Corporate Finance - Berk DeMarzo- Test Bank Chapter 21

- 格式:doc

- 大小:1.30 MB

- 文档页数:20

Our conversations with corporate treasurers suggest to us that the use of book values is popular because of the volatility of the stock market. It is frequently claimed that the inherent volatility of the stock market makes market-based debt ratios move around too much. It is also true that restrictions of debt in bond covenants are usually expressed in book values rather than market values. Moreover, firms such as Standard & Poor’s and Moody’s use debt ratios expressed in book values to measure creditworthiness.A key fact is that whether we use book or market values, debt ratios for U.S. non-financial firms generally have been well below 100 percent of total equity in recent years; that is, firms generally use less debt than equity.Summary and ConclusionsThe basic sources of long-term financing are long-term debt, preferred stock, and common stock. This chapter described the essential features of each.1. We emphasized that common shareholders have:1. Residual risk and return in a corporation.2. Voting rights.3. Limited liability if the corporation elects to default on its debt and must transfer some orall of its assets to the creditors.2. Long-term debt involves contractual obligations set out in indentures. There are many kinds ofdebt, but the essential feature is that debt involves a stated amount that must be repaid. Interest payments on debt are considered a business expense and are tax deductible.3. Preferred stock has some of the features of debt and some of the features of common equity.Holders of preferred stock have preference in liquidation and in dividend payments compared to holders of common equity.4. Firms need financing for capital expenditures, working capital, and other long-term uses. Mostof the financing is provided from internally generated cash flow. In the United States only about 25 percent of financing comes from new debt and new equity. Only firms in Japan have historically relied more on external financing than on internal financing.5. In the 1980s and recently, U.S. firms retired massive amounts of equity. These share buybackshave been financed with new debt.Concept Questions1. Bond Features What are the main features of a corporate bond that would be listed in theindenture?2. Preferred Stock and Debt What are the differences between preferred stock and debt?3. Preferred Stock Preferred stock doesn’t offer a corporate tax shield on the dividends paid.Why do we still observe some firms issuing preferred stock?4. Preferred Stock and Bond Yields The yields on nonconvertible preferred stock are lowerthan the yields on corporate bonds. Why is there a difference? Which investors are the primary holders of preferred stock? Why?5. Corporate Financing What are the main differences between corporate debt and equity? Whydo some firms try to issue equity in the guise of debt?6. Call Provisions A company is contemplating a long-term bond issue. It is debating whether toinclude a call provision. What are the benefits to the company from including a call provision? What are the costs? How do these answers change for a put provision?7. Proxy What is a proxy?8. Preferred Stock Do you think preferred stock is more like debt or equity? Why?9. Long-Term Financing As was mentioned in the chapter, new equity issues are generally onlya small portion of all new issues. At the same time, companies continue to issue new debt. Why docompanies tend to issue little new equity but continue to issue new debt?10. Internal versus External Financing What is the difference between internal financing andexternal financing?11. Internal versus External Financing What factors influence a firm’s choice of external versusinternal equity financing?12. Classes of Stock Several publicly traded companies have issued more than one class of stock.Why might a company issue more than one class of stock?13. Callable Bonds Do you agree or disagree with the following statement: In an efficient market,callable and noncallable bonds will be priced in such a way that there will be no advantage or disadvantage to the call provision. Why?14. Bond Prices If interest rates fall, will the price of noncallable bonds move up higher than thatof callable bonds? Why or why not?15. Sinking Funds Sinking funds have both positive and negative characteristics for bondholders.Why?Questions and Problems connect™BASIC (Questions 1–7)1. Corporate Voting The shareholders of the Unicorn Company need to elect seven newdirectors. There are 600,000 shares outstanding currently trading at $39 per share. You would like to serve on the board of directors; unfortunately no one else will be voting for you. How much will it cost you to be certain that you can be elected if the company uses straight voting? How much will it cost you if the company uses cumulative voting?2. Cumulative Voting An election is being held to fill three seats on the board of directors of afirm in which you hold stock. The company has 5,800 shares outstanding. If the election is conducted under cumulative voting and you own 300 shares, how many more shares must you buy to be assured of earning a seat on the board?3. Cumulative Voting The shareholders of Motive Power Corp. need to elect three new directorsto the board. There are 1,200,000 shares of common stock outstanding, and the current share price is $9. If the company uses cumulative voting procedures, how much will it cost to guarantee yourself one seat on the board of directors?4. Corporate Voting Power Inc. is going to elect six board members next month. Betty Brownowns 15.2 percent of the total shares outstanding. How confident can she be of having one of her candidate friends elected under the cumulative voting rule? Will her friend be elected for certain if the voting procedure is changed to the staggering rule, under which shareholders vote on three board members at a time?5. Zero Coupon Bonds You buy a zero coupon bond at the beginning of the year that has a facevalue of $1,000, a YTM of 7 percent, and 25 years to maturity. If you hold the bond for the entire year, how much in interest income will you have to declare on your tax return?6. Valuing Callable Bonds KIC, Inc., plans to issue $5 million of bonds with a coupon rate of 12percent and 30 years to maturity. The current market interest rates on these bonds are 11 percent.In one year, the interest rate on the bonds will be either 14 percent or 7 percent with equal probability. Assume investors are risk-neutral.1. If the bonds are noncallable, what is the price of the bonds today?2. If the bonds are callable one year from today at $1,450, will their price be greater or lessthan the price you computed in (a)? Why?7. Valuing Callable Bonds New Business Ventures, Inc., has an outstanding perpetual bond witha 10 percent coupon rate that can be called in one year. The bond makes annual couponpayments. The call premium is set at $150 over par value. There is a 40 percent chance that the interest rate in one year will be 12 percent, and a 60 percent chance that the interest rate will be 7 percent. If the current interest rate is 10 percent, what is the current market price of the bond?INTERMEDIATE (Questions 8-13)8. Valuing Callable Bonds Bowdeen Manufacturing intends to issue callable, perpetual bondswith annual coupon payments. The bonds are callable at $1,250. One-year interest rates are 11 percent. There is a 60 percent probability that long-term interest rates one year from today will be13 percent, and a 40 percent probability that they will be 9 percent. Assume that if interest ratesfall the bonds will be called. What coupon rate should the bonds have in order to sell at par value?9. Valuing Callable Bonds Illinois Industries has decided to borrow money by issuing perpetualbonds with a coupon rate of 8 percent, payable annually. The one-year interest rate