A MODEL OF CAPITAL AND CRISES

- 格式:pdf

- 大小:354.93 KB

- 文档页数:45

∙[1] 邵燕著.虚拟经济与中国资本市场的发展[M]. 中国市场出版社, 2006∙[2] (德)卡尔·马克思(KarlMarx)原著,曾令先,卞彬,金永编译.资本论[M]. 人民日报出版社, 2006 ∙[3] 严明编著.虚拟经济[M]. 新华出版社, 2005∙[4] 洪银兴,葛扬,秦兴方编著.《资本论》的现代解析[M]. 经济科学出版社, 2005∙[5] (德)马克思,(德)恩格斯著,中共中央马克思、恩格斯、列宁、斯大林著作编译局编译.马克思恩格斯全集[M]. 人民出版社, 2004∙[6] 史言信,郭华平著.虚拟经济与企业经营[M]. 经济管理出版社, 2004∙[7] 陈信主编.《资本论》学习与研究[M]. 东北财经大学出版社, 2004∙[8] 洪远朋主编.经济理论比较研究[M]. 复旦大学出版社, 2002∙[9] 付强著.虚拟经济论[M]. 中国财政经济出版社, 2002∙[10] 李飞等主编,叶世昌著.中国金融通史[M]. 中国金融出版社, 2002Springer期刊数据库共找到 1 条∙[1] Bertrand Renaud. The 1985 to 1994 Global Real Estate Cycle: An Overview[J] ,1997更多外文题录数据库共找到103 条∙[1] Veblen,T.The Place of Science in Modern Civilization. .∙[2] Global Economic Prospects. . 2006∙[3] Global Financial Stability Reports. . 2006∙[4] Goetzmann,William N. K.GeertRouwenhorst: Global Real Estate Markets: Cycles and Fundamentals. NBER Working Paper 7566 . 2000∙[5] Goldsmith,Raymond parative National Balance Sheets, A Study of Twenty Cou ntries, 1688-1978. . 1985∙[6] Gordon,Barry.Political Economy in Parliament, 1819-1823. . 1976∙[7] Dekle, Robert,Kenneth M Kletzer.Domestic Bank Regulation and Financial Crises: The ory and Empirical Evidence from East Asia. NBER Working Paper 8322 . 2001∙[8] Dike,Charles Wentworth.Memoir of Charles Wentworth Dike. The Papers of a Critic S elected from the Writings of the Late Charles Wentworth Dike .∙[9] Donald,W Moffat.Economics Dictionary. . 1976外文题录数据库共找到 3 条∙[1] Wang,Eric C.A Dynamic Two-sector Model for Analyzing the Interrelation between Fin ancial Development and Industrial Growth. International Review of Economics and Finance . 2000∙[2] Patrick,H. T.Financial Development and Economic Growth in Underdeveloped Countrie s. Economic Development and Cultural Change . 1966∙[3] Levine,Ross & Zervos,Sara.Stock markets, banks, and economic growth. The World B ank Policy Research Working Paper . 1996∙[1] Amaral,P,E Quintin.A Competitive Model of the Informal sector. Journal of Monetary E conomics . 2006∙[2] Jagdish Handa,Shubha Rahman Khan.Financial Development and Economic Growth:a Symbiotic Relationship. Applied Fi-nancial Economics . 2008∙[3] Greenwood Jeremy,Boyan Jovanovic.Financial development,growth and the distribution of Income. Journal of Political Economy, The . 1990∙[4] Bencivenga VR,Smith BD.Financial Intermediation and Endogenous Growth. The Revie w of Economic Studies . 1991∙[5] King R G,Levine R.Finance and Growth: Schumpeter Might Be Right. The Quarterly J ournal of Economics . 1993∙[6] Levine R.Bank-based or Market-based Financial Systems:Which is Better?. The Journ al of Finance . 2002∙[7] Banerjee, A.,and A. Newman."Occupational Choice and the Process of Development".Journal of Politics . 1993∙[8] Khan,A.Financial Development and EconomicGrowth. Macroeconomic Dynamics . 2001∙[1] Modigliani,F.The monetary mechanism and its interaction with real phenomena. Revie w of Economics and Statistic . 1963∙[2] Mayer,Colin,The Assessment:Money and Banking:Theory and Evidence. Oxford Revie w of Education .∙[3] Modigliani,F,Miller,M.The Cost of Capital, Corporation Finance and the Theory of Inve stment. The American Economic Review .∙[4] Patinki、Don.Money, Interest, and Prices. .∙[5] Tobin J.Monetary Policies and the Economy:The Transmission Mechanism. Southern Economic Journal .∙[6] Angus Deaton,Christina Paxson. INTERTEMPORAL CHOICE AND INEQUALITY . 199 3∙[7] Arpan Sengupta.Banks, Capital Markets and Uncertainty:Consequences for Economic Growth. . 2004∙[8] Xiaowei Li.Money, Finance, and Economic Development. .∙[9] Campbell, JY,Mankiw, NG.Permanent income, current income, and consumption. Journ al of Business . 1990∙[10] Modigliani F.The monetary mechanism and its interaction with real phenomena. Revi ew of Economics and Statistic . 1963∙[1] MENG Qing-xuan1,2 (1Department of Management Science and Engineering, Stanford University, CA 94305, USA) (2College of Economics, Zhejiang University, Hangzhou 310 027, China). Optimal restructuring strategies under various dynamic factors[J]. Journal of Zhejiang University(Science A:An International Applied Physics & Engineering Journal). 20 07(06)∙[2] 韩铭珊,孟庆轩. 保险企业涉足基金管理业相关问题研究[J]. 保险研究. 2007(04) 中国图书全文数据库共找到 1 条∙[1] (美)成中英著.从中西互释中挺立[M]. 中国人民大学出版社, 2005Springer期刊数据库共找到 1 条∙[1] Qing-xuan Meng. Optimal restructuring strategies under various dynamic factors[J] ,2007外文题录数据库共找到 5 条∙[1] Howard,R.Decision analysis. . 2006∙[2] Jin,Y.Firm value and hedging:evidence from U.S.oil and gasproducers. The Journal of Finance . 2006∙[3] Krugman,P.International economics. . 1996∙[4] Meng, Qingxuan,Li, Mingzhi.NewEconomy and ICT development in China. Information Economics and Policy . 2002∙[5] Sassen Saskia.The Global City: New York, London, Tokyo. . 2001∙[1] Christos Pantzalis,Jung Chul Park,Ninon Sutton.Corruption and Valuation of Multination al Corporations. Journal of Em-pirical Finance . 2008∙[2] Steven Ongena,,Maria Fabiana Penas.Bond holders‘Wealth Ef-fects in Domestic and Cr oss-border Bank Mergers. Journal of Financial Stability . 2009∙[3] Sirower,Mark,L.The Synergy Trap:How Companies Lose the Acquisition Game?. . 199 7∙[4] Teece,DJ.Internal organization and economic performance: an empirical analysis of the profitability of principal firms. J Ind Econ . 1981∙[5] Li Stan Xiao,Greenwood R.The Effect of Within-industry Diversification on Firm Perfor mance:Synergy Creation,Multi-market Contact and Market Structuration. Strategic Manage ment Journal . 2004∙[6] Kevin J Stiroh,Adrienne Rumble.The dark side of diversification: The case of US finan cial holding companies. Journal of Banking and Finance . 2006∙[7] Coase RH.The nature of the firm. Economica . 1937∙[8] Stein,Jeremy C.Internal capital markets and the competition for corporate resources. T he Journal of Finance . 1997∙[9] Khanna T,Palepu K.Is Group Affiliation Profitable in Emerging Markets: An Analysis of Diversified Indian Business Groups?. The Journal of Finance . 2000∙[10] Ansoff HI.Corporate Strategy: An Analytic Approach to Business Policy for Growth a nd Expansion. . 1965∙[1] 李扬,王国刚主编.资本市场导论[M]. 经济管理出版社, 1998∙[2] (美)罗伯特·劳伦斯·库恩(RobertLawrenceKuhn)著,李申等译.投资银行学[M]. 北京师范大学出版社, 1996∙[3] (美)夏普(Sharpe,WilliamF.)著,霍小虎等译.证券投资理论与资本市场[M]. 中国经济出版社, 1 992∙[4] (美)布兰查德(Blanchard,OlivierJean),(美)费希尔(Fischer,Stanley)著,刘树成等译.宏观经济学[M]. 经济科学出版社, 1992∙[5] (美)布坎南(Buchanan,J.M.)著,平新乔,莫扶民译.自由、市场与国家[M]. 三联书店上海分店, 1 989∙[6] (美)R.I.麦金农(RonaldI.Mckinnon)著,卢骢译.经济发展中的货币与资本[M]. 三联书店上海分店, 1988外文题录数据库共找到10 条∙[1] AllenN Berger,RichardJ.Herring,GiorgioP .Szego.TheRoleofCapitalInFinancialInstitutions.JournalofBanking&Fi nance . 1995∙[2] Allen,Franklin.StockMarketsandResourceAllocation. CapitalMarketsandFinan cialIntermedi ation . 1993∙[3] Anderson,RobertE,SimeonDjankov,GerhardPohl.RestructuringofLargeIndustrialFirmsinCent ralandEasternEurope,1992 - 94. . 1995∙[4] BaffinsLane,Chichester.BankandBadDebts. . 1995∙[5] ColinMayer,XavierVives.CapitalMarketsandFinancialIntermediation. . 1993∙[6] Harries,M,A Raviv.TheoryofCapitalStructure. JournalofFinance . 1991∙[7] JohnH .Welch.CapitalMarketintheDevelopmentProcess. . 1993∙[8] OrenSussman."InvestmentandBanking" :SomeInternationalComparisons. OxfordReviewof EconomicPolicy .∙[9] Stiglitz,J.E.CreditMarketsandtheControlofCapital. JournalofMoneyCreditandBanking . 198 5∙[10] Alchian,Armen.CorporateManagementandpropertyRights. EconomicPolicyandtheRegulati onofCorporateSecurities . 1969∙[1] /wiki/Virtual_economy .∙[2] / .∙[3] Portes,A.Social capital:Its origins and applications in modern sociology. Annual Review of Sociology . 1998∙[4] Prigogine,I.,Nicolis,G.Self-Organization in Non Equilibrium Systems. Dissipative Structur es to Order through Fluctuations . 1977∙[5] Herbert Simon.Administrative Behavior:A Study of Decision-Making Processes in Admi nistrative Organization. . 1976∙[1] Field J A.Anewinterpretation of the onset of the great depression. The Journal of Eco nomic History . 1984∙[2] Palley T.The demand for money and non-GDP transactions. Economics Letters . 199 5∙[3] Binswanger M.The finance process on a macroeconomic level froma flow perspective:a newinterpretation of hoarding. International Reviewof Financial Analysis . 1997∙[4] Patrick H T.Financial development and economic growth in undeveloped countries. Ec onomic Development and Cultural Change . 1966∙[5] Chang,Tsangyao."Financial Development and economic Growth in Mainland China: a note on testing demand–following or supply-leading hypothesis". Applied Economics Lett er . 2002∙[1] S .J.Turnovsky.MethodsofMacroeconomicDynamics. . 1996∙[2] T .J.Sargent.DynamicMacroeconomicTheory. . 1987∙[3] R .J.Barro.InflationandGrowth. FederalReserveBankofSt.LouisReview . 1996∙[4] J.Tobin.MoneyandEconomicGrowth. Econometrica . 1965∙[5] C .E .Walsh.MonetaryTheoryandPolicy. . 1998∙[6] W .Stanners.InflationandGrowth. CambridgeJournalofEconomics . 1996∙[7] T .C .Mills.TheEconometricModellingofFinancialTimeSeries. . 1999∙[8] O .J.Blanchard,D .Quah.TheDynamicEffectsofAggregateDemandandAggregateSupplyDist urbances. AmericanEconomicReview . 1989∙[9] T .Y .Chang.FinancialDevelopmentandEconomicGrowthinMainlandChina:aNoteonTesting DemandFollowingorSupplyLeadingHypothesis. AppliedEconomicLetters . 2002∙[10] R .J.Hodrick,E .C .Prescott.PostWarU .S.BusinessCycles:anEmpiricalInvestigation. . 