英文版国际金融练习题Chapter_4

- 格式:doc

- 大小:51.50 KB

- 文档页数:6

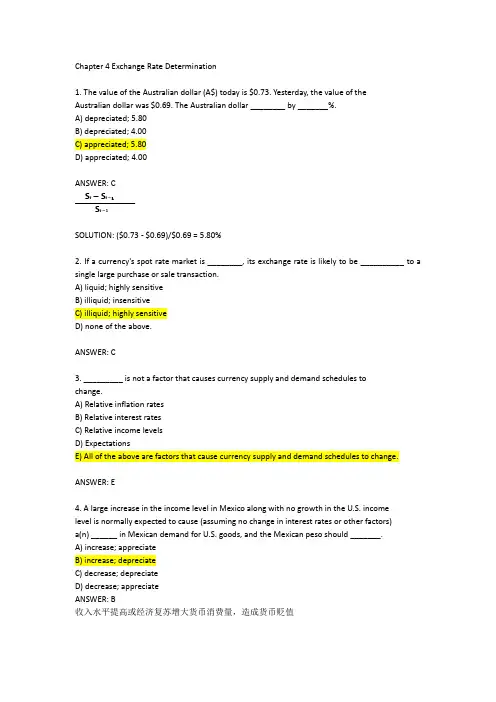

International Finance 国际金融Notes to the ans wers:1、All the terms can be found in the text.2、The discussions can be attained by reading the original text.Chapter 1Answers:II. T T F F F T TIII. 1. reserve currency 2. appreciate 3. was pegged to 4. deficit 5. fixed exchange rates 6. floating exchange rates 7. depreciate 8. market forcesIV. 1. Confidence in the ability of the U.S. to redeem dollars for gold began to fall as potential claims against the dollar increased and U.S. gold reserves fell.2.Under the fixed exchange rate system, the value of the dollar was tied to gold through itsconvertibility in to gold at the U.S. Treasury, and other nations’ currencies were tied to the dollar by the maintenance of a fixed rate of exchange.3.IMF has adjusted its role in the exchange rate system in view of the development of thesituation.4.After the collapse of the Bretton Woods System, the task of ―rigorous monitoring‖theexchange rate policy of member countries fell on the shoulder of IMF.5.Under normal conditions the stabilizing operations were sufficient to contain short-runfluctuations in a currency’s price within the required bounds of 1% of par value and thereby maintain a system of fixed exchange rates.Chapter 2Answers:I. liquid, turnover, due to, hedge, cross trading, electronic broking, outright forwards,Over-the-counter, futures and options, derivatives, remainder.II.. 1. The fundamental changes occurred in post-war world economy. The international flow of commodities, capital and labor is intensifying, thus leading to integration of international markets.1.Often referred to as ―financial institutions with a soul‖, credit unions are member-ownedcooperatives that offer checking accounts, savings accounts, credit cards, and consumer loans.2.If you think the price of gold will rise, you can buy a most simple kind of financial derivativewhich is called ―futures‖. If by that time the price really goes up, then you make a gain. But if you make a wrong guess and the price declines, then you suffer a loss.3.Financial derivatives are financial commodities deriving from such spot market products asinterest rate or bond, foreign exchange or foreign exchange rate and sto ck or stock indexes.There are mainly three types of derivatives: futures, options and swaps, each of which involves a mix of financial contracts.panies and investment funds are using basic currency futures and currency options, onesthat are regarded as traditional hedging products for investors who want to protect their international assets from sharp gains and declines in currency prices.Chapter 3Answers:II. 1. deposit accounts 2. securitization 3. Deregulation 4. consolidation 5. portfolio 6. thrift institutions 7. listing 8. liquidity 9. banking supervision 10. Credit riskIII. 1. Depository institutions 2. commercial banks 3. credit analysis 4. working capital 5. consolidation 6. financing 7. moral hazard 8. Bank supervision and regulation 9. Credit risk 10. Liquidity riskIV. 1. If a bank’s base rate was below money market rates, a customer could borrow from a bank and lend these funds to the money market, thus making a profit on the deal.2.Financing of international trade is one of the basic functions of a commercial bank. Not onlydoes it father deposits (demand, time and savings accounts), but it also grants loans.3.If you have a credit card, you buy a car, eat a dinner, take a trip,a nd even get a haircut bycharging the cost to your account.4.As the central bank and under the leadership of the State Council, the People’s Bank ofChina will formulate and implement monetary policies, execute supervision and control power over the banking industry.5.One of major function of the central bank is the supervision of the clearing mechanis m. Areliable clearing mechanis m which can settle inter-bank transaction with high efficiency is crucial to a well-operated financial system.Chapter 4 Ans wers:II. 1.integrity 2. pretext 3. released 4. produce 5. facilities 6. obliged 7. alleging 8. Claims 9. cleared 10. deliveryIII. 1. in favor of 2. consignment 3. undertaking, terms and conditions 4. cleared 5. regardless of 6. obliged to 7. undervalue arrangement 8. on the pretext of 9. refrain from 10. hinges onIV. 1. The objective of documentary credits is to facilitate international payment by making use of the financial expertise and credit worthiness of one or more banks.2.In compliance with your request, we have effected insurance on your behalf and debited youraccount with the premium in the amount of $1000.3.When an exporter is trading regularly with an importer, he will offer open account terms.4.Exporters usually insist on payment by cash in advance when they are trading with oldcustomers.5.Cash in advance means that the exporter is paid either when the importer places his order orwhen the goods are ready for shipment.Chapter 5.II.1. b 2. c 3. c 4. a 5. b 6. b 7. a 8. cIII. 1. guaranteed 2. without recourse 3. defaults 4. on the buyer’s account 5. is equivalent to 6. in question 7. devaluation 8. validity 9. discrepancy 10. inconsistent withChapter 6Answers:II. 1. open account, creditworthiness 2. demand 3. draw on, creditor 4. protest 5. schedule, discrepancies 6. acceptance 7. drawee 8. guranteedIII. 1. collecting bank 2. tenor 3. the proceeds 4. protest 5. deferred payment 6. presentation 7. the maturity date 8. a document of title 9. the shipping documents 10. transshipmentIV. 1. Documentary collection is a method by which the exporter authorizes the bank to collect money from the importer.2.When a draft is duly presented for acceptance or payment but the acceptance or paymentis refused, the draft is said to be dishonored.3.In the international money market, draft is a circulative and transferable instrument.Endorsement serves to transfer the title of a draft to the transferee.4.A clean bill of lading is favored by the buyer and the banks for financial settlementpurposes.5.Parcel post receipt is issued by the post office for goods sent by parcel post. It is both areceipt and evidence of dispatch and also the basis for claim and adjustment if there is any damage to or loss of parcels.Chapter 7II. financing, discounting, factoring, forfaiting, without recourse, accounts receivable, factor, trade obligations, promissory notes, trade receivables, specialized.III. 1. a cash flow disadvantage 2. without recourse 3. negotiable instruments 4. promissory notes 5. profit margin 6. at a discount, maturity, credit risk 7. A bill of exchange, A promissory noteIV. 1. When a bill is dishonored by non-acceptance or by non-payment, the holder then has an immediate right of recourse against the drawer and the endorsers.2.If a bill of lading is made out to bearer, it can be legally transferred without endorsement.3.The presenting bank should endeavor to ascertain the reasons non-payment ornon-acceptance and advise accordingly to the collecting bank.4.Any charges and expenses incurred by banks in connection with any action for protection o fthe goods will be for the account of the principal.5.Anyone who has a current account at a bank can use a cheque.Chapter EightStructure of the Foreign Exchange Market外汇市场的构成1. Key Terms1)foreign exchange:―Foreign exchange‖ refers t o money denominated in the currency of another nation or group of nations.2)payment“payment”is the transmission of an instruction to transfer value that results from a transaction in the economy.3)settlement―settlement‖ is the final and uncondit ional transfer of the value specified in a payment instruction.2. True or False1) true 2) true 3) true 4) true1)Tell the reasons why the dollar is the market's most widely tradedcurrency?key points: U.S.A economic background; the leadership of USD in the world economy ; the role it plays in investment , trade, etc.2)What kind of market is the foreign exchange market?Make reference to the following parts:(8.7 The Market Is Made Up of An International Network of Dealers)Chapter 9Instruments交易工具1. Key Terms1) spot transactionA spot transaction is a straightforward (or ―outright‖) exchange of one currency for another. The spot rate is the current market price, the benchmark price.Spot transactions do not require immediate settlement, or payment ―on the spot.