(完整word版)国际财务管理课后习题答案chapter10

- 格式:doc

- 大小:240.51 KB

- 文档页数:18

《国际财务管理》章后练习题第一章【题1—1】某跨国公司A,2006年11月兼并某亏损国有企业B。

B企业兼并时账面净资产为500万元,2005年亏损100万元(以前年度无亏损),评估确认的价值为550万元。

经双方协商,A 跨国公司可以用以下两种方式兼并B企业。

甲方式:A公司以180万股和10万元人民币购买B企业(A公司股票市价为3元/股);乙方式:A公司以150万股和100万元人民币购买B企业。

兼并后A公司股票市价3.1元/股。

A公司共有已发行的股票2000万股(面值为1元/股)。

假设兼并后B企业的股东在A公司中所占的股份以后年度不发生变化,兼并后A公司企业每年未弥补亏损前应纳税所得额为900万元,增值后的资产的平均折旧年限为5年,行业平均利润率为10%。

所得税税率为33%。

请计算方式两种发方式的差异。

【题1—1】答案(1)甲方式:B企业不需将转让所得缴纳所得税;B 企业2005年的亏损可以由A公司弥补。

A公司当年应缴所得税=(900-100)×33%=264万元,与合并前相比少缴33万元所得税,但每年必须为增加的股权支付股利。

(2)乙方式:由于支付的非股权额(100万元)大于股权面值的20%(30万元)。

所以,被兼并企业B应就转让所得缴纳所得税。

B企业应缴纳的所得税=(150 ×3 + 100- 500)×33% = 16.5(万元)B企业去年的亏损不能由A公司再弥补。

(3)A公司可按评估后的资产价值入帐,计提折旧,每年可减少所得税(550-500)/5×33%=3.3万元。

【题1—2】东方跨国公司有A、B、C、D四个下属公司,2006年四个公司计税所得额和所在国的所得税税率为:A公司:500万美元 33%B公司:400万美元 33%C公司:300万美元 24%D公司:-300万美元 15%东方公司的计税所得额为-100万美元,其所在地区的所得税税率为15%。

CHAPTER 1 GLOBALIZATION AND THE MULTINATIONAL FIRM ANSWERS & SOLUTIONS TO END-OF-CHAPTER QUESTIONS AND PROBLEMSQUESTIONS1. Why is it important to study international financial management?Answer: We are now living in a world where all the major economic functions, i。

e。

,consumption,production,and investment,are highly globalized。

It is thus essential for financial managers to fully understand vital international dimensions of financial management. This global shift is in marked contrast to a situation that existed when the authors of this book were learning finance some twenty years ago。

At that time, most professors customarily (and safely, to some extent)ignored international aspects of finance。

This mode of operation has become untenable since then.2. How is international financial management different from domestic financial management?Answer: There are three major dimensions that set apart international finance from domestic finance. They are:1. foreign exchange and political risks,2. market imperfections, and3. expanded opportunity set.3. Discuss the major trends that have prevailed in international business during the last two decades。

《国际财务管理》章后练习题及参考答案第一章绪论一、单选题1. 关于国际财务管理学与财务管理学的关系表述正确的是(C)。

A. 国际财务管理是学习财务管理的基础B. 国际财务管理与财务管理是两门截然不同的学科C. 国际财务管理是财务管理的一个新的分支D. 国际财务管理研究的范围要比财务管理的窄2. 凡经济活动跨越两个或更多国家国界的企业,都可以称为( A )。

A. 国际企业B. 跨国企业C. 跨国公司D. 多国企业3.企业的( C)管理与财务管理密切结合,是国际财务管理的基本特点A.资金B.人事C.外汇 D成本4.国际财务管理与跨国企业财务管理两个概念( D) 。

A. 完全相同B. 截然不同C. 仅是名称不同D. 内容有所不同4.国际财务管理的内容不应该包括( C )。

A. 国际技术转让费管理B. 外汇风险管理C. 合并财务报表管理D. 企业进出口外汇收支管理5.“企业生产经营国际化”和“金融市场国际化”的关系是( C )。

A. 二者毫不相关B. 二者完全相同C. 二者相辅相成D. 二者互相起负面影响二、多选题1.国际企业财务管理的组织形态应考虑的因素有()。

A.公司规模的大小B.国际经营的投入程度C.管理经验的多少D.整个国际经营所采取的组织形式2.国际财务管理体系的内容包括()A.外汇风险的管理B.国际税收管理C.国际投筹资管理D.国际营运资金管3.国际财务管理目标的特点()。

A.稳定性B.多元性C.层次性D.复杂性4.广义的国际财务管理观包括()。

A.世界统一财务管理观B.比较财务管理观C.跨国公司财务管理观D.国际企业财务管理观5. 我国企业的国际财务活动日益频繁,具体表现在( )。

A. 企业从内向型向外向型转化B. 外贸专业公司有了新的发展C. 在国内开办三资企业D. 向国外投资办企业E. 通过各种形式从国外筹集资金三、判断题1.国际财务管理是对企业跨国的财务活动进行的管理。

()2.国际财务管理学是着重研究企业如何进行国际财务决策,使所有者权益最大化的一门科学。

1/Banker`s AcceptancesA.Describe how foreign trade would be affected if banks did not provide trade services.Foreign trade would be reduced without the trade-related services by banks, because some trade can only occur if banks back the transaction with bankers acceptances.B.How can a banker`s acceptance be beneficial to an exporter, an importer, and a bank?The exporter does not need to worry about the credit risk of the importer and can therefore penetrate new foreign markets without concern about the credit risk of potential customer.The importer benefit from a banker`s acceptance by obtaining greater access to foreign markets when purchasing supplies and other products. Without banker`s acceptances, exporters may be unwilling to accept credit risk of importers.The bank accepting the draft benefits in that it can earns a commission for creating an acceptance.A banker’s acceptance guarantees payment to the exporter so that credit risk of the importer is not worrisome. It allows the importers to import goods without being turned down due to uncertainty about their credit standing. It is a revenue generator for the bank since a fee is received by the bank for this service.2/Export Financing.a. Why would an exporter provide financing for an importer?b. Is there much risk in this activity? Explain.ANSWER: An exporter could increase sales by allowing the importer to pay at a future date. Importers may not be able to afford to pay. There may be high credit risk incurred by the exporter here, especially if the importer is an unknown small company.3/ Role of Factors. What is the role of a factor in international trade transactions?ANSWER: A factor can relieve the exporter of the worry about the credit risk of the importer. In return, the factor is rewarded by being able to purchase the accounts receivables at a lower price than their cash value.5/What are bills of lading, and how do they facilitate international trade transactions?A bill of lading is a document issued by a carrier which details a shipment of merchandise and gives title of that shipment to a specified party.Bills of lading are one of three important documents used in international trade to help guarantee that exporters receive payment and importers receive merchandise.6/Forfaiting. What is forfaiting? Specify the type of traded goods for which forfaiting is applied. Forfaiting is a type of trade finance. Forfaiting is refers to the purchase of financial obligations, such as bills of exchange or promissory notes, without recourse to the original holder, usually the exporter. In a forfaiting transaction, the importer issues a promissory note to pay the exporter for the importer for the importer goods over a period that generally ranges from 3 to 7years. The exporter then sells the notes, without recourse, to the forfaiting bank.Like mechanical, electronic or complete sets of equipment and other capital goods trading, the amount of the transaction is large. The longer importer’s deferred payment period is, the more suitable for Forfaiting is.9/ Countertrade. What is countertrade?The term countertrade denotes all types of foreign trade transaction in which the sale of goods toone country is linked to t/he purchase or exchange of goods from that same country. Countertrade can be classified into three broad categories-barter, compensation and counterpurchase. Barter is the exchange of goods between two parties without the use of any currency as a medium of exchange. In a compensation, the delivery of goods to one party is compensated for by the seller's buying back a certain amount of the product from the same party. The counterpurchase means that the exchange of goods between two parties under two distinct contracts expressed in monetary terms.。