1980∙[1] McKinnon,R,Pill,H."Credit Liberalizations and International Capital Flows:The Over Borr owing Syndrome.". Financial Reguiation and Integration in East Asia . 1996∙[2] McKinnon,R,Pill,H."The Over Borrowing Syndrome:Are East Asian Economies Different?". Managing Capital Flows and Exchange Rates,Perspectives from the Pacific Basin . 1998∙[3] Krugman,P."Bubble,Boom,Crash:Theoretical Notes on Asia‘s Crisis.". . 1998∙[4] Diamond,D,Dybvig,P."Bank Runs,Deposit Insurance,and Liquidity.". Journal of Politics .1983∙[5] Cooper,R."Living with Global Imbalances:A Contrarian View.". Journal of Policy Modeli ng . 2006∙[6] Gruen,D,Harris,J."Might the United States Continue to Run Large Current Account Def icits?". conference on Strategies for East Asia Growth and Openness . 2005∙[7] Truman,E."Budget and External Deficits:Not Twins but the Same Family.". the FRB A nnual Research Conference . 2005∙[8] Litterman,R,Weiss,L."Money,Real Interest Rates and Output:Reinterpretation of Postwar U.S.Data.". Econometrica . 1985∙[9] Minsky,H."The Financial Instability Hypothesis:Capitalist Process and the Behavior of t he Economy.". Financial Crises:Theory,History and Policy . 1982∙[10] Brunner,K,Meltzer,H."Friedman‘s Monetary Theory.". Journal of Politics . 1972∙[1] (美)彼得·德鲁克(PeterF.Drucker)著,闾佳译.管理前沿[M]. 机械工业出版社, 2006∙[2] 尚金峰著.开放条件下的金融监管[M]. 中国商业出版社, 2006∙[3] 白钦先主编,朱孟楠著.金融监管的国际协调与合作[M]. 中国金融出版社, 2003∙[4] 王爱俭著.金融创新与虚拟经济[M]. 中国金融出版社, 2003∙[5] 陈共,昌忠泽著.美国财政政策的政治经济分析[M]. 中国财政经济出版社, 2002∙[6] (法)弗朗索瓦·沙奈等著.金融全球化[M]. 中央编译出版社, 2001∙[7] (法)弗朗索瓦·沙奈(FrancoisChesnais)著,齐建华译.资本全球化[M]. 中央编译出版社, 2001 ∙[8] (美)W.E.哈拉尔(WilliamE.Halal)著,冯韵文等译.新资本主义[M]. 社会科学文献出版社, 1999 ∙[9] 刘骏民著.从虚拟资本到虚拟经济[M]. 山东人民出版社, 1998∙[10] (美)乔治·洛奇(GeorgeC.Lodge)著,胡延泓译.全球化的管理[M]. 上海译文出版社, 1998 更多外文题录数据库共找到135 条∙[1] Barry Bluestone."Deindustrialization and Unemployment in American". Deindustrializatio n and Plant Closure .∙[2] Chang Tsangyao."Financial Development and Economic Growth in Mainland China:a Note on Testing Demand Following or Supply Leading Hypothsis.". Applied Economic Let ters . 2002∙[3] Cowie, J,Heathcott, J,Bluestone, B."Beyond the Ruins:The Meanings of Deindustrializa tion.". . 2003∙[4] Gerald A. Epstein.Financialization and the World Economy. . 2006∙[5] Joshua Karliner,Ted Lewis."World Socia Forum Conference on Transnational Corporati on". Corpwatch and Global Exchange . 2002∙[6] Krugman,Paul."Domestic Distortions and the Deindustrialization Hypothesis.". NBER W orking Paper 5473 . 1996∙[7] Krugman,Paul."Domestic Distortions and the Deindustrialization Hypothesis.". NBER W orking Paper 5473 . 1996∙[8] Matsumoto,Gentaro."Deindustrialization in the UK:A Comparative Analysis with Japan".International Review of Applied Economics . 1996∙[9] Ronald I Mackinnon."Government Deficits and the Deindustrialization of America". the Economists’’ voice . 2004∙[10] Fligstein,N.The Architecture of Markets:An Economic Sociology of Twenty-First Capita list Societies. . 2001∙[1] 杨琳著.金融发展与实体经济增长[M]. 中国金融出版社, 2002∙[2] (法)弗朗索瓦·沙奈等著.金融全球化[M]. 中央编译出版社, 2001∙[3] 徐滇庆等著.泡沫经济与金融危机[M]. 中国人民大学出版社, 2000∙[4] (德)于尔根·艾希贝格尔(JurgenEichberger),(澳)伊恩·哈珀(IanR.Harper)著,刘锡良等译.金融经济学[M]. 西南财经大学出版社, 2000∙[5] 刘骏民著.从虚拟资本到虚拟经济[M]. 山东人民出版社, 1998∙[6] [德]希法亭(Hilferding,Rudolf) 著,福民等译.金融资本[M]. 商务印书馆, 1994∙[7] (奥)庞巴维克,E.V.著,何〓,高德超译.资本与利息[M]. 商务印书馆, 1959更多外文题录数据库共找到49 条∙[1] Carter Michael.Financial Innovation and Financial Fragility. Journal of Economic Issues . 1989∙[2] Goldstein Don.Uncertainty, Competition, and Speculative Finance in the Eighties. Jour nal of Economic Issues . 1995∙[3] M.Binswanger.Stock Market Booms and Real Economic Activity: Is This Time Differen t?. International Review of Economics and Finance . 2000∙[4] Victoria Chick.The Evolution of the Banking System and the Theory of Monetary Polic y. Monetary Theory and Monetary Policy, New Tracks for the 1990s . 1993∙[5] James Tobin.On the Efficiency of Noise Trading in Securities Markets. Lloyds Bank R eview . 1984∙[6] .∙[7] I.Sachs.From Poverty Trap to Inclusive Development in LDCs. Economic and Political Weekly . 2004∙[8] J.Crochane.Financial Markets and Real Economy. Foundations and Trends in Finance . 2005∙[9] J.Crochane.Financial Markets and Real Economy. Financial Markets and Real Econo my . 2006∙[10] Tor Jacobson,Jesper Lindé,Kasper Roszbach.Exploring Interactions between Real Act ivity and the Financial Stance. Journal of Financial Stability . 2005∙[1] Wallerstein,I.Unthinking Social Science:The Limits of Nineteenth-century Paradigms. .2001∙[2] Prigogine,I.The networked society. Journal of World-Systems Research . 2000∙[3] Ahn,Hyeon-Hyo.Speculation in the financial system as adissipative structure. Seoul Jo urnal of Economics . 1998∙[4] M.I.Wallerstein.World-Systems Analysis:AnIntroduction. . 2004∙[5] G.Nicolis,I.Prigogine.Self-Orgnization in Non-Equilibrium Systerm. . 1985∙[6] Anderson, P. W,Arrow, K. J,and Pines, D.The economy as an evolving complex syste m. . 1988∙[1] 伍超明. 虚拟经济与实体经济关系研究——基于货币循环流模型的分析[J]. 财经研究. 2004(08)∙[2] 成思危. 虚拟经济与金融危机[J]. 管理科学学报. 1999(01)中国图书全文数据库共找到 2 条∙[1] 刘骏民著.从虚拟资本到虚拟经济[M]. 山东人民出版社, 1998∙[2] (奥)庞巴维克,E.V.著,何〓,高德超译.资本与利息[M]. 商务印书馆, 1959外文题录数据库共找到8 条∙[1] C.Green.Flow of Funds:Implications for Research onFinancial Sector Development and the Real Economy. Journalof International Development . 2003∙[2] G.Caporalea,N.Spagnolob.Asset Prices and OutputGrowth Volatility:the Effects of Finan cial Crises. Economics Letters . 2003∙[3] Binswanger M.Stock Market Booms and Real Economic Activity: Is This Time Differen t. International Review of Economics and Finance . 2000∙[4] Goldstein Don.Uncertainty, Competition, and Speculative Finance in the Eighties.. Jour nal of Economic Issues . 1995∙[5] Tobin J.On the Efficiency of the Financial System. Lloyds Bank Review . 1984∙[6] Crotty, James R,Don Goldstein.Do US financial markets allocate credit efficiently? The case of corporate restructuring in the 1980s. Transforming the US Financial System. Eq uity and Efficiency for the 21st Century . 1993∙[7] Guttmann,R.How Credit-Money Shapes the Economy. . 1994∙[8] Carter."Financial innovation and Fi--nancial Fragility". Journal of Economic Issues . 1989∙[1] (法)弗朗索瓦·沙奈等著.金融全球化[M]. 中央编译出版社, 2001外文题录数据库共找到7 条∙[1] I Sachs.From Poverty Trap to Inclusive Development inLDCs. Economic and Political Weekly . 2004∙[2] J Crochane.Financial Markets and Real Economy. Foundations and Trends in Finance . 2005∙[3] Tor Jacobson,Jesper Lindé,Kasper Roszbach.ExploringInteractions between Real Activit y and the Financial Stance. Journal of Financial Stability . 2005∙[4] Michael Hudson.The Fictitious Economy:An Interviewwith Dr.Michael Hudson. http://ww /q=content/fictitious-economy-part-2-interview-dr-michael-hudson-0 .2008∙[5] Andros Gregoriou,John Hunter,Feng Wu.An EmpiricalInvestigation of the Relationship between the Real Economy andStock Returns for the United States. Journal of Policy M odeling . 2009∙[6] G Krippner.The financialisation of the American economy. Socio-Economic Review . 2 005∙[7] Crochane J."Financial Markets and Real Economy.". Financial Markets and Real Econ omy . 2006∙[1] Fotios Pasiouras.Estimating the Technical and Scale Effi-ciency of Greek Commercial Banks:The Impact of Credit Risk,Off-balance Sheet Activities,and International Operations.Research in International Business and Finance . 2008∙[2] Lo Shih fang,Lu Wen min.An Integrated Performance E-valuation of Financial Holding Companies in Taiwan. Euro-pean Journal of Operational Research . 2009∙[3] Casu B,,Girardone rge Banks’’’’’’’’Efficiency in the Sin-gle European Market. The Service Industries Journal . 2004∙[4] HE Feng,CHEN Rong.The comparative analysis of home-electrical company‘s R&D and technical efficiency between China and Japan. Waseda Business Review . 2006∙[5] Hu Wen-Chuan,Lai Mei-Chi,Huang Hao-Chen.Rating the relative efficiency of financial holding compa-nies in an emerging economy:A multiple DEA approach. Expert Systems With Applications . 2009∙[6] Yung-Ho Chiu,Yu-Chuan Chen.The analysis of Taiwanese bank efficiency:Incorporating∙[1] (日)青木昌彦,(日)奥野正宽编著,魏加宁等译.经济体制的比较制度分析[M]. 中国发展出版社, 1999更多外文题录数据库共找到15 条∙[1] Andy Loekett,,Mike Wright.The Syndication of Venture Capital investments. The intern ational Journal of Management Sci-nece . 2001∙[2] Carpenter,M.A.,J.Seo.Strategic refocusing as a pathway to controlling CEO pay. Curre nt Topics in Management . 2007∙[3] Colin Mayer.Financing the New Economy:financial institutions and corporate governance. Information Economics and Po-lice . 2002∙[4] Aghion P,Bloom N,Blundell R,et petition and Innovation: An Inverted U Relation ship. Quarterly Journal . 2005∙[5] Gerschenkron Alexander.Economic Backwardness in Historical Perspective. . 1962∙[6] Khanna T,Palepu K.Is Group Affiliation Profitable in Emerging Markets: An Analysis of Diversified Indian Business Groups?. The Journal of Finance . 2000∙[7] Leonard-Barton D.Core capabilities and core rigidities: a paradox in managing new pr oduct development. Strategic Management Journal . 1992∙[8] Prahalad CK,Hamel G.The core competence for the corporation. Harvard Business . 1 990∙[9] Penrose ET.The theory of the growth of the firm. . 1959∙[10] Subba Narasimha PN.Strategy in turbulent environments:the role of dynamic compet ence. Chinese Journal of Geophysics . 2001。

