财务报表附注披露的分析【外文翻译】

- 格式:doc

- 大小:60.50 KB

- 文档页数:15

财务报表附注英语Financial report notes are additional disclosures that provide detailed information related to the financial statements. These notes are an integral part of any financial statement and provide insight into the financial condition, performance, and cash flow of an organization. The following are some common contents that may be included in financial report notes:1. Accounting Policies: The summary of accounting policies that the organization uses to prepare its financial statements.2. Business Segment Information: A disclosure of revenue, operating profit, and assets by business segment.3. Contingent liabilities: A description of potential liabilities that depend on the occurrence of an uncertain event.4. Depreciation: A detailed breakdown of the methods used to calculate depreciation expense.5. Earnings Per Share (EPS): A calculation of earnings per share for the period.6. Financial Instruments: A comprehensive overview of the financial instruments used in the reporting period, including information on the fair value measurement and the risks involved.7. Goodwill: A detailed valuation of goodwill, along with any impairment charges.8. Inventories: A detailed breakdown of inventory values, including raw materials, work-in-progress, and finished goods.9. Leases: A description of the leased assets and liabilities of the organization.10. Related party transactions: A disclosure of transactions between related parties and the impact on the financial statements.11. Restructuring: A breakdown of the cost associated with restructuring activities, including charges related to employee severance and facility closures.12. Revenue Recognition: A detailed overview of the revenue recognition policies of the organization.Overall, financial report notes provide important context and details to the financial statements that can aid in the interpretation and analysis of the financial health of an organization.。

财务报表附注汉英翻译报告

随着经济全球化进程加速,中国政府鼓励越来越多的中国企业"走出去",寻求国际合作。

在国际合作中,财务报表承担着披露企业经济活动、财务业绩以及经济优势的责任。

因此,好的财务报表翻译尤其重要。

目前,对财务报表的翻译研究主要集中在英汉翻译和词汇翻译两个方面。

本报告基于一份审计报告的汉英翻译实践。

审计报告包括审计意见和财务报表两部分。

翻译实践原文为财务报表附注的部分内容,财务报表附注是财务报表的主要组成部分。

本报告研究了奈达功能对等理论对财务报表翻译的指导作用。

本报告共包括四个部分:第一章介绍了翻译任务以及财务报表;第二章描述了翻译过程,包括译前准备,译中翻译难点以及译后反馈三个部分;第三章首先介绍了功能对等理论和提出翻译过程中所用到的翻译原则;然后通过案例分析,解释了翻译原则及方法的运用;报告最后进行了总结。

研究方法包括举例子和理论解释。

报告希望能为从事财务报表翻译的译者提供一定的参考。

第1篇Executive SummaryThis analysis aims to provide a comprehensive overview of the financial performance of XYZ Corporation over the past fiscal year. By examining the financial statements, including the balance sheet, income statement, and cash flow statement, we can gain insights into the company's profitability, liquidity, solvency, and overall financial health. This report will be presented in both English and Chinese, with key findings and conclusions translated for clarity.I. IntroductionXYZ Corporation, a leading company in the technology industry, has released its financial report for the fiscal year ending December 31, 2022. The report provides a detailed account of the company's financial activities, performance, and position during the period. This analysis will focus on the key financial indicators and ratios, highlighting the company's strengths and weaknesses, and offering recommendations for improvement.II. Financial Statements AnalysisA. Balance SheetThe balance sheet provides a snapshot of the company's financialposition at a specific point in time. The following analysis will focus on the key components of the balance sheet:1. Assets: XYZ Corporation's total assets increased by 15% from the previous fiscal year, driven by a 20% growth in current assets and a 10% increase in non-current assets. This indicates that the company has been successful in expanding its asset base.2. Liabilities: The total liabilities of XYZ Corporation also increased by 12%, with current liabilities growing by 15% and non-currentliabilities by 10%. This suggests that the company has taken on additional debt to finance its growth.3. Equity: The equity of XYZ Corporation increased by 18% over thefiscal year, reflecting the company's profitability and reinvestment in the business.B. Income StatementThe income statement shows the company's revenue, expenses, and net income over a specific period. The following points highlight the key aspects of the income statement:1. Revenue: XYZ Corporation's revenue increased by 20% from the previous fiscal year, driven by strong sales in the technology sector.2. Expenses: The company's expenses increased by 15%, with cost of goods sold (COGS) increasing by 18% and selling, general, and administrative expenses (SG&A) increasing by 12%. This indicates that the company has been able to control its cost of goods sold but has experienced some increases in SG&A expenses.3. Net Income: XYZ Corporation's net income increased by 25% over the fiscal year, reflecting the company's strong operational performance.C. Cash Flow StatementThe cash flow statement provides insights into the company's cashinflows and outflows. The following analysis focuses on the key components of the cash flow statement:1. Operating Cash Flow: XYZ Corporation's operating cash flow increased by 30% over the fiscal year, indicating strong cash-generating capabilities.2. Investing Cash Flow: The company's investing cash flow decreased by 5%, primarily due to lower capital expenditures.3. Financing Cash Flow: Financing cash flow increased by 20%, driven by higher dividends paid to shareholders and an increase in long-term debt.III. Financial Ratios AnalysisA. Liquidity Ratios1. Current Ratio: XYZ Corporation's current ratio increased from 1.5 to 1.8, indicating improved short-term liquidity.2. Quick Ratio: The quick ratio improved from 1.2 to 1.5, suggestingthat the company has a strong ability to meet its short-term obligations.B. Solvency Ratios1. Debt-to-Equity Ratio: The debt-to-equity ratio decreased from 1.2 to 1.0, indicating a more conservative financial structure.2. Interest Coverage Ratio: The interest coverage ratio improved from 5.0 to 6.0, reflecting the company's ability to cover its interest expenses.C. Profitability Ratios1. Gross Profit Margin: The gross profit margin remained stable at 40%, indicating efficient cost management.2. Net Profit Margin: The net profit margin increased from 15% to 20%, reflecting the company's improved profitability.IV. ConclusionXYZ Corporation has demonstrated strong financial performance over the past fiscal year, with significant growth in revenue, net income, and operating cash flow. The company's liquidity and solvency ratios are also healthy, indicating a strong financial position. However, there are areas of concern, such as the increase in SG&A expenses and the need to manage long-term debt.V. Recommendations1. Cost Control: XYZ Corporation should focus on managing SG&A expenses to improve profitability.2. Debt Management: The company should consider strategies to manage long-term debt, such as refinancing or paying down existing debt.3. Investment in Research and Development: Investing in research and development can help the company stay competitive in the technology industry.VI. 中文摘要本报告旨在全面分析XYZ公司过去一个财年的财务表现。

