HND财政预算报告范本(英文版)(pdf 8页)

- 格式:doc

- 大小:78.50 KB

- 文档页数:9

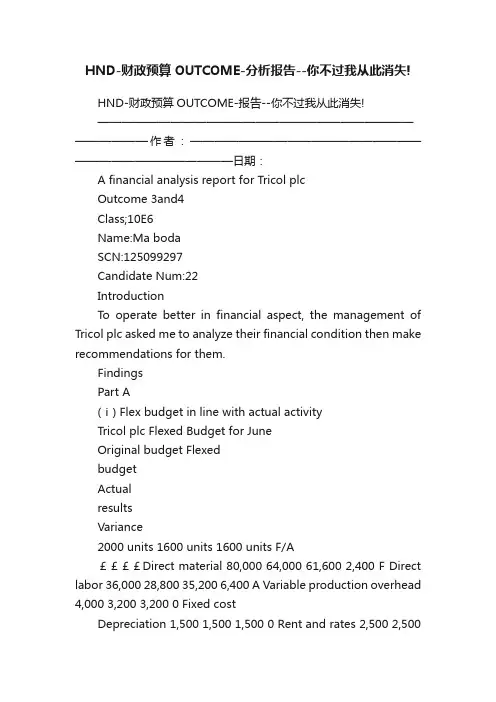

HND-财政预算OUTCOME-分析报告--你不过我从此消失!HND-财政预算OUTCOME-报告--你不过我从此消失!————————————————————————————————作者:————————————————————————————————日期:A financial analysis report for Tricol plcOutcome 3and4Class;10E6Name:Ma bodaSCN:125099297Candidate Num:22IntroductionTo operate better in financial aspect, the management of Tricol plc asked me to analyze their financial condition then make recommendations for them.FindingsPart A(ⅰ) Flex budget in line with actual activityTricol plc Flexed Budget for JuneOriginal budget FlexedbudgetActualresultsVariance2000 units 1600 units 1600 units F/A££££Direct material 80,000 64,000 61,600 2,400 F Direct labor 36,000 28,800 35,200 6,400 A Variable production overhead 4,000 3,200 3,200 0 Fixed costDepreciation 1,500 1,500 1,500 0 Rent and rates 2,500 2,5002,500 0 Administration overhead 2,000 2,000 2,200 200 A Insurance costs 2,200 2,200 2,400 200 A Total 128,200 104,200 108,600 4,400 A (ⅱ) Varianc es calculationDirect material total variance(Standard units of actual production*standard price) -(actual quantity*actual price) (4 kg*1,600*£10) -£61,600 =£2,400 (F)Rate of significance: (3.75%)Direct material usage varianceStandard price*(standard units of actual production -actual quantity)£10*[ (4kgⅹ1,600) -5,600kg]= £8,000 (F)Rate of significance (12.5%)Direct material price varianceActual quantity * (standard price -actual price)5,600kg*[£10 -(£61,600/ 5,600kg) ]= £(5,600) (A)Rate of significance: (8.75%)Direct labour total variance(Standard hours of actual production*standard rate ph) - (actual hours*actual rate ph) [ (2hrs*1,600) *£9]-£35,200=£(6,400) (A)Rate of significance: (22.22%)Direct labour efficiency varianceStandard rate ph* (standard hours of actual production -actual hours)£9*(2hrs*1,600-3,520hrs)=(2,880) (A)Rate of significance: (10%)Direct labour rate varianceActual hours*(standard rate ph – actual rate ph)3,520hrs*(£9*-£35,200/3,520hrs)= £(3,520) (A)Rate of significance: (12.22%)Total overhead varianceTotal standard overhead for actual production -total actual overheads(£18,000/12+£2,500+£2,200+£2,000)- (£1,500+£2,500+£2,200+£2,400)=£(400) (A)Rate of significance: (3.5%)(ⅲ) Report about variancesDirect material varianceThe direct material total variance can be analyzed in two aspects which are direct material volume and direct material price.For volume side, as calculated above, the budget volume is 6400kg; the actual volume is 5600kg. So there is 800kg variance which is favorable and each unit variance is 0.5kg. The likely reason causing the variance comes from three aspects. First of all, the company upgraded the production machinery recently, and new machine may use materials efficiently, so it reduced the waste of materials. Secondly, the company switched suppliers and using higher-grade materials can decrease waste of materials too. Finally, the company has concluded a higher-than-expected wage settlement for production operatives, which will maintain employees with higher skills as well as decrease turnover of employees, and it also can increase efficiency in using materials.For price aspect, the budget price is £10 per kg, and the actual price is £11per kg, it is adverse that one pound over the budget price. The company switching suppliers may cause the increase of negotiation cost. There may be a long-term relationship between Tricol plc and its old suppliers, so the suppliers may take lots of discounts to the firm. After changing suppliers, the discount may disappear. Furthermore, higher gradematerials increased unit price.Overall, the total material variance is favorable. £8,000 -£5,600=£2,400.Direct labour varianceThe direct labour total variance is composed of direct labour efficiency variance and direct labour rate variance.The budget direct labour hours are 3,200hrs and the actual labour hours are 3,520 hrs. There are more 320hrs needed than the budget, and each unit is 0.2hrs, which it isobviously adverse. The company upgrading the production machinery may need time for employees to adopt it. Also, employees need training time. The rebuild process of machinery consumed time too. In a word, the chargeable hours have increased.The budget direct laour hours rate is £9 per hour, the actual hours rate is £10 per hour. It is adverse that one pound higher than budgeted. It is possible caused by both internal and external factors. Higher-than-expected wage settlement may be internal reason for the variance, and new machinery may be needed to recruit new employees to operate the machinery, which also can increase the expense. For external factors, the changing of labour market may increase labour cost; the government legislation also can increase the labour cost, for example minimum pay.Both direct labour efficiency and direct labour rate variances are adverse, so the direct labour total variance is adverse.Overhead varianceAs calculated above, total overhead variance is caused by administration and insurance. Each factor has £200 variance, so the total overhead variance is £400 and it is adverse. During the process of changing supplier, the company needed moreexpense on public relationship or negotiation, in addition, in order to maintain the new machinery, administration cost will be increased too. For insurance aside, the improvement of machinery will need more insurance fees to cover, which also contributes to the increase of insurance fee of new employees.Part BSelection and application of two investment appraisal techniquesAs the company is keen to recoup the cost of the investment within five years, I will choose Payback period and Net Present Value to help me complete the appraisal.In order to fulfill the appraisal easily, there are some assumptions listed below should be considered before the appraisal.⑴ All revenue and inflow are assumed cash flow⑵ All investment cost incurred in year 0⑶ No uncertainty is considered⑷ Do not consider inflation and taxation⑸ Market rate of return is expected rate of return⑹ Rate of return is varying along with timeTricol plc Payback period for project distribution armYear Net cash flow Cumulative Cash Flow££Cash Flow Year 0 (1,000,000) (1,000,000) Cash Inflow Year 1 160,000 (840,000)Year 2 160,000 (680,000)Year 3 320,000 (360,000)Year 4 320,000 (40,000)Year 5 320,000 280,000 Net Cash Benefit Year 5 280.000 Note: req uire 40,000/320,000 in year 5= 1/8*year=1.5 mothsPayback=4 years 1.5 mothsTricol plc Net Present Value for project distribution armAnnual cash flow Present valuePresent Valuefactors at 10%£££Year 0 (1,000,000) 1.000 (1,000,000) Year 1 160,000 0.909 145,440Year 2 160,000 0.826 132,160Year 3 320,000 0.751 240,320Year 4 320,000 0.683 218,560Year 5 320,000 0.621 198,720 935,200 NPV (64,800)◆Recommendation about investmentAccording to Payback Period analysis, the investment cost can be recouped in year 4 and 1.5 moths. In other words, the period is under company’s expectation. The project can be executed. However, according to Net Present Value analysis, in terms of present value, within five years, what the NPV will bring net result is net cash loss but not net cash surplus. In general, the company should consider time value and other factors, so the project should not be executed.◆Factors impact on the investment should be consid eredVarious factors will impact on result of investment. I will outline factors should be considered when the management reviewing my recommendation in financial and non-financial factors.Financial factorAs distribution arm is financial long-term beneficial project, it can be used inlong-term period and bring benefits continuous. Theinvestment cost is £1,000,000, which can be considered a large investment. So it more likely needs long period payback period. The management should focus on longer cash flows for longer period of future. On the other hand, Net Present Value in year five is (28,000) only take 2.8% percents of the investment cost, it is more likely surplus in year six. Another financial factor is source of million pounds. If it is internal source, the management mainly concentrate on opportunities cost. If it is cost of capital or cost of capital taking much weight of the source, the management must pay cost of the source firstly, the marketing rate of return likely low for the company, in addition, the management should use higher discounted cash flow.Non-financial factorThe investment must be consistence with company’s strategic plan. As Tricol is a plc, it must take social responsibility such as obeying government policy, minimizing impact on environment and minimizing impact on natives.ConclusionFor real competition is more complex and fierce, in order to make accurate decisions, management should consider more factors during the decision-making; furthermore, the management should use more tools to help them such as IRR, DCF.。