is 8 percent.Next year, there is a 35 percent probability that interest rates will increase to 9 percent, and there is a 65 percent probability that they will fall to 6 percent.1. What will the market value of these bonds be if they are noncallable?2. If the company decides instead to make the bonds callable in one year, what coupon willbe demanded by the bondholders for the bonds to sell at par? Assume that the bonds will be called if interest rates rise and that the call premium is equal to the annual coupon.3. What will be the value of the call provision to the company?10. Bond Refunding An outstanding issue of Public Express Airlines debentures has a callprovision attached. The total principal value of the bonds is $250 million, and the bonds have an annual coupon rate of 8 percent. The company is considering refunding the bond issue. Refunding means that the company would issue new bonds and use the proceeds from the new bond issuance to repurchase the outstanding bonds. The total cost of refunding would be 12 percent of the principal amount raised. The appropriate tax rate for the company is 35 percent. How low does the borrowing cost need to drop to justify refunding with a new bond issue?11. Bond Refunding Charles River Associates is considering whether to call either of the twoperpetual bond issues the company currently has outstanding. If the bond is called, it will be refunded, that is, a new bond issue will be made with a lower coupon rate. The proceeds from the new bond issue will be used to repurchase one of the existing bond issues. The information about the two currently outstanding bond issues is:The corporate tax rate is 35 percent. What is the NPV of the refunding for each bond? Which, if either, bond should the company refinance?12. Interest on Zeroes Tesla Corporation needs to raise funds to finance a plant expansion, andit has decided to issue 25-year zero coupon bonds to raise the money. The required return on the bonds will be 9 percent.1. What will these bonds sell for at issuance?2. Using the IRS amortization rule, what interest deduction can the company take on thesebonds in the first year? In the last year?3. Repeat part (b) using the straight-line method for the interest deduction.4. Based on your answers in (b) and (c), which interest deduction method would TeslaCorporation prefer? Why?13. Zero Coupon Bonds Suppose your company needs to raise $30 million and you want to issue30-year bonds for this purpose. Assume the required return on your bond issue will be 8 percent, and you’re evaluating two issue alternatives: An 8 percent semiannual coupon bond and a zero coupon bond. Your company’s tax rate is 35 percent.1. How many of the coupon bonds would you need to issue to raise the $30 million?How many of the zeroes would you need to issue?2. In 30 years, what will your company’s repayment be if you issue the coupon bonds? Whatif you issue the zeroes?CHALLENGE (Questions 14-15)14. Valuing the Call Feature Consider the prices of the following three Treasury issues as ofFebruary 24, 2009:The bond in the middle is callable in February 2010. What is the implied value of the call feature? (Hint: Is there a way to combine the two noncallable issues to create an issue that has the same coupon as the callable bond?)15. Treasury Bonds The following Treasury bond quote appeared in The Wall Street Journal onMay 11, 2004.Why would anyone buy this Treasury bond with a negative yield to maturity? How is this possible?。

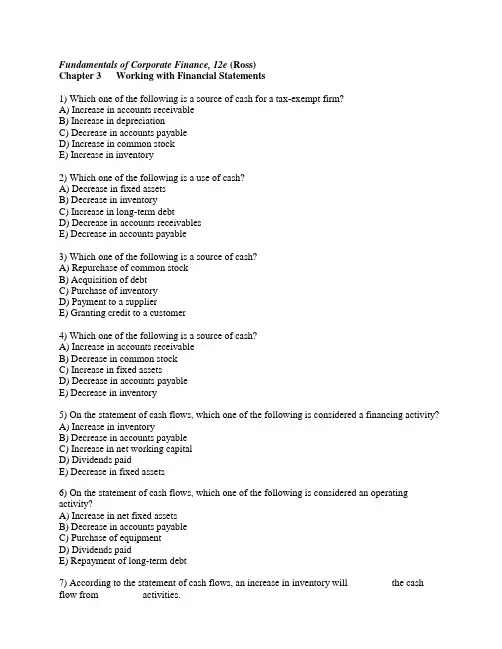

Fundamentals of Corporate Finance, 12e (Ross)Chapter 3 Working with Financial Statements1) Which one of the following is a source of cash for a tax-exempt firm?A) Increase in accounts receivableB) Increase in depreciationC) Decrease in accounts payableD) Increase in common stockE) Increase in inventory2) Which one of the following is a use of cash?A) Decrease in fixed assetsB) Decrease in inventoryC) Increase in long-term debtD) Decrease in accounts receivablesE) Decrease in accounts payable3) Which one of the following is a source of cash?A) Repurchase of common stockB) Acquisition of debtC) Purchase of inventoryD) Payment to a supplierE) Granting credit to a customer4) Which one of the following is a source of cash?A) Increase in accounts receivableB) Decrease in common stockC) Increase in fixed assetsD) Decrease in accounts payableE) Decrease in inventory5) On the statement of cash flows, which one of the following is considered a financing activity?A) Increase in inventoryB) Decrease in accounts payableC) Increase in net working capitalD) Dividends paidE) Decrease in fixed assets6) On the statement of cash flows, which one of the following is considered an operating activity?A) Increase in net fixed assetsB) Decrease in accounts payableC) Purchase of equipmentD) Dividends paidE) Repayment of long-term debt7) According to the statement of cash flows, an increase in inventory will ________ the cash flow from ________ activities.A) increase; operatingB) decrease; financingC) decrease; operatingD) increase; financingE) increase; investment8) According to the statement of cash flows, an increase in interest expense will ________ the cash flow from ________ activities.A) decrease; operatingB) decrease; financingC) increase; operatingD) increase; financingE) Increase; investment9) Activities of a firm that require the spending of cash are known as:A) sources of cash.B) uses of cash.C) cash collections.D) cash receipts.E) cash on hand.10) The sources and uses of cash over a stated period of time are reflected on the:A) income statement.B) balance sheet.C) tax reconciliation statement.D) statement of cash flows.E) statement of operating position.11) A common-size income statement is an accounting statement that expresses all of a firm's expenses as a percentage of:A) total assets.B) total equity.C) net income.D) taxable income.E) sales.12) Which one of the following standardizes items on the income statement and balance sheet relative to their values as of a chosen point in time?A) Statement of standardizationB) Statement of cash flowsC) Common-base year statementD) Common-size statementE) Base reconciliation statement13) On a common-size balance sheet all accounts for the current year are expressed as a percentage of:A) sales for the period.B) the base year sales.C) total equity for the base year.D) total assets for the current year.E) total assets for the base year.14) On a common-base year financial statement, accounts receivables for the current year will be expressed relative to which one of the following?A) Current year salesB) Current year total assetsC) Base-year salesD) Base-year total assetsE) Base-year accounts receivables15) Which one of the following ratios is a measure of a firm's liquidity?A) Cash coverage ratioB) Profit marginC) Debt-equity ratioD) Quick ratioE) NWC turnover16) An increase in current liabilities will have which one of the following effects, all else held constant? Assume all ratios have positive values.A) Increase in the cash ratioB) Increase in the net working capital to total assets ratioC) Decrease in the quick ratioD) Decrease in the cash coverage ratioE) Increase in the current ratio17) An increase in which one of the following will increase a firm's quick ratio without affecting its cash ratio?A) Accounts payableB) CashC) InventoryD) Accounts receivableE) Fixed assets18) A supplier, who requires payment within 10 days, should be most concerned with which one of the following ratios when granting credit?A) CurrentB) CashC) Debt-equityD) QuickE) Total debt19) A firm has an interval measure of 48. This means that the firm has sufficient liquid assets to do which one of the following?A) Pay all of its debts that are due within the next 48 hoursB) Pay all of its debts that are due within the next 48 daysC) Cover its operating costs for the next 48 hoursD) Cover its operating costs