Chapter 5 Currency Derivatives练习

- 格式:docx

- 大小:17.19 KB

- 文档页数:5

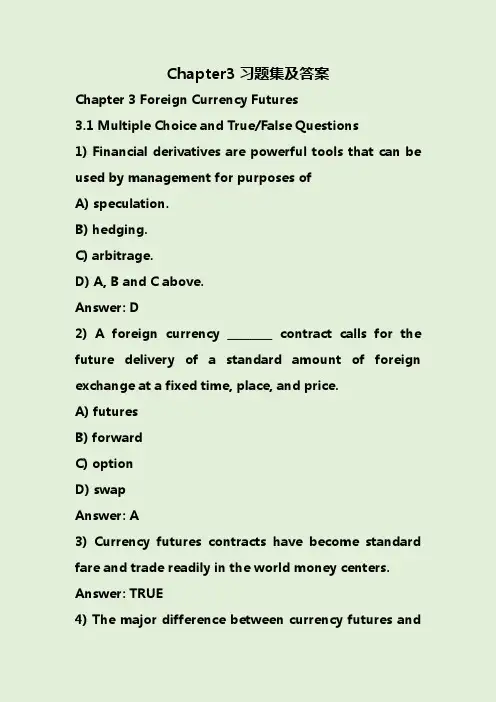

Chapter3习题集及答案Chapter 3 Foreign Currency Futures3.1 Multiple Choice and True/False Questions1) Financial derivatives are powerful tools that can be used by management for purposes ofA) speculation.B) hedging.C) arbitrage.D) A, B and C above.Answer: D2) A foreign currency ________ contract calls for the future delivery of a standard amount of foreign exchange at a fixed time, place, and price.A) futuresB) forwardC) optionD) swapAnswer: A3) Currency futures contracts have become standard fare and trade readily in the world money centers. Answer: TRUE4) The major difference between currency futures andforward contracts is that futures contracts are standardized for ease of trading on an exchange market whereas forward contracts are specialized and tailoredto meet the needs of clients.Answer: TRUE5) Which of the following is NOT a contract specification for currency futures trading on an organized exchange?A) size of the contractB) maturity dateC) last trading dayD) fixed gainsAnswer: D6) About ________ of all futures contracts are settled by physical delivery of foreign exchange between buyer and seller.A) 0%B) 5%C) 50%D) 95%Answer: B7) Futures contracts require that the purchaser deposit an initial sum as collateral. This deposit is called aA) collateralized deposit.B) marked market sum.C) margin.D) settlement.Answer: C8) A speculator in the futures market wishing to lock ina price at which they could ________ a foreign currency will ________ a futures contract.A) buy; sellB) sell; buyC) buy; buyD) none of the aboveAnswer: C9) A speculator that has ________ a futures contract has taken a ________ position.A) sold; longB) purchased; shortC) sold; shortD) purchased; soldAnswer: C10) Peter Simpson expects that the U.K. pound will cost $1.62/£in six months. A 6-month currency futures contract is available today at a rate of $1.63/£. If Peter was to speculate in the currency futures market, and his expectations are correct, which of the following strategies would earn him a profit?A) Sell a pound currency futures contract.B) Buy a pound currency futures contract.C) Sell pounds today.D) Sell pounds in six months.Answer: A11) Jack Hemmings bought a 3-month British pound futures contract for $1.6200/£only to see the dollar appreciate to a value of $1.6118 at which time he sold the pound futures. If each pound futures contract is for an amount of £62,500, how much money did Jack gain or lose from his speculation with pound futures?A) $512.50 lossB) $512.50 gainC) £512.50 lossD) £512.50 gainAnswer: A12) Which of the following statements regarding currency futures contracts and forward contracts is true?A) A futures contract is a standardized amount per currency whereas the forward contact is for any size desired.B) A futures contract is for a fixed maturity whereas the forward contract is for any maturity you like up to one year.C) Futures contracts trade on organized exchanges whereas forwards take place between individuals and banks with other banks via telecom linkages.D) All of the above are true.Answer: D13) Which of the following is a difference between a currency futures contract and a forward contract?A) The futures contract is marked to market daily whereas the forward contract is only due to be settled at maturity.B) The counterparty to the futures participant is unknown with the clearinghouse stepping into each transaction whereas the forward contract participantsare in direct contact setting the forward specifications.C) A single sales commission covers both the purchase and sale of a futures contract whereas there is no specific sales commission with a forward contract because banks earn a profit through the bid-ask spread.D) All of the above are true.Answer: D14) As a general statement, it is safe to say that businesses generally use the ________ for foreign currency forward contracts, and individuals and financial institutions typically use the ________for foreign currency futures contracts.A) exchange markets; over-the-counterB) over-the-counter; exchange marketsC) private; government sponsoredD) government sponsored; privateAnswer: B15) All exchange-traded futures are settled through a clearing house but over-the-counter forwards are not and are thus subject to greater ________ risk.A) exchange rateB) countryC) counterpartyD) none of the aboveAnswer: C16) When reading the futures quotation in the financial section of the newspaper, the column heading indicating the number of contracts outstanding is called ________.A) contracts outstandingB) settleC) open interestD) short positionsAnswer: CTable 3.1Use the below mentioned table to answer following question(s). December 17, 2009, British Pound futures Prices for 2010 (US dollars per pound, 62,500 pound contracts).Maturity Open High Low Change Settle Volume March 10 1.6315 1.6333 1.6071 -0.0155 1.6146 127,234 June 10 1.6315 1.6323 1.6065 -0.0155 1.6137 14517)Refer to Table 3.1. What was the contract price ofthe British pound, if you need to lock the value of GBP for your GBP receivables in 3-month period?A) $1.6146/£B) £1.6146/$C) $1.6315/£D) £1.6315/$Answer: A18) Refer to Table 3.1. The price of ________ making you taking a short position to sell two pounds futures contracts have maturity date in June 10, 2010 has a total contract value of ________.A) £1.6137/$, £201,712.50B) $1.6137/£, $201,712.50C) $1.6146/£, $100,912.50D) £1.6146/$, $100,912.50Answer: B19) Refer to Table 3.1 and question 19. If the spot exchange rate of British pound proves to be $1.6128/£in June 10, 2010, what is your gain or loss for your short position?A) $112.50 gainB) $112.50 lossC) $56.25 gainD) $56.25 lossAnswer: A20) Andrea Lee is a currency speculator who enjoys "betting" on changes in the foreign currency exchange market. Currently the spot price for the Japanese yen is ¥90.870/$ and the 6-month futures contract price is ¥90.530/$. Andrea thinks the yen will move to ¥90.120/$ in the next six months. Andrea should ________ at the futures price to profit from changing currency values.A) buy yenB) buy dollarsC) sell yenD) There is not enough information to answer this question.Answer: A3.2 Essay Questions1) Why are foreign currency futures contracts more popular with individuals and banks while foreign currency forwards are more popular with businesses? Answer: Foreign currency futures are standardizedcontracts that lendthemselves well to speculation purposes but less so for hedging purposes. The standardized nature of the futures contract makes it easy to trade futures and to make bets about general changes in the value of currencies. Forward contracts are better for hedging in that they are tailored to meet the specific needs of the client, typically a business, and can be quite useful in reducing exchange rate risk. Banks are involved in the foreign currency futures market in part to offset positions that they may have taken in the forward markets as dealers.2) How do currency forward and futures contracts differ with respect to maturity, settlement, and the size and timing of cash flows?Answer: see p36-37, Table 3.73) What is the primary role of the exchange clearinghouse?Answer: see p14-15※4) Draw and explain the payoff profile associated with a currency futures contract.Answer: refer to chapter 8。

