advanced accounting Chapter 11 - Solution Manual

- 格式:doc

- 大小:1.97 MB

- 文档页数:71

CHAPTER 13SEGMENT AND INTERIM REPORTINGANSWERS TO QUESTIONSQ13-1 Information on a company's operations in different industries would be helpful to investors in their assessments concerning the different profit rates, different degrees and types of risk, and different opportunities for growth of each of the different industries. In general, this breakdown helps the investors look behind the consolidated totals to the individual components that comprise the company.Q13-2 The relationship between the FASB's segment disclosure requirements and a company's profit centers focuses on the management viewpoint in FASB 131 (ASC 280). The FASB requires that the definitions of operating segments used for internal decision-making purposes be used for presenting segment information for financial statement purposes.Q13-3 The three ten percent significance tests used to determine reportable segments under FASB 131 (ASC 280) are the 10 percent revenue test, the 10 percent operating profit (loss) test, and the 10 percent assets test.For the 10 percent revenue test, the numerator and denominator are as follows:Each operating segment's total revenue(including intersegment transfers and sales)Combined revenue of all operating segments(including intersegment transfers and sales)For the 10 percent profit (loss) test, the numerator and denominator are as follows:Each operating segment's profit (loss)Absolute value of the combined profit orcombined losses of the operating segments(whichever is greater)For the assets test, the numerator and denominator are as follows:Each operating segment’s assetsCombined assets of all industry segmentsQ13-4 Whatever items are used for internal decision-making purposes to measure the operating segment’s profit or loss shall be reported in the external disclosure.Q13-5 Any segments passing one of the 10 percent tests would also be disclosed. The lower limit for the number of segments to be disclosed is set by the 75 percent revenue test. If the assumption is made that the largest four segments fail the 75 percent test and the largest five segments pass the 75 percent test, then the five segments should be separately reported. The remaining segments, if they fail the 10 percent tests, are combined under the heading of "Other Segments" and not defined further.Q13-6 First, FASB 131 (ASC 280)specifies that all companies should disclose revenues and long-lived, productive assets domestically and, in total, for all foreign activities. The two materiality tests applied to country-based foreign operations are the 10 percent revenue test and the 10 percent long-lived asset test. The profit or loss test is not used for foreign operations because of the many differences in tax structures and accounting practices in different geographic areas.Q13-7 A company must disclose for each of its significant customers the amount of sales to these customers and the associated industry segment. The names of the individual customers need not be disclosed, although some companies do disclose the names of the customers.Q13-8 Interim reports can be used by investors to identify a company's seasonal trends by identifying the pattern of revenue and expenses as they occur each interim period.Q13-9 The discrete view of interim reporting holds each interim period as a basic accounting period to be evaluated as if it were an annual accounting period. Any end-of-period adjustments and deferrals would be determined using the same accounting principles used for the annual report. The integral view of interim reporting holds each interim period as an installment of an annual period. Recognition and adjustment of certain income or expense items may be affected by judgments about the expected results of the entire year's operations. APB Opinion 28 (ASC 270 and 740) uses the integral view of interim reporting.Q13-10 Revenue from products sold or services rendered should be recognized as earned during an interim period on the same basis as followed for the full year. Revenue from seasonal businesses cannot be manipulated to eliminate seasonal trends.Q13-11 Those costs and expenses that are associated directly with or allocated to the products sold or to the services rendered for annual reporting purposes should be treated similarly for interim reporting purposes. The following practical modifications are allowed to the general rule:a. Estimated gross profit rates may be used to determine an interim period's cost ofgoods sold.b. Temporary reductions of inventories expected to be replaced by the end of thefiscal year should not be expensed through cost of goods sold at historical cost if the company uses the LIFO inventory valuation method. The expected replacement cost of the liquidated portion of the LIFO base should be used for the interim period's cost of goods sold.c. Inventory losses due to a decline in market prices are recognized in the period ofdecline using the lower-of-cost-or-market valuation method. Recoveries of market prices in later interim periods of the same fiscal year should be recognized as gains (recoveries of prior losses) in the later interim period.d. Companies using a standard cost system for inventories should use the sameprocedures for computing and reporting variances in an interim period as used for the fiscal year. Purchase price variances or volume or capacity variances that are expected to be absorbed by the end of the fiscal year should be deferred at the interim period and should not be included in the interim income.Costs and expenses other than product costs should be charged to income in interim periods as incurred or be allocated among interim periods based on an estimate of the time expired, benefit received, or activity associated with the periods.Q13-12 The application of the lower-of-cost-or-market valuation method differs between interim statements and annual statements when temporary market declines are expected to reverse by the end of the fiscal year. When a temporary market decline is experienced, the decline need not be recognized at the interim date because no loss is expected for the fiscal year.Q13-13 The integral theory of interim reporting would allocate the expenditure over the interim periods benefited. Thus, a portion of the $200,000 might be recognized over one or more interim periods. The discrete theory of interim reporting would recognize the entire $200,000 in the interim period when the expenditure was made.Q13-14 At the end of the second interim period, the company should make its best estimate of the effective tax rate expected to be applicable for the full fiscal year. The rate so determined should be used in providing for income taxes on a current year-to-date basis. The effective annual tax rate should reflect anticipated investment tax credits, foreign tax rates, percentage depletion, capital gains rates, and other available tax planning alternatives. In arriving at this effective annual tax rate, no effect should be included for the tax related to significant unusual or extraordinary items that will be separately reported or reported net of their related tax effect in reports for the interim period or for the fiscal year.Q13-15 If the future realizability of the tax benefit is not assured beyond a reasonable doubt, the tax benefit is not shown in the interim statements.Q13-16 Extraordinary items should be disclosed separately, included in the determination of net income for the interim period in which they occur, and shown net of applicable taxes. In determining materiality, extraordinary items should be related to the estimated income for the full fiscal year.Q13-17 A change in accounting principle made in an interim period is reported using the retrospective application process. The balance sheet for the earliest period presented (usually an annual period) is adjusted for the cumulative amount of the change as of the beginning of that year. Then, all subsequent annual and interim financial statements shall be adjusted to the newly adopted accounting principle. In the example of an inventory change, all the financial statements presented must be adjusted to the new method, the average cost method. The balance sheet for the earliest period presented must include the cumulative effect as of the change computed as of the beginning of that first period presented.SOLUTIONS TO CASESC13-1 Segment Disclosures [CMA Adapted]a. The purpose for requiring segment information to be disclosed in financial statements is to assist financial statement users in analyzing and understanding the enterprise's financial statements by permitting better assessment of the enterprise's past performances and future prospects.b. The determination of the segments appropriate for an enterprise is the responsibility of management; that is, management should use its judgment in deciding how to report its segment information. Specific characteristics or sets of characteristics management can use in determining how to group its products into segments include the following:1. Use of existing profit centers.2. A segment shall be regarded as significant and identified as a reportablesegment if one or more of the following are satisfied:i. 10% or more of the total revenue is derived from one segment.ii. 10% or more of the greater in absolute amount of the aggregate profitsor aggregate losses is contributed by the segment.iii. 10% of the combined assets can be associated with the segment.3. Management has the ability to define the breakdown of the segments, but thesegment definitions used for external purposes must be the same as used for internal decision making purposes.c. The options available to Chemax Industries are as follows:1. Segment by product line — antihistamines. This single product meets the 10percent test and can be anticipated as a significant product line in the future.2. Segment by product group —pharmaceutical, medical instruments, andmedical supplies. Antihistamines can be carried as a part of the pharmaceutical group.3. Disaggregate pharmaceutical into ethical and proprietary drugs and carryantihistamines under whichever industry segment is appropriate (probably proprietary drugs, in this case).C13-2 Matching Revenue and Expenses for Interim Periodsa. Revenue, product costs, gains, and losses should be recognized for interim periods on the same bases as for an annual period. These items should be recognized in the period earned or incurred and should not be deferred or allocated to other interim periods.b. Cost of goods sold and inventory valuation requires several estimations because physical counts typically are not made for interim periods. Cost of goods sold may be estimated using the gross profit method. Temporary liquidations of LIFO layers are priced using the replacement costs of the goods, not the LIFO cost. Temporary reductions in the market value below cost under the lower-of-cost-or-market rule do not need to be recognized in an interim period. However, reductions in value that may be permanent must be recognized. A loss recovery is allowed for recoveries of market value from one interim to another.c. Period costs are those such as depreciation or other amortizations and allocations. These should be allocated to each interim period based on a reasonable allocation method such as straight-line or percentage of the interim period's revenue to expected annual revenue.d. Accounting treatment for interim statements:1. Long-term contracts — These contracts are accounted for on the same basis as forthe annual period. Percentage-of-completion estimates are made each interim and gross profit is recognized. If the completed contract method is used, then profit is recognized only for projects completed within the interim period.2. Advertising costs — These costs may be capitalized and allocated to the interimperiods that benefit. However, no advertising costs are deferred beyond the end of the annual fiscal period. The allocation should be on a reasonable basis such as the percentage of interim revenue to expected annual revenue. Advertising costs or other costs that will benefit more than one interim period may be deferred under the integral approach used for interim reporting.3. Seasonal revenue —Revenue must be recognized in the period earned. Thecompany may not defer revenue from one interim to another in an attempt to smooth the revenue stream.4. Flood loss — Extraordinary items must be recognized in the interim period in whichthe event occurs.5. Annual major repairs and maintenance — Unusually large and nonrecurring costsmay be capitalized to the asset and carried past the end of the fiscal period.However, normal maintenance and repairs may not be carried beyond the end of the fiscal year. Some accountants account for repairs on an interim basis by charging each of the interim periods with a proportionate amount of the annual repair cost and establishing an allowance for repairs contra account to the plant and equipment account. The expenditure is then charged against the allowance account. Other accountants would charge the entire cost off in the interim period in which the expenditure is made.C13-3Segment Disclosures in the Financial Statements [CMA Adapted]a. A subdivision of an entity is a reportable segment if one of the following tests is met:1. Revenue, both unaffiliated and intersegment revenue, is ten percent or more oftotal revenue, which includes intersegment revenue. For each of Bennett's segments, divide the sum of the unaffiliated sales and intersegment sales by total company sales of $63,000. If the result is ten percent or more, the revenue test is met for that specific segment.2. The absolute value of profit or loss is ten percent or more of the greater of eitherthe total profit of segments that did not incur a loss or the total, in absolute amounts, of the segments that did incur a loss. For each segment, divide the absolute value of the profit or loss by the sum