Economics 1 - Fall 2003 - Train - Final Answers

- 格式:pdf

- 大小:41.71 KB

- 文档页数:13

Econometrics IChina Center for Economic Research, Peking UniversityMinggao Shen, Fall 2003Office: 621 CCER; Phone: 6275-3109; Email: mshen@.Office Hour: Mondays 11:00-12:00amTA: Fei XU, phoenix-xf@Class Meets: Wednesdays 1:30-4:20 pm; TA Session: TBACourse DescriptionThis is an introductory graduate level course in Econometrics. This course helps students understand and use regression. In addition, the course should give students insight into how to correct some common problems found in estimation. As such, the lectures will tend to emphasize the practical uses of econometric theory, and students will have considerable opportunity to put this to use in computer-based assignments. At the end of the course, it is expected that students will be able to conduct their own empirical investigations, as well as to critically evaluate econometric and other statistical evidence.Required TextbooksEconometric Analysis, by William H. Green (Fifth Edition), FT Prentice Hall, 2003. (WG)Econometric Analysis of Cross Section and Panel Data, by Jeffrey M. Wooldridge, The MIT Press, 2002. (JW1)Recommended TextbookIntroductory Econometrics: A Modern Approach, by Jeffrey M. Wooldridge.South-Western College Publishing, 2000. (JW2)PrerequisitesProbability and Statistics, Calculus, Linear AlgebraHomeworkThere are weekly graded homework assignments. They will involve both theoretical and empirical exercises. Homework assignments are due in a week.Grading PolicyThe course grade will be based on homework assignments and, a midterm exam, and a final exam. Both exams are open book ones. The weights are:Homework 30%Exam 30%Midterm40%ExamFinalCourse Outline1 Econometrics and Data: An Introduction (WG, Ch.1; JW1, Ch. 1)2 The Simple Regression Model (JW2, Ch. 2)3 The Multiple Linear Regression Model (WG, Ch. 2,3)PropertiesSampleSmallHoliday4 Large Sample Theory (WG, Ch. 5)5 Maximum Likelihood Estimation (WG, Ch. 17)6 Data Problems (JM1, Ch. 4,5)MulticollinearityErrorsMeasurementErrorsUnobservable7 Functional Form and Model Selection (WG, Ch. 7,8; JW1, Ch. 6)VariablesOmittedExtraneousVariablesEndogeneityEstimationInstrumentalVariablesMidterm Exam8 The Nonlinear Regression Model (WG, Ch. 9)9/10 Generalized Regression Models (WG, Ch. 10,11,12,19) HeteroskedasticitySerial Correlation11/12 Systems of Regression Equations (WG, Ch. 14,15; JW1, Ch. 7,9) The Seemingly Unrelated Regression ModelThe Simultaneous Equations Model13 The Generalized Method of Moments (WG, Ch. 18)14 The Dynamic Regression Model (WG, Ch. 19)Final Exam。