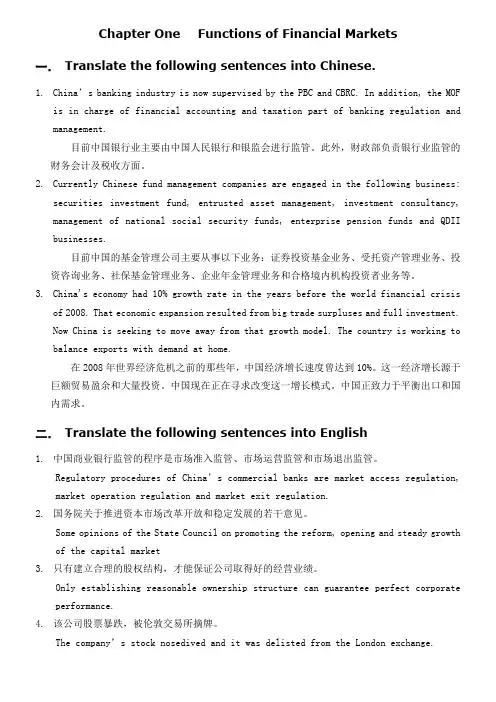

Chapter One Functions of Financial Markets 一.Translate the following sentences into Chinese.1.China’s banking industry is now supervised by the PBC and CBRC. In addition, the MOFis in charge of financial accounting and taxation part of banking regulation and management.目前中国银行业主要由中国人民银行和银监会进行监管。

此外,财政部负责银行业监管的财务会计及税收方面。

2.Currently Chinese fund management companies are engaged in the following business:securities investment fund, entrusted asset management, investment consultancy, management of national social security funds, enterprise pension funds and QDII businesses.目前中国的基金管理公司主要从事以下业务:证券投资基金业务、受托资产管理业务、投资咨询业务、社保基金管理业务、企业年金管理业务和合格境内机构投资者业务等。

3.China's economy had 10% growth rate in the years before the world financial crisisof 2008. That economic expansion resulted from big trade surpluses and full investment.Now China is seeking to move away from that growth model. The country is working to balance exports with demand at home.在2008年世界经济危机之前的那些年,中国经济增长速度曾达到10%。