of the segment profits of $6,200. If the result is ten percent or more, the segment profit or loss test is met for that specific segment.3. Assets are ten percent or more of total assets. For each segment, divide the valueof the assets by total assets of $100,000. If the result is ten percent or more, the assets test is met for that specific segment.The calculations for the segments of Bennett Inc. yield results that show that all segments are reportable with the exception of Security Systems, which does not meet any of the tests. See the results of all the tests in the table below.Bennett Inc.Results of Required Tests for Determining Segment ReportingFor the Year Ended December 31, 20X5Power Fastening Household Plumbing SecurityTools Systems Products Products Systems Revenue 0.67 0.16 0.08 0.06 0.03 Profit 0.73 0.16 0.10 0.11 0.02 Assets 0.50 0.23 0.17 0.06 0.04 Reportable Yes Yes Yes Yes Nob. For the reportable segments of Bennett Inc. to represent a substantial portion of total operations, the combined revenue from sales to unaffiliated customers of all reportable segments must be at least 75 percent of the total sales for the company as a whole. Since the sales to unaffiliated customers of Bennett's reportable segments are $44,300 and represent approximately 96 percent of the company's total sales ($44,300 / $46,300), this criterion would be met.C13-4 Determining Industry and Geographic Segmentsa. This is an actual case adapted from experiences with a large, publicly-held U.S. company. The U.S. company's management was reluctant to disclose information about the Canadian operation's profitability because of the desire to maintain its economic competitiveness, and because of fear that Canadian authorities might want to increase regulation of non-Canadian owned companies operating in Canada.b. Under FASB 131 (ASC 280), the U.S. company must present its segmental disclosures based on the definition of operating segments as used for internal decision making. Therefore, if the management of the company felt that the two product lines were sufficiently comparable, management could aggregate the two product lines in the same operating segment for internal decision-making purposes. Then, because the two product lines were in one operating segment for internal decision-making purposes, they would be considered one operating segment for external disclosure purposes under FASB 131 (ASC 280). However, FASB 131 (ASC 280)also requires separate disclosure of revenues by product line. The company could still be required to disclose revenue information about the pasta product line.One interpretation the company could use to postpone separately disclosing detailed information about its pasta business is to argue that the pasta business passed one of the 10 percent tests in the current year because of some unusual, one-time events that are not expected to continue. Thus, if a segment becomes reportable in a single period because of some significant one-time events, the company may choose not to include it as a separately reportable segment. However, if in the next year, the pasta business continues to meet the separately reportab le segment tests, then the company’s management would not be able to use this argument.c. FASB 131 (ASC 280)requires separate disclosure of total revenues from external customers attributed to the domestic operations and the total attributed to all foreign operations. In addition, disclosure is required of the total of long-lived assets located in the country of the domestic operations and the total long-lived assets in all foreign countries. If the revenues or the long-lived assets in any individual country are material, then separate disclosure of the material revenues or significant amount of long-lived assets must be made for those specific countries. FASB 131 (ASC 280)did not specifically state a measure of materiality to be used in assessing foreign operations. Management does have the flexibility to determine the basis of assigning revenues to specific countries. For example, in this case, management may argue that the revenues should be based on the point-of-sale to the eventual consumer. Thus, sales of the pasta products in the U.S. would be assignable to the U.S. domestic market even though the product may have been manufactured in Canada.C13-5 Segment Reportinga. A great amount of information can be found on a company’s homepage ranging fr om financial information to product information and company profiles. The internet address for many companies includes their company name. Your students may simply use a web browser to do a search for a specific company.b. EDGAR is a comprehensive database of SEC filings for all publicly held firms. The URL is http://www.se and EDGAR can be accessed from there. All SEC filings for publicly held firms are available in this database and the filings can be easily printed off for further use, if required.C13-6 Interim Reportinga & b.Internet URL: /info/edgar.shtmlThe above Internet address provides access to the SEC’s EDGAR database. From thi s page, the user is able to select "Search for Filings” on the left-hand side of the page. The user then selects the link to search by “Company or fund name…" This link takes you to EDGAR Company Search page at which you will enter the Company name. After clicking on the “Find Companies” button at the bottom of the screen, students will be taken to a listing of the companies with that name, and can select their specific company which will then take them to the listing of all SEC filings for that company and they can then quickly scroll down to find a Form 10-Q.In comparison to the Form 10-K, several differences in Form 10-Q are noted. The interim financial statements and footnotes are entirely unaudited. As the interim financial statements are unaudited, no report from the independent public accountants is provided in the Form 10-Q.C13-7 Defining Segments for DisclosureMEMOTo: Randy Rivera, CFO, Stanford CorporationFrom:Re: Segment DisclosuresFor the current annual reporting period, Stanford Corporation has identified four operating segments that meet the quantitative thresholds to be considered reportable segments under FASB Statement No. 131 (FASB 131; ASC 280).Neither the cereals segment nor the sports beverage segment meets any of the three quantitative thresholds in the current period. [FASB 131, Par. 18; ASC 280-10-50-12]However, the FASB 131 (ASC 280) quantitative thresholds are intended to insure that information about significant business segments is included in the disclosures, not to limit the information that can be provided.The cereals segment, which was disclosed as a reportable segment last year, can continue to be reported this year if its disclosure provides significant information for the users of the financial statements, even though the segment does not meet the specific criteria for separate disclosure specified in paragraph 22 of FASB 131 (ASC 280).In addition, the segment disclosure standard allows companies to designate additional operating segments as reportable segments. Management may decide to provide separate disclosure of segment information for other segments that management feels that the disclosure would be of information value to the users of the financial statements.Finally, paragraph 24 of FASB 131 (ASC 280-10-50-18) addresses the possibility that identification of too many reportable segments might result in overly detailed segment information. As a general guideline, the standard suggests that a reasonable limit of 10 segments should be used and smaller, somewhat comparable segments can then be combined for purposes of the footnote disclosure.As a result of my research, I conclude that it would be acceptable for Stanford to report information about six segments, including the cereals and sports beverage segments. Disclosure of information for six segments does not approach the practical limit on the number of segments suggested in FASB 131 (ASC 280). The continuing significance of the cereals segment and the developing significance of the sports beverage segment make their inclusion appropriate even though these segments do not meet the FASB 131 (ASC 280) quantitative thresholds in the current year.Primary referencesFASB 131, Par. 22; ASC 280-10-50-16FASB 135, Par. 4 (x) [replaces a section of FAS 131, Par. 18]Other referencesFASB 131, Par. 24; ASC 280-10-50-18C13-8 Income Tax Provision in Interim PeriodsMEMOTo: Andrea Meyers, Controller's Department, Vanderbilt CompanyFrom:Re: Income Tax Provision in Interim PeriodsIn computing the income tax provision for interim periods, APB 28 (ASC 270 and 740) states that the company should make its best estimate of the effective tax rate expected to be applicable for the year. [APB 28, Para. 19; ASC 740-270-30-6] This estimate should reflect all expected tax credits, and other tax rates, such as foreign taxes. Therefore, anticipated tax credits available to Vanderbilt should be included in the computation of the expected effective annual tax rate.However, the first quarter calculation of this tax rate cannot include the anticipated energy tax credit benefits because the tax law providing the energy tax credit has not yet been enacted into law.Vanderbilt's first quarter estimate of the effective annual tax rate should not include the expected tax benefits of the energy tax credit. Changes in the tax rate are to be recognized as changes in estimate, according to APB 28 (ASC 270 and 740). If the legislation is enacted as expected, the effect of the tax credit should be factored into the estimate of the effective annual tax rate made at the end of the third quarter, which would reduce the income tax provision for the third quarter of 20X5.Primary referencesAPB 28, Par. 19; ASC 740-270-30-6FAS 109, Par. 288(h) [replaces a sentence of APB 28, Par. 20]; ASC 740-20-45-11Other referencesAPB 28, Par. 26; ASC 270-10-45-14C13-9 Questions about Interim Reporting1. In their third-quarter 10-Q, a company would have the following four income statements for the respective reporting periods:a. An income statement for the third quarter and a comparative income statement for thethird quarter of the prior year.b. An income statement for the cumulative first three quarters of the current year and acomparative cumulative income statement for the first three quarters of the prior year. 2. FASB 154 (ASC 250) requires that a change in depreciation method be accounted for as a change in accounting estimate affected by a change in accounting principle. The current and prospective application is used and prior financial statements are not restated. Thus, the third quarter and subsequent periods would report with the new depreciation method.3. The company would report a condensed balance sheet as of the end of the third quarter and a condensed balance sheet as of the end of the prior fiscal year. However, a company should also provide a comparative, condensed balance sheet as of the end of the third quarter of the prior fiscal year if it is necessary for understanding the seasonal fluctuations on the company’s financial condition.4. No, interim financial statements do not need to be audited. However, some companies choose to have their interims audited. Summary amounts from the interim reports are included in the annual financial report and are subject to audit review at that time.5. FASB 131 (ASC 280) requires segment disclosures in each interim report. However, the level of detail of information required in the interim report is less than that required in the annual report.6. Publicly owned companies classified as accelerated filers must file their 10-Q within 35 days after the end of each of their first three quarters. Companies not meeting the criteria of accelerated files must file within 45 days after the end of each of their first three quarters.7. The methods of computing revenues for interim reporting should be the same as those used for the annual financial statements. The reason for this is so that financial statement users may properly determine the revenue patterns during the year. However, if a company makes a change in accounting principle that affects the computation of its revenues, the company must retroactively apply the new accounting principle to all prior interims.8. A company is not required to take a physical inventory at the end of each quarter although a physical inventory is required as part of the annual audit procedures. A company usually estimates ending inventory for each quarter based on beginning inventory plus purchases, less the cost of sales. The cost of sales is estimated using the normal mark-up percentages from cost to retail.9. Many companies allocate costs incurred in a quarter that benefit the entire year. A common example of this are the costs associated with retooling efforts during the short period the company is shut down each year for retooling to take place. Several allocation methods are allowed such as allocating a fourth of the retooling cost to each quarter or relating the retooling cost to proportional sales revenue during the year. The key point to selecting an allocation method is that the method must be rational and relate to the benefits received from the cost.C13-9 (continued)10. This is a change in accounting principle for which FASB 154 (ASC 250)requires a retrospective application. All prior periods, including prior interims, are restated to the new accounting principle (percentage-of-completion) for the direct effects of the change. This presumes that the company is able to determine the effects of the change on previous interim periods. Otherwise the company must wait until the first day of the next fiscal year to make the change.11. This is a change in estimate and is treated currently and prospectively. Prior interims are not restated for this change in estimates. The change in estimate would be made effective as of the first day of the interim period in which the change is made.。