‖ By convention, the settlement date, or ―value date,‖is the second business day after the ―deal date‖ (or ―trade date‖) on which the transaction is agreed to by the two traders. The two-day period provides ample time for the two parties to confirm the agreement and arrange the clearing and necessary debiting and crediting of bank accounts in various international locations.2) American termsThe phrase ―American terms‖means a direct quote from the point of view of someone located in the United States. For the dollar, that means that the rate is quoted in variable amounts of U.S. dollars and cents per one unit of foreign currency (e.g., $1.2270 per Euro).3) outright forward transactionAn outright forward transaction, like a spot transaction, is a straightforward single purchase/ sale of one currency for another. The only difference is that spot is settled, or delivered, on a value date no later than two business days after the deal date, while outright forward is settled on any pre-agreed date three or more business days after the deal date. Dealers use the term ―outright forward‖ to make clear that it is a single purchase or sale on a future date, and not part of an ―FX swap‖.4) FX swapAn FX swap has two separate legs settling on two different value dates, even though it is arranged as a single transaction and is recorded in the turnover statistics as a single transaction. The two counterparties agree to exchange two currencies at a particular rate on one date (the ―near date‖) and to reverse payments, almost always at a different rate, on a specified sub sequent date (the ―far date‖). Effectively, it is a spot transaction and an outright forward transaction going in opposite directions, or else two outright forwards with different settlement dates, and going in opposite directions. If both dates are less than one month from the deal date, it is a ―short-dated swap‖; if one or both dates are one month or more from the deal date, it is a ―forward swap.‖5) put-call parity―Put-call parity‖says that the price of a European put (or call) option can be deduced from the price of a European call (or put) option on the same currency, with the same strike price and expiration. When the strike price is the same as the forward rate (an ―at-the-money‖forward), the put and the call will be equal in value. When the strike price is not the same as the forward price, the difference between the value of the put and the value of the call will equal the difference in the present values of the two currencies.2. True or False1) true 2) true 3) true3. Cloze1) Traders in the market thus know that for any currency pair, if the basecurrency earns a higher interest rate than the terms currency, the currency will trade at a forward discount, or below the spot rate; and if the base currency earns a lower interest rate than the terms currency, the base currency will trade at a forward premium, or above the spot rate. Whichever side of the transaction the trader is on, the trader won't gain (or lose) from both the interest rate differential and the forward premium/discount. A trader who loses on the interest rate will earn the forward premium, and vice versa.2) A call option is the right, but not the obligation, to buy the underlyingcurrency, and a put option is the right, but not the obligation, to sellthe underlying currency. All currency option trades involve two sides—the purchase of one currency and the sale of another—so that a put to sell pounds sterling for dollars at a certain price is also a call to buy dollars for pounds sterling at that price. The purchased currency is the call side of the trade, and the sold currency is the put side of the trade. The party who purchases the option is the holder or buyer, and the party who creates the option is the seller or writer. The price at which the underlying currency may be bought or sold is the exercise , or strike, price. The option premium is the price of the option that the buyer pays to the writer. In exchange for paying the option premium up front, the buyer gains insurance against adverse movements in the underlying spot exchange rate while retaining the opportunity to benefit from favorable movements. The option writer, on the other hand, is exposed to unbounded risk—although the writer can (and typically does) seek to protect himself through hedging or offsetting transactions.4. Discussions1)What is a derivate financial instrument? Why is traded?2)Discuss the differences between forward and futures markets in foreigncurrency.3)What advantages do foreign currency futures have over foreigncurrency options?4)What is meant if an option is ―in the money‖, ―out of the money‖,or ―atthe money‖?5)What major international contracts are traded on the ChicagoMercantile Exchange ? Philadelphia Stock Exchange?Chapter 10Managing Risk in Foreign Exchange Trading外汇市场交易的风险管理1. Key Terms1) Market riskMarket risk, in simplest terms, is price risk, or ―exposure to (adverse)price change.‖ For a dealer in foreign exchange, two major elements of market risk are exchange rate risk and interest rate risk—that is, risks of adverse change in a currency rate or in an interest rate.2) VARVAR estimates the potential loss from market risk across an entire portfolio, using probability concepts. It seeks to identify the fundamental risks that the portfolio contains, so that the portfolio can be decomposed into underlying risk factors that can be quantified and managed. Employing standard statistical techniques widely used in other fields, and based in part on past experience, VAR can be used to estimate the daily statistical variance, or standard deviation, or volatility, of the entire portfolio. On the basis of that estimate of variance, it is possible to estimate the expected loss from adverse price movements with a specified probability over a particular period of time (usually a day).3) credit riskCredit risk, inherent in all banking activities, arises from the possibility that the counterparty to a contract cannot or will not make the agreed payment at maturity. When an institution provides credit, whatever the form, it expects to be repaid. When a bank or other dealing institution enters a foreign exchange contract, it faces a risk that the counterparty will not perform according to the provisions of the contract. Between the time of the deal and the time of thesettlement, be it a matter of hours, days, or months, there is an extension of credit by both parties and an acceptance of credit risk by the banks or other financial institutions involved. As in the case of market risk, credit risk is one of the fundamental risks to be monitored and controlled in foreign exchange trading.4) legal risksThere are legal risks, or the risk of loss that a contract cannot be enforced, which may occur, for example, because the counterparty is not legally capable of making the binding agreement, or because of insufficient documentation or a contract in conflict with statutes or regulatory policy.2. True or False1)True 2) true3. Translation1) Broadly speaking, the risks in trading foreign exchange are the same asthose in marketing other financial products. These risks can be categorized and subdivided in any number of ways, depending on the particular focus desired and the degree of detail sought. Here, the focus is on two of the basic categories of risk—market risk and credit risk (including settlement risk and sovereign risk)—as they apply to foreign exchange trading. Note is also taken of some other important risks in foreign exchange trading—liquidity risk, legal risk, and operational risk2) It was noted that foreign exchange trading is subject to a particular form ofcredit risk known as settlement risk or Herstatt risk, which stems in part from the fact that the two legs of a foreign exchange transaction are often settled in two different time zones, with different business hours. Also noted was the fact that market participants and central banks have undertaken considerable initiatives in recent years to reduce Herstatt risk.4. Discussions2)Discuss the way how V AR works in measuring and managing marketrisk?3)Why are banks so interested in political or country risk?4)Discuss other forms of risks which you know in foreign exchange. Chapter 11The Determination of Exchange Rates汇率的决定1. Key Terms1) PPPPurchasing Power Parity (PPP) theory holds that in the long run, exchange rates will adjust