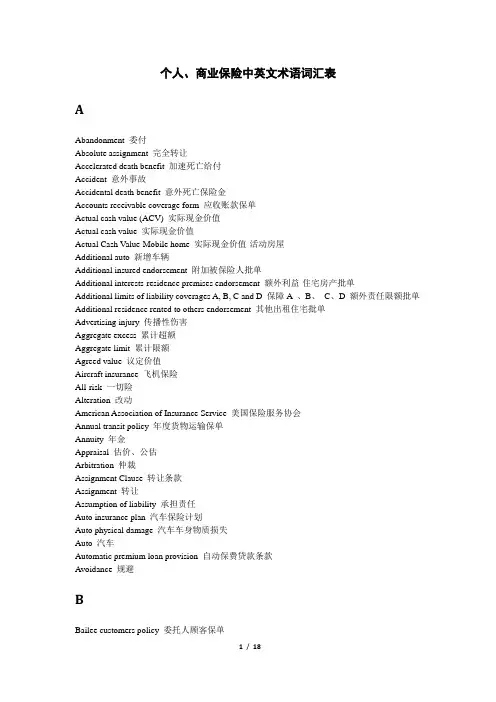

个人、商业保险中英文术语词汇表AAbandonment 委付Absolute assignment 完全转让Accelerated death benefit 加速死亡给付Accident 意外事故Accidental death benefit 意外死亡保险金Accounts receivable coverage form 应收账款保单Actual cash value (ACV) 实际现金价值Actual cash value 实际现金价值Actual Cash Value-Mobile home 实际现金价值-活动房屋Additional auto 新增车辆Additional insured endorsement 附加被保险人批单Additional interests-residence premises endorsement 额外利益-住宅房产批单Additional limits of liability coverages A, B, C and D 保障A 、B、C、D 额外责任限额批单Additional residence rented to others endorsement 其他出租住宅批单Advertising injury 传播性伤害Aggregate excess 累计超额Aggregate limit 累计限额Agreed value 议定价值Aircraft insurance 飞机保险All-risk 一切险Alteration 改动American Association of Insurance Service 美国保险服务协会Annual transit policy 年度货物运输保单Annuity 年金Appraisal 估价、公估Arbitration 仲裁Assignment Clause 转让条款Assignment 转让Assumption of liability 承担责任Auto insurance plan 汽车保险计划Auto physical damage 汽车车身物质损失Auto 汽车Automatic premium loan provision 自动保费贷款条款Avoidance 规避BBailee customers policy 委托人顾客保单Bailee 受托人Bailor 寄托人Basic medical expense coverage 基本医疗费用保障Beachfront and windstorm plan 海滨地区和暴风雨计划Beneficiary designations 受益人指定条款Betterment 改良Bid bonds 投标保证Bill of lading 提单Blackout period 社会保障津贴暂停期Blanket insurance 总括保险Bobtail and deadhead coverage 短尾呆头保障Bodily injury 人身伤害Boiler and machinery coverage form 锅炉和机器保障格式Boiler and machinery insurance 锅炉和机器保险Boiler 锅炉Bonds 债券BOP special property coverage form 企业所有人保险单特别财产保障格式BOP standard property coverage form 企业所有人保险单标准财产保障格式Breach of contract 违约Broad theft coverage 扩展盗窃险Builders risk coverage form 建筑商风险保障格式Building and personal property coverage form(BPP) 建筑商和个人财产保障格式Building 建筑物Burglary and robbery optional coverage 盗窃和抢劫选择性保障Burglary 盗窃Business auto coverage form 商业汽车保障格式Business income (and extra expense) coverage age form 营业收入(包括额外费用)保障格式Business income (without extra expense) coverage form 营业收入(不包括额外费用)保障格式Business income changes- educational institutions endorsement 营业收入变化-教育机构批单Business income insurance 营业收入保险Business income premium adjustment endorsement 营业收入保单保费调整批单Business income 营业收入Business owners liability coverage form 企业所有人责任保障格式Business owners policy (BOP) 企业所有人保险单Business personal property 商用个人财产Business pursuits endorsement 商业事务批单CCalendar-year deductible 日历年度免赔额Camera and musical instrument dealer coverage form 照相机和乐器经销商保单格式Cancellation 撤销(保单)Capital appreciation 资本升值Car pools 汽车合用组织Cargo war risk policy 货物运输战争风险保单Cause of loss 损失原因Causes of loss forms 损失原因格式Causes of loss-basic form 损失原因-基本格式Causes of loss-broad form 损失原因-广义格式Causes of loss-earthquake form 损失原因-地震保单Causes of loss-special form 损失原因-特殊格式Civil law 民法Claim expenses 理赔费用Claims-made coverage trigger 提出索赔式触发机制Class beneficiary 集体受益人Class code 类别号Class rating 分级费率Coinsurance 共同保险(共保)Collapse 倒塌Collateral assignment 担保性转让Collision coverage 碰撞保障Collision damage waiver 碰撞损失弃权书Collision insurance 碰撞保险Collision 碰撞Combined single limit 综合单一限额Commercial automobile insurance 商业汽车保险Commercial crime insurance 商业犯罪保险Commercial general liability insurance 商业普通责任保险Commercial insurance 商业保险Commercial Lines Manual (CML) 商业保险手册Commercial package policy(CPP) 商业一揽子保险保单Commercial property conditions form 商业财产保险条件格式Commercial property conditions 商业财产保险承保条件Commercial property coverage form 商业财产保障格式Commercial property coverage part 商业财产保障部分Commercial property