Agency Problems, Auditing, and the Theory of the Firm

- 格式:pptx

- 大小:1.31 MB

- 文档页数:155

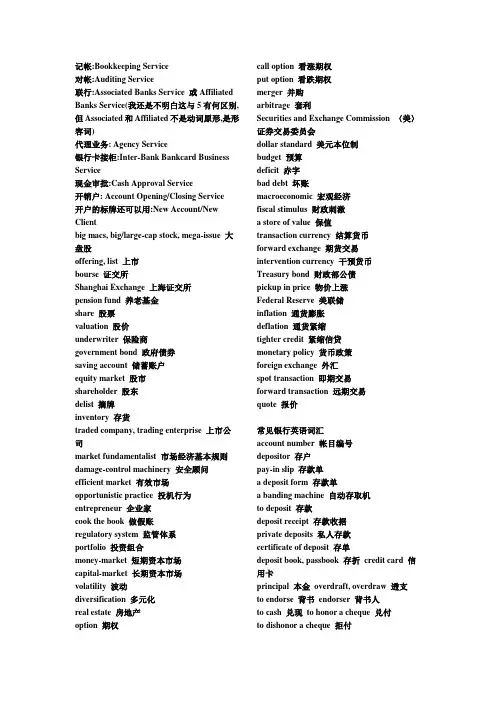

记帐:Bookkeeping Service对帐:Auditing Service联行:Associated Banks Service 或Affiliated Banks Service(我还是不明白这与5有何区别,但Associated和Affiliated不是动词原形,是形容词)代理业务: Agency Service银行卡接柜:Inter-Bank Bankcard Business Service现金审批:Cash Approval Service开销户: Account Opening/Closing Service开户的标牌还可以用:New Account/New Clientbig macs, big/large-cap stock, mega-issue 大盘股offering, list 上市bourse 证交所Shanghai Exchange 上海证交所pension fund 养老基金share 股票valuation 股价underwriter 保险商government bond 政府债券saving account 储蓄账户equity market 股市shareholder 股东delist 摘牌inventory 存货traded company, trading enterprise 上市公司market fundamentalist 市场经济基本规则damage-control machinery 安全顾问efficient market 有效市场opportunistic practice 投机行为entrepreneur 企业家cook the book 做假账regulatory system 监管体系portfolio 投资组合money-market 短期资本市场capital-market 长期资本市场volatility 波动diversification 多元化real estate 房地产option 期权call option 看涨期权put option 看跌期权merger 并购arbitrage 套利Securities and Exchange Commission 〈美〉证券交易委员会dollar standard 美元本位制budget 预算deficit 赤字bad debt 坏账macroeconomic 宏观经济fiscal stimulus 财政刺激a store of value 保值transaction currency 结算货币forward exchange 期货交易intervention currency 干预货币Treasury bond 财政部公债pickup in price 物价上涨Federal Reserve 美联储inflation 通货膨胀deflation 通货紧缩tighter credit 紧缩信贷monetary policy 货币政策foreign exchange 外汇spot transaction 即期交易forward transaction 远期交易quote 报价常见银行英语词汇account number 帐目编号depositor 存户pay-in slip 存款单a deposit form 存款单a banding machine 自动存取机to deposit 存款deposit receipt 存款收据private deposits 私人存款certificate of deposit 存单deposit book, passbook 存折credit card 信用卡principal 本金overdraft, overdraw 透支to endorse 背书endorser 背书人to cash 兑现to honor a cheque 兑付to dishonor a cheque 拒付to suspend payment 止付cheque,check 支票cheque book 支票本crossed cheque 横线支票blank cheque 空白支票rubber cheque 空头支票cheque stub, counterfoil 票根cash cheque 现金支票traveler's cheque 旅行支票cheque for transfer 转帐支票outstanding cheque 未付支票canceled cheque 已付支票forged cheque 伪支票Bandar's note 庄票,银票banker 银行家president 行长savings bank 储蓄银行Chase Bank 大通银行National City Bank of New York 花旗银行Hongkong Shanghai Banking Corporation 汇丰银行Chartered Bank of India, Australia and China 麦加利银行Banque de I'IndoChine 东方汇理银行central bank, national bank, banker's bank 中央银行bank of issue, bank of circulation 发行币银行commercial bank 商业银行,储蓄信贷银行member bank, credit bank 储蓄信贷银行discount bank 贴现银行exchange bank 汇兑银行requesting bank 委托开证银行issuing bank, opening bank 开证银行advising bank, notifying bank 通知银行negotiation bank 议付银行confirming bank 保兑银行paying bank 付款银行associate banker of collection 代收银行consigned banker of collection 委托银行clearing bank 清算银行local bank 本地银行domestic bank 国内银行overseas bank 国外银行unincorporated bank 钱庄branch bank 银行分行trustee savings bank 信托储蓄银行trust company 信托公司financial trust 金融信托公司unit trust 信托投资公司trust institution 银行的信托部credit department 银行的信用部commercial credit company(discount company) 商业信贷公司(贴现公司)neighborhood savings bank, bank of deposit 街道储蓄所credit union 合作银行credit bureau 商业兴信所self-service bank 无人银行land bank 土地银行construction bank 建设银行industrial and commercial bank 工商银行bank of communications 交通银行mutual savings bank 互助储蓄银行post office savings bank 邮局储蓄银行mortgage bank, building society 抵押银行industrial bank 实业银行home loan bank 家宅贷款银行reserve bank 准备银行chartered bank 特许银行corresponding bank 往来银行merchant bank, accepting bank 承兑银行investment bank 投资银行import and export bank (EXIMBANK) 进出口银行joint venture bank 合资银行money shop, native bank 钱庄credit cooperatives 信用社clearing house 票据交换所public accounting 公共会计business accounting 商业会计cost accounting 成本会计depreciation accounting 折旧会计computerized accounting 电脑化会计general ledger 总帐subsidiary ledger 分户帐cash book 现金出纳帐cash account 现金帐journal, day-book 日记帐,流水帐bad debts 坏帐investment 投资surplus 结余idle capital 游资economic cycle 经济周期economic boom 经济繁荣economic recession 经济衰退economic depression 经济萧条economic crisis 经济危机economic recovery 经济复苏inflation 通货膨胀deflation 通货收缩devaluation 货币贬值revaluation 货币增值international balance of payment 国际收支favourable balance 顺差adverse balance 逆差hard currency 硬通货soft currency 软通货international monetary system 国际货币制度the purchasing power of money 货币购买力money in circulation 货币流通量note issue 纸币发行量national budget 国家预算national gross product 国民生产总值public bond 公债stock, share 股票debenture 债券treasury bill 国库券debt chain 债务链direct exchange 直接(对角)套汇indirect exchange 间接(三角)套汇cross rate, arbitrage rate 套汇汇率foreign currency (exchange) reserve 外汇储备foreign exchange fluctuation 外汇波动foreign exchange crisis 外汇危机discount 贴现discount rate, bank rate 贴现率gold reserve 黄金储备money (financial) market 金融市场stock exchange 股票交易所broker 经纪人commission 佣金bookkeeping 簿记bookkeeper 簿记员an application form 申请单bank statement 对帐单letter of credit 信用证strong room, vault 保险库equitable tax system 等价税则specimen signature 签字式样banking hours, business hours 营业时间(Consumer Price Index) 消费者物价指数business 企业商业业务financial risk 财务风险sole proprietorship 私人业主制企业partnership 合伙制企业limited partner 有限责任合伙人general partner 一般合伙人separation of ownership and control 所有权与经营权分离claim 要求主张要求权management buyout 管理层收购tender offer 要约收购financial standards 财务准则initial public offering 首次公开发行股票private corporation 私募公司未上市公司closely held corporation 控股公司board of directors 董事会executove director 执行董事non- executove director 非执行董事chairperson 主席controller 主计长treasurer 司库revenue 收入profit 利润earnings per share 每股盈余return 回报market share 市场份额social good 社会福利financial distress 财务困境stakeholder theory 利益相关者理论value (wealth) maximization 价值(财富)最大化common stockholder 普通股股东preferred stockholder 优先股股东debt holder 债权人well-being 福利diversity 多样化going concern 持续的agency problem 代理问题free-riding problem 搭便车问题information asymmetry 信息不对称retail investor 散户投资者institutional investor 机构投资者agency relationship 代理关系net present value 净现值creative accounting 创造性会计stock option 股票期权agency cost 代理成本bonding cost 契约成本monitoring costs 监督成本takeover 接管corporate annual reports 公司年报balance sheet 资产负债表income statement 利润表statement of cash flows 现金流量表statement of retained earnings 留存收益表fair market value 公允市场价值marketable securities 油价证券check 支票money order 拨款但、汇款单withdrawal 提款accounts receivable 应收账款credit sale 赊销inventory 存货property,plant,and equipment 土地、厂房与设备depreciation 折旧accumulated depreciation 累计折旧liability 负债current liability 流动负债long-term liability 长期负债accounts payout 应付账款note payout 应付票据accrued espense 应计费用deferred tax 递延税款preferred stock 优先股common stock 普通股book value 账面价值capital surplus 资本盈余accumulated retained earnings 累计留存收益hybrid 混合金融工具treasury stock 库藏股historic cost 历史成本current market value 现行市场价值real estate 房地产outstanding 发行在外的a profit and loss statement 损益表net income 净利润operating income 经营收益earnings per share 每股收益simple capital structure 简单资本结构dilutive 冲减每股收益的basic earnings per share 基本每股收益complex capital structures 复杂的每股收益diluted earnings per share 稀释的每股收益convertible securities 可转换证券warrant 认股权证accrual accounting 应计制会计amortization 摊销accelerated methods 加速折旧法straight-line depreciation 直线折旧法statement of changes in shareholders’equity 股东权益变动表source of cash 现金来源use of cash 现金运用operating cash flows 经营现金流cash flow from operations 经营活动现金流direct method 直接法indirect method 间接法bottom-up approach 倒推法investing cash flows 投资现金流cash flow from investing 投资活动现金流joint venture 合资企业affiliate 分支机构financing cash flows 筹资现金流cash flows from financing 筹资活动现金流time value of money 货币时间价值simple interest 单利debt instrument 债务工具annuity 年金future value 终至present value 现值compound interest 复利compounding 复利计算pricipal 本金mortgage 抵押credit card 信用卡terminal value 终值discounting 折现计算discount rate 折现率opportunity cost 机会成本required rate of return 要求的报酬率cost of capital 资本成本ordinary annuity普通年金annuity due 先付年金financial ratio 财务比率deferred annuity 递延年金restrictive covenants 限制性条款perpetuity 永续年金bond indenture 债券契约face value 面值financial analyst 财务分析师coupon rate 息票利率liquidity ratio 流动性比率nominal interest rate 名义利率current ratio 流动比率effective interest rate 有效利率window dressing 账面粉饰going-concern value 持续经营价值marketable securities 短期证券liquidation value 清算价值quick ratio 速动比率book value 账面价值cash ratio 现金比率marker value 市场价值debt management ratios 债务管理比率intrinsic value 内在价值debt ratio 债务比率mispricing 给……错定价格debt-to-equity ratio 债务与权益比率valuation approach 估价方法equity multiplier 权益乘discounted cash flow valuation 折现现金流量模型long-term ratio 长期比率undervaluation 低估debt-to-total-capital 债务与全部资本比率overvaluation 高估leverage ratios 杠杆比率option-pricing model 期权定价模型interest coverage ratio 利息保障比率contingent claim valuation 或有要求权估价earnings before interest and taxes 息税前利润promissory note 本票cash flow coverage ratio 现金流量保障比率contractual provision 契约条款asset management ratios 资产管理比率par value 票面价值accounts receivable turnover ratio 应收账款周转率maturity value 到期价值inventory turnover ratio 存货周转率coupon 息票利息inventory processing period 存货周转期coupon payment 息票利息支付accounts payable turnover ratio 应付账款周转率coupon interest rate 息票利率cash conversion cycle 现金周转期maturity 到期日asset turnover ratio 资产周转率term to maturity 到期时间profitability ratio 盈利比率call provision赎回条款gross profit margin 毛利润call price 赎回价格operating profit margin 经营利润sinking fund provision 偿债基金条款net profit margin 净利润conversion right 转换权return on asset 资产收益率put provision 卖出条款return on total equity ratio 全部权益报酬率indenture 债务契约return on common equity 普通权益报酬率covenant 条款market-to-book value ratio 市场价值与账面价值比率trustee 托管人market value ratios 市场价值比率protective covenant 保护性条款dividend yield 股利收益率negative covenant 消极条款dividend payout 股利支付率positive covenant 积极条款financial statement财务报表secured deht担保借款profitability 盈利能力unsecured deht信用借款viability 生存能力creditworthiness 信誉solvency 偿付能力collateral 抵押品collateral trust bonds 抵押信托契约debenture 信用债券bond rating 债券评级current yield 现行收益yield to maturity 到期收益率default risk 违约风险interest rate risk 利息率风险authorized shares 授权股outstanding shares 发行股treasury share 库藏股repurchase 回购right to proxy 代理权right to vote 投票权independent auditor 独立审计师straight or majority voting 多数投票制cumulative voting 积累投票制liquidation 清算right to transfer ownership 所有权转移权preemptive right 优先认股权dividend discount model 股利折现模型capital asset pricing model 资本资产定价模型constant growth model 固定增长率模型growth perpetuity 增长年金mortgage bonds 抵押债券。