to equalize the relative purchasing power of currencies. This concept follows from the law of one price, which holds that in competitive markets, identical goods will sell for identical prices when valued in the same currency.2) the law of one priceThe law of one price relates to an individual product. A generalization of that law is the absolute version of PPP, the proposition that exchange rates will equate nations' overall price levels.3) FEER―fundamental equilibrium exchange rate,‖ or FEER,envisaged as the equilibrium exchange rate that would reconcile a nation's internal and external balance. In that system, each country would commit itself to a macroeconomicstrategy designed to lead, in the medium term, to ―internal balance‖—defined as unemployment at the natural rate and minimal inflation—and to ―external balance‖—defined as achieving the targeted current account balance. Each country would be committed to holding its exchange rate within a band or target zone around the FEER, or the level needed to reconcile internal and external balance during the intervening adjustment period.4) monetary approachThe monetary approach to exchange rate determination is based on the proposition that exchange rates are established through the process of balancing the total supply of, and the total demand for, the national money in each nation. The premise is that the supply of money can be controlled by the nation's monetary authorities, and that the demand for money has a stable and predictable linkage to a few key variables, including an inverse relationship to the interest rate—that is, the higher the interest rate, the smaller the demand for money.5) portfolio balance approachThe portfolio balance approach takes a shorter-term view of exchange rates and broadens the focus from the demand and supply conditions for money to take account of the demand and supply conditions for other financial assets as well. Unlike the monetary approach, the portfolio balance approach assumes that domestic and foreign bonds are not perfect substitutes. According to the portfolio balance theory in its simplest form, firms and individuals balance their portfolios among domestic money, domestic bonds, and foreign currency bonds, and they modify their portfolios as conditions change. It is the process of equilibrating the total demand for, and supply of, financial assets in each country that determines the exchange rate.2. True or False1) true 2) true3. Cloze1)PPP is based in part on some unrealistic assumptions: that goods are identical; that all goods are tradable; that there are no transportationcosts, information gaps, taxes, tariffs, or restrictions of trade; and—implicitly and importantly—that exchange rates are influenced only byrelative inflation rates. But contrary to the implicit PPP assumption,exchange rates also can change for reasons other than differences ininflation rates. Real exchange rates can and do change significantly overtime, because of such things as major shifts in productivitygrowth, advances in technology, shifts in factor supplies, changes inmarket structure, commodity shocks, shortage, and booms.2)Each individual and firm chooses a portfolio to suit its needs, based on a variety of considerations—the holder's wealth and tastes, the level ofdomestic and foreign interest rates, expectations of future inflation,interest rates, and so on. Any significant change in the underlying factorswill cause the holder to adjust his portfolio and seek a new equilibrium.These actions to balance portfolios will influence exchange rates.4. Discussions1)How does the purchasing power parity work?2)Describe and discuss one model for forecasting foreign exchange rates.3)Make commends on how good are the various approaches mentioned in the chapter.4)Central banks occasionally intervene in foreign exchange markets. Discuss the purpose of such intervention. How effective is intervention?Chapter 12The Financial Markets金融市场1. Key Terms1)money marketThe money market is really a market for short-term credit, or the option to use someone else's money for a period of time in return for the payment of interest. The money market helps the participants in the economic process cope with routine financial uncertainties. It assists in bridging the differences in the timing of payments and receipts that arise in a market economy.2)capital marketMarkets dealing in instruments with maturities that exceed one year are often referred to as capital markets.3)primary marketThe term ―primary market‖ applies to the original issuance of a credit market instrument. There are a variety of techniques for such sales, including auctions, posting of rates, direct placement, and active customer contacts by a salesperson specializing in the instrument4) secondary marketOnce a debt instrument has been issued, the purchaser may be able to resell it before maturity in a ―secondary market.‖ Again, a number of techniques are available for bringing together potential buyers and sellers of existing debt instruments. They include various types of formal exchanges, informal telephone dealer markets, and electronic trading through bids and offers on computer screens. Often, the same firms that provide primary marketing services help to create or ―make‖ secondary markets.5)RPsIn addition to making outright purchases and sales in the secondary market, entities with money to invest for a brief period can acquire a security temporarily, and holders of debt instruments can borrow short term by selling securities temporarily. These two types of transactions are repurchase agree-ments (RPs) and reverse RPs,respectively. In the wholesale market, banks and government securities dealers offer RPs at competitive rates of return by selling securities under contracts providing for their repurchase from one day to several months later6)BAs 7)CDs (reference to 13.1)8) EurodollarEurodollars are U.S. dollar deposits at banking offices in a country other than the United States.9) EurobankEurobanks—banks dealing in Eurodollar or some other nonlocal currency deposits, including foreign branches of U.S. banks— originally held deposits almost exclusively in Europe, primarily London. While most such deposits are still held in Europe, they are also held in such places as the Bahamas, Bahrain, Canada, the Cayman Islands, Hong Kong, Singapore, and Tokyo, as well as other parts of the world.10)LIBOR (reference to 13.2.2 Certificates of Deposit)London inter-bank offer rate11)mortgage-backed securities12)Eurobond market (details make reference to13.3.3 )The Eurobond market, centered in London, is an offshore market in intermediate- and long-term debt issues. It serves as a source of capital for multinational corporations and for foreign governments. It developed after the United States instituted the interest equalization tax in 1963 to stem capital outflows inspired by relatively low U.S. interest rates.2. True or False1) true 2) true 3) true3. Discussions1) Describe the characteristics of Interest Rate Swap and the role of it in thebank-related financial market.2) What risks are encountered in the swaps markets?3) Discuss one or two specific examples of derivative products and their use.4. Translations1) Markets dealing in instruments with maturities that exceed one year are often referred to as capital markets, since credit to finance investments in new capital would generally be needed for more than one year. The time division is arbitrary. A long-term project can be started with short-term credit, with additional instruments may need to be renewed before a project is completed. Debt instruments that differ in maturity share other characteristics. Hence, the term ―capital market‖ could be –and occasionally is applied to some shorter maturity transactions.2) The secondary market for Treasure securities consists of a network of dealers, brokers, and investors who effect transactions either by telephone or electronically. Telephone trades are generally between dealers and their customers. Electronics trading is arranged through screen-based systems provided by some of the dealers to their customers. It allows selected trades to take place without a conversation. When dealers trade with each other, they generally use brokers. Brokers provide information on screen, but the final trades are made bytelephone.Chapter 13Concepts of