实用会计英语Chapter 1 General View of Accounting

- 格式:ppt

- 大小:669.00 KB

- 文档页数:34

会计专业英语习题答案Chapter. 11-1As in many ethics issues, there is no one right answer. The local newspaper reported on this issue in these terms: "The company covered up the first report, and the local newspaper uncovered the company's secret. The company was forced to not locate here (Collier County). It became patently clear that doing the least that is legally allowed is not enough."1-21. B2. B3. E4. F5. B6. F7. X 8. E 9. X 10. B1-3a. $96,500 ($25,000 + $71,500)b. $67,750 ($82,750 – $15,000)c. $19,500 ($37,000 – $17,500)1-4a. $275,000 ($475,000 – $200,000)b. $310,000 ($275,000 + $75,000 – $40,000)c. $233,000 ($275,000 – $15,000 – $27,000)d. $465,000 ($275,000 + $125,000 + $65,000)e. Net income: $45,000 ($425,000 – $105,000 – $275,000) 1-5a. owner's equityb.liabilityc.assetd.assete.owner'sequity f. asset1-6a. Increases assets and increases owner’s equity.b. Increases assets and increases owner’s equity.c. Decreases assets and decreases owner’s equity.d. Increases assets and increases liabilities.e. Increases assets and decreases assets.1-71. increase2. decrease3.increase4. decrease1-8a. (1) Sale of catering services for cash, $25,000.(2) Purchase of land for cash, $10,000.(3) Payment of expenses, $16,000.(4) Purchase of supplies on account, $800.(5) Withdrawal of cash by owner, $2,000.(6) Payment of cash to creditors, $10,600.(7) Recognition of cost of supplies used, $1,400.b. $13,600 ($18,000 – $4,400)c. $5,600 ($64,100 – $58,500)d. $7,600 ($25,000 – $16,000 – $1,400)e. $5,600 ($7,600 – $2,000)1-9It would be incorrect to say that the business had incurred a net loss of $21,750. The excess of the withdrawals over the net income for the period is a decrease in the amount of owner’s equity in the business.1-10Balance sheet items: 1, 3, 4, 8, 9, 101-11Income statement items: 2, 5, 6, 71-12MADRAS COMPANYStatement of Owner’s EquityFor the Month Ended April 30, 2006Leo Perkins, capital, April 1, 2006 ...... $297,200 Net income for the month ................ $73,000Less withdrawals ........................... 12,000Increase in owner’s equity................ 61,000 Leo Perkins, capital, April 30, 2006 .... $358,2001-13HERCULES SERVICESIncome StatementFor the Month Ended November 30, 2006Fees earned ................................ $232,120 Operating expenses:Wages expense .......................... $100,100Rent expense ............................. 35,000Supplies expense ........................ 4,550Miscellaneous expense.................. 3,150Total operating expenses ............. 142,800 Net income .................................. $89,3201-14Balance sheet: b, c, e, f, h, i, j, l, m, n, oIncome statement: a, d, g, k1-151. b–investing activity2.a–operating activity3. c–financing activity4.a–operating activity1-16a. 2003: $10,209 ($30,011 – $19,802)2002: $8,312 ($26,394 – $18,082)b. 2003: 0.52 ($10,209 ÷ $19,802)2002: 0.46 ($8,312 ÷ $18,082)c. The ratio of liabilities to stockholders’ equity increased from2002 to 2003, indicating an increase in risk for creditors.However, the assets of The Home Depot are more than sufficient to satisfy creditor claims.Chapter. 22-1AccountAccount NumberAccounts Payable 21Accounts Receivable 12Cash 11Corey Krum, Capital 31Corey Krum, Drawing 32Fees Earned 41Land 13Miscellaneous Expense 53Supplies Expense 52Wages Expense 512-2Balance Sheet Accounts Income Statement Accounts1. Assets11 Cash12 Accounts Receivable13 Supplies14 Prepaid Insurance15Equipment2. Liabilities21 Accounts Payable22Unearned Rent3. Owner's Equity31 Millard Fillmore, Capital32 Millard Fillmore, Drawing4. Revenue41Fees Earned5. Expenses51 Wages Expense52 Rent Expense53 Supplies Expense59 Miscellaneous Expense2-3a. andb.Account Debited Account Credited Transaction T ype Effect Type Effect(1) asset + owner's equity +(2) asset + asset –(3) asset + asset –liability +(4) expense + asset –(5) asset + revenue +(6) liability –asset –(7) asset + asset –(8) drawing + asset –(9) expense + asset –Ex. 2–4(1) Cash...................................... 40,000Ira Janke, Capital ................... 40,000 (2) Supplies ................................. 1,800Cash................................... 1,800 (3) Equipment ............................... 24,000Accounts Payable ................... 15,000Cash................................... 9,000 (4) Operating Expenses ................... 3,050Cash................................... 3,050 (5) Accounts Receivable .................. 12,000Service Revenue ..................... 12,000 (6) Accounts Payable ...................... 7,500Cash................................... 7,500 (7) Cash...................................... 9,500Accounts Receivable ............... 9,500 (8) Ira Janke, Drawing ..................... 5,000Cash................................... 5,000 (9) Operating Expenses ................... 1,050Supplies .............................. 1,0502-51. debit and credit (c)2. debit and credit (c)3. debit and credit (c)4. credit only (b)5. debit only (a)6. debit only (a)7. debit only (a)2-6a. Liability—credit f. Revenue—creditb. Asset—debit g. Asset—debitc. Asset—debit h. Expense—debitd. Owner's equity i. Asset—debit(Cindy Yost, Capital)—credit j. Expense—debite. Owner's equity(Cindy Yost, Drawing)—debit2-7a. credit g. debitb. credit h. debitc. debit i. debitd. credit j. credite. debit k. debitf. credit l. credit2-8a. Debit (negative) balance of $1,500 ($10,500 – $4,000– $8,000). Such a negative balance means that the liabilities of Seth’s business exceed the assets.b. Y es. The balance sheet prepared at December 31will balance, with Seth Fite, Capital, being reported in the owner’s equity section as a negative $1,500.2-9a. T he increase of $28,750 in the cash accountdoes not indicate earnings of that amount.Earnings will represent the net change in allassets and liabilities from operatingtransactions.b. $7,550 ($36,300 – $28,750)2-10a. $40,550 ($7,850 + $41,850 – $9,150)b. $63,000 ($61,000 + $17,500 – $15,500)c. $20,800 ($40,500 – $57,700 + $38,000)2-112005Aug.1 Rent Expense ........................... 