1936年美国会计师协会(AIA)首次正式提出了内部控制的概念。

此后,理论界和学术界不断推陈出新。

但基本上都没有突破会计控制的范围.1992年COSO对内部控制的概念进行了突破和创新,并得到国际社会的高度认可.但COSO内部控制框架流程与内部控制目标之间存在着逻辑缺陷,致使COSO内部控制框架的概念被质疑,实践中也缺乏可操作性和普适性。

实际上,COSO内部控制框架仅提供了一个较为全面的风险控制导引,各个国家和地区中的企业需要根据自身企业内部特征以及外部环境要素设计具有针对性的内部控制体系。

即不同地区中的企业需要界定内部控制的边界,并基于此设计相应的内控模式、机制、方法,以实现企业的全面风险管理和高效的内部控制①。

因此,无论是基于理论层面还是实物层而,重视对内部控制本质、边界和目标等基本属性的研究,是构建企业内部控制体系的前提和基础.既有文献针对内部控制本质及内涵的研究主要涉及两个层次的内容:一个层次是从企业系统和整体效率的视角界定内部控制的概念;另一个层次是企业内控系统的构成单元和子系统。

内部控制的组成部分或子概念主要包括两个方面:一个方而是按照层级结构来分的企业治理层面的控制和企业管理控制;另一个方面是为了满足不同需要而单独界定的企业各职能部门和各层级所确立的内部控制体系,如财务报告内部控制,会一计控制等概念,I—!前比较成型和有影响力!、勺是财务报告内部控制’、「「。

自华,高_立(2011)’‘在困内外相关研究的琴础_上,指出无沦从历史发展、时间考察还是理论逻辑方而看,财务报告内部控制陷入了一个为不能存在的系统寻找独立存在的理由的尴尬境地。

ICI此,应该尽早用“内部拄制”取代“财务报告内部控制”。

杨清香(2010)`”利用马克思认识论,对如何构建内部控制的概念框架问题进行了探讨,认为内部控制的本质是构建内部控制概念框架或理论体系的逻辑起点,内部控制的其他概念或理沦要素都是根据内部控制的木质演绛推论出来的。