Financial Assets Value金融资产价值的概念1. Key Terms1) absolute measure of valueAn absolute measure of value is used when one must compare it to a nominal amount: purchase price, amount to invest, target sum of money to raise2) relative measure of valueA relative measure of rate of return is more convenient to use when one wishes to compare one financial asset to a set of numerous alternative assets. A rate of return is the most commonly used relative measure of value.3) discountingFuture benefits must be discounted (or converted) to their present (or today's) value, before they are summed. Discounting is part of the study of time value of money, or actuarial mathematics, and a complete treatment of it can be found in specialized textbook.4) time value of moneyTime value of money studies how amounts of money are made equivalent over time. Converting amounts today into their future equivalent consists in adding interest to principal, i.e. compounding. Converting amounts in the future into today's equivalent consists of charging an interest, i.e. discounting. Thus, discounting is the exact inverse of compounding.5) FV 6) PV 7) annuity8) short term securitiesShort term securities (i.e. securities with maturity less than one year) are sold at a discount (i.e. nominal value less the interest to be earned over the remaining number of days to maturity). There is no coupon, and no additional benefits such as conversion right, but there may be a penalty for early redemption in the case of some bank certificates of deposit.9) P/E ratio (make reference to 15.5.3 --Earnings Multiple or P/E Ratio)Another approach which is used as a short-cut by a large number of investors, is the earnings multiple. It is sometimes referred to as earningsmultiplier, and it is most commonly known as price-to-earnings or P/E ratio. In many instances, the approach, rather than being an oversimplification, can be an improvement over the previous format. In its most common presentation, the idea is that the price P of a share should be a multiple m of its earnings per share E. The multiple m is an industry average because it is assumed that all companies in an industry face similar marketing, technological and resource challenges, and thus, should have similar organizational and production patterns.10) intrinsic valueintrinsic value, or difference between market price of the underlying stock and strike price (which is also known as exercise price because it is the price at which an option holder can buy from or sell to the option writer the underlying stock through the options exchange)。

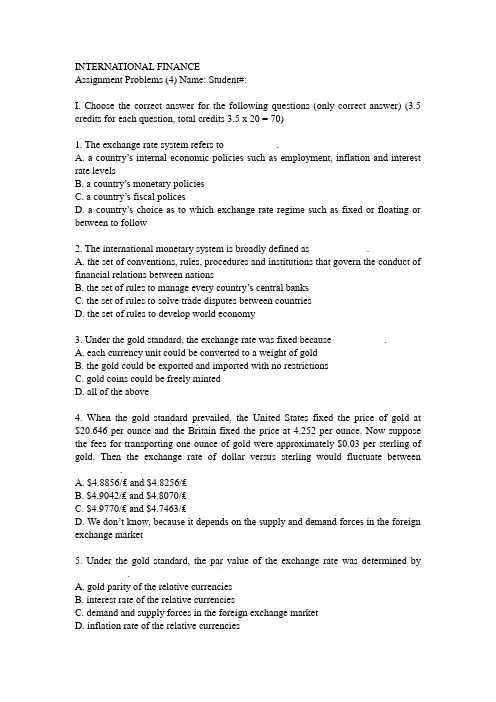

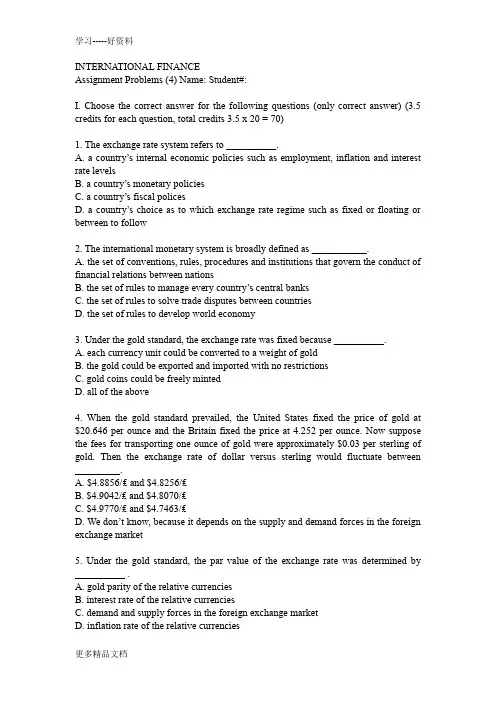

INTERNATIONAL FINANCEAssignment Problems (4) Name: Student#:I. Choose the correct answer for the following questions (only correct answer) (3.5 credits for each question, total credits 3.5 x 20 = 70)1. The exchange rate system refers to __________.A. a country’s internal economic policies such as employment, inflation and interest rate levelsB. a country’s monetary policiesC. a country’s fiscal policesD. a country’s choice as to which exchange rate regime such as fixed or floating or between to follow2. The international monetary system is broadly defined as ___________.A. the set of conventions, rules, procedures and institutions that govern the conduct of financial relations between nationsB. the set of rules to manage every country’s central banksC. the set of rules to solve trade disputes between countriesD. the set of rules to develop world economy3. Under the gold standard, the exchange rate was fixed because __________.A. each currency unit could be converted to a weight of goldB. the gold could be exported and imported with no restrictionsC. gold coins could be freely mintedD. all of the above4. When the gold standard prevailed, the United States fixed the price of gold at $20.646 per ounce and the Britain fixed the price at 4.252 per ounce. Now suppose the fees for transporting one ounce of gold were approximately $0.03 per sterling of gold. Then the exchange rate of dollar versus sterling would fluctuate between _________.A. $4.8856/₤ and $4.8256/₤B. $4.9042/₤ and $4.8070/₤C. $4.9770/₤ and $4.7463/₤D. We don’t know, because it depends on the supply and demand forces in the foreign exchange market5. Under the gold standard, the par value of the exchange rate was determined by __________ .A. gold parity of the relative currenciesB. interest rate of the relative currenciesC. demand and supply forces in the foreign exchange marketD. inflation rate of the relative currencies6. Which of the following is true regarding the collapse of the gold standard system?A. The World War I had many European countries suspend convertibility of their currencies into gold.B. The political costs of maintaining the overvalued pound were so great in the United Kingdom.C. Nations facing 1929 – 1933 worldwide recession decided to pursue objectives such as higher employment rates and real growth rates, rather than to maintain the exchange value of their currencies.D. All of the above are the reasons that the gold standard finally collapsed.7. The U.S. dollar was designated as the international currency in international settlements under the Bretton Woods system. The dollar was accepted by the rest of the world because __________.A. it could be used to purchase U.S. goods and servicesB. it could be converted to gold at a price of $35/ounceC. the U.S. was the only super power at that timeD. the IMF forced the rest of the world to use dollar to settle international debts8. The principal function of the International Monetary Fund (IMF) was originally to __________.A. act as a supranational regulatory agency for all countries’ central banksB. lend to member nations experiencing a shortage of foreign exchange reservesC. finance postwar reconstruction, particularly in Europe and JapanD. reduce trade barriers and settle disputes among countries relating to currency negotiations9. Before 1971 the exchange rates were pretty stable because of the Bretton Woods Agreement. So if the par value of the Japanese Yen and U.S. dollar was set by ¥100/$, the upper limit and lower limit that this exchange rate was allowed to fluctuate freely would be __________ .A. ¥ 101/$ and ¥ 99/$B. ¥ 102.25/$ and ¥ 97.75/$C. ¥ 105/$ and ¥ 95/$D. ¥ 110/$ and ¥ 90/$10. The increase in value of a currency pegged to gold or another currency is known as __________,A. appreciationB. depreciationC. revaluationD. devaluation11. A country that regulates the rate at which its currency is exchanged for all othercurrencies is considered to have a __________ exchange rate system.A. fixed or managedB. floating or flexibleC. currency boardD. dollarization12. Which of the following is true for those who are in favor of floating exchange rate system?A. Floating exchange rates ensure balance-of-payments equilibriumB. Floating exchange rates ensure monetary autonomyC. Floating exchange rates promote economic stabilityD. All of the above are true.13. Since the advent of floating exchange rates in 1973 it has become evident that authorities have not always let their currency float freely but rather they have frequently intervened to influence the exchange rate. This floating exchange rate system is also called __________.A. clean floatB. managed floatC. dirty floatD. Both B and C are correct14. One of the benefits of the creation of euro is that it __________.A. promotes trades and investments in those euro-zone countriesB. makes those euro-zone countries avoid the exchange rate risksC. helps those euro-zone countries restrain inflationD. All of the above are benefits for euro-zone countries.15. Which of the following correctly identifies exchange rate systems from less fixed to more fixed?A. independent floating, currency board, crawling pegsB. independent floating, crawling pegs, dollarizationC. independent floating, currency board, managed floatingD. dollarization, currency board, crawling pegs16. A currency board’s foreign exchange reserves are equal to __________ or slightly more of its notes and coins in circulation, as set by law.A. 100%B. 90%C. 75%D. 50%17. Which of the following features are NOT shared by independent floating exchange rate system?A. The exchange rates are determined by the market forces.B. The exchange rates may change minute by minute.C. The central bank