declaration page 商业财产保单声明页Commercial property insurance 商业财产保险Common carriers 一般承运人Common policy conditions 一般保单条件Common stock 普通股Comparative negligence law 比较过失法Compensatory damages 补偿性损害赔偿金Competitive state funds 竞争性州基金Completed operations liability exposure 完工责任风险Comprehensive coverage 综合保障Compulsory insurance law 强制保险法Computer fraud 计算机行窃Concealment 隐瞒Concurrent causation 并发损失Conditionally renewable条件可续保Condominium association coverage form 共有产权机构保单格式Condominium association insurance 共管住宅协会保险Condominium commercial unit-owners coverage form 共有产权商业单元所有人保单格式Condominium declaration 共管住宅声明书Condominium master policy 共管住宅业主保单Condominium units 共管住宅单位Condominium 共管住宅Consequential damage endorsement 后续损失批单Contingent beneficiary 或有受益人Continuing expenses 继续发生的费用Contract bonds 合同保证Contract carriers 合同承运人Contract 合同Contractors equipment floater 承运人设备运输保险Contractual liability 合同责任Contributory negligence law 共有过失法Contributory plan 分摊型计划Convertible 可转换Cooperative unit 共有单元Coordination-of-benefit provision 协调给付条款Corridor deductible 通道免赔额Cost-of-living rider 生活成本调整附加条款Court bond 法庭担保Coverage C increased special limits of liability 保障C提高特殊责任限额批单Coverage for damage to your auto (Max limit of liability) endorsement 车辆损失险(最大责任限额)批单Coverage for damage to your auto 车辆损失险Coverage for excess sound reproducing equipment, audio visual and data electronic equipment, and tapes, records, disks and other media endorsement 额外的声音复制设备,声频,视频及数据电子设备,磁带、录制品唱片以及其他媒介保险批单Coverage symbols 承保标志Credit card, fund transfer card, forgery and counterfeit money coverage endorsement 信用卡、转账卡、伪造品和伪币保险批单Credit card, fund transfer card, forgery and counterfeit money 信用卡、转账卡、伪造品和伪币Crime insurance 犯罪保险Criminal law 刑法Current assumption whole life insurance 当期假设终身寿险Current interest rate 当期利率Currently insured 目前被保险Custodian 管理人Customizing equipment coverage endorsement 定制设备保险批单DDamages 损害赔偿金Damages 损失Debris removal 损遗物清理Declaration 说明Decreasing term insurance 保额递减型定期寿险Deferred annuity 延期年金Defined benefit plan 规定收益计划Defined contribution plan 规定缴费计划Dental insurance 牙科保险Dependency period 依赖期Dependent property exposures 连带财产风险(间接营业中断风险)Destruction 毁坏DIC, difference in conditions policy 补足保险保单Difference in conditions (DIC) insurance 补足保险Difference in conditions (DIC) policy 补足保险保单Diminution in value 贬值Directors and officers liability policies 董事和经理人责任保险单Disability income insurance 伤残收入保险Disability insured 伤残被保险Disappear 消失Discovery period 发现期Dismemberment 失能Diversification 多元化Dividend options 红利支付选择权条款Drop down coverage 顺延责任保障Dwelling policy 住宅保单EEach occurrence limit 每一事件限额Earthquake endorsement 地震批单Education IRA 教育IRAElectronic data processing (EDP) equipment floater 电子数据处理设备运输流动保单Eligibility period 资格期Elimination period 免责期间Emergency program 紧急计划Employee benefits liability insurance 雇员福利责任保险Employee dishonesty optional coverage 雇员欺诈行为选择性保障Employee dishonesty 雇员不忠诚Employee 雇员Employers non ownership liability 非雇主所有的汽车责任Employment practices liability insurance 雇用行为责任保险Endorsement 批单Ensuing losses 继发损失Equipment dealers coverage form 设备经销商保单格式Errors and omissions liability policy 过错和遗漏责任保单Estate clearance fund 遗产清理基金Estate settlement 遗产分配Evidence of insurability 可保性证明Excess liability policies 超额责任保单Exclusive provider organization 专门供应者组织Expediting expenses 加速费用Experience rating plan 经验费率计划Exposure 风险,风险载体Extended business income 