Economics2010a Fall2003Edward L.Glaeser Lecture22.Choice and Utility Functionsa.Choice in Consumer Demand Theory and Walrasian Demandb.Properties of demand from continuity and properties from WARPc.Representing Preferences with a Utility Functiond.Demand as Derived from Utility Maximizatione.Application:Fertilityx i denotes commodities,continuous numbersx x 1,x 2,....x Lvector of discretecommodities p p 1,p 2,....p L vector of prices w wealth available to be spentThe budget constraint p x i 1Lp i x iwMWG Definition2.D.1The Walrasian Budget SetB p,w x L:p x wis the set of all feasible consumption bundles for the consumer faces market prices p and has wealth w.Note:We will be treating all prices and consumption levels as being weakly positive.Prices are treated as exogenous–as they will be in the production case.While neither consumer nor producer chooses prices(generally)prices are the extra parameter in each side’s problem that ensures that demand and supply are equal.Non-linear prices are certainly possible(example2.D.4).The Walrasian Demand Function is the set C B p,w which is defined for all p,w ,or at least for a full dimensional subsetp,w L 1We generally assume that C B p,w has a single element(for convenience)but it doesn’t need to.We writeC B p,w x p,w x1 p,w ,...x L p,wWe will also generally assume that demand is continuous and differentiable. MWG Definition2.E.1:The Walrasian Demand Function ishomogeneous of degree zero ifx p, w x p,w for any p,w and 0.This property follows from the fact that choice is only a function of the budget set and B p,w x L:p x w is the same set asB p, w x L: p x wThis fairly obvious claim is in many ways the underlying intellectual basis for the economic bias that the price level doesn’t matter.Differentiating x p, w x p,w totally with respect to gives us the following equation:i 1L x k p ,w p i p i x k p ,w ww 0 i 1L x k p ,w p i p i x k x k p ,w w w x k i 1L pi k w k 0This tells you that for any commodity,the sum of own and cross price elasticities equals -1times the income elasticity.MWG Definition2.E.2Walras’Law:The Walrasian Demand correspondence x p,w satisfies Walras’law if for every p 0and w 0,we have p x w for all x x p,w .This just says that the consumer spends all of his wealth.Looking ahead,Walras’law will come about as long as consumers are not “satiated”in at least one of the goods.Walras’Law and differentiability give us two convenient equalities.Differentiating p x w with respect to w yields:i 1Lp i x i p ,w w 1or manipulating this slightly yields:i 1L x i p ,w w w x i p i x i w i 1Lw i i0,where i p i x i w ,the budget share of good i .This means that income elasticities (when weighted by budget shares)sum to one.All goods can’t be luxuries,etc.Sometimes this is known as Engel aggregation (income effects are after all drawn with Engel curves).Differentiating p x w with respect to p k yields:i 1Lp i x i p ,wp k x k 0or multiplying the whole expression by p k w : i 1L x i p ,w p k p k x i p i x i w p k x k w i 1Lp k ii k0,where again i p i x i wThis means that cross price elasticities sum to-1times the budget share of the relevant good.Overall,these elasticities have to sum to a negative number.MWG Definition2.F.1The Walrasian Demand function satisfies the weak axiom of revealed preference if the following property holds for any two price-wealth situations p,w and p ,w : If p x p ,w w and x p ,w x p,wthen p x p,w w .In words–if the goods that are chosen with budget set(a)are affordable at budget set (b),and not the same as the goods that are chosen at budget set(b),then the goods that are chosen at budget set(b) are not affordable at budget set(a).Just like in the last lecture,WARP meansthat if bundle(b)is preferred to bundle(a) in one setting,it will be preferred in all other settings.A property that follows from WARP:price changes that are fully income compensated make consumers weakly better off.Take any p,w and let p p p Compensate the consumer with an income change so that the old bundle is exactly affordable at the new prices,i.e.:w w w x p,w pThe consumer’s new consumption level atp ,w satisfies the WARP condition:p x p,w w ,which then implies thatp x p ,w w,and this holds with strict equality whenx p ,w x p,wGiven that the consumer could have chosen the old bundle,the consumer must have weakly preferred the new bundle.MWG Proposition2.F.1:WARP implies the law of compensated demand.If the Walrasian demand function x p,w satisfies Walras’Law and is homogeneous of degree zero,then x p,w satisfies the weak axiom if and only if the following property holds.For any compensated price change from an initial situation p,w to a new price wealth pair p ,w p ,p x p,x ,then p p x p ,w x p,x 0,and this equality holds strictly whenx p ,w x p,x .We are now interested only in the weakaxiom- law of demand part of the proposition.First,note that if x p ,w x p,w we’re done,so consideronly the case where x p ,w x p,w . In that case,Walras’law gives us:p x p ,w w ,and we havedefined w so that w p x p,w Together,this gives us thatp x p ,w x p,w 0But we also know that as p ,w satisfies theWARP condition:p x p,w w andx p ,w x p,wit follows that p x p ,w w.Using p x p,w w(again by Walras’Law),this gives us that:p x p ,w x p,w 0Subtraction then yields:p p x p ,w x p,w 0 Change in prices times change in quantities is negative.Since p x 0for all compensated price changes,this also holds in the limit for very small price changes and dp dx 0.We can use matrix notation and write:dx D p x p ,w dp D w x p ,w dwwhich just means:dxi 1L x 1 p i dp i x 1 w dw ,.., i 1L x L p i dp i x L w ordx D p x p ,w dp D w x p ,w x p ,w dp ordxD p x p ,w D w x p ,w x p ,wT dpThe D p x p ,w D w x p ,w x p ,wTterm is a matrix where the element in row i ,column j of the matrix isx ip k x i w xkx 1 p 1 x 1 w x 1....x 1 p L x 1w x L.............x L p 1 x L w x 1.... x L p L x Lw xLand thendpD p x p ,w D w x p ,w x p ,wT dp 0The term in brackets is the Slutsky matrix.MWG Proposition2.F.2:If a differentiable Walrasian demand function x p,w satisfies Walras’law, homogeneity of degree zero and WARP, then at any p,w the Slutsky matrix is negative semi-definite,i.e.v Sv 0for any v L.MWG Proposition2.F.3:Suppose that the Walrasian demand function x p,w is differentiably homogeneous of degree zero,and satisfies Walras’Law.Then p S p,w 0 and S p,w p 0for any p,wUtility Functions–Finally getting to the basic tool of99%ofeconomics.Back to preferences.We want fourattributes:(1)completeness and(2)transitivityThese were defined in lecture1and we refer to preferences with these attributes as being rational.Definition3.B.2.:The preference relation on X is monotone if x,y X,and y x impliesy x.It is strongly monotone if y x and y x implies y x.In many cases,we won’t naturally have monotonicity,but then a little redefinition of variables does the trick(turn a bad into a good by multiplying by-1).A slight twist(I mentioned this earlier):Definition3.B.3:The preference relation on Xis locally nonsatiated if for every x,y X,and every0,there exists a ysuch that y x and y x.This means that there exists a y vector that is arbitrarily close to x that is strictly preferred to x.One last property:Definition 3.C.1.:The preference relation on X is continuous if it is preserved under limits.That is,for any sequence of pairs x n ,y n n 1 with x n y n for all n ,x lim n x n and y lim n y n we have x y .The famous counterexample islexicographic preferences,where more of good 2is preferred to less,but unless the bundles have thesame amount good 1,then the bundle with more good 1is always preferred.Consider sequence 1,with no units of good 2and 1/n units of good 1,and sequence 2with no units of good 1,and1 1/n units of good2.For all finite n,sequence1is preferred to sequence1,but in the limit sequence1 yields zero unit of either good and sequence2yields1unit of good2and is therefore preferred.Lexicographic preferences are a famous example,but hardly amainstay of either theory or empirical work.MWG Definition1.B.2:A functionu:X is a utility function representing preference relation if for all x,y X, x y if and only if u x u y Proposition3.C.1:If the rational preference relation on L is continuous, then there is a continuous utility functionu x that represents .The proof in MWG requires monotonicity–a slight variant is toto take a probability measure on L that has positive density everywhere,and then letu x 1 prob y y x .By construction,if x y then u x u y and if u x u y then x y.Now we’ve gotten to a utility function and we know that it is continuous.MWG Definition3.B.4:The preference relation is convex if for every x X the upper contour sety Y:y x is convex,that is if y x and z x then y 1 z x for every 0,1 .MWG Definition3.B.5:The preference relation is strictly convex if for every x X if y x and z x andy z implies that y 1 z x for every 0,1 .Convex preferences imply that u . is quasi-concave,i.e.the sety L:u y u xis concave(equivalentlyu y 1 x Min u x ,u y for any x,y and all 0,1 .Strict convexity implies strictquasi-concavity.The utility maximization problem is to maximize u x subject to theconstraint p x 0.MWG Proposition3.D.1:If p 0and u . is continuous then the utility maximization problem has a solution. The proof relies on the fact that a continuous function always has a maximum on a compact set,so you just need to show that the budget set is closed and bounded,pact.Proposition3.D.2:Suppose that u . is a continuous utility functionrepresenting a locally non-satiated preference relation defined on the consumption set X L.Then the Walrasian demand correspondence has the following properties:(1)x p,w is homogeneous of degree zero in prices and wealth,i.e.x p,w x p, w for every 0(2)Walras’law p x p,w w(3)If is convex so that u . isquasi-concave,then x p,w is a convex set.Moreover if is strictly convex,so that u . is strictly quasi-concave,then x p,w consists of a single element.In practice,we write down a Langrangianmax x, U x1,x2,...x Lwi 1Lp i xiwhich yields us a system of first order conditions:U x1,x2,...x Lx ip iThese are L equations and we have L 1 unknowns,so we need to use the budget set as well to solve the problem.An application:fertility decisions.Many empirical puzzles:(1)Why does fertility drop with income so substantially across countries?(2)Why is fertility below replacement in all of Europe,but not in the U.S.?How would we capture this:Begin with U C,N –utility over consumption and kids.Assume that kids have both a cash cost(k),and a time cost(t)Assume that you have a time budget that can either be used producing kids or making money.Write down the total budget constraintWT Y C k tW NSolving C from the budget set the agent’s maximization problem reduces toU WT Y k tW N,NmaxNWhich in turn produces a F.O.C.k tW U1 WT Y k tW N,NU2 WT Y k tW N,N 0 where U1is the partial w.r.t.the1st argumentof U and similarly for U2.The marginal utility of another kid is weighed off against the marginal cost in terms of time and money.Comparative statics can be derived by (1)Using the implicit function theorem to define N Z ,where Z is a vectorrepresenting all of the parameters in this equation(i.e.,Z t,T,Y,W,k )and(2)Totally differentiating the F.O.C.to findNZ.LetF N,Z k tW U1 WT Y k tW N,NU2 WT Y k tW N,Nso that the F.O.C is F N Z ,Z 0.Differentiation w.r.t parameter Z then gives us:F1 N Z ,Z NZF2 N Z ,Z 0 from whichN Z F2 NZ ,ZF1 N Z ,Z.In this caseF1 N ,Z k tW 2U11 C ,N U22 C ,NU22 C ,N 2 k tW U12 C ,N and C WT Y k tW N .We generally assume that terms likeF1 N Z ,Z are negative(Why?)so thesign of Ndepends entirely on the sign ofZF2 N ,Z F N ,Z.ZIn the case of Z Y for example:Y k tW U1 WT Y k tW N ,N U2 WT Y k tW N ,Nk tW U11 WT Y k tW N ,N U12 WT Y k tW N ,NWhat can we say about this?Does this give us any intuition about anything?In the case of W:W k tW U1 WT Y k tW N ,N U2 WT Y k tW N ,Nk tW T tN U11 WT Y k tW N ,N T tN U12 WT Y k tW N ,NtU1 WT Y k tW N ,NIt’s the same as the unearned incomeeffect expect for the third term.What doesthat third term represent?Now let’s get a little more fancy and assume that parents care about both quantity and quantity,i.e.U C,Q,N .For simplicity assume utility is a separableand quasi-linear in consumption,soU C,Q,N C V Q,Z Q W N,Z N . Assume children cost WtQN.Then the first order conditions are:V Q,Z QWtNQandW N,Z NWtQNIf a parameter increases the marginal return to quality–this will have the following effect2V Q,Z QQ2 QZ Q2V Q,Z QQ Z QWt NZ Qand2W N,Z NN2 NZ QWt QZ Qor QZ Q2V Q,Z QQ Z Q2V Q,ZQQ2Wt 22W N,Z NN2and NZ Q2V Q,Z QQ Z Q2V Q,ZQQ22W N,Z NN2Wt 2How can we sign these two things?Each equation also tells you that the price per child rises as the quality of each child increases,and the price of quality rises as the number of children rises.Through the budget set there is an inherent substitutability between quantity and quality of children.。

