Forthcoming in International Finance FINANCIAL GLOBALIZATION UNEQUAL BLESSINGS …

- 格式:pdf

- 大小:105.67 KB

- 文档页数:21

积极英文怎么说 Aa/anabandonabilityableaboundaboutaboveabroadabsenceabsentabsoluteabsorbabstractaccelerate acceptacceptable accessaccompanyaccomplish accordaccording to accountaccountable accumulate accurateaccuseachieveacidacknowledge acquaintacquireacrossactactionactiveactivityactualadaptaddaddictedaddition adequate adjustadmireadmitadoptadvance advanced advantage adventadventure advertise adviceadviseadvocate affairaffectafflictaffordafraidafterafterwards againagainstageagendaaggravate agoagreeagreement aheadaidaimalertalikealiveallalleviate allocate allowalmostalonealongaloudalreadyalsoalteralternative althoughaltogether alwaysamassambiguous ambitionambitious amendamong/amongst amountamuseamusementamusinganalogyanalysisanalyze/-yse ancientandangerangleangryannoyannualanotheransweranticipateanxietyanxiousapartapologize/-ise apologyapparentappealappearappetiteapplaudapplauseapplyappointappreciateappreciation approachappropriate approvalapproveapproximate approximately arbitraryargueargumentarisearoundarousearrangearrestarrivalarticleartificial asashamedasideaskasleepaspectaspiration aspireassembleassessassignassistassociate association assumeassureastonishatattachattackattainattemptattendattention attitude attractattractive attribute authority available averageavoidawakeawareawayawkwardBbackbackground backward backwards badbakebalancebanbandbankbarbarebarelybargain barrier basebasicbasisbathbathebattlebebearbeatbeautifulbecausebecomebeforebegbeginbeginningbehalfbehavebehavior(u)r behindbeliefbelievebelongbelowbendbeneath benefit beside besides betray better between beyond biasbigbillbindbitbite bitter blame bleed bless blind block blow board boast boil bold bond bookboomboostborder boredboring bornboundboundary bowbranch bravebreakbreath breathebreedbribebriefbrightbringbrinkbroadbroadcast brokenbrushbuildbunchbundleburdenburnburstburybusiness busybutbyCcalculate callcalmcampaign cancancelcapable capacity capital carecareful careless carrycasecashcatchcategory catercausecautionceasecelebrate center/-tre centralcertaincertainly chainchallenge championchancechangechannelcharacter chargechasecheapcheatcheck/cheque cheercheerfulchemicalcherishchiefchoicechoosecirclecircularcircumstancecitecivilclaimclarify classic cleanclearclever climbclingcloseclumsy coarse coherentcoincidecoldcollapsecolleague collectcollidecombination combinecomecomfortcomfortable commandcommencecommentcommercecommission commitcommitment committee commodity commoncommonplace communicate community companycomparecomparison compatiblecompelcompensate competecompetent competition complaincomplaint complement completecomplexcomplicate complicated complycomponentcomposecompoundcomprehensive comprisecompromisecomputeconcealconceiveconcentrate conceptconcernconcerningconcludeconclusionconditionconductconferconfessconfidence confidentconfineconfirmconflictconformconfrontconfusecongratulate connectconquerconscienceconsciousconsentconsequence considerconsiderable consideration considering consistconstantconstituteconstructconsultconsumecontactcontaincontemplate contemporary contendcontentcontextcontinuecontinuous contractcontradict contrarycontrastcontributecontribution controlcontroversial controversy convenientconventionconventional conversation converseconvertconveyconvincecookcoolcooperatecoordinatecopycorporatecorrectcorrespondcorrespondence corrodecorruptcorruptioncostcoughcouldcountcountercountrycountryside couplecouragecoursecourtcovercrackcrashcrazycreatecreationcreativecreaturecreditcreepcrimecripplecrisiscriticcriticalcriticismcriticize/-ise crosscrowdcrucialcruelcruelty crushcrycultivate curbcurecuriosity curious curlcurrent cursecushion customcutcycleDdailydamagedancedangerdangerous daredarkdatadatedeaddeafdealdebatedebtdecadedecaydeceitdeceivedecidedecision declaredeclinedecorate decoration decreasededicatededucedeemdeepdefeatdefenddefense/-ence definedefinitedegreedelaydeliberatedeliberately delicatedelicious delightdeliverdemanddemonstrate denotedenydependdependent depressdepthderivedescenddescribedescription desertdeservedesigndesirabledesiredespairdespitedestroydestruction destructive detaildetectdeterminationdeterminedevelopdevelopment deviatedevicedevotedevotiondifferdifferencedifferentdifferentiate difficultdifficultydigdimensiondiminishdipdirectdirectiondirtydisableddisadvantage disagreedisappeardisappointdisappointed disappointing disasterdisastrous discarddisclosediscountdiscourage discoverdiscoverydiscriminate discussdiscussion diseasedisgustdisgusting disillusiondismissdisplacedisplaydisposaldisposedisputedisregard distancedistantdistinctdistinguish distortdistribute districtdisturb divediverse divert divide division divorce dodomain domestic dominate double doubtdowndownload dozendragdraindrawdrawback dreamdressdrinkdrivedropdrowndrugdryduedulldumpduration during dutydwarfdwelldynamic Eeacheagerearlyearneaseeasyeateconomic edgeediteducate education effecteffective efficient efforteitherelastic。