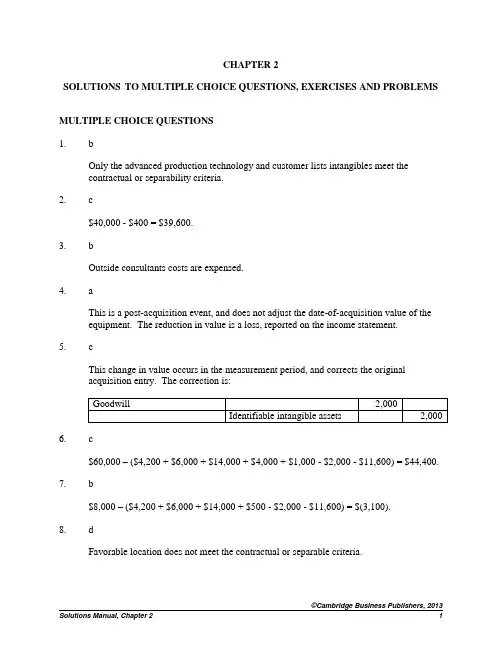

CHAPTER 2SOLUTIONS TO MULTIPLE CHOICE QUESTIONS, EXERCISES AND PROBLEMS MULTIPLE CHOICE QUESTIONS1. bOnly the advanced production technology and customer lists intangibles meet thecontractual or separability criteria.2. c$40,000 - $400 = $39,600.3. bOutside consultants costs are expensed.4. aThis is a post-acquisition event, and does not adjust the date-of-acquisition value of theequipment. The reduction in value is a loss, reported on the income statement.5. cThis change in value occurs in the measurement period, and corrects the originalacquisition entry. The correction is:6. c$60,000 – ($4,200 + $6,000 + $14,000 + $4,000 + $1,000 - $2,000 - $11,600) = $44,400.7. b$8,000 – ($4,200 + $6,000 + $14,000 + $500 - $2,000 - $11,600) = $(3,100).8. dFavorable location does not meet the contractual or separable criteria.©Cambridge Business Publishers, 20139. dThe Codification requires capitalization of acquired in-process R&D regardless of its alternative future use or probability of success.10. aWarranty liabilities are known liabilities, and are likely to be estimable within themeasurement period. The others are “other contingencies” and less likely to havemeasurable fair values at the date of acquisition.©Cambridge Business Publishers, 2013EXERCISESE2.1 Recording a Merger and a Stock Acquisition a.b.E2.2 Post-Combination Balance Sheet: Three Types of Combinations a. Allen makes the entries shown below in cases (1), (2) and (3), respectively:(1)(3)E2.2continueda. continuedAllen’s post-acquisition balance sheet for each case is as follows:Allen Corp.b. In the stock acquisition case, total assets are unchanged from Allen's pre-combinationbalance sheet, reflecting the payment of $300,000 cash and the acquisition of a $300,000 stock investment. In the merger and asset acquisition cases, total assets increase by$350,000. Cash of $300,000 was paid to acquire assets recorded at $650,000 (including $50,000 of goodwill). Note that $350,000 in liabilities were also recorded, so that there was no change in Allen's net assets.c.Benson Corp.Benson's only asset is $300,000 cash, consisting of its $50,000 prior balance plus$250,000 received from Allen in exchange for all its previous noncash assets andliabilities. The noncash assets and liabilities sold had a net book value of $200,000. The $50,000 gain on the sale is reflected in retained earnings.©Cambridge Business Publishers, 2013E2.3 Recording an AcquisitionE2.4 Bargain Purchase a.b.E2.5 Goodwill and Bargain PurchaseE2.6 Changes in Acquisition Valuesa. The value changes occurred during the measurement period. We know this becausegoodwill is adjusted, implying that the initial acquisition entry has been corrected.b.E2.7 Acquisition Cost©Cambridge Business Publishers, 2013E2.8 Identification of Reportable Intangibles a. Identifiable intangibles are to be recorded in a business combination. Identifiableintangibles include those arising from contractual and other legal rights and those which are separable. Of the eight intangibles listed, four appear to be based on contractual and other legalrights:One additional item appears to be separable, capable of being sold, licensed, or otherwisetransferred:The remaining three items appear to neither be based on contractual/legal rights norseparable. b.E2.9 Preacquisition ContingencyThe reduction in the estimated liability from $280,000 to $200,000 is the result of new information on liability value as of the acquisition date, so the reduction is treated as a correction of the original acquisition entry, within the measurement period.Changes in the estimated liability due to new information and events occurring after the acquisition date are reported in income.E2.10 Contingent Considerationa. The expected present value of the earnings contingency is calculated as follows:Value of stock issued x Probability = Expected value$200,000 x 0.25 = $ 50,000400,000 x 0.40 = 160,000500,000 x 0.35 = 175,000$ 385,000$385,000/(1.10)2 = $318,000 (rounded to nearest thousand)The expected present value of the stock price contingency is calculated as follows:Value of stock issued x Probability = Expected value$10,000,000 – 6,000,000 = $4,000,000 x 0.10 = $ 400,000$10,000,000 – 9,000,000 = $1,000,000 x 0.20 = 200,000$ 600,000$600,000/(1.10)2 = $496,000 (rounded to nearest thousand)E2.10 continueda. continuedPlank reports the initial acquisition as follows:b. (1) If the value change occurs within the measurement period, the acquisition entry isadjusted:(2) If the value change occurs after the measurement period (and is therefore due toevents subsequent to the acquisition), the value change is reported in earnings:©Cambridge Business Publishers, 2013E2.11 In-Process R&D, Other Previously Unreported Intangibles, GoodwillThe in-process R&D and patent rights meet Codification requirements for capitalization. The contracts under negotiation with potential customers and the skilled workforce do not meet the contractual or separability criteria, so these assets are reported as part of goodwill.The acquisition entry is as follows:E2.12 Valuation of Earnings ContingencyThe expected payment is computed as follows:(6,500,000 – 5,500,000) x $0.50 x 0.25 = $ 125,000(7,500,000 – 5,500,000) x $0.50 x 0.20 = 200,000$ 325,000The payment takes place at the end of the year, so the present value is:$325,000/(1.06) = $306,604PROBLEMSP2.1 Acquisition Entries, Various Types of Combinations, Acquisition Costsa.b. Assume all fair value estimates have been reassessed and are considered accurate. Thejournal entry made by Plastic to record the merger appears below.c.©Cambridge Business Publishers, 2013P2.2 Identification of Acquirer and Balance Sheet Valuationa. (1) Axtel Inc.Balance Sheet(2) Barcel Inc.Balance Sheetb. Fair values are recorded only for the acquired company; net assets of the acquiringcompany remain at book value. A reconciliation is provided below.c. In this situation, it is likely that Coppel is being formed by the combining parties. One ofthe combining entities must be designated the acquiring company. Both Axtel and Barcel are of equal size in terms of book value of stockholders= equity. Axtel is larger in terms of fair value of net assets. Axtel stockholders also receive the majority interest (60%) in the new company. Thus, Axtel would likely be designated the acquiring company.Coppel, Inc.Balance SheetP2.3 Acquisition Adjustments and Merger Costs(all amounts in thousands)a. The goodwill balance on GameStop’s balance sheet represents the sum of reportedgoodwill on all its acquisitions. GameStop apparently made prior acquisitions where the acquisition price exceeded the fair values of acquired identifiable net assets.b. Balance at February 3, 2007 $ 1,403,907Reduction in goodwill by revision of accruedmerger-related liabilities (406) Additional purchase price adjustments (1,061)Goodwill at February 2, 2008 $ 1,402,440c. Adjustments to the original amount of goodwill recorded must occur within themeasurement period, and relate to clarifications of the fair values of identifiable assetsand liabilities acquired, preacquisition contingencies, earnout or stock price contingency values included as part of the acquisition price, as of the date of acquisition.If the purchase price adjustments reduce goodwill, this implies that the revisions in value either increased the reported fair values of identifiable assets or preacquisitioncontingencies reported as assets, or reduced identifiable liabilities, earnouts, stock price contingencies, or preacquisition contingencies reported as liabilities.d. Prior to 2009, merger-related costs, such as legal or consulting fees, were reported as apart of the acquisition cost, increasing goodwill. Under current GAAP, these costs areexpensed as incurred and do not impact the value of assets and liabilities acquired.According to the GameStop disclosure, $612 in merger-related liabilities were accrued,increasing goodwill. As of February 2, 2008, the actual payments for merger-relatedcosts were only $206, so the estimated costs were $406 too high and therefore goodwillwas adjusted downward by that amount.Following current requirements, the $206 in merger-related costs that remain as part ofthe current goodwill balance would not be reported as goodwill but would instead betreated as expenses. Therefore goodwill at February 2, 2008 would be $1,402,234 (=$1,402,440 – 206).