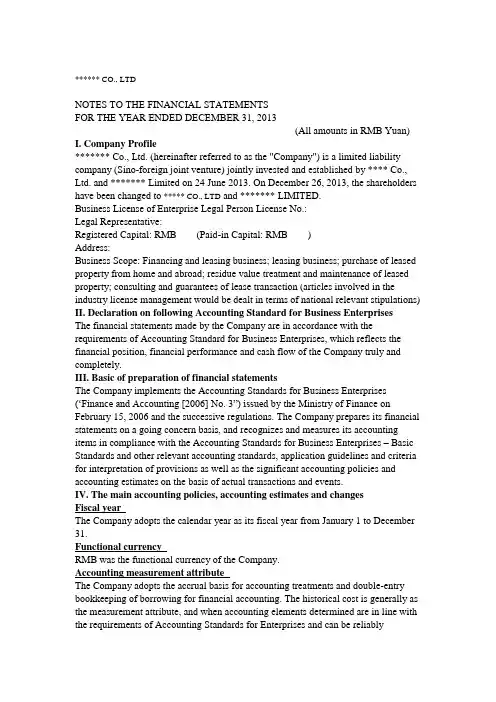

****** CO., LTDNOTES TO THE FINANCIAL STATEMENTSFOR THE YEAR ENDED DECEMBER 31, 2013(All amounts in RMB Yuan)I. Company Profile******* Co., Ltd. (hereinafter referred to as the "Company") is a limited liability company (Sino-foreign joint venture) jointly invested and established by **** Co., Ltd. and ******* Limited on 24 June 2013. On December 26, 2013, the shareholders have been changed to ***** CO., LTD and ******* LIMITED.Business License of Enterprise Legal Person License No.:Legal Representative:Registered Capital: RMB (Paid-in Capital: RMB )Address:Business Scope: Financing and leasing business; leasing business; purchase of leased property from home and abroad; residue value treatment and maintenance of leased property; consulting and guarantees of lease transaction (articles involved in the industry license management would be dealt in terms of national relevant stipulations) II. Declaration on following Accounting Standard for Business EnterprisesThe financial statements made by the Company are in accordance with the requirements of Accounting Standard for Business Enterprises, which reflects the financial position, financial performance and cash flow of the Company truly and completely.III. Basic of preparation of financial statementsThe Company implements the Accounting Standards for Business Enterprises (,Finance and Accounting [2006] No. 3”) issued by the Ministry of Finance on February 15, 2006 and the successive regulations. The Company prepares its financial statements on a going concern basis, and recognizes and measures i ts accounting items in compliance with the Accounting Standards for Business Enterprises – Basic Standards and other relevant accounting standards, application guidelines and criteria for interpretation of provisions as well as the significant accounting policies and accounting estimates on the basis of actual transactions and events.IV. The main accounting policies, accounting estimates and changesFiscal yearThe Company adopts the calendar year as its fiscal year from January 1 to December 31.Functional currencyRMB was the functional currency of the Company.Accounting measurement attributeThe Company adopts the accrual basis for accounting treatments and double-entry bookkeeping of borrowing for financial accounting. The historical cost is generally as the measurement attribute, and when accounting elements determined are in line with the requirements of Accounting Standards for Enterprises and can be reliably measured, t he replacement cost, net realizable value and fair value can be used for measurement.Accounting method of foreign currency transactionsThe Company?s foreign currency transactions adopt approximate spot exchange rate of the transaction date to convert into RMB in accordance with systematic and rational method; on the balance sheet date, the foreign currency monetary items use the spot exchange rate of the balance sheet date. All balances of exchange arising from differences between the balance sheet date spot exchange rate and the initial recognition or the former balance sheet date spot exchange rate, except that the exchange gains and losses arising by borrowing foreign currency for the construction or production of assets e ligible for capitalization are transacted i n accordance w ith capitalization principles, are included in profit or loss in this period; the foreign currency non-monetary items measured at historical cost will still be converted with the spot exchange rate of the transaction date.The standard for recognizing cash equivalentWhen making the cash flow statement, cash on hand and deposits readily to be paid will be recognized as cash, and short-term (usually no more than three months), highly liquid and readily convertible to known amounts of cash with insignificant riskof changes in value are recognized as cash equivalent.Financial InstrumentsClassification, recognition and measurement of financial assets- The company at the time of initial recognition of financial assets divides it into the following four categories: financial assets measured at fair value with changes included in the profit or loss of this period, loans and receivables, financial assets available for sale and held-to-maturity investments. Financial assets are measured at fair value when initially recognized. Relevant transaction costs of financial assets measured at fair value with changes included in the profit or loss of this period are recognized in profit or loss of this period, and relevant transaction costs of other categories of financial assets are recognized in the amount initially recognized.-- Financial assets measured at fair value with changes included in the profit or loss of this period refer to the short-term sales financial assets, including financial assets held for trading or financial assets measured at fair value with changes i ncluded in the profit or loss of this period designated upon initial recognition by the management. Financial assets measured at fair value with changes included in the profit or loss of this period are subsequently measured at fair value, and the interest or cash dividends obtained during the holding period will be recognized as investment income, and the gains or losses of the change in fair value at the end of this period are recognized in the profit or loss in this period. When it is disposed, the difference between the fair value and the initial recorded amount is recognized as investment income, while adjusting gains from changes in the fair value.--Loans and receivables: the non-derivative financial assets w ithout the price in an active market and with fixed and determinable recovery cost are classified as loans and receivables. Loans and receivables adopt the effective interest method and take amortized cost for subsequent measurement, and gains or losses arising from derecognition, impairment or amortization are included in the profit or loss of this period.-- Financial assets available for sale: including non-derivative financial assets available for sale recognized initially and other non-derivative financial assets except for loans and receivables, held-to-maturity investments and trading financial assets. Financial assets available for sale are subsequently measured at fair value, and interest or cash dividends obtained during the holding period will be recognized as investment income, and gains or losses arising from the changes in fair value at the end of this period are recognized directly in owners' equity until the financial asset is derecognized or impaired and then is recognized as the profit or loss in this period.-- Held-to-maturity investments: the non-derivative financial assets with clear intention and ability to hold to maturity by the management of the company, a fixed maturity date and fixed or determinable payments are classified as held-to-maturity investments. Held-to-maturity investments adopt the effective interest method and take amortized cost for subsequent m easurement, a nd gains or losses arising from derecognition, impairment or amortization are included in the profit or loss of this period.Classification, recognition and measurement of financial liabilities- The company at the time of initial recognition of financial liabilities divides it intothe following two categories: financial liabilities measured at fair value with changes included in the profit or loss of this period and other financial liabilities. Financial liabilities are measured at fair value when initially recognized. Relevant transaction costs of financial liabilities measured at fair value with changes included in the profitor loss of this period are recognized in profit or loss of this period, and relevant transaction costs of other financial liabilities are recognized in the amount initially recognized.-- Financial liabilities measured a t fair value with changes included in the profit or loss of this period include the trading financial liabilities and financial liabilities measured at fair value with changes included in the profit or loss of this period designated upon initial recognition. Financial liabilities are subsequently measured at fair value, and the gains or losses of the change in fair value are recognized in the profit or loss in this period.-- Other financial liabilities: adopting the effective interest method and taking amortized cost for subsequent measurement. The gains or losses arising from derecognition or amortization is included in the profit or loss of this period. Requirements for derecognition of financial liabilitiesFinancial liabilities shall be entirely or partially derecognized if the present obligations derived from them are entirely or partially discharged. Where the Company enters into an agreement with a creditor so as to substitute the current financial liabilities with new ones, and the contract clauses of which are substantially different from those of the current ones, it shall recognize the new financial liabilitiesin place of the current ones. Where substantial revisions are made to some or all of the contract clauses of the current financial liabilities, the Company shall recognize the new financial liabilities after revision of the contract clauses in place of the currentones entirely or partially.Upon entire or partial derecognition of financial liabilities, differences between thecarrying amounts of the derecognized financial liabilities and the consideration paid (including non-monetary assets surrendered or new financial liabilities assumed) are charged to profit or loss for the current period.Where the Company redeems part of its financial liabilities, it shall allocate the carrying amounts of the entire financial liabilities between the relative fair values ofthe parts that continue to be recognized and the derecognized parts on the redemption date. Differences between the carrying amounts allocated to the derecognized parts and the consideration paid (including non-monetary assets surrendered and the new financial liabilities assumed) are charged to profit or loss for the current period. Recognition and measurement for transfer of financial assetsIf the Company has transferred nearly all of the risks and rewards relating to the ownership of the financial assets t o the transferee, they shall be derecognized. I f it retains nearly all of the risks and rewards relating to the ownership of the financial assets, they shall not be derecognized and will be recognized as a financial liability. If the Company has not transferred nor retained nearly all of the risks and rewards relating to the ownership of the financial assets:(1) to give up the control of the financial assets to be derecognized; (2) not giving up control of the financial asset to be recognized based on the extent of its continuing involvement in the transferred financial assets and liabilities are recognized accordingly.If the transfer of entire financial assets satisfy the criteria for derecognition, differences between the amounts of the following two items shall be recognized in profit or loss for the current period: (1) the carrying amount of the transferred financial asset; (2) the aggregate consideration received from the transfer plus the cumulative amounts of the changes in the fair values originally recognized in the owners? equity. If the partial transfer of financial assets satisfy the criteria for derecognition, the carrying amounts of the entire financial assets transferred shall be split into the derecognized and recognized parts according to their respective fair values and differences between the amounts of the following two items are charged to profit or loss for the current period: (1) the carrying amounts of the derecognized parts;(2) The aggregate consideration for the derecognized parts plus the portion of the accumulative amounts of the changes in the fair values of the derecognized parts which are originally recognized in the owners? equity.Determination of the fair value of financial instruments- If financial instruments trade in an active market, the quoted price in an active market determines its fair value; if financial instrument trade not in an active market, the valuation techniques determine the fair value. Valuation techniques include recent market transaction price reference to the familiar situation and volunteer transaction, current fair value reference to other substantially similar financial instruments, discounted cash flow method and option pricing model and so on.Test and Provisions for impairment loss on financial assets--Except trading financial assets, the Company makes assessment o n the carrying values of financial assets at the balance sheet date. If there is evidence that the fair value of specific financial asset has been impaired, provisions for impairment loss is made accordingly.-- Measurement of impairment of financial assets measured at amortized costIf there is objective evidence that the financial asset measured at amortized cost has been impaired, the carrying amount of the financial asset is written down to the present value of estimated future cash flows (excluding future credit losses that have not yet occurred), and the amount of reduction is recognized as impairment loss and is recognized in the profit or loss of this period. The Company carries out the impairment test of significant single financial asset separately, carries out the impairment test on insignificant single financial asset from a single or combination of angles, and carries out the impairment test on single asset without objective evidence of impairment along with the financial assets with similar credit risk characteristics to constitute a combination, but does not carry out the impairment test on the provisionfor impairment of financial assets based on the single in the portfolio. In the subsequent period, if there is objective evidence that the value of financial asset has been restored and recognized relevant to the objective matters occurring after the impairment, previously recognized impairment loss shall be reversed and charged into the profit or loss of this period. But the book value after the reversal should not exceed the amortized cost at the reversal date of the financial assets supposed no provision for impairment. When the financial assets measured at amortized cost actually occur loss, offset against the related provision for impairment.