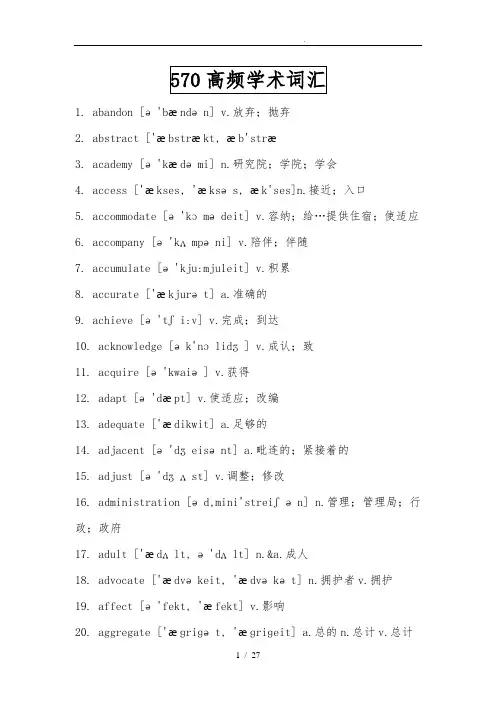

1. abandon [ə'bændən] v.放弃;抛弃2. abstract ['æbstrækt, æb'stræ3. academy [ə'kædəmi] n.研究院;学院;学会4. access ['ækses, 'æksəs, æk'ses]n.接近;入口5. accommodate [ə'kɔmədeit] v.容纳;给…提供住宿;使适应6. accompany [ə'kʌmpəni] v.陪伴;伴随7. accumulate [ə'kju:mjuleit] v.积累8. accurate ['ækjurət] a.准确的9. achieve [ə'tʃi:v] v.完成;到达10. acknowledge [ək'nɔlidʒ] v.成认;致11. acquire [ə'kwaiə] v.获得12. adapt [ə'dæpt] v.使适应;改编13. adequate ['ædikwit] a.足够的14. adjacent [ə'dʒeisənt] a.毗连的;紧接着的15. adjust [ə'dʒʌst] v.调整;修改16. administration [əd,mini'streiʃən] n.管理;管理局;行政;政府17. adult ['ædʌlt, ə'dʌlt] n.&a.成人18. advocate ['ædvəkeit, 'ædvəkət] n.拥护者v.拥护19. affect [ə'fekt, 'æfekt] v.影响20. aggregate ['æɡriɡət, 'æɡriɡeit] a.总的n.总计v.总计22. albeit [ɔ:l'bi:it] conj.虽然23. allocate ['æləukeit] v.分派24. alter ['ɔ:ltə] v.改变25. alternative [ɔ:l'tə:nətiv] n.替代物a.选择的26. ambiguous [æm'biɡjuəs] a.模棱两可的27. amend [ə'mend] v.修订;改正自新28. analogy [ə'nælədʒi] a.类似;比较;类推29. analyze ['ænəlaiz] v.分析30. annual ['ænjuəl] a.每年的n.年鉴31. anticipate [æn'tisipeit] v.预料32. apparent [ə'pærənt] a.明显的33. append [ə'pend] v.附上34. appreciate [ə'pri:ʃieit] v.欣赏;感谢35. approach [ə'prəutʃ] v.靠近n.方法36. appropriate [ə'prəuprieit, ə'prəupriət] a.恰当的37. approximate [ə'prɔksimit] a.近似的v.与…近似38. arbitrary ['ɑ:bitrəri] a.任意的;专断的39. area ['εəriə] n.地区;面积;领域40. aspect ['æspekt] n.方面;面貌41. assemble [ə'sembl] v.集合;装配;收集42. assess [ə'ses] v.对…估价;评价43. assign [ə'sain] v.指定;分配44. assist [ə'sist] v.帮助45. assume [ə'sju:m, ə'su:m] v.假设;认为;承当;呈现46. assure [ə'ʃuə] v.向…保证47. attach [ə'tætʃ] v.系;贴;使附加;使依恋48. attain [ə'tein] v.到达;获得49. attitude ['ætɪtjuːd, -tuːd] n.态度;姿势50. attribute [ə'tribju:t, 'ætribju:t] v.把…归因于n.性质51. author ['ɔ:θə] n.作者;作家;创始人52. authority [ɔ:'θɔrəti] n.当局;权威;权力53. automate ['ɔ:təmeit] v.使自动化54. available [ə'veiləbl] a.可得到的55. aware [ə'wεə] a.意识到的56. behalf [bi'hɑ:f] n.利益57. benefit ['benifit] n.利益;津贴v.有利于;获益58. bias ['baiəs] n.偏见;爱好59. bond [bɔnd] n.纽带;债券60. brief [bri:f] a.简短的61. bulk [bʌlk] n.体积;主体62. capable ['keipəbl] a.能够;有能力的63. capacity [kə'pæsəti] n.容量;潜在能力64. category ['kætiɡəri] n.种类;畴65. cease [si:s] n.&v.停止66. challenge ['tʃælindʒ] n.挑战67. channel ['tʃænəl] n.海峡;渠道;频道68. chapter ['tʃæptə] n.章69. chart [tʃɑ:t] n.图表v.制图表70. chemical ['kemikəl] a.化学的n.化学药品71. circumstance ['sə:kəmstəns] n.情况72. cite [sait] v.引用73. civil ['sivəl] a.公民的;国的;民用的74. clarify ['klærifai] v.说明75. classic ['klæsik] n.名著a.古典的76. clause [klɔ:z] n.条款;从句77. code [kəud] n.法典;代码;习俗78. coherent [kəu'hiərənt] a.一致的;连贯的79. coincide [,kəuin'said] v.巧合,同时发生80. collapse [kə'læps] v.&n.倒坍;瓦解81. colleague ['kɔli:ɡ] n.同事82. commence [kə'mens] v.开场83. comment ['kɔment] n.&v.评论;注释84. commission [kə'miʃən] n.委员会;委托;委托书;佣金85. commit [kə'mit] v.犯罪86. commodity [kə'mɔditi] n.日用品87. communicate [kə'mju:nikeit] v.通信;交流88. community [kə'mju:niti] n.社区;社会;界89. compatible [kəm'pætəbl] a.和睦的;兼容的90. compensate ['kɔmpenseit] v.补偿91. compile [kəm'pail] v.编92. complement ['kɔmplimənt] v.&n.补充93. complex ['kɔmpleks] a.复杂的94. component [kəm'pəunənt] n.组成局部a.组成的95. compound ['kɔmpaund, kəm'paund] n.化合物a.复合的96. comprehensive [,kɔmpri'hensiv] a.综合的97. comprise [kəm'praiz] v.包含;构成98. compute [kəm'pju:t] v.计算99. conceive [kən'si:v] v.构思;怀胎;认为100. concentrate ['kɔnsəntreit] v.集中;浓缩101. concept ['kɔnsept] n.概念102. conclude [kən'klu:d] v.完毕;下结论103. concurrent [kən'kʌrənt] a.同时发生的;并存的104. conduct ['kɔndʌkt, kən'dʌkt] n.行为v.实施;指挥;导电105. confer [kən'fə:] v.授予;协商106. confine [kən'fain, 'kɔnfain] v.限制;禁闭107. confirm [kən'fə:m] v.证实108. conflict [kən'flikt, 'kɔnflikt] n.冲突v.冲突109. conform [kən'fɔ:m] v.遵守;符合110. consent [kən'sent] n.&v.同意111. consequent ['kɔnsi,kwənt] a.作为结果的112. considerable [kən'sidərəbl] a.相当的113. consist [kən'sist] v.由…组成114. constant ['kɔnstənt] a.不断的115. constitute ['kɔnstitju:t] v.构成116. constrain [kən'strein] v.限制;强制117. construct [kən'strʌkt] v.建造118. consult [kɔn'sʌlt, 'kɔnsʌlt] v.商量;咨询;查阅119. consume [kən'sju:m] v.消耗;消费120. contact ['kɔntækt, kən'tækt] v.&n.接触;联系121. contemporary [kən'tempərəri] a.当代的n.同代人122. context ['kɔntekst] n.上下文;背景123. contract ['kɔntrækt, kən'trækt] n.合同v.收缩124. contradict [,kɔntrə'dikt] v.反驳;与…矛盾125. contrary ['kɔntrəri] a.&n.相反126. contrast [kən'trɑ:st, -'træst, 'kɔntrɑ:st, -træst] n.比照v.形成比照127. contribute [kən'tribju:t] v.捐献;奉献;投稿128. controversy ['kɔntrə,və:si] n.争论129. convene [kən'vi:n] v.召集130. converse [kən'və:s] a.相反的131. convert [kən'və:t] v.转化132. convince [kən'vins] v.使确信133. cooperate [kəu'ɔpəreit] v.合作134. coordinate [kəu'ɔ:dinit, kəu'ɔ:dineit] a.同等的v.使协调135. core [kɔ:] n.核心136. corporate ['kɔ:pərit] a.公司的137. correspond [,kɔ:ri'spɔnd] v.通信;符合;对应138. couple ['kʌpl] n.两个;夫妇139. create [kri'eit] v.创造;引起140. credit ['kredit] n.信用;学分;功绩142. crucial ['kru:..l] a.决定性的143. culture ['k.lt..] n.文化;修养145. cycle ['saikl] n.循环;周期146. data ['deit.] n.[复]数据147. debate [di'beit] n.&v.辩论148. decade ['dekeid] n.十年149. decline [di'klain] v.绝;下倾;衰退n.衰退150. deduce [di'dju:s] v.演绎151. define [di'fain] v.给…下定义;明确152. definite ['definit] a.明确的153. demonstrate ['dem.nstreit] v.说明;演示;示威154. denote [di'n.ut] v.表示155. deny [di'nai] v.否认156. depress [di'pres] v.使沮丧157. derive [di'raiv] v.引伸;起源159. despite [di'spait] prep.尽管160. detect [di'tekt] v.觉察;检测161. deviate ['di:vieit, 'di:vi.t] v.背离162. device [di'vais] n.装置;设计163. devote [di'v.ut] v.致力;为…献身164. differentiate [,dif.'ren.ieit] v.区分165. dimension [di'men..n, dai-] n.尺寸;维166. diminish [di'mini.] v.减少167. discrete [dis'kri:t] a.别离的168. discriminate [dis'krimineit, dis'krimin.t] v.区别;歧视169. displace [dis'pleis] v.移置;置换170. display [,dis'plei] v.&n.展览;显示171. dispose [dis'p.uz] v.处置172. distinct [dis'ti.kt] a.清晰的;独特的;不同的173. distort [dis't.:t] v.歪曲;扭曲174. distribute [di'stribju:t, 'dis-] v.分发;分配;分布175. diverse [dai'v.:s, di-] a.多样的177. domain [d.u'mein] n.领域;域;幅员178. domestic [d.u'mestik] a.国的;家庭的179. dominate ['d.mineit] v.支配180. draft [drɑ181. drama ['drɑ:m., dr.m.] n.戏剧182. duration [dju.'rei..n] n.持续时间183. dynamic [dai'n.mik] a.有活力的185. edit ['edit] v.编辑186. element ['elim.nt] n.元素;要素187. eliminate [i'limineit] v.消灭;消除188. emerge [i'm.:d.] v.出现189. emphasis ['emf.sis] n.强调190. empirical [em'pirik.l] n.经历的191. enable [i'neibl] v.使能够192. encounter [in'kaunt.] v.&n.遇到194. enforce [in'f.:s] v.实施;强制195. enhance [in'hɑ:ns, -h.ns] v.增强196. enormous [i'n.:m.s] a.巨大的;大量的197. ensure [in'.u.] v.保证198. entity ['ent.ti] n.实体200. equate [i'kweit] v.使相等;使平等201. equip [i'kwip] v.装备203. erode [i'r.ud] v.腐蚀204. error ['er.] n.错误205. establish [i'st.bli.] v.建立;确立206. estate [i'steit] n.房地产;财产207. estimate ['estimeit] v.估计n.208. ethic ['eθik] n.伦理209. ethnic ['eθnik] n.种族的210. evaluate [i'v.ljueit] v.对…估价;评价212. evident ['evid.nt] a.明显的213. evolve [i'v.lv] v.进化;演变214. exceed [ik'si:d] v.超过215. exclude [iks'klu:d] v.排除216. exhibit [iɡ'zibit] v.显示;展览n.展览217. expand [ik'sp.nd] v.扩大;膨胀219. explicit [ik'splisit] a.明晰的;详述的;直率的220. exploit ['ekspl.it, ik's-] v.剥削;利用;开采n.功绩222. expose [ik'sp.uz] v.暴露;揭露;使接触223. external [ik'st.:n.l] a.外部的224. extract [ik'str.kt, 'ekstr.kt] v.取出;榨取n.摘录225. facilitate [f.'siliteit] v.使容易;促进226. factor ['f.kt.] n.因素;因子227. feature ['fi:t..] n.特征;容貌229. fee [fi:] n.费230. file ['fail] n.档案;文件;锉231. final ['fainl] a.最后的;决定性的232. finance [fai'n.ns] n.财政;金融v.给…提供资金233. finite ['fainait] a.有限的234. flexible ['fleksibl] a.易弯曲的;灵活的235. fluctuate ['fl.ktjueit] v.波动237. format ['f.:m.t] n.格式238. formula ['f.:mjul.] n.公式239. forthcoming ['f.:θ'k.mi.] a.即将到来的240. found [faund] v.创立;建立241. foundation [faun'dei..n] n.创立;根底;基金会242. framework ['freimw.:k] n.框架;体制243. function ['f..k..n] n.功能;函数v.运行244. fund [f.nd] n.基金245. fundamental [,f.nd.'ment.l] a.根底的;根本的246. furthermore ['f.:e.m.:] ad.此外247. gender ['d.end.] n.性别249. generation [,d.en.'rei..n] n.一代;产生250. globe [ɡl.ub] n.球;地球251. goal [ɡ.ul] n.球门;目标252. grade [ɡreid] n.等级;年级;成绩253. grant [ɡrɑ:nt, ɡr.nt] n.授予物;拨款;助学金v.授予254. guarantee [,ɡ.r.n'ti:] n.&v.保证255. guideline ['ɡaidlain] n.方针256. hence [hens] ad.因此257. hierarchy ['hai.,rɑ:ki] n.等级制度259. hypothesis [hai'p.θisis] n.假设;假说260. identical [ai'dentik.l] a.同一的261. identify [ai'dentifai] v.认出;识别263. ignorance ['iɡ264. illustrate ['il.streit] v.举例说明;图解265. image ['imid.] n.像;图像;形象266. immigrate ['imiɡreit] v.移民入境267. impact ['imp.kt, im'p.kt] n.碰撞;影响269. implicate ['implikeit] v.暗示;使牵连270. implicit [im'plisit] a.含蓄的;含的271. imply [im'plai] v.暗示272. impose [im'p.uz] v.征(税);强加273. incentive [in'sentiv] n.&a.刺激274. incidence ['insid.ns] n.发生276. income ['ink.m] n.收入278. index ['indeks] n.索引;指标;指数279. indicate ['indikeit] v.说明280. individual [,indi'vidju.l, -d..l] n.个人;个体a.单个的;独特的281. induce [in'dju:s, in'du:s] v.劝诱;导致282. inevitable [in'evit.bl] a.不可防止的283. infer [in'f.:] v.推断284. infrastructure ['infr.,str.kt..] n.根底设施286. inhibit [in'hibit] v.抑制289. injure ['ind..] v.使受伤290. innovate ['in.uveit] v.创新291. input ['input] v.&n.输入293. insight ['insait] n.洞察力;见识294. inspect [in'spekt] v.检查;视察295. instance ['inst.ns] n.例子296. institute ['institjut, -tu:t] n.研究所;学院v.设立297. instruct [in'str.kt] v.教;指导298. integral ['intiɡr.l] a.整体的299. integrate ['intiɡreit, 'intiɡrit, -ɡreit] v.使结合300. integrity [in'teɡr.ti] n.诚信;完整301. intelligence [in'telid..ns] n.智力;情报302. intense [in'tens] a.强烈的304. intermediate [,int.'mi:dj.t, -dieit] a.中间的;中级的305. internal [in't.:n.l] a.部的306. interpret [in't.:prit] v.解释;口译308. intervene [,int.'vi:n] v.干预309. intrinsic [in'trinsik,-k.l] a.在的310. invest [in'vest] v.投资311. investigate [in'vestiɡeit] v.调查312. invoke [in'] v.恳求;实施313. involve [in'v.lv] v.使卷入314. isolate ['ais.leit, -lit] v.隔离;孤立316. item ['ait.m] n.条款;条317. job [d..b] n.工作318. journal ['d..:n.l] n.杂志319. justify ['d..stifai] v.证明…有理320. label ['leibl] n.标签;标记321. labor ['leib.] n.&v.劳动322. layer ['lei.] n.层323. lecture ['lekt..] n.&v.讲课;讲座324. legal ['li:ɡ.l] a.合法的;法律的325. legislate ['led.isleit] v.为…立法328. license ['lais.ns] n.执照329. likewise ['laikwaiz] ad.同样地331. locate [l.u'keit, 'l.u] v.使位于;找到333. maintain [mein'tein] v.维持;维修335. manipulate [m.'nipjuleit] v.操作;操纵337. margin ['mɑ:d.in] n.页边距;边缘;余地338. mature [m.'tju.] a.&v.成熟339. maximize ['m.ksimaiz] v.使最大化341. media ['mi:di.] n.媒体342. mediate ['mi:dieit] v.调停343. medical ['medik.l] a.医学的344. medium ['mi:di.m, -dj.m] n.媒质;中间a.中等的345. mental ['ment.l] a.精神的;脑力的346. method ['meθ.d] n.方法347. migrate [mai'ɡreit, 'maiɡ-] v.迁移348. military ['milit.ri] a.军事的349. minimal ['minim.l] a.最小的350. minimize ['minimaiz] v.使最小化352. ministry ['ministri] n.部354. mode [m.ud] n.模式355. modify ['m.difai] v.修改;修饰356. monitor ['m.nit.] n.班长;显示器v.监视359. negate [ni'ɡeit, 'neɡeit, 'ni:-] v.否认360. network ['netw.:k] n.网络361. neutral ['nju:tr.l] a.中立的;中性的362. nevertheless [,nev.e.'les] ad.然而363. nonetheless [,n.ne.'les] ad.然而364. norm [n.:m] n.标准365. normal ['n.:m.l] a.正常的;正规的366. notion ['n.u..n] n.概念;想法367. notwithstanding [,n.twiθ'st.ndi., -wie-] prep.&conj.虽然368. nuclear ['nju:kli., 'nu:-] a.核的;核心的370. obtain [.b'tein, .b-] v.获得371. obvious ['.bvi.s] a.明显的372. occupy ['.kjupai] v.占;使忙碌373. occur [.'k.:] v.发生;出现;想起374. odd [.d] a.奇怪的;奇数的;临时的376. ongoing ['.n,ɡ.ui., '.:n-] n.进展中的377. option ['.p..n] n.选择…定位379. outcome ['autk.m] n.结果380. output ['autput, ,aut'put] n.产量;输出381. overall ['.uv.r.:l, ,.uv.'r.:l] n.[overalls]工作服a.总体的383. overseas ['.uv.'si:z] ad.&a.海外384. panel ['p.nl] n.专门小组;面板386. paragraph ['p.r.ɡrɑ:f, -ɡr.f] n.段落388. parameter [p.'r.mit.] n.参数389. participate [pɑ:'tisipeit] v.参加390. partner ['pɑ:tn.] n.伙伴391. passive ['p.siv] a.被动的;消极的392. perceive [p.'si:v] v.感觉到;理解393. percent [p.'sent] n.百分之…394. period ['p..r..d] n.时期;句号395. persist [p.'sist, -'zist] v.坚持;持续396. perspective [p.'spektiv] n.角度;观点397. phase [feiz] n.阶段400. physical ['fizik.l] a.物质的;身体的;物理的402. policy ['p.lisi] n.政策403. portion ['p.:..n, 'p.u-] n.局部;份v.分404. pose [p.uz] v.摆姿势;提出n.姿势407. practitioner [pr.k'ti..n.] n.开业者408. precede [pri:'si:d, pri-] v.先于;优先于409. precise [pri'sais] a.准确的410. predict [pri'dikt] v.预言412. preliminary [pri'limin.ri] a.预备的;初步的n.初试;预赛413. presume [pri'zju:m, -'zu:m] v.假定414. previous ['pri:vj.s] a.先前的415. primary ['praim.ri] a.初级的;主要的418. principle ['prins.pl] n.原那么419. prior ['prai.] a.在先的420. priority [prai'.r.ti] n.在先;重点421. proceed [pr.u'si:d] v.继续进展424. prohibit [pr.u'hibit] v.禁止426. promote [pr.u'm.ut] v.促进;提升;促销427. proportion [pr..p...(.)n] n.比例;相称431. publication [,p.bli'kei..n] n.出版;出版物432. publish ['p.bli.] v.出版433. purchase ['p.:t..s] n.&v.购置434. pursue [p.'sju:, -'su:] v.追;追求;从事436. quote [kw.ut, k.ut] v.引用439. range [reind.] n.围;山脉;炉灶v.排列441. rational ['r...n.l] a.理性的;合理的442. react [ri'.kt, ri:-] v.反响443. recover [ri'k.v.] v.恢复;挽回444. refine [ri'fain] v.提炼445. regime [rei'.i:m, ri-, ri'd.i:m] n.政权;制度446. region ['ri:d..n] n.地区;领域447. register ['red.ist.] n.&v.登记;注册;挂号n.登记簿448. regulate ['reɡjuleit] v.调整449. reinforce [,ri:in'f.:s] v.增援;加强450. reject [ri'd.ekt] v.拒绝451. relax [ri'l.ks] v.使放松452. release [ri'li:s] v.&n.释放;公布455. rely [ri'lai] v.依靠;信赖456. remove [ri'mu:v] v.移开;搬迁;消除457. require [ri'kwai.] v.需要;要求458. research [ri's.:t., 'ri:s-] n.研究459. reside [ri'zaid] v.居住460. resolve [ri'z.lv] v.解决;决心n.决心461. resource [ri's.:s, -'z.:s, 'ri:s-, 'ri:z-] n.资源;谋略462. respond [ri'sp.nd] v.答复;响应463. restore [ri'st.:] v.恢复;归还464. restrain [ri'strein] v.抑制465. restrict [ri'strikt] v.限制466. retain [ri'tein] v.保持;保存467. reveal [ri'vi:l] v.显示;告诉468. revenue ['rev.nju:, -nu:] n.税收470. revise [ri'vaiz, 'ri:vaiz] v.修订471. revolution [,rev.'lu:..n] n.革命;旋转472. rigid ['rid.id] a.刻板的473. role [r.ul] n.角色;作用474. route [ru:t, raut] n.路线475. scenario [si'nɑ:ri.u, -'n.-, -'nε.-] n.剧本;方案478. scope [sk.up] n.围479. section ['sek..n] n.局部;截面480. sector ['sekt.] n.扇形;部门482. seek [si:k] v.寻找;试图483. select [si'lekt] v.选择484. sequence ['si:kw.ns] n.顺序;连续485. series ['si.ri:z, -riz] n.系列486. sex [seks] n.性别;性487. shift [.ift] v.&n.转移488. significant [sig'nifik.nt] n.有意义的;重要的489. similar ['simil.] a.相似的490. simulate ['simjuleit] v.假装;模仿491. site [sait] n.地点;场所492. so-called ['s.u'k.:ld] a.所谓的493. sole [s.ul] n.脚底;鞋底a.唯一的495. source [s.:s] n.源;来源496. specific [spi'sifik] a.具体的;特有的497. specify ['spes.fai, -si-] v.指定;详细说明498. sphere [sfi.] n.球;领域500. statistic [st.'tistik] a.统计的501. status ['steit.s, 'st.-] n.地位502. straightforward [,streit'f.:w.d] a.坦率的;明确的504. stress [stres] n.压力;重音v.强调505. structure ['str.kt..] n.结构;建筑物506. style [stail] n.风格507. submit [s.b'mit] v.服从;提交508. subordinate [s.'b.:din.t, -neit, s.'b.:dineit] a.下级的;附属的n.部下510. subsidy ['s.bsidi] n.补助;津贴512. successor [s.k'ses.] n.继任者513. sufficient [s.'fi..nt] a.足够的514. sum [s.m] n.总数;金额v.总计517. survey [s.:'vei, 's.:vei, s.-] v.俯瞰;测量;调查n.俯瞰;测量;调查518. survive [s.'vaiv] v.幸存519. suspend [s.'spend] v.悬挂;推迟520. sustain [s.'stein] v.保持;忍受521. symbol ['simb.l] n.象征;符号522. tape [teip] v.捆;录(磁带) n.带子;磁带523. target ['tɑ:ɡit] n.靶子;目标524. task [tɑ:sk, t.sk] n.任务525. team [ti:m] n.队;团队v.协作526. technical ['teknik.l] a.技术的527. technique [tek'ni:k] n.技术;技巧531. terminate ['t.:mineit] v.终止532. text [tekst] n.正文,文本533. theme [θi:m] n.主题534. theory ['θi.ri, 'θi:.-] n.理论535. thereby [,eε.'bai, 'eε.bai] ad.从而536. thesis ['θi:sis] n.论文;论点537. topic ['t.pik] n.话题539. tradition [tr.'di..n] n.传统540. transfer [tr.ns'f.:] v.&n.转移;换车;调动541. transform [tr.ns'f.:m, -, trɑ:n-] v.转变;改革542. transit ['tr.nsit, -zit, 'trɑ:n-] n.通过;运输;过渡543. transmit ['mit, tr.ns-, trɑ:n-] v.传播;传递544. transport [tr.ns'p.:t; -tr.ns'p.:t, -, trɑ:n-, 'tr.nsp.:t, '-, 'trɑ:n-] n.&v.运输545. trend [trend] n.趋势546. trigger ['triɡ547. ultimate ['.ltim.t] a.最终的;根本的548. undergo [,.nd.'ɡ.u] v.经历549. underlie [,.nd.'lai] v.是…的根底550. undertake [,.nd.'teik] v.承受;从事552. unify ['ju:nifai] v.统一553. unique [ju:'ni:k] a.独一无二的554. utilize ['ju:tilaiz] v.利用555. valid ['v.lid] a.有效的;正当的556. vary ['vε.ri] v.变化;使多样化557. vehicle ['vi..k(.)l] n.车辆558. version ['v.:..n] n.译文;说法559. via ['vai.] prep.经由560. violate ['vai.leit] v.违犯562. visible ['viz.bl] a.可看见的563. vision ['vi..n] n.视力;眼光564. visual ['vizju.l] a.视觉的565. volume ['v.lju:m] n.卷,册;体积;额;音量567. welfare ['welfε.] n.福利568. whereas [hwε.'.z conj.而569. whereby [hwε.'bai] ad.由此570. widespread ['waid'spred] a.普遍的。