1,500Cash................................... 1,5002 Advertising Expense (700)Cash (700)4 Supplies ................................. 1,050Cash................................... 1,0506 Office Equipment ....................... 7,500Accounts Payable ................... 7,5008 Cash...................................... 3,600Accounts Receivable ............... 3,60012 Accounts Payable ...................... 1,150Cash................................... 1,15020 Gayle McCall, Drawing ................ 1,000Cash................................... 1,00025 Miscellaneous Expense (500)Cash (500)30 Utilities Expense (195)Cash (195)31 Accounts Receivable .................. 10,150Fees Earned ......................... 10,15031 Utilities Expense (380)Cash (380)2-12a.JOURNAL Page 43Post.Date Description Ref. Debit Credit 2006Oct.27 Supplies .......................... 15 1,320Accounts Payable ............ 21 1,320Purchased supplies on account.b.,c.,d.Supplies 15Post.BalanceDate Item Ref. Dr. Cr.Dr. Cr.2006Oct. 1 Balance ................ ✓...... ...... 585 ......27 .......................... 43 1,320 ...... 1,905 ...... Accounts Payable 21 2006Oct. 1 Balance ................ ✓...... ...... ..... 6,15027 .......................... 43 ...... 1,320 ..... 7,4702-13Inequality of trial balance totals would be caused by errors described in (b) and (d).2-14ESCALADE CO.Trial BalanceDecember 31, 2006Cash ........................................... 13,375 Accounts Receivable .......................... 24,600Prepaid Insurance .............................. 8,000 Equipment ...................................... 75,000 Accounts Payable .............................. 11,180 Unearned Rent ................................. 4,250 Erin Capelli, Capital ........................... 82,420 Erin Capelli, Drawing .......................... 10,000Service Revenue ................................ 83,750 Wages Expense ................................ 42,000 Advertising Expense ........................... 7,200 Miscellaneous Expense ....................... 1,425 181,600 181,6002-15a. Gerald Owen, Drawing ................ 15,000Wages Expense ..................... 15,000b. Prepaid Rent ............................ 4,500Cash................................... 4,5002-16题目的资料不全, 答案略.2-17a. KMART CORPORATIONIncome StatementFor the Years Ending January 31, 2000 and 1999(in millions)Increase (Decrease)2000 1999 Amount Percent1. Sales .......................... $37,028 $35,925 .......................... $ 1,1033.1%2. Cost of sales ................ (29,658)(28,111) ......................... 1,5475.5%3. Selling, general, and admin.expenses ..................... (7,415) (6,514) 901 13.8%4. Operating income (loss)before taxes ................. $ (45) $1,300$(1,345)(103.5%)b. The horizontal analysis of Kmart Corporation revealsdeteriorating operating results from 1999 to 2000.While sales increased by $1,103 million, a 3.1%increase, cost of sales increased by $1,547 million, a5.5% increase. Selling, general, and administrativeexpenses also increased by $901 million, a 13.8%increase. The end result was that operating incomedecreased by $1,345 million, over a 100% decrease,and created a $45 million loss in 2000. Little over ayear later, Kmart filed for bankruptcy protection. It hasnow emerged from bankruptcy, hoping to return toprofitability.3-11. Accrued expense (accrued liability)2. Deferred expense (prepaid expense)3. Deferred revenue (unearned revenue)4. Accrued revenue (accrued asset)5. Accrued expense (accrued liability)6. Accrued expense (accrued liability)7. Deferred expense (prepaid expense)8. Deferred revenue (unearned revenue)3-2Supplies Expense (801)Supplies (801)3-3$1,067 ($118 + $949)3-4a. Insurance expense (or expenses) will be understated.Net income will be overstated.b. Prepaid insurance (or assets) will be overstated.Owner’s equity will be overstated.3-5a.Insurance Expense ............................ 1,215Prepaid Insurance ...................... 1,215 b.Insurance Expense ............................ 1,215Prepaid Insurance ...................... 1,2153-6Unearned Fees ................................... 9,570Fees Earned ............................ 9,5703-7a.Salary Expense ................................ 9,360Salaries Payable ........................ 9,360 b.Salary Expense ................................ 12,480Salaries Payable ........................ 12,480 3-8$59,850 ($63,000 – $3,150)3-9$195,816,000 ($128,776,000 + $67,040,000)3-10Error (a) Error (b)Over- Under- Over-Under-stated stated stated stated1. Revenue for the year would be $ 0 $6,900 $ 0 $ 02. Expenses for the year would be 0 0 0 3,7403. Net income for the year would be 0 6,900 3,740 04. Assets at December 31 would be 0 0 0 05. Liabilities at December 31 would be 6,900 0 0 3,7406. Own er’s equity at December 31would be ......................... 0 6,900 3,740 03-11$175,840 ($172,680 + $6,900 – $3,740)3-12a.Accounts Receivable .......................... 11,500Fees Earned ............................ 11,500b. No. If the cash basis of accounting is used, revenuesare recognized only when the cash is received.Therefore, earned but unbilled revenues would not berecognized in the accounts, and no adjusting entrywould be necessary.3-13a. Fees earned (or revenues) will be understated. Netincome will be understated.b. Accounts (fees) receivable (or assets) will beunderstated. Owner’s equity will be understated.3-14Depreciation Expense ........................... 