193This paper provides a model of the interactionbetween risk-management practices and market liquidity. Our main finding is that a feedback effect can arise. Tighter risk management leads to market illiquidity, and this illiquidity further tightens risk management.Risk management plays a central role in insti-tutional investors’ allocation of capital to trad-ing. For instance, a risk manager may limit a trading desk’s one-day 99 percent value at risk (VaR) to $1 million. This means that the trad-ing desk must choose a position such that, over the following day, its value drops no more than $1 million with 99 percent probability. Risk management helps control an institution’s use of capital while limiting default risk, and helps mitigate agency problems. Phillipe Jorion (2000, xxiii) states that VaR “is now increasingly used to allocate capital across traders, business units, products, and even to the whole institution.”We do not focus on the benefits of risk man-agement within an institution adopting such con-trols, but, rather, on the aggregate effects of such practices on liquidity and asset prices. An institu-tion may benefit from tightening its risk manage-ment and restricting its security position, but as a consequence it cannot provide as much liquidity to others. We show that, if everyone uses a tight risk management, then market liquidity is low-ered in that it takes longer to find a buyer with unused risk-bearing capacity, and, since liquidity is priced, prices fall.Search-and-Matching Financial MarketS †Liquidity and Risk ManagementBy Nicolae Gˆa rleanu and Lasse Heje Pedersen*Not only does risk management affect liquid-ity; liquidity can also affect risk-management practices. For instance, the Bank for International Settlements (2001, 15) states, “For the internal risk management, a number of institutions are exploring the use of liquidity adjusted-VaR, in which the holding periods in the risk assessment are adjusted to account for market liquidity, in particular by the length of time required to unwind positions.” For instance, if liquidation is expected to take two days, a two-day VaR might be used instead of a one-day VaR. Since a secu-rity’s risk over two days is greater than over one day, this means a trader must choose a smaller position to satisfy his liquidity-adjusted value at risk (LVaR) constraint. One motivation for this constraint is that, if an institution needs to sell, its maximum loss before the completion of the sale is limited by the LVaR.The main result of the paper is that subjecting traders to an LVaR gives rise to a multiplier effect. Tighter risk management leads to more restricted positions, hence longer expected selling times, implying higher risk over the expected selling period, which further tightens the risk manage-ment, and so on. This feedback between liquidity and risk management can help explain why liquid-ity can suddenly drop. We show that this “snow-balling” illiquidity can arise if volatility rises, or if more agents face reduced risk-bearing capac-ity—for instance, because of investor redemp-tions, losses, or increased risk aversion.Our link between liquidity and risk manage-ment is a testable prediction. While no formal empirical evidence is available, to our knowl-edge, our prediction is consistent with anecdotal evidence on financial market crises. For exam-ple, in August 1998 several traders lost money due to a default of Russian bonds and, simulta-neously, market volatility increased. As a result, the (L)VaR of many investment banks and other institutions increased. To bring risk back in line, many investment banks reportedly asked traders to reduce positions, leading to falling prices and†Discussants: Dimitri Vayanos, London School of Economics; Neil Wallace, Pennsylvania State University; Manuel Amador, Stanford University.* Gˆa rleanu: Wharton School, University of Pennsylva-nia, 3620 Locust Walk, Philadelphia, PA 19104-6367, and National Bureau of Economic Research, and Centre for Economic Policy Research (e-mail: garleanu@); Pedersen: Stern School of Business, New York University, 44 West Fourth Street, Suite 9-190, New York, NY 10012-1126, NBER, and CEPR (e-mail: lpederse@). We are grateful for helpful conversations with Franklin Allen, Dimitri Vayanos, and Jeff Wurgler.MAY 2007 194AEA PAPERS AND PROCEEDINGSlower liquidity. These market moves exacerbated the risk-management problems, fueling the crisis in a similar manner to the one modeled here. We capture these effects by extending the search model for financial securities of Darrell Duffie, Gârleanu, and Pedersen (2005, forthcom-ing, henceforth DGP). This framework of time-consuming search is well suited for modeling liquidity-based risk management as it provides a natural framework for studying endogenous sell-ing times. While DGP relied on exogenous posi-tion limits, we endogenize positions based on a risk-management constraint, and consider both a simple and a liquidity-adjusted VaR. Hence, we solve the fixed-point problem of jointly calculat-ing endogenous positions given the risk-manage-ment constraint and computing the equilibrium (L)VaR given the endogenous positions that deter-mine selling times and price volatility. Pierre-Olivier Weill (forthcoming) considers another extension of DGP in which market maker liquid-ity provision is limited by capital constraints. Our multiplier effect is similar to that of Markus K. Brunnermeier and Pedersen (2006) who show that liquidity and traders’ margin requirements can be mutually reinforcing.I. ModelThe economy has two securities: a “liquid” security with risk-free return r (i.e., a “money-market account”), and a risky illiquid security. The risky security has a dividend-rate process X and a price P(X), which is determined in equi-librium. The dividend rate is Lévy with finite variance. It has a constant drift normalized to zero, E t (X(t1T) − X(t)) 5 0, and a volatility s X . 0, i.e.,(1) var t (X(t1T) − X(t)) 5s2X T.Examples include Brownian motions, (com-pound) Poisson processes, and sums of these. The economy is populated by a continuum of agents who are risk neutral and infinitely lived, have a time-preference rate equal to the risk-free interest rate r. 0, and must keep their wealth bounded from below. Each agent is characterized by an intrinsic type i [ {h, l}, which is a Markov chain, independent across agents, and switching from l(“low”) to h (“high”) with intensity l u, and back with intensity l d. An agent of type i holding u t shares of the asset incurs a holding cost of d. 0 per share and per unit of time if he violates his risk-management constraint(2) v ar t (u t[P(X t1t) 2P(X t)]) # (s i)2, where s i is the risk-bearing capacity, defined by s h5s¯ . 0 and s l5 0. The low risk-bearing capacity of the low-type agents can be inter-preted as a need for more stable earnings, hedg-ing reasons to reduce a position, high financing costs, or a need for cash (e.g., an asset manager whose investors redeem capital).1We use this constraint as a parsimonious way of capturing risk constraints, such as the very popular VaR constraint,2which are used by most financial institutions. Our results are robust in that they rely on two natural proper-ties of the measure of risk: the risk measure increases with the size of the security position, and the length of the time period t over which the risk is assessed. While the constraint is not endogenized in the model, we note that its wide use in the financial world is probably due to agency problems, default risk, and the need to allocate scarce capital.We consider two types of risk management: (a) “simple risk management,” in which the vari-ance of the position in (2) is computed over a fixed time horizon t; and (b) “liquidity-adjusted risk management,” in which the variance is computed over the time required for selling the asset to an unconstrained buyer, which will be a random equilibrium quantity.Because agents are risk neutral and we are interested in a steady-state equilibrium, we restrict attention to equilibria in which, at any given time and state of the world, an agent holds either 0 or u¯ units of the asset, where u¯ is the largest1 An interesting extension of our model would consider the direct benefit of tighter risk management, which could be captured by a lower l d.2 A VaR constraint stipulates that Pr(−u[P(Xt1t) 2 P(X t )] $VaR) #p for some risk limit VaR and some con-fidence level p. If X is a Brownian motion, this is the same as (2). We note that rather than considering only price risk, we could alternatively consider the risk of the gains process(i.e., including dividend risk) G t,t5P(X(t1t)) − P(X(t))1 e t X(s) ds. This yields qualitatively similar results (and quantitatively similar for many reasonable parameters since dividend risk is orders of magnitude smaller than price risk over a small time period).TVOL. 97 NO. 2195LIquIDITY AND RISk MANAGEMENTposition that satisfies (2) with s i5s¯, taking the prices and search times as given.3 Hence, the set of agent types is T5 {ho, hn, lo, ln}, with the letters “h” and “l” designating the agent’s current intrinsic risk-bearing state as high or low, respec-tively, and with “o” or “n” indicating whether the agent currently owns u¯ shares or none, respec-tively. We let m z(t) denote the fraction at time t of agents of type z[T . These fractions add up to 1 and markets must clear:(3) 1 5m ho1m hn1m lo1m ln ,(4) Q 5 u¯(m ho1m lo),where Q . 0 is the total supply of shares per investor.Central to our analysis is the notion that the risky security is not perfectly liquid, in the sense that an agent can trade it only when she finds a counterparty. Every agent finds a potential counterparty, selected randomly from the set of all agents, with intensity l, where l . 