1. American Economic Review/aer/2. Journal of Financial Economic/article/eeejfinec//reprint.htm3. Journal of Finance/journal/10.1111/(ISSN)1540-6261JF杂志除了上面这个链接以外,还有网站/,上面可以查到即将发表的论文(forthcoming articles)4. Financial Review/journal/10.1111/(ISSN)1540-62885. Journal of Accounting Research/journal/10.1111/(ISSN)1475-679X6. Accounting Review/loi/accr7. Accounting & Finance/journal/10.1111/(ISSN)1467-629X8. Journal of Applied Corporate Finance/journal/10.1111/(ISSN)1745-66229. Journal of Corporate Accounting & Finance/journal/10.1002/(ISSN)1097-0053 10. Journal of Financial Research/journal/10.1111/(ISSN)1475-6803 11. Review of Financial Studies/content/current12. Journal of Accounting and Economics/science/journal/0165410113. Financial Management/journal/10.1111/(ISSN)1755-053X 14. International Review of Finance/journal/10.1111/(ISSN)1468-2443 15. International Journal of Finance & Economics/journal/10.1002/(ISSN)1099-1158 16. Journal of Business Finance & Accounting/journal/10.1111/(ISSN)1468-5957 17. Journal of Corporate Finance/journal-of-corporate-finance 18. Journal of International Financial Management & Accounting /journal/10.1111/(ISSN)1467-646X 19. Journal of Financial and Quantitative Analysis/article/cupjfinqa/20. Contemporary Accounting Research/journal/10.1111/(ISSN)1911-3846 21. Journal of Empirical Finance/article/eeeempfin/上面很多都是wiley的在线图书馆,很好用,大家查阅其他相关杂志也可以上里面去找,链接是:/subject/code/000057/titles。

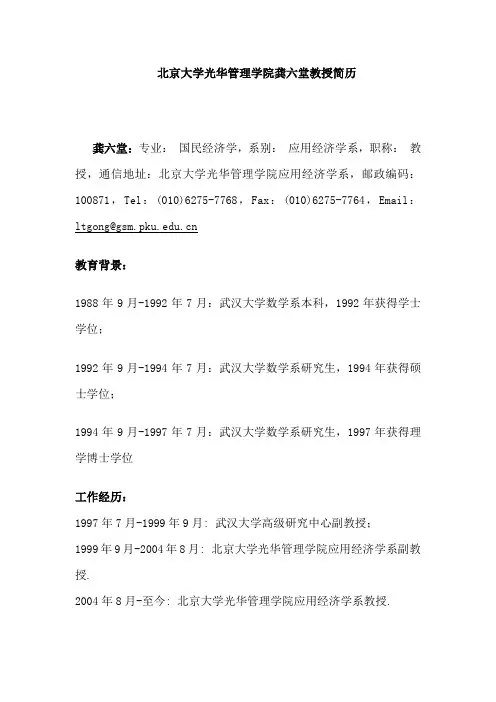

北京大学光华管理学院龚六堂教授简历————————————————————————————————作者:————————————————————————————————日期:北京大学光华管理学院龚六堂教授简历龚六堂:专业:国民经济学,系别:应用经济学系,职称:教授,通信地址:北京大学光华管理学院应用经济学系,邮政编码:100871,Tel:(010)6275-7768,Fax:(010)6275-7764,Email:ltgong@教育背景:1988年9月-1992年7月:武汉大学数学系本科,1992年获得学士学位;1992年9月-1994年7月:武汉大学数学系研究生,1994年获得硕士学位;1994年9月-1997年7月:武汉大学数学系研究生,1997年获得理学博士学位工作经历:1997年7月-1999年9月: 武汉大学高级研究中心副教授;1999年9月-2004年8月: 北京大学光华管理学院应用经济学系副教授.2004年8月-至今: 北京大学光华管理学院应用经济学系教授.主要教学经历:1.中级宏观经济学教材:Macroeconomic Theory and Policy, Branson, W2.线性和非线性规划教材:Introduction to Linear and Nonlinear Programming, Luenberger, D.E.The Theory of Linear Economy, Gale, D.3.动态优化教材:Dynamic Optimization, Kamien, M.I. and Schwartz,N. L.4.消费者和厂商理论教材:Microeconomic Theory, Varian, H.5.市场和均衡理论教材:Microeconomic Theory, Varian, H.6.经济增长理论教材:Economic Growth, Barro, R.J. and Sala-i-Martin,X.7.高级宏观经济学教材:Macroeconomic Theory, Sargent, T.J.Lectures on Macroeconomic, Blanchard, O.J. and Fischer, R.W.8.最优控制理论教材:Deterministic and Stochastic Optimal Control, Fleming, W.H. and Rishel, R.W.9.动态宏观经济学教材:Methods of Macroeconomic Dynamics, Turnovsky, S. T.10.投资理论教材:Investment Under Uncertainty, Dixit, A. K. and Pindyck, R. S.11.公共财政理论教材:Public Finance, Myles.12.动态国际经济学教材:International Macroeconomic Dynamics, Turnovsky S.J.13.经济增长理论专题14.公共财政理论专题1997年3月应邀为中南民族学院研究生讲授宏观经济学课程。