5,200Accumulated Depreciation ............ 5,200 3-15a. $204,600 ($318,500 – $113,900)b. No. Depreciation is an allocation of the cost of theequipment to the periods benefiting from its use. Itdoes not necessarily relate to value or loss of value.3-16a. $2,268,000,000 ($5,891,000,000 – $3,623,000,000)b. No. Depreciation is an allocation method, not avaluation method. That is, depreciation allocates thecost of a fixed asset over its useful life. Depreciationdoes not attempt to measure market values, whichmay vary significantly from year to year.3-17a.Depreciation Expense ......................... 7,500Accumulated Depreciation ............ 7,500 b. (1) D epreciation expense would be understated. Netincome would be overstated.(2) A ccumulated depreciation would be understated,and total assets would be overstated. Owner’sequity would be overstated.3-181.Accounts Receivable (4)Fees Earned (4)2.Supplies Expense (3)Supplies (3)3.Insurance Expense (8)Prepaid Insurance (8)4.Depreciation Expense (5)Accumulated Depreciation—Equipment 5 5.Wages Expense (1)Wages Payable (1)3-19a. Dell Computer CorporationAmount Percent Net sales $35,404,000 100.0Cost of goods sold (29,055,000) 82.1Operating expenses (3,505,000) 9.9Operating income (loss) $2,844,000 8.0b. Gateway Inc.Amount Percent Net sales $4,171,325 100.0Cost of goods sold (3,605,120) 86.4Operating expenses (1,077,447) 25.8Operating income (loss) $(511,242)(12.2)c. Dell is more profitable than Gateway. Specifically,Dell’s cost of goods sold of 82.1% is significantly less(4.3%) than Gateway’s cost of goods sold of 86.4%.In addition, Gateway’s operating expenses are over one-fourth of sales, while Dell’s operating expenses are 9.9% of sales. The result is that Dell generates an operating income of 8.0% of sales, while Gateway generates a loss of 12.2% of sales. Obviously, Gateway must improve its operations if it is to remain in business and remain competitive with Dell.4-1e, c, g, b, f, a, d4-2a. Income statement: 3, 8, 9b. Balance sheet: 1, 2, 4, 5, 6, 7, 104-3a. Asset: 1, 4, 5, 6, 10b. Liability: 9, 12c. Revenue: 2, 7d. Expense: 3, 8, 114-41. f2. c3. b4. h5. g6. j7. a8. i9. d10. e4–5ITHACA SERVICES CO.Work SheetFor the Year Ended January 31, 2006AdjustedTrial Balance Adjustments TrialBalanceAccount Title Dr. Cr. Dr. Cr. Dr. Cr.1 Cash 8 8 12 Accounts Receivable50 (a) 7 57 23 Supplies 8 (b) 5 3 34 Prepaid Insurance 12 (c) 6 6 45 Land 50 50 56 Equipment 32 32 67 Accum. Depr.—Equip. 2 (d) 5 7 78 Accounts Payable 26 26 89 Wages Payable 0 (e) 1 1 910 Terry Dagley, Capital 112 112 1011 Terry Dagley, Drawing8 8 1112 Fees Earned 60 (a) 7 67 1213 Wages Expense 16 (e) 1 17 1314 Rent Expense 8 8 1415 Insurance Expense 0 (c) 6 6 1516 Utilities Expense 6 6 1617 Depreciation Expense0 (d) 5 5 1718 Supplies Expense 0 (b) 5 5 1819 Miscellaneous Expense 2 2 120 Totals 200 200 24 24213 213 20ContinueITHACA SERVICES CO.Work SheetFor the Year Ended January 31, 2006Adjusted Income BalanceTrial Balance StatementSheetAccount Title Dr. Cr. Dr. Cr. Dr. Cr.1 Cash 8 8 12 Accounts Receivable57 57 23 Supplies 3 3 34 Prepaid Insurance 6 6 45 Land 50 50 56 Equipment 32 32 67 Accum. Depr.—Equip. 7 7 78 Accounts Payable 26 26 89 Wages Payable 1 1 910 Terry Dagley, Capital 112 112 1011 Terry Dagley, Drawing8 8 1112 Fees Earned 67 67 1213 Wages Expense 17 17 1314 Rent Expense 8 8 1415 Insurance Expense 6 6 1516 Utilities Expense 6 6 1617 Depreciation Expense5 5 1718 Supplies Expense 5 5 1819 Miscellaneous Expense 2 2 120 Totals 213 213 49 67 164 146 2021 Net income (loss) 18 18 2122 67 67 164 164 224-6ITHACA SERVICES CO.Income StatementFor the Year Ended January 31, 2006Fees earned .................................... $67Expenses:Wages expense ............................ $17Rent expense (8)Insurance expense (6)Utilities expense (6)Depreciation expense (5)Supplies expense (5)Miscellaneous expense (2)Total expenses ...........................49Net income ...................................... $18ITHACA SERVICES CO.Statement of Owner’s EquityFor the Year Ended January 31, 2006 Terry Dagley, capital, February 1, 2005 .... $112 Net income for the year ....................... $18 Less withdrawals . (8)Increase in owner’s equity....................10Terry Dagley, capital, January 31, 2006 ... $122ITHACA SERVICES CO.Balance SheetJanuary 31, 2006Assets LiabilitiesCurrent assets: Current liabilities:Cash ............... $ 8 Accounts payable $26 Accounts receivable 57 .. Wages payable 1 Supplies ........... 3 Total liabilities . $ 27 Prepaid insurance 6Total current assets $ 74Property, plant, and Owner’s Equityequipment: Terry Dagley, capital (12)Land ............... $50Equipment ........ $32Less accum. depr. 7 25Total property, plant,and equipment 75 Total liabilities andTotal assets ......... $149 owner’s equity .. $1494-72006Jan.31 Accounts Receivable (7)Fees Earned (7)31 Supplies Expense (5)Supplies (5)31 Insurance Expense (6)Prepaid Insurance (6)31 Depreciation Expense (5)Accumulated Depreciation—Equipment 531 Wages Expense (1)Wages Payable (1)4-82006Jan.31 Fees Earned (67)Income Summary (67)31 Income Summary (49)Wages Expense (17)Rent Expense (8)Insurance Expense (6)Utilities Expense (6)Depreciation Expense (5)Supplies Expense (5)Miscellaneous Expense (2)31 Income Summary (18)Terry Dagley, Capital (18)31 Terry Dagley, Capital (8)Terry Dagley, Drawing (8)4-9SIROCCO SERVICES CO.Income StatementFor the Year Ended March 31, 2006Service revenue ................................$103,850Operating expenses:Wages expense ............................ $56,800Rent expense ............................... 21,270Utilities expense ............................ 11,500Depreciation expense ..................... 8,000Insurance expense ......................... 