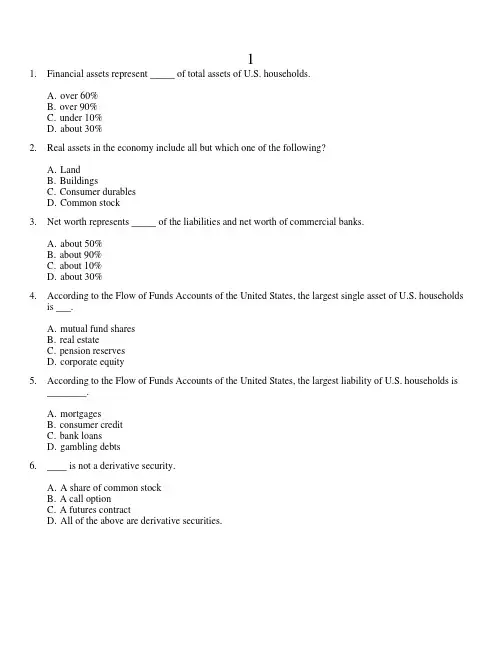

11.Financial assets represent _____ of total assets of U.S. households.A. over 60%B. over 90%C. under 10%D. about 30%2.Real assets in the economy include all but which one of the following?A. LandB. BuildingsC. Consumer durablesD. Common stock worth represents _____ of the liabilities and net worth of commercial banks.A. about 50%B. about 90%C. about 10%D. about 30%4.According to the Flow of Funds Accounts of the United States, the largest single asset of U.S. householdsis ___.A. mutual fund sharesB. real estateC. pension reservesD. corporate equity5.According to the Flow of Funds Accounts of the United States, the largest liability of U.S. households is________.A. mortgagesB. consumer creditC. bank loansD. gambling debts6.____ is not a derivative security.A. A share of common stockB. A call optionC. A futures contractD. All of the above are derivative securities.7.According to the Flow of Funds Accounts of the United States, the largest financial asset of U.S.households is ____.A. mutual fund sharesB. corporate equityC. pension reservesD. personal trusts8.Active trading in markets and competition among securities analysts helps ensure that __________.I. security prices approach informational efficiencyII. riskier securities are priced to offer higher potential returnsIII. investors are unlikely to be able to consistently find under- or overvalued securitiesA. I onlyB. I and II onlyC. II and III onlyD. I, II and III9.The material wealth of society is determined by the economy's _________, which is a function of theeconomy's _________.A. investment bankers, financial assetsB. investment bankers, real assetsC. productive capacity, financial assetsD. productive capacity, real assets10.Which of the following is not a money market security?A. U.S. Treasury billB. Six month maturity certificate of depositC. Common stockD. Banker's acceptance11.__________ assets generate net income to the economy and __________ assets define allocation of incomeamong investors.A. Financial, financialB. Financial, realC. Real, financialD. Real, real12.Which of the following are financial assets?I. Debt securitiesII. Equity securitiesIII. Derivative securitiesA. I onlyB. I and II onlyC. II and III onlyD. I, II and III13.__________ are examples of financial intermediaries.A. Commercial banksB. Insurance companiesC. Investment companiesD. All of the above are financial intermediaries14.Asset allocation refers to the _________.A. allocation of the investment portfolio across broad asset classesB. analysis of the value of securitiesC. choice of specific assets within each asset classD. none of the answers define asset allocation15.Which one of the following best describes the purpose of derivatives markets?A. Transferring risk from one party to anotherB. Investing for a short time period to earn a small rate of returnC. Investing for retirementD. Earning interest income16.__________ was the first to introduce mortgage pass-through securities.A. Chase ManhattanB. CiticorpC. FNMAD. GNMA17.Security selection refers to the ________.A. allocation of the investment portfolio across broad asset classesB. analysis of the value of securitiesC. choice of specific securities within each asset classD. top down method of investing18._____ is an example of an agency problem.A. Managers engage in empire buildingB. Managers protect their jobs by avoiding risky projectsC. Managers over consume luxuries such as corporate jetsD. All of the answers provide examples of agency problems19._____ is a mechanism to mitigate potential agency problems.A. Tying income of managers to success of the firmB. Directors defending top managementC. Anti takeover strategiesD. Straight voting method of electing the board of directors20.__________ are real assets.A. BondsB. Production equipmentC. StocksD. Commercial paper21.__________ portfolio construction starts with selecting attractively priced securities.A. Bottom-upB. Top-downC. Upside-downD. Side-to-side22.In a capitalist system capital resources are primarily allocated by ____________.A. governmentsB. the SECC. financial marketsD. investment bankers23. A __________ represents an ownership share in a corporation.A. call optionB. common stockC. fixed-income securityD. preferred stock24.The value of a derivative security _________.A. depends on the value of other related securityB. affects the value of a related securityC. is unrelated to the value of a related securityD. can only be integrated by calculus professors25. A bond issue is broken up so that some investors will receive interest payments while others will receiveprincipal payments. This is an example of _________.A. bundlingB. credit enhancementC. securitizationD. unbundling26.__________ portfolio management calls for holding diversified portfolios without spending effort orresources attempting to improve investment performance through security analysis.A. ActiveB. MomentumC. PassiveD. Market timing27.Financial markets allow for all but which one of the following?A. Shift consumption through time from higher income periods to lowerB. Price securities according to their riskinessC. Channel funds from lenders of funds to borrowers of fundsD. Allow most participants to routinely earn high returns with low risk28.Financial intermediaries exist because small investors cannot efficiently _________.A. diversify their portfoliosB. gather informationC. monitor their portfoliosD. all of the answers provide reasons why29.Methods to encourage managers to act in shareholders' best interest includeI. Threat of takeoverII. Proxy fights for control of the Board of DirectorsIII. Tying managers' compensation to stock price performanceA. I onlyB. I and II onlyC. II and III onlyD. I, II and III30.Firms that specialize in helping companies raise capital by selling securities to the public are called_________.A. pension fundsB. investment banksC. savings banksD. REITs31.In securities markets, there should be a risk-return trade-off with higher-risk assets having _________expected returns than lower-risk assets.A. higherB. lowerC. the sameD. Can't tell from the information given32.__________ are an indirect way U.S. investors can invest in foreign companies.A. ADRsB. IRAsC. SDRsD. CPCs33.Security selection refers to _________.A. choosing specific securities within each asset-classB. deciding how much to invest in each asset-classC. deciding how much to invest in the market portfolio versus the riskless assetD. deciding how much to hedge34.An example of a derivative security is _________.A. a common share of General MotorsB. a call option on Intel stockC. a Ford bondD. a U.S. Treasury bond35.__________ portfolio construction starts with asset allocation.A. Bottom-upB. Top-downC. Upside-downD. Side-to-side36.Which one of the following firms falsely claimed to have a $4.8 billion bank account at Bank of Americaand vastly understated its debts, eventually resulting in the firm's bankruptcy?A. WorldComB. EnronC. ParmalatD. Global Crossing37.Debt securities promise _________.I. a fixed stream of incomeII. a stream of income that is determined according to a specific formulaIII. a share in the profits of the issuing entityA. I onlyB. I or II onlyC. I and III onlyD. II or III only38.The Sarbanes-Oxley Act tightened corporate governance rules by requiring all but which one of thefollowing?A. Required corporations to have more independent directorsB. Required the CFO to personally vouch for the corporation's financial statementsC. Required that firms could no longer employ investment bankers to sell securities to the publicD. The creation of a new board to oversee the auditing of public companies39.The success of common stock investments depends on the success of _________.A. derivative securitiesB. fixed income securitiesC. the firm and its real assetsD. government methods of allocating capital40.The historical average rate of return on the large company stocks since 1926 has beenA. 5%B. 8%C. 12%D. 20%41.The average rate of return on U.S. Treasury bills since 1926 was _________.A. 0.5%B. 2.4%C. 3.8%D. 6.0%42.An example of a real asset is _________.I. a college educationII. customer goodwillIII. a patentA. I onlyB. II onlyC. I and III onlyD. I, II and III43.The 2002 law designed to improve corporate governance is titled theA. Pension Reform ActB. ERISAC. Financial Services Modernization ActD. Sarbanes-Oxley Act44.Which of the following is not a financial intermediary?A. a mutual fundB. an insurance companyC. a real estate brokerage firmD. a savings and loan company45.The combined liabilities of American households represent approximately __________ percent ofcombined assets.A. 11%B. 21%C. 25%D. 33%46.In 2008 real assets represented approximately __________ percent of the total asset holdings of Americanhouseholds.A. 37%B. 42%C. 48%D. 55%47.In 2008 mortgages represented approximately __________ percent of total liabilities and net worth ofAmerican households.A. 12%B. 15%C. 28%D. 42%48.Liabilities equal approximately _____ of total assets for nonfinancial U.S. businesses.A. 10%B. 25%C. 44%D. 75%49.Which of the following is not an example of a financial intermediary?A. Goldman SachsB. Allstate InsuranceC. First Interstate BankD. IBM50.Real assets represent about ____ of total assets for financial institutions.A. 1%B. 15%C. 25%D. 40%51.Money Market securities are characterized by ________.I. maturity less than one yearII. safety of the principal investmentIII. low rates of returnA. I onlyB. I and II onlyC. I and III onlyD. I, II and III52.After much investigation an investor finds that Intel stock is currently under priced. This is an example of______.A. asset allocationB. security analysisC. top down portfolio managementD. passive management53.After considering current market conditions an investor decides to place 60% of their funds in equities andthe rest in bonds. This is an example ofA. asset allocationB. security analysisC. top down portfolio managementD. passive management54.Suppose an investor is considering one of two investments which are identical in all respects except forrisk. If the investor anticipates a fair return for the risk of the security they invest in they can expect toA. earn no more than the Treasury bill rate on either securityB. pay less for the security that has higher riskC. pay less for the security that has lower riskD. earn more if interest rates are lower55.The efficient markets hypothesis suggests that _______.A. active portfolio management strategies are the most appropriate investment strategiesB. passive portfolio management strategies are the most appropriate investment strategiesC. either active or passive strategies may be appropriate, depending on the expected direction of the marketD. a bottom up approach is the most appropriate investment strategy56.In a perfectly efficient market the best investment strategy is probably a/anA. active strategyB. passive strategyC. asset allocationD. market timing57.An important trend that has changed the contemporary investment market is _________.A. financial engineeringB. globalizationC. securitizationD. all three of the other answers58.Securitization refers to the creation of new securities by _________.A. selling individual cash flows of a security or loanB. repackaging individual cash flows of a security or loan into a new payment patternC. taking an illiquid asset and converting it into a marketable securityD. selling financial services overseas as well as in the U.S.59.Brady bonds were an example of _________.A. securitizationB. mortgagizationC. bundlingD. pass through securities60.Individuals may find it more advantageous to purchase claims from a financial intermediary rather thandirectly purchasing claims in capital markets becauseI. intermediaries are better diversified than most individualsII. intermediaries can exploit economies of scale in investing that individual investors cannotIII. intermediated investments usually offer higher rates of return than direct capital market claimsA. I onlyB. I and II onlyC. II and III onlyD. I, II and III61.Surf City Software Company develops new surf forecasting software. It sells the software to Microsoft inexchange for 1000 shares of Microsoft common stock. Surf City Software has exchanged a _____ asset fora _____ asset in this transaction.A. real, realB. financial, financialC. real, financialD. financial, real62.Stone Harbor Products takes out a bank loan. It receives $100,000 and signs a promissory note to pay backthe loan over 5 years.A. A new financial asset was created in this transaction.B. A financial asset was traded for a real asset in this transaction.C. A financial asset was destroyed in this transaction.D. A real asset was created in this transaction.63.Which of the following firms was not engaged in a major accounting scandal between 2000 and 2005?A. General ElectricB. ParmalatC. EnronD. WorldCom64.Accounting scandals