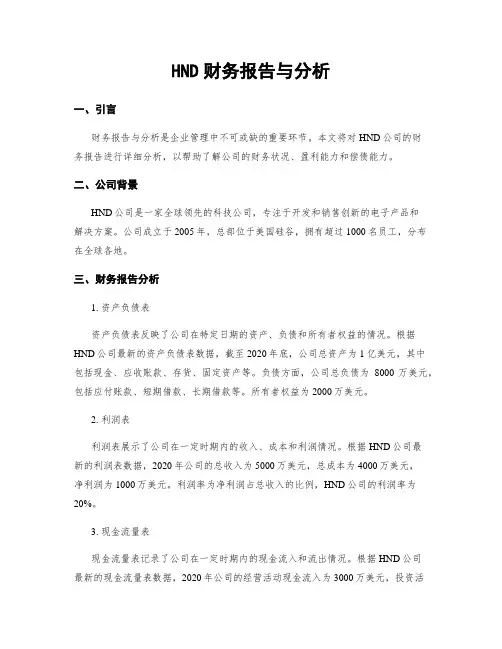

HND财务报告与分析一、引言财务报告与分析是企业管理中不可或缺的重要环节。

本文将对HND公司的财务报告进行详细分析,以帮助了解公司的财务状况、盈利能力和偿债能力。

二、公司背景HND公司是一家全球领先的科技公司,专注于开发和销售创新的电子产品和解决方案。

公司成立于2005年,总部位于美国硅谷,拥有超过1000名员工,分布在全球各地。

三、财务报告分析1. 资产负债表资产负债表反映了公司在特定日期的资产、负债和所有者权益的情况。

根据HND公司最新的资产负债表数据,截至2020年底,公司总资产为1亿美元,其中包括现金、应收账款、存货、固定资产等。

负债方面,公司总负债为8000万美元,包括应付账款、短期借款、长期借款等。

所有者权益为2000万美元。

2. 利润表利润表展示了公司在一定时期内的收入、成本和利润情况。

根据HND公司最新的利润表数据,2020年公司的总收入为5000万美元,总成本为4000万美元,净利润为1000万美元。

利润率为净利润占总收入的比例,HND公司的利润率为20%。

3. 现金流量表现金流量表记录了公司在一定时期内的现金流入和流出情况。

根据HND公司最新的现金流量表数据,2020年公司的经营活动现金流入为3000万美元,投资活动现金流出为2000万美元,筹资活动现金流入为1000万美元。

净现金流量为2000万美元。

四、财务指标分析1. 偿债能力分析偿债能力是衡量公司偿还债务能力的指标。

常用的指标有流动比率和速动比率。

流动比率=流动资产/流动负债,速动比率=(流动资产-存货)/流动负债。

根据HND公司的数据计算,流动比率为2.5,速动比率为1.5。

这说明HND公司具有较强的偿债能力,能够及时偿还债务。

2. 盈利能力分析盈利能力是衡量公司盈利能力的指标。

常用的指标有毛利率、净利率和资产收益率。

毛利率=(销售收入-销售成本)/销售收入,净利率=净利润/销售收入,资产收益率=净利润/总资产。

根据HND公司的数据计算,毛利率为40%,净利率为20%,资产收益率为10%。

Budget Report TemplateThis template is designed to provide a clear and concise format for reporting your budget. It is important that you provide all necessary information in a timely and accurate manner to ensure your budget is effectively managed.Project InformationProject Name: Give the name of your project.Description: Provide a brief description of your project.Fiscal Year: Indicate the fiscal year for which you are submitting this report.Prepared By: Enter the name of the person or department responsible for preparing this report.Budget SummaryProvide a brief summary of your budget in terms of income, expenses, and net balance.Income:Describe your project’s income, including any grants, donations, or other funding sources.Expenses: Prov ide a detailed list of your project’s expenses, including any salaries, equipment, materials, or services.Net Balance: Calculate the difference between your income and expenses to provide the net balance of your budget.Budget NarrativeExplain the detail s of your project’s budget and how it is calculated. Include any relevant information regarding assumptions, projections, and risks.Revenue Provide a breakdown of all your project’s sources of revenue. This could include sales, fees, grants, or donations.Expenses Provide a detailed break down of all the project’s expenses, including any salaries, equipment, services, or materials.Salaries Provide an overview of all the salaries paid out for the project, including salaries for full-time, part-time, and contracted employees.Materials and Supplies Detail all of the costs related to materials and supplies for the project. This could include the cost of equipment, raw materials, and supplies.Services Provide a breakdown of all services utilized during the project, including contract services such as IT or marketing services, accounting or legal fees, and other professional services.Other Expenses Provide information on all other expenses not covered by the categories above, including travel, meals, and other reimbursable expenses.Other Revenue Include any additional revenues or funding sources that were not covered in the previous sections.Budget JustificationExplain the reasoning behind your project’s budget. This should include how the expenses relate to the project’s goals and how the revenue is expected to be generated.SummaryProvide a summary of your budget report, including any potential risks and challenges that may affect the budget. Be sure to indicate any changes that have been made since the last budget report.SignatureEnter the name of the person who prepared the report, and the date the report was prepared. Ensure that the report has been authorized and signed off by the responsible officer.。