延长期营业收入Extended non-owned coverage for named individual endorsement 为记名被保险人扩展非自有车辆责任批单Extended period of indemnity 补偿的延长期期限Extended reporting period 延长报告期Extended term insurance 展期保险Exterior glass optional coverage 外部玻璃选择性保障Extortion 敲诈勒索Extra expense coverage form 额外费用保障格式Extra expenses 额外费用Extraterritorial provisions 治外法权条款FFAIR plans, beachfront and windstorm plans 公平保险需求计划(FAIR),海岸及风暴计划FAIR, Fair Access to Insurance Requirements Plans 公平保险需求计划Farm insurance policies 农场保险保单Farm insurance 农场保险Farmers personal liability endorsement 农场主个人责任批单Fatality rate 事故死亡率FDIC, federal deposit insurance corporation 联邦储蓄保险公司Federal surety bond 联邦保证保险FEMA 联邦紧急事务管理局Fiduciary bond 信托担保Fiduciary liability insurance 信托责任保险Film coverage form 影视保单Financial institution bonds 金融机构保证保险Financial planning 财务计划Financial responsibility 经济责任法Finish stock 制成品存货Fire damage limit 火损限额Fire department service charge 消防费用Fire department service charge 消防局服务费用Fire legal liability coverage 火宅法律责任保障First named insured 第一指定被保险人First party insurance 第一方保险First-party insurance 第一方汽车责任保险Fixed annuity 定额年金Fixed-amount option 固定给付金额方式Fixed-period option 固定给付期限方式Flat deductibles 统一免赔额Flexible-premium annuity 可变保费年金Flood insurance policies 洪水保险保单Floor plan coverage form 抵押物保单格式Forgery 伪造Freight 运费Friendly fire 善意之火Functional replacement cost 同功能重置成本GGarage business 汽车经营业务Garage coverage form 汽车服务商保单Garage keepers insurance 车辆照管人保险Garage policy 车库保险General aggregate limit 全部累计限额General average 共同海损General damages 一般损害赔偿金General provision 一般条款Glass coverage form 玻璃保险Glass or safety glazing material 玻璃或安全玻璃材料Grace period 宽限期Guaranteed cost policies 成本保证保单Guaranteed insurability 保证可保性Guaranteed renewable 保证可续保HHealth insurance, including Medicare 健康保险,包括政府医疗保障保险Health maintenance organization 健康维持组织Highly protected risks 高度保护风险HO- 6 unit-owners form HO-6 共同所有者格式HO-2 broad form HO-2 广义格式HO-4 contents broad form HO-4 室内物品扩展格式HO-8 modified coverage form HO-8修改的承保范围格式Hold harmless agreement 免除伤害协议Home business endorsement 家庭商业保险批单Home business insurance coverage endorsement 家庭商业保险保障批单Home day care coverage endorsement 家庭日托保险批单Homeowner policy 屋主保单Homeowners 3 special form 屋主保单3号特殊格式Hospital expense insurance 住院费用保险Hostile fire 恶意之火HPR insurance 高度保护风险保单Hull insurance 船舶保险Hull 船体Human loss exposure 人身损失风险(载体)IImmediate annuity 即期年金Implied permission 默认许可Improvements and betterments 提高和改良Incidental farming personal liability endorsement 附属性农场个人责任批单Incidental motorized land conveyance endorsement 偶用机动化陆地交通工具批单Incontestable clause 不可争条款Increased limit on personal property in other residence endorsement其他居所个人财产提高责任限额批单Independent contractor 独立订约人Inflation guard endorsement 抵消通货膨胀批单Inflation guard 通货膨胀保护Inland marine insurance 内陆运输保险Installation floater 安装流动保单Insurable interest 可保利益Insured contract 被保险合同Insured location 承保区域Insured status 被保险资格Intentional tort 故意侵权Interest option 利息给付方式Interest-sensitive life insurance 利率敏感型寿险Interior glass optional coverage 内部玻璃选择性保障Investing 投资Investment risk 投资风险Irrevocable beneficiary 不可变更受益人ISO, Insurance Service Office 保险服务局ISO’s homeowners policy program manual ISO屋主保单计划手册Jewelers block coverage form 珠宝保单格式Joint-and-survivor income option 共同生存收入方式JUAs 联合承保协会Judgment rating 判断定费发Judicial bond 司法保证KKeogh plan 基奥计划LLandlords’ furnishings 房东的家具Legal liability 法律责任Liability coverage 责任险Liberalization