for the next 48 daysE) Meet the demands of its customers for the next 48 hours20) Ratios that measure a firm's liquidity are known as ________ ratios.A) asset managementB) long-term solvencyC) short-term solvencyD) profitabilityE) book value21) Which one of the following statements is correct?A) If the total debt ratio is greater than .50, then the debt-equity ratio must be less than 1.0.B) Long-term creditors would prefer the times interest earned ratio be 1.4 rather than 1.5.C) The debt-equity ratio can be computed as 1 plus the equity multiplier.D) An equity multiplier of 1.2 means a firm has $1.20 in sales for every $1 in equity.E) An increase in the depreciation expense will not affect the cash coverage ratio.22) If a firm has a debt-equity ratio of 1.0, then its total debt ratio must be which one of the following?A) 0B) .5C) 1.0D) 1.5E) 2.023) The cash coverage ratio directly measures the ability of a company to meet its obligation to pay:A) an invoice to a supplier.B) wages to an employee.C) interest to a lender.D) principal to a lender.E) a dividend to a shareholder.24) All-State Moving had sales of $899,000 in 2017 and $967,000 in 2018. The firm's current accounts remained constant. Given this information, which one of the following statements must be true?A) The total asset turnover rate increased.B) The days' sales in receivables increased.C) The net working capital turnover rate increased.D) The fixed asset turnover decreased.E) The receivables turnover rate decreased.25) The Corner Hardware has succeeded in increasing the amount of goods it sells while holding the amount of inventory on hand at a constant level. Assume that both the cost per unit and the selling price per unit also remained constant. This accomplishment will be reflected in the firm's financial ratios in which one of the following ways?A) Decrease in the inventory turnover rateB) Decrease in the net working capital turnover rateC) Increase in the fixed asset turnover rateD) Decrease in the day's sales in inventoryE) Decrease in the total asset turnover rate26) RJ's has a fixed asset turnover rate of 1.26 and a total asset turnover rate of .97. Sam's has a fixed asset turnover rate of 1.31 and a total asset turnover rate of .94. Both companies have similar operations. Based on this information, RJ's must be doing which one of the following?A) Utilizing its fixed assets more efficiently than Sam'sB) Utilizing its total assets more efficiently than Sam'sC) Generating $1 in sales for every $1.26 in net fixed assetsD) Generating $1.26 in net income for every $1 in net fixed assetsE) Maintaining the same level of current assets as Sam's27) Ratios that measure how efficiently a firm manages its assets and operations to generate net income are referred to as ________ ratios.A) asset managementB) long-term solvencyC) short-term solvencyD) profitabilityE) turnover28) If a company produces a return on assets of 14 percent and also a return on equity of 14 percent, then the firm:A) may have short-term, but not long-term debt.B) is using its assets as efficiently as possible.C) has no net working capital.D) has a debt-equity ratio of 1.0.E) has an equity multiplier of 1.0.29) Which one of the following will decrease if a firm can decrease its operating costs, all else constant?A) Return on equityB) Return on assetsC) Profit marginD) Total asset turnoverE) Price-earnings ratio30) Al's has a price-earnings ratio of 18.5. Ben's also has a price-earnings ratio of 18.5. Which one of the following statements must be true if Al's has a higher PEG ratio than Ben's?A) Al's has more net income than Ben's.B) Ben's is increasing its earnings at a faster rate than Al's.C) Al's has a higher market value per share than does Ben's.D) Ben's has a lower market-to-book ratio than Al's.E) Al's has a higher earnings growth rate than Ben's.31) Tobin's Q relates the market value of a firm's assets to which one of the following?A) Initial cost of creating the firmB) Current book value of the firmC) Average asset value of similar firmsD) Average market value of similar firmsE) Today's cost to duplicate those assets32) The price-sales ratio is especially useful when analyzing firms that have:A) volatile market prices.B) negative earnings.C) positive PEG ratios.D) a high Tobin's Q.E) increasing sales.33) Mortgage lenders probably have the most interest in the ________ ratios.A) return on assets and profit marginB) long-term debt and times interest earnedC) price-earnings and debt-equityD) market-to-book and times interest earnedE) return on equity and price-earnings34) Relationships determined from a company's financial information and used for comparison purposes are known as:A) financial ratios.B) identities.C) dimensional analysis.D) scenario analysis.E) solvency analysis.35) DL Farms currently has $600 in debt for every $1,000 in equity. Assume the company uses some of its cash to decrease its debt while maintaining its current equity and net income. Which one of the following will decrease as a result of this action?A) Equity multiplierB) Total asset turnoverC) Profit marginD) Return on assetsE) Return on equity36) Which one of these identifies the relationship between the return on assets and the return on equity?A) Profit marginB) Profitability determinantC) Balance sheet multiplierD) DuPont identityE) Debt-equity ratio37) Which one of the following accurately describes the three parts of the DuPont identity?A) Equity multiplier, profit margin, and total asset turnoverB) Debt-equity ratio, capital intensity ratio, and profit marginC) Operating efficiency, equity multiplier, and profitability ratioD) Return on assets, profit margin, and equity multiplierE) Financial leverage, operating efficiency, and profitability ratio38) An increase in which of the following must increase the return on equity, all else constant?A) Total assets and salesB) Net income and total equityC) Total asset turnover and debt-equity ratioD) Equity multiplier and total equityE) Debt-equity ratio and total debt39) Which one of the following is a correct formula for computing the return on equity?A) Profit margin × ROAB) ROA × Equity multiplierC) Profit margin × Total asset turnover × Debt-equity ratioD) Net income/Total assetsE) Debt-equity ratio × ROA40) The DuPont identity can be used to help managers answer which of the following questions related to a company's operations?I. How many sales dollars are being generated per each dollar of assets?II. How many dollars of assets have been acquired per each dollar in shareholders' equity? III. How much net profit is being generating per dollar of sales?IV. Does the company have the ability to meet its debt obligations in a timely manner?A) I and III onlyB) II and IV onlyC) I, II, and III onlyD) II, III and IV onlyE) I, II, III, and IV41) The U.S. government coding system that classifies a company by the nature of its business operations is known as the:A) Centralized Business Index.B) Peer Grouping codes.C) Standard Industrial Classification codes.D) Governmental ID codes.E) Government Engineered Coding System.42) Which one of the following statements is correct?A) Book values should always be given precedence over market values.B) Financial statements are rarely used as the basis for performance evaluations.C) Historical information is useful when projecting a company's future performance.D) Potential lenders place little value on financial statement information.E) Reviewing financial information over time has very limited value.43) The most acceptable method of evaluating the financial statements is to compare the company's current financial:A) ratios to the company's historical ratios.B) statements to the financial statements of similar companies operating in other countries.C) ratios to the average ratios of all companies located within the same geographic area.D) statements to those of larger companies in