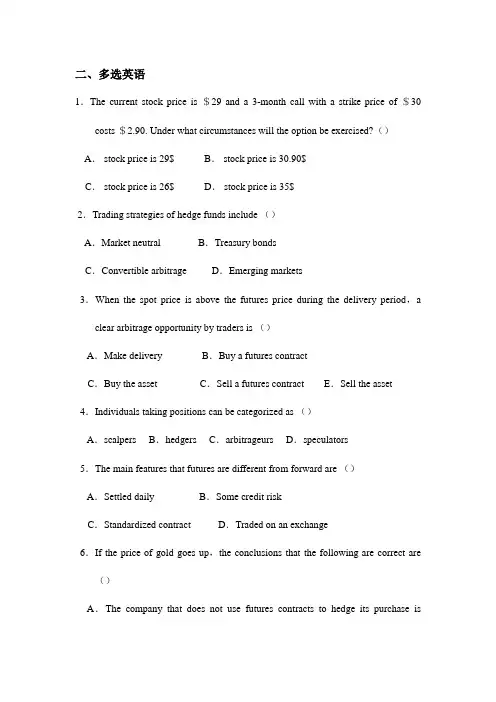

二、多选英语1.The current stock price is $29 and a 3-month call with a strike price of $30 costs $2.90. Under what circumstances will the option be exercised?()A. stock price is 29$ B. stock price is 30.90$C. stock price is 26$ D. stock price is 35$2.Trading strategies of hedge funds include ()A.Market neutral B.Treasury bondsC.Convertible arbitrage D.Emerging markets3.When the spot price is above the futures price during the delivery period,a clear arbitrage opportunity by traders is ()A.Make delivery B.Buy a futures contractC.Buy the asset C.Sell a futures contract E.Sell the asset 4.Individuals taking positions can be categorized as ()A.scalpers B.hedgers C.arbitrageurs D.speculators5.The main features that futures are different from forward are ()A.Settled daily B.Some credit riskC.Standardized contract D.Traded on an exchange6.If the price of gold goes up,the conclusions that the following are correct are ()A.The company that does not use futures contracts to hedge its purchase isunaffected on its gross profit margin.B.The company’s profit margin will increase after the effects of hedge have been taken into account.C.The company’s profit margin will decrease after the effects of hedge have been taken into account.D.The wholesale price of the jewelry will tend to lead a corresponding decrease. 7.When β=3.0,it illustrates that()A.the excess return on the portfolio tends to be three times as great as the excess return on the marketB.the sensitive to market movement is twice as a portfolio with a beta 1.5C.it is therefore necessary to use twice as many contracts to hedge the portfolio D.if the beta of portfolio falls to 2.0,the number of contracts shorted should increase8.The bank’s statement that the interest rate is 10% means that $100 grow to () A.$110.38 when the interest rate is measured with semiannual compoundingB.$110.52 when the interest rate is measured with daily compoundingC.$110.52 when the interest rate is measured with continuous compoundingD.$110.47 when the interest rate is measured with monthly compounding 9.Suppose the underlying asset is gold and assume no storage costs or income. If F0<S0e rT,an investor can adopt the following strategy to make a profit.()A.Borrow S0 dollars at an interest rate r for T yearsB.Sell the gold for S0C.Take a long position in a forward contract on 1 ounce of time TD.Invest the proceeds at interest rate r for time T10.When S is strongly positively correlated with interest rates,so ()A.Forward prices will tend to be slightly higher than futures pricesB.Futures prices will tend to be slightly higher than forward pricesC.when S increases,an investor who holds a long futures position makes an immediate gainD.when S decreases,an investor who holds a long forward contract is not affected.11.If the futures price is an increasing function of the time to maturity,so ()A.the benefits from holding the asset are less than the risk-free rateB.it is usually optimal for the party with the short position to deliver as late as possibleC.the interest earned on the cash received outweighs the benefits of holding the assetD.futures prices should be calculated on the basis that delivery will take place at the end of the delivery period.12.The day count conventions that are commonly used in the United States are()A.actual/365 B.actual/actual C.30/360 D.actual/36013.The examples of the instruments that can be used for hedging by swap market maker are ()A.bonds B.forward rate agreements C.stock option D.interest rate futures14.Suppose that the term structure of interest rates is upward-sloping at the time the swap is negotiated,this means ()A.The value of the FRAS corresponding to early payment dates is negativeB.The forward interest rates increase as the maturity of the FRA increasesC.The value of the FRAS corresponding to later payment dates is negativeD.The forward interest rates decrease as the maturity of the FRA increases 15.The values of puts increase as ()A.The stock price decreases and the strike price decreaseB.The time to expiration increasesC.V olatility increasesD.The net effect of an interest rate increase and the accompanying stock price decrease16.The spread trading strategies that require an initial investment include ()A.A bull spread when created from putsB.A bear spread when created from putsC.A butterfly spread when created from callsD.A butterfly spread when created from puts17.When an investor is expecting a large move in a stock price,the combinations that the investor can choose include ()A.Straddles B.Strips C.Strangles D.Straps四、判断英语1.Derivatives can be dependent on almost any variable.()2.One of the parties to a forward contract assumes a short position and agrees to buy the underlying asset on a certain specified future date for a certain specified price. ()3.Forwards and futures are similar instruments for speculators in that they both provide a way in which a type of leverage can be obtained. ()4.Future contracts offer a way for investors to protect themselves against adverse price movements in the future,but not allowing them to benefit from favorable price movements. ()5.Forwards are traded in over-the-counter market,options are traded on exchanges,but futures are traded both on exchanges and in over-the-counter market. ()6.The purpose of daily price limits is to prevent large price movements from occurring because of too many contracts. ()7.As the delivery period for a futures contract is approached,the futures price converges to the spot price of the underlying asset.()8.A bona fide hedger is often subject to lower margin requirements than a speculator. ()9.Under the forward contract,the whole gain or loss is realized at the end of the life of the contract;under the futures contract,the gain or loss is realized day by day. ()10.A company that does hedge can expect its profit margins to be roughly constant.()11.In general,basis risk increases as time different between the hedge expiration and the delivery month increases. ()12.A hedge using index futures removes risk arising from the performance of the portfolio ralative to the market. ()13.By choosing a portfolio so that the duration of assets equals the duration of liabilities,a financial institution eliminates its credit risk. ()14.Market segmentation theory conjectures that long-term interestrates should reflect expected future short-term interest rates.()15.The forward price is higher than the spot price because of the cost of financing the spot purchase of the asset during the life of the forward contract. ()16.On January 8,2023,interest rates on the Swiss franc were lower than the interest rate on the Us dollar,so futures price for this currency increases with maturity. ()17.If the futures price is an increasing function of the time to maturity,it is usually optimal for the party with the short position to deliver as late as possible. ()18.When bond yields are in excess of 6%,the conversion factor system tends to favor the delivery of low-coupon short-maturity bonds. ()19.Duration matching can ensure that a small parallel shift in interest rates will have little effect on the value of the portfolio of assets and liabilities. ()20.For short maturities Eurodollar futures interest rate is not the same as the corresponding forward interest reate. ()21.The 3-basis-point spread earned by the financial institution ispartly to compensate it for the risk that one of the two companies will default on the swap payments. ()22.The probability of a dafault by a company with a relatively low credit rating is liable to decrease faster than the probability of a default by a company with a relatively high credit rating.()23.If the term structure of interest rates is downward-sloping at the time the swap is negotiated,the forward interest rates increase as the the maturity of the FRA increases. ()23.Potential losses from defaults on a swap are much less than the potential losses from defaults on a loan with the same principal.