has to maintain large quantities of foreign exchange reserves.D. The central bank can pursue desired monetary policy.18. The IMF constitution was amended to allow member nations to determine their own exchange rate arrangements by the __________.A. Louvre AccordB. Jamaica AccordC. Smithsonian AgreementD. Plaza Agreement19. The United States adopted a modified gold standard in 1934 when the dollar was devalued to $35 per ounce of gold from the 20.67 per ounce price in effect prior to World War I. The dollar’s devaluation rate can be calculated as __________.A. (20.67 – 35) /35B. (20.67 – 35) / 20.67C. (35 – 20.67) / 35D. (35 – 20.67) / 20.6720. Which of the following is NOT true regarding the 1976 Jamaica Accord?A. It formally legitimized the floating exchange system.B. It aimed at increasing the importance of SDRs in international reserves.C. It emphasized the importance of gold in international reservesD. All of the above are true.II. QuestionsQuestions 1 through 4 are based on the following information. (2.5 credits for each question, total credits 2.5 x 4 = 10 credits)Assume one Argentina peso is composed of $0.50 and €0.50. Also assume the spot dollar/euro exchange rate is $1.10/€.1. The peso/dollar exchange rate should be __________.2. The peso/euro exchange rate should be __________.3. The weight assigned to the U.S. dollar in one Argentina peso is __________.4. The weight assigned to the euro in one Argentina peso is __________.Questions 5 through 7 are based on the following information. (10 credits total) Under the gold standard the gold par value was $20.67 per ounce in the United States. The gold par value was ₤4.2474 per ounce in Britain.5. The par exchange rate (dollars per pound) implied by the gold parities is __________. (2 credits)6. How would you arbitrage if the exchange rate quoted in the foreign exchange market were $4.00 per pound instead? (4 credits)7. What pressure is placed on the exchange rate by this arbitrage? (4 credits)8. A European-based manufacturer ships a machine tool to a buyer in Jordan. The p urchase price is €375,000. Jordan imposes a 12% import duty on all products purchased from the European Union. The Jordanian importer then re-exports the product to a Saudi Arabian importer, but only after imposing its own resale fee of 22%. Given the following spot exchange rates on May 25, 2004, what is the total cost to the Saudi Arabian importer in Saudi Arabian riyal, and what is the U.S. dollar equivalent of that price? (10 credits)Answers to Assignment Problems (4)Part I.1. D2. A3. D4. A5. A6. D7. B8. B9. A 10. C11. A 12.D 13. D 14. D 15. B 16. A 17.C 18. B 19.A 20. CPart II.1. Since 50% ($1) + 50% (1€) = Mex$ 1S$/€ = 1.10 , S€/$ = 1/1.10 = 0.9091So, 50% ($1.10) + 50% ($1) = $1.05/Mex$ 12. 50% (€0.9091) + 50% (€1) = €0.9545/Mex$ 13. 0.5/1.05 = 0.47624. 0.5/0.9545 = 0.52385. $4.8665/₤6. buy pound in foreign exchange market, change pound for gold in England, transport gold to U.S., convert gold to dollar. (alternative answer)7. towards to the par rate: $4.8665/₤, because the supply of dollar and the demand for pound rise. That pushes up the value of the pound.8. 375,000 x 0.87 = 326,250 x (1 + 12%) = JD365,400365,400 x (1 + 22%) = JD445.788445,788/0.7080 = $629,644.07 (U.S. dollar equivalent)629,644.07 x 3.75 = SRI 2,361,165.26 (total cost to the Saudi Arabian importer)。

INTERNATIONAL FINANCEAssignment Problems (3) Name: Student#:I. Choose the correct answer for the following questions (only ONE correct answer) (2 credits for each question, total credits 2 x 25 = 50)1. Interbank quotations that include the United States dollars are conventionally given in, which state the foreign currency price of one U.S. dollar, such as a bid price of SFr 0.85/$.A. indirect quoteB. direct quoteC. American quoteD. European quote2. The spot exchange rate published in financial newspapers is usually the .A. nominal exchange rateB. real exchange rateC. effective exchange rateD. equilibrium exchange rate3. The foreign exchange refers to the .A. foreign bank notes and coinsB. demand deposits in foreign banksC. foreign securities that can be easily cashedD. all of the above4. The functions of the foreign exchange market come down to .A. converting the currency of one country into the currency of anotherB. providing some insurance against the foreign exchange riskC. making the foreign exchange speculation easyD. Only A and B are true.5. Which of the following is NOT true regarding the foreign exchange market.A. It is the place through which people exchange one currency for another.B. The exchange rate nowadays is mainly determined by the market forces.C. Most foreign exchange transactions are physically completed in this market.D. All of the above are true.6. The world largest foreign exchange markets are respectively.A. London, New York and TokyoB. London, Paris and FrankfurtC. London, Hong Kong and SingaporeD. London, Zurich and Bahrain7. The foreign exchange market is NOT efficient because .A. monetary authorities dominate the foreign exchange market and everybody knows that by definition, central banks are inefficientB. commercial banks and other participants of the market do not compete with one another due to the fact that transaction takes place around the world and not in a single centralized locationC. foreign exchange dealers have different prices such as bid and ask pricesD. None of the reasons listed are correct because the foreign exchange market is an efficient market8. earn a profit by a bid-ask spread on currencies they buy and sell.on the other hand, earn a profit by bringing together buyers and sellers of foreign exchanges and earning a commission on each sale and purchase.A. Foreign exchange brokers; foreign exchange dealersB. Foreign exchange dealers; foreign exchange brokersC. arbitragers; speculatorsD. commercial banks; central banks9. Most foreign exchange transactions are through the U.S. dollars. If the transaction is expressed as the currencies per dollar, this is known as whereas are expressed as dollars per currency.A. direct quote; indirect quoteB. indirect quote; direct quoteC. European quote; American quoteD. American quote, European quote10. From the viewpoint of a Japanese investor, which of the following would be a direct quote..B. .C. ¥110/.D. . ¥11. Which of the following is true about the foreign exchange market.A. It is a global network of banks, brokers, and foreign exchange dealers connected by electronic communications system.B. The foreign exchange market is usually located in a particular place.C. The foreign exchangerates are usually determined by the related monetary authorities.D. The main participants in this market are currency speculatorsfrom different countries.12. The extent to which the income from individual transactions is affected by fluctuations in foreign exchange values is considered to be .A. Translation exposureB. economic exposureC. transaction exposureD. accounting exposure13. Which of the following exchange rates is adjusted for price changes.A. nominal exchange rateB. real exchange rateC. effective exchange rateD. equilibrium exchange rate14. Suppose the exchange rate of the RMB versus U.S. dollar is ¥6.8523/$ n RMB were to undergo a 10% depreciation, the new exchange rate in terms ofbe:A. B. C. D.15. At least in a U.S. MNC’s financial accounting statement, if the value of the euro depreciatesrapidly againstthat of the dollar over a year, this would reducethe dollarvalue of the euro profit made by the European subsidiary. This is a typical .A. transaction exposureB. translation exposureC. economic exposureD. operating exposure16. A Japanese-based firm expects to receive pound-payment in 6 months. The companyhas a (an) .A. economic exposureB. accounting exposureC. long position in sterlingD. short position in sterling17 The exposure to foreign exchangerisk known as Translation Exposure may bedefined as .A. change in reported owne’r s equity in consolidated financial statements caused bya change in exchange ratesB. the impact of settling outstanding obligations entered into before change in exchange rates but to be settled after change in exchange ratesC. the changein expectedfuture cashflows arisingfrom an unexpectedchangein exchange ratesD. All of the above18 When a firm deals with foreign trade or investment, it usually has foreignexchange risk exposure. So if an