大学英语积极词汇表 (2364)a/an abandon ability able abound about above abroad absence absent absolute absorb abstract accelerate accept acceptable access accommodate accompany accomplish accord according toaccountaccountableaccumulateaccurateaccuseachieveacidacknowledgeacquaintacquireacrossactactionactiveactivityactualadaptaddaddictedadditionadequateadjustadmireadmitadoptadvanceadvancedadvantageadventadventureadvertiseadviceadviseadvocateaffairaffectafflictaffordafraidafterafterwardsagainagainstageagendaaggravateagoagreeagreementaheadaidaimairalertalikealiveallalleviateallocateallowalmostalonealongaloudalreadyalsoalter alternative although altogether alwaysamass ambiguous ambition ambitious amendamong/amongst amountamuse amusement amusing analogy analysis analyze/-yse ancientandangerangleangryannoyannualanotheransweranticipateanxietyanxiousanyanywhereapartapologize/-iseapologyapparentappealappearappetiteapplaudapplauseapplyappointappreciateappreciationapproachappropriateapprovalapproveapproximateapproximatelyarbitraryargueargumentarisearoundarousearrangearrestarrivalarrivearticleartificialasashamedasideaskasleepaspectaspirationaspireassembleassessassignassistassociateassociationassumeassureastonishatattachattackattain attempt attend attention attitude attract attractive attribute authority available average avoid awake aware away awkward back background backward backwards badbake balancebanbandbankbarbarebarelybargainbarrierbasebasicbasisbathbathebattlebebearbeatbeautifulbecausebecomebeforebegbeginbeginningbehalfbehavebehavio(u)rbehindbeliefbelievebelongbelowbendbeneathbenefitbesidebesidesbetraybetterbetweenbeyondbiasbigbillbindbitbitebitterblamebleedblessblindblockblowboardboastboilboldbondbookboomboostborderboredboringborn borrow both bound boundary bow branch brave break breath breathe breed bribebrief bright bring brink broad broadcast broken brush build bunchbundleburdenburnburstburybusinessbusybutbuybycalculatecallcalmcampaigncancancelcapablecapacitycapitalcarecarefulcarelesscarrycasecashcatchcategorycatercausecautionceasecelebratecenter/-trecentralcertaincertainlychainchallengechampionchancechangechannelcharacterchargechasecheapcheatcheck/chequecheercheerfulchemicalcherishchiefchoicechoosecirclecircularcircumstancecitecivilclaimclarifyclassiccleanclearclever climbclingclose clumsy coarse coherent coincide cold collapse colleague collect collide combination combine come comfort comfortable command commence comment commerce commissioncommitcommitmentcommitteecommoditycommoncommonplacecommunicatecommunitycompanycomparecomparisoncompatiblecompelcompensatecompetecompetentcompetitioncompilecomplaincomplaintcomplementcompletecomplexcomplicatecomplicatedcomplycomponentcomposecompoundcomprehendcomprehensivecomprisecompromisecomputeconcealconceiveconcentrateconceptconcernconcerningconcludeconclusionconditionconductconferconfessconfidenceconfidentconfineconfirmconflictconformconfrontconfusecongratulateconnectconquerconscienceconsciousconsentconsequenceconsequentconsiderconsiderableconsiderationconsidering consist constant constitute constrain construct consult consume contact contain contemplate contemporary contend content context continue continuous contract contradict contrary contrast contribute contributioncontrolcontroversialcontroversyconvenientconventionconventionalconversationconverseconvertconveyconvincecookcoolcooperatecoordinatecopycorporatecorrectcorrespondcorrespondencecorrodecorruptcorruptioncostcoughcouldcountcountercountrycountrysidecouplecouragecoursecourtcovercrackcrashcrazycreatecreationcreativecreaturecreditcreepcrimecripplecrisiscriticcriticalcriticismcriticize/-isecrosscrowdcrucialcruelcrueltycrushcrycultivatecurbcurecuriositycuriouscurl current curse cushion custom cutcycle daily damage dance danger dangerous daredarkdatadate deaddeafdeal debate debt decade decaydeceitdeceivedecidedecisiondeclaredeclinedecoratedecorationdecreasededicatededucedeemdeepdefeatdefenddefense/-encedefinedefinitedegreedelaydeliberatedeliberatelydelicatedeliciousdelightdeliverdemanddemonstratedenotedenydependdependentdepressdeprivedepthderivedescenddescribedescriptiondesertdeservedesigndesirabledesiredespairdespitedestroydestructiondestructivedetaildetectdeterminationdeterminedevelopdevelopmentdeviatedevicedevotedevotiondiedifferdifferencedifferentdifferentiatedifficultdifficulty diffusedig dimension diminishdipdirect direction dirty disabled disadvantage disagree disappear disappoint disappointed disappointing disaster disastrous discard disclose discount discourage discoverdiscoverydiscriminatediscussdiscussiondiseasedisgustdisgustingdisillusiondismissdisplacedisplaydisposaldisposedisputedisregarddistancedistantdistinctdistinguishdistortdistributedistrictdisturbdivediversedivertdividedivisiondivorcedodomaindomesticdominatedoubledoubtdowndownloaddozendragdraindrawdrawbackdreamdressdrinkdrivedropdrowndrugdryduedulldumpdurationduringdutydwarfdwelldynamiceacheagerearlyearneaseeasyeat economic edgeedit educate education effect effective efficient effort either elastic elderelect election electric electricity electronic eliminate else embark embarrass embraceemergeemergencyemotionemotionalemphasisemphasize/-iseemployemploymentemptyemulateenableencloseencounterencourageencouragementendendeavo(u)renergeticenergyenforceengageengineerenhanceenjoyenjoyableenlistenormousenoughenrichenrol(l)ensureenterentertainentertainmententhusiasticentireentitleentranceenvelopeenvironmentenvyequalequalityequipequipmentequivalentescapeespeciallyessenceessentialestablishestablishmentestateestimateethnicevadeevaluateeveneventuallyevereveryeverywhereevidenceevidentevilevolveexact exaggerate exam(ination) examine example exceedexcelexcellent except excess exchange excite exciting exclude excuse exercise exhibitexist existence expand expectexpectationexpenseexpensiveexperienceexpertexplainexplanationexplicitexplodeexploitexploreexplosionexplosiveexportexposeexposureexpressexpressionextendextraextractextraordinaryextremefacefacilitatefadefailfailurefaintfairfairlyfaithfaithfulfallfalsefamefamiliarfamousfanfancyfarfarefashionfashionablefastfastenfatfatefaultfavo(u)rfavo(u)rablefavo(u)ritefearfeastfeaturefederationfeedfeelfeelingfemalefeverfewfieldfiercefightfigure filefillfinal finally finance financial findfine finish finitefirefitfixflashflat flexible float flood flow fluctuate fly focusfoldfollowfondfoolforforbidforceforeignforeseeforgetforgiveformformalformerformulateforthforthcomingfortunatefortuneforwardfosterfoundationframeworkfreefreedomfreezefrequentfreshfriendlyfrightenfromfrontfrownfryfuelfulfil(l)fullfunfunctionfundamentalfunnyfurnishfurtherfurthermorefuturegaingamblegapgathergeargeneralgenerallygenerategenerationgenerousgentlegetgivegladglassglobalglorygluegogoalgolden good goods govern grace graceful gradual graduate grand grant grasp grateful great greed greedy greet grief grind ground group grow growth guaranteeguardguessguidanceguideguidelineguiltyhabithandhandlehanghappenhappyhardhardenhardlyhardshipharmharmfulharnessharvesthatehatredhavehealhealthhealthyhearheavyheighthelphelpfulhenceherehesitatehidehighhighlighthinderhinthirehistoricalhithobbyholdhollowholyhonesthonestyhono(u)rhookhopehopefulhopelesshorizonhorizontalhosthothowhoweverhumanhumblehumo(u)rhumoroushungerhungryhunthurryhurticeideaideal identical identify idleifignorance ignorant ignoreillillegal illness illusion illustrate image imaginary imagination imagine imitateimmediateimmediatelyimmenseimmuneimpactimpairimpartimpedeimpetusimplementimplicitimplyimportanceimportantimposeimpossibleimpressimpressionimpressiveimproveimprovementinincentiveincidentinclineincludeincorporateincreaseindeedindependenceindependentindexindicateindicationindispensableindividualindoorindoorsinduceindustrialinevitableinfectinfectioninfectiousinferinfluenceinfluentialinforminformationinherentinheritinhibitinitialinitiateinitiativeinjureinjuryinnocentinnovationinputinquire/enquireinquiry/enquiryinsectinsertinsideinsight insist inspect inspiration inspire instance instant instead instinct institute institution instruct instruction insult insurance insure integral integrate integrity intelligence intelligentintendintenseintentioninteractinterestinterestinginterfereintermediateinternalinternationalinterpretinterruptintervalinterveneintointrinsicintroduceintroductioninventinventioninvestinvestigateinvestmentinvitationinviteinvolveinwardirrespectiveisolateissuejealousjobjoinjointjokejournaljoyjudg(e)mentjudgejumpjustjusticejustificationjustifykeenkeepkickkillkindkindnesskisskneelknockknowknowledgelabellabo(u)rlackladderlaglandlargelastlatelatelylatter laugh launch lawlaylazy lead lean learn least leave lecture left legal lend length less lesson letlevel liberty lie lifeliftlightlikelikelihoodlikelylikewiselimblimitlinklistlistenlittleliveloadloanlocallocatelocklogiclogicallonelylonglookloomlooseloselosslotloudlovelowlowerloyalloyaltyluckluckymadmagicmailmainmaintainmajoritymakemalemanagemanifestmanipulatemannermanualmanufacturemanymarchmarginmarkmarriagemarriedmarrymassmastermatchmattermaturemaymaybemeanmeans meantime meanwhile measure mechanic media mediate medicalmeetmelt memorize/-ise memorymendmental mention mercymeremerry messagemetalmethodmiddle mightmigratemildmilitarymindminimize/-iseminimumminorminutemiraclemirrormiserablemissmistakemixmixturemodemodelmoderatemodernmodernize/-isemodestmodifymomentmoneymonitormonthlymoodmoralmoremoreovermostmotionmotivatemountmovemuchmultiplymultitudemurdermustmutualmysteriousmysterynakednarrownastynationalnativenaturalnaturenearnearlyneatnecessarynecessityneednegativeneglectneithernervousneverneverthelessnewnewsnewspaper nextnicenoble noisenone nonetheless nornormnormalnotenotice notion nowhere nuclear number numerous nurture obedient obeyobject objection objectiveobligationobservationobserveobsessionobstacleobtainobviousoccasionoccupyoccuroddoddsofoffoffendoffensiveofferofficeofficialoffsetoftenoldomitononceonlyopenoperateoperationopinionopponentopportunityopposeoppositeoptionoptionalororderordinaryorganorganize/-iseorientoriginotherotherwiseoughtoutoutcomeoutdooroutdoorsoutletoutlineoutputoutstandingoveroverallovercomeoverlapoverlookoverseasovertakeoweownpacepackpainpainful paintpairpalepaperparallel paralyze/-yse parcel pardonparkpart participate particular partly partner partypasspassage passivepastpaste patiencepatientpatrioticpatternpausepaypaymentpeacepeacefulpeculiarpendulumpeopleperperceivepercentageperfectperformperformanceperhapsperiodpermanentpermissionpermitpersistpersistentpersonpersonalpersonallyperspectivepersuadephasephenomenonphysicalpickpicturepiecepilepinpinchpityplaceplagueplainplanplantplasticplaypleasantpleasepleasedpleasureplentypluspointpolicypolishpolitepoliticalponderpoolpoorpopularpopulationportionposepositionpositive possess possession possibility possible possibly post postpone potential poundpourpoverty power powerful practical practice practise/-ice praisepraypreach precede precious precisepredictpreferprejudicepreliminarypreoccupypreparationpreparepresencepresentpreservepresspressureprestigepresumepretendprettyprevailprevalentpreventpreviouspriceprideprimaryprimeprincipalprincipleprintpriorpriorityprivateprizeprobableprobablyproblemproceedprocessproduceproductproductionproductiveprofessionprofessionalprofitprogressprohibitprojectpromisepromisingpromotepromptpronepronounceproofproperpropertyproportionproposalproposeprospectprotectprotectionprotectiveprotestproudproveprovide provision public publication publicity publishpullpump punctual punish punishment purchase pure purpose pursue pursuitpushputpuzzle qualify quality quantity quarrelquestionquickquietquitquitequoteradicalraiserandomrangerankrapidrarerarelyrateratherratiorawreachreactreadreadyrealrealize/-isereallyreasonreasonablerecallreceiptreceiverecentrecentlyrecognitionrecognize/-iserecommendreconcilerecordrecoverrecruitreducereductionreferrefinereflectreformrefrainrefreshrefugerefusalrefuseregardregardingregionregisterregretregularregulateregulationreinforcerejectrejoicerelaterelatedrelationrelationship relative relax release relevant relief relieve religion religious reluctant relyremain remark remarkable remedy remember remind removerenderrentrepairrepeat replacereplyreportrepresentrepresentativereproducereputationrequestrequirerescueresearchresemblanceresembleresentreserveresideresignresistresistanceresolveresourcerespectrespondresponseresponsibilityresponsiblerestrestorerestrainrestrictresultretainretirereturnrevealreversereviewreviserevolutionrewardrichridriderightrigidringriperiseriskrivalroarroastrobrolerollrootrotroughroundrouterowroyalrubrubbishruderuinrulerunrushsacrifice sadsafe safeguard safetysailsakesalesamesample satisfaction satisfactory satisfied satisfysavesaysaying scalescarcescatterscenesceneryscentschedulescientificscoldscopescornscrapescratchscreamscreensearchsecondsecretsectionsectorsecureseeseekseemseizeseldomselectselfishsellsendsensationsensesensiblesensitivesentenceseparatesequenceseriesseriousserveservicesetsettleseventyseveralseveresexsexualshadeshadowshakeshallshallowshameshapesharesharpshaveshieldshiftshineshockshootshortshortageshotshouldshoutshowshowershrinkshutshysickside sideways sightsignsignal significance significant silencesilentsillysimilar simple simulate since sinceresingsinglesingularsinksitsituationsizeskil(l)fulskillsleepslideslightslipslipperyslowsmallsmartsmellsmilesmokesmoothsosoarsocialsocietysoftsolesolidsolutionsolvesomesomehowsometimessomewhatsomewheresoonsorrowsorrysortsoundsoursourcesowspacesparesparkspeakspecialspecialistspecificspecifyspeedspellspendspillspinspiritspitspitesplendidsplitspoilsportspotspreadspringsquare stabilize/-is establestaffstagestainstampstand standardstartstate statement statistic statusstaysteadystealsteepsteerstem stepstickstickystiffstillstimulatestingstirstitchstockstockingstopstorystraightstraightforwardstrangestrapstrategicstrategystrengthstrengthenstressstretchstrictstrikestrikingstringstripstripestrokestrongstructurestrugglestubbornstudystuffstupidstylesubjectsubmitsubordinatesubsequentsubsidysubstitutesubtractsucceedsuccesssuccessfulsuccessivesuchsucksuddensuddenlysuffersufficientsuggestsuggestionsuitsuitablesumsummarize/-isesupplementsupplysupportsupposesuresurface surpass surround surrounding survey survive suspect suspend suspicious sustain swallow swearsweepsweetswellswimswingswitch sympathetic sympathize/-i sesympathysystemtabletackletailortaketalktalltametaptargettasteteachteartechnicaltechnologytelltemporarytempttendtendencytendertenseterminateterribleterrortestthanthankthethentheorytheretherebythereforethickthinthingthinkthirstthirstythoroughthoughthoughtthreadthreatthreatenthrivethroughthrowthustidytietighttilltimetiptiretiredtotogethertootoptotaltouchtough towards tracetrade tradition traditional traffic transcend transfer transform transit translate translation transmit transparent transport travel treasure treat treatment tremble trend trialtricktriggertroubletruetrusttruthtrytuneturntutortwisttypetypicaluglyultimateuncertainunconsciousuncoverunderundergounderlieundermineunderstandundertakeundounfairuniformunifyunionuniqueuniteuniversalunlessuntilunusualupupgradeuponuprightupsetupwardurgeurgentuseusefuluselessusherusualusuallyutilize/-isevainvalidvaluablevaluevarietyvariousvaryvehicleveilverseversionverticalveryvesselviavictoryview viewpoint violate violence violent virtual virtue visible visionvisit visualize/-is evital volume volunteer votevoyagewagewaitwakewalk wanderwantwarmwarmthwarnwashwastewatchwaterwavewayweakweakenwealthwearweaveweekweeklyweighwelcomewelfarewellwetwhatwhateverwhenwheneverwherewhereaswherebywhetherwhichwhicheverwhile/whilstwhipwhisperwhistlewhowhoeverwholewhywickedwidewidespreadwidthwildwillwillingwinwindwipewisdomwisewishwithwithinwithoutwitnesswonderworkworriedworryworshipworthworthwhilewouldwrap write wrongyearlyyetyieldyoung积极词汇参考:1) Nation’s first 1000 vocabulary (980) Nation’s second 1000 vocabulary (983) Nation’s Academic Vocabulary (570)2) From Longman Language ActivatorKey Words List (872)3) Longman Defining Vocabulary (2222)附录四:常用前缀、后缀一、常用前缀anti-auto-be-bi-bio-centi-co-con-, col-, com-, cor-contra-counter-de-dis-e-en-, em-ex-extra- fore-in-, il-, im-, ir-inter-intra-kilo-macro-mal-micro-mid-mini-mis-mono-multi-non-out-over-poly-post-pre-pseudo-re-semi-sub-super-tele-therm-, thermo-trans-tri-ultra-un-under-uni-vice-二、常用后缀1、名词后缀-ability,-ibility-age-al-an, -ian, -arian-ance, -ence -ancy, -ency -ant, -ent-cy -dom-ee-er, -or, -ar-ery-ese-ess-ful-hood-ics-ion, -ition,-ation-ism-ist-ity, -ty-ment-ness-ology-ship-sion, -ssion-ure2、动词后缀-en -ify -ize, -ise3、形容词后缀-able, -ible -al-an, -arian, -ian-ant, -ent-ary, -ory-ate -en-ese-free-ful-ic, -ical-ish-ive-less-like-ly-ous, -ious-some-ward-y4、副词后缀-ly -ward, -wards -wise 大学英语词组表a bita case in pointa far cry froma fewa good/great deala good/great manya littlea lota lot/lots ofa number ofa piece of cakea sea ofa variety ofabandon oneself toabide byabove allabove boardabove/over one's head according toaccount foraccuse sb of sth across the boardact onact outact upadd inadd onadd upadd up toafter allagain and again ahead ofahead of schedule ahead of timeall alongall at onceall butall in allall manner ofall of a suddenall overall over againall rightall the sameall the timeall the wayall the whileall things considered all thumbsallow forallow ofalong withamount toand so on/forthangle foranswer foranything butanything likeapart fromapply toarm in armaround/round the corner as a matter of factas a resultas a result ofas a ruleas a wholeas far asas followsas for/toas good asas if/thoughas it isas it wereas often as notas opposed toas regardsas soon asas suchas wellas well asas yetas/so far as…be concerned as/so long asas…asaside fromassociate withat (long) lastat a glanceat a lossat a stretchat a timeat allat all costsat all eventsat all timesat any priceat any rateat bestat easeat faultat firstat first glanceat first sightat full blastat handat heartat homeat intervalsat largeat leastat leisureat lengthat libertyat mostat no timeat onceat one timeat one with sbat one's wits' endat peaceat presentat riskat sb's disposalat seaat short/a moment's noticeat stakeat the cost ofat the expense of at the latestat the mercy of at the momentat the outsideat the risk ofat the same time at timesat willat workat/in a pinchat/on sightavail oneself of back and forth back awayback down/off back outback upbadly offbank onbargain for/onbarge inbe about to dobe addicted tobe aware ofbe bound up inbe bound up withbe composed ofbe fed up withbe friends withbe in forbe mad aboutbe made up ofbe named afterbe to blamebe/get used to doing sth be/stand in awe ofbear downbear on/uponbear outbear upbear withbear/keep in mindbeat downbeat upbecause ofbecome ofbefore longbeg offbehind barsbehind sb's back behind the scenes behind the times believe inbeside oneselfbeside the pointbetter offbeyond (a) doubt beyond all question beyond beliefbeyond measurebeyond/without compare bit by bitblack and blueblock inblock offblock upblot outblow upboard upboil down toboil overbook inborder on bounce backbox inbranch outbreak awaybreak downbreak evenbreak inbreak intobreak offbreak outbreak sb's heart break the ice。