武汉大学2003攻读硕士学位研究生入学考试试题考试科目:现代经济理论(含宏、微观经济学) 科目代码:4611. (25’) Consider an economic model in which the production function can be written as 10 1≤+=−ββa g L K Y a a p , here g is the government spending per capita, K, L, Y are aggregate capital, population and output respectively. The government spending is financed by an income tax, i.e., Y Lg G τ==. Capital accumulation equation is K sY K δ−=. Suppose the saving rate s ,income tax rate τ,depreciation rate δand population growth rate n are given exogenously, S+τ<1.(1)Show that if 1p βα+, then the capital stock per capita will convergesto a steady-state value k * which is positively correlated with income tax rate τ.(2)Show that if 1=+βα, then the capital stock per capital will increase with a constant growth rate if δτ+n s f .2. (25’) Consider an economy with identical long-lived individuals whose utility functions can be written as 10 0, ,]lnk lnc [t t 0p p f βγγβdt e t +∫−∞, her c t ,k t are consumption and capital stock per capita in time t. Suppose the population growth rate is zero. The capital accumulation equation is 1a 0 ,p p k c Ak k a δ−−=.Solve the steady state values of consumption, capital stock and output per capita.3. (25’) Consider an OLG model in which each individual can live two period. Individuals’ utility function can be written as 12t 1t lnc lnc ++=βt U , here c 1t and c 2t+1 are the consumptions in period t of young and old individuals respectively. Individual’s wealth constraints are,1t t t w s c =+ )1(112+++=t t t r s cHere w t , s t and r t+1 are wage, saving and interest rate respectively. Production function can be written as at t Ak y =. Suppose that the depreciation rate δ=1 and population growth rate are zero. Assumption the government levies an output tax with a constant tax rate τ.(1) Solve the steady state values of capital stock and output per capita.(2) Show that the relationship between the tax income of the government and tax rate can be described as a Laffer Curve, i.e., as the tax rate increase, the tax income increases when the tax rate is small and decreases when it is large enough. Solve the tax rate with the maximum tax income.4. (25’) If preferences are locally nonsatiated, and if (x *,y *,p )is anequilibrium with transfers, then the allocation(x *,y *)is Pareto optimal.5. (25’) If preference i ≥ is homothetic, assume that x i (p,w i ) is differentiable, then x i (p,w i ) satisfies the uncompensated law of demand property.6. (25’) Suppose that production set Y is convex. Then every efficient production Y y ∈is a profit-maximizing production for some nonzero price vector 0≥p .答案部分武汉大学2003攻读硕士学位研究生入学考试试题考试科目:现代经济理论(含宏、微观经济学) 科目代码:4611. Consider an economic model in which the production function can be written as 10 1≤+=−ββa g L K Y a a p , here g is the government spending per capita, K, L, Y are aggregate capital, population and output respectively. The government spending is financed by an income tax, i.e., Y Lg G τ==. Capital accumulation equation is K sY K δ−=. Suppose the saving rate s ,income tax rate τ,depreciation rate δand population growth rate n are given exogenously, S+τ<1.(1) Show that if 1p βα+, then the capital stock per capita will convergesto a steady-state value k * which is positively correlated with income tax rate τ.(2)Show that if 1=+βα,then the capital stock per capital will increase with a constant growth rate if δτ+n s f .2. Consider an economy with identical long-lived individuals whose utility functions can be written as 10 0, ,]lnk lnc [t t 0p p f βγγβdt e t +∫−∞, her c t , k t areconsumption and capital stock per capita in time t. Suppose the population growth rate is zero. The capital accumulation equation is 1a 0 ,p p k c Ak k a δ−−=.Solve the steady state values of consumption, capital stock and output per capita.3. Consider an OLG model in which each individual can live two period. Individuals’ utility function can be written as 12t 1t lnc lnc ++=βt U , here c 1t and c 2t+1 are the consumptions in period t of young and old individuals respectively. Individual’s wealth constraints are,1t t t w s c =+ )1(112+++=t t t r s cHere w t , s t and r t+1 are wage, saving and interest rate respectively. Production function can be written as a t t Ak y =. Suppose that the depreciation rate δ=1 and population growth rate are zero. Assumption the government levies an output tax with a constant tax rate τ.(1) Solve the steady state values of capital stock and output per capita.(2) Show that the relationship between the tax income of the government and tax rate can be described as a Laffer Curve, i.e., as the tax rate increase, the tax income increases when the tax rate is small and decreases when it is large enough. Solve the tax rate with the maximum tax income.4. If preferences are locally nonsatiated, and if (x *,y *,p )isan equilibrium with transfers, then the allocation(x *,y *)is Pareto optimal.5. If preference i ≥ is homothetic, assume that x i (p,w i ) is differentiable, then x i (p,w i ) satisfies the uncompensated law of demand property.6. Suppose that production set Y is convex. Then every efficient production Y y ∈is a profit-maximizing production for some nonzero price vector 0≥p .。

Department of Economics Professor Kenneth Train University of California, Berkeley Spring 2003ECONOMICS 1FINAL EXAMINATIONMay 16, 5-8pmINSTRUCTIONS1. Please fill in the information below:Your Name:Your SID#:GSI’s Name:Section Days/Time:2. There are a total of 180 points, 8 questions, and 11 pages (including this cover sheet). The suggested times to spend oneach question are in parentheses.3. Answer the questions in the space provided. (NO BLUE BOOKS.) If you need extra room to answer questions, use thebacks of the pages.4. Calculators are not permitted.5. You may leave early if you finish prior to 7:45. So that the end of the exam is orderly, please do not leave between 7:45and 8pm.6. When time is called, stop writing immediately and pass your exam to your right.HAVE A GOOD SUMMER! J>>> D O NOT TURN THE PAGE UNTIL YOU ARE TOLD TO BEGIN THE EXAM. <<<QUUESTION 1: 40 Total Points (40 Minutes)True, False, or Uncertain For each of the following decide whether the statement is true, false, or uncertain and explain why. Your explanation determines the grade; you will be given no credit for an answer without an explanation. Use diagrams where they are appropriate to complement your answer.a) [8 points] A competitive market maximizes social welfare because in a competitive market profits are zero.b) [8 points] The socially optimal level of pollution is zero.c) [8 points] An additional dollar of tax reduction has the same effect on the economy as an additional dollar of governmentexpenditure.QUESTION 1 (Continued)d) [8 points] When OPEC triples the price of oil used by American producers, it causes aggregate output and prices to rise.e) [8 points] The aggregate demand curve for the economy is derived by aggregating market demand curves across allmarkets.Consider an island economy with only two persons, Alex and Ben, and only two goods, fish and coconuts. Alex could catch 6 fish per hour or collect 12 coconuts per hour, and Ben could catch 4 fish per hour or collect 2 coconuts per hour. These rates are the same no matter how much time they spend in each activity. Each person works 10 hours each day.a) [3 points] What is the opportunity cost of fish for Alex?b) [7 points] Draw the production possibility frontier for this island economy. Be sure to label the axes, and show the unitson the axes.c) [10 points] Now suppose that a third person, Maria, enters the island economy. She could catch 5 fish per hour or 5coconuts per hour. She also works 10 hours each day. Draw the new PPF for this three-person economy1010 20 MC ACD $20Q MR 2 4 6 812 14 18 16 12 86 4214 16 18Berkeley Waste Management (BWM) has a monopoly on the garbage pickup market in Berkeley. BWM’s costs are shown below.a) [6 points] Given the costs of BWM and the demand curve as in the graph above, explain the most likely reason that BWM has a monopoly.b) [5 points] What are the profit maximizing level of output and price? Calculate profits and deadweight loss. Show yourwork.c) [6 points] The government decides to regulate BWM by inquiring them to produce at the socially optimal level of output.What are the firm’s output, price, and profits and inefficiency (i.e., deadweight loss) under this regulation? Show your work.d) [8 points] Suppose instead of forcing BWM to produce at the socially optimal level, the government decided to regulatethe monopoly by placing a business tax of $200 on the land owned by BWM. When entry/exit is not allowed, will trash pickup consumers prefer this policy over the policy proposed in part c)? Use consumer surplus and efficiency (deadweight loss) as criteria for making your judgment.Consider an oligopoly consisting of two firms. The table below depicts each firm’s profits, depending on what price both firms charge. Firm B chooses: Firm A chooses:a) [5 points] Find (if any) each firm’s dominant strategy.b) [5 points] Which strategy does each firm choose in equilibrium when no collusion is allowed?c) [5 points] Suppose that collusion is allowed between the two firms. Could these firms benefit from collusion? Why orwhy not?QUESTION 5: 15 Total Points (15 Minutes) The demand and supply schedule for coffee are:Price ($ per cup)Qd Qs 1.50 90 30 1.75 70 40 2.00 50 50 2.25 30 60 2.751070a) [3 points] If there is no tax on coffee, what is the price and how much coffee is consumed?b) [6 points] If a tax of 75 cents a cup is imposed, what is the price and how much coffee is consumed?c) [6 points] How much of the tax is paid by consumers? How much of the tax is paid by sellers? Low High Low Firm A earns $18 Mill. Firm B earns $18 Mill. Firm A earns $20 Mill. Firm B earns $23 Mill. High Firm A earns $23 Mill. Firm B earns $4 Mill. Firm A earns $16 Mill. Firm B earns $16 Mill.The Korean economy, a small and open economy, is in quite a slump these days. Its president, Moo Hyun Roh, has decided to use either monetary or fiscal policy to revive economic activity. Suppose the following model provides a good description of this economy:C = 0.9 (Y – T)T = 100I = 100G = 100EX = 20IM = 20 + 0.1Ywhere C is consumption, Y is aggregate output, T is tax, G is government expenditure, I is planned investment, EX is exports, and IM is imports. Suppose that prices, interest rates and exchange rates are fixed. (Since these variables are fixed, you can ignore the “feedback effects” to answer the following questions.)a) [4 points] Find the equilibrium values of output, consumption, imports, and the trade deficit (or surplus). Show yourwork.b) [4 points] Increase G by 100 to observe the effects of fiscal policy. What is the G multiplier? What is the newequilibrium output? Show your work.c) [4 points] What is the G multiplier if there were no exports and imports? Is it greater or smaller than the multiplier youfound in part b)? Explain.Now assume that prices, interest rate, and exchange rates are no longer fixed. In reality, the Korean economy is little bit more complicated than the equations given above. For the following questions, consider the usual relationships among different variables that we discussed in class.d) [7 points] As a result of the fiscal policy in part b),• Does Korean Won appreciate or depreciate?• Does the balance of trade improve or worsen?• Does the price level increase or decrease?Answer using graphs and explain in words.e) [7 points] Now suppose that the money supply increases by 40, without a change in G. Answer the following questionsusing graphs and explain in words.• Does the equilibrium output increase or decrease?• Does Korean Won appreciate or depreciate?• Does the balance of trade improve or worsen?• Does the price level increase or decrease?f) [4 points] Suppose that Mr. Roh wants to choose a policy that can enhance the long term growth of the Korean economy.If you were an economist making a recommendation to Mr. Roh, which policy would you recom mend? Explain.QUESTION 7: 20 Total Points (20 Minutes)Consider two countries, Japan and U.S., producing two goods, cell phones and computers. Suppose that there are 10 workers in each country. The table below depicts how many goods can be produced by a worker per day in each country.Output per workerJapan U.S.Cell phones 1 2Computers 6 6a) [2 points] Which country (if any) has the absolute advantage in producing cell phones?b) [2 points] Which country (if any) has the absolute advantage in producing computers?c) [3 points] Which country (if any) has the comparative advantage in producing cell phones?d) [3 points] Which country (if any) has the comparative advantage in producing computers?e) [5 points] If the terms of trade are one cell phone for one computer, can trade benefit both countries? Why or why not?f) [5 points] Describe the range of terms of trade (i.e., relative prices) at which both countries would want to specialize (i.e.,produce only one good) and trade. Explain your answer.Page 11 of 11 QUESTION 8: 15 Total Points (15 Minutes)Using AS-AD curves to illustrate your point, discuss the impact of the following events on the equilibrium price level and output:a) [5 points] In an effort to fight inflation, the fed decides to implement contractionary monetary policy.b) [5 points] After some period of time inflation is finally under control but the country is still in recession. The Congresspasses a tax cut with no corresponding change in government spending.c) [5 points] Due to the outbreak of Severe Acute Respiratory Syndrome (SARS) in Asia, shipments of input products fromAsia to the U.S. have decreased significantly.。