American firm expects to receive a dollar-payment from a Chinese company in the next 30 days, the U.S. firm has the possible .A. economic exposureB. transaction exposureC. translation exposureD. none of the above19. In order to avoid the possible loss because of the exchange rate fluctuations, a firm that has a position in foreign exchanges can that position in the forward market.A. short; sellB. long; sellC. long; buyD. none of the above20. A forward contract to deliver Japaneseyens for Swissfrancs could be describedeither as or ,A. selling yens forward; buying francs forwardB. buying francs forward; buying yens forwardC. selling yens forward; selling francs forwardD. selling francs forward; buying yens forwardSFr/$21. Dollars are trading at S0=SFr0.7465/$ in the spot market. The 90-dayforwardSFr/$rate is F1=SFr0.7432/$. So the forward on the dollar in basis points is :A. discount,B. discount, 33C. premium,D. premium, 3322. If the spot rate is /. , 3-month forward rate is6./, which of the following is NOT true.A. euro is at forward premium by 100 points.B. dollar is at forward discount by 100 points.C. dollar is at forward discount by 55 points.D. euro is at forward premium by 2.96% p.a.23. If the spot C$/$ rate is 1.0305/15, forward dollar is 25/30 premium, the outright forward quote in American term should be .A. –B. –C. ––24. If the spot C$/$ rate is 1.0305/15, forward dollar is 25/30 premium, the $/C$ forward quote in terms of points should be .A. 30/25B. 25/30C. –(23/28)D. –(28/23)25. The current U.S. dollar exchange rate is¥85/$. If the 90-day forward dollar rate is ¥90/$, then the yen is selling at a per annum of .A. premium; 5.88%B. discount; 5.56%C. premium; 23.52%D. discount; 22.23%II. ProblemsQuestions1through10are based on the information presented in Table 3.1(2.credits for each question, total credits 2 x 10 = 20)TableCountry Exchange rate(2021) Exchange rate CPI Volume of Volume ofimports from U.S.(2021) (2021)Germany Mexico U.S.. 0.75/$Mex$11.8/$. 0.70/$Mex$12.20/$$200m$120m$350m$240m1. The real exchange rate of the dollar against the euro in 2021 was .2. The real exchange rate of the dollar against the peso in 2021 was .3. The dollar was against the euro in nominal term by .A. appreciated; 6.67%B. depreciated; 6.67%C. appreciated; 7.14%D depreciated; 7.14%4. The Mexican peso was against the dollar in nominal term by.A. appreciated; 3.39%B. depreciated; 3.39%C. appreciated; 3.28%D. depreciated; 3.28%5. The volume of the German foreign trade with the U.S. was .6. The volume of the Mexican foreign trade with the U.S. was .7. Assume the U.S. trades only with the Germany and Mexico. Now if we want to calculate the dollar effective exchange rate in 2021 against a basket of currencies of euroand Mexican peso, the weight assigned to the euro should be .8. The weight assigned to the peso should be .9. Assumethe 2021 is the baseyear. The dollar effective exchangerate in 2021 was.10. Was the dollar generally stronger or weaker in 2021 according to your calculation.11. The following exchange rates are available to you.Fuji Bank ¥80.00/$United Bank of Switzerland SFr0.8900/$Deutsche Bank ¥Assume you have an initial SFr10 million. Can you make a profit via triangular arbitrage. If so, show steps and calculate the amount of profit in Swiss fra n8cs c.r e(dit s)12. If the dollar appreciates 1000% against the ruble, by what percentage does the ruble depreciate against the dolla(r5. credits)13. As a percentage of an arbitrary starting amount, about how large would transactions costs have to be to make arbitrage between the exchange rat e S s Fr/$S= SFr1.7223/$, S$/¥¥/SFr= ¥, and S = ¥unprofitable. Explain(.7 credits14. You are given the following exchange rates:¥/A$S = 67.05 –£/A$S –¥/ £Calculate the bid and ask rate of S : (5 credits)15.Suppose the spot quotation on the Swiss franc (CHF) in New York is4–42–68. Compute the percentage bid-ask spreads on the CHF/EUR quo t(e5. credits)Answers to Assignment Problems (3)Part I1. D2. A3. D4. D5. D6. A7. D8. B9. C 10. C11. A 12. A 13. B 14. D 15. B16. C 17. A 18. D 19. B 20. A21. B 22. B 23. C 24. C 25. D Part II1. 0.70 x (105.3/102.5) = 0.7 x 1.0273 =2. 12.2 x (105.3/110.5) = 12.2 x .9529 =3. B (0.7 /.75)–1 = -6.67%4. D (1/12.2)/(1/11.8) –1 = -3.28%5. 5506. 3607. 550/910 = 60.44%8. 360/910 =9. (0.70/0.75)(60.44%) + (12.2/11.8)(39.56%) = .5641 + 0.4090 = .9731 = 97.31%10. weaker, because dollar depreciated by 2.69%.¥/$ $/SFr SFr/ ¥11. Since S S S = 0.946186< 1, there is an arbitrage opportunity.Steps: ①Buy ¥from Deutsche Bank, SFr10 million x =¥950million② m③ mProfit (ignoring transaction fees):–SFr10 = 0.56875 million = 568,75012. (x–1) = 1000%; 1/11 –1 = 90.9%13. S SFr/$ S$/ ¥S¥/SFr = SFr1.7223/$ x x¥¥F=rIf transaction costs exceed $0.0326 (3.26%), the arbitrage is unprofitable.¥/A$14. Given: S = –£/A$S –¥/.(bid)£/.(ask)15. Given: –52/SFr–68/SFrSo, S SRr/ . (bid)S SFr/ . (ask)Bid-ask margin = –1.424) / 1.4264 = 0.1683%。

米什金货币金融学英文版习题答案chapter4英文习题Economics of Money, Banking, and Financial Markets, 11e, Global Edition(Mishkin)Chapter 4The Meaning of Interest Rates4.1Measuring Interest Rates1) The concept of ________ is based on the common-sense XXX.A) present valueB) future valueC) interestD) deflationXXX:Aof Knowledge2) The present value of an expected future payment ________ as the interest rate XXX) fallsB) risesC) is constantD) is unaffectedXXX:AThinking3) An increase in the time to the promised future payment ________ the present value of XXX.A) decreasesB) increasesC) has no effect onD) is XXXXXX:AThinking4) With an interest rate of 6 percent, the present value of $100 next year is approximatelyA) $106.B) $100.C) $94.D) $92.Answer:CThinking5) What is the present value of $500.00 to be paid in two years if the interest rate is 5 percent?A) $453.51B) $500.00C) $476.25D) $550.00XXX:AThinking6) If a security pays $55 in one year and $133 in three years, its present value is $150 if XXXA) 5 percent.B) 10 percent.C) 12.5 percent.D) 15 percent.XXX:BThinking7) XXX who is to receive $1 million per year for twenty years has won$20 million ignores the process ofA) face value.B) par value.C) deflation.D) discounting the future.XXX:DThinking8) A credit market XXX with an amount of XXX date along with an interest payment is known as aA) simple loan.B) fixed-payment loan.C) XXX.D) discount bond.XXX:Aof Knowledge9) A credit market instrument that requires the borrower to make the same payment XXX date is known as aA) simple loan.B) fixed-payment loan.C) XXX.D) discount bond.XXX:Bof Knowledge10) Which of the following are TRUE of fixed payment loans?A) XXX.B) XXX.C) XXX.D) XXX are often of this type.XXX:BThinking11) A XXX is another name forA) a simple loan.B) a fixed-payment loan.C) a commercial loan.D) an unsecured loan.XXX:Bof Knowledge12) A credit market XXX date and then repays the face value is called aA) simple loan.B) fixed-payment loan.C) XXX.D) discount bond.Answer:Cof Knowledge13) A ________ pays the owner a fixed coupon payment every year until the maturity date, whenthe ________ value is repaid.A) coupon bond; discountB) discount bond; discountC) coupon bond; faceD) discount bond; faceAnswer:CThinking14) The ________ is the final amount that will be paid to the XXX) discount valueB) coupon valueC) face valueD) present valueAnswer:Cof Knowledge15) When talking about a coupon bond, face value and ________ mean the same thing.A) par valueB) coupon valueC) amortized valueD) discount valueXXX:Aof Knowledge16) The dollar amount of the XXX of the face valueof the bond is called the bond'sA) XXX.B) maturity rate.C) face value rate.D) XXX.XXX:Aof Knowledge17) The ________ XXX rate times the par value of the bond.A) present valueB) face valueC) XXXD) maturity XXXAnswer:CThinking18) If a $1000 face value coupon bond has a coupon rate of3.75 percent, then the couponpayment every year isA) $37.50.B) $3.75.C) $375.00.D) $13.75XXX:AThinking19) If a $5,000 coupon bond has a coupon rate of 13 percent, then the XXXA) $650.B) $1,300.C) $130.D) $13.XXX:AThinking20) An $8,000 coupon bond with a $400 coupon payment every year has a coupon rate ofA) 5 percent.B) 8 percent.C) 10 percent.D) 40 percent.XXX:AThinking21) A $1000 face value coupon bond with a $60 coupon payment every year has a coupon rate ofA) .6 percent.B) 5 percent.C) 6 percent.D) 10 percent.Answer:CThinking22) All of the following are examples