can often be attributed to a particular concept in the study of finance known as theA. agency problemB. risk - return trade - offC. allocation of riskD. securitization65.An intermediary that pools and manage funds for many investors is called a/an ______.A. investment companyB. savings and loanC. investment bankerD. ADR66.Financial institutions that specialize in assisting corporations in primary market transactions are called_______.A. mutual fundsB. investment bankersC. pension fundsD. globalization specialists67.WEBS allow investors to _______.A. invest in U.S. mortgage backed securitiesB. invest in an individual foreign stockC. invest in a portfolio of foreign stocksD. avoid any exposure to foreign exchange risk68.In 2008 the largest corporate bankruptcy in the U.S. history involved the investment banking firm of______.A. Goldman SachsB. Lehman BrothersC. Morgan StanleyD. Merrill Lynch69.The inability of shareholders to influence the decisions of managers, despite overwhelming shareholdersupport, is a breakdown in what process or mechanism?A. AuditingB. Public financeC. Corporate governanceD. Public reporting70.Real assets are ______.A. are assets used to produce goods and servicesB. always the same as financial assetsC. always equal to liabilitiesD. claims on company's income71. A major cause of mortgage market meltdown in 2007 and 2008 was linked to ________.A. globalizationB. securitizationC. negative analyst recommendationsD. online trading72.In recent years the greatest dollar amount of securitization occurred for which type loan?A. Home mortgagesB. Credit card debtC. Automobile loansD. Equipment leasing73.The process of securitizing poor quality bank loans made to developing nations resulted in the creation of__________.A. Pass-throughsB. Brady bondsC. WEBSD. FHLMC participation certificates74.U.S. Treasury bonds pay interest every six months and repay the principal at maturity. The U.S.Treasury routinely sells individual interest payments on these bonds to investors. This is an example of ___________.A. unbundlingB. bundlingC. securitizationD. security selection75.An investment advisor has decided to purchase gold, real estate, stocks, and bonds in equal amounts. Thisdecision reflects which part of the investment process?A. Asset allocationB. Investment analysisC. Portfolio analysisD. Security selection1 Key1.Financial assets represent _____ of total assets of U.S. households.A. over 60%B. over 90%C. under 10%D. about 30%Bodie - Chapter 01 #1Difficulty: Easy2.Real assets in the economy include all but which one of the following?A. LandB. BuildingsC. Consumer durablesD. Common stockBodie - Chapter 01 #2Difficulty: Easy worth represents _____ of the liabilities and net worth of commercial banks.A. about 50%B. about 90%C. about 10%D. about 30%Bodie - Chapter 01 #3Difficulty: Medium 4.According to the Flow of Funds Accounts of the United States, the largest single asset of U.S.households is ___.A. mutual fund sharesB. real estateC. pension reservesD. corporate equityBodie - Chapter 01 #4Difficulty: Medium 5.According to the Flow of Funds Accounts of the United States, the largest liability of U.S. households is________.A. mortgagesB. consumer creditC. bank loansD. gambling debtsBodie - Chapter 01 #5Difficulty: Medium6.____ is not a derivative security.A. A share of common stockB. A call optionC. A futures contractD. All of the above are derivative securities.Bodie - Chapter 01 #6Difficulty: Easy 7.According to the Flow of Funds Accounts of the United States, the largest financial asset of U.S.households is ____.A. mutual fund sharesB. corporate equityC. pension reservesD. personal trustsBodie - Chapter 01 #7Difficulty: Medium8.Active trading in markets and competition among securities analysts helps ensure that __________.I. security prices approach informational efficiencyII. riskier securities are priced to offer higher potential returnsIII. investors are unlikely to be able to consistently find under- or overvalued securitiesA. I onlyB. I and II onlyC. II and III onlyD. I, II and IIIBodie - Chapter 01 #8Difficulty: Hard 9.The material wealth of society is determined by the economy's _________, which is a function of theeconomy's _________.A. investment bankers, financial assetsB. investment bankers, real assetsC. productive capacity, financial assetsD. productive capacity, real assetsBodie - Chapter 01 #9Difficulty: Medium10.Which of the following is not a money market security?A. U.S. Treasury billB. Six month maturity certificate of depositC. Common stockD. Banker's acceptanceBodie - Chapter 01 #10Difficulty: Medium11.__________ assets generate net income to the economy and __________ assets define allocation ofincome among investors.A. Financial, financialB. Financial, realC. Real, financialD. Real, realBodie - Chapter 01 #11Difficulty: Medium12.Which of the following are financial assets?I. Debt securitiesII. Equity securitiesIII. Derivative securitiesA. I onlyB. I and II onlyC. II and III onlyD.I, II and IIIBodie - Chapter 01 #12Difficulty: Hard13.__________ are examples of financial intermediaries.A. Commercial banksB. Insurance companiesC. Investment companiesD. All of the above are financial intermediariesBodie - Chapter 01 #13Difficulty: Easy14.Asset allocation refers to the _________.A.allocation of the investment portfolio across broad asset classesB. analysis of the value of securitiesC. choice of specific assets within each asset classD. none of the answers define asset allocationBodie - Chapter 01 #14Difficulty: Easy15.Which one of the following best describes the purpose of derivatives markets?A.Transferring risk from one party to anotherB. Investing for a short time period to earn a small rate of returnC. Investing for retirementD. Earning interest incomeBodie - Chapter 01 #15Difficulty: Medium16.__________ was the first to introduce mortgage pass-through securities.A. Chase ManhattanB. CiticorpC. FNMAD. GNMABodie - Chapter 01 #16Difficulty: Easy17.Security selection refers to the ________.A. allocation of the investment portfolio across broad asset classesB. analysis of the value of securitiesC.choice of specific securities within each asset classD. top down method of investingBodie - Chapter 01 #17Difficulty: Medium18._____ is an example of an agency problem.A. Managers engage in empire buildingB. Managers protect their jobs by avoiding risky projectsC. Managers over consume luxuries such as corporate jetsD. All of the answers provide examples of agency problemsBodie - Chapter 01 #18Difficulty: Easy19._____ is a mechanism to mitigate potential agency problems.A. Tying income of managers to success of the firmB. Directors defending top managementC. Anti takeover strategiesD. Straight voting method of electing the board of directorsBodie - Chapter 01 #19Difficulty: Hard20.__________ are real assets.A. BondsB. Production equipmentC. StocksD. Commercial paperBodie - Chapter 01 #20Difficulty: Easy21.__________ portfolio construction starts with selecting attractively priced securities.A. Bottom-upB. Top-downC. Upside-downD. Side-to-sideBodie - Chapter 01 #21Difficulty: Easy22.In a capitalist system capital resources are primarily allocated by ____________.A. governmentsB. the SECC. financial marketsD. investment bankersBodie - Chapter 01 #22Difficulty: Easy23. A __________ represents an ownership share in a corporation.A. call optionmon stockC. fixed-income securityD. preferred stockBodie - Chapter 01 #23Difficulty: Easy24.The value of a derivative security _________.A.depends on the value of other related securityB. affects the value of a related securityC. is unrelated to the value of a related securityD. can only be integrated by calculus professorsBodie - Chapter 01 #24Difficulty: Easy 25. A bond issue is broken up so that some investors will receive interest payments while others willreceive principal payments. This is an example of _________.A. bundlingB. credit enhancementC. securitizationD.unbundlingBodie - Chapter 01 #25Difficulty: Easy 26.__________ portfolio management calls for holding diversified portfolios without spending effort orresources attempting to improve investment performance through security analysis.A. ActiveB. MomentumC.PassiveD. Market timingBodie - Chapter 01 #26Difficulty: Easy27.Financial markets allow for all but which one of the following?A. Shift consumption through time from higher income periods to lowerB. Price securities according to their riskinessC. Channel funds from lenders of funds to borrowers of fundsD. Allow most participants to routinely earn high returns with low riskBodie - Chapter 01 #27Difficulty: Moderate28.Financial intermediaries exist because small investors cannot efficiently _________.A. diversify their portfoliosB. gather informationC. monitor their portfoliosD. all of the answers provide reasons whyBodie - Chapter 01 #28Difficulty: Easy29.Methods to encourage managers to act in shareholders' best interest includeI. Threat of takeoverII. Proxy fights for control of the Board of DirectorsIII. Tying managers' compensation to stock price performanceA. I onlyB. I and II onlyC. II and III onlyD. I, II and IIIBodie - Chapter 01 #29Difficulty: Easy 30.Firms that specialize in helping companies raise capital by selling securities to the public are called_________.A. pension fundsB.investment banksC. savings banksD. REITsBodie - Chapter 01 #30Difficulty: Easy 31.In securities markets, there should be a risk-return trade-off with higher-risk assets having _________expected returns than lower-risk assets.A. higherB. lowerC. the sameD. Can't tell from the information givenBodie - Chapter 01 #31Difficulty: Easy32.__________ are an indirect way U.S. investors can invest in foreign companies.A. ADRsB. IRAsC. SDRsD. CPCsBodie - Chapter 01 #32Difficulty: Easy33.Security selection refers to _________.A. choosing specific securities within each asset-classB. deciding how much to invest in each asset-classC. deciding how much to invest in the market portfolio versus the riskless assetD. deciding how much to hedgeBodie - Chapter 01 #33Difficulty: Easy34.An example of a derivative security is _________.A. a common share of General MotorsB. a call option on Intel stockC. a Ford bondD. a U.S. Treasury bondBodie - Chapter 01 #34Difficulty: Easy35.__________ portfolio construction starts with asset allocation.A. Bottom-upB. Top-downC. Upside-downD. Side-to-sideBodie - Chapter 01 #35Difficulty: Easy 36.Which one of the following firms falsely claimed to have a $4.8 billion bank account at Bank ofAmerica and vastly understated its debts, eventually resulting in the firm's bankruptcy?A. WorldComB. EnronC. ParmalatD. Global CrossingBodie - Chapter 01 #36Difficulty: Medium37.Debt securities promise _________.I. a fixed stream of incomeII. a stream of income that is determined according to a specific formulaIII. a share in the profits of the issuing entityA. I onlyB.I or II onlyC. I and III onlyD. II or III onlyBodie - Chapter 01 #37Difficulty: Medium 38.The Sarbanes-Oxley Act tightened corporate governance rules by requiring all but which one of thefollowing?A. Required corporations to have more independent directorsB. Required the CFO to personally vouch for the corporation's financial statementsC. Required that firms could no longer employ investment bankers to sell securities to the publicD. The creation of a new board to oversee the auditing of public companiesBodie - Chapter 01 #38Difficulty: Medium39.The success of common stock investments depends on the success of _________.A. derivative securitiesB. fixed income securitiesC. the firm and its real assetsD. government methods of allocating capitalBodie - Chapter 01 #39Difficulty: Easy40.The historical average rate of return on the large company stocks since 1926 has beenA. 5%B. 8%C.12%D. 20%Bodie - Chapter 01 #40Difficulty: Medium41.The average rate of return on U.S. Treasury bills since 1926 was _________.A. 0.5%B. 2.4%C. 3.8%D. 6.0%Bodie - Chapter 01 #41Difficulty: Medium42.An example of a real asset is _________.I. a college educationII. customer goodwillIII. a patentA. I onlyB. II onlyC. I and III onlyD. I, II and IIIBodie - Chapter 01 #42Difficulty: Medium43.The 2002 law designed to improve corporate governance is titled theA. Pension Reform ActB. ERISAC. Financial Services Modernization ActD. Sarbanes-Oxley ActBodie - Chapter 01 #43Difficulty: Easy44.Which of the following is not a financial intermediary?A. a mutual fundB. an insurance companyC. a real estate brokerage firmD. a savings and loan companyBodie - Chapter 01 #44Difficulty: Medium 45.The combined liabilities of American households represent approximately __________ percent ofcombined assets.A. 11%B.21%C. 25%D. 33%Bodie - Chapter 01 #45Difficulty: Medium 46.In 2008 real assets represented approximately __________ percent of the total asset holdings ofAmerican households.A. 37%B. 42%C. 48%D. 55%Bodie - Chapter 01 #46Difficulty: Medium。