clause 自动承保条款License bond 执照担保Lien holder 留置权人Life income option 终身收入方式Life insurance amount 人寿保险限额Life insurance 人寿保险Limited Mexico coverage endorsement 有限制的墨西哥保险批单Limited payment life insurance 限期缴费终身寿险Limited theft coverage 有限盗窃险Line of business 业务范围Liquidity 流动性Liquor liability coverage form 酒类责任保单格式Litigation 起诉Livestock collision coverage endorsement 家畜碰撞险批单Long-term care insurance 长期护理保险Loss adjustment endorsement 损失调整批单Loss assessment coverage endorsement 损失追征金保险批单Loss assessment coverage 损失评估保障Loss assessment 损失追征金Loss conditions 损失条件Loss control 损失控制Loss cost 损失费用Loss exposure 损失风险Loss prevention 防损Loss reduction 减损Mail coverage form 邮件保单Maintenance bond 维修保证Maintenance of underlying insurance condition 维持基本保险条件Maintenance of underlying insurance condition 下层保单的维持条件Major medical insurance 大宗医疗费用保险Managed care plans 管理医疗计划Marine extension clauses 海上保险扩展保障条款Marine insurance 运输保险Market value 市场价值Master deed 业主证书Material fact 重要事实Material misrepresentation 重大不实告知Maximum period of indemnity 最长补偿期限Maximum probable loss (MPL) 最大可能损失Mechanical breakdown optional coverage 机械故障选择性保障Medicaid 政府医疗补助计划Medical expense limit 医疗费用限额Medical payment coverage 医疗费用赔偿险Medical payment insurance 医疗给付保险Medical payments to others 他人医疗费用保险Medicare 政府医疗保障计划Messenger 信使Mint condition 完好无损Miscellaneous real property coverage 混合不动产保障Miscellaneous type vehicle amendment(motor home)其他车辆修正批单(移动房车)Miscellaneous type vehicle endorsement 多种车辆保险Miscellaneous type vehicle endorsement 其他车辆保险批单Misrepresentation 不实告知Misrepresentation 误告Misstatement of age or sex 年龄或性别误报条款Mobile equipment 机动设备Mobile home endorsement 活动房屋批单Mobile home insurance 活动房屋保险Mobile home lienholder’s single interest 活动房屋留置权人单方面利益Monetary threshold 货币临界Money and securities optional coverage 货币和证券选择性保障Money purchase pension plan 保费基准制养老金计划Money 现金Monocline policy 单一保险保单Monopolistic state funds 垄断性州基金Monthly limit of indemnity 每月补偿限额Moral hazard 道德风险Motor carrier coverage form机动车承运人保单格式Motor truck cargo insurance 卡车货运保险Multistate revisions 多州修订本Mutual funds 共同基金NNamed insured 记名被保险人National Council on Compensation Insurance 美国劳工保险委员会National flood insurance program (NFIP) 全国洪水保险计划National flood insurance program, NFIP国家洪水保险计划National security Council 国家安全理事会Nationwide marine definition 全国范围运输定义Needs approach 需求法Net income 净收入Net worth 净财富Newly acquired auto 新置车辆No-fault automobile insurance 无过失汽车保险Non cancelable 不可撤销Non forfeiture options 不丧失价值选择权条款Nonfiled policies 非归档保单Noninsurance transfer 非保险风险转移Non-owned auto 非自有车辆Nonparticipating policies 非分红型保单Nonrenewable 拒绝续保OObject definitions endorsements 对象定义批单Object 对象Obligee 权利人Occurrence coverage trigger 事故发生式触发机制Occurrence limit 事故限额Occurrence 事件Ocean marine insurance 海洋运输保险Open cargo policy 预约货物运输保单Operation 经营Operations liability exposure 业务经营责任保险Ordinance or law coverage 法令或法律保险Ordinance or law 法令或法律Ordinance or law-increased amount of coverage endorsement 法令或法律—提高保险金额批单Ordinance or law-increased period of restoration endorsement 法令或法律增加的恢复期间批单Ordinary life insurance 普通寿险Ordinary payroll limitation or exclusion endorsement 普通工人工资限制或除外责任批单Other insurance 其他保险Other structure 其他建筑Other structure-increased limits endorsement 其他建筑—提高责任限额批单Other-than-collision loss 非碰撞损失Outdoor signs optional coverage 室外标志选择性保障Out-of-state coverage 州外保险Owner-operators 所有者-运营者Owners and contractors