unrelated industries.E) statements to the projections that were created based on Tobin's Q.44) All of the following issues represent problems encountered when comparing the financial statements of two separate entities except the issue of the companies:A) being conglomerates with unrelated lines of business.B) having geographically varying operations.C) using differing accounting methods.D) differing seasonal peaks.E) having the same fiscal year.45) Which one of these is the least important factor to consider when comparing the financial situations of utility companies that generate electric power and have the same SIC code?A) Type of ownershipB) Government regulations affecting the firmC) Fiscal year endD) Methods of power generationE) Number of part-time employees46) At the beginning of the year, Brick Makers had cash of $183, accounts receivable of $392, accounts payable of $463, and inventory of $714. At year end, cash was $167, accounts payables was $447, inventory was $682, and accounts receivable was $409. What is the amount of the net source or use of cash by working capital accounts for the year?A) Net use of $16 cashB) Net use of $17 cashC) Net source of $17 cashD) Net source of $15 cashE) Net use of $15 cash47) During the year, Al's Tools decreased its accounts receivable by $160, increased its inventory by $115, and decreased its accounts payable by $70. How did these three accounts affect the sources of uses of cash by the firm?A) Net source of cash of $120B) Net source of cash of $205C) Net source of cash of $45D) Net use of cash of $115E) Net use of cash of $2548) Lani's generated net income of $911, depreciation expense was $47, and dividends paid were $25. Accounts payables increased by $15, accounts receivables increased by $28, inventory decreased by $14, and net fixed assets decreased by $8. There was no interest expense. What was the net cash flow from operating activity?A) $776B) $865C) $959D) $922E) $98549) For the past year, Jenn's Floral Arrangements had taxable income of $198,600, beginning common stock of $68,000, beginning retained earnings of $318,750, ending common stock of $71,500, ending retained earnings of $316,940, interest expense of $11,300, and a tax rate of 21 percent. What is the amount of dividends paid during the year?A) $157,280B) $159,935C) $163,200D) $153,555E) $158,70450) The Floor Store had interest expense of $38,400, depreciation of $28,100, and taxes of $19,600 for the year. At the start of the year, the firm had total assets of $879,400 and current assets of $289,600. By year's end total assets had increased to $911,900 while current assets decreased to $279,300. What is the amount of the cash flow from investment activity for the year?A) −$51,150B) $21,850C) $29,300D) −$70,900E) −$89,40051) Williamsburg Market is an all-equity firm that has net income of $96,200, depreciation expense of $6,300, and an increase in net working capital of $2,800. What is the amount of the net cash from operating activity?A) $91,300B) $99,700C) $93,400D) $105,300E) $113,70052) The accounts payable of a company changed from $136,100 to $104,300 over the course of a year. This change represents a:A) use of $31,800 of cash as investment activity.B) source of $31,800 of cash as an operating activity.C) source of $31,800 of cash as a financing activity.D) source of $31,800 of cash as an investment activity.E) use of $31,800 of cash as an operating activity.53) Oil Creek Auto has sales of $3,340, net income of $274, net fixed assets of $2,600, and current assets of $920. The firm has $430 in inventory. What is the common-size statement value of inventory?A) 12.22 percentB) 44.16 percentC) 16.54 percentD) 13.36 percentE) 46.74 percent54) Pittsburgh Motors has sales of $4,300, net income of $320, total assets of $4,800, and total equity of $2,950. Interest expense is $65. What is the common-size statement value of the interest expense?A) .89 percentB) 1.51 percentC) 1.69 percentD) 2.03 percentE) 1.35 percent55) Last year, which is used as the base year, a firm had cash of $52, accounts receivable of $223, inventory of $509, and net fixed assets of $1,107. This year, the firm has cash of $61,accounts receivable of $204, inventory of $527, and net fixed assets of $1,216. What is this year's common-base-year value of inventory?A) .67B) .91C) .88D) 1.04E) 1.1856) Duke's Garage has cash of $68, accounts receivable of $142, accounts payable of $235, and inventory of $318. What is the value of the quick ratio?A) 2.25B) .53C) .71D) .89E) 1.3557) Uptown Men's Wear has accounts payable of $2,214, inventory of $7,950, cash of $1,263, fixed assets of $8,400, accounts receivable of $3,907, and long-term debt of $4,200. What is the value of the net working capital to total assets ratio?A) .31B) .42C) .47D) .51E) .5658) DJ's has total assets of $310,100 and net fixed assets of $168,500. The average daily operating costs are $2,980. What is the value of the interval measure?A) 31.47 daysB) 47.52 daysC) 56.22 daysD) 68.05 daysE) 104.62 days59) Corner Books has a debt-equity ratio of .57. What is the total debt ratio?A) .36B) .30C) .44D) 2.27E) 2.7560) SS Stores has total debt of $4,910 and a debt-equity ratio of 0.52. What is the value of the total assets?A) $16,128.05B) $7,253.40C) $9,571.95D) $11,034.00E) $14,352.3161) JK Motors has sales of $96,400, costs of $53,800, interest paid of $2,800, and depreciation of $7,100. The tax rate is 21 percent. What is the value of the cash coverage ratio?A) 15.21B) 12.14C) 17.27D) 23.41E) 12.6862) Terry's Pets paid $2,380 in interest and $2,200 in dividends last year. The times interest earned ratio is 2.6 and the depreciation expense is $680. What is the value of the cash coverage ratio?A) 1.42B) 2.72C) 2.94D) 2.89E) 2.4663) The Up-Towner has sales of $913,400, costs of goods sold of $579,300, inventory of $123,900, and accounts receivable of $78,900. How many days, on average, does it take the firm to sell its inventory assuming that all sales are on credit?A) 74.19 daysB) 84.69 daysC) 78.07 daysD) 96.46 daysE) 71.01 days64) Flo's Flowers has accounts receivable of $4,511, inventory of $1,810, sales of $138,609, and cost of goods sold of $64,003. How many days does it take the firm to sell its inventory and collect the payment on the sale assuming that all sales are on credit?A) 11.88 daysB) 22.20 daysC) 16.23 daysD) 14.50 daysE) 18.67 days65) The Harrisburg Store has net working capital of $2,715, net fixed assets of $22,407, sales of $31,350, and current liabilities of $3,908. How many dollars' worth of sales are generated from every $1 in total assets?A) $1.08B) $1.14C) $1.19D) $84E) $9366) TJ's has annual sales of $813,200, total debt of $171,000, total equity of $396,000, and a profit margin of 5.78 percent. What is the return on assets?A) 8.29 percentB) 6.48 percentC) 9.94 percentD) 7.78 percentE) 8.02 percent67) Frank's Used Cars has sales of $807,200, total assets of $768,100, and a profit margin of 6.68 percent. The firm has a total debt ratio of 54 percent. What is the return on equity?A) 13.09 percentB) 12.04 percentC) 11.03 percentD) 8.56 percentE) 15.26 percent68) Bernice's has $823,000 in sales. The profit margin is 4.2 percent and the firm has 7,500 shares of stock outstanding. The market price per share is $16.50. What is the price-earnings ratio?A) 3.58B) 3.98C) 4.32D) 3.51E) 4.2769) Hungry Lunch has net income of $73,402, a price-earnings ratio of 13.7, and earnings per share of $.43. How many shares of stock are outstanding?A) 13,520B) 12,460C) 165,745D) 171,308E) 170,70270) A firm has 160,000 shares of stock outstanding, sales of $1.94 million, net income of $126,400, a price-earnings ratio of 21.3, and a book value per share of $7.92. What is the market-to-book ratio?A) 2.12B) 1.84C) 1.39D) 2.45E) 2.6971) Taylor's Men's Wear has a debt-equity ratio of 48 percent, sales of $829,000, net income of $47,300, and total