ACCA考试《专业会计师P1》复习详解2本文由高顿ACCA整理发布,转载请注明出处Impact on the corporate government(1)Including social objectives in the mission statement oforganization is a sign that the board believes that they have significantimpact on corporate strategy.(2)Ethical codes are part of corporate guidance to promote goodcorporate behavior among their employees.(3)Company should report on ethical and social conduct in theirOperation and Financial Review and also may prepare social accounts showing impactof stakeholders.(4)Impact of stakeholders on corporate governance may includerepresentatives from key stakeholder groups on the board.Institutional investor(1)Institutional investors are now the biggest investors in many stockmarkets. They manage funds invested by individuals. Institutional investors canwield great power over the companies in which they invest.(2)The major institutional investors include pension funds, lifeinsurance companies, unit trusts and venture capitals companies.Role & influence(1)The significant role of institutional investors is to promote goodcorporate governance.(2)Due to the size of their shareholdings, institutional investors canexert significant influence on corporate policy.(3)Institutional investors should make a dialogue with companies baseon the mutual understanding of objectives.(4)Institutional investors can use many means to intervene and exerttheir influences on companies, such as voting, calling on extraordinary generalmeeting.(5)The key issue is to increase dominance of investors and contributepositively to corporate governance through concentrating power in a few hands.Principal-agent relationship(1)Under the form of joint-stock, companies are limited by shares. Theseparation of ownership from management makes agency is a significant issue incorporate governance, especially for large companies.(2)The problem of principals (owners)not being able to run thecompany themselves and therefore having to rely on agents (directors)to do sofor them can cause issues if there is a breach of trust by directors who maypursue their own interests rather than he shareholders’。

2016年6月ACCA考试《高级审计与认证业务》真题(总分:120.00,做题时间:150分钟)案例分析题Section A为必做题,Section B任意选两题。

Section A – BOTH questions are compulsory and MUST be attempted1、You are an audit manager in Montreal & Co, a firm of Chartered Certified Accountants, and you are responsible for the audit of the Vancouver Group (the Group). The Group operates in the supply chain management sector, offering distribution, warehousing and container handling services.The Group comprises a parent company, Vancouver Co, and two subsidiaries, Toronto Co and Calgary Co. Both of the subsidiaries were acquired as wholly owned subsidiaries many years ago. Montreal & Co audits all of the individual company financial statements as well as the Group consolidated financial statements.You are beginning to plan the Group audit for the financial year ending 31 July 2016, and the audit engagement partner has sent you the following email:Notes from meeting with the Group finance director and audit committee representative The Group has not changed its operations significantly this year. However, it has completed a modernisation programme of its warehousing facilities at a cost of $25 million. The programme was financed with cash raised from two sources: $5 million was raised from a debenture issue, and $20 million from the sale of 5% of the share capital of Calgary Co, with the shares being purchased by an institutional investor.An investigation into the Group’s tax affairs started in January 2016. The taxauthorities are investigating the possible underpayment of taxes by each of the companies in the Group, claiming tha t tax laws have been breached. The Group’s tax planning was performed by another firm of accountants, Victoria & Co, but the Group’s audit committee has asked if our firm will support the Group by looking into its tax position and liaising with the tax authorities in respect of the tax investigation on its behalf. Victoria & Co has resigned from their engagement to provide tax advice to the Group. The matter is to be resolved by a tribunal which is scheduled to take place in September 2016.The Group audit committee has also asked whether one of Montreal & Co’s audit partners can be appointed as a non-executive director and serve on the audit committee. The audit committee lacks a financial reporting expert, and the appointment of an audit partner would bring much needed knowledge and experience.Financial information provided by the Group finance directorConsolidated statement of financial positionConsolidated statement of profit or loss for the year to 31 JulyNotes:1. Several old warehouses were modernised during the year. The modernisation involved the redesign of the layout of each warehouse, the installation of new computer systems, and the replacement of electrical systems.2. The deferred tax asset is in respect of unused tax losses (tax credits) which accumulated when Toronto Co was loss making for a period of three years from 2009 to 2012.3. The non-controlling interest has arisen on the disposal of shares in Calgary Co. On 1 January 2016, a 5% equity shareholding in Calgary Co was sold, raising cash of $20 million. The profit made on the disposal is separately recognised in the Group statement of profit or loss.4. The provisions relate to onerous leases in respect of vacant properties which are surplus to the Group’s requirements.Required:Respond to the instructions in the partner’s email. (31 marks)Note: The split of the mark allocation is shown within the email.Professional marks will be awarded for presentation, logical flow, and clarity of explanations provided. (4 marks)(分数:35.00)_________________________________________________________________________________ _________正确答案:(Briefing notesTo: Albert Franks, audit engagement partnerFrom: Audit managerSubject: Vancouver Group audit planningIntroductionThese briefing notes are prepared for use in the audit team briefing for the Vancouver Group (the Group). Following a meeting between the audit partner and the Group finance director and a member of the Group audit committee, and using information provided, audit risks have been identified and explained. Analytical procedures have been used to identify several audit risks, and the briefing notes also explain why analytical procedures are required as part of risk assessment. Finally, the briefing notes discuss the ethical implications of suggestions made by the Group audit committee.(a) Analytical procedures and risk assessmentAccording to ISA 520 Analytical Procedures, analytical procedures are the evaluation of。