--Available for sale financial assetsIf there is objective evidence that an impairment of available for sale financial assets occurs, even though the financial asset has not been derecognised, the cumulative loss of decrease o f the faire value originally recorded in the owner's equity should be transferred out and charged into the current profit and loss. The cumulative loss is the initial acquisition cost of available for sale financial assets, deducting the fair value of the withdrawing principal and amortization amount and impairment loss as well as net impairment amount originally charged into the profit or loss.Recognition and provision for bad debts of accounts receivableIf there is objective evidence that receivables are impaired at the end of this period,the carrying value will be written down to its present value of estimated future cash flows, and the amount of reduction is recognized as impairment loss and is recognized in the current profit or loss. Present value of estimated future cash flows is determined through future cash flows (excluding credit losses that have not been incurred) discounted at the original effective interest rate, taking into account the value of related collateral (less estimated disposal costs, etc.). Original effective interest rate is the actual interest rate when the receivables are recognized initially. The estimated future cash flows of short-term receivables have small difference from the present value, and the estimated future cash flows are not discounted in determining the related impairment loss.The significant single receivables are separately carried out impairment test at the end of this period, and if there is objective evidence that the impairment has occurred, based on the difference of the present value of future cash flows less than the book value, the impairment loss is recognized and the provision of bad debts is done. The significant single amount refers to top five receivable balances or the sum ofpayments accounting for more than 10% of receivable balances.If there is objective evidence that the individual non-significant receivables impairment has occurred, separate impairment test is done, the impairment loss is recognized and the provision for bad debts is done; other individual non-significant receivables and receivables not impaired after separate test are together divided into several combinations for impairment testing with aging as the similar credit risk characteristics, to determine the impairment loss and do provision for bad debts.In addition to separate provision for impairment of receivables, the company is based on the actual loss rate of receivable portfolio with the same or similar to the previous year and aging as the similar credit risk characteristics, and combines the current situation to determine the ratio of provision for bad debts as follows:Aging Ratio of provisionWithin one year 5%1 –2 years 20%2 –3 years 50%Over 3 years 80%Fixed assets and depreciation accounting methodRecognition criteria of fixed assets: fixed assets refer to tangible assets held for the purpose of producing commodities, providing services, renting or business management with useful lives exceeding one accounting year and high unit value. Classification of fixed assets: buildings and constructions, machinery equipment, transport equipment and office equipment.Fixed assets pricing and depreciation method: the fixed assets is priced based on actual cost and depreciated in a straight-line method. The estimated useful lives, estimated residual rate and annual depreciation rate of various categories of fixed assets are listed as follows:Category of fixed assets Estimateduseful lives(year)Estimated residualrate (year)Annualdepreciation rate(%)Buildings andconstructions20 10 4.5machinery equipment 10 5 9.5transport equipment 5 5 19office equipment 5 5 19Impairment of fixed assets: the Company checks the fixed assets term by term at the end of the reporting period, and if the market continuing to fall or technological obsolescence, damage, long-term idle and other reasons result in fixed assets recoverable amount lower than its book value, in accordance with the difference provision for impairment of fixed assets, the impairment loss is recognized in fixed assets a nd can not be reversed in a subsequent a ccounting period. The recoverable amount is recognized based on the fair value of the assets deducting the net amount after disposal expenses a nd the present value of cash flows of the estimated future assets. The present value of the future cash flows of the asset is determined in accordance with the resulting estimated future cash flows in the process of continuoususe and final disposal to select its appropriate discount rate and the amount of the discount.Accounting method of construction in progressThe construction in progress is priced on the actual cost, to temporarily transfer to fixed assets when reaching the intended use state in accordance with the project budget and the actual cost of the project, and to adjust the book value of fixed assets according to the actual cost after handling final settlement of accounts. Acquisition, construction or production of assets eligible for capitalization borrowed specifically or the interest on general borrowing costs and auxiliary expenses of specific borrowings occurred can be included in the cost of capital assets and subsequently recognized in the current profit or loss before the acquisition, construction or production of the qualifying asset reaches the intended use state or the sale state.Impairment of construction in progress: the Company conducts a comprehensive inspection of construction in progress at the end of the reporting period; if the construction in process is stopped for long time and will not be constructed in the next three years and the construction in progress brings great uncertainty to the economic benefits of enterprises due to backward performance or techniques and the construction in progress occurs impairment, the balance of recoverable amount of single construction in progress lower than the book value of construction in progressis for impairment provisions of construction in progress. Impairment loss on the construction in progress shall not be reversed in subsequent accounting periods once recognized.The pricing and amortizing of intangible assetsPricing of the intangible assets---The cost of outsourcing intangible assets shall be priced based on the actual expenditure directly attributable to intangible assets for the expected purpose.--- Expenditure on internal research and development projects is charged into the current profit or loss, and expense in the development stage can be recognized as intangible costs if meeting the criteria for capitalization.--- Intangible assets of investment is in accordance with the agreed value of the investment contract or agreement as costs, excluding not fair agreed value of the contract or agreement.--- Intangible assets of the debtor obtained in the non-cash asset cover debt method can be accepted; if the receivable creditor?s right is changed into intangible assets, then record according to the fair value of intangible assets.--- For non-monetary transaction intangible assets, t he fair value and related taxes payable of non-monetary assets should be the accounting cost.Amortization of intangible assets: as for the intangible assets with limited service life, it is amortized by straight-line method when it is available for use within the service period. As for unforeseeable period of intangible assets bringing future economic benefits to the company, it is regarded as intangible assets with uncertain service life, and intangible assets with uncertain service life can not be amortized. The Company?s intangible assets include land use rights, forest land use rights and the production and marketing information management software. The land use rights are amortizedaveragely in accordance with 50 years of service life, forest land use rights are amortized averagely in accordance with 30 years of service life, and the production and marketing information management software are amortized averagely in accordance with 5 years of service life.Expenditures arising from development phase on internal research and development projects can be recognized as intangible assets w hen satisfying all of the following conditions: (1) there is technical feasibility of completing the intangible assets so that they will be available for use or sale; (2) there is intention to complete and use or sell the intangible assets; (3) the method that the intangible assets g enerate economic benefits, including existence of a market for products produced by the intangible assets or for the intangible assets themselves, shall be proved. Or, if to be used internally, the usefulness of the intangible assets shall be proved; (4) adequate technical, financial, and other resources are available to complete the development of intangible assets, and the Company has the ability to use or sell the intangible assets;(5) the expenditures arising from development phase of the intangible assets can be measured reliably.Impairment of intangible assets: the Company conducts a comprehensive inspection on intangible assets a t the end of the reporting period. If the intangible assets h ave been replaced by other new technologies so as to seriously affect its capacity to create economic benefits for the enterprise, the market value of certain intangible assets sharply fall and is not expected to recover in the remaining amortization period, certain intangible asset has exceeded the legal time limit but still has some value in use as well as the intangible asset impairment has occurred, the provision for impairment is done according to the difference between the individual estimated recoverable amount and the book value. Impairment loss on the intangible asset shall not be reversed in subsequent accounting periods once recognized.Accounting method of capitalization of borrowing costsBorrowing costs that are directly attributable to the acquisition, construction or production of qualifying assets for capitalization should be charged into the relevant costs of assets and therefore should be capitalized. Borrowing costs incurred after qualifying assets for capitalization reaches the estimated use state are charged to profit or loss in the current period. Other borrowing costs are recognized as expenses based on the accrual and are charged to profit or loss in the current period.Capitalization of borrowing costs should meet the following conditions: expenditures are being incurred, which comprise disbursements incurred in the form of paymentsof cash, transfer of non-monetary assets o r assumption of interest-bearing debts for the acquisition, construction or production of qualifying assets for capitalization; borrowing costs are being incurred; purchase, construction or manufacturing activities that are necessary to prepare the assets for their intended use or sale are in progress. Capitalization amount of borrowing interest: the borrowing interest incurred from the acquisition, construction or production of assets eligible for capitalization borrowed specifically or generally should be determined the capitalization amount according to the following method before the acquisition, construction or production of a qualifying asset reaching its intended use or sale state:---Where funds are borrowed specifically for purchase, construction or manufacturingof assets eligible for capitalization, costs eligible for capitalization are the actual interest costs incurred in current period less the interest income of unused borrowing funds deposited in the bank or any income earned on the temporary investment of such borrowings.---Where funds allocated for purchase, construction or manufacturing of assets eligible for capitalization are part of a general pool, the eligible capitalization interest amounts are determined by multiplying a capitalization rate of general borrowing bythe weighted average of accumulated capital expenditures over those on specific borrowings. The capitalization rate will be determined based on the weighted average rate of the borrowing costs applicable to the general pool.Suspension for capitalization: Capitalization of borrowing costs should be suspended during periods in which purchase, construction or manufacturing of assets eligible for capitalization is interrupted abnormally with the interruption time exceeding three months continuously. Borrowing costs incurred during the interruption should be charged to profit or loss for the current period, and should continue to be capitalized when purchase, construction or manufacturing of the relevant assets resumes. If the interruption is the necessary procedure to prepare the assets purchased, constructed or manufactured eligible for capitalization for their intended use or sale, the borrowing costs should continue to be capitalized.Recognition criteria and measurement method of estimated liabilities Recognition criteria of estimated liabilities: when the external security, pending litigation or arbitration, product quality assurance, layoffs, loss of contracts, restructuring obligations, fixed asset retirement obligations and other pertinent business meet the following conditions, it can be recognized as the liability: (1) the obligation is a present obligation of the Company; (2)it is probable that settlement of such an obligation will result in the economic benefit to flow out from the Company; (3) the amount of the obligation can be measured reliably.Measurement method of estimated liabilities: The Company?s estimated liabilities shall be initially measured at the best estimates of the necessary expenditures for the fulfillment of the present obligations. To determine the best estimates, the Company shall take into full account the risks, uncertainties, time value of money, and other factors relating to the contingencies. If the time value of money is significant, the best estimates shall be determined after discounting the relevant future cash outflows. If there is a continuous range for the necessary expenses, and probabilities of occurrence of all the outcomes within this range are equal, the best estimate shall be determinedat the average amount within the range. The best estimates shall be determined as follows in other circumstances: (1) if the contingency involves a single item, the best estimate shall be determined at the most likely outcome; (2) if the contingency involves two or more items, the best estimate should be determined according to allthe possible outcomes with their relevant probabilities; (3) when all or part of the expenses necessary f or the settlement of estimated liabilities of the Company are expected to be compensated by a third parties, the compensations should be separately recognized as assets only when it is virtually certain that the compensations will be。

