- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

4-25

Too Little Growth

• What to do with the profits? • In a couple of slides, examine Table 4-3 (Scotts Miracle-Gro). • Before that, the next slide displays the overall pattern in respect to how companies finance themselves.

Reduce the Payout Ratio

• Saves cash that can be used to build up equity. • Can anger shareholders who respond by selling their stock, thereby driving down stock price.

4-4

The Sustainable Growth Equation

• Consider a situation when a company has a target dividend payout policy, target capital structure, and does not wish to issue new shares or repurchase existing shares. • Consider a firm whose sales are growing rapidly. • Sales growth requires investment in AR, inventory, and productive capacity.

4-12

TABLE 4-1 A Sustainable Growth Analysis of Genentech, Inc., 2003 – 2007*

4-13

Respond to Gap

• • • • • Compare 2007 against prior years. R stayed at 100%. With some exceptions, P, A, and T all rose. Look at Figure 4-3. In 2007, was Genentech still in cash deficit mode?

4-23

Pricing

• Increases ROE, if %-demand doesn’t fall by more than the %-price increase.

4-24

Merger

• Find a cash cow (white knight, if threatened) with deep pockets.

4-28

What Did Scotts Do?

• • • • Paid dividends. Reduced financial leverage. Leveraged recap in 2007! See Figure 4-4, and ask whether Scotts will need the cash? • Looking forward, new products, targets to acquire?

4-1

McGraw-Hill/Irwin Copyright © 2007 The McGraw-Hill Companies, Inc. All rights reserved.

CHAPTER 4 CHAPTER 4 CHAPTER 4 CHAPTER 4

Managing Growth

Slides Prepared by Hersh Shefrin

4-8

Levers of Growth

• The levers of growth here are PRAT. • g* is the only sustainable growth rate consistent with these ratios. • A company that grows too quickly might not be able to increase operating efficiency, and therefore resort to increased leverage. • Sometimes that is like playing Russian roulette.

4-26

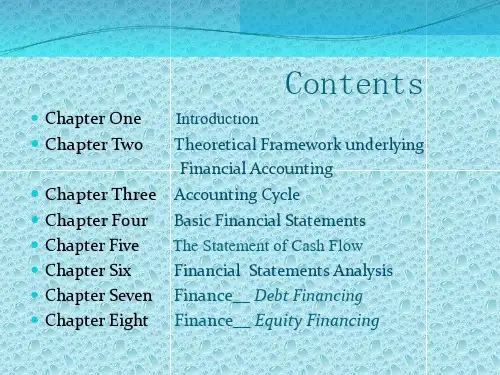

TABLE 4-2 Sources of Capital to U. S. Nonfinancial Corporations, 1998-2007

4-27

TABLE 4-3 A Sustainable Growth Analysis of Scotts Miracle-Gro Company, 2003-2007*

4-10

FIGURE 4-2 A Graphical Representation of Sustainable Growth

4-11

Unbalanced Growth

• A company with unbalanced growth has 3 choices: 1. Change its growth rate. 2. Change its ROA. 3. Change its financial policy, meaning the slope of the line. • Let’s look at Genentech, Inc. and compare their actual growth rates to their g*-estimates.

4-7

Plowback

• If the firm pays out all of its earnings as dividends, it cannot grow equity. • If R stands for the plowback ratio, then g* is the product of R and Earnings over Equity. • g* = R x ROE. • g* = R x P x A x T or PRAT, where T (T-hat) is Assets/Equity based on beginning of period Equity, A is asset turnover, and P is profit margin.

• Get cash. • Increase borrowing capacity. • Difficult to do in most countries.

4-19

Increase Leverage

• Raises cash. • Also raises risk of bankrupanced Growth

• ROA is Net income / Assets. • With this definition, g* is the product of (RT) and ROA, where RT reflects financial policy and ROA reflects operating performance. • Look at Figure 4-2 in the next slide, where sales growth off the line with slope RT generate either cash deficits or surpluses.

– Sell new equity – Increase financial leverage – Reduce dividend payout – Prune marginal activities – Increase prices – Merge with a “cash cow”

4-18

Sell New Equity

4-21

Profitable Pruning

• Raises ROE, and therefore earnings, and therefore retained earnings. • Retained earnings are part of equity. • Prune by un-diversifying unrelated product lines with no synergy.

4-3

Phases

1. Startup (usually with losses) 2. Rapid growth (with infusions of outside financing) 3. Maturity (generating cash) 4. Decline (marginally profitable, with cash to search for new products, investments)

• A company’s sustainable growth rate is the maximum rate it can grow without depleting financial resources. • How to compute a company’s sustainable growth rate? • How to respond when growth veers off the sustainable trajectory?

Introduction

• It is possible for companies to grow too quickly. • It is possible for companies to grow too slowly. • Growth needs to be managed.

4-2

Sustainable Growth

– Who benefits from corporate diversification, shareholders or managers?