4,100Supplies expense .......................... 3,100Miscellaneous expense .................... 2,250Total operating expenses ....... 107,020Net loss ..........................................$ (3,170)4-10SYNTHESIS SYSTEMS CO.Statement of Owner’s EquityFor the Year Ended October 31, 2006 Suzanne Jacob, capital, November 1, 2005$173,750Net income for year ........................... $44,250 Less withdrawals ............................... 12,000 Increase in owner’s equity....................32,250Suzanne Jacob, capital, October 31, 2006 $206,0004-11a. Current asset: 1, 3, 5, 6b. Property, plant, and equipment: 2, 44-12Since current liabilities are usually due within one year, $165,000 ($13,750 × 12 months) would be reported as a current liability on the balance sheet. The remainder of $335,000 ($500,000 – $165,000) would be reported as a long-term liability on the balance sheet.4-13TUDOR CO.Balance SheetApril 30, 2006AssetsLiabilitiesCurrent assetsCurrent liabilities:Cash $31,500Accounts payable ........... $9,500Accounts receivable 21,850 Salaries payable1,750Supplies ............ 1,800 Unearned fees ............... Prepaid insurance 7,200 Total liabilitiesPrepaid rent ....... 4,800Total current assets $67,150 Owner’s E Property, plant, and equipment: Vernon Posey,capital 114,200Equipment ....... $80,600Less accumulated depreciation 21,100 59,500Total liabilities andTotal assets $126,650 owner’s equity ...............4-14Accounts Receivable ............................ 4,100Fees Earned ......................... 4,100 Supplies Expense ...................... 1,300Supplies .............................. 1,300 Insurance Expense ..................... 2,000Prepaid Insurance ................... 2,000 Depreciation Expense ................. 2,800Accumulated Depreciation—Equipment 2,800 Wages Expense ........................ 1,000Wages Payable ...................... 1,000 Unearned Rent .......................... 2,500Rent Revenue ........................ 2,5004-15c. Depreciation Expense—Equipmentg. Fees Earnedi. Salaries Expensel. Supplies Expense4-16The income summary account is used to close the revenue and expense accounts, and it aids in detectingand correcting errors. The $450,750 represents expense account balances, and the $712,500 represents revenue account balances that have been closed.4-17a.Income Summary ............................. 167,550Sue Alewine, Capital ................... 167,550 Sue Alewine, Capital ............................ 25,000Sue Alewine, Drawing ................. 25,000b. $284,900 ($142,350 + $167,550 – $25,000)4-18a. Accounts Receivableb. Accumulated Depreciationc. Cashe. Equipmentf. Estella Hall, Capitali. Suppliesk. Wages Payable4-19a. 2002 2001Working capital ($143,034)($159,453)Current ratio 0.81 0.80b. 7 Eleven has negative working capital as of December31, 2002 and 2001. In addition, the current ratio is below one at the end of both years. While the working capital and current ratios have improved from 2001 to 2002, creditors would likely be concerned about the ability of 7 Eleven to meet its short-term credit obligations. This concern would warrant further investigation to determine whether this is a temporaryissue (for example, an end-of-the-periodphenomenon) and the company’s plans to address itsworking capital shortcomings.4-20a. (1) Sales Salaries Expense ................ 6,480Salaries Payable ........................ 6,480(2) Accounts Receivable ................... 10,250Fees Earned ............................. 10,250b. (1) Salaries Payable ........................ 6,480Sales Salaries Expense ................ 6,480(2) Fees Earned ............................. 10,250Accounts Receivable ................... 10,2504-21a. (1) Payment (last payday in year)(2) Adjusting (accrual of wages at end of year)(3) Closing(4) Reversing(5) Payment (first payday in following year)b. (1) W ages Expense ........................ 45,000Cash ...................................... 45,000(2) Wages Expense ......................... 18,000Wages Payable .......................... 18,000(3) Income Summary .......................1,120,800Wages Expense ......................... 1,120,800(4) Wages Payable .......................... 18,000Wages Expense ......................... 18,000(5) Wages Expense ......................... 43,000Cash ...................................... 43,000 Chapter6(找不到答案,自己处理了哦)Ex. 8–1a. Inappropriate. Since Fridley has a large number ofcredit sales supported by promissory notes, a notesreceivable ledger should be maintained. Failure tomaintain a subsidiary ledger when there are asignificant number of notes receivable transactionsviolates the internal control procedure that mandates proofs and security. Maintaining a notes receivable ledger will allow Fridley to operate more efficiently and will increase the chance that Fridley will detect accounting errors related to the notes receivable. (The total of the accounts in the notes receivable ledger must match the balance of notes receivable in the general ledger.)b. Inappropriate. The procedure of proper separation ofduties is violated. The accounts receivable clerk is responsible for too many related operations. The clerk also has both custody of assets (cash receipts) and accounting responsibilities for those assets.c. Appropriate. The functions of maintaining theaccounts receivable account in the general ledger should be performed by someone other than the accounts receivable clerk.d. Appropriate. Salespersons should not be responsiblefor approving credit.e. Appropriate. A promissory note is a formal creditinstrument that is frequently used for credit periods over 45 days.Ex. 8–2-aa.Customer Due Date Number of DaysPast DueJanzen Industries August 29 93 days (2 + 30+ 31 + 30)Kuehn Company September 3 88 days (27 + 31+ 30)Mauer Inc. October 21 40 days (10 +30)Pollack Company November 23 7 daysSimrill Company December 3 Not past dueEx. 