Solutions for International Corporate FinanceChapter 1 (2)Chapter 2 (4)Chapter 3 (6)Chapter 4 (8)Chapter 5 (12)Chapter 6 (14)Chapter 7 (16)Chapter 8 (18)Chapter 9 (21)Chapter 10 (23)Chapter 11 (26)Chapter 12 (29)Chapter 15. International Business Methods. Snyder Golf Co., a U.S. firm that sells high-quality golf clubs in the U.S., wants to expand internationally by selling the same golf clubs in Brazil.a. Describe the tradeoffs that are involved for each method (such as exporting, direct foreign investment, etc.) that Snyder could use to achieve its goal.ANSWER: Snyder can export the clubs, but the transportation expenses may be high. If could establish a subsidiary in Brazil to produce and sell the clubs, but this may require a large investment of funds. It could use licensing, in which it specifies to a Brazilian firm how to produce the clubs. In this way, it does not have to establish its own subsidiary there.b. Which method would you recommend for this firm? Justify your recommendation. ANSWER: If the amount of golf clubs to be sold in Brazil is small, it may decide to export. However, if the expected sales level is high, it may benefit from licensing. If it is confident that the expected sales level will remain high, it may be willing to establish a subsidiary. The wages are lower in Brazil, and the large investment needed to establish a subsidiary may be worthwhile.8. Comparative Advantage.a. Explain how the theory of comparative advantage relates to the need for international business. ANSWER: The theory of comparative advantage implies that countries should specialize in production, thereby relying on other countries for some products. Consequently, there is a need for international business.b. Explain how the product cycle theory relates to the growth of an MNC.ANSWER: The product cycle theory suggests that at some point in time, the firm will attempt to capitalize on its perceived advantages in markets other than where it was initially established.10. Valuation of Wal-Mart’s International Business. In addition to all of its stores in the U.S., Wal-Mart has 11 stores in Argentina, 24 stores in Brazil, 214 stores in Canada, 29 stores in China, 92 stores in Germany, 15 stores in South Korea, 611 stores in Mexico, and 261 stores in the U.K. Consider the value of Wal-Mart as being composed of two parts, a U.S. part (due to business in the U.S.) and a non-U.S. part (due to business in other countries). Explain how to determine the present value (in dollars) of the non-U.S. part assuming that you had access to all the details of Wal-Mart businesses outside the U.S.ANSWER: The non-U.S. part can be measured as the present value of future dollar cash flows resulting from the non-U.S. businesses. Based on recent earnings data for each store and applying an expected growth rate, you can estimate the remitted earnings that will come from each country in each year in the future. You can convert those cash flows to dollars using a forecasted exchange rate per year. Determine the present value of cash flows of all stores within one country. Then repeat the process for other countries. Then add up all the present values that you estimated to derive a consolidated present value of all non-U.S. subsidiaries.15. International Joint Venture. Anheuser-Busch, the producer of Budweiser and other beers, has recently expanded into Japan by engaging in a joint venture with Kirin Brewery, the largest brewery in Japan. The joint venture enables Anheuser-Busch to have its beer distributed through Kirin’s distribution channels in Japan. In addition, it can utilize Kirin’s facilities to produce beer that will be sold locally. In return, Anheuser-Busch provides information about the American beer market to Kirin.a. Explain how the joint venture can enable Anheuser-Busch to achieve its objective of maximizing shareholder wealth.ANSWER: The joint venture creates a way for Anheuser-Busch to distribute Budweiser throughout Japan. It enables Anheuser-Busch to penetrate the Japanese market without requiring a substantial investment in Japan.b. Explain how the joint venture can limit the risk of the international business.ANSWER: The joint venture has limited risk because Anheuser-Busch does not need to establish its own distribution network in Japan. Thus, Anheuser-Busch may be able to use a smaller investment for the international business, and there is a higher probability that the international business will be successful.c. Many international joint ventures are intended to circumvent barriers that normally prevent foreign competition. What barrier in Japan is Anheuser-Busch circumventing as a result of the joint venture? What barrier in the United States is Kirin circumventing as a result of the joint venture?ANSWER: Anheuser-Busch is able t o benefit from Kirin’s distribution system in Japan, which would not normally be so accessible. Kirin is able to learn more about how Anheuser-Busch expanded its product across numerous countries, and therefore breaks through an “information”barrier.d. Explain how Anheuser-Busch could lose some of its market share in countries outside Japan as a result of this particular joint venture.ANSWER: Anheuser-Busch could lose some of its market share to Kirin as a result of explaining its worldwide expansion strategies to Kirin. However, it appears that Anheuser-Busch expects the potential benefits of the joint venture to outweigh any potential adverse effects.24. Global Competition. Explain why more standardized product specifications across countries can increase global competition.ANSWER: Standardized product specifications allow firms to more easily expand their business across other countries, which increases global competition.Chapter 24. Free Trade. There has been considerable momentum to reduce or remove trade barriers in an effort to achieve “free trade.” Yet, one disgruntled executive of an exporting firm stated, “Free trade is not conceivable; we are always at the mercy of the exchange rate. Any country can use this mechanism to impose trade bar riers.” What does this statement mean?ANSWER: This statement implies that even if there were no explicit barriers, a government could attempt to manipulate exchange rates to a level that would effectively reduce foreign competition. For example, a U.S. firm may be discouraged from attempting to export to Japan if the value of the dollar is very high against the yen. The prices of the U.S. goods from the Japanese perspective are too high because of the strong dollar. The reverse situation could also be possible in which a Japanese exporting firm is priced out of the U.S. market because of a strong yen (weak dollar). [Answer is based on opinion.]8. International Investments. In recent years many U.S.-based MNCs have increased their investments in foreign securities, which are not as susceptible to negative shocks in the U.S. market. Also, when MNCs believe that U.S. securities are overvalued, they can pursue non-U.S. securities that are driven by a different market. Moreover, in periods of low U.S. interest rates, U.S. corporations tend to seek investments in foreign securities. In general, the flow of funds into foreign countries tends to decline when U.S. investors anticipate a strong dollar.a. Explain how expectations of a strong dollar can affect the tendency of U.S. investors to invest abroad.ANSWER: A weak dollar would discourage U.S. investors from investing abroad. It can cause the investors to purchase foreign currency (when investing) at a higher exchange rate than the exchange rate at which they would sell the currency (when the investment is liquidated).b. Explain how low U.S. interest rates can affect the tendency of U.S.-based MNCs to invest abroad.ANSWER: Low U.S. interest rates can encourage U.S.-based MNCs to invest abroad, as investors seek higher returns on their investment than they can earn in the U.S.c. In general terms, what is the attraction of foreign investments to U.S. investors?ANSWER: The main attraction is potentially higher returns. The international stocks can outperform U.S. stocks, and international bonds can outperform U.S. bonds. However, there is no guarantee that the returns on international investments will be so favorable. Some investors may also pursue international investments to diversify their investment portfolio, which can possibly reduce risk.10. Exchange Rate Effects on Trade.a. Explain why a stronger dollar could enlarge the U.S. balance of trade deficit. Explain why a weaker dollar could affect the U.S. balance of trade deficit.ANSWER: A stronger dollar makes U.S. exports more expensive to importers and may reduceimports. It makes U.S. imports cheap and may increase U.S. imports. A weaker home currency increases the prices of imports purchased by the home country and reduces the prices paid by foreign businesses for the home country’s exports. This should cause a decrease in the home country’s demand for imports and an increase in the foreign demand for the home country’s exports, and therefore increase the current account. However, this relationship can be distorted by other factors.b. It is sometimes suggested that a floating