debt of $206,300. What is the return on equity?A) 19.29 percentB) 11.01 percentC) 15.74 percentD) 18.57 percentE) 14.16 percent72) Nielsen's has inventory of $29,406, accounts receivable of $46,215, net working capital of $4,507, and accounts payable of $48,919. What is the quick ratio?A) 1.55B) .49C) 1.32D) .94E) .9273) The Strong Box has sales of $859,700, cost of goods sold of $648,200, net income of $93,100, and accounts receivable of $102,300. How many days of sales are in receivables?A) 57.60 daysB) 40.32 daysC) 54.53 daysD) 29.41 daysE) 43.43 days74) Corner Books has sales of $687,400, cost of goods sold of $454,200, and a profit margin of 5.5 percent. The balance sheet shows common stock of $324,000 with a par value of $5 a share, and retained earnings of $689,500. What is the price-sales ratio if the market price is $43.20 per share?A) 4.28B) 12.74C) 6.12D) 4.07E) 14.5175) Gem Jewelers has current assets of $687,600, total assets of $1,711,000, net working capital of $223,700, and long-term debt of $450,000. What is the debt-equity ratio?A) .87B) .94C) 1.21D) 1.15E) 1.0676) Russell's has annual sales of $649,200, cost of goods sold of $389,400, interest of $23,650, depreciation of $121,000, and a tax rate of 21 percent. What is the cash coverage ratio for the year?A) 8.43B) 10.99C) 11.64D) 5.87E) 18.2277) Lawn Care, Inc., has sales of $367,400, costs of $183,600, depreciation of $48,600, interest of $39,200, and a tax rate of 25 percent. The firm has total assets of $422,100, long-term debt of $102,000, net fixed assets of $264,500, and net working capital of $22,300. What is the return on equity?A) 24.26 percentB) 15.38 percentC) 38.96 percentD) 29.96 percentE) 17.06 percent78) Frank's Welding has net fixed assets of $36,200, total assets of $51,300, long-term debt of $22,000, and total debt of $29,700. What is the net working capital to total assets ratio?A) 12.18 percentB) 16.82 percentC) 14.42 percentD) 17.79 percentE) 9.90 percent79) The Green Fiddle has current liabilities of $28,000, sales of $156,900, and cost of goods sold of $62,400. The current ratio is 1.22 and the quick ratio is .71. How many days on average does it take to sell the inventory?A) 128.13 daysB) 74.42 daysC) 199.81 daysD) 147.46 daysE) 83.53 days80) Green Yard Care has net income of $62,300, a tax rate of 21 percent, and a profit margin of 6.7 percent. Total assets are $1,100,500 and current assets are $328,200. How many dollars of sales are being generated from every dollar of net fixed assets?A) $2.83B) $1.37C) $.84D) $1.20E) $1.2381) Jensen's Shipping has total assets of $694,800 at year's end. The beginning owners' equity was $362,400. During the year, the company had sales of $711,000, a profit margin of 5.2 percent, a tax rate of 21 percent, and paid $12,500 in dividends. What is the equity multiplier at year-end?A) 1.67B) 1.72C) 1.93D) 1.80E) 1.8682) Western Gear has net income of $12,400, a tax rate of 21 percent, and interest expense of $1,600. What is the times interest earned ratio for the year?A) 9.63B) 7.75C) 10.81D) 14.97E) 10.9783) Big Tree Lumber has earnings per share of $1.36. The firm's earnings have been increasing at an average rate of 2.9 percent annually and are expected to continue doing so. The firm has 21,500 shares of stock outstanding at a price per share of $23.40. What is the firm's PEG ratio?A) 2.27B) 11.21C) 4.85D) 3.94E) 5.9384) Townsend Enterprises has a PEG ratio of 5.3, net income of $49,200, a price-earnings ratio of 17.6, and a profit margin of 7.1 percent. What is the earnings growth rate?A) 2.48 percentB) 1.06 percentC) 3.32 percentD) 5.20 percentE) 10.60 percent85) A firm has total assets with a current book value of $71,600, a current market value of $82,300, and a current replacement cost of $90,400. What is the value of Tobin's Q?A) .85B) .87C) .90D) .94E) .9186) Dixie Supply has total assets with a current book value of $368,900 and a current replacement cost of $486,200. The market value of these assets is $464,800. What is the value of Tobin's Q?A) .79B) .76C) .96D) 1.26E) 1.0587) Dandelion Fields has a Tobin's Q of .96. The replacement cost of the firm's assets is $225,000 and the market value of the firm's debt is $101,000. The firm has 20,000 shares of stock outstanding and a book value per share of $2.09. What is the market-to-book ratio?A) 2.75 timesB) 3.18 timesC) 3.54 timesD) 4.01 timesE) 4.20 times88) The Tech Store has annual sales of $416,000, a price-earnings ratio of 18, and a profit margin of 3.7 percent. There are 12,000 shares of stock outstanding. What is the price-sales ratio?A) .97B) .67C) 1.08D) 1.15E) .8689) Lassiter Industries has annual sales of $328,000 with 8,000 shares of stock outstanding. The firm has a profit margin of 4.5 percent and a price-sales ratio of 1.20. What is the firm's price-earnings ratio?A) 21.9B) 17.4C) 18.6D) 26.7E) 24.390) Drive-Up has sales of $31.4 million, total assets of $27.6 million, and total debt of $14.9 million. The profit margin is 3.7 percent. What is the return on equity?A) 6.85 percentB) 9.15 percentC) 11.08 percentD) 13.31 percentE) 14.21 percent91) Corner Supply has a current accounts receivable balance of $246,000. Credit sales for the year just ended were $2,430,000. How many days on average did it take for credit customers to pay off their accounts during this past year?A) 44.29 daysB) 55.01 daysC) 55.50 daysD) 36.95 daysE) 41.00 days92) BL Industries has ending inventory of $302,800, annual sales of $2.33 million, and annual cost of goods sold of $1.41 million. On average, how long did a unit of inventory sit on the shelf before it was sold?A) 47.43 daysB) 22.18 daysC) 78.38 daysD) 61.78 daysE) 83.13 days93) Billings Inc. has net income of $161,000, a profit margin of 7.6 percent, and an accounts receivable balance of $127,100. Assume that 66 percent of sales are on credit. What is the days' sales in receivables?A) 21.90 daysB) 27.56 daysC) 33.18 daysD) 35.04 daysE) 36.19 days94) Stone Walls has a long-term debt ratio of .6 and a current ratio of 1.2. Current liabilities are $800, sales are $7,800, the profit margin is 6.5 percent, and return on equity is 15.5 percent. What is the amount of the firm's net fixed assets?A) $8,880.15B) $8,017.43C) $7,666.67D) $5,848.15E) $8,977.43。

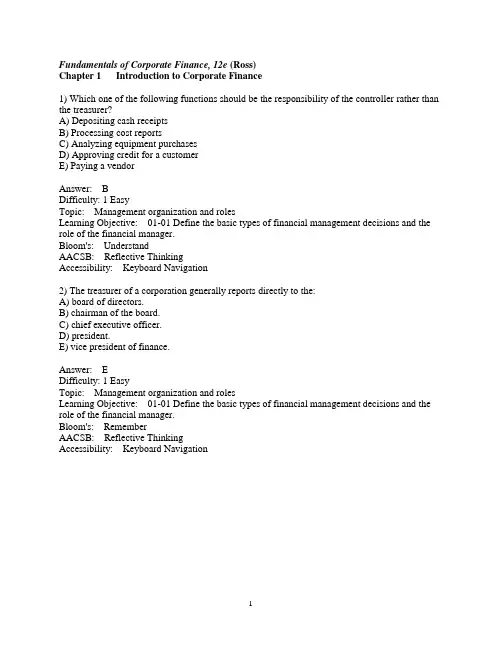

Fundamentals of Corporate Finance, 12e (Ross)Chapter 1 Introduction to Corporate Finance1) Which one of the following functions should be the responsibility of the controller rather than the treasurer?A) Depositing cash receiptsB) Processing cost reportsC) Analyzing equipment purchasesD) Approving credit for a customerE) Paying a vendorAnswer: BDifficulty: 1 EasyTopic: Management organization and rolesLearning Objective: 01-01 Define the basic types of financial management decisions and the role of the financial manager.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation2) The treasurer of a corporation generally reports directly to the:A) board of directors.B) chairman of the board.C) chief executive officer.D) president.E) vice president of finance.Answer: EDifficulty: 1 EasyTopic: Management organization and rolesLearning Objective: 01-01 Define the basic types of financial management decisions and the role of the financial manager.Bloom's: RememberAACSB: Reflective ThinkingAccessibility: Keyboard Navigation3) Which one of the following correctly defines the upward chain of command in a typical corporate organizational structure?A) The vice president of finance reports to the chairman of the board.B) The chief executive officer reports to the president.C) The controller reports to the chief financial officer.D) The treasurer reports to the president.E) The chief operations officer reports to the vice president of production.Answer: CDifficulty: 1 EasyTopic: Management organization and rolesLearning Objective: 01-01 Define the basic types of financial management decisions and the role of the financial manager.Bloom's: RememberAACSB: Reflective ThinkingAccessibility: Keyboard Navigation4) An example of a capital budgeting decision is deciding:A) how many shares of stock to issue.B) whether or not to purchase a new machine for the production line.C) how to refinance a debt issue that is maturing.D) how much inventory to keep on hand.E) how much money should be kept in the checking account.Answer: BDifficulty: 1 EasyTopic: Financial management decisionsLearning Objective: 01-01 Define the basic types of financial management decisions and the role of the financial manager.