8–3Nov.30 Uncollectible Accounts Expense ..... 53,315*Allowances for Doubtful Accounts 53, *$60,495 – $7,180 = $53,315Ex. 8–4Estimated Uncollectible AccountsAge Interval Balance Percent AmountNot past due .............. $450,000 2% $9,0001–30 days past due...... 110,000 4 4,40031–60 days past due .... 51,000 6 3,06061–90 days past due .... 12,500 20 2,50091–180 days past due .. 7,500 60 4,500Over 180 days past due 5,500 80 4,400 Total .................... $636,500 $27,860Ex. 8–52006Dec. 31 Uncollectible Accounts Expense ..... 29,435*.A llowance for Doubtful Accounts 29,435 *$27,860 + $1,575 = $29,435Ex. 8–6a. $17,875 c. $35,750b. $13,600 d. $41,450Ex. 8–7a.Allowance for Doubtful Accounts ........... 7,130Accounts Receivable .................. 7,130b.Uncollectible Accounts Expense ............ 7,130Accounts Receivable .................. 7,130Ex. 8–8Feb.20 Accounts Receivable—Darlene Brogan 12,100 Sales .................................. 12,10020 Cost of Merchandise Sold ............ 7,260Merchandise Inventory .............. 7,260May30 Cash...................................... 6,000Accounts Receivable—Darlene Brogan 6,030 Allowance for Doubtful Accounts .... 6,100Accounts Receivable—Darlene Brogan 6,1Aug. 3Accounts Receivable—Darlene Brogan 6,100 Allowance for Doubtful Accounts . 6,1003 Cash...................................... 6,100Accounts Receivable—Darlene Brogan 6,1$223,900 [$212,800 + $112,350 –($4,050,000 × 21/2%)]Ex. 8–10Due Date Interesta. Aug. 31 $120b. Dec. 28 480c. Nov. 30 250d. May 5 150e. July 19 100Ex. 8–11a. August 8b. $24,480c. (1) N otes Receivable .......................... 24,000Accounts Rec.—Magpie Interior Decorators 24,(2) C ash......................................... 24,480Notes Receivable ....................... 24,000Interest Revenue (480)1. Sale on account.2. Cost of merchandise sold for the sale on account.3. A sales return or allowance.4. Cost of merchandise returned.5. Note received from customer on account.6. Note dishonored and charged maturity value of note tocustomer’s account receivable.7. Payment received from customer for dishonored noteplus interest earned after due date.Ex. 8–132005Dec.13 Notes Receivable ....................... 25,000Accounts Receivable—Visage Co. 25,31 Interest Receivable ..................... 75*Interest Revenue (75)31 Interest Revenue (75)Income Summary (75)2006。

会计英语第四版参考答案Chapter 1: Introduction to Accounting1. What is accounting?- Accounting is the systematic recording, summarizing, and reporting of financial transactions and events of a business entity.2. What are the main functions of accounting?- The main functions of accounting are to providefinancial information for decision-making, ensure compliance with laws and regulations, and facilitate the management of a business.3. What are the two main branches of accounting?- The two main branches of accounting are financial accounting and management accounting.4. What is the purpose of financial accounting?- The purpose of financial accounting is to provide an accurate and fair representation of an entity's financial position and performance to external users.5. What is the double-entry bookkeeping system?- The double-entry bookkeeping system is a method of recording financial transactions in which every transactionis recorded twice, once as a debit and once as a credit, to maintain the equality of the accounting equation.Chapter 2: Accounting Concepts and Principles1. What are the fundamental accounting concepts?- The fundamental accounting concepts include the accrual basis of accounting, going concern, consistency, and materiality.2. What is the accrual basis of accounting?- The accrual basis of accounting records transactions when they occur, regardless of when cash is received or paid.3. What is the going concern assumption?- The going concern assumption is the premise that a business will continue to operate for the foreseeable future.4. What is the principle of consistency?- The principle of consistency requires that an entity should apply accounting policies consistently over time.5. What is the principle of materiality?- The principle of materiality states that only items that could potentially affect the decisions of users of financial statements are included in the financial statements.Chapter 3: The Accounting Equation and Financial Statements1. What is the accounting equation?- The accounting equation is Assets = Liabilities +Owner's Equity.2. What are the four main financial statements?- The four main financial statements are the balance sheet, income statement, statement of changes in equity, and cashflow statement.3. What is the purpose of the balance sheet?- The balance sheet provides a snapshot of an entity's financial position at a specific point in time.4. What is the purpose of the income statement?- The income statement reports the revenues, expenses, and net income of an entity over a period of time.5. What is the purpose of the cash flow statement?- The cash flow statement reports the cash inflows and outflows of an entity over a period of time.Chapter 4: Recording Transactions1. What is a journal entry?- A journal entry is the initial recording of atransaction in the general journal.2. What are the steps in the accounting cycle?- The steps in the accounting cycle are analyzing transactions, journalizing, posting, preparing a trial balance, adjusting entries, preparing financial statements, and closing entries.3. What is the difference between a debit and a credit?- A debit is an increase in assets or a decrease inliabilities or equity, while a credit is an increase in liabilities or equity or a decrease in assets.4. What are adjusting entries?