exchange rate will adjust to reduce or eliminate any current account deficit. Explain why this adjustment would occur.ANSWER: A current account deficit reflects a net sale of the home currency in exchange for other currencies. This places downward pressure on that home currency’s value. If the currency weakens, it will reduce the home demand for foreign goods (since goods will now be more expensive), and will increase the home export volume (since exports will appear cheaper to foreign countries).c. Why does the exchange rate not always adjust to a current account deficit?ANSWER: In some cases, the home currency will remain strong even though a current account deficit exists, since other factors (such as international capital flows) can offset the forces placed on the currency by the current account.13. Effects of Tariffs. Assume a simple world in which the U.S. exports soft drinks and beer to France and imports wine from France. If the U.S. imposes large tariffs on the French wine, explain the likely impact on the values of the U.S. beverage firms, U.S. wine producers, the French beverage firms, and the French wine producers.ANSWER: The U.S. wine producers benefit from the U.S. tariffs, while the French wine producers are adversely affected. The French government would likely retaliate by imposing tariffs on the U.S. beverage firms, which would adversely affect their value. The French beverage firms would benefit.15. Demand for Exports. A relatively small U.S. balance of trade deficit is commonly attributed toa strong demand for U.S. exports. What do you think is the underlying reason for the strong demand for U.S. exports?ANSWER: The strong demand for U.S. exports is commonly attributed to strong foreign economies or to a weak dollar.Chapter 35. International Financial Markets. Recently, Wal-Mart established two retail outlets in the city of Shenzhen, China, which has a population of 3.7 million. These outlets are massive and contain products purchased locally as well as imports. As Wal-Mart generates earnings beyond what it needs in Shenzhen, it may remit those earnings back to the United States. Wal-Mart is likely to build additional outlets in Shenzhen or in other Chinese cities in the future.a. Explain how the Wal-Mart outlets in China would use the spot market in foreign exchange. ANSWER: The Wal-Mart stores in China need other currencies to buy products from other countries, and must convert the Chinese currency (yuan) into the other currencies in the spot market to purchase these products. They also could use the spot market to convert excess earnings denominated in yuan into dollars, which would be remitted to the U.S. parent.b. Explain how Wal-Mart might utilize the international money market when it is establishing other Wal-Mart stores in Asia.ANSWER: Wal-Mart may need to maintain some deposits in the Eurocurrency market that can be used (when needed) to support the growth of Wal-Mart stores in various foreign markets. When some Wal-Mart stores in foreign markets need funds, they borrow from banks in the Eurocurrency market. Thus, the Eurocurrency market serves as a deposit or lending source for Wal-Mart and other MNCs on a short-term basis.c. Explain how Wal-Mart could use the international bond market to finance the establishment of new outlets in foreign markets.ANSWER: Wal-Mart could issue bonds in the Eurobond market to generate funds needed to establish new outlets. The bonds may be denominated in the currency that is needed; then, once the stores are established, some of the cash flows generated by those stores could be used to pay interest on the bonds.11. Foreign Exchange. You just came back from Canada, where the Canadian dollar was worth $.70. You still have C$200 from your trip and could exchange them for dollars at the airport, but the airport foreign exchange desk will only buy them for $.60. Next week, you will be going to Mexico and will need pesos. The airport foreign exchange desk will sell you pesos for $.10 per peso. You met a tourist at the airport who is from Mexico and is on his way to Canada. He is willing to buy your C$200 for 130 pesos. Should you accept the offer or cash the Canadian dollars in at the airport? Explain.ANSWER: Exchange with the tourist. If you exchange the C$ for pesos at the foreign exchange desk, the cross-rate is $.60/$10 = 6. Thus, the C$200 would be exchanged for 120 pesos (computed as 200 ×6). If you exchange Canadian dollars for pesos with the tourist, you will receive 130 pesos.15. Exchange Rate Effects on Borrowing. Explain how the appreciation of the Japanese yen against the U.S. dollar would affect the return to a U.S. firm that borrowed Japanese yen and used the proceeds for a U.S. project.ANSWER: If the Japanese yen appreciates over the borrowing period, this implies that the U.S. firm converted yen to U.S. dollars at a lower exchange rate than the rate at which it paid for yen at the time it would repay the loan. Thus, it is adversely affected by the appreciation. Its cost of borrowing will be higher as a result of this appreciation.20. Interest Rates. Why do interest rates vary among countries? Why are interest rates normally similar for those European countries that use the euro as their currency? Offer a reason why the government interest rate of one country could be slightly higher than that of the government interest rate of another country, even though the euro is the currency used in both countries.ANSWER: Interest rates in each country are based on the supply of funds and demand for funds for a given currency. However, the supply and demand conditions for the euro are dictated by all participating countries in aggregate, and do not vary among participating countries. Yet, the government interest rate in one country that uses the euro could be slightly higher than others that use the euro if it is subject to default risk. The higher interest rate would reflect a risk premium.21. Forward Contract. The Wolfpack Corporation is a U.S. exporter that invoices its exports to the United Kingdom in British pounds. If it expects that the pound will appreciate against the dollar in the future, should it hedge its exports with a forward contract? Explain.ANSWER: The forward contract can hedge future receivables or payables in foreign currencies to insulate the firm against exchange rate risk. Yet, in this case, the Wolfpack Corporation should not hedge because it would benefit from appreciation of the pound when it converts the pounds to dollars.Chapter 43. Inflation Effects on Exchange Rates. Assume that the U.S. inflation rate becomes high relative to Canadian inflation. Other things being equal, how should this affect the (a) U.S. demand for Canadian dollars, (b) supply of Canadian dollars for sale, and (c) equilibrium value of the Canadian dollar?ANSWER: Demand for Canadian dollars should increase, supply of Canadian dollars for sale should decrease, and the Canadian dollar’s value should increase.12. Factors Affecting Exchange Rates. Mexico tends to have much higher inflation than the United States and also much higher interest rates than the United States. Inflation and interest rates are much more volatile in Mexico than in industrialized countries. The value of the Mexican peso is typically more volatile than the currencies of industrialized countries from a U.S. perspective; it has typically depreciated from one year to the next, but the degree of depreciation has varied substantially. The bid/ask spread tends to be wider for the peso than for currencies of industrialized countries.a. Identify the most obvious economic reason for the persistent depreciation of the peso. ANSWER: The high inflation in Mexico places continual downward pressure on the value of the peso.b. High interest rates are commonly expected to strengthen a country’s currency because they can encourage foreign investment in securities in that country, which results in the exchange of other currencies for that currency. Yet, the peso’s value has declined against the dollar over most years even though Mexican interest rates are typically much higher than U.S. interest rates. Thus, it appears that the high Mexican interest rates do not attract substantial U.S. investment in Mexico’s securities. Why do you think U.S. investors do not try to capitalize on the high interest rates in Mexico?ANSWER: The high interest rates in Mexico result from expectations of high inflation. That is, the real interest rate in Mexico may not be any higher than the U.S. real interest rate. Given the high inflationary expectations, U.S. investors recognize the potential weakness of the peso, which could more than offset the high interest rate (when they convert the pesos back to dollars at the end of the investment period). Therefore, the high Mexican interest rates do not encourage U.S. investment in Mexican securities, and do not help to strengthen the value of the peso.c. Why do you think the bid/ask spread is higher for pesos than for currencies of industrialized countries? How does this affect a U.S. firm that does substantial business in Mexico?ANSWER: The bid/ask spread is wider because the banks that provide foreign