()24.As the time to expiration increases,call American options become valuable but put American options become unvaluable. ()25.The net effect of an interest rate decrease and the accompanying stock price decrease can be to decrease the value of a put option.()26.The value of a call option is negatively related to the size of an anticipated dividend. ()27.One of the reason that an American call on a non-dividend-payingstock should not be exercised early is the time value of money.()28.A bull spread strategy limits the investor’s upside potential by buying a call option. ()29.A butterfly spread is an appropriate strategy for an investor who feels that stock price can move largely. ()30.For a calendar spread a loss is incurred when the stock price is significantly above or significantly below the strike price of the short-maturity option at the expiration of this option. ()31.In a strip the investor considers a decrease in the stock price to be more likely than an increase. ()32.As the probability of an upward movement in the stock price increases,the value of a call option on the stock increases.()33.When we move from a world with one set of risk preferences to a world with another set of risk preferences,the expected growth rates in variables change and their volatilities change. ()34.If European options expiring at time T were available with every single possible strike price,any payoff function at time T could in theory be obtained. ()35.When pricing options the resulting prices are not just correct in a risk-neutral world ,but in other worlds as well. ()六、填空英语1.Suppose that you enter into a short futures contract to sell July silver for $10.20 per ounce on the New York Commodity Exchange. The size of the contract is 5,000 ounces. The initial margin is $4,000, and the maintenance margin is $3,000. What change in the futures price will lead to a margin call?()2.Suppose that the standard deviation of quarterly changes in the prices of a commodity is $0.65, the standard deviation of quarterly changes in a futures price on the commodity is $0.81, and the coefficient of correlation between the two changes is 0.8. What is the optimal hedge ratio for a 3-month contract?()3.An airline expects to purchase 4 million gallons of jet fuel in 2 month and decides to use heating oil futures for hedging.Each heating oil contract traded on NYMEX is on 42 000 gallons of heating oil.We suppose F σ=0.0313,s σ=0.0263,ρ=0.928,and the spot price and the futures price are 2.74 and 2.79 dollars per gallon.So that the optimal number of contracts is ().4.What rate of interest with continuous compounding is equivlent to15%per annum with monthly compounding?()5.Suppose that LIBOR zero and forward rates are as in Table4.5.Consider an FRA where we will receive a rate of 7%,measuredwith annual compounding,on a principal of $5 million between the end of year 3 and the end of year 4.So the value of the FRA is $().6.Suppose that 6-month, 12-month, 18-month, 24-month, and 30-month zero rates are, respectively, 4%, 4.2%, 4.6%, and 4.8% per annum, with continuous compounding.The cash price of a bond with a face value of 100 that will mature in 30 months and pays a coupon of 4% per annum semiannually is ().7.Suppose a bond price B is 96.273,and the duration D is3.562.When the yield on the bond increases by 15 basis points,the bond price goes down to ().8.Suppose that you enter into a 6-month forward contract on a non-dividend-paying stock when the stock price is $30 and the risk-free interest rate (with continuous compounding) is 12% per annum.The forward price is $().9.A 1-year long forward contract on a non-dividend-paying stock is entered into when the stock price is $40 and the risk-free rate of interest is 10% per annum with continuous compounding. Six months later, the price of the stock is $45 and the risk-free interest rate is still 10%. The value of the forward contract is $().10.The spot price of silver is $9 per ounce. The storage costs are $0.24 per ounce per year payable quarterly in advance. Assuming that interest rates are 10% per annum for all maturities, the futures price of silver for delivery in 9 months is $()per ounce.11.It is January 9, 2023. The price of a Treasury bond with a 12% coupon that matures on October 12, 2023, is quoted as 102-07. The cash price is ().12.It is January 30. You are managing a bond portfolio worth $6 million. The duration of the portfolio in 6 months will be 8.2 years. The September Treasury bond futures price is currently108-15, and the cheapest-to-deliver bond will have a duration of7.6 years in September. You should hedge against changes ininterest rates over the next 6 months.So you need ()contracts to short!13.On August 1, a portfolio manager has a bond portfolio worth $10 million. The duration of the portfolio in October will be 7.1 years. The December Treasury bond futures price is currently 91-12 and the cheapest-to-deliver bond will have a duration of 8.8years at maturity. The portfolio manager want to immunize the portfolio against changes in interest rates over the next 2 months.So he should short ()contracts.14.Consider an exchange-traded call option contract to buy 500 shares with a strike price of $40 and maturity in 4 months. When there is a 4-for-1 stock split,the number of shares covered by one contract is ().15.The rice of a European call that expires in 6 months and has a strike price of $30 is $2. The underlying stock price is $29, and a dividend of $0.50 is expected in 2 months and again in 5 months. The term structure is flat, with all risk-free interest rates being 10%. The price of a European put option that expiresin 6 months and has a strike price of $30 is $().。

《财经英语》UNIT5明智的投资课后练习《财经英语》UNIT 5 明智的投资课后练习一、单项选择题共10 题1、--- What would you do if you ___ the traffic accident?--- I would ____.A . see; do my housework firstB . saw; buy some fruitsC . see; call the 110 at onceD . saw; call the police right away参考答案:D2、-- Pass me the dictionary, ____?--- Yes, with pleasure.A . would youB . will youC . won’t youD . wouldn’t you参考答案:A3、Old people get a ____ for everyday living.A . accountB . loanC . pensionD . investment参考答案:C4、If I ___ you, I’d take the small apple.A . amB . wasC . wereD . be参考答案:C5、If a person wants to open an account for everydayexpenses, he or she should choose ______.A . personal deposit accountB . personal savings accountC . personal current accountD . business current account参考答案:C6、Franco wants to use the loan to ____ his restaurant.A . investB . expandC . sellD . close参考答案:A7、Franco could get a ____ on his land.A . interestB . accountC . chargeD . mortgage参考答案:C8、.He has never ridden a horse before, _____?A . does heB . has heC . hasn’t heD . doesn’t he参考答案:B9、He ought to win the first prize, _____he?.A . didn’t heB . did heC . used heD . wouldn’t he参考答案:D10、You ____ lost your umbrella, have you?A . haveB . didn’tC . doD . haven’t参考答案:D二、阅读理解共 1 题1、A British teenager has become a multi-millionaire after selling an application software he created to web giant Yahoo. The deal is reported to be worth up to 30 million dollars and includes a position working on Yahoo’s future mobile projects. Nick D’Aloisio, 17, started his Summly app(应用软件) when he was just 15. He was studying for school exams and became frustrated at ploughing through lengthy online articles. He created the app to summarize long reports so that people could more easily understand the content. Yahoo’s boss of mobile content development Adam Cahan said: “It started with an insight that we live in a world of constant information and need new ways to simplify ho w we find the stories that are important to us, at a glance.” Nick taught himself。