©Cambridge Business Publishers, 2013P2.4 Type of Business Combination, Identification of Acquiring Companya. Corporate History:11/96: Babbage’s is formed.10/99: Babbage’s acquired by, and becomes wholly-owned subsidiary of, Barnes & Noble.6/00: Barnes & Noble acquires Funco, Inc.; Babbage’s becomes a wholly-owned subsidiary of Funco.12/00: Funco changes its name to GameStop, Inc.8/01: The original GameStop Corp. (now referre d to as “Historical GameStop”) is incorporated as a holding company for GameStop, Inc.2/02: Historical GameStop issues 41,528,000 shares in a public offering. Barnes & Noble receives 72,018,000 shares for its ownership of GameStop, Inc.10/04: Historical GameStop repurchases and retires 12,214,000 shares from Barnes & Noble. Barnes & Noble distributes its remaining 59,804,000 shares to itsshareholders as a dividend. GameStop Holdings Corp. is formed, and all stock isconverted to stock of that company.4/05: GSC Holdings Corp. is formed for the purpose of completing the business combination of GameStop Holdings Corp. (formerly GameStop Corp. or“Historical GameStop”) and Electronics Boutique Holdings Corp.10/05: The above merger is completed. GSC Holdings Corp. changes its name to GameStop Corp.b. This combination was a statutory consolidation. GSC Holdings Corp. was formed toacquire GameStop Holdings Corp. and Electronics Boutique Holdings Corp.c. GameStop Holdings’ stockholders had the large r voting interest in the combinedcompany – they received 104,135,000 shares compared to 40,458,000 shares for theformer Electronics Boutique stockholders. There is not enough information to assess the other criteria.d. The acquisition price of Electronics Boutique was $1,430,398,000. This may bedetermined as the total consideration paid of $1,443,956,000 minus the transactions costs (merger expenses) of $13,558,000, or as the value of the stock given to EB stockholders $437,144,000 plus the cash paid for EB stock and stock options $993,254,000.P2.5 Identifiable Intangibles and Goodwilla.Note: The lease, service contracts, and trade name qualify as identifiable intangibles, asthey are based on legal or contractual rights. The work force does not qualify as anidentifiable intangible, as it is neither separable nor based on legal/contractual rights.Thus the work force value is included as part of goodwill.b.Notes:(1) Cash paid for professional fees ($1,200,000) and registration and issue costs($600,000).(2)Proceeds from stock issue ($35,000,000) less registration and issue costs ($600,000).No par value is specified, so it is not possible to distinguish common stock at parvalue from additional paid-in capital.©Cambridge Business Publishers, 2013P2.6 Goodwilla. The following business factors or conditions might give rise to goodwill:∙Well-trained, motivated, and cooperative employees, and superior management.∙Product-related factors such as reputed high quality.∙Exclusive processes or formulas.∙Loyal customer base.∙Favorable or unusual location, and good distribution channels.b.c. Goodwill is recorded as an asset only when acquired from another enterprise, i.e., LisaCorporation's purchase of Toga Corporation. The goodwill was not included on Toga Corporation's balance sheet since the cost of developing, maintaining, or restoringintangible assets that are not specifically identifiable was expensed as incurred by Toga Corporation.P2.7 Bargain Purchase and Preacquisition Contingencya. The entry below assumes the fair values of net identifiable assets acquired are accurate.b. The $500,000 decline in the value of the lawsuit is a clarification of value as of the dateof acquisition and is within one year of the acquisition date. Therefore the value change occurs within the measurement period, and the original acquisition entry is adjusted, asfollows:c. The $100,000 increase in the value of the lawsuit is reported as a loss, and is not acorrection in the original acquisition entry. The entry to record settlement of the lawsuit is as follows:©Cambridge Business Publishers, 2013P2.8 Post-Combination Balance Sheet, Goodwill(all amounts in millions)Softdata makes the following entry to record the acquisition:Softdata’s post-acquisition balance sheet is as follows:P2.9 Merger Entry, Valuation Adjustments(all amounts in millions)a.Price paid $ 37,738Fair value of identifiable net assets 22,267Goodwill $ 15,471b. The following discussion appears in Sprint Nextel’s 2005 10-K:We paid a premium (i.e., goodwill) over the fair value of the net tangible and identifiedintangible assets of Nextel for a number of potential strategic and financial benefits that are expected to be realized as a result of the merger, including, but not limited to, thefollowing:∙the combination of extensive network and spectrum assets, which enables us to offer consumers, businesses and government agencies a wide array of broadband wirelessand integrated communications services;∙the combination of Nextel’s strength in business and government wireless services with our position in consumer wireless and data services, including servicessupported by our global IP network, which enables us to serve a broader customerbase;∙the size and scale of the combined company, which is comparable to that of our two largest competitors, is expected to enable more operating efficiencies than eithercompany could achieve on its own; and,∙the ability to position us strategically in the fastest growing areas of thecommunications industry.c. Because this acquisition took place prior to the current standards, Sprint used theannouncement date share price to value the stock issued to Nextel’s former shareholders.Currently, stock issued for acquisitions is valued at the share price when control changes hands, typically when the acquisition is completed. One might argue that theannouncement date stock price represents the intended acquisition cost. However, thestock price at the date of acquisition better represents actual acquisition cost. Thedifference between these two prices may not be an issue, however, if the acquiringcompany adjusts the amount of stock issued for changes in stock price between theannouncement date and the acquisition date.©Cambridge Business Publishers, 2013P2.9 continuedd.e.(1) Sprint’s disclosure does not identify the specific equity account affected by thedeferred compensation. It is likely that Sprint recorded the liability but the relatedexpense does not yet appear on the income statement; in that case the original debitand the subsequent credit adjustment may be to accumulated other comprehensiveincome.P2.10 Earnings Contingency, In-Process R&D, Bargain Purchase(all amounts in thousands)a. ($60,000 – $50,000) x 2 = $20,000 x.08 = $1,600($80,000 – $50,000) x 2 = $60,000 x .02 = 1,200$2,800$2,800/(1.05)2 = $2,540b. Price paid: Cash $1,250,000Earnout 2,540Total price $1,252,540Fair value of reported assets: $8,200,000Fair value of reported liabilities: (7,850,000) (350,000)Fair value of unreported IPR&D (1,000,000)Gain on acquisition $ 97,460c.d.©Cambridge Business Publishers, 2013P2.11 Bargain Gain, Contingent Consideration, and Changes in Estimates(in thousands)a.b.c.d. The entry would be the same, except the contingency consideration fair value would notbe adjusted; the loss would be $3,167.P2.12 Multiple Asset Acquisitions, Analysis of Combination Termsa. Reconciliation of shares issued, as per balance sheet:Shares issued as of March 31, 2008 49,509,829Shares issued as of June 30, 2007 15,764,842Increase in shares 33,744,987Shares issued to Alternative Energy 4,000,000Shares issued to Boreal for wind project assets 18,500,000Shares issued to Boreal for Navitas stock 10,000,000Shares issued for cash 1,159,987Shares issued to executives 85,000Total shares issued 33,744,987b. Dollar amount assigned to shares issued:(1) Per analysis of asset accounts:Increase in wind farm assets $ 3,150,000Increase in wind projects assets 13,096,175Increase in Navitas stock 11,287,250Increase in goodwill 1,387,750Less: acquisitions for cash (851,175)Calculated value of shares issued $28,070,000(2) Per analysis of equity accounts:Increase in common stock account $ 1,687,249Increase in additional paid-in capital account 27,374,667Less: cash received for issued shares (945,416)Less: value assigned to shares issued to executives (76,500)Calculated value of shares issued $28,040,000 Note to instructor: There are slight unexplained differences between these two calculated values and the value disclosed on the company’s cash flow stat ement.©Cambridge Business Publishers, 2013P2.12 continuedc. Per share valuations for each acquisition:∙Wind farms from Northern Alternative Energy, $3,150,000, divided by 4,000,000 shares, equals $.7875 per share∙Wind projects from Boreal, $13,632,750 ($13,096,175 increase in wind project assets, less $851,175 acquired for cash, plus $1,387,750 goodwill), divided by 18,500,000shares, equals $.7369 per share∙Navitas stock acquired from Boreal, $11,287,250, divided by 10,000,000 shares, equals $1.1287 per shareThe first two were valued below the market value of the shares when the acquisitionoccurred, and the third may have been as well. A reason for this is that the issuance of a large number of shares relative to the number already outstanding likely would havedepressed the prevailing market price. Note that the shares sold for cash averaged $.8150 per share.d. The company’s MD&A disclosed the following:Our valuation of Boreal assets was based on a number of tangible and intangible factors including the book value of certain as sets on Boreal’s audited balance sheet, thedevelopment status of certain wind farms now underway, the extensive Boreal pipeline of future prospects, recent industry transactions reflecting value creation payments forcompleted wind farms and early stage pipeline prospects, anticipated price/earningsratios from comparisons to peer group public companies, and other considerations of the Board of Directors of the Company.e. The acquired assets need to be carefully estimated in terms of their fair values, includingpreviously unreported identifiable intangibles. Assuming this is a business combination subject to ASC Topic 805 requirements, if the cost (the recorded amount of Navitas stock) exceeds the fair value of the identifiable net assets acquired, goodwill will be recorded.If the fair value of net identifiable assets acquired exceeds the cost, a gain on acquisition will be recorded.。