exchange services are subject to more risk when they maintain currencies such as the peso that could decline abruptly at any time. A wider bid/ask spread adversely affects the U.S. firm that does business in Mexico because it increases the transactions costs associated with conversion of dollars to pesos, or pesos to dollars.14. Aggregate Effects on Exchange Rates. Assume that the United States invests heavily in government and corporate securities of Country K. In addition, residents of Country K invest heavily in the United States. Approximately $10 billion worth of investment transactions occur between these two countries each year. The total dollar value of trade transactions per year is about $8 million. This information is expected to also hold in the future. Because your firm exports goods to Country K, your job as international cash manager requires you to forecast the value of Country K’s currency (the “krank”) with respect to the dollar. Explain how each of the following conditions will affect the value of the krank, holding other things equal. Then, aggregate all of these impacts to develop an ov erall forecast of the krank’s movement against the dollar.a. U.S. inflation has suddenly increased substantially, while Country K’s inflation remains low. ANSWER: Increased U.S. demand for the krank. Decreased supply of kranks for sale. Upward pressure in the krank’s value.b. U.S. interest rates have increased substantially, while Country K’s interest rates remain low. Investors of both countries are attracted to high interest rates.ANSWER: Decreased U.S. demand for the krank. Increased supply of kranks for sale. Downward pressure on the krank’s value.c. The U.S. income level increased substantially, while Country K’s income level has remained unchanged.ANSWER: Increased U.S. demand for the krank. Upward pressure on the krank’s value.d. The U.S. is expected to impose a small tariff on goods imported from Country K. ANSWER: The tariff will cause a decrease in the United States’ desire for Country K’s goods, and will therefore reduce the demand for kranks for sale. Downward pressure on the krank’s value.e. Combine all expected impacts to develop an overall forecast.ANSWER: Two of the scenarios described above place upward pressure on the value of the krank. However, these scenarios are related to trade, and trade flows are relatively minor between the U.S. and Country K. The interest rate scenario places downward pressure on the krank’s value. Since the interest rates affect capital flows and capital flows dominate trade flows between the U.S. and Country K, the interest rate scenario should overwhelm all other scenarios. Thus, when considering the importance of implications of all scenarios, the krank is expected to depreciate.22. Speculation. Blue Demon Bank expects that the Mexican peso will depreciate against the dollar from its spot rate of $.15 to $.14 in 10 days. The following interbank lending and borrowingin the interbank market, depending on which currency it wants to borrow.a. How could Blue Demon Bank attempt to capitalize on its expectations without using deposited funds? Estimate the profits that could be generated from this strategy.ANSWER: Blue Demon Bank can capitalize on its expectations about pesos (MXP) as follows:1. Borrow MXP70 million2. Convert the MXP70 million to dollars:MXP70,000,000 × $.15 = $10,500,0003. Lend the dollars through the interbank market at 8.0% annualized over a 10-day period. The amount accumulated in 10 days is:$10,500,000 × [1 + (8% × 10/360)] = $10,500,000 × [1.002222] = $10,523,3334. Repay the peso loan. The repayment amount on the peso loan is:MXP70,000,000 × [1 + (8.7% × 10/360)] = 70,000,000 × [1.002417]=MXP70,169,1675. Based on the expected spot rate of $.14, the amount of dollars needed to repay the peso loan is: MXP70,169,167 × $.14 = $9,823,6836. After repaying the loan, Blue Demon Bank will have a speculative profit (if its forecasted exchange rate is accurate) of:$10,523,333 – $9,823,683 = $699,650b. Assume all the preceding information with this exception: Blue Demon Bank expects the peso to appreciate from its present spot rate of $.15 to $.17 in 30 days. How could it attempt to capitalize on its expectations without using deposited funds? Estimate the profits that could be generated from this strategy.ANSWER: Blue Demon Bank can capitalize on its expectations as follows:1. Borrow $10 million2. Convert the $10 million to pesos (MXP):$10,000,000/$.15 = MXP 66, 666,6673. Lend the pesos through the interbank market at 8.5% annualized over a 30-day period. The amount accumulated in 30 days is:MXP66,666,667 × [1 + (8.5% × 30/360)] = 66,666,667 × [1.007083] = MXP67,138,8894. Repay the dollar loan. The repayment amount on the dollar loan is:$10,000,000 × [1 + (8.3% × 30/360)] = $10,000,000 × [1.006917] = $10,069,1705. Convert the pesos to dollars to repay the loan. The amount of dollars to be received in 30 days (based on the expected spot rate of $.17) is:MXP67,138,889 × $.17 = $11,413,6116. The profits are determined by estimating the dollars available after repaying the loan:$11,413,611 – $10,069,170 = $1,344,44123. SpeculationDiamond Bank expects that the Singapore dollar will depreciate against the dollar from its spotDiamond Bank considers borrowing 10 million Singapore dollars in the interbank market andinvesting the funds in dollars for 60 days. Estimate the profits(or losses) that could be earned from this strategy. Should Diamond Bank pursue this strategy?ANSWER:Borrow S$10,000,000 and convert to U.S. $:S$10,000,000 × $.43 = $4,300,000Invest funds for 60 days. The rate earned in the U.S. for 60 days is:7% × (60/360) = 1.17%Total amount accumulated in 60 days:$4,300,000 × (1 + .0117) = $4,350,310Convert U.S. $ back to S$ in 60 days:$4,350,310/$.42 = S$10,357,881The rate to be paid on loan is:.24 × (60/360) = .04Amount owed on S$ loan is:S$10,000,000 × (1 + .04) = S$10,400,000This strategy results in a loss:S$10,357,881 – S$10,400,000 = –S$42,119Diamond Bank should not pursue this strategy.Chapter 52. Risk of Currency Futures. Currency futures markets are commonly used as a means of capitalizing on shifts in currency values, because the value of a futures contract tends to move in line with the change in the corresponding currency value. Recently, many currencies appreciated against the dollar. Most speculators anticipated that these currencies would continue to strengthen and took large buy positions in currency futures. However, the Fed intervened in the foreign exchange market by immediately selling foreign currencies in exchange for dollars, causing an abrupt decline in the values of foreign currencies (as the dollar strengthened). Participants that had purchased currency futures contracts incurred large losses. One floor broker responded to the effects of the Fed's intervention by immediately selling 300 futures contracts on British pounds (with a value of about $30 million). Such actions caused even more panic in the futures market.a. Explain why the central bank s intervention caused such panic among currency futures traders with buy positions.ANSWER: Futures prices on pounds rose in tandem with the value of the pound. However, when central banks intervened to support the dollar, the value of the pound declined, and so did values of futures contracts on pounds. So traders with long (buy) positions in these contracts experienced losses because the contract values declined.b. Explain why the floor broker s willingness to sell 300 pound futures contracts at the going market rate aroused such concern. What might this action signal to other brokers?ANSWER: Normally, this order would have been sold in pieces. This action could signal a desperate situation in which many investors sell futures contracts at any price, which places more downward pressure on currency future prices, and could cause a crisis.c. Explain why speculators with short (sell) positions could benefit as a result of the central bank s intervention.ANSWER: The central bank intervention placed downward pressure on the pound and other European currencies. Thus, the values of futures contracts on these currencies declined. Traders that had short positions in futures would benefit because they could now close out their short positions by purchasing the same contracts that they had sold earlier. Since the prices of futures contracts declined, they would purchase the contracts for a lower price than the price at which they initially sold the contracts.d. Some traders with buy positions may have responded immediately to the central bank s intervention by selling futures contracts. Why would some speculators with buy positions leave their positions unchanged or even increase their positions by purchasing more futures contracts in response to the central bank s intervention?ANSWER: Central bank intervention sometimes has only a temporary effect on exchange rates. Thus, the European currencies could strengthen after a temporary effect caused by central bank intervention. Traders have to predict whether natural market forces will ultimately overwhelm any pressure induced as a result of central bank intervention. ]。