0 is an exogenous parameter characterizing the mar-ket liquidity for the asset. Hence, the intensity of finding a type-z investor is lm z, that is, the search intensity multiplied by the fraction of investors of that type. When two agents meet, they bargain over the price, with the seller hav-ing bargaining power q[ [0, 1].This model of illiquidity directly captures the search that characterizes over-the-counter (OTC) markets. In these markets, traders must find an appropriate counterparty, which can be time consuming. Trading delays also arise due to time spent gathering information, reach-ing trading decisions, mobilizing capital, etc. Hence, trading delays are commonplace, and, therefore, the model can also capture features of other markets such as specialist and electronic limit-order-book markets, although these mar-kets are, of course, distinct from OTC markets.II. Equilibrium Risk Management, Liquidity, and PricesWe now proceed to derive the steady-state equilibrium agent fractions m, the maximum-3 Note that the existence of such an equilibrium requires that the risk limit s¯ not be too small relative to the total sup-ply Q, a condition that we assume throughout.holding u¯, and the price P. Naturally, low-type owners lo want to sell and high-type non-owners hn want to buy, which leads to(5) 05 22lm hn(t)m lo(t) 2l u m lo(t) 1l d m ho(t) and three more such steady-state equations. Equation (5) states that the change in the fraction of lo agents has three components, correspond-ing to the three terms on the right-hand-side of the equation. First, whenever a lo agent meets a hn investor, he sells his asset and is no longer a lo agent. Second, whenever the intrinsic type of a lo agent switches to high, he becomes a ho agent. Third, ho agents can switch type and become lo. Duffie, Gârleanu, and Pedersen (2005) show that, taking u¯ as fixed, there is a unique stable steady-state mass distribution as long as u¯$ Q. Here, agents’ positions u¯ are endogenous and depend on m, so that we must calculate a fixed point. Agents take the steady-state distribution m as fixed when they derive their optimal strategies and utilities for remaining lifetime consumption, as well as the bargained price P. The utility of an agent depends on his current type z(t) [T (i.e., whether he is a high or a low type and whether he owns zero or u¯ shares), the current dividend X(t), and the wealth W(t) in his bank account: (6) V z1X(t), W t25W t1 11z[{ho, lo}2u¯ X(t)/r1u¯ v z, where the type-dependent utility coefficients v z are to be determined. With q the bargaining power of the seller, bilateral Nash bargaining yields the price(7) P u¯ 5 (V lo2V ln) (1 2q) 1 (V ho2V hn) q. We conjecture, and later confirm, that the equi-librium asset price per share is of the form (8) P(X(t)) 5 X(t)/r 1p,for a constant p to be determined. The value-function coefficients v z and p are given by a set of Hamilton-Jacobi-Bellman equations, stated and solved in the Appendix available at www.e-aer. org/data/may07/p07048_app.pdf. The Appendix contains all the proofs.PROPOSITION 1: If the risk-limit s¯ is suffi-ciently large, there exists an equilibrium withMAY 2007196AEA PAPERS AND PROCEEDINGS holdings 0 and u¯ that satisfy the risk manage-ment constraint (2) with equality for low- and high-type agents, respectively. With simple risk management, the equilibrium is unique and (9)u¯With liquidity-adjusted risk management, u¯ depends on the equilibrium fraction of potential buyers m hn and satisfies(10) u¯In both cases, the equilibrium price is given by (11) P (X t )where the fractions of agents m depend on the type of risk management .These results are intuitive. The “position limit” u ¯ increases in the risk limit s ¯ and decreases in the asset volatility and in the square root of the VaR period length, which is t under simple risk management and (2lm hn )21 under liquid-ity-adjusted risk management. In the latter case, position limits increase in the search intensity and in the fraction of eligible buyers m hn .The price equals the present value of divi-dends, X t /r , minus a discount for illiquidity.Naturally, the liquidity discount is larger if there are more low-type owners in equilibrium (m lo is larger) and fewer high-type nonowners ready to buy (m hn is smaller).Of the equilibria with liquidity-adjusted risk management, we concentrate on the ones that arestable, in the sense that increasing u¯ marginally would result in equilibrium quantities violating the VaR constraint (2). Conversely, an equilib-rium is unstable if a marginal change in hold-ings that violates the constraint would result inthe equilibrium adjusting so that the constraint is not violated. If an equilibrium exists, then a stable equilibrium exists. Indeed, the equilib-rium with the largest u¯ is stable and has the high-est welfare among all equilibria.The main result of the paper characterizes the equilibrium connection between liquidity and risk management.PROPOSITION 2: Suppose that s ¯ is large enough for the existence of an equilibrium. Consider a stable equilibrium with liquidity-adjusted risk management and let t 5 1/(2lm hn ), which means that the equilibrium allocations and price are the same with simple risk man-agement. Consider any combination of the conditions (a) higher dividend volatility s X , (b) lower risk limit s ¯, (c) lower meeting intensity l , (d) lower switching intensity l u to the high risk-bearing state, and (e) higher switching intensity l d to the low risk-bearing state. Then, (i) theequilibrium position u¯ decreases, (ii) expected search times for selling increase, and (iii) prices decrease. All three effects are larger with liquid-ity-adjusted risk management .To see the intuition for these results, consider the impact of a higher dividend volatility. This makes the risk-management constraint tighter, inducing agents to reduce their positions and spreading securities among more agents, thus leaving a smaller fraction of agents with unused risk-bearing capacity. Hence, sellers’ search time increases and their bargaining position worsens, leading to lower prices. This price drop is due to illiquidity, as agents are risk neutral.4With liquidity-adjusted risk management, the increased search time for sellers means that the risk over the expected liquidation period rises, thus further tightening the risk-management constraint, reducing positions, increasing search times, and so on.This multiplier also increases the sensitiv-ity of the economy with liquidity-adjusted risk management to the other shocks (b)–(e). Indeed, a lower risk limit (b) is equivalent to a higher4In a Walrasian market with immediate trade, the priceis the present value of dividends X/r when (Q/ u¯ ) , l u / (l u 1 l d ), a condition that is satisfied in our examplesbelow. (When Q / u ¯ . l u /(l u 1 l d ), the Walrasian price is(X 2d ) /r .)VOL. 97 NO. 2197LIquIDITY AND RISk MANAGEMENTdividend risk. The “liquidity shocks” (c)–(e) donot affect the equilibrium position u¯ with simple risk management, but they do increase the sell-ers’ search times and reduce prices. With liquid-ity-adjusted risk management, these liquidity shocks reduce security positions, too, because of increased search times and, as explained above, a multiplier effect arises.The multiplier arising from the feedback between trading liquidity and risk manage-ment clearly magnifies the effects of changes in the economic environment on liquidity and prices. Our steady-state model illustrates this point using comparative static analyses that essentially compare across economies. Similar results would arise in the time series of a single economy if there were random variation in the model characteristic, e.g., parameters switched in a Markov chain as in Duffie, Gârleanu, and Pedersen (forthcoming). In the context of such time-series variation, our multiplier effect can generate the abrupt changes in prices and selling times that characterize crises.We illustrate our model with a numerical example in which l 5 100, r 5 0.1, X 0 5 1, l d 5 0.2, l u 5 2, d 5 3, q 5 0.5, Q 5 1, and s ¯ 5 1. Figure 1 shows how prices (right panel) and sellers’ expected search times (left panel) depend on asset volatility. The solid line shows this for liquidity-adjusted risk management and the dashed line for simple risk managementwith t 5 0.0086, which is chosen so that the risk management schemes are identical for s X 5 0.3. Search times increase and prices decrease with volatility. These sensitivities are stron-ger (i.e., the curves are steeper) with liquidity-adjusted risk management due to the interaction between market liquidity (i.e., search times) and risk management.REFERENCESBrunnermeier, Markus K., and Lasse Heje Pedersen. 2006. “Market Liquidity and Fund-ing Liquidity.” Unpublished.Duffie, Darrell, Nicolae Gârleanu, and Lasse Heje Pedersen. 2005. “Over-the-Counter Markets.”Econometrica , 73(6): 1815–47.Duffie, Darrell, Nicolae Gârleanu, and Lasse Heje Pedersen. Forthcoming. “Valuation in Over-the-Counter Markets.” Review of Financial Studies .Bank for International Settlements. 2001. “Final Report of the Multidisciplinary Working Group on Enhanced Disclosure.” /publ/joint01.htm.Jorion, Phillipe. 2000. Value at Risk . New York: McGraw-Hill.Weill, Pierre-Olivier. Forthcoming. “Leaning against the Wind.” Review of Economic Studies .Figure 1Note: The effects of dividend volatility on equilibrium seller search times (left panel) and prices (right panel) with simple (dashed line) and liquidity-adjusted (solid line) risk management, respectively.%JWJEFOE WPMBUJMJUZ S 9-JRVJEJUZ 7B34JNQMF 7B3&Y Q F D U F E T B M F U J N F T Z F B S T1S J D F-JRVJEJUZ 7B34JNQMF 7B3%JWJEFOE WPMBUJMJUZ S 9。