HND-财政预算OUTCOME-报告--你不过我从此消失!————————————————————————————————作者:————————————————————————————————日期:A financial analysis report for Tricol plcOutcome 3and4Class;10E6Name:Ma bodaSCN:125099297Candidate Num:22IntroductionTo operate better in financial aspect, the management of Tricol plc asked me to analyze their financial condition then make recommendations for them.FindingsPart A(ⅰ) Flex budget in line with actual activityTricol plc Flexed Budget for JuneOriginal budget FlexedbudgetActualresultsVariance2000 units 1600 units 1600 units F/A££££Direct material 80,000 64,000 61,600 2,400 F Direct labor 36,000 28,800 35,200 6,400 A Variable production overhead 4,000 3,200 3,200 0 Fixed costDepreciation 1,500 1,500 1,500 0 Rent and rates 2,500 2,500 2,500 0 Administration overhead 2,000 2,000 2,200 200 A Insurance costs 2,200 2,200 2,400 200 A Total 128,200 104,200 108,600 4,400 A (ⅱ) Variances calculationDirect material total variance(Standard units of actual production*standard price) -(actual quantity*actual price) (4 kg*1,600*£10) -£61,600 =£2,400 (F)Rate of significance: (3.75%)Direct material usage varianceStandard price*(standard units of actual production -actual quantity)£10*[ (4kgⅹ1,600) -5,600kg]= £8,000 (F)Rate of significance (12.5%)Direct material price varianceActual quantity * (standard price -actual price)5,600kg*[£10 -(£61,600/ 5,600kg) ]= £(5,600) (A)Rate of significance: (8.75%)Direct labour total variance(Standard hours of actual production*standard rate ph) - (actual hours*actual rate ph) [ (2hrs*1,600) *£9]-£35,200=£(6,400) (A)Rate of significance: (22.22%)Direct labour efficiency varianceStandard rate ph* (standard hours of actual production -actual hours)£9*(2hrs*1,600-3,520hrs)=(2,880) (A)Rate of significance: (10%)Direct labour rate varianceActual hours*(standard rate ph – actual rate ph)3,520hrs*(£9*-£35,200/3,520hrs)= £(3,520) (A)Rate of significance: (12.22%)Total overhead varianceTotal standard overhead for actual production -total actual overheads(£18,000/12+£2,500+£2,200+£2,000)- (£1,500+£2,500+£2,200+£2,400)=£(400) (A)Rate of significance: (3.5%)(ⅲ) Report about variances✧Direct material varianceThe direct material total variance can be analyzed in two aspects which are direct material volume and direct material price.For volume side, as calculated above, the budget volume is 6400kg; the actual volume is 5600kg. So there is 800kg variance which is favorable and each unit variance is 0.5kg. The likely reason causing the variance comes from three aspects. First of all, the company upgraded the production machinery recently, and new machine may use materials efficiently, so it reduced the waste of materials. Secondly, the company switched suppliers and using higher-grade materials can decrease waste of materials too. Finally, the company has concluded a higher-than-expected wage settlement for production operatives, which will maintain employees with higher skills as well as decrease turnover of employees, and it also can increase efficiency in using materials.For price aspect, the budget price is £10 per kg, and the actual price is £11per kg, it is adverse that one pound over the budget price. The company switching suppliers may cause the increase of negotiation cost. There may be a long-term relationship between Tricol plc and its old suppliers, so the suppliers may take lots of discounts to the firm. After changing suppliers, the discount may disappear. Furthermore, higher grade materials increased unit price.Overall, the total material variance is favorable. £8,000 -£5,600=£2,400.✧Direct labour varianceThe direct labour total variance is composed of direct labour efficiency variance and direct labour rate variance.The budget direct labour hours are 3,200hrs and the actual labour hours are 3,520 hrs. There are more 320hrs needed than the budget, and each unit is 0.2hrs, which it isobviously adverse. The company upgrading the production machinery may need time for employees to adopt it. Also, employees need training time. The rebuild process of machinery consumed time too. In a word, the chargeable hours have increased.The budget direct laour hours rate is £9 per hour, the actual hours rate is £10 per hour. It is adverse that one pound higher than budgeted. It is possible caused by both internal and external factors. Higher-than-expected wage settlement may be internal reason for the variance, and new machinery may be needed to recruit new employees to operate the machinery, which also can increase the expense. For external factors, the changing of labour market may increase labour cost; the government legislation also can increase the labour cost, for example minimum pay.Both direct labour efficiency and direct labour rate variances are adverse, so the direct labour total variance is adverse.Overhead varianceAs calculated above, total overhead variance is caused by administration and insurance. Each factor has £200 variance, so the total overhead variance is £400 and it is adverse. During the process of changing supplier, the company needed more expense on public relationship or negotiation, in addition, in order to maintain the new machinery, administration cost will be increased too. For insurance aside, the improvement of machinery will need more insurance fees to cover, which also contributes to the increase of insurance fee of new employees.Part BSelection and application of two investment appraisal techniquesAs the company is keen to recoup the cost of the investment within five years, I will choose Payback period and Net Present Value to help me complete the appraisal.In order to fulfill the appraisal easily, there are some assumptions listed below should be considered before the appraisal.⑴ All revenue and inflow are assumed cash flow⑵ All investment cost incurred in year 0⑶ No uncertainty is considered⑷ Do not consider inflation and taxation⑸ Market rate of return is expected rate of return⑹ Rate of return is varying along with timeTricol plc Payback period for project distribution armYear Net cash flow Cumulative Cash Flow££Cash Flow Year 0 (1,000,000) (1,000,000) Cash Inflow Year 1 160,000 (840,000)Year 2 160,000 (680,000)Year 3 320,000 (360,000)Year 4 320,000 (40,000)Year 5 320,000 280,000 Net Cash Benefit Year 5 280.000 Note: req uire 40,000/320,000 in year 5= 1/8*year=1.5 mothsPayback=4 years 1.5 mothsTricol plc Net Present Value for project distribution armAnnual cash flow Present valuePresent Valuefactors at 10%£££Year 0 (1,000,000) 1.000 (1,000,000) Year 1 160,000 0.909 145,440Year 2 160,000 0.826 132,160Year 3 320,000 0.751 240,320Year 4 320,000 0.683 218,560Year 5 320,000 0.621 198,720 935,200 NPV (64,800)◆Recommendation about investmentAccording to Payback Period analysis, the investment cost can be recouped in year 4 and 1.5 moths. In other words, the period is under company’s expectation. The project can be executed. However, according to Net Present Value analysis, in terms of present value, within five years, what the NPV will bring net result is net cash loss but not net cash surplus. In general, the company should consider time value and other factors, so the project should not be executed.◆Factors impact on the investment should be consideredVarious factors will impact on result of investment. I will outline factors should be considered when the management reviewing my recommendation in financial and non-financial factors.✧Financial factorAs distribution arm is financial long-term beneficial project, it can be used inlong-term period and bring benefits continuous. The investment cost is £1,000,000, which can be considered a large investment. So it more likely needs long period payback period. The management should focus on longer cash flows for longer period of future. On the other hand, Net Present Value in year five is (28,000) only take 2.8% percents of the investment cost, it is more likely surplus in year six. Another financial factor is source of million pounds. If it is internal source, the management mainly concentrate on opportunities cost. If it is cost of capital or cost of capital taking much weight of the source, the management must pay cost of the source firstly, the marketing rate of return likely low for the company, in addition, the management should use higher discounted cash flow.Non-financial factorThe investment must be consistence with company’s strategic plan. As Tricol is a plc, it must take social responsibility such as obeying government policy, minimizing impact on environment and minimizing impact on natives.ConclusionFor real competition is more complex and fierce, in order to make accurate decisions, management should consider more factors during the decision-making; furthermore, the management should use more tools to help them such as IRR, DCF.。