《国际财务管理》章后练习题及参考答案第一章绪论一、单选题1. 关于国际财务管理学与财务管理学的关系表述正确的是(C)。

A. 国际财务管理是学习财务管理的基础B. 国际财务管理与财务管理是两门截然不同的学科C. 国际财务管理是财务管理的一个新的分支D. 国际财务管理研究的范围要比财务管理的窄2. 凡经济活动跨越两个或更多国家国界的企业,都可以称为( A )。

A. 国际企业B. 跨国企业C. 跨国公司D. 多国企业3.企业的( C)管理与财务管理密切结合,是国际财务管理的基本特点A.资金B.人事C.外汇 D成本4.国际财务管理与跨国企业财务管理两个概念( D) 。

A. 完全相同B. 截然不同C. 仅是名称不同D. 内容有所不同4.国际财务管理的内容不应该包括( C )。

A. 国际技术转让费管理B. 外汇风险管理C. 合并财务报表管理D. 企业进出口外汇收支管理5.“企业生产经营国际化”和“金融市场国际化”的关系是( C )。

A. 二者毫不相关B. 二者完全相同C. 二者相辅相成D. 二者互相起负面影响二、多选题1.国际企业财务管理的组织形态应考虑的因素有()。

A.公司规模的大小B.国际经营的投入程度C.管理经验的多少D.整个国际经营所采取的组织形式2.国际财务管理体系的内容包括()A.外汇风险的管理B.国际税收管理C.国际投筹资管理D.国际营运资金管3.国际财务管理目标的特点()。

A.稳定性B.多元性C.层次性D.复杂性4.广义的国际财务管理观包括()。

A.世界统一财务管理观B.比较财务管理观C.跨国公司财务管理观D.国际企业财务管理观5. 我国企业的国际财务活动日益频繁,具体表现在( )。

A. 企业从内向型向外向型转化B. 外贸专业公司有了新的发展C. 在国内开办三资企业D. 向国外投资办企业E. 通过各种形式从国外筹集资金三、判断题1.国际财务管理是对企业跨国的财务活动进行的管理。

()2.国际财务管理学是着重研究企业如何进行国际财务决策,使所有者权益最大化的一门科学。

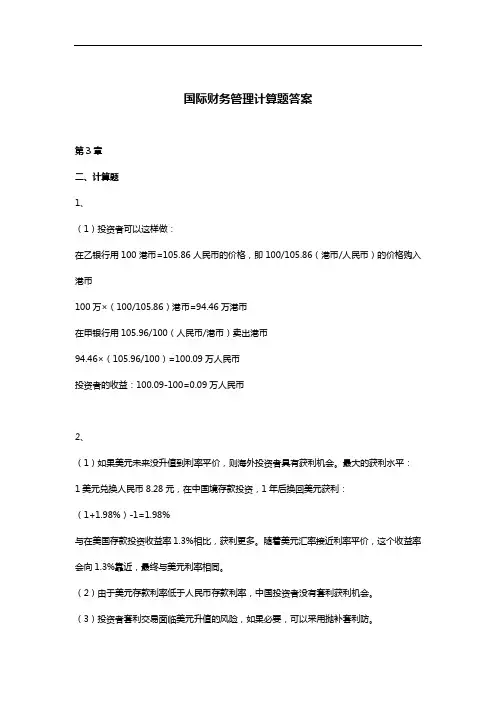

国际财务管理计算题答案第3章二、计算题1、(1)投资者可以这样做:在乙银行用100港币=105.86人民币的价格,即100/105.86(港币/人民币)的价格购入港币100万×(100/105.86)港币=94.46万港币在甲银行用105.96/100(人民币/港币)卖出港币94.46×(105.96/100)=100.09万人民币投资者的收益:100.09-100=0.09万人民币2、(1)如果美元未来没升值到利率平价,则海外投资者具有获利机会。