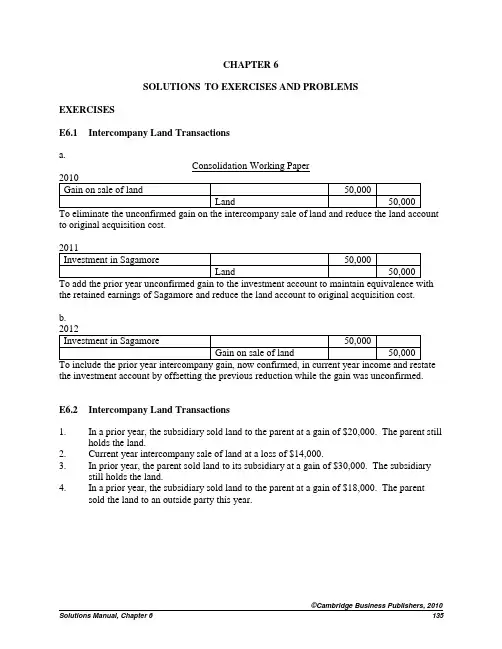

CHAPTER 6SOLUTIONS TO EXERCISES AND PROBLEMSEXERCISESE6.1Intercompany Land Transactionsa.Consolidation Working Paperto original acquisition cost.the retained earnings of Sagamore and reduce the land account to original acquisition cost.b.the investment account by offsetting the previous reduction while the gain was unconfirmed.E6.2 Intercompany Land Transactions1. In a prior year, the subsidiary sold land to the parent at a gain of $20,000. The parent stillholds the land.2. Current year intercompany sale of land at a loss of $14,000.3. In prior year, the parent sold land to its subsidiary at a gain of $30,000. The subsidiarystill holds the land.4. In a prior year, the subsidiary sold land to the parent at a gain of $18,000. The parentsold the land to an outside party this year.during 2011, from the beginning inventory. Prior year profits on upstream sales are removed from Converse’s beginning retained earnings; $10,000 = $50,000 x 20%. Prior year profits on downstream sales are added to Nike’s Investment in Conv erse as they had been removed from the Investment account via the 2011 equity accrual; $18,000 = $78,000 - 78,000/1.3.20% = $8,000) + [91,000 - (91,000/1.3) = $21,000].E6.4 Analysis of Land Sale AlternativesUnder a direct sale of the land by Sawyer to the developer, Sawyer reports a gain of $3,900,000. The noncontrolling interest in net income is $780,000 (= .2 x $3,900,000) and the distribution to the noncontrolling shareholder is $390,000 (= .5 x $780,000).Under the intercompany sale, even though the gain is larger, it is eliminated in consolidation, and does not enter into the noncontrolling interest in net income. As long as the parent holds the land (which it plans to do under a long-term lease), the gain is not reflected in noncontrolling interest i n net income. Moreover, the income from the lease is the parent’s income, so the noncontrolling interest is unaffected. Under this approach, the noncontrolling stockholder receives nothing.Hence, the direct sale of the land by Sawyer to the developer generates the most dividends for the noncontrolling stockholder.$150,000).basis.depreciation recorded in prior years and reduce the equipment to its net book value at date of intercompany sale.basis.E6.6 Various Intercompany Transactionsa. Consolidation Working Paperb. Consolidation Working PaperE6.7 Intercompany Transactions, Equity Method Income and Noncontrolling Interestsales (=7/10 x $800,000).E6.8 Income Effects of Unconfirmed Intercompany ProfitsE6.9 Consolidated Income Statement—Intercompany Transactions (all amounts in thousands)b.PCO and SCOE6.10 Consolidated Income Statement, Intercompany Transactionsb.Pon and StarE6.11 Ratio Analysis of Enron-Type Intercompany Transactions(all dollar amounts in millions)a.1. ROA = ($9,000 - $8,000 + $500)/($10,000 + $500) = $1,500/$10,500 = .143ROS = $1,500/($9,000 + $3,000) = $1,500/$12,000 = .1252. ROA = ($9,000+$2,000-$8,000-$1,900)/($10,000+$4,000)= $1,100/$14,000 = .079ROS = $1,100/($9,000 +$2,000) = .10Consolidation (2) eliminates the intercompany revenue and the unconfirmedintercompany gain, voiding the internal transaction for financial reporting purposes.Ratios look b etter when the transaction with the SPE is considered to be arm’s length and consolidation is avoided (1).b.1. TL/TA = $6,000/($10,000 + $3,500) = $6,000/$13,500 = .4442. TL/TA = ($6,000 + $3,600 + $3,500)/($10,000 + $4,000 + $3,500)= $13,100/$17,500 = .749Without consolidation (1) Sponsor recognizes the $3,500 cash but not the liability, but in consolidation (2) the liability is also counted along with Sponsoree’s assets and liabilities.Sponsoree is more leveraged than Sponsor; Sponsoree’s se parate TL/TA = $3,600/$4.000 = .9, while Sponsor’s separate TL/TA = $6,000/$10,000 = .6. Therefore consolidatingSponsoree causes consolidated TL/TA to be higher than Sponsor’s separate TL/TA.c.1. ROA = [$9,000 - $8,000 + .25 ($4,300 - $3,500)]/($10,000 + $3,500)= $1,200/$13,500 = .0892. ROA = ($9,000 + $2,000 – $8,000 – $1,900)/($10,000 + $4,000 + $3,500)= $1,100/$17,500 = .063Enron apparently used this technique to recognize gains on its own stock as income,something not permitted by GAAP. Without consolidation (1), Sponsor’s incomeincludes 25% of the “gain” on its stock recognized in Sponsoree’s income and booked by Sponsor via the equity method. With consolidation (2) the “stock issuance” is voided and neither entity recognizes income on the appreciation of Sponsor’s stock.E6.12 Comprehensive Consolidated Net IncomePROBLEMSP6.1 Consolidation Working Paper, Noncontrolling Interest, Intercompany Inventory Transactionsb. Calculation of 2010 Equity in Net Income and Noncontrolling Interest in Net Income (inP6.2 Consolidation Working Paper, Noncontrolling Interest, Intercompany Merchandise Transactions(all amounts thousands)Note: The long-term debt premium is completely amortized by 2010.P6.3 Intercompany Transfers of Depreciable Assetsa. Consolidation Working Paperrecorded in prior years and reduce the asset account to its net book value at date of intercompany sale.recorded in prior years and reduce the asset account to its net book value at date of intercompany sale.To eliminate the intercompany loss unconfirmed in prior years, add back the reduced depreciation recorded in prior years and increase the asset account to its book value at date of intercompany sale.which had not been confirmed through depreciation as of the beginning of the year. This remaining portion, which would have reduced depreciation over the next six years (including 2012), has now been fully confirmed by an external sale in 2012.NOTE: If there is a noncontrolling interest in Smart, it shares in this $30,000 gain but not in the gain of $280,000 recorded by Pert on the external sale; $280,000 = $400,000 – [$200,000 – 4 x ($200,000/10)].P6.4 Consolidated Income Statement—Intercompany Transactionsb.Pow Company and Sow Company(1) $32,000,000 = $25,000,000 + $10,000,000 - $3,000,000 (intercompany sales).(2) $1,510,000 = $1,200,000 + $500,000 - $250,000 (unconfirmed gain on machinery) +$60,000 (prior period gain on land now confirmed).(3) $23,400,000 = $19,000,000 + $7,600,000 - $3,000,000 (intercompany purchases) - $400,000(intercompany profit in beginning inventory assumed confirmed) + $200,000(unconfirmed intercompany profit in ending inventory)(4) $5,850,000 = $4,100,000 + $1,800,000 - $50,000 (excess depreciation)(5) $1,000,000 = $800,000 + $300,000 - $100,000 (unconfirmed loss on land)P6.5 Equity Accrual and Eliminating Entries—Intercompany Asset Transfers and Services(all numbers in thousands)b. Consolidation Working Paperland account to original acquisition cost.the $20,000 gain confirmed to Singular in 2012.basis.and establish the book value of noncontrolling interest as of 1/1/12.(1) $1,580,000 = $1,500,000 + $150,000 - .4 x $150,000 - $10,000, where $1,500,000 = $1,250,000 + $300,000 –$50,000 Goodwill = Stockholders’ equity—Singular at 1/2/11.Goodwill attributed to the controlling interest = $1,250,000 – 80% x $1,500,000 = $50,000; no goodwill is attributed to the noncontrolling interest.Note that the above entries eliminate the Investment in Singular balance of $1,390,800, calculated as follows:(2) Equity in net income for 2011 calculation:P6.6 Comprehensive Problem: Consolidation Working Paper and Financial Statements(all amounts in thousands)b. Calculation of 2012 Equity in Net Income and Noncontrolling Interest in Net Income (inP6.7 Calculation of Investment balance and Consolidated Retained Earnings Several Years Later(all amounts in thousands)P6.8 Bonus Based on Adjusted Subsidiary IncomeP6.9 Consolidated Income Statement—Intercompany Transactionsb.Portland Company and Salem CompanyC heck: Consolidated net income to the controlling interest must equal Portland’s reported net income, including the equity income accrual. $15,478,000 = $10,000,000 + $5,478,000.NOTE ON THE PATENT: The patent acquired internally from Salem had a net book value of $200,000 [= $500,000 - (3/5) X 500,000] when sold by Portland for $420,000. The $220,000 (= $420,000 - 200,000) external gain reported in other income is fully confirmed and does not affect the consolidation. This year’s $50,000 (= $250,000/5) excess amortization is eliminated—increasing income—because the patent was held internally for the entire year. Moreover, the remaining $100,000 upstream intercompany gain is now fully confirmed by the external sale and is added to this year’s income. T he $100,000 is the original $250,000 intercompany gain reduced by three years of excess amortization at $50,000 a year.P6.10 Comprehensive Intercompany EliminationsConsolidation Working PaperP6.11 Consolidation of Equity Method InvestmentsEliminating entries:(a) Removes equity investees’intercompany revenues and cost of sales from theequity method income account and assigns them to revenues and cost of sales.(C) Removes the remaining equity method income balance, 51% of investeedividends, and adjusts the investment by the difference.(I-1) Removes intercompany revenues generated from investees.(I-2) Removes intercompany receivables and payables ($32,200 = $30,600 + $1,600).(E) Eliminates investee beginning equity against the investment (51%) andnoncontrolling interest (49%).(R) Recognizes the beginning-of-year goodwill balance. The remaining balance in the investment ($70,685) represents 51% of the total goodwill balance of$138,598 (= $70,685/.51). The remainder is credited to noncontrolling interest.(N) Recognizes $78,178 noncontrolling interest in investee income (= 49% x $159,547), eliminates the noncontrolling interest’s dividends and updates thenoncontrolling interest for the current year.b.P6.12 Evaluation of Eliminations Disclosuresa.Machinery & Engines is the parent company. Its records show an “Investment in Financial Products” account. We also observe that the income and stockholders’ equity of Machinery & Engines equal the consolidated amounts, a characteristic that is true of parent companies of wholly-owned subsidiaries that use the complete equity method on their own books.b.The fact that no goodwill arises in the consolidation of Machinery & Engines with Financial Products suggests that Financial Products was formed as a subsidiary company by Machinery & Engines, rather than acquired in a business combination. Goodwill arises when the acquisition cost exceeds the fair value of the subsidiary’s identifiable net assets. When a parent company forms a subsidiary, there is no goodwill.Another possible explanation is that the excess of acquisition cost over the acquisition-date fair value of identifiable net assets acquired is fully explained by revaluations of identifiable net assets.A third explanation is that the acquired goodwill has been completely written off as impairment loss (or amortization prior to 2002) in previous years.c.The goodwill on the books of Machinery & Engines suggests that Machinery & Engines acquired other companies in the past, and merged them into the parent. Because the other companies are no longer separate legal entities, Machinery & Engines reports their assets and liabilities directly on its own books, as discussed in Chapter 2 of this text.d.Financial Products earned $400 million in revenue from Machinery & Engines; there was no intercompany revenue in the other direction.e.Eliminating entry (in millions):f.The main intercompany activity involves financing of customer receivables. Over $3 billion was added to current trade receivables and subtracted from current finance receivables, and over $550 million is added to long-term trade receivables and subtracted from long-term finance receivables, suggesting that Financial Products finances a significant amount of the sales made to Machinery & Engines customers.。