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation5) When evaluating the timing of a project's projected cash flows, a financial manager is analyzing:A) the amount of each expected cash flow.B) only the start-up costs that are expected to require cash resources.C) only the date of the final cash flow related to the project.D) the amount by which cash receipts are expected to exceed cash outflows.E) when each cash flow is expected to occur.Answer: EDifficulty: 1 EasyTopic: Financial management decisionsLearning Objective: 01-01 Define the basic types of financial management decisions and the role of the financial manager.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation6) Capital structure decisions include determining:A) which one of two projects to accept.B) how to allocate investment funds to multiple projects.C) the amount of funds needed to finance customer purchases of a new product.D) how much debt should be assumed to fund a project.E) how much inventory will be needed to support a project.Answer: DDifficulty: 1 EasyTopic: Financial management decisionsLearning Objective: 01-01 Define the basic types of financial management decisions and the role of the financial manager.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation7) The decision to issue additional shares of stock is an example of:A) working capital management.B) a net working capital decision.C) capital budgeting.D) a controller's duties.E) a capital structure decision.Answer: EDifficulty: 1 EasyTopic: Financial management decisionsLearning Objective: 01-01 Define the basic types of financial management decisions and the role of the financial manager.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation8) Which one of the following questions is a working capital management decision?A) Should the company issue new shares of stock or borrow money?B) Should the company update or replace its older equipment?C) How much inventory should be on hand for immediate sale?D) Should the company close one of its current stores?E) How much should the company borrow to buy a new building?Answer: CDifficulty: 1 EasyTopic: Financial management decisionsLearning Objective: 01-01 Define the basic types of financial management decisions and the role of the financial manager.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation9) Which one of the following is a working capital management decision?A) What type(s) of equipment is (are) needed to complete a current project?B) Should the firm pay cash for a purchase or use the credit offered by the supplier?C) What amount of long-term debt is required to complete a project?D) How many shares of stock should the firm issue to fund an acquisition?E) Should a project should be accepted?Answer: BDifficulty: 1 EasyTopic: Financial management decisionsLearning Objective: 01-01 Define the basic types of financial management decisions and the role of the financial manager.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation10) Working capital management decisions include determining:A) the minimum level of cash to be kept in a checking account.B) the best method of producing a product.C) the number of employees needed to work during a particular shift.D) when to replace obsolete equipment.E) if a competitor should be acquired.Answer: ADifficulty: 1 EasyTopic: Financial management decisionsLearning Objective: 01-01 Define the basic types of financial management decisions and the role of the financial manager.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation11) Which one of the following terms is defined as the management of a firm's long-term investments?A) Working capital managementB) Financial allocationC) Agency cost analysisD) Capital budgetingE) Capital structureAnswer: DDifficulty: 1 EasyTopic: Financial management decisionsLearning Objective: 01-01 Define the basic types of financial management decisions and the role of the financial manager.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation12) Which one of the following terms is defined as the mixture of a firm's debt and equity financing?A) Working capital managementB) Cash managementC) Cost analysisD) Capital budgetingE) Capital structureAnswer: EDifficulty: 1 EasyTopic: Financial management decisionsLearning Objective: 01-01 Define the basic types of financial management decisions and the role of the financial manager.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation13) A firm's short-term assets and its short-term liabilities are referred to as the firm's:A) working capital.B) debt.C) investment capital.D) net capital.E) capital structure.Answer: ADifficulty: 1 EasyTopic: Financial management decisionsLearning Objective: 01-01 Define the basic types of financial management decisions and the role of the financial manager.Bloom's: RememberAACSB: Reflective ThinkingAccessibility: Keyboard Navigation14) Which one of the following questions is least likely to be addressed by financial managers?A) How should a product be marketed?B) Should customers be given 30 or 45 days to pay for their credit purchases?C) Should the firm borrow more money?D) Should the firm acquire new equipment?E) How much cash should the firm keep on hand?Answer: ADifficulty: 1 EasyTopic: Financial management decisionsLearning Objective: 01-01 Define the basic types of financial management decisions and the role of the financial manager.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation15) A business owned by a solitary individual who has unlimited liability for the firm's debt is called a:A) corporation.B) sole proprietorship.C) general partnership.D) limited partnership.E) limited liability company.Answer: BDifficulty: 1 EasyTopic: Forms of business organizationLearning Objective: 01-03 Articulate the financial implications of the different forms of business organization.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation16) A business formed by two or more individuals who each have unlimited liability for all of the firm's business debts is called a:A) corporation.B) sole proprietorship.C) general partnership.D) limited partnership.E) limited liability company.Answer: CDifficulty: 1 EasyTopic: Forms of business organizationLearning Objective: 01-03 Articulate the financial implications of the different forms of business organization.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation17) A business partner whose potential financial loss in the partnership will not exceed his or her investment in that partnership is called a:A) general partner.B) sole proprietor.C) limited partner.D) corporate shareholder.E) zero partner.Answer: CDifficulty: 1 EasyTopic: Forms of business organizationLearning Objective: 01-03 Articulate the financial implications of the different forms of business organization.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation18) A business created as a distinct legal entity and treated as a legal "person" is called a(n):A) corporation.B) sole proprietorship.C) general partnership.D) limited partnership.E) unlimited liability company.Answer: ADifficulty: 1 EasyTopic: Forms of business organizationLearning Objective: 01-03 Articulate the financial implications of the different forms of business organization.