最大的获利水平:1美元兑换人民币8.28元,在中国境存款投资,1年后换回美元获利:(1+1.98%)-1=1.98%与在美国存款投资收益率1.3%相比,获利更多。

随着美元汇率接近利率平价,这个收益率会向1.3%靠近,最终与美元利率相同。

(2)由于美元存款利率低于人民币存款利率,中国投资者没有套利获利机会。

(3)投资者套利交易面临美元升值的风险,如果必要,可以采用抛补套利防。

(4)如果存在利率平价,此时美元远期汇率升水,升水幅度:K=(1+1.98%)/(1+1.3)-1=0.67%1美元=8.28×(1+0.67%)=8.3355(元人民币)(5)处于利率平价时,投资者无法获得抛补套利收益。

(6)如果目前不存在利率平价,是否抛补套利,取决于投资者对未来美元升值可能性和可能幅度的判断,以及投资者的风险承受能力。

4、公司到期收回人民币:5000×81.21/100=4060(万元)5、如果掉期交易,则卖掉美元得到的人民币: 50×6.79=339.5(万元)美元掉期交易下支付美元的人民币价格:50×6.78=339(万)买卖价差人民币收入净额=339.5-339=0.5(万元)如果不做掉期交易,则美元两周的存款利息收入为50×0.4%×14/365=0.00767(万美元)折合人民币利息收入:0.00767×6.782=0.052(万元)两者相比,掉期交易比较合适.6、2011年11月16日合约执行价格1澳元=1.02美元即期汇率1澳元=1.024美元合约价格低于即期汇率,企业应该履行该合约,企业履约支付的澳元加上期权费:1澳元=1.02+(2.6834/100)=1.0468(美元)与即期交易相比,企业亏损:50×100×(1.0468-1.024)=114(美元)8、远期汇率低于及其汇率,故远期贴水为:远期汇率-即期汇率=0.188-0.190=-0.0029、行权,因为行权价低于实施期权时的即期汇率。

《国际财务管理》章后练习题及参考答案第一章绪论一、单选题1. 关于国际财务管理学与财务管理学的关系表述正确的是(C)。

A. 国际财务管理是学习财务管理的基础B. 国际财务管理与财务管理是两门截然不同的学科C. 国际财务管理是财务管理的一个新的分支D. 国际财务管理研究的范围要比财务管理的窄2. 凡经济活动跨越两个或更多国家国界的企业,都可以称为( A )。

A. 国际企业B. 跨国企业C. 跨国公司D. 多国企业3.企业的( C)管理与财务管理密切结合,是国际财务管理的基本特点A.资金B.人事C.外汇 D成本4.国际财务管理与跨国企业财务管理两个概念( D) 。

A. 完全相同B. 截然不同C. 仅是名称不同D. 内容有所不同4.国际财务管理的内容不应该包括( C )。

A. 国际技术转让费管理B. 外汇风险管理C. 合并财务报表管理D. 企业进出口外汇收支管理5.“企业生产经营国际化”和“金融市场国际化”的关系是( C )。

A. 二者毫不相关B. 二者完全相同C. 二者相辅相成D. 二者互相起负面影响二、多选题1.国际企业财务管理的组织形态应考虑的因素有()。

A.公司规模的大小B.国际经营的投入程度C.管理经验的多少D.整个国际经营所采取的组织形式2.国际财务管理体系的内容包括()A.外汇风险的管理B.国际税收管理C.国际投筹资管理D.国际营运资金管3.国际财务管理目标的特点()。