f开头的单词寓意好的 F 开头的英文单词导读:就爱阅读网友为您分享以下“F开头的英文单词”资讯,希望对您有所帮助,感谢您对的支持! fablen.寓言fabricn.织物;织品;结构;构造;建筑物fabricatev.捏造,编造(谎言,借口等);建造,制造fabulousa.极好的;极为巨大的;寓言中的,传说中的facen.脸,面貌;表情;正面v.面对着;朝,面向facilitatev.使变得(更)容易;使便利;推动;帮助;处进facilityn.灵巧,熟练;(pl.)设备,设施,便利条件factn.事实,实际factorn.因素,要素factoryn.工厂facultyn.才能;学院,系;(学院或系的)全体教学人员fadev.褪色;衰减,消失n.淡入(出)n.乏味(平淡)的failv.失败,不及格;衰退,减弱failuren.失败,不及格;失败者;故障,失灵;未能fainta.微弱的;不明显的;暗淡的n./v.昏倒;昏晕faira.公平的,合理的;相当的n.集市,交易会fairlyad.公正地,正当地;相当,还算fairya.幻想中的;虚构的;优雅的n.仙女;精灵faithn.信任,信用;信仰,信条faithfula.守信的,忠实的,如实的,可靠的faken.假货,赝品a.假的,冒充的v.伪造;伪装fallv.跌倒;下降;减弱;坠落;变成,陷于n.秋季falsea.谬误的,虚伪的,伪造的,假的famen.名声;名望;传说vt使出名;传扬…的名familiara.熟悉的;通晓的;亲近的n.熟客;密友familyn.家,家庭成员;氏族,家庭;族,科faminen.饥荒,饥馑famousa.著名的fann.扇子,风扇;(影,球等)迷v.扇,扇动,激起fancyn.爱好,迷恋v.想象,幻想a.花式的,奇特的fantastica.(fantastical)奇异的,幻想的,异想天开的fantasyn.幻想,空想;空想的产物,幻想作品fara./ad.远,久远,遥远ad.到…程度,…得多faren.车费,船费;伙食;乘客v.过活;进展;经营farewellint.再会,别了n.告别farmn.农场,饲养场v.种田,经营农牧业farmern.农民,农场主fartherad.更远地,再往前地a.更远的fascinatev.迷住,强烈吸引fashionn.流行式样(或货品),风尚,风气;样子,方式fashionablea.流行的,时髦的fasta.快的,迅速的;坚固的ad.紧紧地;迅速地fastenv.扎牢,使固定fata.多脂肪的,肥胖的;丰厚的n.脂肪,肥肉fatala.致命的,毁灭性的faten.命运fathern.父亲;创始人,发明者;(Father)神父fatiguen./v.(使)疲劳faultn.过失,过错;缺点,毛病faultya.有错误的,有缺点的,不完善的favorn.(favour)好感;喜爱;关切v.赞成,支持,偏爱favorablea.(favourable)赞许的,有利的,讨人喜欢的favoriten.(favourite)最喜欢的人或物a.喜爱的faxn./v.传真(机)fearn.害怕,恐惧;危险vt.畏惧,害怕,担心fearfula.可怕的,吓人的;害怕,担心,惊恐feasiblea.可行的;切实可行的;行得通的;可用的feastn.节日;宴会featn.功绩,伟业,技艺feathern.羽毛featuren.特征;容貌;特色;特写v.以...为特色Februaryn.二月federala.联邦的;联邦制的;联合的;同盟的federationn.同盟;联邦;联合;联盟;联合会feen.费(会费,学费等);酬金feeblea.虚弱的,无力的feedv.(on,with)喂养,饲养;(with)向…供给feedbackn.反馈;反应;回授feelv.触;认为vi.摸上去有…感觉;摸索;觉得feelingn.感情;心情;知觉;同情fellv.击倒;打倒(疾病等);砍伐a.凶猛的;可怕的fellown.人,家伙;伙伴,同事a.同样的,同事的fellowshipn.伙伴关系;联谊会,团体femalen.女性;女人;雌兽a.女性的;雌的;柔弱的femininea.女性的;娇柔的fencen.篱笆;围栏;剑术v.用篱笆瓦围住;击剑ferryn.摆渡;渡船;渡口v.摆渡;渡运(人,车或物等)fertilea.肥沃的,富饶的;能繁殖的fertilizern.(fertiliser)肥料festivaln.节日;音乐节;戏剧节a.节日的;快乐的fetchv.取来;接来;引出;售得;吸引n.取得;拿feudala.封建的;封地的;领地的fevern.发热,狂热fewa.[表肯定]有些,几个;[表否定]几乎没有的fibern.(fibre)纤维;构造;纤维制品fictionn.虚构,编造;小说fieldn.田野;运动场;(电或磁)场;领域,范围fiercea.凶猛的,残忍的;狂热的,强烈的fifteennum.十五pron./a.十五(个,只...) fiftynum.五十,五十个fightv./n.打(仗),搏斗,斗争,战斗figuren.体形;轮廓;数字;图形v.描绘;计算;推测filen.锉刀;文件,档案v.锉fillv.(with)填满,充满filmn.电影;胶片;薄膜,薄层vt.把..拍成电影filtern.滤器,滤纸finala.最终的,决定性的n.结局;决赛;期末考试finallyad.最后,最终;决定性地financen.财政,金融v.为…提供资金financiala.财政的,金融的findv.(found,found)找到;发现;发觉;感到findingn.发现,发现物;(常pl.)调查/研究结果finea.晴朗的,美好的,细致的v./n.罚金,罚款fingern.手指;指状物;指针finishn.完成;结束;磨光v.完成;结束;用完;毁掉finitea.有限的;[数]有穷的,限定的firen.火;火灾,失火;炉火vi.开火vt.放(枪) firemann.消防队员fireplacen.壁炉firma.坚固的;坚决的,坚定的n.公司,商号firsta./ad.第一;最初;首次n.开始pron.第一名fishn.(pl.fish(es))鱼;鱼肉v.捕鱼;钓鱼fishermann.渔夫,捕鱼人fistn.拳头vt.用拳头打;紧握fita.(病的)发作,痉挛v./a.n.合适,试穿,安装fittinga.适当的,恰当的n.(常pl.)配件,附件;装配fivenum.五pron./a.五(个,只...)fixv.(使)固定;修理;安装;决定;注视n.困境fixturen.固定设备;预定日期;比赛时间;定期存款flagn.旗flamen.火焰,火苗;热情;光辉v.发火焰,燃烧flapn.垂下物,帽沿,袋盖n./v.拍打,拍动flarev./n.闪耀,闪烁flashn./a.闪光(的) v.发闪光,闪亮;闪现flata.平坦的,扁平的,平淡的n.一套房间;平面flattervt.奉承;使高兴;使满意;胜过flavorn.(flavour)情味;风味;滋味v.给…调味flawn.裂缝;缺陷v.使破裂;使有缺陷fleev.逃走;逃避fleetn.舰队,船队fleshn.肉,肌肉flexiblea.柔韧的,易弯曲的,灵活的,能变形的flightn.飞翔,飞行;航班;航程;逃跑;楼梯的一段flingv.(用力地)扔,抛,丢floatn.飘浮;漂流物v.浮动;漂浮;传播;动摇flockn.(一)群,(禽,畜等的)群;大量v.群集,成群floodn.洪水,水灾v.淹没,发大水,泛滥floorn.地板,(楼房)的层flourn.面粉flourishn./v.繁荣,茂盛,兴旺flowv.流,流动n.流量,流速flowern.花;精华,精粹,精英;盛时vi.开花flun.(influenza)流行性感冒fluctuatev.(使)波动;(使)起伏fluenta.流利的,流畅的fluida.流动的,液体的n.流体,液体flushn.脸红v.发红;奔流a.洋溢的;富裕的;齐平的flyn.飞行;苍蝇v飞行;飘杨a.机敏的foamv./n.泡沫,起泡沫focusn.焦点,(活动,兴趣等的)中心v.(on)使聚集fogn.雾气,雾v.以雾笼罩,被雾笼罩foldv.折叠;合拢;抱住n.褶,褶痕;羊栏;信徒folkn.人们;民族;亲属a.民间的followv.跟随,接着;领会;沿着…前进,遵循;结果是followinga.下列的,下述的,其次的,接着的fonda.(of)喜爱的,爱好的foodn.食物,粮食,养料fooln.傻子,笨蛋vt.欺骗,愚弄vi.干蠢事foolisha.愚笨的,愚蠢的footn.(pl.feet)脚,足;英尺;底部footballn.足球footstepn.脚步(声),足迹forprep.为了;给;代替;向;支持conj.因为?forbidv.禁止,不许forcen.力量,力;势力;(pl.)(总称)军队v.强迫foread.在前面a.先前的;在前部的n.前部forecastv./n.预测,预报foreheadn.前额;(任何事物的)前部foreigna.外国的,(to)无关的;外来的;异质的foreignern.外国人foremosta.最先的;最初的; 主要的ad.首要地foreseev.预见,预知forestn.森林foreveradv.(for ever)永远;总是forgev.锻造,伪造n.锻工车间;锻炉forgetv.忘记,遗忘forgivev.原谅,饶恕forkn.叉,耙;叉形物;餐叉formn.形状,形式;表格v.组成,构成;形成formala.正式的;形式的formatn.(出版物的)开本,版式,格式vt.设计;安排formation n.形成;构成;组织;构造;编制;塑造formera.以前的,在前的pron.前者formidablea.强大的;令人敬畏的;可怕的;艰难的formulan.(pl.formulae)公式;规则;分子式;药方formulatev. 用公式表示;规划;设计;系统地阐述forthad.向前;向外,往外forthcominga.即将到来的;准备好的;乐意帮助的;n.来临fortnightn.两星期fortunatea.幸运的,侥幸的fortunen.运气;命运;财产;财富fortynum./a.四十pron.四十(个,只...)forumn.论坛,讨论会forwardad.(also forwards)向前a.向前的v.转交fossiln.化石fostervt.养育;收养;怀抱;鼓励a.收养的n.养育者foula.污秽的;邪恶的v.弄脏;妨害;犯规n.犯规foundvt.建立;创立;创办;使有根据;铸造;熔制foundationn.基础,根本,建立,创立;地基,基金,基金会fountainn.泉水,喷泉,源泉fournum.四pron./a.四(个,只...)fourteennum.十四,十四个foxn.狐狸fractionn.碎片,小部分,一点儿;分数fracturen.裂缝(痕);骨折v.(使)断裂,(使)折断fragilea.易碎的,脆的,易损坏的;虚弱的,脆弱的fragmentn.碎片,小部分,片断fragranta.香的;芬芳的framen.框架;体格;骨架;组织;机构v.设计;制定11。