- Adjusting entries are made at the end of an accounting period to ensure that revenues and expenses are recorded in the correct period.5. What is the purpose of closing entries?- Closing entries are made to transfer the balances of temporary accounts to the owner's equity account and to prepare the accounts for the next accounting period.Chapter 5: Accounting for Merchandising Businesses1. What is a merchandise inventory?- A merchandise inventory is the stock of goods held by a business for sale to customers.2. What is the cost of goods sold?- The cost of goods sold is the direct cost of producing the merchandise sold during an accounting period.3. What is the gross profit?- The gross profit is the difference between the sales revenue and the cost of goods sold.4. What is the difference between a perpetual and a periodic inventory system?- A perpetual inventory system updates inventory records in real-time with each sale or purchase, while a periodicinventory system updates inventory records at specific intervals, such as at the end of an accounting period.5. What is the retail method of inventory pricing?- The retail method of inventory pricing is a method of estimating the cost of ending inventory by applying a cost-to-retail ratio to the retail value of the inventory.Chapter 6: Accounting for Service Businesses1. What are the main differences in accounting for service businesses compared to merchandise businesses?- Service businesses do not have inventory and their primary expenses are typically labor and overhead costs.2. What is the main source of revenue for service businesses? - The main source of revenue for service businesses is the fees charged for the services provided.3. What are the typical expenses。

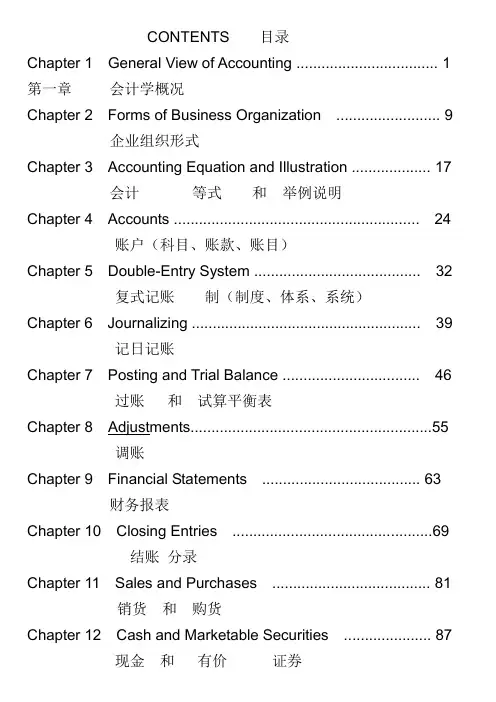

CONTENTS 目录Chapter 1 General View of Accounting (1)第一章会计学概况Chapter 2 Forms of Business Organization (9)企业组织形式Chapter 3 Accounting Equation and Illustration (17)会计等式和举例说明Chapter 4 Accounts (24)账户(科目、账款、账目)Chapter 5 Double-Entry System (32)复式记账制(制度、体系、系统)Chapter 6 Journalizing (39)记日记账Chapter 7 Posting and Trial Balance (46)过账和试算平衡表Chapter 8 Adjustments (55)调账Chapter 9 Financial Statements (63)财务报表Chapter 10 Closing Entries (69)结账分录Chapter 11 Sales and Purchases (81)销货和购货Chapter 12 Cash and Marketable Securities (87)现金和有价证券Chapter 13 Accounts Receivable (92)应收账款Chapter 14 Notes Receivable (97)应收票据Chapter 15 Inventories (103)存货盘点to take inventories at the end of accounting period在会计期末盘点存货Chapter 16 Plant Assets (109)厂房设备资产Chapter 17 Bonds Payable (117)应付债券Chapter 18 Capital Stocks (122)股本Reference Answer (127)参考答案General View of AccountingCHAPTER 1Chapter 1General View of Accounting会计学概况As one of the oldest professions,作为历史最古老的职业之一,accounting is as old as the civilization of human.会计和人类文明一样历史悠久。

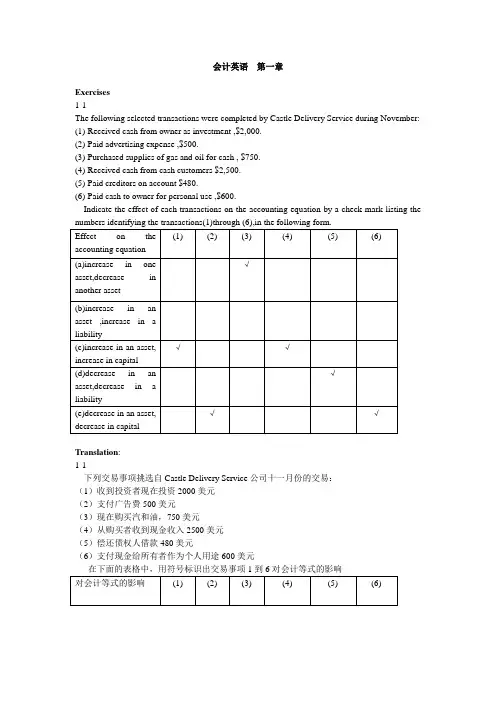

会计英语第一章Exercises1-1The following selected transactions were completed by Castle Delivery Service during November:(1)Received cash from owner as investment ,$2,000.(2)Paid advertising expense ,$500.(3)Purchased supplies of gas and oil for cash , $750.(4)Received cash from cash customers $2,500.(5)Paid creditors on account $480.(6)Paid cash to owner for personal use ,$600.Indicate the effect of each transactions on the accounting equation by a check mark listing theTranslation:1-1下列交易事项挑选自Castle Delivery Service公司十一月份的交易:(1)收到投资者现在投资2000美元(2)支付广告费500美元(3)现在购买汽和油,750美元(4)从购买者收到现金收入2500美元(5)偿还债权人借款480美元(6)支付现金给所有者作为个人用途600美元1-2Foreman Corporation, engaged in a service business , completed the following selected transactions during the period:1)Added additional investment, receiving cash2)Purchased supplies on account3)Returned defective supplies purchased on account and not yet paid for4)Received cash as a refund from the erroneous overpayment of an expense5)Charged customers for services sold on account6)Paid salary expense7)Paid a creditor on account8)Received cash on account from charge customer9)Paid cash for the owner’s personal use10)Determined the amount of supplies used during the monthTranslation :Foreman是一家从事服务行业的公司,以下是该公司在一段时间内的交易事项。

Chapter one Introduction to Accounting 1.1 Bookkeeping and AccountingAccounting is an information system that identifies,measures,records and communicates relevant,reliable,consistent,and comparable information about an organization’s economic activity. Its objective is to help people make better decisions.An understanding of the principles of bookkeeping and accounting is essential for anyone who is interested in a successful career in business. The purpose of bookkeeping and accounting is to provide information concerning the financial affairs of a business. Owners, managers, creditors, and governmental agencies need this information.An individual who earns living by recording the financial activities of business is known as a bookkeeper, while the process of classifying and summarizing business transactions and interpreting their effects is accomplished by an accountant. Accountant is the individual who understands the accounting principles, theoretical and practical application, and can manage, analyze, and interpret the accounting records. The bookkeeper is concerned with techniques involving the recording of transactions, and the accountant’s objective is the use of data for interpretation.第一章['tʃæptə]会计导论[.intrə'dʌkʃən]1.1 簿记与会计会计是一个信息系统,[ai'dentəfai]辨别、['meʒəz]测量、记录和交流相关的['reləvənt]、可靠的[ri'laiəbl]、持续的[kən'sistənt]和可比的['kɔmpərəbl]一个组织经济活动的信息。