2003年首都经济贸易大学经济学考研真题及详解一、名词解释1.边际产品价值(VMP)答:边际产品价值(VMP)指在完全竞争条件下,厂商在生产中增加某种生产要素一个单位的投入所增加的产品的价值,等于边际物质产品(MP)与价格(P)的乘积,即:VMP=MP·P。

因为存在边际收益递减规律,随着这种可变要素投入量的增多,其边际产品递减,从而边际产品价值也逐渐下降,所以边际产品价值曲线为一条自左上方向右下方倾斜的曲线。

在完全竞争条件下,边际产品价值曲线(VMP)与边际收益产品曲线(MRP)互相重合,该生产要素的边际收益产品曲线,同时就是其边际产品价值曲线,从而也就是完全竞争条件下厂商对该生产要素的需求曲线。

在不完全竞争市场上,MR、AR、P 三者不全相等,厂商必须降低商品价格才能出售更多的产品,因此边际收益产品必然小于边际产品价值。

VMP、MRP 两条曲线不再重合,此时仅有厂商的边际收益产品曲线代表了对该种生产要素的需求曲线。

2.帕累托标准答:帕累托标准也称为帕累托最优状态,是指在一个经济体中,资源的任何一种重新配置,已经不可能在其他人的效用水平不下降或福利不减少的情况下使任何一个人的效用水平或福利水平提高的状态。

换言之,社会已达到这样一种情况,即任何变革都不可能使任何人的福利有所增加,而不使其他人的福利减少。

3.投资乘数答:投资乘数指收入的变化与带来这种变化的投资变化量的比率。

投资乘数的大小与居民边际消费倾向有关:居民边际消费倾向越高,投资乘数则越大;居民边际储蓄倾向越高,投资乘数则越小。

即k i=ΔY/ΔI=1/(1-b)或k i=1/(1-MPC)=1/MPS。

式中,ΔY 是增加的收入,ΔI 是增加的投资,MPC 或b 是边际消费倾向,MPS 是边际储蓄倾向。

投资增加会引起收入多倍增加,投资减少会引起收入成比例减少。

由于这是凯恩斯最早提出来的,所以又称之为“凯恩斯乘数”。

投资乘数发挥作用的前提假设是:①社会中存在闲置资源;②投资和储蓄的决定相互独立;③货币供应量的增加适应支出增加的需要。

对外经济贸易大学2003年攻读硕士学位研究生入学考试(金融学院)金融学:专业基础课(试题代码:471)所有答题(包括英语的判断题和选择题)均做在答卷纸上,并在每题答案前标明各级题号。

答在本试题卷上无效。

本试卷共4页。

一、True-False Questions (1×15=15 points. Please write “T” for true statements or “F” forfales statements following every question number on your answer sheet)1.International investment position is a concept of stocks.n currency market does not belong to European currency market.3.Tariff is of expenditure shifting policies, but monetary policy is just one of expenditure switching policies.4.Yankee bond is a kind of Eurobonds.5.Foreign exchange control is mainly aimed at residents.6.The theoretical foundation of commodity arbitrage is the Law of One Price, so is that of interest arbitrage.7.The meaning of foreign exchange at premium or discount in direct quotation system is just the opposite of that in indirect quotation system.8.Monetary Approach to exchange rate determination is actually another version of Purchasing Power Parity Theory.9.Interest Parity Theory is about determination of short-run exchange rate.10.Buying in the international gold market will increase international reserves.11.Free floating of exchange rate leads to a huge drain on foreign exchange reserves.12.Devaluating native currency may improve on trade account balance.13.In buyer’s credit, payment at sight is required.14.Bretton Woods System can be regarded as an exchange rate system of gold exchange standard.15.Reverse position in IMF is included in general drawing rights.答案:1T 2F 3F 4F 5F 6t 7F 8F 9 T 10F 11F 12F 13F 14F 15F二、Single or Multiple-Choice Questions(2×10=20 points. In each question, at least oneanswer in true. If your choices are right but fewer than the standard, you will still get fewer points. Please write the letters of your choice following every question number on your answer sheet)1.Meade’s conflict will take place in conditions ofa. unemployment and deficit in the balance of paymentsb. unemployment and surplus in the balance of paymentsc. inflation and deficit in the balance of paymentsd. inflation and surplus in the balance of payments2.Which of the following organizations are included in the world bank group?a. International Bank for Reconstruction and Developmentb. International Development Associationc. International Finance Companyd. Bank for International settlements3.Assume that annual interest rate of Great British pound is 21% and that of US dollar is 9%, then according to Interest Parity Theory Great British pound relative to US dollar in 3 monthsforward exchange market will be devaluated bya. 30%b. 12%c. 10%d. 7.5%e. 4%f. 3%4.Bretton Woods System is the result ofa. White Planb. Keynes Planc. Brady Pland. Marshall Plan5.Currencies determining value of SDRs after 1999 includea. Swiss Francb.United State Dollarc. French Francd. Deutsche Marke. Italian Liraf. Great British Poundg. Japanese Yenh. Euro6.According to Balance of Payment Theory of Exchange Rate , which of the following factors will lead to devaluation of native of native currency?a. domestic interest rate level upb. foreign GNP increasedc. native GNP increasedd. domestic price level up7.Eurodollat meansa. US dollar in Europeb. US dollar outside USAc. a general term of US dollars in the whole worldd. US dollar reserve8.In general, a letter of credit isa. irrevocableb. confirmedc. unconfirmedd. transferablee. nontransferable9.In Absorption Approach to the balance of payments , the direct influence of devaluation on absorption includesa. cash balances effectb. terms-of-trade effectc. income redistribution effectd. monetary illusion effecte. idle resources effect10. When economy is in conditions of inflation and deficit in the balance of payments, which of policy mixes should be practiced by Mundell Assignment Rule?a. decreasing fiscal expenditure and raising interest rateb. increasing fiscal expenditure and reducing interest ratec. increasing fiscal expenditure and raising interest rated. decreasing fiscal expenditure and reducing interest rate答案:1ad 2abc 3f 4ab 5cde 6cd 7b 8 9acd 10ac三、简答题(每小题4分,共36分)1.什么是边际效用递减规律?答:(1)基数效用论者的两个基本概念就是总效用和边际效用。

北京市考研经济学复习资料发展经济学重要模型解析北京市考研经济学复习资料——发展经济学重要模型解析经济学作为一门重要的社会科学,研究的是如何有效分配有限资源满足人类无限的需求。