会议发言稿英文(精选多篇)目录第一篇:英文学术会议主持人发言稿第二篇:会议的各种英文第三篇:国际会议--英文第四篇:学术会议英文邀请函第五篇:会议布展英文更多相关范文正文第一篇:英文学术会议主持人发言稿good morning,ladies and gentleman.welcome to harbin,a beautiful northland ice city of china.i’m abc,from school of economics and management of hit.its a very very great pleasure to participate in the 5th international finance conference as the chairman,its my first time to do so.and i really really enjoy being stay here with you this morning.the international finance conference has been held 4th times by cfa institute since 1998. the purpose of the conference is to share our experiences and knowledge in regard to the theory, frontier developments and reaserches, as well as possible applications of them in solving practical problems a lot of current issues have been discussed,and some of them have been effectively soluted..today,as the first time of the conference debut in this city,we’ll have a unique session.the topic of prepared presentations is the application of quantitative methods in finance ,today’s speakerswill share their thoughts on how to effectively run models in different issues and give a reasonable answer.then,we’ll have a q&a session,which allows the everyone to ask some questions you may be interested.i am sure that you will find some topics to be presented both interesting and informative. now,let me introduce the first speaker,who is very very rich,not in dollars,but in knowledges and experiences,he got his ph.d in financial economics at the ucb,followed by a series of teaching and research positions at mit and harvard. please dont hesitate to join me in welcoming our first speaker, prof.syc, whose topic is entitled threshold effect between the scale of se.thank you for the impressive speech .as far as we konw,shadow banking system played an important role in the last financial crisis mainly derived from its high leverage and asymmetric information characteristics.which produced a supervision dilemma.because lack of information, regulators were unable to measure the actual risk of the financial system.it is crucial for to take a further knowledge of appr(小编推荐你关注网)oaches to gauge the risk exposure more entirely and more precisely.prof syc has given an eye opener aswell as a very meaningful lesson.thank you again,prof syc.plz alow me to introduce the next speaker, wusiqin,who is the corporate department manager of china construction bank in harbin. she holds abachelor degree of science in engineering of hit,she also holds a master of business administration of renmin university of china.her topic today is ce miss wu.thank you for your speech,miss wu. we aredelighted to be able to share your new specific strategies and techniques. miss wu’s speech is about frontier science,which is profound andpredictive,greatly widen our horizon,as least my horizon. anyway, i would like to express to her the most sincere appreciationthe next speaker,mr.jxs, has hosted a daily tv program with respect to economic issues on the and has appeared on cctv,who is also the author of an upcoming book named <more money than nation>.so to speak to you on innovation capability of high tech enterprises by gray theory, please weclome mr jxs with the warmest applause.wow what an innovative idea,to quantify the inonovation ability and classify into different categories. try to think about it and you’ ll find its very enlightening. thank you for the excellent presentations andideas.now,i ll be very pleased and excited tointroduce the next speaker,mrs hujianjie,who is the vice president of cfa institute.to represent the sponsor host unit ,it’s the fifth time for her to be the final presenter.her breadth and depth of knowledge,profound discoveries and distinctive ideas always cause shock at the conference.today,mrs hu will panies,i cant wait to her inspiring ideas.welcome!!!thank you very much for the extremely enlightening presentation. generally,we wanna investigate the correlation of asset liquidity and stock liquidity, thereby linking stock liquidity to corporate finance decisions.but the relationship between asset liquidity and stock liquidity is ambiguous.in her speech, mrs hu introduce a useful model to explore the ambiguous relationship,which may shed new light on the importance of firm’s investment and financing decisions.ladies and gentleman,our distinguished speakers hv finished their presentations,we now enter into the question and answer session.during thissession,prof.syc,miss.wu,mr.jxs,mrs.hujianjie and i will be very happy to answer as many of your questions as we could.are there any questions?ok,well,i m sorry to say that this session will have to stop here.thank you for your questions.i hope this was as good a session for you as it was for dies and gentlemen,i shall end here by thanking you for coming to thethe 5th international finance conference. i hope that you have benefited much from the conference and from discussions with colleagues.i would like to thank mrs.hu and the cfa institute for offering me the opportunity to be the chairman.thanks to everybody who has contributed to the conference and all other participants.thank you for your time and attendance.ladies and gentlemen, you have my best wishes for your still greater achievements in your career. now, i declare the conference closed.lets meet again in beijing in 2020.第二篇:会议的各种英文会议场地:1.pening ceremony开幕典礼2.onference room. 会议厅3.nternational conference room国际会议厅4.eeting-place;venue会议地点5.ffical meeting 正式会议6.eliberate conference 研讨会7.forum;symposium座谈会8.tea party茶话会9. hall大堂10.leisure bar餐厅11.cafeteria自助餐厅12.entrance, 会议厅入口13. exit 会议厅出口会议各种名称:1.报会(status meeting):领导组织(leader-led),单向交流(one-way communication)的汇报(reporting)。