of XXXA) XXX.B) XXX.C) XXX.D) XXX.XXX:BThinking23) XXX at a price below its face value and the face value is XXX called aA) simple loan.B) fixed-payment loan.C) XXX.D) discount bond.XXX:Dof Knowledge24) A ________ is bought at a price below its face value, and the ________ value is XXX.A) coupon bond; discountB) discount bond; discountC) coupon bond; faceD) discount bond; faceXXX:DThinking25) A discount bondA) pays the bondholder a fixed amount every period and the face value at maturity.B) XXX.C) pays all interest and the face value at maturity.D) pays the face value at maturity plus any capital gain.XXX:BThinking26) Examples of discount bonds includeA) XXX.B) XXX.C) XXX.D) municipal bonds.XXX:AThinking27) Which of the following are TRUE for discount bonds?A) A discount XXX par.B) The purchaser receives the face value of the bond at the maturity date.C) XXX and notes are examples of discount bonds.D) The purchaser receives the par value at maturity plus any capital gains.XXX:BThinking28) The interest rate that equates the present value of payments received from a debt instrumentwith its value today is theA) simple interest rate.B) current yield.C) XXX.D) real interest rate.Answer:Cof Knowledge29) Economists consider the ________ to be the most XXX) simple interest rate.B) current yield.C) XXX.D) real interest rate.Answer:CThinking30) For simple loans, the simple interest rate is ________ the yield to maturity.A) greater thanB) less thanC) equal toD) not comparable toAnswer:Cof Knowledge31) If the amount payable in two years is $2420 for a simple loan at 10 percent interest, the loanamount isA) $1000.B) $1210.C) $2000.D) $2200.Answer:CThinking32) For a 3-year simple loan of $10,000 at 10 percent, the amount to be repaid isA) $10,030.B) $10,300.C) $13,000.D) $13,310.XXX:DThinking33) If $22,050 is the amount payable in two years for a $20,000 simple loan made today, XXXA) 5 percent.B) 10 percent.C) 22 percent.D) 25 percent.XXX:AThinking34) If a security pays $110 next year and $121 the year after that, what is its yield to maturity if itsells for $200?A) 9 percentB) 10 percentC) 11 percentD) 12 percentXXX:BThinking35) The present value of a fixed-payment loan is calculated as the ________ of the present valueof all cash flow payments.A) sumB) differenceC) multipleD) logXXX:AThinking36) Which of the following are TRUE for a coupon bond?A) When the coupon bond is priced at its face value, the yield to XXX) The price of a coupon bond and the yield to XXX.C) The yield to maturity is greater than the coupon rate when the bond price is above the parvalue.D) The yield is less than the coupon rate when the bond price is below the par value.Answer:AThinking37) The ________ of a coupon bond and the yield to maturity are inversely related.A) priceB) par valueC) maturity dateD) termXXX:AThinking38) The price of a coupon bond and the yield to maturity are ________ related; that is, as theyield to maturity ________, the price of the bond ________.A) positively; rises; risesB) negatively; falls; fallsC) positively; rises; fallsD) negatively; rises; fallsXXX:DThinking39) The yield to maturity is ________ than the ________ rate when the bond price is ________its face value.A) greater; coupon; aboveB) greater; coupon; belowC) greater; perpetuity; aboveD) less; perpetuity; belowXXX:BThinking40) The ________ is below the coupon rate when the bond price is ________ its par value.A) yield to maturity; aboveB) yield to maturity; belowC) discount rate; aboveD) discount rate; belowXXX:AThinking41) A $10,000 8 percent coupon bond that sells for $10,000 has a yield to maturity ofA) 8 percent.B) 10 percent.C) 12 percent.D) 14 percent.XXX:AThinking42) Which of the following $1,000 face-value securities has XXX?A) a 5 percent XXX,000B) a 10 percent XXX,000C) a 12 percent XXX,000D) a 12 percent XXX,100Answer:CThinking43) Which of the following $5,000 face-value securities has XXX?A) a 6 percent XXX,000B) a 6 XXX,500C) a 10 percent XXX,000D) a 12 percent XXX,500XXX:DThinking44) Which of the following $1,000 face-value securities has XXX?A) a 5 percent coupon bond with a price of $600B) a 5 percent coupon bond with a price of $800C) a 5 percent coupon bond with a price of $1,000D) a 5 percent coupon bond with a price of $1,200XXX:AThinking45) Which of the following $1,000 face-value securities has XXX?A) a 5 percent XXX,000B) a 10 percent XXX,000C) a 15 percent XXX,000D) a 15 percent XXXXXX:AThinking46) Which of the following bonds would you prefer to be buying?A) a $10,000 face-value security with a 10 percent XXX,000B) a $10,000 face-value security with a 7 percent XXX,000C) a $10,000 face-value security with a 9 percent XXX,000D) a $10,000 face-value security with a 10 percent XXX,000XXX:AThinking47) XXX and no repayment of principal is called aA) consol.B) cabinet.C) Treasury bill.D) Treasury note.XXX:Aof Knowledge48) The price of a XXXA) times the interest rate.B) plus the interest rate.C) minus the interest rate.D) divided by the interest rate.XXX:DThinking49) The interest rate on a consol equals theA) price times the XXX.B) XXX.C) XXX plus the price.D) XXX.XXX:DThinking50) A consol paying $20 annually when the interest rate is 5 percent has a price ofA) $100.B) $200.C) $400.D) $800.Answer:CThinking51) If a perpetuity has a price of $500 and an annual interest payment of $25, the interest rate isA) 2.5 percent.B) 5 percent.C) 7.5 percent.D) 10 percent.XXX:BThinking52) The yield to XXX. It is called the ________ when approximating the XXX.A) current yieldB) discount yieldC) future yieldD) XXX yieldXXX:AThinking53) The yield to maturity for a one-year discount bond equals the increase in price over the year,divided by theA) initial price.B) face value.C) interest rate.D) XXX.XXX:AThinking54) If a $10,000 face-value discount XXX,000, XXXA) 5 percent.B) 10 percent.C) 50 percent.D) 100 percent.XXX:DThinking55) If a $5,000 face-value discount XXX,000, then its XXXA) 0 percent.B) 5 percent.C) 10 percent.D) 20 percent.XXX:AThinking56) XXX for $15,000 with a face value of $20,000 in one year has a yield XXXA) 3 percent.B) 20 percent.C) 25 percent.D) 33.3 percent.XXX:DThinking57) The yield to maturity for a discount bond is ________ related to the current bond price.A) negativelyB) positivelyC) notD) directlyXXX:AThinking58) A discount bond is also called a ________ because the owner does not receive periodicpayments.A) XXX-coupon bondB) municipal bondC) corporate bondD) consolXXX:Aof Knowledge59) Another name for a consol is a ________ because it is a bond with no XXX.A) XXXB) discount bondC) municipalityD) high-yield bondXXX:Aof Knowledge60) If the interest rate is 5%, what is the present value of a security that pays you $1, 050 nextyear and $1,102.50 two years from now? If this security sold for $2200, is the yield to XXX less than 5%? Why?Answer:PV = $1,050/(1. +.05) + $1,102.50/(1 + 0.5)2PV = $2,000If this security sold for $2200, the yield to maturity is less than 5%. The lower the interest ratethe higher the present value.Thinking4.2The Distinction XXX1) The ________ is defined as the payments to the owner plus the change in a security'XXX.A) XXXB) current yieldC) rate of returnD) yield rateAnswer:Cof Knowledge2) Which of the following are TRUE concerning the distinction between interest rates andreturns?A) The rate of return on a bond will not necessarily equal the interest rate on that bond.B) The return can be expressed as the difference between the current yield and the rate of capitalgains.C) The rate of return will be greater than the interest rate when the price of the bond XXX.D) The return can be expressed as the sum of the discount yield and the rate of capital XXX:AThinking3) The sum of the current yield and the rate of capital gain is called theA) rate of return.B) discount yield.C) perpetuity yield.D) par value.XXX:AThinking4) What is the return on a 5 percent XXX initially sells for $1,000 and sells for$1,200 next year?A) 5 percentB) 10 percentC) -5 percentD) 25 percentXXX:DThinking5) What is the return on a 5 percent XXX initially sells for $1,000 and sells for $900next year?A) 5 percentB) 10 percentC) -5 percentD) -10 percentAnswer:CThinking6) The return on a 5 percent XXX initially sells for $1,000 and sells for $950 nextyear isA) -10 percent.B) -5 percent.C) 0 percent.D) 5 percent.Answer:CThinking7) Suppose you are holding a 5 percent XXX in one