A.稳定性B.多元性C.层次性D.复杂性4.广义的国际财务管理观包括()。

A.世界统一财务管理观B.比较财务管理观C.跨国公司财务管理观D.国际企业财务管理观5. 我国企业的国际财务活动日益频繁,具体表现在( )。

A. 企业从内向型向外向型转化B. 外贸专业公司有了新的发展C. 在国内开办三资企业D. 向国外投资办企业E. 通过各种形式从国外筹集资金三、判断题1.国际财务管理是对企业跨国的财务活动进行的管理。

()2.国际财务管理学是着重研究企业如何进行国际财务决策,使所有者权益最大化的一门科学。

CHAPTER 1 GLOBALIZATION AND THE MULTINATIONAL FIRM SUGGESTED ANSWERS TO END-OF-CHAPTER QUESTIONSQUESTIONS1. Why is it important to study international financial managementAnswer: We are now living in a world where all the major economic functions i.e. consumptionproduction and investment are highly globalized. It is thus essential for financial managers to fullyunderstand vital international dimensions of financial management. This global shift is in markedcontrast to a situation that existed when the authors of this book were learning finance some twenty yearsago.At that time most professors customarily and safely to some extent ignored international aspectsof finance. This mode of operation has become untenable since then.2. How is international financial management different from domestic financial managementAnswer: There are three major dimensions that set apart international finance from domestic finance.They are: 1. foreign exchange and political risks 2. market imperfections and 3. expanded opportunity set.3. Discuss the three major trends that have prevailed in international business during the last two decades.Answer: The 1980s brought a rapid integration of international capital and financial markets. Impetus forglobalized financial markets initially came from the governments of major countries that had begun toderegulate their foreign exchange and capital markets. The economic integration and globalization thatbegan in the eighties is picking up speed in the 1990s via privatization. Privatization is the process bywhich a country divests itself of the ownership and operation of a business venture by turning it over tothe free market system. Lastly trade liberalization and economic integration continued to proceed at boththe regional and global levels.4. How is a country‟s economic well-being enhanced through free international trade in goods andservicesAnswer: According to David Ricardo with free international trade it is mutually beneficial for twocountries to each specialize in the production of the goods that it can produce relatively most efficientlyand then trade those goods. By doing so the two countries can increase their combined productionwhich allows both countries to consume more of both goods. This argument remains valid even if acountry can produce both goods more efficiently than the other country. International trade is not a …zero-sum‟ game in which one country benefits at the expense of another country. Rather international tradecould be an …increasing-sum‟ game at which all players become winners.5. What considerations might limit the extent to which the theory of comparative advantage is realisticAnswer: The theory of comparative advantage was originally advanced by the nineteenth centuryeconomist David Ricardo as an explanation for why nations trade with one another. The theory claimsthat economic well-being is enhanced if each country‟s citizens produce what they have a comparativeadvantage in producing relative to the citizens of other countries and then trade products. Underlying thetheory are the assumptions of free trade between nations and that the factors of production landbuildings labor technology and capital are relatively immobile. To the extent that these assumptions donot hold the theory of comparative advantage will not realistically describe international trade.6. What are multinational corporations MNCs and what economic roles do they playAnswer: A multinational corporation MNC can be defined as a business firm incorporated in onecountry that has production and sales operations in several other countries. Indeed some MNCs haveoperations in dozens of different countries. MNCs obtain financing from major money centers around theworld in many different currencies to finance their operations. Global operations force the treasurer‟soffice to establish international banking relationships to place short-term fundsin several currencydenominations and to effectively manage foreign exchange risk.7. Mr. Ross Perot a former Presidential candidate of the Reform Party which is a third political party inthe United States had strongly objected to the creation of the North American Trade AgreementNAFTA which nonetheless was inaugurated in 1994 for the fear of losing American jobs to Mexicowhere it is much cheaper to hire workers. What are the merits and demerits of Mr. Perot‟s position onNAFTA Considering the recent economic developments in North America how would you assess Mr.Perot‟s position on NAFTAAnswer: Since the inception of NAFTA many American companies indeed have invested heavily inMexico sometimes relocating production from the United States to Mexico. Although this might havetemporarily caused unemployment of some American workers they were eventually rehired by otherindustries often for higher wages. Currently the unemployment rate in the U.S. is quite low by historicalstandard. At the same time Mexico has been experiencing a major economic boom. It seems clear thatboth Mexico and the U.S. have benefited from NAFTA. Mr. Perot‟s concern appears to hav e been illfounded.8. In 1995 a working group of French chief executive officers was set up by the Confederation of FrenchIndustry CNPF and the French Association of Private Companies AFEP to study the French corporategovernance structure. The group reported the following among other things “The board of directorsshould not simply aim at maximizing share values as in the U.K. and the U.S. Rather its goal should be toserve the company whose interests should be clearly distinguished from those of its shareholdersemployees creditors suppliers and clients but still equated with their general common interest which isto safeguard the prosperity and continuity of the company”. Evaluate the above recommendation of theworking group.Answer: The recommendations of the French working group clearly show that shareholder wealthmaximization is not a universally accepted goal of corporate management especially outside the UnitedStates and possibly a few other Anglo-Saxon countries including the United Kingdom and Canada. Tosome extent this may reflect the fact that share ownership is not wide spread in most other countries. InFrance about 15 of households own shares.9. Emphasizing the importance of voluntary compliance as opposed to enforcement in the aftermath ofcorporate scandals e.g. Enron and WorldCom U.S. President George W. Bush stated that while tougherlaws might help “ultimately the ethics of American business depends on the conscience of America‟sbusiness leaders.” Describe your view on this statement.Answer: There can be different answers to this question. If business leaders always behave with a highethical standard many of the corporate scandals we have seen lately might not have happened. Since wecannot fully depend on the ethical behavior on the part of business leaders the society should protectitself by adopting therules/regulations and governance structure that would induce business leaders tobehave in the interest of the society at large.10. Suppose you are interested in investing in shares of Nokia Corporation of Finland which is a worldleader in wireless communication. But before you make investment decision you would like to learnabout the company. Visit the website of CNN Financial network and collectinformation about Nokia including the recent stock price history and analysts‟ views of the company.Discuss what you learn about the company. Also discuss how the instantaneous access to information viainternet would affect the nature and workings of financial markets.Answer: As students might have learned from visiting the website information is readily available evenfor foreign companies like Nokia. Ready access to international information helpsintegrate financialmarkets dismantling barriers to international investment and financing. Integration however may help afinancial shock in one market to be transmitted to other markets.MINI CASE: NIKE‟S DECISION Nike a U.S.-based company with a globally recognized brand name manufactures athletic shoes insuch Asian developing countries as China Indonesia and Vietnam using subcontractors and sells theproducts in the U.S. and foreign markets. The company has no production facilities in the United States.In each of those Asian countries where Nike has production facilities the rates of unemployment andunderemployment are quite high. The wage rate is very low in those countries by the U.S. standardhourly wage rate in the manufacturing sector is less than one dollar in each of those countries which iscompared with about 18 in the U.S. In addition workers in those countries often are operating in poorand unhealthy environments and their rights are not well protected. Understandably Asian host countriesare eager to attract foreign investments like Nike‟s to develop their economies and raise the livingstandards of th eir citizens. Recently however Nike came under a world-wide criticism for its practice ofhiring workers for such a low pay “next to nothing” in the words of critics and condoning poor workingconditions in host countries. Evaluate and discuss various …ethical‟ as well as economic ramifications of Nike‟s decision toinvest in those Asian countries.Suggested Solution to Nike‟s Decision Obviously Nike‟s investments in such Asian countries as China Indonesia and Vietnam weremotivated to take advantage of low labor costs in those countries. While Nike was criticized for the poorworking conditions for its workers the company has recognized the problem and has substantiallyimproved the working environments recently. Although Nike‟s workers get paid very low wages by theWestern standard they probably are making substantially more than their local compatriots who are eitherunder- or unemployed. While Nike‟s detractors may have valid points one should not ignore the fact thatthe company is making contributions to the economic welfare of those Asian countries by creating jobopportunities. CHAPTER 1A THEORY OF COMPARATIVE ADVANTAGE SUGGESTED SOLUTIONS TO APPENDIX PROBLEMSPROBLEMS1. Country C can produce seven pounds of food or four yards of textiles per unit of input. Compute theopportunity cost of producing food instead of textiles. Similarly compute the opportunity cost ofproducing textiles instead of food.Solution: The opportunity cost of producing food instead of textiles is one yard of textiles per 7/4 1.75pounds of food. A pound of food has an opportunity cost of4/7 .57 yards of textiles.2. Consider the no-trade input/output situation presented in the following table for Countries X and Y.Assuming that free trade is allowed develop a scenario that will benefit the citizens of both countries.INPUT/OUTPUT WITHOUT TRADE_________________________________________________________________ ______ Country X YTotal___________________________________________________________________ _____I. Units of Input000000_____________________________________________________Food 70 60Textiles 4030______________________________________________________________________ __II. Output per Unit of Inputlbs or yards____________________________________________________Food 17 5Textiles 52_______________________________________________________________________ _III. Total Outputlbs or yards000000____________________________________________________Food 1190 300 1490Textiles 200 60260_____________________________________________________________________ ___IV. Consumptionlbs or yards000000___________________________________________________Food 1190 300 1490Textiles 200 60260_____________________________________________________________________ ___Solution: Examination of the no-trade input/output table indicates that Country X has an absoluteadvantage in the production of food and textiles. Country X can “trade off” one unit of productionneeded to produce 17 pounds of food for five yards of textiles. Thus a yard of textiles has an opportunitycost of 17/5 3.40 pounds of food or a pound of food has an opportunity cost of 5/17 .29 yards oftextiles. Analogously Country Y has an opportunity cost of 5/2 2.50 pounds of food per yard oftextiles or 2/5 .40 yards of textiles per pound of food. In terms of opportunity cost it is clear thatCountry X is relatively more efficient in producing food and Country Y is relatively more efficient inproducing textiles. Thus Country X Y has a comparative advantage in producing food textile iscomparison to Country Y X. When there are no restrictions or impediments to free trade the economic-well being of thecitizens of both countries is enhanced through trade. Suppose that Country X shifts 20000000 unitsfrom the production of textiles to the production of food where it has a comparative advantage and thatCountry Y shifts 60000000 units from the production of food to the production of textiles where it has acomparative advantage. Total output will now be 90000000 x 17 1530000000 pounds of food and20000000 x 5 100000000 90000000 x 2 180000000 280000000 yards of textiles.Further suppose that Country X and Country Y agree on a price of 3.00 pounds of food for one yard oftextiles and that Country X sells Country Y 330000000 pounds of food for 110000000 yards of textiles.Under free trade the following table shows that the citizens of Country X Y have increased theirconsumption of food by 10000000 30000000 pounds and textiles by 10000000 10000000 yards.INPUT/OUTPUT WITH FREE TRADE_________________________________________________________________ _________ Country X YTotal___________________________________________________________________ _______I. Units of Input 000000_______________________________________________________Food 90 0Textiles 2090______________________________________________________________________ ____II. Output per Unit of Input lbs or yards______________________________________________________Food 17 5Textiles 52_______________________________________________________________________ ___III. Total Output lbs or yards 000000_____________________________________________________Food 1530 0 1530Textiles 100 180280_____________________________________________________________________ _____IV. Consumption lbs or yards 000000_____________________________________________________Food 1200 330 1530Textiles 210 70280_____________________________________________________________________ _____ CHAPTER 3 BALANCE OF PAYMENTS SUGGESTED ANSWERS AND SOLUTIONS TO END-OF-CHAPTER QUESTIONS AND PROBLEMSQUESTIONS1. Define the balance of payments.Answer: The balance of payments BOP can be defined as the statistical record of a country‟sinternational transactions over a certain period of time presented in the form of double-entry bookkeeping.2. Why would it be useful.。