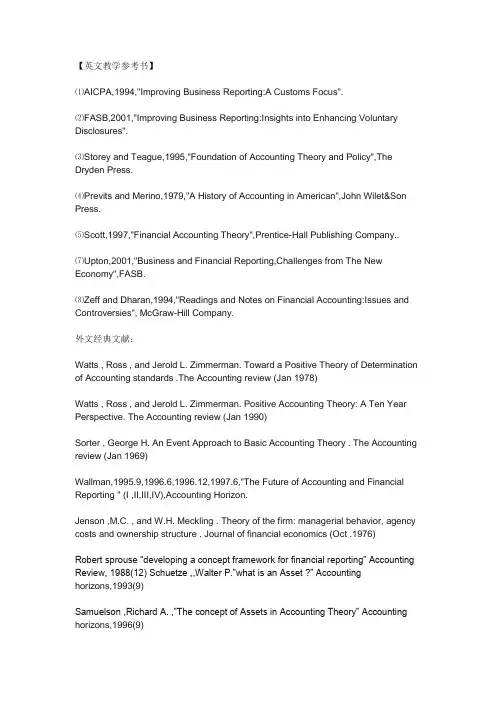

【英文教学参考书】⑴AICPA,1994,"Improving Business Reporting:A Customs Focus".⑵FASB,2001,"Improving Business Reporting:Insights into Enhancing Voluntary Disclosures".⑶Storey and Teague,1995,"Foundation of Accounting Theory and Policy",The Dryden Press.⑷Previts and Merino,1979,"A History of Accounting in American",John Wilet&Son Press.⑸Scott,1997,"Financial Accounting Theory",Prentice-Hall Publishing Company..⑺Upton,2001,"Business and Financial Reporting,Challenges from The New Economy",FASB.⑻Zeff and Dharan,1994,"Readings and Notes on Financial Accounting:Issues and Controversies", McGraw-Hill Company.外文经典文献:Watts , Ross , and Jerold L. Zimmerman. Toward a Positive Theory of Determination of Accounting standards .The Accounting review (Jan 1978)Watts , Ross , and Jerold L. Zimmerman. Positive Accounting Theory: A Ten Year Perspective. The Accounting review (Jan 1990)Sorter , George H. An Event Approach to Basic Accounting Theory . The Accounting review (Jan 1969)Wallman,1995.9,1996.6,1996.12,1997.6,"The Future of Accounting and Financial Reporting " (I ,II,III,IV),Accounting Horizon.Jenson ,M.C. , and W.H. Meckling . Theory of the firm: managerial behavior, agency costs and ownership structure . Journal of financial economics (Oct .1976)Robert sprouse “developing a concept framework for financial reporting” Accounting Review, 1988(12) Schuetze ,,Walter P.”what is an Asset ?” Accountinghorizons,1993(9)Samuelson ,Richard A. ,”The concept of Assets in Accounting Theory” Accounting horizons,1996(9)AAA ,”American Accounting Association on Accounting and Auditing Measurement:1989-1990” Accounting Horizons 1991(9)L.Todd Johnson and Kimberley R.Petrone “Is Goodwill an Asset?” Accounting Horizons1998(9)Linsmeier, Thomas J. and Boatsman ,Ja mes R. ,”AAA’s financial accounting standard response to IASC ED60 intangible assets” Accounting Horizons 1998(9)Linsmeier, Thomas J. and Boatsman,JamesR.”Response to IASC ExposureDraft ,’Provisions,Contingent Liabilities and Contingent Assets’ ” Accoun ting Horizons1998(6)L.Todd Johnson and Robert. Swieringa “derivatives, hedging and comprehensive income” Accounting Horizons 1996(11)Stephen A. .Zeff ,”The Rise of Economics Concequences”, The Journal of Accountancy 1978(12)David Solomons “the FASB’s Conceptual Framework:An Evaluation ” The Journal of Accountancy 1986(6)Paul Miller , “Conceptual Framework:Myths or Realities” The Journal of Accountancy 1985(3)Part I Financial Accounting TheorySuggested Bedtime Readings:1. C.J. Lee, Lecture Note on Accounting and Capital Market2. R. Watts and J. Zimmerman: Positive Accounting Theory3. W. Beaver: Revolution of Financial ReportingAlthough these three books are relatively "low-tech" in comparison with the reading assignments, but they provide much useful institutional background to the course. Moreover, these books give a good survey of accounting literature, especially in the empirical area.1. Financial Information and Asset Market Equilibrium*Grossman, S. and J. Stiglitz, "On the Impossibility of Informationally EfficientMarkets," American Economic Review (1980), 393-408.*Diamond, D. and R. Verrecchia, "Information Aggregation in a Noisy Rational Expectations Economy," Journal of Financial Economics, (1981), 221-35.*Milgrom, P. "Good News and Bad News: Representation Theorems and Applications," Bell Journal of Economics, (1981): 380-91.Grinblatt, M. and S. Ross, "Market Power in a Securities Market with Endogenous Information," Quarterly Journal of Economics, (1985), 1143-67.2. Financial Disclosure* Verrecchia, R. "Discretionary Disclosure," Journal of Accounting and Economics (1983),179-94.2Dye, R., "Proprietary and Nonproprietary Disclosure," Journal of Business, 59 (1986), 331-66.Dye, R., "Mandatory Versus Voluntary Disclosures: The Cases of Financial and Real Externalities," Accounting Review, (1990), 1-24.Bhushan, R., "Collection of Information About Public Traded Firms: Theory and Evidence," Journal of Economics and Accounting, (1989), 183-206.Diamond, D. "Optimal Release of Information by Firms," Journal of Economic Theory (1985), 1071-94.Verrecchia, R. "Information Quality and Discretionary Disclosure," Journal of Accounting and Economics, 1990.Trueman, B. "Theories of Earnings-announcement Timing," Journal of Accounting and Economics, 13 (1990), 1-17.Joh, G. and C. J. Lee "Timing of Financial Disclosure in Oligopolies," mimeo.* Joh, G. and C. J. Lee "Stock Market Reactions to Accounting Information in Oligopoly," Journal of Business, 1992.Darrough, M.N. and N.M. Stoughton, "Financial Disclosure Policy in an Entry Game," Journal of Accounting and Economics, (1990), 219-243.Wagenhofer, A. "Voluntary Disclosure with a Strategic Opponent," Journal of Accounting and Economics, 12 (1990), 341-363.Chang, C. and C.J. Lee, "Information Acquisition as a Business Strategy," Southern Economic Journal, 1992.Chang, C. and C.J. Lee, "Optimal Pricing Strategy in Marketing Research Consulting," International Economic Review, May 1994.Chang, C. and C.J. Lee, "Selling Proprietary Information to Rivaling Clients," mimeo.3. Earnings Manipulation and Accounting Choice* Watts, R. and J. Zimmerman,"Toward a Positive Theory of the Determination ofAccounting Standards," Accounting Review, January 1978, pp.112-34.*Healy, P.M. "The Effect of Bonus Schemes on Accounting Decisions" Journal of Accounting and Economics, April 1985, 85-108.*Chen, K. and C.J. Lee, "Executive Bonus Plans and Accounting Trade-off: The Case of the 3Oil and Gas Industry, 1985-86," Accounting Review, January, 1995.*Lee, C.J. and D. Hsieh, "Choice of Inventory Accounting Methods: A Test of Alternative Hypotheses," Journal of Accounting Research, Autumn 1985.*Lee, C.J. and C.R. Petruzzi, "Inventory Accounting Switch and Uncertainty", Journal of Accounting Research, Autumn 1989.*Chau, D. and C.J. Lee, “Big Bath and Dress Up in the Process of Chapter 11 Restructuring,” working paper.*Aharony, J., C.J. Lee, and T.J. Wong, “Financial Packaging of IPO Firms in China” Journal of Accounting Research, Spring 2000.Gu, Z. and C.J. Lee, “How Widespread is Earnings Management? A Measurement Based on Seasonal Heteroscedasticity.” working paperGu, Z. and C.J. Lee, “Cross-sectional Heteroscedasticity of Accounting Accruals,” working paper.Holthausen, R.W. and R.W. Leftwich, "The Economic Consequences of Accounting Choice: Implications of Costly Contracting and Monitoring," Journal of Accounting and Economics, August 1983, PP. 77-118.Moyer, S.E. "Capital Adequacy Ratio Regulations and Accounting Choices in Commercial banks," Journal of Accounting and Economics, (1990), 123-154.Blacconiere, W.G., R.M. Bowen, S.E. Sefcik, and C.H. Stinson, "Determinants of the Use of Regulatory Accounting Principles by Savings and Loans," Journal of Accounting and Economics, (1991) 167-202.Hand, J.R.M. and P.J. Hughes, and S.E. Sefcik, "Insubstance Defeasances," Journal of Accounting and Economics, (1990), 47-89.Duke, J.C. and H.G. Hunt III, "An Empirical Examination of Debt Covenant Restrictions and Accounting-Related Debt Proxies," Journal of Accounting and Economics, 12 (1990), 45-64.Malmquist, D.H., "Efficient Contracting and the Choice of Accounting Method in the Oil and Gas Industry," Journal of Accounting and Economics, 12 (1990), 173-207.Holthausen, R.W., "Accounting Method Choice: Opportunistic Behavior, Efficient Contracting, and Information Perspectives," Journal of Accounting and Economics, 12 (1990), 207-218.Watts, R. L. and J. L. Zimmerman, Positive Accounting Theory, Prentice Hall, 1985, Chapters 7-15.44. Measurement and Valuation Role of Accounting*Ball, R. and P. Brown, “Empirical Evaluation of Accounting Income Numbers,” Journal of Accounting Research, 1968.*Lee, C.J. and A. Li, “Risk, Contrarian Strategies, and Analysts’ Over-reaction: A Study of B/M and E/P Anomaly in Cross-sectional Returns.” Working Paper.Lee, C.J. "Inventory Accounting and Earnings/Price Ratios: A Puzzle," Contemporary Accounting Research, Fall, 1988.Chen, K. and C.J. Lee, "Accounting Measurement of Economic Performance and Tobin's q Theory," Journal of Accounting, Auditing, and Finance, Spring, 1995.Gu, Z. and C.J. Lee, "Co-integration and Test of Present Value Model: A Revisit," mimeo.Ghosh, A. and C.J. Lee, "Accounting Information and Market Valuation of Takeover Premium," Financial Management, Forthcoming* Joh, G. and C. J. Lee "Stock Market Reactions to Accounting Information in Oligopoly," Journal of Business, 1992.Part II Managerial Accounting5. Agency Theory*Holmstrom, B. "Moral Hazard and Observability," Bell Journal of Economics, (1979), 74-91Rogerson, "The First Order Approach to Principal-Agent Problems," Econometrica, March 1985.*Jesen, M. and W. Meckling, "Theory of the Firm, Managerial Behavior, Agency Costs and Ownership Structure," Journal of Financial Economcs, (1976), 305-60.*Grossman, S. and O. Hart, "An Analysis of the Principal-Agent Problem," Econometrica, (1983), 7-46.Holmstrom, B. "Moral Hazard in Teams," Bell Journal of Economics, (1982), 224-40.Milgrom, P. and J. Roberts, "Relying on the Information of Interested Parties," The Rand Journal of Economics, (1986), 18-32.Malcomson, J. "Rank-order Contract for a Principal with Many Agents," Review of Eonomic Studies, (1986), 807-817.Lambert, R. "Long-term Contracts and Moral Hazard," Bell Journal of Economics, (1983),5.441-452.Malcomson, J. and F. Spinnewyn, "The Multiperiod Principal-Agent Problem," Review of Economic Studies, (1988), 391-408.6. Theory of Firm and Organization*Coase, R.H. "The Nature of the Firm," Economica, (1937), 386-405.*Alchian, A.A. "Uncertainty, Evolution and Economic Theory," Journal of Political Economy,(1950), 211-21.*Alchian, A.A. and H. Demsetz, "Production, Information Costs and Economic Organization," American Economic Review, (1972), 777-795.* Sah, R. and J. Stiglitz, "The Architecture of Economic Systems: Hierarchies and Polyarchies," American Economic Review (1986), 716-727Aoki, M. "Horizontal vs. Vertical Information Structure of the Firm," American Economic Review (1986), 971-983.Tirole, J. "Hierarchies and Bureaucracies," Journal of Law, Economics and Organization (1986), 181-214.Christensen, J. "Communication in Agencies," Bell Journal of Economics, (1981), 661-674.Grossman, S. and O. Hart, "The Costs and Benefits of Ownership: A Theory of Vertical and Horizontal Integration," Journal of Political Economy, (1986), 691-719.Mookherjee, D. "Optimal Incentive Schemes with Many Agents," Review of Economic Studies (1984), 433-46.Demski, J. and D. Sappington, "Optimal Incentives with Multiple Agents," Journal of Economic Theory (1984), 152-71.Holmstrom, B. and J. Tirole, "The Theory of the Firm," in Handbook of Industrial Organization, 1990.Williamson, O. Markets and Hierarchies, 1975Williamson, O. The Economic Institution of Capitalism, 1985, Ch.6, 9, 11.7. Accounting and Internal Control*Demski, J. and D. Sappington, "Hierarchical Structure and Responsibility Accounting," Journal of Accounting Research, 1989.6*Coase, R.H., "Accounting and the Theory of Firm," Journal of Accounting and Economics, (1990), 3-13.Jordan, J., "The Economics of Accounting Information Systems," American Economic Review, 1989.Antle, R. and J. Fellingham, "Resource Rationing and Oganizational Slack in aTwo-Period Model," Journal of Accounting Research, (1990) 1-24.Demski, J., J. Patell, and M. Wolfson, "Decentralized Choice of Monitoring Systems," Accounting Review, (1984), 16-34.Penno, M. "Accounting Systems, Participation in Budgeting, and Performance Evaluation," Accounting Review, (1990), 303-314.Melumed, N.D. and S. Reichelstein, "Centralized vesus Delegation and the Value of Communication," Journal of Accounting Research, (1987 Supplement), 1-21.8. Field Studies of Management Accounting*Baiman, S., D.F. Larcker, and M.V. Rajan, "Organizational Design for Business Units," Journal of Accounting Research, 33 (Autumn 1995): 205-231.Lee, C.J. “Financial Restructuring of State-owned Enterprises in China: The Case of Shanghai Sunve Co.” Accounting, Organization and Society, fo rthcoming.Part 3. Auditing and Accounting Regulation9. Role of Auditing*R.A. Dye, B.V. Balachandran, and R.P. Magee, "Contingent Fees for Audit Firms," Journal of Accounting Research, (1990), 239-266.*L. DeAngelo, "Auditor Independence, 'Low Balling,' and Disclosure Regulation," Journal of Accounting and Economics, (1981), 113-27.*Lee, C.J. and Z. Gu, " Low Balling, Legal Liability and Auditor Independence,” Accounting Review, 1998.Magee, R.P. and M. Tseng, "Audit Pricing and Independence," Accounting Review, (1990), 315-336.Datar, S., G.A. Feltham, and J.S. Hughes, "The Role of Audits and Audit Quality in Valuing New Issues," Journal of Accounting and Economics, (1991), 3-50.7Penno, M. "Auditing for Performance Evaluation," Accounting Review, (1990),520-536.Melumad, N.D. and L. Thoman, "On Auditors and the Courts in an Adverse Selection Setting," Journal of Accounting Research, (1990) 77-120.Baiman, S., J.H. Evans III, and N.J. Nagarajan, "Collusion in Auditing," Journal of Accounting Research, (1991), 1-18.10. Financial Accounting Standards*Dye, R. and R.E. Verrecchia, "Discretion vs. Uniformity: Choices Among GAAP," Accounting Review, July 1995, 389-415.Farrell, J. and G. Saloner, "Standardization, Compatibility, and Innovation," Rand Journal of Economics. 16 (Spring 1985): 70-83.*Lev, B. "Toward a Theory of Equitable and Efficient Accounting Policy," Accounting Review, January 1988.11. The Market of CPAs*Dye, R. "Incorporation and the Audit Market," Journal of Accounting and Economics, 19 (1995): 75-114.*Lee, C.J., C. Liu, and T. Wang, “The 150 Hours Rule,” Journal of Accounting and Economics, 1999.Liu, C., C.J. Lee, and T. Wang, “Human Capital, Auditor Independence, and Legal Liability,” working paper.Riodan, M. and D. Sappington, "Information, Incentives, and Organizational Mode,"Quarterly Journal of Economics, 102 (1987): 243-264.*Gigler, F. and M. Penno, "Imperfect Competition in Audit Markets and its Effects on the Demand for Audit-Related Services," Accounting Review, 70 (April 1995):317-336.。