Unit19答案Unit 19 An Overview of AuditingⅠ.Multiple choice questions1.D2.D3.A4.BⅡ. Translate the following accounting terms into English1.Independent mental attitude2.Operational audit3.Quantifiable information4.Established Criteria5.Economic entity/doc/5814708498.html,pliance audit7.Audit of Financial Statements8.Recommendation to management9.Replacement cost of fixed assets10.Tax returnⅢ. Translate the following sentences into English1.Auditing is a process by which a competent , independent person accumulates andevaluates about quantifiable information related to a specific economic entity for the purpose of determining and reporting on the degree of correspondence between the quantifiable information and established criteria.2.Evidence is defined as any information used by the auditor to determine whetherthe quantifiable information being audited is stated in accordance with the established criteria.3.An operational audit is a review of any part of an organization operatingprocedures and methods for the purpose of evaluating efficiency and effectiveness.Ⅳ. Answer the following questions1.(1) Quantifiable information and established Criteria.(2) Economic entity.(3)Accumulating and evaluating evidence.(4) Competent, independent person.(5) Reporting.2.An operational audit is a review of any part of an organization operating procedures and methods for the purpose of evaluating efficiency and effectiveness. At the completion of an operational audit , recommendation to management for improving are normally expected. The purpose of a compliance audit is to determine whether the auditee is following procedures or rules set down by some higher authority. An audit of financial statements is conducted to determine whether the overall financial statements—the quantifiable information being verified—are stated in accordance with specified criteria. The conduct of an operational audit and the reported results are less easily defined than either of the other two types of audits. Efficiency and effectiveness of operations are far more difficult to evaluate objectively than compliance or the presentation of financial statements in accordance with generally accepted accounting principles; and establishing criteria for evaluating the quantifiable information in an operational audit is an extremely subjective matter. Ⅴ. Translate the follows into Chinese 财务报表审计是为了确定被审查信息,即财务报表是否符合特定的标准而进行的审计。

cpa综合阶段英语作答英文回答:The CPA exam is a standardized test administered by the American Institute of Certified Public Accountants (AICPA) to individuals who wish to become certified public accountants (CPAs). The exam is divided into four sections: Auditing and Attestation (AUD), Business Environment and Concepts (BEC), Financial Accounting and Reporting (FAR), and Regulation (REG). Candidates can choose to take the exam in either English or Spanish.There are several advantages to taking the CPA exam in English. First, English is the language of business in the United States and most other countries around the world. This means that CPAs who are proficient in English will have a wider range of job opportunities available to them. Second, the CPA exam is written in English, so candidates who take the exam in English will not have to worry about translating the exam questions. Third, there are moreresources available to candidates who are studying for the CPA exam in English.However, there are also some disadvantages to taking the CPA exam in English. First, candidates who are not native English speakers may find it difficult to understand the exam questions and materials. Second, candidates who are not fluent in English may make mistakes on the examthat they would not make if they were taking the exam in their native language.Ultimately, the decision of whether to take the CPA exam in English or Spanish is a personal one. Candidates should consider their own language skills and circumstances when making this decision.中文回答:注册会计师考试(CPA)是由美国注册会计师协会(AICPA)管理的一项标准化考试,面向希望成为注册会计师(CPA)的个人。

2014年ACCA考试(P1专业会计师)考前总结1本文由高顿ACCA整理发布,转载请注明出处Governance and ResponsibilityPrinciples-based vs. Rules-basedPrinciples-based approach(1) Principles-based approach requires the company to adhere to thespirit rather than the letter of code.(2) The approaches focus on objectives rather than the mechanisms bywhich these objectives will be achieved.(3) The approaches can lay stress on those elements of corporategovernance to which rules cannot easily be applied.(4) The approaches can applied across different legal jurisdictionsrather being founded in the legal regulations of one country.(5) The approaches avoid inflexible legislation and allows companies todevelop their own approaches to corporate governance.(6) The approaches are too board to be used as a guide to bestcorporate governance practice.(7) There may be confusion over what is compulsory and what isn’t.Rules-based approach(1) Rules-based approach places more definite achievement and provideclarity in terms of what you must do. The rules are legal requirement.(2) The approaches allow no leeway. The key is whether or not you havecomplied with the rules.(3) It should in theory be easy to see whether there has beencompliance with the rules. But that depends on whether the rules areunambiguous.(4) It is rigid and difficult to deal with questionable situation thatare not covered sufficiently in the rulebook.Influence of ownership: Family firms vs. Joint-stockcompaniesInsider systemsInsider system is where companies are ownedand controlled by a small number of major shareholders, which may be members ofthe company’s founding family.(Advantages)(1) It is easier to establish ties between owners and managers. Theagency problem is reduced in the case of that the owners are involved inmanagement.(2) It is easier to influence company management even if the owners arenot involved in management.(3) A smaller base of shareholders may be more able to take a long-termview. Long-term growth is a bigger issue for such families.(Disadvantages)(1) There may be discrimination against minority shareholders and lackof minority shareholders protections.(2) Insider systems tend not to be monitored effectively and may bereluctant to employ outsiders in influential position.(3) Insider systems often don’t develop more formal governancestructures.(4) Insider systems may be more prone to opaque financial transactionsand misuse of fund.Outsider systemsOutsider systems are companies whereshareholding is more widely dispersed, and there is the manager-ownershipseparation.(Advantages)(1) The separation of ownership and management has provided an impetusfor the development of more robust governance to protect shareholders.(2) Shareholders have voting rights that they can use to exercisecontrol.(3) Hostile takeovers become far more frequent and this kind of threatsact as a disciplining mechanism on company management.(Disadvantages)(1) Companies are more likely to have an agency problem and significantcosts of agency.(2) Larger shareholders have often had short-term priorities.Stakeholders in corporate governance(1) Stakeholders are any entity (person, group or non-human entity)that can affect or be affected by the actions or policies of an organization. Itis a bi-directional relationship.(2) Stakeholder theory indicates that large companies have significantimpact on society so that they cannot only be responsible to theirshareholders, but have accountability to a broad range of stakeholders.(3) Companies should concentrate on employees, creditors and governmentas well as behave ethically and have regard for the environment and society asa whole.Instrumental view vs. Normativeviews(Instrumentalview)(1) From the point of instrumental view, the motivation of companies tofulfill the responsibilities towards stakeholders is that they believe that it wouldhave an impact on maximizing company’s profits if not to do so.(2) The companies don’t have any moral standpoint of its own, thereforeis devoid of any moral obligation.(Normativeview)(1) From the point of normative view, themotivation of companies to fulfill the responsibilities towards stakeholder isthat they have consciousness of accepting moral duty towards others.(2) The companies is altruistic, and haveethical, philanthropic responsibilities in addition to economic, legalresponsibilities.更多ACCA资讯请关注高顿ACCA官网:。