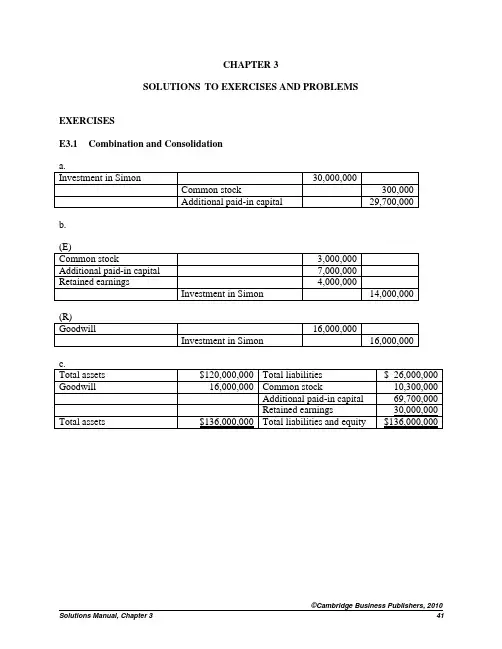

CHAPTER 3SOLUTIONS TO EXERCISES AND PROBLEMS EXERCISESE3.1Combination and Consolidationb.E3.2Eliminating Entries—Various CasesIn each case, Pluto acquires 100,000 shares of Saturn (=$200,000/$2). Entry (E):Entry (R):E3.3 Simple Consolidation, Previously Unreported IntangiblesE3.4 Eliminating Entries, Acquisition Expensesconsolidation eliminating entries.E3.5 Acquisition and Eliminating Entries—Bargain Purchase (amounts in millions)Calculation of gain on acquisition:Fair value of S = $2,500 + $100 + $100 + $250 + $30 = $2,980 $2,980 – $2,750 = $230 gainb. Consolidation working paper elimination entries:entries.E3.6 Interpreting Eliminating Entriesa.The stockholders’ equity (book value) of Seaboard is $48,000,000, based on the first eliminating entry.b.The acquisition cost is $88,000,000, so the excess paid over book value is $40,000,000.E3.7 Acquisition Entry and Consolidation Working Papera. Bates makes the following entry to record the acquisition (amounts in millions):This entry is reflected in Bates’ account balances in the consolidation working paper below.E3.8 Identifying and Analyzing Variable Interest Entitiesa.The equity interests are traditional variable interests. However, because minority shareholder C guarantees 92% of A’s debt, which is most of A’s capital, and will absorb 92% of A=s expected losses by protecting the subordinated debtholders, A is a VIE. Even if a single investor owns the other 70% of the equity, and obtains 70% of the expected residual returns, C will absorb a majority of A’s expected losses and will likely be designated as A’s primary beneficiary. One could also note that because A’s equity is less than 10% of its total assets (.08 = 1 - .92) a presumption exists that A is a VIE.b.Without any other information, D is the sole owner of B and should consolidate B under SFAS 94. Although contractual and other arrangements could suggest that B is a VIE, the problem is silent on these matters.c.The 15% equity could be enough to avoid identifying A as a VIE, if that amount of equity is deemed adequate to absorb A’s expected losses. If the 15% equity is not adequate, by agreeing to compensate E for any of A=s losses, C is providing the subordinated financial support that qualifies as a variable interest, makes A into a VIE, and is likely A’s primary beneficiary. As an example, if A reports income that exceeds 10% of its average equity, the excess is distributed to C. A’s shareholders could view this as a kind of insurance payment for being protected from losses, and would report it as an expense. Suppose A earns $18 on average equity of $100. Of this, $8 (= $18 – 10% x $100) is C=s share, accounted for as follows:Dr. Expense 8Cr. Payable to C 8A therefore reports final net income of $10 (= $18 - $8).d.The facts indicate that D is the likely primary beneficiary of variable interest entity B. B’s 10% stockholders= equity is insulated from losses by the guarantees provided by C and D, indicating that B is a VIE. Even though B leases far more property to C than to D, losses in guaranteed residual values on D’s specialized property seem much more likely because of the active aftermarket for property leased by C. Moreover, D’s unsecured loan to B provides additional subordinated financial support.E3.9 Reconstructing Eliminating Entries and Book Valuea.Consolidated total assets $ 13,000,000Less: Cove’s current assets (5,200,000)Less: Cove’s noncurrent as sets (3,800,000)Fair value of Bay’s total assets $ 4,000,000Less: Goodwill (340,000)Fair value of Bay’s identifiable assets $ 3,660,000b.Acquisition cost $ 1,600,000Less: Goodwill (340,000)Fair v alue of Bay’s identifiable net assets $ 1,260,000Fair value of Bay’s identifiable assets (from a. above) $ 3,660,000Less: Fair value of Bay’s identifiable net assets (1,260,000)Fair value of Bay’s liabilities $ 2,400,000c.Fair value of Bay’s identifiable net assets (from b. above) $ 1,260,000Less: Fair value of previously unreported intangibles (800,000)Book value of Bay’s net assets $ 460,000d.E3.10 Identification of Variable Interest Entity and Primary Beneficiarya.The answer to this question depends on the ability of the equity interest to absorbStartek’s potential losses. FIN46(R) specifies that if the equity interest is less than 10percent of total assets, the entity is a VIE unless there is evidence to the contrary.However, in this case, the equity interest is 13 percent of assets (=$4,000,000/$30,000,000). An analysis of expected gains and losses is as follows (inmillions):The equity interest of $4,000,000 is insufficient to absorb expected losses of $8,000,000, so Startek would likely be identified as a VIE.b.Because Softek gu arantees Startek’s debt, it is the primary beneficiary that willconsolidate Startek.E3.11 Acquisition and Eliminating Entriesa.No—goodwill of $2.2 billion is currently present, so it is unlikely that any revaluationswill result in a bargain purchase.b.c.E3.12 Consolidation Policy: U.S. GAAP and IFRSa.Randolph owns 64% of the voting rights [.64 = (.8 x .60) + (.4 x .40)], and meets the majority ownership test for consolidation of SFAS 94.b.IFRS also recognizes the legal control signified by ownership of 64% of the voting rights and consolidation would occur.c.Randolph’s ownership of the Class A shares produces 48% ( = .8 x .60) of the voting interest. U.S. GAAP emphasizes majority ownership of the voting stock, so consolidation is unlikely. IFRS looks at decision making power. The other investor owns 40% of the voting rights. Thus Randolph does not control the voting rights and decision-making authority appears to be shared. However, the influence of the other 12% of the Class A shares voting rights must be examined. If Randolph can demonstrate sufficient influence over that other 12% to dominate Marshall’s governing board, effective control may exist, requiring consolidation under IFRS, but it seems unlikely without additional information. In sum, the available evidence points away from consolidation.d.Now Randolph owns 42% ( = .7 x .60) of the voting interest and all other interests are dispersed. These facts sugg est that Randolph can dominate Marshall’s governing board thereby possessing unshared decision-making power and consolidation would be required under IFRS. Randolph does not have majority ownership, and consolidation under U.S. GAAP is unlikely.PROBLEMSP3.1 Working Paper Eliminating Entries, Goodwill (amounts in millions)b.P3.2 Consolidated Balance Sheet Working Paper, Identifiable Intangibles, Goodwill$60 – $2 - $3P3.3 Stock Acquisition and Consolidation Working Paper Eliminating Entries (amounts in millions)c.P3.4 Consolidated Balance Sheet, Bargain Purchase ( amounts in millions)a. Calculation of gain on acquisition:P3.5 Consolidated Balance Sheet Working Paper, Previously Reported Goodwill( amounts in thousands)(1) Although proper accounting for held-to-maturity debt securities is amortized cost, theyare nonetheless adjusted to fair value, as that represents their cost to Placid.