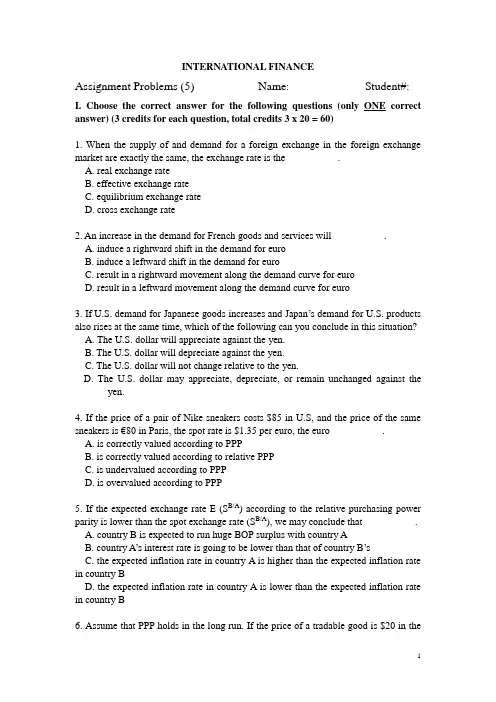

INTERNATIONAL FINANCEAssignment Problems (5) Name: Student#: I. Choose the correct answer for the following questions (only ONE correct answer) (3 credits for each question, total credits 3 x 20 = 60)1. When the supply of and demand for a foreign exchange in the foreign exchange market are exactly the same, the exchange rate is the __________.A. real exchange rateB. effective exchange rateC. equilibrium exchange rateD. cross exchange rate2. An increase in the demand for French goods and services will __________.A. induce a rightward shift in the demand for euroB. induce a leftward shift in the demand for euroC. result in a rightward movement along the demand curve for euroD. result in a leftward movement along the demand curve for euro3. If U.S. demand for Japanese goods increases and Japan’s demand for U.S. products also rises at the same time, which of the following can you conclude in this situation?A. The U.S. dollar will appreciate against the yen.B. The U.S. dollar will depreciate against the yen.C. The U.S. dollar will not change relative to the yen.D. The U.S. dollar may appreciate, depreciate, or remain unchanged against theyen.4. If the price of a pair of Nike sneakers costs $85 in U.S, and the price of the same sneakers is €80 in Paris, the spot rate is $1.35 per euro, the euro __________.A. is correctly valued according to PPPB. is correctly valued according to relative PPPC. is undervalued according to PPPD. is overvalued according to PPP5. If the expected exchange rate E (S B/A) according to the relative purchasing power parity is lower than the spot exchange rate (S B/A), we may conclude that __________.A. country B is expected to run huge BOP surplus with country AB. country A’s interest rate is going to be lower than that of country B’sC. the expected inflation rate in country A is higher than the expected inflation rate in country BD. the expected inflation rate in country A is lower than the expected inflation rate in country B6. Assume that PPP holds in the long run. If the price of a tradable good is $20 in theU.S. and 100 pesos in Mexico; and the exchange rate is 7 pesos/$ right now, which of the following changes might we expect in the future?A. an increase in the price of the good in the U.SB. a decrease in the price of the good in MexicoC. an appreciation of the peso in nominal termsD. a depreciation of the peso in nominal terms7. Which basket of goods would be most likely to exhibit absolute purchasing powerparity?A. Highly tradable commodities, such as wheatB. The goods in the Consumer Price indexC. Specialized luxury goods, which are subject to different tax rates across countriesD. Locally produced goods, such as transportation services, which are not easily traded8. The absolute purchasing power parity says that the exchange rate between the two currencies should be determined by the __________ .A. relative inflation rate of the two currenciesB. relative price level of the two countriesC. relative interest rate of the two currenciesD. relative money supply of the two countries9. According to the relative PPP, if country A’s inflation rate is higher than country B’s inflation rate by 3%, __________.A. country A’s currency should depreciate against country B’s currency by 3%B. country A’s currency should appreciate against country B’s currency by 3%C. it is hard to say whether country A’s currency should appreciate or depreciate against country B’s currency. The exchange rate is influenced by many factorsD. none of the above is true10. If the law of one price holds for a particular good, we may conclude that __________.A. there is no trade barriers for the good among the different nationsB. the price of the good is the same ignoring the other expensesC. arbitrage for the good does not existD. all of the above are true11. An investor borrows money in one market, sells the borrowed money on the spot market, invests the proceeds of the sale in another place and simultaneously buys back the borrowed currency on the forward market. This is called __________.A. uncovered interest arbitrageB. covered interest arbitrageC. triangular arbitrageD. spatial arbitrage12. Real return equalization across countries on similar financial instruments is called __________.A. interest rate parityB. uncovered interest parityC. forward parityD. real interest parity13. In which of the following situations would a speculator wish to sell foreign currency on the forward market?A. If E[S1d/f] < F1d/fB. If E[S1d/f] > F1d/fC. If E[S1d/f] = F1d/fD. If E[S1d/f] = 1/F1d/f14. According to IRP, if the interest rate in country A is higher than that in country B, the forward exchange rate, defined as F1A/B is expected to be __________.A. lower than the spot rate S0A/BB. the same as the spot rate S0A/BC. higher than the spot rate S0A/BD. necessary the same as the future spot rate S1A/B15. For arbitrage opportunities to be practicable, __________.A. arbitragers must have instant access to quotesB. arbitragers must have instant access to executionsC. arbitragers must be able to execute the transactions without an initial sum of money relying on their bank’s credit standingD. All of the above must be true.16. The __________ states that the forward exchange rate quoted at time 0 for delivery at time t is equal to what the spot rate is expected to be at time t.A. interest rate parityB. uncovered interest parityC. forward parityD. real interest parity17. Assume expected value of the U.S. dollar in the future is lower than that now compared to the value of the Japanese yen. The U.S. inflation rate must be higher than Japan’s inflation rate according to __________.A. relative PPPB. Fisher equationC. International Fisher relationD. IRP18. According to covered interest arbitrage if an investor purchases a five-year U.S. bond that has an annual interest rate of 5% rather than a comparable British bond that has an annual interest rate of 6%, then the investor must be expecting the __________ to __________ at a rate at least of 1% per year over the next 5 years.A. British pound; appreciateB. British pound; revalueC. U.S. dollar; appreciateD. U.S. dollar; depreciate19. Covered interest arbitrage moves the market __________ equilibrium because __________.A. toward; investors are now more willing to invest in risky securitiesB. toward; purchasing a currency on the spot market and selling in the forward market narrows the differential between the twoC. away from; purchasing a currency on the spot market and selling in the forward market increases the differential between the twoD. away from; demand for the stronger currency forces up the interest rates on the weaker security20. If the forward exchange rate is an unbiased predictor of the expected future spot rate, which of the following is NOT true?A. The future spot rate will actually be equal to what the forward rate predictsB. The forward premium or discount reflects the expected change in the spot exchange rate.C. Speculative activity ensures that the forward rate does not diverge too far from the market’s consensus expectation.D. All of the above are true.II. Problems (40 credits)1.The Argentine peso was fixed through a currency board at Ps1.00/$ throughout the 1990s. In January 2002 the Argentine peso was floated. On January 29, 2003, it was trading at Ps3.20/$. During that one year period Argentina’s inflation rate was 20% on an annualized basis. Inflation in the United States during that same period was2.2% annualized. (10 credits)a. What should have been the exchange rate in January 2003 if purchasing power parity held?b. By what percentage was the Argentine peso undervalued on an annualized basis?2. Assume that the interest rate paid by an American borrower on a ten-year foreign bond is 10% if the bond is sold in Denmark and 7% if the bond is sold in the Netherland. Will the expected inflation rate in the Netherlands likely be higher than the expected inflation rate in Denmark? Will the Danish kroner be expected to increase in value against the Dutch guilder? Explain your answer. (5 credits)3. Suppose S = $1.25/₤ and the 1-year forward rate is F = $1.20/₤. The real interest rate on a riskless government security is 2 percent in both England and the United States. The U.S. inflation rate is 5 percent. (5 credits)a. What is England’s nominal required rate of return on riskless government securities?b. What is England’s inflation rate if the equilibrium relationships hold?4. Akira Numata, a foreign exchange trader at Credit Suisse (Tokyo), is exploring covered interest arbitrage possibilities. He wants to invest $5,000,000 or its yen equivalent, in a covered interest arbitrage between U.S. dollars and Japanese yen. He faced the following exchange rate and interest rate quotes: (12 credits)Spot rate: ¥118.60/$ 180-day forward rate: ¥117.80/$ 180-day dollar 4.8% per yearinterest rate180-day yen 3.4% per yearinterest rateThe bank does not calculate transaction costs on any individual transaction because these costs are part of the overall operating budget of the arbitrage department. Plot the given information on the covered interest parity grid. Explain and illustrate the specific steps Akira must take to make a covered interest arbitrage profit.5. On a particular day, the spot rate between Czech koruna (CKR) and the U.S. dollar is CKR30.35/$, while the interest rate on a one-year financial instrument in Czech is7.5% and 3.5% in U.S. (8 credits)a. What is your expected spot exchange rate a year later?b. You’re concerned your investment in the Czech Republic because of the economic uncertainty in that country. When you expect the future value of the koruna, you require a risk premium of 2%. What is the expected future spot rate supposed to be?Answers to Assignment Problems (5)Part II1. a. inflation differential (20% -2.2%) = 17.8%U.S. should have appreciated by 17.8%Implied exchange rate 1(1 + 17.8%) = Ps1.178/$b. (1.178 – 3.2 ) / 3.2 = -63.19%2. a. According to international Fisher equation: (1 + i d) / (1 + i f) = (1 + E[πd]) / (1 + E[πf])i d: interest rate in Denmarki f: interest rate in Netherlandπd: Danish inflation rateπf Dutch inflation rateSince (1 + i d) / (1 + i f) = (1 +10%)/(1 + 7%) > 0So, (1 + E[πd]) / (1 + E[πf]) >0, which means the expected inflation rate in Denmark would be greater than that in Netherland.b. If Danish inflation is higher than Dutch inflation, Danish kroner will be expected to decrease in value against the Dutch guilder. (relative PPP theory)3. a. U.S. nominal interest rate 2% + 5% = 7% (Fisher equation)7% - U.K.i = (1.2 – 1.25)/1.25 (IRP)U.K.i = 7% + 4% = 11%b. 11% - 2% = 9% (Fisher equation)4. a. According to IRP:i¥– i$ = 4.8%/2 – 3.4%/2 = 0.7% = 0.007(F¥/$– S¥、$) / S¥/$ = (117.8 – 118.6) / 118.6 = - 0.006745i¥– i$¥/$– S¥、$) / S¥/$greater than forward-spot exchange rate differential.Step 1: Since Akira decides to invest $5,000,000, so he borrow yen equivalent $5,000,000 x ¥118.6/$ = ¥593,000,000Akira’s obligation: ¥593,000,000 x (1 + 1.7%) = ¥603,081,000 Step 2: Sell yen for dollar at the spot market¥593,000,000 / ¥118.6/$ = $5,000,000 (dollar inflow)Step 3: invest in U.S. market$5,000,000 x (1 + 2.4%) = $5,120,000 (payoff)Step 4: sell dollar for yen at the forward market($5,120,000) x (¥117.8/$) = ¥603,136,000 (yen inflow)Akira’s net profit: ¥603,136,000 –¥603,081,000 = ¥55,0005. a. According to UIP, i CKR– i$ = (E(S) – S)/S7.5% - 3.5% = ((E(S) – 30.35)/30.35E[S] = (30.35 x 0.04) + 30.35 = 31.564b. i CKR– i$ = (E(S) – S)/S + risk premium7.5% - 3.5% = ((E(S) – 30.35)/30.35 + 2%E[S] = (30.35 x 0.02) + 30.35 = 30.957。