发展经济学作为经济学中的一支重要分支,主要关注的是如何实现经济的增长、减少贫困、提高社会福利等方面的问题。

在北京市考研经济学复习资料中,发展经济学的重要模型是学习的重点之一。

本文将对几个重要的发展经济学模型进行解析。

一、哈罗德-多马模型哈罗德-多马(Harrod-Domar)模型是描述投资和经济增长关系的经济模型,也被称为投资等于储蓄模型。

该模型基于一个简化的国民收入模型,认为经济增长主要依赖于实际投资和储蓄之间的关系。

哈罗德-多马模型的核心思想是,投资决定了经济增长速度,而储蓄决定了投资水平。

二、索洛模型索洛(Solow)模型是描述经济增长过程的模型,也被称为新古典增长模型。

该模型基于一系列假设,包括技术进步、人口增长和储蓄率等因素对经济增长的影响。

索洛模型的核心思想是,人口增长和技术进步是经济增长的主要驱动力,而储蓄投资是经济增长的基础。

三、劳伦斯曲线模型劳伦斯(Laffer)曲线模型是描述税收与经济增长之间关系的模型,也被称为税收弯曲理论。

该模型基于税收对经济活动的影响,认为税收率对税收收入的影响存在一个临界点,即超过临界点后,增加税收率反而会降低税收收入。

劳伦斯曲线模型的核心思想是,合理的税收政策可以激励经济发展,但过高的税收率可能导致经济活动的减少。

四、大卫-罗默模型大卫-罗默(David Romer)模型是描述技术进步与经济增长之间关系的模型,也被称为新增长理论。

该模型基于技术进步对经济增长的重要性,强调技术创新和知识的积累对经济发展的影响。

大卫-罗默模型的核心思想是,通过增加知识和创新投资,可以促进经济增长和社会福利的提高。

以上是北京市考研经济学复习资料中的发展经济学重要模型解析。

通过对这些模型的学习和理解,可以帮助我们更好地把握和分析经济发展的规律,为解决现实经济问题提供理论指导。

贸易对产业内重新配置和产业总生产率的影响(The Impact of Trade On Intra-industry Reallocations and Aggregate Industry Productivity)Melitz, Marc(2003),Econometrica; Nov 2003; 71, 6浙江财经大学经济与国际贸易学院茹玉骢翻译\推导并注释摘要:本文发展了一个异质性产业动态模型,分析国际贸易的产业内作用。

模型显示如何开展贸易,会导致更有生产率的企业进入出口市场(同时,一些生产率比较低的企业只在国内市场进行生产),并同时迫使最没有生产率的企业退出市场。

它还表明产业的贸易开放会导致向更有生产率企业的公司之间额外的重新配置。

文章也表明,通过重新配置所导致的产业总生产率的提高带来了福利的改进,从而揭示了以前从未探讨的贸易益处。

本文把Hopenhayn(1992)的动态产业模型结合垄断竞争,在一般均衡中加以讨论。

因此,文章结合生产率的差异,拓展了Krugman1980的贸易模型。

不同生产率的企业共存于一个产业是因为,每个企业在做不可逆转投资进入该产业之前,面临不确的初始生产率。

进入出口市场也是颇费成本,但企业仅在获得其生产率知识后做出出口决定。

1、引言最近的经验研究表明企业之间的生产率存在持续性的差异,另外一些研究也表明生产率高的企业通常会倾向于出口。

文章发展了一个异质性动态产业模型,用来分析国际贸易所祈祷了产业内企业之间配置催化剂作用。

模型重复了许多与贸易相关的微观研究,它显示贸易如何导致那些生产率更高的企业出口,而同时迫使生产率最低的企业退出。

效率最低企业的退出和更有效率企业获得额外出口销售,使得市场份额更趋向于生产率更高的企业,并导致总生产率的提高。

利润也分配给更有生产率的企业。

模型和许多经验研究相吻合,如Bernard and Jensen(1999a)(对美国), Aw, Chung and Roberts(2000)(对台湾),Clerides, Lack and Tybout(1998)(对哥伦比亚、墨西哥和摩洛哥)都, 发现了更有效率企业选择出口市场的证据。

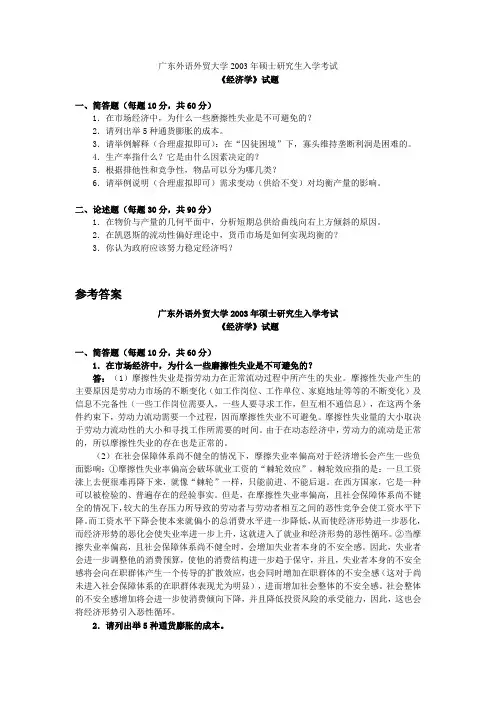

广东外语外贸大学2003年硕士研究生入学考试《经济学》试题一、简答题(每题10分,共60分)1.在市场经济中,为什么一些磨擦性失业是不可避免的?2.请列出举5种通货膨胀的成本。

3.请举例解释(合理虚拟即可):在“囚徒困境”下,寡头维持垄断利润是困难的。

4.生产率指什么?它是由什么因素决定的?5.根据排他性和竞争性,物品可以分为哪几类?6.请举例说明(合理虚拟即可)需求变动(供给不变)对均衡产量的影响。

二、论述题(每题30分,共90分)1.在物价与产量的几何平面中,分析短期总供给曲线向右上方倾斜的原因。

2.在凯恩斯的流动性偏好理论中,货币市场是如何实现均衡的?3.你认为政府应该努力稳定经济吗?参考答案广东外语外贸大学2003年硕士研究生入学考试《经济学》试题一、简答题(每题10分,共60分)1.在市场经济中,为什么一些磨擦性失业是不可避免的?答:(1)摩擦性失业是指劳动力在正常流动过程中所产生的失业。

摩擦性失业产生的主要原因是劳动力市场的不断变化(如工作岗位、工作单位、家庭地址等等的不断变化)及信息不完备性(一些工作岗位需要人,一些人要寻求工作,但互相不通信息),在这两个条件约束下,劳动力流动需要一个过程,因而摩擦性失业不可避免。

摩擦性失业量的大小取决于劳动力流动性的大小和寻找工作所需要的时间。

由于在动态经济中,劳动力的流动是正常的,所以摩擦性失业的存在也是正常的。

(2)在社会保障体系尚不健全的情况下,摩擦失业率偏高对于经济增长会产生一些负面影响:①摩擦性失业率偏高会破坏就业工资的“棘轮效应”。

棘轮效应指的是:一旦工资涨上去便很难再降下来,就像“棘轮”一样,只能前进、不能后退。

在西方国家,它是一种可以被检验的、普遍存在的经验事实。

但是,在摩擦性失业率偏高,且社会保障体系尚不健全的情况下,较大的生存压力所导致的劳动者与劳动者相互之间的恶性竞争会使工资水平下降。

而工资水平下降会使本来就偏小的总消费水平进一步降低,从而使经济形势进一步恶化,而经济形势的恶化会使失业率进一步上升,这就进入了就业和经济形势的恶性循环。

对外经济贸易大学2003年硕士研究生入学考试企业管理综合试卷(试题代码:432)第一部分:管理专业英语Ⅰ. Carefully fill in each of the 10 blanks with a word most appropriate to the context.(10 points)In the report entitled “Build a well-off society in ()all-round way and create a new situation in building socialism with Chinese characteristics” delivered by Jiang Zemin at the National Congress of the Communist Party of China, the theme of the congress was defined () “to hold () the great banner of Deng Xiaoping Theory, fully act ( ) the important thought of “Three Represents,” carry () our cause ( ) the future, keep pace () the times, build a well-off society in an all-round way, speed ( ) socialist modernization and work ( ) to create a new situation ( ) building socialism with Chinese characteristic.”Ⅱ. True/False Questions (please circle your choice) (30 points, each 1.5 points)1.How to allocate organizational resources to attain goals is part of the organizing process.TrueFalse2.A decentralized work place requires that managers invest in training and development to ensure that employees have the knowledge they need to make decisions that would otherwise be made by top managers only.TrueFalse3.Managers are more effective when they expose their perceptions to competing points of view. TrueFalse4.Maslow’s theory states that, once a need has been satisfied, it nonetheless continues to act as a source of motivation.TrueFalse5.MBO states that managers and subordinates must participate in setting subordinates’ goals. TrueFalse6.Job enrichment involves increasing the degree of responsibility a worker has over his or her job. TrueFalse7.An example of backward vertical integration is a car company’s decision to open company owned stores to sell its cars.TrueFalse8.Most decision-making that relates to the day-to-day running of an organization is non-programmed decision making.TrueFalse9.Boundary spanning refers to the process of relating to groups of people outside the organizationto secure valuable information.TrueFalse10.Decentralization refers to the degree to which authority is split up among major departments in an organization.TrueFalse11.Theory X managers believe that characteristics of the work setting determine worker satisfaction.TrueFalse12.The trait model of leadership focuses on identifying the personal characteristics that are responsible for effective leadership.TrueFalse13.A task force is formed to solve a problem in a certain time period.TrueFalse14.Good communication can help organizations improve responsiveness to customers.TrueFalse15.Wheel networks are often found in command groups with poled interdependence.TrueFalseanizational conflict is usually centered on competing interests among stakeholders.TrueFalse17.The rise of computer-based information systems has been associated with a flattening of the organizational hierarchy.TrueFalse18.JIT systems can decrease efficiency by increasing warehousing and storage costs.TrueFalse19.Process reengineering refers to the dramatic redesign of business processes.TrueFalse20.A major responsibility of top manages is to establish organizational goals.TrueFalseⅢ.Discussion Questions (30 points)1.Please explain the difference between “to do the right thing” and “to do the things right” with one specific example (10 points)2.Please define the following terms (total 20 points, each 5 points)(1) QFⅡscheme(2) IPO(3) OEM(4) TQM第二部分:管理专业知识Ⅰ、单项选择题(请在你认为正确的选择上画圈,30分,每题2分) 1.在明茨伯格“管理者角色”的研究中,他提出管理者主要在三个领域发挥重要作用。