A financial analysis report for Tricol plcOutcome 3and4Class;10E6Name:Ma bodaSCN:125099297Candidate Num:22IntroductionTo operate better in financial aspect, the management of Tricol plc asked me to analyze their financial condition then make recommendations for them.FindingsPart A(ⅰ) Flex budget in line with actual activityTricol plc Flexed Budget for JuneOriginal budget FlexedbudgetActualresultsVariance2000 units 1600 units 1600unitsF/A££££Direct material 80,000 64,000 61,600 2,400 F Direct labor 36,000 28,800 35,200 6,400 A Variable productionoverhead4,000 3,200 3,200 0 Fixed costDepreciation 1,500 1,500 1,500 0 Rent and rates 2,500 2,500 2,500 0 Administration overhead 2,000 2,000 2,200 200 A Insurance costs 2,200 2,200 2,400 200 A Total 128,200 104,200 108,600 4,400 A(ⅱ) Variances calculationDirect material total variance(Standard units of actual production*standard price) -(actualquantity*actual price)(4 kg*1,600*£10) -£61,600 =£ 2,400 (F)Rate of significance: (3.75%)Direct material usage varianceStandard price*(standard units of actual production - actual quantity) £ 10*[ (4kgⅹ1,600) -5,600kg]= £8,000 (F)Rate of significance (12.5%)Direct material price varianceActual quantity * (standard price - actual price)5,600kg*[£ 10 -(£61,600/ 5,600kg) ]= £ (5,600) (A)Rate of significance: (8.75%)Direct labour total variance(Standard hours of actual production*standard rate ph) - (actual hours*actual rate ph)[ (2hrs*1,600) *£9]-£35,200=£(6,400) (A)Rate of significance: (22.22%)Direct labour efficiency varianceStandard rate ph* (standard hours of actual production - actual hours) £9*(2hrs*1,600-3,520hrs)=(2,880) (A)Rate of significance: (10%)Direct labour rate varianceActual hours*(standard rate ph – actual rate ph)3,520hrs*(£9*-£35,200/3,520hrs)= £(3,520) (A)Rate of significance: (12.22%)Total overhead varianceTotal standard overhead for actual production - total actual overheads (£18,000/12+£2,500+£2,200+£2,000)- (£1,500+£2,500+£2,200+£2,400)=£(400) (A)Rate of significance: (3.5%)(ⅲ) Report about variancesDirect material varianceThe direct material total variance can be analyzed in two aspects which are direct material volume and direct material price.For volume side, as calculated above, the budget volume is 6400kg; the actual volume is 5600kg. So there is 800kg variance which is favorable and each unit variance is 0.5kg. The likely reason causing the variance comes from three aspects. First of all, the company upgraded the production machinery recently, and new machine may use materials efficiently, so it reduced the waste of materials. Secondly, the company switched suppliers and using higher-grade materials can decrease wasteof materials too. Finally, the company has concluded ahigher-than-expected wage settlement for production operatives, which will maintain employees with higher skills as well as decrease turnoverof employees, and it also can increase efficiency in using materials.For price aspect, the budget price is £10 per kg, and the actual priceis £11per kg, it is adverse that one pound over the budget price. The company switching suppliers may cause the increase of negotiation cost. There may be a long-term relationship between Tricol plc and its old suppliers, so the suppliers may take lots of discounts to the firm. Afterchanging suppliers, the discount may disappear. Furthermore, higher grade materials increased unit price.Overall, the total material variance is favorable. £8,000 -£5,600=£2,400.Direct labour varianceThe direct labour total variance is composed of direct labour efficiency variance and direct labour rate variance.The budget direct labour hours are 3,200hrs and the actual labour hours are 3,520 hrs. There are more 320hrs needed than the budget, and each unit is 0.2hrs, which it is obviously adverse. The company upgrading the production machinery may need time for employees to adopt it. Also, employees need training time. The rebuild process of machinery consumed time too. In a word, the chargeable hours have increased.The budget direct laour hours rate is £9 per hour, the actual hours rate is £10 per hour. It is adverse that one pound higher than budgeted. It is possible caused by both internal and external factors.Higher-than-expected wage settlement may be internal reason for the variance, and new machinery may be needed to recruit new employees to operate the machinery, which also can increase the expense. For external factors, the changing of labour market may increase labour cost; the government legislation also can increase the labour cost, for example minimum pay.Both direct labour efficiency and direct labour rate variances are adverse, so the direct labour total variance is adverse.✧Overhead varianceAs calculated above, total overhead variance is caused by administration and insurance. Each factor has £200 variance, so the total overhead variance is £400 and it is adverse. During the process of changing supplier, the company needed more expense on public relationship or negotiation, in addition, in order to maintain the new machinery, administration cost will be increased too. For insurance aside, the improvement of machinery will need more insurance fees to cover, which also contributes to the increase of insurance fee of new employees.Part B◆Selection and application of two investment appraisal techniquesAs the company is keen to recoup the cost of the investment within five years, I will choose Payback period and Net Present Value to help me complete the appraisal.In order to fulfill the appraisal easily, there are some assumptions listed below should be considered before the appraisal.⑴ All revenue and inflow are assumed cash flow⑵ All investment cost incurred in year 0⑶ No uncertainty is considered⑷ Do not consider inflation and taxation⑸ Market rate of return is expected rate of return⑹ Rate of return is varying along with timeTricol plc Payback period for project distribution armYear Net cash flow Cumulative Cash Flow££Cash Flow Year 0 (1,000,000) (1,000,000) Cash Inflow Year 1 160,000 (840,000)Year 2 160,000 (680,000)Year 3 320,000 (360,000)Year 4 320,000 (40,000)Year 5 320,000 280,000 Net Cash Benefit Year 5 280.000 Note: req uire 40,000/320,000 in year 5= 1/8*year=1.5 mothsPayback=4 years 1.5 mothsTricol plc Net Present Value for project distribution armPresent Value Annual cash flow Present valuefactors at 10%£££Year 0 (1,000,000) 1.000 (1,000,000) Year 1 160,000 0.909 145,440Year 2 160,000 0.826 132,160Year 3 320,000 0.751 240,320Year 4 320,000 0.683 218,560Year 5 320,000 0.621 198,720 935,200 NPV (64,800)◆Recommendation about investmentAccording to Payback Period analysis, the investment cost can be recouped in year 4 and 1.5 moths. In other words, the period is under company’s expectation. The project can be executed. However, according to Net Present Value analysis, in terms of present value, within five years, what the NPV will bring net result is net cash loss but not net cash surplus. In general, the company should consider time value and other factors, so the project should not be executed.◆Factors impact on the investment should be consideredVarious factors will impact on result of investment. I will outline factors should be considered when the management reviewing my recommendation in financial and non-financial factors.✧Financial factorAs distribution arm is financial long-term beneficial project, it can be used inlong-term period and bring benefits continuous. The investment cost is £1,000,000, which can be considered a large investment. So it more likely needs long period payback period. The management should focus on longer cash flows for longer period of future. On the other hand, Net Present Value in year five is (28,000) only take 2.8% percents of the investment cost, it is more likely surplus in year six. Another financial factor is source of million pounds. If it is internal source, the management mainly concentrate on opportunities cost. If it is cost of capital or cost of capital taking much weight of the source, the management must pay costof the source firstly, the marketing rate of return likely low for the company, in addition, the management should use higher discounted cash flow.Non-financial factorThe investment must be consistence with company’s strategic plan. As Tricol is a plc, it must take social responsibility such as obeying government policy, minimizing impact on environment and minimizing impact on natives.ConclusionFor real competition is more complex and fierce, in order to make accurate decisions, management should consider more factors during the decision-making; furthermore, the management should use more tools to help them such as IRR, DCF.。

Contents1.0 Introduction ...................................................................................................................... - 2 -2.0 The flexed budget ............................................................................................................. - 2 -3.0 Calculate the Materials variances, Labour variances and the Total overhead.....- 2 -3.1Direct the materials variances , labour variances and the total overhead....- 2 -3.2Variance analysis ................................................................................................... - 3 -4.0 The recommendations for management (variances) ........................................................ - 4 -5.0 Using four different methods to evaluate the financial .................................................... - 5 -5.1Identify the accounting rate of return ..................................................................... - 5 -5.2Identify the payback .............................................................................................. - 5 -5.3Identify the Net present value ................................................................................ - 5 -5.4Identify the Internal rate of return ......................................................................... - 6 -6.0 Recommendations for investment decision ...................................................................... - 6 -7.0 Conclusion ........................................................................................................................ - 7 -8.0 Appendices ....................................................................................................................... - 7 -1.0 IntroductionThis report will divided into two parts. Part A and Part B. In Part A,First of all, I will prepare a flexed budget in line with actual activity. Second, this will including the Materials variances, Labour variances and total overhead. At the same time, I will identify a minimum of one possible cause of the each variance. Finally, according to data analysis, there have been some recommendations to management of Matteck PLC. In Part B, It will have four different ways to evaluate financial performance and give recommendations for Matteck PLC. These ways are ARR ,Payback, NPV and IRR.Part A2.0 The flexed budgetFor Flex budged of Matteck PLC, we can see the Appendix 1.3.0 Calculate the Materials variances, Labour variances and the Total overhead.3.1Direct the materials variances , labour variances and the total overhead・This section shows the Appendix 2.3.2Variance analysis.Material price variance:The material price variance is £32,000(F). According to the data analysis, it is £2/kg less expensive-2-than planned. The possible reasons can be divided into three points: first, they could replace raw materials, using a lower - grade material. Second, the supplier to provide some discount for this batch of raw materials. Finally, learn from the case, the company has managed to locate new materials from an overseas. Due to the product from overseas, according to different exchange rate, the material will reduce the price.Material usage variance:The material usage variance is £30,000(A). The possible reasons include the effects of raw materials and the influence of the machine. If the company using poor quality raw materials, it may be more difficult to work. This will increase the waste materials. At the same time, the case shows that the company's new machinery can be fully used in the second week. The delay time may have caused the machine to use more materials than planned.Material total variance:The material total variance is 2,000(F). Case shows that the company's raw materials are from overseas suppliers. This will reduce some costs. Which leads to the material price variance is 32,000 (F). On the other hand, the company has introduced a new machine, the influence of machine installed time, caused some wasted of materials. This makes the material usage variance is €30000 (A). Even if The company's material total variance is 2000 (F). The company's management still should pay attention to The utilization of raw materials.Labour efficiency variance:The Labour efficiency variance is 10,000(F). The possible reasons could include the new machine to improve staff work cfYiciency. Using new machine can less labour hours. At the same lime , the case shows that the company has had to employ more highly qualified staff. They can increase theworking efficiently through the higher skill.Labour Rate Variance:The Labour rate variance is 15,000(A). Through the calculation, the labour rate is £1.50 per hour higher than original. The possible reasons is £1.50 per hour higher than planned. The cost of direct labour is adverseness for this firm.Labour Total Variance:the Labour total variance is 5,000(A). The reasons of variance, the company has introduced the newmachine, As the result the direct labor efficiency variance is favorable which is 10.000(F). On other hand, the labour rate is higher than standard labour rate. Finally, lead to the labour total variance is adverse,4.0 The recommendations for management (variances)・1.The company should be had a variety of data investigation to set up complete data system. At the same time, through the difierent variance, the company can know more about the market information.2.The company should intensify the performance monitor for statTbecause the lower performance will accelerate waste of material and then lead to the material usage is increase, the performance monitor can help the company shrink the variance.3.Management: the company can provide some motivation policies to motivate the staft' that is work hard and enhance the work enthusiastic of the staff. This can improve the staff work efficiency.Part B5.0 Using four different methods to evaluate the financial. 5.1 Identify the accounting rate of return ・ARRAverage profit= 3,300,0005=660,000Accounting rate of retum==26.4%The cases show that the company should have an accounting rate of return of at least 15%, through calculation, the ARR is 26.4%. Therefore, the data has meet company standards.5.2 Identify the payback.The company hopes to recover the cost of the investment within 4 four years. In fact, they just use 3 years 341 days, (see Appendix 3.)5.3 Identify the Net present value.The NPV method calculates the present values of cash inflows and outflows and establishes whether. Basically, NPV provides an objective for evaluating and selecting investment projects. Moreover, it takes into account required rate of return of company and then takes into account time value of money. But there are substantial660,000 2,500,000uncertainly factors in our world. For instance the inflation and deflation, the exchange rate. When the Matteck's cost of capital is 10%. The NPV is (46200). The NPV value less than 0. The company should not invest this project. ( see Appendix 4.)5.4Identify the Internal rate of return.When the present value is 5%, the internal rate of return is 9.39%. Which less than 10% of company slandard.thcrcfore,the company should not invest this project.(see Appendix 5)6.0 Recommendations for investment decision.1.According the four method, The ARR and Payback are both implement for this project, but the NPV and IRR are not implemented for this Project. In this case ,thc company should focus on the NPV and IRR.2.By calculates the net present values, it seems that the deficit, which means that the annual cash flows are not enough to allow more interest to be deducted and still repay the original investment. This investment is unworthy .3.Within five years. All the market factors are changeable. The information will have different change. And there are maybe some other situations occurred. So the Matteck PLC should not concern with the project.7.0 ConclusionThe report can help the company make the flex budget, and then by variances analysis and use the-6-four methods to evaluate the financial. Through the recommendations can help the company choose the best investment to gain the maximum profits.8.0 Appendices8.1Appendix 18.2Appendix 2-7-。