Unit 1 Introduction to Accounting I.Key termsII.Reading Materials(I)AccountingAccounting is an information system. It measures business activities, processes data into reports, and communicates results to people.Recognition 确认Measurement 计量Record 记录Report 报告There are both external users (外部使用者) and internal users (内部使用者) of accounting information. We therefore classify accounting into financial accounting and management accounting.Financial accounting (财务会计)provides information for people outside the firm, such as Wall Street investors and bankers. Government agencies and the public are other external users. Financial accounting information must meet certain standards of relevance(相关)and reliability (可靠).Management accounting (管理会计)generates inside information for internal decision makers, such as the managers. Management information is tailored to serve the company’s specific needs and thus does not have to meet external standards of reliability.(II)ObjectivesGeneral objectives of financial reporting include the followingFinancial reporting should provide information that is useful to external users in making rational investment (投资), credit (信用), and similar decisions.Investor:投资人risk & returnCreditor:债权人liquidity 流动性solvency 偿债能力Specific objectives of financial reporting show the types of information that should be included in specific financial reportsFinancial reporting should provide information about the economic resources (assets) of an entity, any claims (要求权)to those resources (liabilities), including obligations to transfer resources to other entities or to owner’s equity, and the effects of circumstances, transactions, and events that alter(改变)the entity’s resources and claims to those resources.Statement of Financial Position or Balance Sheet 财务状况表资产负债表Financial reporting should provide information about an entity’s comprehensive income and its components.Statement of Comprehensive Income 全面收益表Financial reporting should provide information about an entity’s cash flows.Statement of Cash flows 现金流量表(III)Accounting assumptions and conventionsMonetary unit (stable monetary unit concept)币值稳定假设In the United States, we record transactions in dollars. British accountants record transactions in pounds sterling, Japanese in yen, and Europeans in euro.Under the stable monetary unit concept, accountants assume that the do llar’s purchasing power is stable,ignoring the effect of inflation (通货膨胀) in the accounting records.Economic entityAn economic entity is any business enterprise, ranging from a sole proprietorship to a global corporation. The economic entity assumption distinguishes business enterprises from their owners and accounts for each separately (独立核算).Going concernIt is assumed that the entity will continue in operation for the foreseeable future and it has neither the intention nor the necessity of liquidation (清算)or of curtailing (缩减)materially the scale of its operation.Periodic ityPeriodic ity assumes that economic activities are divided into artific ial portions of time such as months, quarters, and years.Cost-benefit relationship 成本收益关系Cost-benefit relationship assumes that unless the benefits of providing information exceed the costs associated with it, the information should not be prepared.MaterialityMateriality refers to the threshold (最低要求)at which the omission(漏报)or misstatement (错报)of an item in a financial report would influence or change the judgment of the information users. In other words, if the item makes a difference, it should be included or corrected. Conservatism 稳健性Conservatism is defined as a prudent reaction to uncertainty to try to ensure that uncertainty and risks inherent (固有)in business situations are adequately considered.对商业环境中的不确定性和风险因素给予足够谨慎的考虑Traditional conservatism has led to undervalued inventories and unreasonable depreciation or income recognition practices. Both conservative and optimistic biases can mislead investors, so the FASB now recommends conservatism be defined by neutrality and honesty in the disclosure of uncertainties, thus allowing users to form their own opinions as to the outcomes of uncertain events.通常的谨慎性会导致低估存货和不合理的折旧或收益确认等问题。

会计实用英语第一篇:会计实用英语account current 往来帐account form of balance sheet 帐户式资产负债表account form of profit and loss statement 帐户式损益表account payable 应付帐款account receivable 应收帐款account of payments 支出表account of receipts 收入表account title 帐户名称,会计科目accounting year 或financial year 会计年度accounts payable ledger 应付款分类帐Accounting period(会计期间)are related to specifictime periods ,typically one year(通常是一年)资产负债表:balance sheet 可以不大写b利润表: income statements(or statements of income)利润分配表:retained earnings现金流量表:cash flowsAccounting system 会计系统American Accounting Association 美国会计协会American Institute of CPAs 美国注册会计师协会Audit 审计Balance sheet 资产负债表Bookkeepking 簿记Cash flow prospects 现金流量预测Certificate in Internal Auditing 内部审计证书Certificate in Management Accounting 管理会计证书Certificate Public Accountant注册会计师Cost accounting 成本会计External users 外部使用者Financial accounting 财务会计Financial Accounting Standards Board 财务会计准则委员会Financial forecast 财务预测Generally accepted accounting principles 公认会计原则General-purpose information 通用目的信息Government Accounting Office 政府会计办公室accountant genaral 会计主任 account balancde 结平的帐户 account bill 帐单account books 帐account classification 帐户分类Income statement 损益表 Institute of Internal Auditors 内部审计师协会Institute of Management Accountants 管理会计师协会Integrity 整合性Internal auditing 内部审计Internal control structure 内部控制结构Internal Revenue Service 国内收入署Internal users 内部使用者Management accounting 管理会计Return of investment 投资回报Return on investment 投资报酬Securities and Exchange Commission 证券交易委员会 Statement of cash flow 现金流量表 Statement of financial position 财务状况表Tax accounting 税务会计Accounting equation 会计等式Articulation 勾稽关系 Assets 资产 Business entity 企业个体 Capital stock 股本 Corporation 公司 Cost principle 成本原则 Creditor 债权人Deflation 通货紧缩Disclosure 批露Expenses 费用Financial statement 财务报表Financial activities 筹资活动Going-concern assumption 持续经营假设 Inflation 通货膨涨 Investing activities 