2003年全国攻读硕士学位研究生入学考试英语试题Section I Use of EnglishDirections:Read the following text. Choose the best word(s) for each numbered blank and mark A, B, C OR D on ANSWER SHEET 1. (10 points)Teachers need to be aware of the emotional, intellectual, and physical changes that young adults experience. And they also need to give serious 1 to how they can best 2 such changes. Growing bodies need movement and 3 , but not justin ways that emphasize competition. 4 they are adjusting to their new bodies and a whole host of new intellectual and emotional challenges, teenagers are especially self-conscious and need the 5 that comes from achieving success and knowing that their accomplishments are 6 by others. However, the typical teenage lifestyle is already filled with so much competition that it would be 7 to plan activities in which there are more winners than losers, 8 ,publishing newsletters with many student-written book reviews, 9 student artwork, and sponsoring book discussion clubs. A variety of small clubs can provide 10 opportunities for leadership, as well as for practice in successful 11 dynamics. Making friends is extremely important to teenagers, and many shy students need the 12 of some kind of organization with a supportive adult 13 visible in the background.In these activities, it is important to remember that the young teens have 14 attention spans. A variety of activities should be organized 15 participants can remain active as long as they want and then go on to 16 else without feeling guilty and without letting the other participants 17 . This does not mean that adults must accept irresponsibility. 18 they can help students acquire a sense of commitment by 19 for roles that are within their 20 and their attention spans and by having clearly stated rules.1. [A] thought [B] idea [C] opinion [D] advice2. [A] strengthen [B] accommodate [C] stimulate [D] enhance3. [A] care [B] nutrition [C] exercise [D] leisure4. [A] If [B] Although [C] Whereas [D] Because5. [A] assistance [B] guidance [C] confidence [D] tolerance6. [A] claimed [B] admired [C] ignored [D] surpassed7. [A] improper [B] risky [C] fair [D] wise8. [A] in effect [B] as a result [C] for example [D] in a sense9. [A] displaying [B] describing [C] creating [D] exchanging10. [A] durable [B] excessive [C] surplus [D] multiple11. [A] group [B] individual [C] personnel [D]corporation12. [A] consent [B] insurance [C] admission [D] security13. [A] particularly [B] barely [C] definitely [D] rarely14. [A] similar [B] long [C] different [D] short15. [A] if only [B] now that [C] so that [D] even if16. [A] everything [B] anything [C] nothing [D] something17. [A] off [B] down [C] out [D] alone18. [A] On the contrary [B] On the average [C] On the whole [D] On the other hand19. [A] making [B] standing [C] planning [D] taking20. [A] capability [B] responsibility [C] proficiency [D] efficiencySection II Reading ComprehensionPart ADirections:Read the following four texts. Answer the questions below each text by choosing [A], [B], [C] or [D]. Mark your answers on ANSWER SHEET 1. (40 points)Text 1Wild Bill Donovan would have loved the Inter net. The American spymaster who built the Office of Strategic Services in the World War Ⅱ and later laid the roots for the CIA was fascinated with information. Donovan believed in using whatever tools came to hand in the “great game”of espionage—spying as a “profession.”These days the Net, which has already re-made such everyday pastimes as buying books and sending mail, is reshaping Donovan’s vocation as well.The latest revolution isn’t simply a matter of gentlemen reading other gentlemen’s e-mail. That kind of electronic spying has been going on for decades. In the past three or four years, the World Wide Web has given birth to a whole industry of point-and-clic k spying. The spooks call it “open source intelligence,” and as the Net grows, it is becoming increasingly influential. In 1995 the CIA held a contest to see who could compile the most data about Burundi. The winner, by a large margin, was a tiny Virginia company called Open-Source Solutions,whose clear advantage was its mastery of the electronic world.Among the firms making the biggest splash in the new world is Straitford, Inc., a private intelligence-analysis firm based in Austin, Texas. Straitford makes money by selling the results of spying (covering nations from Chile to Russia) to corporations like energy-services firm McDermott International. Many of its predictions are available online at xxx.Straiford president George Friedman says he sees the online world as a kind ofmutually reinforcing tool for both information collection and distribution, a spymaster’s dream. Last week his firm was busy vacuuming up data bits from the far corners of the world and predicting a crisis in Ukraine. “As soon as that report runs, we’ll suddenly get 500 new internet sign-ups from Ukraine,”says Friedman, a former political science professor. “And we’ll hear back from some of them.”Open-source spying does have its risks, of course, since it can be difficult to tell good information from bad. That’s where Straitford earns its keep.Friedman relies on a lean staff of 20 in Austin. Several of his staff members have military-intelligence backgrounds. He sees the firm’s outsider status as the key to its success. Straitford’s briefs don’t sound like the usual Washington back-and-forthing, whereby agencies avoid dramatic declarations on the chance they might be wrong. Straitford, says Friedman, takes pride in its independent voice.21. The emergence of the Net has .[A] received support from fans like Donovan[B] remolded the intelligence services[C] restored many common pastimes[D] revived spying as a profession22. Donovan’s story is mentioned in the text to .[A] introduce the topic of online spying[B] show how he fought for the US[C] give an episode of the information war[D] honor his unique services to the CIA23. The phrase “making the biggest splash” (line 1,paragraph 3) most probablymeans .[A] causing the biggest trouble[B] exerting the greatest effort[C] achieving the greatest success[D] enjoying the widest popularity24. It can be learned from paragraph 4 that .[A] straitford’s prediction about Ukraine has proved true[B] straitford guarantees the truthfulness of its information[C] straitford’s business is characterized by unpredictability[D] straitford is able to provide fairly reliable information25. Straitford is most proud of its .[A] official status[B] nonconformist image[C] efficient staff[D] military backgroundText 2To paraphrase 18th-century statesman Edmund Burke, “all that is needed for thetriumph of a misguided cause is that good people do nothing.” One such cause now seeks to end biomedical research because of the theory that animals have rights ruling out their use in research. Scientists need to respond forcefully to animal rights advocates, whose arguments are confusing the public and thereby threatening advances in health knowledge and care. Leaders of the animal rights movement target biomedical research because it depends on public funding, and few people understand the process of health care research. Hearing allegations of cruelty to animals in research settings, many are perplexed that anyone would deliberately harm an animal.For example, a grandmotherly woman staffing an animal rights booth at a recent street fair was distributing a brochure that encouraged readers not to use anything that comes from or is tested in animals—no meat, no fur, no medicines. Asked if she opposed immunizations, she wanted to know if vaccines come from animal research. When assured that they do, she replied, “Then I would have to say yes.”Asked what will happen when epidemics return, she said, “Don’t worry, scientists will find some way of using computers.” Such well-meaning people just don’t understand.Scientists must communicate their message to the public in a compassionate, understandable way—in human terms, not in the language of molecular biology. We need to make clear the connection between animal research and a grandmother’s hip replacement, a father’s bypass operation, a baby’s vaccinations, and even a pet’s shots. To those who are unaware that animal research was needed to produce these treatments, as well as new treatments and vaccines, animal research seems wasteful at best and cruel at worst.Much can be done. Scientists could “adopt” middle school classes and present their own research. They should be quick to respond to letters to the editor, lest animal rights misinformation go unchallenged and acquire a deceptive appearance of truth. Research institutions could be opened to tours, to show that laboratory animals receive humane care. Finally, because the ultimate stakeholders are patients, the health research community should actively recruit to its cause not only well-known personalities such as Stephen Cooper, who has made courageous statements about the value of animal research, but all who receive medical treatment. If good people do nothing, there is a real possibility that an uninformed citizenry will extinguish the precious embers of medical progress.26. The author begins his article with Edmund Burke’s words to .[A] call on scientists to take some actions[B] criticize the misguided cause of animal rights[C] warn of the doom of biomedical research[D] show the triumph of the animal rights movement27. Misled people tend to think that using an animal in research is .[A] cruel but natural[B] inhuman and unacceptable[C] inevitable but vicious[D] pointless and wasteful28. The example of the grandmotherly woman is used to show the public’s .[A] discontent with animal research[B] ignorance about medical science[C] indifference to epidemics[D] anxiety about animal rights29. The author believes that, in face of the challenge from animal rights advocates,scientists should .[A] communicate more with the public[B] employ hi-tech means in research[C] feel no shame for their cause[D] strive to develop new cures30. From the text we learn that Stephen Cooper is .[A] a well-known humanist[B] a medical practitioner[C] an enthusiast in animal rights[D] a supporter of animal researchText 3In recent years, railroads have been combining with each other, merging into supersystems, causing heightened concerns about monopoly. As recently as 1995, the top four railroads accounted for under 70 percent of the total ton-miles moved by rails. Next year, after a series of mergers is completed, just four railroads will control well over 90 percent of all the freight moved by major rail carriers.Supporters of the new supersystems argue that these mergers will allow for substantial cost reductions and better coordinated service. Any threat of monopoly, they argue, is removed by fierce competition from trucks. But many shippers complain that for heavy bulk commodities traveling long distances, such as coal, chemicals, and grain, trucking is too costly and the railroads therefore have them by the throat.The vast consolidation within the rail industry means that most shippers are served by only one rail company. Railroads typically charge such“captive”shippers 20 to 30 percent more than they do when another railroad is competing for the business. Shippers who feel they are being overcharged have the right to appeal to the federal government's Surface Transportation Board for rate relief, but the process is expensive, time consuming, and will work only in truly extreme cases.Railroads justify rate discrimination against captive shippers on the grounds that in the long run it reduces everyone's cost. If railroads charged all customers the same average rate, they argue, shippers who have the option of switching to trucks or other forms of transportation would do so, leaving remaining customers to shoulder the cost of keeping up the line. It's theory to which many economists subscribe, but in practice it often leaves railroads in the position of determining which companies will flourish and which will fail.“Do we really want railroads to be the arbiters of who wins and who loses in the marketplace?”asks Martin Bercovici, a Washington lawyer who frequently represents shipper.Many captive shippers also worry they will soon be hit with a round of huge rate increases. The railroad industry as a whole, despite its brightening fortuning fortunes, still does not earn enough to cover the cost of the capital it must invest to keep up with its surging traffic. Yet railroads continue to borrow billions to acquire one another, with Wall Street cheering them on. Consider the $10.2 billion bid by Norfolk Southern and CSX to acquire Conrail this year. Conrail's net railway operating income in 1996 was just $427 million, less than half of the carrying costs of the transaction. Who's going to pay for the rest of the bill? Many captive shippers fear that they will, as Norfolk Southern and CSX increase their grip on the market.31. According to those who support mergers, railway monopoly is unlikelybecause .[A] cost reduction is based on competition.[B] services call for cross-trade coordination.[C] outside competitors will continue to exist.[D] shippers will have the railway by the throat.32. What is many captive shippers' attitude towards the consolidation in the railindustry?[A] Indifferent.[B] Supportive.[C] Indignant.[D] Apprehensive.33. It can be inferred from paragraph 3 that .[A] shippers will be charged less without a rival railroad.[B] there will soon be only one railroad company nationwide.[C] overcharged shippers are unlikely to appeal for rate relief.[D] a government board ensures fair play in railway business.34. The word “arbiters”(line 7,paragraph 4)most probably refers to those .[A] who work as coordinators.[B] who function as judges.[C] who supervise transactions.[D] who determine the price.35. According to the text, the cost increase in the rail industry is mainly causedby .[A] the continuing acquisition.[B] the growing traffic.[C] the cheering Wall Street.[D] the shrinking market.Text 4It is said that in England death is pressing, in Canada inevitable and in California optional. Small wonder. Americans’ life expectancy has nearly doubled over the past century. Failing hips can be replaced, clinical depression controlled,cataracts removed in a 30-minute surgical procedure. Such advances offer the aging population a quality of life that was unimaginable when I entered medicine 50 years ago. But not even a great health-care system can cure death—and our failure to confront that reality now threatens this greatness of ours.Death is normal; we are genetically programmed to disintegrate and perish, even under ideal conditions. We all understand that at some level, yet as medical consumers we treat death as a problem to be solved. Shielded by third-party payers from the cost of our care, we demand everything that can possibly be done for us, even if it’s useless. The most obvious example is late-stage cancer care. Physicians —frustrated by their inability to cure the disease and fearing loss of hope in the patient—too often offer aggressive treatment far beyond what is scientifically justified.In 1950, the US spent $12.7 billion on health care. In 2002, the cost will be $1,540 billion. Anyone can see this trend is unsustainable. Yet few seem willing to try to reverse it. Some scholars conclude that a government with finite resources should simply stop paying for medical care that sustains life beyond a certain age—say 83 or so. Former Colorado governor Richard Lamm has been quoted as saying that the old and infirm “have a duty to die and get out of the way”, so that younger, healthier people can realize their potential.I would not go that far. Energetic people now routinely work through their 60s and beyond, and remain dazzlingly productive. At 78, Viacom chairman Sumner Redstone jokingly claims to be 53. Supreme Court Justice Sandra Day O’Connor is in her 70s, and former surgeon general C. Everett Koop chairs an Internet start-up in his 80s.These leaders are living proof that prevention works and that we can manage the health problems that come naturally with age. As a mere 68-year-old, I wish to age as productively as they have.Yet there are limits to what a society can spend in this pursuit. As a physician, I know the most costly and dramatic measures may be ineffective and painful. I also know that people in Japan and Sweden, countries that spend far less on medical care, have achieved longer, healthier lives than we have. As a nation, we may be overfunding the quest for unlikely cures while underfunding research on humbler therapies that could improve people’s lives.36. What is implied in the first sentence?[A] Americans are better prepared for death than other people.[B] Americans enjoy a higher life quality than ever before.[C] Americans are over-confident of their medical technology.[D] Americans take a vain pride in their long life expectancy.37. The author uses the example of caner patients to show that .[A] medical resources are often wasted[B] doctors are helpless against fatal diseases[C] some treatments are too aggressive[D] medical costs are becoming unaffordable38. The author’s attitude toward Richard Lamm’s remark is one of.[A] strong disapproval [B] reserved consent[C] slight contempt [D] enthusiastic support39. In contras to the US, Japan and Sweden are funding their medical care.[A] more flexibly [B] more extravagantly[C] more cautiously [D] more reasonably40. The text intends to express the idea that.[A]medicine will further prolong people’s lives[B]life beyond a certain limit is not worth living[C] death should be accepted as a fact of life[D] excessive demands increase the cost of health carePart BDirections:Read the following text carefully and then translate the underlined segments into Chinese. Your translation should be written clearly on ANSWER SHEET 2. (10 points)Human beings in all times and places think about their world and wonder at their place in it. Humans are thoughtful and creative, possessed of insatiable curiosity.(41)Furthermore, humans have the ability to modify the environment in which they live, thus subjecting all other life forms to their own peculiar ideas and fancies. Therefore, it is important to study humans in all their richness and diversity in a calm and systematic manner, with the hope that the knowledge resulting from such studies can lead humans to a more harmonious way of living with themselves and with all other life forms on this planet Earth.“Anthropology” derives from the Greek words anthropos “human” and logos “the study of.” By its very name, anthropology encompasses the study of all humankind.Anthropology is one of the social sciences.(42)Social science is that branch of intellectual enquiry which seeks to study humans and their endeavors in the same reasoned, orderly, systematic, and dispassioned manner that natural scientists use for the study of natural phenomena.Social science disciplines include geography, economics, political, science, psychology, and sociology. Each of these social sciences has a subfield or specialization which lies particularly close to anthropology.All the social sciences focus upon the study of humanity. Anthropology is a field-study oriented discipline which makes extensive use of the comparative method in analysis.(43)The emphasis on data gathered first-hand, combined with a cross-cultural perspective brought to the analysis of cultures past and present, makes this study a unique and distinctly important social science.Anthropological analyses rest heavily upon the concept of culture. Sir EdwardTylor’s formulation of the concept of culture was one of the great intellectual achievements of 19th century science.(44)Tylor defined culture as “…that compl ex whole which includes belief, art, morals, law, custom, and any other capabilities and habits acquired by man as a member of society.” This insight, so profound in its simplicity, opened up an entirely new way of perceiving and understanding human life. Implicit within Tylor’s definition is the concept that culture is learned. shared, and patterned behavior.(45)Thus, the anthropological concept of “culture,” like the concept of “set” in mathematics, is an abstract concept which makes possible immense am ounts of concrete research and understanding.Section III Writing46. Directions:Study the following set of drawings carefully and write an essay entitled in which you should1)describe the set of drawings, interpret its meaning, and2)point out its implications in our life.You should write about 200 words neatly on ANSWER SHEET 2. (20 points)第一部分英语知识运用试题解析一、文章总体分析文章主要论述了教师们应该关注青少年在成长时期所经历的情感、心智和生理上的变化,并采取方法帮助他们适应这些变化,健康成长。