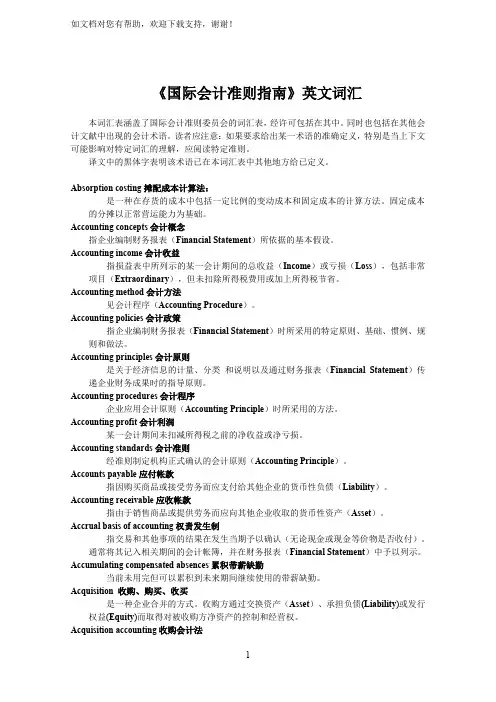

《国际会计准则指南》英文词汇本词汇表涵盖了国际会计准则委员会的词汇表,经许可包括在其中。

同时也包括在其他会计文献中出现的会计术语。

读者应注意:如果要求给出某一术语的准确定义,特别是当上下文可能影响对特定词汇的理解,应阅读特定准则。

译文中的黑体字表明该术语已在本词汇表中其他地方给已定义。

Absorption costing摊配成本计算法:是一种在存货的成本中包括一定比例的变动成本和固定成本的计算方法。

固定成本的分摊以正常营运能力为基础。

Accounting concepts会计概念指企业编制财务报表(Financial Statement)所依据的基本假设。

Accounting income会计收益指损益表中所列示的某一会计期间的总收益(Income)或亏损(Loss),包括非常项目(Extraordinary),但未扣除所得税费用或加上所得税节省。

Accounting method会计方法见会计程序(Accounting Procedure)。

Accounting policies会计政策指企业编制财务报表(Financial Statement)时所采用的特定原则、基础、惯例、规则和做法。

Accounting principles会计原则是关于经济信息的计量、分类和说明以及通过财务报表(Financial Statement)传递企业财务成果时的指导原则。