1. IntroductionThis report is about a company Tricol plc, which makes a range of furniture and kitchenware, is now considering the development of its own distribution arm. It is provided assumptions, application of pay back period and NPV, evaluation and recommendation and other factors to be considered in this report. It could has important significance for assessing the rationalization of investment.2.0 Part AThe budget and calculation is showed on AppendixThere is a company policy to apply a rate of significance of 3% for any variance analysis. And the direct material variance can be analyzed in two aspects which are direct material volume and direct material price.The direct material price variance is adverse. The company has recently switched suppliers and it is now using high-grade materials. This may make the company lose the discount offered by original suppliersDirect labour variance is adverse. Reason may be that insurance is more than the budget insurance. The new machines use may result in this kind of situation, for the same reason overhead, including installation charges, staffing fees, maintenance increase and so on.There are two aspects what are weight of the direct materials and direct material price to analysis the total variance of direct material. From the weight of the direct materials, the budget for 6400 kg weight, the actual weight for 4600 kg, and the weight of each unit sent a 0.5 kg. The reasons are: the company changed suppliers,use the advanced materials to reduce the material waste; the production of equipment get upgrades, improve the production efficiency; Raised salary for employees to keep the higher technology and reduce the error, improve the efficiency in the use of materialsOverhead variance: total overhead variance is caused by administration and insurance. Each factor has £200 variance, so the total overhead variance is £400 and it is adverse. In addition, on side of insurance, Improving mechanical efficiency will need to pay more insurance cost, the employee of operate these equipment insurance costs also will be increasedRecommendationThere are some Suggestions can make the situation improved. The first, Ensure the quality, the price is cheap, but use the material. Secondly, The Company can establish policies to control administrative costs. They can try to use material price discount. The variance of labor, for enterprise is a must for the long-term cost of place, and wage increase, and may continue to increase, but Labour had reduced rate. Also has some advice. The company can provide the plan of the training, in order to improve production efficiency. Can also make employees responsible for the machine can be used a longer time.2.1 Part BAssumptionsThere are some views in the use of these data.The effects of the tax and inflation are neglected. Second, a given market returns will not change.●In the initial outflows of cash flow is satisfied, the time value of money beignored, not including interest is for the initial capital investment.●The expected return on the investment, here is to point to deduct the net cash flowfrom all the relevant costs.●Uncertainty does not exist●All the market factors are stableNet Present Value (NPV): The NPV method calculates the present values of cash inflows and outflows and establishes whether, in total, the present value of cash inflows is greater than the present value of cash outflows.Calculation of net present value, It is showed by Appendix.Payback: Those ways of in order to restore the original investment cost methods have to investment and project evaluation have many years, in order to received effect in shortest time. (1) year 0 means now (2) year 1 means at the end of 12 months from now (3) year 2 at the end of 2 years from now.Calculation of the payback period method, It is showed by Appendix.AnalyzeThe analysis of two investment appraisal techniquesDisadvantages of the payback method·It ignores cash flows after initial outflow has been met·It ignores risk·It ignores time value of money·It ignores the fact that benefits from different projects may accrue at an uneven rate ·No allowance is made for interest on the initial capital investment.Advantages of the NPV method·Provides an objective basis for evaluating and selecting investment projects ·Takes account of both magnitude and timing of expected cash flows in each period of a project’s lifeInvestors can not use a single formula to calculate the rate of return, they should consider the value of the time.In view of the data calculated above, payback will take four years and one-and-half month to complete, therefore, it seems to be reasonable to accept and invest this kind of project. However, in other method, it is impossible to fulfill a requirement of a 10% return. The actual rate of return must be less than 10%.Taking this two methods into consideration, firstly, net present value methods is more accurate than payback period method, secondly, although it cannot realize the expected return in 10% in the first 5 years, mainly basing on growing slowly and low return at beginning, it may bring a higher revenue and positive cash inflow in the future years.Personally, I think we can accept the new project for a period time. RecommendationThere are some Suggestions to continue to do investment company. We can from the financial factor analysis and the financial factors. The first. Form the economic factors. There are some Suggestions. The company must make sure that they have enough money to complete this investment. The company also need to consider budget control and the ability to solve problems. And then sure need to move on this investment. The company should consider whether to profit the most for the companylong-term interests. Then from non-financial aspects. Focus on the information about the change in the current social economic, political and legal. Whether can increase employment guidance. Clearly know people are willing to pay is suitable for this investment. Finally, the investment is in accordance with the company's strategy.3. ConclusionsThe company's consultants, this report can help the company bend of the budget and variance and use these two kinds of methods are analyzed, and help the company choose investment investment method. The company will make much profit.4. AppendixTricol Plc Flexed budgedBased on the all information about “Zupper” expendable table, I draw a table as following:The calculation of the variances and the variance rate1.Direct material total variance(standard units of actual production×standard price) –(actual quantity×actual price)[(4kg×1600)×£10] –£61600= £64000 –£61600=£2400 ( F )The rate for direct material total variances is £ 2,400/£ 64,000×100%=3.75%2.Direct material price varianceactual quantity×( standard price-actual price)=5600kg×( £10- £11)=5600kg×£1=5600 (A)The rate of direct material price variance is £ 5,600/£ 64,000×100%=8.75%3.Direct material usage variancestandard price×(standard units of actual production-actual units)=£10×(4kg×1600-5600kg)=£10×800kg=£8000 (F)The rate of direct material usage variance is £ 8,000/£ 64,000×100%=12.5%Note: When adding the price and usage variances the result must equal the total variance. Therefore, £5600(A) (price)+£8000(F) (usage) = £2400(F) (total).4.Direct labour total variance( standard hours of actual production×standard rate ph) -(actual hours×actual rate ph)[(2h×1600)×£9] -(3520h×£10)=(3200h×£9)-£35200=£28800 -£35200=£6400(A)The rate of diretc labour variance is 6400/28800×100%=22.2%5.Direct labour rate varianceactual hours×( standard rate ph-actual rate ph)3520h×(£9-£10)=3520h×£1=£3520(A)The rate of direct labour rate variance is £ 3,520/£ 28,800×100%=12.2%6.Direct labour efficiency variancestandard rate ph ×( standard hours of actual production-actual hours)£9×[2h×1600-3520h]=£9×(3200h-3520h)=£9×320h=£2880(A)The rate of direct labour efficiency variance is £ 2,880/£ 28,000×100%=10% Note: When adding rate and efficiency variances the result must equal the totalvariance. Therefore, £3520(A) (rate)+£2880(A) (efficiency) = £6400(A) (total).7.Overhead total variance(standard insurance cost-actual insurance cost)+(standard administration overheads-actual administration overheads)(£2200-£2400)+(£2000-£2200)=£200(A)+£200(A)=£400(A)The rate of overhead total variance is £ 400/£ 4,200×100%=9.52%Calculation of net present value at 10%Payback period method:In Year 5 the cash inflows for the full year are £320,000 but only £40,000 is required to recoup the initial investment. This is therefore reached in 1.5 months.Payback= 40000/320000*Year 5= 1/8 Year 5= 4 year 1.5monthsPayback will take 4 year 1.5months.。