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation19) Which one of the following statements concerning a sole proprietorship is correct?A) A sole proprietorship is designed to protect the personal assets of the owner.B) The profits of a sole proprietorship are subject to double taxation.C) The owner of a sole proprietorship is personally responsible for all of the company's debts.D) There are very few sole proprietorships remaining in the U.S. today.E) A sole proprietorship is structured the same as a limited liability company.Answer: CDifficulty: 1 EasyTopic: Forms of business organizationLearning Objective: 01-03 Articulate the financial implications of the different forms of business organization.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation20) Which one of the following statements concerning a sole proprietorship is correct?A) The life of a sole proprietorship is limited.B) A sole proprietor can generally raise large sums of capital quite easily.C) Transferring ownership of a sole proprietorship is easier than transferring ownership of a corporation.D) A sole proprietorship is taxed the same as a C corporation.E) A sole proprietorship is the most regulated form of organization.Answer: ADifficulty: 1 EasyTopic: Forms of business organizationLearning Objective: 01-03 Articulate the financial implications of the different forms of business organization.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation21) Which of the following individuals have unlimited liability for a firm's debts based on their ownership interest?A) Only general partnersB) Only sole proprietorsC) All stockholdersD) Both limited and general partnersE) Both general partners and sole proprietorsAnswer: EDifficulty: 1 EasyTopic: Forms of business organizationLearning Objective: 01-03 Articulate the financial implications of the different forms of business organization.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation22) The primary advantage of being a limited partner is:A) the receipt of tax-free income.B) the partner's active participation in the firm's activities.C) the lack of any potential financial loss.D) the daily control over the business affairs of the partnership.E) the partner's maximum loss is limited to their capital investment.Answer: EDifficulty: 1 EasyTopic: Forms of business organizationLearning Objective: 01-03 Articulate the financial implications of the different forms of business organization.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation23) A general partner:A) is personally responsible for all partnership debts.B) has no say over a firm's daily operations.C) faces double taxation whereas a limited partner does not.D) has a maximum loss equal to his or her equity investment.E) receives a salary in lieu of a portion of the profits.Answer: ADifficulty: 1 EasyTopic: Forms of business organizationLearning Objective: 01-03 Articulate the financial implications of the different forms of business organization.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation24) A limited partnership:A) has an unlimited life.B) can opt to be taxed as a corporation.C) terminates at the death of any one limited partner.D) has at least one partner who has unlimited liability for all of the partnership's debts.E) consists solely of limited partners.Answer: DDifficulty: 1 EasyTopic: Forms of business organizationLearning Objective: 01-03 Articulate the financial implications of the different forms of business organization.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation25) A partnership with four general partners:A) distributes profits based on percentage of ownership.B) has an unlimited partnership life.C) limits the active involvement in the firm to a single partner.D) limits each partner's personal liability to 25 percent of the partnership's total debt.E) must distribute 25 percent of the profits to each partner.Answer: EDifficulty: 1 EasyTopic: Forms of business organizationLearning Objective: 01-03 Articulate the financial implications of the different forms of business organization.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation26) One disadvantage of the corporate form of business ownership is the:A) limited liability of its shareholders for the firm's debts.B) double taxation of distributed profits.C) firm's greater ability to raise capital than other forms of ownership.D) firm's potential for an unlimited life.E) firm's ability to issue additional shares of stock.Answer: BDifficulty: 1 EasyTopic: Forms of business organizationLearning Objective: 01-03 Articulate the financial implications of the different forms of business organization.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation27) Which one of the following statements is correct?A) The majority of firms in the U.S. are structured as corporations.B) Corporate profits are taxable income to the shareholders when earned.C) Corporations can have an unlimited life.D) Shareholders are protected from all potential losses.E) Shareholders directly elect the corporate president.Answer: CDifficulty: 1 EasyTopic: Forms of business organizationLearning Objective: 01-03 Articulate the financial implications of the different forms of business organization.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation28) Which one of the following statements is correct?A) A general partnership is legally the same as a corporation.B) Income from both sole proprietorships and partnerships that is taxable is treated as individual income.C) Partnerships are the most complicated type of business to form.D) All business organizations have bylaws.E) Only firms organized as sole proprietorships have limited lives.Answer: BDifficulty: 1 EasyTopic: Forms of business organizationLearning Objective: 01-03 Articulate the financial implications of the different forms of business organization.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation29) The articles of incorporation:A) describe the purpose of the firm and set forth the number of shares of stock that can be issued.B) are amended periodically especially prior to corporate elections.C) explain how corporate directors are to be elected and the length of their terms.D) sets forth the procedures by which a firm regulates itself.E) include only the corporation's name and intended life.Answer: ADifficulty: 1 EasyTopic: Forms of business organizationLearning Objective: 01-03 Articulate the financial implications of the different forms of business organization.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation30) Corporate bylaws:A) must be amended should a firm decide to increase the number of shares authorized.B) cannot be amended once adopted.C) define the name by which the firm will operate.D) describe the intended life and purpose of the organization.E) determine how a corporation regulates itself.Answer: EDifficulty: 1 EasyTopic: Forms of business organizationLearning Objective: 01-03 Articulate the financial implications of the different forms of business organization.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation31) A limited liability company:A) can only have a single owner.B) is comprised of limited partners only.C) is taxed similar to a partnership.D) is taxed similar to a C corporation.E) generates totally tax-free income.Answer: CDifficulty: 1 EasyTopic: Forms of business organizationLearning Objective: 01-03 Articulate the financial implications of the different forms of business organization.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation32) Which business form is best suited to raising large amounts of capital?A) Sole proprietorshipB) Limited liability companyC) CorporationD) General partnershipE) Limited partnershipAnswer: CDifficulty: 1 EasyTopic: Forms of business organizationLearning Objective: 01-03 Articulate the financial implications of the different forms of business organization.