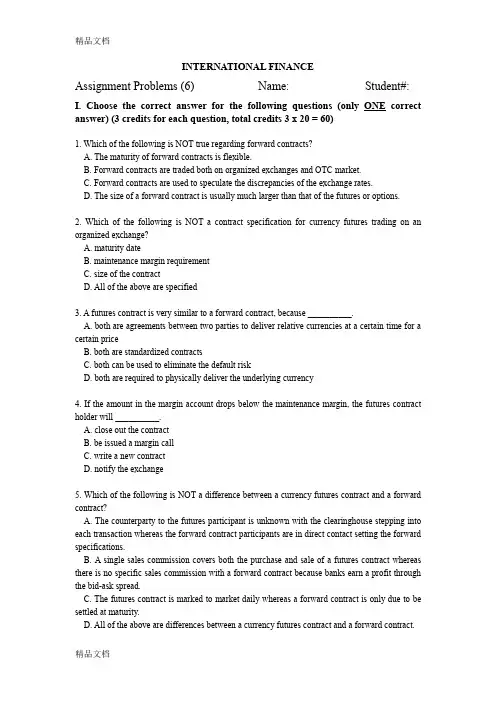

INTERNATIONAL FINANCEAssignment Problems (6) Name: Student#: I. Choose the correct answer for the following questions (only ONE correct answer) (3 credits for each question, total credits 3 x 20 = 60)1. Which of the following is NOT true regarding forward contracts?A. The maturity of forward contracts is flexible.B. Forward contracts are traded both on organized exchanges and OTC market.C. Forward contracts are used to speculate the discrepancies of the exchange rates.D. The size of a forward contract is usually much larger than that of the futures or options.2. Which of the following is NOT a contract specification for currency futures trading on an organized exchange?A. maturity dateB. maintenance margin requirementC. size of the contractD. All of the above are specified3. A futures contract is very similar to a forward contract, because __________.A. both are agreements between two parties to deliver relative currencies at a certain time for a certain priceB. both are standardized contractsC. both can be used to eliminate the default riskD. both are required to physically deliver the underlying currency4. If the amount in the margin account drops below the maintenance margin, the futures contract holder will __________.A. close out the contractB. be issued a margin callC. write a new contractD. notify the exchange5. Which of the following is NOT a difference between a currency futures contract and a forward contract?A. The counterparty to the futures participant is unknown with the clearinghouse stepping into each transaction whereas the forward contract participants are in direct contact setting the forward specifications.B. A single sales commission covers both the purchase and sale of a futures contract whereas there is no specific sales commission with a forward contract because banks earn a profit through the bid-ask spread.C. The futures contract is marked to market daily whereas a forward contract is only due to be settled at maturity.D. All of the above are differences between a currency futures contract and a forward contract.6. Assume that Citibank in New York quotes a 30-day forward rate on euro of $0.7533 while the Singapore International Monetary Exchange (SIMEX) euro futures for delivery in 30 days is being quoted at $0.7522. You can make a riskless profit by __________.A. taking a short position on euro in SIMEX euro futures contract and a long position on euro in the forward contractB. taking a long position on euro in SIMEX euro futures contract and a short position on euro in the forward contractC. taking a short position on dollar in SIMEX euro futures contract and a short position on dollar in the forward contractD. taking a long position on dollar in SIMEX euro futures contract and a long position on dollar in the forward contract7. The main function of the “Marking to market” procedure comes down to __________.A. avoid default risk inherent in forward contractsB. cover risk exposure arisen from the international transactionsC. protect the contract holders from suffering the lossD. all of the above8. The buyer of a futures contract is required to put a sum of money in the exchange. This sum of money is called __________.A. down paymentB. initial marginC. premiumD. commission9. When reading the futures quotation in the newspaper, the column heading indicating the number of contracts outstanding on the previous day is called __________.A. percentage changeB. settleC. open interestD. estimated volume10. A put option on Japanese yen is written with a strike price of ¥ 88/$. Which of the following spot rate maximizes your profit if you choose to execute the contract before maturity?A. ¥70/$B. ¥80/$C. ¥90/$D. ¥100/$11. The agreed price in a currency option contract is called the __________.A. forward priceB. futures priceC. exercise priceD. spot price12. For a currency put option if the future spot rate is above the strike price, the option is said to be __________.A. in-the-moneyB. at-the-moneyC. out-of-the-moneyD. break-even13. The writer of an option contract has __________ whereas the holder has __________.A. obligation; choiceB. right; responsibilityC. choice; obligationD. priority; privilege14. Assume you bought a call option with the exercise price of $1.55/₤in Chicago Mercantile Exchange on September 6. The contract would be expired in December. If the spot exchange rate was $1.50/₤on October 10, the intrinsic value of this call option on that day would be __________.A. $0.05B. -$0.05C. $0D. None of the above, because the contract doesn’t expire on October 10.15. The foreign-currency accounts payable can be hedged by buying a __________ option on the foreign currency, whereas accounts receivable can be hedged by buying a __________ option on the foreign currency.A. call; putB. put; callC. American; EuropeanD. European; American16. Mr. Bull tries to speculate on the direction of the entire stock market, the most efficient method he should use is to acquire __________.A. a stock index futuresB. a portfolio containing stocks of all traded companiesC. a currency forward contractD. a currency futures contract17. The amount that the option purchaser must pay to obtain an option contract may be described as option __________.A. costB. premiumC. priceD. All of the above18. A Canadian dollar option quoted as “C$ Sep 9800 put” is selling on the CME at a price of $0.0026/C$. The size of the contract is C$100,000. Assume the spot exchange rate on the maturity day turns out to be $0.95/C$. You will have __________ if you hold 10 contracts.A. $30,000 net profitB. $30,000 net lossC. $27,400 net profitD. $27,400 net loss19. A fixed-to-fixed currency swap is used to __________.A. hedge currency riskB. speculate discrepancies of the exchange rateC. make a riskless profitD. All of the above20. Exxon and Chase Manhattan Bank reached an agreement. In the next two years, Exxon would pay fixed price of oil to Chase Manhattan Bank on June 30, and Chase Manhattan Bank would pay floating price of oil according to the spot price on the same day. This is an example of __________.A. fixed-for-floating currency swapB. commodity swapC. swaptionD. equity swapII. Problems (40 Credits)1. Samuel Samosir trades currencies for Peregrine Funds in Jakarta, Indonesia. He focuses nearly all of his time and attention on the U.S. dollar/Singapore dollar ($/S$) exchange rate. The current spot rate is $0.6000/S$. After considerable study this week, he has concluded that the Singapore dollar will appreciate versus the U.S. dollar in the coming 90 days, probably to about $0.7000/S$. He has the following options on the Singapore dollar to choose from: (3 credits for each question, total credits 3 x 5 = 15 credits)Option Strike Price PremiumPut on S$ $0.6500/S$ $0.00003/S$Call on S$ $0.6500/S$ $0.00046/S$a. Should Samuel buy a put on Singapore dollars or a call on Singapore dollar?b. Using your answer to part a, what is Samuel’s break-even price?c. Using your answer to part a, what is Samuel’s gross profit and net profit (including the premium) if the spot rate at the end of the 90 days is indeed $0.7000/S$?d. Using your answer to part a, what is Samue l’s gross profit and net profit (including the premium) if the spot rate at the end of the 90 days is indeed $0.8000/S$?e. Using your answer to part a, what is the contract’s time value at the end of the 90 days?2. Jennifer Magnussen, a currency trader for Chicago-based Black River Investments, uses the futures quotes below on the British pound to speculate on its value: (5 credits for each question, total credits 4 x 3 = 12 credits)British Pound Futures, US$/pound (CME) Contract = 62,500 pounds Initial margin: $2,500/contract Maintenance margin: $1,250Maturity Open High Low Settle Change High Low OpenInterest March 1.4246 1.4268 1.4214 1.4228 .0032 1.4700 1.3810 25,605 June 1.4164 1.4188 1.4146 1.4162 .0030 1.4550 1.3910 809a. If Jennifer buys 5 June pound futures right after CME opens, and the spot rate at maturity is $1.3980/pound, what is the value of her position?b. If Jennifer sells 12 March pound futures with the opening quote, and the spot rate at maturity is $1.4560/pound, what is the value of her position?c. If Jennifer buys 10 June pound futures at $1.3500/₤in the early afternoon, and the closing rate at the end of the day is $1.3246/pound instead of $1.4162/pound, what will happen? Explain.3. You head the currency trading desk at Bearings Bank in London. As the middleman in a deal between the U.K. and Danish government, you have just paid₤1,000,000 to the U.K. government and have been promised DKr8,438,000 from the Danish government in three months. All else constant, you wouldn’t mind leaving this long krone position open. However, next month’s referendum in Denmark may close the possibility of Denmark joining the European Union. If this happens, you expect the krone to drop on world markets. As a hedge, you are considering purchasing a call option on pounds sterling with an exercise price of DKr8.4500/₤that sells for DKr0.1464/₤. (13 credits total)a. Fill in the call option values at expiration the following table. (3 credits) Spot rate at expiration (DKr/₤): 8.00 8.40 8.42 8.44 8.46 8.48Call value at expiration (DKr/₤):b, Based on the previous information, draw the payoff profile for a long krone put option at expiration. Note that these exchange rates are reciprocals of those in problem a. (3 credits)Spot rate atexpiration (₤/DKr) .12500 .11905 .11876 .11848 .11820 .11792 Put value atexpiration (₤/DKr)c. Label your axes and plot each of the points. Draw a profit/loss graph for this long krone put at expiration. (7 credits)Answers to Assignment (6)I. (60 credits)1. B2. D3. A4.B5. D6. B7. A8. B9. C 10. A 11. C 12. C 13. A 14. C 15. A 16. A 17. D 18. C 19. A 20.BII. (40 credits)1. Option problema. Samuel should buy a call on Singapore dollar.b. Break-even exchange rate for a call option = strike price + premium= 0.6500 + 0.00046 = $0.65046/S$c. Gross profit = 0.7000 – 0.6500 = $0.05Net profit = 0.7000 – 0.65046 = $0.04954d. Gross profit = 0.8000 – 0.6500 = $0.15Net profit = 0.8000 – 0.65046 = $0.14954e. time value = 0, no time value when the contract expires.2. Futures problema. Jennifer’s loss = (1.3980 – 1.4164) x (62,500) x 5 = -$5,750Value of her position: (2,500 x 5) – 5,750 = $12,500 – 5,750 = $6,750b. Jennifer’s loss = (1.4246 – 1.4560) x (62,500 x 12 = -$23,550Value of her position: (2,500 x 12) – 23,550 = $30,000 – 23,550 = $6,450c. Jennifer’s margin account at the end of the day drops to: (1.3246 – 1.3500) x (62,500) x 10 = -$15,875 + 25,000 = $9,125Jennifer will receive a margin call from the exchange which is12,500 – 9,125 = $3,375Jennifer should bring $3,375 more to meet the maintenance margin requirement.3. Option profilea. Spot rate at expiration (DKr/₤): 8.00 8.40 8.42 8.44 8.46 8.48Call value at expiration (DKr/₤): 0 0 0 0 0.01 0.03 Call option intrinsic value at the expiration = (S DKr/₤– K DKr/₤)b. Spot rate atexpiration (₤/DKr) .12500 .11905 .11876 .11848 .11820 .11792 Put value atexpiration (₤/DKr) 0 0 0 0 0.000143 0.000423 Put option intrinsic value at the expiration = (K DKr/₤– S DKr/₤)c. K = ₤0.118343/DKrOption premium (x): 0.1464/8.45 = x/0.118343x = ₤0.002050/DKrPremium cost = 0.002050 x 8,438,000 = ₤17,298Cost of exercise = 0.118343 x 8,438,000 = ₤998,578.Profit/Loss profileBreak-even price = 0.11834 – 0.00205 = ₤0.11629/DKrIf spot exchange rate at expiration is 0.11610, net profit:(0.11629 – 0.11610) x 8,438,000 = ₤1,603If spot exchange rate at expiration is 0.118343 or below, net lossPremium cost ₤17,297.90Put t₤/DKr₤1,603 ABreak-even K S₤/DKr 00.11610 0.11629 0.11834 0.11848 0.11905-₤17,298。