Accounting procedures会计程序企业应用会计原则(Accounting Principle)时所采用的方法。

Accounting profit会计利润某一会计期间未扣减所得税之前的净收益或净亏损。

Accounting standards会计准则经准则制定机构正式确认的会计原则(Accounting Principle)。

Accounts payable应付帐款指因购买商品或接受劳务而应支付给其他企业的货币性负债(Liability)。

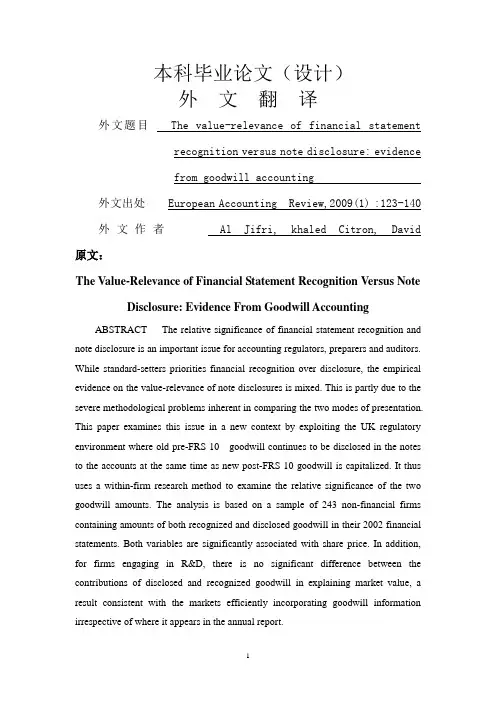

本科毕业论文(设计)外文翻译外文题目 The value-relevance of financial statementrecognition versus note disclosure: evidencefrom goodwill accounting外文出处European Accounting Review,2009(1) :123-140 外文作者Al Jifri, khaled Citron, David原文:The Value-Relevance of Financial Statement Recognition Versus NoteDisclosure: Evidence From Goodwill AccountingABSTRACT The relative significance of financial statement recognition andnote disclosure is an important issue for accounting regulators, preparers and auditors.While standard-setters priorities financial recognition over disclosure, the empiricalevidence on the value-relevance of note disclosures is mixed. This is partly due to thesevere methodological problems inherent in comparing the two modes of presentation.This paper examines this issue in a new context by exploiting the UK regulatoryenvironment where old pre-FRS 10 goodwill continues to be disclosed in the notesto the accounts at the same time as new post-FRS 10 goodwill is capitalized. It thususes a within-firm research method to examine the relative significance of the twogoodwill amounts. The analysis is based on a sample of 243 non-financial firmscontaining amounts of both recognized and disclosed goodwill in their 2002 financialstatements. Both variables are significantly associated with share price. In addition,for firms engaging in R&D, there is no significant difference between thecontributions of disclosed and recognized goodwill in explaining market value, aresult consistent with the markets efficiently incorporating goodwill informationirrespective of where it appears in the annual report.This paper examines whether the market values goodwill disclosed only in the notes to the accounts equivalently to goodwill recognized in the balance sheet. It exploits the unique UK regulatory framework in which accounting for goodwill moved from note disclosure to balance sheet recognition. This context enables the study to contribute to the recognition vs. disclosure debate without encountering the self-selection bias introduced when firms have a choice about the reporting method or the influence of contemporaneous events if recognized and disclosed amounts are observed at different points in time.This issue is important for a number of reasons. Firstly, the question as to whether share prices reflect amounts disclosed in the notes and those recognized in the financial statements similarly, as would be expected in efficient markets, is of interest to regulators, accounts preparers and auditors. In this connection, regulators appear to priorities recognition over disclosure. Thus the UK Accounting Standards Board’s conceptual framework favors recognition when it states:” ... disclosure of information in the notes is not a substitute for recognition and does not correct or justify any misrepresentation in or omission from the primary financial statements’(ASB,1999,para.7.5).Si milarly, in its conceptual framework the IASB (International Accounting Standards Board)states that note disclosure is not a substitute for financial statement recognition (Alfredson et al. , 2005);and in the USA the FASB (Financial Accounting Standards Board)has argued, in the context of accounting for post-retirement benefits, that disclosure is not a substitute for recognition (SFAS No.106,para.164,cited by Davis-Friday etal. , 1999). On the other hand, as Schipper (2007) points out, these comments in t he regulators’ conceptual framework documents neither set out the conceptual role of mandatory disclosures nor do they provide clear guidance as to the fundamental distinction between disclosure and recognition. Efficient markets theory does suggest that the markets adopt a substance over form approach and incorporate all publicly available information, irrespective of the mode of disclosure. However, there are conditions under which note disclosures are less strongly associated with market values (Bernard and Schipper, 1994; Davis-Friday et al., 1999; Ahmed et al., 2006). One of these is ifinvestors inappropriately undervalue disclosed amounts either through lack of expertise or due to the cost of processing note information. Secondly, recognition may imply greater relevance or reliability, in which case users correctly assign lower weight to disclosed amounts. For example, auditors or management may require more stringent standards for recognized values. In the absence of a clear theory relating to disclosures, this paper seeks to provide empirical evidence as to whether these two modes of reporting have a differential effect on share prices.Secondly, goodwill accounting is itself a controversial issue, with standard setters changing required accounting methods on a regular basis. Many studies have investigated the value-relevance of recognized goodwill amounts (for example, McCarthy and Schneider, 1995; Barth and Clinch, 1996; Jennings et al., 1996; Godfrey and Koh, 2001). More recently the introduction of SFAS 142 (FASB, 2001) in the USA has triggered research into whether the new standard has improved the reliability of recognized goodwill amounts. Results are mixed with Ahmed and Guler (2007) finding that it has while Chambers (2007) has contrary results. Other studies (e.g. Beatty and Weber, 2006; Guler, 2007) find that management incentives and corporate governance structures affect the recognition of impairment charges under SFAS 142. While these studies have focused on the value-relevance of goodwill recognized on the face of the financial statements, this paper investigates whether accounting for goodwill via note disclosure vs. financial statement recognition affects investors’ decisions, a feature of goodwill accounting not examined hitherto.The paper addresses some key methodological problems inherent in researching this issue. It examines the differential market valuation of goodwill in the notes vs. that in the balance sheet in a context in which firms, firstly, had no choice about the method of reporting, thus eliminating the self-selection problem; secondly, in which both sets of amounts are reported at the same time so that differences in contemporaneous disclosures do not distort the results; and thirdly, by addressing, if only partially, potential differential reliability of disclosed and recognized amounts。