protective liability coverage 所有人和承包商保护性责任批单PPackage modification factors 一揽子保单修正系数Package policy 一揽子保险保单Paid-up additions 增额缴清保险Participating policies 分红型保单Particular average 单独海损Payment bond 支付保证Peak season limit of insurance endorsement 高峰季节保险金额批单Performance bond 履约保证Peril 风险事故Perils of the seas 海上危险Period of restoration 恢复期间Permanent partial disability永久部分残疾Permanent total disability 永久全残Permit bond 允许担保Permitted incidental occupancies-residence premises endorsement许可的附属性占有—住宅房产批单Permitted incidental occupancy endorsement 许可的附属性占用批单Personal and advertising injury limit 个人传播性伤害限额Personal articles floater 个人特定财产保险Personal articles floater 个人物品流动保险单Personal auto insurance 个人汽车保险Personal auto policy 个人汽车保单Personal effects floater 个人流动物品保单Personal injury endorsement 个人伤害批单Personal injury protection个人伤害保障Personal injury 个人伤害Personal insurance 个人保险Personal liability supplement 个人责任补充保险Personal loss exposure 个人损失风险,个人损失风险载体Personal property floater 个人财产流动保险单Personal property of others 他人个人财产Personal property replacement cost endorsement 个人财产重置成本批单Personal risk management 个人风险管理Personal umbrella liability insurance 个人伞式责任保险Physical coverage 车身损失险Physical damage coverage 物质损失险Physician’s visits insurance 医生诊费保险Physicians and surgeons equipments coverage form 医师用具保单格式Physicians professional liability policy 内科医生职业责任保单Pickup 小型运货车PIP endorsement 人身伤害保障批单Point-of-service plan 自选医疗服务机构计划Policy period 保单期Pollutant cleanup and removal 污染物清理和转移Pollution liability coverage form 污染责任保单格式Portability 可移植性Post judgment interest 判决后利息Power, heat, and refrigeration Endorsement 供电、加热及制冷费用批单Pre judgment interest 预断利息Pre-existing conditions 既存病况Preferred provider organization 优先供应者组织Preferred stock 优先股Premature death 早逝Premise liability exposure 营业场所责任风险Premises alarm or fire protection system endorsement 居所警报或防火系统批单Premium audit 费率审计Premium base 保费基础Preservation of property 财产保存Presumptive disability 推定伤残Principal 被保证人Principle Liability Coverage 基本责任保险Private carriers 私人承运人Private passenger auto 私人轿车Pro rata refund 比例返还Probate 遗嘱检验Products liability exposure 产品责任风险Products-completed operations aggregate limit 产品及完工累计限额Professional liability policies 职业责任保险单Professional liability 职业责任Profit sharing plan 利润分享计划Proof of loss 损失证明Property damage 财产损坏Property exposed to loss 受险财产Property loss exposure 财产损失风险Property other than money and securities 现金和有价证券外的其他财产Property removed increased limit 提高移走财产责任限额Property removed 移走的财产Protection and indemnity (R&I) insurance 保赔保险Protection and indemnity insurance 保护和赔偿金保险Punitive damages 惩罚性损害赔偿金RRate 费率Rater 费率厘定人Rating factors 费率因素Rating 费率制定Readjustment period 重整期Real estate investment trusts(REITs)不动产投资信托Real estate 不动产Reasonable repairs 合理的修理Reduced paid-up insurance 减额缴清保险Reentry 再投保Regular program 常规计划Reinstatement clause 复效条款Reinsurance facilities 再保险机构Released value bill of lading 豁免价值提单Renewable 可续保Replacement auto 重置车辆Replacement cost 重置成本Residence employee 住所雇员Residence premises 住宅房产Residence premises-three or four family dwelling endorsement 住宅房产——由三个或四个家庭使用的住宅保险批单Residual disability 后续伤残收入减少给付Residual market 剩余市场Retention 自留Retroactive date 回溯日Retrospective rating plan 追溯费率计划Revocable beneficiary 可变更受益人Rider 附加条款Risk management 风险管理Robbery 抢劫Roth IRA 税后个人退休账户SSafe burglary 保险箱入室行窃Safe driver rating plan 驾驶者安全行驶费率计划Salvage 救助费用Saving Incentive