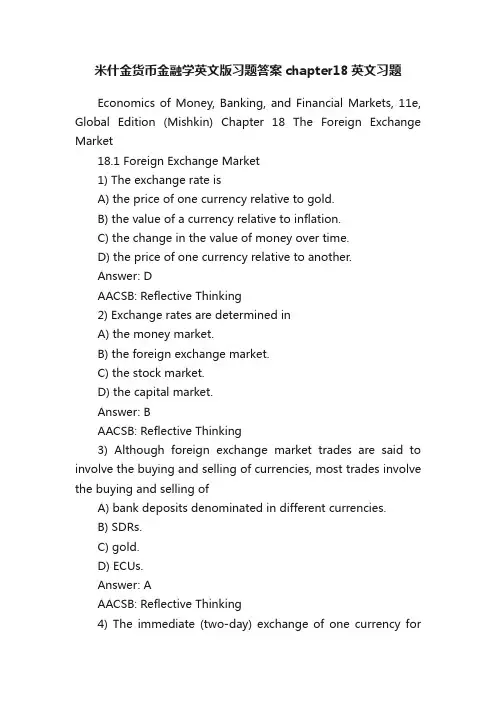

米什金货币金融学英文版习题答案chapter18英文习题Economics of Money, Banking, and Financial Markets, 11e, Global Edition (Mishkin) Chapter 18 The Foreign Exchange Market18.1 Foreign Exchange Market1) The exchange rate isA) the price of one currency relative to gold.B) the value of a currency relative to inflation.C) the change in the value of money over time.D) the price of one currency relative to another.Answer: DAACSB: Reflective Thinking2) Exchange rates are determined inA) the money market.B) the foreign exchange market.C) the stock market.D) the capital market.Answer: BAACSB: Reflective Thinking3) Although foreign exchange market trades are said to involve the buying and selling of currencies, most trades involve the buying and selling ofA) bank deposits denominated in different currencies.B) SDRs.C) gold.D) ECUs.Answer: AAACSB: Reflective Thinking4) The immediate (two-day) exchange of one currency foranother is aA) forward transaction.B) spot transaction.C) money transaction.D) exchange transaction.Answer: BAACSB: Reflective Thinking5) An agreement to exchange dollar bank deposits for euro bank deposits in one month is aA) spot transaction.B) future transaction.C) forward transaction.D) deposit transaction.Answer: CAACSB: Reflective Thinking6) Today 1 euro can be purchased for $1.10. This is theA) spot exchange rate.B) forward exchange rate.C) fixed exchange rate.D) financial exchange rate.Answer: AAACSB: Reflective Thinking7) In an agreement to exchange dollars for euros in three months at a price of $0.90 per euro, the price is theA) spot exchange rate.B) money exchange rate.C) forward exchange rate.D) fixed exchange rate.Answer: CAACSB: Reflective Thinking8) When the value of the British pound changes from $1.25 to $1.50, the pound has ________ and the U.S. dollar has ________.A) appreciated; appreciatedB) depreciated; appreciatedC) appreciated; depreciatedD) depreciated; depreciatedAnswer: CAACSB: Reflective Thinking9) When the value of the British pound changes from $1.50 to $1.25, then the pound has________ and the U.S. dollar has ________.A) appreciated; appreciatedB) depreciated; appreciatedC) appreciated; depreciatedD) depreciated; depreciatedAnswer: BAACSB: Reflective Thinking10) When the value of the dollar changes from £0.5 to £0.75, then the British pound has________ and the U.S. dollar has ________.A) appreciated; appreciatedB) depreciated; appreciatedC) appreciated; depreciatedD) depreciated; depreciatedAnswer: BAACSB: Reflective Thinking11) When the value of the dollar changes from £0.75 to £0.5, then the British pound has________ and the U.S. dollar has ________.A) appreciated; appreciatedB) depreciated; appreciatedC) appreciated; depreciatedD) depreciated; depreciatedAnswer: CAACSB: Reflective Thinking12) When the exchange rate for the Mexican peso changes from 9 pesos to the U.S. dollar to 10 pesos to the U.S. dollar, then the Mexican peso has ________ and the U.S. dollar has ________.A) appreciated; appreciatedB) depreciated; appreciatedC) appreciated; depreciatedD) depreciated; depreciatedAnswer: BAACSB: Reflective Thinking13) When the exchange rate for the Mexican peso changes from 10 pesos to the U.S dollar to 9 pesos to the U.S. dollar, then the Mexican peso has ________ and the U.S. dollar has ________.A) appreciated; appreciatedB) depreciated; appreciatedC) appreciated; depreciatedD) depreciated; depreciatedAnswer: CAACSB: Reflective Thinking14) On January 25, 2009, one U.S. dollar traded on the foreign exchange market for about 0.75 euros. Therefore, one euro would have purchased about ________ U.S. dollars.A) 0.75B) 1.00C) 1.33D) 1.75Answer: CAACSB: Analytical Thinking15) On January 25, 2009, one U.S. dollar traded on the foreign exchange market for about 49.0 Indian rupees. Thus, one Indian rupee would have purchased about ________ U.S. dollars.A) 0.02B) 1.20C) 7.00D) 49.0Answer: AAACSB: Analytical Thinking16) On January 25, 2009, one U.S. dollar traded on the foreign exchange market for about 1.15 Swiss francs. Therefore, one Swiss franc would have purchased about ________ U.S. dollars.A) 0.30B) 0.87C) 1.15D) 3.10Answer: BAACSB: Analytical Thinking17) On January 25, 2009, one U.S. dollar traded on the foreign exchange market for about 3.33 Romanian new lei. Therefore, one Romanian new lei would have purchased about ________ U.S. dollars.A) 0.30B) 1.86C) 2.86D) 3.33Answer: AAACSB: Analytical Thinking18) If the U.S. dollar appreciates from 1.25 Swiss franc per U.S. dollar to 1.5 francs per dollar, then the franc depreciates from ________ U.S. dollars per franc to ________ U.S. dollars per franc.A) 0.80; 0.67B) 0.67; 0.80C) 0.50; 0.33D) 0.33; 0.50Answer: AAACSB: Analytical Thinking19) If the British pound appreciates from $0.50 per pound to $0.75 per pound, the U.S. dollar depreciates from ________ per dollar to ________ per dollar.A) £2; £2.5B) £2; £1.33C) £2; £1.5D) £2; £1.25Answer: BAACSB: Analytical Thinking20) If the Japanese yen appreciates from $0.01 per yen to $0.02 per yen, the U.S. dollar depreciates from ________ per dollar to ________ per dollar.A) 100¥; 50¥B) 10¥; 5¥C) 5¥; 10¥D) 50¥; 100¥Answer: AAACSB: Analytical Thinking21) If the dollar appreciates from 1.5 Brazilian reals per dollar to 2.0 reals per dollar, the real depreciates from ________ per real to ________ per real.A) $0.67; $0.50B) $0.33; $0.50C) $0.75; $0.50D) $0.50; $0.67E) $0.50; $0.75Answer: AAACSB: Analytical Thinking22) When the exchange rate for the British pound changes from $1.80 per pound to $1.60 per pound, then, holding everything else constant, the pound has ________ and ________ expensive.A) appreciated; British cars sold in the United States become moreB) appreciated; British cars sold in the United States become lessC) depreciated; American wheat sold in Britain becomes moreD) depreciated; American wheat sold in Britain becomes lessAnswer: CAACSB: Analytical Thinking23) If the dollar depreciates relative to the Swiss francA) Swiss chocolate will become cheaper in the United States.B) American computers will become more expensive in Switzerland.C) Swiss chocolate will become more expensive in the United States.D) Swiss computers will become cheaper in the United States.Answer: CAACSB: Analytical Thinking24) Everything else held constant, when a country's currencyappreciates, the country's goods abroad become ________ expensive and foreign goods in that country become ________ expensive.A) more; lessB) more; moreC) less; lessD) less; moreAnswer: AAACSB: Analytical Thinking25) Everything else held constant, when a country's currency depreciates, its goods abroad become ________ expensive while foreign goods in that country become ________ expensive.A) more; lessB) more; moreC) less; lessD) less; moreAnswer: DAACSB: Analytical Thinking。