****** CO., LTDNOTES TO THE FINANCIAL STATEMENTSFOR THE YEAR ENDED DECEMBER 31, 2013(All amounts in RMB Yuan) I. Company Profile******* Co., Ltd. (hereinafter referred to as the "Company") is a limited liability company (Sino-foreign joint venture) jointly invested and established by **** Co., Ltd. and ******* Limited on 24 June 2013. On December 26, 2013, the shareholders have been changed to ***** CO., LTD and ******* LIMITED.Business License of Enterprise Legal Person License No.:Legal Representative:Registered Capital: RMB (Paid-in Capital: RMB )Address:Business Scope: Financing and leasing business; leasing business; purchase of leased property from home and abroad; residue value treatment and maintenance of leased property; consulting and guarantees of lease transaction (articles involved in the industry license management would be dealt in terms of national relevant stipulations) II. Declaration on following Accounting Standard for Business EnterprisesThe financial statements made by the Company are in accordance with the requirements of Accounting Standard for Business Enterprises, which reflects the financial position, financial performance and cash flow of the Company truly and completely.III. Basic of preparation of financial statementsThe Company implements the Accounting Standards for Business Enterprises(‘Finance and Accounting [2006] No. 3”) issued by the Ministry of Finance on February 15, 2006 and the successive regulations. The Company prepares its financial statements on a going concern basis, and recognizes and measures its accounting items in compliance with the Accounting Standards for Business Enterprises – Basic Standards and other relevant accounting standards, application guidelines and criteria for interpretation of provisions as well as the significant accounting policies and accounting estimates on the basis of actual transactions and events.IV. The main accounting policies, accounting estimates and changesFiscal yearThe Company adopts the calendar year as its fiscal year from January 1 to December 31.Functional currencyRMB was the functional currency of the Company.Accounting measurement attributeThe Company adopts the accrual basis for accounting treatments and double-entry bookkeeping of borrowing for financial accounting. The historical cost is generally as the measurement attribute, and when accounting elements determined are in line with the requirements of Accounting Standards for Enterprises and can be reliablymeasured, the replacement cost, net realizable value and fair value can be used for measurement.Accounting method of foreign currency transactionsThe Company’s fo reign currency transactions adopt approximate spot exchange rate of the transaction date to convert into RMB in accordance with systematic and rational method; on the balance sheet date, the foreign currency monetary items use the spot exchange rate of the balance sheet date. All balances of exchange arising from differences between the balance sheet date spot exchange rate and the initial recognition or the former balance sheet date spot exchange rate, except that the exchange gains and losses arising by borrowing foreign currency for the construction or production of assets eligible for capitalization are transacted in accordance with capitalization principles, are included in profit or loss in this period; the foreign currency non-monetary items measured at historical cost will still be converted with the spot exchange rate of the transaction date.The standard for recognizing cash equivalentWhen making the cash flow statement, cash on hand and deposits readily to be paid will be recognized as cash, and short-term (usually no more than three months), highly liquid and readily convertible to known amounts of cash with insignificant risk of changes in value are recognized as cash equivalent.Financial InstrumentsClassification, recognition and measurement of financial assets- The company at the time of initial recognition of financial assets divides it into the following four categories: financial assets measured at fair value with changes included in the profit or loss of this period, loans and receivables, financial assets available for sale and held-to-maturity investments. Financial assets are measured at fair value when initially recognized. Relevant transaction costs of financial assets measured at fair value with changes included in the profit or loss of this period are recognized in profit or loss of this period, and relevant transaction costs of other categories of financial assets are recognized in the amount initially recognized.-- Financial assets measured at fair value with changes included in the profit or loss of this period refer to the short-term sales financial assets, including financial assets held for trading or financial assets measured at fair value with changes included in the profit or loss of this period designated upon initial recognition by the management. Financial assets measured at fair value with changes included in the profit or loss of this period are subsequently measured at fair value, and the interest or cash dividends obtained during the holding period will be recognized as investment income, and the gains or losses of the change in fair value at the end of this period are recognized in the profit or loss in this period. When it is disposed, the difference between the fair value and the initial recorded amount is recognized as investment income, while adjusting gains from changes in the fair value.--Loans and receivables: the non-derivative financial assets without the price in an active market and with fixed and determinable recovery cost are classified as loans and receivables. Loans and receivables adopt the effective interest method and take amortized cost for subsequent measurement, and gains or losses arising fromderecognition, impairment or amortization are included in the profit or loss of this period.-- Financial assets available for sale: including non-derivative financial assets available for sale recognized initially and other non-derivative financial assets except for loans and receivables, held-to-maturity investments and trading financial assets. Financial assets available for sale are subsequently measured at fair value, and interest or cash dividends obtained during the holding period will be recognized as investment income, and gains or losses arising from the changes in fair value at the end of this period are recognized directly in owners' equity until the financial asset is derecognized or impaired and then is recognized as the profit or loss in this period.-- Held-to-maturity investments: the non-derivative financial assets with clear intention and ability to hold to maturity by the management of the company, a fixed maturity date and fixed or determinable payments are classified as held-to-maturity investments. Held-to-maturity investments adopt the effective interest method and take amortized cost for subsequent measurement, and gains or losses arising from derecognition, impairment or amortization are included in the profit or loss of this period.Classification, recognition and measurement of financial liabilities- The company at the time of initial recognition of financial liabilities divides it into the following two categories: financial liabilities measured at fair value with changes included in the profit or loss of this period and other financial liabilities. Financial liabilities are measured at fair value when initially recognized. Relevant transaction costs of financial liabilities measured at fair value with changes included in the profit or loss of this period are recognized in profit or loss of this period, and relevant transaction costs of other financial liabilities are recognized in the amount initially recognized.-- Financial liabilities measured at fair value with changes included in the profit or loss of this period include the trading financial liabilities and financial liabilities measured at fair value with changes included in the profit or loss of this period designated upon initial recognition. Financial liabilities are subsequently measured at fair value, and the gains or losses of the change in fair value are recognized in the profit or loss in this period.-- Other financial liabilities: adopting the effective interest method and taking amortized cost for subsequent measurement. The gains or losses arising from derecognition or amortization is included in the profit or loss of this period. Requirements for derecognition of financial liabilitiesFinancial liabilities shall be entirely or partially derecognized if the present obligations derived from them are entirely or partially discharged. Where the Company enters into an agreement with a creditor so as to substitute the current financial liabilities with new ones, and the contract clauses of which are substantially different from those of the current ones, it shall recognize the new financial liabilities in place of the current ones. Where substantial revisions are made to some or all of the contract clauses of the current financial liabilities, the Company shall recognize thenew financial liabilities after revision of the contract clauses in place of the current ones entirely or partially.Upon entire or partial derecognition of financial liabilities, differences between the carrying amounts of the derecognized financial liabilities and the consideration paid (including non-monetary assets surrendered or new financial liabilities assumed) are charged to profit or loss for the current period.Where the Company redeems part of its financial liabilities, it shall allocate the carrying amounts of the entire financial liabilities between the relative fair values of the parts that continue to be recognized and the derecognized parts on the redemption date. Differences between the carrying amounts allocated to the derecognized parts and the consideration paid (including non-monetary assets surrendered and the new financial liabilities assumed) are charged to profit or loss for the current period. Recognition and measurement for transfer of financial assetsIf the Company has transferred nearly all of the risks and rewards relating to the ownership of the financial assets to the transferee, they shall be derecognized. If it retains nearly all of the risks and rewards relating to the ownership of the financial assets, they shall not be derecognized and will be recognized as a financial liability. If the Company has not transferred nor retained nearly all of the risks and rewards relating to the ownership of the financial assets:(1) to give up the control of the financial assets to be derecognized; (2) not giving up control of the financial asset to be recognized based on the extent of its continuing involvement in the transferred financial assets and liabilities are recognized accordingly.If the transfer of entire financial assets satisfy the criteria for derecognition, differences between the amounts of the following two items shall be recognized in profit or loss for the current period: (1) the carrying amount of the transferred financial asset; (2) the aggregate consideration received from the transfer plus the cumulative amounts of the changes in the fair values originally recognized in the owners’ equity. If the partial transfer of financial assets satisfy the criteria for derecognition, the carrying amounts of the entire financial assets transferred shall be split into the derecognized and recognized parts according to their respective fair values and differences between the amounts of the following two items are charged to profit or loss for the current period: (1) the carrying amounts of the derecognized parts;(2) The aggregate consideration for the derecognized parts plus the portion of the accumulative amounts of the changes in the fair values of the derecognized parts which are originally recognized in the owners’ equity.Determination of the fair value of financial instruments- If financial instruments trade in an active market, the quoted price in an active market determines its fair value; if financial instrument trade not in an active market, the valuation techniques determine the fair value. Valuation techniques include recent market transaction price reference to the familiar situation and volunteer transaction, current fair value reference to other substantially similar financial instruments, discounted cash flow method and option pricing model and so on.Test and Provisions for impairment loss on financial assets--Except trading financial assets, the Company makes assessment on the carrying values of financial assets at the balance sheet date. If there is evidence that the fair value of specific financial asset has been impaired, provisions for impairment loss is made accordingly.-- Measurement of impairment of financial assets measured at amortized costIf there is objective evidence that the financial asset measured at amortized cost has been impaired, the carrying amount of the financial asset is written down to the present value of estimated future cash flows (excluding future credit losses that have not yet occurred), and the amount of reduction is recognized as impairment loss and is recognized in the profit or loss of this period. The Company carries out the impairment test of significant single financial asset separately, carries out the impairment test on insignificant single financial asset from a single or combination of angles, and carries out the impairment test on single asset without objective evidence of impairment along with the financial assets with similar credit risk characteristics to constitute a combination, but does not carry out the impairment test on the provision for impairment of financial assets based on the single in the portfolio. In the subsequent period, if there is objective evidence that the value of financial asset has been restored and recognized relevant to the objective matters occurring after the impairment, previously recognized impairment loss shall be reversed and charged into the profit or loss of this period. But the book value after the reversal should not exceed the amortized cost at the reversal date of the financial assets supposed no provision for impairment. When the financial assets measured at amortized cost actually occur loss, offset against the related provision for impairment.