Match Plan for Employees SIMPLE计划(匹配雇员储蓄机动计划)Saving 储蓄Scheduled article 表定财产Scheduled personal property endorsement 列举式个人财产保险批单Seasonal increase provision 季节性增加条款Securities 有价证券Self-insured retention (SIR) 自保自留Self-insured retention 自保自留额SEP,simplified employee pension 简化的雇员养老金Separate account 分离账户Settlement options 赔付方式选择Severability of insurance 保险的可分性Shared market 共享市场Signs coverage form 标记物保单格式Single liability limit endorsement 单一责任限额批单Small boat policy 小型船只保单Small business boiler and machinery forms 小企业锅炉和机器保障格式Snowmobile endorsement 机动雪橇批单Social Security 社会保障Soft cost coverage 软费用保障Special computer coverage endorsement 计算机特别保险批单Special coverage 特别保障Special damages 特殊损害赔偿金Special flood hazard areas 特别洪水风险地区Special personal property coverage endorsement 特别个人财产保险批单Specialty insurers 专营保险人Specific beneficiary 特定受益人Specific excess 特定超额Specific insurance 特定保险Specific rating 特定费率Specified causes of loss coverage 特定原因损失保障Specified causes of loss 特殊风险事故Split limit 分项限额Stacking 重叠Standard Coverage Homeowners Program 标准屋主保险计划Statute 法规Stop gap coverage 停止差异保障Stop-loss insurance 止损保险Stop-loss provision 止损条款Straight bill of lading 记名提单Straight life insurance 连续缴费终身寿险Strict liability 严格责任Strikes, riots, and civil commotion (SP&CC) endorsement 罢工暴动批单Structured settlement 结构赔付Structures rented to other endorsement 租与他人的建筑批单Subrogation 代位求偿Sue and labor clause 施救费用条款Suicide clause 自杀条款Supplementary payments 额外给付Surety bonds 保证保险Surety 保证人Surgical expense insurance 外科手术费用保险Surviving spouse 遗嘱Survivor benefits 生存者津贴Suspension of insurance 保险暂停TTax-deferred retirement plans 延税退休计划Tax-sheltered annuities 避税年金Temporary partial disability 短期部分残疾Temporary substitute vehicle 暂时性替代用车Temporary total disability 短期全残Term insurance 定期寿险Theatrical property coverage form 舞台演出用具保单格式Theft 偷窃Third party insurance 第三方保险Thrift plan(or savings plan)节约计划(或储蓄计划)Time policy 定期保单Tort reform 侵权法改革Tort 侵权Total disability 全残Totally disabled 完全伤残,全残Towing and labor costs coverage endorsement 拖车及人工费保险批单Towing and labor costs coverage 拖车及人工费保险Towing coverage 拖车保障Traditional Individual Retirement Account 传统个人退休账户(IRA)Trailer interchange agreement 拖车互换协议Trailer interchange coverage 拖车互换保障Trailer 拖车Trailer/camper body coverage(maximum limit of liability)endorsement 拖车/野营挂车保险(最大责任限额)批单Transportation 交通Transportation/permission to move 运输、获准移动Trees, shrubs and other plans 树木、灌丛和其他植物Trip transit policy 单程运输保单UUmbrella and excess liability policies 伞式和超额责任保险Umbrella liability policies 伞式责任保单Umbrella policies 伞式保单Underground storage tank policy 地下贮罐保单Underinsured motorist coverage endorsement 投保不足驾驶者保险批单Underinsured motorist coverage 不足额保险驾驶人保障Underlying insurance 基本保险Underwriting loss 承保损失Underwriting 核保Unearned premium 未赚保费Unemployment compensation programs 失业补偿计划Uninsured motor vehicles 未投保机动车辆Uninsured boater coverage 未投保驾船者保险Uninsured motorists coverage 未保险驾驶人保障Uninsured motorists laws 未保险驾驶人法United states long shore and harbor worker’s compensation act (LHWCA) 美国海岸及港口劳工补偿法案United states Long shore and Harbor Workers’ Compensation Act 美国海岸和港口劳工补偿法案Unit-owner coverage A 共同拥有者保障A批单Unit-owner coverage C 共同拥有者保障C批单Unit-owner rental to others 房屋租与他人共同拥有者Universal life insurance 万能寿险Unoccupied 无人居住的Unsatisfied judgment fund 未偿判决基金Usual,reasonable,and customary charges 通常、合理并符合惯例(URC)的费用Utility services-time element