摘要大卫·哈维空间理论研究——基于当代资本主义经济危机批判资本增殖的逻辑支配着资本主义社会的发展,在资本扩张的过程中,资本主义遭遇过一次又一次的危机,但是却能够一次又一次地从危机之中挣脱出来并持续存在和发展,这就说明资本主义拥有一套能够修复自身危机的独特方法,这种方法就是资本主义的“时间—空间”修复策略。

哈维指出,资本主义的生产方式必然会导致资本过度积累引发经济危机,危机以多种空间表现形式呈现在人们眼前,而资本主义的空间生产机制利用时空修复策略不断消化和吸收过度积累的资本,从而缓解资本主义经济危机,这就是当代资本主义能够不断经历危机并长久发展的秘密所在。

但是,资本主义的空间生产机制只是暂时性地缓解和修复了资本主义的困境,并不能够从根本上避免和消除资本主义的危机问题,而且,这种时空修复策略在缓解危机的过程中会产生一系列的负面影响,给资本主义带来空间正义的缺失。

因此,如何看待并评价空间生产对资本主义发展的意义和作用,就成为当代西方学者关注的一个重要话题,大卫·哈维就在这个思想转型的背景之下展开对空间问题的探索和研究。

他在马克思历史唯物主义的基础上融合空间的维度,站在历史—地理唯物主义的视角上,用自己的空间理论对当代资本主义社会展开分析和批判。

基于此,哈维整体上把握住资本主义经济、政治和文化的症结所在,从现实的批判和理想的规划两个层面探索资本主义的替代性方案,以实现辩证乌托邦,从而达到希望的空间。

本文以空间理论为逻辑主线,通过分析当代资本主义经济危机的空间表现形式,解释当代资本主义的空间生产机制,将哈维的空间理论和政治与社会理论贯穿起来并做出系统的梳理,旨在利用大卫·哈维的空间理论探讨如何理解当代资本主义经济危机,并深入分析哈维对资本主义政治、经济和文化等方面的批判。

第一章主要阐述了马克思主义传统的资本主义经济危机理论,也就是哈维理论建构的时代背景和理论渊源。

第二章分析了当代资本主义经济危机的空间表现形式,资本主义在不断追求利润最大化时造成了不平衡地理发展以及后现代的文化、城市和生态转变。

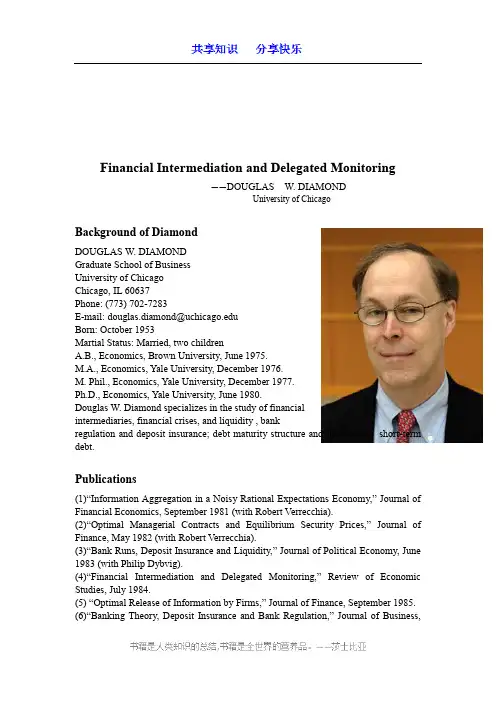

Financial Intermediation and Delegated Monitoring——DOUGLAS W. DIAMONDUniversity of ChicagoBackground of DiamondDOUGLAS W. DIAMONDGraduate School of BusinessUniversity of ChicagoChicago, IL 60637Phone: (773) 702-7283E-mail: douglas.diamond@Born: October 1953Martial Status: Married, two childrenA.B., Economics, Brown University, June 1975.M.A., Economics, Yale University, December 1976.M. Phil., Economics, Yale University, December 1977.Ph.D., Economics, Yale University, June 1980.Douglas W. Diamond specializes in the study of financialintermediaries, financial crises, and liquidity , bankregulation and deposit insurance; debt maturity structure and the role of short-term debt.Publications(1)“Information Aggregation in a Noisy Rational Expectations Economy,” Journal of Financial Economics, September 1981 (with Robert Verrecchia).(2)“Optimal Managerial Contracts and Equilibrium Security Prices,” Journal of Finance, May 1982 (with Robert Verrecchia).(3)“Bank Runs, Deposit Insurance and Liquidity,” Journal of Political Economy, June 1983 (with Philip Dybvig).(4)“Financial Intermediation and Delegated Monitoring,” Review of Economic Studies, July 1984.(5) “Optimal Release of Information by Firms,” Journal of Finance, September 1985.(6)“Banking Theory, Deposit Insurance and Bank Regulation,” Journal of Business,January 1986 (with Philip Dybvig).(7)“Debt Maturity Structure and Liquidity Risk,” Quarterly Journal of Economics, August 1991.(8)“Monitoring and Reputation: The Choice Between Bank Loans and Directly Placed Debt,”Journal of Political Economy, August 1991.(9)“Disclosure, Liquidity and the Cost of Capital,” Journal of Finance, September 1991. (withRobert Verrecchia).(10) “Bank Loan Maturity and Priority When Borrowers Can Refinance,” in Capital Markets and Financial Intermediation, Colin Mayer and Xavier Vives (editors), Cambridge University Press, 1993.(11)“Seniority and Maturity of Debt Contracts,” Journal of Financial Econ omics, June 1993.(12)“Corporate Capital Structure: The Control Roles of Bank and Public Debt, with Taxes and Costly Bankruptcy,” Economic Quarterly of the Federal Reserve Bank of Richmond, Spring 1994.(13)“Financial Intermediation as Delegated Monitoring, a Simple Example,” Economic Quarterlyof the Federal Reserve Bank of Richmond, Summer 1996.(14) “Liquidity, Banks, and Markets,” Journal of Political Economy, October 1997.(15)“Liquidity risk, liquidity creation and financial fragility: A theory of banking,” Journal of Political Economy 109 (April 2001). (with Raghuram Rajan).(16) “Banks, Short Term Debt and Financial Crises: Theory, Policy Implications and Applications,” March 2000, Carnegie Rochester Conference on Public Policy, 54 (Summer 2001). (with Raghuram Rajan).(17) “Banks and Liquidity,” American Economic Review, Papers and Proceedings, (May 2001). (with Raghuram Rajan).(18)“Liquidity Shortages and Banking Crises,” April 2005, Journal of Finance. (with Raghuram Rajan).(19)“Money in a Theory of Banking,” American Economic Review, March 2006. (with Raghuram Rajan).(20)“Delegated Monitoring and Legal Protection,” working paper, University of Chicago GSB, June 2005, revised October 2006.(21)“Banks and Liquidity Creation: A Simple Exposition of the Diamond-Dybvig Model,” Economic Quarterly of the Federal Reserve Bank of Richmond ,Spring 2007 V ol. 93 No. 2.(22)“Banks, Runs and Liquidity Creation,” working paper, University of Chicago GSB, January 2007, revised August 2007.(23)“Illiquidity and Interest Rate Policy,” working paper, University of Chicago, GSB, September 2008. (with Raghuram Rajan).Financial Intermediation◆Gurley & Shaw : Money in a Theory of Finance◆Leland & Pyle : Information asymmetries,financial structure,and financial intermediation◆Diamond:Financial Intermediation and Delegated Monitoring◆Merton : Financial Innovations Spiral◆Allen & Santomero : Managerial self-interest, The non-linearity of taxes, The cost of financial distress, The existence of capital market imperfectionOUTLINEThis paper develops a theory of financial intermediation based on minimizing the cost of monitoring information which is useful for resolving incentive problems between borrowers and lenders. It presents a characterization of the cost of providing incentives for delegated monitoring by a financial intermediary.Diversification within an intermediary serves to reduce these costs, even in a risk neutral economy. The paper presents some more general analysis of the effect of diversification on resolving incentive problems. In the environment assumed in the model, debt contracts with costly bankruptcy are shown to be optimal. The analysis has implications for the portfolio structure and capital structure of intermediaries.1.INTRODUCTION2.A SIMPLE MODEL OF FIRM BORROWING3.DELEGATED MONITORING BY A FINANCIAL INTERMEDIARY4.RISK A VERSION AND DIVERSIFICATIONPARISON WITH LELAND-PYLE (1977) RESULTS6.CONCLUSIONSection 2 and 3Risk Neutral and Wealth Constraint现代金融中介理论基于功能分析范式其基石:交易成本理论和委托代理理论Section 4Risk Aversion and No Wealth Constraint&Section 5Comparison with Leland-Pyle resultsA SIMPLE MODEL OF FIRM BORROWING Basic model :When no intermediaries],0[~y y ∈假设:1.只考虑一期,所有经济主体均为风险中性。