--Available for sale financial assetsIf there is objective evidence that an impairment of available for sale financial assets occurs, even though the financial asset has not been derecognised, the cumulative loss of decrease of the faire value originally recorded in the owner's equity should be transferred out and charged into the current profit and loss. The cumulative loss is the initial acquisition cost of available for sale financial assets, deducting the fair value of the withdrawing principal and amortization amount and impairment loss as well as net impairment amount originally charged into the profit or loss.Recognition and provision for bad debts of accounts receivableIf there is objective evidence that receivables are impaired at the end of this period, the carrying value will be written down to its present value of estimated future cash flows, and the amount of reduction is recognized as impairment loss and is recognized in the current profit or loss. Present value of estimated future cash flows is determined through future cash flows (excluding credit losses that have not been incurred) discounted at the original effective interest rate, taking into account the value of related collateral (less estimated disposal costs, etc.). Original effective interest rate is the actual interest rate when the receivables are recognized initially. The estimated future cash flows of short-term receivables have small difference from the present value, and the estimated future cash flows are not discounted in determining the related impairment loss.The significant single receivables are separately carried out impairment test at the end of this period, and if there is objective evidence that the impairment has occurred, based on the difference of the present value of future cash flows less than the book value, the impairment loss is recognized and the provision of bad debts is done. The significant single amount refers to top five receivable balances or the sum of payments accounting for more than 10% of receivable balances.If there is objective evidence that the individual non-significant receivables impairment has occurred, separate impairment test is done, the impairment loss is recognized and the provision for bad debts is done; other individual non-significant receivables and receivables not impaired after separate test are together divided into several combinations for impairment testing with aging as the similar credit risk characteristics, to determine the impairment loss and do provision for bad debts.In addition to separate provision for impairment of receivables, the company is based on the actual loss rate of receivable portfolio with the same or similar to the previous year and aging as the similar credit risk characteristics, and combines the currentFixed assets and depreciation accounting methodRecognition criteria of fixed assets: fixed assets refer to tangible assets held for the purpose of producing commodities, providing services, renting or business management with useful lives exceeding one accounting year and high unit value. Classification of fixed assets: buildings and constructions, machinery equipment, transport equipment and office equipment.Fixed assets pricing and depreciation method: the fixed assets is priced based on actual cost and depreciated in a straight-line method. The estimated useful lives, estimated residual rate and annual depreciation rate of various categories of fixedend of the reporting period, and if the market continuing to fall or technological obsolescence, damage, long-term idle and other reasons result in fixed assets recoverable amount lower than its book value, in accordance with the difference provision for impairment of fixed assets, the impairment loss is recognized in fixedassets and can not be reversed in a subsequent accounting period. The recoverable amount is recognized based on the fair value of the assets deducting the net amount after disposal expenses and the present value of cash flows of the estimated future assets. The present value of the future cash flows of the asset is determined in accordance with the resulting estimated future cash flows in the process of continuous use and final disposal to select its appropriate discount rate and the amount of the discount.Accounting method of construction in progressThe construction in progress is priced on the actual cost, to temporarily transfer to fixed assets when reaching the intended use state in accordance with the project budget and the actual cost of the project, and to adjust the book value of fixed assets according to the actual cost after handling final settlement of accounts. Acquisition, construction or production of assets eligible for capitalization borrowed specifically or the interest on general borrowing costs and auxiliary expenses of specific borrowings occurred can be included in the cost of capital assets and subsequently recognized in the current profit or loss before the acquisition, construction or production of the qualifying asset reaches the intended use state or the sale state.Impairment of construction in progress: the Company conducts a comprehensive inspection of construction in progress at the end of the reporting period; if the construction in process is stopped for long time and will not be constructed in the next three years and the construction in progress brings great uncertainty to the economic benefits of enterprises due to backward performance or techniques and the construction in progress occurs impairment, the balance of recoverable amount of single construction in progress lower than the book value of construction in progress is for impairment provisions of construction in progress. Impairment loss on the construction in progress shall not be reversed in subsequent accounting periods once recognized.The pricing and amortizing of intangible assetsPricing of the intangible assets---The cost of outsourcing intangible assets shall be priced based on the actual expenditure directly attributable to intangible assets for the expected purpose.--- Expenditure on internal research and development projects is charged into the current profit or loss, and expense in the development stage can be recognized as intangible costs if meeting the criteria for capitalization.--- Intangible assets of investment is in accordance with the agreed value of the investment contract or agreement as costs, excluding not fair agreed value of the contract or agreement.--- Intangible assets of the debtor obtained in the non-cash asset cover debt method can be accepted; if the receivable creditor’s right is changed into intangible assets, then record according to the fair value of intangible assets.--- For non-monetary transaction intangible assets, the fair value and related taxes payable of non-monetary assets should be the accounting cost.Amortization of intangible assets: as for the intangible assets with limited service life, it is amortized by straight-line method when it is available for use within the serviceperiod. As for unforeseeable period of intangible assets bringing future economic benefits to the company, it is regarded as intangible assets with uncertain service life, and intangible assets with uncertain service life can not be amortized. The Company’s intangible assets include land use rights, forest land use rights and the production and marketing information management software. The land use rights are amortized averagely in accordance with 50 years of service life, forest land use rights are amortized averagely in accordance with 30 years of service life, and the production and marketing information management software are amortized averagely in accordance with 5 years of service life.Expenditures arising from development phase on internal research and development projects can be recognized as intangible assets when satisfying all of the following conditions: (1) there is technical feasibility of completing the intangible assets so that they will be available for use or sale; (2) there is intention to complete and use or sell the intangible assets; (3) the method that the intangible assets generate economic benefits, including existence of a market for products produced by the intangible assets or for the intangible assets themselves, shall be proved. Or, if to be used internally, the usefulness of the intangible assets shall be proved; (4) adequate technical, financial, and other resources are available to complete the development of intangible assets, and the Company has the ability to use or sell the intangible assets;(5) the expenditures arising from development phase of the intangible assets can be measured reliably.Impairment of intangible assets: the Company conducts a comprehensive inspection on intangible assets at the end of the reporting period. If the intangible assets have been replaced by other new technologies so as to seriously affect its capacity to create economic benefits for the enterprise, the market value of certain intangible assets sharply fall and is not expected to recover in the remaining amortization period, certain intangible asset has exceeded the legal time limit but still has some value in use as well as the intangible asset impairment has occurred, the provision for impairment is done according to the difference between the individual estimated recoverable amount and the book value. Impairment loss on the intangible asset shall not be reversed in subsequent accounting periods once recognized.Accounting method of capitalization of borrowing costsBorrowing costs that are directly attributable to the acquisition, construction or production of qualifying assets for capitalization should be charged into the relevant costs of assets and therefore should be capitalized. Borrowing costs incurred after qualifying assets for capitalization reaches the estimated use state are charged to profit or loss in the current period. Other borrowing costs are recognized as expenses based on the accrual and are charged to profit or loss in the current period.Capitalization of borrowing costs should meet the following conditions: expenditures are being incurred, which comprise disbursements incurred in the form of payments of cash, transfer of non-monetary assets or assumption of interest-bearing debts for the acquisition, construction or production of qualifying assets for capitalization; borrowing costs are being incurred; purchase, construction or manufacturing activities that are necessary to prepare the assets for their intended use or sale are in progress.Capitalization amount of borrowing interest: the borrowing interest incurred from the acquisition, construction or production of assets eligible for capitalization borrowed specifically or generally should be determined the capitalization amount according to the following method before the acquisition, construction or production of a qualifying asset reaching its intended use or sale state:---Where funds are borrowed specifically for purchase, construction or manufacturing of assets eligible for capitalization, costs eligible for capitalization are the actual interest costs incurred in current period less the interest income of unused borrowing funds deposited in the bank or any income earned on the temporary investment of such borrowings.---Where funds allocated for purchase, construction or manufacturing of assets eligible for capitalization are part of a general pool, the eligible capitalization interest amounts are determined by multiplying a capitalization rate of general borrowing by the weighted average of accumulated capital expenditures over those on specific borrowings. The capitalization rate will be determined based on the weighted average rate of the borrowing costs applicable to the general pool.Suspension for capitalization: Capitalization of borrowing costs should be suspended during periods in which purchase, construction or manufacturing of assets eligible for capitalization is interrupted abnormally with the interruption time exceeding three months continuously. Borrowing costs incurred during the interruption should be charged to profit or loss for the current period, and should continue to be capitalized when purchase, construction or manufacturing of the relevant assets resumes. If the interruption is the necessary procedure to prepare the assets purchased, constructed or manufactured eligible for capitalization for their intended use or sale, the borrowing costs should continue to be capitalized.Recognition criteria and measurement method of estimated liabilities Recognition criteria of estimated liabilities: when the external security, pending litigation or arbitration, product quality assurance, layoffs, loss of contracts, restructuring obligations, fixed asset retirement obligations and other pertinent business meet the following conditions, it can be recognized as the liability: (1) the obligation is a present obligation of the Company; (2)it is probable that settlement of such an obligation will result in the economic benefit to flow out from the Company;(3) the amount of the obligation can be measured reliably.Measurement method of estimated liabilities: The Company’s estimated liabilities shall be initially measured at the best estimates of the necessary expenditures for the fulfillment of the present obligations. To determine the best estimates, the Company shall take into full account the risks, uncertainties, time value of money, and other factors relating to the contingencies. If the time value of money is significant, the best estimates shall be determined after discounting the relevant future cash outflows. If there is a continuous range for the necessary expenses, and probabilities of occurrence of all the outcomes within this range are equal, the best estimate shall be determined at the average amount within the range. The best estimates shall be determined as follows in other circumstances: (1) if the contingency involves a single item, the best estimate shall be determined at the most likely outcome; (2) if the contingency。