Chapter 1The Demand for Audit and Other Assurance ServicesReview Questions1-1The relationship among audit services, attestation services, and assurance services is reflected in Figure 1-3 on page 12 of the text. An assurance service is an independent professional service to improve the quality of information for decision makers. An attestation service is a form of assurance service in which the CPA firm issues a report about the reliability of an assertion that is the responsibility of another party. Audit services are a form of attestation service in which the auditor expresses a written conclusion about the degree of correspondence between information and established criteria.The most common form of audit service is an audit of historical financial statements, in which the auditor expresses a conclusion as to whether the financial statements are presented in accordance with an applicable financial reporting framework such as U.S. GAAP or IFRS. An example of an attestation ser vice is a report on the effectiveness of an entity’s internal control over financial reporting. There are many possible forms of assurance services, including services related to business performance measurement, health care performance, and information system reliability.1-2 An independent audit is a means of satisfying the need for reliable information on the part of decision makers. Factors of a complex society which contribute to this need are:1. Remoteness of informationa. Owners (stockholders) divorced from managementb. Directors not involved in day-to-day operations or decisionsc. Dispersion of the business among numerous geographiclocations and complex corporate structures2. Biases and motives of providera. Information will be biased in favor of the provider when his orher goals are inconsistent with the decision maker's goals.3. Voluminous dataa. Possibly millions of transactions processed daily viasophisticated computerized systemsb. Multiple product linesc. Multiple transaction locations4. Complex exchange transactionsa. New and changing business relationships lead to innovativeaccounting and reporting problemsb. Potential impact of transactions not quantifiable, leading toincreased disclosures1-3 1. Risk-free interest rate This is approximately the rate the bank could earn by investing in U.S. treasury notes for the same length of timeas the business loan.2. Business risk for the customer This risk reflects the possibility thatthe business will not be able to repay its loan because of economicor business conditions such as a recession, poor managementdecisions, or unexpected competition in the industry.3. Information risk This risk reflects the possibility that the informationupon which the business risk decision was made was inaccurate. Alikely cause of the information risk is the possibility of inaccuratefinancial statements.Auditing has no effect on either the risk-free interest rate or business risk. However, auditing can significantly reduce information risk.1-4The four primary causes of information risk are remoteness of information, biases and motives of the provider, voluminous data, and the existence of complex exchange transactions.The three main ways to reduce information risk are:1. User verifies the information.2. User shares the information risk with management.3. Audited financial statements are provided.The advantages and disadvantages of each are as follows:1-5 To do an audit, there must be information in a verifiable form and some standards (criteria) by which the auditor can evaluate the information. Examples of established criteria include generally accepted accounting principles and the Internal Revenue Code. Determining the degree of correspondence between information and established criteria is determining whether a given set of information is in accordance with the established criteria. The information for Jones Company's tax return is the federal tax returns filed by the company. The established criteria are found in the Internal Revenue Code and all interpretations. For the audit of Jones Company's financial statements the information is the financial statements being audited and the established criteria are generally accepted accounting principles.1-6The primary evidence the internal revenue agent will use in the audit of the Jones Company's tax return include all available documentation and other information available in Jones’ office or from other sources. For example, when the internal revenue agent audits taxable income, a major source of information will be bank statements, the cash receipts journal and deposit slips. The internal revenue agent is likely to emphasize unrecorded receipts and revenues. For expenses, major sources of evidence are likely to be cancelled checks and electronic funds transfers, vendors' invoices, and other supporting documentation.1-7This apparent paradox arises from the distinction between the function of auditing and the function of accounting. The accounting function is the recording, classifying and summarizing of economic events to provide relevant information to decision makers. The rules of accounting are the criteria used by the auditor for evaluating the presentation of economic events for financial statements and he or she must therefore have an understanding of accounting standards, as well as auditing standards. The accountant need not, and frequently does not, understand what auditors do, unless he or she is involved in doing audits, or has been trained as an auditor.1-81-9Five examples of specific operational audits that could be conducted by an internal auditor in a manufacturing company are:1. Examine employee time records and personnel records to determineif sufficient information is available to maximize the effective use ofpersonnel.2. Review the processing of sales invoices to determine if it could bedone more efficiently.3. Review the acquisitions of goods, including costs, to determine ifthey are being purchased at the lowest possible cost consideringthe quality needed.1-9 (continued)4. Review and evaluate the efficiency of the manufacturing process.5. Review the processing of cash receipts to determine if they aredeposited as quickly as possible.1-10 When auditing historical financial statements, an auditor must have a thorough understanding of the client and its environment. This knowledge should include the client’s regulatory and operating environment, business strategies and processes, and measurement indicators. This strategic understanding is also useful in other assurance or consulting engagements. For example, an auditor who is performing an assurance service on information technology would need to understand the client’s business strategies an d processes related to information technology, including such things as purchases and sales via the Internet. Similarly, a practitioner performing a consulting engagement to evaluate the efficiency and effectiveness of a client’s manufacturing process woul d likely start with an analysis of various measurement indicators, including ratio analysis and benchmarking against key competitors.1-11 The major differences in the scope of audit responsibilities are:1. CPAs perform audits in accordance with auditing standards ofpublished financial statements prepared in accordance with U.S.GAAP or IFRS.2. GAO auditors perform compliance or operational audits in order toassure the Congress of the expenditure of public funds in accordancewith its directives and the law.3. IRS agents perform compliance audits to enforce the federal taxlaws as defined by Congress, interpreted by the courts, and regulatedby the IRS.4. Internal auditors perform compliance or operational audits in orderto assure management or the board of directors that controls andpolicies are properly and consistently developed, applied andevaluated.1-12 The four parts of the Uniform CPA Examination are: Auditing and Attestation, Financial Accounting and Reporting, Regulation, and Business Environment and Concepts.1-13 It is important for CPAs to be knowledgeable about information technology, including e-commerce, because many of their clients rely extensively on these technologies. Examples of commonly used e-commerce technologies include purchases and sales of goods through the Internet, automatic inventory reordering via direct connection to inventory suppliers, and online banking. CPAs who perform audits or provide other assurance services about information generated with these technologies need a basic knowledge and understanding of information technology and e-commerce in order to identify and respond to risks in the financial and other information generated by these technologies.Multiple Choice Questions From CPA Examinations1-14 a. (3) b. (2) c. (2) d. (3)1-15 a. (2) b. (3) c. (4) d. (3)Discussion Questions And Problems1-16 a. The relationship among audit services, attestation services and assurance services is reflected in Figure 1-3 on page 12 of the text.Audit services are a form of attestation service, and attestationservices are a form of assurance service. In a diagram, auditservices are located within the attestation service area, andattestation services are located within the assurance service area.b. 1. (2) An attestation service other than an audit service2. (1) An audit of historical financial statements3. (2) An attestation service other than an audit service4. (2) An attestation service other than an audit service; or(3) An assurance service that is not an attestation service(WebTrust developed from the AICPA Special Committeeon Assurance Services, but the service meets thecriteria for an attestation service.)5. (2) An attestation service other than an audit service6. (2) An attestation service other than an audit service7. (2) An attestation service that is not an audit service(Review services are a form of attestation, but areperformed according to Statements on Standards forAccounting and Review Services.)8. (2) An attestation service other than an audit service9. (2) An attestation service other than an audit service10. (3) An assurance service that is not an attestation service 1-17 a. The interest rate for the loan that requires a review report is lower than the loan that did not require a review because of lowerinformation risk. A review report provides moderate assurance tofinancial statement users, which lowers information risk. An auditreport provides further assurance and lower information risk. As aresult of reduced information risk, the interest rate is lowest for theloan with the audit report.b. Given these circumstances, Busch should select the loan from FirstCity Bank that requires an annual audit. In this situation, theadditional cost of the audit is less than the reduction in interest dueto lower information risk. The following is the calculation of totalcosts for each loan:c. Busch should select the loan from United National Bank due to thehigher cost of the audit and the reduced interest rate for the loanfrom United National Bank. The following is the calculation of totalcosts for each loan:d. Busch may desire to have an audit because of the many otherbenefits that an audit provides. The audit will provide Busch’smanagement with assurance about annual financial information usedfor decision-making purposes. The audit may detect errors or fraud, andprovide management with information about the effectiveness ofcontrols. In addition, the audit may result in recommendations tomanagement that will improve efficiency or effectiveness.e. The auditor must have a thorough understanding of the client and itsenvironment, including the client’s e-commerce technologies, industry,regulatory and operating environment, suppliers, customers, creditors,and business strategies and processes. This thorough analysis helpsthe auditor identify risks associated with the client’s strategies thatmay affect whether the financial statements are fairly stated. Thisstrategic knowledge of the client’s business often helps the auditoridentify ways to help the client improve business operations, therebyproviding added value to the audit function.1-18 a. The services provided by Consumers Union are very similar to assurance services provided by CPA firms. The services providedby Consumers Union and assurance services provided by CPAfirms are designed to improve the quality of information for decisionmakers. CPAs are valued for their independence, and the reportsprovided by Consumers Union are valued because ConsumersUnion is independent of the products tested.b. The concepts of information risk for the buyer of an automobile andfor the user of financial statements are essentially the same. They are both concerned with the problem of unreliable information being provided. In the case of the auditor, the user is concerned about unreliable information being provided in the financial statements.The buyer of an automobile is likely to be concerned about the manufacturer or dealer providing unreliable information.c. The four causes of information risk are essentially the same for abuyer of an automobile and a user of financial statements:(1) Remoteness of information It is difficult for a user to obtainmuch information about either an automobile manufactureror the automobile itself without incurring considerable cost.The automobile buyer does have the advantage of possiblyknowing other users who are satisfied or dissatisfied with asimilar automobile.(2) Biases and motives of provider There is a conflict betweenthe automobile buyer and the manufacturer. The buyer wantsto buy a high quality product at minimum cost whereas theseller wants to maximize the selling price and quantity sold.(3)Voluminous data There is a large amount of availableinformation about automobiles that users might like to havein order to evaluate an automobile. Either that information isnot available or too costly to obtain.(4) Complex exchange transactions The acquisition of anautomobile is expensive and certainly a complex decisionbecause of all the components that go into making a goodautomobile and choosing between a large number ofalternatives.d. The three ways users of financial statements and buyers ofautomobiles reduce information risk are also similar:(1) User verifies information him or herself That can be obtainedby driving different automobiles, examining the specifications ofthe automobiles, talking to other users and doing research invarious magazines.(2) User shares information risk with management Themanufacturer of a product has a responsibility to meet itswarranties and to provide a reasonable product. The buyerof an automobile can return the automobile for correction ofdefects. In some cases a refund may be obtained.(3) Examine the information prepared by Consumer ReportsThis is similar to an audit in the sense that independentinformation is provided by an independent party. Theinformation provided by Consumer Reports is comparable tothat provided by a CPA firm that audited financial statements.1-19 a. The following parts of the definition of auditing are related to the narrative:(1) Altman is being asked to issue a report about qualitative andquantitative information for trucks. The trucks are thereforethe information with which the auditor is concerned.(2) There are four established criteria which must be evaluatedand reported by Altman: existence of the trucks on the nightof June 30, 2011, ownership of each truck by RegionalDelivery Service, physical condition of each truck and fairmarket value of each truck.(3) Samantha Altman will accumulate and evaluate four types ofevidence:(a) Count the trucks to determine their existence.(b) Use registrations documents held by Burrow forcomparison to the serial number on each truck todetermine ownership.(c) Examine the trucks to determine each truck's physicalcondition.(d) Examine the blue book to determine the fair marketvalue of each truck.(4) Samantha Altman, CPA, appears qualified, as a competent,independent person. She is a CPA, and she spends most ofher time auditing used automobile and truck dealerships andhas extensive specialized knowledge about used trucksthat is consistent with the nature of the engagement.(5) The report results are to include:(a) which of the 25 trucks are parked in Regional'sparking lot the night of June 30.(b) whether all of the trucks are owned by RegionalDelivery Service.(c) the condition of each truck, using establishedguidelines.(d) fair market value of each truck using the current bluebook for trucks.b. The only parts of the audit that will be difficult for Altman are:(1) Evaluating the condition, using the guidelines of poor, good,and excellent. It is highly subjective to do so. If she uses adifferent criterion than the "blue book," the fair market valuewill not be meaningful. Her experience will be essential inusing this guideline.(2) Determining the fair market value, unless it is clearly definedin the blue book for each condition.1-20 a. The major advantages and disadvantages of a career as an IRS agent, CPA, GAO auditor, or an internal auditor are:(b) Other auditing careers that are available are:Auditors within many of the branches of the federal government(e.g., Atomic Energy Commission)Auditors for many state and local government units (e.g., state insurance or bank auditors)1-21 The most likely type of auditor and the type of audit for each of the examples are:1-22 a. Financial statement audits reduce information risk, which lowers borrowing costs. An audit also provides assurances to managementabout information used for decision-making purposes, and may alsoprovide recommendations to improve efficiency or effectiveness ofoperations.b. Hogan and Czarnecki likely provide tax services, accountingservices, and management advisory services. They may also provideadditional assurance and attestation services other than audits offinancial statements.c. Student answers will vary. They may identify new types of informationthat require assurance, such as environmental or corporateresponsibility reporting. Students may also identify opportunitiesfor consulting or management advisory services, such as assistancewith the adoption of international financial reporting standards.Internet Problem Solution: CPA RequirementsInternet Problem 1-1a. Answers will vary by state. Most states require 150 hours ofeducation, with specific requirements for number of accounting hoursand credit hours in other subject areas.b. Most states have frequently addressed questions. Many of theseaddress education requirements, as well as information on how toprepare for the exam, as well as information on applying for licensure.Internet Problem 1-1 (continued)c. The Elijah Watt Sells award program was established in 1923by the American Institute of Certified Public Accountants(AICPA) to recognize outstanding performance on the UniformCPA Examination. The Sells award is presented annually to tencandidates with the highest cumulative scores who completedtesting during the previous calendar year and passed all foursections of the Uniform CPA Examination on their first attempt.d. Passing information is available on the CPA Examination portion ofthe AICPA web site. Recent passing rates have been approximately45% for each section.(Note: Internet problems address current issues using Internet sources. Because Internet sites are subject to change, Internet problems and solutions may change. Current information on Internet problems is available at /arens.)。