year witha yield tomaturity of 15 percent. If the interest rate on one-yearbonds rises from 15 percent to 20 percentover the course of the year, what is the yearly return on the bond you are holding?A) 5 percentB) 10 percentC) 15 percentD) 20 percentAnswer:CThinking8) I purchase a 10 percent coupon bond. Based on my purchase price, I XXX of 8 percent. If I hold this bond to maturity, then my return on this asset isA) 10 percent.B) 8 percent.C) 12 percent.D) there is not enough information to determine the return.XXX:BThinking9) If the interest rates on all bonds rise from 5 to 6 percent over the course of the year, whichbond would you prefer to have been holding?A) a bond with one year to maturityB) a bond with five years to maturityC) a bond with ten years to maturityD) XXXXXX:AThinking10) An equal decrease in all bond interest ratesA) increases the price of a five-year bond more than the price of a ten-year bond.B) increases the price of a ten-year bond more than the price of a five-year bond.C) decreases the price of a five-year bond more than the price of a ten-year bond.D) decreases the price of a ten-year bond more than the price of a five-year bond.XXX:BThinking11) An equal increase in all bond interest ratesA) increases the return to all XXX.B) decreases the return to all XXX.C) has no effect on the returns to bonds.D) decreases long-term bond returns more than short-term bond returns.XXX:DThinking12) Which of the following are generally TRUE of bonds?A) XXX when the time to maturity is the same as theholding period.B) A rise in interest rates is associated with a fall in bond prices, XXX.C) XXX, the smaller is the size of the price change associated with aninterest rate change.D) Prices and returns for short-term bonds are more volatile than those for longer-XXX:AThinking13) Which of the following are generally TRUE of all bonds?A) XXX, the greater is the rate of return that occurs as a result of theincrease in the interest rate.B) Even though a bond has a substantial initial interest rate, its return can turn out to be negativeif interest rates rise.C) Prices and returns for short-term bonds are more volatile than those for longer term bonds.D) A fall in interest rates results in capital XXX.XXX:BThinking14) XXXA) exchange-rate risk.B) price risk.C) asset risk.D) interest-rate risk.XXX:Dof Knowledge15) Interest-rate risk is the riskiness of an asset's returns due toA) interest-rate changes.B) XXX.C) default of the borrower.D) XXX.XXX:Aof Knowledge16) Prices and returns for ________ bonds are more volatile than those for ________ bonds,everything else held constant.A) long-term; long-termB) long-term; short-termC) short-term; long-termD) short-term; short-termXXX:BThinking7) There is ________ for any bond whose time to XXX) no interest-rate riskB) a large interest-rate riskC) rate-of-return riskD) yield-to-maturity riskXXX:AThinking18) All bonds that will not be held to maturity have interest rate risk which occurs because of thechange in the price of the bond as a result ofA) interest-rate changes.B) XXX.C) default of the borrower.D) XXX.XXX:Aof Knowledge19) Your favorite uncle advises you to purchase long-term bonds because their interest rate is10%. Should you follow his advice?Answer:It depends on where you think interest rates are headed in the future. If you thinkinterest rates will be going up, you should not follow your XXX your bond if you needed to sell it before the maturity date. Long-term bondshave a greater interest-rate risk.Thinking4.3The Distinction Between Real and Nominal Interest Rates1) The ________ interest rate is adjusted for expected changes in the price level.A) ex ante realB) ex post realC) ex post nominalD) ex ante nominalXXX:Aof Knowledge2) The ________ XXX the true cost of borrowing.A) nominalB) realC) discountD) marketXXX:BThinking3) The nominal interest rate minus the expected rate of inflationA) defines the real interest rate.B) is a less accurate measure of the XXX.C) is a less accurate indicator of the tightness of credit market XXX.D) XXX.XXX:AThinking4) When the ________ interest rate is low, there are greater incentives to ________ and fewerincentives to ________.A) nominal; lend; borrowB) real; lend; borrowC) real; borrow; lendD) market; lend; borrowAnswer:CThinking5) The interest rate that describes how well a lender has done in real terms after the XXXA) ex post real interest rate.B) ex ante real interest rate.C) ex post XXX.D) ex XXX.XXX:AThinking6) The ________ XXX the real interest rate plus XXX.A) Fisher XXXB) XXXC) Monetarist XXXD) XXXXXX:Aof Knowledge7) If the nominal rate of interest is 2 percent, and the expected inflation rate is -10 percent, thereal rate of interest isA) 2 percent.B) 8 percent.C) 10 percent.D) 12 percent.XXX:DThinking8) In which of the following XXX lender?A) The interest rate is 9 percent and the expected inflation rate is 7 percent.B) The interest rate is 4 percent and the expected inflation rate is 1 percent.C) The interest rate is 13 percent and the expected inflation rate is 15 percent.D) The interest rate is 25 percent and the expected inflation rate is 50 percent.XXX:BThinking9) In which of the following XXX?A) The interest rate is 9 percent and the expected inflation rate is 7 percent.B) The interest rate is 4 percent and the expected inflation rate is 1 percent.C) The interest rate is 13 percent and the expected inflation rate is 15 percent.D) The interest rate is 25 percent and the expected inflation rate is 50 percent.XXX:DThinking10) XXX rate to be 15 percent next year and a one-year bond has a yield tomaturity of 7 percent, then the real interest rate on this bond isA) 7 percent.B) 22 percent.C) -15 percent.D) -8 percent.XXX:DThinking11) XXX rate to be 12 percent next year and a one-year bond has a yield tomaturity of 7 percent, then the real interest rate on this bond isA) -5 percent.B) -2 percent.C) 2 percent.D) 12 percent.XXX:AThinking12) XXX rate to be 4 percent next year and a one year bond has a yield tomaturity of 7 percent, then the real interest rate on this bond isA) -3 percent.B) -2 percent.C) 3 percent.D) 7 percent.Answer:CThinking13) In the United States during the late 1970s, the nominal interest rates were quite high, but thereal interest rates werenegative. From the Fisher equation, XXX in the United States during this period wasA) XXX.B) XXX.C) negative.D) high.XXX:DThinking14) The interest rate on XXX) the real interest rate.B) the XXX.C) the rate of inflation.D) the rate of deflation.XXX:AThinking15) Assuming the same XXX, XXX Indexed Security and the yield on a XXXA) the XXX.B) the real interest rate.C) the XXX.D) the XXX.XXX:DThinking16) Assuming the same XXX, when the interest rate on a TreasuryInflation Indexed Security is 3 percent, and the yield on a nonindexed Treasury bond is 8 percent,the expected rate of XXXA) 3 percent.B) 5 percent.C) 8 percent.D) 11 percent.XXX:BThinking17) Would it make sense to buy a house when mortgage rates are 14% and expected XXX? XXX.though the nominal rate for the mortgage appears high, the real cost ofborrowing the funds is -1%. Yes, under this circumstance it XXX.Thinking4.4Web Appendix: Measuring Interest-Rate Risk: XXX1) Duration isA) XXX.B) the time until the next interest XXX.C) the average lifetime of a debt security's stream of payments.D) the time between interest XXX.Answer:Cof Knowledge2) XXX with the same maturityA) the coupon bond has the greater effective maturity.B) the discount bond has the greater effective maturity.C) XXX.D) XXX.XXX:BThinking3) XXX increasesA) XXX.B) when interest rates increase.C) XXX.D) XXX.XXX:AThinking4) All else equal, when interest rates ________, the duration of a coupon bond ________.A) rise; fallsB) rise; increasesC) falls; fallsD) falls; does not changeXXX:AThinking5) All else equal, the ________ the coupon rate on a bond, the ________ XXX) higher; longerB) higher; shorterC) lower; shorterD) greater; longerXXX:BThinking6) If a financial institution has 50% of its portfolio in a bond with a five-year duration and 50%of its portfolio in a bond with a seven-year duration, what is the duration of the portfolio?A) 12 yearsB) 7 yearsC) 6 yearsD) 5 yearsAnswer:CThinking7) An asset's interest rate risk ________ as the duration of the asset ________.A) increases; decreasesB) decreases; decreasesC) decreases; increasesD) remains constant; increasesXXX:B。