(2) All pre-existing goodwill is eliminated, even though it may be deemed to have a non-zerofair value.P3.6 Consolidated Balances, Different Acquirersa.The consolidated working paper for Microtech’s acquisition of Webnet Solutions is asb. The consolidated working paper for Webnet Solutions’ acquisition of Microtech is asfollows:c.Both sets of consolidated balances report the same total assets and the same individual liabilities and equities. However, the individual asset accounts differ. The acquirer’s assets are not revalued to fair value, nor are previously unreported assets recognized. Microtech has understated property, plant and equipment and patents, as well as unreported identifiable intangible assets. Webnet Solutions’ assets and liabilities are fairly reported, and there are no identifiable intangibles. When Microtech is the acquirer, the difference between Webnet Solutions’ acquisit ion price and reported book value is reported as goodwill, and the difference between book and fair value of Microtech’s assets is not recognized. When Webnet Solutions is the acquirer, its goodwill is not recognized, but Microtech’s property, patents, an d identifiable intangibles are reported.Does management want the $159 million purchase premium to be reported as the unspecified and possibly unproductive asset goodwill, or distributed among several potentially productive identifiable assets ($20 million to property, plant and equipment; $10 million to patents; $100 million to developed technology; $29 million to client relationships)? If Webnet Solutions is the acquirer, Microtech’s previously unreported assets will come to light. To the extent that the existence of identifiable intangibles such as developed technology and client relationships indicate favorable future earnings potential, investors may view the new disclosures as a positive signal, increasing stock price. If Microtech is the acquirer, no identifiable intangibles are recognized, and investors may wonder if Webnet Solutions will sustain its value in the future, as these assets would seem to be the lifeblood of a technology company.Management will also consider the implications for future income. Identifiable assets usually have limited lives and are depreciated or amortized over time, reducing earnings on a regular basis. Goodwill is tested for impairment loss, and may never be written off. If Microtech is the acquirer, future reported income may be higher because there are no identifiable intangibles to be amortized.Note to instructor: This contrived problem illustrates the games companies can play to choose between different financial statement effects portraying the same transaction economics.P3.7 Tangible and Intangible Asset Revaluations(in millions)b.The fair values of the tangible liabilities of Good Technology, Netopia, and Terayon are greater than the fair values of their assets, and since net book values are positive, the fair values of net tangible assets must be less than related book values. Since book values of liabilities are generally close to fair value, the cause is likely to be a decline in the value of tangible assets. For technology companies, tangible assets such as equipment are likely to lose resale value quickly. Motorola lists identifiable intangibles acquired as completed technology, patents, customer-related assets, licensed technology and other intangibles. Value is derived almost exclusively from the future earnings potential of these intangible assets.c.d.IPR&D reflects the estimated fair value of projects that have not yet resulted in viable products. Fair value is generally based on the present value of future expected cash flows. Below is an excerpt from Motorola’s disclosure of Symbol Technologies, Inc. in-process R&D: At the date of acquisition, 31 projects were in process and are expected to be completed through 2008.The average risk adjusted rate used to value these projects is 15-16%. The allocation of value to in-process research and development was determined using expected future cash flows discounted at average risk adjusted rates reflecting both technological and market risk as well as the time value of money. (Source: Motorola, Inc. annual report, 2007)P3.8 Working Backwards—Eliminating Entries, Preparing Subsidiary’s Balance Sheet a.b.Scientific Company(1) $3,200,000 = $8,700,000 - $500,000 - $5,000,000(2) $13,800,000 = $40,000,000 - $1,200,000 - $25,000,000(3) $8,000,000 = $27,000,000 - $19,000,000P3.9 Merger and Stock Acquisition, Merger-Related Costs(all amounts in thousands)a.Fair value of net assets acquired $3,556,500Value of consideration given:46,700,000 shares x $75.25 $3,514,175Stock options 4,000Total consideration given $3,518,175Apparent amount of merger-related costs capitalized $ 38,325b. (entry on books of MCBC)c.Book value of Mo lson’s stockholders’ equity = net assets carried at fair value = $486,700 +1,011,600 + 489,600 – 688,300 – 3,315,600 = $(2,016,000).(consolidated balance sheet working paper):This solution assumes Molson did not previously report recognized intangible assets. If intangible assets already had a substantial book value, a positive stockholders’ equity could result.d.If SFAS 141R had been in effect when this merger occurred, the $38,325 of merger-related costs would have been expensed and not capitalized. Goodwill would therefore have been smaller by $38,325, or $1,799,275. The entries would be as follows:Requirement b. (entry on books of MCBC)Requirement c. (consolidated balance sheet working paper)Note: Because merger-related costs are not capitalized under SFAS 141R, the Investment account balance on the books of MCBC is $38,325 lower.P3.10 Consolidation of Variable Interest Entities(dollar amounts in thousands)a.MCBC owns about 50% of each of these joint ventures, close to the over 50% needed for traditional consolidation; its 52% interest in BRI suggests consolidation. It reports guarantees of debt issued by BTI and RMMC but it is not clear how significant this is. All of these ventures appear to be captive or near-captive entities largely designed to ser ve MCBC’s needs in beer production and distribution. The ventures’ profits directly benefit MCBC and the other owners. RMMC and RMBC are nontaxable entities and Grolsch is a taxable entity in the U.K., not the U.S. Grolsch’s profits are limited by agreem ent. These conditions point toward VIE status and there are likely other agreements not disclosed that point toward MCBC being the primary beneficiary of all four ventures.b.At the end of 2007, total assets of the four VIEs sum to $580,341; half is $290,171, a little over 2% of MCBC’s $13,451,566 of total assets, with and without the $290,171. Half of the $38,356 in pre-tax income of the ventures (credited to cost of goods sold) is $19,178, about 4% of MCBC’s 2007 net income of $497,192. Neither of these are highly significant percentages of MCBC; the ventures’ liabilities (unknown) are not likely large enough to have much of an effect on MCBC’s leverage ratios.c.Considering that MCBC’s purchases from the ventures affect its cost of goods sold, offsetting ventures’ “profits” against COGS to reduce the cost reported there seems reasonable.P3.11 Identifiable Intangibles and Goodwilla.Prince makes the following entry to record the acquisition on its own books (in thousands):The account balances for Prince, shown in the working paper below, reflect the above entry. Merger expenses reduce retained earnings, a component of stockholders’ equity.b.If Prince records the acquisition as a statutory merger, Prince makes the following entry (in thousands):When the above entry is reflected in Prince’s account balances, Prince’s balance sheet is identical to that shown in the consolidated working paper for a stock acquisition.P3.12 Consolidation Policy: U.S. GAAP and IFRSUnder SFAS 94, consolidation is not appropriate, as no case has majority ownership. Under IFRS, the following considerations apply.In cases (1), (2) and (3),1. Andrews owns a large minority interest (40 to 49 percent) and the remainingownership is widely dispersed (no single party holds more than 3 percent).2. A recent election has shown that Andrews is able to cast a majority of votes cast(53 to 58 percent).Absent evidence to the contrary, either one of these is sufficient to presume that Andrews has effective control, and that consolidated statements should be prepared.In cases (4), (5) and (6), the conclusion is less clear. While Andrews owns a fairly large minority interest (25 to 35 percent) and other ownership is widely dispersed, it would be a matter of judgment as to whether Andrews' interest is large enough. Andrews was able to nominate its director candidates, solicit some proxies, and convince other stockholders to vote for its nominees in order to obtain a majority of the votes. While a conclusion of effective control seems highly likely here, it is not automatic. Further, case (4) is stronger than case (5), which in turn is stronger than case (6).。