货币派生的流程Currency derivatives refer to financial instruments whose value is derived from the value of an underlying asset, such as a foreign exchange rate or a stock index. 货币衍生品指的是其价值是由底层资产的价值所衍生出来的一种金融工具,比如外汇汇率或股票指数。

One of the primary reasons for using currency derivatives is to manage risk. 企业使用货币衍生品的主要原因之一是为了管理风险。

When a company engages in international trade, it is exposed to fluctuations in exchange rates that can significantly impact their bottom line. 当一家公司从事国际贸易时,它会面临汇率波动的风险,这可能会对公司的利润产生重大影响。

By using currency derivatives, a company can protect itself from adverse movements in exchange rates and stabilize its cash flows. 通过使用货币衍生品,一家公司可以保护自己免受汇率不利波动的影响,并稳定其现金流。

Another reason for using currency derivatives is to speculate on future exchange rate movements. 使用货币衍生品的另一个原因是对未来汇率波动进行投机。

Investors and traders can use currency derivatives to take positions on the direction of currency movements,potentially earning profits from correctly predicting exchange rate changes. 投资者和交易员可以使用货币衍生品来对货币走势进行投注,如果能正确预测汇率的变化,可能会赚取利润。

国际金融习题集英语版Single-Choice Questions下载该金融英语习题集1.A country’s balance of payments records:ba.The value of all exports of goods and services from that country for a period of time.b.All flows of value between that country’s residents and residents of the rest of the world during a period of time.c.All flows of financial assets that cross that country’s borders during a period of time.d.All flows of goods into that country during a period of time.2.A credit item in the balance of payments is:aa.An item for which the country must be paid.b.An item for which the country must pay.c.Any imported item.d.An item that creates a monetary claim owed to a foreigner.3.Every international exchange of value is entered into the balance-of-payments accounts __________ time(s).ba.1b.2c.3d.4下载该金融英语习题集4.A debit item in the balance of payments is:ba.An item for which the country must be paid.b.An item for which the country must pay.c.Any exported item.d.An item that creates a monetary claim on a foreigner.5.In a nation's balance of payments,which one of the following items is always recorded as a positive entry? da.Changes in foreign currency reserves.b.Imports of goods and services.c.Military foreign aid supplied to allied nations.d.Purchases by foreign travelers visiting the country.6.The sum of all of the debit items in the balance of payments:ba.Equals the overall balance.b.Equals the sum of all credit items.c.Equals ‘compensating’ transactions.d.Equals the sum of credit items minus errors and omissions.7.Which of the following capital transactions are entered as debits in the U.S.balance of payments?ba.A U.S.resident transfers $100 from his account at Credit Suisse in Basel (Switzerland)to his account at a San Francisco branch of Wells Fargo Bank.b.A French resident transfers $100 from his account at Wells Fargo Bank in San Francisco to his Credit Suisse account in Basel.c.A U.S.resident sells his IBM stock to a French resident.d.A U.S.resident sells his Credit Suisse stock to a French resident.8.An increase in a nation's financial liabilities to foreign residents is a:ca.Reserve inflow.b.Reserve outflow.c.Capital inflow.d.Capital outflow.下载该金融英语习题集9.__________ are money-like assets that are held by governments and that are recognized by governments as fully acceptable for payments between them.a a.Official international reserve assetsb.Unofficial international reserve assetsc.Official domestic reserve assetsd.Unofficial domestic reserve assets10.Which of the following is considered a capital inflow?aa.A sale of U.S.financial assets to a foreign buyer.b.A loan from a U.S.bank to a foreign borrower.c.A purchase of foreign financial assets by a U.S.buyer.d.A U.S.citizen’s repayment of a loan from a foreign bank.11.In a country’s balance of payments,which of the following transactions are debits?aa.Domestic bank balances owned by foreigners are decreased.b.Foreign bank balances owned by domestic residents are decreased.c.Assets owned by domestic residents are sold to nonresidents.d.Securities are sold by domestic residents to nonresidents.12.The role of __________ is to direct one nation’s savings into another nation’s investments:da.Merchandise trade flowsb.Services flowsc.Current account flowsd.Capital flows下载该金融英语习题集13.The net value of flows of goods,services,income,and unilateral transfers is called the:ba.Capital account.b.Current account.c.Trade balance.d.Official reserve balance.14.The net value of flows of financial assets and similar claims (excluding official international reserve asset flows)is called the:aa.Financial account.b.Current account.c.Trade balance.d.Official reserve balance.15.The financial account in the U.S.balance of payments includes:ba.Everything in the current account.b.U.S.government payments to other countries for the use of military bases.c.Profits that Nissan of America sends back to Japan.d.New U.S.investments in foreign countries.16.A U.S.resident increasing her holdings of a foreign financial asset causes a:da.Credit in the U.S.current account.b.Debit in the U.S.current account.c.Credit in the U.S.capital account.下载该金融英语习题集d.Debit in the U.S.capital account.17.A foreign resident increasing her holdings of a U.S.financial asset causes a:ca.Credit in the U.S.current account.b.Debit in the U.S.current account.c.Credit in the U.S.capital account.d.Debit in the U.S.capital account.18.A deficit in the current account:aa.Tends to cause a surplus in the financial account.b.Tends to cause a deficit in the financial account.c.Has no relationship to the financial account.d.Is the result of increasing exports and decreasing imports.19.In September,2005,exports of goods from the U.S.decreased $3.3 billion to $73.4 billion,and imports of goods increased $3.8 billion to $144.5 billion.This increased the deficit in:ca.The balance of payments.b.The financial account.c.The current account.d.Unilateral transfers.20.Which of the following would contribute to a U.S.current account surplus?ba.The United States makes a unilateral tariff reduction on imported goods.b.The United States cuts back on American military personnel stationed in Japan.c.U.S.tourists travel in large numbers to Asia.d.Russian vodka becomes increasingly popular in the United States.21.Which of the following transactions is recorded in the financial account?aa.Ford motor company builds a new plant in Chinab.A Chinese businessman imports Ford automobiles from the United States.c.A U.S.tourist spends money on a trip to China.d.The New York Yankees are paid $10 million by the Chinese to play an exhibition game in Beijing,China.22.If a British business buys U.S.government securities,how will this be entered in the balance of payments?ca.It will appear in the trade account as an import.b.It will appear in the trade account as an export.c.It will appear in the financial account as an increase in U.S.assets held by foreigners.d.It will appear in the financial account as a decrease in U.S.assets held by foreigners.23.In the balance of payments,the statistical discrepancy or error term is used to:a a.Ensure that the sum of all debits matches the sum of all credits.b.Ensure that imports equal the value of exports.c.Obtain an accurate account of a balance-of-payments deficit.d.Obtain an accurate account of a balance-of-payments surplus.24.Official reserve assets are:ba.The gold holdings in the nation’s central bank.下载该金融英语习题集b.Money like assets that are held by governments and that are recognized by governments as fully acceptable for payments between them.c.Government T-bills and T-bonds.d.Government holdings of SDR’s25.Which of the following constitutes the largest component of the world’s international reserve assets?da.Gold.b.Special Drawing Rights.c.IMF Reserve Positions.d.Foreign Currencies.26.The net accumulation of foreign assets minus foreign liabilities is: ca.Net official reserves.b.Net domestic investment.c.Net foreign investment.d.Net foreign deficit.27.A country experiencing a current account surplus:ba.Needs to borrow internationally.b.Is able to lend internationally.下载该金融英语习题集c.Must also have had a surplus in its "overall" balance.d.Spent more than it earned on its merchandise and service trade,international income payments and receipts and international transfers.28.The __________ measures the sum of the current account balance plus the private capital account balance.ca.Official capital balanceb.Unofficial capital balancec.Official settlements balanced.Unofficial settlements balance29.If the overall balance is in __________,there is an accumulation of official reserve assets by the country or a decrease in foreign official reserve holdings of the country's assets.a a.Surplusb.Deficitc.Balanced.Foreign hands30.Which of the following is the current account balance NOT equal to?da.The difference between domestic product and domestic expenditure.b.The difference between national saving and domestic investment.c.Net foreign investment.d.The difference between government saving and government investment.。