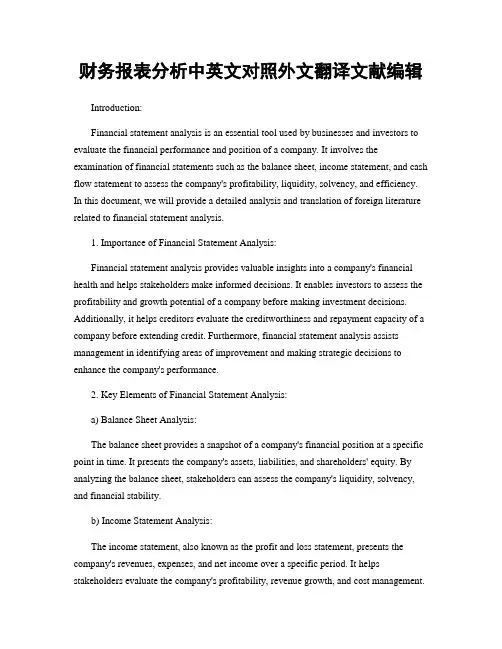

财务报表分析中英文对照外文翻译文献编辑Introduction:Financial statement analysis is an essential tool used by businesses and investors to evaluate the financial performance and position of a company. It involves the examination of financial statements such as the balance sheet, income statement, and cash flow statement to assess the company's profitability, liquidity, solvency, and efficiency. In this document, we will provide a detailed analysis and translation of foreign literature related to financial statement analysis.1. Importance of Financial Statement Analysis:Financial statement analysis provides valuable insights into a company's financial health and helps stakeholders make informed decisions. It enables investors to assess the profitability and growth potential of a company before making investment decisions. Additionally, it helps creditors evaluate the creditworthiness and repayment capacity of a company before extending credit. Furthermore, financial statement analysis assists management in identifying areas of improvement and making strategic decisions to enhance the company's performance.2. Key Elements of Financial Statement Analysis:a) Balance Sheet Analysis:The balance sheet provides a snapshot of a company's financial position at a specific point in time. It presents the company's assets, liabilities, and shareholders' equity. By analyzing the balance sheet, stakeholders can assess the company's liquidity, solvency, and financial stability.b) Income Statement Analysis:The income statement, also known as the profit and loss statement, presents the company's revenues, expenses, and net income over a specific period. It helps stakeholders evaluate the company's profitability, revenue growth, and cost management.c) Cash Flow Statement Analysis:The cash flow statement details the inflows and outflows of cash during a specific period. It provides insights into the company's operating, investing, and financing activities. By analyzing the cash flow statement, stakeholders can assess the company's ability to generate cash, meet its financial obligations, and fund its growth.3. Financial Ratios for Analysis:Financial ratios are essential tools used in financial statement analysis to assess a company's performance and compare it with industry benchmarks. Some commonly used financial ratios include:a) Liquidity Ratios:- Current Ratio: Measures a company's ability to meet short-term obligations.- Quick Ratio: Measures a company's ability to meet short-term obligations without relying on inventory.b) Solvency Ratios:- Debt-to-Equity Ratio: Measures the proportion of debt to equity in a company's capital structure.- Interest Coverage Ratio: Measures a company's ability to meet interest payments on its debt.c) Profitability Ratios:- Gross Profit Margin: Measures the profitability of a company's core operations.- Net Profit Margin: Measures the profitability of a company after all expenses, including taxes.d) Efficiency Ratios:- Inventory Turnover Ratio: Measures how quickly a company sells its inventory.- Accounts Receivable Turnover Ratio: Measures how quickly a company collects cash from its customers.4. Translation of Foreign Literature:In this section, we will provide a translation of key points from foreign literature related to financial statement analysis. The literature emphasizes the importance of accurate financial reporting, the use of financial ratios for analysis, and the interpretation of financial statements to make informed decisions.Conclusion:Financial statement analysis is a crucial process for evaluating a company's financial performance and position. It provides valuable insights into a company's profitability, liquidity, solvency, and efficiency. By analyzing financial statements and using financial ratios, stakeholders can make informed decisions regarding investments, credit extension, and strategic planning. Accurate translation and understanding of foreign literature related to financial statement analysis can further enhance the effectiveness of this process.。

财务报表分析外文文献及翻译LNTU---Acc附录A财务报表分析的杠杆左右以及如何体现盈利性和值比率摘要关键词:财政杠杆;运营债务杠杆;股本回报率;值比率传统观点认为,杠杆效应是从金融活动中产生的:公司通过借贷来增加运营的资金。

杠杆作用的衡量标准是负债总额与股东权益。

然而,一些负债——如银行贷款和发行的债券,是由于资金筹措,其他一些负债——如贸易应付账款,预收收入和退休金负债,是由于在运营过程中与供应商的贸易,与顾客和雇佣者在结算过程中产生的负债。

融资负债通常交易运作良好的资本市场其中的发行者是随行就市的商人。

与此相反,在运营中公司能够实现高增值。

因为业务涉及的是与资本市场相比,不太完善的贸易的输入和输出的市场。

因此,考虑到股票估值,运营负债和融资负债的区别的产生有一些先验的原因。

我们研究在资产负债表上,运营负债中的一美元是否与融资中的一美元等值这个问题。

因为运营负债和融资负债是股票价值的组成部分,这个问题就相当于问是否股价与账面价值比率是否取决于账面净值的组成。

价格与账面比率是由预期回报率的账面价值决定的。

所以,如果部分的账面价值要求不同的溢价,他们必须显示出不同的账面价值的预期回报率。

因此,标准的财务报表分析的能够区分股东从运营中和借贷的融资业务中产生的利润。

因此,资产回报有别于股本回报率,这种差异是由于杠杆作用。

然而,在标准的分析中,经营负债不区别于融资负债。

因此,为了制定用于实证分析的规范,我们的研究结果是用于愿意分析预期公司的收益和账面收益率。

这些预测和估值依赖于负债的组成。

这篇文章结构如下。

第一部分概述并指出了了能够判别两种杠杆作用类型,连接杠杆作用和盈利的财务报表分析第二节将杠杆作用,股票价值和价格与账面比率联系在一起。

第三节中进行实证分析,第四节进行了概述与结论。

1 杠杆作用的财务报表分析以下财务报表分析将融资债务和运营债务对股东权益的影响区别开。

这个分析从实证的详细分析中得出了精确的杠杆效应等式普通股产权资本收益率=综合所得?普通股本(1) 杠杆影响到这个盈利等式的分子和分母。