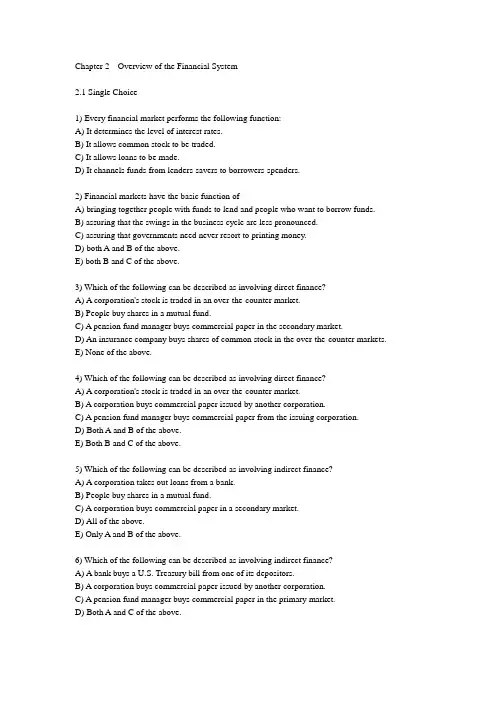

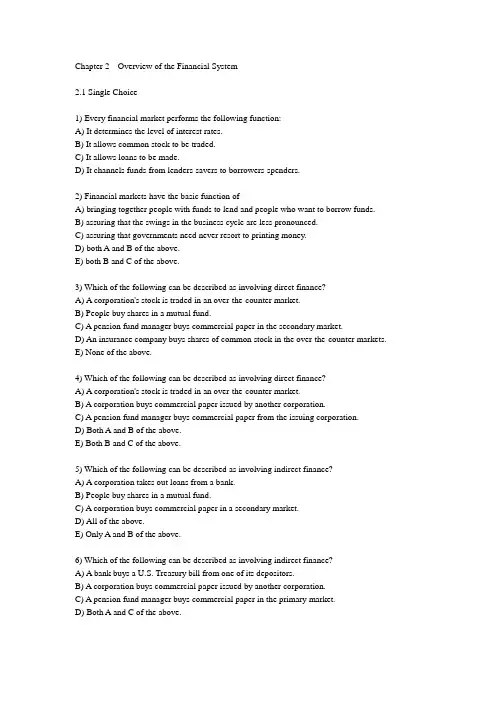

Chapter 2 Overview of the Financial System2.1 Single Choice1) Every financial market performs the following function:A) It determines the level of interest rates.B) It allows common stock to be traded.C) It allows loans to be made.D) It channels funds from lenders-savers to borrowers-spenders.2) Financial markets have the basic function ofA) bringing together people with funds to lend and people who want to borrow funds.B) assuring that the swings in the business cycle are less pronounced.C) assuring that governments need never resort to printing money.D) both A and B of the above.E) both B and C of the above.3) Which of the following can be described as involving direct finance?A) A corporation's stock is traded in an over-the-counter market.B) People buy shares in a mutual fund.C) A pension fund manager buys commercial paper in the secondary market.D) An insurance company buys shares of common stock in the over-the-counter markets.E) None of the above.4) Which of the following can be described as involving direct finance?A) A corporation's stock is traded in an over-the-counter market.B) A corporation buys commercial paper issued by another corporation.C) A pension fund manager buys commercial paper from the issuing corporation.D) Both A and B of the above.E) Both B and C of the above.5) Which of the following can be described as involving indirect finance?A) A corporation takes out loans from a bank.B) People buy shares in a mutual fund.C) A corporation buys commercial paper in a secondary market.D) All of the above.E) Only A and B of the above.6) Which of the following can be described as involving indirect finance?A) A bank buys a U.S. Treasury bill from one of its depositors.B) A corporation buys commercial paper issued by another corporation.C) A pension fund manager buys commercial paper in the primary market.D) Both A and C of the above.7) Financial markets improve economic welfare becauseA) they allow funds to move from those without productive investment opportunities to those who have such opportunities.B) they allow consumers to time their purchases better.C) they weed out inefficient firms.D) they do all of the above.E) they do A and B of the above.8) A country whose financial markets function poorly is likely toA) efficiently allocate its capital resources.B) enjoy high productivity.C) experience economic hardship and financial crises.D) increase its standard of living.9) Which of the following are securities?A) A certificate of depositB) A share of Texaco common stockC) A Treasury billD) All of the aboveE) Only A and B of the above10) Which of the following statements about the characteristics of debt and equity are true?A) They both can be long-term financial instruments.B) They both involve a claim on the issuer's income.C) They both enable a corporation to raise funds.D) All of the above.E) Only A and B of the above.11) The money market is the market in which _________ are traded.A) new issues of securitiesB) previously issued securitiesC) short-term debt instrumentsD) long-term debt and equity instruments12) Long-term debt and equity instruments are traded in the _________ market.A) primaryB) secondaryC) capitalD) money13) Which of the following are primary markets?A) The New York Stock ExchangeB) The U.S. government bond marketC) The over-the-counter stock marketD) The options marketsE) None of the above14) Which of the following are secondary markets?A) The New York Stock ExchangeB) The U.S. government bond marketC) The over-the-counter stock marketD) The options marketsE) All of the above15) A corporation acquires new funds only when its securities are sold in theA) secondary market by an investment bank.B) primary market by an investment bank.C) secondary market by a stock exchange broker.D) secondary market by a commercial bank.16) Intermediaries who are agents of investors and match buyers with sellers of securities are calledA) investment bankers.B) traders.C) brokers.D) dealers.E) none of the above.17) Intermediaries who link buyers and sellers by buying and selling securities at stated prices are calledA) investment bankers.B) traders.C) brokers.D) dealers.E) none of the above.18) An important financial institution that assists in the initial sale of securities in the primary market is theA) investment bank.B) commercial bank.C) stock exchange.D) brokerage house.19) Which of the following statements about financial markets and securities are true?A) Most common stocks are traded over-the-counter, although the largest corporations have their shares traded at organized stock exchanges such as the New York Stock Exchange.B) A corporation acquires new funds only when its securities are sold in the primary market.C) Money market securities are usually more widely traded than longer-term securities and so tendto be more liquid.D) All of the above are true.E) Only A and B of the above are true.20) Which of the following statements about financial markets and securities are true?A) A bond is a long-term security that promises to make periodic payments called dividends to the firm's residual claimants.B) A debt instrument is intermediate term if its maturity is less than one year.C) A debt instrument is long term if its maturity is ten years or longer.D) The maturity of a debt instrument is the time (term) that has elapsed since it was issued.21) Which of the following statements about financial markets and securities are true?A) Few common stocks are traded over-the-counter, although the over-the-counter markets have grown in recent years.B) A corporation acquires new funds only when its securities are sold in the primary market.C) Capital market securities are usually more widely traded than longer term securities and so tend to be more liquid.D) All of the above are true.E) Only A and B of the above are true.22) Which of the following markets is sometimes organized as an over-the-counter market?A) The stock marketB) The bond marketC) The foreign exchange marketD) The federal funds marketE) all of the above23) Bonds that are sold in a foreign country and are denominated in that country's currency are known asA) foreign bonds.B) Eurobonds.C) Eurocurrencies.D) Eurodollars.24) Bonds that are sold in a foreign country and are denominated in a currency other than that of the country in which they are sold are known asA) foreign bonds.B) Eurobonds.C) Eurocurrencies.D) Eurodollars.25) Financial intermediariesA) exist because there are substantial information and transaction costs in the economy.B) improve the lot of the small saver.C) are involved in the process of indirect finance.D) do all of the above.E) do only A and B of the above.26) The main sources of financing for businesses, in order of importance, areA) financial intermediaries, issuing bonds, issuing stocks.B) issuing bonds, issuing stocks, financial intermediaries.C) issuing stocks, issuing bonds, financial intermediaries.D) issuing stocks, financial intermediaries, issuing bonds.27) The presence of transaction costs in financial markets explains, in part, whyA) financial intermediaries and indirect finance play such an important role in financial markets.B) equity and bond financing play such an important role in financial markets.C) corporations get more funds through equity financing than they get from financial intermediaries.D) direct financing is more important than indirect financing as a source of funds.28) Financial intermediaries can substantially reduce transaction costs per dollar of transactions because their large size allows them to take advantage ofA) poorly informed consumers.B) standardization.C) economies of scale.D) their market power.29) The purpose of diversification is toA) reduce the volatility of a portfolio's return.B) raise the volatility of a portfolio's return.C) reduce the average return on a portfolio.D) raise the average return on a portfolio.30) An investor who puts all her funds into one asset _________ her portfolio's _________.A) increases; diversificationB) decreases; diversificationC) increases; average returnD) decreases; average return31) Through risk-sharing activities, a financial intermediary _________ its own risk and _________ the risks of its customers.A) reduces; increasesB) increases; reducesC) reduces; reducesD) increases; increases32) The presence of _________ in financial markets leads to adverse selection and moral hazardproblems that interfere with the efficient functioning of financial markets.A) noncollateralized riskB) free-ridingC) asymmetric informationD) costly state verification33) When the lender and the borrower have different amounts of information regarding a transaction, _________ is said to exist.A) asymmetric informationB) adverse selectionC) moral hazardD) fraud34) When the potential borrowers who are the most likely to default are the ones most actively seeking a loan, _________ is said to exist.A) asymmetric informationB) adverse selectionC) moral hazardD) fraud35) When the borrower engages in activities that make it less likely that the loan will be repaid, _________ is said to exist.A) asymmetric informationB) adverse selectionC) moral hazardD) fraud36) The concept of adverse selection helps to explainA) which firms are more likely to obtain funds from banks and other financial intermediaries, rather than from the securities markets.B) why indirect finance is more important than direct finance as a source of business finance.C) why direct finance is more important than indirect finance as a source of business finance.D) only A and B of the above.E) only A and C of the above.37) Adverse selection is a problem associated with equity and debt contracts arising fromA) the lender's relative lack of information about the borrower's potential returns and risks of his investment activities.B) the lender's inability to legally require sufficient collateral to cover a 100 percent loss if the borrower defaults.C) the borrower's lack of incentive to seek a loan for highly risky investments.D) none of the above.38) When the least desirable credit risks are the ones most likely to seek loans, lenders are subjectto theA) moral hazard problem.B) adverse selection problem.C) shirking problem.D) free-rider problem.E) principal-agent problem.39) Financial institutions expect thatA) moral hazard will occur, as the least desirable credit risks will be the ones most likely to seek out loans.B) opportunistic behavior will occur, as the least desirable credit risks will be the ones most likely to seek out loans.C) borrowers will commit moral hazard by taking on too much risk, and this is what drives financial institutions to take steps to limit moral hazard.D) none of the above will occur.40) Successful financial intermediaries have higher earnings on their investments because they are better equipped than individuals to screen out good from bad risks, thereby reducing losses due toA) moral hazard.B) adverse selection.C) bad luck.D) financial panics.41) In financial markets, lenders typically have inferior information about potential returns and risks associated with any investment project. This difference in information is calledA) comparative informational disadvantage.B) asymmetric information.C) variant information.D) caveat venditor.42) The largest depository institution at the end of 2004 wasA) life insurance companies.B) pension funds.C) state retirement funds.D) none of the above.43) Which of the following financial intermediaries are depository institutions?A) A savings and loan associationB) A commercial bankC) A credit unionD) All of the aboveE) Only A and C of the above44) Which of the following is a contractual savings institution?A) A life insurance companyB) A credit unionC) A savings and loan associationD) A mutual fund45) Which of the following are not investment intermediaries?A) A life insurance companyB) A pension fundC) A mutual fundD) Only A and B of the above46) Which of the following are investment intermediaries?A) Finance companiesB) Mutual fundsC) Pension fundsD) All of the aboveE) Only A and B of the above47) The government regulates financial markets for three main reasons:A) to ensure soundness of the financial system, to improve control of monetary policy, and to increase the information available to investors.B) to improve control of monetary policy, to ensure that financial intermediaries earn a normal rate of return, and to increase the information available to investors.C) to ensure that financial intermediaries do not earn more than the normal rate of return, to ensure soundness of the financial system, and to improve control of monetary policy.D) to ensure soundness of financial intermediaries, to increase the information available to investors, and to prevent financial intermediaries from earning less than the normal rate of return.48) Which of the following government regulations has the chief purpose of improving control of the money supply?A) deposit insuranceB) restrictions on entry into banking or insuranceC) reserve requirementsD) restrictions on the assets financial intermediaries can hold49) Asymmetric information can lead to widespread collapse of financial intermediaries, referred to as aA) bank holiday.B) financial panic.C) financial disintermediation.D) financial collapse.50) Foreign currencies that are deposited in banks outside the home country are known asA) foreign bonds.B) Eurobond.C) Eurocurrencies.D) Eurodollars.51) U.S. dollars deposited in foreign banks outside the United States or in foreign branches of U.S. are referred to asA) Eurodollars.B) Eurocurrencies.C) Eurobonds.D) foreign bonds.52) Banks providing depositors with checking accounts that enable them to pay their bills easily is known asA) liquidity services.B) asset transformation.C) risk sharing.D) transaction costs.53) A ________ is when one party in a financial contract has incentives to act in its own interest rather than in the interests of the other party.A) moral hazardB) riskC) conflict of interestD) financial panic54) Fire and casualty insurance companies are what type of intermediary?A) Contractual savings institutionB) Depository institutionsC) Investment intermediariesD) None of the above55) The country whose banks are the most restricted in the range of assets they may hold isA) Japan.B) Canada.C) Germany.D) the United States.答案:1-5:DAEBE 6-10:DECDD 11-15:CCEEB 16-20:CDADC 21-25:BEABD 26-30:AACAB 31-35:BCABC 36-40:DABCB 41-45:BDDAD 46-50:EACBC 51-55:AACAD。