投资活动Liabilities 负债Negative cash flow 负现金流量 Operating activities 经营活动 Owner's equity 所有者权益 Partnership 合伙企业Positive cash flow 正现金流量Retained earning 留存利润Revenue 收入Sole proprietorship 独资企业Solvency 清偿能力Stable-dollar assumption 稳定货币假设 Stockholders 股东Stockholders' equity 股东权益Window dressing 门面粉饰Account 帐第二篇:会计常用英语现金 Cash in hand银行存款 Cash in bank其他货币资金-外埠存款Other monetary assetscashier‘s check其他货币资金-银行汇票 Other monetary assetscredit cards 其他货币资金-信用证保证金Other monetary assetscash for investment短期投资-股票投资 Investmentsstocks短期投资-债券投资 Investmentsbonds短期投资-基金投资 Investmentsfunds短期投资-其他投资 Investmentsothers短期投资跌价准备 Provision for short-term investment长期股权投资-股票投资 Long term equity investmentothers长期债券投资-债券投资 Long term securities investemntothers长期投资减值准备 Provision for long-term investment应收票据 Notes receivable应收股利 Dividends receivable应收利息 Interest receivable应收帐款 Trade debtors坏帐准备-应收帐款 Provision for doubtful debtsother debtors 其他流动资产 Other current assets物资采购 Purchase原材料 Raw materials包装物 Packing materials低值易耗品 Low value consumbles材料成本差异 Material cost difference自制半成品 Self-manufactured goods库存商品 Finished goods商品进销差价Difference between purchase & sales of commodities委托加工物资 Consigned processiong material 委托代销商品 Consignment-out受托代销商品 Consignment-in分期收款发出商品 Goods on instalment sales存货跌价准备 Provision for obsolete stocks待摊费用 Prepaid expenses待处理流动资产损益 Unsettled G/L on current assets待处理固定资产损益 Unsettled G/L on fixed assets委托贷款-本金 Consignment loaninterest委托贷款-减值准备 Consignment loanBuildings固定资产-机器设备Fixed assetsElectronic Equipment, furniture and fixtures固定资产-运输设备Fixed assetsspecific materials工程物资-专用设备 Project materialprepaid for equipment工程物资-为生产准备的工具及器具 Project materialpatent无形资产-非专利技术 Intangible assetstrademark rights无形资产-土地使用权 Intangible assetsgoodwill无形资产减值准备 Impairment of intangible assets长期待摊费用 Deferred assets未确认融资费用 Unrecognized finance fees其他长期资产 Other long term assets递延税款借项 Deferred assets debits应付票据 Notes payable应付帐款 Trade creditors预收帐款 Adanvances from customers代销商品款 Consignment-in payables其他应交款 Other payable to government其他应付款 Other creditors应付股利 Proposed dividends待转资产价值 Donated assets预计负债 Accrued liabilities应付短期债券 Short-term debentures payable其他流动负债 Other current liabilities预提费用 Accrued expenses应付工资 Payroll payable应付福利费 Welfare payable短期借款-抵押借款 Bank loanspledged短期借款-信用借款 Bank loanscredit短期借款-担保借款 Bank loansguaranteed一年内到期长期借款 Long term loans due within one year一年内到期长期应付款 Long term payable due within one year 长期借款 Bank loansPar value应付债券-债券溢价 Bond payableDiscount应付债券-应计利息 Bond payableincome tax应交税金-增值税 Tax payablebusiness tax应交税金-消费税 Tax payableothers递延税款贷项 Deferred taxation credit股本 Share capital已归还投资 Investment returned利润分配-其他转入Profit appropriationstatutory surplus reserve利润分配-提取法定公益金 Profit appropriationreserve fund利润分配-提取企业发展基金Profit appropriationstaff bonus and welfare fund利润分配-利润归还投资Profit appropriationpreference shares dividends利润分配-提取任意盈余公积Profit appropriationordinary shares dividends利润分配-转作股本的普通股股利Profit appropriationshare premium资本公积-接受捐赠非现金资产准备Capital surpluscash donation资本公积-股权投资准备 Capital surplussubsidiary资本公积-外币资本折算差额 Capital surplusothers盈余公积-法定盈余公积金Surplus reserveother surplus reserve盈余公积-法定公益金 Surplus reservereserve fund盈余公积-企业发展基金Surplus reservereture investment by investment主营业务收入 Sales主营业务成本 Cost of sales主营业务税金及附加 Sales tax营业费用 Operating expenses管理费用 General and administrative expenses财务费用 Financial expenses投资收益 Investment income其他业务收入 Other operating income营业外收入 Non-operating income补贴收入 Subsidy income其他业务支出 Other operating expenses营业外支出 Non-operating expenses所得税 Income tax一、资产类 assets现金 cash on hand银行存款 cash in bank其他货币资金 other cash and cash equivalent短期投资 short-term investment短期投资跌价准备short-term investments falling price reserve应收票据 notes receivable应收股利 dividend receivable应收利息 interest receivable应收帐款 accounts receivable坏帐准备 bad debt reserve预付帐款 advance money应收补贴款 cover deficit receivable from state subsidize其他应收款 other notes receivable在途物资 materials in transit原材料 raw materials包装物 wrappage低值易耗品 low-value consumption goods库存商品 finished goods委托加工物资 work in process-outsourced委托代销商品trust to and sell the goods on a commission basis受托代销商品commissioned and sell the goods on a commission basis存货跌价准备 inventory falling price reserve 分期收款发出商品 collect money and send out the goods by stages待摊费用 deferred and prepaid expenses长期股权投资 long-term investment on stocks长期债权投资 long-term investment on bonds长期投资减值准备 long-term investment depreciation reserve 固定资产 fixed assets累计折旧 accumulated depreciation工程物资 project goods and material在建工程 project under construction固定资产清理 fixed assets disposal无形资产 intangible assets开办费 organization/preliminary expenses长期待摊费用 long-term deferred and prepaid expenses待处理财产损溢 wait deal assets loss or income二、负债类 debts短期借款 short-term loan应付票据 notes payable应付帐款 accounts payable预收帐款 advance payment代销商品款 consignor payable应付工资 accrued payroll应付福利费 accrued welfarism应付股利 dividends payable应交税金 tax payable其他应交款 accrued other payments 其他应付款 other payable预提费用 drawing expenses in advance 长期借款 long-term loan应付债券 debenture payable长期应付款 long-term payable递延税款 deferred tax住房周转金 revolving fund of house 三、所有者权益 owners equity股本 paid-up stock资本公积 capital reserve盈余公积 surplus reserve本年利润 current year profit利润分配 profit distribution四、成本类 cost生产成本 cost of manufacture制造费用 manufacturing overhead 五、损益类 profit and loss(p/l)主营业务收入 prime operating revenue 其他业务收入 other operating revenue 折扣与折让 discount and allowance投资收益 investment income补贴收入 subsidize revenue营业外收入 non-operating income主营业务成本 operating cost主营业务税金及附加tax and associate charge其他业务支出other operating expenses存货跌价损失 inventory falling price loss营业费用 operating expenses管理费用 general and administrative expenses财务费用 financial expenses营业外支出 non-operating expenditure所得税 income tax以前损益调整 adjusted p/l for prior year第三篇:会计英语求职信在外企上班用英语的求职信是不是会跟合适点呢?来看看如何写一篇好的英语求职信吧。