Beijing Institute of Technology SQA HND AssignmentTable of contentsIntroduction (3)Part A (3)Part B (5)Conclusion (6)Reference (6)Appendix (7)IntroductionThis report is for Tricol plc which makes a range of furniture and kitchenware. One of the most popular products is the Zupper expandable table. It will do some variance analysis in the Part A. It will includes direct material usage, direct material price, direct labor rate direct, labor efficiency and total overhead. Some suggestions will be given following the analysis. In Part B, there will take two methods to analyze the project that is whether to accept. It will discuss the advantages and disadvantages of the two methods, finding out the best methods that is suit for the company. At last, some other factors such as environment, technology, legal, and customers will be discussed for the managers. Furthermore, some needed appendixes will be followed the report.Part AVariance analysis and reportingOnce the variances have been calculated, they should be analyzed to find what the problems are. The criterion that the rate of variance needs to be analyzed is more than 3%, and according to the Appendix 3, as a result, it needs to analyze all the variances.Direct material usage:According to the Appendix 2, the variance of direct material usage is favorable, which is about £8000 and the rate of direct material usage variance reaches 12.5%. This is a high level and it may due to the two reasons such as higher quality materials and higher grade workforce. The company chooses the higher quality materials could reduce the spoilages during the producing. And it could reduce the inferiors in the finish products. To reduce the materials is as a result. Giving the labor higher workforce may reduce the mistakes by labors during the producing that will reduce the rejection rate and save the materials.Direct material priceAccording to the Appendix 2, the variance of direct material price is adverse, which is about £5600 and at the rate of 8.75%. There may be two reasons for this result. One is higher quality materials. Because of the higher quality, this kind of materials will be more expensive than other low quality materials. It will increase the costs of the materials. Also, the loss of discounts will be another reason to make the material price increase. Tricol may cooperate with a new supplier; company may not get the discounts received because of the low reliance.Direct labor rateAccording to the Appendix 2, the variance of direct labor rate is £3520 in adverse, and at the rate of 12.2%. There may be also two reasons for this result. One is salary increase award. Company made the labor rate become £10 per hour, which is higher than standard labor rate for £1 per hour. This could encourage the staffs to work hard and improve their efficiency and reduce the mistakes. Another reason may be the unplanned overtime. For this situation, company may pay more wages to the staffs for their overtime work.Direct labor efficiencyAccording to the Appendix 2, the variance of direct labor efficiency is adverse with £2880 in the rate of 10%. There are two reasons for this. One is may be the low morale. Because the company let its labors to work overtime for the unplanned goals and the high workforce will make the staffs unsatisfied. The second reason is that there may be shortage of skilled labor, which results in more labor hours and labors to finish the goals.Total overheadAccording to the Appendix 2, the variance of total overhead is £400 in adverse, and at the rate of 3.51%. It may due to the higher insurance, and higher administration. Company may spend too much on the insurance of its staffs. Some wages of the managers may be higher.Recommendation for the managementThe direct material usage is a good sign for the company. Company should continue to reduce the spoilages during its producing. However, the price of the materials are little higher. It is not a good sign. Company may purchase the lower quality materials from the new supplier. And try the best to get some discount received. The price of materials should be lower than before but quality could not be too lower. This action will reduce the costs in the materials and insurance the low rejection rate. According to the labor, company should not raise the employees’wages easily to motivate the staffs and it should not do much the unplanned overtime. Because of the much unplanned overtime, the staffs may against this action and become morale. So, company should reduce the unplanned overtime and use the other ways to encourage its staffs often. However, in order to finish the unplanned overtime, the company may hire some new employees to work. But there is shortage of skilled labor. Company should give them some training to improve their skills. The total overhead is not very good for the company. The insurance and administration may be higher for the company. Company should go to the greatest extent of reducing the costs in the insurance. It may be possible for company get some discount allowed form theinsurance company. And control the spending in the managing.Part BAssumptionThe premise of payback period methodsIdentify all of the costs of initial investment. Assume that they will be paid now. Find the cash inflow for each project. Add up cash flows each year until cost of project covered. Pick the project with the shortest payback period. If the payback period is only one year then it should be compared with an internal figureThe premise of discounted cash flow techniqueUncertainty does not exist. There is no inflation. The appropriate discount rate to use is known, to avoid unnecessary calculations. When undertaking DCF questions, the discount rates have been computed for you, and are given in the discount tables .Unlimited funds can be raised at a competitive rate.Analyzing payback period methodAccording to the payback period method, the original capital that the company invest is £1,000,000 and there are 5 years for the company to get the return that is the budgeted payback period. According to the program, 4 years and 1.5 months that the company will get its all investments. At the last year, company will get the return about £280,000. As a result, based on the period method, the project will be profitable and is worth to invest.Analyzing discounted cash flow techniqueIf the company uses the discounted cash flow technique, according to the peogram, the investment is £1,000,000, and the net present value is 10%. The budgeted payback period is 5 years. After 5 years, the NPV for the project will be £-64,800. It shows that the return is less than the investment. It will be the loss of £64,800 to invest this project. So this project will not be profitable and is not worth to invest.RecommendationAccording to the two methods, it is not difficult to find that the company would better to choose the payback period method. The company chooses payback period method could get the profit of £280,000 and less 5 years could get the all investment. And for the discounted cash flow technique, it will cost 5 years and loss £64,800 at last of the project. So, based on the profit, the company would better to choose thepayback period method.Consideration of other factorsFirst, the environment is one factor that the managers should to consider. Tricol makes a range of furniture and kitchenware. It may make pollute during the producing. If the company does not pay attention to the environment, it may get some fine.Technology is one factor that the managers should to consider about. If the company uses the new technology and equipment in the project, it could improve its productivity. And improve its profitability.The company should also think about the legal. The company should insure that the project is not against the legal. If not, company may be punished by the government and even be banded.At last, company should consider its customers. It should consider that its products, making by the project, will be attracted by the customers. If no customers like it, they may get little profit for the project.ConclusionAs an advisor for the company, this report can help the company make the flex budget and variances and use the two methods to analysis the investment and help the company choose the best method. This will help company make much profit. ReferenceSQA, preparing Financial Forecast (version 3),China Modern Economic Publishing House, 2004./definition/direct-labor-efficiency-variance.html/wiki/Payback_period/terms/d/dcf.aspThe calculation of the variances would be:1.Direct material total variance(standard units of actual production × standard price) – (actual quantity × actual price)[(4kg × 1600) ×£10]–£61600=£64000–£61600=£2400 ( F )2.Direct material usage variancestandard price × (standard units of actual production-actual units)=£10 × (4kg × 1600-5600kg)=£10 × 800kg=£8000 (F)3.Direct material price varianceactual quantity × (standard price-actual price)=5600kg × (£10-£11)=5600kg ×£1=£5600 (A)4.Direct labor total variance(standard hours of actual production × standard rate ph)-(actual hours × actual rate ph)[(2h×1600) ×£9]-(3520h ×£10)=(3200h ×£9)-£35200=£28800-£35200=£6400(A)5.Direct labor rate varianceactual hours × (standard rate ph-actual rate ph)3520h × (£9-£10)=3520h ×£1=£3520(A)6.Direct labor efficiency variancestandard rate ph × (standard hours of actual production-actual hours)£9×[2h×1600-3520h]=£9×(3200h-3520h)=£9×320h=£2880(A)7.Total overhead variance(budgeted variable overhead + budgeted fixed overhead-(actual variable overhead + actual fixed overhead)(£3200+£8200)+(£3200+£8600)=£11400(A)-£11800(A)=£400(A)Appendix 3Variance ratio:The rate for direct material total variances is £ 2400/£ 64000×100%=3.75% The rate of direct material usage variance is £ 8000/£ 64000×100%=12.5% The rate of direct material price variance is £ 5600/£ 64000×100%=8.75% The rate of direct labor variance is 6400/28800×100%=22.2%The rate of direct labor rate variance is £ 3520/£ 28800×100%=12.2%The rate of direct labor efficiency variance is £ 2880/£ 28000×100%=10% The rate of total overhead variance is £ 400/(£ 3200+8600)×100%=3.51%Payback Period:Discounted Cash Flow:。