北京大学光华管理学院龚六堂教授简历龚六堂:专业:国民经济学,系别:应用经济学系,职称:教授,通信地址:北京大学光华管理学院应用经济学系,邮政编码:100871,Tel:(010)6275-7768,Fax:(010)6275-7764,Email:ltgong@教育背景:1988年9月-1992年7月:武汉大学数学系本科,1992年获得学士学位;1992年9月-1994年7月:武汉大学数学系研究生,1994年获得硕士学位;1994年9月-1997年7月:武汉大学数学系研究生,1997年获得理学博士学位工作经历:1997年7月-1999年9月: 武汉大学高级研究中心副教授;1999年9月-2004年8月: 北京大学光华管理学院应用经济学系副教授.2004年8月-至今: 北京大学光华管理学院应用经济学系教授.主要教学经历:1.中级宏观经济学教材:Macroeconomic Theory and Policy, Branson, W2.线性和非线性规划教材:Introduction to Linear and Nonlinear Programming, Luenberger, D.E.The Theory of Linear Economy, Gale, D.3.动态优化教材:Dynamic Optimization, Kamien, M.I. and Schwartz,N. L.4.消费者和厂商理论教材:Microeconomic Theory, Varian, H.5.市场和均衡理论教材:Microeconomic Theory, Varian, H.6.经济增长理论教材:Economic Growth, Barro, R.J. and Sala-i-Martin,X.7.高级宏观经济学教材:Macroeconomic Theory, Sargent, T.J.Lectures on Macroeconomic, Blanchard, O.J. and Fischer, R.W.8.最优控制理论教材:Deterministic and Stochastic Optimal Control, Fleming, W.H. and Rishel, R.W.9.动态宏观经济学教材:Methods of Macroeconomic Dynamics, Turnovsky, S. T.10.投资理论教材:Investment Under Uncertainty, Dixit, A. K. and Pindyck, R. S.11.公共财政理论教材:Public Finance, Myles.12.动态国际经济学教材:International Macroeconomic Dynamics, Turnovsky S.J.13.经济增长理论专题14.公共财政理论专题1997年3月应邀为中南民族学院研究生讲授宏观经济学课程。

最牛英语口语培训模式:躺在家里练口语,全程外教一对一,三个月畅谈无阻!洛基英语,免费体验全部在线一对一课程:/ielts/xd.html(报名网址)[范文9]congratulations on one’s published wordsmarch 14dear john,your new book entitled“western economics”is very interesting and instructive. you deal with the subject skillfully and comprehensively.the details you present and the way you present them captured my attention. it was so fascinating that i could not tear myself away before i finished reading the last word. i think now i have a better understanding of such subject.it’s certain that more and more students and research workers will read your book and derive great benefit from it.congratulations on such a good book!cordially yours,cathy[范文10]tactful refusal to an invitationdear mrs. james,i’ve been putting off this note until the last possible moment, hoping mr. jackson would get back from london in time for your dinner party. but now i must regretfully write that he’ll still be out of town on thursday, the fifth; and we therefore cannot accept your kind invitation for dinner on that day. it was sweet of you to invite us; and i know mr. jackson will be as sorry as i am to miss an evening with you and dr. james. we know how delightful such evenings at your house usually are.sincerely yours,susan jackson第三章大学英语四级考试预测题与范文1.助学贷款申请信directions: for this part, you are allowed 30 minutes to write a letter applying for a bank loan. you should write at least 120 words following the outline given below in chinese.(1)个人情况介绍(2)申请贷款的原因、数额及用途(3)如何保证专款专用以及你的还款打算dear sir/madame,i am a sophomore in shanghai university, majoring in computer software. in the previous one and a half years i have been a model student and monitor of my class.however, since i registered here, the expenses have become a burden for my average family. you know, my parents are both laid off workers, and, to make matters worse, my mother has suddenly fallen ill and is expecting a major operation. it will be beyond their ability to finance me through my remaining education. it is now a must for me to help relieve their financial pressure. so i’m applying to your bank fora loan of 10,000 yuan. if my application is approved, all the money will go to my tuition and fees for the coming academic years.i’ve made a detailed plan to arrange my school life. a part time job as a family tutor will not be difficult to find and some work study programs for students like me are also provided in our university. from these sources i will be able to earn more than enough to support myself. i guarantee that i will repay the loan within five years, that is, within two years after my graduation. please have confidence in me: i have a very good credit record.i would be greatly obliged if my application is granted. many thanks.yours sincerely,li ming2.找工作的时候选择兴趣还是工资高salary or interestupon graduation,virtually all college students will confront the problem of the career choice. it is truly a tough choice. students’opinions differ greatly on this issue. some hold that priority should be given to their interest in jobs,but others take the attitude that salary is the most critical factor influencing their career choices.as to myself,i prefer the latter view. a well paid job exerts a tremendous fascination on a great number of people,with no exception to me. although it might be impossible to measure the value of one’s job in terms of money,salary counts most when i choose my future career. in my view,our career choices largely depend on how and where we have been brought up. i come from a poor urban family and my parents were both laid off workers. in order to finance my tuition,they have been working hard over the past four years. as the only son in my family,i have to shoulder the burden of supporting my family.in short,salary is the first and only consideration in my choice of career.3. 拥有手机的优点和缺点advantages and disadvantages of the mobile phonewith the rapid economic development,the mobile phone has found its way into campuses and a host of students take advantage of this wonderful gadget to communicate with each other. this phenomenon gives rise to this question:what are the advantages and disadvantages of the mobile phone?it is widely believed that it greatly facilitates students’campus life. many instances could be found to support this type of opinion. a graduating student in our university bought a mobile phone in the course of hunting for his job. he told me that through the mobile phone he could easily keep in touch with the employer of the company he intends to work with and would not miss any opportunities.however,everything has both positive and negative facets. the mobile phone also has many disadvantages. for instance,the ringing of the mobile phone often disturbs the teacher’s teaching and other students’learning.来源:优习网personally,the advantages of the mobile phone outweigh the disadvantages of it as long as we don’t interfere with others while using it.4.给中国的航天英雄杨利伟写信,表达你的祝贺和对中国太空事业的看法。