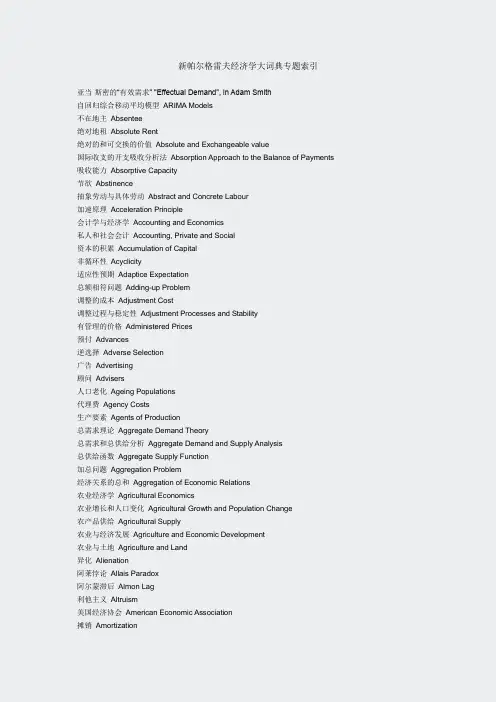

新帕尔格雷夫经济学大词典专题索引亚当·斯密的“有效需求” "Effectual Demand", in Adam Smith自回归综合移动平均模型ARIMA Models不在地主Absentee绝对地租Absolute Rent绝对的和可交换的价值Absolute and Exchangeable value国际收支的开支吸收分析法Absorption Approach to the Balance of Payments 吸收能力Absorptive Capacity节欲Abstinence抽象劳动与具体劳动Abstract and Concrete Labour加速原理Acceleration Principle会计学与经济学Accounting and Economics私人和社会会计Accounting, Private and Social资本的积累Accumulation of Capital非循环性Acyclicity适应性预期Adaptice Expectation总额相符问题Adding-up Problem调整的成本Adjustment Cost调整过程与稳定性Adjustment Processes and Stability有管理的价格Administered Prices预付Advances逆选择Adverse Selection广告Advertising顾问Advisers人口老化Ageing Populations代理费Agency Costs生产要素Agents of Production总需求理论Aggregate Demand Theory总需求和总供给分析Aggregate Demand and Supply Analysis总供给函数Aggregate Supply Function加总问题Aggregation Problem经济关系的总和Aggregation of Economic Relations农业经济学Agricultural Economics农业增长和人口变化Agricultural Growth and Population Change农产品供给Agricultural Supply农业与经济发展Agriculture and Economic Development农业与土地Agriculture and Land异化Alienation阿莱悖论Allais Paradox阿尔蒙滞后Almon Lag利他主义Altruism美国经济协会American Economic Association摊销Amortization类比Analogy无政府主义Anarchism反托拉斯政策Antitrust Policy适用技术Appropriate Technology套利Arbitrage套利定价理论Arbitrage Pricing Theory仲裁Arbitration军备竞赛Arms Races阿罗定理Arrow's Theorem阿罗-德布勒一般均衡模型Arrow-Debren Model of General Equilibrium资产定价Asset Pricing资产与负债Assets and Liabilities指派问题Assignment Problems非对称信息Asymmetric Information原子状竞争Atomistic Competition拍卖者Auctioneer拍卖Auctions奥地利经济学派Austrian School of Economics自给自足Autarky自发支出Autonomous Expenditures自回归和移动平均时间序列过程Autoregressive and Moving-average Time-series Processes 平均成本定价Average Cost Pricing阿弗奇一约翰逊效应Averch-Johnson effect公理化理论Axiomatic Theories交割延期费Backwardation落后性Backwardness贸易差额理论史Balance of Trade, History of The Theory平衡预算乘数Balanced Budget Maltiptier平衡增长Balanced Growth中央银行利率Bank Rate银行学派,通货学派,自由银行学派Banking School, Currency School, Free Banking School 讨价还价(议价) Bargaining物物交换Barter物物交换和交易Barter and Exchange基本品和非基本品Basics and Non-Basics基点计价制Basing Point System杂牌凯恩斯主义Bastard Keynesianism贝叶斯推断Bayesian Inference以邻为整Beggar-the-neighbor行为经济学Behavioral Economics有偏和无偏的技术进步Biased and Unbiased technological Change出价Bidding双边垄断Bilateral Monopoly复本位制Bimetallism生物经济学Bioeconomics经济学在生物学中的应用Biological Applications of Economics伯明翰学派Birmingham School生死过程Birth-and-death Processes债券Bonds有限理性论Bounded Rationality资产阶级Bourgeoisie贿赂Bribery泡沫状态Bubbles预算政策Budgetary Policy缓冲存货Buffer Stocks内在稳定器Built-in Stabilizers金银本位主义的争论Bullionist Controversy束状图Bunch Maps公债负担Burden of The Debt官僚制度Bureaucracy经济周期Business Cycles不变替代弹性生产函数CES Production Function变分法Calculus of Variations官房经济学派Cameralism资本资产定价模型Capital Asset Pricing Model资本预算的编制Capital Budgeting资本外逃Capital Flight资本的收益与损失Capital Gains and Losses资本品Capital Goods资本的反常现象Capital Perversity资本理论Capital Theory资本的理论:争论Capital Theory: Debates资本理论:悖论Capital Theory: Paradoxes固定资本利用程度Capital Utilization作为一种生产要素的资本Capital as A Factor of Production作为一种社会关系的资本Capital as a Social Relation资本、信贷和货币市场Capital, Credit and Money Markets资本主义Capitalism资本主义的与非资本主义的生产Capitalistic and Acapitalistic Production 卡特尔Cartel交易学Catallactics突变论Catastrophe Theory赶超Catching-up因果推理Causal Inference经济模型中的因果关系Causality in Economic Models删截数据模型Censored Data Models中央银行业务Central Banking中心地区理论Central Place Theory中央计划Central Planning波动重心Centre of Gravitation确定性等价Certainty Equivalent如果其他条件不变Ceteris Paribus偏好的改变Changes in Tastes宪章运动:宪章的条款Chantism: the point of the Charter物品特性Characteristics宪章运动Chartism低息借款Cheap Money芝加哥学派Chicago School技术选择与利润率Choice of Technique and the Rate of Profit 牟利学(理财) Chrematistics基督教社会主义Christian Socialism循环流动Circular Flow流通资本Circulating Capital阶级Class古典经济学Classical Economics古典增长模型Classical Growth Models古典货币理论Classical Theory of Money历史计量学Cliometrics社团Clubs合作社Co-operatives科斯定理Coase Theorem柯布-道格拉斯函数Cobb-Douglas Function蛛网定理Cobweb Theorem共同决定和利润分享Codetermination and Profit-sharing同族学科Cognate Displines柯尔培尔主义Colbertism集体行动Collective Action集体农业Collective Agriculture劳资集体谈判Collective bargaining合谋Collusion殖民主义Colonialism殖民地Colonies联合Combination组合论Combinatorics命令经济Command Economy商品拜物教Commodity Fetishism商品货币Commodity Money商品储备货币Commodity Reserve Currency公共土地Common Land习惯法Common Law公共财产权Common Property Rights通讯Communications共产主义Communism社会(公共)无差异曲线Community Indifference Curves比较利益Comparative Advantage比较静态学Comparative Statics补偿需求Compensated Demand补偿Compensation补偿原理Compensation Principle竞争Competition竞争政策Competition Policy竞争与效率Competition and Efficiency竞争与选择Competition and Selection国际贸易竞争Competition in International Trade奥地利学派的竞争理论Competition: Austrian Conceptions古典竞争理论Competition: Classical Conceptions马克思学派的竞争理论Competition: Marxian Conceptions竞争性市场过程Competitive Market Processes一般均衡的计算Computation of General Equlibria集中比率Concentration Ratios冲突与解决Conflict and Settlement冲突与战争Conflict and War拥挤Congestion综合性大企业Conglomerates推测均衡Conjectural Equilibria炫耀性消费Conspicuous Consumption不变资本和可变资本Constant and Variable Capital制度经济学Constitutional Economics耐用消费品Consumer Durables消费者剩余Consumer Surplus消费者支出Consumers, Expenditure消费函数Consumption Function消费集Consumption Sets消费税Consumption Taxation消费与生产Consumption and Production可竞争市场Contestable Markets或有商品Contingent Commodities经济历史的连续性Continuity in Economic History连续和离散时间模型Continuous and Discrete Time Models连续-时间随机模型Continuous-time Stochastic Model连续时间随机过程Continuous-time Stochastic Processes矛盾Contradiction资本主义的矛盾Contradictions of Capitalism经济活动的控制与协调Control and Coordination of Economic Activity 趋向性假说Convergence Hypothesis凸规划Convex Programming凸性Convexity合作均衡Cooperative Equilibrium合作对策Cooperative Games核心Cores谷物法Corn Laws谷物模型Corn Model公司经济Corporate Economy公司Corporations社团主义Corporatism对应原理Correspondence Principle对应Correspondences成本函数Cost Functions成本最小化和效用最大化Cost Minimization and Utility Maximization 成本和供给曲线Cost and Supply Curves生产成本Cost of Production成本-效益分析Cost-benefit Analysis成本推动型通货膨胀Cost-push Inflation反向贸易Counter Trade反设事实Counterfactuals抗衡力量Countervailing Power蠕动钉住汇率Crawling Peg创造性破坏Creative Destruction信贷Credit信贷周期Credit Cycle信贷配给Credit Rationing犯罪与处罚Crime and Punishment危机Crises关键路径分析Critical Path Analysis挤出效应Crowding Out累积的因果关系Cumulative Causation累积过程Cumulative Processes通货Currencies通货委员会Currency Boards关税同盟Customs Unions周期Cycles社会主义经济的周期Cycles in Socialist Economies技能退化De-skilling高息借款Dear Money销路理论Debouches, Theorie des分权Decentralization决策理论Decision Theory衰落产业Declining Industries人口下降Declining Population国防经济学Defence Economics赤字财政Deficit Financing赤字支出Deficit Spending垄断程度Degree of Monopoly效用程度Degree of utility需求管理Demand Management需求价格Demand Price需求理论Demand Theory货币需求:经验研究Demand for Money: Empirical Studies货币需求:理论研究Demand for Money: Theoretical Studies需求拉动型通货膨胀Demand-pull Inflation人口转变Demographic Transition人口统计学Demography依附Dependency折耗Depletion折旧Depreciation萧条Depressions派生需求Derived Demand决定论Determinism发展Development发展经济学Development Economics发展计划Development Planning辩证唯物主义Dialectical Materialism辩证推理Dialectical Reasoning微分对策Differential Games获得的困难Difficulty of Attainment生产的难易程度Difficulty or Facility of Production技术扩散Diffusion of Technology经济量的维数Dimension of Economic Quantities直接税Direct Taxes直接非生产性寻利活动Directly Unproductive Profit-seeking (DUP) Activities 离散的选择模型Discrete Choice Models歧视性垄断Discriminating Monopoly歧视Discrimination非均衡分析Disequilibrium Analysis隐蔽性失业Disguised Unemployment反中介行动Disintermediation扭曲Distortions分配Distribution占典分配理论Distribution Theories: Classical凯恩斯主义的分配理论Distribution