endorsement 公共能源和用水服务-时间因素批单VVacant 空闲的Valuable papers and records coverage form 重要文件和档案保单Value reporting form 价值报告格式Van 面包车Variable annuity 变额年金Variable life insurance 变额寿险Variable universal life insurance 变额万能寿险Verbal threshold 文字临界Vesting 受领权Vicarious liability 代理人责任V oid contract 无效合同V oluntary compensation endorsement 自愿补偿批单V oyage policy 航程保险单WWaiver of premium 保费豁免Warehouse to warehouse clause 仓至仓条款Watch person 看守人Water back and sumo overflow endorsement 污水倒流及排水泵溢出批单Watercraft endorsement 船只批单Watercraft insurance 船只保险Workers compensation and employers liability insurance 劳工补偿和雇主责任保险Workers compensation and employers liability 劳工补偿和雇主责任Workers compensation laws 劳工补偿法Workers compensation statutes 劳工补偿法Workers compensation劳工补偿Worksheet计算表Write-your-own program自承保计划YYearly renewable term insurance年可续定期寿险Your covered auto 你的被保车辆ZZone rated vehicles 地域定价汽车。

健全社会保障体系英语A comprehensive social security system is crucial for ensuring the well-being and security of individuals within a society. This system aims to provide economic protection and support to individuals and families throughout their lifetimes, especially during times of need such as illness, disability, unemployment, and old age.A robust social security system typically includes various programs and initiatives that provide financial assistance, healthcare coverage, and other forms of social support. Examples of key components of a comprehensive social security system may include:1. Social insurance programs: These programs typically provide workers and their families with benefits in the event of work-related injuries, illness, unemployment, or retirement. Examples include workers' compensation, unemployment insurance, and old-age pension schemes.2. Healthcare coverage: Access to affordable healthcare is an essential aspect of social security. Publicly funded or subsidized healthcare systems can ensure that individuals have access to necessary medical treatments and services.3. Disability benefits: Social security systems may provide financial assistance and support services to individuals with disabilities, ensuring their inclusion and participation in society.4. Family benefits: Social security systems may include benefitsand support for individuals and families, such as child allowances, maternity and paternity leave, and family care benefits.5. Social assistance programs: These programs provide temporary or long-term assistance to individuals and families facing financial hardships, including income support, housing assistance, and food assistance.6. Long-term care support: As populations age, social security systems may include long-term care support for elderly or disabled individuals, such as home care services or nursing home care.7. Active labor market policies: In addition to providing financial support, social security systems may also include measures aimed at promoting employment and job creation, such as training programs, job placement services, and subsidies for employers.A well-functioning and comprehensive social security system helps to promote social cohesion, reduce inequality, and ensure a basic standard of living for all members of society. It provides a safety net for individuals and families, protecting them from economic and social risks and allowing them to fully participate in society.。