工程项目全过程跟踪审计资质要求1.审计机构应具备法定资质和相关许可证件。

The auditing agency shall have the statutory qualifications and relevant licenses.2.审计机构应有专业的项目审计相关资质和经验。

The auditing agency shall have professional qualifications and experience in project auditing.3.审计人员应具备国家规定的相关资格证书。

The auditors shall possess the relevant qualifications and certificates stipulated by the state.4.审计机构应具备良好的信誉和业绩。

The auditing agency shall have good reputation and performance.5.审计机构应有独立性和公正性。

The auditing agency shall have independence and impartiality.6.审计机构应具备有效的质量管理体系。

The auditing agency shall have an effective quality management system.7.审计人员应具备良好的职业道德和敬业精神。

The auditors shall possess good professional ethics and dedication.8.审计机构应具备相关行业的专业知识和经验。

The auditing agency shall have professional knowledge and experience in relevant industries.9.审计机构应有能力完成所委托的审计任务。

Chapter 1The Goals and Functions of Financial ManagementDiscussion Questions1-1. How did the recession of 2007–2009 compare with other recessions since the Great Depression in terms of length?It was the longest.1-2. What effect did the recession of 2007–2009 have on government regulation?It was greatly increased.1-3. What advantages does a sole proprietorship offer? What is a major drawback of this type of organization?A sole proprietorship offers the advantage of simplicity of decision making andlow organizational and operating costs. A major drawback is that there isunlimited liability to the owner.1-4. What form of partnership allows some of the investors to limit their liability?Explain briefly.A limited partnership allows some of the partners to limit their liability. Underthis arrangement, one or more partners are designated general partners and haveunlimited liability for the debts of the firm; other partners are designated limitedpartners and are liable only for their initial contribution. The limited partners arenormally prohibited from being active in the management of the firm.1-5. In a corporation, what group has the ultimate responsibility for protecting and managing the stockholders' interests?The board of directors.1-6. What document is necessary to form a corporation?The articles of incorporation.1-7. What issue does agency theory examine? Why is it important in a public corporation rather than in a private corporation?Agency theory examines the relationship between the owners of the firm and themanagers of the firm. In privately owned firms, management and the owners areusually the same people. Management operates the firm to satisfy its own goals,needs, financial requirements and the like. As a company moves from private topublic ownership, management now represents all owners. This placesmanagement in the agency position of making decisions in the best interest of allshareholders.1-8. Why are institutional investors important in today's business world?Because institutional investors such as pension funds and mutual funds own alarge percentage of major U.S. companies, they are having more to say about theway publicly owned companies are managed. As a group, they have the ability tovote large blocks of shares for the election of a board of directors, which issupposed to run the company in an efficient, competitive manner. The threat ofbeing able to replace poor performing boards of directors makes institutionalinvestors quite influential. Since these institutions, like pension funds and mutualfunds, represent individual workers and investors, they have a responsibility to seethat the firm is managed in an efficient and ethical way.1-9. Why is profit maximization, by itself, an inappropriate goal? What is meant by the goal of maximization of shareholder wealth?The problem with a profit maximization goal is that it fails to take account of risk,the timing of the benefits is not considered, and profit measurement is a veryinexact process. The goal of shareholders’ wealth maximization implies that thefirm will attempt to achieve the highest possible total valuation in themarketplace. It is the one overriding objective of the firm and should influenceevery decision.1-10. When does insider trading occur? What government agency is responsible for protecting against the unethical practice of insider trading?Insider trading occurs when anyone with non-public information buys or sellssecurities to take advantage of that private information. The Securities andExchange Commission is responsible for protecting markets against insidertrading. In the past, people have gone to jail for trading on non-publicinformation. This has included company officers, investment bankers, printerswho have information before it is published, and even truck drivers who deliverbusiness magazines and read positive or negative articles about a company beforethe magazine is on the newsstands and then place trades or have friends placetrades based on that information. The SEC has prosecuted anyone who profitsfrom inside information.1-11. In terms of the life of the securities offered, what is the difference between money and capital markets?Money markets refer to those markets dealing with short-term securities that havea life of one year or less. Capital markets refer to securities with a life of morethan one year.1-12. What is the difference between a primary and a secondary market?A primary market refers to the use of the financial markets to raise new funds forthe corporation. After the securities are sold to the public (institutions andindividuals), they trade in the secondary market between investors. It is in thesecondary market that prices are continually changing as investors buy and sellsecurities based on the expectations of corporate prospects.1-13. Assume you are looking at many companies with equal risk. Which ones will have the highest stock prices?Given companies with equal risk, those companies with expectations of highreturn will have higher common stock prices relative to those companies withexpectations of poor returns.1-14. What changes can take place under restructuring? In recent times, what group of investors has often forced restructuring to take place?Restructuring can result in changes in the capital structure (liabilities and equityon the balance sheet). It can also result in the selling of low-profit-margindivisions with the proceeds reinvested in better investment opportunities, andsometimes restructuring results in the removal of the current management team orlarge reductions in the workforce. Restructuring has also included mergers andacquisitions.Institutional investors have been very influential in forcing restructuring to takeplace in recent years.1-15. How did the Sarbanes–Oxley Act impact corporations’ financial reports?The Sarbanes–Oxley Act of 2002 set up a five-member Public CompanyAccounting Oversight Board with the responsibility for establishing auditingstandards within companies, controlling the quality of audits, and setting rulesand standards for the independence of the auditors. It also puts greatresponsibility on the internal audit committee of each publicly traded company toenforce compliance with the act. The major focus of the act is to make sure thatpublicly traded corporations accurately present their assets, liabilities, and equityand income on their financial statements.1-16. Name the departments, offices, or agencies that were created by the Dodd–Frank legislation.1) The act created the Financial Stability Oversight Council within theTreasury Department.2) The act created the Office of Financial Research within the TreasuryDepartment.3) Dodd–Frank established the Federal Insurance Office within the TreasuryDepartment to oversee the insurance industry and streamline state-basedinsurance regulation.4) The act created the Bureau of Consumer Financial Protection. Theoversight given to the Bureau of Consumer Financial Protection allows itto dictate the fees that banks charge and the types of products they offer.。