Theories: Keynesian马克思主义的分配理论Distribution Theories: Marxian新古典分配理论Distribution Theories: Neoclassical分配伦理Distribution, Ethics of分配规律Distribution, Law of分配公平Distributive Justice多样化经营Diversification of activities分段的总体和随机模型Divided Populations and Stochastic Models股息政策Dividend Policy迪维西亚指数Divisia Index劳动分工Division of Labour经济学说Doctrines土地调查清册Domesday Book家务劳动Domestic Labour复式簿记Double-entry Bookkeeping二元经济Dual Economies二元性Duality虚拟变量Dummy Variables倾销Dumping双头垄断Duopoly动态规划和马尔可夫决策过程Dynamic Programming and Markov Decision Process 经济增长和发展的动力学Dynamics, Growth and Development东西方经济关系East-west Economic Relations伊斯特林假说Easterlin Hypothesis经济计量学Econometrics经济人类学Economic Anthropology社会主义经济的经济计算Economic Calculation in Socialist Economies经济自由Economic Freedom经济增长Economic Growth经济和谐Economic Harmony经济史Economic History经济一体化Economic Integration历史的经济学解释Economic Interpretation of History经济法则Economic Laws经济人Economic Man经济组织Economic Organization经济组织与交易成本Economic Organization and Transaction Costs经济科学与经济学Economic Science and Economics经济剩余与等边际原理Economic Surplus and the Equimarginal Principle经济理论与理性假说Economic Theory and The Hypothesis of Rationality国家的经济理论Economic Theory of the State经济战Economic War经济和社会人类学Economic and Social Anthropology经济和社会史Economic and Social History经济学图书馆与文献的使用Economics Libraries and Documentation规模经济与规模不经济Economies and Diseconomies ofScale经济计量学Economitrics有效需求Effective Demand实际保护Effective Protection有效配置Efficient Allocation有效率市场假说Efficient Market Hypothesis国际收支的弹性分析方法Elasticities Approach to the Balance of Payments弹性Elasticity替代弹性Elasticity of Substitution就业理论Employment, Theories of空匣Empty Boxes内生性与外生性Endogencity and Exoyeneity内生货币与外生货币Endogenous and Exogenous Money能源经济学Energy Economics强制执行Enforcement恩格尔曲线Engel Curve恩格尔定律Engel's Law英国历史学派English Historical School权利Entitlements企业家Entrepreneur熵Entropy进入与市场结构Entry and Market structure包络定理Envelope Theorem环境经济学Environmental Economics妒忌Envy国民历代大事记或民族精神编年史Ephemerides du Citoyen ou Chronique de I'esprit National 经济学中的认识论问题Epistemological Issues in Economics均等利润率Equal Rates of Profit平等Equality交易方程Equation of Exchange均衡:概念的发展Equilibrium: Development of The Concept均衡:一个预期性的概念Equilibrium: an Expectational Concept公平Equity遍历理论Ergodic Theory变量误差Errors in Variables估计Estimation欧拉定理Euler's Theorem欧洲美元市场Eurodollar Market事前与事后Ex Ante and Ex Post过度需求与供给Excess Demand and Supply交换Exchange外汇管制Exchange Control汇率Exchange Rate可能竭资源Exhaustible Resources一般均衡的存在性Existence of General Equilibrium退出和进言Exit and Voice预期Expectations预期效用假说Expected Utility Hypothesis预期效用及数学期望Expected Utility and Methematical Expectation消费支出税Expenditure Tax经济学中的实验方法(i) Experimental Methods in Economics(i)经济学中的实验方法(ii) Experimental Methods in Economics(ii)剥削Exploitation展延家庭Extended Family扩展型对策Extensive Form Games粗放与集约地租Extensive and Intensive Rent外债External Debt外在经济External Economies外在性Externalities费边经济学Fabian Economics因子分析Factor Analysis要素价格边界Factor Price Frontier公平分配Fair Division公平性Fairness下降的利润率Falling Rate of Profit家庭Family计划生育Family Planning饥荒Famine法西斯主义Fascism生育力Fecundity人口出生率Fertibity封建主义Feudalism法定不兑现纸币Fiat Money虚拟资本Fictitious Capital信用发行Fiduciary Issue最终效用程度Final Degree of Utility最终效用Final Utility金融Finance金融资本Finance Capital融资和储蓄Finance and Saving金融危机Financial Crisis金融中介Financial Intermediaries金融新闻业Financial Journalism金融市场Financial Markets微调Fine Tuning厂商理论Firm, Theory of The财政联邦主义Fiscal Federalism财政态势Fiscal Stance发展中国家的财政和货币政策Fiscal and Monetary Policies in Developing Countries 渔业Fisheries固定资本Fixed Capital固定汇率Fixed Exchange Rates不变生产要素Fixed Factors不动点定理Fixed Point Theorems固定价格模型Fixprice Models浮动汇率Flexible Exchange Rates强制储蓄Forced Saving预测Forecasting对外援助Foreign Aid国外投资Foreign Investment对外贸易Foreign Trade对外贸易乘数Foreign Trade Multiplier森林经济Forests欺骗Fraud自由银行制度Free Banking自由处置Free Disposal免费物品Free Goods免费午餐Free Lunch自由贸易和保护主义Free Trade and Protection充分就业Full Employment充分就业预算盈余Full Employment Budget Surplus完全及有限信息方法Full and Limited Information Methods泛函分析Functional Analysis功能财政Functional Finance根本性失衡Fundamental Disequilibrium可替代性Fungibility期贷市场、套头交易与投机Futures Markets, Hedging and Speculation 期货交易Futures Trading模糊集合Fuzzy Sets贸易收益Gains from Trade对策论(博奕论) Game Theory不完全信息对策Games With Incomplete Information赌博合同Gaming Contracts度规函数Gauge Functions资本搭配Gearing性别Gender一般均衡General Equilibrium一般系统理论General System Theory德国历史学派German Historical School吉布拉定律Gibrat's Law吉芬悖论Giffen's Paradox赠品Gifts吉尼比率Gini Ratio经济理论中的整体分析Global Analysis in Economic Theory金本位Gold Standard黄金时代Golden Age黄金律Golden Rule货物与商品Goods and Commodities政府预算约束Government Budget Restraint图论Graph Theory重力模型Gravity Models格莱辛定律Gresham's Law总替代品Gross Substitutes群(李群)论Group(Lie Group)Theory增长的核算Growth Accounting增长与周期Growth and Cycles经济增长与国际贸易Growth and International Trade哈恩问题Hahn Problem汉密尔顿体系Hamiltonians哈里斯-托达罗模型Harris-Todaro Model哈罗德-多马增长模型Harrod-Domar Growth Model霍金斯一西蒙条件Hawkins-Simon Condition卫生经济学Health Economics赫克歇尔-俄林贸易理论Heckscher-Ohlin Trade Theory套头交易Hedging享乐函数和享乐指数Hedonic Functions and Hedonic Indexes享乐主义Hedonism黑格尔主义Hegelianism赫芬达尔指数Herfindahl index异方差性Heteroskedasticity隐蔽活动,道德风险与合同理论Hidden Action, Moral Hazard and Contract Theory 等级制度Hierarchy讨价还价Higgling健全货币与货币基础High-powered Money and The Monetary Base历史成本会计Historical Cost accounting历史人口统计学Historical Demography经济思想及学说史History of Thought and Doctrine齐次函数和位似函数Homogeneous and Homothetic Functions国际游资Hot Money家庭预算Household Budgets家庭生产Household Production家务劳动Housework住房市场Housing Markets人力资本Human Capital人类资源Human Resources虚构的生产函数Humbug Production Function持猎和采集经济Hunting and Gathering Economies恶性通货膨胀Hyperinflation假设检验Hypothesis TestingIS-LM分析IS-LM Analysis理想指数Ideal Indexes理想产出Ideal Output理想类型Ideal Type识别Identification意识形态Ideology贫困化增长Immiserizing Grow尽早消费偏好Impatience不完全竞争Imperfect Competition不完全模型Imperfectionist Models帝国主义Imperialism默认契约Implicit Contracts进口替代和出口导向型增长Import Substitution and Export-Led Growth 派算Imputation剌激的协调性Incentive Compatibility刺激性合同Incentive Contracts收入Income收入-支出分析Income-Expenditure Analysis收入政策Incomes Policies不完全合同Incomplete Contracts不完全市场Incomplete Markets规模报酬递增Increasing Return to Scale指数Index Numbers指数化证券Indexed Securities指导性计划Indicative Planning指标Indicators无差异定律Indifference, Law of间接税Indirect Taxes间接效用函数Indirect Utility Function个人主义Individualism不可分性Indivisibilities归纳Induction产业组织Industrial Organization劳资关系Industrial Relations产业革命Industrial Revolution工业化Industrialization不等式Inequalities不平等Inequality国家之间的不平等Inequality between Nations人与人的不平等Inequality between Persons性别的不平等Inequality between The Sexes工资的不平等Inequality of Pay新生工业Infant Industry婴儿死亡率Infant Mortality通货膨胀Inflation通货膨胀会计Inflation Accounting通货膨胀与增长Inflation and Growth通货膨胀预期Inflationary Expections通货膨胀缺口Inflationary Gap非正规经济Informal Economy信息论Information Theory继承Inheritance继承税Inheritance Taxes创新Innovation投入-产出分析Input-output Analysis制度经济学Institutional Economics工具变量Instrumental Variables保险Insurance整数规划Integer Programming需求的可积性Integrability of Demand智力Intelligence相依偏好Interdependent Preferences利率Interest Rate利息和利润Interest and Profit多种利益Interests代际模型Intergenerational Models内部经济Internal Economies国内移民Internal Migration内部收益率Internal Rate of Return国际资本流动International Capital Flows国际金融International Finance国际收入比较International Income Comparisons 国际债务International Indebtedness国际清偿能力International Liquidity国际移民International Migration国际货币经济学International Monetary Economics 国际货币体制International Monetary Institutions 国际货币政策International Monetary Policy国际贸易International Trade。