Budget Report Template for English Writing IntroductionBudget reports are essential for businesses, organizations and projects to keep track of their expenses and revenue. As a writer, it is important to be able to create a budget report in English that is clear and concise. In this document, we will provide a template for a budget report in English writing.Budget Report TemplateIntroductionThe introduction section should provide a brief overview of the budget report. It should include the name of the project/organization/business, the period covered by the budget report, and the purpose of the report.RevenueThe revenue section should list all sources of income for the period covered by the budget report. This can include sales revenue, grants, donations, and other sources of income. It should also include any changes in revenue from the previous period if applicable.ExpensesThe expenses section should list all expenses incurred during the period covered by the budget report. This can include salaries, rent, utilities, marketing costs, and any other expenses. It should also include any changes in expenses from the previous period if applicable.Profit/LossThe profit/loss section should calculate the difference between revenue and expenses for the period covered by the budget report. If the result is a positive number, it represents profit, and if it is a negative number, it represents a loss.ConclusionThe conclusion section should summarize the key findings of the budget report. It should highlight any areas where revenue and expenses have changed significantly from the previous period, and any areas where adjustments may need to be made in the future.ConclusionWriting a budget report in English can seem daunting, but with this template, you can create a clear and concise budget report for your organization or project. Remember to provide an overview of the period covered by the report, list all sources of income and expenses, calculate the profit/loss, and summarize the key findings. By following these steps, you can create an effective budget report that is easy to understand and use.。