Advanced Accounting第十一版教学设计课程概述本课程是高级会计学的重要课程,旨在让学生掌握财务报告、财务分析、财务管理等专业知识和技能。

本课程主要针对会计专业本科生,也适用于财务、管理和经济类相关专业的学生。

课程目标通过本课程的学习,学生将会:1.掌握准确和全面编制公司财务报表的方法;2.了解并能够运用财务分析的基本原理,能够分析企业的财务状况;3.熟练掌握公司财务管理的基本概念和方法;4.能够准确解读、应对企业财务管理中的问题和挑战。

教学内容本课程主要包括以下内容:第一章:公司财务报告概述本章主要介绍公司财务报告的定义、类型、基本原则和编制过程。

学生将了解公司财务报告的基本要素、作用和对利益相关方的重要性。

第二章:财务报表编制的基本准则和方法本章主要涵盖企业会计和财务报告的基本准则、方法和技巧。

学生将学习会计方程的应用、会计记账、账户调整、估计和会计错误处理等内容。

第三章:财务报表的分析与解读本章主要讲解财务报表分析的基本原理和方法。

学生将了解财务比率分析、趋势分析、财务理论分析、现金流量分析等内容,掌握分析方法并运用于实际数据中。

第四章:会计信息系统与内部控制本章主要介绍会计信息系统和内部控制的概念、原则和方法。

学生将了解企业信息化系统的基本结构、管理的基本目标和内部控制设计、实施和检查的基本内容。

第五章:财务预算本章主要讲解企业财务预算编制的原则、方法和技巧。

学生将掌握企业战略和预算目标的确定、绩效度量和控制、投资估计和决策分析等内容。

教学方法本课程采用讲授、案例分析、课堂研讨和实践教学相结合的方式,以增加学生对实际问题的了解和处理能力。

具体教学方法和要求如下:1.讲授:教师将依据教学大纲的安排,结合经典案例和最新资料,从历史、理论和实践等角度,系统讲述本课程的主要内容。

2.案例分析:选取实际企业或金融机构的相关财务报表,并于课堂上进行分析,引导学生熟悉并对财务报表进行深入分析。

Advanced Accounting 第十一版课程设计一、引言本文旨在介绍Advanced Accounting第十一版的课程设计方案。

该方案适用于会计、财务、税务等专业的学生,是一门高级会计课程。

通过学习本课程,学生将深入掌握合并财务报表、合并纳税申报、关联交易、投资者关系等方面的知识和技能。

二、课程目标本课程的目标是让学生掌握以下知识和技能:1.了解合并财务报表的编制方法和要求;2.掌握合并纳税申报的填报方法和注意事项;3.熟悉关联交易的法规和原则,能够判断其是否违反公平交易原则;4.了解投资者关系的概念和操作方法,能够有效管理公司与股东、投资者之间的关系。

三、课程内容本课程的主要内容包括:1. 合并财务报表1.合并财务报表的基本原则;2.合并财务报表的编制方法;3.合并财务报表的分析和解读。

2. 合并纳税申报1.合并纳税申报的法规和要求;2.合并纳税申报的填报方法和技巧;3.合并纳税申报的风险管理和处理。

3. 关联交易1.关联交易的定义和分类;2.关联交易的法规和原则;3.关联交易的审查方法和实践。

4. 投资者关系1.投资者关系的概念和意义;2.投资者关系的建立和维护;3.投资者关系的管理和评估。

四、教学方法本课程采用多种教学方法,包括:1.讲授法:通过授课、讲解案例等方式,向学生介绍合并财务报表、合并纳税申报、关联交易、投资者关系等重要知识点;2.讨论法:通过小组讨论、案例分析等方式,引导学生主动思考和发表观点;3.实践法:通过实际操作、模拟实战等方式,提高学生应用相关知识和技能的能力。

五、考核方式本课程采用多种考核方式,包括:1.课堂表现:包括出勤率、参与度、讨论质量等方面;2.作业:包括课程作业和实践作业;3.期中考试:考察学生对本课程知识点的掌握情况;4.期末考试:考察学生对本课程整体知识的理解和应用能力。

六、参考书目1.Floyd A. Beams, Joseph H. Anthony, Bruce Bettinghaus,Kenneth Smith. Advanced Accounting, 11th Edition. Pearson, 2018.2.Philip R. Easton, John J. Wild, Robert F. Halsey, Mary LeaMcAnally. Advanced Accounting, 14th Edition. McGraw Hill Education, 2019.3.Cynthia Jeffrey, Lawrence Conover. Advanced FinancialAccounting, 11th Edition. Cengage Learning, 2016.七、结语本文介绍了Advanced Accounting第十一版的课程设计方案,包括课程目标、内容、教学方法和考核方式等方面。

AdvancedFinancialAccounting《⾼级财务会计》Advanced Financial Accounting教学⼤纲第⼀部分:教学要求⼀、授课对象:会计系本科⽣学⽣。

⼆、先修课程:《基础会计学》、《中级财务会计学》。

三、学分学时分配:3学分、每周3学时第⼆部分:教学内容1、教学⽬的:随着我国会计改⾰的不断深⼊和会计教育的进⼀步发展,⾼级会计学已作为⼀门独⽴课程出现在我国各⾼等院校会计专业的教学体系中。

⾼级会计是随着社会经济的发展,对原有的财务会计内容进⾏补充、延伸和开拓的⼀种会计学,既利⽤财务会计的固有⽅法,对现有财务会计未包括的业务,或者需要深⼊进⾏论述的业务以及随着客观经济环境变化⽽产⽣的⼀些特殊业务进⾏反映和监督。

通过本课程教学,有助于学⽣运⽤⾼级会计学这⼀特殊领域的会计理论与⽅法,更好地搞好业务实践,在解决我国会计改⾰⾯临的难题⽅⾯发挥作⽤。

2、教学要求由于⾼级会计学涉及领域较⼴,难度较⼤,⾸先要求学⽣注意处理好《财务会计学》与《⾼级会计学》之间的关系,它是在中级财务会计基础上,对⼀些专门的会计领域,特殊的经济业务进⾏的更⾼层次理论探讨。

其次通过各个专题的学习,掌握基本理论操作程序和⽅法,并且在此基础上进⼀步分析我国现⾏做法与国际通⾏做法的异同及其原因。

3、课程与其他课程的关系⾼级会计学⽬前作为会计本科专业⾼年级开设的⼀门专业选修课,从内容上既是会计专业系列课程中属于⾼级会计学的内容,同时它⼜是⼀门综合课程,涉及到国际贸易、国际结算、国际税务,国际财务管理等课程。

内容较深,涉及⾯⼴。

因此在开设这门课前学⽣必须掌握初级会计学、中级会计学、财务管理学、管理会计学等会计学专业基础课程。

同时还应要求学⽣学习有关的国际贸易、国际⾦融、国际税务等知识。

第⼀章绪论⼀、教学⽬的和基本要求通过本章学习,使学⽣了解⾼级会计学的理论基础,掌握⾼级会计学的内涵,熟悉所研究的内容与中级会计学的异同。