Individual AssignmentECMA211 : Principles of Macro EconomicsDate : 20 September 2011Name : How Chun RenID : 1106-060-2311-1-00831.Refer to/Data.aspx?d=SNAAMA&f=grID%3A101%3BcurrID%3AUSD%3BpcFlag%3A0The table show that some data which is denominated in US dollars.The amount of household consumption expenditure (consumerexpenditure in GDP) is 7.804 billion US dollars in year 2003.In percentage, the consumer expenditure (C) accounts for 70.375% ofthe total amount of all economic activity in 2003.Normally, the government spending will become higher when thenation involved in war because of spending associated with militaryitems. During 2003, United States was preparing for war with Iraq. Yet, the government spending (G) accounts for merely 15.82% of theamount of GDP. This indicates that US maybe borrowed funds fromothers countries to cover the spending of war and the funds will bereturned in the future. Therefore, the spending did not accounted inexpenditure of year 2003.Apart from this, US Array government reduce the taxon rich men. This policyraises straight the purchasingpower because they havemore money. Indirectly, itraises the consumption. Thisis why the consumptionbecome so high in year 2003and not affected by the war.2.The stock market would be concerned with falling consumerconfidence because the confidence influences their decision making on whether they spend their money on stock market or not. Thefluctuation or instability of the economy will decrease the consumer confidence.Consumer will considers about what is the impact of the war to anation economy when they intend to spend their money on it.Before US was preparing for war with Iraq, US encountered 911 attacks and hit the US consumer confidence. So, when US was preparing for war, the civilian no dare to invest money on the US stock marketbecause they thought the war will spread to US and effect US economy, safety.Apart from this, the war raises the unemployment rate and hit theconsumer confidence again.That is why the stock market would be concerned.3.“this doesn’t mean a sudden decline in consumer spending”Because of no dare to spend in stock market, the civilian have morecash on hand. Therefore, they tend to spend the money on tangiblegoods to store at their home.Normally, the civilian more concerned with the value of money ontheir hand rather than the war. They also rather to purchase someproducts because those products retain certain value compare with the dollar.Apart from this, I mentioned about the decrease of taxes also impacted the consumption before. Thus, the consumer spending will not sudden decline.In my opinion, I think these are why the economist said so.Conclusion:During year 2003, US borrowed funds from others countries formilitary spending. US did not collected the funds from civilians and also reduce the taxes on civilian. US government not intended to let the war impact their country, and also stimulate their civilians keepspending in domestic. It seems a good policy to treat the countryeconomy during the war. Yet, it still has some impacts there and even bad impacts to the US economy in the future.When US tried to borrowed a numerous of funds from others countries, the government appreciated the value of US dollars to stimulate others countries willing to lend the funds to US and caused an increase insupply of money.The following points are the outcomes of increase in supply of money: exports in US decrease because of the increase in import (theloans imported into US).Net Exports = Export – ImportNet exports (NX) can define as net capital outflow (NCO)NCO = Saving – Domestic InvestmentThe great rise in import represents the decline in NX and alsodecline in NCO. That is, the decline in national saving and also the increase in the government budget deficit.2.Inflation occurred. The money supply in US increase and causedthe value of money decrease.Therefore, the consumers in US economy must will spend morepurchase something with higher price of money than beforebecause of inflation.Otherwise, the GDP deflator and inflation in Consumer Price Index (CPI) will increase.In addition, the unemployment rate in US during year 2003 is about 6% while the unemployment rate in year 2002 is about 5.7%. (Unemployment rate refer to/fred2/data/UNRATE.txt)After the war, US debt increase a lot too.Finally, I want to say, the war affected the economy of countries involved in various sectors.。