第1篇Executive SummaryThis document provides an in-depth analysis of the financial report for [Company Name], covering the period from [Start Date] to [End Date]. The analysis includes an overview of the company’s financial performance, liquidity, solvency, profitability, and investment activities. It also identifies key strengths, weaknesses, and areas of concern that could impact the company’s future financial health.1. Introduction[Company Name] is a [Industry] company that has been operating in the market for [Number of Years]. The company’s primary business activities include [List Key Business Activities]. This financial report analysis aims to provide stakeholders with a comprehensive understanding of the company’s financial position and per formance.2. Financial Performance Overview2.1 Revenue and Net Income- Revenue: [Amount] for the period [Start Date] to [End Date], representing a [Percentage] increase/decrease from the previous year.- Net Income: [Amount] for the period [Start Date] to [End Date], representing a [Percentage] increase/decrease from the previous year.2.2 Earnings Per Share (EPS)- EPS: [Amount] for the period [Start Date] to [End Date], representing a [Percentage] increase/decrease from the previous year.2.3 Gross Margin- Gross Margin: [Percentage] for the period [Start Date] to [End Date], indicating the percentage of revenue remaining after accounting for the cost of goods sold.2.4 Operating Margin- Operating Margin: [Percentage] for the period [Start Date] to [End Date], reflecting the company’s profitability from its core operations.3. Liquidity Analysis3.1 Current Ratio- Current Ratio: [Ratio] for the period [Start Date] to [End Date], indicating the company’s ability to cover its short-term liabilities with its current assets.3.2 Quick Ratio- Quick Ratio: [Ratio] for the period [Start Date] to [End Date], providing a more stringent measure of liquidity by excluding inventory from current assets.3.3 Cash Flow from Operations- Cash Flow from Operations: [Amount] for the period [Start Date] to [End Date], showing the cash generated from the company’s core operations.4. Solvency Analysis4.1 Debt-to-Equity Ratio- Debt-to-Equity Ratio: [Ratio] for the period [Start Date] to [End Date], indicating the proportion of debt to equity used to finance the company’s assets.4.2 Interest Coverage Ratio- Interest Coverage Ratio: [Ratio] for the period [Start Date] to [End Date], measuring the company’s ability to cover its interest expenses with its operating income.5. Profitability Analysis5.1 Return on Assets (ROA)- ROA: [Percentage] for the period [Start Date] to [End Date],reflecting the company’s efficiency in using its assets to generate profits.5.2 Return on Equity (ROE)- ROE: [Percentage] for the period [Start Date] to [End Date],indicating the return on investment for shareholders.6. Investment Activities6.1 Capital Expenditures- Capital Expenditures: [Amount] for the period [Start Date] to [End Date], representing the company’s investments in long-term assets.6.2 Dividends Paid- Dividends Paid: [Amount] for the period [Start Date] to [End Date], showing the cash distributed to shareholders.7. Key Strengths- Strong Revenue Growth: The company has demonstrated consistent revenue growth over the past few years.- Solid Profit Margins: The company maintains healthy profit margins, indicating efficient operations.- Robust Cash Flow: The company has generated substantial cash flow from operations, providing financial flexibility.8. Key Weaknesses- High Debt Levels: The company has a high debt-to-equity ratio, which may increase financial risk.- Dependence on Key Customers: The company’s revenue is heavily reliant on a few key customers, which could be a potential risk.- Competition: The company operates in a highly competitive industry, which may impact its profitability.9. Areas of Concern- Regulatory Changes: Changes in regulations could impact the company’s operations and profitability.- Economic Downturn: An economic downturn could negatively affect the company’s revenue and profitability.- Technological Disruption: The company may face challenges from technological advancements that disrupt its business model.10. Conclusion[Company Name] has demonstrated strong financial performance, with robust revenue growth and healthy profit margins. However, the company also faces certain risks and challenges, including high debt levels and dependence on key customers. Stakeholders should closely monitor the company’s liquidity, solvency, and profitabi lity to ensure its long-term financial health.11. Recommendations- Reduce Debt Levels: The company should focus on reducing its debt-to-equity ratio to mitigate financial risk.- Diversify Customer Base: The company should work on diversifying its customer base to reduce dependence on key customers.- Invest in Research and Development: The company should invest in research and development to stay competitive in a rapidly evolving industry.Appendix- Financial Statements (Income Statement, Balance Sheet, Cash Flow Statement)- Key Financial Ratios- Industry Comparison---This template provides a comprehensive framework for analyzing a company’s financial report. It can be customized to fit the specific needs of the analysis and to include additional information as required.第2篇Executive SummaryThis report provides an in-depth analysis of the financial performance of [Company Name] for the fiscal year [Year]. The analysis covers key financial metrics, profitability, liquidity, solvency, and efficiency ratios, as well as a comparative study with industry benchmarks. The report aims to offer insights into the company's financial health, performance trends, and potential areas of improvement.1. Introduction[Company Name] is a [brief description of the company's industry and business activities]. The company operates in a highly competitive market and has been experiencing [mention any recent developments or market trends]. This report is prepared to evaluate the company's financial position and performance over the fiscal year [Year].2. Financial Statement OverviewThe following sections provide a summary of the company's financial statements for the fiscal year [Year].2.1 Income StatementThe income statement shows the company's revenues, expenses, and net income over the fiscal year [Year]. Key points to consider include:- Revenue Growth: Compare the revenue for the current year with the previous year to determine if there is an increase or decrease in sales.- Expense Analysis: Examine the cost of goods sold, operating expenses, and other expenses to identify any trends or anomalies.- Net Income: Calculate the net income by subtracting total expenses from total revenue and analyze the trend over the years.2.2 Balance SheetThe balance sheet provides a snapshot of the company's assets, liabilities, and equity at a specific point in time. Key points to consider include:- Assets: Analyze the composition of assets, including current assets, fixed assets, and intangible assets.- Liabilities: Review the company's short-term and long-term liabilities to assess its financial obligations.- Equity: Evaluate the changes in equity over time, including retained earnings and additional paid-in capital.2.3 Cash Flow StatementThe cash flow statement tracks the inflow and outflow of cash from the company's operating, investing, and financing activities. Key points to consider include:- Operating Cash Flow: Assess the cash generated from the company's core operations.- Investing Cash Flow: Analyze the cash used for investments, such as purchasing new assets or selling existing assets.- Financing Cash Flow: Review the cash used for financing activities, such as issuing or repurchasing stock, and taking on or repaying debt.3. Financial Ratio AnalysisThis section presents an analysis of various financial ratios to evaluate the company's financial performance and health.3.1 Liquidity RatiosLiquidity ratios measure the company's ability to meet its short-term obligations. Key ratios to consider include:- Current Ratio: Compare current assets to current liabilities to determine the company's short-term solvency.- Quick Ratio: Calculate the quick ratio by excluding inventory from current assets to assess the company's ability to meet short-term obligations without relying on inventory.- Working Capital: Calculate the difference between current assets and current liabilities to determine the company's working capital.3.2 Solvency RatiosSolvency ratios measure the company's long-term financial stability. Key ratios to consider include:- Debt-to-Equity Ratio: Compare the company's total debt to its equity to assess its leverage.- Interest Coverage Ratio: Calculate the interest coverage ratio by dividing earnings before interest and taxes (EBIT) by interest expense to determine the company's ability to cover its interest payments.- Times Interest Earned: Calculate the times interest earned by dividing EBIT by interest expense to assess the company's ability to generate sufficient income to cover its interest obligations.3.3 Profitability RatiosProfitability ratios measure the company's ability to generate profits from its operations. Key ratios to consider include:- Net Profit Margin: Calculate the net profit margin by dividing net income by revenue to determine the company's profitability.- Return on Assets (ROA): Calculate the ROA by dividing net income by total assets to assess the company's efficiency in using its assets to generate profits.- Return on Equity (ROE): Calculate the ROE by dividing net income by shareholders' equity to assess the company's profitability from the perspective of its equity holders.3.4 Efficiency RatiosEfficiency ratios measure how effectively the company uses its resources to generate revenue. Key ratios to consider include:- Inventory Turnover: Calculate the inventory turnover by dividing the cost of goods sold by average inventory to assess how efficiently the company manages its inventory.- Accounts Receivable Turnover: Calculate the accounts receivable turnover by dividing net credit sales by average accounts receivable to assess how efficiently the company collects payments from its customers.- Fixed Asset Turnover: Calculate the fixed asset turnover by dividing sales by average fixed assets to assess how efficiently the company uses its fixed assets to generate revenue.4. Comparative AnalysisThis section compares the company's financial ratios with industry benchmarks to assess its relative performance.4.1 Industry BenchmarksProvide a comparison of the company's financial ratios with industry averages to identify any areas where the company is performing better or worse than its peers.4.2 Peer Group AnalysisSelect a group of similar companies and compare their financial ratios to identify the company's competitive position within the industry.5. ConclusionBased on the analysis of the company's financial statements and ratios, the following conclusions can be drawn:- Overall Performance: [Summarize the company's overall financial performance, including profitability, liquidity, solvency, and efficiency].- Areas of Strength: [Identify the company's areas of strength, such as high profitability, strong liquidity, or efficient operations].- Areas for Improvement: [Identify the company's areas for improvement, such as reducing debt levels, improving liquidity, or increasing efficiency].6. RecommendationsBased on the analysis, the following recommendations are made:- Strategic Actions: [Suggest strategic actions the company can take to improve its financial performance, such as expanding into new markets or improving cost management].- Operational Improvements: [Recommend operational improvements to enhance efficiency and productivity].- Financial Decisions: [Advise on financial decisions that can strengthen the company's financial position, such as refinancing debt or investing in growth opportunities].7. AppendicesThe appendices provide additional supporting information, such as detailed financial statements, calculations of financial ratios, and industry data.---This template serves as a comprehensive guide for analyzing a company's financial report. It can be customized to suit the specific needs of the analysis and to incorporate additional information or metrics as required.第3篇Executive SummaryThis report provides a comprehensive analysis of the financial performance of [Company Name] for the fiscal year ending [Date]. The analysis covers key financial statements, including the balance sheet, income statement, and cash flow statement. The report aims to evaluatethe company's profitability, liquidity, solvency, and efficiency, and to provide insights into its financial health and future prospects.I. Introduction[Company Name] is a [brief description of the company’s industry and business]. The company has been operating in the market for [number of years], and has established itself as a [mention any significant market position or achievements]. This report aims to analyze the financial performance of the company over the fiscal year, providing stakeholders with a clear understanding of its financial health and strategic direction.II. Financial Statements AnalysisA. Balance Sheet Analysis1. Assets Analysis- Current Assets: The current assets of [Company Name] include [list current assets like cash, receivables, inventory, etc.]. An analysis of the trends in current assets can provide insights into the company's liquidity position. For instance, an increasing trend in accounts receivable might indicate a growth in sales, but it could also suggest a longer collection period, which might be a concern.- Fixed Assets: The fixed assets of [Company Name] consist of [list fixed assets like property, plant, and equipment]. An analysis of the depreciation expense and the useful life of these assets can help in understanding the company's investment in long-term assets.- Intangible Assets: [Company Name] has [mention any intangible assets like patents, trademarks, etc.]. An assessment of the value and usage of these assets can provide insights into the company's competitive advantage.2. Liabilities Analysis- Current Liabilities: The current liabilities of [Company Name] include [list current liabilities like accounts payable, short-termloans, etc.]. An analysis of the trends in current liabilities can provide insights into the company's short-term financial obligations and its ability to meet these obligations.- Long-term Liabilities: The long-term liabilities of [Company Name] consist of [list long-term liabilities like long-term loans, bonds, etc.]. An analysis of these liabilities can help in understanding the company's capital structure and its ability to meet long-term financial obligations.3. Equity Analysis- Shareholder’s Equity: The shareholder’s equity of [Company Name] includes common stock, retained earnings, and other equity accounts. An analysis of the changes in equity can provide insights into the company's profitability and its dividend distribution policies.B. Income Statement Analysis1. Revenue Analysis- Revenue Trends: An analysis of the revenue trends over the fiscal year can provide insights into the company's sales performance. An increasing trend in revenue might indicate a successful sales strategy, while a decreasing trend might suggest a need for a new marketing approach.- Revenue Composition: An analysis of the revenue composition can provide insights into the company's dependence on different productlines or services. For instance, if the company is heavily reliant on a single product line, it might be vulnerable to changes in market demand for that product.2. Expense Analysis- Cost of Goods Sold (COGS): An analysis of the COGS can provide insights into the company's cost structure and its efficiency in producing goods or services.- Selling, General, and Administrative Expenses (SG&A): An analysis of SG&A expenses can provide insights into the company's operating efficiency and its marketing and administrative strategies.3. Profitability Analysis- Net Profit Margin: The net profit margin can be calculated by dividing net income by revenue. This metric provides an indication of the company's profitability.- Return on Assets (ROA): The ROA can be calculated by dividing net income by total assets. This metric provides an indication of the company's efficiency in using its assets to generate profits.C. Cash Flow Statement Analysis1. Operating Cash Flow: The operating cash flow provides insights into the cash generated from the company's core business operations. A positive operating cash flow is generally a good sign, indicating that the company can generate enough cash to sustain its operations.2. Investing Cash Flow: The investing cash flow provides insights into the cash used for or generated from investments in assets, such as property, plant, and equipment, and acquisitions.3. Financing Cash Flow: The financing cash flow provides insights into the cash used for or generated from financing activities, such as issuing or repurchasing shares, and taking on or repaying debt.III. Financial Ratios AnalysisThis section presents a summary of key financial ratios that provide a more detailed view of the company's financial performance.1. Liquidity Ratios- Current Ratio: Indicates the company's ability to meet short-term obligations.- Quick Ratio: A more stringent measure of liquidity, excluding inventory.2. Solvency Ratios- Debt-to-Equity Ratio: Indicates the proportion of debt used to finance the company's assets.- Interest Coverage Ratio: Indicates the company's ability to meetits interest payments.3. Profitability Ratios- Gross Margin: Indicates the company's ability to maintain a healthy profit margin on its sales.- Net Profit Margin: Indicates the company's overall profitability.- Return on Equity (ROE): Indicates the return earned on the shareholders' equity.4. Efficiency Ratios- Inventory Turnover: Indicates how quickly the company sells its inventory.- Receivables Turnover: Indicates how quickly the company collectsits receivables.IV. ConclusionThe financial analysis of [Company Name] for the fiscal year ending [Date] indicates that the company has demonstrated strong profitability and liquidity. The company has maintained a healthy balance between debt and equity, and has generated positive cash flow from its operations. However, there are areas of concern, such as the increasing trend in accounts receivable, which might require further investigation and action.Based on the analysis, the following recommendations are made:- Improving Collections: The company should implement strategies to improve its collections process and reduce the average collection period.- Cost Optimization: The company should continue to optimize its cost structure to improve profitability.- Diversification: The company should consider diversifying its product lines or services to reduce dependence on a single market segment.This report provides a comprehensive overview of [Company Name]'s financial performance and offers insights that can guide strategic decision-making and future growth.V. AppendicesThis section includes additional supporting data and analyses, such as detailed financial statements, variance analysis, and industry benchmarks.---This template is a starting point for analyzing a financial report. It can be customized based on the specific needs of the analysis and the nature of the company being evaluated.。