《国际财务管理》章后练习题及参考答案第一章绪论一、单选题1. 关于国际财务管理学与财务管理学的关系表述正确的是(C)。

A. 国际财务管理是学习财务管理的基础B. 国际财务管理与财务管理是两门截然不同的学科C. 国际财务管理是财务管理的一个新的分支D. 国际财务管理研究的范围要比财务管理的窄2. 凡经济活动跨越两个或更多国家国界的企业,都可以称为( A )。

A. 国际企业B. 跨国企业C. 跨国公司D. 多国企业3.企业的( C)管理与财务管理密切结合,是国际财务管理的基本特点A.资金B.人事C.外汇 D成本4.国际财务管理与跨国企业财务管理两个概念( D) 。

A. 完全相同B. 截然不同C. 仅是名称不同D. 内容有所不同4.国际财务管理的内容不应该包括( C )。

A. 国际技术转让费管理B. 外汇风险管理C. 合并财务报表管理D. 企业进出口外汇收支管理5.“企业生产经营国际化”和“金融市场国际化”的关系是( C )。

A. 二者毫不相关B. 二者完全相同C. 二者相辅相成D. 二者互相起负面影响二、多选题1.国际企业财务管理的组织形态应考虑的因素有()。

A.公司规模的大小B.国际经营的投入程度C.管理经验的多少D.整个国际经营所采取的组织形式2.国际财务管理体系的内容包括()A.外汇风险的管理B.国际税收管理C.国际投筹资管理D.国际营运资金管3.国际财务管理目标的特点()。

A.稳定性B.多元性C.层次性D.复杂性4.广义的国际财务管理观包括()。

A.世界统一财务管理观B.比较财务管理观C.跨国公司财务管理观D.国际企业财务管理观5. 我国企业的国际财务活动日益频繁,具体表现在( )。

A. 企业从内向型向外向型转化B. 外贸专业公司有了新的发展C. 在国内开办三资企业D. 向国外投资办企业E. 通过各种形式从国外筹集资金三、判断题1.国际财务管理是对企业跨国的财务活动进行的管理。

()2.国际财务管理学是着重研究企业如何进行国际财务决策,使所有者权益最大化的一门科学。

国际财务管理智慧树知到课后章节答案2023年下北京第二外国语学院北京第二外国语学院第一章测试1.国际企业是指()。

答案:任何超出本国界限从事商业活动的公司2.企业国际化的动因包括()。

答案:绕开贸易壁垒;分散风险;寻找必要的市场;发挥企业自身优势;降低生产成本(获取低成本生产要素);获得关键要素的供给3.国际财务管理的主导目标是()。

答案:企业价值最大化4.跨国公司是国际企业发展的较高阶段。

()答案:对5.与国内企业相比,国际企业需要保持资金的流动性和较好的偿债能力。

()答案:对第二章测试1.国际收支平衡表中,经常账户、资本和金融账户、净误差与遗漏三部分的余额加总为()。

答案:2.下列说法正确的有()。

答案:如果货物或服务的出口大于进口,称为贸易顺差;货物是一国出口货物所得外汇收入和进口货物的外汇支出的总称;资金流入本国,在国际收支平衡表上将产生货物或服务贷方的增加3.初次收入包括()。

答案:雇员报酬;投资收益4.储备资产减少,应记入贷方;反之,储备资产增加,应记入借方。

()答案:对5.亚洲的大部分国家是低个人主义(即高集体主义)的国家。

()答案:对第三章测试1.关于外汇期权,下列说法正确的是()。

答案:期权的内在价值是立即行使期权时所能获得的收益2.下列说法正确的有()。

答案:单独浮动汇率制度是指一国货币不与其他货币发生固定的联系,汇率根据外汇市场供求关系浮动的制度;钉住浮动汇率制度是指一国货币与某一种外币或某一记账单位保持固定比例关系,随着该种外币或记账单位的浮动而浮动的制度3.外汇期货合约有以下特征()。

答案:是一种标准化的合约;需要缴纳保证金并逐日清算4.外汇,是指以外国货币表示的支付手段或资产。

()答案:对5.直接标价法是以一定单位的本国货币折算为一定数额的外国货币的标价方法。

()答案:错第四章测试1.关于经济风险,下列说法正确的是()。

答案:核心能力较弱的企业更容易在汇率波动中遭受损失2.交易风险的种类有()。