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation33) A ________ has all the respective rights and privileges of a legal person.A) sole proprietorshipB) general partnershipC) limited partnershipD) corporationE) limited liability companyAnswer: DDifficulty: 1 EasyTopic: Forms of business organizationLearning Objective: 01-03 Articulate the financial implications of the different forms of business organization.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation34) Sam, Alfredo, and Juan want to start a small U.S. business. Juan will fund the venture but wants to limit his liability to his initial investment and has no interest in the daily operations. Sam will contribute his full efforts on a daily basis but has limited funds to invest in the business. Alfredo will be involved as an active consultant and manager and will also contribute funds. Sam and Alfredo are willing to accept liability for the firm's debts as they feel they have nothing to lose by doing so. All three individuals will share in the firm's profits and wish to keep the initial organizational costs of the business to a minimum. Which form of business entity should these individuals adopt?A) Sole proprietorshipB) Joint stock companyC) Limited partnershipD) General partnershipE) CorporationAnswer: CDifficulty: 2 MediumTopic: Forms of business organizationLearning Objective: 01-03 Articulate the financial implications of the different forms of business organization.Bloom's: ApplyAACSB: Knowledge ApplicationAccessibility: Keyboard Navigation35) Sally and Alicia are equal general partners in a business. They are content with their current management and tax situation but are uncomfortable with their unlimited liability. Which form of business entity should they consider as a replacement to their current arrangement assuming they wish to remain the only two owners of the business?A) Sole proprietorshipB) Joint stock companyC) Limited partnershipD) Limited liability companyE) CorporationAnswer: DDifficulty: 2 MediumTopic: Forms of business organizationLearning Objective: 01-03 Articulate the financial implications of the different forms of business organization.Bloom's: ApplyAACSB: Knowledge ApplicationAccessibility: Keyboard Navigation36) The growth of both sole proprietorships and partnerships is frequently limited by the firm's:A) double taxation.B) bylaws.C) inability to raise cash.D) limited liability.E) agency problems.Answer: CDifficulty: 1 EasyTopic: Forms of business organizationLearning Objective: 01-03 Articulate the financial implications of the different forms of business organization.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation37) Corporate dividends are:A) tax-free because the income is taxed at the personal level when earned by the firm.B) tax-free because they are distributions of aftertax income.C) tax-free since the corporation pays tax on that income when it is earned.D) taxed at both the corporate and the personal level when the dividends are paid to shareholders.E) taxable income of the recipient even though that income was previously taxed.Answer: EDifficulty: 1 EasyTopic: Forms of business organizationLearning Objective: 01-03 Articulate the financial implications of the different forms of business organization.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation38) Financial managers should primarily focus on the interests of:A) stakeholders.B) the vice president of finance.C) their immediate supervisor.D) shareholders.E) the board of directors.Answer: DDifficulty: 1 EasyTopic: Goal of financial managementLearning Objective: 01-02 Explain the goal of financial management.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation39) Which one of the following best states the primary goal of financial management?A) Maximize current dividends per shareB) Maximize the current value per shareC) Increase cash flow and avoid financial distressD) Minimize operational costs while maximizing firm efficiencyE) Maintain steady growth while increasing current profitsAnswer: BDifficulty: 1 EasyTopic: Goal of financial managementLearning Objective: 01-02 Explain the goal of financial management.Bloom's: RememberAACSB: Reflective ThinkingAccessibility: Keyboard Navigation40) Which one of the following best illustrates that the management of a firm is adhering to thegoal of financial management?A) An increase in the amount of the quarterly dividendB) A decrease in the per unit production costsC) An increase in the number of shares outstandingD) A decrease in the net working capitalE) An increase in the market value per shareAnswer: EDifficulty: 1 EasyTopic: Goal of financial managementLearning Objective: 01-02 Explain the goal of financial management.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation41) Financial managers should strive to maximize the current value per share of the existing stock to:A) guarantee the company will grow in size at the maximum possible rate.B) increase employee salaries.C) best represent the interests of the current shareholders.D) increase the current dividends per share.E) provide managers with shares of stock as part of their compensation.Answer: CDifficulty: 1 EasyTopic: Goal of financial managementLearning Objective: 01-02 Explain the goal of financial management.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation42) Decisions made by financial managers should primarily focus on increasing the:A) size of the firm.B) growth rate of the firm.C) gross profit per unit produced.D) market value per share of outstanding stock.E) total sales.Answer: DDifficulty: 1 EasyTopic: Goal of financial managementLearning Objective: 01-02 Explain the goal of financial management.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation43) The Sarbanes-Oxley Act of 2002 is a governmental response to:A) decreasing corporate profits.B) the terrorist attacks on 9/11/2001.C) a weakening economy.D) deregulation of the stock exchanges.E) management greed and abuses.Answer: EDifficulty: 1 EasyTopic: Ethics, governance, and regulationLearning Objective: 01-04 Explain the conflicts of interest that can arise between managers and owners.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation44) Which one of the following is an unintended result of the Sarbanes-Oxley Act?A) More detailed and accurate financial reportingB) Increased management awareness of internal controlsC) Corporations delisting from major exchangesD) Increased responsibility for corporate officersE) Identification of internal control weaknessesAnswer: CDifficulty: 1 EasyTopic: Ethics, governance, and regulationLearning Objective: 01-04 Explain the conflicts of interest that can arise between managers and owners.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation45) A firm which opts to "go dark" in response to the Sarbanes-Oxley Act:A) must continue to provide audited financial statements to the public.B) must continue to provide a detailed list of internal control deficiencies on an annual basis.C) can provide less information to its shareholders than it did prior to "going dark".D) can continue publicly trading its stock but only on the exchange on which it was previously listed.E) ceases to exist.Answer: CDifficulty: 1 EasyTopic: Ethics, governance, and regulationLearning Objective: 01-04 Explain the conflicts of interest that can arise between managers and owners.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation46) The Sarbanes-Oxley Act of 2002 holds a public company's ________ responsible for the accuracy of the company's financial statements.A) managersB) internal auditorsC) external legal counselD) internal legal counselE) Securities and Exchange Commission agentAnswer: ADifficulty: 1 EasyTopic: Ethics, governance, and regulationLearning Objective: 01-04 Explain the conflicts of interest that can arise between managers and owners.Bloom's: UnderstandAACSB: Reflective ThinkingAccessibility: Keyboard Navigation。