北京大学(经济学院)2003年硕士研究生入学考试试题考试科目:经济学 考试时间:2003年1月19日下午 招生专业:各专业 研究方向:宏观经济学一、(16分)假设初始均衡为稳定性均衡,试分析劳动生产率上升对价格、产量和实际工资会产生什么短期和长期影响,并作出该种情况的几何图形。

二、(22分)索洛模型中的劳动增进型总量生产函数为Y=F (K ,AL ),假定对资本和劳动均按其边际产品支付报酬。

用W 表示L AL K F ∂∂/),(,r 表示K AL K F ∂∂/),(。

1.证明:劳动的边际产品W 为[])()('k kf k f A -。

2.证明:如果劳动和资本均按其边际产品取得报酬,规模报酬不变意味着:生产要素总收入等于总产量。

即在规模报酬不变的情形下,wL+rK=F (K,AL )。

3.卡尔多(1961年)列出的另外两个关于增长的特征事实是:资本报酬率r 近似不变;产量中分配向资本和劳动的比例也各自大致不变。

处于平衡增长路径上的索洛经济是否表现出这些性质?在平衡增长路径上,w 和r 的增长率是多少?4.假定经济开始时,k<k *。

随着k 移向k *,W 的增长率高于、低于还是等于其在平衡增长路径上的增长率?对r 来说,结果又是什么呢?微观经济学一、解释下列概念,并比较每对概念的区别与联系:(每题4分,共12分)1.扩展线与长期成本曲线2.风险爱好者与期望效用3.一级价格歧视与三级价格歧视二、利用图分析在自然垄断条件下政府以边际成本定价法实行价格管制的各种可能的效果。

(11分)三、已知某完全竞争行业中每个厂商的短期成本函数203031.023++-=Q Q Q STC 。

1.假定市场的产品价格P=120,求厂商的短期均衡产量和利润。

2.当市场的价格降为多少时,厂商必须停产?3.求厂商的短期生产函数。

(15分)政治经济学1.如何认识我国现阶段所有制结构中公有制是主体的内涵和外延?(18分)2.如何认识我国现阶段分配制度中“效率段先、兼顾公平”的原则?(19分)3.如何理解资本主义生产过程是劳动过程和价值增殖过程的统一。

海翔商科留学整理:哥伦比亚大学商科专业简介海翔商科留学中介为大家整理哥伦比亚大学简介和商科专业介绍,希望能帮助大家更好的进行留学申请。

1、大学简介哥伦比亚大学全称哥伦比亚大学Columbia University也有人叫哥大,Columbia University (New York),成立于1754,是一所规模大型(15000-29999人)的私立研究型综合大学。

哥伦比亚大学位于美国纽约市曼哈顿,于1754年根据英国国王乔治二世颁布的《国王宪章》而成立,属于私立的常春藤盟校,由三个本科生院和十三个研究生院构成,哥伦比亚大学的校友和教授中一共有87人获得过诺贝尔奖。

包括奥巴马总统在内的三位美国总统是该校的毕业生。

此外,哥伦比亚大学的医学、法学、商学和新闻学院都名列前茅。

其新闻学院颁发的普利策奖是美国新闻界的最高荣誉。

“哥伦比亚大学的学生在联合国学政治,在华尔街读金融,在百老汇看戏剧,在林肯中心听音乐。

她是美国最古老的五所大学之一。

欧元之父蒙代尔在这里留下光辉的足迹,基因学的奠基人摩尔根在这里掀起生物界最彻底的的革命!”美国新闻界至高无上的普利策奖在这里诞生。

这里拥有美国第一所授予博士学位的医学院。

美国前总统罗斯福,联合国前秘书长加林曾在这里求学,胡适、徐志摩、李政道等著名学者在这里留下了青春的脚步。

二百五十年来科学与艺术是她永恒不变的主题! 主要学院哥伦比亚大学的主要学院有哥伦比亚学院、普通教育学院(成人学院)及工程与应用科学学院。

其它学院有:商学研究生院、图书馆服务学院、法学院、艺术学院、艺术与科学研究生院、社会工作学院、内科与外科医学院、公共卫生学院、牙科与口腔外科学院和护理学院。

哥伦比亚大学工程学院与文理学院的具体专业:应用数学\应用物理\生物医学工程\化学工程\ 土木工程\计算机\计算机科学\地球和环境工程\ 电子工程\工程和管理系统\工程机械\ 金融工程\工业工程\ 材料科学和工程\ 机械工程\运筹学\金融工程\工程管理系统。